One Atlantic Center

1201 West Peachtree Street

Atlanta, GA 30309-3424

404-881-7000 | Fax: 404-881-7777

| Martin Dozier | Direct Dial: 404-881-4932 | Email: martin.dozier@alston.com |

December 6, 2022

VIA EDGAR

Chad Eskildsen

Staff Accountant

U.S. Securities and Exchange Commission

Division of Investment Management, Disclosure Review and Accounting

100 F Street NE

Washington, DC 20549

| Re: | AOG Institutional Diversified Fund (File No. 333-265783; 811-23764) |

Dear Mr. Eskildsen:

This letter sets forth the response of our clients, AOG Institutional Diversified Fund (the “Issuer”), to your comments dated October 31, 2022 (the “Comment Letter”), pertaining to the registration statements filed on Form N-2 on June 23, 2022 (the “Registration Statements”).

The Issuer’s responses to the Staff’s accounting comments contained in the Comment Letter are set out in the order in which the comments were set out in the Comment Letter and are numbered accordingly.

Seed Financial Statements Comments and Questions:

Comment: The following disclosure appears in footnote 2 of the Notes to Financial Statements, under the caption “Significant Accounting Policies—Organization and Offering Costs”:

“The Fund expenses organization costs as incurred. Offering costs include insurance fees, state registration fees and legal fees regarding the preparation of the initial registration statement. Offering costs are accounted for as deferred costs until operations begin. Offering costs are then amortized to expense over twelve months on a straight-line basis. These organization and offering costs will be advanced by the Adviser and the Adviser has agreed to reimburse the Fund for these expenses, subject to potential recovery (see Note 3). Organizational costs which are subject to reimbursement by the Adviser are presented in the Statement of Assets and Liabilities as a receivable from Adviser. The

| Alston & Bird LLP | | | www.alston.com | |

Atlanta | Beijing | Brussels | Charlotte | Dallas | Los Angeles | New York | Research Triangle | San Francisco | Silicon Valley | Washington, D.C.

Mr. Chad Eskildsen

December 6, 2022

Page 2

total amount of the organization costs and offering costs incurred by the Fund is estimated at approximately $19,327 and $47,285, respectively.”

Related to the above disclosure:

1. Comment: The staff could not locate disclosure related to the potential recovery of waived organization and offering expenses in Note 3 of the seed financial statements (see highlighted section above). Please update the seed financial statements to include the details of any expense waiver and recoupment plan.

Response: The Issuer notes that it was not a party to any expense limitation agreements during the time period covered by the seed financials statements. The Issuer undertakes to revise Note 3 to the seed financial statements to remove the reference to “subject to potential recovery.”

2. Comment: Disclosure above states that offering costs will be amortized over 12 months. Please explain why there are no offering cost expenses on the March 31, 2022 statement of operations included in the semi-annual financial statements for the auction fund. The fund appears to have commenced operations on December 31, 2021 so the staff would have expected the amortization of the expenses to begin on that date.

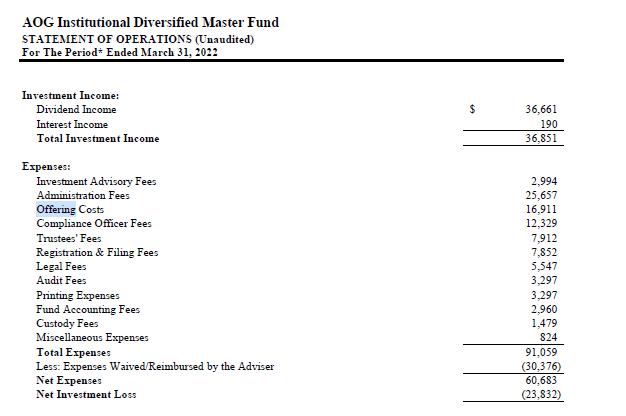

Response: The offering costs expenses were allocated to AOG Institutional Diversified Master Fund (the “Master Fund”) as reflected in the statement of operations for the Master Fund:

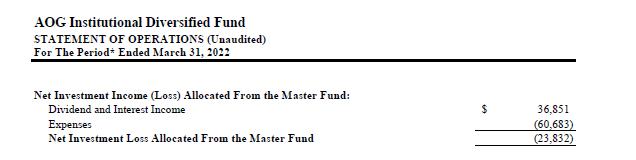

The semi-annual financial statements for AOG Institutional Diversified Fund (the “Auction Fund”) do not include expenses of the Master Fund as a line item. Expenses of the Master Fund are reflected in the semi-annual financial statements as follows:

Mr. Chad Eskildsen

December 6, 2022

Page 3

3. Comment: Please explain why the potential recovery of organization and offering expenses is not disclosed in the March 31, 2022 semi-annual F/S.

Response: As stated in the Issuer’s response to Comment #1, the reference to “subject to potential recovery” was included in the seed financial statements in error. Since there was not an expense limitation agreement in effect during the reporting period, there was not any potential recovery of organization and offering expenses to disclose in the 3/31/2022 semi-annual financial statements.

If you have any further questions or comments, please do not hesitate to contact me at (404) 881-4932.

Sincerely,

Martin Dozier

cc: Frederick Baerenz, President and Chief Executive Director