UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23772

Bluerock High Income Institutional Credit Fund

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, 32nd Floor, New York, NY 10105

(Address of principal executive offices) (Zip code)

1-844-819-8287

(Registrant’s telephone number, including area code)

Jason Emala, Esq.

Bluerock Credit Fund Advisor, LLC

1345 Avenue of the Americas, 32nd Floor

New York, NY 10105

(Name and address of agent for service)

Date of fiscal year end: September 30

Date of reporting period: March 31, 2024

Item 1. Reports to Stockholders.

(a)

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Portfolio Review | 6 |

| Index to Financial Statements | |

| Portfolio of Investments | 8 |

| Statement of Assets and Liabilities | 11 |

| Statement of Operations | 12 |

| Statements of Changes in Net Assets | 13 |

| Statement of Cash Flows | 15 |

| Financial Highlights | 16 |

| Notes to Financial Statements | 20 |

| Renewal of Investment Advisory Agreement and Sub-Advisory Agreement | 30 |

| Additional Information | 32 |

| Privacy Policy | 33 |

| Semi-Annual Report

3.31.2024 |

| | |

SEMI-ANNUAL REPORT: (4Q 2023 - 1Q 2024) (UNAUDITED)

Letter from the Credit Fund Advisors | |

To Our Valued Shareholders:

We are pleased to present an update for the Bluerock High Income Institutional Credit Fund (“the Fund,” or “High Income Fund”) as of March 31, 2024.

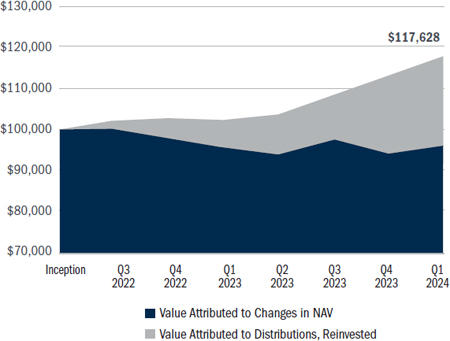

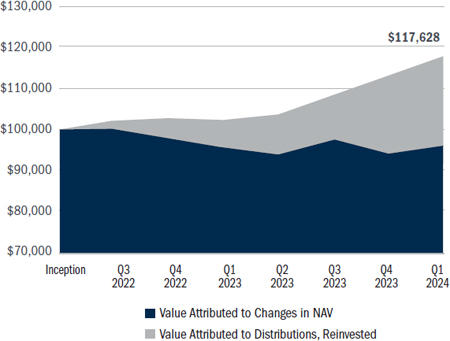

Since inception, the High Income Fund has generated a 9.4% annualized return, while also declaring ten distributions (seven quarterly and three special) totaling $4.90 per share. The underlying portfolio has generated substantial income due to the floating rate nature of the assets and active portfolio management. The Fund has strategically diversified the portfolio year-to-date, investing higher in the Collateralized Loan Obligation (CLO) capital stack, effectively reducing potential risk while simultaneously generating a double-digit underlying yield from the CLO securities, thus increasing the risk-adjusted return profile of the Fund.

| * | The underlying senior secured loan portfolio highlights summary presented herein reflects the Fund’s weighted average investment of the Fund’s gross assets and exposure to the underlying investments calculated using quarter-end CLO holdings. The Underlying Loan Value, Debt/Equity Allocation, and Number of Loans are a summation of the Fund’s underlying holdings. Calculations are based on CLOs that publicly report loan information; some collateral managers may not report holdings. Source: Bloomberg. |

High Income Fund I Share Performance

CORPORATE HEADQUARTERS | 1345 AVENUE OF THE AMERICAS | 32ND FLOOR | NEW YORK, NY 10105 | 877.826.BLUE (2583) | BLUEROCK.COM

| SEMI-ANNUAL REPORT ( 3.31.2024 ) | BLUEROCK HIGH INCOME INSTITUTIONAL CREDIT FUND | (UNAUDITED) |

Market Overview & Outlook

The “higher for longer” interest rate environment we saw develop in the first quarter of 2024 provided a positive backdrop for CLO debt and equity securities. Market expectations shifted significantly during the 6-month period ending in March 31, 2024. In the fourth quarter of 2023, Federal Reserve Chairman Jay Powell signaled that rate cuts were to occur in 2024. However, these expectations subsequently diminished by the close of the first quarter of 2024. This resulted in optimism in CLO markets especially CLO debt, which translated to increasing valuations and also contributed to the High Income Fund’s strong positive performance in the fourth quarter of 2023 and the first quarter of 2024. The market optimism also benefitted CLO equity, as CLO debt tranches at the top of the CLO stack saw yields narrow and thus benefitted CLO equity investors via wider “excess spreads,” or residual cash flow accreting to equity.

The optimism also trickled to senior loan markets, where prices incrementally appreciated, and yields ultimately ended marginally lower than at the beginning of the year. This price appreciation benefits CLO holders, as collateral managers can sell across the loan quality spectrum at attractive prices and position the portfolio with additional high-quality loans.

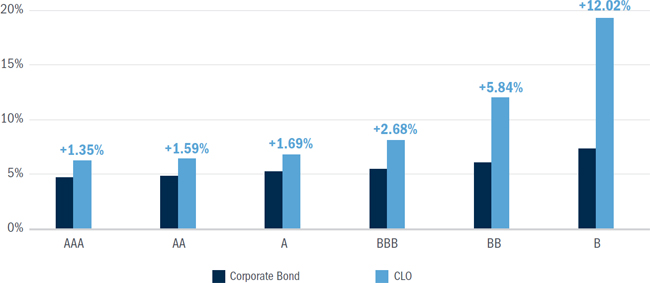

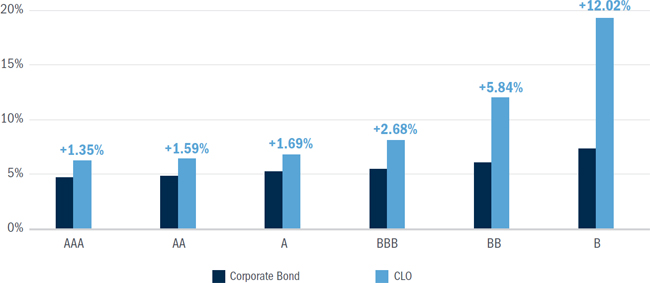

Additionally, as of 3.31.2024, CLO debt yields are well above similar rated corporate debt, presenting an opportunity for the Fund. Fixed rate corporate debt yields currently reflect historically low spreads vs risk free rates with CLOs generating much higher yields due, in part, to the floating rate nature of their underlying senior secured loans. The CLO yield premiums increase as across the ratings spectrum, highlighting the significantly higher income opportunities across categories of CLOs.

CLO Debt Yields vs. Similar Rated Corporate Bond Yield1

(as of 3.31.2024)

| 1 | Sources: Federal Reserve (ICE BofA Index), Bloomberg for CLO data (JP Morgan U.S. CLO Index) |

Past performance is not necessarily indicative of future results

Through the Fund’s Sub-Advisor, Whitestar, the High Income Fund continues its approach on two-fold active management: the first is of the CLO holdings, and the Sub-Advisor continues rotating the Fund’s holdings into CLO BB and B debt for attractive risk-adjusted returns relative to other tranches. The portfolio management team continues to find pockets of opportunity in the new issue market from quality CLO managers. Secondly is the active management within the CLOs themselves—for those CLOs where Whitestar is the collateral manager, Whitestar continues to seek out quality senior secured loans issued by corporations with strong balance sheets and robust revenue growth for inclusion in the CLO collateral pools.

| SEMI-ANNUAL REPORT ( 3.31.2024 ) | BLUEROCK HIGH INCOME INSTITUTIONAL CREDIT FUND | (UNAUDITED) |

About WhiteStar

The Fund is subadvised by WhiteStar, a structured credit specialist and CLO sponsor who underwrites each senior secured loan and also purchases CLOs on the secondary market to find those with the most attractive risk-reward profiles.

WhiteStar focuses on generating “alpha by avoidance,” or by avoiding investments with a higher default probability and instead investing in loans with a high likelihood of repayment through maturity. As a result, WhiteStar has historically performed as a top quartile CLO manager with low loss and default rates of underlying loans.

On behalf of the entire Bluerock and WhiteStar investment management teams, we thank you for your support in the Fund.

