UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-42013

Junee Limited

(Exact name of Registrant as specified in its charter)

British Virgin Islands

(Jurisdiction of incorporation or organization)

3791 Jalan Bukit Merah

#09-03 E-Centre @ Redhill

Singapore 159471

(Address of principal executive offices)

Ho Wai (Howard) Tang, Executive Director

Telephone: +65 6022 1124

3791 Jalan Bukit Merah

#09-03 E-Centre @ Redhill

Singapore 159471

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Ordinary shares, no par value | | JUNE | | The Nasdaq Capital Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 12,977,354 shares outstanding as of June 30, 2024, no par value.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒ No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☐ Yes ☒ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ |

| | | Emerging growth company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | International Financial Reporting Standards as issued | Other ☐ |

| | by the International Accounting Standards Board ☐ | |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934).

☐ Yes ☒ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

☐ Yes ☐ No

Table of Contents

INTRODUCTION

Except where the context otherwise requires and for purposes of this annual report only the term:

| ● | “Amended Memorandum and Articles” refer to the current memorandum and articles of association of Junee, as amended on September 6, 2022; |

| ● | “Asian investors” refers to the Asian population around the globe; |

| ● | “BVI” means British Virgin Islands; |

| ● | “China” or “PRC” refers to the People’s Republic of China, excluding, for the purpose of this annual report only, Taiwan; |

| ● | “Controlling Shareholder” refers to OPS Holdings Limited; |

| ● | “HK$” or “Hong Kong dollars” refers to the legal currency of Hong Kong; |

| ● | “Hong Kong” refers to Hong Kong Special Administrative Region of the People’s Republic of China; |

| ● | “Ordinary Shares” refers to the Company’s ordinary shares, no par value; |

| ● | “Operating Subsidiary” refers to OPS Interior Design Consultant Limited.; |

| ● | “Investment Holding Subsidiaries” refers to, collectively, Junee Investments International Limited, Junee Technology Pte. Ltd., and ASPAC AI Computing Pty Ltd, which are wholly-owned subsidiaries of the Company with no operations, as of the date of this annual report. |

| ● | “OPS HK” and “OPS” refer to OPS Interior Design Consultant Limited., a Hong Kong company incorporated on July 13, 2011 and a wholly-owned subsidiary of Junee; |

| ● | “SEC” refers to the United States Securities and Exchange Commission; |

| ● | “SEHK” refers to the Stock Exchange of Hong Kong Limited; |

| ● | “JUNE”, “Junee”, the “Company”, “we,” “us,” “or “our” refers to Junee Limited, a British Virgin Islands company, and, in the context of describing its operation and business, its subsidiary; |

| ● | “US$” or “U.S. dollars” refers to the legal currency of the United States; |

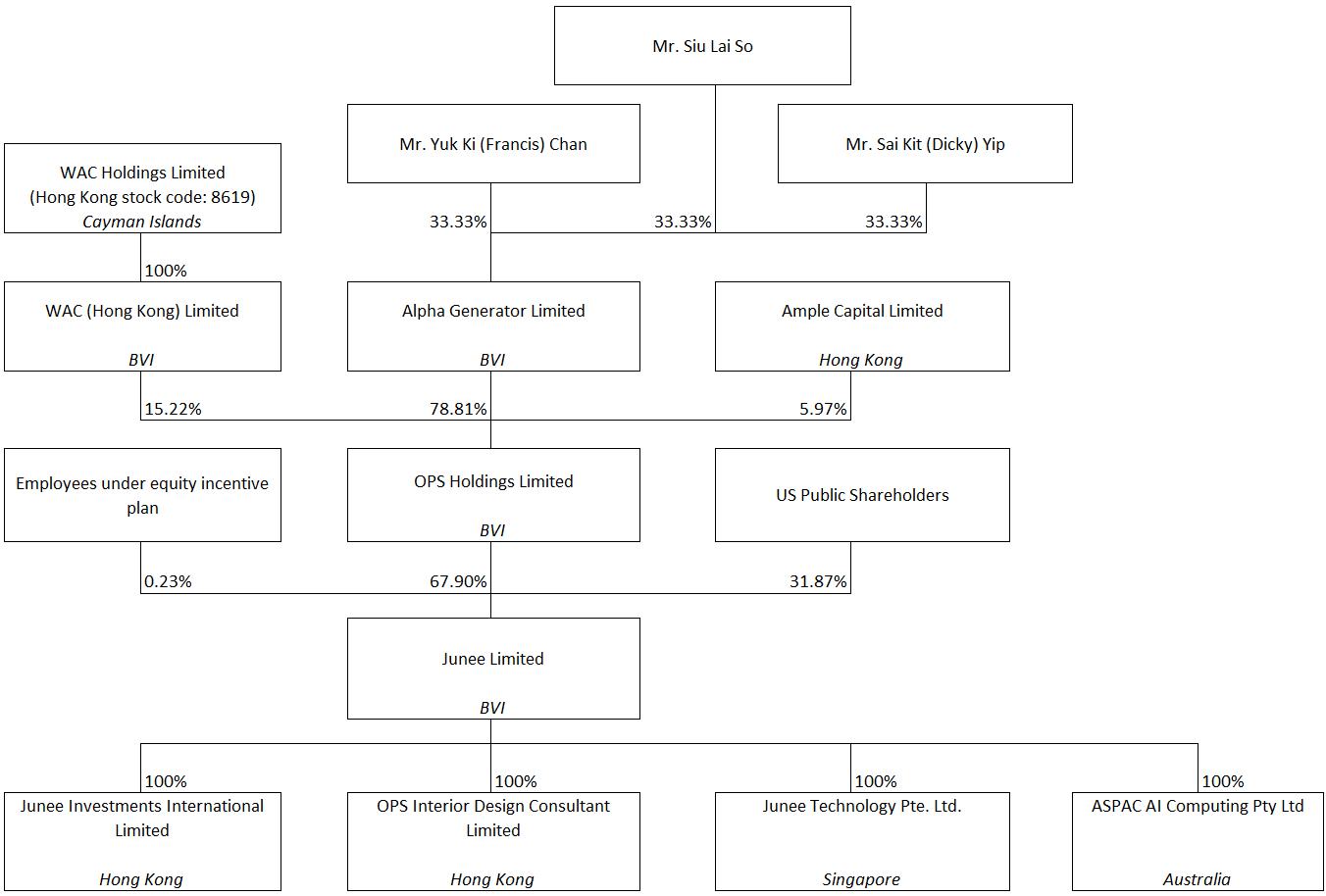

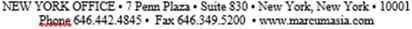

JUNE is a holding company with operations conducted in Hong Kong through its Operating Subsidiary in Hong Kong, OPS HK, using Hong Kong dollars. The OPS HK reporting currency is in Hong Kong dollars. This annual report contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Assets and liabilities are translated into U.S. dollars at the closing rate of exchange as of the balance sheet dates, the statement of income is translated using average rate of exchange in effect during the reporting periods, and the equity accounts are translated at historical exchange rates. Translation adjustments resulting from this process are included in accumulated other comprehensive income (loss). Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred. The balance sheet amounts, with the exception of shareholders’ equity at June 30, 2024, 2023 and 2022, were translated at HK$7.81 to $1.00, HK$7.83 to $1.00 and HK$7.85 to $1.00, respectively. The shareholders’ equity accounts were stated at their historical rate. The average translation rates applied to statement of income accounts for the years ended June 30, 2024, 2023 and 2022 were HK$7.82 to $1.00, HK$7.84 to $1.00 and HK$7.80 to $1.00, respectively. Cash flows are also translated at average translation rates for the periods, therefore, amounts reported on the statements of cash flows will not necessarily agree with changes in the corresponding balances on the consolidated balance sheets. No representation is made that the HK$ amounts could have been, or could be, converted, realized or settled into US$ at such rate, or at any other rate.

