. T

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

| |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

OR

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______ to ______

Commission File Number: 333-265588

J.P. Morgan Real Estate Income Trust, Inc.

(Exact Name of Registrant as Specified in its Charter)

| |

Maryland | 87-3439916 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer

Identification No.) |

277 Park Avenue 9th Floor New York, New York | 10172 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (212) 270-6000

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

None | | N/A | | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer |

| ☐ |

| Accelerated filer |

| ☐ |

Non-accelerated filer |

| ☒ |

| Smaller reporting company |

| ☒ |

Emerging growth company | | ☒ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 9, 2023, the registrant had 426,458 shares of Class D common stock, 5,144,522 shares of Class I common stock, 54,212 shares of Class S common stock and 6,949,873 shares of Class E common stock $0.01 par value per share. There were no outstanding shares of Class T common stock.

Table of Contents

i

Item 1. Financial Statements.

J.P. Morgan Real Estate Income Trust, Inc.

Consolidated Balance Sheets (Unaudited)

(in thousands, except per share data)

| | | | | | | | |

| | September 30, | | | December 31, | |

| | 2023 | | | 2022 | |

ASSETS | | | | | | |

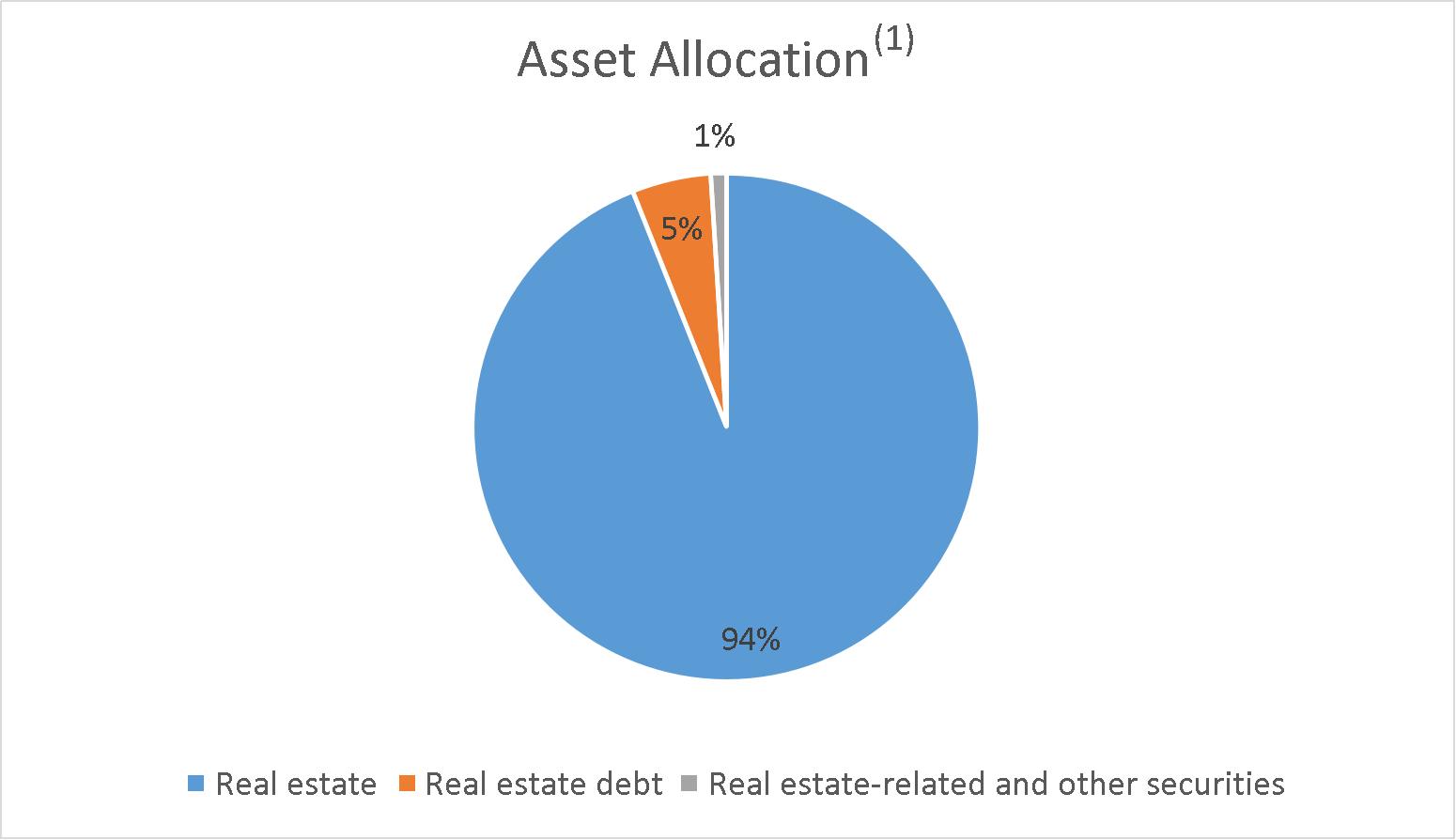

Investments in real estate, net | | $ | 263,727 | | | $ | 199,429 | |

Investment in real estate debt | | | 16,825 | | | | 16,825 | |

Investments in real estate-related and other securities | | | 2,163 | | | | 1,842 | |

Intangible assets, net | | | 9,693 | | | | 3,767 | |

Cash and cash equivalents | | | 23,601 | | | | 5,660 | |

Restricted cash | | | 197 | | | | 128 | |

Deposits on real estate | | | — | | | | 5,494 | |

Other assets, net | | | 902 | | | | 1,167 | |

Total assets | | $ | 317,108 | | | $ | 234,312 | |

LIABILITIES AND EQUITY | | | | | | |

Credit facility | | $ | — | | | $ | 40,200 | |

Mortgage notes, net | | | 113,624 | | | | 113,760 | |

Intangible liabilities, net | | | 1,714 | | | | 1,800 | |

Mandatorily redeemable instruments | | | 97,079 | | | | 45,784 | |

Due to affiliate | | | 14,054 | | | | 9,970 | |

Accounts payable, accrued expenses and other liabilities | | | 3,863 | | | | 4,852 | |

Total liabilities | | $ | 230,334 | | | $ | 216,366 | |

| | | | | | |

Commitments and Contingencies (Note 17) | | | | | | |

| | | | | | |

Equity | | | | | | |

Common stock- Class D shares, $0.01 par value per share, 600,000 shares authorized, and 324 and 0 issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | | $ | 3 | | | $ | — | |

Common stock- Class I shares, $0.01 par value per share, 600,000 shares authorized, and 4,334 and 57 issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | | | 43 | | | | 1 | |

Common stock- Class S shares, $0.01 par value per share, 600,000 shares authorized, and 54 and 0 issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | | | 1 | | | | — | |

Common stock- Class T shares, $0.01 par value per share, 600,000 shares authorized, and 0 issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | | | — | | | | — | |

Common stock- Class E shares, $0.01 par value per share, 600,000 shares authorized, and 5,640 and 2,361 issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | | | 56 | | | | 24 | |

Preferred stock- $0.01 par value per share, 100,000 shares authorized, 0 issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | | | — | | | | — | |

Additional paid-in capital | | | 101,742 | | | | 19,427 | |

Accumulated deficit | | | (17,204 | ) | | | (3,814 | ) |

Total stockholders' equity | | $ | 84,641 | | | $ | 15,638 | |

Non-controlling interests in consolidated joint ventures | | | 2,133 | | | | 2,308 | |

Total equity | | $ | 86,774 | | | $ | 17,946 | |

Total liabilities and equity | | $ | 317,108 | | | $ | 234,312 | |

The accompanying notes are an integral part of these consolidated financial statements.

2

J.P. Morgan Real Estate Income Trust, Inc.

Consolidated Statements of Operations (Unaudited)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | |

| | September 30, | | | September 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

Revenues | | | | | | | | | | | | |

Rental revenue | | $ | 4,774 | | | $ | — | | | $ | 12,634 | | | $ | — | |

Total revenues | | | 4,774 | | | | — | | | | 12,634 | | | | — | |

Expenses | | | | | | | | | | | | |

Rental property operating | | | 1,468 | | | | — | | | | 3,826 | | | | — | |

General and administrative | | | 989 | | | | 1,527 | | | | 3,274 | | | | 1,528 | |

Depreciation and amortization | | | 1,674 | | | | 4 | | | | 6,044 | | | | 4 | |

Total expenses | | | 4,131 | | | | 1,531 | | | | 13,144 | | | | 1,532 | |

Other income (expense), net | | | | | | | | | | | | |

Income from investment in real estate debt | | | 447 | | | | 105 | | | | 1,287 | | | | 105 | |

Loss from investments in real estate-related and other securities | | | (318 | ) | | | — | | | | (366 | ) | | | — | |

Mandatorily redeemable instruments interest costs | | | (1,376 | ) | | | (27 | ) | | | (6,045 | ) | | | (27 | ) |

Interest expense | | | (1,708 | ) | | | (55 | ) | | | (5,632 | ) | | | (55 | ) |

Other income (expenses), net | | | 114 | | | | (152 | ) | | | (11 | ) | | | (153 | ) |

Total other income (expense), net | | | (2,841 | ) | | | (129 | ) | | | (10,767 | ) | | | (130 | ) |

Net loss | | $ | (2,198 | ) | | $ | (1,660 | ) | | $ | (11,277 | ) | | $ | (1,662 | ) |

Net loss attributable to non-controlling interests in consolidated joint ventures | | | (10 | ) | | | — | | | | (89 | ) | | | — | |

Net loss attributable to JPMREIT stockholders | | $ | (2,188 | ) | | $ | (1,660 | ) | | $ | (11,188 | ) | | $ | (1,662 | ) |

Net loss per share of common stock - basic and diluted | | $ | (0.23 | ) | | $ | (1.79 | ) | | $ | (1.63 | ) | | $ | (4.74 | ) |

Weighted-average shares of common stock outstanding - basic and diluted | | | 9,488 | | | | 928 | | | | 6,860 | | | | 351 | |

The accompanying notes are an integral part of these consolidated financial statements.

3

J.P. Morgan Real Estate Income Trust, Inc.

