United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

Investment Company Act file number: 811-23759

Thrivent ETF Trust

(Exact name of registrant as specified in charter)

901 Marquette Avenue, Suite 2500

Minneapolis, Minnesota 55402-3211

(Address of principal executive offices) (Zip code)

John D. Jackson, Secretary and Chief Legal Officer

Thrivent ETF Trust

901 Marquette Avenue, Suite 2500

Minneapolis, Minnesota 55402-3211

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 844-7190

Date of fiscal year end: September 30

Date of reporting period: September 30, 2024

Item 1. Report to Stockholders

(a) A copy of the registrant’s report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “Act”), as amended, is filed herewith.

Thrivent Small-Mid Cap ESG ETF

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about the Thrivent Small-Mid Cap ESG ETF (the Fund) for the 12 months ended September 30, 2024. You can find additional information about the Fund at www.thriventetfs.com/prospectus. You can also request this information by contacting us at 800-847-4836.

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| ETF | Costs of a $10K investment | Costs paid as a % of a $10K investment |

|---|

| Fund | $75 | 0.65% |

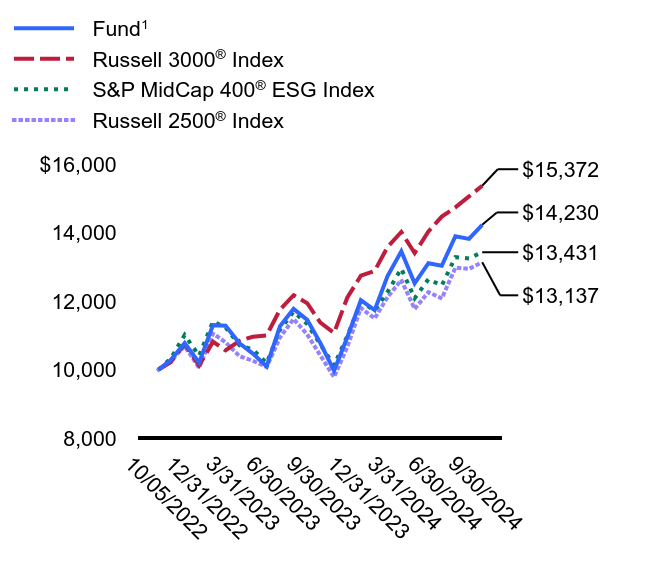

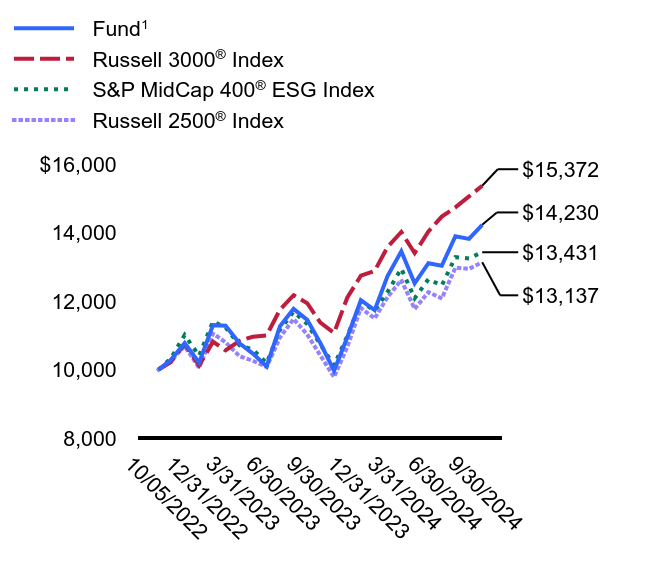

How did the Fund perform over the past 12 months?

For the 12 months ended September 30, 2024, the Fund earned a return of 32.21%, outperforming its peer group, the Morningstar Mid-Cap Blend category which returned 27.57%. The Fund's broad-based benchmark Russell 3000® Index earned a return of 35.19% over the same period.

The key factors that contributed to the Fund's performance over the past 12 months include:

How did the Fund perform since Inception?

| FundFootnote Reference1 | Russell 3000® Index | S&P MidCap 400® ESG Index | Russell 2500® Index |

|---|

| 10/05/2022 | $10,000 | $10,000 | $10,000 | $10,000 |

| 10/31/2022 | $10,278 | $10,213 | $10,324 | $10,254 |

| 11/30/2022 | $10,776 | $10,746 | $11,013 | $10,687 |

| 12/31/2022 | $10,203 | $10,117 | $10,403 | $10,051 |

| 1/31/2023 | $11,298 | $10,814 | $11,410 | $11,056 |

| 2/28/2023 | $11,283 | $10,561 | $11,229 | $10,797 |

| 3/31/2023 | $10,768 | $10,843 | $10,709 | $10,392 |

| 4/30/2023 | $10,466 | $10,959 | $10,586 | $10,257 |

| 5/31/2023 | $10,091 | $11,001 | $10,190 | $10,077 |

| 6/30/2023 | $11,265 | $11,753 | $11,160 | $10,935 |

| 7/31/2023 | $11,774 | $12,174 | $11,696 | $11,479 |

| 8/31/2023 | $11,453 | $11,939 | $11,331 | $11,028 |

| 9/30/2023 | $10,770 | $11,370 | $10,733 | $10,412 |

| 10/31/2023 | $9,969 | $11,069 | $10,119 | $9,780 |

| 11/30/2023 | $10,942 | $12,101 | $10,978 | $10,660 |

| 12/31/2023 | $12,028 | $12,743 | $11,982 | $11,803 |

| 1/31/2024 | $11,737 | $12,884 | $11,725 | $11,494 |

| 2/29/2024 | $12,734 | $13,581 | $12,269 | $12,119 |

| 3/31/2024 | $13,458 | $14,020 | $12,950 | $12,619 |

| 4/30/2024 | $12,520 | $13,403 | $12,084 | $11,774 |

| 5/31/2024 | $13,108 | $14,036 | $12,643 | $12,264 |

| 6/30/2024 | $13,034 | $14,470 | $12,457 | $12,080 |

| 7/31/2024 | $13,898 | $14,739 | $13,286 | $12,977 |

| 8/31/2024 | $13,818 | $15,060 | $13,248 | $12,944 |

| 9/30/2024 | $14,230 | $15,372 | $13,431 | $13,137 |

Lattice Semiconductor Corp.

Grocery Outlet Holding Corp.

| Average Annual Total Returns* | 1 Year | Since Inception 10/5/22 |

|---|

Fund (NAV)Footnote Reference1 | 32.21% | 19.42% |

Russell 3000® Index | 35.19% | 24.13% |

S&P MidCap 400® ESG Index | 25.14% | 15.96% |

Russell 2500® Index | 26.17% | 14.68% |

* Total returns assume reinvestment of all dividends and capital gains. At various times, the Fund's adviser may have waived certain fees and/or

reimbursed expenses, without which total returns would have been lower.

1The Fund’s past performance is not a good predictor of the Fund’s future performance. The line graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Call 800-847-4836 or visit www.thriventfunds.com/etfs/small-mid-cap-esg-etf.html for performance results current to the most recent month-end.

| Total Net Assets | # of Portfolio Holdings | Portfolio Turnover Rate | Total Advisory Fees Paid |

|---|

| $214,541,705 | 70 | 58% | $1,038,412 |

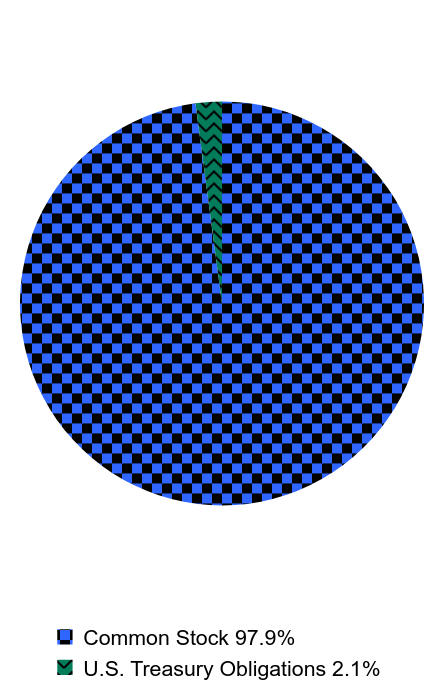

What did the Fund invest in?

