Mineral Resource increases by 168% to 3.4 Mt lithium carbonate

Underscores growth potential for U.S. supply chain

| • | Rhyolite Ridge South Basin Mineral Resource of 360 Mt containing 3.4 Mt of lithium carbonate equivalent (168% increase) and 14.1 Mt of boric acid equivalent (18% increase) 1. |

| • | The Mineral Resource now includes both high-boron lithium mineralisation and low-boron lithium mineralisation. The previous Mineral Resource estimate only included high-boron lithium mineralisation. |

| • | Demonstrates optionality around future growth opportunities including increasing lithium production with or without increasing boron production. |

| • | The March 2023 Mineral Resource lies entirely within the project boundary currently being permitted under the Mine Plan of Operation. |

| • | All mineralised units remain open in three directions with approximately 60% of the South Basin remaining to be drilled, underscoring the potential for further increases in the Resource. |

| • | Rhyolite Ridge is ideally placed to play a pivotal role in the electrification of transportation in the U.S. In production, it will support the rapidly developing domestic lithium battery supply chain and lead innovation and sustainability in the production of materials critical to a clean energy future. |

Wednesday, 26 April 2023 – Ioneer Ltd (“Ioneer” or the “Company”) (ASX: INR, NASDAQ: IONR) is pleased to announce an updated Mineral Resource estimate for the South Basin at the Rhyolite Ridge Lithium-Boron Project located in Nevada, USA. The effective date for the updated Mineral Resource estimate is March 31, 2023.

WSP USA Inc. (‘WSP’; formerly Golder Associates Inc.) estimated the March 2023 Mineral Resource and provided the previous (2020) Mineral Resource and Ore Reserve estimates for the Rhyolite Ridge Definitive Feasibility Study (‘DFS’)2 completed in April 2020.

The updated South Basin Mineral Resource estimate comprises:

| • | Tonnage increase from 146.5 Mt to 360.0 Mt (up 145%) |

| • | Lithium carbonate equivalent (LCE) increase from 1.2 Mt to 3.4 Mt (up 168%) |

| • | Boric acid equivalent (BAE) increase from 11.9 Mt to 14.1 Mt (up 18%) |

| • | Cut-off grades unchanged at 1,090ppm Li and 5,000ppm B |

1 See ASX announcement titled “Rhyolite Ridge Ore Reserve Increased 280% to 60 million tonnes” dated 30 April 2020.

2 See ASX announcement titled “Ioneer delivers Definitive Feasibility Study that confirms Rhyolite Ridge as a world-class lithium and boron project” dated 30 April 2020.

Ioneer Ltd. (ASX: INR, NASDAQ: IONR) Suite 16.01, 213 Miller Street, North Sydney, NSW 2060 T: +61 2 9922 5800 W: Ioneer.com ABN: 76 098 564 606

Approximately 80% of the Mineral Resource is classified as Measured and Indicated. Approximately 44% of the Mineral Resource is classified as high-boron lithium mineralisation (HiB-Li) and 56% as low-boron lithium mineralisation (LoB-Li).

Background

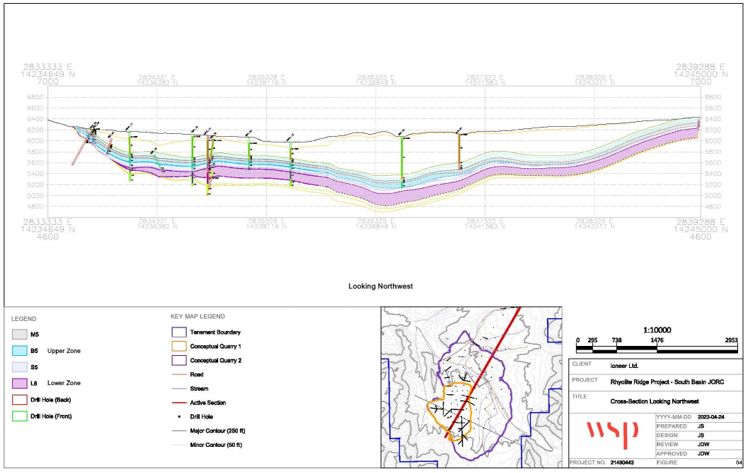

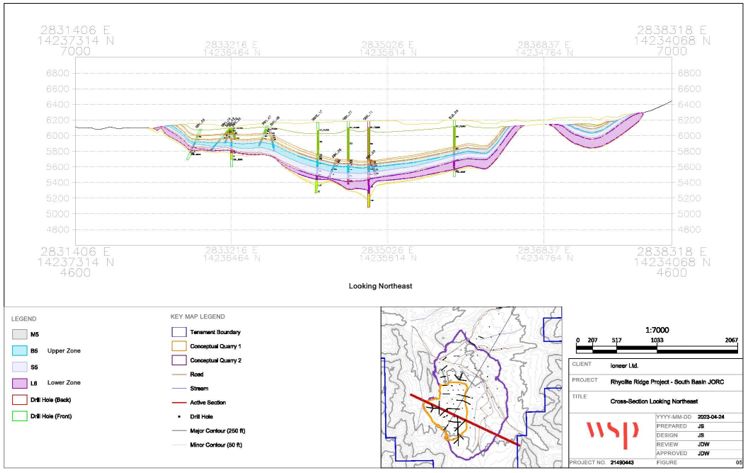

The Rhyolite Ridge South Basin stratigraphy comprises lake-bed sedimentary rocks of the Cave Spring Formation overlaying volcanic rocks of the Rhyolite Ridge Volcanic unit. The Cave Spring Formation can reach total thickness in excess of 300 metres and comprises a series of 11 sub-horizontal sedimentary units.

