UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended May 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report _____________

For the transition period from _____________ to _____________

Commission File number: 0-56576

ZKGC NEW ENERGY LIMITED

(Exact name of Registrant as specified in its charter)

| N/A | | CAYMAN ISLANDS |

| (Translation of Registrant’s | | (Jurisdiction of incorporation |

| name into English) | | or organization) |

12 Xinxiangdi Jiari

Laocheng Town, Chengmai County

Hainan Province 571924

People’s Republic of Chinas

(Address of principal executive offices)

CCS Global Solutions, Inc.

99 Washington Avenue, Suite 805A

Albany, NY 12210

800-300-5067

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | | Name of each exchange on which registered |

| None. | | None. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Ordinary Shares, $0.001 par value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Ordinary Shares, $0.001 par value

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 13,000,000 ordinary shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Note-Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data file required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☐ Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | International Financial Reporting Standards as issued by the

International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

INDEX

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable

ITEM 3. KEY INFORMATION

The financial statements of the Company are attached hereto and found immediately following Item 8 in this Annual Report. The audit report of Michael T. Studer CPA, P.C. is included herein immediately preceding the financial statements and schedules. Listed below is a summary of the Company’s selected financial data as required by Item 3 of Form 20-F:

A. [Reserved]

B. Capitalization and Indebtedness

Not Applicable.

C. Reasons for the Offer and Use of Proceeds

Not Applicable

D. Risk Factors

An investment in the ZKGC Cayman Ordinary Shares involves a high degree of risk. You should carefully consider the following risk factors and other information in this Report before deciding to invest in the Ordinary Shares. If any of the following risks actually occur, the Company business, financial condition, results of operations and prospects for growth could be seriously harmed. As a result, the trading price of the ZKGC Cayman Ordinary Shares could decline and you could lose all or part of your investment.

Risks Related to the Business of Hainan ZKGC

Hainan ZKGC will require substantial additional capital contributions in order to fully implement its business plan and achieve a significant position in the market for charging station services.

The operations of Hainan ZKGC, on which the financial success of the Company depends, have been financed primarily by capital contributions and loans from related parties, primarily Liao Jinqi. Significant expansion of the operations of Hainan ZKGC, however, will require significant capital investment. There can be no assurance that we would be able to raise the additional funding needed to implement its business plan.

Based upon current plans, we expect that Hainan ZKGC will incur operating losses in future periods as it incurs significant expenses associated with the effort of expanding the business of Hainan ZKGC. Further, we cannot guarantee that Hainan ZKGC will be successful in realizing sufficient revenues or in achieving or sustaining positive cash flows at any time in the future. Any such failure could result in the possible closure of the business or force us to seek additional financing through loans or additional sales of our equity securities to continue business operations, which could dilute the value of any shares you purchase.

Hainan ZKGC faces intense competition. It may lose market share and customers if it fails to compete effectively.

The demand for charging stations in China is strong, and the barriers to entry into the supply market are not great. So there are many enterprises competing to meet the demand. Hainan ZKGC’s current or potential competitors include several major suppliers of charging stations as well as many low volume suppliers similar to Hainan ZKGC. Increased competition may adversely affect its margins, market share and brand recognition, or result in significant losses. When Hainan ZKGC sets prices, it has to consider how competitors have set prices, since electricity is fungible. When they cut prices or offer additional benefits to compete with Hainan ZKGC, Hainan ZKGC may have to lower its own prices or offer additional benefits or risk losing market share, either of which could harm our financial condition and results of operations.

Some of the competitors have longer operating histories, greater brand recognition, better supplier relationships, larger customer bases and greater financial, technical and marketing resources than Hainan ZKGC has. These and other smaller companies may receive investment from or enter into strategic relationships with well-established and well-financed companies or investors, which would help enhance their competitive positions. Some of the competitors may be able to secure more favorable terms from suppliers, devote greater resources to marketing and promotional campaigns, adopt more aggressive pricing policies and devote substantially more resources to their website, mobile application and systems development. We cannot assure you that Hainan ZKGC will be able to compete successfully against current or future competitors, and competitive pressures may have a material and adverse effect on its business, financial condition and results of operations.

Changes to fuel economy standards or the success of alternative fuels may negatively impact the EV market and thus the demand for Hainan ZKGC’s products and services.

As regulatory initiatives have required an increase in the mileage capabilities of cars, consumption of renewable transportation fuels, such as ethanol and biodiesel, and consumer acceptance of EVs and other alternative vehicles has been increasing. If fuel efficiency of non-electric vehicles continues to rise, whether as the result of regulations or otherwise, and affordability of vehicles using renewable transportation fuels improves, the demand for electric vehicles could diminish. In addition, developments in alternative technologies, such as advanced diesel, ethanol, fuel cells or compressed natural gas, or improvements in the fuel economy of the internal combustion engine, may materially and adversely affect demand for EVs and EV charging stations. Regulatory bodies may also adopt rules that substantially favor certain alternatives to petroleum-based propulsion over others, which may not necessarily be EVs. If any of these factors contribute to consumers or businesses to no longer purchasing EVs or purchasing them at a lower rate, it would materially and adversely affect Hainan ZKGC’s business, operating results, financial condition and prospects.

The EV market in China has benefitted from the availability of rebates, tax benefits and other financial incentives from governments to offset the purchase or operating cost of EVs and EV charging stations. In particular, Hainan ZKGC’s marketing efforts have benefitted from rebates and interest free loans available to purchasers of its EV charging stations that effectively provide purchasers with a significantly discounted purchase price. The reduction, modification, or elimination of such benefits could cause reduced demand for EVs and EV charging stations, which would adversely affect Hainan ZKGC’s financial results.

Over the past decade, the central government of the PRC has swelled the market for EVs in China by providing rebates to purchasers of EVs calculated to significantly reduce the disparity in cost between internal combustion powered vehicles and EVs. The government began in 2020 to reduce and eliminate those rebates. It is not clear how the eventual elimination of the rebates will affect the Chinese market for EVs. If it results in a substantial slowing of the market’s growth, that result could have an adverse effect on Hainan ZKGC’s financial results.

In addition, the government of Hainan Province has provided financial support to the expansion of EV charging infrastructure, primarily in the form of purchaser rebates and interest free loans. If Hainan Province decides to withdraw its support for the industry’s growth, demand for Hainan ZKGC’s charging stations would be likely to diminish.

The EV charging market is characterized by rapid technological change, which requires Hainan ZKGC to continue to develop new products and product innovations. Any delays in such development could adversely affect market adoption of its products and Hainan ZKGC’s financial results.

Continuing technological changes in battery and other EV technologies could adversely affect adoption of current EV charging technology and/or Hainan ZKGC’s products. Hainan ZKGC’s future success will depend upon its ability to develop and introduce a variety of new capabilities and innovations to its existing product offerings, as well as introduce a variety of new product offerings, to address the changing needs of the EV charging market. As new products are introduced, gross margins tend to decline in the near term and improve as the product become more mature and with a more efficient manufacturing process.

