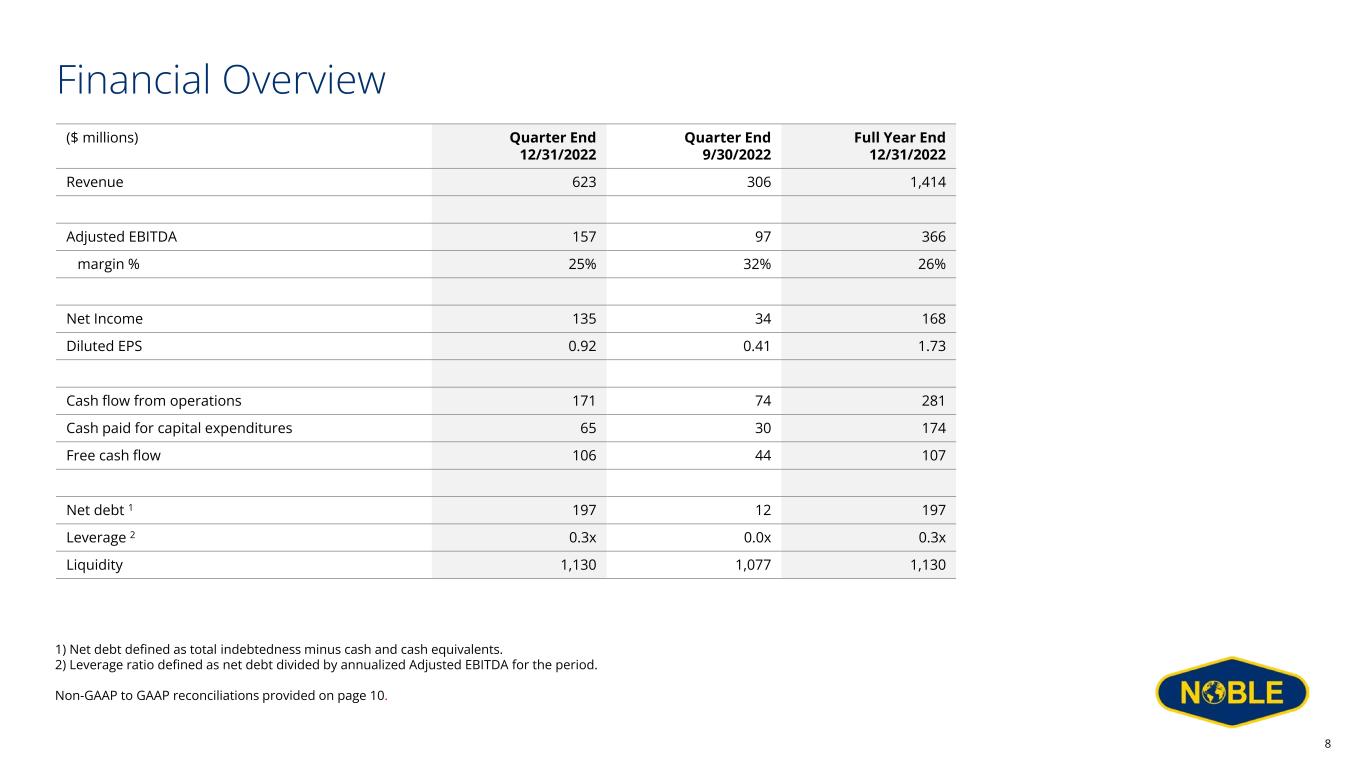

Disclaimer Forward-Looking Statements This presentation and the conference call to which it pertains contains “forward-looking statements” about Noble Corporation plc’s (“Noble” or the “Company”) business, financial performance and position, contracts and prospects. Words such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "might,“ “on track,” "plan," "project," "should," "shall," “target,” and "will" and similar expressions are intended to be among the statements that identify forward-looking statements. Statements regarding strategic rationale, sustainability and innovation expectations, offshore macro supply and demand perspectives, cash taxes, free cash flow and Adjusted EBITDA potential and projections, return of capital policy, contract backlog, financial position, capital structure, fleet strategy and rig reactivation expectations, integration synergy realization and related costs to achieve, bidding activity, rig demand, contract commencements and durations, expectations and pressures regarding dayrates, impact of future regulations, fleet condition, capabilities or performance, industry fundamentals, shareholder value, 2023 financial guidance, capital expenditures expectations, capital allocation framework, as well as any other statements that are not historical facts in this release, are forward-looking statements that involve certain risks, uncertainties and assumptions. These include but are not limited to risk, uncertainties and assumption surrounding the continued integration of Maersk Drilling, actions by regulatory authorities or