Top Ten Holdings (% of Net Assets)

| Fair Isaac Corp. | 2.4% |

| SharkNinja, Inc. | 2.3% |

| NVR, Inc. | 2.2% |

| FTAI Aviation Ltd. | 2.0% |

| Modine Manufacturing Co. | 1.9% |

| Insight Enterprises, Inc. | 1.9% |

| Tractor Supply Co. | 1.9% |

| Patrick Industries, Inc. | 1.9% |

| TPG, Inc. | 1.9% |

| Labcorp Holdings, Inc. | 1.9% |

Portfolio Composition (% of Portfolio)

| Value | Value |

|---|

| Common Stock | 97.9% |

| U.S. Treasury Obligations | 2.1% |

Major Market Sectors (% of Net Assets)

| Industrials | 22.8% |

| Consumer Discretionary | 16.7% |

| Information Technology | 16.3% |

| Financials | 15.0% |

| Health Care | 8.4% |

| Materials | 7.0% |

| Real Estate | 4.0% |

| Utilities | 3.3% |

| Consumer Staples | 3.0% |

| Energy | 1.4% |

This is a summary of certain changes of the Fund since September 30, 2023. For more complete information you may review the Fund's next prospectus which will be available at thriventetfs.com/prospectus or upon request at 800-847-4836.

Changes in or Disagreements with Accountants

There were no changes to the Fund's auditor or disagreements with them for the year ended September 30, 2024.

Certain additional fund information is available on the Fund's website, including the Fund's prospectus, financial information, holdings, and proxy voting information.

Important data provider notices and terms available at www.thriventfunds.com/privacy-and-security/index-provider-notices.html

ALPS Distributors, Inc. is the distributor for Thrivent ETF Trust. Thrivent Distributors, LLC, a subsidiary of Thrivent, is a marketing agent. ALPS Distributors, Inc. is not affiliated with Thrivent, the marketing name for Thrivent Financial for Lutherans, or any of its subsidiaries.

Thrivent Small-Mid Cap ESG ETF

Annual Shareholder Report - September 30, 2024

(b) Not applicable.

Item 2. Code of Ethics

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. There were no amendments made to or waivers granted under the code of ethics during the period covered by this report. The registrant’s code of ethics is filed herewith pursuant to Item 19(a)(1) of this Form N-CSR.

Item 3. Audit Committee Financial Expert

Registrant’s board of trustees has determined that Robert J. Chersi, an independent trustee, is the Audit Committee Financial Expert.

Item 4. Principal Accountant Fees and Services

(a) through (d)

Thrivent Small-Mid Cap ESG ETF (the “Fund”) incepted on October 5, 2022, is a series of Thrivent ETF Trust, a Massachusetts business trust (the “Trust”). This Form N-CSR relates to the annual report of the Fund.

The following table presents the aggregate fees billed to the Fund for the fiscal period ended September 30, 2023 and fiscal year ended September 30, 2024 by the Funds’ independent public accountants, PricewaterhouseCoopers LLP (“PwC”), for professional services rendered for the audit of the Funds’ annual financial statements and fees billed for other services rendered by PwC during those periods.

| | | | | | | | | | |

Fiscal Period Ended | | 9/30/2023 | | | 9/30/2024 | | | |

Audit Fees | | | $21,100 | | | | $21,950 | |

Audit-Related Fees(1) | | | $0 | | | | $0 | |

Tax Fees(2) | | | $7,410 | | | | $7,881 | |

All Other Fees(3) | | | $4,150 | | | | $0 | |

| | | | |

Total | | | $32,660 | | | | $29,831 | |

| | | | |

(1) Audit-related fees consist of the aggregate fees billed for assurance and related services that are reasonably related to the performance of the audit of financial statements and are not reported under the category of audit fees.

(2) Tax fees consist of the aggregate fees billed for professional services rendered by the principal accountant relating to tax compliance, tax advice, and tax planning and specifically include fees for tax return preparation. These fees include payments for tax return compliance services, excise distribution review services, and other tax related matters.

(3) All other fees consist of the aggregate fees billed for products and services provided by the principal accountant other than audit, audit-related, and tax services. This payment was for access to a PwC-sponsored online library that provides interpretive guidance regarding U.S. and foreign accounting standards. These figures are also reported in the response to Item 4(g) below.

| (e) | Registrant’s audit committee charter, adopted in February 2010, provides that the audit committee (comprised of the independent Trustees of registrant) is responsible for preapproval of all auditing services performed for the registrant. The audit committee also is responsible for pre-approval (subject to the de minimis exceptions for non-audit services described in Section |

| | 10A(i)(1)(B) of the Securities Exchange Act of 1934) of all non-auditing services performed for the registrant or an affiliate of registrant. In addition, registrant’s audit committee charter permits a designated member of the audit committee to pre-approve, between meetings, one or more audit or non-audit service projects, subject to an expense limit and notification to the audit committee at the next committee meeting. Registrant’s audit committee pre-approved all fees described above that PwC billed to registrant. |

| (f) | Less than 50% of the hours billed by PwC for auditing services to registrant for the fiscal period ended September 30, 2024 was for work performed by persons other than full-time permanent employees of PwC. |

| (g) | The aggregate non-audit fees billed by PwC to registrant and to registrant’s investment adviser and any entity controlling, controlled by, or under common control with registrant’s investment adviser for the fiscal period since the Fund’s inception on October 5, 2022 through September 30, 2023 and the fiscal year ended September 30, 2024 were $4,150 and $0 respectively. This figure is also reported in response to Item 4(d) above. |

| (h) | Registrant’s audit committee has considered the non-audit services provided to the registrant and registrant’s investment adviser and any entity controlling, controlled by, or under common control with registrant’s investment adviser as described above and determined that these services do not compromise PwC’s independence. |

Item 5. Audit Committee of Listed Registrants

| (a) | Registrant is a listed issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and has an audit committee which was established in accordance with Section 3(a)(58)(A) of the Exchange Act. The audit committee members are Janice B. Case, Robert J. Chersi, Arleas Upton Kea, Paul R. Laubscher, Robert J. Manilla, James A. Nussle, James W. Runcie, and Constance L. Souders. |

Item 6. Investments

| (a) | Registrant’s Schedule of Investments is included in the financial statements filed under Item 7 of this Form N-CSR. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies

The registrant’s audited financial statements and financial highlights as of the end of the period covered by this report are included in this Form N-CSR.

Financial Statements and Additional Information

Go paperless. Manage your delivery preferences and sign up for email notifications by logging into your account.

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Thrivent ETF Trust and Shareholders of Thrivent Small-Mid Cap ESG ETF

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Thrivent Small-Mid Cap ESG ETF (the "Fund") as of September 30, 2024, the related statement of operations for the year ended September 30, 2024, the statement of changes in net assets and the financial highlights for the year ended September 30, 2024 and for the period October 5, 2022 (commencement of operations) through September 30, 2023, including the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2024, the results of its operations for the year then ended, the changes in its net assets and the financial highlights for the year ended September 30, 2024 and for the period October 5, 2022 (commencement of operations) through September 30, 2023 in conformity with accounting principles generally accepted in the United States of America.

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of September 30, 2024 by correspondence with the custodian and broker. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more investment companies in the Thrivent Financial investment company complex since 1987.

