As filed with the Securities and Exchange Commission on January 25, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ZKGC New Energy Limited

(Exact Name of Registrant as Specified in Its Charter)

Not Applicable

(Translation of Registrant’s name into English)

| Cayman Islands | | 3699 | | Not Applicable |

(State or Other Jurisdiction of

Incorporation or Organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification No.) |

12 Xinxiangdi Jiari

Laocheng Town, Chengmai County

Hainan Province 571924, People’s Republic of China

(+86) 0760 88963658

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

CCS Global Solutions, Inc.

99 Washington Avenue, Suite 805A, Albany, NY 12210

(800)-300-5067

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Robert Brantl, Esq.

181 Dante Avenue

Tuckahoe, NY 10707-3042

(914) 693-3026

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to Be Registered | | Amount to be Registered | | | Proposed Maximum Offering

Price per

Unit | | | Proposed Maximum Aggregate Offering

Price (1)(2) | | | Amount of Registration

Fee | |

| Ordinary shares, par value $0.001 | | | 3,000,000 | | | $ | 0.30 | | | | $1,000,000. | | | $ | 92.70 | |

| (1) | Estimated solely for the purpose of determining the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933. |

| | |

| (2) | Includes (a) ordinary shares represented by American depositary shares initially offered and sold outside the United States that may be resold from time to time in the United States, and (b) ordinary shares represented by American depositary shares that are issuable upon the exercise of the underwriters’ overallotment option to purchase additional shares. The ordinary shares are not being registered for the purpose of sales outside the United States. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

| The information in this prospectus is not complete and may be amended. The Issuer may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. |

SUBJECT TO COMPLETION DATED JANUARY 25, 2022

PRELIMINARY PROSPECTUS

ZKGC NEW ENERGY LIMITED

3,000,000 ORDINARY SHARES

OFFERING PRICE $0.30 PER SHARE

This prospectus relates to the resale from time to time of up to 3,000,000 of our ordinary shares by the selling shareholders identified in the section entitled “Selling Shareholders” on page 34. We issued the 3,000,000 shares in private placement transactions prior to the filing of the registration statement that contains this prospectus.

The selling shareholders may offer and sell all or a portion of the shares in accordance with one or more of the methods described in the plan of distribution, which begins on page 36 of this prospectus. ZKGC New Energy Limited is not selling any of our ordinary shares in this offering and therefore, we will not receive any proceeds from the sales by the selling shareholders. The selling shareholders will offer and sell the ordinary shares at a fixed price of $0.30 per share until our ordinary shares are quoted on the OTCQB or other established public market, at which time the selling shareholders may sell the ordinary shares at prevailing market prices or in privately negotiated transactions.

This is an initial public offering of our ordinary shares. There is no public market for our ordinary shares, nor are our ordinary shares currently eligible for trading on any national securities exchange, NASDAQ or any over-the-counter market. We intend to arrange for a registered broker-dealer to apply for permission to post a quotation for our stock, and we intend to then apply to have our ordinary shares quoted on the OTCQB system of the OTC Market Group. However, no assurance can be given that our ordinary shares will be quoted on the OTCQB or any other quotation service.

ZKGC New Energy Limited is a holding company organized in the Cayman Islands. The business described in this prospectus is not carried out by ZKGC New Energy Limited or by any of its subsidiaries, but by a variable interest entity (“VIE”) located in China. We have no direct control over the VIE; our control is based on a series of contracts. The enforceability of such contracts has not been tested in the courts of China, We adopted the VIE arrangement because Chinese law restricts foreign ownership of value-added telecommunications companies, such as our VIE. For this reason, there is doubt as to whether Chinese courts would enforce our contracts with the VIE. If they did not, that refusal could cause the value of our ordinary shares to significantly decline or be eliminated. See the discussion of the risks of the VIE arrangement in “Risk Factors: Risks Relating to our VIE Structure” on page 13.

OUR BUSINESS IS SUBJECT TO MANY RISKS AND AN INVESTMENT IN OUR ORDINARY SHARES WILL ALSO INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY CONSIDER THE FACTORS DESCRIBED UNDER THE HEADING “RISK FACTORS” BEGINNING ON PAGE 8 BEFORE INVESTING IN OUR ORDINARY SHARES.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is ____, 2022

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-1 that we filed with the Securities and Exchange Commission (the “SEC”) using the “shelf” registration process. Under this shelf registration process, the selling shareholders may, from time to time, sell the shares offered by them described in this prospectus. We will not receive any proceeds from the sale by such selling shareholders of the securities offered by them described in this prospectus.

We have not, nor have any of the selling shareholders, authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. None of us or the selling shareholders take responsibility for, or can provide assurance as to the reliability of, any other information that others may give you. Neither we nor the selling shareholders will make an offer to sell these shares in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of our ordinary shares. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: We have not, nor have any of the selling shareholders done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside the United States.

TABLE OF CONTENTS

PROSPECTUS SUMMARY

Identifiers

As used in this prospectus, the following terms have the following meanings:

PRC means the People’s Republic of China.

SEC means the U.S. Securities and Exchange Commission

For ease of reference, the entities discussed in this prospectus will be identified as follows:

| Identifier | | Jurisdiction | | Entity Name |

| ZKGC Cayman | | Cayman Islands | | ZKGC New Energy Limited |

| ZKGC International | | Hong Kong | | ZKGC International Group Holdings Limited |

| Zhongke WFOE | | PRC | | Hainan GCGY Commercial & Trading Co., Ltd. |

| Hainan ZKGC | | PRC | | Hainan ZKGC New Energy Co., Ltd. |

| Network ZKGY | | PRC | | Hainan ZKGY Network Technology Co., Ltd. |

The terms “we”, “us” and “our”, as used in this prospectus, refer to ZKGC Cayman and its subsidiaries, ZKGC International and Zhongke WFOE, both of which are holding companies without operations. When we refer to the two operating entities discussed in this prospectus, we identify them by name (Hainan ZKGC and Network ZKGY) and we at times refer to Hainan ZKGC as our “VIE” – i.e. variable interest entity. We make this distinction because we have no ownership interest in the VIE or in its subsidiary, Network ZKGY.

