UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-23779

PIMCO Flexible Real Estate Income Fund

(Exact name of registrant as specified in charter)

650 Newport Center Drive

Newport Beach, CA 92660

(Address of principal executive offices)

Ryan G. Leshaw

c/o Pacific Investment

Management Company

LLC

650 Newport Center

Drive

Newport Beach,

California 92660

(Name and Address (Number, Street,

City, State, Zip Code) of Agent for

Service)

Copies to:

Douglas P. Dick,

Esq.

William Bielefeld,

Esq.

Dechert LLP

1900 K Street,

N.W.

Washington, D.C.

20006

Registrant’s telephone number, including area code: (844) 312-2113

Date of fiscal year end: December 31

Date of reporting period: June 30, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE , Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Shareholders. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1).

PIMCO INTERVAL FUNDS

Semiannual Report

June 30, 2024

PIMCO Flexible Real Estate Income Fund | REFLX

Table of Contents

Important Information About the Fund

We believe that equity funds and bond funds have an important role to play in a well-diversified investment portfolio. It is important to note, however, that equity funds and bond funds are subject to notable risks.

Among other things, equity and equity-related securities may decline in value due to both real and perceived general market, economic, and industry conditions. The values of equity securities, such as common stocks and preferred securities, have historically risen and fallen in periodic cycles and may decline due to general market conditions, which are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. Equity securities may also decline due to factors that affect a particular industry or industries, such as labor shortages, increased production costs and competitive conditions within an industry. In addition, the value of an equity security may decline for a number of reasons that directly relate to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods or services, as well as the historical and prospective earnings of the issuer and the value of its assets. Different types of equity securities may react differently to these developments and a change in the financial condition of a single issuer may affect securities markets as a whole.

During a general downturn in the securities markets, multiple asset classes, including equity securities, may decline in value simultaneously. The market price of equity securities owned by the Fund may go up or down, sometimes rapidly or unpredictably. Equity securities generally have greater price volatility than fixed income securities and common stocks generally have the greatest appreciation and depreciation potential of all corporate securities.

Bond funds and fixed income securities are subject to a variety of risks, including interest rate risk, liquidity risk and market risk. It is important to note, however, that in an environment where interest rates may trend upward, rising rates would negatively impact the performance of most bond funds, and fixed-income securities and other instruments held by the Fund are likely to decrease in value. A wide variety of factors can cause interest rates or yields of U.S. Treasury securities (or yields of other types of bonds) to rise (e.g., central bank monetary policies, inflation rates, general economic conditions, etc.). In addition, changes in interest rates can be sudden and unpredictable, and there is no guarantee that Fund management will anticipate such movement accurately. The Fund may lose money as a result of movements in interest rates.

As of the date of this report, interest rates in the United States and many parts of the world, including certain European countries, remain high. In efforts to combat inflation, the U.S. Federal Reserve (the “Fed”) raised interest rates multiple times in 2022 and 2023. In the second half of 2023 and the beginning of 2024, however, the Fed paused the rate hikes, keeping interest rates steady. It is uncertain whether rates will remain steady, increase or decrease in the future. As such, the Fund may face a heightened level of risk associated with rising interest rates and/or bond yields. This could be driven by a variety of factors, including but not limited to central bank monetary policies, changing inflation or real growth rates, general economic conditions, increasing bond issuances or reduced market demand for low yielding investments. Further, while bond markets have steadily grown over the past three decades, dealer inventories of corporate bonds are near historic lows in relation to market size. As a result, there has been a significant reduction in the ability of dealers to “make markets”.

Bond funds and individual bonds with a longer duration (a measure used to determine the sensitivity of a security’s price to changes in interest rates) tend to be more sensitive to changes in interest rates, usually making them more volatile than securities or funds with shorter durations. All of the factors mentioned above, individually or collectively, could lead to increased volatility and/or lower liquidity in the fixed income markets or negatively impact the Fund’s performance or cause the Fund to incur losses.

The PIMCO Flexible Real Estate Income Fund’s (the “Fund”) investment strategy will be, under normal circumstances, primarily to acquire stabilized, income-oriented commercial real estate (“CRE”) and debt secured by commercial real estate. The Fund’s investments in real estate industry securities, either directly or through its investments in properties, and debt secured by properties, will be significantly impacted by the performance of the real estate market and may experience more volatility and be exposed to greater risk than a more diversified portfolio. The value of companies engaged in the real estate industry is affected by: (i) changes in general economic and market conditions; (ii) changes in the value of real estate properties; (iii) risks related to local economic conditions, overbuilding and increased competition; (iv) increases in property taxes and operating expenses; (v) changes in zoning laws; (vi) casualty and condemnation losses; (vii) variations in rental income, neighborhood values or the appeal of property to tenants; (viii) the availability of financing and (ix) changes in interest rates and leverage. There are also special risks associated with particular real estate sectors, or real estate operations generally.

Classifications of the Fund’s portfolio holdings in this report are made according to financial reporting standards. The classification of a particular portfolio holding as shown in the Allocation Breakdown and Schedule of Investments or Consolidated Schedule of Investments, as applicable, and other sections of this report may differ from the classification used for the Fund’s compliance calculations, including those used in the Fund’s prospectus, investment objectives, regulatory, and other investment limitations and policies, which may be based on different asset class, sector or geographical classifications. The Fund is separately monitored for compliance with respect to investment parameters and regulatory requirements.

The geographical classification of foreign (non-U.S.) securities in this report, if any, are classified by the country of incorporation of a holding. In certain instances, a security’s country of incorporation may be different from its country of economic exposure.

In February 2022, Russia launched an invasion of Ukraine. As a result, Russia and other countries, persons and entities that provided material aid to Russia’s aggression against Ukraine have been the subject of economic sanctions and import and export controls imposed by countries throughout the world, including the United States. Such measures have had and may continue to have an adverse effect on the Russian, Belarusian and other securities and economies, which may, in turn, negatively impact the Fund. The extent, duration and impact of Russia’s military action in Ukraine, related sanctions and retaliatory actions are difficult to ascertain, but could be significant and have severe adverse effects on the region, including significant adverse effects on the regional, European and global economies and the markets for certain securities and commodities, such as oil and natural gas, as well as other sectors. Further, the Fund may have investments in securities and instruments that are economically tied to the region and may have been negatively impacted by the sanctions and counter-sanctions by Russia, including declines in value and reductions in liquidity. The sanctions may cause the Fund to sell portfolio holdings at a disadvantageous time or price or to continue to

| | | | | | | | | | |

| | | SEMIANNUAL REPORT | | | | JUNE 30, 2024 | | | 3 | |

Important Information About the Fund (Cont.)

hold investments that the Fund may no longer seek to hold. PIMCO will continue to actively manage these positions in the best interests of the Fund and its shareholders.

The United States’ enforcement of restrictions on U.S. investments in certain issuers and tariffs on goods from certain other countries has contributed to and may continue to contribute to international trade tensions and may impact portfolio securities. The United States’ enforcement of sanctions or other similar measures on various Russian entities and persons, and the Russian government’s response, may also negatively impact securities and instruments that are economically tied to Russia.

The Fund may invest in certain instruments that rely in some fashion upon the London Interbank Offered Rate (“LIBOR”). LIBOR was traditionally an average interest rate, determined by the ICE Benchmark Administration, that banks charge one another for the use of short-term money. The United Kingdom’s Financial Conduct Authority, which regulates LIBOR, has announced plans to ultimately phase out the use of LIBOR. Although the transition process away from LIBOR for many instruments has been completed, some LIBOR use is continuing and there are potential effects related to the transition away from LIBOR or continued use of LIBOR on a Fund, or on certain instruments in which the Fund invests, which can be difficult to ascertain, and may vary depending on factors that include, but are not limited to: (i) existing fallback or termination provisions in individual contracts and (ii) whether, how, and when industry participants adopt new reference rates for affected instruments. The transition of investments from LIBOR to a replacement rate as a result of amendment, application of existing fallbacks, statutory requirements or otherwise may also result in a reduction in the value of certain instruments held by a Fund or a reduction in the effectiveness of related Fund transactions such as hedges. In addition, an instrument’s transition to a replacement rate could result in variations in the reported yields of a Fund that holds such instrument. Any such effects of the transition away from LIBOR, as well as other unforeseen effects, could result in losses to a Fund.