The Cave Spring Formation units are generally laterally continuous over several kilometres across the extent of the South Basin; however, thickness of the units can vary due to both primary depositional and secondary structural features. The Cave Spring Formation is unconformably overlain by approximately 20 metres of unconsolidated alluvium.

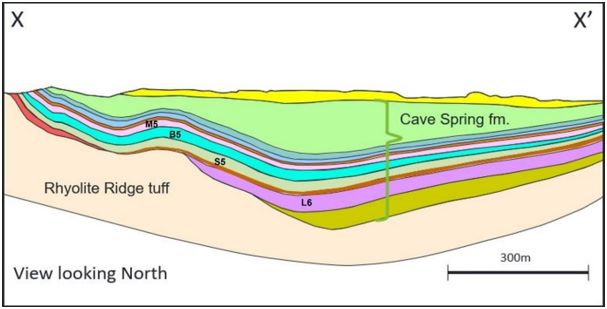

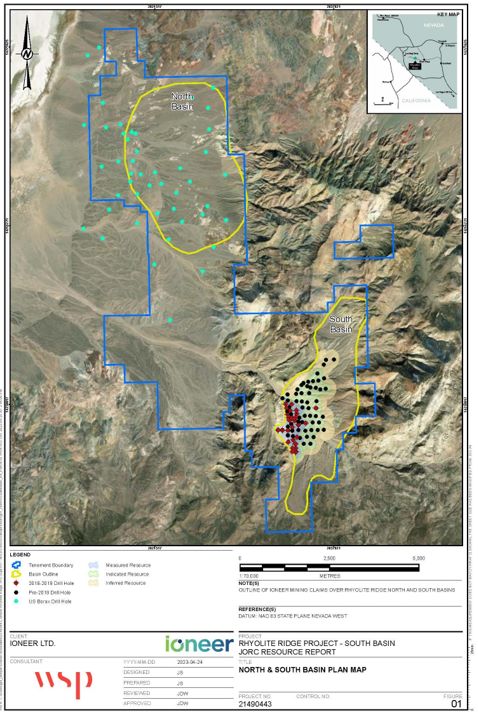

Figure 1. Geological map showing South Basin (green), Mineral Resource area (grey) and location of east-west cross-section (black) shown below in Figure 2.

Figure 2 – Schematic east-west cross-section illustrating Cave Spring Formation and mineralised layers

The key mineralised units of the Cave Spring Formation in the sequence are as follows (illustrated in Fig. 2), from top to bottom:

| ◾ | M5 - high-grade lithium, low-grade boron, high-clay |

| ◾ | B5 - high-grade lithium, high-grade boron, low-clay |

| ◾ | S5 -moderate-grade lithium, low-grade boron, low-clay |

| ◾ | L6 – moderate grade lithium, high and low-grade boron, low clay |

Lithium mineralisation is present in all four units in the range of 1000-3000ppm. For the purpose of flowsheet design and ore characterisation, Ioneer classifies the lithium mineralisation into three basic types:

| 1. | Type 1: High-boron lithium mineralisation where searlesite is the dominant minerals (B5 and L6) |

| 2. | Type 2: Low-boron lithium mineralisation where smectite-clay is the dominant mineral (M5) |

| 3. | Type 3: Low-boron lithium mineralisation where other minerals dominate and searlesite and smectite-clay are very low or absent (S5 and L6) |

The April 2020 Mineral Resource estimate by Golder Associates USA Inc. (now WSP) only included Type 1 HiB-Li mineralisation from the B5 and L6 layers. The HiB-Li mineralisation was constrained by applying a 5,000 ppm Boron cut-off grade as well as a high-level optimised Mineral Resource pit shell.

Type 1 HiB-Li mineralisation (B5 and L6) was considered the most suitable and exclusively used in the Mineral Resource and Ore Reserve estimate for its superior metallurgical and process flowsheet properties.

As the ore zones that overlay and underlay the B5 ore zone, specifically the M5, S5 and L6 zones, are also lithium and to a lesser extent boron bearing, there is potential for processing as either feed material to the current design process stream or as a standalone process stream via a second processing facility.

The March 2023 Mineral Resource estimate has been updated and now includes all four stratigraphic layers to incorporate all previously drilled and assayed HiB-Li and LoB-Li mineralisation.