PricewaterhouseCoopers LLP, 45 South 7th Street, Suite 3400, Minneapolis, Minnesota 55402T: (612) 596 6000, www.pwc.com/us

Thrivent Small-Mid Cap ESG ETFSchedule of Investments as of September 30, 2024

| | |

Consumer Discretionary 16.7% |

| | |

| | |

| Installed Building Products, Inc. | |

| Modine Manufacturing Co. a | |

| | |

| | |

| Savers Value Village, Inc. a | |

| | |

| | |

| Wyndham Hotels & Resorts, Inc. | |

| | |

|

| | |

| Darling Ingredients, Inc. a | |

| Grocery Outlet Holding Corp. a | |

| | |

|

| | |

| | |

|

| Arch Capital Group, Ltd. a | |

| | |

| Enterprise Financial Services Corp. | |

| | |

| Kinsale Capital Group, Inc. | |

| | |

| Raymond James Financial, Inc. | |

| | |

| | |

| Triumph Financial, Inc. a | |

| | |

|

| | |

| | |

| | |

| | |

| Maravai LifeSciences Holdings, Inc. | |

| | |

| | |

|

| Advanced Drainage Systems, Inc. | |

| | |

| CECO Environmental Corp. a | |

| Core & Main, Inc. Class A a | |

| | |

| Gates Industrial Corp. plc a | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| WESCO International, Inc. | |

| | |

Information Technology 16.3% |

| | |

| | |

| | |

| | |

| | |

Information Technology 16.3% – continued |

| | |

| | |

| Insight Enterprises, Inc. a | |

| | |

| Lattice Semiconductor Corp. a | |

| | |

| Zebra Technologies Corp. Class A a | |

| | |

|

| | |

| | |

| | |

| | |

| Summit Materials, Inc. Class A a | |

| | |

|

| Colliers International Group, Inc. | |

| National Storage Affiliates Trust | |

| Rexford Industrial Realty, Inc. | |

| | |

|

| | |

| | |

| | |

| Total Common Stock

(Cost $181,778,805) | |

| Short-Term Investments 2.1% | |

| U.S. Treasury Bills, 5.23%, 10/17/2024 b | |

| U.S. Treasury Bills, 5.07%, 10/24/2024 b | |

| U.S. Treasury Bills, 4.90%, 10/15/2024 b | |

| U.S. Treasury Bills, 4.55%, 12/19/2024 b | |

| Total Short-Term Investments

(Cost $4,545,322) | |

| Total Investments (Cost $186,324,127) 100.0% | |

| Other Assets and Liabilities, Net (0.0%) | |

| | |

| Non-income producing security. |

| The interest rate shown reflects the yield. |

Unrealized Appreciation (Depreciation)

Gross unrealized appreciation and depreciation of investments of the portfolio as a whole (including derivatives, if any), based on cost for federal income tax purposes, were as follows:

Gross unrealized appreciation | |

Gross unrealized depreciation | |

Net unrealized appreciation (depreciation) | |

Cost for federal income tax purposes | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

Thrivent Small-Mid Cap ESG ETFSchedule of Investments as of September 30, 2024 Fair Valuation Measurements

The following table is a summary of the inputs used, as of September 30, 2024, in valuing Thrivent Small-Mid Cap ESG ETF's assets carried at fair value.

Investments in Securities | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Total Investments at Value | | | | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

Thrivent ETF TrustStatement of Assets and Liabilities

| |

| |

Investments in unaffiliated securities, at cost | |

Investments in unaffiliated securities, at value | |

| |

Dividends and interest receivable | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Capital stock (beneficial interest) | |

Distributable earnings/(accumulated loss) | |

| |

Shares of beneficial interest outstanding | |

Net asset value per share | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Thrivent ETF TrustStatement of Operations

For the year ended September 30, 2024 | |

| |

| |

| |

| |

| |

| |

| |

|

Net Investment Income/(Loss) | |

Realized and Unrealized Gains/(Losses) | |

Net realized gains/(losses) on: | |

| |

| |

Change in net unrealized appreciation/(depreciation) on: | |

| |

Net Realized and Unrealized Gains/(Losses) | |

|

Net Increase/(Decrease) in Net Assets Resulting From Operations | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Thrivent ETF TrustStatement of Changes in Net Assets

| | |

| Small-Mid Cap ESG ETF

September 30, 2024 | Small-Mid Cap ESG ETF#

September 30, 2023 |

| | |

Net investment income/(loss) | | |

Net realized gains/(losses) | | |

Change in net unrealized appreciation/(depreciation) | | |

Net Change in Net Assets Resulting From Operations | | |

Distributions to Shareholders | | |

From net investment income/net realized gains | | |

Total Distributions to Shareholders | | |

Capital Stock Transactions | | |

| | |

| | |

Total Capital Stock Transactions | | |

|

Net Increase/(Decrease) in Net Assets | | |

Net Assets, Beginning of Period | | |

Net Assets, End of Period | | |

Capital Stock Share Transactions | | |

| | |

| | |

Total Capital Stock Share Transactions | | |

| For the period from October 5, 2022 (inception) through September 30, 2023. |

The accompanying Notes to Financial Statements are an integral part of this statement.

Thrivent ETF TrustNotes to Financial StatementsSeptember 30, 2024 Thrivent ETF Trust (the “Trust”) was organized as a Massachusetts Business Trust on September 2, 2021, and is registered with the Securities and Exchange Commission (“SEC”) as an open-end management investment company under the Investment Company Act of 1940. The Trust is currently comprised of a single series, Thrivent Small-Mid Cap ESG ETF (the “Fund”), which seeks long-term capital growth. The Trust is authorized to issue an unlimited number of shares of beneficial interest with a par value (if any) in one or more series as the Trust's Board of Trustees (the "Board") may determine from time to time.

The Fund is an investment company which follows the accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 – Financial Services – Investment Companies.

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business, the Trust enters into contracts with vendors and others that provide general damage clauses. The Trust's maximum exposure under these contracts is unknown, as this would involve future claims that may be made against the Trust. However, based on experience, the Trust expects the risk of loss to be remote.

(2)

SIGNIFICANT ACCOUNTING POLICIES

Valuation of Investments — Securities traded on U.S. or foreign securities exchanges or included in a national market system are valued at the last sale price on the principal exchange as of the close of regular trading on such exchange or the official closing price of the national market system. Over-the-counter securities and listed securities for which no price is readily available are valued at the current bid price considered best to represent the value at that time. Security prices are based on quotes that are obtained from an independent pricing service approved by the Board. Securities which cannot be valued by the approved pricing service are valued using valuations obtained from dealers that make markets in the securities. Investments in open-ended mutual funds are valued at their net asset value ("NAV") at the close of each business day.

The Board has delegated responsibility for daily valuation of the Fund's securities to Thrivent Asset Management, LLC (the “Adviser”). The Adviser has formed a Valuation Committee (the “Committee”) that is responsible for overseeing the Fund’s valuation policies in accordance with Valuation Policies and Procedures. The Committee meets on a monthly and on an as-needed basis to review price challenges, price overrides, stale prices, shadow prices, manual prices, and other securities requiring fair valuation.

The Committee monitors for significant events occurring prior to the close of trading on the New York Stock Exchange that could have a material impact on the value of any securities that are held by the Fund. Examples of such events include trading halts, national news/events, and issuer-specific developments. If the Committee decides that such events warrant using fair value estimates, the Committee will take such events into consideration in determining the fair value of such securities. If market quotations or prices are not

readily available or determined to be unreliable, the securities will be valued at fair value as determined in good faith pursuant to procedures adopted by the Board.

In accordance with U.S. Generally Accepted Accounting Principles (“GAAP”), the various inputs used to determine the fair value of the Fund's investments are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities, typically included in this level are U.S. equity securities, futures, options and registered investment company funds. Level 2 includes other significant observable inputs such as quoted prices for similar securities, interest rates, prepayment speeds and credit risk, typically included in this level are fixed income securities, international securities, swaps and forward contracts. Level 3 includes significant unobservable inputs such as the Adviser’s own assumptions and broker evaluations in determining the fair value of investments. The valuation levels are not necessarily an indication of the risk associated with investing in these securities or other investments. Investments measured using net asset value per share as a practical expedient for fair value and that are not publicly available-for-sale are not categorized within the fair value hierarchy.