Bluerock Credit Fund Advisor | WhiteStar Asset Management

Performance: Distributions and Total Return Periods as of 3.31.2024

Distributions

Class I (IIMWX) | Q1 | Q2 | Q3 | Q4 | Special

Distributions | Annualized

Distribution Rate** |

| 2022 | - | - | $0.4818 | $0.4975 | $0.15 | 8.63% |

| 2023 | $0.4794 | $0.4818 | $0.4829 | $0.6778 | $1.00 | 12.91% |

| 2024 | $0.6439 | | | | | 11.00% |

| | 6 Month Return | 1-Year Return | Return Since Inception2 |

| Class I (IIMWX) | +7.41% | +14.88% | +9.41% |

| 2 | Inception date of the Fund is June 21, 2022. |

The total annual fund operating expense ratio, gross of any fee waivers or expense reimbursements is 5.45% for Class I Shares. The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted. Past performance is not necessarily indicative of future results. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The Fund’s investment adviser has contractually agreed to reduce its fees and/or absorb expenses of the fund, at least until January 31, 2025, to ensure that the net annual fund operating expenses will not exceed 2.35% for Class I, subject to possible recoupment from the Fund in future years. In addition to the contractual obligations under its expense limitation agreement, the Adviser, on a purely voluntary basis, has borne all of the operating expenses of the Fund and waived its entire management fee since inception. Such operating expenses and management fees voluntarily paid or waived during this period are not subject to recoupment from the Fund in future years. Without such waiver of fees and payment of expenses by the Adviser, expenses of the Fund would have been higher and the Fund’s returns would have been lower.

| ** | The Fund accrues distributions daily. The current annualized distribution rate is calculated by annualizing the daily accrual rate of the Fund as of October 1, 2023. The Fund’s distribution policy is to make quarterly distributions to its shareholders, but the amount of such distributions is not fixed. There is no assurance that the Fund will continue to declare distributions or that they will continue at the current rate. A portion of the distributions may consist of a return of capital (nondividend distribution) based on the character of the distributions received from the underlying holdings. The actual components of the Fund’s distributions for U.S. tax reporting purposes can only be determined as of the end of each calendar year and will be reported on Form 1099-DIV. A distribution comprised in whole or in part by a return of capital does not necessarily reflect the Company’s investment performance and should not be confused with yield, income, or net profit. |

| SEMI-ANNUAL REPORT ( 3.31.2024 ) | BLUEROCK HIGH INCOME INSTITUTIONAL CREDIT FUND | (UNAUDITED) |

Definitions

Asset Backed Securities (ABS): Pools of familiar asset types that represent that security’s contractual obligation to pay a distribution.

Collateralized Loan Obligations (CLOs): Structurally, CLOs are actively managed special purpose vehicles that are formed to manage a portfolio of Senior Secured Loans. The loans within a CLO are predominately limited to Senior Secured Loans which meet specified credit and diversity criteria and are subject to concentration limitations in order to create an investment portfolio that is strategically diversified across different loans, borrowers, and industries, with limitations on non-U.S. borrowers.

CLO Equity (or CLO equity tranche): The tranche within a CLO that is paid any excess spread. The equity tranche is paid after all the CLO debt and subordinated tranches.

Commercial Mortgage-Backed Securities (CMBS): An asset backed security that’s backed by mortgages on commercial properties.

Investment Grade Bonds (IG Bonds): Bonds that are believed to have a lower risk of default and receive higher ratings by the credit rating agencies namely bonds rated Baa (by Moody’s) or BBB (by S&P and Fitch) or above. These bonds tend to be issued at lower yields than less creditworthy bonds.

Senior Secured Loans (SSLs): Senior Secured Loans are floating rate credit instruments structured primarily with first-priority liens on the assets of the borrower, including, but not limited to cash, receivables, inventory and PP&E, that serve as collateral in support of the repayment of such debt. Senior Secured Loans are predominately used to fund a company’s growth, financing their business, M&A-related transactions or capital expenditures. Senior Secured Loans typically have the highest priority in receiving payments, ahead of both bondholders and preferred stockholders.

Morningstar LSTA US Leveraged Loan Index: The index is a market-value weighted index designed to measure the performance of the U.S. leveraged loan market. Investors cannot invest directly in an index or benchmark.

Risk Disclosures

Not FDIC Insured | No Bank Guarantee | May Lose Value

Investing in the Fund involves risks, including the risk that you may receive little or no return on your investment, and that you may lose part or all of your investment. This is neither an offer to sell nor a solicitation to purchase any security.

Investors should carefully consider the investment objectives, risks, sales charges and expenses of the Bluerock High Income Institutional Credit Fund (the “Fund”). This and other important information about the Fund is contained in the prospectus, which can be obtained online by visiting bluerock.com/hi-fund/documents. The prospectus should be read carefully before investing.

Past performance is not a guarantee of future results. The ability of the Fund to achieve its investment objective depends, in part, on the ability of the Advisor and Sub-Advisor to allocate effectively the assets of the Fund among the various available investment opportunities. There can be no assurance that the actual allocations will be effective in achieving the Fund’s investment objective or delivering positive returns. There is no guarantee that the Fund’s investment strategies will work under all market conditions. Statements relating to the performance of the Fund contained herein are historical and the Fund’s performance subsequent to the date as of which such statements were made may differ materially. Updated performance data for the Fund is available at bluerockfunds.com/performance.

Please note that the performance data relating to various indices included herein is for informational purposes only. You cannot invest directly in an index. Index performance does not represent actual fund or portfolio performance. Performance of a fund or portfolio may differ significantly from the performance of index holding the same securities. Index performance assumes reinvestment of dividends but does not reflect any management fees, transaction costs or other expenses that would be incurred by a fund or portfolio, or brokerage commissions on transactions in fund shares. Such fees, expenses, and commissions would likely reduce returns.

The Fund is a closed-end interval fund, the shares have no history of public trading, nor is it intended that the shares will be listed on a public exchange at this time. No secondary market is expected to develop for the Fund’s shares. Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% of the Fund’s shares outstanding at net asset value. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer. Quarterly repurchases by the Fund of its shares typically will be funded from available cash or sales of portfolio securities. The sale of securities to fund repurchases could reduce the market price of those securities, which in turn would reduce the Fund’s net asset value. The Fund is suitable only for investors who can bear the risks associated with the limited liquidity of the Fund and should be viewed as a long-term investment.

Investors in the Fund should understand that the net asset value (“NAV”) of the Fund will fluctuate, which means the value of your shares at any point in time may be worth less than the value of your original investment, even after taking into account any reinvestment of dividends and distributions. An investment in shares represents an indirect investment in the securities owned by the Fund. The value of these securities, like other market investments, may move up or down, sometimes rapidly and unpredictably. The Fund is “non-diversified” under the Investment Company Act of 1940 and therefore may invest more than 5% of its total assets in the securities of one or more issuers. As such, changes in the financial condition or market value of a single issuer may cause a greater fluctuation in the Fund’s net asset value than in a “diversified” fund. The Fund is not intended to be a complete investment program.

Because the Fund invests primarily in debt-anchored instruments and securities, the value of your investment in the Fund may fluctuate with changes in interest rates. The Fund may invest in senior secured debt and CLOs. Substantial increases in interest rates may cause an increase in loan defaults and the value of the Fund’s assets may also be affected by other uncertainties such as economic developments affecting the market for senior secured term loans or uncertainties affecting borrowers generally. There is a risk that the borrowers under the Senior Secured Loans may not make scheduled interest and/or principal payments on their loans and/or debt securities, which may result in losses or reduced cash flow to the Fund, either or both of which may cause the NAV of, or the distributions by, the Fund to decrease. CLOs carry additional risks, including but not limited to (i) the possibility that distributions from collateral will not be adequate to make interest or other payments; (ii) the quality of the collateral may decline in value or default; (iii) the possibility that the Fund’s investments in CLOs are subordinate to other classes or tranches thereof; and (iv) the complex structure of the CLO investment may not be fully understood at the time of investment and may produce disputes with the issuer, holders of senior tranches or other unexpected investment results. In addition, the nature of the Fund’s investment strategy also subjects it to various risks, including credit risk (the debtor may default), liquidity risk (the investment may not be able to be sold at an advantageous time or price) and prepayment risk (the debtor may pay its obligation early, reducing the amount of interest payments). All potential investors should read the Risk Factors section of the prospectus for additional information related to the risks associated with an investment in the Fund.

The Bluerock High Income Institutional Credit Fund is distributed by ALPS Distributors, Inc (ALPS). Bluerock Credit Fund Advisor, LLC is not affiliated with ALPS, or WhiteStar Asset Management.

This material is provided for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product or be relied upon for any other purpose. Certain information contained herein has been obtained from sources deemed to be reliable, but has not been independently verified. This material represents views as of its date and is subject to change without notice of any kind.

