Murphy Canyon Acquisition Corp.

4995 Murphy Canyon Road, Suite 300

San Diego, CA 92123

May 12, 2023

Securities and Exchange Commission

Division of Corporate Finance

100 F Street, N.E.

Washington, D.C. 20549

Attn: Tyler Howes and Laura Crotty

| | Re: | Murphy Canyon Acquisition Corp. |

| | | Draft Registration Statement on Form S-4 Submitted |

| | | February 1, 2023 |

| | | CIK No. 0001896212 |

Dear Mr. Howes and Ms. Crotty:

Murphy Canyon Acquisition Corp. (the “Company” or “Murphy Canyon”) previously submitted a Draft Registration Statement on Form S-4 (the “Registration Statement”) on a confidential basis pursuant to Title I, Section 106 under the Jumpstart Our Business Startups Act with the Securities and Exchange Commission (the “Commission”) on February 1, 2023. The Company hereby submits its response to the comment letter to the Registration Statement received on March 1, 2023 from the staff of the Commission (the “Staff”). The Registration Statement has been revised (the “Amendment”) to reflect the Company’s responses to the comment letter.

For ease of review, we have set forth below each of the numbered comments of your letter followed by the Company’s responses thereto. Unless otherwise indicated, capitalized terms used herein have the meanings assigned to them in the Amendment and all references to page numbers in such responses are to page numbers in the Amendment.

Draft Registration Statement on Form S-4

Cover Page

| 1. | On the cover page of the joint proxy statement/prospectus which appears immediately following the letter to stockholders, please clearly disclose the valuation of the target company where the business combination consideration is discussed, expressed as a dollar amount. |

Response: The Company acknowledges Staff’s comment and has revised the cover page as requested.

| 2. | Please revise your disclosure in the third paragraph on this page to show the potential impact of redemptions on the per share value of the shares owned by non-redeeming shareholders by including a sensitivity analysis showing a range of redemption scenarios, including minimum, maximum and interim redemption levels. Please include similar disclosure in the summary of the material terms of the transaction on page 3 and the Q&A referencing the post combination equity stakes on page 7. |

Response: The Company acknowledges the Staff’s comment and has revised the disclosures on the cover page and pages 4 and 7.

| 3. | Please identify the Private Placement Investor where first discussed. |

Response: The Company acknowledges Staff’s comment and has revised the initial disclosure as well as the defined term in the section Frequently Used Terms.

Summary of the Material Terms of the Transaction, page 4

| 4. | We note that certain shareholders have agreed to waive their redemption rights. Please describe any consideration provided in exchange for this agreement. |

Response: The Company acknowledges the Staff’s comment and respectfully confirms that pursuant to that certain Letter Agreement dated February 2, 2022, the Sponsor and directors and officers of MURF agreed to waive their redemption rights without any separate consideration paid in connection with providing such waiver. The Company has incorporated this clarification on pages 5, 11, 17 and 72.

| 5. | We note your discussions of the Shareholder Support Agreement and the Sponsor Support Agreement throughout the document. In this section, please disclose the percentage of outstanding shares that have agreed to vote in favor of the business combination. |

Response: The Company acknowledges the Staff’s comment and has incorporated such a disclosure as requested on page 5.

| 6. | Please clarify if the Sponsor and its affiliates can earn a positive rate of return on their investment, even if other SPAC stockholders experience a negative rate of return in the post-business combination company. |

Response: The Company acknowledges the Staff’s comment and has made the requested revision on pages 5, 11, 18 and 72.

| 7. | Please disclose the Sponsor and its affiliates’ total potential ownership interest in the combined company, assuming exercise and conversion of all securities. Disclose the approximate dollar value of that interest based on the transaction value and recent trading prices as compared to the price paid. |

Response: The Company acknowledges the Staff’s comment and has made the requested revision on pages 5, 11, 18 and 72.

| 8. | Please quantify the aggregate dollar amount and describe the nature of what the Sponsor and its affiliates have at risk that depends on completion of a business combination. Include the current value of securities held, loans extended, fees due, and out-of-pocket expenses for which the Sponsor and its affiliates are awaiting reimbursement. Provide similar disclosure for the company’s officers and directors, if material. |

Response: The Company acknowledges the Staff’s comment and has made the requested revision on pages 5, 11, 18 and 72.

Questions and Answers about the Business Combination and Proposals, page 6

| 9. | Please add a Q&A discussing all possible sources and extent of dilution that shareholders who elect not to redeem their shares may experience in connection with the business combination. Provide disclosure of the impact of each significant source of dilution, including the amount of equity held by founders, convertible securities, including warrants retained by redeeming shareholders, at each of the redemption levels detailed in your sensitivity analysis, including any needed assumptions. |

Response: The Company acknowledges the Staff’s comment and has made the requested revision on page 7.

Summary of the Proxy Statement/Prospectus Sponsor, page 13

| 10. | We note that the company’s CEO, Jack Heilbron, is the sole and managing member of the Sponsor, Murphy Canyon Acquisition Sponsor LLC. Please clearly disclose this information where the Sponsor is first discussed and disclose all associated conflicts of interest, including quantification of any financial benefit Mr. Heilbron may receive in connection with the business combination by virtue of his membership in the Sponsor entity. Your disclosure regarding these conflicts should appear in each place where the differing interests of the directors and officers of MURF compared to those of MURF stockholders are discussed. |

Response: The Company acknowledges the Staff’s comment and has made the requested disclosure at first instance on page 5 as well as disclosures on pages 11, 18 and 72 where the differing interests of the directors and officers of MURF compared to those of MURF stockholders are discussed.

Interests of MURF’s Directors and Officers in the Business Combination, page 15

| 11. | We note your statement that the Sponsor, Conduit or Conduit’s shareholders and/or their respective affiliates may purchase shares or enter into agreements to purchase shares to increase the likelihood of approval of the business combination proposal. Confirm your intent to comply, and revise your disclosure on pages 16, 47 and 63 accordingly, with the conditions set forth in Question 166.01 of the Tender Offers and Schedules C&DI. |

Response: The Company acknowledges the Staff’s comment and makes reference to the Tender Offer Compliance and Disclosure Interpretation Question 166.01 (March 22, 2022) that sets forth parameters relating to purchases by a SPAC sponsor or its affiliates outside of the redemption offer. In connection with the Staff’s comment, the Company has revised the disclosure on pages 18, 49 and 65.

The Company agrees and confirms that any purchase of MURF common stock will comply with the conditions indicated in C&DI Question 166.01. In the revised disclosure on the above referenced pages, the Company discloses that any Public Shares purchased by MURF’s Sponsor or affiliates of MURF will (i) be purchased at a price no higher than the price offered through the SPAC redemption process, (ii) not be voted in favor of the business combination transaction and (iii) not have redemption rights, or such rights would be waived. Further, in the event of such purchase, MURF intends to file on a Form 8-K with the required information outlined in C&DI Question 166.01.

Conditions to the Closing of the Business Combination, page 17

| 12. | Please revise to identify which conditions the parties may waive and still proceed with the business combination. |

Response: The Company acknowledges the Staff’s comment and has revised the disclosure on page 19 and a similar disclosure on page 78.

Risk Factors, page 22

| 13. | Please highlight the risk that the Sponsor will benefit from the completion of a business combination and may be incentivized to complete an acquisition of a less favorable target company or on terms less favorable to stockholders rather than liquidate. |

Response: The Company acknowledges the Staff’s comment and has made the requested revision on pages 11, 18, and 72 and has also incorporated a risk factor on page 40 concerning the same disclosure.

| 14. | Disclose the material risks to unaffiliated investors presented by taking the company public through a merger rather than an underwritten offering. These risks could include the absence of due diligence conducted by an underwriter that would be subject to liability for any material misstatements or omissions in a registration statement. |

Response: The Company acknowledges the Staff’s comment and has incorporated a risk factor concerning this disclosure on page 40.

We have identified material weaknesses in our internal control over financial reporting..., page 26

| 15. | Please revise this risk factor to discuss the steps you have taken, or will take, in order to remediate the significant deficiency in your internal controls. |

Response: The Company acknowledges the Staff’s comment and has revised the risk factor on page 24.

If the Business Combination’s benefits do not meet the expectations of investors or securities analysts..., page 39

| 16. | Please disclose here if the parties are currently aware of any ongoing litigation related to the merger agreement. |

Response: The Company acknowledges the Staff’s comment and respectfully advises the Staff that the Company is not aware of any ongoing litigation related to the merger agreement.