Foreign Currency Translation — The accounting records of the Fund are maintained in U.S. dollars. Securities and other assets and liabilities that are denominated in foreign currencies are translated into U.S. dollars at the daily closing rates of exchange.

Foreign currency amounts related to the purchase or sale of securities and income and expenses are translated at the exchange rate on the transaction date. Net realized and unrealized currency gains and losses are recorded from closed currency contracts, disposition of foreign currencies, exchange gains or losses between the trade date and settlement date on securities transactions, and other translation gains or losses on dividends, interest income and foreign withholding taxes. The Fund does not separately report the effect of changes in foreign exchange rates from changes in prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments in the Statement of Operations.

For federal income tax purposes, the Fund treats the effect of changes in foreign exchange rates arising from actual foreign currency transactions and the changes in foreign exchange rates between the trade date and settlement date as ordinary income.

Federal Income Taxes — No provision has been made for income taxes because the Fund’s policy is to qualify as a regulated investment company under the Internal Revenue Code and distribute substantially all investment company taxable income and net capital gain on a timely basis. It is also the intention of the Fund to distribute an amount sufficient to avoid imposition of any federal excise tax. The Fund, accordingly, anticipates paying no federal taxes and no federal tax provision was recorded. The Fund is treated as a separate taxable entity for federal income tax purposes. The Fund may utilize earnings and profits distributed to shareholders on the redemption of shares as part of the dividends paid deduction.

GAAP requires management of the Fund (i.e., the Adviser) to make additional tax disclosures with respect to the tax effects of certain income tax positions, whether those positions were taken on

Thrivent ETF TrustNotes to Financial StatementsSeptember 30, 2024 previously filed tax returns or are expected to be taken on future returns. These positions must meet a “more-likely-than-not” standard that, based on the technical merits of the position, it would have a greater than 50 percent likelihood of being sustained upon examination. In evaluating whether a tax position has met the "more-likely-than-not" recognition threshold, the Adviser must presume that the position will be examined by the appropriate taxing authority that has full knowledge of all relevant information.

The Adviser analyzed all open tax years, as defined by the statute of limitations, for all major jurisdictions. Open tax years are those that are open for examination by taxing authorities. Major jurisdictions for the Fund include U.S. Federal, and certain state jurisdictions as well as certain foreign countries. The Fund’s federal income tax returns are subject to examination for a period of three years after the filing of the return for the tax period. State returns may be subject to examination for an additional year depending on the jurisdiction. The Fund has no examinations in progress, and none are expected at this time.

As of September 30, 2024, the Adviser has reviewed all open tax years and major jurisdictions and concluded that there is no effect to the Fund's tax liability, financial position, or results of operations. There is no tax liability resulting from unrecognized tax benefits related to uncertain income tax positions taken or expected to be taken in future tax returns. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next 12 months.

Expenses and Income — Estimated expenses are accrued daily. The Fund is charged for those expenses that are directly attributable to it such as advisory fees, interest expense, other costs of the Fund's borrowing, etc. Expenses that are not directly attributable such as costs related to meeting of shareholders, litigation expenses, etc are generally allocated among all appropriate affiliated funds in proportion to their respective net assets or other reasonable basis.

Dividend income and capital gain distributions are recorded on the ex-dividend date. Non-cash income, if any, is recorded at the fair market value of the securities received.

Distributions to Shareholders — Net investment income is distributed to each shareholder as a dividend. Dividends are declared and distributed annually. Net realized gains from securities transactions, if any, are paid annually after the close of the fiscal year. In addition, the Fund may claim a portion of the payment to redeeming shareholders as a distribution for income tax purposes. Distributions to shareholders are recorded on the ex-dividend date.

Contingent Liabilities — In the event of adversary action proceedings where the Fund is a defendant, a loss contingency will not be accrued as a liability until the amount of potential damages and the likelihood of loss can be reasonably estimated. For the year ended September 30, 2024, no contingent liabilities were reported.

Accounting Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of

assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from these estimates.

Interfund Lending — The Fund may participate in an interfund lending program (the "Program") pursuant to an exemptive order issued by the SEC. The Program permits the Fund to borrow cash for temporary purposes from Thrivent Core Short-Term Reserve Fund. Interest is charged to each participating Fund based on its borrowings at the average of the repo rate and bank loan rate, each as defined in the Program. Each borrowing made under the Program matures no later than seven calendar days after the date of the borrowing, and each borrowing must be securitized by a pledge of segregated collateral with a market value at least equal to 102% of the outstanding principal value of the loan. For the year ended September 30, 2024, the Fund has not borrowed cash through the interfund lending program.

Organization and Offering Costs – The organization and offering costs associated with the establishment and offering of the Fund generally include any legal costs associated with registering the Fund, among others. These organization and offering costs were paid by Thrivent Asset Management, LLC (the “Adviser”) and will not be subject to reimbursement by the Fund.

(3)

FEES AND COMPENSATION PAID TO AFFILIATES

Investment Advisory Fees — The Trust has entered into an investment management agreement with the Adviser pursuant to which the Adviser provides certain administrative personnel and services. The Adviser makes investment decisions for the Fund and continuously reviews and administers the Fund’s investment programs and manages the operations of the Fund under the general supervision of the Board. Under the investment management agreement, the Fund pays an annual fee of 0.65% of average daily net assets for investment advisory services. The fees are accrued daily and paid monthly.

Distribution Plan — ALPS Distributors, Inc. ("ALPS"), a Colorado corporation, is the distributor and principal underwriter of the Fund’s Shares. ALPS serves as the distributor of aggregations of shares of the Fund known as “Creation Units”. ALPS is not entitled to compensation from the Trust for services provided under this agreement but receives compensation from the Adviser for its services.

Other Expenses — The Trust has entered into an agreement with State Street Bank and Trust Company ("State Street"), to provide transfer agency and dividend payment services, custodian and administration services necessary to the Fund. Under the transfer agency agreement, State Street performs shareholder services and acts as the dividend disbursing agent. Pursuant to administration agreement, State Street provides certain accounting and administrative personnel and services to the Fund. Under the custody agreement, State Street provides custodian services for the Fund’s assets. Additionally, the Trust has entered into an agreement with Thrivent Financial Investor Services Inc., to provide primarily

Thrivent ETF TrustNotes to Financial StatementsSeptember 30, 2024 call center services and to assist in coordinating with other service providers for the distribution of the Fund's regulatory filings to shareholders.

Each Trustee who is not affiliated with the Adviser receives an annual fee from the Adviser for services as a Trustee. In addition, the Adviser reimburses unaffiliated Trustees for reasonable expenses incurred in relation to attendance at the meetings and industry conferences.

Certain officers and non-independent Trustees of the Trust are officers and directors of Thrivent Asset Mgt., the Adviser, Thrivent Financial Investor Services Inc. and Thrivent Distributors, LLC. Employees of the Adviser and board consultants are reimbursed for reasonable expenses incurred in relation to board meeting attendance by the Adviser.

Distributions are based on amounts calculated in accordance with applicable federal income tax regulations, which may differ from GAAP. The differences between book-basis and tax-basis distributable earnings are primarily attributable to timing differences recognizing certain gains and losses on investment transactions, such as wash sales. At the end of the year, reclassifications between net assets accounts are made for differences that are permanent in nature. These differences relate to the tax treatment of in-kind transactions.