In June 2019, FNMA and FHLMC started issuing Uniform Mortgage Backed Securities in place of their current offerings of TBA-eligible securities (the “Single Security Initiative”). The Single Security Initiative seeks to support the overall liquidity of the TBA market and aligns the characteristics of FNMA and FHLMC certificates. The long-term effects that the Single Security Initiative may have on the market for TBA and other mortgage-backed securities are uncertain.

The Fund expects to operate so as to qualify as a REIT under the Internal Revenue Code of 1986, as amended (the “Code”). The Fund’s qualification as a REIT subjects the Fund to various risks as described in the Fund’s prospectus.

The Fund, directly or indirectly through a subsidiary (which includes an operating entity, operating company or special purpose entity used by the Fund) that primarily engages in investment activities in securities or other assets and in which the Fund owns all or a majority of the voting securities, i.e., has sole majority voting control (“Controlled Subsidiary”), expects to enter into joint ventures with third parties to make investments. The Fund also expects that its unconsolidated operating entities will incur property management, disposition and other expenses related to investments in real property, the costs of which will be indirectly borne by shareholders. The Fund may hire affiliated or unaffiliated property managers or other service providers (who could also be joint venture partners for an investment) at prevailing market rates to perform management and specialized services for the Fund’s CRE investments.

U.S. and global markets have experienced increased volatility, including as a result of the failures of certain U.S. and non-U.S. banks in 2023, which could be harmful to the Fund and issuers in which it invests. For example, if a bank at which the Fund or issuer has an account fails, any cash or other assets in bank or custody accounts, which may be substantial in size, could be temporarily inaccessible or permanently lost by the Fund or issuer. If a bank that provides a subscription line credit facility, asset-based facility, other credit facility and/or other services to an issuer or to the fund fails, the issuer or fund could be unable to draw funds under its credit facilities or obtain replacement credit facilities or other services from other lending institutions with similar terms.

Issuers in which the Fund may invest can be affected by volatility in the banking sector. Even if banks used by issuers in which the Fund invests remain solvent, volatility in the banking sector could contribute to, cause or intensify an economic recession, increase the costs of capital and banking services or result in the issuers being unable to obtain or refinance indebtedness at all or on as favorable terms as could otherwise have been obtained. Potential impacts to funds and issuers resulting from changes in the banking sector, market conditions and potential legislative or regulatory responses are uncertain. Such conditions and responses, as well as a changing interest rate environment, can contribute to decreased market liquidity and erode the value of certain holdings, including those of U.S. and non-U.S. banks. Continued market volatility and uncertainty and/or a downturn in market and economic and financial conditions, as a result of developments in the banking sector or otherwise (including as a result of delayed access to cash or credit facilities), could have an adverse impact on the Fund and issuers in which they invest.

On the Fund Summary page in this Shareholder Report, the Average Annual Total Return table and Cumulative Returns chart measure performance assuming that any dividend and capital gain distributions were reinvested. Total return is calculated by determining the percentage change in NAV in the specific period. Returns do not reflect the deduction of taxes that a shareholder would pay on (i) Fund distributions or (ii) the repurchase of Fund shares. Total return for a period of more than one year represents the average annual total return. Performance shown is net of fees and expenses. Historical performance for the Fund or share class may have been positively impacted by fee waivers or expense limitations in place during some or all of the periods shown, if applicable. Future performance (including total return or yield) and distributions may be negatively impacted by the expiration or reduction of any such fee waivers or expense limitations.

The dividend rate that the Fund pays on its common shares may vary as portfolio and market conditions change, and will depend on a number of factors, including without limit the amount of the Fund’s undistributed net investment income and net short- and long-term capital gains, as well as the costs of any leverage obtained by the Fund. As portfolio and market conditions change, the rate of distributions on the common shares and the Fund’s dividend policy could change. There can be no assurance that a change in market conditions or other factors will not result in a change in the Fund’s distribution rate or that the rate will be sustainable in the future.

The following table discloses the inception date and diversification status of the Fund:

| | | | | | | | | | | | | | |

| Fund Name | | | | | Fund

Inception | | | Institutional

Class | | | Diversification

Status |

| | | | |

| PIMCO Flexible Real Estate Income Fund | | | | | | | 11/17/2022 | | | | 11/17/2022 | | | Non-diversified |

| | | | | | | | | | |

| | | SEMIANNUAL REPORT | | | | JUNE 30, 2024 | | | 5 | |

Important Information About the Fund (Cont.)

An investment in the Fund is not a bank deposit and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Fund.

The Trustees are responsible generally for overseeing the management of the Fund. The Trustees authorize the Fund to enter into service agreements with Pacific Investment Management Company LLC (“PIMCO”) and other service providers in order to provide, and in some cases authorize service providers to procure through other parties, necessary or desirable services on behalf of the Fund. Shareholders are not parties to or third-party beneficiaries of such service agreements. Neither the Fund’s prospectus nor Statement of Additional Information (“SAI”), any press release or shareholder report, any contracts filed as exhibits to the Fund’s registration statement, nor any other communications, disclosure documents or regulatory filings (including this report) from or on behalf of the Fund creates a contract between or among any shareholders of the Fund, on the one hand, and the Fund, a service provider to the Fund, and/or the Trustees or officers of the Fund, on the other hand.

The Trustees (or the Fund and its officers, service providers or other delegates acting under authority of the Trustees) may amend the most recent prospectus or use a new prospectus or SAI with respect to the Fund, adopt and disclose new or amended policies and other changes in press releases and shareholder reports and/or amend, file and/or issue any other communications, disclosure documents or regulatory filings, and may amend or enter into any contracts to which the Fund is a party, and interpret the investment objective(s), policies, restrictions and contractual provisions applicable to the Fund, without shareholder input or approval, except in circumstances in which shareholder approval is specifically required by law (such as changes to fundamental investment policies) or where a shareholder approval requirement was specifically disclosed in the Fund’s prospectus, SAI or shareholder report and is otherwise still in effect.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted by the Fund as the policies and procedures that PIMCO will use when voting proxies on behalf of the Fund. A description of the policies and procedures that PIMCO uses to vote proxies relating to portfolio securities of the Fund, and information about how the Fund voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling the Fund at (844) 312-2113, on the Fund’s website at www.pimco.com, and on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov.

The Fund files portfolio holdings information with the SEC on Form N-PORT within 60 days of the end of each fiscal quarter. The Fund’s complete schedules of securities holdings as of the end of each fiscal quarter will be made available to the public on the SEC’s website at www.sec.gov and on PIMCO’s website at www.pimco.com, and will be made available, upon request, by calling PIMCO at (844) 312-2113.

SEC rules allow the Fund to fulfill its obligation to deliver shareholder reports to investors by providing access to such reports online free of charge and by mailing a notice that the report is electronically available. Investors may elect to receive all reports in paper free of charge by contacting their financial intermediary or, if invested directly with the Fund, investors can inform the Fund by calling (844) 312-2113. Any election to receive reports in paper will apply to all funds held

with the fund complex if invested directly with the Fund or to all funds held in the investor’s account if invested through a financial intermediary.

In October 2022, the SEC adopted changes to the mutual fund and exchange-traded fund (“ETF”) shareholder report and registration statement disclosure requirements and the registered fund advertising rules, which impact the disclosures provided to shareholders. The rule amendments addressing fee and expense information in advertisements that might be materially misleading, which impact the Funds, were effective January 24, 2023.