Our certificate of incorporation provides, subject to limited exceptions, that the Court of Chancery..., page 42

| 17. | We note your disclosure regarding the exclusive forum provision. Please also disclose that investors may incur increased costs due to the provision and clarify that investors cannot waive compliance with the federal securities laws and the rules and regulations thereunder. |

Response: In response to the Staff’s comment, the Company has revised the disclosure on page 44 of the Amendment.

We may not be able to complete the Private Placement in connection with the Business Combination., page 44

| 18. | We note the above titled risk factor undermines your disclosure elsewhere which presumes the private placement will close, including your disclosure that a subscription agreement has been entered into between the Private Placement Investor and MURF. Please reconcile or explain. |

Response: The Company acknowledges the Staff’s comment and respectfully advises that the Private Placement Investor has executed a subscription agreement and is expected to fund immediately prior to the closing of the Business Combination. However, the Company cannot guarantee that the Private Placement will close. In response to the Staff’s comment, the Company has revised the risk factor on page 46.

MURF’s stockholders may be held liable for claims by third parties..., page 47

| 19. | We note the above titled risk factor. Please revise to explain why you believe this risk factor presents a material risk related to the transaction and why you believe that MURF may not properly assess claims that may be brought against the company. |

Response: The Company acknowledges the Staff’s comment and has removed the risk factor as it does not present a material risk.

Special Meeting of MURF Stockholders Opinion of ValueScope, Inc., page 51

| 20. | Please remove your statement on page 52 that ValueScope’s reports and opinions “have been reviewed by the SEC, Internal Revenue Service and United States Department of Justice”, as such statement implies approval of such reports and opinions by the named agencies, which is not the case. |

Response: The Company acknowledges the Staff’s comment and has removed the statement as requested.

Opinion of ValueScope, Inc.

Overview of Key Assumptions and Inputs, page 54

| 21. | We note that the valuation prepared by ValueScope considered 14 indications by Conduit for the proposed clinical assets. Please explain how these 14 indications relate to the pipeline table disclosed on page 128. In this regard, the disclosure on page 128 indicates that Conduit (through its funding arrangement with St George Street) currently only has rights to development clinical assets, AZD1656 and AZD5904, in six indications. |

Response: The Company acknowledges the Staff’s comment and has revised the Amendment on page 134 to expand the discussion of potential future product candidates developed from AZD5904 to treat glioma and future product candidates developed from AZD1656 to treat psoriasis, Crohn’s disease, lupus, sarcoidosis, diabetic wound healing, idiopathic pulmonary fibrosis and nonalcoholic steatohepatitis. The 14 indications referenced on page 564 include the six indications listed on page 130 (COVID-19, uveitis, Hashimoto’s Thyroiditis, renal transplant, preterm labor, renal transplant and idiopathic male infertility) as well as the eight indications referenced in the preceding sentence that may be treated by potential future product candidates. The Company has also revised the Amendment on page 56 to clarify that the 14 applications include eight related to potential future product candidates.

| 22. | You state that the current development stage of each application was provided by Conduit and MURF, which estimated that completion of Phase I would take approximately 1 year, Phase II would take approximately 2 years, Phase III would take about 1 year, and approval from the FDA would take an additional 1 year. You also disclose that ValueScope researched development timelines by phase in the pharmaceutical industry and determined that the estimates provided by Conduit management were reasonable. Please discuss the type and extent of research performed by ValueScope in assessing the reasonableness of these development timelines. |

Response: The Company acknowledges the Staff’s comment and has revised the Amendment on page 56 to address the Staff’s comment.

| 23. | You disclose that Conduit intends to license their products upon successful Phase II completion and expects that licensing agreements would provide them with development success driven milestone payments and a royalty on future revenue generated by the products. Please address the following: |

| ● | Clearly explain how the Global Funding Agreement with St George Street provides you with exclusive rights to develop AZD1656 and AZD5904 and cite the specific provisions within this agreement that entitle you to future license fees, milestone payments and royalties. Provide us with a copy of the Global Funding Agreement to assist us with our analysis. |

| ● | Tell us why you believe comparing industry milestone payments with large pharmaceutical companies is comparable to Conduit’s operations. |

| ● | We note that most of the applications have a low probability rate of success. Tell us how milestone payments and licensing income were determined for those applications given the probability of success appears unlikely they would achieve a stage that would result in milestone payments or licensing income. For example, for Crohn’s disease with a PoS of 20% tell us why it is appropriate to project revenue for this application. |

| ● | Tell us which applications are assumed to have future licensing income and milestone payments and why. |

Response: The Company acknowledges the Staff’s comment and repeats portions of the Staff’s comment in italics and responds to each portion as set forth below.

| ● | Clearly explain how the Global Funding Agreement with St George Street provides you with exclusive rights to develop AZD1656 and AZD5904 and cite the specific provisions within this agreement that entitle you to future license fees, milestone payments and royalties. Provide us with a copy of the Global Funding Agreement to assist us with our analysis. |

Conduit (formerly known as SGS Global Ltd) entered into an Exclusive Funding Agreement (the “Funding Agreement”) with St George Street Capital (“St George”) on March 26, 2021, which the Company has filed as Exhibit 10.20 to the Amendment. Section 3.1 of the Funding Agreement grants Conduit the exclusive first right to provide to St George, or procure the provision of, all funding for the performance of a drug discovery and/or development project in consideration for a share of the net revenue in respect of such project. Net revenue for each drug discovery and/or development project is defined in the Funding Agreement to include future license fees, milestone payments and royalties. Section 3.4.5 of the Funding Agreement sets this share of net revenue at 100% for projects Conduit funds itself and 100% less the total percentage payable to third parties where third parties have contributed to funding the project. Conduit and St George have entered into five project funding agreements, which are subject to the terms of the Global Funding Agreement, to develop certain clinical assets that have been licensed to St George Street by AstraZeneca. The project funding agreements relate to:

| ● | AZD1656 for use in renal transplant, |

| ● | AZD1656 for use in pre-term labor, |

| | | |

| ● | AZD1656 for use in Hashimoto’s Thyroiditis and Graves’ Disease, |

| | | |

| ● | AZD1656 for use in uveitis, and |

| | | |

| ● | AZD5904 for use in idiopathic male infertility. |

Section 5 of each project funding agreement set forth that 100% of net sales and sublicensing revenue shall be paid to Conduit.

| ● | Tell us why you believe comparing industry milestone payments with large pharmaceutical companies is comparable to Conduit’s operations. |

The Company believes that comparing industry milestone payments with large pharmaceutical companies is comparable to Conduit’s operations because milestone payments within the biopharmaceutical development industry typically do not vary based on the size or history of the developer. ValueScope reviewed publicly available data sources and identified and analyzed 66 Phase II pharmaceutical license transactions. Due to the nature of the pharmaceutical development industry, most clinical trial stage license transactions take place between a large global pharmaceutical company as the buyer and a small developer as the seller. Additionally, Conduit will seek to license its assets, following successful clinical trials, to these large pharmaceutical companies.

| ● | We note that most of the applications have a low probability rate of success. Tell us how milestone payments and licensing income were determined for those applications given the probability of success appears unlikely they would achieve a stage that would result in milestone payments or licensing income. For example, for Crohn’s disease with a PoS of 20% tell us why it is appropriate to project revenue for this application. |

The milestone payments are assumed to be triggered upon successful completion of Phase II, Phase III, and Approval. While the cumulative probability of success is often low in the industry and in the analysis of Conduit, the probability of achieving each milestone is slightly higher than the cumulative probability. For example, the Crohn’s Disease indication has a 19.9% probability of successfully completing all phases and launching. However, it has a 40.0% probability of achieving the first milestone, successful Phase II completion. The subsequent probability of achieving the second milestone, successful Phase III completion, is 60.0%. However, the conditional probability that both Phase II and Phase III are successfully completed is 24.1%. Therefore, it is appropriate to project the milestones and adjust their value based on the cumulative probability of their success.

| ● | Tell us which applications are assumed to have future licensing income and milestone payments and why. |

All indications are assumed to have future licensing income and milestone payments, which are subsequently probability weighted and discounted. ValueScope has followed the standard procedure when valuing a startup or early-stage company to forecast the financial results under a success scenario and then subsequently adjust for the probability of success and discount based on the level risk involved.