As EV technologies change, Hainan ZKGC may need to upgrade or adapt its charging station technology and introduce new products and services in order to serve vehicles that have the latest technology, in particular battery cell technology, which could involve substantial costs. Even if Hainan ZKGC is able to keep pace with changes in technology and develop new products and services, its research and development expenses could increase, its gross margins could be adversely affected in some periods and its prior products could become obsolete more quickly than expected.

If Hainan ZKGC is unable to devote adequate resources to develop products or cannot otherwise successfully develop products or services that meet customer requirements on a timely basis or that remain competitive with technological alternatives, its products and services could lose market share, its revenue will decline, it may experience higher operating losses and its business and prospects will be adversely affected.

If Hainan ZKGC fails to obtain and maintain the requisite licenses, permits and approvals applicable to our business, or fails to obtain additional licenses that become necessary as a result of new enactment or promulgation of laws and regulations or the expansion of its business, its business and results of operations may be materially and adversely affected.

Energy delivery services in China are highly regulated, which require multiple licenses, permits, filings and approvals to conduct and develop business. In particular, each new charging station installation requires that Hainan ZKGC secure a permit from the provincial government. The labor cost related to the effort to comply with these government regulations is extensive, and the need to sustain good relations with local government can be burdensome. In addition, as the market for charging stations expands, more regulations are likely to emerge. If Hainan ZKGC is unable to efficiently meet the regulatory requirements applicable to its business, its expansion will slow.

If China decides to support the international sanctions against Russia arising from Russia’s invasion of Ukraine, the cost of energy in China would be likely to rise, which could reduce usage of charging stations.

Hainan ZKGC does not do any business with parties in Russia, Ukraine or Belarus, nor is any of the equipment that Hainan ZKGC sells or the parts for that equipment manufactured in any of those countries. Russia’s invasion of Ukraine and the international sanctions against Russia that followed the invasion have, therefore, not had a direct effect on the business of Hainan ZKGC. Moreover, because China has not supported the international sanctions, the sanctions have not had a significant effect on China’s economy and have had no effect on Hainan ZKGC. The price of gasoline has risen in China since the invasion commenced; but there has been no change in the price of electricity.

It is possible that the government of China will decide in time to support the international sanctions on Russia in whole or in part. If that were to occur, the most likely impact would be on China’s ongoing purchase of oil from Russia. China is the world’s largest importer of petroleum, and Russia is its second largest supplier (after Saudi Arabia). If the supply of petroleum from Russia to China were disrupted, the price of gas in China would increase far more dramatically than it recently has. That increase would be likely to pull the price of electricity up as well, since demand for electricity would increase as gasoline became unavailable. The result of these events, if they were to occur, could be a reduction in the demand for charging station services, as motorists might reduce their travel in reaction to increased costs.

Risks Related to Doing Business in China

Because all of our operations are in China, that business is subject to the complex and rapidly evolving laws and regulations there. The Chinese government may exercise significant oversight and discretion over the conduct of the business of the VIE and may intervene in or influence its operations at any time, which could result in a material change in our operations and/or the value of our Ordinary Shares.

As a business operating in China, Hainan ZKGC is subject to the laws and regulations of the PRC, which can be complex and which evolve rapidly. The PRC government has the power to exercise significant oversight and discretion over the conduct of its business, and the regulations to which Hainan Zhongke is subject may change rapidly and with little notice to us or our shareholders. As a result, the application, interpretation, and enforcement of new and existing laws and regulations in the PRC are often uncertain. In addition, these laws and regulations may be interpreted and applied inconsistently by different agencies or authorities, and inconsistently with our current policies and practices. New laws, regulations, and other government directives in the PRC may also be costly to comply with, and such compliance or any associated inquiries or investigations or any other government actions may:

| ● | Delay or impede the development of the VIE, |

| ● | Result in negative publicity or increase its operating costs, |

| ● | Require significant management time and attention, and |

| ● | Subject the VIE to remedies, administrative penalties and even criminal liabilities that may harm its business, including fines assessed for its current or historical operations, or demands or orders that it modify or even cease our business practices. |

The promulgation of new laws or regulations, or the new interpretation of existing laws and regulations, that restrict or otherwise unfavorably impact the ability or manner in which Hainan ZKGC conducts its business and could require it to change certain aspects of its business to ensure compliance, could decrease demand for its products, reduce revenues, increase costs, require us to obtain more licenses, permits, approvals or certificates, or subject us to additional liabilities. To the extent any new or more stringent measures are required to be implemented, the business, financial condition and results of operations of Hainan ZKGC could be adversely affected as well as materially decrease the value of our ordinary shares.

Because the operations of Hainan ZKGC, on which the financial success of ZKGC Cayman depend, are located entirely in the PRC, you may not receive the benefits that come from effective enforcement of U.S. federal securities laws.

China has often restricted U.S. regulators’ access to information and limited regulators’ ability to investigate or pursue remedies with respect to China-based issuers, generally citing to state secrecy and national security laws, blocking statutes, or other laws or regulations. In addition, according to Article 177 of the PRC Securities Law, which became effective in March 2020, no overseas securities regulator can directly conduct investigations or evidence collection activities within the PRC and no entity or individual in China may provide documents and information relating to securities business activities to overseas regulators without Chinese government approval. The SEC, U.S. Department of Justice, and other U.S. authorities face substantial challenges in bringing and enforcing actions against China-based issuers and their officers and directors. As a result, investors in China-based issuers, such as ZKGC Cayman, may not benefit from a regulatory environment that fosters effective enforcement of U.S. federal securities laws.

If the Chinese government were to impose new requirements for approval from the PRC government to issue our ordinary shares to foreign investors or list on a foreign exchange, such action could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

The General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the “Opinions on Severely Cracking Down on Illegal Securities Activities According to Law,” (the “Opinions”), which were made available to the public on July 6, 2021. The Opinions emphasized the need to strengthen the administration over illegal securities activities, and the need to strengthen the supervision over overseas listings by Chinese companies. Given the current PRC regulatory environment, it is uncertain when and whether we or Hainan ZKGC, the VIE, will be required to obtain permission from the PRC government before the Ordinary Shares of ZKGC Cayman are listed on U.S. exchanges. We have been closely monitoring regulatory developments in China regarding any necessary approvals from the CSRC or other PRC governmental authorities required for overseas listings. As of the date of this Report, we have not received any inquiry, notice, warning, sanctions or regulatory objection from the CSRC or other PRC governmental authorities. However, there remains significant uncertainty as to the enactment, interpretation and implementation of regulatory requirements related to overseas securities offerings and other capital markets activities. According to the Administration Provision and the Measures (Draft for Comments), only new initial public offerings and refinancing by existent overseas listed Chinese companies will be required to go through the filing process with PRC administrations; other existent overseas listed companies will be allowed sufficient transition period to complete their filing procedure, which means if we complete the offering prior to the effectiveness of Administration Provisions and Measures, we will certainly go through the filing process in the future, perhaps because of refinancing or given by sufficient transition period to complete filing procedure as an existent overseas listed Chinese company. However, it is uncertain when the Administration Provision and the Measures will take effect or if they will take effect as currently drafted. If it is determined in the future that the approval of the CSRC, the CAC or any other regulatory authority is required for an offering, we may face sanctions by the CSRC, the CAC or other PRC regulatory agencies. These regulatory agencies may impose fines and penalties on our operations in China, limit our ability to pay dividends outside of China, limit our operations in China, delay or restrict the repatriation of the proceeds from an offering into China or take other actions that could have a material adverse effect on our business, financial condition, results of operations and prospects, as well as the trading price of our securities. The CSRC, the CAC, or other PRC regulatory agencies also may take actions requiring us, or making it advisable for us, to halt the offering before settlement and delivery of our ordinary shares. Consequently, if you engage in market trading or other activities in anticipation of and prior to settlement and delivery, you do so at the risk that settlement and delivery may not occur. In addition, if the CSRC, the CAC or other regulatory PRC agencies later promulgate new rules requiring that we obtain their approvals for an offering, we may be unable to obtain a waiver of such approval requirements, if and when procedures are established to obtain such a waiver. Any uncertainties and/or negative publicity regarding such an approval requirement could have a material adverse effect on the trading price of our securities.

PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may restrict or delay us from using monies invested in ZKGC Cayman to make loans or additional capital contributions to our PRC subsidiaries and making loans to Hainan ZKGC or its subsidiary, which could adversely affect our liquidity and our ability to fund and expand the business of Hainan ZKGC.

We are an offshore holding company conducting operations in China through a VIE arrangement with Hainan ZKGC. Our business plan contemplates that we will finance the growth of Hainan ZKGC by making loans to Zhongke WFOE, our PRC subsidiary, or to Hainan ZKGC, or we may make additional capital contributions to our PRC subsidiary.

Any loans to Zhongke WFOE, our PRC subsidiary, will be subject to PRC regulations and foreign exchange loan registrations. For example, loans by us to our PRC subsidiary to finance its activities cannot exceed statutory limits and must be registered with the local counterpart of the State Administration on Foreign Exchange (“SAFE”), or filed with SAFE in its information system. We may also provide loans directly to Hainan ZKGC, according to the Circular of the People’s Bank of China on Matters relating to the Comprehensive Macro-prudential Management of Cross-border Financing issued by the People’s Bank of China in January 2017. According to the Notice of the People’s Bank of China and the State Administration of Foreign Exchange on Adjustments to Comprehensive Macro-prudential Regulation Parameters for Cross-border Financing issued by the People’s Bank of China and the State Administration of Foreign Exchange in March 2020, the limit for the total amount of foreign debt is 2.5 times its net assets. Moreover, any medium or long-term loan to be provided by us to Hainan ZKGC or to our PRC subsidiary must also be filed and registered with the NDRC. We may also decide to finance our PRC subsidiary by means of capital contributions. These capital contributions must be reported to the Ministry of Commerce, or MOFCOM, or its local counterpart. In addition, a foreign invested enterprise is required to use its capital pursuant to the principle of authenticity and self-use within its business scope.

SAFE promulgated the Notice of the State Administration of Foreign Exchange on Reforming the Administration of Foreign Exchange Settlement of Capital of Foreign-invested Enterprises, or SAFE Circular 19, effective June 2015. Although SAFE Circular 19 allows RMB capital converted from foreign currency-denominated registered capital of a foreign-invested enterprise to be used for equity investments within China, it also reiterates the principle that RMB converted from the foreign currency-denominated capital of a foreign-invested company may not be directly or indirectly used for purposes beyond its business scope. Thus, it is unclear whether SAFE will permit such capital to be used for equity investments in China in actual practice. SAFE promulgated the Notice of the State Administration of Foreign Exchange on Reforming and Standardizing the Foreign Exchange Settlement Management Policy of Capital Account, or SAFE Circular 16, effective on June 9, 2016, which reiterates some of the rules set forth in SAFE Circular 19, but changes the prohibition against using RMB capital converted from foreign currency- denominated registered capital of a foreign-invested company to issue RMB entrusted loans to a prohibition against using such capital to issue loans to non-associated enterprises. Violations of SAFE Circular 19 and SAFE Circular 16 could result in administrative penalties. SAFE Circular 19 and SAFE Circular 16 may significantly limit our ability to transfer any foreign currency we hold to Zhongke WFOE or to Hainan ZKGC, which may adversely affect our liquidity and our ability to fund and expand our business in China.

On October 23, 2019, SAFE issued Notice by the State Administration of Foreign Exchange of Further Facilitating Cross-border Trade and Investment, or Circular 28, which took effect on the same day. Circular 28, subject to certain conditions, allows foreign-invested enterprises whose business scope does not include investment, or non-investment foreign-invested enterprises, to use their capital funds to make equity investments in China. Since Circular 28 was issued only recently, its interpretation and implementation in practice are still subject to substantial uncertainties.

In light of the various requirements imposed by PRC regulations on loans to and direct investment in PRC entities by offshore holding companies, we cannot assure you that we will be able to complete the necessary government registrations or obtain the necessary government approvals on a timely basis, if at all, with respect to future loans to Zhongke WFOE or to Hainan ZKGC or future capital contributions by us to Zhongke WFOE. As a result, uncertainties exist as to our ability to provide prompt financial support to Zhongke WFOE or to Hainan ZKGC when needed. If we fail to complete such registrations or obtain such approvals, our ability to use capital invested in ZKGC Cayman to capitalize or otherwise fund the operations of Hainan ZKGC may be negatively affected, which could materially and adversely affect our liquidity and our ability to fund and expand our business. Unless Zhongke WFOE or Hainan ZKGC were able to find other funding sources, the business of Hainan ZKGC could fail for lack of sufficient working capital.

Rules recently adopted by the Cyberspace Administration of China may restrict our ability to finance the VIE from the proceeds of securities offerings by ZKGC Cayman.

On January 4, 2022 the Cyberspace Administration of China (“CAC”) adopted rules mandating that an issuer who is a “critical information infrastructure operator” or a “data processing operator” as defined therein and who possesses personal information of more than one million users, and intends to have its securities listed for trading in a foreign country must complete a cybersecurity review by the CAC. Alternatively, relevant governmental authorities in the PRC may initiate cyber security review if such governmental authorities determine an operator’s cyber products or services, data processing or potential listing in a foreign country affect or may affect national security. The rules became effective on February 15, 2022.

The new CAC rules do not appear to apply to Hainan ZKGC or Network ZKGY at this time. First, the number of users of Hainan ZKGC’s services is far short of one million in number. Moreover, the software used by Network ZKGY to collect user information is based on a wechat applet that collects the phone number and identity information of users during registration after informing them of their privacy rights and soliciting approval of an online privacy contract. Finally, Hainan ZKGC does not sell or transfer any of the user information that it collects. To our knowledge, the procedures used by Hainan ZKGC to collect user information comply with all current laws.