In September 2023, the SEC adopted amendments to a current rule governing fund naming conventions. In general, the current rule requires funds with certain types of names to adopt a policy to invest at least 80% of their assets in the type of investment suggested by the name. The amendments expand the scope of the current rule in a number of ways that are expected to result in an increase in the types of fund names that would require the fund to adopt an 80% investment policy under the rule. Additionally, the amendments address deviations from a fund’s 80% investment policy and the use and valuation of derivatives instruments for purposes of the rule. The amendments were effective as of December 11, 2023, but the SEC is providing a 24-month compliance period following the effective date for fund groups with net assets of $1 billion or more (and a 30-month compliance period for fund groups with net assets of less than $1 billion).

| | | | | | | | | | |

| | | SEMIANNUAL REPORT | | | | JUNE 30, 2024 | | | 7 | |

| | |

| PIMCO Flexible Real Estate Income Fund | | Institutional Class - REFLX |

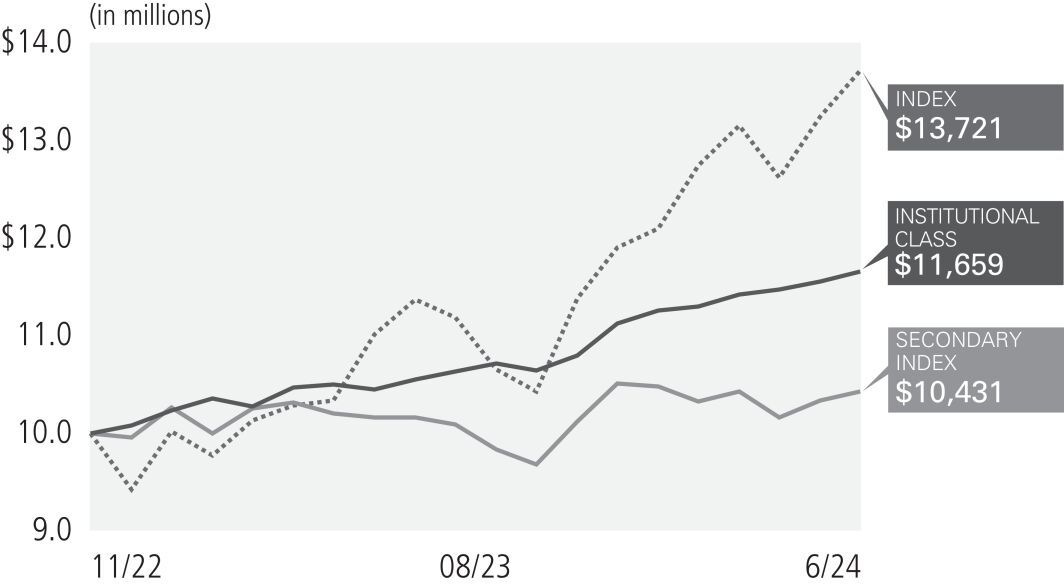

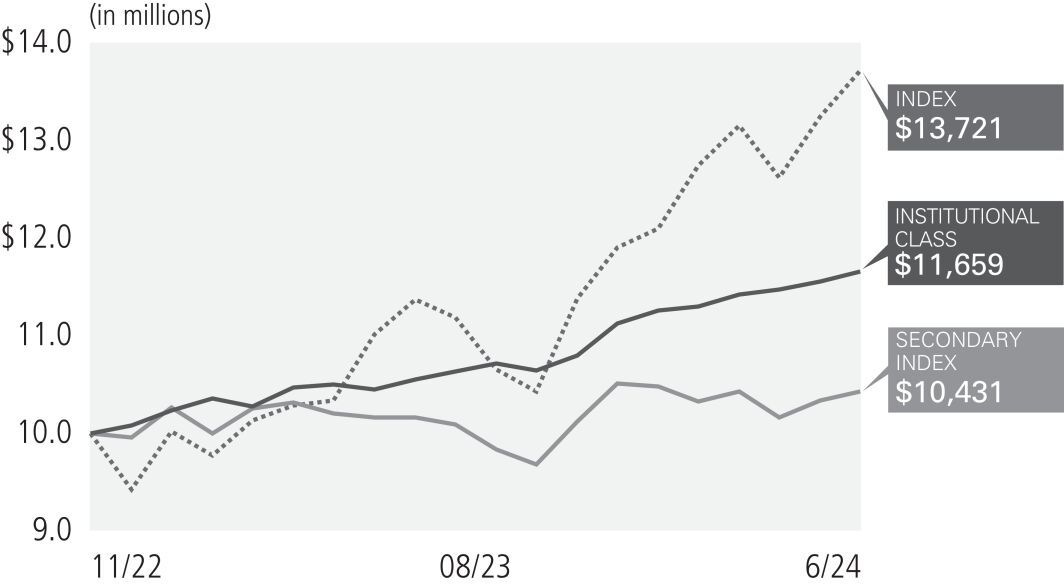

Cumulative Returns Through June 30, 2024

$10,000 invested at the end of the month when the Fund commenced operations.

| | | | |

| |

| Allocation Breakdown as of June 30, 2024†§ | | | |

| |

| Loan Participations and Assignments | | | 47.4 | % |

| Non-Agency Mortgage-Backed Securities | | | 30.9 | % |

| Short-Term Instruments | | | 21.7 | % |

| † | | % of Investments, at value. |

| § | | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | |

|

| Average Annual Total Return for the period ended June 30, 2024 | |

| | | | |

| | | | | 6 Months* | | | 1 Year | | | Commencement

of Operations

(11/17/22) | |

| | PIMCO Flexible Real Estate Income Fund Institutional Class | | | 4.79% | | | | 11.57% | | | | 10.16% | |

| | S&P 500 Index | | | 15.29% | | | | 24.56% | | | | 24.15% | |

| | Bloomberg U.S. Aggregate Index | | | (0.71)% | | | | 2.63% | | | | 3.34% | |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance current to the most recent month-end is available at www.pimco.com or via (844) 312-2113. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect brokerage commissions in connection with the purchase or sale of Fund shares.

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance.

The Fund’s total annual operating expense ratio, as stated in the Fund’s currently-effective prospectus (as of the date of this report), was 5.38% for Institutional Class shares. As of June 30 2024, the Fund’s Total Effective leverage(1) was 0.07%. See Financial Highlights for actual expense ratios as of the end of the period covered by this report.

| (1) | Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Investment Objective and Strategy Overview

The Fund’s primary investment objective is to provide current income with a secondary objective of long-term capital appreciation. The Fund’s investment strategy will be, under normal circumstances, primarily to acquire stabilized, income-oriented commercial real estate and debt secured by commercial real estate. The Fund intends, under normal circumstances, to invest at least 80% of its net assets (plus the amount of its borrowings for investment purposes) in a portfolio of real estate, including in the form of property investments, equity investments in real estate or real estate-related companies, real estate related loans or other real estate debt investments and securities of real estate and real estate-related issuers or real estate related companies. The Fund may also invest in private real estate investment funds. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights

The following affected performance (on a gross basis) during the reporting period:

| » | | Exposure to commercial mortgage-backed securities (“CMBS”) contributed to absolute performance, as these securities in the Fund posted positive returns. |

| » | | Exposure to private real estate debt contributed to absolute performance, as both positions in the fund posted positive returns. |

| » | | Exposure to select public real estate investment trusts (“REITs”) contributed to absolute performance, as the Fund sold positions in six securities at a gain. |

| » | | Exposure to select public REITs detracted from absolute performance, as the Fund sold a position in one security at a loss. |

| » | | There were no other material detractors for this Fund. |

| | | | | | | | | | |

| | | SEMIANNUAL REPORT | | | | JUNE 30, 2024 | | | 9 | |

Index Descriptions

| | |

| Index* | | Index Description |

| | |

| |

| S&P 500 Index | | S&P 500 Index is an unmanaged market index generally considered representative of the stock market as a whole. The Index focuses on the large-cap segment of the U.S. equities market. |

| |

| Bloomberg U.S. Aggregate Index | | Bloomberg U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis. |

* It is not possible to invest directly in an unmanaged index.

(THIS PAGE INTENTIONALLY LEFT BLANK)

| | | | | | | | | | |

| | | SEMIANNUAL REPORT | | | | JUNE 30, 2024 | | | 11 | |

Financial Highlights PIMCO Flexible Real Estate Income Fund (Consolidated)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | Investment Operations | | | | Less Distributions to