Consolidated Statement of Changes in Equity (Unaudited)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Par Value | | | | | | | | | | | |

| Common Stock Class D | | Common Stock Class I | | Common Stock Class S | | Common Stock Class T | | Common Stock Class E | | Additional Paid-In Capital | | Accumulated Deficit | | Total Stockholder's Equity | | Non-Controlling Interests | | Total Equity | |

Balance at December 31, 2022 | $ | — | | $ | 1 | | $ | — | | $ | — | | $ | 24 | | $ | 19,426 | | $ | (3,813 | ) | $ | 15,638 | | $ | 2,308 | | $ | 17,946 | |

Net loss | | — | | | — | | | — | | | — | | | — | | | — | | | (6,418 | ) | | (6,418 | ) | | (53 | ) | | (6,471 | ) |

Common stock issued | | 1 | | | 17 | | | — | | | — | | | 7 | | | 24,827 | | | — | | | 24,852 | | | — | | | 24,852 | |

Distributions declared on common stock | | — | | | — | | | — | | | — | | | — | | | — | | | (400 | ) | | (400 | ) | | — | | | (400 | ) |

Distribution reinvestments | | — | | | — | | | — | | | — | | | — | | | 60 | | | — | | | 60 | | | — | | | 60 | |

Distributions to non-controlling interests | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (4 | ) | | (4 | ) |

Offering costs | | — | | | — | | | — | | | — | | | — | | | (200 | ) | | — | | | (200 | ) | | — | | | (200 | ) |

Stock based compensation | | — | | | — | | | — | | | — | | | — | | | 25 | | | — | | | 25 | | | — | | | 25 | |

Balance at March 31, 2023 | $ | 1 | | $ | 18 | | $ | — | | $ | — | | $ | 31 | | $ | 44,138 | | $ | (10,631 | ) | $ | 33,557 | | $ | 2,251 | | $ | 35,808 | |

Net loss | | — | | | — | | | — | | | — | | | — | | | — | | | (2,582 | ) | | (2,582 | ) | | (26 | ) | | (2,608 | ) |

Common stock issued | | 1 | | | 12 | | | — | | | — | | | 13 | | | 29,104 | | | — | | | 29,130 | | | — | | | 29,130 | |

Distributions declared on common stock | | — | | | — | | | — | | | — | | | — | | | — | | | (760 | ) | | (760 | ) | | — | | | (760 | ) |

Distribution reinvestments | | — | | | — | | | — | | | — | | | — | | | 104 | | | — | | | 104 | | | — | | | 104 | |

Distributions to non-controlling interests | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (43 | ) | | (43 | ) |

Offering costs | | — | | | — | | | — | | | — | | | — | | | (326 | ) | | — | | | (326 | ) | | — | | | (326 | ) |

Stock based compensation | | — | | | — | | | — | | | — | | | — | | | 25 | | | — | | | 25 | | | — | | | 25 | |

Balance at June 30, 2023 | $ | 2 | | $ | 30 | | $ | — | | $ | — | | $ | 44 | | $ | 73,045 | | $ | (13,973 | ) | $ | 59,148 | | $ | 2,182 | | $ | 61,330 | |

Net loss | | — | | | — | | | — | | | — | | | — | | | — | | | (2,188 | ) | | (2,188 | ) | | (10 | ) | | (2,198 | ) |

Common stock issued | | 1 | | | 14 | | | 1 | | | — | | | 12 | | | 28,898 | | | — | | | 28,926 | | | — | | | 28,926 | |

Distributions declared on common stock | | — | | | — | | | — | | | — | | | — | | | — | | | (1,043 | ) | | (1,043 | ) | | — | | | (1,043 | ) |

Distribution reinvestments | | — | | | — | | | — | | | — | | | — | | | 176 | | | — | | | 176 | | | — | | | 176 | |

Distributions to non-controlling interests | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (39 | ) | | (39 | ) |

Common stock repurchased | | — | | | (1 | ) | | — | | | — | | | — | | | (98 | ) | | — | | | (99 | ) | | — | | | (99 | ) |

Offering costs | | — | | | — | | | — | | | — | | | — | | | (298 | ) | | — | | | (298 | ) | | — | | | (298 | ) |

Stock based compensation | | — | | | — | | | — | | | — | | | — | | | 19 | | | — | | | 19 | | | — | | | 19 | |

Balance at September 30, 2023 | $ | 3 | | $ | 43 | | $ | 1 | | $ | — | | $ | 56 | | $ | 101,742 | | $ | (17,204 | ) | $ | 84,641 | | $ | 2,133 | | $ | 86,774 | |

4

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Par Value | | | | | | | | | | | |

| Common Stock Class D | | Common Stock Class I | | Common Stock Class S | | Common Stock Class T | | Common Stock Class E | | Additional Paid-In Capital | | Accumulated Deficit | | Total Stockholder's Equity | | Non-Controlling Interests | | Total Equity | |

Balance at December 31, 2021 | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 200 | | $ | — | | $ | 200 | | $ | — | | $ | 200 | |

Net loss(1) | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Balance at March 31, 2022 | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 200 | | $ | — | | $ | 200 | | $ | — | | $ | 200 | |

Net loss(1) | | — | | | — | | | — | | | — | | | — | | | — | | | (2 | ) | | (2 | ) | | — | | | (2 | ) |

Common stock issued | | — | | | — | | | — | | | — | | | 9 | | | 9,073 | | | — | | | 9,082 | | | — | | | 9,082 | |

Balance at June 30, 2022 | $ | — | | $ | — | | $ | — | | $ | — | | $ | 9 | | $ | 9,273 | | $ | (2 | ) | $ | 9,280 | | $ | — | | $ | 9,280 | |

Net loss | | — | | | — | | | — | | | — | | | — | | | — | | | (1,660 | ) | | (1,660 | ) | | — | | | (1,660 | ) |

Offering costs | | — | | | — | | | — | | | — | | | — | | | (4,820 | ) | | — | | | (4,820 | ) | | — | | | (4,820 | ) |

Stock based compensation | | — | | | — | | | — | | | — | | | — | | 19 | | | — | | | 19 | | | — | | | 19 | |

Balance at September 30, 2022 | $ | — | | $ | — | | $ | — | | $ | — | | $ | 9 | | $ | 4,472 | | $ | (1,662 | ) | $ | 2,819 | | $ | — | | $ | 2,819 | |

(1) J.P. Morgan Real Estate Income Trust, Inc. was formed on November 5, 2021 and commenced operations on September 2, 2022, accordingly, there were minimal operations during the three months ended March 31, 2022 and June 30, 2022.

The accompanying notes are an integral part of these consolidated financial statements.

5

J.P. Morgan Real Estate Income Trust, Inc.

Consolidated Statement of Cash Flows (Unaudited) (in thousands)

| | | | | | | | |

| | Nine Months Ended September 30, | |

| | 2023 | | | 2022 | |

Cash flow from operating activities: | | | | | | |

Net loss | | $ | (11,277 | ) | | $ | (1,662 | ) |

| | | | | | |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | |

Depreciation and amortization | | | 6,044 | | | | — | |

Amortization of above market lease | | | 59 | | | | — | |

Amortization of below market lease | | | (89 | ) | | | — | |

Amortization of deferred financing costs | | | 570 | | | | 39 | |

Stock based compensation | | | 69 | | | | 19 | |

Amortization of deferred expense | | | — | | | | 4 | |

Realized loss on sale of real estate related and other securities | | | 654 | | | | — | |

Unrealized loss on treasury note futures contracts | | | 209 | | | | — | |

Unrealized gain on real estate-related and other securities | | | (80 | ) | | | — | |

Redemption value adjustment on mandatorily redeemable instruments | | | 4,138 | | | | 27 | |

Change in assets and liabilities: | | | | | | |

Increase in other assets | | | (280 | ) | | | (354 | ) |

Increase in due to affiliates | | | 3,212 | | | | 1,727 | |

Increase/(decrease) in accounts payable, accrued expenses and other liabilities | | | (2,307 | ) | | | 275 | |

Net cash provided by operating activities | | | 922 | | | | 75 | |

| | | | | | |

Cash flow from investing activities: | | | | | | |

Acquisitions of real estate | | | (67,312 | ) | | | — | |

Capital improvements on real estate | | | (891 | ) | | | — | |

Deposits on real estate acquisition | | | (3,054 | ) | | | (9,436 | ) |

Return of deposits on real estate acquisition | | | 1,800 | | | | — | |

Purchase of investment in real estate debt | | | — | | | | (16,825 | ) |

Variation margin payments | | | (249 | ) | | | — | |

Proceeds from real estate-related and other securities | | | 4,438 | | | | — | |

Purchases of real-estate related and other securities | | | (5,332 | ) | | | — | |

Net cash used in investing activities | | | (70,600 | ) | | | (26,261 | ) |

| | | | | | |

Cash flows from financing activities: | | | | | | |

Proceeds from issuance of common stock | | | 82,869 | | | | 9,082 | |

Repurchase of common stock | | | (99 | ) | | | — | |

Proceeds from issuance of mandatorily redeemable instruments | | | 47,157 | | | | 15,768 | |

Distributions paid on common stock | | | (1,551 | ) | | | — | |

Distributions to non-controlling interests | | | (86 | ) | | | — | |

Proceeds from credit facility | | | — | | | | 4,000 | |

Repayments of credit facility | | | (40,200 | ) | | | — | |

Payment of deferred financing costs on secured credit facility | | | (29 | ) | | | (130 | ) |

Principal repayments of mortgage notes | | | (366 | ) | | | — | |

Payment of deferred financing costs on mortgage notes | | | (7 | ) | | | — | |

Net cash provided by financing activities | | | 87,688 | | | | 28,720 | |

| | | | | | |

Net change in cash, cash equivalents and restricted cash: | | | 18,010 | | | | 2,534 | |

Cash, cash equivalents and restricted cash, at the beginning of the period | | | 5,788 | | | | 200 | |

Cash, cash equivalents and restricted cash, at the end of the period | | $ | 23,798 | | | $ | 2,734 | |

6

J.P. Morgan Real Estate Income Trust, Inc.