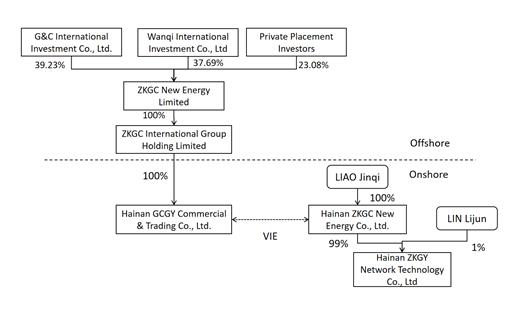

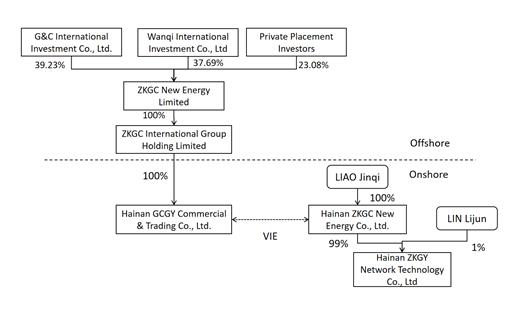

Our Corporate Structure

The following diagram illustrates our corporate and operating structure:

Contractual Arrangements with VIE

This is an offering of ordinary shares issued by ZKGC Cayman. However, ZKGC Cayman does not have any business operations; nor do either of its two subsidiaries. The business operations described in this prospectus are carried on by two companies organized and located in the PRC: one is a variable interest entity (“VIE”) with respect to the Chinese subsidiary of ZKGC Cayman; the other is a subsidiary of the VIE. ZKGC Cayman has entered into contracts that promise it control over the VIE. However, there is no reason to believe that ZKGC Cayman will ever gain direct ownership of the business carried on by the VIE.

“Variable Interest Entity” does not describe a legal relationship; it is an accounting concept. Under U.S. Generally Accepted Accounting Principles, if Entity A exercises effective control over Entity B through contractual arrangements, then the financial results and balance sheet of Entity B should be consolidated with the financial results and balance sheet in Entity A’s consolidated financial statements.

Due in part to limitations under PRC law on foreign investment in value-added telecommunication services, we conduct substantially all of our operations in China through contractual arrangements with Hainan ZKGC and Network ZKGY, our consolidated variable interest entity, its subsidiary, and their shareholders. We do not hold any equity interest in either Hainan ZKGC or Network ZKGY. We depend on Hainan ZKGC and Network ZKGY to operate substantially all of our business. We have entered into contractual arrangements with Hainan ZKGC and its shareholder, which enable us to:

| ● | direct the activities of Hainan ZKGC and Network ZKGY that most significantly impact their economic performance; |

| ● | absorb losses and receive benefits from Hainan ZKGC’s and Network ZKGY’s operations; and |

| ● | have an exclusive option to purchase, to the extent permitted by applicable PRC law, all of the equity interests in Hainan ZKGC. |

These contracts promise that we will realize substantially all of the benefits and losses resulting from the business operations of the VIE, and will have control over the operations carries on in China. (A detailed summary of the terms of the VIE contracts may be found in the section titled “Our Corporate Structure” at page 20.) However, for reasons described in the section of this prospectus titled “Risk Factors: Risks Related to our VIE Structure”, we may not be able to exercise the control promised by the VIE contracts and we may not realize the benefits resulting from the business operations of the VIE.

In general, investment in an entity whose equity value depends on contractual arrangements governed by the laws of the PRC is less advantageous to the investor than investment in an entity that has legal ownership of the assets on which the business of the entity depends. The specific risks of depending on a VIE relationship with a Chinese entity include the following:

| ● | The courts in China have not determined whether the VIE contracts are enforceable. |

| ● | The reason for using the VIE relationship is that Chinese law prevents direct ownership of a company engaged in the business described in this prospectus. This may influence the Chinese courts to decide that the VIE contracts are not enforceable. |

| ● | The courts may determine that the VIE structure actually violates the restriction on foreign investment in the value-added telecommunications industry, and so find our VIE to be operating illegally. |

| ● | If the enforceability of the VIE contracts became the subject of legal proceedings in China, ZKGC Cayman could incur substantial legal expenses in the effort to enforce its rights, with no assurance of ultimate success. |

Cash Flow

The Exclusive Business Cooperation Agreement between Zhongke WFOE and Hainan ZKGC provides that on a quarterly basis Hainan ZKGC will pay to Zhongke WFOE a fee equal to the net income of Hainan ZKGC for the preceding quarter. However, the same agreement also says that the quarterly fee payable may be reduced to assure that Hainan ZKGC has sufficient capital to implement its business plan. In reliance on that latter provision, Hainan ZKGC has, to date, paid nothing to Zhongke WFOE, as it requires all of its cash resources to launch its business operations.

Business Summary

The business that will be described in this prospectus is business carried on by Hainan ZKGC and Network ZKGY. Neither ZKGC nor its subsidiaries has any direct control over that business, as they do not own either Hainan ZKGC or Network ZKGY. The Company’s control over the business is limited to the contractual covenants contained in certain agreements (identified by reference to their accounting significance as “VIE Agreements”) among Zhongke WFOE, Hainan ZKGC, and Liao Jinqi in his role as owner of the equity in Hainan ZKGC.

Hainan ZKGC and its 99%-owned subsidiary, Network ZKGY, are engaged in the business of constructing and operating charging stations for electric vehicles (“EV”). All of the charging stations installed by Hainan ZKGC are linked to a software platform provided by Network ZKGY under the tradename “Charging Cloud SaaS Platform”, which enables the parties responsible for each charging station to monitor and manage the charging stations.

The offices of Hainan ZKGC are located in Haikou City, which is the capital city of Hainan Province. To date, Hainan ZKGC has installed charging stations exclusively in the 18 cities and counties of Hainan Province. Its business plan is to rapidly grow into a dominant provider of charging stations in Hainan Province, and then, during 2022, expand its operations onto the mainland, and develop a market presence in southeast China.

Foreign Private Issuer Status

We are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

| ● | we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company; |

| ● | for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies in the United States; |

| ● | we are not required to provide the same level of disclosure on certain issues, such as executive compensation; |

| ● | we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information; |

| | ● | we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and |

| | ● | we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction. |

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”), and we are eligible to take advantage of certain exemptions from various reporting and financial disclosure requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, (1) presenting only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations in this prospectus, (2) not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, (3) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and (4) exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these exemptions. As a result, investors may find investing in our ordinary shares less attractive.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards. As a result, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

We could remain an emerging growth company for up to five years, or until the earliest of (1) the last day of the first fiscal year in which our annual gross revenues exceed $1.07 billion, (2) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our Ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter and we have been publicly reporting for at least 12 months, or (3) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

THE OFFERING

| Shares of common stock offered by us: | | None |

| | | |

| Securities offered by Selling Shareholders | | 3,000,000 Ordinary Shares. |

| | | |

| Ordinary Shares currently outstanding | | 13,000,000 Ordinary Shares |

| | | |

| Other Equity Securities Outstanding | | None |

| | | |

| Use of Proceeds: | | The Company will not receive any proceeds from the resale or other disposition of common stock offering by the selling shareholders covered by this prospectus. |

Risk Factors

An investment in the Company’s common stock is speculative and involves substantial risks. You should read the “Risk Factors” section of this prospectus beginning on page 8 for a discussion of certain factors to consider carefully before deciding to invest in our Ordinary Shares.