The continued expansion of business operations by Hainan ZKGC, however, could bring that company within the scope of authority of the CAC rules. CAC rules may also expand the protections involved in collection of user information. Hainan ZKGC may face challenges in addressing such enhanced regulatory requirements and in making necessary changes to its internal policies and practices in data privacy and cybersecurity matters. If Hainan ZKGC is unable to develop the security structures required by the CAC, it may be prevented from carrying on its collection of user data. In addition, it Hainan ZKGC is unable to satisfy the CAC’s cybersecurity review, it may be prevented by the CAC from accepting loans from Zhongke WFOE that arise from offshore offerings of the Ordinary Shares of ZKGC Cayman. In that event, our ability to finance the business of Hainan ZKGC could be hindered, which could prevent Hainan ZKGC from achieving profitable operations.

Increased regulation of offshore offerings by the CSRC could significantly limit or completely hinder our ability to offer or continue to offer our ordinary shares to investors and could cause the value of our ordinary shares to significantly decline or become worthless.

On July 6, 2021, PRC government authorities published the Opinions on Strictly Cracking Down Illegal Securities Activities in Accordance with the Law. These opinions call for strengthened regulation over illegal securities activities and supervision on overseas listings by China-based companies. They propose to take effective measures, such as promoting the construction of relevant regulatory systems, to deal with the risks faced by China-based overseas-listed companies.

On December 24, 2021, the CSRC released the Draft Rules Regarding Overseas Listing, which had a comment period that expired on January 23, 2022. The Draft Rules Regarding Overseas Listing lay out the filing regulation arrangement for both direct and indirect overseas listing, and clarify the determination criteria for indirect overseas listing in overseas markets. The Draft Rules stipulate that the Chinese-based companies, or the issuer, shall fulfill the filing procedures within three working days after the issuer makes an application for initial public offering and listing in an overseas market. The required filing materials for an initial public offering and listing should include at least the following: record-filing report and related undertakings; regulatory opinions, record-filing, approval and other documents issued by competent regulatory authorities of relevant industries (if applicable); and security assessment opinion issued by relevant regulatory authorities (if applicable); PRC legal opinion; and prospectus.

In addition, an overseas offering and listing is prohibited under any of the following circumstances: (1) if the intended securities offering and listing is specifically prohibited by national laws and regulations and relevant provisions; (2) if the intended securities offering and listing may constitute a threat to or endangers national security as reviewed and determined by competent authorities under the State Council in accordance with law; (3) if there are material ownership disputes over the equity, major assets, and core technology, etc. of the issuer; (4) if, in the past three years, the domestic enterprise or its controlling shareholders or actual controllers have committed corruption, bribery, embezzlement, misappropriation of property, or other criminal offenses disruptive to the order of the socialist market economy, or are currently under judicial investigation for suspicion of criminal offenses, or are under investigation for suspicion of major violations; (5) if, in past three years, directors, supervisors, or senior executives have been subject to administrative punishments for severe violations, or are currently under judicial investigation for suspicion of criminal offenses, or are under investigation for suspicion of major violations; (6) other circumstances as prescribed by the State Council. The Draft Administration Provisions defines the legal liabilities of breaches such as failure in fulfilling filing obligations or fraudulent filing conducts, imposing a fine between RMB 1 million and RMB 10 million, and in cases of severe violations, a parallel order to suspend relevant business or halt operation for rectification, revoke relevant business permits or operational license.

The Draft Rules Regarding Overseas Listing, if enacted, may subject us to additional compliance requirement in the future, and we cannot assure you that we will be able to get the clearance of filing procedures under the Draft Rules Regarding Overseas List on a timely basis, or at all. Any failure by us to fully comply with new regulatory requirements may significantly limit or completely hinder our ability to offer or continue to offer our ordinary shares, cause significant disruption to our business operations, and severely damage our reputation, which would materially and adversely affect our financial condition and results of operations and cause our ordinary shares to significantly decline in value or become worthless.

PRC laws and regulations governing the VIE’s current business operations are sometimes vague and subject to interpretation. Moreover, the PRC has recently adopted regulatory policies regarding the conduct of business in the PRC that have had sudden adverse effects on business operations. Any changes in PRC laws and regulations or in their interpretation may have a material and adverse effect on our business.

There are substantial uncertainties regarding the interpretation, application and enforcement of PRC laws and regulations, including but not limited to the laws and regulations governing the business of Hainan ZKGC. These laws and regulations are sometimes vague and are subject to future changes, and their official interpretation and enforcement by the various branches of the PRC government may involve substantial uncertainty. The PRC legal system is based in part on governmental policies and internal rules some of which are not published on a timely basis or at all. New laws, regulations, rules and policies that affect existing and proposed future businesses may also be applied retroactively.

The principles of substantive due process that apply to the regulatory scheme in the United States are not honored in China. As a result, particularly in the past several years, enterprises operating in China are often subject to policies adopted by the government without prior notice that have had sudden and significant adverse effect on the ability of the enterprise to conduct its business. We cannot predict with certainty what effect existing or new PRC laws or regulations may have on the business of the VIE. If restrictions are adopted that make it impossible for Hainan ZKGC to operate profitably, your investment could become worthless.

Although the audit report included in this Report was issued by U.S. auditors who are currently inspected by the PCAOB, if it is later determined that the PCAOB is unable to inspect or investigate our auditor completely, investors would be deprived of the benefits of such inspection and our ordinary shares may be delisted or prohibited from trading.

The audit report included in this Report was issued by Michael T. Studer CPA, P.C., a U.S.-based accounting firm that is registered with the PCAOB and can be inspected by the PCAOB. We have no intention of dismissing Michael T. Studer CPA, P.C. in the future or of engaging any auditor not based in the U.S. and not subject to regular inspection by the PCAOB. As an auditor of companies that are registered with the SEC and publicly traded in the United States and a firm registered with the PCAOB, our auditor is required under the laws of the United States to undergo regular inspections by the PCAOB to assess its compliance with the laws of the United States and professional standards. If we were to engage a different auditor in the future, we would engage an auditor that is U.S.-based and subject to full PCAOB inspection with all materials related to the audit of our financial statements accessible to the PCAOB.

There have been recent deliberations within the U.S. government regarding limiting or restricting China-based companies from accessing U.S. capital markets. On December 18, 2020, the Holding Foreign Companies Accountable Act (the “HFCAA”) was signed into law. The HFCAA includes requirements for the SEC to identify issuers whose audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely because of a restriction imposed by a non-U.S. authority in the auditor’s local jurisdiction. Additionally, in July 2020, the U.S. President’s Working Group on Financial Markets issued recommendations for actions that can be taken by the executive branch, the SEC, the PCAOB or other federal agencies and department with respect to Chinese companies listed on U.S. stock exchanges and their audit firms, in an effort to protect investors in the United States. In response, on November 23, 2020, the SEC issued guidance highlighting certain risks (and their implications to U.S. investors) associated with investments in China-based issuers and summarizing enhanced disclosures the SEC recommends China-based issuers make regarding such risks. On December 2, 2021, the SEC adopted final rules relating to the implementation of certain disclosure and documentation requirements of the HFCAA. The SEC is assessing how to implement the requirements of the HFCAA, including the listing and trading prohibition requirements described above. Under the HFCAA, our securities may be prohibited from trading on the Nasdaq or other U.S. stock exchanges if our auditor is not inspected by the PCAOB for three consecutive years, and this ultimately could result in our Ordinary Shares being delisted. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”), which, if enacted, would amend the HFCAA and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three. On September 22, 2021, the PCAOB adopted a final rule implementing the HFCAA, which provides a framework for the PCAOB to use when determining, as contemplated under the HFCAA, whether the Board is unable to inspect or investigate completely registered public accounting firms located in a foreign jurisdiction because of a position taken by one or more authorities in that jurisdiction. On December 16, 2021, the PCAOB issued a Determination Report which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China, because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong.