Updated Mineral Resource

The South Basin Mineral Resource estimate is now 360 million tonnes containing 3.4 million tonnes of lithium carbonate equivalent and 14.1 million tonnes of boric acid equivalent (5,000ppm B and 1,090ppm Li cut-offs applied for the HiB-Li and LoB-Li mineralization streams respectively).

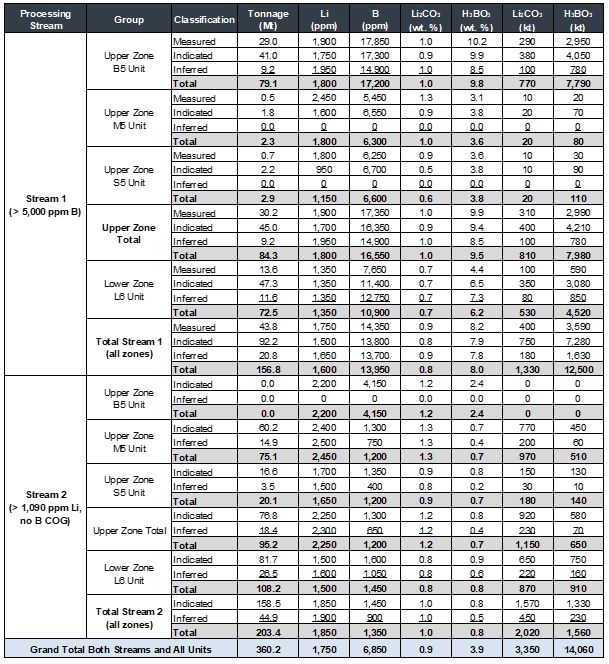

Summary of March 2023 Mineral Resource Estimate – Rhyolite Ridge South Basin

Processing Stream | Classification | Total Ore | Li | B | Li2CO3 | H3BO3 | Li2CO3 | H3BO3 |

| | | Million MT | ppm | ppm | wt% | wt% | kMt | kMt |

Total Stream 1 (> 5,000 ppm B) | Measured | 43.8 | 1,750 | 14,350 | 0.9 | 8.2 | 400 | 3,590 |

| Indicated | 92.2 | 1,500 | 13,800 | 0.8 | 7.9 | 750 | 7,280 |

| Inferred | 20.8 | 1,650 | 13,700 | 0.9 | 7.8 | 180 | 1,630 |

Total Stream 1 | 156.8 | 1,600 | 13,950 | 0.8 | 8.0 | 1,330 | 12,500 |

Total Stream 2 (> 1,090 ppm Li, no B COG) | Indicated | 158.5 | 1,850 | 1,450 | 1.0 | 0.8 | 1,570 | 1,330 |

| Inferred | 44.9 | 1,900 | 900 | 1.0 | 0.5 | 450 | 230 |

Total Stream 2 | 203.4 | 1,850 | 1,350 | 1.0 | 0.8 | 2,020 | 1,560 |

| Stream 1 + 2 | Total | 360.2 | 1,750 | 6,850 | 0.9 | 3.9 | 3,350 | 14,060 |

The updated March 2023 Mineral Resource estimate was completed by WSP, to JORC Code (2012) standards and replaces the Mineral Resource estimate contained within the April 2020 Mineral Resource and Ore Reserves estimate.

The Ore Reserves referenced in this report have not been updated from the April 2020 Ore Reserves estimate. The Ore Reserves are based exclusively on HiB-Li mineralisation. The Mineral Resources are reported inclusive of the Ore Reserves.

The March 2023 Mineral Resource estimate has been constrained by applying a 5,000 ppm Boron cut-off grade to HiB-Li mineralisation within the B5, M5, and L6 geological units as well as a 1,090 ppm Lithium cut-off grade to LoB-Li mineralisation in the M5, S5 and L6 geological units. Both styles of mineralisation have also been constrained by the application of a single high-level optimised Mineral Resource pit shell.

Relative to the April 2020 Mineral Resource estimate, the updated March 2023 Mineral Resource estimate for the Project reflects a significant increase in the estimated Mineral Resource tonnes, including the reporting of the Mineral Resources for the LoB-Li mineralisation for the first time for the Project. The updated Mineral Resource estimate also presents a small increase to the HiB-Li Mineral Resource tonnes as the impact of the LoB-Li mineralisation resulted in a net expansion of the constraining Mineral Resource pit shell.

As all four mineralised layers are tabular and stacked vertically, the increased Mineral Resource sits entirely within the same 3 square kilometre (km2) area as the April 2020 Mineral Resource estimate and represents only 38% of the 8km2 South Basin total prospective area (as illustrated in Fig. 1). Additionally, all four mineralised layers remain open to the North, South and East providing significant further Resource growth potential with extension drilling, initially to the south, to be pursued immediately upon receipt of final permitting.