Our operations in China give rise to a number of significant risks that could result in a significant reduction in the value of the ordinary shares you purchase, or could limit the ability of ZKGC Cayman to finance the operations of the VIE. In brief, some of the more significant risks that arise from investment in an entity dependent on operations in China carried on by a VIE are:

| ● | the possibility that Chinese courts will refuse to enforce the VIE contracts which give us control over our operating entities; |

| ● | the possibility that Chinese courts may consider our involvement in the field of value-added telecommunications to be illegal; |

| ● | restrictions by the Chinese government on foreign investment in China may limit our ability to adequately finance the business activities of our VIE; |

| ● | currency conversion restrictions imposed by the government of China may limit or eliminate our ability to distribute the profits from our Chinese operation. |

| ● | recently adopted regulations of the Cyberspace Administration of China or recently pronounced policies of the China Securities Regulatory Commission may in the future lead to restrictions on our ability to fund our VIE from the proceeds of securities offerings by ZKGC Cayman; |

| ● | the fact that the Chinese legal system is still in its development stage, and lacks the binding precedents that enable business entities to anticipate how the courts will interpret regulations; |

| ● | The absence of principles of substantive due process in China, which enables the Chinese government to frequently intervene in business affairs in China for the sake of new government policies. |

At the same time, our business operations face the kind of significant risks that are common to start-up enterprises, including:

| ● | The ability of larger competitors to exert pressure on Hainan ZKGC by charging lower service fees to customers; and |

| ● | Hainan ZKGC's need to secure substantial capital investment in order to secure a competitive position in the market for EV charging services. |

These and other risks that may cause your investment in ZKGC Cayman to fail are discussed in detail in the section of this prospectus titled “Risk Factors” at page 8.

SUMMARY CONSOLIDATED FINANCIAL AND OPERATING DATA

The following summary consolidated statement of operations data for the period from August 11, 2020 (inception of operations) to May 31, 2021 and the summary balance sheet information as of May 31, 2021 have been derived from the audited financial statement of ZKGC Cayman and subsidiaries included elsewhere in this prospectus. This summary financial data should be read in conjunction with the consolidated financial statements of ZKGC Cayman and subsidiaries for the period ended May 31, 2021.

ZKGC NEW ENERGY LIMITED AND SUBSIDIARIES AND VARIABLE INTEREST ENTITY

SUMMARY CONSOLIDATED BALANCE SHEET

| | | May 31,

2021 | |

| Current assets | | $ | 695,452 | |

| Total assets | | | 961,291 | |

| Current and total liabilities | | $ | 735,785 | |

| Shareholders’ equity | | $ | 225,316 | |

ZKGC NEW ENERGY LIMITED AND SUBSIDIARIES AND VARIABLE INTEREST ENTITY

SUMMARY CONSOLIDATED STATEMENTS OF OPERATIONS

| | | Period from

August 11,

2020 (inception) to

May 31,

2021 | |

| Revenues | | $ | 320,012 | |

| Gross profit | | | 54,543 | |

| Loss from operations | | $ | (7,552 | ) |

| Net income | | $ | 35,806 | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements and information relating to our business that are based on our beliefs as well as assumptions made by us or based upon information currently available to us. These statements reflect our current views and assumptions with respect to future events and are subject to risks and uncertainties. Forward-looking statements are often identified by words such as: “believe,” “expect,” “estimate,” “anticipate,” “intend,” “project” and similar expressions or words which, by their nature, refer to future events. In some cases, you can also identify forward-looking statements by terminology such as “may,” “will,” “should,” “plans,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled Risk Factors beginning on page 8, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. In addition, you are directed to factors discussed in the Management’s Discussion and Analysis of Financial Condition and Results of Operation section beginning on page 22, and the section entitled “Business of Hainan ZKGC” beginning on page 27, and as well as those discussed elsewhere in this prospectus.

These forward-looking statements speak only as of the date of this prospectus. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, or achievements. Except as required by applicable law, including the securities laws of the United States, we expressly disclaim any obligation or undertaking to disseminate any update or revisions of any of the forward-looking statements to reflect any change in our expectations with regard thereto or to conform these statements to actual results.

DETERMINATION OF THE OFFERING PRICE

Since our Ordinary Shares are not listed or quoted on any exchange or quotation system, the offering price of our Ordinary Shares in this prospectus was arbitrarily determined. The offering price of our Ordinary Shares does not bear any rational relationship to our book value, assets, past operating results, financial condition or any other established criteria of value. The facts considered in determining the offering price were our financial condition and prospects, our limited operating history and the general condition of the securities market.

DIVIDEND POLICY

We have not declared or paid any cash dividends on our Ordinary Shares since our inception. Our Board of Directors currently intends to retain all earnings for use in the business of our VIE for the foreseeable future. Any future payment of dividends will depend upon the results of operations of our VIE, our financial condition, cash requirements and other factors deemed relevant by our board of directors. There are currently no restrictions that limit our ability to declare cash dividends on our Ordinary Shares.

The source of funds for any payment of dividends by ZKGC Cayman would be fee payments by Hainan ZKGC to Zhongke WFOE pursuant to the Exclusive Business Cooperation Agreement. To date, no fees have been paid, and we do not anticipate any fees being paid while Hainan ZKGC is implementing its plan to expand its business operations through Hainan Province and then into mainland China. Investors in ZKGC Cayman, therefore, should not anticipate receiving dividends by reason of their investment at any time in the next several years.

MARKET FOR OUR ORDINARY SHARES

There is no established public market for our Ordinary Shares.

We intend to apply for a listing on the Pink Market maintained by OTC Markets concurrently with the filing of the effective notice of this prospectus, and then apply for a listing on the OTCQB as soon as we meet the standards for such a listing. In order to be quoted on the OTC Markets, a market maker must file an application on our behalf in order to make a market for our Ordinary Shares. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, nor can there be any assurance that such an application for quotation will be approved.

In addition, there is no assurance that our Ordinary Shares will trade at market prices in excess of the initial offering price as prices for the Ordinary Shares in any public market which may develop will be determined in the marketplace and may be influenced by many factors, including the stock’s depth and liquidity.

We have issued 13,000,000 shares of our Ordinary Shares since our inception on May 31, 2021. There are no outstanding options, warrants, or other securities that are convertible into Ordinary Shares.

EXCHANGE RATE INFORMATION

An entity’s functional currency is the currency of the primary economic environment in which it operates. Normally that is the currency of the jurisdiction in which the entity primarily generates and expends cash. Management’s judgment is essential to determine the functional currency by assessing various indicators, such as cash flows, sales price and market, expenses, financing and inter-company transactions and arrangements. The functional currency of the Company is the Renminbi (“RMB’). The reporting currency of these consolidated financial statements is the United States Dollar (“US Dollars” or “$”).

The financial statements of the Company, which are prepared using the RMB, are translated into the Company’s reporting currency, the United States Dollar. Assets and liabilities are translated using the exchange rate at each reporting period end date. Revenue and expenses are translated using weighted average rates prevailing during each reporting period, and shareholders’ equity is translated at historical exchange rates. Adjustments resulting from the translation are recorded as a separate component of accumulated other comprehensive income or expense.