| 24. | You disclose that Conduit expects future licensing agreements to contain a royalty rate of 15.0% of revenue, and that ValueScope reviewed industry data and observed a range of 12.5% to 18.0% within similar licensing agreements and used a 15.0% royalty rate in its base case. Tell us what consideration was given to the company being an early stage biotech with no significant operating history in research and development in determining a 15% royalty rate. For the royalty rates disclosed on page 60, explain to us whether such rates take into consideration the existing agreements among Conduit Pharmaceuticals Inc., St George Street Capital, Vela Technology PLC, and Cizzle PLC, which seem to limit Conduit’s entitlement to future royalties. In your response, please also discuss whether such limitations also exist for other product candidates. |

Response: The Company acknowledges the Staff’s comment. ValueScope reviewed publicly available data sources and identified and analyzed 66 Phase II pharmaceutical license transactions. ValueScope observed a median royalty rate of 18.0% and an average royalty rate of 18.5%. The observed standard deviation was 8.7%. ValueScope selected 15.0% in its analysis of Conduit as a conservative estimate and to account for other factors, such as development cost sharing and other contractual benefits, observed in Conduit’s prior agreements, as well as Conduit being an early stage biotech with limited operating history in research and development.

With respect to the royalty rates disclosed on page 60, which is now page 62 of the Amendment, such rates do not take into consideration the existing agreements among Conduit, St George Street Capital, Vela Technology PLC, and Cizzle PLC that limit Conduit’s entitlement to future royalties.

ValueScope believes that the agreement with St George Street covering AZD1656 for use in Covid-19 is not reflective of Conduit’s strategy to have 100% of the economic and development rights to non-Covid indications.

Comparable Public Companies Selected for Beta Analysis, page 55

| 25. | We note your disclosure of numerous public companies that ValueScope determined were comparable to Conduit. Please revise to further disclose the methodology used to reach this determination and explain why ValueScope believed the identified companies were comparable to Conduit given its stage of operations and appropriate to use in the analysis. in the analysis. |

Response: The Company acknowledges the Staff’s comment and has revised the disclosure on page 57 of the Amendment to address the Staff’s comment.

Probability of Success (“PoS”), page 57

| 26. | You state on page 55 that ValueScope reviewed two industry studies to determine the appropriate PoS for each application by stage, and that they selected the PoS data it deemed most appropriate from each study based on the therapeutic area involved and averaged the two data points to form its base-case PoS assumptions for each indication. Please address the following: |

| ● | Provide narrative disclosure explaining what is depicted in each of the charts appearing in this section. |

| ● | For each column in the PoS table at the top of page 57, clarify what the PoS percentages represent and how each was derived. In this regard, clarify whether the percentages are meant to indicate the PoS that each indication will complete each phase of development. |

| ● | Walk us through a specific indication and explain what the PoS percentages imply. For example, are we to infer from this table that for Crohn’s Disease you estimate that there is a 40% PoS that the product candidate will successfully complete Phase II trials? If this is the case, why would the PoS for successful completion of Phase III and ultimate FDA approval then increase to 60% and 83%, respectively? How do these phase-by-phase probabilities correlate to a total PoS of 20%? |

| ● | Clarify how and when the 61% probability for the COVID-19 indication was determined and if the new COVID-19 variations affect that probability. |

Response: The Company acknowledges the Staff’s comment and has revised the disclosure on page 59 of the Amendment to address the first two bullet points of above comment. With respect to Crohn’s Disease, this indication has already completed Phase I and has a 40% probability of successfully completing Phase II. If the Crohn’s Disease indication successfully completes Phase II, it has a 60% probability of completing Phase III. If the Crohn’s Disease indication successfully completes Phase III, it has an 83% probability of completing Approval. The cumulative probability of the Crohn’s Disease indication successfully completing Approval from its current stage is 20%. The cumulative probability is a multiplicative figure that is calculated as the product of the PoS of each remaining development stage. In the case of the Crohn’s Disease indication, the calculation is 40% x 60% x 83% = 20%. These figures have been rounded for presentation purposes.

With respect to COVID-19, based on discussions with Conduit’s management, the COVID-19 indication is assumed to have successfully completed Phase II. Based on ValueScope’s analysis, it is assumed to have a 70% probability of successfully completing Phase III and, if successful, an 87% probability of successfully achieving regulatory approval. The total PoS for the COVID-19 indication was calculated as 70% x 87% which is equal to 61%.

Certain Unaudited Conduit Prospective Financial Information, page 60

| 27. | You disclose that the projections disclosed on page 60 were prepared by Conduit management, provided to MURF in connection with the evaluation of the Business Combination, and provided to ValueScope in connection with its fairness opinion. You also disclose that the projections were provided on a base-case non-probability adjusted basis and that ValueScope has made adjustments to pre-tax income of each product for the probability of its success at that point in time. Please address the following: |

| ● | Explain how you determined that presenting these projections on a non-probability adjusted basis without also providing balancing disclosure on a probability-adjusted basis provides meaningful information to investors. |

| | | |

| | | Response: Conduit’s management provided its analysis with respect to the potential growth opportunities for Conduit in connection with ValueScope’s analysis relating to its Probability of Success (“PoS”)/Discounted Cash Flow (“DCF”) model. We respectfully advise the Staff that Conduit’s management team believes that the projections that were prepared by Conduit’s management and provided to ValueScope were reasonable and reflect assumptions that are consistent with those applied by other biotech companies. Conduit believes that non-probability adjusted projections provide meaningful information to investors by focusing on the projected revenue and earnings growth of the Company based on successful clinical trials where there is market demand consistent with the Company’s estimates. As Conduit is a development stage company, Conduit’s management believes that the non-probability adjusted basis projections are more useful to investors. However, we note that the DCF analysis prepared by ValueScope was on a risk adjusted basis. The DCF analysis included information relating to the likelihood of success for clinical trials based on historical clinical trials (for example, Phase II data for AZD1656), the anticipated timeline for reaching peak sales, the number of years at which such clinical assets will continue at peak sales, and anticipated royalty rates and milestone payments based on industry rates, which were sourced from industry research. Accordingly, Conduit’s management believes that the information as provided in the Amendment reflects balanced disclosure relating to the projections. |

| ● | Explain your consideration of providing similar pro forma income statement projections on a probability-adjusted basis, taking into consideration the adjustments made by ValueScope for purposes of their fairness opinion. |

| | | |

| | | Response: Conduit advises the Staff that it has provided pro forma income statement projections on a probability adjusted basis to present a balanced view of Conduit’s potential future financial performance by incorporating estimated probabilities of different scenarios. For example, Conduit considered the likelihood of regulatory approval, potential competition in each of the indications, and the total anticipated market size. In connection with its opinion, ValueScope reviewed revenue growth rates, operating margins, and capital expenditures on clinical trials and general and administrative expenses. Because Conduit is a development stage company and its clinical assets have different probabilities for approval in each indication, ValueScope determined that it was appropriate to value adjust the projections rather than using a discount method. Conduit believes that the value weighted approach is more appropriate in this context and is often used valuations of biotech companies. |

| ● | Expand your narrative discussion to clearly disclose the material assumptions used by Conduit management when preparing the projections for each line item as well as the adjustments made by ValueScope. For example, quantify the assumptions used by management in projecting future revenues and development costs for each indication and quantify the specific adjustments made by ValueScope. |

| | | Response: We advise the Staff that ValueScope’s projections were prepared by ValueScope based on inputs and adjustments that were derived from a combination of a review of industry historical standards, market and industry projections, ValueScope’s experience in the valuation industry, and discussions with Conduit’s management and a review of the projections prepared by Conduit’s management. ValueScope did not use the projections prepared by Conduit’s management as the basis for its projections. The assumptions made by Conduit’s management in its projections include, among other things, the likelihood of success for clinical trials based on historical clinical trials, the anticipated timeline for reaching peak sales, the number of years at which such clinical assets will continue at peak sales, and anticipated royalty rates and milestone payments based on industry rates, which were sourced from industry research. The projections prepared by Conduit’s management included three different scenarios – a downside case based on conservative assumptions, a base case based on assumptions that Conduit’s management believes are reasonable and customary, and an upside case based on growth-based assumptions. |

