Investor Update February 2025

Disclaimer Forward-Looking Statements This communication includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, as amended. All statements other than statements of historical facts included in this communication are forward looking statements. These statements, opinions, forecasts, scenarios and projections relate to, among other things, the long-term objectives of Noble Corporation plc (“Noble” or the “Company”), those regarding future guidance, revenue, adjusted EBITDA, the offshore drilling market and demand fundamentals, realization and timing of integration synergies, capital additions, costs, the benefits or results of acquisitions or dispositions such as the acquisition of Diamond Offshore Drilling, Inc. (the “Diamond Transaction”), free cash flow expectations, capital expenditures, including planned dividends and share repurchases, contract backlog, rig demand, expected future contracts, anticipated contract start dates, major project schedules, dayrates and duration, any asset sales or the retirement of rigs, access to capital, fleet condition and utilization, timing and amount of insurance recoveries and 2025 financial guidance. Forward-looking statements involve risks, uncertainties and assumptions, and actual results may differ materially from any future results expressed or implied by such forward- looking statements. When used in this communication, or in the documents incorporated by reference, the words “guidance,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “on track,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would,” “achieve,” “shall,” “target,” “will” and similar expressions are intended to be among the statements that identify forward-looking statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we cannot assure you that such expectations will prove to be correct. These forward-looking statements speak only as of the date of this communication and we undertake no obligation to revise or update any forward-looking statement for any reason, except as required by law. Risks and uncertainties include, but are not limited to, those detailed in Noble’s most recent Annual Report on Form 10-K, Quarterly Reports Form 10-Q and other filings with the U.S. Securities and Exchange Commission, including, but not limited to, risks related to the recently completed Diamond Transaction, including the risk that the benefits of the transaction may not be fully realized or may take longer to realize than expected. We cannot control such risk factors and other uncertainties, and in many cases, we cannot predict the risks and uncertainties that could cause our actual results to differ materially from those indicated by the forward-looking statements. You should consider these risks and uncertainties when you are evaluating us. With respect to our capital allocation policy, distributions to shareholders in the form of either dividends or share buybacks are subject to the Board of Directors’ assessment of factors such as business development, growth strategy, current leverage and financing needs. There can be no assurance that a dividend or buyback program will be declared or continued. Third Party Sources This presentation contains statistical data, estimates and forecasts that are based on publicly available information or information and data furnished to us by third parties. We have not independently verified the accuracy or completeness of the information and data provided by third parties, and other publicly available information. Accordingly, we make no representations as to the accuracy or completeness of that data nor do we undertake to update such data after the date of this presentation. Non-GAAP Measures This presentation includes certain financial measures that we use to describe the Company's performance that are not in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). The non-GAAP information presented herein provides investors with additional useful information but should not be considered in isolation or as substitutes for the related GAAP measures. Moreover, other companies may define non-GAAP measures differently, which limits the usefulness of these measures for comparisons with such other companies. The Company defines "Adjusted EBITDA" as net income adjusted for interest expense, net of amounts capitalized; interest income and other, net; income tax benefit (provision); and depreciation and amortization expense, as well as, if applicable, gain (loss) on extinguishment of debt, net; losses on economic impairments; restructuring and similar charges; costs related to mergers and integrations; and certain other infrequent operational events. We believe that the Adjusted EBITDA measure provides greater transparency of our core operating performance. The Company defines net debt as indebtedness minus cash and cash equivalents; free cash flow as net cash provided by (used in) operating activities less capital expenditures net of proceeds from insurance claims; adjusted EBITDA margin as adjusted EBITDA divided by total revenues; and leverage as net debt divided by annualized adjusted EBITDA from the most recently reported quarter. Noble believes these metrics and performance measures are widely used by the investment community and are useful in comparing investments among upstream oil and gas companies in making investment decisions or recommendations. These measures may have differing calculations among companies and investment professionals and a non-GAAP measure should not be considered in isolation or as a substitute for the related GAAP measure or any other measure of a company’s financial or operating performance presented in accordance with GAAP. Please see the Appendix to this communication for more information regarding the non-GAAP measures in this communication. Additionally, due to the forward-looking nature of Adjusted EBITDA and capital expenditures (net of reimbursements), management cannot reliably predict certain of the necessary components of the most directly comparable forward-looking GAAP measure. Accordingly, the company is unable to present a quantitative reconciliation of such forward-looking non-GAAP financial measure to the most directly comparable forward-looking GAAP financial measure without unreasonable effort. 2