We obtained the industry and market data used in this annual report or any document incorporated by reference from industry publications, research, surveys and studies conducted by third parties and our own internal estimates based on our management’s knowledge and experience in the markets in which we operate. We did not, directly or indirectly, sponsor or participate in the publication of such materials, and these materials are not incorporated in this annual report other than to the extent specifically cited in this annual report. We have sought to provide current information in this annual report and believe that the statistics provided in this annual report remain up-to-date and reliable, and these materials are not incorporated in this annual report other than to the extent specifically cited in this annual report.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements, all of which are subject to risks and uncertainties. Forward-looking statements give our current expectations or forecasts of future events. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Many (but not all) of these statements can be found by the use of words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may” or other similar expressions in this annual report. These statements are likely to address our growth strategy, financial results and product and development programs. You must carefully consider any such statements and should understand that many factors could cause actual results to differ from our forward-looking statements. These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known and some that are not. No forward-looking statement can be guaranteed and actual future results may vary materially. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to:

| ● | future financial and operating results, including revenues, income, expenditures, cash balances and other financial items; |

| ● | our ability to execute our growth, expansion and acquisition strategies, including our ability to meet our goals; |

| ● | current and future economic and political conditions; |

| ● | our expectations regarding demand for and market acceptance of our services and the products; |

| ● | our expectations regarding our client base; |

| ● | our ability to procure the applicable regulatory licenses in the relevant jurisdictions in which we operate; |

| ● | competition in our industry; |

| ● | relevant government policies and regulations relating to our industry; |

| ● | our capital requirements and our ability to raise any additional financing which we may require; |

| ● | our ability to protect our intellectual property rights and secure the right to use other intellectual property that we deem to be essential or desirable to the conduct of our business; |

| ● | our ability to hire and retain qualified management personnel and key employees in order to enable us to develop our business; |

| ● | overall industry and market performance; |

| ● | the spread of COVID-19 and its new variants; |

| ● | other assumptions described in this annual report underlying or relating to any forward-looking statements; and |

| ● | other risk factors discussed under “Item 3. Key Information - 3.D. Risk Factors.” |

We base our forward-looking statements on our management’s beliefs and assumptions based on information available to our management at the time the statements are made. We caution you that actual outcomes and results may, and are likely to, differ materially from what is expressed, implied or forecast by our forward-looking statements. Accordingly, you should be careful about relying on any forward-looking statements. Except as required under the federal securities laws, we do not have any intention or obligation to update publicly any forward-looking statements after the distribution of this annual report, whether as a result of new information, future events, changes in assumptions, or otherwise.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable for annual reports on Form 20-F.

Item 2. Offer Statistics and Expected Timetable

Not applicable for annual reports on Form 20-F.

Item 3. Key Information

Transfers of Cash between Our Company and Our Subsidiaries

Our management monitors the cash position of each entity within our organization regularly and prepare budgets on a monthly basis to ensure each entity has the necessary funds to fulfill its obligation for the foreseeable future and to ensure adequate liquidity. In the event that there is a need for cash or a potential liquidity issue, it will be reported to our Chief Financial Officer and subject to approval by our board of directors, we will enter into an intercompany loan for the subsidiary.

For JUNE to transfer cash to its subsidiaries, JUNE is permitted under the laws of British Virgin Islands to provide funding to our subsidiaries in Hong Kong, Singapore and Australia through loans or capital contributions without restrictions on the amount of the funds. OPS HK is permitted under the laws of Hong Kong to provide funding to Junee, the holding company incorporated in the British Virgin Islands, through dividend distribution or payments without restrictions on the amount of the funds.

For the Operating Subsidiary to transfer cash to JUNE, according to the BVI Business BVI Act 2004 (as amended), a British Virgin Islands company may make dividends distribution to the extent that immediately after the distribution, such company’s such company’s liabilities do not exceed its assets and that such company is able to pay its debts as they fall due. According to the Companies Ordinance of Hong Kong, a Hong Kong company may only make a distribution out of profits available for distribution. Other than the above, we did not adopt or maintain any cash management policies and procedures as of the date of this annual report.

We do not intend to transfer cash between Investment Holding Subsidiaries to JUNE for the foreseeable future.

The following describes the dividends and distributions made by our subsidiaries. JUNE has not made any dividends or distributions to U.S. investors as of the date of this annual report.

On May 19, 2022, OPS HK declared an interim dividend of HK$2.7 per share (equivalent to $0.346 per share) with respect to the 600,000 issued shares of OPS HK or HK$1,620,000 (equivalent to $207,692) to its sole shareholder, i.e. Junee. On the same date, having received the dividend income from OPS HK, Junee declared the same amount of interim dividend, i.e. an interim dividend of HK$1,620 per share (equivalent to $208 per share) with respect to the 1,000 issued shares of Junee or HK$1,620,000 (equivalent to $207,692) to the shareholders of Junee.

During the fiscal year ended June 30, 2022, Junee paid dividend of HK$1,360,000 (equivalent to $174,359) to the shareholders of Junee and the remaining unpaid dividend of HK$260,000 (equivalent to $33,333) was recorded as amount due to the related party as of June 30, 2022 and was fully settled in December 2022.

On September 15, 2022, Junee declared an interim dividend of approximately HK$0.11199 per share (equivalent to approximately $0.01429 per share) with respect to the 10,714,286 issued shares of Junee, or HK$1,200,000 (equivalent to $153,061), to the shareholders of Junee. The dividend declared by Junee on September 15, 2022 has been fully paid as of the date of this annual report.

Under the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect of dividends paid by us. The laws and regulations of the PRC do not currently have any material impact on the transfer of cash from Junee to OPS HK or from OPS HK to Junee, our shareholders and U.S. investors. There are no restrictions or limitations under the laws of Hong Kong imposed on the conversion of HK dollar into foreign currencies and the remittance of currencies out of Hong Kong, nor is there any restriction on any foreign exchange to transfer cash between Junee and its subsidiary, across borders and to U.S. investors, nor there is any restrictions and limitations to distribute earnings from the subsidiary, to Junee and U.S. investors and amounts owed.

For JUNE to make dividends to its shareholders, subject to the BVI Business BVI Act, 2004 (as amended), which we refer to as the BVI Act below, and our Amended Memorandum and Articles, our board of directors may authorize and declare a dividend to shareholders from time to time out of the profits from the Company, realized or unrealized, or out of the share premium account, provided that the Company will remain solvent, meaning the Company is able to pay its debts as they come due in the ordinary course of business. There is no further British Virgin Islands statutory restriction on the amount of funds which may be distributed by us in the form of dividends.