| ● | As it relates specifically to revenue projections, in addition to illustrating how the PoS of each indication was utilized when estimating future licensing income and milestone payments, please also provide clarity as to how forecasted patent expiry is reflected in the projected revenue streams. In this regard, we note your disclosure that Conduit’s revenue was projected to grow rapidly once several products launch to market, after which, revenue was projected to grow steadily until the product’s patents are expected to expire in 2030 (with declining revenue over the three years after expiry and a low rate of growth afterwards at total addressable market expands.) The development timelines provided by Conduit management suggest a total of five years to get FDA approval, which appears to indicate that your products will be marketed, at the earliest, in 2028. With patent expiry in 2030, this suggests a relatively short life span of revenue generation. |

| | | |

| | | Response: We advise the Staff that the co-crystal patent that is owned by Conduit provides for patent protection for a period of 20 years, which exceeds the timeframe of Conduit’s management projections that were provided to ValueScope. Any revenue due to the development of the co-crystals will be provided in a licensing agreement that is entered into with respect to the co-crystal. Conduit anticipates developing clinical assets through successful completion of Phase II clinical trials and then seeking opportunities to a licensing or sale transaction relating to the applicable clinical asset. Conduit does not currently anticipate continuing to develop clinical assets through Phase III trials. As a result, Conduit expects that revenue may be generated from the up-front and milestone payments relating to clinical assets following successful completion of Phase II clinical trials, which would be prior to the completion of Phase III trials and prior to the actual launch of such products. |

| ○ | As it relates specifically to development cost projections, clarify what adjustments were made by ValueScope to the projections provided by management. For example, based on the development timelines provided by Conduit management, it would appear that 2027 would be the projected phase III development period for 14 applications, yet there is only $3.8 million in projected development costs for this year no developments costs in 2028 when presumably additional costs/studies will still be required to obtain regulatory approval. |

| | | Response: As more fully described in the chart below, we respectfully advise the Staff that Conduit’s management projections assume that 12 out of the 14 applications for the clinical assets will be launched by the end of fiscal year 2026. The remaining two applications, which relate to idiopathic pulmonary fibrosis (“IPF”) and non-alcoholic steatohepatitis (“NASH”), are expected to be in the “approval” stage of development during fiscal year 2027 and launched thereafter. |

| 28. | Please also revise your disclosure to address the following: : |

| ● | Clearly state when these projections were prepared and management’s reasons for producing the projections. To the extent that a material amount of time has passed since the projections were prepared, disclose whether these projections still reflect management’s views on future performance. |

| ● | Disclose all material assumptions used to develop the projections, including assumed timing of regulatory approvals for Conduits’ product candidates, the length of time from approval to commercial availability, assumptions about market acceptance / penetration rates, market growth rates and the impact of competition. |

| ● | Explain why Conduit prepared projections for 11 years and discuss any associated risks related to projections covering operating results over this time period. |

Please also increase the size of the graphic appearing on page 60 so that the text is easily readable.

Response: In response to the Staff’s comment, Conduit advises the Staff that the discounted cash flow (“DCF”) projections were prepared by Conduit in connection with ValueScope rendering its fairness opinion. Conduit believes that the DCF projections were relevant to ValueScope’s overall analysis of Conduit’s financial condition.

Based on the prior experience of Conduit’s management, Conduit believes that license agreements within the pharmaceutical industry often have a term of ten years from the date of product launch or until the expiration of any applicable patent protection. Conduit believes that the patent term for its two current clinical assets, AZD1656 and AZD5904, will exceed ten years. In addition, Conduit prepared an eleven-year projection as the projections were prepared in 2022 based on the expectation that clinical trials would begin in 2023.

The projections prepare by Conduit’s management included assumptions based on market size, historical clinical trials, anticipated timeline for reaching peak sales, number of years at which such clinical assets will continue at peak sales, and anticipated royalty rates and milestone payments based on industry rates. In preparing the projections, Conduit considered a downside case, a base case and an upside case using industry-wide data for performance of similarly situated clinical assets. Conduit’s management also determined the estimated length of time from when a clinical asset is approved by regulatory authorities to the time at which a product using such clinical asset is available commercially.

In preparation of the projections, Conduit included an anticipated impact of competition, based on the total estimated market size of the use of the clinical asset to treat a particular indication and management’s belief of the addressable market share for such indication. Accordingly, Conduit’s management has assumed there will be several different competitors and that the maximum market penetration of any market participant would be less than 20%.

Conduit believes that the assumptions used in connection with the projections are reasonable and reflect assumptions that are consistent with those applied by other industry participants. Conduit’s management believes that the projections that were used in connection with ValueScope’s fairness opinion continue to be relevant. However, such projections are subject to change based on, among other things, general economic conditions, performance within the pharmaceutical industry, and Conduit’s ability to execute its strategy.

We respectfully advise the Staff that the font has been increased in the graphic on page 61 of the Amendment.

Background of the Business Combination, page 64

| 29. | We note that Alliance Global Partners acted as a financial advisor to both Murphy Canyon and Conduit for this transaction. Please revise to clarify at what point the parties were made aware of the potential conflict of interest and whether the same individuals were engaged to perform the advisory services. To the extent you have not done so, please also describe the steps the parties took to mitigate the risks resulting from the engagements and, if applicable, how potential conflicts of interest were considered by the Murphy Canyon board in negotiating the terms of the merger agreement. Additionally, please include a risk factor in the risk factors section discussing the risks to investors related to this potential conflict of interest. |

Response: The Company acknowledges the Staff’s comment and revised the disclosure on pages 67 and 68 of the Amendment regarding Alliance Global Partners’ advisory relationship by the parties and included an additional risk factor on page 48 in response to the Staff’s comment. We have been advised by Alliance Global Partners that the lead responsible individual that advises MURF in connection with the SPAC transaction is not the same lead responsible individual that advises Conduit in connection with the transaction.

| 30. | Please name the legal, accounting and financial advisors that attended the “all hands” organizational call on August 11, 2022, discussed on page 65. |

Response: The Company acknowledges the Staff’s comment and has revised the disclosure on page 67 of the Amendment in response to the Staff’s comment.

| 31. | In this section, disclose any discussions about the need to obtain additional financing for the combined company, such as the Private Placement, and the negotiation/marketing processes undertaken to date (e.g., identification of the Private Placement Investor and how the terms of the Private Placement were determined). |

Response: The Company acknowledges the Staff’s comment and has revised the disclosure on page 68 of the Amendment in response to the Staff’s comment.

| 32. | Please provide more fulsome disclosure of the discussions related to Mr. Sragovicz continuing employment as the Chief Financial Officer of New Conduit. |

Response: The Company acknowledges the Staff’s comment and has revised the disclosure on page 68 of the Amendment in response to the Staff’s comment.

| 33. | We note your statement on page 67 that the Board reviewed an investor presentation and analyses contained therein as part of its evaluation of the business combination. Please provide further detail regarding the contents of such presentation. |

Response: The Company acknowledges the Staff’s comment and has revised the disclosure on page 69 of the Amendment in response to the Staff’s comment. The Company also notes that it filed this presentation as an exhibit to its Current Report on Form 8-K filed with the Commission on November 8, 2022.

Approval of the Transactions by Conduit’s Board of Directors

Interests of the Sponsor and MURF’s Directors and Officers in the Business Combination, page 70

| 34. | Please disclose specifically how the Board considered Jack Heilbron’s control of the Sponsor and the financial benefits he would gain as a result of the business combination. If such issue was not specifically considered, please clearly state this fact and explain. |

Response: The Company acknowledges the Staff’s comment and revised the disclosure on page 73 of the Amendment in response to the Staff’s comment.

| 35. | We note that Murphy Canyon’s initial charter waived the corporate opportunities doctrine. Please discuss how the board considered this in determining whether to approve and recommend the transaction. |

Response: The Company acknowledges the Staff’s comment and revised the disclosure on page 73 of the Amendment in response to the Staff’s comment.