Consolidated Statement of Cash Flows (Unaudited) (in thousands)

| | | | | | | | |

| | Nine Months Ended September 30, | |

| | 2023 | | | 2022 | |

Reconciliation of cash, cash equivalents and restricted cash to the Consolidated Balance Sheets: | | | | | | |

Cash and cash equivalents | | $ | 23,601 | | | $ | 2,734 | |

Restricted cash | | | 197 | | | | — | |

Total cash, cash equivalents and restricted cash | | $ | 23,798 | | | $ | 2,734 | |

| | | | | | |

Supplemental disclosure of cash flow information: | | | | | | |

Cash paid for interest | | $ | 5,274 | | | $ | — | |

| | | | | | |

Supplemental disclosure of non-cash investing and financing activities: | | | | | | |

Assumption of working capital in conjunction with acquisition in real estate | | $ | 1,568 | | | $ | — | |

Accrued offering costs due to affiliate | | $ | 785 | | | $ | 4,820 | |

Accrued loan costs due to affiliate | | $ | 7 | | | $ | 354 | |

Accrued distributions | | $ | 312 | | | $ | — | |

Distribution re-investments | | $ | 340 | | | $ | — | |

Accrued acquisition costs | | $ | 36 | | | $ | 1,369 | |

Accrued deposits on real estate acquisitions | | $ | — | | | $ | 250 | |

Accrued capex | | $ | 118 | | | $ | — | |

Reclassification of deposits of real estate to investments in real estate, net | | $ | 6,748 | | | $ | — | |

Reclassfication of pre-acquisition costs to investments in real estate, net | | $ | 216 | | | $ | — | |

Accrued stockholder servicing fee due to affiliate | | $ | 37 | | | $ | — | |

The accompanying notes are an integral part of these consolidated financial statements.

7

J.P. Morgan Real Estate Income Trust, Inc.

Notes to Consolidated Financial Statements (Unaudited)

September 30, 2023

1. Organization and Business Purpose

J.P. Morgan Real Estate Income Trust, Inc. (the “Company” or "JPMREIT") was formed on November 5, 2021 as a Maryland corporation and intends to qualify as a real estate investment trust (“REIT”) for U.S. federal income tax purposes. The Company invests primarily in stabilized, income-generating real estate properties, and to a lesser extent, real estate debt, real estate-related securities and other securities. The Company is the sole general partner of J.P. Morgan REIT Operating Partnership, L.P., a Delaware limited partnership (“JPMREIT OP” or “Operating Partnership”). J.P. Morgan REIT OP Special Limited Partner, L.P. (the “Special Limited Partner”), an affiliate of J.P. Morgan Investment Management Inc. (the “Adviser” or “JPMIM” and together with its affiliates “J.P. Morgan”), owns a special limited partner interest in JPMREIT OP. Substantially all of the Company’s business is conducted through JPMREIT OP. The Company and JPMREIT OP are externally managed by JPMIM.