We do not have any present plan to declare or pay any dividends on our Ordinary Shares in the foreseeable future. We currently intend to retain all available funds and future earnings, if any, for the operation and expansion of our business. Any future determination related to our dividend policy will be made at the discretion of our board of directors after considering our financial condition, results of operations, capital requirements, contractual requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in any future financing instruments, in our Amended Memorandum and Articles and in the BVI Act.

See “Item 8. Financial Information - A. Consolidated Statements and Other Financial Information - Dividend Policy” and “Item 3. Key Information - 3.D. Risk Factors - Risks Relating to our Corporate Structure - • We rely on dividends and other distributions on equity paid by our Operating Subsidiary to fund any cash and financing requirements we may have. In the future, funds may not be available to fund operations or for other use outside of Hong Kong, due to interventions in, or the imposition of restrictions and limitations on, our ability or our subsidiaries by the PRC government to transfer cash. Any limitation on the ability of our subsidiary to make payments to us could have a material adverse effect on our ability to conduct our business and might materially decrease the value of our Ordinary Shares or cause them to be worthless”.

Enforceability of Civil Liabilities

JUNE was incorporated under the laws of the British Virgin Islands with limited liability. We chose to incorporate JUNE in the British Virgin Islands because of certain benefits associated with being a British Virgin Islands corporation, such as political and economic stability, an effective judicial system, a favorable tax system, the absence of exchange control or currency restrictions and the availability of professional and support services. However, the British Virgin Islands has a less developed body of securities laws as compared to the United States and provides protections for you to a lesser extent. In addition, British Virgin Islands companies may not have the standing to sue before the federal courts of the United States.

Currently, all of our Operating Subsidiary’s operations are conducted outside the United States, and all of our assets are located outside the United States. All of our directors and officers are Hong Kong nationals or residents and a substantial portion of their assets are located in Hong Kong outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons or to enforce against us or them, judgments obtained in United States courts, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

We have been advised by our counsel as to British Virgin Islands law that the United States and the British Virgin Islands do not have a treaty providing for reciprocal recognition and enforcement of judgments of courts of the United States in civil and commercial matters and that a final judgment for the payment of money rendered by any general or state court in the United States based on civil liability, whether or not predicated solely upon the U.S. federal securities laws, may not be enforceable in the British Virgin Islands. We have also been advised by our counsel as to British Virgin Islands law that a final and conclusive judgment obtained in U.S. federal or state courts under which a sum of money is payable as compensatory damages (i.e., not being a sum claimed by a revenue authority for taxes or other charges of a similar nature by a governmental authority, or in respect of a fine or penalty or multiple or punitive damages) may be the subject of an action on a debt at common law in the Grand Court of the British Virgin Islands.

Implication of the Holding Foreign Companies Accountable Act (the “HFCA Act”)

The HFCA Act was enacted on December 18, 2020. The HFCA Act states if the SEC determines that a company has filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years beginning in 2021, the SEC shall prohibit the company’s shares from being traded on a national securities exchange or in the over the counter trading market in the United States.

On March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements of the HFCA Act. A company will be required to comply with these rules if the SEC identifies it as having a “non-inspection” year under a process to be subsequently established by the SEC. The SEC is assessing how to implement other requirements of the HFCA Act, including the listing and trading prohibition requirements described above.

On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, and on December 29, 2022, legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law by President Biden, which contained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable Act and amended the HFCA Act by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time period for triggering the prohibition on trading.

On December 2, 2021, the SEC issued amendments to finalize rules implementing the submission and disclosure requirements in the HFCA Act, which took effect on January 10, 2022. The rules apply to registrants that the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that PCAOB is unable to inspect or investigate completely because of a position taken by an authority in foreign jurisdictions.

On December 16, 2021, PCAOB announced the PCAOB HFCA Act determinations (the “PCAOB determinations”) relating to the PCAOB’s inability to inspect or investigate completely registered public accounting firms headquartered in mainland China of the PRC or Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in the PRC or Hong Kong.

On August 26, 2022, the PCAOB announced that it had signed a Statement of Protocol (the “SOP”) with the China Securities Regulatory Commission and the Ministry of Finance of China. The SOP, together with two protocol agreements governing inspections and investigations (together, the “SOP Agreement”), establishes a specific, accountable framework to make possible complete inspections and investigations by the PCAOB of audit firms based in mainland China and Hong Kong, as required under U.S. law. The SOP Agreement remains unpublished and is subject to further explanation and implementation. Pursuant to the fact sheet with respect to the SOP Agreement disclosed by the SEC, the PCAOB shall have sole discretion to select any audit firms for inspection or investigation and the PCAOB inspectors and investigators shall have a right to see all audit documentation without redaction. On December 15, 2022, the PCAOB Board determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations to the contrary.

Friedman LLP, one of our former independent registered public accounting firm that issued the audit report for the fiscal year ended June 30, 2022; Marcum Asia CPAs LLP, one of our former independent registered public accounting firm that issues the audit report for the fiscal year ended June 30, 2023; and CT International LLP, our current independent registered public accounting firm that issued the audit report for the fiscal year ended June 30, 2024, are subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess its compliance with the applicable professional standards. Friedman LLP was headquartered in New York, NY prior to its merger with Marcum LLP. Marcum LLP is headquartered in New York, NY. Our current auditor, CT International LLP, headquartered in San Francisco, CA, is currently subject to PCAOB inspections and the PCAOB is able to inspect our auditor, CT International LLP was registered with PCAOB in April 2023, no inspection has occurred. In the future, if there is any regulatory change or step taken by PRC regulators or the SEC or Nasdaq applies additional and more stringent criteria, and if PCAOB determines that it is not able to inspect Marcum Asia CPAs LLP at such future time, Nasdaq may delist our Ordinary Shares and the value of our Ordinary Shares may significantly decline or become worthless. See “Item 3. Key Information - 3.D. Risk Factors - Risks Relating to Our Ordinary Shares- Our Ordinary Shares may be prohibited from being traded on a national exchange under the HFCA Act if the PCAOB determines that it cannot inspect or fully investigate our auditors for two consecutive years, and, as a result, an exchange may determine to delist our securities. As of the date of this annual report, our auditor is not subject to the determinations announced by the PCAOB on December 16, 2021. However, the delisting of our Ordinary Shares, or the threat of being delisted, may materially and adversely affect the value of investment in our Ordinary Shares.”

Recent Regulatory Development in the PRC

We are a holding company incorporated in the BVI with all of the operations conducted by an operating entity in Hong Kong. We currently do not have, nor do we currently intend to establish, any subsidiary nor do we plan to enter into any contractual arrangements to establish a VIE structure with any entity in mainland China. As of the date of this annual report, we and our Operating Subsidiary have received all requisite licenses, permissions, or approvals from Hong Kong and BVI authorities needed to engage in the businesses currently conducted in Hong Kong and BVI, and no permission or approval has been denied.