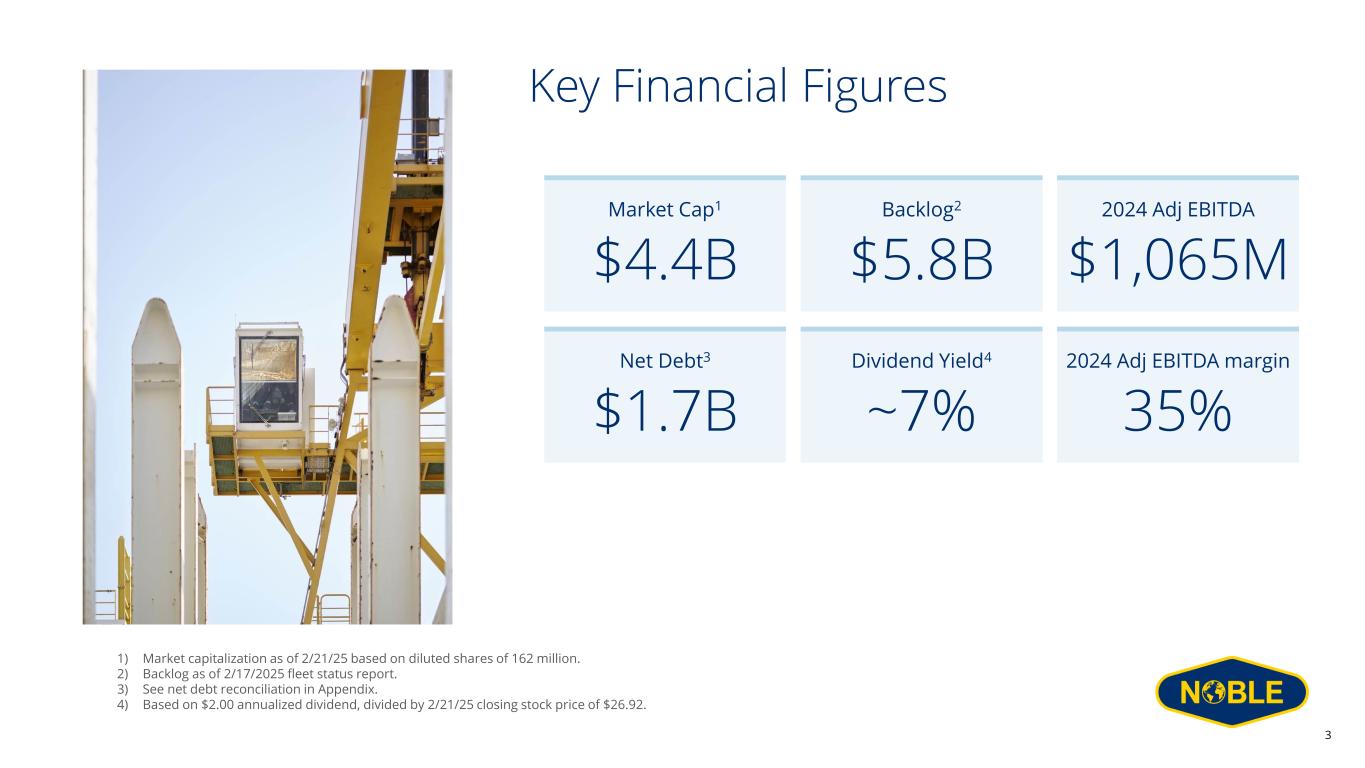

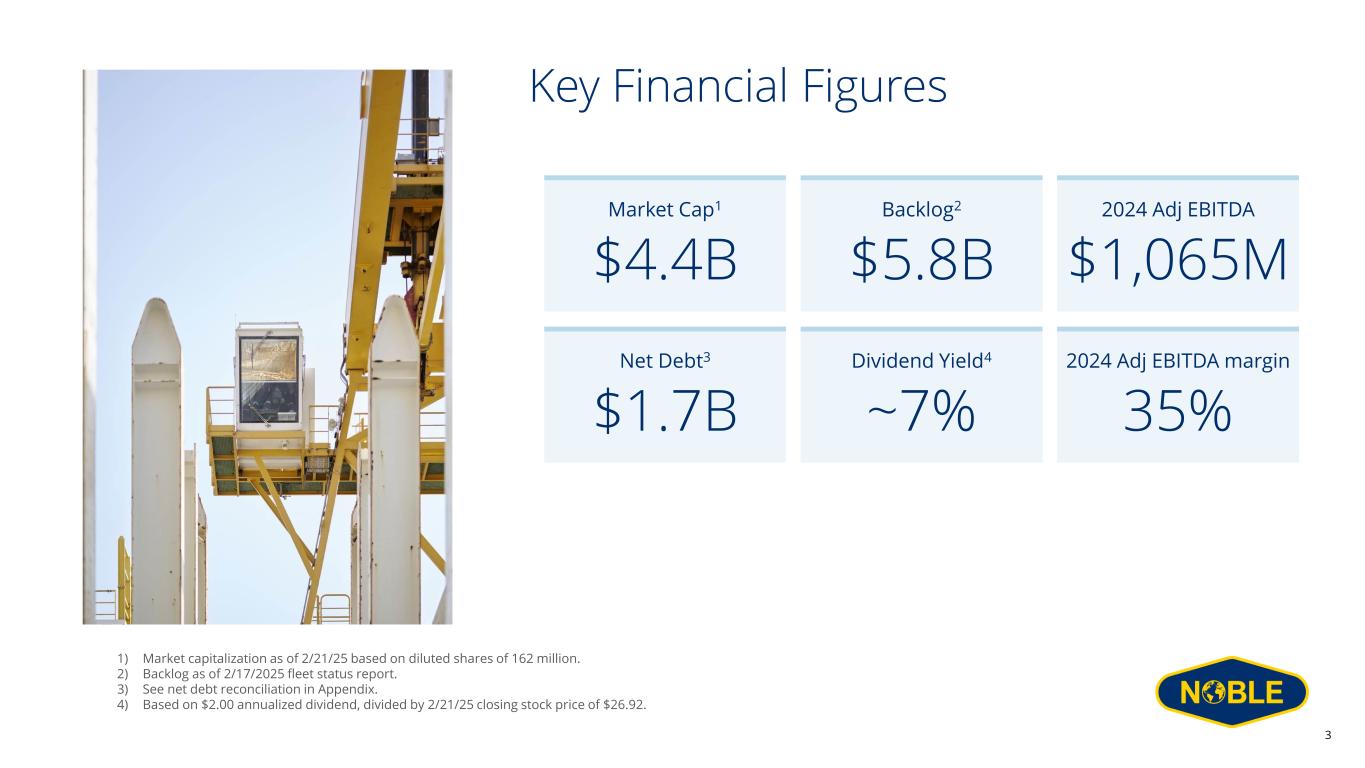

Key Financial Figures 1) Market capitalization as of 2/21/25 based on diluted shares of 162 million. 2) Backlog as of 2/17/2025 fleet status report. 3) See net debt reconciliation in Appendix. 4) Based on $2.00 annualized dividend, divided by 2/21/25 closing stock price of $26.92. 3 $1.7B Net Debt3 ~7% Dividend Yield4 35% 2024 Adj EBITDA margin $4.4B Market Cap1 $5.8B Backlog2 $1,065M 2024 Adj EBITDA

