includes primarily egg and potato products; the Refrigerated Retail segment includes primarily side dish, egg, cheese and sausage products; and the BellRing Brands segment includes RTD protein shakes and other RTD beverages, powders and nutrition bars.

In its year ended September 30, 2013, Post acquired Premier Nutrition, which, at the time, was a marketer and distributor of high quality protein shakes and nutrition bars under the Premier Protein brand and nutritional supplements under the Joint Juice brand. Premier Nutrition, Inc. was founded in 1997, and Joint Juice, Inc. was founded in 1999. In 2011, Joint Juice, Inc. acquired the Premier Protein brand and related assets from Premier Nutrition, Inc. via a corporate restructuring, and the resulting entity assumed the name Premier Nutrition Corporation. Effective September 30, 2019, Premier Nutrition Corporation converted to a limited liability company and changed its corporate name to Premier Nutrition Company, LLC.

In its year ended September 30, 2014, Post acquired Dymatize, which, at the time, was a manufacturer and marketer of high-quality protein powders and nutritional supplements under the Dymatize brand. Dymatize was founded in 1994.

In its year ended September 30, 2015, Post acquired the PowerBar brand and Active Nutrition International. The PowerBar brand was founded in 1986.

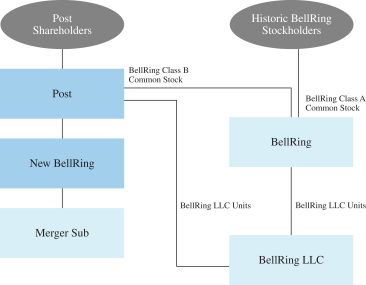

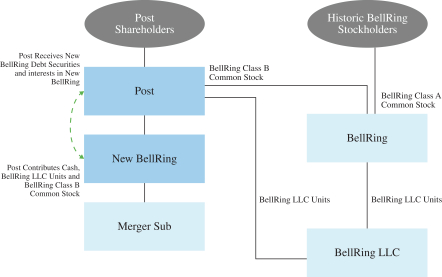

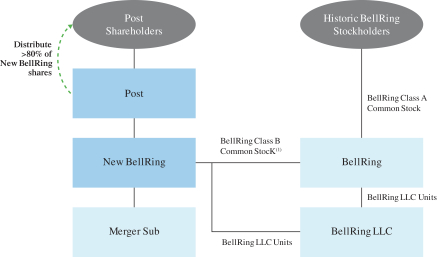

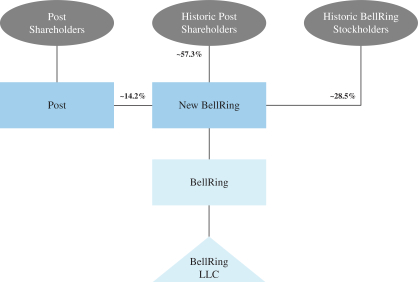

As of January 14, 2022, Post owned approximately 97.5 million BellRing LLC Units, representing approximately 71.5% of the economic interests in BellRing LLC. Following the completion of the transactions contemplated by the transaction agreement, Post expects to retain approximately 14.2% of the issued and outstanding shares of New BellRing Common Stock.

BellRing Distribution, LLC

BellRing Distribution, LLC

2503 S. Hanley Road

St. Louis, Missouri 63144

Telephone: (314) 644-7600

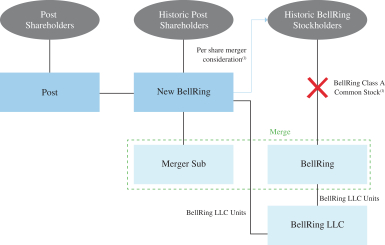

New BellRing is a wholly owned subsidiary of Post, formed in the State of Delaware on October 20, 2021 for the purpose of effecting the transactions. Immediately prior to the distribution, Post will cause New BellRing to convert into a Delaware corporation and the units representing limited liability company interests of New BellRing shall be converted into additional shares of New BellRing Common Stock. Prior to the completion of the transactions, Post will distribute at least 80.1% of its shares of New BellRing Common Stock to holders of Post Common Stock. In the merger, each holder of shares of BellRing Class A Common Stock will be entitled to receive, with respect to each share of Class A Common Stock held by such holder, (i) an amount of per share cash consideration equal to a pro rata portion of the amount by which the aggregate principal amount of the New BellRing debt exceeds the amount of cash required to repay the outstanding indebtedness of BellRing under its credit agreement as described under the section of this prospectus entitled “The Transaction Agreement and Plan of Merger—Merger Consideration” beginning on page 83 and (ii) one share of New BellRing Common Stock. At the completion of the transactions, New BellRing, named BellRing Brands, Inc., will be a public company, the successor issuer to BellRing and listed under the ticker symbol “BRBR” on the NYSE, and will not be a “controlled company.”

BellRing Merger Sub Corporation

BellRing Merger Sub Corporation

2503 S. Hanley Road

St. Louis, Missouri 63144

Telephone: (314) 644-7600

Merger Sub is a newly formed corporation, incorporated in the State of Delaware on October 20, 2021, for the purpose of effecting the merger. In the merger, Merger Sub will merge with and into BellRing with BellRing as the surviving company.