Hong Kong is a special administrative region of the PRC and the basic policies of the PRC regarding Hong Kong are reflected in the Basic Law of the Hong Kong Special Administrative Region (the “Basic Law”), which serves as Hong Kong’s constitution. The Basic Law provides Hong Kong with a high degree of autonomy and executive, legislative and independent judicial powers, including that of final adjudication under the principle of “one country, two systems”. Accordingly, as confirmed by our Hong Kong counsel, Long An & Lam, LLP, we believe the PRC laws and regulations do not currently have any material impact on our business, financial condition or results of operations. However, there is no assurance that there will not be any changes in the economic, political and legal environment in Hong Kong in the future. If there is significant change to current political arrangements between mainland China and Hong Kong, companies operated in Hong Kong may face similar regulatory risks as those operated in mainland China, including their ability to offer securities to you, list securities on a U.S. or other foreign exchange, conduct business or accept foreign investment. In light of China’s recent expansion of authority in Hong Kong, there are risks and uncertainties which we cannot foresee for the time being, and rules, regulations and the enforcement of laws in China can change quickly with little or no advance notice. The Chinese government may intervene or influence the current and future operations in Hong Kong at any time, or may exert more oversight and control over offerings conducted overseas and/or foreign investment in issuers likes ourselves.

The Regulations on Mergers and Acquisitions of Domestic Companies by Foreign Investors, or the M&A Rules, adopted by six PRC regulatory agencies in 2006 and amended in 2009, require an overseas special purpose vehicle formed for listing purposes through acquisitions of domestic companies in mainland China and controlled by companies or individuals of mainland China to obtain the approval of the CSRC, prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange.

In addition, on February 17, 2023, with the approval of the State Council, the CSRC released the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”) and five supporting guidelines, which came into effect on March 31, 2023. According to the Trial Measures, mainland China domestic companies that seek to offer and list securities in overseas markets, either by direct or indirect means, are required to fulfill the filing procedures with the CSRC and report relevant information. Junee is a holding company incorporated in the British Virgin Islands with an operating entity solely based in Hong Kong, and it does not have any subsidiary or VIE in the mainland China or intend to acquire any equity interest in any domestic companies within mainland China, nor is it controlled by any companies or individuals of mainland China.

Further, we are headquartered in Singapore with our chief executive officer, chief financial officer and all members of the board of directors based in Hong Kong who are not mainland China citizens, and all of our revenues and profits are generated by our subsidiary in Hong Kong. As such, we do not believe we would be subject to the M&A Rules or the Trial Measures. Moreover, pursuant to the Basic Law, PRC laws and regulations shall not be applied in Hong Kong except for those listed in Annex III of the Basic Law (which is confined to laws relating to national defense, foreign affairs and other matters that are not within the scope of autonomy). Therefore, as confirmed by our PRC counsel, Jincheng Tongda & Neal Law Firm, as of the date of this annual report, no permission or filing requirements from CSRC or any other governmental agency of mainland China is required to approve our subsidiary’s operations. Additionally, neither we nor our subsidiary is required to obtain the CSRC’s approval or complete any filing procedures prior to our listing on an exchange in the U.S. As of the date of this annual report, neither we nor OPS HK has applied for any such permission, approval or submitted any filing procedures. Notwithstanding the above opinion, our PRC counsel has further advised us that uncertainties exist as to how the M&A Rules and the Trial Measures will be interpreted and implemented by Chinese regulators and its opinions summarized above are subject to any new laws, rules, and regulations or detailed implementations and interpretations in any form relating to the M&A Rules and the Trial Measures. If the CSRC or other PRC regulatory agencies subsequently determine that prior CSRC approvals or filings are required for any of our offerings, we may face regulatory actions or other sanctions from the CSRC or other PRC regulatory agencies. Moreover, if there is significant change to the current political arrangements between mainland China and Hong Kong, or the applicable laws, regulations, or interpretations change that require us to obtain approvals from, or complete filings with, the CSRC or other PRC regulatory agencies at any stage in the future, and, if in such event, we or our Operating Subsidiary (i) do not receive or maintain the approval, or fail to comply with the filing requirements, (ii) inadvertently conclude that such permissions, approvals or filings are not required, (iii) are required to obtain such permissions, approvals or complete the filings in the future if applicable laws, regulations, or interpretations change, or (iv) are denied permission or filings from the CSRC or any other PRC regulatory agencies, we will not be able to list our Ordinary Shares on a U.S. exchange, or continue to offer securities to you, which would materially affect the interests of investors and cause the value of Ordinary Shares to significantly decline or be worthless.

Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in certain areas in mainland China with little advance notice, including a cracking down on illegal activities in the securities market, enhancing supervision over mainland China-based companies listed overseas using the variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. For example, on July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly issued a document to crack down on illegal activities in the securities market and promote the high-quality development of the capital market, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over mainland China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the mainland China securities laws. Also, on January 4, 2022, the Measures for Cybersecurity Review (the “Measures”) were published and became effective on February 15, 2022, which were originally promulgated on April 13, 2020, and, as revised on July 10, 2021, require that, among other things, and in addition to any “operator of critical information infrastructure”, any “data processor” controlling personal information of no less than one million users (which to be further specified) which seeks to list in a foreign stock exchange should also be subject to cybersecurity review, and which the Measures further elaborate on the factors to be considered when assessing the national security risks of the relevant activities.

Our Operating Subsidiary, OPS HK, currently has only served the Hong Kong local market and does not presently have any operations in mainland China. We do not currently expect the Measures to have an impact on our business, operations, nor do we anticipate the we or our Operating Subsidiary are covered by permission requirements from the CAC that is required to approve our subsidiary’s operations, as we do not believe that we may be deemed to be an “operator of critical information infrastructure” or a “data processor” controlling personal information of no less than one million users, that are required to file for cybersecurity review before listing in the U.S., because (i) all of our operations are conducted by our Operating Subsidiary which currently solely serve the Hong Kong local market, we currently have no operations in mainland China; (ii) we do not have or intend to have any subsidiary, nor do we have or intend to establish a VIE structure with any entity in mainland China and the Measures remain unclear whether they shall be applied to a company such as ours; (iii) as of date of this annual report, we have neither collected nor stored any personal information of any mainland China individual or within mainland China, nor do we entrust or expect to be entrusted by any individual or entity to conduct any data processing activities of any mainland China individual or within mainland China; and (iv) as of the date of this annual report, we have not been informed by any PRC governmental authority of any requirement that we must file for a cybersecurity review. Moreover, pursuant to the Basic Law, PRC laws and regulations shall not be applied in Hong Kong except for those listed in Annex III of the Basic Law (which is confined to laws relating to national defense, foreign affairs and other matters that are not within the scope of autonomy). As confirmed by our PRC counsel, Jincheng Tongda & Neal Law Firm, based on their understanding of the PRC laws and regulations that are currently in effect, neither we nor our subsidiary, OPS HK, are currently subject to the cybersecurity review by the CAC as provided under the Measures. Additionally, neither we nor our subsidiary is covered by permission requirements from the CAC or any other governmental agency that is required to approve our subsidiary’s operations. However, there remains uncertainty as to how the Measures will be interpreted or implemented and the relevant PRC governmental authority may not take a view that is consistent with our PRC counsel. Also, significant uncertainty exists in relation to the interpretation and enforcement of relevant PRC cybersecurity laws and regulations. If we were deemed to be an “operator of critical information infrastructure” or a “data processor” controlling personal information of no less than one million users under the Measures, or if other regulations promulgated in relation to the Measures are deemed to apply to us, our business operations and the listing of our Ordinary Shares in the U.S. could be subject to cybersecurity review by the Cyberspace Administration of China, or the CAC, in the future. Moreover, if there is significant change to the current political arrangements between mainland China and Hong Kong, or the applicable laws, regulations, or interpretations change, that require our Company to obtain approval from the CAC or any other governmental agency in the future, and, if in such event, at any stage, we or our Operating Subsidiary (i) do not receive or maintain the approval, (ii) inadvertently conclude that such permissions or approvals are not required, or (iii) are required to obtain such permissions or approvals in the future if applicable laws, regulations, or interpretations change, or (iv) are denied permission from the CAC or any other PRC regulatory agencies, we will not be able to list our Ordinary Shares on a U.S. exchange, or continue to offer securities to you, which would materially affect the interests of investors and cause the value of Ordinary Shares to significantly decline or be worthless.