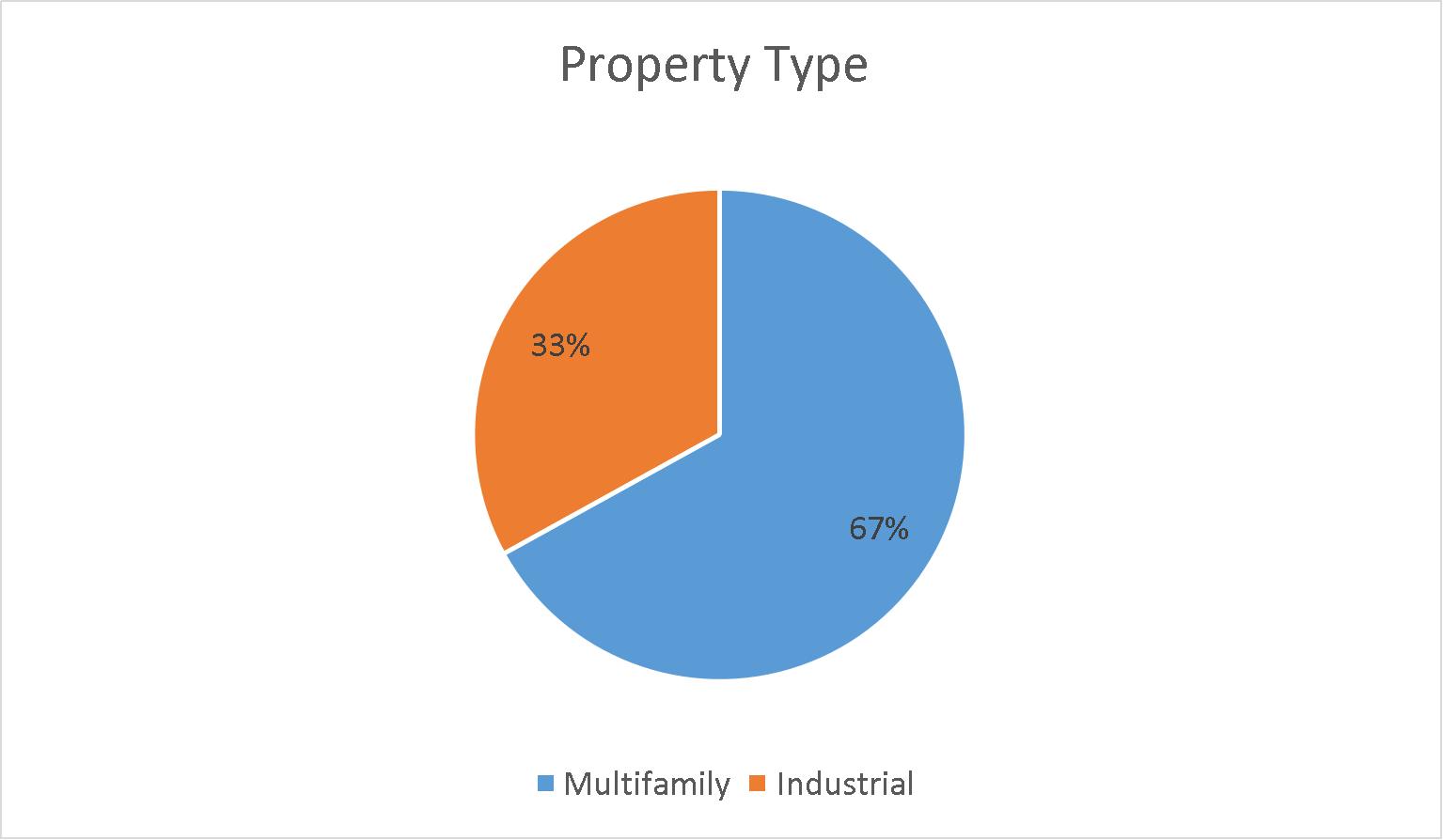

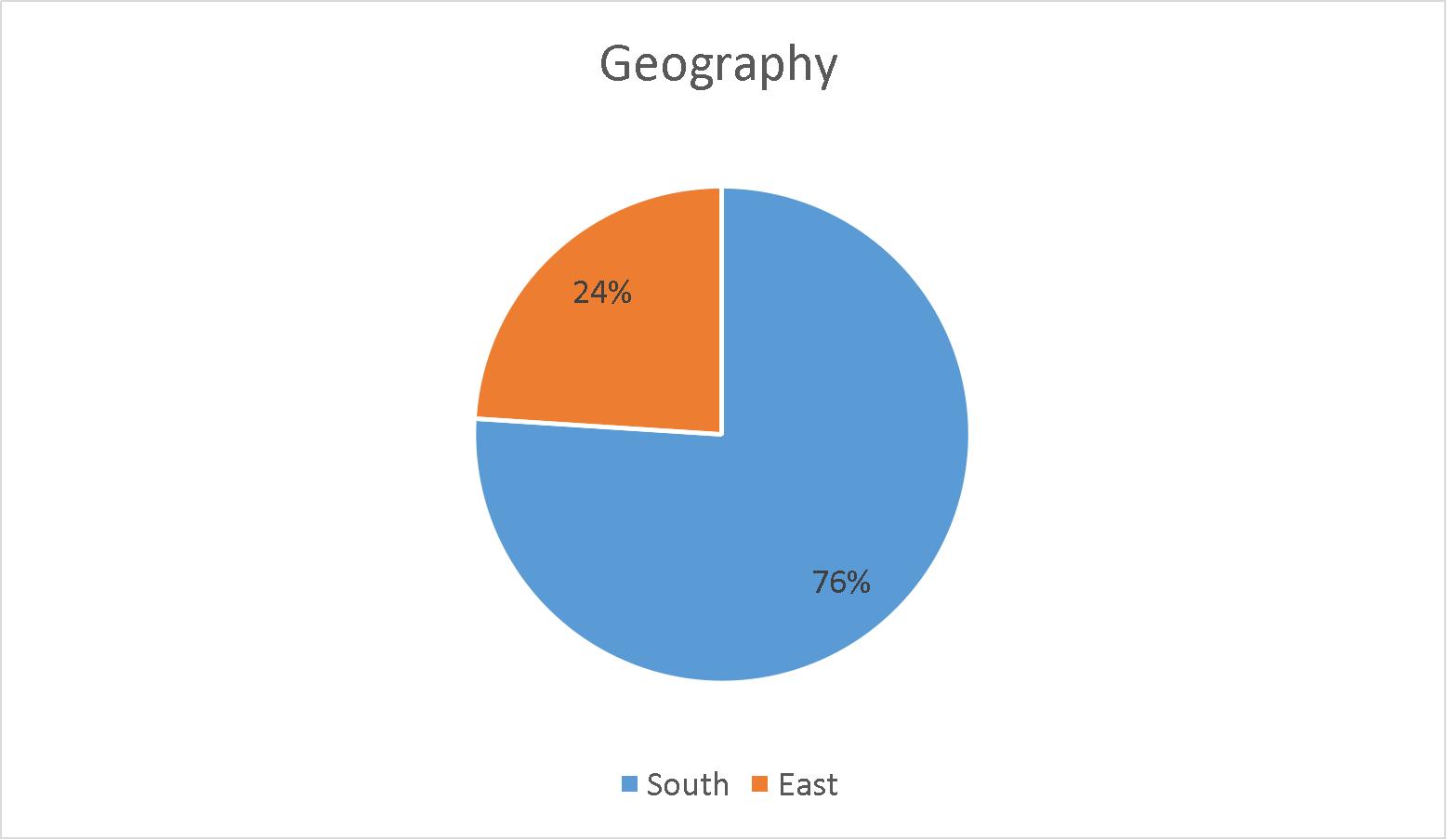

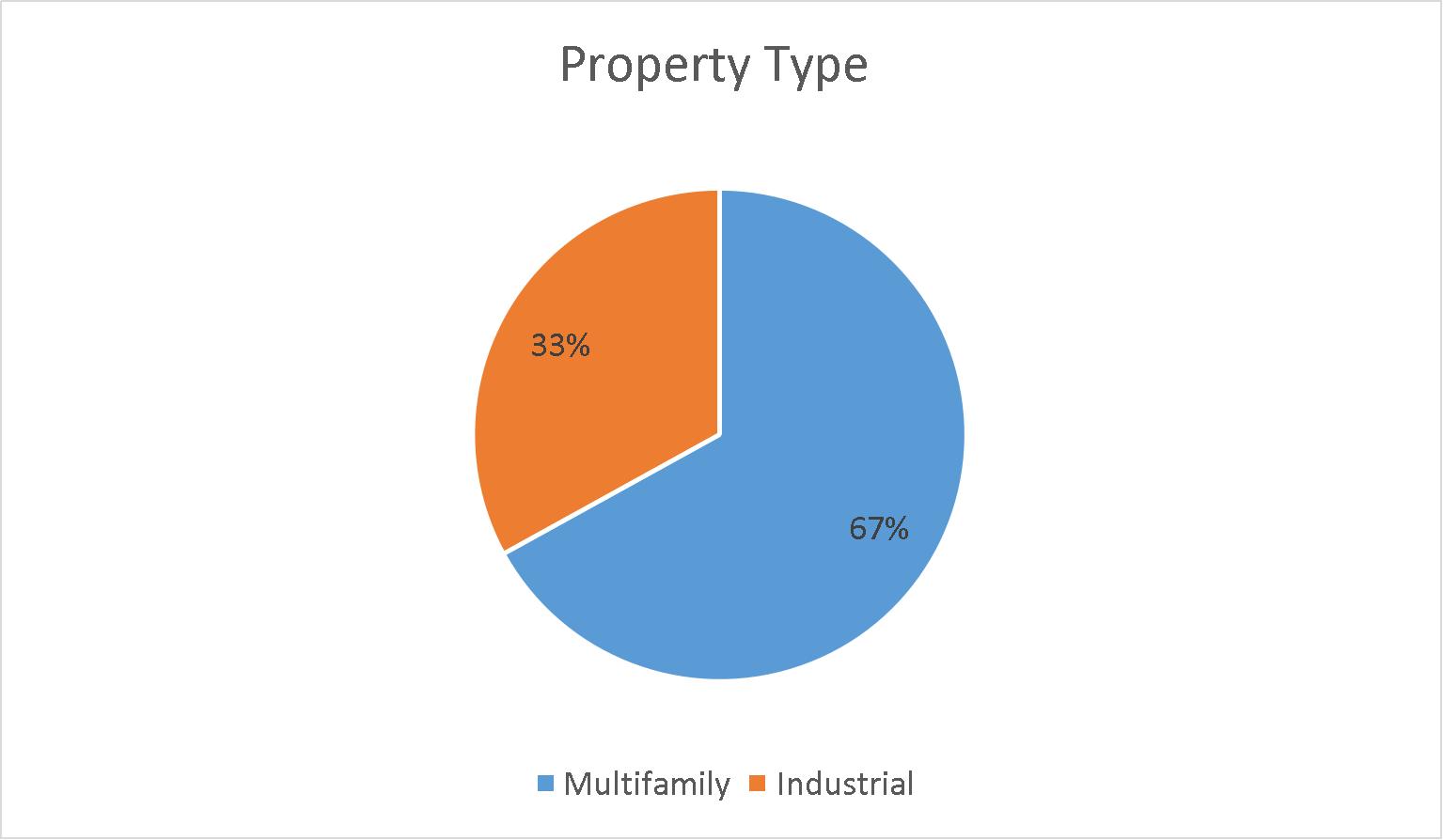

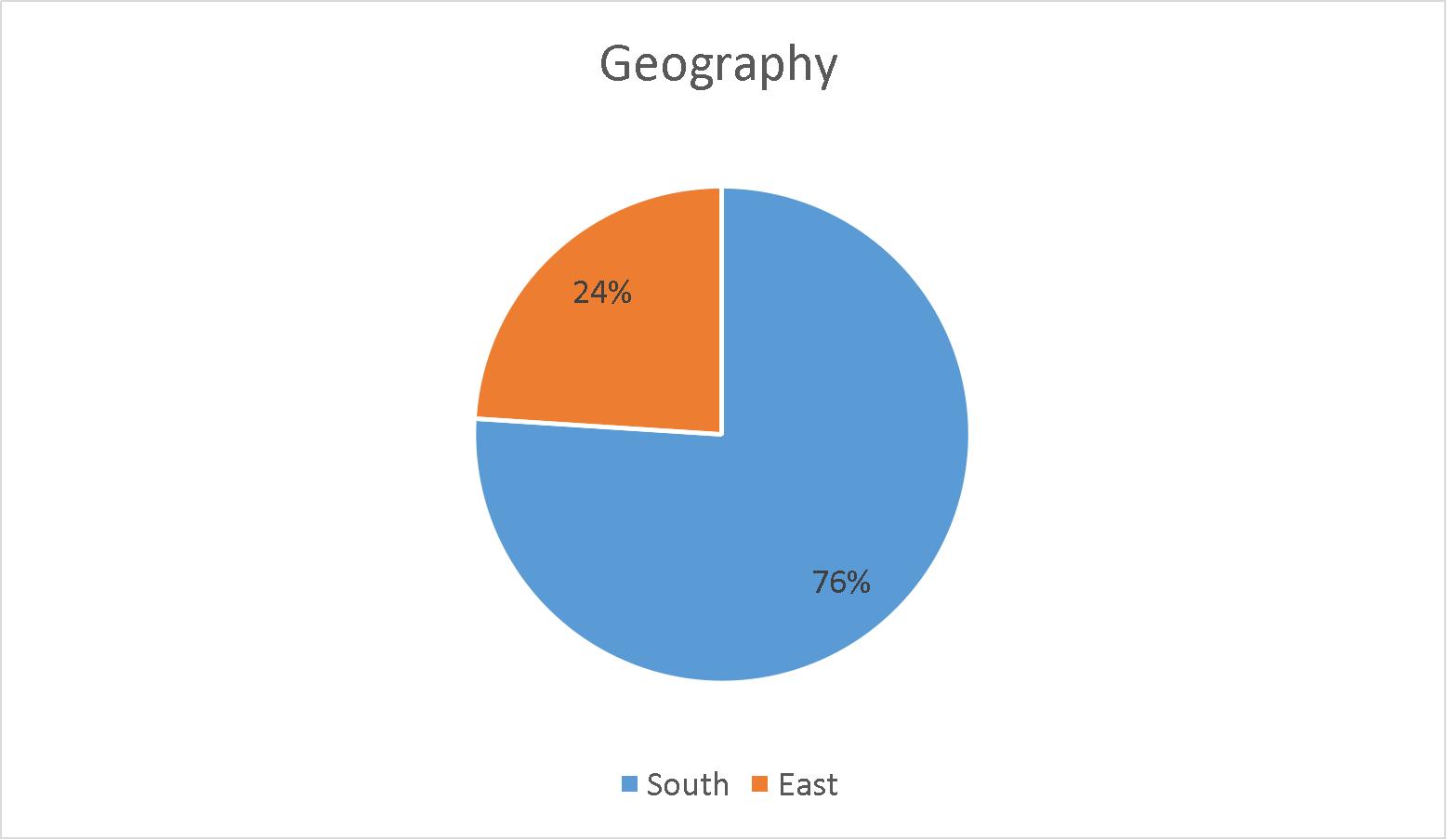

As of September 30, 2023, the Company owned five real estate properties consisting of three multifamily properties and two industrial properties. The Company also owned one position in a real estate debt investment, an investment in a real estate-related security as well as an investment in a U.S Treasury bond. The Company currently operates in three reportable segments: multifamily, industrial, and investments in real estate debt, real estate-related and other securities. See Note 15 for a description of the Company's segment reporting.

2. Capitalization

On July 6, 2022, the Company filed a Registration Statement on Form S-11 to register with the Securities and Exchange Commission ("SEC") an offering of up to $5.0 billion in shares of common stock, consisting of up to $4.0 billion in shares in its primary offering and up to $1 billion in shares pursuant to its distribution reinvestment plan (the “Offering”). The Registration Statement on Form S-11 related to the Offering was declared effective by the SEC on July 22, 2022. The Company is selling any combination of four classes of shares of its common stock, Class D shares, Class I shares, Class S shares and Class T shares, with a dollar value up to the maximum offering amount. The share classes have different upfront selling commissions and ongoing stockholder servicing fees. The initial per share purchase price for the Company’s shares of common stock sold in its primary offering will be equal to the most recently determined net asset value (“NAV”) per share for the Class E common stock sold in the Company’s private offering (which is deemed to be $10.00 until the last calendar day of the month during which the Company makes its first investment), plus, for Class T shares, Class S shares and Class D shares only, applicable upfront selling commissions and dealer manager fees. Thereafter, the purchase price per share for each class of the Company’s common stock will vary and will generally equal the prior month’s NAV of the Company per share for such class, as determined monthly, plus any applicable upfront selling commissions and dealer manager fees.

On November 15, 2021, the Company was capitalized with a $0.2 million investment by the Adviser in exchange for 20,000 shares of the Company’s Class E common stock. The Adviser has agreed to not sell, transfer or dispose of the shares to any party other than an affiliate of the Adviser for so long as the Adviser or its affiliate performs an advisory function for the Company.

Pursuant to a separate private offering, JPMIM agreed to purchase $25 million in Class E common stock, par value $0.01 per share (“Class E shares”) or Class E units of the Operating Partnership (“Class E units”), or a combination thereof, and up to an additional $75 million in Class E shares or Class E units. JPMIM's commitment to purchase such Class E shares and Class E units from the Company expired in August 2023 and as of September 30, 2023, JPMIM has purchased 369,693 Class E shares and 8,515,771 Class E units. As of September 30, 2023, the Company has received $162.1 million in commitments to purchase shares of its common stock and units in the Operating Partnership (“Operating Partnership units”), including the shares and units to be purchased by JPMIM, and has sold $53.2 million in Class E shares and $88.7 million in Class E units from such commitments (collectively, the “Initial Capitalization”). The Company is not required to call all of the capital commitments made by investors pursuant to the Initial Capitalization prior to their expiration. In addition, the Company sold $2.6 million in Class E shares to employees of the Adviser.