In December 2022, the United States Fish and Wildlife Service (USFWS) listed Tiehm’s buckwheat as an endangered species under the Endangered Species Act (ESA) and has designated critical habitat by way of applying a 500 m radius around several distinct plant populations that occur on the Project site. Ioneer is committed to the protection and conservation of the Tiehm’s buckwheat. The Project’s Mine Plan of Operations submitted to the BLM in July 2022 and currently under NEPA review has no direct impact on Tiehm’s buckwheat and includes measures to minimise and mitigate for indirect impacts within the designated critical habitat areas identified.

The mineral resource pit shell used to constrain the March 31, 2023, Mineral Resource estimate was not adjusted to account for any impacts from avoidance of Tiehm’s buckwheat or minimisation of disturbance within the designated critical habitat. Estimates run inside the buckwheat avoidance areas identified 29.4 Mt at 1,650 ppm Li and 9,000 ppm B (both HiB-Li and LoB-Li streams combined), reflecting approximately 8% of the March 2023 global Mineral Resource estimate for the Project. The tonnes and grade within the avoidance polygons have not been removed from the Mineral Resources for the March 2023 estimate. Environmental and permitting assumptions and factors will be taken into consideration during future modifying factors studies for the Project. These permitting assumptions and factors may result in potential changes to the Mineral Resource footprint in the future.

Further detailed information is provided in:

| • | Appendix A - Mineral Resource Statement and Parameters |

| • | Appendix C – JORC Table 1 |

James Calaway, Executive Chairman of Ioneer commented:

“We are extremely pleased with the significant increase in the South Basin Mineral Resource estimate. It highlights Rhyolite Ridge’s optionality and multi-generational scale potential to provide a secure, sustainable, and reliable domestic source of lithium for the growing electric vehicle battery supply chain.”

Bernard Rowe, Managing Director of Ioneer commented:

“To date, we have focussed heavily on progressing our development plan for Rhyolite Ridge. With binding offtakes in place, debt & equity commitments of nearly US$1.2 billion and the project in the final stage of permitting, we can now begin demonstrating the broader scale potential at Rhyolite Ridge. The updated Mineral Resource base for the South Basin is a fantastic start and we look forward to building on this further with significant growth potential through South Basin extensions as well as increased exploration efforts on the mineralised and much larger North Basin.”

This ASX release has been authorised by Ioneer Managing Director Bernard Rowe.

-- ENDS --

Contacts:

Chad Yeftich Ioneer USA Corporation | Jason Mack Ioneer Limited |

| Investor Relations (USA) | Investor Relations (AUS) |

| T: +1 775 993 8509 | T: +61 410 611 709 |

E: ir@Ioneer.com | E: jmack@Ioneer.com |

Resource Estimate Advisers

Ioneer engaged the independent services of Golder Associates USA Inc. (now WSP) to compile and complete the updated South Basin Mineral Resource estimate, which has been verified and approved by their appointed Competent Person in compliance with JORC Code (2012).

Competent Persons Statement

The information in this report that relates to the March 2023 Mineral Resource estimate is based on information compiled by Jerry DeWolfe, a Competent Person who is a Professional Geologist (P.Geo.) with the Association of Professional Engineers and Geoscientists of Alberta (APEGA), a “Recognized Professional Organisation” included in a list promulgated by ASX from time to time. Mr DeWolfe is a full-time employee of WSP Canada Inc. (WSP, formerly Golder) and is independent of Ioneer and its affiliates. Mr DeWolfe has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (JORC Code 2012). Mr DeWolfe consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

The information in this report that relates to the 2020 Ore Reserve estimate is based on information compiled by Terry Kremmel, a Competent Person who is a certified Professional Engineer (‘PE’) in the US and a Registered Member of the Society for Mining, Metallurgy, & Exploration (‘SME’), a “Recognized Professional Organisation” included in a list promulgated by ASX from time to time. Mr Kremmel is a full-time employee of WSP USA Inc. (WSP, formerly Golder) and is independent of Ioneer and its affiliates. Mr Kremmel has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (JORC Code 2012). Mr Kremmel consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

About Ioneer

Ioneer Ltd is the 100% owner of the Rhyolite Ridge Lithium-Boron Project located in Nevada, USA, the only known lithium-boron deposit in North America and one of only two known such deposits in the world. The Definitive Feasibility Study (DFS) completed in 2020 confirmed Rhyolite Ridge as a world-class lithium and boron project that is expected to become a globally significant, long-life, low-cost source of lithium and boron vital to a sustainable future. In September 2021, Ioneer entered into an agreement with Sibanye-Stillwater where, following the satisfaction of conditions precedent, Sibanye-Stillwater will acquire a 50% interest in the Project, with Ioneer maintaining a 50% interest and retaining the operational management responsibility for the joint venture. In January 2023, Ioneer received a conditional commitment from the U.S. Department of Energy Loan Programs Office for up to $700 million of debt financing. Ioneer signed separate offtake agreements with Ford Motor Company and PPES (joint venture between Toyota and Panasonic) in 2022 and Korea’s EcoPro Innovation in 2021.