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transactions. Foreign currency exchange gains and losses resulting from these transactions are included in results of operations.

The exchange rates used for foreign currency translation in this prospectus are as follows:

| | | | Period from

August 11,

2020

(inception) to

May 31,

2021 | |

| | | | (USD to RMB) | |

| Assets and liabilities (period-end exchange rate) | | | 1 to 6.369427 | |

| Revenue and expenses (period weighted average) | | | 1 to 6.600660 | |

RISK FACTORS

An investment in the ZKGC Cayman Ordinary Shares involves a high degree of risk. You should carefully consider the following risk factors and other information in this prospectus before deciding to invest in the Ordinary Shares. If any of the following risks actually occur, the Company business, financial condition, results of operations and prospects for growth could be seriously harmed. As a result, the trading price of the ZKGC Cayman Ordinary Shares could decline and you could lose all or part of your investment.

Risks Related to Our Business

Hainan ZKGC will require substantial additional capital contributions in order to fully implement its business plan and achieve a significant position in the market for charging station services.

The operations of Hainan ZKGC, on which the financial success of the Company depends, have been financed primarily by capital contributions and loans from related parties, primarily Liao Jinqi. Significant expansion of the operations of Hainan ZKGC, however, will require significant capital investment. There can be no assurance that we would be able to raise the additional funding needed to implement its business plan.

Based upon current plans, we expect that Hainan ZKGC will incur operating losses in future periods as it incurs significant expenses associated with the effort of expanding the business of Hainan ZKGC. Further, we cannot guarantee that Hainan ZKGC will be successful in realizing sufficient revenues or in achieving or sustaining positive cash flows at any time in the future. Any such failure could result in the possible closure of the business or force us to seek additional financing through loans or additional sales of our equity securities to continue business operations, which could dilute the value of any shares you purchase in this offering.

Hainan ZKGC faces intense competition. It may lose market share and customers if it fails to compete effectively.

The demand for charging stations in China is strong, and the barriers to entry into the supply market are not great. So there are many enterprises competing to meet the demand. Hainan ZKGC’s current or potential competitors include several major suppliers of charging stations as well as many low volume suppliers similar to Hainan ZKGC. Increased competition may adversely affect its margins, market share and brand recognition, or result in significant losses. When Hainan ZKGC sets prices, it has to consider how competitors have set prices, since electricity is fungible. When they cut prices or offer additional benefits to compete with Hainan ZKGC, Hainan ZKGC may have to lower its own prices or offer additional benefits or risk losing market share, either of which could harm our financial condition and results of operations.

Some of the competitors have longer operating histories, greater brand recognition, better supplier relationships, larger customer bases and greater financial, technical and marketing resources than Hainan ZKGC has. These and other smaller companies may receive investment from or enter into strategic relationships with well-established and well-financed companies or investors, which would help enhance their competitive positions. Some of the competitors may be able to secure more favorable terms from suppliers, devote greater resources to marketing and promotional campaigns, adopt more aggressive pricing policies and devote substantially more resources to their website, mobile application and systems development. We cannot assure you that Hainan ZKGC will be able to compete successfully against current or future competitors, and competitive pressures may have a material and adverse effect on its business, financial condition and results of operations.

Changes to fuel economy standards or the success of alternative fuels may negatively impact the EV market and thus the demand for Hainan ZKGC’s products and services.

As regulatory initiatives have required an increase in the mileage capabilities of cars, consumption of renewable transportation fuels, such as ethanol and biodiesel, and consumer acceptance of EVs and other alternative vehicles has been increasing. If fuel efficiency of non-electric vehicles continues to rise, whether as the result of regulations or otherwise, and affordability of vehicles using renewable transportation fuels improves, the demand for electric vehicles could diminish. In addition, developments in alternative technologies, such as advanced diesel, ethanol, fuel cells or compressed natural gas, or improvements in the fuel economy of the internal combustion engine, may materially and adversely affect demand for EVs and EV charging stations. Regulatory bodies may also adopt rules that substantially favor certain alternatives to petroleum-based propulsion over others, which may not necessarily be EVs. If any of these factors contribute to consumers or businesses to no longer purchasing EVs or purchasing them at a lower rate, it would materially and adversely affect Hainan ZKGC’s business, operating results, financial condition and prospects.

The EV market in China has benefitted from the availability of rebates, tax benefits and other financial incentives from governments to offset the purchase or operating cost of EVs and EV charging stations. In particular, Hainan ZKGC’s marketing efforts have benefitted from rebates and interest free loans available to purchasers of its EV charging stations that effectively provide purchasers with a significantly discounted purchase price. The reduction, modification, or elimination of such benefits could cause reduced demand for EVs and EV charging stations, which would adversely affect Hainan ZKGC’s financial results.

Over the past decade, the central government of the PRC has swelled the market for EVs in China by providing rebates to purchasers of EVs calculated to significantly reduce the disparity in cost between internal combustion powered vehicles and EVs. The government began in 2020 to reduce and eliminate those rebates. It is not clear how the eventual elimination of the rebates will affect the Chinese market for EVs. If it results in a substantial slowing of the market’s growth, that result could have an adverse effect on Hainan ZKGC’s financial results.

In addition, the government of Hainan Province has provided financial support to the expansion of EV charging infrastructure, primarily in the form of purchaser rebates and interest free loans. If Hainan Province decides to withdraw its support for the industry’s growth, demand for Hainan ZKGC’s charging stations would be likely to diminish.

The EV charging market is characterized by rapid technological change, which requires Hainan ZKGC to continue to develop new products and product innovations. Any delays in such development could adversely affect market adoption of its products and Hainan ZKGC’s financial results.

Continuing technological changes in battery and other EV technologies could adversely affect adoption of current EV charging technology and/or Hainan ZKGC’s products. Hainan ZKGC’s future success will depend upon its ability to develop and introduce a variety of new capabilities and innovations to its existing product offerings, as well as introduce a variety of new product offerings, to address the changing needs of the EV charging market. As new products are introduced, gross margins tend to decline in the near term and improves as the product become more mature and with a more efficient manufacturing process.

As EV technologies change, Hainan ZKGC may need to upgrade or adapt its charging station technology and introduce new products and services in order to serve vehicles that have the latest technology, in particular battery cell technology, which could involve substantial costs. Even if Hainan ZKGC is able to keep pace with changes in technology and develop new products and services, its research and development expenses could increase, its gross margins could be adversely affected in some periods and its prior products could become obsolete more quickly than expected.

If Hainan ZKGC is unable to devote adequate resources to develop products or cannot otherwise successfully develop products or services that meet customer requirements on a timely basis or that remain competitive with technological alternatives, its products and services could lose market share, its revenue will decline, it may experience higher operating losses and its business and prospects will be adversely affected.