Nevertheless, since these statements and regulatory actions are new, it is highly uncertain how soon the legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any. It is also highly uncertain what the potential impact such modified or new laws and regulations will have on OPS HK’s daily business operation, its ability to accept foreign investments and the listing of our Ordinary Shares on a U.S. or other foreign exchanges.

If there is significant change to current political arrangements between mainland China and Hong Kong, if we or our Operating Subsidiary at any stage, (i) do not receive or maintain the approval, (ii) inadvertently conclude that such permissions or approvals are not required, (iii) are required to obtain such permissions or approvals in the future if applicable laws, regulations, or interpretations change, or (iv) are denied permission from the CSRC, the CAC or any other relevant PRC regulatory agencies, the relevant regulatory authorities, such as the CAC or the CSRC, might have broad discretion in dealing with such violations, including: imposing fines on us or the Operating Subsidiary, discontinuing or restricting the operations of the subsidiary; imposing conditions or requirements with which we or OPS HK may not be able to comply; restricting or prohibiting our use of the proceeds from our initial public offering to finance the business and operations in Hong Kong. The imposition of any of these penalties would also result in a material and adverse effect on our ability to conduct business, and on our operations and financial condition. If any or all of the foregoing were to occur, it may cause the value of our Ordinary Shares to significantly decline or become worthless. Moreover, we might not be able to list our Ordinary Shares on a U.S. exchange, or continue to offer securities to you, which would also materially affect the interests of investors and cause the value of Ordinary Shares to significantly decline or be worthless.

Regarding our Hong Kong operating entity, OPS HK is an interior design service provider incorporated and with all the business operations in Hong Kong. OPS HK, is required to and has obtained, business registration certificate as required by every company carrying on business in Hong Kong. As of the date of this annual report, our Hong Kong counsel, Long An & Lam LLP, confirms that there is no statutory or mandatory licensing and qualification system in Hong Kong governing the provision of interior designs, project management services and fitting-out works, other than certain permit requirements for certain business that OPS HK conducts. OPS HK is a Registered Minor Works Contractor (Class II and III) with the Buildings Department under the Building (Minor Works) Regulation (Chapter 123N of the Laws of Hong Kong) and therefore, OPS HK can perform fit-out services requiring such qualifications. In addition, OPS HK carries on business that may become subject to the registration requirements under Buildings Ordinance (Chapter 123 of the Laws of Hong Kong) if it expands into the category of “buildings works” which is defined thereunder as “any kind of building construction, site formation works, ground investigation in the scheduled areas, foundation works, repairs, demolition, alteration, addition and every kind of building operation, and includes drainage works”. As of the date of this annual report, where specific fit-out work requires a particular license, permit or approval, OPS HK will engage subcontractors with suitable qualifications to perform such work.

3.A. [Reserved]

3.B. Capitalization and Indebtedness

Not applicable for annual reports on Form 20-F.

3.C. Reasons for the Offer and Use of Proceeds

Not applicable for annual reports on Form 20-F.

3.D. Risk Factors

Risk Factor Summary

You should carefully consider all of the information in this annual report before making an investment in our Ordinary Shares. Below please find a summary of the principal risks and uncertainties we face, organized under relevant headings. In particular, as we are a Hong Kong-based company incorporated in the British Virgin Islands, you should pay special attention to subsections headed “Item 3. Key Information-3.D. Risk Factors-Risks Relating to Our Corporate Structure.” and “Item 3. Key Information-3.D. Risk Factors-Risks Relating to Doing Business in Hong Kong in which the Operating Subsidiary Operates”.

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows, and prospects. These risks are discussed more fully below and include, but are not limited to, risks related to:

Risks Relating to Our Corporate Structure

| ● | We rely on dividends and other distributions on equity paid by our Operating Subsidiary to fund any cash and financing requirements we may have. In the future, funds may not be available to fund operations or for other use outside of Hong Kong, due to interventions in, or the imposition of restrictions and limitations on, our ability or our subsidiaries by the PRC government to transfer cash. Any limitation on the ability of our Ordinary Subsidiary to make payments to us could have a material adverse effect on our ability to conduct our business and might materially decrease the value of our Ordinary Shares or cause them to be worthless. |

| ● | Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in certain areas in mainland China with little or no advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over mainland China-based companies listed overseas using the variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. In the future, we may be subject to PRC laws and regulations related to the current business operations of our Operating Subsidiary and any changes in such laws and regulations and interpretations may impair its ability to operate profitably, which could result in a material negative impact on its operations and/or the value of the securities we are registering for sale. |

| ● | We may become subject to a variety of PRC laws and other obligations regarding M&A Rules and data security, and any failure to comply with applicable laws and obligations could have a material and adverse effect on our business, financial condition and results of operations. |

| ● | Substantially all of our Operating Subsidiary’s operations are conducted in Hong Kong. However, due to the long arm provisions under the current PRC laws and regulations, the Chinese government may exercise significant oversight and discretion over the conduct of such business and may intervene in or influence such operations. at any time, which could result in a material change in the operations of the Operating Subsidiary and/or the value of our Ordinary Shares. The PRC government may also intervene or impose restrictions on our ability to move money out of Hong Kong to distribute earnings and pay dividends or to reinvest in our business outside of Hong Kong. Changes in the policies, regulations, rules, and the enforcement of laws of the Chinese government may also occur quickly with little advance notice and our assertions and beliefs of the risk imposed by the PRC legal and regulatory system cannot be certain. |

| ● | If the Chinese government chooses to extend oversight and control over offerings that are conducted overseas and/or foreign investment in mainland China-based issuers to Hong Kong-based issuers, such action may cause the value of our Ordinary Shares to significantly decline or be worthless. |

| ● | We are an “emerging growth company” within the meaning of the Securities Act, and if we take advantage of certain exemptions from disclosure requirements available to emerging growth companies, this could make it more difficult to compare our performance with other public companies. |

| ● | As an “emerging growth company” under applicable law, we are subject to lessened disclosure requirements. Such reduced disclosure may make our Ordinary Shares less attractive to investors. |

| ● | We continue to incur increased costs as a result of being a public company, particularly after we cease to qualify as an “emerging growth company”. |

| ● | OPS Holdings Limited, our largest shareholder, continues to own more than a majority of the voting power of our outstanding Ordinary Shares. As a result, OPS Holdings Limited has the ability to control the outcome of matters submitted to the shareholders for approval. Additionally, we are deemed as a “controlled company” and may follow certain exemptions from certain corporate governance requirements that could adversely affect our public shareholders. |

| ● | It is not certain if Junee Limited will be classified as a Singapore tax resident. |

