- HWH Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

HWH International (HWH) CORRESPCorrespondence with SEC

Filed: 17 Mar 23, 12:00am

ALSET CAPITAL ACQUISITION CORP.

4800 Montgomery Lane, Suite 210

Bethesda, MD, 20814

March 17, 2023

Nasreen Mohammed and Angela Lumley

Division of Corporation Finance

Office of Manufacturing

Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

| Re: | Alset Capital Acquisition Corp. | |

| Amendment No. 3 to Registration Statement on Form S-4 | ||

| Filed February 3, 2023 | ||

| File No. 333-267841 |

Dear Ms. Mohammed and Ms. Lumley:

On behalf of Alset Capital Acquisition Corp. (the “Company”), this letter responds to comments provided by the staff of the Division of Corporation Finance (the “Staff”), of the Securities and Exchange Commission (the “Commission”) provided to the undersigned on February 28, 2023 regarding the Company’s registration Statement on Form S-4.

For convenience, the Staff’s comments have been restated below and the Company’s responses are set out immediately under the restated comments. Unless otherwise indicated, defined terms used herein have the meanings set forth in the registration statement.

Form S-4 Filed February 3, 2023

Amendment 3 to Registration Statement on Form S-4

Q: What equity stake will current stockholders of Alset and the HWH Holders hold in Alset after the Closing? page 12

| 1. | Please revise the tables on pages 12, 33 and 119 so that they include a separate line item for each of the Sponsor, HWH Holders, the “newly issued shares,” and public stockholders of Alset, and a line item for the shares ultimately controlled by Mr. Chan. |

Response: In response to this comment, the Company advises the Staff that it has updated the table on pages 12, 33 and 119 to include the requested line items.

Q: What interests do Alset’s current officers and directors have in the Business Combination?, page 16

| 2. | We note your revised disclosure in response to comment 3 and reissue our comment in part. Please make conforming changes to your disclosure in this section on page 16 as you have made on pages 43, 95, and 117. Please also quantify any amounts subject to reimbursement and quantify the aggregate amount that the sponsor, its affiliates, and the company’s officers and directors have at risk that depends on completion of a business combination on pages 16, 43, 95, and 117. |

Division of Corporation Finance

Office of Manufacturing

Securities and Exchange Commission

March 17, 2023

Page 2

Response: In response to this comment, the Company advises the Staff that it has made conforming changes on page 16, as we have initially made those changes on pages 43, 95 and 117. Additionally, assuming a $10 per share stock price at the time of the business combination, the market value of the Alset shares the Sponsor owns is approximately $29.1 million. Additionally, the market value of the Alset shares which is attributable to Mr. Chan’s indirect ownership is approximately $71.5 million considering additional HWH ownership which is not under the Sponsor. Total market value of Alset shares under the ownership of the Sponsor and Mr. Chan is approximately $85.2 million. Other Alset current officers and directors do not have interests. No officers and directors, including Mr. Chan, would be directly compensated by cash or other considerations, except Alset’s stock discussed above.

Unaudited Pro Forma Condensed Combined Financial Information

Notes to the Unaudited Pro Forma Condensed Combined Financial Information

Note 3. Transaction Accounting Adjustments to the Alset and HWH Unaudited Pro Forma Condensed Combined Balance Sheet as of August 31, 2022, page 57

| 3. | We have reviewed your response to comment 7 noting it does not appear to address our comment in its entirety, therefore it is being reissued. Please tell us how you considered the indirect ownership in determining that HWH International and Alset were not under common control. In addition, your response states that Mr. Chan owns 23.4% of Alset before and after the business combination. This appears to be inconsistent with the disclosure on page 28 which states Mr. Chan only owned 16.2% indirect interest in Alset before the business combination. Please clarify and revise. |

Response: In response to this comment, the Company advises the Staff that all direct and indirect ownerships were included and considered in the process to determine that HWH International and Alset were not under common control. Additionally, pre-business combination, Mr. Chan beneficially owns 11.3% of Alset, and post business combination, Mr. Chan will own 22.2% of HWH.

Risk Factors

We may not be able to complete an initial business combination with a U.S. target company, page 81

| 4. | We note your revised disclosure in response to comment 8 that “investors will not have the opportunity to liquidate.” Please clarify what this means and if investors would still have the opportunity to redeem their shares for cash. |

Response: In response to this comment, the Company advises the Staff that we have removed the disclosure on page 81 with regard to investors not having the opportunity to liquidate, and have confirmed that no such disclosure is made throughout the S-4. Additionally, note that holders have the opportunity to redeem the Class A Shares.