Preferred Shares(C) | | | | Less Distributions to Common Shareholders(d) |

| | | | | | | | | | | Net Increase

(Decrease) in

Net Assets

Applicable

to Common

Shareholders

Resulting

from

Operations | | |

Selected Per Share Data for the Year or Period Ended^: | | Net Asset

Value

Beginning

of Year

or Period(a) | | Net

Investment

Income

(Loss)(b) | | Net

Realized/

Unrealized

Gain (Loss) | | | | From Net

Investment

Income | | From Net

Realized

Capital

Gains | | From Net

Investment

Income | | From Net

Realized

Capital

Gains | | Total |

| | | | | | | | | | |

Institutional Class 01/01/2024 - 06/30/2024+ | | | $ | 10.39 | | | | $ | 0.39 | | | | $ | 0.10 | | | | | | | | | $ | 0.00 | | | | $ | 0.00 | | | | $ | 0.49 | | | | $ | (0.38 | ) | | | $ | 0.00 | | | | $ | (0.38 | ) |

| | | | | | | | | | |

12/31/2023 | | | | 10.06 | | | | | 0.83 | | | | | 0.19 | | | | | | | | | | 0.00 | | | | | 0.00 | | | | | 1.02 | | | | | (0.69 | ) | | | | 0.00 | | | | | (0.69 | ) |

| | | | | | | | | | |

11/17/2022 - 12/31/2022 | | | | 10.00 | | | | | 0.06 | | | | | 0.04 | | | | | | | | | | (0.00 | ) | | | | 0.00 | | | | | 0.10 | | | | | (0.04 | ) | | | | 0.00 | | | | | (0.04 | ) |

| ^ | A zero balance may reflect actual amounts rounding to less than $0.01 or 0.01%. |

| * | Annualized, except for organizational expense, if any. |

| (a) | Includes adjustments required by U.S. GAAP and may differ from net asset values and performance reported elsewhere by the Fund. |

| (b) | Per share amounts based on average number of common shares outstanding during the year or period. |

| (c) | Preferred Shareholders. See Note 14, Preferred Shares, in the Notes to Financial Statements for more information. |

| (d) | The tax characterization of distributions is determined in accordance with Federal income tax regulations. The actual tax characterization of distributions paid is determined at the end of the fiscal year. See Note 2, Distributions — Common Shares, in the Notes to Financial Statements for more information. |

| (e) | Includes adjustments required by U.S. GAAP and may differ from net asset values and performance reported elsewhere by the Fund. Additionally, excludes initial sales charges. |

| (f) | Calculated on the basis of income and expenses applicable to both common and preferred shares relative to the average net assets of common shareholders. The expense ratio and net investment income do not reflect the effects of dividend payments to preferred shareholders. |

| (g) | Ratio includes interest expense which primarily relates to participation in borrowing and financing transactions. See Note 5, Borrowings and Other Financing Transactions, in the Notes to Financial Statements for more information. |

| (h) | Certain organizational costs were incurred prior to the commencement of operations and reflected in the financial statements accompanying the initial registration statement. If the Fund had incurred all organization and trustee related expenses in the current period, the ratio of expenses to average net assets excluding waivers and ratio of expenses to average net assets excluding interest expense and waivers would have been 9.32% and 8.04% respectively. |

| 1 | “Asset Coverage per Preferred Share” means the ratio that the value of the total assets of the Fund, less all liabilities and indebtedness not represented by Preferred Shares, bears to the aggregate of the involuntary liquidation preference of Preferred Shares, expressed as a dollar amount per Preferred Shares. |

| 2 | “Involuntary Liquidating Preference” means the amount to which a holder of Preferred Shares would be entitled upon the involuntary liquidation of the Fund in preference to the Common Shareholders, expressed as a dollar amount per Preferred Share. |

| 3 | The liquidation value of the Preferred Shares represents their liquidation preference, which approximates fair value of the shares less any accumulated unpaid dividends. See Note 14, Preferred Shares, in the notes to Financial Statements for more information. |

| | | | |

| 12 | | PIMCO INTERVAL FUNDS | | See Accompanying Notes |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | | | | Ratios/Supplemental Data |

| | | | | | | Ratios to Average Net Assets Applicable to Common Shareholders(f) | | |

| | | | | | | | |

Net Asset

Value End

of Year or

Period(a) | | Total

Investment

Return(e) | | Net Assets

Applicable

to Common

Shareholders

End of Year

(000s) | | Expenses(g) | | Expenses

Excluding

Waivers(g) | | Expenses

Excluding

Interest

Expense | | Expenses

Excluding

Interest

Expense

and

Waivers | | Net

Investment

Income (Loss) | | Portfolio

Turnover

Rate |

| | | | | | | | |

| | $ | 10.50 | | | | | 4.79 | % | | | $ | 169,227 | | | | | 2.88 | %* | | | | 3.02 | %* | | | | 1.88 | %* | | | | 2.02 | %* | | | | 7.45 | %* | | | | 9 | % |

| | | | | | | | |

| | | 10.39 | | | | | 10.44 | | | | | 79,188 | | | | | 4.67 | | | | | 5.36 | | | | | 1.86 | | | | | 2.55 | | | | | 8.17 | | | | | 59 | |

| | | | | | | | |

| | | 10.06 | | | | | 1.03 | | | | | 30,690 | | | | | 3.11 | * | | | | 5.11 | *(h) | | | | 1.82 | * | | | | 3.83 | *(h) | | | | 4.70 | * | | | | 0 | |

Ratios/Supplemental Data

| | | | | | | | | | | | | | | | | | | | |

| | | Preferred Shares |

| Selected Per Share Data for the Year or Period Ended^: | | Total Amount

Outstanding | | Asset Coverage

per Preferred

Share(1) | | Involuntary

Liquidating

Preference

per Preferred

Share(2) | | Average

Market

Value per

Preferred

Share(3) |

| | | | |

1/1/2024-6/30/2024 | | | $ | 125,000 | | | | $ | 1,354,816 | | | | $ | 1,000 | | | | | N/A | |

| | | | |

12/31/2023 | | | | 125,000 | | | | | 634,505 | | | | | 1,000 | | | | | N/A | |

| | | | |

11/17/2022 - 12/31/2022+ | | | | N/A | | | | | N/A | | | | | N/A | | | | | N/A | |

| | | | | | | | | | |

| | | SEMIANNUAL REPORT | | | | JUNE 30, 2024 | | | 13 | |

Consolidated Statement of Assets and Liabilities PIMCO Flexible Real Estate Income Fund

(Unaudited)

June 30, 2024

| | | | |

| (Amounts in thousands†, except per share amounts) | | | |

| |

Assets: | | | | |

| |

Investments, at value | | | | |

Investments in securities* | | $ | 168,652 | |

| |

Financial Derivative Instruments | | | | |

Over the counter | | | 6 | |

Cash | | | 4 | |

Receivable for Fund shares sold | | | 1,472 | |

Interest and/or dividends receivable | | | 1,373 | |

Reimbursement receivable from PIMCO | | | 16 | |

Other assets | | | 21 | |

| |

Total Assets | | | 171,544 | |

| |

Liabilities: | | | | |

| |

Financial Derivative Instruments | | | | |

Over the counter | | $ | 16 | |

Payable for investments purchased | | | 821 | |

Payable for unfunded loan commitments | | | 660 | |

Distributions payable to common shareholders | | | 477 | |

Overdraft due to custodian | | | 10 | |

Accrued management fees | | | 146 | |

Accrued supervisory and administrative fees | | | 59 | |

Other liabilities | | | 3 | |

| |

Total Liabilities | | | 2,192 | |

| |

Commitments and Contingent Liabilities^ | | | | |

| |

Preferred Shares^^ | | $ | 125 | |

| |

Net Assets Applicable to Common Shareholders | | $ | 169,227 | |

| |

Net Assets Applicable to Common Shareholders Consist of: | | | | |

| |

Par value^^^ | | $ | 0 | |

Paid in capital in excess of par | | | 166,422 | |

Distributable earnings (accumulated loss) | | | 2,805 | |

| |

Net Assets Applicable to Common Shareholders | | $ | 169,227 | |

| |

Institutional Class | | $ | 169,227 | |

| |

Common Shares Outstanding | | | 16,123 | |

| |

Institutional Class | | | 16,123 | |

| |

Preferred Shares Issued and Outstanding: | | | | |

| |

Institutional Class | | | 0 | |

| |

Net Asset Value Per Common Share(a): | | | | |

| |

Institutional Class | | | 10.50 | |

| |

Cost of investments in securities | | $ | 168,306 | |

| |

* Includes repurchase agreements of: | | $ | 302 | |

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

| ^ | See Note 9, Fees and Expenses, in the Notes to Financial Statements for more information. |

| ^^ | ($0.00001 par value and $1,000 liquidation preference per share) |

| (a) | Includes adjustments required by U.S. GAAP and may differ from net asset values and performance reported elsewhere by the Fund. |

| | | | |

| 14 | | PIMCO INTERVAL FUNDS | | See Accompanying Notes |

Consolidated Statement of Operations PIMCO Flexible Real Estate Income Fund

| | | | |

| Six Months Ended June 30, 2024 (Unaudited) | | | |

| (Amounts in thousands†) | | | |

| |

Investment Income: | | | | |

| |

Interest | | $ | 5,798 | |

Dividends | | | 38 | |

Miscellaneous income | | | 2 | |

Total Income | | | 5,838 | |

| |

Expenses: | | | | |

| |

Management fees | | | 704 | |

Supervisory and administrative fees | | | 282 | |

Trustee fees and related expenses | | | 81 | |

Interest expense | | | 564 | |

Loan expense | | | 4 | |

Miscellaneous expense | | | 67 | |

Total Expenses | | | 1,702 | |

Waiver and/or Reimbursement by PIMCO | | | (81 | ) |

Net Expenses | | | 1,621 | |

| |

Net Investment Income (Loss) | | | 4,217 | |

| |

Net Realized Gain (Loss): | | | | |

| |

Investments in securities | | | 229 | |

Over the counter financial derivative instruments | | | 158 | |

Foreign currency | | | 43 | |

| |

Net Realized Gain (Loss) | | | 430 | |

| |

Net Change in Unrealized Appreciation (Depreciation): | | | | |

| |

Investments in securities | | | 524 | |

Over the counter financial derivative instruments | | | (11 | ) |

| |

Net Change in Unrealized Appreciation (Depreciation) | | | 513 | |

| |

Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 5,160 | |

| |

Distributions on Preferred Shares from Net Investment Income and/or Realized Capital Gains | | $ | (8 | ) |

| |

Net Increase (Decrease) in Net Assets Applicable to Common Shareholders Resulting from Operations | | $ | 5,152 | |