This report may contain certain forward-looking statements. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. These risks, uncertainties and contingencies include, but are not limited to: uncertainties relating to changes in general economic and real estate conditions; uncertainties relating to the implementation of our investment strategy; uncertainties relating to capital proceeds; and other risk factors as outlined in the Fund’s prospectuses, statement of additional information, annual report and semi-annual report filed with the Securities and Exchange Commission.

| Bluerock High Income Institutional Credit Fund | Portfolio Review |

| | March 31, 2024 (Unaudited) |

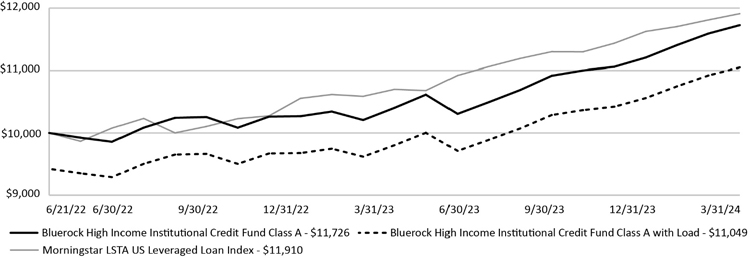

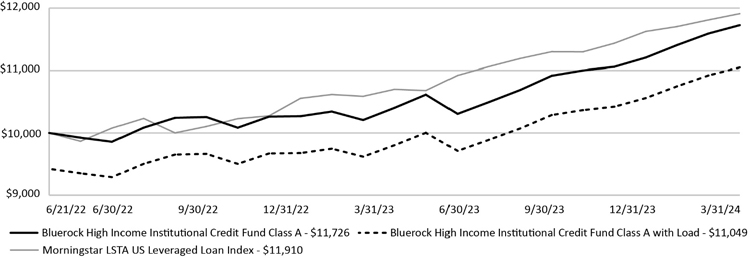

Comparison of the Change in Value of a $10,000 Investment

Performance figures for certain periods ended March 31, 2024:

| Bluerock High Income Institutional Credit Fund: | 6 Month | 1 Year | Since Inception* |

| Class A | | | |

| Without Load | 7.40% | 14.87% | 9.38% |

| With Load(a) | 1.22% | 8.25% | 5.78% |

| Class C | | | |

| Without Load | 7.46% | 14.88% | 9.42% |

| With Load(b) | 6.48% | 13.88% | 9.42% |

| Class F | 7.39% | 14.81% | 9.38% |

| Class I | 7.41% | 14.88% | 9.41% |

| Morningstar LSTA US Leveraged Loan Index | 5.40% | 12.47% | 10.35% |

| * | Class A, Class C, Class F and Class I commenced operations June 21, 2022. |

| (a) | Adjusted for initial maximum sales charge of 5.75%. |

| (b) | Adjusted for early withdrawal charge of 1.00%. |

The Morningstar LSTA US Leveraged Loan Index is a market-value weighted index designed to measure the performance of the U.S. leveraged loan market. Investors cannot invest directly in an index or benchmark.

Total returns are calculated using closing Net Asset Value as of March 31, 2024, and may not match returns presented in the Financial Highlights due to adjustments under accounting principles generally accepted in the United States of America.

The performance data quoted is historical. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total returns are calculated using closing Net Asset Value as of March 31, 2024. Total returns are calculated assuming reinvestment of all dividends and distributions. Total returns would have been lower had the Advisor not waived its fees. Returns greater than one year are annualized. The Advisor and the Fund have entered into an expense limitation and reimbursement agreement (the “Expense Limitation Agreement”) under which the Advisor has contractually agreed to waive the base management fees and/or reimburse the Fund for ordinary operating expenses the Fund incurs but only to the extent necessary to maintain the Fund’s total annual operating expenses after fee waivers and/or reimbursement (exclusive of any incentive fee, taxes, interest, brokerage commissions, and extraordinary expenses, such as litigation or reorganization costs, but inclusive of organizational costs and offering costs), to the extent that such expenses exceed 2.60%, 3.35%, 1.75% and 2.35% per annum of the Fund’s average daily net assets attributable to Class A, Class C, Class F and Class I shares, respectively. For the avoidance of doubt, acquired fund fees and expenses are not operating costs and are therefore excluded from the Expense Limitation. In consideration of the Advisor’s agreement to limit the Fund’s expenses, the Fund has agreed to repay the Advisor in the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: any waiver or reimbursement by the Advisor is subject to repayment by the Fund within the three years following the date the waiver or reimbursement occurred (provided the Advisor continues to serve as investment advisor to the Fund), if the Fund is able to make the repayment without exceeding the expense limitation then in effect or in effect at the time of the waiver and the repayment is approved by the Board of Trustees (the “Board”). The Expense Limitation Agreement will remain in effect at least until January 31, 2025, unless and until the Board approves its modification or termination. After January 31, 2025, the Expense Limitation Agreement may be renewed at the Advisor’s and Board’s discretion. Additionally, on a purely voluntary basis, the Advisor has borne all of the operating expenses of the Fund and waived its entire management fee since inception. The Advisor shall not seek to recoup the voluntary operating expenses reimbursed and voluntary management fees waived during this period. Without such waiver of fees and payment of expenses by the Advisor, expenses of the Fund would have been higher and the Fund’s returns would have been lower.

6

| Bluerock High Income Institutional Credit Fund | Portfolio Review |

March 31, 2024 (Unaudited)

The Fund’s total gross annual operating expenses, including the expenses of underlying funds and before any fee waiver, are 5.73%, 6.46%, 5.60% and 5.45% for Class A, Class C, Class F and I, respectively, per the February 1, 2024 prospectus and may differ from the ratios presented in the Financial Highlights. Class A shares are subject to a maximum sales charge imposed on purchases of 5.75%. Class A shareholders who tender for repurchase Class A shares that were purchased in amounts of $ 1,000,000 or more that have been held less than one year (365 days) from the purchase date will be subject to an early withdrawal charge of 1.00% of the original purchase price. Class C shares are subject to an early withdrawal charge of 1.00% if redeemed less than 365 days after the purchase. The above performance figures do not reflect the deduction of taxes that a shareholder would have to pay on Fund distributions or the redemption of the Fund shares. For performance information current to the most recent month-end, please call 1-844-819-8287.

Portfolio Composition as of March 31, 2024

| | Percent of Net Assets |

| Collaterized Loan Obligations Equity | 45.59% |

| Collaterized Loan Obligations Debt | 50.33% |

| Short-Term Investments | 5.18% |

| TOTAL INVESTMENTS | 101.10% |

| Liabilities in Excess of Other Assets | -1.10% |

| TOTAL NET ASSETS | 100.00% |

| Semi-Annual Report | March 31, 2024 | 7 |

| Bluerock High Income Institutional Credit Fund | Portfolio of Investments |

March 31, 2024 (Unaudited)

| Security(a) | | Estimated

Yield/Interest

Rate | | Acquisition

Date(b) | | Maturity

Date | | Principal | | | Cost(c) | | | Value(d) | |

| COLLATERALIZED LOAN OBLIGATIONS (95.92%)(e) | | | | | | | |

| Collateralized Loan Obligations Equity (45.59%)(f) | | | | | |

| CIFC Funding 2022-II, Ltd., Class SUBB | | 19.21% | | 6/21/2022 | | 4/19/2035 | | $ | 2,500,000 | | | $ | 2,073,837 | | | $ | 1,968,573 | |

| Trinitas CLO VI, Ltd., Class SUB | | 11.86% | | 6/21/2022 | | 1/25/2034 | | | 35,421,178 | | | | 23,993,587 | | | | 20,273,169 | |

| Trinitas CLO VII, Ltd., Class SUB | | 10.61% | | 6/21/2022 | | 1/25/2035 | | | 9,450,000 | | | | 5,707,636 | | | | 4,543,729 | |

| Trinitas CLO IX, Ltd., Class SUB | | 1.24% | | 6/21/2022 | | 1/20/2032 | | | 13,000,000 | | | | 6,762,760 | | | | 5,327,867 | |

| Trinitas CLO X, Ltd., Class SUB | | 13.33% | | 6/21/2022 | | 1/15/2035 | | | 22,900,000 | | | | 18,084,610 | | | | 15,250,071 | |

| Trinitas CLO XII, Ltd., Class SUB | | 19.29% | | 6/21/2022 | | 4/25/2033 | | | 11,820,000 | | | | 10,022,476 | | | | 10,331,743 | |

| TOTAL Collateralized Loan Obligations Equity (Cost $66,644,906) | | | | 57,695,152 | |

| | | | | | | | | | | | | | | | | | | |

| Collateralized Loan Obligations Debt (50.33%) | | | | | |

| 1988 CLO 1, Ltd., Class E | | 3M SOFR + 8.05% | | 4/14/2023 | | 10/15/2037 | | | 2,950,000 | | | | 2,812,794 | | | | 2,954,584 | |

| 1988 CLO 2, Ltd., Class E | | 3M SOFR + 8.27% | | 8/2/2023 | | 4/15/2038 | | | 3,500,000 | | | | 3,490,780 | | | | 3,596,205 | |

| 1988 CLO 3, Ltd., Class E | | 3M SOFR + 8.14% | | 2/8/2024 | | 10/15/2038 | | | 1,500,000 | | | | 1,507,477 | | | | 1,515,894 | |

| 37 Capital CLO II, Class E | | 3M SOFR + 8.32% | | 7/14/2023 | | 7/15/2034 | | | 500,000 | | | | 476,910 | | | | 487,070 | |

| 37 Capital CLO III, Class F | | 3M SOFR + 8.90% | | 2/13/2024 | | 4/15/2036 | | | 1,000,000 | | | | 990,039 | | | | 994,538 | |

| AGL CLO 9, Ltd., Class E | | 3M SOFR + 7.52% | | 2/21/2024 | | 1/20/2034 | | | 500,000 | | | | 502,488 | | | | 509,032 | |

| AGL CLO 19, Ltd., Class F | | 3M SOFR + 8.84% | | 1/9/2024 | | 7/21/2035 | | | 750,000 | | | | 709,054 | | | | 718,098 | |

| BBAM US CLO II, Ltd., Class D | | 3M SOFR + 8.15% | | 1/3/2024 | | 10/15/2038 | | | 1,000,000 | | | | 1,000,000 | | | | 1,016,930 | |

| BBAM US CLO III, Ltd., Class D | | 3M SOFR + 8.60% | | 10/3/2023 | | 10/15/2038 | | | 2,500,000 | | | | 2,431,828 | | | | 2,501,855 | |