Should the PCAOB be unable to conduct an inspection of our auditor’s work papers in China, it will make it difficult to evaluate the effectiveness of our auditor’s audit procedures or equity control procedures. Investors may consequently lose confidence in our reported financial information and procedures or quality of the financial statements, which would adversely affect us and our securities. In addition, by reason of the regulations described above, our Ordinary Shares could be delisted or excluded from trading on any U.S. platform.

Failure to make adequate contribution to various employee benefit plans, as required by PRC regulations, may subject Hainan ZKGC to penalties.

Companies operating in China are required to participate in various government-sponsored employee benefit plans, including certain social insurance, housing funds and other welfare-oriented payment obligations. Such companies must contribute to the plans in amounts equal to certain percentages of salaries, including bonuses and allowances, earned by employees up to a maximum amount specified by the local government from time to time at locations where the employees are based. The requirement to contribute to employee benefit plans has not been implemented consistently by the local governments in China, reflecting the different levels of economic development in different locations. For the sake of efficient administration and to optimize the cash flows of Hainan ZKGC and Network ZKGY, the VIE does not make the contribution to benefit plans for its employees. Due to its failure to make contributions to employee benefit plans, Hainan ZKGC could be required to make the contributions to these plans as well as to pay late fees and fines. We have accrued liability for the unpaid contributions on our financial statements. However, if the amount of our estimates is inaccurate, our financial condition and cash flow may be adversely affected if Hainan ZKGC was required to pay late fees or fines in relation to the underpaid employee benefits.

Dividends payable to foreign investors and gains on the sale of our Ordinary Shares by our foreign investors may become subject to PRC taxation.

Under the Enterprise Income Tax Law and its implementation regulations, a 10% PRC withholding tax is applicable to dividends payable by a resident enterprise to investors that are non-resident enterprises, which do not have an establishment or place of business in the PRC or which have an establishment or place of business but the dividends are not effectively connected with the establishment or place of business, to the extent these dividends are derived from sources within the PRC, subject to any reduction set forth in applicable tax treaties. Similarly, any gain realized on the transfer of shares of a PRC resident enterprise by these investors is also subject to PRC tax at a current rate of 10%, subject to any exemption set forth in relevant tax treaties. If we are deemed a PRC resident enterprise, dividends paid on our Ordinary Shares and any gain realized by the non-resident enterprise investors from the transfer of our Ordinary Shares may be treated as income derived from sources within the PRC and as a result be subject to PRC taxation. Furthermore, if we are deemed a PRC resident enterprise, dividends payable to individual investors who are non-PRC residents and any gain realized on the transfer of our Ordinary Shares by these investors may be subject to PRC tax at a current rate of 20%, subject to any reduction or exemption set forth in applicable tax treaties. It is unclear, if we are considered a PRC resident enterprise, whether holders of our Ordinary Shares would be able to claim the benefit of income tax treaties or agreements entered into between China and other countries or areas and claim foreign tax credit if applicable. If dividends payable to our non-PRC investors, or gains from the transfer of our Ordinary Shares by these investors are subject to PRC tax, the value of your investment in our ADSs and/or ordinary shares may decline significantly.

You may experience difficulties in effecting service of a legal process, enforcing foreign judgments or bringing actions in China against us or our management named in this Report based on foreign laws.

We are an exempted company with limited liability incorporated under the laws of the Cayman Islands. However, the VIE conducts substantially all of its operations in China, and substantially all of the assets reflected on our balance sheet are located in China. In addition, all of our senior executive officers reside within China and are PRC nationals. As a result, it may be difficult for our shareholders to effect service of process upon us or those persons inside China. In addition, China does not have treaties providing for the reciprocal recognition and enforcement of judgments of courts with the Cayman Islands or the United States. Therefore, recognition and enforcement in China of judgments of a court in any of these non-PRC jurisdictions in relation to any matter not subject to a binding arbitration provision may be difficult or impossible. To the extent that the discussion in this paragraph relates to matters of PRC tax law, it represents the opinion of Zhonglun W&D Law Firm, our PRC counsel.

Shareholder claims that are common in the United States, including securities law class actions and fraud claims, generally are difficult to pursue as a matter of law or practicality in China. For example, in China, there are significant legal and other obstacles to obtaining information needed for shareholder investigations or litigation outside China or otherwise with respect to foreign entities. Although the local authorities in China may establish a regulatory cooperation mechanism with the securities regulatory authorities of another country or region to implement cross-border supervision and administration, such regulatory cooperation with the securities regulatory authorities in the Unities States have not been efficient in the absence of a mutual and practical cooperation mechanism.

Risks Related to the VIE Structure

We rely on contractual arrangements with Hainan ZKGC and Liao Jinqi to exercise control over the operations of Hainan ZKGC, which may not be as effective as direct ownership in providing operational control.

We have relied and expect to continue to rely on contractual arrangements with Hainan ZKGC and Liao Jinqi to conduct operations through the VIE in China. These contractual arrangements, however, may not be as effective as direct ownership in providing us with control over Hainan ZKGC. For example, Hainan ZKGC and Mr. Liao could breach their contractual arrangements with us by, among other things, failing to conduct the operations of Hainan ZKGC in an acceptable manner or taking other actions that are detrimental to our interests.

If we had direct ownership of Hainan ZKGC, we would be able to exercise our rights as a shareholder to effect changes in the board of directors of Hainan ZKGC, which in turn could implement changes, subject to any applicable fiduciary obligations, at the management and operational level. However, under the current contractual arrangements, we rely on the performance by Hainan ZKGC and Mr. Liao of their obligations under the contracts to exercise control over Hainan ZKGC. If any dispute relating to these contracts remains unresolved, we will have to enforce our rights under these contracts through the operations of PRC law and arbitration, litigation and other legal proceedings and therefore will be subject to uncertainties in the PRC legal system.

Neither the Government of the PRC nor the Chinese legal system has ever formally acknowledged the legality of using a VIE-type contractual arrangement where direct ownership of a Chinese entity is forbidden. If the government determines that the VIE contracts are illegal or unenforceable, our Ordinary Shares may become worthless.