8

JPMIM has agreed to hold all of the Class E shares and Class E units it purchases pursuant to its capital commitment as part of the Initial Capitalization (the “JPM Initial Capitalization”) until the earlier of (i) the first date that the Company’s NAV reaches $1.5 billion and (ii) July 22, 2025, the third anniversary of the commencement of the Offering. Following such date, each month the Company will repurchase, without further action by JPMIM (each, a “JPM Mandatory Repurchase”) (see Note 13), a number of Class E shares or Class E units from JPMIM in an amount equal to the amount available under the Company’s share repurchase plan’s 2% monthly and 5% quarterly caps after satisfying repurchase requests from investors who purchase shares pursuant to the Offering and other holders of shares that are otherwise subject to repurchase under the Company’s share repurchase plan, until such time as the JPM Initial Capitalization has been fully repurchased; provided, that the number of shares subject to each JPM Mandatory Repurchase may be reduced where other holders of the Company’s Class E shares that were issued pursuant to the Initial Capitalization and are not subject to repurchase under the Company’s share repurchase plan request repurchase of their shares, in which case the Class E shares held by JPMIM and such other investors will be repurchased on a pro rata basis based on their respective percentage ownership in the Company immediately prior to such repurchase (not to exceed an aggregate number of shares equal to the amount available under the Company’s share repurchase plan’s 2% monthly and 5% quarterly caps). Notwithstanding the foregoing, the Company will not affect any JPM Mandatory Repurchase during any month in which the full amount of all shares requested to be repurchased by stockholders other than JPMIM under the Company’s share repurchase plan is not repurchased or when the Company’s share repurchase plan has been suspended.

In addition, subject to certain exceptions, where the shares of the Company’s common stock and Operating Partnership units owned by the Adviser, together with any such shares and units owned by the Adviser and its affiliates, including any shares or units issued in lieu of cash management fees payable to the Adviser or the performance participation payable to the Special Limited Partner (such aggregate ownership, the “JPM Interest”) represent a 24.99% or lesser interest in the Company, the Company will, or will cause the JPMREIT OP to, automatically and without further action by the Adviser, repurchase or redeem, as applicable, an amount of shares or units from the Adviser as may be necessary to cause the JPM Interest to remain equal to or less than 24.99% (each such repurchase or redemption, a “JPM Regulatory Repurchase”). To the extent the Adviser elects to receive its management fee in shares of the Company’s common stock or Operating Partnership units, the Company may repurchase those shares or units without regard to the limitations described above or the early repurchase deduction.

On May 26, 2022, JPMIM’s Subscription Agreement dated February 23, 2022 for Class E shares or Class E units was amended to provide that, if the Company receives capital commitments from investors in the private placement of Class E shares exceeding $100 million (“Other Seed Investor Commitments”), JPMIM’s commitment may, in JPMIM’s discretion, be reduced by an amount equal to (i) the aggregate amount of Other Seed Investor Commitments, minus (ii) $100 million, provided that such reduction amount will not exceed $75 million. The amendment to the Subscription Agreement also provided that the expiration of the JPMIM commitment was August 23, 2023, which was the 18-month anniversary of the date of the Subscription Agreement; provided, that following such date JPMIM may, in its discretion, elect to purchase additional Class E shares or Class E units until the earlier to occur of (i) July 22, 2025, the three-year anniversary of the date that the Company’s Registration Statement on Form S-11 with respect to the Offering was declared effective by the SEC and (ii) the date that the Company’s NAV is at least $1.5 billion.

3. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited consolidated financial statements include the accounts of the Company, and in the opinion of management, include all necessary adjustments, consisting of only normal and recurring items, necessary for a fair statement of the Company’s financial position and results of operations for the interim period. These financial statements have been prepared by the Company in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and the applicable rules and regulations of the SEC. The accompanying unaudited consolidated interim financial statements should be read in conjunction with the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 29, 2023.

Certain amounts on the Company's three and nine months ended September 30, 2022 Consolidated Statements of Operations have been reclassified to conform to the current period presentation. Such reclassifications had no effect on net loss or previously reported totals or subtotals on the Consolidated Statements of Operations.

All intercompany balances and transactions have been eliminated in consolidation. The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the balance sheet. Actual results could differ from those estimates.

There is no other comprehensive income (loss) for the three and nine months ended September 30, 2023 and 2022, resulting in comprehensive loss equaling net loss. Accordingly, the statement of other comprehensive income (loss) is not presented.

9

From November 15, 2021 (date of the initial capitalization) through June 30, 2022, the Company had not commenced its principal operations and was focused on its formation and the registration of the Offering. The Offering commenced on July 22, 2022 and the Company commenced principal operations on September 2, 2022 with the acquisition of its first investment.

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of the Company and the Company’s subsidiaries in which the Company has a controlling interest. For consolidated joint ventures, the non-controlling partner’s share of the assets, liabilities and operations of the joint ventures is included in non-controlling interests on the Company's Consolidated Balance Sheets and Consolidated Statements of Operations. The non-controlling partner’s interest is generally computed as the joint venture partner’s ownership percentage.

In determining whether the Company has a controlling financial interest in a partially owned entity and the requirement to consolidate the accounts of that entity, the Company considers whether the entity is a variable interest entity ("VIE") and whether it is the primary beneficiary. The Company is the primary beneficiary of a VIE when it has (i) the power to direct the most significant activities impacting the economic performance of the VIE and (ii) the obligation to absorb losses or receive benefits significant to the VIE. Entities that do not qualify as VIEs are generally considered voting interest entities ("VOEs”) and are evaluated for consolidation under the voting interest model. VOEs are consolidated when the Company controls the entity through a majority voting interest or other means. When the requirements for consolidation are not met and the Company has significant influence over the operations of the entity, the investment is accounted for under the equity method of accounting. Equity method investments for which the Company has not elected a fair value option ("FVO”) are initially recorded at cost and subsequently adjusted for the Company’s pro-rata share of net income, contributions and distributions. When the Company elects the FVO, the Company records its share of net asset value of the entity and any related unrealized gains and losses.

The Operating Partnership is considered to be a VIE. The Company consolidates the Operating Partnership because it has the ability to direct the most significant activities of the entities such as purchases, dispositions, financings, budgets, and overall operating plans. Where the Company does not have the power to direct the activities of the VIE that most significantly impact its economic performance, the Company’s interest for those partially owned entities is accounted for using the equity method of accounting.

The Company holds an interest in two joint ventures that are each considered to be a VIE. The Company consolidated these entities because it has the ability to direct the most significant activities of the joint venture. The total assets and liabilities of the Company’s consolidated VIEs were $129.7 million and $87.6 million and $135.7 million and $89.5 million as of September 30, 2023 and December 31, 2022, respectively. Such amounts are included on the Company’s Consolidated Balance Sheets.

Cash and Cash Equivalents

Cash and cash equivalents represents cash held in banks, cash on hand, cash held in money market funds and liquid investments with original maturities of three months or less. The Company may have bank balances in excess of federally insured amounts; however, the Company deposits its cash and cash equivalents with high credit-quality institutions to minimize credit risk exposure. The Company held $21.9 million in cash equivalents (see Note 9) as of September 30, 2023 and did not hold any cash equivalents as of December 31, 2022.

Restricted Cash

Restricted cash primarily consists of amounts in escrow related to real estate taxes, insurance and utilities in connection with mortgages at certain of the Company’s properties.

Investments in Real Estate

The Company determines whether the acquisition of a property qualifies as a business combination, which requires that the assets acquired and liabilities assumed constitute a business. If the property acquired is not a business, the Company accounts for the transaction as an asset acquisition. All property acquisitions to date have been accounted for as asset acquisitions.

Whether the acquisition of a property acquired is considered a business combination or asset acquisition, the Company recognizes the identifiable tangible and intangible assets acquired, the liabilities assumed, and any non-controlling interest in the acquired entity. In addition, for transactions that are business combinations, the Company evaluates the existence of goodwill or a gain from a bargain purchase. The Company expenses acquisition-related costs associated with business combinations as they are incurred and capitalizes acquisition-related costs associated with asset acquisitions.

10

Upon the acquisition of a property deemed to be an asset acquisition, the Company assesses the fair value of acquired tangible and intangible assets (including land, buildings, tenant improvements, above-market and below-market leases, acquired in-place leases, other identified intangible assets and assumed liabilities) and allocates the purchase price to the acquired assets and assumed liabilities. The Company assesses and considers fair value based on estimated cash flow projections that utilize discount and/or capitalization rates that it deems appropriate, as well as other available market information. Estimates of future cash flows are based on a number of factors including the historical operating results, known and anticipated trends and market and economic conditions.

The fair value of the tangible assets of an acquired property considers the value of the property as if it were vacant. The Company also considers an allocation of purchase price of other acquired intangibles, including acquired in-place leases that may have a customer relationship intangible value, including (but not limited to) the nature and extent of the existing relationship with the tenants, the tenants’ credit quality and expectations of lease renewals.

The cost of buildings and improvements includes the purchase price of the Company’s properties and any acquisition-related costs, along with any subsequent capitalized improvements to such properties.

The Company’s investments in real estate are stated at cost and are generally depreciated on a straight-line basis over the estimated useful lives of the assets as follows:

| | |

Description | | Depreciable Life |

Buildings | | 40 years |

Site improvements - buildings and land | | 4-20 years |

Furniture, fixtures and equipment | | 6-11 years |

Lease intangibles | | Over lease term |

Repairs and maintenance are expensed to operations as incurred and are included in property operating expenses on the Company’s Consolidated Statement of Operations. Significant improvements to properties are capitalized. When assets are sold or retired, their costs and related accumulated depreciation are removed from the accounts with the resulting gains or losses reflected in net income or loss for the period.

The Company records acquired above-market and below-market leases at their fair values (using a discount rate which reflects the risks associated with the leases acquired) equal to the difference between (1) the contractual amounts to be received pursuant to each in-place lease and (2) management’s estimate of fair market lease rates for each corresponding in-place lease, measured over a period equal to the remaining term of the lease for above-market leases and the initial term plus the term of any below-market fixed rate renewal options for below-market leases. Other intangible assets acquired include amounts for in-place lease values that are based on the Company’s evaluation of the specific characteristics of each tenant’s lease. Factors to be considered include estimates of carrying costs during hypothetical expected lease-up periods considering current market conditions, and costs to execute similar leases. In estimating carrying costs, the Company includes real estate taxes, insurance and other operating expenses and estimates of lost rentals at market rates during the expected lease-up periods, depending on local market conditions.

In estimating costs to execute similar leases, the Company considers leasing commissions, legal and other related expenses. The amortization of acquired above-market and below-market leases is recorded as an adjustment to rental revenue on the Company’s Consolidated Statements of Operations. The amortization of in-place leases is recorded as an adjustment to depreciation and amortization expense on the Company’s Consolidated Statements of Operations.