If Hainan ZKGC fails to obtain and maintain the requisite licenses, permits and approvals applicable to our business, or fails to obtain additional licenses that become necessary as a result of new enactment or promulgation of laws and regulations or the expansion of our business, its business and results of operations may be materially and adversely affected.

Energy delivery services in China are highly regulated, which require multiple licenses, permits, filings and approvals to conduct and develop business. In particular, each new charging station installation requires that we secure a permit from the provincial government. The labor cost related to the effort to comply with these government regulations is extensive, and the need to sustain good relations with local government can be burdensome. In addition, as the market for charging stations expands, more regulations are likely to emerge. If Hainan ZKGC is unable to efficiently meet the regulatory requirements applicable to our business, its expansion will slow.

Risks Related to Doing Business in China

Because the operations of Hainan ZKGC, on which the financial success of ZKGC Cayman depend, are located entirely in the PRC, you may not receive the benefits that come from effective enforcement of U.S. federal securities laws.

China has often restricted U.S. regulators’ access to information and limited regulators’ ability to investigate or pursue remedies with respect to China-based issuers, generally citing to state secrecy and national security laws, blocking statutes, or other laws or regulations. In addition, according to Article 177 of the PRC Securities Law, which became effective in March 2020, no overseas securities regulator can directly conduct investigations or evidence collection activities within the PRC and no entity or individual in China may provide documents and information relating to securities business activities to overseas regulators without Chinese government approval. The SEC, U.S. Department of Justice, and other U.S. authorities face substantial challenges in bringing and enforcing actions against China-based issuers and their officers and directors. As a result, investors in China-based issuers, such as ZKGC Cayman, may not benefit from a regulatory environment that fosters effective enforcement of U.S. federal securities laws.

PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may restrict or delay us from using monies invested in ZKGC Cayman to make loans or additional capital contributions to our PRC subsidiaries and making loans to Hainan ZKGC or its subsidiary, which could adversely affect our liquidity and our ability to fund and expand the business of Hainan ZKGC.

We are an offshore holding company conducting our operations in China through a VIE arrangement with Hainan ZKGC. Our business plan contemplates that we will finance the growth of Hainan ZKGC by making loans to Zhongke WFOE, our PRC subsidiary, or to Hainan ZKGC, or we may make additional capital contributions to our PRC subsidiary.

Any loans to Zhongke WFOE, our PRC subsidiary, will be subject to PRC regulations and foreign exchange loan registrations. For example, loans by us to our PRC subsidiary to finance its activities cannot exceed statutory limits and must be registered with the local counterpart of the State Administration on Foreign Exchange (“SAFE”), or filed with SAFE in its information system. We may also provide loans directly to Hainan ZKGC, according to the Circular of the People’s Bank of China on Matters relating to the Comprehensive Macro-prudential Management of Cross-border Financing issued by the People’s Bank of China in January 2017. According to the Notice of the People’s Bank of China and the State Administration of Foreign Exchange on Adjustments to Comprehensive Macro-prudential Regulation Parameters for Cross-border Financing issued by the People’s Bank of China and the State Administration of Foreign Exchange in March 2020, the limit for the total amount of foreign debt is 2.5 times its net assets. Moreover, any medium or long-term loan to be provided by us to Hainan ZKGC or to our PRC subsidiary must also be filed and registered with the NDRC. We may also decide to finance our PRC subsidiary by means of capital contributions. These capital contributions must be reported to the Ministry of Commerce, or MOFCOM, or its local counterpart. In addition, a foreign invested enterprise is required to use its capital pursuant to the principle of authenticity and self-use within its business scope.

SAFE promulgated the Notice of the State Administration of Foreign Exchange on Reforming the Administration of Foreign Exchange Settlement of Capital of Foreign-invested Enterprises, or SAFE Circular 19, effective June 2015. Although SAFE Circular 19 allows RMB capital converted from foreign currency-denominated registered capital of a foreign-invested enterprise to be used for equity investments within China, it also reiterates the principle that RMB converted from the foreign currency-denominated capital of a foreign-invested company may not be directly or indirectly used for purposes beyond its business scope. Thus, it is unclear whether SAFE will permit such capital to be used for equity investments in China in actual practice. SAFE promulgated the Notice of the State Administration of Foreign Exchange on Reforming and Standardizing the Foreign Exchange Settlement Management Policy of Capital Account, or SAFE Circular 16, effective on June 9, 2016, which reiterates some of the rules set forth in SAFE Circular 19, but changes the prohibition against using RMB capital converted from foreign currency- denominated registered capital of a foreign-invested company to issue RMB entrusted loans to a prohibition against using such capital to issue loans to non-associated enterprises. Violations of SAFE Circular 19 and SAFE Circular 16 could result in administrative penalties. SAFE Circular 19 and SAFE Circular 16 may significantly limit our ability to transfer any foreign currency we hold to Zhongke WFOE or to Hainan ZKGC, which may adversely affect our liquidity and our ability to fund and expand our business in China.

On October 23, 2019, SAFE issued Notice by the State Administration of Foreign Exchange of Further Facilitating Cross-border Trade and Investment, or Circular 28, which took effect on the same day. Circular 28, subject to certain conditions, allows foreign-invested enterprises whose business scope does not include investment, or non-investment foreign-invested enterprises, to use their capital funds to make equity investments in China. Since Circular 28 was issued only recently, its interpretation and implementation in practice are still subject to substantial uncertainties.

In light of the various requirements imposed by PRC regulations on loans to and direct investment in PRC entities by offshore holding companies, we cannot assure you that we will be able to complete the necessary government registrations or obtain the necessary government approvals on a timely basis, if at all, with respect to future loans to Zhongke WFOE or to Hainan ZKGC or future capital contributions by us to Zhongke WFOE. As a result, uncertainties exist as to our ability to provide prompt financial support to Zhongke WFOE or to Hainan ZKGC when needed. If we fail to complete such registrations or obtain such approvals, our ability to use capital invested in ZKGC Cayman to capitalize or otherwise fund the operations of Hainan ZKGC may be negatively affected, which could materially and adversely affect our liquidity and our ability to fund and expand our business. Unless Zhongke WFOE or Hainan ZKGC were able to find other funding sources, the business of Hainan ZKGC could fail for lack of sufficient working capital.

Rules recently adopted by the Cybersppace Administration of China may restrict our ability to finance our VIE from the proceeds of securities offerings by ZKGC Cayman.

On January 4, 2022 the Cyberspace Administration of China (“CAC”) adopted rules mandating that an issuer who is a “critical information infrastructure operator” or a “data processing operator” as defined therein and who possesses personal information of more than one million users, and intends to have its securities listed for trading in a foreign country must complete a cybersecurity review by the CAC. Alternatively, relevant governmental authorities in the PRC may initiate cyber security review if such governmental authorities determine an operator’s cyber products or services, data processing or potential listing in a foreign country affect or may affect national security. The rules will become effective on February 15, 2022.