Foreign ownership of value-added telecommunications services, such as those provided by Hainan ZKGC, is restricted by the laws of the PRC. Primarily for this reason, our Company does not directly engage in the business of providing charging stations, but instead has entered into a series of contracts with Hainan ZKGC that are intended to provide our Company with control over the operations of Hainan ZKGC and the right to receive the net profits realized by Hainan ZKGC. These contracts are customarily identified as “VIE Agreements”, as they are designed to cause the operating company to be treated under U.S. generally accepted accounting principles as a “variable interest entity”, whose profits and losses can be consolidated with those of its contractual counterpart.

One significant risk of this structure is that the Chinese government has never expressly acknowledged it as a way to legally navigate the country’s investment restrictions. The Chinese government could determine at any time and without notice that the underlying contractual arrangements on which our control of Hainan ZKGC is based do not comply with PRC regulations, or PRC regulations could change or be interpreted differently in the future so as to render the VIE agreements unenforceable. Any such determination from the Chinese government would cancel our legal entitlement to control the operations of Hainan ZKGC. Because our right to consolidate the financial results of Hainan ZKGC in our financial reports depends on our contractual control over Hainan ZKGC, the elimination of that control would force us to deconsolidate, leaving ZKGC Cayman with no reportable operating results and limited equity. In that event, it would be likely that all or most of the value of your investment in ZKGC Cayman would be eliminated.

All or most of the value of an investment in ZKGC Cayman depends on the enforceability of the VIE Agreements between Zhongke WFOE and Hainan ZKGC. A breach of any of the VIE Agreements between Zhongke WFOE and Hainan ZKGC (or its officers, directors, or Chinese equity owners) will be subject to Chinese law and jurisdiction. We cannot assume that the Chinese legal system would enforce the VIE Agreements. If judicial or regulatory determinations are made in China that contractual relationships such as ours with the VIE are unenforceable under Chinese law, we would be unable to assert contractual control over Hainan ZKGC and/or, perhaps, Zhongke WFOE, the entities that carry on all of the operations described in this Report. In that event, it will be likely that the value of any Ordinary Shares of ZKGC Cayman that you may own will significantly diminish or be eliminated.

Although we cannot predict with certainty the results that would occur if the Chinese government or its judiciary determined that VIE relationships such as ours are illegal, it does appear likely that the relationship between ZKGC Cayman and Hainan ZKGC would end. Because foreign ownership of companies providing value-added telecommunications services in China is barred by Chinese regulations, we would not be able to replace the VIE relationship with direct ownership of Hainan ZKGC by ZKGC Cayman. ZKGC Cayman would, therefore, be left with the choice of entering into a different business activity or terminating its business operations and dissolving. Dissolution under those circumstances would likely cause investors in ZKGC Cayman to lose most or all of their investment.

Substantial uncertainties exist with respect to the interpretation and implementation of the newly enacted Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance and operations.

The value-added telecommunications services that the VIE and its subsidiaries conducts are subject to foreign investment restrictions set forth in the Special Management Measures (Negative List) for the Access of Foreign Investment issued by the MOFCOM, and the National Development and Reform Commission, or the NDRC, effective July 2020.

On March 15, 2019, the National People’s Congress promulgated the Foreign Investment Law, or the Foreign Investment Law (2019), which became effective on January 1, 2020 and replaced the Sino-Foreign Equity Joint Venture Enterprise Law, the Sino-Foreign Cooperative Joint Venture Enterprise Law and the Wholly Foreign-Owned Enterprise Law to become the legal foundation for foreign investment in the PRC. Since it is relatively new, uncertainties still exist in relation to its interpretation and implementation. For instance, under the Foreign Investment Law (2019), “foreign investment” refers to the investment activities directly or indirectly conducted by foreign individuals, enterprises or other entities in China. Though it does not explicitly classify contractual arrangements as a form of foreign investment, there is no assurance that foreign investment via contractual arrangements would not be interpreted as a type of indirect foreign investment activity in the future. In addition, the definition of foreign investment contains a catch-all provision which includes investments made by foreign investors through means stipulated in laws, administrative regulations or provisions of the State Council. Therefore, it still leaves leeway for future laws, administrative regulations or provisions promulgated by the State Council to provide for contractual arrangements as a form of foreign investment. In any of these cases, it will be uncertain whether our contractual arrangements will be deemed to be in violation of the market access requirements for foreign investment under the PRC laws and regulations. If further actions must be taken under future laws, administrative regulations or provisions of the State Council, we may face substantial uncertainties as to whether we can complete such actions. Failure to do so could materially and adversely affect our current corporate structure, corporate governance and operations.

The contractual arrangements we have entered into with Hainan ZKGC may be subject to scrutiny by the PRC tax authorities. A finding that we owe additional taxes could negatively affect our financial condition and the value of your investment.

Under applicable PRC laws and regulations, arrangements and transactions among related parties may be subject to audit or challenge by the PRC tax authorities. We could face material and adverse tax consequences if the PRC tax authorities determine that the contractual arrangements in relation to Hainan ZKGC were not entered into on an arm’s-length basis in such a way as to result in an impermissible reduction in taxes under applicable PRC laws, rules and regulations, and therefore adjust the income of Hainan ZKGC in the form of a transfer pricing adjustment. A transfer pricing adjustment could, among other things, result in a reduction of expense deductions recorded by Hainan ZKGC for PRC tax purposes, which could in turn increase its tax liabilities without reducing the PRC tax expenses of Zhongke WFOE. In addition, the PRC tax authorities may impose late payment fees and other administrative sanctions on Hainan ZKGC for the adjusted but unpaid taxes according to the applicable regulations. Our financial position could be materially and adversely affected if Hainan ZKGC’s tax liabilities increase or if they are required to pay late payment fees and other penalties.

Risks Related to the Organization of our Holding Company in the Cayman Islands

We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions of the securities regulations applicable to U.S. domestic public companies. We are also governed by Cayman Island principles

Because we qualify as a foreign private issuer under the Exchange Act, we are exempt from certain provisions of the securities rules and regulations in the United States that are applicable to U.S. domestic issuers, including:

| | ● | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q or current reports on Form 8-K; |

| | ● | the sections of the Exchange Act regulating the solicitation of proxies or written consents in respect of a security registered under the Exchange Act; |

| | ● | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities, as well as the sections that impose liability on insiders who profit from trades made in a short period of time; and |

| | ● | the rules under Regulation FD prohibiting selective disclosure by issuers of material nonpublic information. |

We will be required to file an annual report on Form 20-F within four months after the end of each fiscal year. Press releases relating to financial results and material events will also be furnished to the SEC on Form 6-K. However, the information we are required to file with or furnish to the SEC will be less extensive and less timely compared to that required to be filed with the SEC by U.S. domestic issuers. As a result, you may not be afforded the same protections or information that would be made available to you were you investing in a U.S. domestic issuer.