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

| | | | | | | | | | |

| | | SEMIANNUAL REPORT | | | | JUNE 30, 2024 | | | 15 | |

Consolidated Statements of Changes in Net Assets PIMCO Flexible Real Estate Income Fund

| | | | | | | | |

| (Amounts in thousands†) | | Six Months Ended

June 30, 2024

(Unaudited) | | | Year Ended

December 31, 2023 | |

| | |

Increase (Decrease) in Net Assets from: | | | | | | | | |

| | |

Operations: | | | | | | | | |

| | |

Net investment income (loss) | | $ | 4,217 | | | $ | 3,655 | |

Net realized gain (loss) | | | 430 | | | | 1,522 | |

Net change in unrealized appreciation (depreciation) | | | 513 | | | | (215 | ) |

| | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | 5,160 | | | | 4,962 | |

| | |

Distributions on Preferred Shares | | | | | | | | |

| | |

From net investment income and/or realized capital gains | | | | | | | | |

Institutional Class | | | (8 | ) | | | (15 | ) |

| | |

Total Distributions on Preferred Shares | | | (8 | ) | | | (15 | ) |

| | |

Net Increase (Decrease) in Net Assets Applicable to Common Shareholders Resulting from Operations | | | 5,152 | | | | 4,947 | |

| | |

Distributions to Common Shareholders: | | | | | | | | |

| | |

From net investment income and/or net realized capital gains | | | | | | | | |

Institutional Class | | | (4,230 | ) | | | (3,135 | ) |

| | |

Total Distributions to Common Shareholders(a) | | | (4,230 | ) | | | (3,135 | ) |

| | |

Common Share Transactions*: | | | | | | | | |

| | |

Receipts for shares sold | | | 87,584 | | | | 44,103 | |

Issued as reinvestment of distributions | | | 2,339 | | | | 2,603 | |

Cost of shares redeemed | | | (806 | ) | | | (20 | ) |

Net increase (decrease) resulting from common share transactions | | | 89,117 | | | | 46,686 | |

| | |

Total increase (decrease) in net assets applicable to common shareholders | | | 90,039 | | | | 48,498 | |

| | |

Net Assets Applicable to Common Shareholders: | | | | | | | | |

| | |

Beginning of period | | | 79,188 | | | | 30,690 | |

End of period | | $ | 169,227 | | | $ | 79,188 | |

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

| * | See Note 13, Common Shares Offering, in the Notes to Financial Statements. |

| (a) | The tax characterization of distributions is determined in accordance with Federal income tax regulations. See Note 2, Distributions — Common Shares, in the Notes to Financial Statements for more information. |

| | | | |

| 16 | | PIMCO INTERVAL FUNDS | | See Accompanying Notes |

Consolidated Statement of Cash Flows PIMCO Flexible Real Estate Income Fund

| | | | |

Six Months Ended June 30, 2024 (Unaudited) (Amounts in thousands†) | |

| |

Cash Flows Provided by (Used for) Operating Activities: | | | | |

| |

Net increase (decrease) in net assets resulting from operations | | $ | 5,160 | |

| |

Adjustments to Reconcile Net Increase (Decrease) in Net Assets from Operations to Net Cash Provided by (Used for) Operating Activities: | | | | |

| |

Purchases of long-term securities | | | (67,232 | ) |

Proceeds from sales of long-term securities | | | 15,944 | |

(Purchases) Proceeds from sales of short-term portfolio investments, net | | | (16,164 | ) |

(Increase) decrease in deposits with counterparty | | | 777 | |

(Increase) decrease in interest and/or dividends receivable | | | (1,059 | ) |

Proceeds from (Payments on) over the counter financial derivative instruments | | | 157 | |

(Increase) decrease in reimbursement receivable from PIMCO | | | 125 | |

(Increase) decrease in other assets | | | 20 | |

Increase (decrease) in payable for investments purchased | | | 821 | |

Increase (decrease) in payable for unfunded loan commitments | | | 660 | |

Increase (decrease) in accrued management fees | | | 70 | |

Increase (decrease) in accrued supervisory and administrative fees | | | 28 | |

Proceeds from (Payments on) foreign currency transactions | | | 43 | |

Increase (decrease) in other liabilities | | | (58 | ) |

Net Realized (Gain) Loss | | | | |

Investments in securities | | | (229 | ) |

Over the counter financial derivative instruments | | | (158 | ) |

Foreign currency | | | (43 | ) |

Net Change in Unrealized (Appreciation) Depreciation | | | | |

Investments in securities | | | (524 | ) |

Over the counter financial derivative instruments | | | 11 | |

Net amortization (accretion) on investments | | | (1,946 | ) |

Net Cash Provided by (Used for) Operating Activities | | | (63,597 | ) |

| |

Cash Flows Received from (Used for) Financing Activities: | | | | |

| |

Proceeds from shares sold | | | 86,580 | |

Payments on shares redeemed | | | (806 | ) |

Increase (decrease) in overdraft due to custodian | | | 10 | |

Cash distributions paid* | | | (1,545 | ) |

Cash distributions paid to auction rate preferred shareholders | | | (8 | ) |

Proceeds from reverse repurchase agreements | | | 51,660 | |

Payments on reverse repurchase agreements | | | (72,337 | ) |

Net Cash Received from (Used for) Financing Activities | | | 63,554 | |

| |

Net Increase (Decrease) in Cash and Foreign Currency | | | (43 | ) |

| |

Cash and Foreign Currency: | | | | |

| |

Beginning of period | | | 47 | |

End of period | | $ | 4 | |

* Reinvestment of distributions | | $ | 2,339 | |

| |

Supplemental Disclosure of Cash Flow Information: | | | | |

Interest expense paid during the period | | $ | 873 | |

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

A Statement of Cash Flows is presented when the Fund has a significant amount of borrowing during the period, based on the average total borrowing outstanding in relation to total assets or when substantially all of the Fund’s investments are not classified as Level 1 or 2 in the fair value hierarchy.

| | | | | | | | | | |

| | | SEMIANNUAL REPORT | | | | JUNE 30, 2024 | | | 17 | |

Consolidated Schedule of Investments PIMCO Flexible Real Estate Income Fund

(Amounts in thousands*, except number of shares, contracts, units and ounces, if any)

| | | | | | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | | MARKET

VALUE

(000S) | |

| INVESTMENTS IN SECURITIES 99.7% | |

| | | | | | | | | | | | |

| LOAN PARTICIPATIONS AND ASSIGNMENTS 47.3% | |

| |

Binghamton NY Title Holder LLC | | | | |

8.226% due 11/09/2026 «(c) | | $ | | | 15,000 | | | $ | | | 15,037 | |

| |

New Boston Real Estate LLC | | | | |

TBD% due 07/07/2027 «µ(c) | | | 16,650 | | | | | | 16,567 | |

| |

Project Luminous | | | | |

8.328% due 12/15/2027 «(c) | | | 4,571 | | | | | | 4,345 | |

8.330% due 12/15/2024 «(c) | | | 4,403 | | | | | | 4,185 | |

| |

Project Summit | | | | |

7.076% due 05/09/2025 « | | | | | 15,024 | | | | | | 14,479 | |

| |

Pure Industrial | | | | |

7.145% due 09/09/2024 « | | CAD | | | 22,105 | | | | | | 15,325 | |

| |

Sodo House | | | | |

TBD% due 10/04/2025 « | | $ | | | 10,000 | | | | | | 10,009 | |

| | | | | | | | | | | | |

Total Loan Participations and Assignments

(Cost $81,178) | | | | | | 79,947 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| NON-AGENCY MORTGAGE-BACKED SECURITIES 30.8% | |