The new CAC rules do not appear to apply to Hainan ZKGC or Network ZKGY at this time. The continued expansion of business operations by Hainan ZKGC, however, could bring that company within the scope of authority of the CAC rules. We may face challenges in addressing such enhanced regulatory requirements and in making necessary changes to our internal policies and practices in data privacy and cybersecurity matters. In that event, our ability to finance the business of Hainan ZKGC could be hindered, which could prevent Hainan ZKGC from achieving profitable operations.

Increased regulation of offshore offerings by the CSRC could interfere with our ability to finance the operations of Hainan ZKGC from sales of securities issued by ZKGC Cayman.

On July 6, 2021, PRC government authorities published the Opinions on Strictly Cracking Down Illegal Securities Activities in Accordance with the Law. These opinions call for strengthened regulation over illegal securities activities and supervision on overseas listings by China-based companies. They propose to take effective measures, such as promoting the construction of relevant regulatory systems, to deal with the risks faced by China-based overseas-listed companies. As of the date of this prospectus, no official guidance or related implementation rules have been issued in relation to these recently issued opinions. We could, however, become subject to a requirements that we obtain pre-approval by the China Securities Regulatory Commission (“CSRC”) before offering securities or listing the securities for trade outside of China. These requirements, if adopted, could interfere with our ability to fund Hainan ZKGC from the proceeds of sales of securities issued by ZKGC Cayman.

PRC laws and regulations governing our current business operations are sometimes vague and subject to interpretation. Moreover, the PRC has recently adopted regulatory policies regarding the conduct of business in the PRC that have had sudden adverse effects on business operations. Any changes in PRC laws and regulations or in their interpretation may have a material and adverse effect on our business.

There are substantial uncertainties regarding the interpretation, application and enforcement of PRC laws and regulations, including but not limited to the laws and regulations governing our business. These laws and regulations are sometimes vague and are subject to future changes, and their official interpretation and enforcement by the various branches of the PRC government may involve substantial uncertainty. The PRC legal system is based in part on governmental policies and internal rules some of which are not published on a timely basis or at all. New laws, regulations, rules and policies that affect existing and proposed future businesses may also be applied retroactively.

The principles of substantive due process that apply to the regulatory scheme in the United States are not honored in China. As a result, particularly in the past several years, enterprises operating in China are often subject to policies adopted by the government without prior notice that have had sudden and significant adverse effect on the ability of the enterprise to conduct its business. We cannot predict with certainty what effect existing or new PRC laws or regulations may have on the business of our VIE. If restrictions are adopted that make it impossible for Hainan ZKGC to operate profitably, your investment could become worthless.

Failure to make adequate contribution to various employee benefit plans, as required by PRC regulations, may subject Hainan ZKGC to penalties.

Companies operating in China are required to participate in various government-sponsored employee benefit plans, including certain social insurance, housing funds and other welfare-oriented payment obligations. Such companies must contribute to the plans in amounts equal to certain percentages of salaries, including bonuses and allowances, earned by employees up to a maximum amount specified by the local government from time to time at locations where the employees are based. The requirement to contribute to employee benefit plans has not been implemented consistently by the local governments in China, reflecting the different levels of economic development in different locations. For the sake of efficient administration and to optimize the cash flows of Hainan ZKGC and Network ZKGY, our VIE does not make the contribution to benefit plans for its employees. Due to its failure to make contributions to employee benefit plans, Hainan ZKGC could be required to make the contributions to these plans as well as to pay late fees and fines. We have accrued liability for the unpaid contributions on our financial statements. However, if the amount of our estimates is inaccurate, our financial condition and cash flow may be adversely affected if Hainan ZKGC was required to pay late fees or fines in relation to the underpaid employee benefits.

Dividends payable to foreign investors and gains on the sale of our Ordinary Shares by our foreign investors may become subject to PRC taxation.

Under the Enterprise Income Tax Law and its implementation regulations, a 10% PRC withholding tax is applicable to dividends payable by a resident enterprise to investors that are non-resident enterprises, which do not have an establishment or place of business in the PRC or which have an establishment or place of business but the dividends are not effectively connected with the establishment or place of business, to the extent these dividends are derived from sources within the PRC, subject to any reduction set forth in applicable tax treaties. Similarly, any gain realized on the transfer of shares of a PRC resident enterprise by these investors is also subject to PRC tax at a current rate of 10%, subject to any exemption set forth in relevant tax treaties. If we are deemed a PRC resident enterprise, dividends paid on our Ordinary Shares and any gain realized by the non-resident enterprise investors from the transfer of our Ordinary Shares may be treated as income derived from sources within the PRC and as a result be subject to PRC taxation. Furthermore, if we are deemed a PRC resident enterprise, dividends payable to individual investors who are non-PRC residents and any gain realized on the transfer of our Ordinary Shares by these investors may be subject to PRC tax at a current rate of 20%, subject to any reduction or exemption set forth in applicable tax treaties. It is unclear, if we are considered a PRC resident enterprise, whether holders of our Ordinary Shares would be able to claim the benefit of income tax treaties or agreements entered into between China and other countries or areas and claim foreign tax credit if applicable. If dividends payable to our non-PRC investors, or gains from the transfer of our Ordinary Shares by these investors are subject to PRC tax, the value of your investment in our ADSs and/or ordinary shares may decline significantly.

You may experience difficulties in effecting service of a legal process, enforcing foreign judgments or bringing actions in China against us or our management named in the prospectus based on foreign laws.

We are an exempted company with limited liability incorporated under the laws of the Cayman Islands. However, we conduct substantially all of our operations in China, and substantially all of the assets reflected on our balance sheet are located in China. In addition, all of our senior executive officers reside within China and are PRC nationals. As a result, it may be difficult for our shareholders to effect service of process upon us or those persons inside China. In addition, China does not have treaties providing for the reciprocal recognition and enforcement of judgments of courts with the Cayman Islands or the United States. Therefore, recognition and enforcement in China of judgments of a court in any of these non-PRC jurisdictions in relation to any matter not subject to a binding arbitration provision may be difficult or impossible.

Shareholder claims that are common in the United States, including securities law class actions and fraud claims, generally are difficult to pursue as a matter of law or practicality in China. For example, in China, there are significant legal and other obstacles to obtaining information needed for shareholder investigations or litigation outside China or otherwise with respect to foreign entities. Although the local authorities in China may establish a regulatory cooperation mechanism with the securities regulatory authorities of another country or region to implement cross-border supervision and administration, such regulatory cooperation with the securities regulatory authorities in the Unities States have not been efficient in the absence of a mutual and practical cooperation mechanism.

Risks Related to our VIE Structure

We rely on contractual arrangements with Hainan ZKGC and Liao Jinqi to exercise control over the operations of Hainan ZKGC, which may not be as effective as direct ownership in providing operational control.

