The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 1, 2023

PRELIMINARY PROSPECTUS

Pershing Square SPARC Holdings, Ltd.

Up to 61,111,111 Subscription Warrants to Purchase Two Shares of Common Stock at a minimum price of $10.00 per Share

Pershing Square SPARC Holdings, Ltd., a Delaware corporation, is a newly organized company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses, which we refer to throughout this prospectus as our business combination. Our sponsor, Pershing Square SPARC Sponsor, LLC, a Delaware limited liability company (“Sponsor”), is an affiliate of Pershing Square Capital Management, L.P. (“Pershing Square” or “PSCM”), a registered investment advisor under the Investment Advisers Act of 1940, as amended. Our Sponsor is wholly owned by three investment funds managed by PSCM (the “Pershing Square Funds”). Our Sponsor was also an affiliate of Pershing Square Tontine Holdings, Ltd., a Delaware corporation (“PSTH”), which was a special purpose acquisition company (a “SPAC”) listed on the New York Stock Exchange that did not enter into an initial business combination within the prescribed time period and redeemed all of its Class A common stock and subsequently dissolved.

Our company is not a SPAC and we are not raising capital from public investors at this time. Instead, we are distributing, at no cost to the recipients, subscription warrants, which we refer to as special purpose acquisition rights, or “SPARs”, to purchase our shares at a future date in connection with our business combination. We are distributing an aggregate of up to 50,000,000 SPARs to the former holders of the Class A common stock of PSTH and an aggregate of up to 11,111,111 SPARs to the former holders of the distributable redeemable warrants of PSTH (collectively, the “Distribution”), in each case based on ownership of PSTH Class A common stock and distributable redeemable warrants as of July 25, 2022, the final date on which PSTH securities traded, as further described herein. We will not distribute SPARs to former beneficial holders of PSTH Class A common stock and PSTH distributable redeemable warrants who are located in states in which a state securities regulatory authority is required to approve the Distribution, and has not done so prior to the effective date of the Distribution. If any particular state securities regulatory authority does not approve the Distribution (and assuming former beneficial holders of PSTH Class A common stock or PSTH distributable warrants are located in any such state), the total number of SPARs distributed will be reduced to less than 61,111,111.

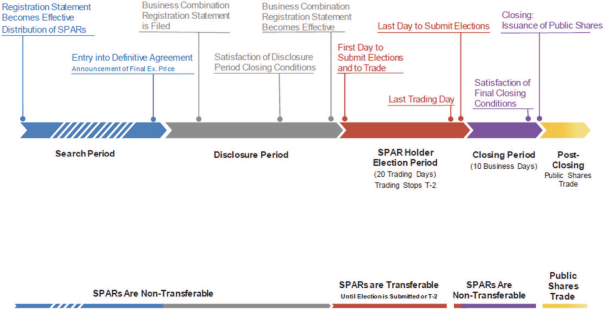

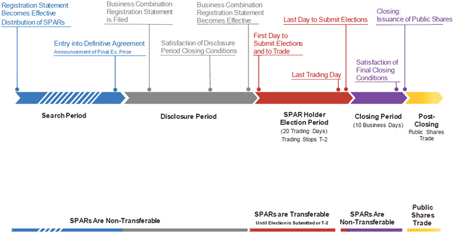

Our SPARs will not be tradable or exercisable, and we will not raise capital from public investors, until after we have entered into a definitive agreement for our business combination and distributed to SPAR holders a prospectus included in a post-effective effective amendment to the registration statement of which this prospectus is a part that provides comprehensive disclosure of the proposed business combination, including the number of SPARs that we expect will have been distributed and are eligible for election as of the beginning of the SPAR Election Period (as defined below) (the “Business Combination Registration Statement”). We are seeking to have our SPARs quoted, after the distribution of the Business Combination Registration Statement, on the OTCQX marketplace of the OTC Markets Group Inc. (“OTCQX”), during a 20-business-day period which we refer to as the “SPAR Election Period”.

During the SPAR Election Period, holders will be entitled to elect to have each SPAR exercised at the closing of our business combination, in full and not in part, for two Public Shares (as defined below) at a minimum exercise price of $10.00 per share ($20.00 in total). The funds received in connection with the submission of Elections will be held in an account controlled by an independent custodian (the “Custodial Account”) as further described in this prospectus. Funds will be released from the Custodial Account to us in connection with the Closing, or to electing SPAR holders in connection with the abandonment of our business combination or the liquidation of our company. Any return of funds to electing SPAR holders will be made promptly, on a pro rata basis, with interest, and net of taxes. In no other event will funds be released from the Custodial Account.

The exercise of the SPARs will occur concurrently with the consummation of our business combination (the “Closing”), as described elsewhere in this prospectus. In connection with a proposed business combination, we may decide to seek a greater amount of capital from public investors, in which case we may increase, but not decrease, the exercise price of our SPARs. If we decide to increase the per-share exercise price of our SPARs, we will publicly announce such increase at the time we announce that we have entered into a definitive agreement with respect to our business combination. We refer to the $10.00 SPAR exercise price per share as the “Minimum Exercise Price” and to the publicly announced final exercise price as the “Final Exercise Price.” The total proceeds from the exercise of all SPARs at the Minimum Exercise Price will be $1,222,222,220. There is no maximum Final Exercise Price, and accordingly, no maximum amount of total proceeds we could raise from the