BLUEROCK HIGH INCOME INSTITUTIONAL CREDIT FUND

Class A Shares (IIMAX)

of Beneficial Interest

Supplement dated December 31, 2024 to

the Prospectus and Statement of Additional Information

dated February 1, 2024

The Advisor has agreed that effective January 1, 2025, it will (a) reduce its base management fee from an annual rate of 1.75% of the average value of the Fund’s daily net assets to 1.25% of the average value of the Fund’s daily net assets and (b) reduce its incentive fee from 20% of the Fund’s “pre-incentive fee net investment income” subject to an annual hurdle rate of 8.0% to 12.50% of the Fund’s “pre-incentive fee net investment income” subject to an annual hurdle rate of 7.50%. The changes to the fees, and to the Prospectus, are described more fully below.

| I. | The “Advisor Fees” section in the Prospectus is replaced with the following: |

Advisor Fees

The Advisor is entitled to receive a fee consisting of two components — a base management fee and an incentive fee.

The base management fee is calculated and payable monthly in arrears at the annual rate of 1.25% of the average value of the Fund’s daily net assets during such period.

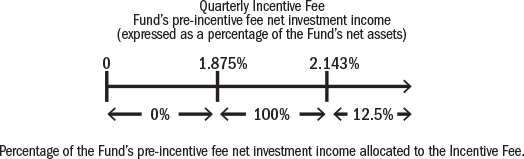

The incentive fee is calculated and payable quarterly in arrears in an amount equal to 12.50% of the Fund’s “pre-incentive fee net investment income” for the immediately preceding quarter, and is subject to a hurdle rate, expressed as a rate of return on the Fund’s net assets, equal to 1.875% per quarter (or an annualized hurdle rate of 7.50%), subject to a “catch-up” feature, which allows the Advisor to recover foregone incentive fees that were previously limited by the hurdle rate. For these purposes, “pre-incentive fee net investment income” means interest income, dividend income and any other income accrued during the calendar quarter, minus the Fund’s quarterly operating expenses (including the base management fee, expenses reimbursed to the Advisor or Sub-Advisor and any interest expenses and distributions paid on any issued and outstanding preferred shares, but excluding the incentive fee).

The calculation of the incentive fee on pre-incentive fee net investment income for each quarter is as follows:

| ● | No incentive fee is payable in any calendar quarter in which the Fund’s pre-incentive fee net investment income does not exceed the hurdle rate of 1.875% per quarter (or an annualized rate of 7.50%); |

| ● | 100% of the Fund’s pre-incentive fee net investment income, if any, that exceeds the hurdle rate but is less than or equal to 2.143% (the “Catch-Up”). The Catch-Up is intended to provide the Advisor with an incentive fee of 12.50% on all of the Fund’s pre-incentive fee net investment income when its pre-incentive fee net investment income reaches 2.143% in any calendar quarter; and |

| ● | 12.50% of the amount of the Fund’s pre-incentive fee net investment income, if any, that exceeds 2.143% in any calendar quarter (8.571% annualized) is payable to the Advisor once the hurdle rate is reached and the Catch-Up is achieved (12.50% of all pre-incentive fee net investment income thereafter will be allocated to the Advisor). |

| II. | The “Expense Limitation Agreement” section in the Prospectus is replaced with the following: |

Expense Limitation Agreement

The Advisor and the Fund have entered into an expense limitation and reimbursement agreement (the “Expense Limitation Agreement”) under which the Advisor has contractually agreed to waive the base management fees and/or reimburse the Fund for ordinary operating expenses the Fund incurs but only to the extent necessary to maintain the Fund’s total annual operating expenses after fee waivers and/or reimbursement (exclusive of any incentive fee, taxes, interest, brokerage commissions, and extraordinary expenses, such as litigation or reorganization costs, but inclusive of organizational costs and offering costs), to the extent that such expenses exceed 2.10% per annum of the Fund’s average daily net assets attributable to Class A shares (the “Expense Limitation”). For the avoidance of doubt, acquired fund fees and expenses are not operating costs and are therefore excluded from the Expense Limitation. In consideration of the Advisor’s agreement to limit the Fund’s expenses, the Fund has agreed to repay the Advisor in the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: any waiver or reimbursement by the Advisor is subject to repayment by the Fund within the three years following the date the waiver or reimbursement occurred (provided the Advisor continues to serve as investment adviser to the Fund), if the Fund is able to make the repayment without exceeding the expense limitation then in effect or in effect at the time of the waiver and the repayment is approved by the Board of Trustees (the “Board”). The Expense Limitation Agreement will remain in effect at least until January 31, 2026, unless and until the Board approves its modification or termination. After January 31, 2026, the Expense Limitation Agreement may be renewed at the Advisor’s and Board’s discretion. See “Management of the Fund.”