| Bridge Street CLO III, Ltd., Class E | | 3M SOFR + 8.04% | | 6/2/2023 | | 10/20/2034 | | | 700,000 | | | | 660,992 | | | | 692,523 | |

| Bryant Park Funding 2024-22, Ltd., Class E | | 3M SOFR + 7.13% | | 2/13/2024 | | 4/15/2037 | | | 750,000 | | | | 742,279 | | | | 746,071 | |

| CIFC Funding 2022-II, Ltd., Class E | | 3M SOFR + 7.00% | | 2/8/2024 | | 4/19/2035 | | | 1,000,000 | | | | 1,002,486 | | | | 1,006,756 | |

| Diameter Capital CLO 5, Ltd., Class D | | 3M SOFR + 7.57% | | 12/1/2023 | | 10/15/2036 | | | 1,000,000 | | | | 995,051 | | | | 1,030,865 | |

| Elevation CLO 2021-14, Ltd., Class D2 | | 3M SOFR + 5.28% | | 12/6/2023 | | 10/20/2034 | | | 605,000 | | | | 539,385 | | | | 552,406 | |

| Elmwood CLO 25, Ltd., Class F | | 3M SOFR + 8.33% | | 1/24/2024 | | 4/17/2037 | | | 2,500,000 | | | | 2,475,049 | | | | 2,493,778 | |

| Elmwood CLO III, Ltd., Class FR | | 3M SOFR + 8.00% | | 1/11/2024 | | 10/20/2034 | | | 2,900,000 | | | | 2,760,677 | | | | 2,770,588 | |

| Elmwood CLO XII, Ltd., Class E | | 3M SOFR + 6.61% | | 12/7/2023 | | 1/20/2035 | | | 450,000 | | | | 446,891 | | | | 455,687 | |

| Elmwood CLO XII, Ltd., Class F | | 3M SOFR + 8.54% | | 8/9/2023 | | 1/20/2035 | | | 2,000,000 | | | | 1,908,143 | | | | 1,955,476 | |

| Empower CLO 2022-1, Ltd., Class E | | 3M SOFR + 8.55% | | 3/29/2023 | | 10/20/2034 | | | 3,730,000 | | | | 3,633,169 | | | | 3,807,088 | |

| Empower CLO 2023-2, Ltd., Class E | | 3M SOFR + 8.25% | | 11/17/2023 | | 7/15/2036 | | | 500,000 | | | | 501,236 | | | | 513,629 | |

| Flatiron CLO 20, Ltd., Class E | | 3M SOFR + 8.11% | | 8/23/2023 | | 11/20/2033 | | | 1,101,000 | | | | 1,104,173 | | | | 1,120,889 | |

The accompanying notes are an integral part of these financial statements.

8

| Bluerock High Income Institutional Credit Fund | Portfolio of Investments (Continued) |

March 31, 2024 (Unaudited)

| Security(a) | | Estimated

Yield/Interest

Rate | | Acquisition

Date(b) | | Maturity

Date | | Principal | | | Cost(c) | | | Value(d) | |

| Collateralized Loan Obligations Debt (50.33%) (continued) | | | | | |

| Fortress Credit BSL IX, Ltd., Class E | | 3M SOFR + 8.19% | | 2/20/2024 | | 10/20/2033 | | $ | 1,550,000 | | | $ | 1,540,365 | | | $ | 1,544,932 | |

| Fortress Credit BSL XXI, Ltd., Class E | | 3M SOFR + 7.83% | | 3/27/2024 | | 4/24/2037 | | | 3,000,000 | | | | 2,970,000 | | | | 2,970,000 | |

| Generate CLO 4, Ltd., Class ER | | 3M SOFR + 7.01% | | 12/7/2023 | | 4/20/2032 | | | 3,000,000 | | | | 3,010,279 | | | | 3,022,947 | |

| Generate CLO 9, Ltd., Class E | | 3M SOFR + 7.11% | | 2/12/2024 | | 10/20/2034 | | | 1,000,000 | | | | 1,002,485 | | | | 1,006,249 | |

| Generate CLO 12, Ltd., Class E | | 3M SOFR + 8.40% | | 9/28/2023 | | 7/20/2036 | | | 3,000,000 | | | | 3,014,774 | | | | 3,069,177 | |

| Katayma CLO I, Ltd., Class E | | 3M SOFR + 8.14% | | 11/14/2023 | | 10/20/2036 | | | 3,000,000 | | | | 2,956,462 | | | | 3,044,451 | |

| LCM 40, Ltd., Class E | | 3M SOFR + 8.15% | | 8/1/2023 | | 1/15/2036 | | | 2,000,000 | | | | 1,980,429 | | | | 2,030,694 | |

| Madison Park Funding XXIX, Ltd., Class F | | 3M SOFR + 7.83% | | 9/5/2023 | | 10/18/2030 | | | 1,500,000 | | | | 1,407,129 | | | | 1,434,291 | |

| Mountain View CLO XVII, Ltd., Class E | | 3M SOFR + 8.53% | | 2/2/2024 | | 9/14/2036 | | | 500,000 | | | | 506,221 | | | | 509,374 | |

| Park Avenue Institutional Advisers CLO, Ltd. 2021-1, Class D | | 3M SOFR + 7.56% | | 7/20/2023 | | 1/20/2034 | | | 500,000 | | | | 461,805 | | | | 473,169 | |

| Park Blue CLO 2022-1, Ltd., Class F | | 3M SOFR + 10.00% | | 1/17/2024 | | 10/20/2034 | | | 1,000,000 | | | | 1,002,482 | | | | 1,010,011 | |

| Park Blue CLO 2022-II, Ltd., Class F | | 3M SOFR + 7.00% | | 1/18/2024 | | 1/20/2035 | | | 1,000,000 | | | | 992,563 | | | | 999,407 | |

| Park Blue CLO 2023-III, Ltd., Class F | | 3M SOFR + 7.16% | | 1/18/2024 | | 4/20/2036 | | | 1,000,000 | | | | 982,617 | | | | 992,264 | |

| Park Blue CLO 2023-III, Ltd., Class E | | 3M SOFR + 7.80% | | 1/30/2024 | | 4/20/2036 | | | 1,000,000 | | | | 1,004,972 | | | | 1,010,663 | |

| Regatta XIX Funding, Ltd., Class F | | 3M SOFR + 8.25% | | 1/9/2024 | | 4/20/2035 | | | 500,000 | | | | 457,828 | | | | 463,947 | |

| TCI-Flatiron CLO 2017-1, Ltd., Class E | | 3M SOFR + 6.61% | | 12/7/2023 | | 11/18/2030 | | | 2,000,000 | | | | 2,009,708 | | | | 2,013,440 | |

| Trimaran CAVU 2022-1, Ltd., Class E | | 3M SOFR + 9.08% | | 6/28/2023 | | 10/22/2035 | | | 1,400,000 | | | | 1,396,583 | | | | 1,415,390 | |

| TSTAT 2022-1, Ltd., Class F | | 3M SOFR + 10.00% | | 7/27/2022 | | 7/20/2031 | | | 2,500,000 | | | | 2,500,000 | | | | 2,440,048 | |

| Wellfleet CLO 2022-2, Ltd., Class E | | 3M SOFR + 8.56% | | 7/24/2023 | | 10/18/2035 | | | 2,750,000 | | | | 2,731,424 | | | | 2,815,120 | |

| TOTAL Collateralized Loan Obligations Debt (Cost $62,619,027) | | | | 63,705,536 | |

| | | | | | | | | | | | | | | | | | | |

| TOTAL COLLATERALIZED LOAN OBLIGATIONS (Cost $129,263,933) | | | | 121,400,688 | |

| | | | | | | | | | | | | | | | | | | |

| SHORT TERM INVESTMENT (5.18%) | | | | | |

| Fidelity Government Portfolio, 5.21%(g) (Cost $6,557,470) | | $ | 6,557,470 | | | | | | | | 6,557,470 | |

| | | | | | | | | | | | | | | | | | | |

| TOTAL INVESTMENTS (101.10%) (Cost $135,821,403) | | | $ | 127,958,158 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-1.10%) | | | | (1,393,443 | ) |

| NET ASSETS (100.00%) | | | $ | 126,564,715 | |

The accompanying notes are an integral part of these financial statements.

| Semi-Annual Report | March 31, 2024 | 9 |

| Bluerock High Income Institutional Credit Fund | Portfolio of Investments (Continued) |

March 31, 2024 (Unaudited)

Investment Abbreviations:

SOFR - Secured Overnight Financing Rate

Reference Rates:

3M SOFR - 3 Month SOFR as of March 31, 2024 was 5.33%

| (a) | The Fund does not "control" nor is an "affiliate" of any of the portfolio investments, each term as defined in the Investment Company Act of 1940, as amended (the "1940 Act"). In general, under the 1940 Act, the Fund would be presumed to "control" a portfolio company if the Fund owned more than 25% of its voting securities and would be an "affiliate" of a portfolio company if the Fund owned 5% or more of its voting securities. |

| (b) | Acquisition date represents the initial purchase trade date, or the date the investment was contributed to the Fund at inception. |

| (c) | Cost represents the GAAP amortized cost, defined as the initial cost minus any return of principal and/or adjusted for the accretion(amortization) of discounts(premiums). |

| (d) | Fair value is determined in good faith in accordance with valuation principles pursuant to FASB ASC Topic 820 "Fair Value Measurement". Fair value is determined using significant unobservable inputs. |

| (e) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. As of March 31, 2024, the aggregate market value of those securities was $121,400,688, representing 95.92% of net assets. |

| (f) | The CLO subordinated notes are considered equity positions in the CLO funds. Equity investments are entitled to recurring distributions which are generally equal to the remaining cash flow of the payments made by the underlying fund’s securities less contractual payments to CLO debt tranche holders and CLO expenses. The estimated yield indicated is based upon a current projection of the amount and timing of these recurring distributions, and the estimated amount of repayment of principal upon termination. Such projections are periodically reviewed and adjusted, and the estimated yield may not ultimately be realized. |

| (g) | The rate shown is the 7-day effective yield as of March 31, 2024. |

The accompanying notes are an integral part of these financial statements.