We have relied and expect to continue to rely on contractual arrangements with Hainan ZKGC and Liao Jinqi to conduct our operations in China. These contractual arrangements, however, may not be as effective as direct ownership in providing us with control over Hainan ZKGC. For example, Hainan ZKGC and Mr. Jinqi could breach their contractual arrangements with us by, among other things, failing to conduct the operations of Hainan ZKGC in an acceptable manner or taking other actions that are detrimental to our interests.

If we had direct ownership of Hainan ZKGC, we would be able to exercise our rights as a shareholder to effect changes in the board of directors of Hainan ZKGC, which in turn could implement changes, subject to any applicable fiduciary obligations, at the management and operational level. However, under the current contractual arrangements, we rely on the performance by Hainan ZKGC and Mr. Jinqi of their obligations under the contracts to exercise control over Hainan ZKGC. If any dispute relating to these contracts remains unresolved, we will have to enforce our rights under these contracts through the operations of PRC law and arbitration, litigation and other legal proceedings and therefore will be subject to uncertainties in the PRC legal system.

Neither the Government of the PRC nor the Chinese legal system has ever formally acknowledged the legality of using a VIE-type contractual arrangement where direct ownership of a Chinese entity is forbidden.

Foreign ownership of value-added telecommunications services, such as those provided by Hainan ZKGC, is restricted by the laws of the PRC. Primarily for this reason, our Company does not directly engage in the business of providing charging stations, but instead has entered into a series of contracts with Hainan ZKGC that are intended to provide our Company with control over the operations of Hainan ZKGC and the right to receive the net profits realized by Hainan ZKGC. These contracts are customarily identified as “VIE Agreements”, as they are designed to cause the operating company to be treated under U.S. generally accepted accounting principles as a “variable interest entity”, whose profits and losses can be consolidated with those of its contractual counterpart.

One significant risk of this structure is that the Chinese government has never expressly acknowledged it as a way to legally navigate the country’s investment restrictions. The Chinese government could determine at any time and without notice that the underlying contractual arrangements on which our control of Hainan ZKGC is based violate Chinese law. Any such determination from the Chinese government could eliminate all or most of the value of your investment in ZKGC Cayman.

All or most of the value of an investment in ZKGC Cayman depends on the enforceability of the VIE Agreements between Zhongke WFOE and Hainan ZKGC. A breach of any of the VIE Agreements between Zhongke WFOE and Hainan ZKGC (or its officers, directors, or Chinese equity owners) will be subject to Chinese law and jurisdiction. We cannot assume that the Chinese legal system would enforce the VIE Agreements. If judicial or regulatory determinations are made in China that contractual relationships such as ours with our VIE are unenforceable under Chinese law, it will be likely that the value of the ordinary shares of ZKGC Cayman will significantly diminish or be eliminated.

Substantial uncertainties exist with respect to the interpretation and implementation of the newly enacted Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance and operations.

The value-added telecommunications services that we conduct through our VIE and its subsidiaries are subject to foreign investment restrictions set forth in the Special Management Measures (Negative List) for the Access of Foreign Investment issued by the MOFCOM, and the National Development and Reform Commission, or the NDRC, effective July 2020.

On March 15, 2019, the National People’s Congress promulgated the Foreign Investment Law, or the Foreign Investment Law (2019), which became effective on January 1, 2020 and replaced the Sino-Foreign Equity Joint Venture Enterprise Law, the Sino-Foreign Cooperative Joint Venture Enterprise Law and the Wholly Foreign-Owned Enterprise Law to become the legal foundation for foreign investment in the PRC. Since it is relatively new, uncertainties still exist in relation to its interpretation and implementation. For instance, under the Foreign Investment Law (2019), “foreign investment” refers to the investment activities directly or indirectly conducted by foreign individuals, enterprises or other entities in China. Though it does not explicitly classify contractual arrangements as a form of foreign investment, there is no assurance that foreign investment via contractual arrangements would not be interpreted as a type of indirect foreign investment activity in the future. In addition, the definition of foreign investment contains a catch-all provision which includes investments made by foreign investors through means stipulated in laws, administrative regulations or provisions of the State Council. Therefore, it still leaves leeway for future laws, administrative regulations or provisions promulgated by the State Council to provide for contractual arrangements as a form of foreign investment. In any of these cases, it will be uncertain whether our contractual arrangements will be deemed to be in violation of the market access requirements for foreign investment under the PRC laws and regulations. If further actions must be taken under future laws, administrative regulations or provisions of the State Council, we may face substantial uncertainties as to whether we can complete such actions. Failure to do so could materially and adversely affect our current corporate structure, corporate governance and operations.

The contractual arrangements we have entered into with Hainan ZKGC may be subject to scrutiny by the PRC tax authorities. A finding that we owe additional taxes could negatively affect our financial condition and the value of your investment.

Under applicable PRC laws and regulations, arrangements and transactions among related parties may be subject to audit or challenge by the PRC tax authorities. We could face material and adverse tax consequences if the PRC tax authorities determine that the contractual arrangements in relation to Hainan ZKGC were not entered into on an arm’s-length basis in such a way as to result in an impermissible reduction in taxes under applicable PRC laws, rules and regulations, and therefore adjust the income of Hainan ZKGC in the form of a transfer pricing adjustment. A transfer pricing adjustment could, among other things, result in a reduction of expense deductions recorded by Hainan ZKGC for PRC tax purposes, which could in turn increase its tax liabilities without reducing the PRC tax expenses of Zhongke WFOE. In addition, the PRC tax authorities may impose late payment fees and other administrative sanctions on Hainan ZKGC for the adjusted but unpaid taxes according to the applicable regulations. Our financial position could be materially and adversely affected if Hainan ZKGC’s tax liabilities increase or if they are required to pay late payment fees and other penalties.

Risks Related to the Organization of our Holding Company in the Cayman Islands

You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law.

We are an exempted company with limited liability incorporated under the laws of the Cayman Islands and certain of our officers and directors are residents of jurisdictions outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon our directors or executive officers, or enforce judgments obtained in the United States courts against our directors or officers.

Our corporate affairs will be governed by our Memorandum and Articles of Association as amended from time to time, the Companies Act and the common law of the Cayman Islands. The rights of shareholders to take legal action against our directors and us, actions by minority shareholders and the fiduciary responsibilities of our directors to us under Cayman Islands law are to a large extent governed by the common law of the Cayman Islands. The common law of the Cayman Islands is derived in part from comparatively limited judicial precedent in the Cayman Islands as well as that from English common law, which has persuasive, but not binding authority on a court in the Cayman Islands. The rights of our shareholders and the fiduciary responsibilities of our directors under Cayman Islands law may not be as clearly established as they would be under statutes or judicial precedent in some jurisdictions in the United States. In particular, the Cayman Islands has a less developed body of securities laws as compared to the United States, and some states, such as Delaware, have more fully developed and judicially interpreted bodies of corporate law than the Cayman Islands. In addition, shareholders of Cayman Islands companies may not have standing to initiate a shareholder derivative action in a federal court of the United States.