The Company’s management reviews its real estate properties for impairment when there is an event or change in circumstances that indicates an impaired value. Since cash flows on real estate properties considered to be "long-lived assets to be held and used" are considered on an undiscounted basis to determine whether an asset has been impaired, the Company’s strategy of holding properties over the long term decreases the likelihood of recording an impairment loss. If the Company’s strategy changes or market conditions otherwise dictate an earlier sale date, an impairment loss may be recognized and such loss could be material to the Company’s results. If the Company determines that an impairment has occurred, the affected assets must be reduced to their estimated fair value. During the three and nine months ended September 30, 2023, no such impairments occurred.

Investments in Real Estate Debt

The Company’s investment in real estate debt consisted of the Mezzanine Loan (defined below) secured by real estate. The Company elected the FVO for its real estate debt investment. As such, the resulting unrealized gains and losses of such loan is recorded as a component of income from investment in real estate debt on the Company’s Consolidated Statements of Operations. No unrealized gain or loss was recognized for the three and nine months ended September 30, 2023.

11

Interest income from the Company’s investment in real estate debt is recognized over the life of each investment using the effective interest method and is recorded on the accrual basis. Recognition of premiums and discounts associated with these investments is deferred and recorded over the term of the investment as an adjustment to yield. Upfront costs and fees related to items for which the FVO is elected shall be recognized in earnings as incurred and not deferred. Interest income of $0.4 million and $1.3 million was recognized for the three and nine months ended September 30, 2023. Such items are recorded as components of income (loss) from investments in real estate debt on the Company’s Consolidated Statements of Operations.

Investments in Real Estate-Related and Other Securities

The Company’s investments in real estate-related and other securities consist of one commercial mortgage backed security ("CMBS") investment and one United States Government Treasury security ("U.S. Treasury"). The Company has elected to classify its real estate-related and other securities as trading securities, which are recorded at fair value. As such, the Company records changes in fair value and interest income as a component of loss from investments in real estate-related and other securities on the Company’s Consolidated Statements of Operations. An unrealized gain of $0.3 million and $0.08 million and interest income of $0.08 million and $0.2 million was recognized for the three and nine months ended September 30, 2023, respectively. A realized loss of $0.7 million was recognized for the three and nine months ended September 30, 2023 (see Note 6). Accrued interest of less than $0.01 million and less than $0.01 million was recorded in other assets on the Company's Consolidated Balance Sheets as of September 30, 2023 and December 31, 2022, respectively.

Mandatorily Redeemable Instruments

The Company reports its mandatorily redeemable Class E shares and Class E units (collectively the "Mandatorily Redeemable Instruments") as a liability on its Consolidated Balance Sheets at JPMIM’s cash redemption value. JPMIM’s cash redemption value is determined based on the Company's NAV per Class E share or Class E unit as of the Company's balance sheet date. For purposes of determining the Company's NAV, the Company's investments in real estate are recorded at fair value based on third party valuations prepared by licensed appraisers in accordance with standard industry practice. These fair value estimates of the Company's investments in real estate are particularly important as they are used for the calculation of NAV, which determines the adjustment to the carrying value of the Company's Mandatorily Redeemable Instruments. Significant differences in the fair value of the Company's Mandatorily Redeemable Instruments may result from changes in market conditions that cause the Company's NAV, and thus JPMIM’s redemption value, to increase or decrease during the period and is recorded as a component of mandatorily redeemable instruments interest cost on the Company's Consolidated Statements of Operations. Distributions declared on the Mandatorily Redeemable Instruments are recorded as a component of mandatorily redeemable instruments interest cost on the Company's Consolidated Statements of Operations. Declared but unpaid distributions as of September 30, 2023 and December 31, 2022, respectively, were recorded as a liability within accounts payable, accrued expenses and other liabilities on the Company's Consolidated Balance Sheets.

Fair Value Measurements

Under normal market conditions, the fair value of an investment is the amount that would be received to sell an asset or transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). Additionally, there is a hierarchical framework that prioritizes and ranks the level of market price observability used in measuring investments at fair value. Market price observability is impacted by a number of factors, including the type of investment and the characteristics specific to the investment and the state of the marketplace, including the existence and transparency of transactions between market participants. Investments with readily available active quoted prices or for which fair value can be measured from actively quoted prices generally will have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value. Investments measured and reported at fair value are classified and disclosed in one of the following levels within the fair value hierarchy:

Level 1 — quoted prices are available in active markets for identical investments as of the measurement date. The Company does not adjust the quoted price for these investments.

Level 2 — quoted prices are available in markets that are not active, or model inputs are based on inputs that are either directly or indirectly observable as of the measurement date.

Level 3 — pricing inputs are unobservable and include instances where there is minimal, if any, market activity for the investment.

These inputs require significant judgment or estimation by management or third parties when determining fair value and generally represent anything that does not meet the criteria of Levels 1 and 2. Due to the inherent uncertainty of these estimates, these values may differ materially from the values that would have been used had a ready market for these investments existed.

12

Valuation of assets and liabilities measured at fair value

The Company’s investments in real estate debt, real estate-related and other securities and derivatives are recorded at fair value. The Company generally determines the fair value of its investments by utilizing third-party pricing service providers. In determining the value of a particular real estate-related security, the pricing service providers may use broker-dealer quotations, reported trades or valuation estimates from their internal pricing models to determine the reported price. The pricing service providers’ internal models for real estate-related securities usually consider the attributes applicable to a particular class of security (e.g., credit rating, seniority), current market data, and estimated cash flows for each class and incorporate deal collateral performance such as prepayment speeds and default rates, as available.

Certain of the Company’s investments in real estate debt include loans secured by real estate, such as its mezzanine loan, are unlikely to have readily available market quotations. In such cases, the Company will generally determine the initial value based on the origination amount or acquisition price of such investment if acquired by the Company or the par value of such investment if originated by the Company. Following the initial measurement, the Company will determine fair value by utilizing or reviewing certain of the following inputs (i) market yield data, (ii) discounted cash flow modeling, (iii) collateral asset performance, (iv) local or macro real estate performance, (v) capital market conditions, (vi) debt yield or loan-to-value ratios and (vii) borrower financial condition and performance.

The Company's derivative financial instruments consist of treasury note futures contracts. The fair value of the Company's treasury futures contracts is based on quoted market prices for identical instruments.

The Mandatorily Redeemable Instruments are carried at their cash redemption value as if the units were repurchased or redeemable at the reporting date, which equals NAV per unit at the reporting date.

The carrying amounts of financial instruments such as other assets, accounts payable, accrued expenses and other liabilities approximate their fair values due to the short-term maturities and market rates of interest of these instruments.

The following table details the Company’s assets and liabilities measured at fair value on a recurring basis ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 | | | December 31, 2022 | |

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Investment in real estate debt | | $ | — | | | $ | — | | | $ | 16,825 | | | $ | 16,825 | | | $ | — | | | $ | — | | | $ | 16,825 | | | $ | 16,825 | |

Investments in real estate-related and other securities | | | 410 | | | | 1,753 | | | | — | | | | 2,163 | | | | — | | | | 1,842 | | | | — | | | | 1,842 | |

Treasury note futures contracts(1) | | | 40 | | | | — | | | | — | | | | 40 | | | | — | | | | — | | | | — | | | | — | |

Total | | $ | 450 | | | $ | 1,753 | | | $ | 16,825 | | | $ | 19,028 | | | $ | — | | | $ | 1,842 | | | $ | 16,825 | | | $ | 18,667 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

Mandatorily Redeemable Instruments | | $ | — | | | $ | — | | | $ | 97,079 | | | $ | 97,079 | | | $ | — | | | $ | — | | | $ | 45,784 | | | $ | 45,784 | |

Total | | $ | — | | | $ | — | | | $ | 97,079 | | | $ | 97,079 | | | $ | — | | | $ | — | | | $ | 45,784 | | | $ | 45,784 | |

(1) Included in other assets, net in the Company's Consolidated Balance Sheets.

The following table details the Company’s assets and liabilities measured at fair value on a recurring basis using Level 3 inputs ($ in thousands):

| | | | | | | | |

| | Investment in Real Estate Debt (asset) | | | Mandatorily Redeemable Instruments (liability) | |

Balance at December 31, 2022 | | $ | 16,825 | | | $ | 45,784 | |

Proceeds | | | — | | | | 47,157 | |

Distributions declared | | | — | | | | (1,907 | ) |

Reclassify to distributions payable/paid | | | — | | | | 1,907 | |

Redemption value adjustment | | | — | | | | 4,138 | |

Balance at September 30, 2023 | | $ | 16,825 | | | $ | 97,079 | |

13

The following table contains the quantitative inputs and assumptions used for items categorized in Level 3 of the fair value hierarchy ($ in thousands):

| | | | | | | | | | | | |

| | September 30, 2023 |

| | Fair Value | | | Valuation Technique | | Unobservable Inputs | | Weighted Average Rate | | Impact to Valuation from an Increase in Input |

Assets: | | | | | | | | | | | |

Investment in real estate debt | | $ | 16,825 | | | Discounted cash flow | | Market credit spread | | SOFR(1) + 5.22% | | Decrease |

| | | | | | | | | | | |

Liabilities: | | | | | | | | | | | |

Mandatorily redeemable instruments(2) | | $ | 97,079 | | | Discounted cash flow | | Discount rate/

Exit capitalization rate/Market yield | | 5.26%/

6.79%/

5.96% | | Decrease |

(1) "SOFR" refers to the Secured Overnight Financing Rate. 30-day SOFR at September 30, 2023 was 5.32% per annum.

(2) Mandatorily Redeemable Instruments are carried at the NAV of the Class E units or Class E shares which is determined monthly in accordance with the Company's valuation guidelines.

Valuation of assets and liabilities not measured at fair value

The fair value of the Company’s financial instruments (other than mortgage notes), including cash and cash equivalents and other financial instruments, approximate their carrying or contract value. The fair value of the Company’s indebtedness is estimated by modeling the cash flows required by the Company’s debt agreements and discounting them back to the present value using an appropriate discount rate. Additionally, the Company considers current market rates and conditions by evaluating similar borrowing agreements with comparable loan-to-value ratios and credit profiles. The inputs used in determining the fair value of the Company’s indebtedness are considered Level 3.

The following table presents the carrying value and fair value of financial instruments that are not carried at fair value on the Consolidated Balance Sheets:

| | | | | | | | | | | | | | | | |

| | September 30, 2023 | | | December 31, 2022 | |

| | Carrying Value | | | Fair Value | | | Carrying Value | | | Fair Value | |

Credit Facility | | $ | — | | | $ | — | | | $ | 40,200 | | | $ | 40,200 | |

Mortgage notes(1) | | | 115,471 | | | | 112,995 | | | | 115,838 | | | | 115,838 | |

Total | | $ | 115,471 | | | $ | 112,995 | | | $ | 156,038 | | | $ | 156,038 | |

(1) Mortgage notes carrying value excludes deferred financing costs and mortgage discounts.