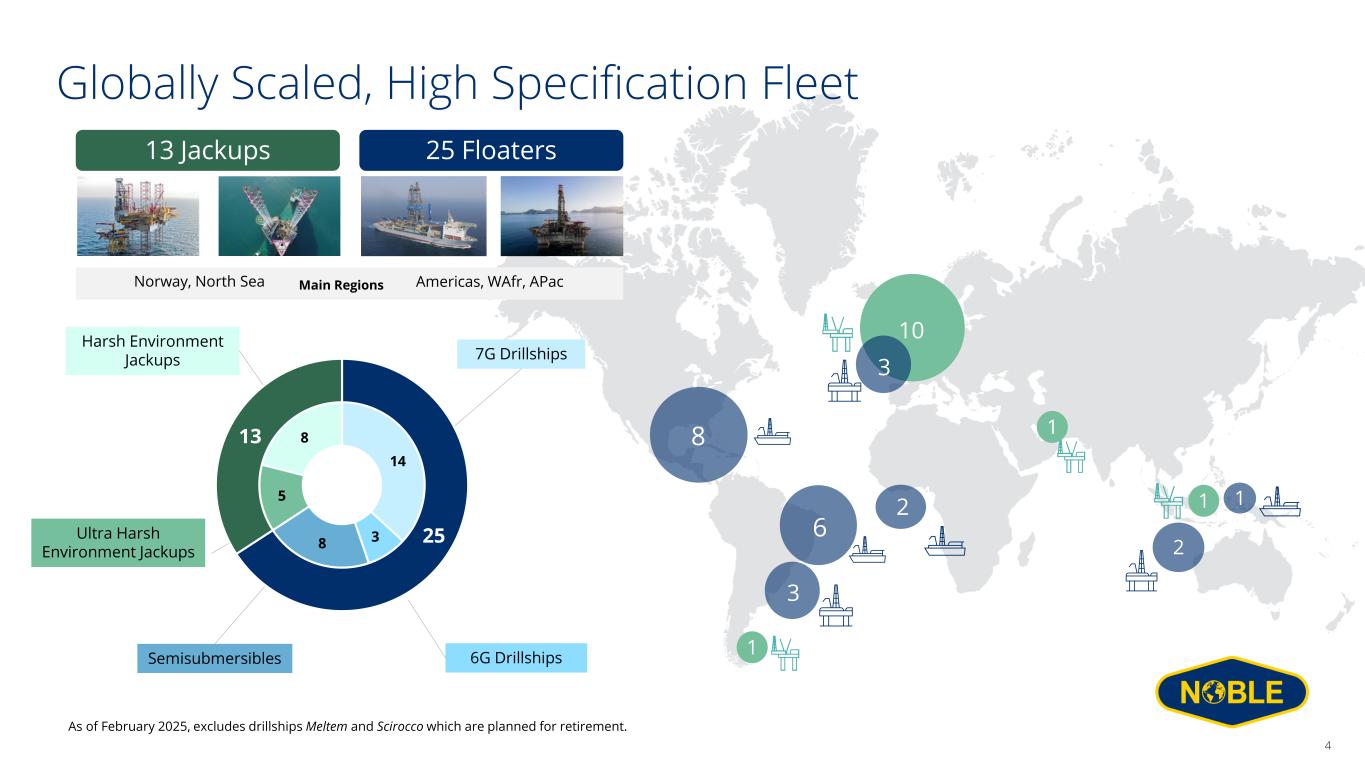

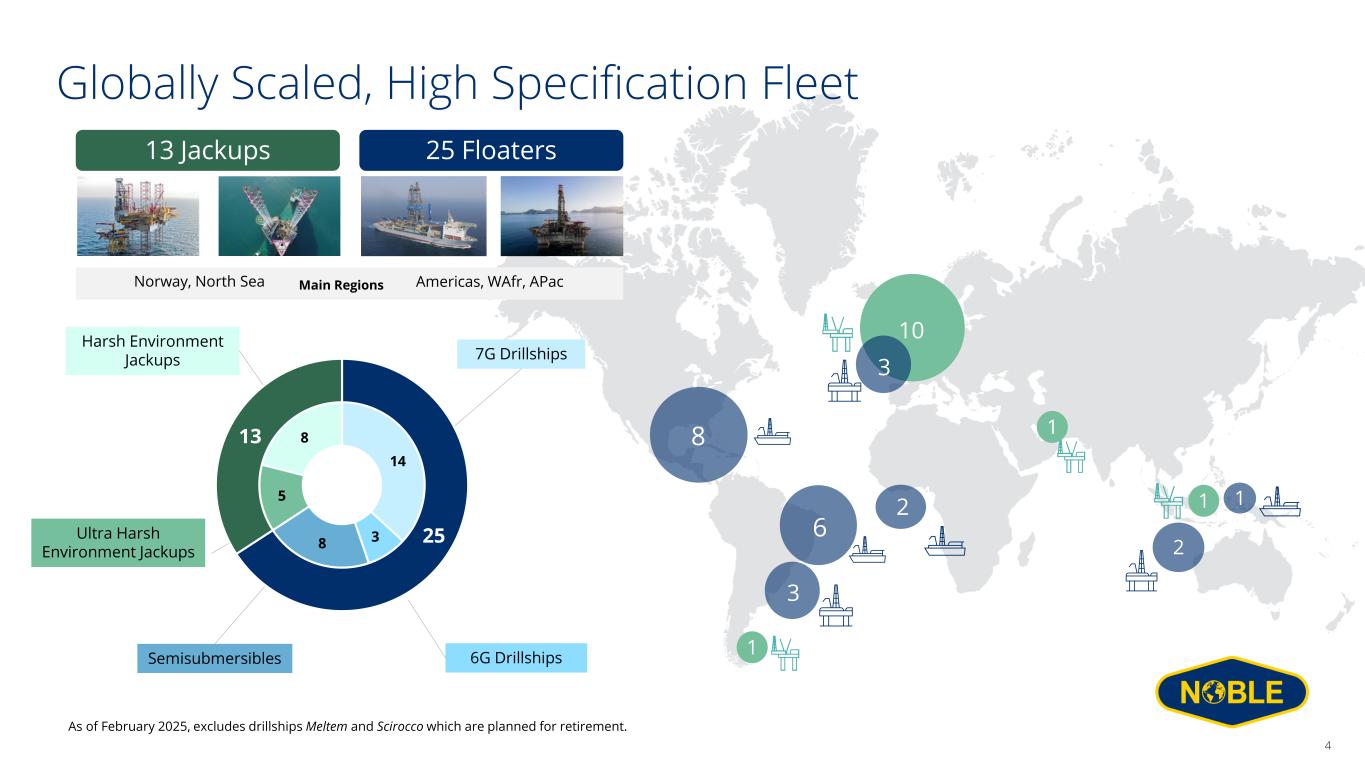

8 4 3 4 1 2 10 1 1 Globally Scaled, High Specification Fleet 6 2 1 25 Floaters13 Jackups Americas, WAfr, APacNorway, North Sea Main Regions 4 As of February 2025, excludes drillships Meltem and Scirocco which are planned for retirement. Ultra Harsh Environment Jackups Harsh Environment Jackups Semisubmersibles 6G Drillships 7G Drillships 3 14 38 5 8 25 13

Current Backlog Stands at $5.8 Billion 2025 2026 2027 2028 Floaters Jackups 58% 37% 9%21% Percentage of available days committed1 Backlog ($B) and Contract Coverage 5 2.4 1.9 1.0 0.5 1) Committed days on total marketed fleet of 38 rigs, excluding two retired rigs, per 2/17/2025 fleet status report 2) 2025 backlog represents remainder of the year, from 2/17/25.