| III. | The table and footnotes under the “SUMMARY OF FUND EXPENSES” section in the Prospectus are replaced with the following: |

| Shareholder Transaction Expenses | Class A |

| Maximum Sales Load (as a percent of offering price) | 5.75% |

| Maximum Early Withdrawal Charge (as a percent of original purchase price) | None1 |

| Annual Expenses (as a percentage of average net assets attributable to shares) |

| Base Management Fee | 1.25% |

| Incentive Fee2 | 1.42% |

| Other Expenses3 | 1.04% |

| Shareholder Servicing Expenses | 0.25% |

| Distribution Fee | None |

| Remaining Other Expenses3 | 0.79% |

| Interest Payments on Borrowed funds4 | 0.10% |

| Total Annual Expenses | 3.81% |

| Fee Waiver and Reimbursement5 | (0.19%) |

| Total Annual Expenses (after fee waiver and reimbursement)5 | 3.62% |

| 1. | Class A shares that were purchased in amounts of $1,000,000 or more that have been held less than one year (365 days) from the purchase date will be subject to an early withdrawal charge of 1.00% of the original purchase price. |

| 2. | The Fund anticipates that it may generate income in a manner sufficient to result in the payment of an Incentive Fee to the Advisor during certain periods. However, the Incentive Fee is based on the Fund’s performance and will not be paid unless the Fund achieves certain performance targets. The Fund expects the Incentive Fee the Fund pays to increase to the extent the Fund earns greater income through its investments. The Incentive Fee is calculated and payable quarterly in arrears in an amount equal to 12.50% of the Fund’s ‘‘pre-incentive fee net investment income’’ for the immediately preceding fiscal quarter, and is subject to a hurdle rate, expressed as a rate of return on the Fund’s net assets, equal to 1.875% per quarter, or an annualized hurdle rate of 7.50%, subject to a ‘‘catch-up’’ feature. The amount presented in this table has been restated to reflect the Incentive Fee the Advisor would have earned during the fiscal year ended September 30, 2024 under the now current incentive fee arrangement. |

| 3. | Other Expenses include acquired fund fees and expenses of 0.01%. |

| 4. | The actual amount of interest expense borne by the Fund will vary over time in accordance with the level of the Fund’s use of borrowings and variations in market interest rates. |

| 5. | The Advisor and the Fund have entered into an expense limitation and reimbursement agreement (the “Expense Limitation Agreement”) under which the Advisor has contractually agreed to waive the base management fees and/or reimburse the Fund for ordinary operating expenses the Fund incurs but only to the extent necessary to maintain the Fund’s total annual operating expenses after fee waivers and/or reimbursement (exclusive of any incentive fee, taxes, interest, brokerage commissions, and extraordinary expenses, such as litigation or reorganization costs, but inclusive of organizational costs and offering costs), to the extent that such expenses exceed 2.10% per annum of the Fund’s average daily net assets attributable to Class A shares (the “Expense Limitation”). For the avoidance of doubt, acquired fund fees and expenses are not operating costs and are therefore excluded from the Expense Limitation. In consideration of the Advisor’s agreement to limit the Fund’s expenses, the Fund has agreed to repay the Advisor in the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: any waiver or reimbursement by the Advisor is subject to repayment by the Fund within the three years following the date the waiver or reimbursement occurred (provided the Advisor continues to serve as investment adviser to the Fund), if the Fund is able to make the repayment without exceeding the expense limitation then in effect or in effect at the time of the waiver and the repayment is approved by the Board. The Expense Limitation Agreement will remain in effect at least until January 31, 2026, unless and until the Board approves its modification or termination. After January 31, 2026, the Expense Limitation Agreement may be renewed at the Advisor’s and Board’s discretion. See “Management of the Fund.” |

| IV. | The “Base Management Fee and Incentive Fee” section in the Prospectus is replaced with the following: |