Division of Corporation Finance

Office of Manufacturing

Securities and Exchange Commission

March 17, 2023

Page 3

Timeline of the Business Combination with HWH, page 106

| 5. | We note your disclosure that “seeking to confirm the valuation provided in late May 2022,” Alset engaged ValueScope Inc. to provide an independent valuation of HWH. Please disclose the amount of the valuation provided in late May 2022 and disclose which party proposed the valuation. |

Response: In response to this comment, the Company advises the Staff that the company obtained a valuation from Kraft Analytics in late May, 2022. The valuation showed a value of between $334- $556 million. The Company, however, did not materially rely on this valuation, and instead, engaged ValueScope Inc. to provide an independent valuation of HWH. The Company relied on the valuation from ValueScope, Inc., which was completed in late July, 2022, in determining the proper consideration to be paid in the business combination, which was valued at $125,000,000. This was the valuation independently relied on in helping establish the purchase price of $125,000,000.

| 6. | We reissue comment 11. Where you state on page 106 that in early June, 2022, Alset received a copy of HWH’s corporate presentation containing preliminary high-level projections, please clarify in your disclosure whether those projections are the same as those included on page 109. If not, please disclose such projections in your filing. |

Response: In response to this comment, the Company advises the Staff that the projections are the same as originally included on page 109.

| 7. | We note your revised disclosure in response to comment 14 that once you get closer to the date of approval of the Business Combination, you and EF Hutton will enter into negotiations with potential investors. Please discuss why additional financing has not been secured to date. |

Response: In response to this comment, the Company advises the Staff that it has begun discussions with EF Hutton regarding additional financings, but no structure has been agreed upon at this time. Investors will continue evaluating the progress of the SEC comment response process, and will continue to evaluate this progress until the S-4 gets closer to becoming effective with the SEC.

Division of Corporation Finance

Office of Manufacturing

Securities and Exchange Commission

March 17, 2023

Page 4

Alset’s Board of Directors Reasons for the Approval of the Business Combination, page 109

| 8. | We note your revised disclosure in response to comment 13 that Mr. Chan participated in the votes to approve the business combination. Please clarify how Alset’s board considered the conflicts of interest presented by the affiliation between Alset and HWH and the overlapping nature of directors and officers of Alset and HWH in negotiating and recommending the business combination. |

Response: In response to this comment, the Company advises the Staff that due to the related nature of the Board, the Agreement has not been negotiated on an arm’s length basis. The Company makes this fact clear throughout the S-4, where we discuss the related party nature of the transaction.

Material U.S. Federal Income Tax Considerations, page 131

| 9. | We reissue comment 16, as we are unable to locate your revised disclosure. Please revise your disclosure in this section to explain why counsel is giving a “should” opinion and cannot give a “firm” opinion with respect to the company’s treatment under Sections 302(a) and 351 of the Code, and describe the nature and degree of the uncertainty concerning the opinion. Please also re-insert the similar language that you deleted from page 91. In addition, please confirm that, to the extent Exhibit 8.1 will constitute a short- form tax opinion, you will revise this section to state that it is the opinion of named counsel. Refer to Section III.B of Staff Legal Bulletin No. 19 for more information. |

Response: In response to this comment, the Company advises the Staff that it has removed the discussion with respect to the “should opinion” issued, and similar discussions, throughout the S-4 as it relates Section 302(a) and 351 of the Code. Accordingly, we feel we’ve addressed this comment.

Executive Compensation of HWH, page 166

| 10. | We note your revised disclosure in response to comment 17. Please further revise to include amounts in the “total” column of your Summary Compensation table. Please also update your Director Compensation disclosure on page 167 for 2022. |

Response: In response to this comment, the Company advises the Staff that it has updated the Summary Compensation table for 2022 on page 167.

Liquidity and Capital Resources, page 171

| 11. | Please further revise to state the source of the “proceeds we raise as part of the Business Combination,” as well as the likely range in the amount of such proceeds. |

Response: In response to this comment, the Company advises the Staff that the Company’s, as discussed in comment 7, the Company intends to work with EF Hutton to enter in negotiations with potential investors when the S-4 gets closer gets closer to becoming effective. The Company anticipates that there will be approximately $30,000,000 in gross proceeds in the PIPE.