If we achieve a listing on the Nasdaq Global Market, the NYSE or the OTCQX, because we are a company incorporated in the Cayman Islands, we will be permitted to adopt certain home country practices in relation to corporate governance matters, and those home country practices would differ significantly from the corporate governance requirements applicable to U.S. domestic issuers. For example, shareholders of Cayman Islands exempted companies such as ZKGC Cayman have no general rights under Cayman Islands law to inspect corporate records or to obtain copies of lists of shareholders of these companies. Our directors have discretion under our articles of association to determine whether or not, and under what conditions, our corporate records may be inspected by our shareholders, but are not obliged to make them available to our shareholders. This may make it more difficult for you to obtain the information needed to establish any facts necessary for a shareholder motion or to solicit proxies from other shareholders in connection with a proxy contest. In addition, Cayman Islands does not require us to comply with the following corporate governance listing standards of both the NYSE and NASDAQ: (i) having the majority of our board of directors composed of independent directors, (ii) having a minimum of three members in our audit committee, (iii) holding annual shareholders’ meetings, (iv) having a compensation committee composed entirely of independent directors, and (v) having a nominating and corporate governance committee composed entirely of independent directors. If we choose to follow home country practices in the future, our shareholders may be afforded less protection than they would otherwise enjoy under the NYSE and NASDAQ corporate governance listing standards applicable to U.S. domestic issuers.

Our home country practices may afford less protection to shareholders than they would enjoy if we complied fully with the corporate governance requirements applicable to U.S. domestic issuers. At present, we have not determined whether or to what extent we will rely on home country practice with respect to our corporate governance.

You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law.

We are an exempted company with limited liability incorporated under the laws of the Cayman Islands and certain of our officers and directors are residents of jurisdictions outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon our directors or executive officers, or enforce judgments obtained in the United States courts against our directors or officers.

Our corporate affairs will be governed by our Memorandum and Articles of Association as amended from time to time, the Companies Act and the common law of the Cayman Islands. The rights of shareholders to take legal action against our directors and us, actions by minority shareholders and the fiduciary responsibilities of our directors to us under Cayman Islands law are to a large extent governed by the common law of the Cayman Islands. The common law of the Cayman Islands is derived in part from comparatively limited judicial precedent in the Cayman Islands as well as that from English common law, which has persuasive, but not binding authority on a court in the Cayman Islands. The rights of our shareholders and the fiduciary responsibilities of our directors under Cayman Islands law may not be as clearly established as they would be under statutes or judicial precedent in some jurisdictions in the United States. In particular, the Cayman Islands has a less developed body of securities laws as compared to the United States, and some states, such as Delaware, have more fully developed and judicially interpreted bodies of corporate law than the Cayman Islands. In addition, shareholders of Cayman Islands companies may not have standing to initiate a shareholder derivative action in a federal court of the United States. There is no statutory recognition in the Cayman Islands of judgments obtained in the United States, although the courts of the Cayman Islands will in certain circumstances recognize and enforce a non-penal judgment of a foreign court of competent jurisdiction without retrial on the merits.

As a result of all of the above, our public shareholders may have more difficulty in protecting their interests in the face of actions taken by management, members of the board of directors or controlling shareholders than they would as public shareholders of a company incorporated in the United States.

We have been advised by our Cayman Islands legal counsel, Ogier, that there is uncertainty as to whether the courts of the Cayman Islands would:

| | ● | recognize or enforce against us judgments of courts of the United States based on certain civil liability provisions of U.S. securities laws; and |

| | ● | entertain original actions brought in the Cayman Islands against us or our directors or officers predicated upon the securities laws of the United States or any state in the United States. |

There is no statutory enforcement in the Cayman Islands of judgments obtained in the United States, although the courts of the Cayman Islands will in certain circumstances recognize and enforce a foreign judgment, without any re-examination or re-litigation of matters adjudicated upon, provided such judgment:

| | (a) | is given by a foreign court of competent jurisdiction; |

| | (b) | imposes on the judgment debtor a liability to pay a liquidated sum for which the judgment has been given; |

| | (d) | is not in respect of taxes, a fine or a penalty; |

| | (e) | was not obtained by fraud; and |

| | (f) | is not of a kind the enforcement of which is contrary to natural justice or the public policy of the Cayman Islands. |

Subject to the above limitations, in appropriate circumstances, a Cayman Islands court may give effect in the Cayman Islands to other kinds of final foreign judgments such as declaratory orders, orders for performance of contracts and injunctions.

As a result of all of the above, public shareholders may have more difficulty in protecting their interests in the face of actions taken by our board of directors, management or controlling shareholders than they would as public shareholders of a U.S. company.

Risks Related To Our Management

The loss of the services of our Chairman could negatively impact our ability to develop our products and sales.

Liao Jinqi, Chairman of both ZKGC Cayman and Hainan ZKGC, was the founder of those entities and initially was the sole executive officer responsible for our operations. During 2023, Mr. Liao stepped down from his position as CEO of ZKGC Cayman in favor of a professional management team. Mr. Liao remains, however, the CEO responsible for the operations of Hainan ZKGC, and is also the primary source of the know-how that governs the VIE’s installation of charging stations. Our future success depends upon the continued service of Mr. Liao, as well as on our ability to identify and retain additional competent executives with the skills required to execute our business objectives. The loss of the services of any of our officers or our failure to timely identify and retain competent personnel could negatively impact our ability to develop a competitive position in the market for charging stations, which would adversely affect our financial results and impair the growth of Hainan ZKGC.

Our internal controls over financial reporting may not be effective, which could have a significant and adverse effect on our business and reputation.

As a newly public reporting company, we will be in a continuing process of developing, establishing, and maintaining internal controls and procedures that will allow our management to report on, and our independent registered public accounting firm to attest to, our internal controls over financial reporting if and when required to do so under Section 404 of the Sarbanes-Oxley Act of 2002. Although our independent registered public accounting firm is not required to attest to the effectiveness of our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act until the date we are no longer an emerging growth company, our management will be required to report on our internal controls over financial reporting under Section 404. If we do not remediate any material weaknesses in our internal controls, our reported financial results could be materially misstated or could subsequently require restatement, and we could be subject to investigations or sanctions by regulatory authorities.

Our board of directors acts as our compensation committee, which presents the risk that compensation and benefits paid to those executive officers who are board members and other officers may not be commensurate with our financial performance.

A compensation committee consisting of independent directors is a safeguard against self-dealing by company executives. Our board of directors, which has no independent members, acts as the compensation committee for the Company and determines the compensation and benefits of our executive officers, will administer our employee stock and benefit plans, if any, and reviews policies relating to the compensation and benefits of our employees. Our lack of an independent compensation committee presents the risk that an executive officer on the board may have influence over his or her personal compensation and may obtain benefits levels that may not be commensurate with our financial performance.

Limitations on director and officer liability and indemnification of our Company’s officers and directors by us may discourage shareholders from bringing a lawsuit against an officer or director.

Our Company’s Memorandum and Articles of Association provide that a director or officer shall not be personally liable to us or our shareholders for breach of fiduciary duty as a director or officer, except for acts or omissions which involve actual fraud or willful default. These provisions may discourage shareholders from bringing a lawsuit against a director or officer for breach of fiduciary duty and may reduce the likelihood of derivative litigation brought by shareholders on the Company’s behalf against a director or officer.