Risks Relating to Doing Business in Hong Kong in which the Operating Subsidiary Operates

| ● | It may be difficult for overseas shareholders and/or regulators to conduct investigations or collect evidence within the territory of China, including Hong Kong. |

| ● | You may incur additional costs and procedural obstacles in effecting service of legal process, enforcing foreign judgments or bringing actions in Hong Kong against us or our management named in this annual report based on Hong Kong laws. |

| ● | The enactment of Law of the PRC on Safeguarding National Security in the Hong Kong Special Administrative Region (the “Hong Kong National Security Law”) could impact our Operating Subsidiary. |

| ● | The Hong Kong regulatory requirement of prior approval for the transfer of shares in excess of a certain threshold may restrict future takeovers and other transactions. |

| ● | The enforcement of foreign civil liabilities in the British Virgin Islands and Hong Kong is subject to certain conditions. Therefore, certain judgments obtained against us by our shareholders may be difficult to enforce in such jurisdictions. |

| ● | The enforcement of laws and rules and regulations in China can change quickly with little advance notice. Additionally, the PRC laws and regulations and the enforcement of such that apply or are to be applied to Hong Kong can change quickly with little or no advance notice. As a result, the Hong Kong legal system embodies uncertainties which could limit the availability of legal protections, which could result in a material change in our Operating Subsidiary’s operations and/or the value of the securities we are registering for sale. |

| ● | There are some political risks associated with conducting business in Hong Kong. |

Risks Relating to Our Ordinary Shares

| ● | We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to U.S. domestic public companies. |

| ● | Our Ordinary Shares may be prohibited from being traded on a national exchange under the HFCA Act if the PCAOB determines that it cannot inspect or fully investigate our auditors for two consecutive years, and, as a result, an exchange may determine to delist our securities. As of the date of this annual report, our auditor is not subject to the determinations announced by the PCAOB on December 16, 2021. However, the delisting of our Ordinary Shares, or the threat of being delisted, may materially and adversely affect the value of investment in our Ordinary Shares. |

| ● | The recent joint statement by the SEC and proposed rule changes submitted by NASDAQ, all call for additional and more stringent criteria to be applied to emerging market companies. These developments could add uncertainties to our business operations, share price and reputation. |

| ● | Substantial future sales of our Ordinary Shares or the anticipation of future sales of our Ordinary Shares in the public market could cause the price of our Ordinary Shares to decline. |

| ● | We do not intend to pay further dividends for the foreseeable future. |

| ● | If securities or industry analysts do not publish research or reports about our business, or if they publish a negative report regarding our Ordinary Shares, the price of our Ordinary Shares and trading volume could decline. |

| ● | The market price for our Ordinary Shares may be volatile. |

| ● | You may face difficulties in protecting your interests, and the ability to protect your rights through U.S. courts may be limited, because we are incorporated under British Virgin Islands law. |

| ● | As a foreign private issuer, we are permitted to, and we will, rely on exemptions from certain NASDAQ Stock Exchange corporate governance standards applicable to domestic U.S. issuers. This may afford less protection to holders of our Ordinary Shares. |

| ● | If we cease to qualify as a foreign private issuer, we would be required to comply fully with the reporting requirements of the Exchange Act applicable to U.S. domestic issuers, and we would incur significant additional legal, accounting and other expenses that we would not incur as a foreign private issuer. |

| ● | Because our business is conducted in Hong Kong dollars and the price of our Ordinary Shares is quoted in United States dollars, changes in currency conversion rates may affect the value of investments. |

| ● | Volatility in our Ordinary Shares price may subject us to securities litigation. |

| ● | Our existing shareholders that are not included in the registration statement of our initial public offering is able to sell their Ordinary Shares subject to restrictions under the Rule 144. |

| ● | There can be no assurance that we will not be deemed to be a passive foreign investment company, or PFIC, for U.S. federal income tax purposes for any taxable year, which could result in adverse U.S. federal income tax consequences to U.S. holders of our ordinary shares. |

| ● | Our lack of effective internal controls over financial reporting may affect our ability to accurately report our financial results or prevent fraud which may affect the market for and price of our Ordinary Share. |

| ● | The price of our Ordinary Shares could be subject to rapid and substantial volatility, and such volatility may make it difficult for prospective investors to assess the rapidly changing value of our Ordinary Shares. |

| ● | Any resale of our Ordinary Shares in the public market by the Selling Shareholders or by investors in our initial public offering may cause the market price of our Ordinary Shares to decline. |

Risks Relating to Our Industry and Business

| ● | OPS HK faces a high level of competition in the interior design industry in Hong Kong. |

| ● | OPS HK’s business may suffer if it does not respond effectively to changes in regulatory and industry standards. |

| ● | The interior design business is project-based and profitability is dependent on the negotiated terms under each of the agreement through OPS HK, and may vary from project to project. In addition, the overall gross profit margin is affected by strategies from time to time. OPS HK’s past performance does not indicate future performance. |

| ● | The costs of sales of OPS HK have historically fluctuated. If OPS HK experiences any significant/material increase in costs of sales, its gross profit margin might decrease and the business operations and financial position might be materially and adversely affected. |

| ● | The estimated project costs could prove inaccurate and any cost overruns for projects may reduce the profits of OPS HK and its financial performance would be adversely affected. |

| ● | OPS HK incurs time and cost in the design stage. If the potential customers that OPS HK presents its interior design proposals but do not ultimately engage OPS HK for its fitting-out works, the business and financial performance could be adversely affected. |

| ● | OPS HK relies heavily on its recurring customers for business and experience in its alternative means of obtaining new business is limited. |

| ● | A significant portion of total revenue of OPS HK was derived from a few major customers. A high concentration of its revenue from a few major customers means that loss of business from any of them may have a significant negative impact on its business and financial performance. |

| ● | Fit-out work can be labor-intensive. If subcontractors of OPS HK experience any shortage of labor or significant increase in labor costs, or more expenses may be incurred, projects may be delayed or OPS HK may not be able to pass on such cost to the customers and, in turn its profitability may be adversely affected. |

| ● | Our financial performance relies on designers and other skilled workers hired by it to complete the projects and the retention and recruitment of these skilled professionals is challenging. We cannot be certain that OPS HK will be able to retain its existing designers and other skilled workers or recruit additional qualified professionals to support its future operations and growth. Any failure to do so may adversely affect the business and growth. |

| ● | We depend on our core management personnel in operating business. As competition for such management talents is fierce and new hires may not necessarily fit in well with the current management team, any loss of key management personnel may be detrimental to our business and prospects. |

| ● | OPS HK may not be able to implement our business plans effectively to achieve future growth. |

| ● | We may not be successful in our future acquisitions, and we may face difficulties in integrating acquired businesses with our existing business. |

| ● | OPS HK’s business is affected by the conditions of the Hong Kong economy and property market and the performance of the relevant business sectors. |