Certain Agreements Related to the Business Combination Subscription Agreement, page 78

| 36. | Please highlight the material differences in the terms and price of securities issued at the time of the IPO as compared to private placements contemplated at the time of the business combination. Please also disclose if any of Murphy Canyon’s directors, officers, Sponsor or their affiliates will participate in this private placement. |

Response: The Company acknowledges the Staff’s comment and respectfully advises the Staff that there are no material differences between the terms and price of the Units issued at the time of the IPO and the Units that will be issued at the Private Placement as they are similar: each unit is priced at $10.00 per unit and is comprised of one share of Class A common stock and one warrant to purchase one share of Class A common stock, which has an exercise price of $11.50 per share, registration rights and a five-year exercise period. Upon the closing of the Business Combination, specifically the filing of the Proposed Charter, MURF’s Class A common stock and Class B common stock will be reclassified as a single class of common stock, and MURF’s company name will change to “Conduit Pharmaceuticals Inc.” also referred to as New Conduit. The underlying terms of the separate class of Class A common stock and the single class of common stock are materially the same as each has or will have the same voting right of one vote per each share, same dividend rights and same liquidation rights.

In addition, MURF’s directors, officers, Sponsor and their affiliates will not be participating in the private placement. The Company has incorporated such disclosure on page 80.

Material U.S. Federal Income Tax Consequences, page 79

| 37. | We note your disclosure that the parties “intend” for this transaction to qualify as a reorganization within the meaning of Section 368(a) of the Internal Revenue Code. However, the disclosure does not clearly indicate whether the parties expect the business combination to be tax-free to U.S. holders. Revise to make clear whether the parties expect the business combination to be tax-free to U.S. holders. If you are able to conclude that the business combination is likely to be tax-free to U.S. holders, file a tax opinion supporting such a conclusion. For further guidance see Staff Legal Bulletin No. 19 and Item 601(b)(8) of Regulation S-K. If there is uncertainty regarding the tax treatment of the business combination, counsel’s opinion should discuss the degree of uncertainty. |

Response: The Company acknowledges the Staff’s comment and has revised the Amendment on page 82 to clarify that the parties expect the business combination to be tax-free to U.S. holders and intends to file a tax opinion supporting such conclusion as Exhibit 8.1.

Unaudited Pro Forma Condensed Combined Financial Information Basis of Pro Forma Presentation, page 86

| 38. | Please explain to us, and revise to disclose, how you have calculated the 12,381,296 MURF Class A common stock under the maximum redemption scenario. |

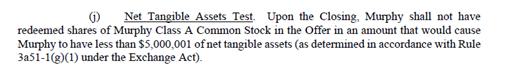

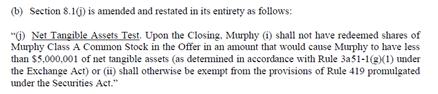

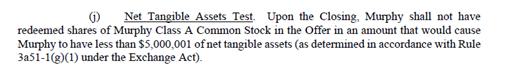

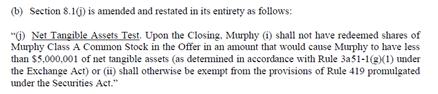

Response: We acknowledge the Staff’s comment and have revised the December 31, 2022 pro forma information to indicate how the number of shares assumed redeemed in the maximum redemption scenario was arrived at. After the first confidential submission of our S-4 and prior to the second confidential submission, section 8.1(j) of the Agreement and Plan of Merger was amended as indicated in the screenshots below.

Before the Amendment:

After the Amendment:

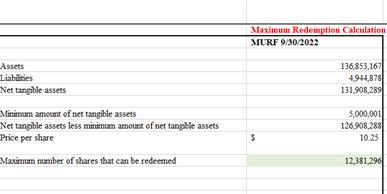

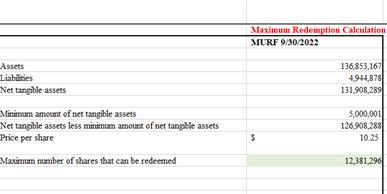

As such, before the Amendment, the Business Combination could only close if MURF redemptions left MURF with at least $5,000,001 in net tangible assets. Therefore, in the first S-4, the maximum redemption scenario assumed 12,381,296 shares of MURF Class A common stock could be redeemed based on the requirement of MURF having to have at least $5,000,001 in net tangible assets after redemptions in order for the Business Combination to close. To arrive at this number of shares, we deducted $5,000,001 from the net tangible assets of MURF as of September 30, 2022 of $131.9 million, which results in $126.9 million. Therefore, $126.9 million is the maximum dollar amount of redemptions that can occur to leave MURF with at least $5,000,001 in net tangible assets. Therefore, we divided $126.9 million by the redemption price per share of $10.25 (per MURF’s September 30, 2022 10-Q) to arrive at 12,381,296 shares redeemed in the maximum redemption scenario. The table directly below shows each step in the calculation of the 12,381,296 shares.

After the Amendment to the Agreement and Plan of Merger above, the Agreement and Plan of Merger does not require minimum net tangible assets of at least $5,000,001 if MURF “shall otherwise be exempt from the provisions of Rule 419 promulgated under the Securities Act.” MURF determined that it is exempt from the provisions of Rule 419 under Rule 3a51-1(a)(2) as MURF’s securities are listed on The Nasdaq Global Market and have been so listed since the consummation of the IPO. MURF has made the determination that The Nasdaq Global Market has initial listing standards that meet the criteria identified in the Exchange Rule and that it can therefore rely on the Exchange Rule to avoid being treated as a penny stock. Therefore, after the Amendment, it is not necessary to meet the net tangible assets requirement for the Business Combination to close. As a result, after the Amendment, 100% of the shares of MURF Class A common stock subject to possible redemption can be redeemed and the Business Combination can still close. Therefore, in this second submission, the pro forma financial statements and disclosures have been updated to reflect a maximum redemption scenario that assumes 100% of the shares of MURF Class A common stock subject to possible redemption are redeemed.

Unaudited Pro Forma Condensed Combined Financial Information , page 87

| 39. | Please revise your disclosure in the tables on page 87 to include the Private Placement Investor’s shares. |

Response: In response to the Staff’s comment, we have revised the disclosure on page 87 of the Amendment.

Exchange of Conduit Shares for Shares of New Conduit, page 88

| 40. | Please explain to us, and revise to disclose, how you have calculated the 218,629 shares resulted from the conversion of the convertible notes payables. Also as it relates to your exchange ratio, please expand to disclose whether the exchange ratio is subject to variations, and if so, what they are. Also consider the need for providing a sensitivity analysis. |

Response: We acknowledge the Staff’s comment and Conduit has revised the disclosure in the December 31, 2022 pro forma information to include the calculation of the previous total of 218,629 shares, now 381,389 shares following additional issuances, resulting from the conversion of the convertible notes payable. The 381,389 shares are calculated by taking the principal of the convertible notes payable outstanding in Great British Pounds (“GBP”) of £2.4 million and applying the GBP-to-United States Dollars (“USD”) exchange rate as of May 3, 2023 to convert the principal to $3.05 million USD. The Conversion Price (as defined in clause 1.1 of the Convertible Loan Note Instrument documents) is equal to the $10.00 price per share per the PIPE Financing (as provided for in Section 8.1(k) of the Merger Agreement) discounted by 20% for the Change of Control (per section 1124 of the UK Corporation Tax Act of 2010). $10.00 * 20% discount = $8.00. The 381,389 shares resulting from the conversion are calculated as the $3.05 million outstanding principal in USD divided by $8.00 = 381,389 shares.

The Exchange Ratio is defined as the Merger Consideration (which is $650,000,000 and not (emphasis added) subject to variations) divided by the number of shares of Company Capital Stock divided by $10 (the $10 is not (emphasis added) subject to variations). As is typical for share exchanges in de-SPAC transactions, the number of Conduit common shares (including the number of shares to be issued upon note conversion as a result of changes in the GBP-to-USD exchange rate) may change up until the Closing and as a result the denominator for the number of shares changes and the Exchange Ratio would also change. However, Conduit does not believe that any expanded disclosures or sensitivity analysis is necessary as the number of shares of the target company in all de-SPAC transactions can cause the exchange ratio to vary up until Closing and disclosure of sensitivity analysis for the number of shares of the target is not typically disclosed in pro forma financial information for de-SPAC transactions.