| |

Ashford Hospitality Trust | | | | |

6.901% due 04/15/2035 • | | | 3,000 | | | | | | 2,972 | |

| |

Benchmark Mortgage Trust | | | | |

3.555% due 08/15/2052 ~ | | | 4,954 | | | | | | 4,702 | |

| |

BX Trust | | | | |

6.699% due 04/15/2039 • | | | 2,402 | | | | | | 2,359 | |

6.869% due 10/15/2036 • | | | 350 | | | | | | 343 | |

7.209% due 01/15/2039 • | | | 1,000 | | | | | | 982 | |

7.396% due 05/15/2035 • | | | 3,000 | | | | | | 2,988 | |

7.688% due 10/15/2036 • | | | 3,000 | | | | | | 2,945 | |

7.793% due 02/15/2038 • | | | 4,000 | | | | | | 3,811 | |

8.628% due 01/15/2039 • | | | 500 | | | | | | 489 | |

| |

CD Mortgage Trust | | | | |

5.688% due 10/15/2048 | | | | | 4,327 | | | | | | 3,942 | |

|

Credit Suisse Mortgage Capital Mortgage-Backed Trust | |

3.828% due 08/15/2037 ~ | | | 3,000 | | | | | | 2,736 | |

| |

Independence Plaza Trust | | | | |

4.356% due 07/10/2035 | | | | | 2,250 | | | | | | 2,109 | |

|

JP Morgan Chase Commercial Mortgage Securities Trust | |

7.676% due 02/15/2035 • | | | 2,544 | | | | | | 2,473 | |

8.958% due 11/15/2038 • | | | 2,400 | | | | | | 2,358 | |

| | | | | | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | | MARKET

VALUE

(000S) | |

| |

Morgan Stanley Capital Trust | | | | |

5.444% due 11/14/2042 ~ | | $ | | | 52 | | | $ | | | 49 | |

| |

New Orleans Hotel Trust | | | | |

6.965% due 04/15/2032 • | | | 3,000 | | | | | | 2,843 | |

| |

Starwood Mortgage Trust | | | | |

7.743% due 04/15/2034 • | | | 1,000 | | | | | | 984 | |

8.493% due 04/15/2034 • | | | | | 4,000 | | | | | | 3,904 | |

| |

Waikiki Beach Hotel Trust | | | | |

8.306% due 12/15/2033 • | | | | | 3,500 | | | | | | 3,373 | |

| |

Wells Fargo Commercial Mortgage Trust | | | | |

4.708% due 09/15/2031 ~ | | | | | 3,000 | | | | | | 2,812 | |

| |

WSTN Trust | | | | |

10.174% due 07/05/2037 ~ | | | | | 3,000 | | | | | | 2,961 | |

| | | | | | | | | | | | |

Total Non-Agency Mortgage-Backed Securities

(Cost $50,559) | | | | | | 52,135 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| SHORT-TERM INSTRUMENTS 21.6% | |

| | | | | | | | | | | | |

| REPURCHASE AGREEMENTS (d) 0.2% | |

| | | | | | | | | | | 302 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| U.S. TREASURY BILLS 21.4% | |

5.425% due 08/29/2024 - 10/22/2024 (a)(b) | | | | | 36,700 | | | | | | 36,268 | |

| | | | | | | | | | | | |

Total Short-Term Instruments

(Cost $36,569) | | | | | | 36,570 | |

| | | | |

| | | | | | | | | | | | |

Total Investments in Securities

(Cost $168,306) | | | | | | 168,652 | |

| | | | |

| | | | | | | | | | | | |

Total Investments 99.7%

(Cost $168,306) | | | $ | | | 168,652 | |

| | | | | | | | | | | | |

| Preferred Shares (0.1)% | | | | | | | | | | | (125 | ) |

| | | | | | | | | | | | |

Financial Derivative Instruments (e) (0.0)% (Cost or Premiums, net $0) | | | | | | (10 | ) |

| | | | | | | | | | | | |

| Other Assets and Liabilities, net 0.4% | | | | | | 710 | |

| | | | | | | | | | | | |

| Net Assets Applicable to Common Shareholders 100.0% | | | $ | | | 169,227 | |

| | | | | | | | | | | | |

NOTES TO CONSOLIDATED SCHEDULE OF INVESTMENTS:

| * | A zero balance may reflect actual amounts rounding to less than one thousand. |

| « | Security valued using significant unobservable inputs (Level 3). |

| ~ | Variable or Floating rate security. Rate shown is the rate in effect as of period end. Certain variable rate securities are not based on a published reference rate and spread, rather are determined by the issuer or |

| | | | |

| 18 | | PIMCO INTERVAL FUNDS | | See Accompanying Notes |

(Unaudited)

June 30, 2024

| | agent and are based on current market conditions. Reference rate is as of reset date, which may vary by security. These securities may not indicate a reference rate and/or spread in their description. |

| µ | All or a portion of this amount represents unfunded loan commitments. The interest rate for the unfunded portion will be determined at the time of funding. |

| • | Rate shown is the rate in effect as of period end. The rate may be based on a fixed rate, a capped rate or a floor rate and may convert to a variable or floating rate in the future. These securities do not indicate a reference rate and spread in their description. |

| (a) | Coupon represents a weighted average yield to maturity. |

(c) RESTRICTED SECURITIES:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer Description | | Coupon | | | Maturity

Date | | | Acquisition

Date | | | Cost | | | Market

Value | | | Market Value

as Percentage

of Net Assets Applicable to Common Shareholders | |

Binghamton NY Title Holder LLC | | | 8.226 | % | | | 11/09/2026 | | | | 01/29/2024 | | | $ | 15,038 | | | $ | 15,037 | | | | 8.89 | % |

New Boston Real Estate LLC | | | 0.000 | | | | 07/07/2027 | | | | 06/12/2024 | | | | 16,571 | | | | 16,567 | | | | 9.79 | |

Project Luminous | | | 8.328 | | | | 12/15/2027 | | | | 04/24/2024 | | | | 4,367 | | | | 4,345 | | | | 2.57 | |

Project Luminous | | | 8.330 | | | | 12/15/2024 | | | | 09/20/2023 | | | | 4,247 | | | | 4,185 | | | | 2.47 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | $ | 40,223 | | | $ | 40,134 | | | | 23.72 | % |

| | | | | | | | | | | | | | | | | | | | |

BORROWINGS AND OTHER FINANCING TRANSACTIONS

(d) REPURCHASE AGREEMENTS:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Lending

Rate | | | Settlement

Date | | | Maturity

Date | | | Principal

Amount | | | Collateralized By | | Collateral

(Received) | | | Repurchase

Agreements,

at Value | | | Repurchase

Agreement

Proceeds

to be

Received(1) | |

FICC | | | 2.600 | % | | | 06/28/2024 | | | | 07/01/2024 | | | $ | 302 | | | U.S. Treasury Inflation Protected Securities 0.625% due 01/15/2026 | | $ | (308 | ) | | $ | 302 | | | $ | 302 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Repurchase Agreements | | | | | $ | (308 | ) | | $ | 302 | | | $ | 302 | |

| | | | | | | | | | | | | | | |

BORROWINGS AND OTHER FINANCING TRANSACTIONS SUMMARY

The following is a summary by counterparty of the market value of Borrowings and Other Financing Transactions and collateral pledged/(received) as of June 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Repurchase

Agreement

Proceeds to be

Received(1) | | | Payable for

Reverse

Repurchase

Agreements | | | Payable for

Sale-Buyback

Transactions | | | Total

Borrowings and

Other Financing

Transactions | | | Collateral

Pledged/

(Received) | | | Net Exposure(2) | |

Global/Master Repurchase Agreement | |

FICC | | $ | 302 | | | $ | 0 | | | $ | 0 | | | $ | 302 | | | $ | (308 | ) | | $ | (6 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Borrowings and Other Financing Transactions | | $ | 302 | | | $ | 0 | | | $ | 0 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Includes accrued interest. |

| (2) | Net Exposure represents the net receivable/(payable) that would be due from/to the counterparty in the event of default. Exposure from borrowings and other financing transactions can only be netted across transactions governed under the same master agreement with the same legal entity. See Note 8, Master Netting Arrangements, in the Notes to Financial Statements for more information. |

| | | | | | | | | | |

| See Accompanying Notes | | SEMIANNUAL REPORT | | | | JUNE 30, 2024 | | | 19 | |

Consolidated Schedule of Investments PIMCO Flexible Real Estate Income Fund (Cont.)