Important notice and disclaimer

Forward-looking statements

This announcement contains certain forward-looking statements and comments about future events, including Ioneer’s expectations about the Project and the performance of its businesses. Forward looking statements can generally be identified by the use of forward-looking words such as ‘expect’, ‘anticipate’, ‘likely’, ‘intend’, ‘should’, ‘could’, ‘may’, ‘predict’, ‘plan’, ‘propose’, ‘will’, ‘believe’, ‘forecast’, ‘estimate’, ‘target’ and other similar expressions within the meaning of securities laws of applicable jurisdictions. Indications of, and guidance on, the Conditional Commitment, financing plans, future earnings or financial position or performance are also forward-looking statements.

Forward-looking statements involve inherent risks and uncertainties, both general and specific, and there is a risk that such predictions, forecasts, projections and other forward-looking statements will not be achieved. Forward-looking statements are provided as a general guide only and should not be relied on as an indication or guarantee of future performance. Forward looking statements involve known and unknown risks, uncertainty and other factors which can cause Ioneer’s actual results to differ materially from the plans, objectives, expectations, estimates, and intentions expressed in such forward-looking statements and many of these factors are outside the control of Ioneer. Such risks include, among others, uncertainties related to the finalisation, execution, and funding of the DOE financing, including our ability to successfully negotiate definitive agreements and to satisfy any funding conditions, as well as other uncertainties and risk factors set out in filings made from time to time with the U.S. Securities and Exchange Commission and the Australian Securities Exchange. As such, undue reliance should not be placed on any forward-looking statement. Past performance is not necessarily a guide to future performance and no representation or warranty is made by any person as to the likelihood of achievement or reasonableness of any forward-looking statements, forecast financial information or other forecast. Nothing contained in this announcement, nor any information made available to you is, or shall be relied upon as, a promise, representation, warranty or guarantee as to the past, present or the future performance of Ioneer.

Except as required by law or the ASX Listing Rules, Ioneer assumes no obligation to provide any additional or updated information or to update any forward-looking statements, whether as a result of new information, future events or results, or otherwise.

Appendix A

Mineral Resource Statement and Parameters

A summary of the March 2023 Mineral Resource estimate is provided in the table below. Note that Mineral Resources are reported inclusive of the Ore Reserve described in Appendix B.

March 2023 Mineral Resource Estimate for Rhyolite Ridge South Basin

Notes:

1. mt = million tonnes; Li = lithium; B = boron; ppm = parts per million; Li2CO3 = lithium carbonate; H3BO3 = boric acid; kt = thousand tonnes.

ioneer Ltd. (ASX: INR) Suite 5.03, 140 Arthur Street, North Sydney, NSW 2060 T: +61 2 9922 5800 W: ioneer.com ABN: 76 098 564 606

2. Totals may differ due to rounding, Mineral Resources reported on a dry in-situ basis. Lithium is converted to Equivalent Contained Tonnes of Lithium Carbonate (Li2CO3) using a stochiometric conversion factor of 5.322, and boron is converted to Equivalent Contained Tonnes of Boric Acid (H3BO3) using a stochiometric conversion factor of 5.718. Equivalent stochiometric conversion factors are derived from the molecular weights of the individual elements which make up Lithium Carbonate (Li2CO3) and Boric Acid (H3BO3).

3. The statement of estimates of Mineral Resources has been compiled by Mr. Jerry DeWolfe, who is a full-time employee of WSP Canada Inc. (WSP; formerly Golder) and a Professional Geologist (‘P.Geo’.) with the Association of Professional Engineers and Geoscientists of Alberta (‘APEGA’), a “Recognized Professional Organization” included in a list promulgated by the ASX from time to time. Mr. DeWolfe has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity that he has undertaken to qualify as a Competent Person as defined in the JORC Code (2012).

4. All Mineral Resource figures reported in the table above represent estimates at March 31, 2023. Mineral Resource estimates are not precise calculations, being dependent on the interpretation of limited information on the location, shape and continuity of the occurrence and on the available sampling results. The totals contained in the above table have been rounded to reflect the relative uncertainty of the estimate.

5. Mineral Resources are reported in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (The Joint Ore Reserves Committee Code – JORC 2012 Edition).