On the Statement of Assets and Liabilities, as a result of permanent book-to-tax differences, reclassification adjustments were made as follows [Increase/(Decrease)]:

| Distributable

earnings/

(accumulated

loss) | |

| | |

At September 30, 2024, the components of distributable earnings on a tax basis were as follows:

| Undistributed

Ordinary Income | Undistributed

Long-Term Capital

Gain |

| | |

At September 30, 2024, the Fund had an accumulated net capital loss carryover as follows:

To the extent the Fund realizes future net capital gains, taxable distributions will be reduced by any unused capital loss carryovers as permitted by the Internal Revenue Code.

During the year and period ended September 30, 2024 and September 30, 2023, respectively, the Fund distributed $840,025 and $105,010 from ordinary income.

(5)

CREATION AND REDEMPTION TRANSACTIONS AND TRANSACTION FEES

The Fund issues and redeems shares on a continuous basis at NAV in large blocks of shares called “Creation Units”. A Creation Unit consists of 10,000 shares. Creation Units are issued and redeemed in cash and/or in-kind for securities included in the relevant underlying securities basket. Investors such as market markers, large investors and institutions who wish to deal in Creation Units directly with a Fund must have entered into an authorized participant agreement with the principal underwriter and the transfer agent, or purchase through a dealer that has entered into such an agreement. Transactions in shares for the Fund include both cash and in-kind transactions and are disclosed in detail in the Statement of Changes in Net Assets.

Transaction fees are imposed to cover the cost associated with the issuance and redemption of Creation Units. There is fixed and variable component to the total transaction fee. A fixed transaction fee is paid to the transfer agent and is applicable to each creation or redemption transaction, regardless of the number of the Creation Units purchased or redeemed. In addition, a variable transaction fee equal to a percentage of the value of each Creation Unit purchased or redeemed, as part of a cash order, is applicable to each creation or redemption transaction and is paid to the Fund. Variable transaction fees received by the Fund are presented in the Capital Share Transaction section of the Statement of Changes in Net Assets.

Purchases and Sales of Investment Securities — For the year ended September 30, 2024, the Fund had net in-kind contributions of $146,587,427 and net in-kind redemptions of $111,224,046 with a gain of $21,834,786. In addition, purchases and sales of investment securities were $91,665,615 and $92,467,118 respectively.

(7)

SECURITY TRANSACTIONS WITH AFFILIATED FUNDS

The Fund is permitted to purchase or sell securities from or to certain other Funds, or affiliated portfolios under specified conditions outlined in procedures adopted by the Board. The procedures have been designed to ensure that any purchase or sale of securities by the Fund from or to another fund or portfolio that is or could be considered an affiliate by virtue of having a common investment adviser (or affiliated investment advisers), common Trustees and/or common officers complies with Rule 17a-7 of the 1940 Act. Further, as defined under the procedures, each transaction is executed at the current market price.

Thrivent ETF TrustNotes to Financial StatementsSeptember 30, 2024 During the year ended September 30, 2024, the Fund did not engage in these types of transactions.

The Adviser has evaluated the impact of subsequent events through the date the financial statements were issued, and, except as already included in the Notes to Financial Statements, has determined that no additional items require disclosure.

Investing in the Fund involves risks. The following is an alphabetical list of significant risks in investing in the Fund.

Authorized Participant Concentration Risk - Only authorized participants (“Authorized Participants”) (which are members or participants of a clearing agency registered with the SEC, which have a written agreement with the Fund that allows them to place orders for the purchase and redemption of Creation Units) may engage in creation or redemption transactions directly with the Fund. The Fund may have a limited number of institutions that act as Authorized Participants, none of which are obligated to engage in creation and/or redemption transactions. To the extent that these institutions exit the business or are unable or unwilling to proceed with creation and/or redemption orders with respect to the Fund and no other Authorized Participant is able to step forward to process creation and/or redemption orders, Fund shares may trade at a discount to NAV and possibly face trading halts and/or delisting. This risk may be more pronounced during periods of market volatility or market disruptions. The fact that the Fund is offering a novel and unique structure may result in a fewer number of entities willing to act as Authorized Participants, particularly during times of market volatility.

Conflicts of Interest Risk - An investment in the Fund is subject to a number of actual or potential conflicts of interest. The following does not purport to be a comprehensive list or complete explanation of all potential conflicts of interest which may affect the Fund. The Fund may encounter circumstances, or enter into transactions, in which conflicts of interest may arise, which are not listed or discussed below.

The Adviser or its affiliates may provide services to the Fund for which the Fund would compensate the Adviser and/or such affiliates. The Fund may invest in Permissible Investments affiliated with the Adviser. The Adviser may have an incentive (financial or otherwise) to enter into transactions or arrangements on behalf of the Fund with itself or its affiliates in circumstances where it might not have done so otherwise.

The Adviser or its affiliates manage other investment funds and/or accounts (including proprietary accounts) and have other clients with investment objectives and strategies that are similar to, or overlap with, the investment objective and strategy of the Fund, creating conflicts of interest in investment and allocation decisions regarding the allocation of investments that could be appropriate for the Fund and other clients of the Adviser or their affiliates. The Adviser and its affiliates have no obligation to make available any information regarding their proprietary activities or strategies, or the

activities or strategies used for other funds and/or accounts managed by them, for the benefit of the management of the Fund. No affiliate of the Adviser is under any obligation to share any investment opportunity, including an investment technique, idea, model or strategy, with the Fund. The portfolio compositions and performance results of the Fund therefore will differ from other such funds and/or accounts. These conflicts of interest are exacerbated to the extent that the Adviser’s other clients are proprietary or pay them higher fees or performance-based fees. Further, the activities in which the Adviser and its affiliates are involved on behalf of other accounts could limit or preclude the flexibility that the Fund could otherwise have to participate in certain investments.

Cybersecurity Risk - The Fund and its service providers may be susceptible to operational, information security, and related risks. In general, cyber incidents can result from deliberate attacks or unintentional events. Cyber-attacks include, but are not limited to, gaining unauthorized access to digital systems to misappropriate assets or sensitive information, corrupt data, or otherwise disrupt operations. Cyber incidents affecting the Adviser or other service providers (including, but not limited to, fund accountants, custodians, transfer agents, and financial intermediaries) have the ability to disrupt and impact business operations, potentially resulting in financial losses, by interfering with the Fund’s ability to calculate their NAV, corrupting data or preventing parties from sharing information necessary for the Fund’s operation, preventing or slowing trades, stopping shareholders from making transactions, potentially subjecting the Fund or the Adviser to regulatory fines and penalties, and creating additional compliance costs. Similar types of cybersecurity risks are also present for issuers or securities in which the Fund may invest, which could result in material adverse consequences for such issuers and may cause the Fund’s investments in such companies to lose value. While the Fund’s service providers have established business continuity plans in the event of such cyber incidents, there are inherent limitations in such plans and systems. Additionally, the Fund cannot control the cybersecurity plans and systems put in place by their service providers or any other third parties whose operations may affect the Fund or its shareholders. Although the Fund attempts to minimize such failures through controls and oversight, it is not possible to identify all of the operational risks that may affect the Fund or to develop processes and controls that completely eliminate or mitigate the occurrence of such failures or other disruptions in service. The value of an investment in the Fund’s shares may be adversely affected by the occurrence of the operational errors or failures or technological issues or other similar events and the Fund and its shareholders may bear costs tied to these risks.

Equity Security Risk - Equity securities held by the Fund may decline significantly in price, sometimes rapidly or unpredictably, over short or extended periods of time, and such declines may occur because of declines in the equity market as a whole, or because of declines in only a particular country, geographic region, company, industry, or sector of the market. From time to time, the Fund may invest a significant portion of its assets in companies in one particular country or geographic region or one or more related sectors or industries, which would make the Fund more vulnerable to adverse developments affecting such countries, geographic regions, sectors or industries. Equity securities are generally more volatile than most debt securities.