other third parties, market conditions, factors affecting the level of activity in the oil and gas industry, supply and demand of drilling rigs, factors affecting the duration of contracts, the actual amount of downtime, factors that reduce applicable dayrates, violations of anti-corruption laws, hurricanes and other weather conditions, the future price of oil and gas and other factors detailed in Noble’s most recent Annual Report on Form 10-K, Quarterly Reports Form 10-Q and other filings with the U.S. Securities and Exchange Commission. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated. The Company disclaims any duty to update the information presented here. Non-GAAP Measures This presentation includes certain financial measures that we use to describe the Company's performance that are not in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). The non-GAAP information presented herein provides investors with additional useful information but should not be considered in isolation or as substitutes for the related GAAP measures. Moreover, other companies may define non-GAAP measures differently, which limits the usefulness of these measures for comparisons with such other companies. The Company defines "Adjusted EBITDA" as income (loss) from continuing operations before income taxes; interest income and other, net; gain (loss) on extinguishment of debt, net; interest expense, net of amounts capitalized; loss on impairment; pre-petition charges; merger and integration costs; reorganization items, net; certain corporate legal matters; and depreciation and amortization expense. We believe that the Adjusted EBITDA measure provides greater transparency of our core operating performance. The Company defines net debt as indebtedness minus cash and cash equivalents; free cash flow as cash flow from operations minus capital expenditures; adjusted EBITDA margin as adjusted EBITDA divided by total revenues; and leverage as net debt divided by annualized adjusted EBITDA from the most recently reported quarter. Additionally, due to the forward-looking nature of Adjusted EBITDA, management cannot reliably predict certain of the necessary components of the most directly comparable forward-looking GAAP measure. Accordingly, the company is unable to present a quantitative reconciliation of such forward-looking non-GAAP financial measure to the most directly comparable for-ward-looking GAAP financial measure without unreasonable effort. 2

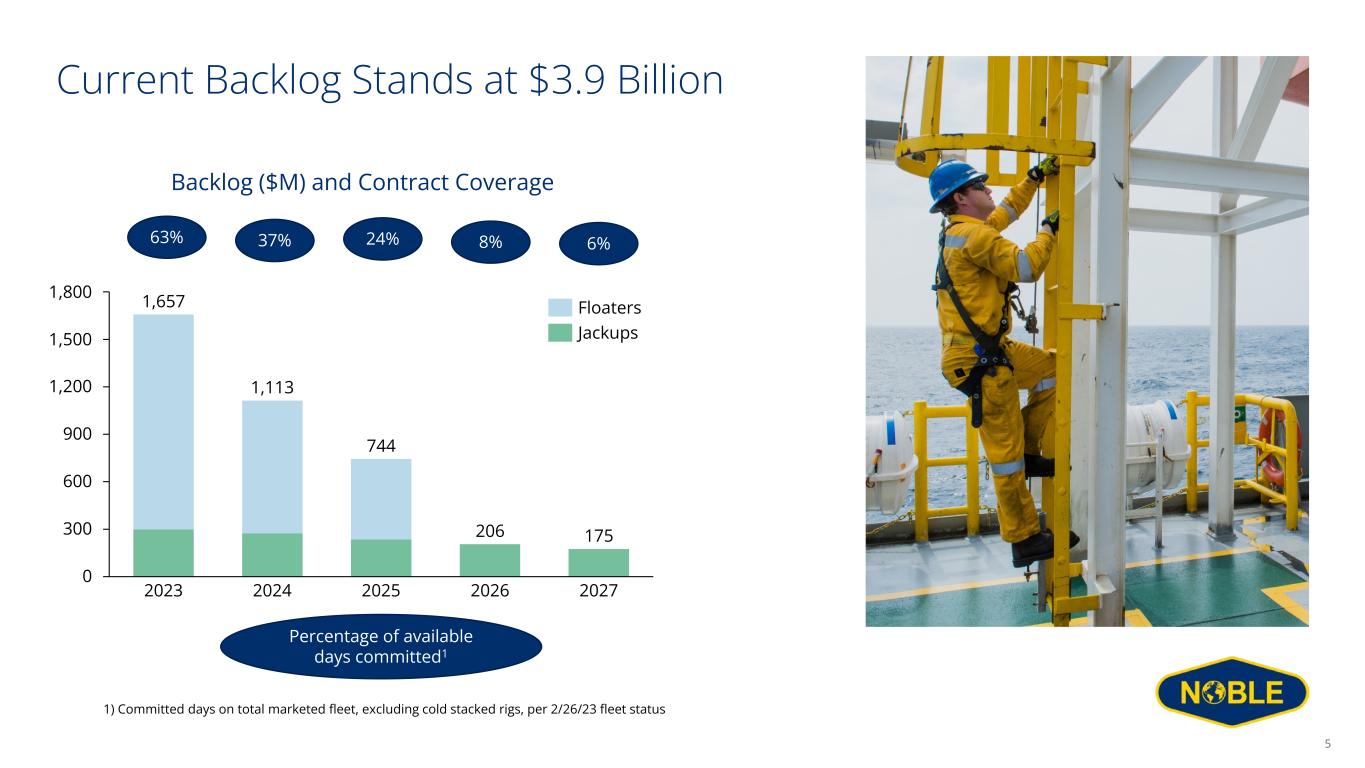

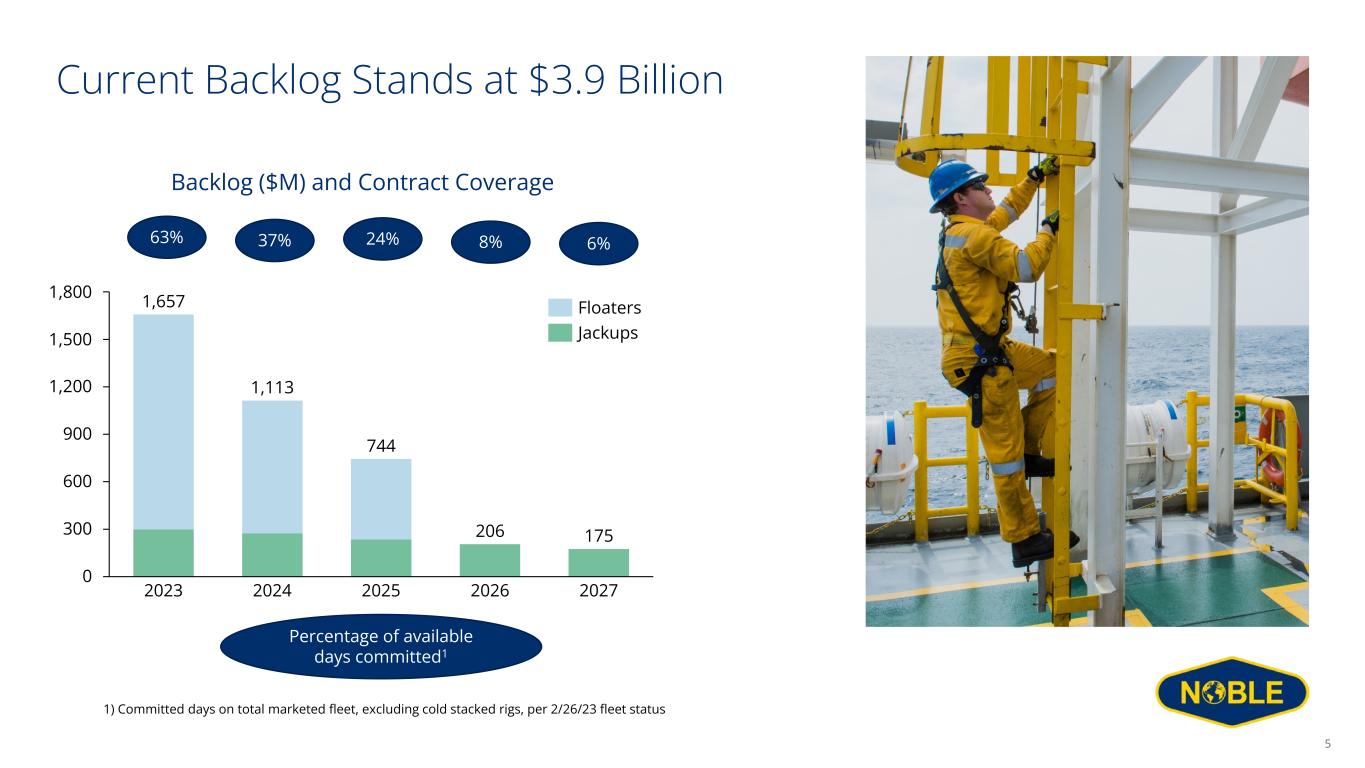

Current Backlog Stands at $3.9 Billion 600 1,800 300 900 0 1,200 1,500 2023 2024 2025 2026 2027 175206 1,657 1,113 744 Jackups Floaters 63% 37% 8% 6%24% Percentage of available days committed1 Backlog ($M) and Contract Coverage 1) Committed days on total marketed fleet, excluding cold stacked rigs, per 2/26/23 fleet status 5

Deepwater Fleet Overview 2023 2024 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Noble Voyager (7g dual BOP) Noble Tom Madden (7g dual BOP) DRILLSHIPS Noble Venturer (7g dual BOP) Noble Faye Kozack (7g dual BOP) Noble Viking (7g) Noble Gerry de Souza (6g dual BOP) Noble Bob Douglas (7g dual BOP) Pacific Scirocco (6g) – cold stacked Noble