The average amount of borrowings outstanding during the period ended June 30, 2024 was $(17,104) at a weighted average interest rate of 6.546%. Average borrowings may include reverse repurchase agreements and sale-buyback transactions, if held during the period.

(e) FINANCIAL DERIVATIVE INSTRUMENTS: OVER THE COUNTER

FORWARD FOREIGN CURRENCY CONTRACTS:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Settlement

Month | | | Currency to

be Delivered | | | Currency to

be Received | | | Unrealized Appreciation/

(Depreciation) | |

| | Asset | | | Liability | |

FAR | | | 07/2024 | | | | CAD | | | | 18,597 | | | $ | | | | | 13,585 | | | $ | 0 | | | $ | (8 | ) |

RBC | | | 07/2024 | | | | | | | | 2,012 | | | | | | | | 1,469 | | | | 0 | | | | (2 | ) |

| | | 07/2024 | | | $ | | | | | 104 | | | | CAD | | | | 142 | | | | 0 | | | | 0 | |

SSB | | | 07/2024 | | | | | | | | 14,954 | | | | | | | | 20,466 | | | | 6 | | | | 0 | |

| | | 08/2024 | | | | CAD | | | | 20,466 | | | $ | | | | | 14,965 | | | | 0 | | | | (6 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Forward Foreign Currency Contracts | | | $ | 6 | | | $ | (16 | ) |

| | | | | | | | | |

FINANCIAL DERIVATIVE INSTRUMENTS: OVER THE COUNTER SUMMARY

The following is a summary by counterparty of the market value of OTC financial derivative instruments and collateral pledged/(received) as of June 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Financial Derivative Assets | | | | | | Financial Derivative Liabilities | | | | | | | | | | |

| Counterparty | | Forward

Foreign

Currency

Contracts | | | Purchased

Options | | | Swap

Agreements | | | Total

Over the

Counter | | | | | | Forward

Foreign

Currency

Contracts | | | Written

Options | | | Swap

Agreements | | | Total

Over the

Counter | | | Net Market

Value of OTC

Derivatives | | | Collateral

Pledged/

(Received) | | | Net

Exposure(1) | |

FAR | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | | | | | $ | (8 | ) | | $ | 0 | | | $ | 0 | | | $ | (8 | ) | | $ | (8 | ) | | $ | 0 | | | $ | (8 | ) |

RBC | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | | | | | (2 | ) | | | 0 | | | | 0 | | | | (2 | ) | | | (2 | ) | | | 0 | | | | (2 | ) |

SSB | | | 6 | | | | 0 | | | | 0 | | | | 6 | | | | | | | | (6 | ) | | | 0 | | | | 0 | | | | (6 | ) | | | 0 | | | | 0 | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Over the Counter | | $ | 6 | | | $ | 0 | | | $ | 0 | | | $ | 6 | | | | | | | $ | (16 | ) | | $ | 0 | | | $ | 0 | | | $ | (16 | ) | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Net Exposure represents the net receivable/(payable) that would be due from/to the counterparty in the event of default. Exposure from OTC derivatives can only be netted across transactions governed under the same master agreement with the same legal entity. See Note 8, Master Netting Arrangements, in the Notes to Financial Statements for more information. |

FAIR VALUE OF FINANCIAL DERIVATIVE INSTRUMENTS

The following is a summary of the fair valuation of the Fund’s derivative instruments categorized by risk exposure. See Note 7, Principal and Other Risks, in the Notes to Financial Statements on risks of the Fund.

Fair Values of Financial Derivative Instruments on the Consolidated Statement of Assets and Liabilities as of June 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Derivatives not accounted for as hedging instruments | |

| | | Commodity

Contracts | | | Credit

Contracts | | | Equity

Contracts | | | Foreign

Exchange

Contracts | | | Interest

Rate Contracts | | | Total | |

Financial Derivative Instruments - Assets | |

Over the counter | |

Forward Foreign Currency Contracts | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 6 | | | $ | 0 | | | $ | 6 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

|

Financial Derivative Instruments - Liabilities | |

Over the counter | |

Forward Foreign Currency Contracts | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 16 | | | $ | 0 | | | $ | 16 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| 20 | | PIMCO INTERVAL FUNDS | | See Accompanying Notes |

(Unaudited)

June 30, 2024

The effect of Financial Derivative Instruments on the Consolidated Statement of Operations for the period ended June 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Derivatives not accounted for as hedging instruments | |

| | | Commodity

Contracts | | | Credit

Contracts | | | Equity

Contracts | | | Foreign

Exchange

Contracts | | | Interest

Rate Contracts | | | Total | |

Net Realized Gain (Loss) on Financial Derivative Instruments | |

Over the counter | |

Forward Foreign Currency Contracts | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 158 | | | $ | 0 | | | $ | 158 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

|

Net Change in Unrealized Appreciation (Depreciation) on Financial Derivative Instruments | |

Over the counter | |

Forward Foreign Currency Contracts | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | (11 | ) | | $ | 0 | | | $ | (11 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

FAIR VALUE MEASUREMENTS

The following is a summary of the fair valuations according to the inputs used as of June 30, 2024 in valuing the Fund’s assets and liabilities:

| | | | | | | | | | | | | | | | |

| Category and Subcategory | | Level 1 | | | Level 2 | | | Level 3 | | | Fair

Value at

06/30/2024 | |

Investments in Securities, at Value | |

Loan Participations and Assignments | | $ | 0 | | | $ | 0 | | | $ | 79,947 | | | $ | 79,947 | |

Non-Agency Mortgage-Backed Securities | | | 0 | | | | 52,135 | | | | 0 | | | | 52,135 | |

Short-Term Instruments | |

Repurchase Agreements | | | 0 | | | | 302 | | | | 0 | | | | 302 | |

U.S. Treasury Bills | | | 0 | | | | 36,268 | | | | 0 | | | | 36,268 | |

| | | | | | | | | | | | | | | | |

Total Investments | | $ | 0 | | | $ | 88,705 | | | $ | 79,947 | | | $ | 168,652 | |

| | | | | | | | | | | | | | | | |

|

Financial Derivative Instruments - Assets | |

Over the counter | | $ | 0 | | | $ | 6 | | | $ | 0 | | | $ | 6 | |

| | | | | | | | | | | | | | | | |

|

Financial Derivative Instruments - Liabilities | |

Over the counter | | $ | 0 | | | $ | (16 | ) | | $ | 0 | | | $ | (16 | ) |

| | | | | | | | | | | | | | | | |

Total Financial Derivative Instruments | | $ | 0 | | | $ | (10 | ) | | $ | 0 | | | $ | (10 | ) |

| | | | | | | | | | | | | | | | |

Totals | | $ | 0 | | | $ | 88,695 | | | $ | 79,947 | | | $ | 168,642 | |

| | | | | | | | | | | | | | | | |

The following is a reconciliation of the fair valuations using significant unobservable inputs (Level 3) for the Fund during the period ended June 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Category and Subcategory | | Beginning

Balance at

12/31/2023 | | | Net

Purchases | | | Net Sales/

Settlements | | | Accrued

Discounts/

(Premiums) | | | Realized

Gain/

(Loss) | | | Net Change in

Unrealized

Appreciation/

(Depreciation) (1) | | | Transfers

into

Level 3 | | | Transfers

out of

Level 3 | | | Ending

Balance at

06/30/2024 | | | Net Change in

Unrealized

Appreciation/

(Depreciation)

on Investments

Held at

06/30/2024 (1) | |

Investments in Securities, at Value | |

Loan Participations and Assignments | | $ | 23,786 | | | $ | 62,250 | | | $ | (5,178 | ) | | $ | 0 | | | $ | 0 | | | $ | (911 | ) | | $ | 0 | | | $ | 0 | | | $ | 79,947 | | | $ | (911 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Totals | | $ | 23,786 | | | $ | 62,250 | | | $ | (5,178 | ) | | $ | 0 | | | $ | 0 | | | $ | (911 | ) | | $ | 0 | | | $ | 0 | | | $ | 79,947 | | | $ | (911 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| See Accompanying Notes | | SEMIANNUAL REPORT | | | | JUNE 30, 2024 | | | 21 | |

Consolidated Schedule of Investments PIMCO Flexible Real Estate Income Fund (Cont.)