Thrivent ETF TrustNotes to Financial StatementsSeptember 30, 2024 ESG Investment Selection Risk - Because the Fund considers whether a company has a sustainable long-term business model and a demonstrated commitment to ESG policies, practices or outcomes in addition to other considerations when selecting securities, its portfolio may perform differently than funds that do not consider those issues. The Fund’s incorporation of ESG considerations in the investment process may exclude securities of certain issues for non-investment reasons and therefore the Fund may forgo some market opportunities available to funds that do not screen ESG attributes. Additionally, the criteria used to select companies for investment may result in the Fund investing in securities, industries or sectors that underperform the market as a whole. Selecting for sustainable long-term business models and ESG policies, practices or outcomes may prioritize long-term rather than short-term returns. Furthermore, when screening for these considerations, the portfolio management team may utilize information published by third-party sources and as a result there is a risk that this information might be incorrect, incomplete, inconsistent or incomparable, which could cause the Adviser to incorrectly assess a company’s business model or practices. In addition, there may be limited or no information available to the Adviser regarding the ESG policies, practices, outcomes or ratings of companies representing a substantial portion of the Fund’s investment universe. Any limits on the information or ratings available for an issuer may increase the risk that the Adviser will not be successful in its attempt to identify securities of companies with sustainable long-term business models and a demonstrated commitment to ESG policies, practices or outcomes.

ETF Risk - An investment in an ETF is subject to the risks of the underlying investments that it holds. For index-based ETFs, while such ETFs seek to achieve the same returns as a particular market index, the performance of an ETF may diverge from the performance of such index (commonly known as tracking error). ETFs are subject to fees and expenses (like management fees and operating expenses) and the Fund indirectly bears its proportionate share of any such fees and expenses paid by the ETFs in which it invests. In addition, ETF shares may trade at a premium or discount to their net asset value and investors may fail to bring the trading price in line with the underlying shares (known as the arbitrage mechanism). As ETFs trade on an exchange, they are subject to the risks of any exchange-traded instrument, including: (i) an active trading market for its shares may not develop or be maintained, (ii) trading of its shares may be halted by the exchange, and (iii) its shares may be delisted from the exchange.

Growth Investing Risk - Growth style investing includes the risk of investing in securities whose prices historically have been more volatile than other securities, especially over the short term. Growth stock prices reflect projections of future earnings or revenues and, if a company’s earnings or revenues fall short of expectations, its stock price may fall dramatically.

Investment Adviser Risk - The Fund is actively managed and the success of its investment strategy depends significantly on the skills of the Adviser in assessing the potential of the investments in which the Fund invests. This assessment of investments may prove incorrect, resulting in losses or poor performance, even in rising markets. There is also no guarantee that the Adviser will be able to effectively implement the Fund’s investment objective.

Issuer Risk - Issuer risk is the possibility that factors specific to an issuer to which the Fund is exposed will affect the market prices of the issuer’s securities and therefore the value of the Fund.

Large Shareholder Risk - From time to time, shareholders of the Fund (which may include institutional investors, financial intermediaries, or affiliated funds) may make relatively large redemptions or purchases of shares. These transactions may cause the Fund to sell securities at disadvantageous prices or invest additional cash, as the case may be. While it is impossible to predict the overall impact of these transactions over time, there could be adverse effects on the Fund’s performance to the extent that the Fund may be required to sell securities or invest cash at times when it would not otherwise do so. Redemptions of a large number of shares also may increase transaction costs or have adverse tax consequences for shareholders of the Fund by requiring a sale of portfolio securities. In addition, a large redemption could result in the Fund's current expenses being allocated over a smaller asset base, leading to an increase in the Fund's expense ratio.

Market Risk - Over time, securities markets generally tend to move in cycles with periods when security prices rise and periods when security prices decline. The value of the Fund’s investments may move with these cycles and, in some instances, increase or decrease more than the applicable market(s) as measured by the Fund’s benchmark index(es). The securities markets may also decline because of factors that affect a particular industry or market sector, or due to impacts from domestic or global events, including regulatory events, economic downturn, government shutdowns, the spread of infectious illness such as the outbreak of COVID-19, public health crises, war, terrorism, social unrest, recessions, natural disasters or similar events.

Market Trading Risk - Although Fund shares are listed on national securities exchanges, there can be no assurance that an active trading market for Fund shares will develop or be maintained or that any listing will be maintained. If an active market or a listing is not maintained, investors may find it difficult to buy or sell Fund shares.

Mid Cap Risk - Medium-sized companies often have greater price volatility, lower trading volume, and less liquidity than larger, more-established companies. These companies tend to have smaller revenues, narrower product lines, less management depth and experience, smaller shares of their product or service markets, fewer financial resources, and less competitive strength than larger companies.

New and Smaller Sized Fund Risk - The Fund is relatively new and has a limited operating history for investors to evaluate and may not be successful in implementing its investment strategies. The Fund may fail to attract sufficient assets to achieve or maintain economies of scale, which could result in the Fund being liquidated at any time without shareholder approval and at a time that may not be favorable for all shareholders. Smaller ETFs will have a lower public float and lower trading volumes, leading to wider bid/ask spreads.

Premium/Discount Risk - Publication of the Proxy Portfolio is not the same level of transparency as the publication of the Actual

Thrivent ETF TrustNotes to Financial StatementsSeptember 30, 2024 Portfolio by a fully transparent ETF. Although the Proxy Portfolio is intended to provide Authorized Participants and other market participants with enough information to allow for an effective arbitrage mechanism that is intended to keep the market price of the Fund at or close to the underlying NAV per share of the Fund, there is a risk (which may increase during periods of market disruption or volatility) that the market price of the Fund’s shares will vary significantly from the NAV per share of the Fund. This means the price paid to buy shares on an exchange may not match the value of the Fund’s portfolio. The same is true when shares are sold.

Proxy Portfolio Risk - Unlike traditional ETFs that disclose their portfolio holdings on a daily basis, the Fund does not disclose its holdings daily, rather it discloses a Proxy Portfolio. The goal of the Proxy Portfolio, during all market conditions, is to track closely the daily performance of the Actual Portfolio and minimize intra-day misalignment between the performance of the Proxy Portfolio and the performance of the Actual Portfolio. The Proxy Portfolio is designed to reflect the economic exposures and the risk characteristics of the Actual Portfolio on any given trading day. The Proxy Portfolio is intended to provide Authorized Participants and other market participants with enough information to support an effective arbitrage mechanism that keeps the market price of the Fund at or close to the underlying NAV per share of the Fund. The Adviser has licensed from a third party the right to use a model that will determine the Proxy Portfolio. The Fund’s ability to operate as described herein depends on the quality of that model and the timely and accurate determination of the Proxy Portfolio each day. The Proxy Portfolio methodology is novel, has only been in use for a limited period of time, and is not yet proven as an effective arbitrage mechanism. There can be no assurance that the Proxy Portfolio will function as expected or that it will support an effective arbitrage mechanism, especially under difficult or stressed market conditions, and there can be no assurance that the intellectual property necessary to utilize the Proxy Portfolio will remain available to the Fund. The effectiveness of the Proxy Portfolio as an arbitrage mechanism is contingent upon, among other things, the Proxy Portfolio performing in a manner substantially identical to the performance of the Actual Portfolio and the willingness of Authorized Participants and other market participants to trade based on the Proxy Portfolio. There is no guarantee that this arbitrage mechanism will operate as intended or with the intended effects. The Fund may not function as intended and the market price of its shares may be adversely affected if the licensor of the methodology used to determine the Proxy Portfolio fails to continue to make the intellectual property used to determine the Proxy Portfolio available for use by the Fund. Further, while the Proxy Portfolio may include some of the Fund’s holdings, it is not the Fund’s Actual Portfolio. ETFs trading on the basis of a published Proxy Portfolio may exhibit wider premiums and discounts, bid/ask spreads, and tracking error than other ETFs using the same investment strategies that publish their portfolios on a daily basis, especially during periods of market disruption or volatility. Therefore, shares of the Fund may cost investors more to trade than shares of a traditional ETF. There is also a possibility of additional expenses related to operating the Proxy Portfolio.