10

| Bluerock High Income Institutional Credit Fund | Statement of Assets and Liabilities |

March 31, 2024 (Unaudited)

| ASSETS | | | |

| Investments, at value (Cost $135,821,403) | | $ | 127,958,158 | |

| Cash | | | 1,549,888 | |

| Receivable for shares sold | | | 1,339,671 | |

| Dividends and Interest receivable | | | 1,947,749 | |

| Receivable due from Advisor | | | 115,359 | |

| Prepaid expenses and other assets | | | 36,373 | |

| Total Assets | | | 132,947,198 | |

| LIABILITIES | | | | |

| Payable for investments purchased | | | 2,970,000 | |

| Payable for distributions | | | 3,212,112 | |

| Administration fees payable | | | 36,304 | |

| Transfer agency fees payable | | | 6,737 | |

| Shareholder servicing fees payable | | | 3,846 | |

| Distribution fees payable | | | 2,174 | |

| Trustees' fees payable | | | 236 | |

| Accrued expenses and other liabilities | | | 151,074 | |

| Total Liabilities | | | 6,382,483 | |

| | | | | |

| Commitments and Contingencies (See Note 3) | | | | |

| | | | | |

| NET ASSETS | | $ | 126,564,715 | |

| NET ASSETS CONSIST OF | | | | |

| Paid-in capital | | $ | 127,416,930 | |

| Total distributable earnings | | | (852,215 | ) |

| NET ASSETS | | $ | 126,564,715 | |

| PRICING OF SHARES | | | | |

| Class A: | | | | |

| Net asset value, per share | | $ | 23.97 | |

| Net assets | | $ | 15,781,048 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 658,342 | |

| Maximum offering price per share ((NAV/0.9425), based on maximum sales charge of 5.75% of the offering price) | | $ | 25.43 | |

| Class C: | | | | |

| Net asset value, per share | | $ | 23.98 | |

| Net assets | | $ | 3,764,128 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 156,994 | |

| Class F: | | | | |

| Net asset value, per share | | $ | 23.97 | |

| Net assets | | $ | 81,707,903 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 3,408,241 | |

| Class I: | | | | |

| Net asset value, per share | | $ | 23.85 | |

| Net assets | | $ | 25,311,636 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 1,061,413 | |

The accompanying notes are an integral part of these financial statements.

| Semi-Annual Report | March 31, 2024 | 11 |

| Bluerock High Income Institutional Credit Fund | Statement of Operations |

For the Six Months Ended March 31, 2024 (Unaudited)

| INVESTMENT INCOME | | | |

| Interest income | | $ | 8,114,173 | |

| Total Investment Income | | | 8,114,173 | |

| | | | | |

| EXPENSES | | | | |

| Investment Advisory fees | | | 978,793 | |

| Incentive Fees | | | 1,328,656 | |

| Administrative fees | | | 112,090 | |

| Transfer Agency fees | | | 37,827 | |

| Shareholder servicing fees: | | | | |

| Class A | | | 12,611 | |

| Class C | | | 2,482 | |

| Distribution fees: | | | | |

| Class C | | | 7,446 | |

| Legal fees | | | 36,512 | |

| Professional fees | | | 130,947 | |

| Tax expense | | | 43,436 | |

| Reports to shareholders and printing fees | | | 23,233 | |

| Custody fees | | | 8,325 | |

| Chief compliance officer fees | | | 16,103 | |

| Trustees' fees | | | 20,236 | |

| Other expenses | | | 39,300 | |

| Total Expenses | | | 2,797,997 | |

| Less: Fees waived/expenses reimbursed by Advisor (See Note 3) | | | (2,797,997 | ) |

| Net Expenses | | | – | |

| Net Investment Income | | | 8,114,173 | |

| NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | | | | |

| Net realized gain/(loss) on investments | | | 514,157 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | (416,004 | ) |

| NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | | | 98,153 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 8,212,326 | |

The accompanying notes are an integral part of these financial statements.

12

| Bluerock High Income Institutional Credit Fund | Statements of Changes in Net Assets |

| | | For the Six

Months Ended

March 31, 2024

(Unaudited) | | | For the

Year Ended

September 30, 2023 | |

| OPERATIONS: | | | | | | | | |

| Net investment income | | $ | 8,114,173 | | | $ | 14,845,424 | |

| Net realized gain/(loss) on investments | | | 514,157 | | | | (2,888,644 | ) |

| Net change in unrealized depreciation on investments | | | (416,004 | ) | | | (5,839,581 | ) |

| Net Increase in Net Assets Resulting from Operations | | | 8,212,326 | | | | 6,117,199 | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Class A | | | | | | | | |

| From distributable earnings | | | (934,350 | ) | | | (168,060 | ) |

| From return of capital | | | – | | | | (31,334 | ) |

| Class C | | | | | | | | |

| From distributable earnings | | | (177,705 | ) | | | (16,970 | ) |

| From return of capital | | | – | | | | (3,164 | ) |

| Class F | | | | | | | | |

| From distributable earnings | | | (7,622,490 | ) | | | (6,648,128 | ) |

| From return of capital | | | – | | | | (1,239,529 | ) |

| Class I | | | | | | | | |

| From distributable earnings | | | (1,359,656 | ) | | | (179,963 | ) |

| From return of capital | | | – | | | | (33,554 | ) |

| Total Distributions to Shareholders | | | (10,094,201 | ) | | | (8,320,702 | ) |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Class A | | | | | | | | |

| Shares sold | | | 10,078,705 | | | | 5,473,955 | |

| Distributions reinvested | | | 585,294 | | | | 143,033 | |

| Shares redeemed | | | (124,667 | ) | | | (22,298 | ) |

| Shares transferred out(a) | | | – | | | | (432,002 | ) |

| Class C | | | | | | | | |

| Shares sold | | | 3,178,930 | | | | 524,375 | |

| Distributions reinvested | | | 54,721 | | | | 6,735 | |

| Shares redeemed | | | (10,606 | ) | | | – | |

| Class F | | | | | | | | |

| Shares sold | | | – | | | | 2,500,000 | |

| Distributions reinvested | | | 473,310 | | | | 4,129,361 | |

| Shares redeemed | | | (5,563,007 | ) | | | – | |

| Class I | | | | | | | | |

| Shares sold | | | 17,866,012 | | | | 7,054,746 | |

| Distributions reinvested | | | 281,448 | | | | 67,352 | |

| Shares redeemed | | | (324,941 | ) | | | (48,029 | ) |

| Shares transferred in(b) | | | – | | | | 432,002 | |

| Net Increase in Net Assets Derived from Capital Share Transactions | | | 26,495,199 | | | | 19,829,230 | |

| Net increase in net assets | | | 24,613,324 | | | | 17,625,727 | |

| NET ASSETS: | | | | | | | | |

| Beginning of Period | | | 101,951,391 | | | | 84,325,664 | |

| End of Period | | $ | 126,564,715 | | | $ | 101,951,391 | |

The accompanying notes are an integral part of these financial statements.

| Semi-Annual Report | March 31, 2024 | 13 |

| Bluerock High Income Institutional Credit Fund | Statements of Changes in Net Assets |

| | | For the Six

Months Ended

March 31, 2024

(Unaudited) | | | For the

Year Ended

September 30, 2023 | |

| Other Information | | | | | | | | |

| Share Transactions: | | | | | | | | |

| Class A | | | | | | | | |

| Beginning shares | | | 220,324 | | | | 5,642 | |

| Shares sold | | | 418,476 | | | | 227,293 | |

| Distributions reinvested | | | 24,704 | | | | 5,965 | |

| Shares redeemed | | | (5,162 | ) | | | (929 | ) |

| Shares transferred out(a) | | | – | | | | (17,647 | ) |

| Net increase in shares outstanding | | | 438,018 | | | | 214,682 | |

| Ending shares | | | 658,342 | | | | 220,324 | |

| Class C | | | | | | | | |

| Beginning shares | | | 22,879 | | | | 1,000 | |

| Shares sold | | | 132,258 | | | | 21,600 | |

| Distributions reinvested | | | 2,304 | | | | 279 | |

| Shares redeemed | | | (447 | ) | | | – | |

| Net increase in shares outstanding | | | 134,115 | | | | 21,879 | |

| Ending shares | | | 156,994 | | | | 22,879 | |

| Class F | | | | | | | | |

| Beginning shares | | | 3,619,797 | | | | 3,350,938 | |

| Shares sold | | | – | | | | 101,709 | |

| Distributions reinvested | | | 19,994 | | | | 167,150 | |

| Shares redeemed | | | (231,550 | ) | | | – | |

| Net increase/(decrease) in shares outstanding | | | (211,556 | ) | | | 268,859 | |

| Ending shares | | | 3,408,241 | | | | 3,619,797 | |

| Class I | | | | | | | | |

| Beginning shares | | | 313,549 | | | | 2,015 | |

| Shares sold | | | 743,756 | | | | 293,097 | |

| Distributions reinvested | | | 11,876 | | | | 2,811 | |

| Shares redeemed | | | (13,665 | ) | | | (2,014 | ) |

| Shares transferred in(b) | | | – | | | | 17,640 | |

| Net increase in shares outstanding | | | 741,967 | | | | 311,534 | |

| Ending shares | | | 1,055,516 | | | | 313,549 | |

| (a) | Shares transferred out - net reduction in shares of a particular class resulting from transfer to other share classes. |

| (b) | Shares transferred in - net increase in shares of a particular class resulting from transfers from other share classes. |

The accompanying notes are an integral part of these financial statements.