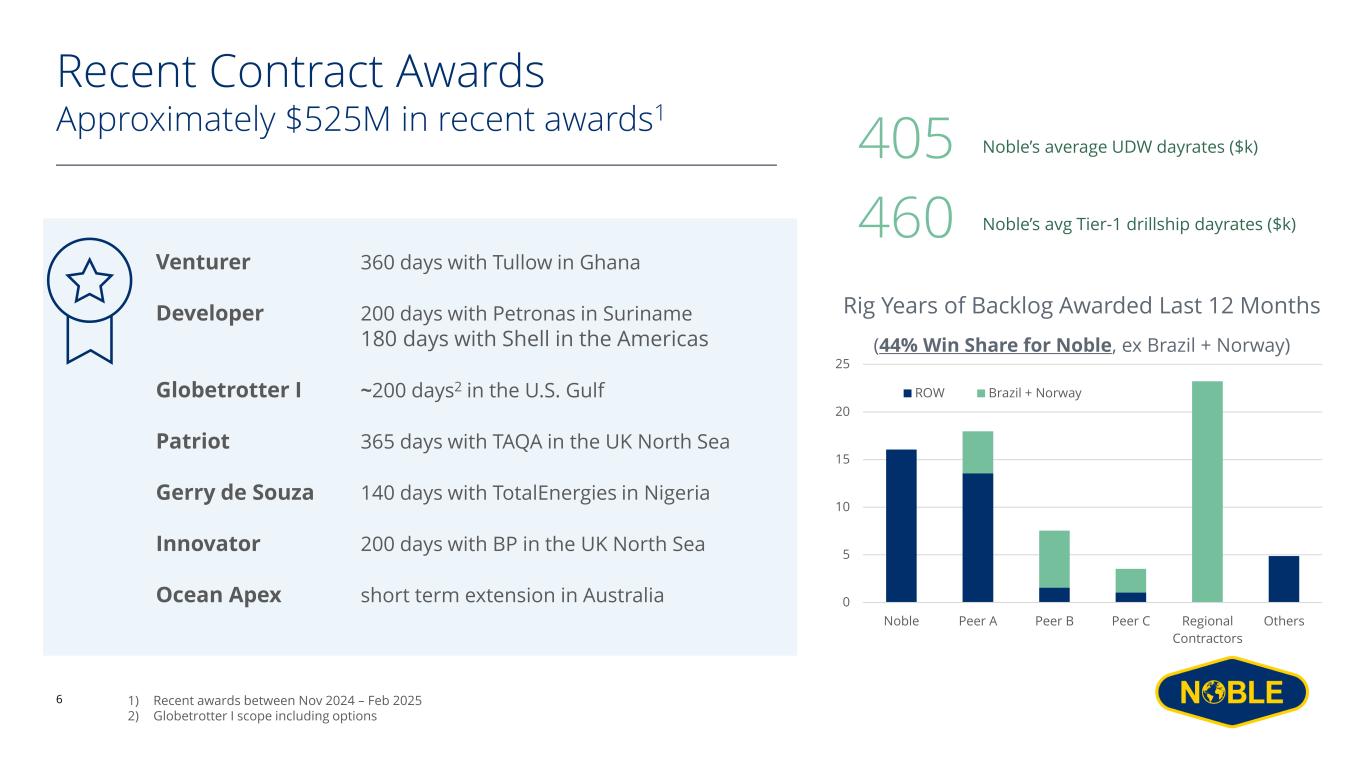

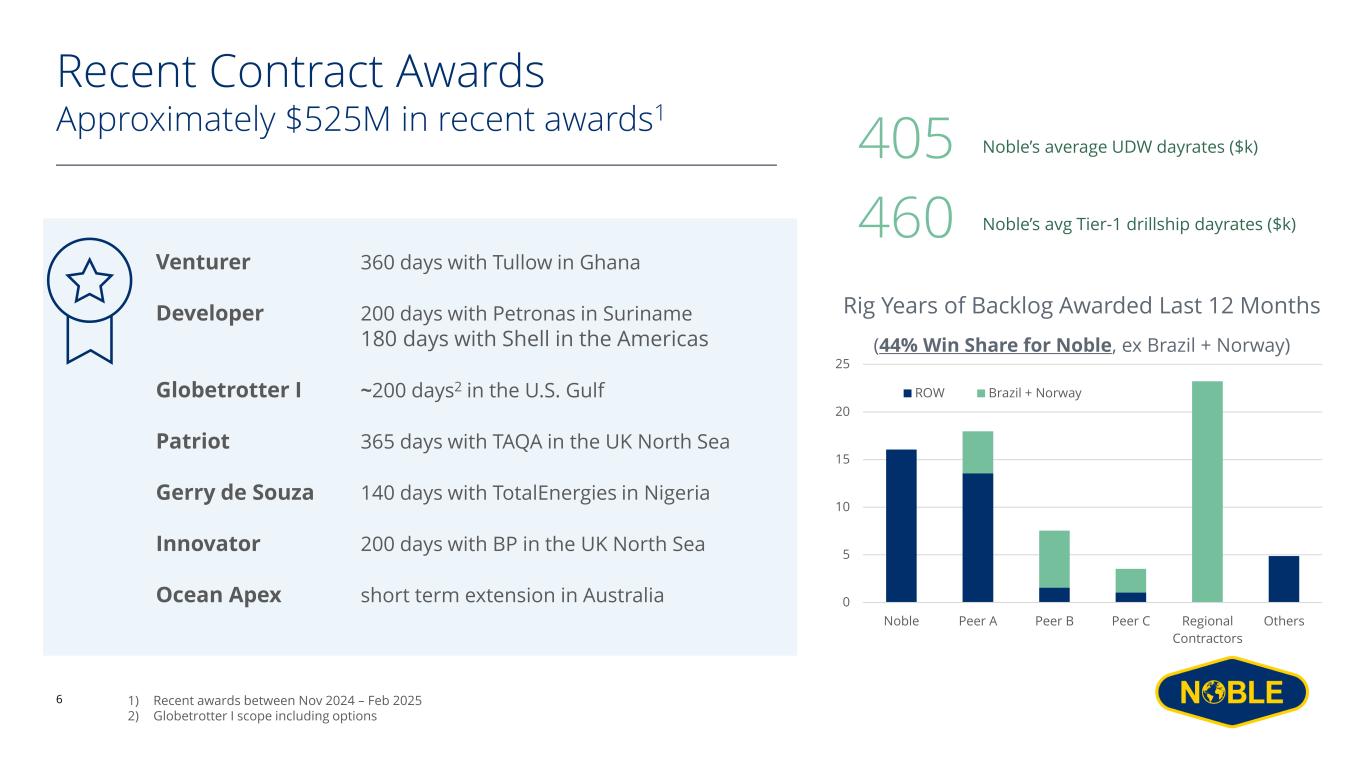

6 Noble’s average UDW dayrates ($k)405 Noble’s avg Tier-1 drillship dayrates ($k)460 Rig Years of Backlog Awarded Last 12 Months (44% Win Share for Noble, ex Brazil + Norway) Venturer 360 days with Tullow in Ghana Developer 200 days with Petronas in Suriname 180 days with Shell in the Americas Globetrotter I ~200 days2 in the U.S. Gulf Patriot 365 days with TAQA in the UK North Sea Gerry de Souza 140 days with TotalEnergies in Nigeria Innovator 200 days with BP in the UK North Sea Ocean Apex short term extension in Australia Recent Contract Awards Approximately $525M in recent awards1 0 5 10 15 20 25 Noble Peer A Peer B Peer C Regional Contractors Others ROW Brazil + Norway 1) Recent awards between Nov 2024 – Feb 2025 2) Globetrotter I scope including options

Marketed Floater Fleet is 93% Contracted 90% including 7G sideline capacity with significant reactivation costs and lead times Sources: Noble, Petrodata February 2025 7 ($100-200M entry cost) Deepwater Apollo Deepwater Athena Deepwater Mylos Dorado Draco Libra Meltem Valaris DS-11 Valaris DS-13 Valaris DS-14 5-8 units 10 units Current Demand Other floaters 27 6g harsh semis 20 Other benign UDW 46 Tier 1 drillships 46 139 units Current demand has dipped below 145-150 range from 2023-24 Expected to bottom slightly lower later this year Utilization rates remain healthy, supported by capacity refinements.