Pro Forma Transaction Accounting Adjustments, page 93

| 41. | Under adjustment (h) you classify the warrants issued to the Private Placement Investor as a derivative liability. You also state that these warrants have materially similar terms as MURF’s publicly traded warrants, which appear to be equity classified. Please explain to us the related terms and your accounting basis for the classification of all your outstanding warrants, including MURF’s publicly traded warrants, MURF’s private placement warrants, and the Private Placement Investor warrants. Disclose all the significant terms of the Subscription agreement for the Private Placement warrants in the filing, including the terms that result in the Private Placement warrants being classified as liabilities. |

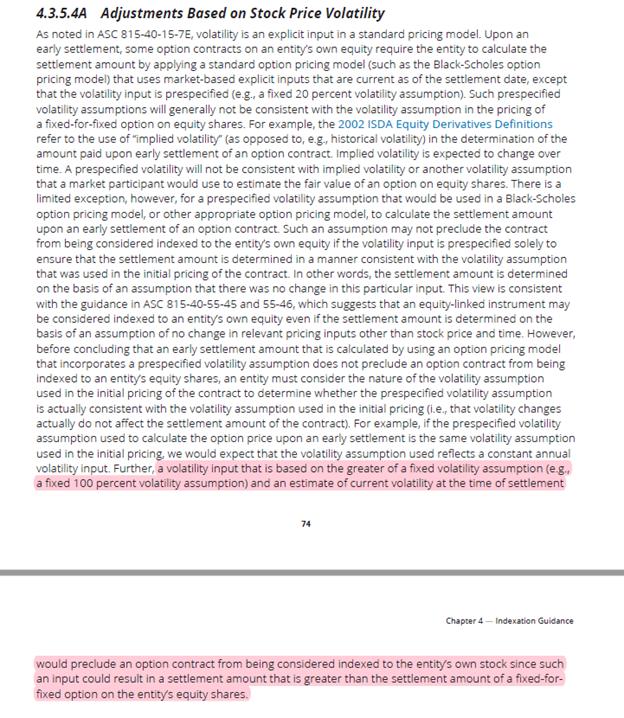

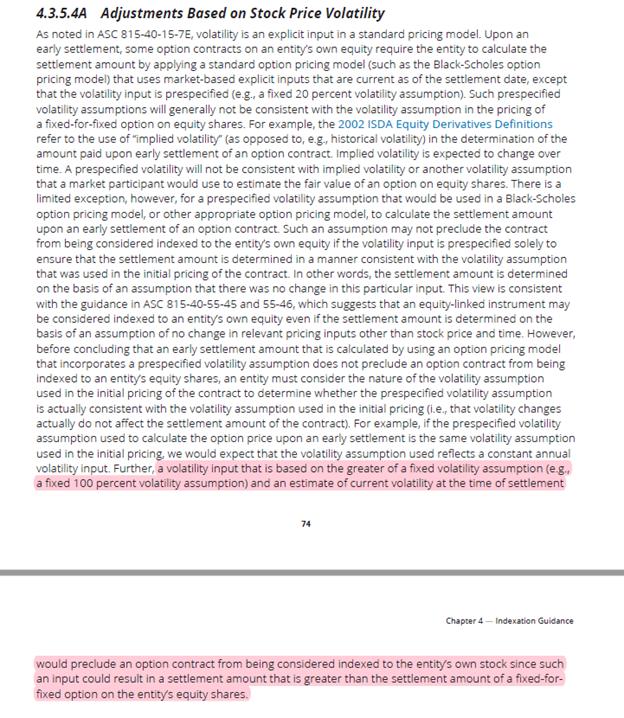

Response: The Company acknowledges the Staff’s comment and has updated the disclosures within the pro forma to clarify that the warrant issued to the Private Placement Investor has materially similar terms to the Public Warrants from a valuation (emphasis added) perspective. The warrant issued to the Private Placement Investor indicates that upon a Fundamental Transaction (as defined in the warrant issued to the Private Placement Investor), the holder has the option of receiving a settlement in cash equal to the Black Scholes Value (as defined in the warrant issued to the Private Placement Investor). The Black Scholes value is calculated using “an expected volatility equal to the greater of 100% and the 100 day volatility obtained from the HVT function on Bloomberg (determined utilizing a 365 day annualization factor) as of the Trading Day.” This clause could result in settlement for an amount greater than the settlement amount of a fixed-for-fixed option on the entity’s equity shares (please see screenshot below for applicable guidance from section 4.3.5.4A of the Deloitte Roadmap for Contracts on an Entity’s Own Equity from March 2023 – please see highlighted section of screenshot in particular). As such, the volatility language in the Black Scholes Value definition above causes the warrant issued to the Private Placement Investor to not be equal to the difference between the fair value of a fixed number of the entity’s shares and a fixed monetary amount. Therefore, under ASC 815-40-15-7C, the warrant issued to the Private Placement Investor is not indexed to the entity’s own stock and is therefore a derivative liability. We have updated the pro forma disclosures to specify that the warrant is classified as a liability because it could be settled for an amount that is not equal to the difference between the fair value of a fixed number of the entity’s shares and a fixed monetary amount.

Unlike the warrant issued to the Private Placement Investor, the Private Warrants issued to MURF’s Sponsor and the Public Warrants issued to the MURF Public Stockholders do not contain a similar clause about potential settlement using a Black Scholes Value upon the occurrence of a Fundamental Transaction. As such, the Private Warrants issued to MURF’s Sponsor and the Public Warrants issued to MURF’s Public Stockholders were considered indexed to the entity’s own stock and were thus not required to be classified as derivative liabilities. In addition, while the warrant issued to the Private Placement Investor contains the clauses about a Fundamental Transaction and the Black Scholes Value, this does not cause this warrant to have materially different terms from the other warrants from a valuation (emphasis added) perspective because the likelihood of a Fundamental Transaction occurring is remote (emphasis added) and therefore the Fundamental Transaction clauses do not have a material impact on the valuation of the warrant issued to the Private Placement Investor. In addition, the 54,000 warrants to be issued to A.G.P. upon the closing will have similar terms to the Public Warrants and will not have the clause about settlement using a Black Scholes Value upon a Fundamental Transaction and therefore the warrants issued to A.G.P. will be equity-classified. To summarize, all warrants have materially similar terms from a valuation (emphasis added) perspective, as has now been clarified within the pro forma disclosures.

The form of the warrant that will be issued to the Private Placement Investor is included in the Registration Statement as Exhibit 4.6 and the form of the warrant agreement in Exhibit 4.4 contains all of its terms. The pro forma disclosures have been updated to explain that the volatility input to the Black Scholes Value causes the warrant to be classified as a derivative liability as described above.

Comparative Per Share Data, page 95

| 42. | Please revise to disclose all equity shares (e.g. warrants) that are excluded from these comparative share information. |

Response: In response to the Staff’s comment, the Company has revised the disclosure on pages 95 and 96 of the Amendment.

Business of Conduit Pharmaceuticals Limited, page 125

| 43. | Throughout this section please revise your disclosure to clarify the role Conduit plays and has played to date in the discovery and development efforts discussed. For example, clearly disclose whether any of the clinical trials reflected in the pipeline table on page 128 were conducted by Conduit. If trials were conducted by a third party, please so state. If Conduit’s role is merely to provide funding for clinical trials conducted by third parties, including St George Street, this should be clear throughout the prospectus. |

Response: In response to the Staff’s comments, Conduit has revised the disclosure in the Amendment on pages 134 and 135. We respectfully advise the Staff that the table on page 139 is not a list of completed trials – it reflects the pipeline and stage of development in each therapeutic area. We have revised the disclosure in the Amendment to reflect this.

| 44. | We note your statement that your current development pipeline includes a glucokinase activator “which is Phase II ready”; however, you also state on page 23 that “Conduit has not generated the data to support such [an Investigational New Drug] application, and the results of preclinical studies will require FDA review prior to the initiation of clinical studies which may not be granted”. Please reconcile and clarify your disclosure throughout the prospectus regarding the phase of development of each product candidate and the steps that must be undertaken by Conduit, including regulatory submissions, to progress the identified products candidates to commercialization. |

Response: In response to the Staff’s comments, Conduit has revised the disclosure in the Amendment on pages 135 and 142.

| 45. | Where clinical studies or trials are discussed, please revise your disclosure to clarify the scope, size and design of the trial; the primary and secondary endpoints, as applicable; whether the studies or trials were powered to show statistical significance; and whether any adverse side effects were observed. |

Response: We respectfully advise the Staff that the historical clinical trials were completed by AstraZeneca prior to such assets being licensed by St George Street to Conduit. However, Conduit does not view these historical trials as relevant for the purposes of developing AZD1656 and AZD5904 in indications which have AstraZeneca tested the assets. Conduit regularly assesses its asset portfolio to identify potential risks and take steps to mitigate those risks, such as the repurposing of assets, which reduces development costs and timelines, as the clinical has already undergone safety and toxicity testing in humans. If a clinical asset is used for a new indication, the early stages of drug development, including preclinical studies and Phase I clinical trials, do not need to be conducted again, which allows for Conduit to begin its development of such clinical assets at a later stage. The prior preclinical and clinical studies conducted by AstraZeneca may allow Conduit to reduce the costs, expenses and time associated with the early stages of drug development by allowing Conduit to continue the development of the clinical assets at the Phase Ib or Phase II stage, rather than the preclinical or Phase I stage, even if Conduit is investigating the assets for a new indication. In response to the Staff’s comment, we have revised the disclosure on pages 135 and 142 of the Amendment.