We have been advised by our Cayman Islands legal counsel, Ogier, that there is uncertainty as to whether the courts of the Cayman Islands would:

| ● | recognize or enforce against us judgments of courts of the United States based on certain civil liability provisions of U.S. securities laws; and |

| ● | entertain original actions brought in the Cayman Islands against us or our directors or officers predicated upon the securities laws of the United States or any state in the United States. |

There is no statutory enforcement in the Cayman Islands of judgments obtained in the United States, although the courts of the Cayman Islands will in certain circumstances recognize and enforce a foreign judgment, without any re-examination or re-litigation of matters adjudicated upon, provided such judgment:

| (a) | is given by a foreign court of competent jurisdiction; |

| (b) | imposes on the judgment debtor a liability to pay a liquidated sum for which the judgment has been given; |

| (d) | is not in respect of taxes, a fine or a penalty; |

| (e) | was not obtained by fraud; and |

| (f) | is not of a kind the enforcement of which is contrary to natural justice or the public policy of the Cayman Islands. |

Subject to the above limitations, in appropriate circumstances, a Cayman Islands court may give effect in the Cayman Islands to other kinds of final foreign judgments such as declaratory orders, orders for performance of contracts and injunctions.

As a result of all of the above, public shareholders may have more difficulty in protecting their interests in the face of actions taken by our board of directors, management or controlling shareholders than they would as public shareholders of a U.S. company. For a discussion of certain differences between the provisions of the Companies Act, remedies available to shareholders and the laws applicable to companies incorporated in the United States and their shareholders, see “Enforceability of Civil Liabilities” and “Description of Securities.”

Risks Related To Our Management

The loss of the services of our Chairman our failure to timely identify and retain competent personnel could negatively impact our ability to develop our products and sales.

Liao Jinqi, Chairman of both ZKGC Cayman and Hainan ZKGC, is the sole executive officer responsible for our operations and the operations of Hainan ZKGC, and is also the primary source of the know-how that governs our installation of charging stations. Our future success depends upon the continued service of Mr. Jinqi, as well as on our ability to identify and retain additional competent executives with the skills required to execute our business objectives. The loss of the services of any of our officers or our failure to timely identify and retain competent personnel could negatively impact our ability to develop a competitive position in the market for charging stations, which would adversely affect our financial results and impair the growth of Hainan ZKGC.

Our internal controls over financial reporting may not be effective, which could have a significant and adverse effect on our business and reputation.

As a newly public reporting company, we will be in a continuing process of developing, establishing, and maintaining internal controls and procedures that will allow our management to report on, and our independent registered public accounting firm to attest to, our internal controls over financial reporting if and when required to do so under Section 404 of the Sarbanes-Oxley Act of 2002. Although our independent registered public accounting firm is not required to attest to the effectiveness of our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act until the date we are no longer an emerging growth company, our management will be required to report on our internal controls over financial reporting under Section 404. If we do not remediate any material weaknesses in our internal controls, our reported financial results could be materially misstated or could subsequently require restatement, and we could be subject to investigations or sanctions by regulatory authorities.

Our board of directors acts as our compensation committee, which presents the risk that compensation and benefits paid to those executive officers who are board members and other officers may not be commensurate with our financial performance.

A compensation committee consisting of independent directors is a safeguard against self-dealing by company executives. Our board of directors, which has no independent members, acts as the compensation committee for the Company and determines the compensation and benefits of our executive officers, will administer our employee stock and benefit plans, if any, and reviews policies relating to the compensation and benefits of our employees. Our lack of an independent compensation committee presents the risk that an executive officer on the board may have influence over his or her personal compensation and may obtain benefits levels that may not be commensurate with our financial performance.

Limitations on director and officer liability and indemnification of our Company’s officers and directors by us may discourage shareholders from bringing a lawsuit against an officer or director.

Our Company’s Memorandum and Articles of Association provide that a director or officer shall not be personally liable to us or our shareholders for breach of fiduciary duty as a director or officer, except for acts or omissions which involve actual fraud or willful default. These provisions may discourage shareholders from bringing a lawsuit against a director or officer for breach of fiduciary duty and may reduce the likelihood of derivative litigation brought by shareholders on the Company’s behalf against a director or officer.

Our management has no experience managing a public company.

At the present time, none of our management or any person associated with the Company has experience in managing a public company. This may hinder our ability to establish effective controls and systems and comply with all applicable requirements associated with being a public company. If compliance problems result, these problems could have a material adverse effect on our business, financial condition or results of operations. As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. Our management and other personnel will need to devote a substantial amount of time to our new compliance requirements. Moreover, these requirements will increase our legal, accounting and financial compliance costs and will make some activities more time-consuming and costly. These requirements could also make it more difficult for us to attract and retain qualified persons to serve on our board of directors, our board committees or as executive officers.

Hainan ZKGC may have difficulty establishing adequate management, legal and financial controls in the PRC.

Hainan ZKGC may have difficulty in hiring and retaining a sufficient number of qualified employees to perform financial management services in the PRC. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet western standards. Therefore, we may, in turn, experience difficulties in implementing and maintaining adequate internal controls as will be required under Section 404 of the Sarbanes Oxley Act of 2002.

ENFORCEABILITY OF CIVIL LIABILITIES

We are incorporated under the laws of the Cayman Islands as an exempted company with limited liability in order to enjoy the following benefits:

| ● | political and economic stability; |

| ● | an effective judicial system; |

| ● | the absence of foreign exchange control or currency restrictions; and |

| ● | the availability of professional and support services. |

However, certain disadvantages accompany incorporation in the Cayman Islands. These disadvantages include, but are not limited to, the following:

| ● | the Cayman Islands has a less developed body of securities laws as compared to the United States, and these securities laws provide significantly less protection to investors; and |

| ● | Cayman Islands companies and their shareholders may not have standing to sue in the federal courts of the United States. |

Currently, substantially all of our operations are conducted outside the United States, and substantially all of our assets are located outside the United States. Substantially or all of our officers are nationals or residents of jurisdictions other than the United States and a substantial portion of their assets are located outside the United States. As a result, it may be difficult for a shareholder to effect service of process within the United States upon these persons, or to enforce against us or them judgments obtained in United States courts, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States.

We have appointed CCS Global Solutions, Inc., located at 99 Washington Avenue, Suite 805A, Albany, NY 12210, as our agent upon whom process may be served in any action brought against us under the securities laws of the United States.

Ogier, our counsel as to Cayman Islands law, has advised us that there is uncertainty as to whether the courts of the Cayman Islands would:

| ● | recognize or enforce judgments of U.S. courts obtained against us or our directors or officers predicated upon the civil liability provisions of securities laws of the United States or any state in the United States; or |

| ● | entertain original actions brought against us or our directors or officers predicated upon the securities laws of the United States or any state in the United States. |