14

| Bluerock High Income Institutional Credit Fund | Statement of Cash Flows |

| | | For the Six Months Ended

March 31, 2024

(Unaudited) | |

| Cash Flows from Operating Activities: | | | | |

| Net increase in net assets resulting from operations | | $ | 8,212,326 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | | |

| Purchase of investment securities | | | (43,527,265 | ) |

| Proceeds from disposition of investment securities | | | 19,615,436 | |

| Net purchases of short-term investment securities | | | (608,554 | ) |

| Net realized gain on investments | | | (514,157 | ) |

| Net change in unrealized appreciation/(depreciation) on investments | | | 416,004 | |

| Discount and premiums amortized | | | 2,265,714 | |

| (Increase)/Decrease in Assets: | | | | |

| Dividends and interest receivable | | | (868,246 | ) |

| Prepaid expenses and other assets | | | 16,132 | |

| Receivable due from advisor | | | (115,359 | ) |

| Increase/(Decrease) in Liabilities: | | | | |

| Due to advisor | | | (134,740 | ) |

| Administrative fees payable | | | (2,791 | ) |

| Transfer agency fees payable | | | (17,770 | ) |

| Shareholder servicing fees payable | | | 2,698 | |

| Distribution fees payable | | | 1,844 | |

| Accrued expenses and other liabilities | | | (82,288 | ) |

| Trustees' fees payable | | | 236 | |

| Net Cash Provided by Operating Activities | | | (15,340,780 | ) |

| | | | | |

| Cash Flows from Financing Activities: | | | | |

| Proceeds from shares sold | | | 30,161,960 | |

| Payment on shares redeemed | | | (6,023,221 | ) |

| Cash distributions paid | | | (7,461,058 | ) |

| Net Cash Used in Financing Activities | | | 16,677,681 | |

| | | | | |

| Net Change in Cash | | | 1,336,901 | |

| | | | | |

| Cash Beginning of Period | | $ | 212,987 | |

| Cash End of Period | | $ | 1,549,888 | |

| | | | | |

| Non-cash financing activities not included herein consist of reinvestment of distributions of: | | $ | 1,394,773 | |

The accompanying notes are an integral part of these financial statements.

| Semi-Annual Report | March 31, 2024 | 15 |

| Bluerock High Income Institutional Credit Fund - Class A | Financial Highlights |

The table below sets forth financial data for one share of beneficial interest outstanding throughout the periods presented.

| | | For the Six Months

Ended

March 31, 2024

(Unaudited) | | | For the Year Ended

September 30,

2023 | | | For the Period Ended

September 30,

2022 (a) | |

| Net asset value, beginning of year/period | | $ | 24.41 | | | $ | 25.11 | | | $ | 25.00 | |

| | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | |

| Net investment income(b) | | | 1.72 | | | | 4.01 | | | | 1.09 | |

| Net change in unrealized gain/(loss) on investments | | | 0.01 | | | | (2.47 | ) | | | (0.48 | ) |

| Total from investment operations | | | 1.73 | | | | 1.54 | | | | 0.61 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS: | | | | | | | | | | | | |

| From net investment income | | | (2.17 | ) | | | (1.89 | ) | | | (0.02 | ) |

| Return of capital | | | – | | | | (0.35 | ) | | | (0.48 | ) |

| Total distributions | | | (2.17 | ) | | | (2.24 | ) | | | (0.50 | ) |

| | | | | | | | | | | | | |

| Net asset value, end of year/period | | $ | 23.97 | | | $ | 24.41 | | | $ | 25.11 | |

| TOTAL RETURN(c) | | | 7.40 | %(d) | | | 6.58 | % | | | 2.43 | %(d) |

| | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | |

| Net assets, end of year/period (000s) | | $ | 15,781 | | | $ | 5,378 | | | $ | 142 | |

| Ratios to Average Net Assets | | | | | | | | | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(e) | | | 5.21 | %(f) | | | 5.72 | % | | | 7.61 | %(f) |

| Ratio of expenses to average net assets including fee waivers and reimbursements(g) | | | 0.00 | %(f) | | | 0.00 | % | | | 0.00 | %(f) |

| Ratio of net investment income to average net assets | | | 14.38 | %(f) | | | 16.68 | % | | | 15.94 | %(f) |

| | | | | | | | | | | | | |

| Portfolio turnover rate | | | 18 | %(d) | | | 23 | % | | | 0 | %(d) |

| (a) | Class A inception date was June 21, 2022. |

| (b) | Per share amounts are calculated using the average shares method. |

| (c) | Total returns are historical in nature and assumes changes in net asset value per share, reinvestment of dividends and capital gains distributions, if any, and do not reflect the impact of sales charges. Had the Advisor not absorbed a portion of the Fund expenses, total returns would have been lower. |

| (e) | Represents the ratio of expenses to average net assets absent fee waivers expense reimbursement and/or recoupment by the Advisor. |

| (g) | In addition to the Expense Limitation Agreement, the Advisor voluntarily absorbed all of the operating expenses of the Fund since the commencement of the Fund's operations, resulting in 4.97%, 5.33% and 5.86% voluntarily waived during the year/period ended March 31, 2024, September 30, 2023 and September 30, 2022 respectively. In the absence of the election by the Fund's investment advisor to bear all of the Fund's operating expenses, the ratio of expenses to average net assets including fee waivers and reimbursements would have been higher. |

The accompanying notes are an integral part of these financial statements.

16

| Bluerock High Income Institutional Credit Fund - Class C | Financial Highlights |

The table below sets forth financial data for one share of beneficial interest outstanding throughout the periods presented.

| | | For the Six Months

Ended

March 31, 2024

(Unaudited) | | | For the Year Ended

September 30,

2023 | | | For the Period Ended

September 30,

2022 (a) | |

| Net asset value, beginning of year/period | | $ | 24.41 | | | $ | 25.10 | | | $ | 25.00 | |

| | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | |

| Net investment income(b) | | | 1.72 | | | | 3.87 | | | | 1.08 | |

| Net change in unrealized gain/(loss) on investments | | | 0.03 | | | | (2.32 | ) | | | (0.48 | ) |

| Total from investment operations | | | 1.75 | | | | 1.55 | | | | 0.60 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS: | | | | | | | | | | | | |

| From net investment income | | | (2.18 | ) | | | (1.89 | ) | | | (0.02 | ) |

| Return of capital | | | – | | | | (0.35 | ) | | | (0.48 | ) |

| Total distributions | | | (2.18 | ) | | | (2.24 | ) | | | (0.50 | ) |

| | | | | | | | | | | | | |

| Net asset value, end of year/period | | $ | 23.98 | | | $ | 24.41 | | | $ | 25.10 | |

| TOTAL RETURN(c) | | | 7.46 | %(d) | | | 6.63 | % | | | 2.39 | %(d) |

| | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | |

| Net assets, end of year/period (000s) | | $ | 3,764 | | | $ | 559 | | | $ | 25 | |

| Ratios to Average Net Assets | | | | | | | | | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(e) | | | 5.96 | %(f) | | | 6.45 | % | | | 7.31 | %(f) |

| Ratio of expenses to average net assets including fee waivers and reimbursements(g) | | | 0.00 | %(f) | | | 0.00 | % | | | 0.00 | %(f) |

| Ratio of net investment income to average net assets | | | 14.32 | %(f) | | | 16.09 | % | | | 15.76 | %(f) |

| | | | | | | | | | | | | |

| Portfolio turnover rate | | | 18 | %(d) | | | 23 | % | | | 0 | %(d) |

| (a) | Class C inception date was June 21, 2022. |

| (b) | Per share amounts are calculated using the average shares method. |

| (c) | Total returns are historical in nature and assumes changes in net asset value per share, reinvestment of dividends and capital gains distributions, if any. Had the Advisor not absorbed a portion of the Fund expenses, total returns would have been lower. |

| (e) | Represents the ratio of expenses to average net assets absent fee waivers expense reimbursement and/or recoupment by the Advisor. |

| (g) | In addition to the Expense Limitation Agreement, the Advisor voluntarily absorbed all of the operating expenses of the Fund since the commencement of the Fund's operations, resulting in 5.72%, 6.08% and 5.56% voluntarily waived during the year/period ended March 31, 2024, September 30, 2023 and September 30, 2022 respectively. In the absence of the election by the Fund's investment advisor to bear all of the Fund's operating expenses, the ratio of expenses to average net assets including fee waivers and reimbursements would have been higher. |