(Unaudited)

June 30, 2024

The following is a summary of significant unobservable inputs used in the fair valuations of assets and liabilities categorized within Level 3 of the fair value hierarchy:

| | | | | | | | | | | | | | | | | | | |

Category and Subcategory | | Ending

Balance at

06/30/2024 | | Valuation Technique | | Unobservable Inputs | | (% Unless Noted Otherwise) |

| | Input

Value(s) | | Weighted

Average |

Investments in Securities, at Value | |

Loan Participations and Assignments | | | $ | 79,947 | | | Discounted Cash Flow | | Discount Rate | | | | 7.384-12.374 | | | | | 8.940 | |

| | | | | | | | | | | | | | | | | | | |

Total | | | $ | 79,947 | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| (1) | Any difference between Net Change in Unrealized Appreciation/(Depreciation) and Net Change in Unrealized Appreciation/(Depreciation) on Investments Held at June 30, 2024 may be due to an investment no longer held or categorized as Level 3 at period end. |

| | | | |

| 22 | | PIMCO INTERVAL FUNDS | | See Accompanying Notes |

Notes to Financial Statements

(Unaudited)

June 30, 2024

1. ORGANIZATION

PIMCO Flexible Real Estate Income Fund (the “Fund”) is a non-diversified closed-end management investment company registered under the Investment Company Act of 1940, as amended, and the rules and regulations thereunder (the “Act”). The Fund was organized as a Delaware statutory trust on November 23, 2021 and commenced operations on November 17, 2022. The Fund has elected to be taxed as a real estate investment trust for U.S. federal income tax purposes under the Internal Revenue Code of 1986, as amended. The Fund continuously offers its shares (“Common Shares”) and is operated as an “interval fund”. The Fund currently offers one class of Common Shares: Institutional Class. Institutional Class Shares are sold at their offering price, which is net asset value (“NAV”) per share. Institutional Class Shares are offered for investment to investors such as pension and profit sharing plans, employee benefit trusts, endowments, foundations, corporations and individuals that can meet the minimum investment amount. The Fund has authorized an unlimited number of Common Shares at a par value of $0.00001 per share. Pacific Investment Management Company LLC (“PIMCO” or the “Manager”) serves as the Fund’s investment manager.

On January 5, 2023, the Fund issued 125 Shares of 12.0% Series A Preferred Shares at a purchase price of $1,000 per share, and par value of $0.00001 per share, to a select group of Individual Investors who are “accredited investors” within the meaning of Rule 501(a) of Regulation D promulgated under the Securities Act of 1933. The shares of the Series A Preferred Shares sold will not be registered under the Securities Act, and will be subject to certain additional restrictions on transfer necessary to protect the Fund’s status as a REIT. Holders of shares of the Series A Preferred Shares will not be entitled to participate in the appreciation of the value of the Fund.

The Fund has established a wholly-owned and controlled subsidiary in Delaware. See Note 16, Basis for Consolidation in the Notes to Financial Statements for more information regarding the treatment of the Fund’s subsidiary in the financial statements.

Hereinafter, the Board of Trustees of the Fund shall be collectively referred to as the “Board”.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Fund is treated as an investment company under the reporting requirements of U.S. GAAP. The functional and reporting currency for the Fund is the U.S. dollar. The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

(a) Securities Transactions and Investment Income Securities transactions are recorded as of the trade date for financial reporting purposes. Securities purchased or sold on a when-issued or delayed-delivery basis may be settled beyond a standard settlement period for the security after the trade date. Realized gains (losses) from securities sold are recorded on the identified cost basis.

| | | | | | | | | | |

| | | SEMIANNUAL REPORT | | | | JUNE 30, 2024 | | | 23 | |

Notes to Financial Statements (Cont.)

Dividend income is recorded on the ex-dividend date, except certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Interest income, adjusted for the accretion of discounts and amortization of premiums, is recorded on the accrual basis from settlement date, with the exception of securities with a forward starting effective date, where interest income is recorded on the accrual basis from effective date. For convertible securities, premiums attributable to the conversion feature are not amortized. Estimated tax liabilities on certain foreign securities are recorded on an accrual basis and are reflected as components of interest income or net change in unrealized appreciation (depreciation) on investments on the Consolidated Statement of Operations, as appropriate. Tax liabilities realized as a result of such security sales are reflected as a component of net realized gain (loss) on investments on the Consolidated Statement of Operations. Paydown gains (losses) on mortgage-related and other asset-backed securities, if any, are recorded as components of interest income on the Consolidated Statement of Operations. Income or short-term capital gain distributions received from registered investment companies, if any, are recorded as dividend income. Long-term capital gain distributions received from registered investment companies, if any, are recorded as realized gains.

Debt obligations may be placed on non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivable when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. A debt obligation is removed from non-accrual status when the issuer resumes interest payments or when collectability of interest is probable. A debt obligation may be granted, in certain situations, a contractual or non-contractual forbearance for interest payments that are expected to be paid after agreed upon pay dates.

(b) Income Taxes The Fund has elected to be taxed as a REIT. The Fund’s qualification and taxation as a REIT depend upon the Fund’s ability to meet on a continuing basis, through actual operating results, certain qualification tests set forth in the U.S. federal tax laws. Those qualification tests involve the percentage of income that the Fund earns from specified sources, the percentage of the Fund’s assets that falls within specified categories, the diversity of the ownership of the Fund’s shares of common stock, and the percentage of the Fund’s taxable income that the Fund distributes. No assurance can be given that the Fund will in fact satisfy such requirements for any taxable year. If the Fund qualifies as a REIT, the Fund generally will be allowed to deduct dividends paid to shareholders and, as a result, the Fund generally will not be subject to U.S. federal income tax on that portion of the Fund’s ordinary income and net capital gain that the Fund annually distributes to shareholders, as long as the Fund meets the minimum distribution requirements under the Code. The Fund intends to make distributions to shareholders on a regular basis as necessary to avoid material U.S. federal income tax and to comply with the REIT distribution requirements.

(c) Foreign Currency Translation The market values of foreign securities, currency holdings and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the current exchange rates each business day. Purchases and sales of securities and income and expense items denominated in foreign currencies, if any, are translated into U.S. dollars at the exchange rate in effect on the transaction date. The Fund does not separately report the effects of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized gain (loss) and net change in unrealized appreciation (depreciation) from investments on the Consolidated Statement of Operations. The Fund may invest in foreign

(Unaudited)

June 30, 2024

currency-denominated securities and may engage in foreign currency transactions either on a spot (cash) basis at the rate prevailing in the currency exchange market at the time or through a forward foreign currency contract. Realized foreign exchange gains (losses) arising from sales of spot foreign currencies, currency gains (losses) realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid are included in net realized gain (loss) on foreign currency transactions on the Consolidated Statement of Operations. Net unrealized foreign exchange gains (losses) arising from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period are included in net change in unrealized appreciation (depreciation) on foreign currency assets and liabilities on the Consolidated Statement of Operations.

(d) Distributions — Common Shares Distributions from net investment income, if any, are declared daily and distributed to Common Shareholders monthly. The Fund intends to distribute each year all of its net investment income and net short-term capital gains. In addition, at least annually, the Fund intends to distribute net realized long-term capital gains not previously distributed, if any. The Fund may revise its distribution policy or postpone the payment of distributions at any time.

Income distributions and capital gain distributions are determined in accordance with income tax regulations which may differ from U.S. GAAP. Differences between tax regulations and U.S. GAAP may cause timing differences between income and capital gain recognition. Further, the character of investment income and capital gains may be different for certain transactions under the two methods of accounting. As a result, income distributions and capital gain distributions declared during a fiscal period may differ significantly from the net investment income (loss) and realized gains (losses) reported on the Fund’s annual financial statements presented under U.S. GAAP.

The Fund may invest in one or more subsidiaries that are treated as disregarded entities for U.S. federal income tax purposes. In the case of a subsidiary that is so treated, for U.S. federal income tax purposes, (i) the Fund is treated as owning the subsidiary’s assets directly; (ii) any income, gain, loss, deduction or other tax items arising in respect of the subsidiary’s assets will be treated as if they are realized or incurred, as applicable, directly by the Fund; and (iii) distributions, if any, the Fund receives from the subsidiary will have no effect on the Fund’s U.S. federal income tax liability.