Developer (6g) Noble Globetrotter I (6g) Noble Globetrotter II (6g) Noble Stanley Lafosse (7g dual BOP) SEMISUBMERSIBLES Pacific Meltem (7g dual BOP) – cold stacked Noble Sam Croft (7g dual BOP) Noble Valiant (7g dual BOP) Noble Don Taylor (7g dual BOP) Noble Discoverer (6g) Noble Deliverer (6g) Firm contracts, excluding options, per 2/26/23 fleet status Recent Highlights • Since Nov ’22 FSR: 24 months of additional backlog across four 6g and 7g drillships at an average dayrate above $420,000. • Gerry de Souza: 9 months in Nigeria, starting Q1’23 • Stanley Lafosse: six well program in the GOM, $148M over slightly greater than 11 months • Faye Kozak: one well in the GOM at $450 k/d • Globetrotter I: 70-day P&A in the GOM at $375 k/d. 6

Jackup Fleet Overview 2023 2024 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Noble Integrator (CJ70) Noble Innovator (CJ70) Noble Highlander (JU-2000E) Noble Tom Prosser (JU-3000N) Noble Resolute (CJ50) HARSH ENVIRONMENT Noble Interceptor (CJ70) Noble Reacher (CJ50) Noble Resilient (CJ50) ULTRA HARSH ENVIRONMENT Noble Intrepid (CJ70) Noble Resolve (CJ50) Noble Mick O’Brien (JU-3000N) Noble Regina Allen (JU-3000N) Noble Invincible (CJ70) Firm contracts, excluding options, per 2/26/23 fleet status Recent Highlights • Noble Innovator was awarded a one-year contract with BP in the UK North Sea at $135,000 per day, with a one-year option with dayrate escalation. • Noble Resolve recently commenced pilot injections at Project Greensand, the world’s first industrial scale offshore carbon capture project off-shore Denmark in which Noble is an equity stakeholder. 7