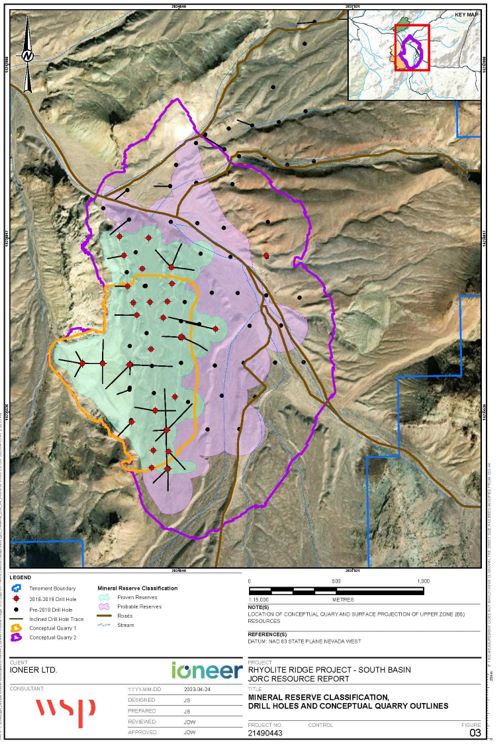

6. The Mineral Resource estimate is the result of determining the mineralized material that has a reasonable prospect of economic extraction. In making this determination, constraints were applied to the geological model based upon a pit optimization analysis that defined a conceptual pit shell limit. The conceptual pit shell was based upon a 5,000ppm boron cut-off grade for HiB-Li mineralisation and 1,090ppm lithium cut-off grade for LoB-Li mineralization below 5,000ppm boron. The pit shell was constrained by a conceptual Mineral Resource optimized pit shell for the purpose of establishing reasonable prospects of eventual economic extraction based on potential mining, metallurgical and processing grade parameters identified by mining, metallurgical and processing studies performed to date on the Project. Key inputs in developing the Mineral Resource pit shell included a 5,000ppm boron cut-off grade for HiB-Li mineralisation and 1,090ppm lithium cut-off grade for LoB-Li mineralization; mining cost of US$2.67/tonne plus $0.0059/tonne-vertical metre of haulage; plant feed processing and grade control costs of US$45.45/tonne of plant feed; boron and lithium recovery of 83.5% and 81.8%, respectively; boric acid sales price of US$700/tonne; lithium carbonate sales price of US$10,000/tonne; and sales/transport costs of US$160/tonne of product.

In December 2022, the United States Fish and Wildlife Service (USFWS) listed Tiehm’s buckwheat as an endangered species under the Endangered Species Act (ESA) and has designated critical habitat by way of applying a 500 m radius around several distinct plant populations that occur on the Project site. ioneer is committed to the protection and conservation of the Tiehm’s buckwheat. The Project’s Mine Plan of Operations submitted to the BLM in July 2022 and currently under NEPA review has no direct impact on Tiehm’s buckwheat and includes measures to minimise and mitigate for indirect impacts within the designated critical habitat areas identified.

The mineral resource pit shell used to constrain the March 31, 2023, mineral resource estimate was not adjusted to account for any impacts from avoidance of Tiehm’s buckwheat or minimisation of disturbance within the designated critical habitat. Estimates run inside the avoidance polygons identified 29.4 Mt at 1,650 ppm Li and 9,000 ppm B (both HiB-Li and LoB-Li streams combined), reflecting approximately 8% of the March 2023 global Mineral Resource estimate for the Project. The tonnes and grade within the avoidance polygons have not been removed from the Mineral Resources for the March 2023 estimate. Environmental and permitting assumptions and factors will be taken into consideration during future modifying factors studies for the Project. These permitting assumptions and factors may result in potential changes to the Mineral Resource footprint in the future.

Comparison with Previous Resource

The Table below presents a summary comparison of the current March 31, 2023 Mineral Resource estimate against the previous Mineral Resource estimate for the Project, prepared by Golder (now WSP) in April 2020 in association with the 2020 DFS.

The updated March 31, 2023 Mineral Resource estimate has been constrained by applying a 5,000 ppm Boron cut-off grade to HiB-Li mineralisation within the B5, M5, and L6 geological units as well as a 1,090 ppm Lithium cut-off grade to LoB-Li mineralisation in the M5, S5 and L6 geological units. Both styles of mineralisation have also been constrained by the application of a single high-level optimised resource pit shell.

Relative to the April 2020 Mineral Resource estimate, the updated March 2023 Mineral Resource estimate for the Project reflects a significant increase in the estimated resource tonnes, including the reporting of the Mineral Resources for the LoB-Li mineralisation for the first time for the Project.

The updated Mineral Resource estimate also presents a small increase to the HiB-Li Mineral Resource tonnes as the impact of the LoB-Li mineralisation resulted in a net expansion of the constraining Mineral Resource pit shell.

As all four mineralised layers are tabular and stacked vertically, the increased Mineral Resource sits entirely within the same 3 square kilometre (km2) area as the April 2020 Mineral Resource estimate.