The accompanying notes are an integral part of these financial statements.

| Semi-Annual Report | March 31, 2024 | 17 |

| Bluerock High Income Institutional Credit Fund - Class F | Financial Highlights |

The table below sets forth financial data for one share of beneficial interest outstanding throughout the periods presented.

| | | For the Six Months

Ended

March 31, 2024

(Unaudited) | | | For the Year Ended

September 30,

2023 | | | For the Period Ended

September 30,

2022 (a) | |

| Net asset value, beginning of year/period | | $ | 24.41 | | | $ | 25.10 | | | $ | 25.00 | |

| | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | |

| Net investment income(b) | | | 1.75 | | | | 4.00 | | | | 1.08 | |

| Net change in unrealized gain/(loss) on investments | | | (0.02 | ) | | | (2.45 | ) | | | (0.48 | ) |

| Total from investment operations | | | 1.73 | | | | 1.55 | | | | 0.60 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS: | | | | | | | | | | | | |

| From net investment income | | | (2.17 | ) | | | (1.89 | ) | | | (0.02 | ) |

| Return of capital | | | – | | | | (0.35 | ) | | | (0.48 | ) |

| Total distributions | | | (2.17 | ) | | | (2.24 | ) | | | (0.50 | ) |

| | | | | | | | | | | | | |

| Net asset value, end of year/period | | $ | 23.97 | | | $ | 24.41 | | | $ | 25.10 | |

| TOTAL RETURN(c) | | | 7.39 | %(d) | | | 6.63 | % | | | 2.39 | %(d) |

| | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | |

| Net assets, end of year/period (000s) | | $ | 81,708 | | | $ | 88,359 | | | $ | 84,108 | |

| Ratios to Average Net Assets | | | | | | | | | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(e) | | | 4.95 | %(f) | | | 5.59 | % | | | 6.31 | %(f) |

| Ratio of expenses to average net assets including fee waivers and reimbursements(g) | | | 0.00 | %(f) | | | 0.00 | % | | | 0.00 | %(f) |

| Ratio of net investment income to average net assets | | | 14.53 | %(f) | | | 16.51 | % | | | 15.75 | %(f) |

| | | | | | | | | | | | | |

| Portfolio turnover rate | | | 18 | %(d) | | | 23 | % | | | 0 | %(d) |

| (a) | Class F inception date was June 21, 2022. |

| (b) | Per share amounts are calculated using the average shares method. |

| (c) | Total returns are historical in nature and assumes changes in net asset value per share, reinvestment of dividends and capital gains distributions, if any. Had the Advisor not absorbed a portion of the Fund expenses, total returns would have been lower. |

| (e) | Represents the ratio of expenses to average net assets absent fee waivers expense reimbursement and/or recoupment by the Advisor. |

| (g) | In addition to the Expense Limitation Agreement, the Advisor voluntarily absorbed all of the operating expenses of the Fund since the commencement of the Fund's operations, resulting in 4.12%, 4.48% and 4.56% voluntarily waived during the year/period ended March 31, 2024, September 30, 2023 and September 30, 2022 respectively. In the absence of the election by the Fund's investment advisor to bear all of the Fund's operating expenses, the ratio of expenses to average net assets including fee waivers and reimbursements would have been higher. |

The accompanying notes are an integral part of these financial statements.

18

| Bluerock High Income Institutional Credit Fund - Class I | Financial Highlights |

The table below sets forth financial data for one share of beneficial interest outstanding throughout the periods presented.

| | | For the Six Months

Ended

March 31,

2024

(Unaudited) | | | For the Year Ended

September 30,

2023 | | | For the Period Ended

September 30,

2022 (a) | |

| Net asset value, beginning of year/period | | $ | 24.42 | | | $ | 25.10 | | | $ | 25.00 | |

| | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | |

| Net investment income(b) | | | 1.73 | | | | 3.82 | | | | 1.08 | |

| Net change in unrealized gain/(loss) on investments | | | (0.12 | ) | | | (2.26 | ) | | | (0.48 | ) |

| Total from investment operations | | | 1.61 | | | | 1.56 | | | | 0.60 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS: | | | | | | | | | | | | |

| From net investment income | | | (2.18 | ) | | | (1.89 | ) | | | (0.02 | ) |

| Return of capital | | | – | | | | (0.35 | ) | | | (0.48 | ) |

| Total distributions | | | (2.18 | ) | | | (2.24 | ) | | | (0.50 | ) |

| | | | | | | | | | | | | |

| Net asset value, end of year/period | | $ | 23.85 | | | $ | 24.42 | | | $ | 25.10 | |

| TOTAL RETURN(c) | | | 7.41 | %(d) | | | 6.67 | % | | | 2.39 | %(d) |

| | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | |

| Net assets, end of year/period (000s) | | $ | 25,312 | | | $ | 7,656 | | | $ | 51 | |

| Ratios to Average Net Assets | | | | | | | | | | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements(e) | | | 5.00 | %(f) | | | 5.44 | % | | | 6.22 | %(f) |

| Ratio of expenses to average net assets including fee waivers and reimbursements(g) | | | 0.00 | %(f) | | | 0.00 | % | | | 0.00 | %(f) |

| Ratio of net investment income to average net assets | | | 14.38 | %(f) | | | 15.91 | % | | | 15.78 | %(f) |

| | | | | | | | | | | | | |

| Portfolio turnover rate | | | 18 | %(d) | | | 23 | % | | | 0 | %(d) |

| (a) | Class I inception date was June 21, 2022. |

| (b) | Per share amounts are calculated using the average shares method. |

| (c) | Total returns are historical in nature and assumes changes in net asset value per share, reinvestment of dividends and capital gains distributions, if any. Had the Advisor not absorbed a portion of the Fund expenses, total returns would have been lower. |

| (e) | Represents the ratio of expenses to average net assets absent fee waivers expense reimbursement and/or recoupment by the Advisor. |

| (g) | In addition to the Expense Limitation Agreement, the Advisor voluntarily absorbed all of the operating expenses of the Fund since the commencement of the Fund's operations, resulting in 4.72%, 5.08% and 4.47% voluntarily waived during the year/period ended March 31, 2024, September 30, 2023 and September 30, 2022 respectively. In the absence of the election by the Fund's investment advisor to bear all of the Fund's operating expenses, the ratio of expenses to average net assets including fee waivers and reimbursements would have been higher. |

The accompanying notes are an integral part of these financial statements.

| Semi-Annual Report | March 31, 2024 | 19 |

| Bluerock High Income Institutional Credit Fund | Notes to Financial Statements |

March 31, 2024 (Unaudited)

1. ORGANIZATION

The Bluerock High Income Institutional Credit Fund (the "Fund" or the "Trust") was organized as a Delaware statutory trust on August 19, 2021 and is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as a closed-end management investment company that operates as an interval fund with a continuous offering of Fund shares. The Fund is non-diversified. The Fund's investment advisor is Bluerock Credit Fund Advisor, LLC (the "Advisor"). WhiteStar Asset Management LLC (the "Sub-Advisor" and/or "WhiteStar") serves as the Fund's investment sub-advisor, pursuant to the Sub-Advisor Agreement with the Advisor. The Fund's primary investment objective is to generate high current income, while secondarily seeking attractive, long-term risk-adjusted returns with low correlation to the broader markets.

The Fund pursues its investment objective by investing, directly or indirectly, in senior secured loans ("Senior Secured Loans"). The Fund may purchase Senior Secured Loans directly in the primary or secondary market and will invest in them indirectly by purchasing various tranches, including senior, junior and equity tranches, of entities that own a diversified pool of Senior Secured Loans known as Collateralized Loan Obligations, or "CLOs", (collectively with Senior Secured Loans, "Target Securities"). The Fund may invest in any structure where the primary collateral or assets are Target Securities. The Fund will generally focus its investment activities on U.S. dollar -denominated loans that (i) are broadly syndicated and made to U.S. companies, (ii) are senior in the capital structure with a priority claim on assets and cash flow of the underlying borrower, (iii) are primarily secured by first priority liens on assets of the underlying borrowers, (iv) are rated BB+ or below, known as "below investment grade" or "junk", or are unrated (v) are floating rate to provide some protection against rising interest rates, (vi) have loan to value ratios generally in the 40 – 60% range at origination, and (vii) in CLOs that own such loans and additionally (a) are diversified by issuer, industry and geography, (b) have senior tranches with high credit ratings in order to maximize excess spread, (c) have attractive risk-adjusted spreads, and (d) are actively managed by experienced CLO collateral managers, including Trinitas Capital Management, LLC ("Trinitas") or other advisors who may also be associated with the Sub-Advisor. Securities which are "below investment grade" or "junk" are predominantly speculative in nature.