Base Management Fee and Incentive Fee

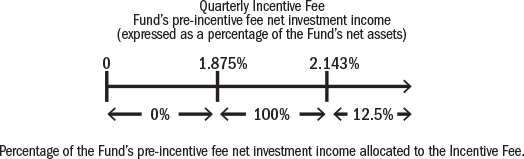

The base management fee is calculated and payable monthly in arrears at the annual rate of 1.25% of the average value of the Fund’s daily net assets during such period. The base management fee is calculated at the Fund-level and not based on the performance of a specific class. The incentive fee is calculated and payable quarterly in arrears in an amount equal to 12.50% of the Fund’s “pre-incentive fee net investment income” for the immediately preceding quarter, and is subject to a hurdle rate, expressed as a rate of return on the Fund’s net assets, equal to 1.875% per quarter (or an annualized hurdle rate of 7.50%), subject to a “catch-up” feature, which allows the Advisor to recover foregone incentive fees that were previously limited by the hurdle rate. For these purposes, “pre-incentive fee net investment income” means interest income, dividend income and any other income accrued during the calendar quarter, minus the Fund’s quarterly operating expenses (including the management fee, expenses reimbursed to the Advisor and any interest expenses and distributions paid on any issued and outstanding preferred shares, but excluding the incentive fee). The incentive fee is calculated at the Fund-level and not based on the performance of a specific class. The calculation of the incentive fee on pre-incentive fee net investment income for each quarter is as follows:

| ● | No incentive fee is payable in any calendar quarter in which the Fund’s pre-incentive fee net investment income does not exceed the hurdle rate of 1.875% per quarter (or an annualized rate of 7.50%); |

| ● | 100% of the Fund’s pre-incentive fee net investment income, if any, that exceeds the hurdle rate but is less than or equal to 2.143% (the “Catch-Up”). The Catch-Up is intended to provide the Advisor with an incentive fee of 12.50% on all of the Fund’s pre-incentive fee net investment income when its pre-incentive fee net investment income reaches 2.143% in any calendar quarter; and |

| ● | 12.50% of the amount of the Fund’s pre-incentive fee net investment income, if any, that exceeds 2.50% in any calendar quarter (8.571% annualized) is payable to the Advisor once the hurdle rate is reached and the Catch-Up is achieved (12.50% of all pre-incentive fee net investment income thereafter will be allocated to the Advisor). |

The following is a graphical representation of the calculation of the Incentive Fee:

These calculations will be appropriately prorated for any period of less than three months.

| V. | The fourth paragraph of the “Fund Fees and Expenses” section in the Prospectus is replaced with the following: |

The Advisor and the Fund have entered into an expense limitation and reimbursement agreement (the “Expense Limitation Agreement”) under which the Advisor has contractually agreed to waive the base management fees and/or reimburse the Fund for ordinary operating expenses the Fund incurs but only to the extent necessary to maintain the Fund’s total annual operating expenses after fee waivers and/or reimbursement (exclusive of any incentive fee, taxes, interest, brokerage commissions, and extraordinary expenses, such as litigation or reorganization costs, but inclusive of organizational costs and offering costs), to the extent that such expenses exceed 2.10% per annum of the Fund’s average daily net assets attributable to Class A shares (the “Expense Limitation”). For the avoidance of doubt, acquired fund fees and expenses are not operating costs and are therefore excluded from the Expense Limitation. In consideration of the Advisor’s agreement to limit the Fund’s expenses, the Fund has agreed to repay the Advisor in the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: any waiver or reimbursement by the Advisor is subject to repayment by the Fund within the three years following the date the waiver or reimbursement occurred (provided the Advisor continues to serve as investment adviser to the Fund), if the Fund is able to make the repayment without exceeding the expense limitation then in effect or in effect at the time of the waiver and the repayment is approved by the Board of Trustees (the “Board”). The Expense Limitation Agreement will remain in effect at least until January 31, 2026, unless and until the Board approves its modification or termination. After January 31, 2026, the Expense Limitation Agreement may be renewed at the Advisor’s and Board’s discretion. See “Management of the Fund.”

| VI. | The descriptions of the advisory fee, performance fee and expense limitation agreement in the Statement of Additional Information are hereby amended by the foregoing descriptions effective January 1, 2025. |

This Supplement and the Prospectus dated February 1, 2024 provide relevant information for all shareholders and should be retained for future reference. The Prospectus has been filed with the Securities and Exchange Commission, is incorporated by reference and can be obtained without charge by calling the Fund at 1-844-819-8287.