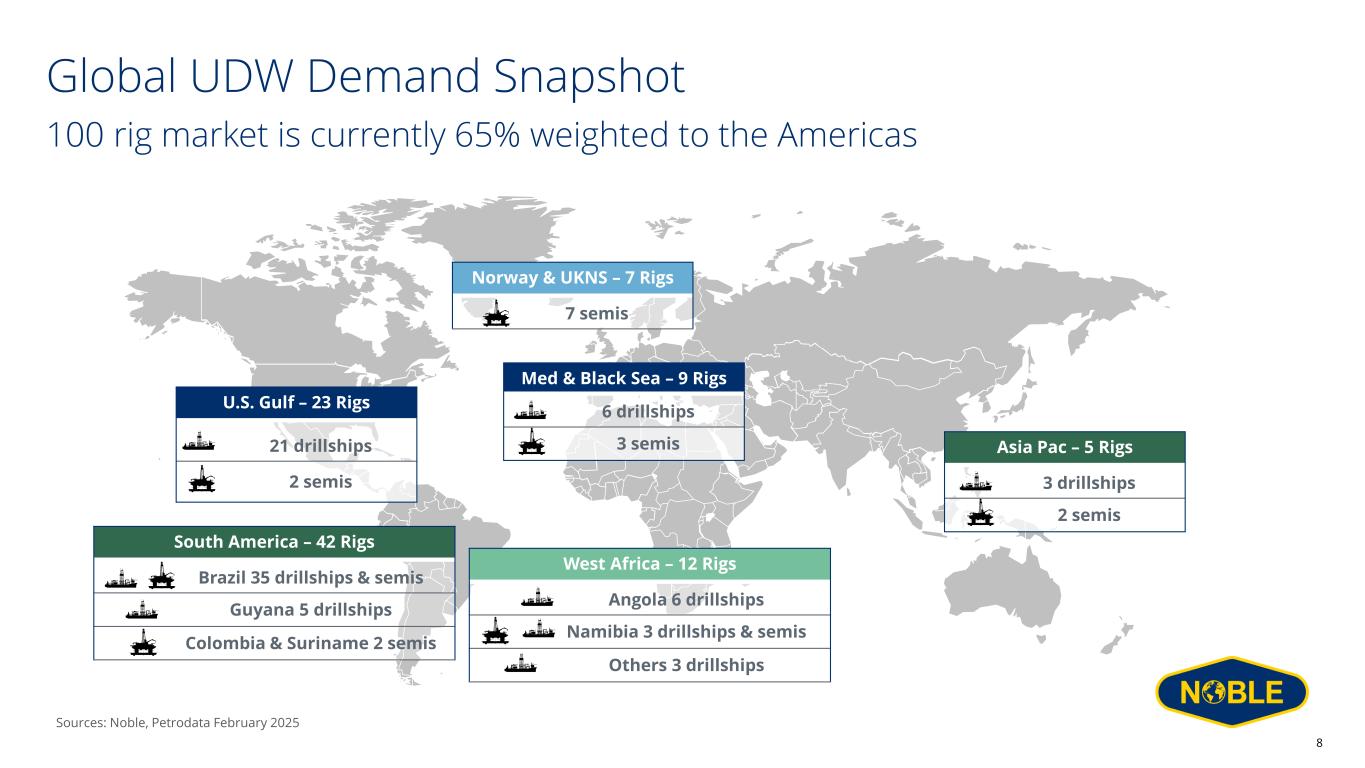

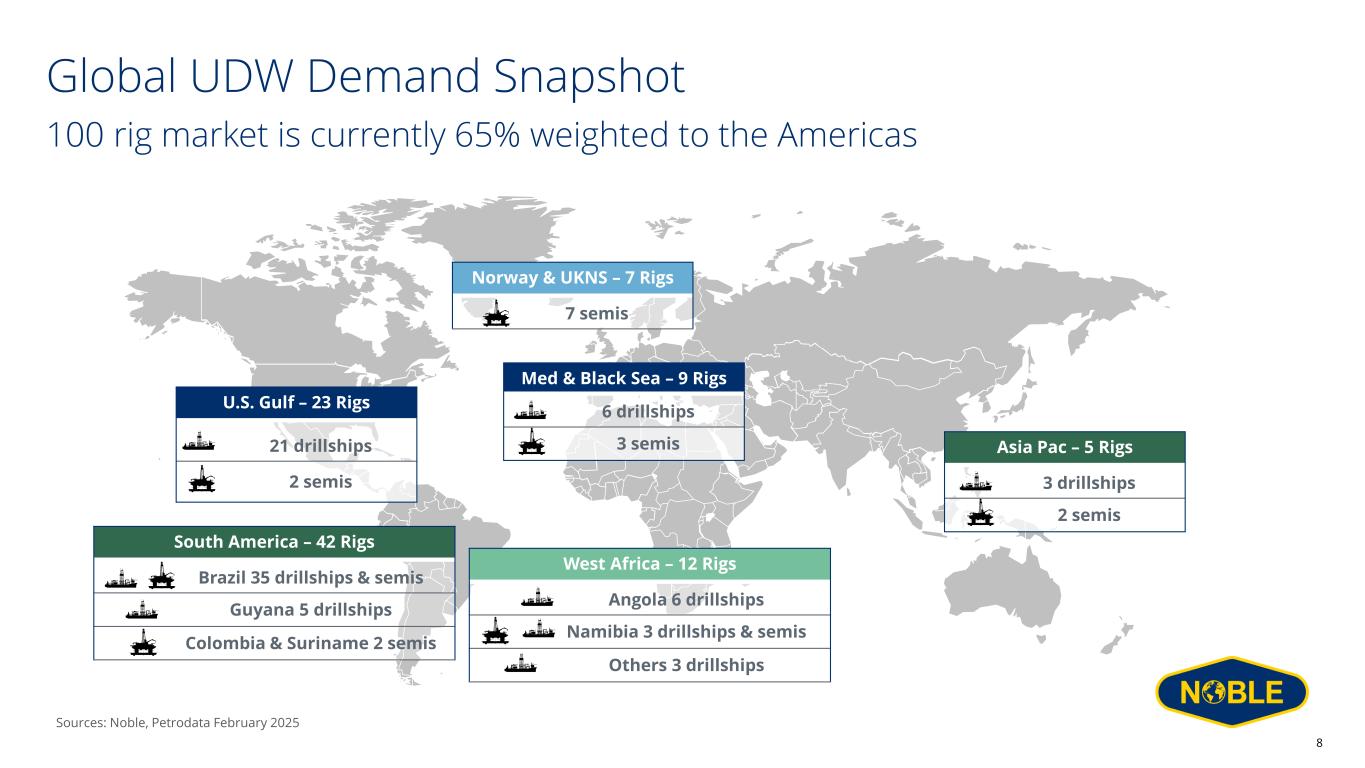

Asia Pac – 5 Rigs 3 drillships 2 semis South America – 42 Rigs Brazil 35 drillships & semis Guyana 5 drillships Colombia & Suriname 2 semis West Africa – 12 Rigs Angola 6 drillships Namibia 3 drillships & semis Others 3 drillships Med & Black Sea – 9 Rigs 6 drillships 3 semis Norway & UKNS – 7 Rigs 7 semis U.S. Gulf – 23 Rigs 21 drillships 2 semis Global UDW Demand Snapshot 100 rig market is currently 65% weighted to the Americas 8 Sources: Noble, Petrodata February 2025

Meltem and Scirocco • cold stacked drillships (legacy Pacific Drilling) • retirements announced Feb 3rd 2025 Ocean Onyx and Ocean Valiant • cold stacked semis (legacy Diamond Offshore) • scrapped Q4 2024 – Q1 2025 Globetrotter I and Globetrotter II • effectively removed from competitive drilling market • bidding into well intervention programs and other highly select opportunities in niche geographies 9 Fleet Rationalization

Return of Capital Track Record >$935M Dividends + Buybacks to Date1 $0.50 Quarterly Dividend per Share $1.7B Net Debt2 1) Includes total share repurchases since Q4 2022 through 12/31/24, including $70M associated with the Maersk Drilling squeeze-out, and including Q1 2025 announced dividend. 2) See net debt reconciliation in Appendix. 3) Leverage ratio defined as net debt divided by annualized Adjusted EBITDA for the prior reported quarter (quarter ending 12/31/24). 1.4x Leverage Ratio3 ✓Committed to returning essentially all FCF to shareholders via buybacks and dividends ✓Currently offering the highest dividend payout in U.S. OFS sector ✓Distributions supported by strong balance sheet 10 Buybacks Dividends $ Millions 0 50 100 150 200 250 300 350 400 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024