Summary of Resource Estimate Parameters and Reporting Criteria

In accordance with ASX Listing Rules and the JORC Code (2012 Edition), a summary of the material information used to estimate the Mineral Resource is summarised below (for further information please refer to Table 1 in Appendix D).

| • | The Rhyolite Ridge Mineral Resource area extends over a north-south strike length of 2,450m (from 4,184,000 mN – 4,186,450 mN), has a maximum width of 1,250m (424,150 mE – 425,400 mE) and includes the 420m vertical interval from 1,920mRL to 1,500 mRL. |

| • | The Rhyolite Ridge Project tenements (unpatented mining claims) are owned by ioneer Minerals Corporation, a company wholly owned by ioneer Ltd. The unpatented mining claims are located on US federal land administered by the Bureau of Land Management (BLM). |

Geology and Geological Interpretation

| • | Lithium and boron mineralisation is stratiform in nature and is hosted within Tertiary-age carbonate-rich sedimentary rock, deposited in a lacustrine environment in the Basin and Range terrain of Nevada, USA. |

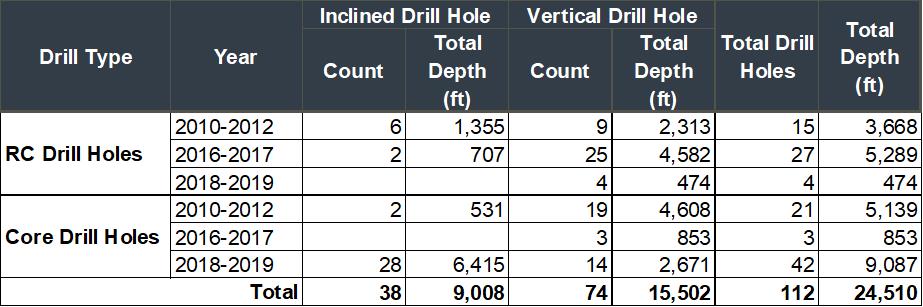

Drilling Techniques and Hole Spacing

| • | Drill holes used in the Mineral Resource estimate included 42 reverse circulation (RC) holes and 65 core holes for a total of 8,952m within the defined mineralisation. The full database for the South Basin contains records for 109 drill holes for 24,300m of drilling. |

| • | Drill hole spacing is 100m by 100m (or less) over most of the deposit. Spacing increases to approximately 200m by 300m along the eastern margin of the deposit. |

| • | Drill holes were logged for a combination of geological and geotechnical attributes. The core has been photographed and measured for RQD and core recovery. |

Sampling and Sub-Sampling Techniques

| • | Drilling was conducted by American Lithium Minerals Inc., the previous owner of the property between 2010 and 2011 and by ioneer in 2017 to 2019. For RC drilling, a 12.7-centimetre (cm) hammer was used with sampling conducted on 1.52m intervals and split using a rig mounted rotary splitter. The hammer was replaced with a tri-cone bit in instances of high groundwater flow. For diamond core, HQ core size diameter with standard tube was used. Core recoveries of 97% were achieved by ioneer at the project. The core was sampled as half core at 1.52m intervals using a standard electric core saw. |

Sampling Analysis Method

| • | Samples were submitted to ALS Minerals Laboratory in Reno, Nevada for sample preparation and analysis. The entire sample was oven dried at 105˚ and crushed to -2 millimetre (mm). A sub-sample of the crushed material was then pulverised to better than 85% passing -75 microns (µm) using a LM5 pulveriser. The pulverised sample was split with multiple feed in a Jones riffle splitter until a 100-200 gram (g) sub-sample was obtained for analysis. |

| • | Analysis of the samples was conducted using aqua regia 2-acid and 4-acid digest for ICP-MS on a multi-element suite. This method is appropriate for understanding sedimentary lithium deposits and is a total method. |

| • | Standards for lithium, boron, strontium and arsenic and blanks were routinely inserted into sample batches and acceptable levels of accuracy were reportedly obtained. Based on an evaluation of the quality assurance and quality control (QA/QC) results all assay data has been deemed by the WSP Competent Person as suitable and fit for purpose in Mineral Resource estimation. |

Cut-off Grades

| • | The Mineral Resource estimate presented in this Report has been constrained by the application of an optimized Mineral Resource pit shell. The Mineral Resource pit shell was developed using Maptek Vulcan Mine Planning software. |

| • | The Mineral Resource estimate assumes the use of two processing streams: one which can process ore with boron content greater than 5,000 ppm and one which can process ore with boron content less than 5,000 ppm. |

| • | The Mineral Resource estimate has been constrained by applying a 5,000 ppm Boron cut-off grade to HiB-Li mineralisation within the B5, M5, and L6 geological units as well as a 1,090 ppm Lithium cut-off grade to LoB-Li mineralisation in the M5, S5 and L6 geological units. |

| | • | Key input parameters and assumptions for the Mineral Resource pit shell included the following: |

| o | B cut-off grade of 5,000 ppm for HiB-Li processing stream and no B cut-off grade for LoB-Li processing stream |

| o | No Li cut-off grade for HiB-Li processing stream and Li cut-off grade of 1,090 ppm for LoB-Li processing stream |

| o | Overall pit slope angle of 35 degrees in the alluvium and 42 degrees in other rock units (wall angle guidance provided by EnviroMINE, Inc., who developed the geotechnical design). |

| o | Mining cost of US$2.67/tonne (t) plus US$0.0059/t-vertical foot of haulage. |

| o | Ore processing and grade control costs of US$45.45/t of ore for HiB-Li Processing Stream and US$40.69/t of ore for LoB-Li Processing Stream. |