Deposits on Real Estate

Deposits paid on real estate purchase contracts are recorded and classified as deposits on real estate on the Company’s Consolidated Balance Sheets until the related real estate purchase is completed. Deposits are reclassified as a component of real estate at the time the deposit is used to offset the acquisition price of the real estate based on the terms of the underlying agreement. To the extent a deposit is non-refundable and the real estate purchase is terminated, the deposit is expensed to other income (expense), net on the Consolidated Statements of Operations. There were no deposits that were written off during the three and nine months ended September 30, 2023. The Company's deposits on real estate totaled $0 million and $5.5 million as of September 30, 2023 and December 31, 2022, respectively. In addition, the Company made a deposit of $1.8 million as a result of entering into an agreement to acquire a property. That agreement was terminated on June 30, 2023, during the due diligence period, and the deposit of $1.8 million was returned during the three months ended September 30, 2023. On July 17, 2023, the Company acquired a pre-leased truck transload facility located within the Savannah, Georgia metropolitan area (the "Truck Transload Facility") at which time total deposits of $6.7 million were reclassified as a component of investments in real estate, net on the Company's Consolidated Balance Sheets.

14

The Company’s deferred charges include financing and leasing costs. Deferred financing costs include legal, structuring and other loan costs incurred by the Company for its financing agreements. Deferred financing costs related to the Company’s mortgage notes are recorded as an offset to the related liability and amortized over the term of the applicable financing instruments as interest expense. Deferred financing costs related to the Company’s Credit Facility (Note 8) are recorded as a component of other assets on the Company’s Consolidated Balance Sheets and amortized over the term of the applicable financing agreement. Deferred leasing costs incurred in connection with new leases, consisting primarily of brokerage and legal fees, are recorded as a component of other assets on the Company’s Consolidated Balance Sheets and amortized over the term of the related lease.

Income Taxes

The Company intends to make an election to be taxed as a REIT under Sections 856 through 860 of the Internal Revenue Code effective January 1, 2023. If the Company qualifies for taxation as a REIT, the Company generally will not be subject to federal corporate income tax to the extent it distributes 90% of its taxable income to its stockholders. REITs are subject to a number of other organizational and operational requirements. Even if the Company qualifies for taxation as a REIT, it may be subject to certain state and local taxes on its income and property, and federal income and excise taxes on its undistributed income.

Revenue Recognition

The Company commences revenue recognition on its leases based on a number of factors, including the initial determination that the contract is or contains a lease. Generally, all of the Company’s contracts are, or contain leases, and therefore revenue is recognized when the lessee takes possession of or controls the physical use of the leased assets. In most instances this occurs on the lease commencement date. At the inception or acquisition of a lease, including new leases that arise from amendments, the Company assesses the terms and conditions of the lease to determine the proper lease classification.

A lease is classified as an operating lease if none of the following criteria are met: (i) ownership transfers to the lessee at the end of the lease term, (ii) the lessee has a purchase option that is reasonably expected to be exercised, (iii) the lease term is for a major part of the economic life of the leased property, (iv) the present value of the future lease payments and any residual value guaranteed by the lessee that is not already reflected in the lease payments equals or exceeds substantially all of the fair value of the leased property, and (v) the leased property is of such a specialized nature that it is expected to have no future alternative use to the Company at the end of the lease term. If one or more of these criteria are met, the lease will generally be classified as a sales-type lease, unless the lease contains a residual value guarantee from a third party other than the lessee, in which case it would be classified as a financing lease under certain circumstances in accordance with ASC 842.

The Company’s rental revenue primarily consists of fixed contractual base rent arising from tenant leases at the Company’s properties under operating leases. Revenue under operating leases that are deemed probable of collection, is recognized as revenue on a straight-line basis over the terms of the related leases. For leases that have fixed and measurable rent escalations, the difference between such rental income earned and the cash rent due under the provisions of the lease is recorded in the Company’s Consolidated Balance Sheets. Management exercises judgment in assessing collectability of leases with revenue for any leases deemed not probable of collection being recognized when cash is collected.

Certain of the Company’s contracts contain non-lease components (e.g., charges for management fees, common area maintenance, reimbursement of third-party maintenance expenses, real estate taxes and insurance) in addition to lease components (i.e., monthly rental charges). Services related to non-lease components are provided over the same period of time as, and billed in the same manner as, monthly rental charges. The Company elected to apply the practical expedient available under ASC 842, for all classes of assets, not to segregate the lease components from the non-lease components when accounting for operating leases. Since the lease component is the predominant component under each of these leases, combined revenues from both the lease and non-lease components are accounted for in accordance with ASC 842 and reported as rental revenues in the Company’s Consolidated Statements of Operations.

Organization and Offering Costs

Organization costs are expensed as incurred and recorded as a component of general and administrative expenses on the Company’s Consolidated Statements of Operations. The Company recognized no organization costs for either the three or nine months ended September 30, 2023. Offering costs are charged to equity as such amounts are incurred. Since inception, the Company recognized $5.6 million and $4.8 million of offering costs as of September 30, 2023 and December 31, 2022, respectively.

The Adviser will advance the Company’s organization and offering costs on behalf of the Company (including legal, accounting, and other expenses attributable to the Company’s organization, but excluding upfront selling commissions, dealer manager fees and stockholder servicing fees) through July 22, 2024, the second anniversary of the commencement of the Offering. The Company will reimburse the Adviser for all such advanced costs ratably over a 60-month period following the second anniversary of the commencement of the Offering.

15

The Adviser and its affiliates incurred organization and offering costs, since inception, on the Company’s behalf of $6.3 million and $5.5 million as of September 30, 2023 and December 31, 2022, respectively. These organization and offering costs were recorded as a component of due to affiliates in the accompanying Consolidated Balance Sheets as of September 30, 2023 and December 31, 2022, respectively. Such costs became the Company’s liability on July 22, 2022, the date on which the Offering commenced.

Operating Expenses

The Adviser will advance on our behalf certain of the Company’s operating expenses through the earlier of (i) the first date that the Company’s NAV reaches $500 million and (ii) December 31, 2024. The Company will reimburse the Adviser for all such advanced operating expenses ratably over the 60 months following such date. Operating expenses incurred directly by the Company are expensed in the period incurred.

The Adviser and its affiliates incurred, since inception, operating expenses on the Company’s behalf totaling $7.3 million and $4.4 million as of September 30, 2023 and December 31, 2022, respectively. These operating expenses were recorded as a component of due to affiliates in the accompanying Consolidated Balance Sheets.

Share Repurchases

The Company has adopted a share repurchase plan, whereby on a monthly basis, stockholders may request that the Company repurchase all or any portion of their shares. The Company may choose to repurchase all, some or none of the shares that have been requested to be repurchased at the end of any particular month, in its discretion, subject to any limitations in the share repurchase plan. The total amount of aggregate repurchases of Class D, Class I, Class S, Class T and Class E shares is limited to 2% of the aggregate NAV per month and 5% of the aggregate NAV per calendar quarter. Shares are repurchased at a price equal to the transaction price on the applicable repurchase date, subject to any early repurchase deduction. Shares that have not been outstanding for at least one year are repurchased at 98% of the transaction price. In the event the Company determines to repurchase some but not all of the shares submitted for repurchase during any month, shares submitted for repurchase during such month will be repurchased on a pro rata basis based on the amount requested after the Company has repurchased all shares for which repurchase was requested due to death, disability or divorce and other limited exceptions. All unsatisfied repurchase requests must be resubmitted after the start of the next month or quarter, or upon the recommencement of the share repurchase plan, as applicable.

Due to the illiquid nature of investments in real estate, the Company may not have sufficient liquid resources to fund repurchase requests and has established limitations on the amount of funds the Company may use for repurchases during any calendar month and quarter. Should repurchase requests, in the Company's judgment, place an undue burden on the Company's liquidity, adversely affect the Company's operations or risk having an adverse impact on the Company as a whole, or should the Company otherwise determine that investing its liquid assets in real properties or other investments rather than repurchasing its shares is in the best interests of the Company as a whole, the Company may choose to repurchase fewer shares in any particular month than have been requested to be repurchased, or none at all. Further, the Company's board of directors may make exceptions to, modify or suspend the Company's share repurchase plan if in its reasonable judgment it deems such action to be in the Company's best interest and the best interests of the Company's stockholders.

Class E share repurchase rights

The Class E shares issued in the Initial Capitalization are not eligible for repurchase pursuant to the share repurchase plan. The Class E shares issued in the Initial Capitalization will only be eligible for repurchase following the earlier to occur of (i) July 22, 2025, the third anniversary of the date the Company commenced the Offering, and (ii) the date that the Company's aggregate NAV is at least $1.5 billion. Following such period, holders of Class E shares (other than the Class E shares and Class E units purchased by JPMIM as part of the Initial Capitalization, which are subject to special terms discussed below) may request that the Company repurchase such holder’s Class E shares on a monthly basis. The Company will repurchase Class E shares at a price per share equal to the most recently determined NAV per Class E share as of the repurchase date.

The aggregate amount of Class E shares that the Company is required to repurchase in any month will be limited to an amount equal to any remaining availability for share repurchases pursuant to the terms and conditions of the share repurchase plan for the Company's Class D, Class I, Class S and Class T shareholders, after the Company has fulfilled all repurchase requests submitted pursuant to the share repurchase plan. In addition, the Company will not repurchase any Class E shares during any period that the share repurchase plan has been suspended.

16

JPMIM class E share and unit repurchases

JPMIM has agreed to hold all of the Class E shares and Class E units it purchased as part of the Initial Capitalization until the earlier of (i) the first date that the Company's NAV reaches $1.5 billion and (ii) July 22, 2025, three years from the commencement of the Offering. Following such date, each month the Company will repurchase, without further action by JPMIM, a number of Class E shares or Class E units from JPMIM in an amount equal to the amount available under the share repurchase plan’s 2% monthly and 5% quarterly caps after satisfying repurchase requests from investors, until such time as the JPM Initial Capitalization has been fully repurchased; provided, that the number of shares subject to each mandatory repurchase may be reduced where other holders of Class E shares that were issued pursuant to the Initial Capitalization and are not subject to repurchase under the share repurchase plan request repurchase of their shares, in which case the Class E shares and Class E units held by JPMIM and such other investors will be repurchased on a pro rata basis based on their respective percentage ownership immediately prior to such repurchase (not to exceed an aggregate number of shares equal to the amount available under the share repurchase plan’s 2% monthly and 5% quarterly caps). Notwithstanding the foregoing, the Company will not affect any mandatory repurchases during any month in which the full amount of all shares requested to be repurchased by stockholders other than JPMIM under the Company's share repurchase plan is not repurchased or when the Company's share repurchase plan has been suspended.