Science Strategy, page 125

| 46. | We note your statement that all of the assets in your pipeline have been successfully tested in Phase I clinical trials. This statement conflicts with the pipeline table on page 128 indicating that AZD5904 has not yet completed Phase I trials. Please reconcile your disclosure or advise. |

Response: In response to the Staff’s comment, the Company has revised the disclosures regarding the pipeline on page 139 of the Amendment. We note that this table reflects Conduit’s initial pipeline of clinical assets and the anticipated therapeutic area in which Conduit intends to conduct further development of each of the clinical assets. Prior to the license of such assets from AstraZeneca to St George Street and the subsequent arrangement for the funding and further development of such clinical assets between St George Street and Conduit, both AZD1656 and AZD5904 were subject to Phase I trials conducted by AstraZeneca. For example, AZD5904 has been investigated by AstraZeneca in five Phase I clinical trials with 181 subjects for idiopathic male infertility to assess the safety, tolerability and pharmacokinetics following single and repeated oral doses as an extended-release formulation in healthy volunteers.

While AZD5904 was investigated in five Phase I clinical trials by AstraZeneca and these trials confirmed its suitability to progress to Phase II trials, Conduit’s management intends to conduct a Phase Ib “proof of mechanism” trial to verify AZD5904 has the intended biological effect in semen (as well as in blood) prior to commencing a Phase II trial for the use of AZD5904 to treat idiopathic male infertility.

| 47. | Please remove claims that you have an advantage in the speed you will conduct trials as these statements are speculative. You may state, if true, that Conduit’s goal is to develop its product candidates more efficiently than current industry standards. |

Response: In response to the Staff’s comment, the Company has revised the disclosures on page 135 of the Amendment.

Strategic Alliances and Arrangements, page 127

| 48. | For each licensing agreement disclosed in this section, please revise to include the nature and scope of intellectual property transferred, each parties’ rights and obligations, the duration of agreement and royalty term, up-front or execution payments received or paid, aggregate amounts paid or received to date under agreement, aggregate future potential milestone payments to be paid or received, segregated by development and commercial milestone payments, and royalty rates or a royalty range not to exceed ten percentage points. Please also file these agreements as exhibits to the registration statement, or tell us why you do not think such a filing is appropriate. For guidance, refer to Item 601 of Regulation S-K. |

Response: In response to the Staff’s comment, the Company has revised the disclosures on page 136 of the Amendment.

Initial Pipeline: AZD1656 and AZD5904, page 128

| 49. | Please describe how management arrived at the potential market values for each indication discussed in this section. For example only, disclosure on page 129 indicates that Conduit’s management believes the global market for uveitis will be $1.7 billion in 2023. Please discuss the methodology management used in reaching these conclusion or provide other support for this and similar statements. |

Response: We respectfully advise the Staff that Conduit’s management conducted market analysis on the total addressable market sizes for each of the specified indications. These figures have been derived from, and are supported by, industry reports. As the information relating to the total estimated population impacted by each disease and the market analysis with respect thereto are publicly available, Conduit has not specifically cited to each reference in the Amendment. Set forth below are the statements from the Amendment and the publicly available resources that support such statements.

| Thyroid Disease: Hashimoto’s Thyroiditis and Graves’ Disease |

| |

“Management believes that HT is the most prevalent autoimmune thyroid disease worldwide and around 2% of adults in the United States are sufferers and that HT is 15-20 times more likely to occur in women compared to men. We anticipate that the prevalence of HT will continue to increase due to rising obesity and the rising prevalence of other autoimmune disorders that made patients more susceptible to HT. Graves’ disease is the most common cause of persistent hyperthyroidism, which is an over production of hormones by the thyroid gland located in the front of the neck, in adults. It is estimated that approximately 3% of women and 0.5% of men will develop Graves’ disease during their lifetime.” | | https://www.technavio.com/report/thyroid-gland-disorder-treatment-market-industry-analysis#:~:text=What%20is%20the%20CAGR%20for,4.63%25%20during%202021%2D2025 https://medlineplus.gov/genetics/condition/hashimoto-thyroiditis/ Genetic predictors of the development and recurrence of Graves’ disease - PubMed (nih.gov) https://www.btf-thyroid.org/research-news-graves-disease#:~:text=Graves’%20disease%20(GD)%20is,are%20the%20largest%20group%20affected |

| | | |

“After using RAI, patients are left dependent upon levothyroxine hormone replacement treatment. It is also believed that the use of RAI has also been associated with the development or worsening of thyroid eye disease in approximately 15% to 20% of patients.” | | https://pubmed.ncbi.nlm.nih.gov/26670972/ Hashimoto’s Thyroiditis - Endotext - NCBI Bookshelf (nih.gov) |

| | | |

| “[T]he thyroid gland disorder treatment market is set to grow by approximately $632 million at a compound annual growth rate (“CAGR”) of 4.63% from 2020 to 2025.” | | Thyroid Gland Disorder Treatment Market Records a CAGR of 4.63% by 2025|35% of Growth to Originate from North America |17000+ Technavio Reports (prnewswire.com) |

| Uveitis |

| |

| “Management believes that in the U.S. uveitis causes an estimated approximately 30,000 new cases of blindness per year and may be the third leading cause of blindness worldwide.” | | https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5904090/ |

| | | |

| “Management believes that the global uveitis market could reach at least approximately $1.7 billion for 2023 and may be expected to grow at a CAGR of 6.6%, potentially reaching $2.5 billion by 2028.” | | https://www.researchandmarkets.com/reports/5633590/uveitis-market-global-market-size-forecast The Global Uveitis Drugs Market is expected to grow by $ (globenewswire.com) |

| Renal Transplant Failure |

| | |

“According to the United Network for Organ Sharing, there are over 100,000 patients waiting for a kidney transplant in the U.S. The prevalence of chronic kidney disease is rising due to other conditions, such as diabetes, and as a result of an aging population. During 2021, over 24,000 individuals received a kidney transplant. According to the Organ Procurement & Transplantation Network, approximately 13 people die each day in the U.S. while waiting for a life-saving kidney transplant.” | | https://www.cnbc.com/2022/10/26/how-organ-donation-works-in-the-united-states.html#:~:text=There%20are%20more%20than%20100%2C000,the%20word%20transplant%20thrown%20around https://www.kidney.org/news/newsroom/factsheets/Organ-Donation-and-Transplantation-Stats How to Support Someone Who’s Had a Kidney Transplant | Everyday Health |

| Preterm Labor |

| | | |

| “Management believes that approximately 60,000 babies per year in the U.K. and approximately 380,000 per year in the U.S. are born preterm. Globally, prematurity is the leading cause of death in children under the age of 5 years, and preterm labor rates are increasing. For example, according to the Centers for Disease Control and Prevention, in the U.S., the preterm labor rate rose for the fifth straight year in 2019. For 2021, the preterm labor rate in the U.S. was approximately 10.5%. According to the World Health Organization, the rates of preterm labor by country range from approximately 5% to approximately 18%. Management believes that the preterm birth and PROM testing market size was valued at approximately $1.6 billion in 2021 and is anticipated to be over $2.2 billion by 2030 with a CAGR of 3.2% from 2022 to 2030.” | | Vital Statistics Rapid Release, Number 008 (May 2020) (cdc.gov) Premature Birth (cdc.gov) Preterm Birth and PROM Testing Market Size, Report 2022-2030 (precedenceresearch.com) Preterm birth (who.int) |