Division of Corporation Finance

Office of Manufacturing

Securities and Exchange Commission

March 17, 2023

Page 5

HWH Management’s Discussion and Analysis of Financial Condition and Results of Operations Results of Operations, page 171

| 12. | We note your response and revised disclosure to comment 19 and 20 noting it does not appear to address our comment in its entirety, therefore it is being reissued. Please provide a robust explanation to further explain your decline in your membership fees, including the number of members and the fees charges for the memberships in each of the corresponding periods. In addition, please provide an explanation for the increase in food and beverage. |

Response: In response to this comment, the Company advises the Staff that we had planned to launch a new program, which changed our focus, which as a result slowed down sales beginning from May 2021, and membership sales stopped in March of 2022, completely. Additionally, we started the Food and Beverage (“FnB”) business in the year 2022, in which we launched two cafés in Singapore, and one in South Korea. Additionally, please see the following table below, which illustrates revenues received from memberships:

| For Year 2022 | For Year 2021 | Variance | ||||||||||

| Number of Memberships Sold | 200 | 3,676 | (3,631 | ) | ||||||||

| Cash received from membership | 168,900 | 3,496,365 | (3,327,465 | ) | ||||||||

Revenue, page 171

| 13. | We note your response to comment 18 that your revenue decreased approximately 10% due to restrictions related to the COVID-19 pandemic. Please revise your discussion in this section where you mention the decrease in revenue to address the impact of COVID as well. |

Response: In response to this comment, the Company advises the Staff that we have revised the discussion per the Staff’s request regarding the 10% decrease in revenue due to the COVID-19 pandemic, on page 171 and throughout.

Division of Corporation Finance

Office of Manufacturing

Securities and Exchange Commission

March 17, 2023

Page 6

HWH International Inc. and Subsidiaries

Consolidated Statements of Operations and Comprehensive Income, page F-24

| 14. | We have reviewed your response to comments 26 and 27 noting you have revised your disclosure to properly report sales commission in cost of revenue and not operating expenses. Please tell us how you considered the guidance in ASC 250, including the disclosures required by ASC 250-10-50-7. In addition, please make arrangements with your auditors for them to revise their audit reports to reference the error corrections and the specific footnote that discusses them. Refer to paragraphs .09 and .16 of PCAOB AS 2820. |

Response: In response to this comment, the Company advises the Staff that the Company has revised the financial statements for the error in classification of certain commission expenses and identified error in income tax expenses and made appropriate disclosures in Note 4. to HWH’s Financial Statements on page F-32. Accordingly, the auditors have revised their opinion included on page F-21 to reference the errors correction based on PCAOB AS 2820, paragraphs .09 and.16.

Notes to Consolidated Financial Statements

2. Summary of Significant Accounting Policies Revenue Recognition, page F-46

| 15. | We have reviewed your response and revised disclosure for comment 22. Please provide a roll forward of your memberships showing the number sold, cancelled, expired and provided for free for each of the financial statement periods presented. In addition, please provide the annual fee charged for these memberships in US dollars. |

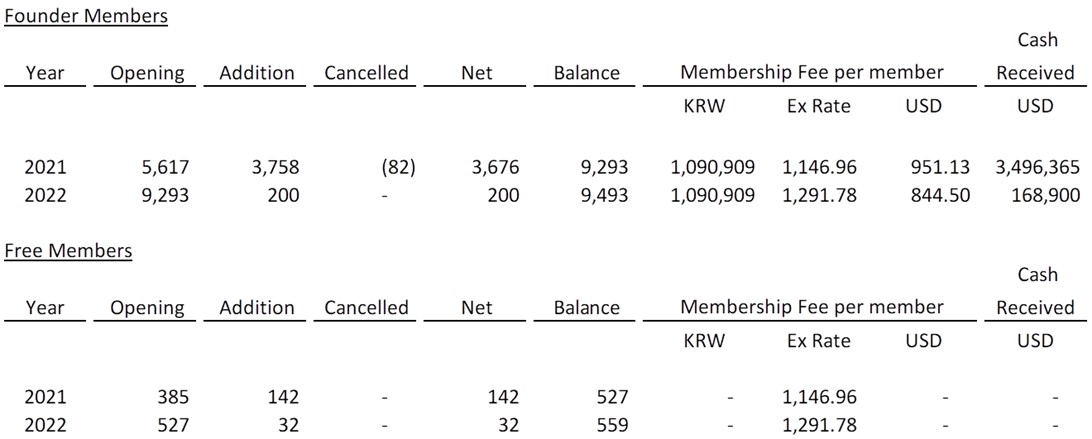

Response: In response to this comment, the Company advises the Staff that the below table illustrates the roll forward of our memberships:

Division of Corporation Finance

Office of Manufacturing

Securities and Exchange Commission

March 17, 2023

Page 7

Additionally, this table has been included on page 157.