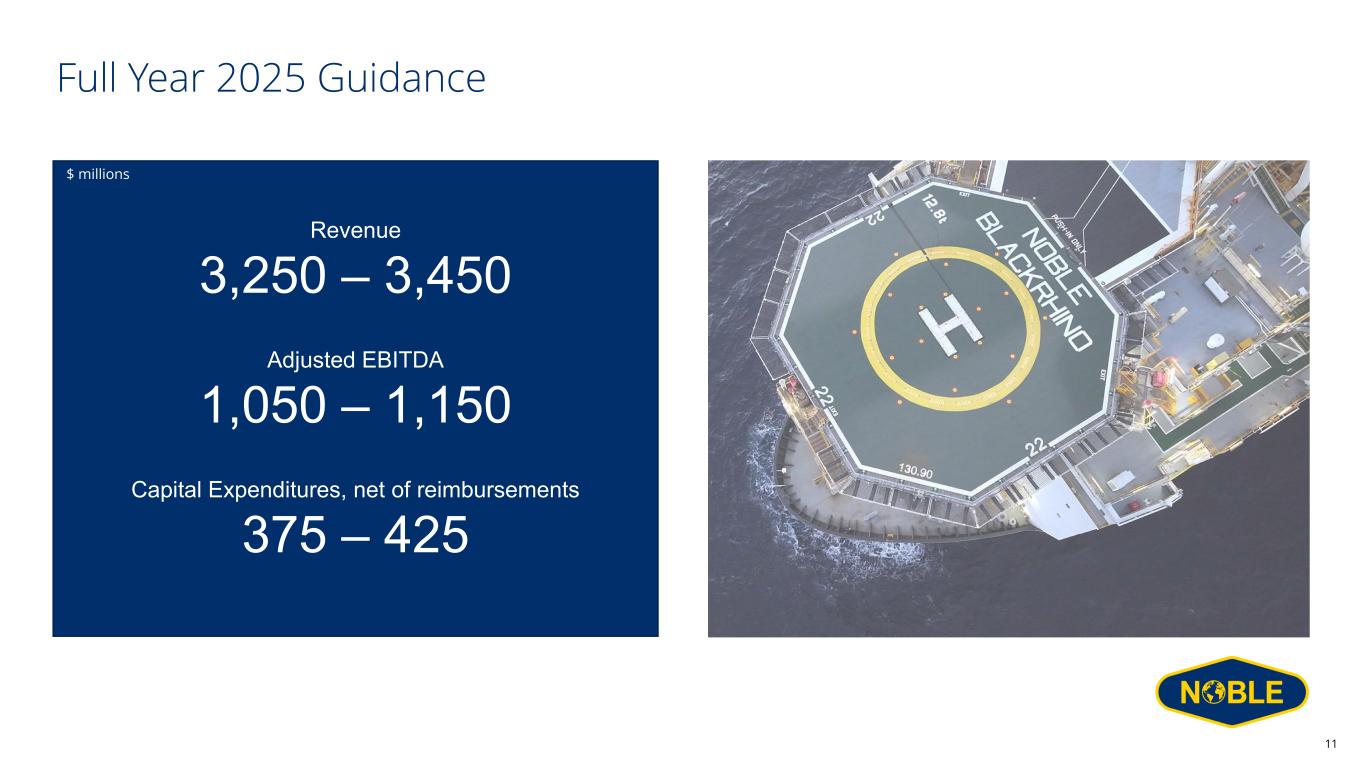

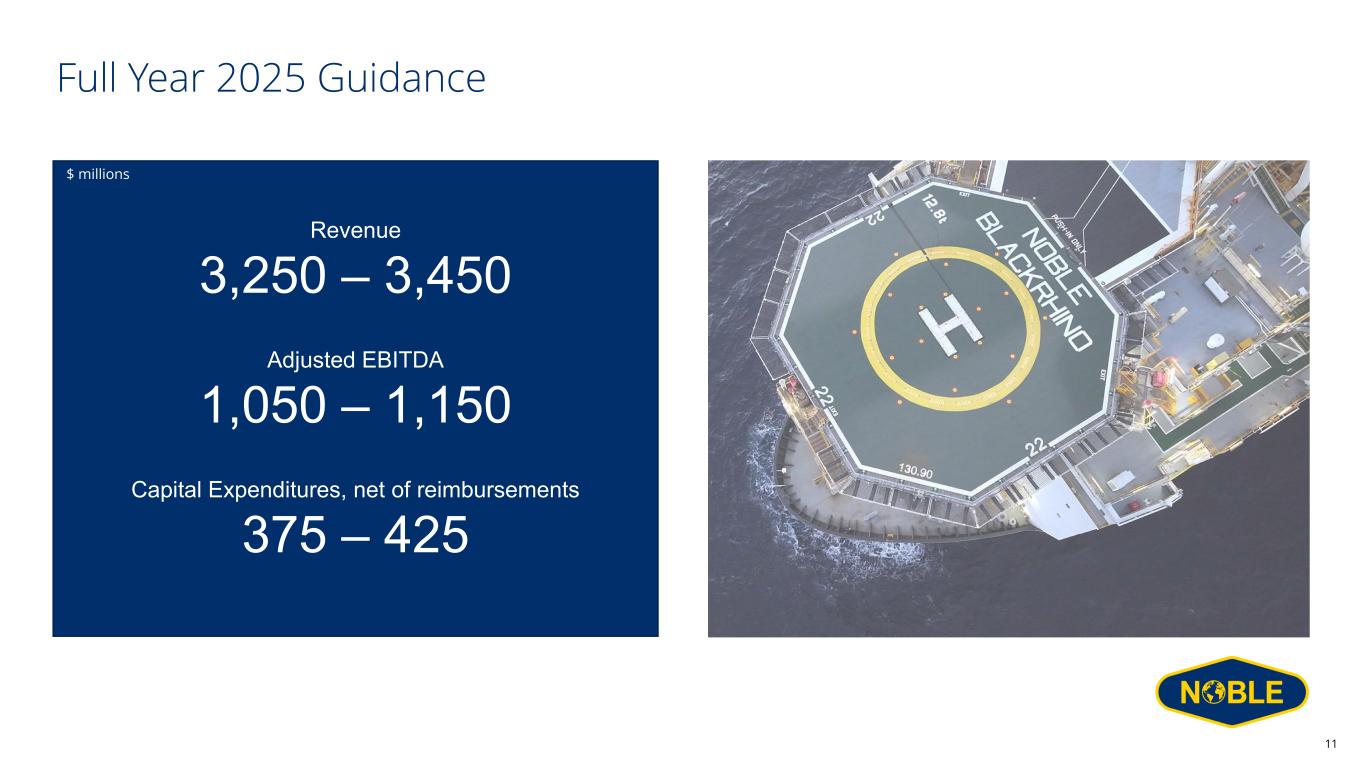

Full Year 2025 Guidance Revenue 3,250 – 3,450 Adjusted EBITDA 1,050 – 1,150 Capital Expenditures, net of reimbursements 375 – 425 $ millions 11

First Choice Offshore Industry leading FCF generation and return of capital, anchored by strong balance sheet Globally scaled, top tier fleet supported by world class crews and organizational breadth 12 Technical leadership in drilling performance and business innovation Deep relationships with leading upstream operators – customer centric service posture

Appendix

Appendix: Reconciliation to GAAP Measures 14 Reconciliation of Adjusted EBITDA Three Months Ended Twelve Months Ended December 31, 2024 September 30, 2024 December 31, 2024 Net income (loss) $ 96,648 $ 61,216 $ 448,353 Income tax (benefit) provision 27,814 31,608 43,981 Interest expense, net of amounts capitalized 39,720 24,951 94,211 Interest income and other, net 6,812 (2,292) 17,438 Depreciation and amortization 141,279 109,879 428,626 Amortization of intangible assets and contract liabilities, net (13,452) (3,730) (60,032) Merger and integration costs 20,261 69,214 109,424 (Gain) loss on sale of operating assets, net — — (17,357) Adjusted EBITDA $ 319,082 $ 290,846 $ 1,064,644 Total revenue $ 927,341 $ 800,549 $ 3,057,818 Adjusted EBITDA margin 34 % 36 % 35 % Reconciliation of Free Cash Flow and Capital expenditures net of proceeds from insurance claims Three Months Ended Twelve Months Ended December 31, 2024 September 30, 2024 December 31, 2024 Net cash provided by (used in) operating activities $ 136,214 $ 283,781 $ 655,475 Capital expenditures (140,662) (127,002) (575,315) Proceeds from insurance claims 6,871 7,898 23,297 Free cash flow $ 2,423 $ 164,677 $ 103,457 Reconciliation of Net Debt December 31, 2024 December 31, 2023 Long-term debt $ 1,980,186 $ 586,203 Cash and cash equivalents 247,303 360,794 Net Debt $ 1,732,883 $ 225,409

Thank you