Derivative Instruments

The Company uses derivative financial instruments such as treasury note futures contracts to manage on-going risks from fluctuations in interest rates. The Company records its derivative instruments at fair value and such instruments are reflected in other assets, net or accounts payable, accrued expenses and other liabilities on the Company's Consolidated Balance Sheets. Any changes in the fair value of these derivative instruments are recorded within other income (expenses), net on the Company's Consolidated Statements of Operations (see Note 16).

Earnings Per Share

Basic net loss per share is computed by dividing net loss for the period by the weighted average number of shares of common stock outstanding during the period. Diluted loss per share is computed by dividing net loss for the period by the weighted average number of shares of common stock and common stock equivalents outstanding (unless their effect is anti-dilutive) for the period. For the three and nine months ended September 30, 2023 and 2022, unvested Class E common shares awarded to the Company's independent directors are excluded from the calculation of diluted earnings per share as the inclusion of such potential common shares in the calculation would be anti-dilutive. There were no other potentially dilutive, unissued common shares for the three and nine months ended September 30, 2023 and 2022. The weighted average number of shares of common stock outstanding is identical for both basic and diluted shares.

4. Investments in Real Estate

Investments in real estate, net consisted of the following ($ in thousands):

| | | | | | | | |

| | September 30, 2023 | | | December 31, 2022 | |

Building and building improvements | | $ | 191,201 | | | $ | 147,629 | |

Land and land improvements | | | 73,693 | | | | 49,359 | |

Furniture, fixtures and equipment | | | 3,010 | | | | 2,965 | |

Total | | | 267,904 | | | | 199,953 | |

Accumulated depreciation | | | (4,177 | ) | | | (524 | ) |

Investments in real estate, net | | $ | 263,727 | | | $ | 199,429 | |

Acquisitions

During the nine months ended September 30, 2023, the Company acquired one property, a truck transload facility.

The following table provides details of the property acquired during the nine months ended September 30, 2023 ($ in thousands):

| | | | | | | | | | | | | | |

Property Type | | Purchase Price(1) | | | Number of Transactions | | | Number of Properties | | | Sq. Ft. (in thousands)/Units |

Industrial property | | $ | 75,231 | | | | 1 | | | | 1 | | | 136 sq ft |

(1) Purchase price is inclusive of acquisition-related costs including in-place lease intangible assets, above-market lease intangible assets and tenant improvements.

On July 17, 2023, the Company acquired the Truck Transload Facility for $75.2 million, inclusive of closing costs. The Truck Transload Facility, constructed in 2023, is a Class A logistics facility encompassing 136,240 square feet with 134 doors situated on an approximately 50-acre site.

17

The following table details the purchase price allocation for the property acquired during the nine months ended September 30, 2023 ($ in thousands):

| | | | |

| | For the Nine Months Ended September 30, 2023 | |

Building and building improvements | | $ | 49,663 | |

Land | | | 16,534 | |

In-place lease intangibles | | | 6,323 | |

Above-market lease intangibles | | | 2,037 | |

Tenant Improvements | | | 674 | |

Total purchase price | | | 75,231 | |

Net working capital assumed | | | (1,568 | ) |

Acquisition costs paid by JPMIM | | | (213 | ) |

Net purchase price | | $ | 73,450 | |

5. Investment in Real Estate Debt

The following table details the Company’s investment in real estate debt ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | September 30, 2023 | | | December 31, 2022 | |

Real Estate Debt | | Number of Positions | | | Credit Rating | | Coupon | | Maturity Date | | Cost Basis | | | Fair Value | | | Cost Basis | | | Fair Value | |

Mezzanine loan | | | 1 | | | Not Rated | | SOFR + 5.22% | | September 7, 2024 | | $ | 16,825 | | | $ | 16,825 | | | $ | 16,825 | | | $ | 16,825 | |

On September 2, 2022, the Company acquired a $26.8 million mezzanine loan ("Mezzanine Loan") and, concurrent with the acquisition, sold a $10 million pari passu participation interest to an affiliate of the Adviser. The sale of the participating interest met the criteria to be classified as an accounting sale, and not a financing, as the Company did not retain a controlling interest in the loan. The loan financed the acquisition of a garden-style multifamily property located in Murfreesboro, Tennessee. The Mezzanine Loan is an interest only loan and was fully funded as of the acquisition date. The loan has a stated maturity of September 7, 2024 and includes up to three one-year extension options.

The following table details the amounts recognized for the Company's investment in real estate debt ($ in thousands):

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | |

| | September 30, | | | September 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

Interest income | | $ | 450 | | | $ | 106 | | | $ | 1,293 | | | $ | 106 | |

Other income (expense), net | | | (3 | ) | | | (1 | ) | | | (6 | ) | | | (1 | ) |

Total income from investment in real estate debt | | $ | 447 | | | $ | 105 | | | $ | 1,287 | | | $ | 105 | |

6. Investments in Real Estate-Related and Other Securities

The following table details the Company’s investments in real estate-related and other securities ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | September 30, 2023 | | | December 31, 2022 | |

Real Estate-Related and Other Securities | | Coupon | | Maturity Date | | Face Amount | | | Cost Basis | | | Fair Value | | | Face Amount | | | Cost Basis | | | Fair Value | |

CMBS | | SOFR + 0.75% | | April 30, 2024 | | $ | 1,812 | | | $ | 1,671 | | | $ | 1,753 | | | $ | 2,000 | | | $ | 1,840 | | | $ | 1,842 | |

U.S. Treasury(1) | | N/A | | March 14, 2024 | | | 420 | | | | 410 | | | | 410 | | | | — | | | | — | | | | — | |

Total real estate-related and other securities | | | | | | $ | 2,232 | | | $ | 2,081 | | | $ | 2,163 | | | $ | 2,000 | | | $ | 1,840 | | | $ | 1,842 | |

18

(1) Includes $0.4 million of securities pledged as collateral related to the treasury note futures contracts.

The following table details the amounts recognized for the Company's investments in real estate-related and other securities ($ in thousands):

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | |

| | September 30, | | | September 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

Interest income | | $ | 76 | | | $ | — | | | $ | 208 | | | $ | — | |

Unrealized gain | | | 260 | | | | — | | | | 80 | | | | — | |

Realized loss | | | (654 | ) | | | — | | | | (654 | ) | | | — | |

Total loss from investments in real estate-related and other securities | | $ | (318 | ) | | $ | — | | | $ | (366 | ) | | $ | — | |

For the three and nine months period ended September 30, 2023, the Company received proceeds of $4.2 million from a sale of a U.S.Treasury bond with a costs basis of $4.9 million resulting in a realized loss of $0.7 million.

7. Intangibles

The gross carrying amount and accumulated amortization of the Company’s intangible assets and liabilities, not fully amortized, consisted of the following ($ in thousands):

| | | | | | | | |

| | September 30, 2023 | | | December 31, 2022 | |

Intangible assets: | | | | | | |

In-place lease intangibles | | $ | 8,007 | | | $ | 4,311 | |

Above-market lease intangibles | | | 2,037 | | | | — | |

Total intangible assets | | | 10,044 | | | | 4,311 | |

Accumulated amortization: | | | | | | |

In-place lease amortization | | | (292 | ) | | | (544 | ) |

Above-market lease amortization | | | (59 | ) | | | — | |

Total accumulated amortization | | | (351 | ) | | | (544 | ) |

Intangible assets, net | | $ | 9,693 | | | $ | 3,767 | |

Intangible liabilities: | | | | | | |

Below-market lease intangibles | | $ | (1,830 | ) | | $ | (1,828 | ) |

Accumulated amortization: | | | | | | |

Below-market lease amortization | | | 116 | | | | 28 | |

Intangible liabilities, net | | $ | (1,714 | ) | | $ | (1,800 | ) |

The estimated future amortization on the Company’s intangibles for each of the next five years and thereafter as of September 30, 2023 is as follows ($ in thousands):

| | | | | | | | | | | |

| In-place Lease Intangibles | | | Above-market Lease Intangibles | | | Below-market Lease Intangibles | |

2023 (remainder) | $ | 252 | | | $ | 72 | | | $ | (30 | ) |

2024 | | 1,007 | | | | 289 | | | | (118 | ) |

2025 | | 1,007 | | | | 289 | | | | (118 | ) |

2026 | | 1,007 | | | | 289 | | | | (118 | ) |

2027 | | 1,007 | | | | 289 | | | | (118 | ) |

Thereafter | | 3,435 | | | | 750 | | | | (1,212 | ) |

Total | $ | 7,715 | | | $ | 1,978 | | | $ | (1,714 | ) |

The in-place lease intangible amortization is recorded in depreciation and amortization while the above-market intangible amortization and below-market intangible amortization are recorded in rental revenue on the Company's Consolidated Statements of Operations.

As of September 30, 2023, the weighted-average amortization period for both the acquired in-place lease intangibles and above-market lease intangibles was 7 years.

19

8. Mortgage Notes and Credit Facility

Mortgage notes

The following is a summary of the fixed-rate mortgage notes secured by the Company’s properties ($ in thousands):

| | | | | | | | | | | | | | |

| | | | | | | Principal Balance Outstanding | |

Indebtedness | | Interest Rate | | | Maturity Date | | September 30, 2023 | | | December 31, 2022 | |

Caroline West Gray | | | 5.44 | % | | 12/1/2029 | | $ | 45,911 | | | $ | 45,911 | |

Caroline Post Oak | | | 5.44 | % | | 12/1/2029 | | | 40,528 | | | | 40,528 | |

Coda on Centre | | | 4.28 | % | | 5/30/2029 | | | 29,032 | | | | 29,399 | |

Total fixed-rate loans | | | | | | | | 115,471 | | | | 115,838 | |

Deferred financing costs, net | | | | | | | | (1,075 | ) | | | (1,202 | ) |

Mortgage discount, net | | | | | | | | (772 | ) | | | (876 | ) |

Total mortgage notes | | | | | | | $ | 113,624 | | | $ | 113,760 | |

Credit facility

The following is a summary of the Company's Credit Facility (defined below) ($ in thousands):

| | | | | | | | | | | | | | | | |

| | | | | | | | | Principal Balance Outstanding | |