| COVID-19 AND LONG COVID |

| |

“The World Health Organization declared the outbreak of Covid-19 a public health emergency of international concern on January 30, 2020, and a pandemic on March 11, 2020. We anticipate that the Covid-19 infection will become endemic in populations just as flu has become endemic despite various vaccinations. The chronic effect of viral infection, or Long Covid, is a newly recognized disease which we believe may become embedded in the population as Covid-19 becomes endemic. Long Covid typically refers to when a patient experiences Covid-19 symptoms that persist for longer than 4 weeks from such patient’s initial diagnosis with Covid-19. Evidence indicates that an important component of Long Covid is chronic inflammation of organs: lungs, brain, kidney and heart. According to the World Health Organization, new modelling conducted for WHO/Europe by the Institute for Health Metrics and Evaluation (“IHME”) at the University of Washington’s School of Medicine in the United States shows that in the first two years of the pandemic, at least 17 million individuals across the 53 Member States of the WHO European Region may have experienced post COVID-19 condition, also known as long COVID. In other words, an estimated 17 million people met the WHO criteria of a new case of long COVID with symptom duration of at least three months in 2020 and 2021. The modelling indicates a staggering 307% increase in new long COVID cases identified between 2020 and 2021, driven by the rapid increase in confirmed COVID-19 cases from late 2020 and throughout 2021. The modelling also suggests that females are twice as likely as males to experience long COVID. Furthermore, the risk increases dramatically among severe COVID-19 cases needing hospitalization, with one in three females and one in five males likely to develop long COVID.” | | https://www.who.int/europe/news/item/13-09-2022-at-least-17-million-people-in-the-who-european-region-experienced-long-covid-in-the-first-two-years-of-the-pandemic--millions-may-have-to-live-with-it-for-years-to-come |

| Idiopathic Male Infertility |

| |

| “Management believes that approximately 15% of couples globally, or 48.5 million couples globally, are infertile and that 30% of infertility cases can be attributed solely to the female, 30% can be attributed solely to the male, 30% can be attributed to a combination of both partners, and 10% of cases have an unknown cause. Male sperm counts have declined approximately 50% over the last 40 years in Western men, which is believed due, in part, to increasing rates of diseases such as obesity and diabetes that can reduce fertility.” | | https://pubmed.ncbi.nlm.nih.gov/25928197/ |

| | | |

| “Management believes that the male infertility market (including diagnostic testing) is predicted to reach approximately $6 billion by 2030.” | | https://www.grandviewresearch.com/industry-analysis/male-infertility-market Male Infertility Market Size Hit $6.21Bn, Globally, by 2027 (globenewswire.com) |

AZD1656 in Infectious Diseases - Covid-19 and Long Covid, page 130

| 50. | Please revise your disclosure to present objective information about trial results, rather than conclusions as to the safety or efficacy of your product candidates. For example only, on page 131 you state that AZD1656 was “effective” in treating severe inflammatory disease and seen to be “safe.” Please revise this statement, and any others like it, to remove the conclusions that your product candidates will be safe and effective, as such conclusions are within the sole authority of the FDA and comparable foreign regulators. |

Response: In response to the Staff’s comment, the Company has revised the disclosure on page 141 of the Amendment.

Intellectual Property, page 132

| 51. | For each patent or patent application appearing in this section, please disclose the product candidate to which each patent relates, whether the patents are owned or licensed, the type of patent protection you have, the expiration dates or potential expiration, if granted, and the applicable jurisdictions of protection. |

Response: In response to the Staff’s comment, the Company has revised the disclosure on page 144 of the Amendment.

Management’s Discussion and Analysis of Financial Condition and Results of Operations of Conduit Pharmaceuticals Limited

Key Component of Result of Operations Operating Expenses

Research and Development Expenses, page 148

| 52. | You appear to indicate on page 128 that, except for Idiopathic Male Infertility, which is in preclinical, and COVID-19, which is in Phase II, the indications are in Phase I. Please clarify in the filing: |

| ● | how the applications reached Phase I if you have only worked on the COVID-19 application. |

| | | |

| ● | how the COVID-19 application reached Phase II based on the amount of research and development expenses incurred in the periods presented. In this regard, we note that it does not appear that research and development expense occurred prior to the fourth quarter of 2021. |

Response: We respectfully advise the Staff that AZD5904 for IMI is not in preclinical development. St George Street licensed AZD5904 from AstraZeneca after substantial data relating to the clinical asset had already been generated by AstraZeneca. The data generated by AstraZeneca supports would allow for the initiation of Phase II trials. Specifically, AZD5904 was investigated by AstraZeneca in 5 Phase I clinical trials and these trials confirmed the suitability to progress to Phase II trials. However, when assessing the optimal development pathway for IMI, Conduit has determined that a short proof of mechanism trial, which is referred to as a Phase Ib trial, should first be conducted prior to commencing a Phase II trial. In order to address the foregoing, we have revised the disclosure on pages 135 and 142 of the Amendment. Please also see the responses to Staff comments 44 and 46.

Conduit Financial Statements

4. Liability related to the Sale of Future Revenue

Indirect Investment Regarding the Covid Asset, page F-10

| 53. | Please revise to expand your disclosures to provide more details of the terms under the Indirect Investment Regarding the Covid Asset with St George Street Capital (SGSC), including but not limited to the following: |

| ● | The rights and obligations between Conduit and SGSC, as they are related to intellectual properties, clinical trials, manufacturing, funding obligations, and etc. |

| ● | The rights and obligations between Conduit, SGSC and the third party funding companies when indirect investment is obtained from other third party companies, either via Conduit or directly by SGSC. |

| ● | The rights and obligations between Conduit, SGSC and the third party pharmaceutical companies when out licensing to third party pharmaceutical companies for further development and commercialization. |

| ● | Clarify for us whether Conduit and SGSC are under common control. And if so, please disclose that fact. |

Provide quantitative disclosures whenever applicable. The same comment also applies to your Global Funding Agreement with SGSC as disclosed at page 128.

Response: In response to the Staff’s comment, we have revised the disclosure on page F-16 of the Amendment.

| 54. | Clarify the accounting treatment for amounts incurred related to research and development expenditures and the accounting basis thereof. Distinguish between amounts funded to SGSC and research and development activities performed directly by you. Clarify if you have the license to perform the research and development in-house or if the license is held by SGSC. Also clarify throughout the filing if all research and development is being performed by St George Street Capital. |

Response: In response to the Staff’s comment, we have revised the disclosure on page F-10 of the Amendment.

| 55. | You state on page 162 that the Funding Agreement entitles Conduit to 100% of the net revenue on projects that Conduit funds by itself which appears to differ from the disclosure on page F-10 that states SGSC agreed to pay you a royalty of 30% of sales in excess of $24.5 million (£19.2 million) of the Covid Asset should it reach the commercialization stage and generate revenue in exchange for the Company funding SGSC’s research and development efforts. Please revise to clarify. |

Response: In response to the Staff’s comment, we have revised the disclosure on page F-20 of the Amendment.

Cizzles PLC, page F-11

| 56. | You state on page F-11 that on February 11, 2022, you entered into an agreement with Cizzle whereby Cizzle “agreed to purchase a percentage of future revenue earned in the Covid Asset, should it reach the commercialization stage.” The disclosure appears inconsistent with the disclosure on page F-29 that states that “Cizzle agreed to provide funding to the Company for the Covid Asset for use in the field in exchange for a percentage of future revenue earned if the Covid Asset is commercialized.” Also, the consideration for the agreement of $1.6 million in the disclosure on page F-11 differs from the consideration of $1.3 million in the roll-forward on page F-11 and the disclosure on page F-29. Please revise for consistency. |

Response: In response to the Staff’s comment, we have revised the disclosure on page F-16 and F-17 of the Amendment.

Vela Technologies PLC and Cizzle PLC, page F-11

| 57. | We have the following comments related to your agreements with Vela Technologies PLC and Cizzle PLC: |

| ● | Revise to clarify who are the parties under the agreements, as you disclosed that the Vela agreement was between Conduit and SGSC, while the Cizzle agreement was between Conduit and Cizzle. Also revise to provide in detail the rights and obligations of each party, for example, the royalty percentage Cizzle purchased under that agreement. |

| | | |

| ● | Provide us an analysis of the factors you relied upon to overcome the debt presumption under ASC 470-10-25. Disclose the related terms in the agreements that help address each bullet point under ASC 470-10-25-2. In your analysis, please tell us how you have considered the fact that you have offered an option for Cizzle to sell its economic interest in the Covid Asset back to you at a higher price. |

| | | |