Each day the Fund calculates the overlap between the holdings of the prior Business Day’s Proxy Portfolio compared to the Actual Portfolio that formed the basis for the Fund’s calculation of NAV at

the end of the prior Business Day (“Proxy Overlap”) and the difference, in percentage terms, between the Proxy Portfolio per share NAV and that of the Actual Portfolio (“Tracking Error”). If the Tracking Error becomes large, there is a risk that the performance of the Proxy Portfolio may deviate from the performance of the Actual Portfolio.

The Board monitors its Tracking Error, bid/ask spread and premiums/discounts. If deviations become too large, the Board will consider the continuing viability of the Fund, whether shareholders are being harmed, and what, if any, corrective measures would be appropriate. See the Statement of Additional Information for further discussion of the Board’s monitoring responsibilities.

Although the Fund seeks to benefit from keeping its portfolio information nontransparent, market participants may attempt to use the Proxy Portfolio to identify the Fund’s trading strategy, which if successful, could result in such market participants engaging in certain predatory trading practices that may have the potential to harm the Fund and its shareholders. The Proxy Portfolio and any related disclosures have been designed to minimize the risk of predatory trading practices, but they may not be successful in doing so.

Regulatory Risk - Legal, tax, and regulatory developments may adversely affect the Fund. Securities and futures markets are subject to comprehensive statutes, regulations, and margin requirements enforced by the SEC, other regulators and self-regulatory organizations, and exchanges, which are authorized to take extraordinary actions in the event of market emergencies. The regulatory environment for the Fund is evolving, and changes in the regulation of investment funds, managers, and their trading activities and capital markets, or a regulator’s disagreement with the Fund’s interpretation of the application of certain regulations, may adversely affect the ability of the Fund to pursue its investment strategy, its ability to obtain leverage and financing, and the value of investments held by the Fund.

Small Cap Risk - Smaller, less seasoned companies often have greater price volatility, lower trading volume, and less liquidity than larger, more established companies. These companies tend to have small revenues, narrower product lines, less management depth and experience, small shares of their product or service markets, fewer financial resources, and less competitive strength than larger companies. Such companies seldom pay significant dividends that could soften the impact of a falling market on returns.

Tax Risk - Changes in federal income tax laws or rates may affect both the net asset value of the Fund and the returns generated from securities in the Fund.

Tracking Error Risk - Although the Proxy Portfolio is designed to reflect the economic exposure and risk characteristics of the Fund’s Actual Portfolio on any given trading day, there is a risk that the performance of the Proxy Portfolio will diverge from the performance of the Actual Portfolio, potentially materially.

Trading Halt Risk - If securities representing 10% or more of the Fund’s Actual Portfolio do not have readily available market quotations, the Fund will promptly request that the listing exchange

Thrivent ETF TrustNotes to Financial StatementsSeptember 30, 2024 halt trading in the Fund’s shares which means that investors would not be able to trade their shares. Trading halts may have a greater impact on the Fund compared to other ETFs due to the Fund’s semi-transparent structure. If the trading of a security held in the Fund’s Actual Portfolio is halted, or otherwise does not have readily available market quotations, and the Adviser believes that the lack of any such readily available market quotations may affect the reliability of the Proxy Portfolio as an arbitrage vehicle, or otherwise determines it is in the best interest of the Fund, the Adviser will

promptly disclose on the Fund’s website the identity and weighting of such security for so long as such security’s trading is halted or otherwise does not have readily available market quotations and remains in the Actual Portfolio.

Value Investing Risk - Value style investing includes the risk that stocks of undervalued companies may not rise as quickly as anticipated if the market doesn’t recognize their intrinsic value or if value stocks are out of favor.

This page intentionally left blank

Thrivent ETF TrustFinancial Highlights

| Per Share Outstanding Throughout Each Period* |

| | Income from Investment Operations | |

| Net Asset

Value,

Beginning of

| Net Investment

Income/(Loss) | Net Realized

and Unrealized

Gain/(Loss) on

| Total from

Investment

Operations | | Net Realized

Gain on

Investments |

| | | | | | |

Year Ended September 30, 2024 (c) | | | | | | |

Period Ended September 30, 2023 (c),# | | | | | | |

| The amount shown may not correlate with the change in aggregate gains and losses of portfolio securities due to the timing of sales and redemptions of fund shares. |

| Total return assumes dividend reinvestment and does not reflect any deduction for applicable sales charges. Not annualized for periods less than one year. |

| Per share amounts have been calculated using the average shares outstanding method. |

| All per share amounts have been rounded to the nearest cent. |

| Computed on an annualized basis for periods less than one year. |

| For the period from October 5, 2022 (inception) through September 30, 2023. |

The accompanying Notes to Financial Statements are an integral part of this statement.

Thrivent ETF TrustFinancial Highlights

| |

| | | | | Ratio to Average Net

Assets Before Expenses

Waived, Credited or

Acquired Fund Fees and

|

| Net Asset Value,

End of Period | | Net Assets,

End of Period

(in millions) | | Net

Investment

Income/

(Loss) | | Net Investment

Income/(Loss) | |

| | | | | | | | |

| | | | | | | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Federal Tax Information(unaudited) Shareholder Notification of Federal Tax Information

Small-Mid Cap ESG ETF designates 100% of dividends declared from net investment income as dividends qualifying for the 70% dividends received deduction for corporations and 100% as qualified dividend income for individuals under the Jobs and Growth Tax Relief Reconciliation Act of 2003 for the tax period ending September 30, 2024.

Change in and Disagreement with Accountants

The accompanying Notes to Financial Statements are an integral part of this statement.

The accompanying Notes to Financial Statements are an integral part of this statement.

Remuneration Paid to Directors, Officers, and Others

The information is disclosed as part of the Financial Statements included in Item 7 of this Form N-CSR.

The accompanying Notes to Financial Statements are an integral part of this statement.

Statement Regarding Basis for Approval of Investment Advisory Contract

Section 15(c) of the Investment Company Act of 1940, as amended (the “1940 Act”), requires that a fund’s investment advisory agreement be approved initially by the fund’s board of trustees. Section 15(c) also requires that the continuation of the agreement, after an initial term of up to two years, be annually reviewed and approved by the board. Any such agreement must be approved by a vote of a majority of the trustees who are not parties to the agreement or “interested persons” (as defined in the 1940 Act) of a party to the agreement at a meeting of the board called for the purpose of voting on such approval.

At its meeting on August 20-21, 2024 (the “Meeting”), the Board of Trustees (the “Board”) of the Thrivent ETF Trust (the “Trust”), including the trustees who are not parties to the agreement or “interested persons” as defined in the 1940 Act (the “Independent Trustees”), considered and voted unanimously to renew the existing advisory agreement (the “Advisory Agreement”) between the Trust and Thrivent Asset Management, LLC (the “Adviser”) for the Thrivent Small-Mid Cap ESG ETF (the “Fund”), a series of the Trust.

In connection with its evaluation of the agreement with the Adviser, the Board reviewed a broad range of information requested for this purpose and considered a variety of factors, including the following:

1. The nature, extent, and quality of the services provided by the Adviser;

2. The performance of the Fund;

3. The advisory fee and net operating expense ratio of the Fund compared to a peer group;

4. The cost of services provided and any profit realized by the Adviser;

5. The extent to which economies of scale may be realized as the Fund grows;

6. Whether fee levels reflect these economies of scale for the benefit of the Fund’s shareholders;

7. Other benefits realized by the Adviser and its affiliates from their relationship with the Fund; and

8. Any other factors that the Board deemed relevant to its consideration.

The Contracts Committee of the Board (consisting of all of the Independent Trustees) met on three occasions from May 21 to August 20, 2024 to consider information relevant to the annual contract renewal process furnished by the Adviser in advance of the meetings. The Board had the opportunity to ask questions and request further information in connection with its consideration. The Independent Trustees also retained the services of Management Practice LLC (“MPI”) as an independent consultant to assist in the compilation, organization, and evaluation of relevant information.