| 16. | We note your response to comment 23 stating non-members can sign up for a free membership. On page 158 you disclose a member will receive a similar commission if a non-member signs up for a free membership and purchases any of [y]our products through a member referral. Please explain when and why you began offering free memberships considering 99.9% of your total revenues were membership fees for the year ended December 31, 2021. Please compare and contrast the benefits and terms of the free membership compared to the paid membership. Also, clearly disclose the number of free memberships included in the total memberships presented in each period. In addition, please tell us how you accounted for these free memberships under ASC 606. |

Response: In response to this comment, the Company advises the Staff that the paid member can refer other individuals to sign up as a free member to purchase the products in our marketplace, in which the paid member can then receive the commission from any purchase made by the free member. Free members do not have any benefits aside from the ability to purchase from our marketplace, however, the founder members can refer other individuals to buy membership or products in order to get the commission. Using this free membership model, it allows the founder members to refer individuals interested in our products, and the founder members can earn a commission simultaneously. Please note, the free members do not have any benefits, and we did not record anything regarding these free memberships in our financial statements.

General

| 17. | We note your revised disclosure in response to comment 4. On your prospectus cover and page 29, you say that you will take advantage of the controlled company exemption, on page 149 you say that you “may” elect not to comply with certain corporate governance standards, and on page 62 you say both that you will take advantage of the exemption and do not currently intend to rely on such exemptions. Please revise for consistency. On page 62 and 149, please discuss the corporate governance requirements from which you would be exempt. |

Response: In response to this comment, the Company advises the Staff that on page 62, we have removed the discussion which relates to the inconsistencies regarding the Company not intending to rely on such exemptions. For the avoidance of doubt, and to maintain consistency throughout, the Company does in fact plan to take advantage of the controlled company exemption if it is successful in listing its common stock on Nasdaq.

| 18. | Please provide us with your analysis as to the applicability of Rule 13e-3 under the Exchange Act. |

Response: In response to this comment, the Company advises the Staff that the Company does not believe that Rule 13e-3 applies to the Business Combination due to the applicable exception at Rule 13e-3(g)(2).

Among the transactions to which Rule 13e-3 applies is a “solicitation subject to Regulation 14A […] of any proxy, consent or authorization of […] any equity security holder by the issuer of the class of securities or by an affiliate of such issuer, in connection with: a merger […]” having the effect of causing any class of equity securities of the issuer listed with a national securities exchange to be delisted. (17 C.F.R. § 240.13e-3(a)(3)(i)(C)).

Rule 13e-3 includes certain exceptions from the application of the rule, including any “Rule 13e-3 transaction in which the security holders are offered or receive only an equity security Provided, That: (i) Such equity security has substantially the same rights as the equity security which is the subject of the Rule 13e-3 transaction […]; (ii) Such equity security is registered pursuant to section 12 of the Act[…]; and (iii) If the security which is the subject of the Rule 13e-3 transaction was either listed on a national securities exchange [>>>], such equity security is either listed on a national securities exchange […].” (17 C.F.R § 240.13e-3(g)(2), emphasis in the original.

In connection with the Business Combination, the Company will solicit proxy votes from its stockholders to approve of the Merger, among other proposals. Following the consummation of the Business Combination, if approved, whereby Alset Class A Common Stock will be exchanged for shares of newly authorized Alset Common Stock, the Company will seek to remove Alset Class A Common Stock (including Alset’s publicly traded equity securities that were converted into Alset Class A Common Stock at consummation) from listing with the Nasdaq Global Market. Consequently, the Business Combination qualifies as a Rule 13e-3 transaction.

However, the Business Combination is excepted from Rule 13e-3 because the stockholders will receive only Alset Common Stock and, further, that such equity security (i) will have substantially the same rights as Alset Class A Common Stock, (ii) will be registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended, and (iii) as anticipated by the Company, will be accepted for listing Nasdaq Capital Market.

In conclusion, the Company believes that Rule 13e-3 does not apply to this Business Combination.

Please call Darrin Ocasio of Sichenzia Ross Ference LLP at (212) 930-9700 if you would like additional information with respect to any of the foregoing. Thank you.

Division of Corporation Finance

Office of Manufacturing

Securities and Exchange Commission

March 17, 2023

Page 8

| Sincerely, | |

ALSET CAPITAL ACQUISITION CORP. | |

| /s/ Heng Fai Ambrose Chan | |

| Heng Fai Ambrose Chan | |

| Chairman and Chief Executive Officer |