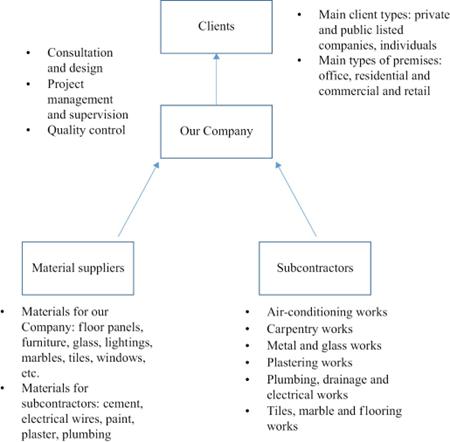

| ● | OPS HK’s business depends on materials suppliers and subcontractors to complete its projects. |

| ● | OPS HK’s business relies on subcontractors to comply with relevant laws, rules and regulations. If subcontractors fail to comply with any laws, rules and regulations, our financial performance and business operation may be adversely affected and we may be subject to prosecution. |

| ● | OPS HK relies on the seamless communication and cooperation between its sales and marketing team, the design team and the project team to ensure smooth completion of projects. |

| ● | The success of OPS HK depends on customers’ perception of the quality of its work and its ability to satisfy possibly multiple interested parties in any given project. |

| ● | If OPS HK were to become unable to anticipate or respond effectively to its customers’ preferences, its financial performance could be adversely affected. |

| ● | OPS HK is exposed to liquidity risk and the credit risk of its customers. |

| ● | Delays in the completion of projects may cause OPS HK to incur additional costs and experience delays in receiving payments and its reputation may be adversely affected. |

| ● | If OPS HK fails to meet certain standards in relation to the quality, safety or environmental aspects of its work or products, OPS HK may incur additional costs in remedying the defects and its reputation may suffer. |

| ● | Negative publicity or damage to the reputation of OPS HK may have adverse an impact on its business, growth prospects and financial performance. |

| ● | OPS HK’s insurance policies may be insufficient to cover all liabilities arising from claims and litigation. |

| ● | Any recurrence of global financial crisis may have negative repercussions on the target customers of OPS HK. |

| ● | The business of OPS HK may be adversely affected by further increase in interest rates. |

Risks Relating to our Corporate Structure

We rely on dividends and other distributions on equity paid by our Operating Subsidiary to fund any cash and financing requirements we may have. In the future, funds may not be available to fund operations or for other use outside of Hong Kong, due to interventions in, or the imposition of restrictions and limitations on, our ability or our Operating Subsidiary by the PRC government to transfer cash. Any limitation on the ability of our Operating Subsidiary to make payments to us could have a material adverse effect on our ability to conduct our business and might materially decrease the value of our Ordinary Shares or cause them to be worthless.

We are a holding company incorporated in the British Virgin Islands, and we rely on dividends and other distributions on equity paid by our Operating Subsidiary for our cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders and service any debt we may incur. If our Operating Subsidiary incurs debt on its own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to us.

Under the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect of dividends paid by us. We are headquartered in Singapore, under the current practice of the Inland Revenue Authority of Singapore, no tax is payable in Singapore in respect of dividends paid by us. The PRC laws and regulations do not currently have any material impact on transfers of cash from Junee to OPS HK or from OPS HK to Junee, our shareholders and U.S. investors. However, the Chinese government may, in the future, impose restrictions or limitations on our ability to transfer money out of Hong Kong, to distribute earnings and pay dividends to and from the other entities within our organization, or to reinvest in our business outside of Hong Kong. Such restrictions and limitations, if imposed in the future, may delay or hinder the expansion of our business to outside of Hong Kong and may affect our ability to receive funds from our Operating Subsidiary in Hong Kong. The promulgation of new laws or regulations, or the new interpretation of existing laws and regulations, in each case, that restrict or otherwise unfavorably impact the ability or way we conduct our business, could require us to change certain aspects of our business to ensure compliance, which could decrease demand for our services, reduce revenues, increase costs, require us to obtain more licenses, permits, approvals or certificates, or subject us to additional liabilities. To the extent any new or more stringent measures are required to be implemented, our business, financial condition and results of operations could be adversely affected and such measured could materially decrease the value of our Ordinary Shares, potentially rendering them worthless.

Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in certain areas in mainland China with little or no advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over mainland China-based companies listed overseas using the variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. In the future, we may be subject to PRC laws and regulations related to the current business operations of our Operating Subsidiary and any changes in such laws and regulations and interpretations may impair its ability to operate profitably, which could result in a material negative impact on its operations and/or the value of the securities we are registering for sale.

Although we have direct ownership of our operating entities in Hong Kong and currently do not have or intend to have any subsidiary or any contractual arrangement to establish a VIE structure with any entity in mainland China, we are still subject to certain legal and operational risks associated with our Operating Subsidiary, OPS HK, being based in Hong Kong and having all of its operations to date in Hong Kong. Additionally, the legal and operational risks associated in mainland China may also apply to operations in Hong Kong, and we face the risks and uncertainties associated with the complex and evolving PRC laws and regulations and as to whether and how the recent PRC government statements and regulatory developments, such as those relating to data and cyberspace security and anti-monopoly concerns, would be applicable to a company such as OPS HK or Junee, given the substantial operations of OPS HK in Hong Kong and the Chinese government may exercise significant oversight over the conduct of business in Hong Kong. In the event that we or our Operating Subsidiary were to become subject to PRC laws and regulations, we could incur material costs to ensure compliance, and we or our Operating Subsidiary might be subject to fines, experience devaluation of securities or delisting, no longer be permitted to conduct offerings to foreign investors, and\or no longer be permitted to continue business operations as presently conducted. Our organizational structure involves risks to the investors, and Chinese regulatory authorities could disallow this structure, which would likely result in a material change in OPS HK’s operations and/or a material change in the value of the securities Junee has registered for sale, including the risk that such event could cause the value of such securities to significantly decline or become worthless. Moreover, there are substantial uncertainties regarding the interpretation and application of PRC laws and regulations including, but not limited to, the laws and regulations related to our business and the enforcement and performance of our arrangements with customers in certain circumstances. The laws and regulations are sometimes vague and may be subject to future changes, and their official interpretation and enforcement may involve substantial uncertainty. The effectiveness and interpretation of newly enacted laws or regulations, including amendments to existing laws and regulations, may be delayed, and our business may be affected if we rely on laws and regulations which are subsequently adopted or interpreted in a manner different from our understanding of these laws and regulations. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our business.

The uncertainties regarding the enforcement of laws and the fact that rules and regulations in China can change quickly with little advance notice, along with the risk that the Chinese government may intervene or influence our Operating Subsidiary’s operations at any time could result in a material change in our Operating Subsidiary’s operations and/or the value of the securities we are registering.

We may become subject to a variety of PRC laws and other obligations regarding M&A Rules and data security, and any failure to comply with applicable laws and obligations could have a material and adverse effect on our business, financial condition and results of operations.

The Regulations on Mergers and Acquisitions of Domestic Companies by Foreign Investors, or the M&A Rules, adopted by six PRC regulatory agencies in 2006 and amended in 2009, requires an overseas special purpose vehicle formed for listing purposes through acquisitions of domestic companies in mainland China and controlled by companies or individuals of mainland China to obtain the approval of the China Securities Regulatory Commission, or CSRC, prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange. In addition, on February 17, 2023, with the approval of the State Council, the CSRC released the Trial Measures and five supporting guidelines, which came into effect on March 31, 2023. According to the Trial Measures, mainland China domestic companies that seek to offer and list securities in overseas markets, either by direct or indirect means, are required to fulfill the filing procedures with the CSRC and report relevant information.