Our management has limted experience managing a public company.

At the present time, none of our management or any person associated with the Company has extensive experience in managing a company whose securities trade on U.S. securities markets. This may hinder our ability to establish effective controls and systems and comply with all applicable requirements associated with being a public company. If compliance problems result, these problems could have a material adverse effect on our business, financial condition or results of operations. As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. Our management and other personnel will need to devote a substantial amount of time to our new compliance requirements. Moreover, these requirements will increase our legal, accounting and financial compliance costs and will make some activities more time-consuming and costly. These requirements could also make it more difficult for us to attract and retain qualified persons to serve on our board of directors, our board committees or as executive officers.

Hainan ZKGC may have difficulty establishing adequate management, legal and financial controls in the PRC.

Hainan ZKGC may have difficulty in hiring and retaining a sufficient number of qualified employees to perform financial management services in the PRC. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet western standards. Therefore, we may, in turn, experience difficulties in implementing and maintaining adequate internal controls as will be required under Section 404 of the Sarbanes Oxley Act of 2002.

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

Our Chairman, Liao Jinqi, organized Hainan ZKGC on August 11, 2020 and Network ZKGY on September 28, 2020 to carry out the business plan he developed.

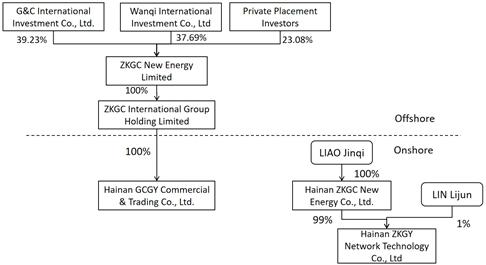

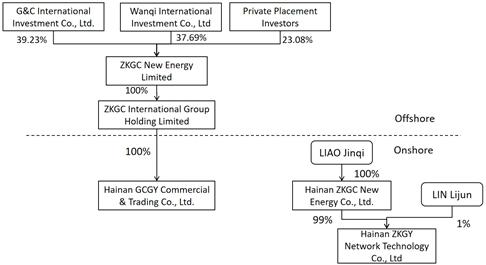

After deciding that a listing in the U.S. would best serve our capital requirements, we organized ZKGC Cayman on May 31, 2021 and subsequently organized ZKGC International and Zhongke WFOE later in 2021 in order to achieve the optimal corporate structure for securities listing and tax purposes. As of October 18, 2021, the Company had been organized by ZKGC Cayman’s acquisition of ZKGC International and ZKGC International’s acquisition of Zhongke WFOE, and the Company’s business had been organized by Zhongke WFOE’s acquisition of contractual control over the operations of Hainan ZKGC and its subsidiary, Network ZKGY.

The following diagram illustrates our corporate and operating structure:

Contractual Arrangements

Due in part to limitations under PRC law on foreign investment in value-added telecommunications services, we conduct substantially all of the operations in China reflected in our financial statements through contractual arrangements with Hainan ZKGC and Network ZKGY, our consolidated variable interest entities, and their shareholders. We do not hold any equity interest in either Hainan ZKGC or its subsidiary, Network ZKGY. We depend on Hainan ZKGC and Network ZKGY to operate substantially all of the business reflected in our financial statements. We have entered into contractual arrangements with Hainan ZKGC and its shareholder, which enable us to:

| | ● | direct the activities of Hainan ZKGC and Network ZKGY that most significantly impact their economic performance; |

| | ● | absorb losses and receive benefits from Hainan ZKGC’s and Network ZKGY’s operations; and |

| | ● | have an exclusive option to purchase, to the extent permitted by applicable PRC law, all of the equity interests in Hainan ZKGC. |

Set forth below is a summary of those contractual arrangements. This summary is qualified in its entirety by reference to the relevant agreements, which have been incorporated by reference as exhibits to this Report.

Exclusive Business Cooperation Agreement

Under the Exclusive Business Consulting Agreement between Zhongke WFOE and Hainan ZKGC, Zhongke WFOE has the exclusive right to provide to Hainan ZKGC marketing, management, consulting and other services related to its business operations. Most significantly, Zhongke WFOE will license to Hainan ZKGC intellectual property relating to the operation of Charging Stations and will provide Hainan ZKGC consulting services and technical support regarding the development, marketing and installation of Charging Stations. Zhongke WFOE will also provide the software development services required for Zhongke WFOE to expand its client base.

In compensation for the services and licenses provided by Zhongke WFOE, Hainan ZKGC will pay Zhongke WFOE a quarterly fee equal net income of Zhongke WFOE for the preceding quarter less any losses carried forward from prior quarters. The Exclusive Business Consulting Agreement will remain in effect until terminated by the parties.

Equity Interest Pledge Agreement

Liao Jinqi, who owns all of the registered equity in Hainan ZKGC, has entered into an Equity Interest Pledge Agreement with Zhongke WFOE. Pursuant to this agreement, Mr. Liao pledged all of his equity interest in Hainan ZKGC, including the right to receive dividends, to Zhongke WFOE to secure the performance of Hainan ZKGC’s obligations under the Exclusive Business Consulting Agreement described above. If Hainan ZKGC breaches relevant contractual obligations under this agreement, Zhongke WFOE, as pledgee, will be entitled to certain rights, including the right to sell the pledged equity interests. Mr. Liao has agreed not to transfer or create any new encumbrance on his equity interests without the prior written consent of Zhongke WFOE. The Equity Interest Pledge Agreement shall terminate when Hainan ZKGC has fully performed its obligations under the Exclusive Business Consulting Agreement.

Exclusive Option Agreement

Under the Exclusive Option Agreement among Zhongke WFOE, Hainan ZKGC and Liao Jinqi, Mr. Liao irrevocably granted Zhongke WFOE or its designated person(s) an exclusive option to purchase, when and to the extent permitted under PRC law, all or part of his equity interest in Hainan ZKGC. The purchase price for the equity interest in Hainan ZKGC shall be determined through consultation according to the appraisal value approved by the relevant authorities and shall be the minimum amount permissible under PRC law. The Exclusive Option Agreement will be valid until all of the equity interest in Hainan ZKGC has been transferred to Zhongke WFOE. The Exclusive Option Agreement provides, among other things, that without Zhongke WFOE’s prior written consent:

| | ● | Liao Jinqi may not transfer, encumber, grant a security interest in, or otherwise dispose of any equity interest in Hainan ZKGC, except as provided in the Exclusive Option Agreement; |

| | ● | Hainan ZKGC may not (i) sell, transfer, grant security interest in or otherwise dispose of any assets, business, revenue or interest, (ii) enter into any material contract except for those incurred in the ordinary course of business, or (iii) incur any liabilities (except for those incurred in the ordinary course of business) or extend loans or credit facilities to any third party; |

| | ● | Hainan ZKGC may not declare or pay any dividends and its shareholder must remit in full any funds received from Hainan ZKGC to Zhongke WFOE; and |

| | ● | Hainan ZKGC may not merge with or acquire any third parties, or make investment in any third parties. |

Power of Attorney