The Fund commenced operations on June 21, 2022. The Fund currently offers Class A, Class C, Class F and Class I shares. Class A shares are offered at net asset value plus a maximum sales charge of 5.75%. Class C shares, Class F shares and Class I shares are not subject to sales charges. The minimum initial investment by a shareholder for Class A shares is $2,500 for regular accounts and $1,000 for retirement plan accounts, and a minimum subsequent investment of at least $100 for regular accounts and $50 for retirement plan accounts. Class A shares that were purchased in amounts of $1,000,000 or more that have been held less than one year (365 days) from the purchase date will be subject to an early withdrawal charge of 1.00% of the original purchase price. The minimum initial investment by a shareholder for Class C shares is $2,500 for regular accounts and $1,000 for retirement plan accounts, and a minimum subsequent investment of at least $100 for regular accounts and retirement plan accounts. Class C shares that have been held less than one year (365 days) from the purchase date will be subject to an early withdrawal charge of 1.00% of the original purchase price. The minimum initial investment for Class I shares is $1,000,000, while subsequent investments may be made with any amount. There is no minimum initial investment amount for Class F shares. Class F shares are not publicly available for purchase.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are governed by accounting principles generally accepted in the United States of America ("GAAP"). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income, expenses and unrealized gain/(loss) on investments for the period. Actual results could differ from those estimates. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board ("FASB") Accounting Standard Codification ("ASC") Topic 946 "Financial Services – Investment Companies.”

A. Valuation of Investments – Fund investments are recognized at fair value, and subsequent changes in fair value are recognized in unrealized appreciation/(depreciation) on investments in the Statement of Operations. Fund investments are valued in accordance with FASB ASC Topic 820 "Fair Value Measurement", and governed by the Fund's valuation policies. The Fund's Board of Trustees (the "Board") has named the Advisor as its valuation designee. As the valuation designee, the Advisor executes the Fund's valuation policies. The Board reviews the execution of this process at least annually to assure the process produces reliable results. Fair valuation involves subjective judgments, and it is possible that the fair value determined for a security may differ materially from the value that could be realized upon the sale of the security. There is no single standard for determining fair value of a security. Rather, in determining the fair value of a security for which there are no readily available market quotations, several factors may be considered, including fundamental analytical data relating to the investment in the security, the nature and duration of any restriction on the disposition of the security, the cost of the security at the date of purchase, the liquidity of the market for the security and the recommendation of the Fund's third-party valuation consultants. The Advisor will attempt to obtain current information to value all fair valued securities.

20

| Bluerock High Income Institutional Credit Fund | Notes to Financial Statements |

March 31, 2024 (Unaudited)

Fair valuation procedures may be used to value a substantial portion of the assets of the Fund, including the Fund's investments in CLOs. The Fund may use the fair value of a security to calculate its NAV when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a substantial period, or (4) the Advisor determines that the quotation or price for a portfolio security provided by a broker-dealer or independent pricing service is inaccurate.

The fair value of securities may be difficult to determine and thus judgment plays a greater role in the valuation process. The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level, supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; (4) other factors relevant to the security which would include, but not be limited to, duration, yield, fundamental analytical data, the Treasury yield curve, and credit quality.

The values assigned to fair valued investments are based on available information and do not necessarily represent amounts that might ultimately be realized, since such amounts depend on future developments inherent in long-term investments. Changes in the fair valuation of portfolio securities may be less frequent and of greater magnitude than changes in the price of portfolio securities valued at their last sale price, by an independent pricing service, or based on market quotations. Imprecision in estimating fair value can also impact the amount of unrealized appreciation or depreciation recorded for a particular portfolio security and differences in the assumptions used could result in a different determination of fair value, and those differences could be material.

The Fund utilizes various methods to measure the fair value of its investments in accordance with FASB ASC Topic 820 "Fair Value Measurement". The framework establishes a hierarchy that prioritizes inputs to valuation methods, which the Fund utilizes on a recurring basis. The three levels of input are:

| | Level 1 – | Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access. |

| | | |

| | Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | | |

| | Level 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund's own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The valuation techniques used by the Fund to measure fair value during the six months ended March 31, 2024, maximized the use of observable inputs and minimized the use of unobservable inputs. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of March 31, 2024 for the Fund's investments measured at fair value:

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Collateralized Loan Obligations | | $ | – | | | $ | – | | | $ | 121,400,688 | | | $ | 121,400,688 | |

| Short Term Investments | | | 6,557,470 | | | | – | | | | – | | | | 6,557,470 | |

| TOTAL | | $ | 6,557,470 | | | $ | – | | | $ | 121,400,688 | | | $ | 127,958,158 | |

| Semi-Annual Report | March 31, 2024 | 21 |

| Bluerock High Income Institutional Credit Fund | Notes to Financial Statements |

March 31, 2024 (Unaudited)

The following table shows the aggregate changes in fair value of the Fund's Level 3 investments during the six months ended March 31, 2024.

| Asset Type | | Balance as of

September 30,

2023 | | | Accrued

Discount/

premium | | | Realized Gain/

(Loss) | | | Change in

Unrealized

Appreciation/

Depreciation | | | Purchases | | | Sales Proceeds | | | Balance as

of March 31,

2024 | | | Net change in

unrealized

appreciation/

(depreciation)

included in the

Statements of

Operations

attributable to Level 3

Investments held

at March 31,

2024 | |

| Collateralized Loan Obligations | | $ | 99,914,407 | | | $ | 22,651 | | | $ | 514,157 | | | $ | (416,004 | ) | | $ | 39,973,515 | | | $ | (18,608,038 | ) | | $ | 121,400,688 | | | $ | (393,293 | ) |

A.1. Valuation of Collateralized Loan Obligations – The Fund primarily invests in junior debt and equity tranches of CLOs. With respect to CLOs, the Fund has engaged an independent third-party valuation specialist to assist in estimating fair value for such securities in circumstances where a market price is not readily available. The factors that may be considered with respect to the valuation of CLOs include: loan terms and covenants, loan duration, contract (coupon) rate, rate structure, quality of collateral, debt service coverage ratio, prevailing interest rates, borrower's ability to adequately service its debt, loan prepayment rate, loan default rate, loan default recovery percentage, recent loan ratings migration, average loan prices in secondary market, pipeline of new issue CLO issuance, environment of high-yield bond markets, market interest rate sentiment, and other factors deemed applicable. All of these factors may be subject to adjustments based upon the particular circumstances of a security or the Fund's actual investment position. In addition, the Advisor considers the operating metrics of the specific investment vehicle, including compliance with collateralization tests, defaulted and restructured securities, payment defaults, if any, and covenant cushions. In periods of illiquidity and volatility, the Advisor may rely more heavily on other qualities and metrics, including, but not limited to, the collateral manager, time left in the reinvestment period, and expected cash flows and overcollateralization ratios.

The Advisor categorizes CLO investments as a Level 3 investment. Certain pricing inputs may be unobservable. An active market may exist, but not necessarily for CLO investments in which the Fund invests. The Advisor incorporates the prices from a third-party valuation specialist to estimate the fair value of CLO investments. Estimates are based on detailed information on the characteristics of each CLO, including recent information about the underlying senior secured loans and CLO debt liabilities from data sources such as trustee reports, in order to project future cash flows in a consistent and transparent manner.

The following table summarizes the quantitative inputs and assumptions used for investments categorized as Level 3 of the fair value hierarchy as of March 31, 2024. In addition to the technique and inputs noted in the table below, the Advisor may use other valuation techniques and methodologies when determining the Fund's fair value measurements as provided for in the valuation policy approved by the Board. The table below is not intended to be all-inclusive, but rather provides information on the significant Level 3 inputs as they relate to the Fund's fair value measurements as of March 31, 2024. Unobservable inputs and assumptions are periodically reviewed and updated as necessary to reflect current market conditions.

| Asset Class | | Fair Value at

March 31, 2024 | | | Valuation

Technique/Methodologies | | Unobservable Inputs | | Range/Weighted Average(1) |

| Collateralized Loan Obligations | | $ | 121,400,688 | | | Discounted Cash Flows | | Annual Default Rate | | 1.42% - 2.00% / 1.87% |

| | | | | | | | | Annual Prepayment Rate | | 25.00% |

| | | | | | | | | Reinvestment Price | | $96.50 - $99.50 / $98.83 |

| | | | | | | | | Recovery Rate | | 70.00% |

| | | | | | | | | Expected Yield | | 10.38% - 26.91% / 15.46% |

| (1) | Weighted average calculations are based on the fair value of investments as of March 31, 2024. In the cases where no range is provided, a single assumption is being utilized. |

22

| Bluerock High Income Institutional Credit Fund | Notes to Financial Statements |

March 31, 2024 (Unaudited)

Increases (decreases) in the annual default rate, reinvestment price and expected yield in isolation would result in a lower (higher) fair value measurement. Increases (decreases) in recovery rate in isolation would result in a higher (lower) fair value measurement. Changes in the annual prepayment rate may result in a higher (or lower) fair value, depending on the circumstances. Generally, a change in the assumption used for the annual default rate may be accompanied by a directionally opposite change in the assumption used for the annual prepayment rate and recovery rate.