The Board received information from the Adviser regarding the personnel providing services to the Fund, including investment management, compliance and administrative personnel. The Board also received monthly reports from the Adviser’s investment management staff with respect to the performance of the Fund. In addition to its review of the information presented to the Board during the annual contract renewal process, the Board considered information obtained from management throughout the course of the year. The Board also reviewed information from MPI, including an independent assessment of information relating to the Fund and the Advisory Agreement.

The Independent Trustees were represented by independent counsel throughout the review process and during executive sessions without management present to consider the reapproval of the Advisory Agreement for the Fund. Each Independent Trustee relied on his or her own business judgment in determining the weight to be given to each factor considered in evaluating the materials that were presented to them. The Contracts Committee’s and Board’s review and conclusions were based on a comprehensive consideration of all information presented to them and were not the result of any single controlling factor. In addition, each Trustee may have weighed individual factors differently. The key factors considered and the conclusions reached are described below.

Nature, Extent and Quality of Services

At each of the Board’s regular quarterly meetings, management presented information describing the services furnished to the Fund by the Adviser. During these meetings, management reported on the investment management, trading and compliance services provided to the Fund. During the annual contract renewal process, the Board considered the specific services provided under the Advisory Agreement. The Board considered information relating to the investment experience and qualifications of the portfolio managers of the Adviser overseeing investments for the Fund.

The accompanying Notes to Financial Statements are an integral part of this statement.

Statement Regarding Basis for Approval of Investment Advisory Contract

The Board received reports and presentations about the Fund at each of its quarterly meetings from the Adviser’s representatives. These reports and presentations gave the Board or one of its Committees the opportunity to evaluate the abilities of the portfolio managers and other investment professionals and the quality of services they provide to the Fund. The Adviser reviewed with the Board the services provided by the Adviser. The Independent Trustees also met, including in executive session, with and received periodic reports from the Trust’s Chief Compliance Officer, the Trust’s independent accounting firm, and representatives from the internal audit department of the Adviser (Business Risk Management). The Board noted that the Chief Compliance Officer met regularly between quarterly meetings with the Chair of the Ethics and Compliance Committee and the Chairs of other Committees communicated with Adviser representatives between quarterly meetings. The Board noted that investment management staff of the Adviser and the Trust’s Chief Compliance Officer follow up on any additional questions or concerns that arise during quarterly meetings and then report the results of the follow up to the Board or one of its Committees.

The Board considered the adequacy of the Adviser’s resources used to provide services to the Fund pursuant to the Advisory Agreement. The Adviser reviewed with the Board the Adviser’s process for overseeing the portfolio management team of the Fund. In addition, the Adviser reviewed with the Board the Adviser’s continued investments in technology, personnel, compliance, operations, and the Adviser’s oversight of other service providers to the Fund. The Board viewed these actions as a positive factor in reapproving the existing Advisory Agreement, as they demonstrated the Adviser’s commitment to provide the Fund with quality service and competitive investment performance.

The Board concluded that, within the context of its full deliberations, the nature, extent and quality of the investment advisory services provided to the Fund by the Adviser supported renewal of the Advisory Agreement.

In connection with each of its regular quarterly meetings, the Board received information on the performance of the Fund, including net performance, relative performance rankings within the Fund’s Morningstar peer universe, comparisons to benchmark index returns, and risk metrics. At each quarterly Board meeting, members of the Adviser’s senior investment team reviewed with the Board information on the economic and market environment and risk management.

The Board noted that the Fund had less than two years of operational history and considered investment performance for the Fund for the one-year period ended June 30, 2024. The Board considered that the Fund had performed better than its benchmark indexes and the median of Fund’s Morningstar peer universe over that one-year period. The Board concluded that the performance of the Fund was satisfactory.

Advisory Fees and Fund Expenses

The Board reviewed information prepared by MPI comparing Fund’s advisory fee with the advisory fee of a peer group selected by MPI based on similar investment objective and size. The Board also reviewed information prepared by MPI comparing the Fund’s overall expense ratio with the expense ratio of its peer group. The Board considered the Fund’s unitary fee structure, similar to other funds in its peer group, and noted that the Adviser would pay all of the expenses of the Fund other than the management fee, brokerage expenses, taxes, interest, fees and expenses of the Independent Trustees (including any Trustees’ counsel fees), acquired fund fees and expenses, litigation expenses and other extraordinary expenses. The Board noted that the Fund’s unitary fee and net expense ratio were both at the median of the peer group.

On the basis of its review, the Board concluded that the unitary fee charged under the Advisory Agreement was reasonable.

Cost of Services, Profitability and Economies of Scale

The Board considered the Adviser’s estimates of its profitability, which included allocations by the Adviser of its costs in providing advisory services to the Fund. The internal audit department of the Adviser (Business Risk Management) conducted a review of such allocations and provided a report to the Board, which included an assessment of the reasonableness and consistency of these allocations. The Board also received a report from an independent accountant confirming certain calculations. The Board considered the profitability of the Adviser both overall and for the Fund. Based on its review of the data prepared by MPI and expense and profit information provided by the Adviser, the Board concluded that any profits earned by the Adviser from the Advisory Agreement were not excessive in light of the nature, extent and quality of services provided to the Fund.

The Board considered information regarding the extent to which economies of scale may be realized as a Fund’s assets increase and whether the fee levels reflect these economies of scale for the benefit of shareholders. The Board considered that the Fund had less

The accompanying Notes to Financial Statements are an integral part of this statement.

Statement Regarding Basis for Approval of Investment Advisory Contract

than two years of operational history and that advisory fee breakpoints are not common in the exchange-traded fund market. The Board also considered management’s view that it is difficult to generalize as to whether, or to what extent, economies in the advisory function may be realized as any fund’s assets increase.

Other Benefits to the Adviser and its Affiliates

The Board considered information regarding “fall-out” or ancillary benefits that the Adviser and its affiliates may receive as a result of their relationship with the Fund, both tangible and intangible, such as their ability to leverage investment professionals who manage other portfolios, an enhanced reputation as an investment adviser which may help in attracting other clients and investment personnel, and the engagement of affiliates as service providers to the Fund. The Board noted that such benefits were difficult to quantify but were consistent with benefits received by other fund advisers.

Based on the factors discussed above, the Contracts Committee unanimously recommended approval of the Advisory Agreement, and the Board, including all of the Independent Trustees voting separately, approved the Advisory Agreement.

The accompanying Notes to Financial Statements are an integral part of this statement.

8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Not applicable.

9. Proxy Disclosures for Open-End Management Investment Companies.

Not applicable.

10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

Information is included in the financial statements filed under Item 7 of this Form N-CSR.

11. Statement Regarding Basis for Approval of Investment Advisory Contract.

Information is included in the financial statements filed under Item 7 of this Form N-CSR.

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 13. Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Not applicable.

Item 15. Submission of Matters to a Vote of Security Holders

There have been no material changes to the procedures by which shareholders may recommend nominees to registrant’s board of trustees since the registrant last provided disclosure in response to this Item.

Item 16. Controls and Procedures

| (a) | Registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) are effective, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report. |

| (b) | There were no changes in registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, registrant’s internal control over financial reporting. |

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable.

Item 18. Recovery of Erroneously Awarded Compensation.

Not applicable.

Item 19. Exhibits

| (a)(2) | Any policy required by the listing standards adopted pursuant to Rule 10D-1 under the Exchange Act (17 CFR 240.10D-1) by the registered national securities exchange or registered national securities association upon which the registrant’s securities are listed: Not applicable. |

| (a)(4) | Any written solicitation to purchase securities under Rule 23c-1 under the 1940 Act (17 CFR 270.23c-1) sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons: Not applicable. |