Junee is a holding company incorporated in the British Virgin Islands with an operating entity based in Hong Kong, as of the date of this annual report, we have no subsidiary, VIE structure or any direct operations in mainland China, nor do we intend to have any subsidiary or VIE structure or to acquire any equity interests in any domestic companies in mainland China, and we are not controlled by any companies or individuals of mainland China. Further, we are headquartered in Singapore, with our chief executive officer, chief financial officer and all members of the board of directors of Junee are based in Hong Kong are not mainland China citizens and all of our revenues and profits are generated by our Operating Subsidiary in Hong Kong. Moreover, pursuant to the Basic Law, PRC laws and regulations shall not be applied in Hong Kong except for those listed in Annex III of the Basic Law (which is confined to laws relating to national defense, foreign affairs and other matters that are not within the scope of autonomy). Therefore, as confirmed by our PRC counsel, Jincheng Tongda & Neal Law Firm, as of the date of this annual report, the CSRC’s approval is not required for the listing and trading of our Ordinary Shares on a U.S. exchange as provided under the M&A Rules, and we are not subject to filing requirements with the CSRC under the Trial Measures.

We are aware that, recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in certain areas in mainland China with little advance notice, including a cracking down on illegal activities in the securities market, enhancing supervision over mainland China-based companies listed overseas using the variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. For example, on July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly issued a document to crack down on illegal activities in the securities market and promote the high-quality development of the capital market, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over mainland China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC securities laws.

In addition, on January 4, 2022, the Measures were published and became effective on February 15, 2022, which were originally promulgated by the CAC on April 13, 2020, and, as revised on July 10, 2021, required that, among other things, and in addition to any “operator of critical information infrastructure”, any “data processor” controlling personal information of no less than one million users which seeks to list in a foreign stock exchange should also be subject to cybersecurity review, and which further elaborate on the factors to be considered when assessing the national security risks of the relevant activities. The publication of the Measures indicates greater oversight by the CAC over data security, which may impact our business and any of our future offering. As of the date of this annual report, our Operating Subsidiary, OPS HK, does not have any mainland China individuals as clients. However, OPS HK may collect and store certain data (including certain personal information) from its customers for “Know Your Customers” purposes, which may include mainland China individuals in the future. As of the date of this annual report, as confirmed by our PRC counsel, Jincheng Tongda & Neal Law Firm, we do not expect the Measures to have an impact on our business, operations to subject us or our Operating Subsidiary to permission requirements from the CAC or any other government agency that is required to approve our Operating Subsidiary’s operations, as we do not believe that we will be deemed to be an “operator of critical information infrastructure” or a “data processor” controlling personal information of no less than one million users, that are required to file for cybersecurity review before listing in the U.S., because (i) all of our Operating Subsidiary’s operations are conducted by our Operating Subsidiary which currently solely serve the Hong Kong local market, we currently have no operations in mainland China; (ii) we do not have or intend to have any subsidiary nor do we have or intend to establish a VIE structure with any entity in mainland China and the Measures remain unclear whether they shall be applied to a company like us; (iii) as of date of this annual report, we have neither collected nor stored any personal information of any mainland China individual or within mainland China, nor do we entrust or expect to be entrusted by any individual or entity to conduct any data processing activities of any mainland China individual or within mainland China; (iv) as of the date of this annual report, we have not been informed by any PRC governmental authority of any requirement that we must file for a cybersecurity review; and (v) pursuant to the Basic Law of the Hong Kong Special Administrative Region, or the Basic Law, PRC laws and regulations shall not be applied in Hong Kong except for those listed in Annex III of the Basic Law (which is confined to laws relating to national defense, foreign affairs and other matters that are not within the scope of autonomy). However, there remains significant uncertainty in the interpretation and enforcement of relevant PRC cybersecurity laws and regulations. If we were deemed to be an “operator of critical information infrastructure” or a “data processor” controlling personal information of no less than one million users, or if other regulations promulgated in relation to the Measures are deemed to apply to us, our business operations and the listing of our Ordinary Shares in the U.S. could be subject to CAC’s cybersecurity review or we and our Operating Subsidiary might be covered by permission from the CAC or any other government agency that is required to approve our Operating Subsidiary’s operations in the future. Nevertheless, since these statements and regulatory actions are new, it is highly uncertain how soon the legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any. It also remains highly uncertain what the potential impact such modified or new laws and regulations will have on our Operating Subsidiary’s daily business operations, its ability to accept foreign investments and the listing of our Ordinary Shares on a U.S. or other foreign exchanges. If any or all of the foregoing were to occur, it may cause the value of our Ordinary Shares to significantly decline or become worthless.

As of the date of this annual report, we are advised by Hong Kong counsel, Long An & Lam LLP, that we are not required to obtain permission or approval from Hong Kong authorities to offer the securities being registered to foreign investors. Should there be any change in applicable laws, regulations, or interpretations, and we or any of our subsidiaries are required to obtain such permissions or approvals in the future, we will strive to comply with the then applicable laws, regulations, or interpretations.

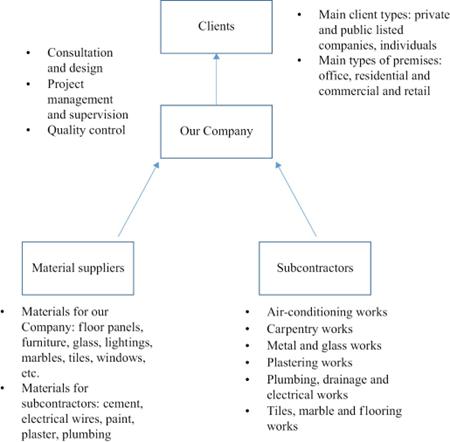

As confirmed by our PRC counsel, Jincheng Tongda & Neal Law Firm, based on their understanding of the PRC laws and regulations currently in effect, as of the date of this annual report, neither we nor our Operating Subsidiary, OPS HK, is subject to the M&A Rules, the Trial Measures, the Measures or the regulations or policies that have been issued by the CSRC or the CAC as of the date of this annual report, nor are we currently covered by permission requirements from the CSRC, the CAC or any other PRC governmental agency that is required to approve our listing on the U.S. exchanges and offering securities. Hence, based on the foregoing, since we are not subject to the regulations or policies issued by the CAC to date, we believe that we are currently not required to be compliant with such regulations and policies issued by the CAC as of the date of this annual report. Further, as of the date of this annual report, neither we nor OPS HK has ever applied for any such permission or approval, as we currently are not subject to the M&A Rules or the regulations and policies issued by the CAC. However, if there is significant change to current political arrangements between mainland China and Hong Kong, or the applicable laws, regulations, or interpretations change, and, in such event, if we are required to obtain such approvals in the future and we do not receive or maintain the approvals or is denied permission from mainland China or Hong Kong authorities, we will not be able to list our Ordinary Shares on a U.S. exchange, or continue to offer securities to you, which would materially affect the interests of the investors and cause significant the value of our Ordinary Shares significantly decline or be worthless.