| o | Boron and Li recovery of 83.5% and 81.8% respectively for HiB-Li Processing Stream. |

| o | Boron Recovery for LoB-Li Processing Stream variable by lithology as follows: 72% in M5 Unit, 79.5% in B5 unit, 75% in S5 unit, and 81% in L6 unit. |

| o | Lithium Recovery for LoB-Li Processing Stream variable by lithology as follows: 76% in M5 unit, 85% in B5 unit, 85% in S5 unit, and 86% in L6 unit. |

| o | Boric Acid sales price of US$700/t. |

| o | Lithium Carbonate sales price of US$10,000/t. |

| o | Sales/Transport costs of US$160/t of product. |

Estimation Methodology

| • | Drill core samples were composited to 1.52m composite lengths prior to interpolation of grade data into the block model. Composite lengths honoured geological contacts (i.e. composites did not span unit contacts). The composite length was selected based on the median sample length from the drill hole assay database. |

| • | Based on a statistical analysis, extreme B grade values were identified in some of the units other than the targeted B5, M5 and L6 units. As a result, restricted interpolation was applied to B grades in units other than the B5, M5 and L6. |

| • | The geological model was developed as a gridded surface stratigraphic model and a stratigraphically constrained grade block model using MineScape (v6.1.1) StratModel and BlockModel, which are computer-assisted geological, grade modelling, and estimation software applications. |

| • | Domaining in the model was constrained by the roof and floor surfaces of the geological units. The unit boundaries were modelled as hard boundaries, with samples interpolated only within the unit in which they occurred. |

| • | The geological model used as the basis for estimating Mineral Resources was developed as a stratigraphic gridded surface model using a 7.6m regularized grid. The grade block model was developed using a 15.2m north-south by 15.2m east-west by 1.52m vertical parent block dimension with maximum sub-celling dimensions of 3.8m by 3.8m by 0.4m. The grid cell and block size dimensions represent 25 percent of the nominal drill hole spacing across the model area. |

| • | Inverse Distance Squared (‘ID2’) grade interpolation was used for the estimate, constrained by stratigraphic unit roof and floor surfaces from the geological model. Up to four passes were used to estimate the blocks in the model and more than 99% of blocks were filled in the first two passes. |

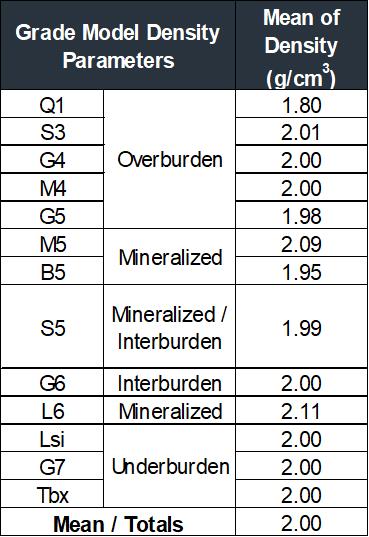

| • | The density values used to convert volumes to tonnages were assigned on a by-geological unit basis using mean values calculated from 249 density samples collected from drill core during the 2010-2011 and drilling programs. The density values ranged from 1.80 grams per cubic centimetre (‘g/cm3’) to 2.11g/cm3. The density analyses were performed using the Archimedes-principle (water displacement) method for density determination, with values reported in dry basis. |

Classification Criteria

| • | Estimated Mineral Resources were classified as follows: |

| o | Measured: 152.5m spacing between points of observation, with sample interpolation from a minimum of two drill holes. |

| o | Indicated: 305m spacing between points of observation, with sample interpolation from a minimum of two drill holes. |

| o | Inferred: 610m spacing between points of observation, with sample interpolation from a minimum of two drill holes. |

| • | The Mineral Resource classification has included the consideration of data reliability, spatial distribution and abundance of data and continuity of geology and grade parameters. |

Mining and Metallurgical Methods and Parameters

| • | The Mineral Resource estimate presented in this Report was developed with the assumption that the HiB-Li mineralization within the Mineral Resource pit shell has a reasonable prospect for eventual economic extraction using current conventional open pit mining methods. |

| • | The basis of the mining assumptions made in establishing the reasonable prospects for eventual economic extraction of the HiB-Li mineralization are based on preliminary results from mine design and planning work that is in-progress as part of an ongoing Feasibility Study for the Project. |

| • | The basis of the metallurgical assumptions made in establishing the reasonable prospects for eventual economic extraction of the HiB-Li mineralization are based on results from metallurgical and material processing work that was developed as part of the ongoing Feasibility Study for the Project. This test work was performed using current processing and recovery methods for producing Boric acid and Lithium carbonate products. |

A second process stream to recover Li from low boron mineralized (LoB-Li) units is being developed. Current results indicate a reasonable process and expectation for economic extraction of the LoB-Li from the S5, M5 and L6 units. This test work was performed using current processing and recovery methods for producing Boric acid and Lithium carbonate products.