Table of Contents

As confidentially submitted to the Securities and Exchange Commission on January 28, 2022 as Amendment No. 1 to the initial confidential submission. This draft registration statement has not been publicly filed with the Securities and Exchange Commission and all information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

Steinway Musical Instruments Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 3931 | 46-3419986 | ||

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

1 Steinway Place

Astoria, New York 11105

(718) 721-2600

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Benjamin Steiner

President and Chief Executive Officer

1 Steinway Place

Astoria, New York 11105

(718) 721-2600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Marc D. Jaffe Benjamin J. Cohen Latham & Watkins LLP 1271 Avenue of the Americas New York, NY 10020 (212) 906-1200 | Joshua N. Korff Ross M. Leff Kirkland & Ellis LLP 601 Lexington Avenue New York, New York 10022 (212) 446-4800 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| ||||

Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee | ||

Class A common stock, par value $0.0001 per share | $ | $ | ||

| ||||

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933, as amended. |

| (2) | Includes shares of Class A common stock subject to the underwriters’ option to purchase additional shares. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

EXPLANATORY NOTE

Pursuant to the applicable provisions of the Fixing America’s Surface Transportation Act, we are omitting from this draft registration statement our consolidated financial statements as of and for the nine months ended September 30, 2020 and 2021 because they relate to historical periods that we believe will not be required to be included in the accompanying prospectus at the time we first file this registration statement publicly. We intend to amend this registration statement on or prior to the date of such public filing to include all financial information required by Regulation S-X under the Securities Act of 1933, as amended.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the Securities and Exchange Commission declares our registration statement effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2022

PRELIMINARY PROSPECTUS

Shares

Steinway Musical Instruments Holdings, Inc.

Class A Common Stock

This is the initial public offering of shares of Class A common stock of Steinway Musical Instruments Holdings, Inc. The selling stockholders identified in this prospectus are offering shares of Class A common stock in this offering. We are not selling any shares of our Class A common stock under this prospectus and we will not receive any of the proceeds from the sale of shares of our Class A common stock by the selling stockholders in this offering, including any shares it may sell pursuant to the underwriters’ option to purchase additional shares of Class A common stock.

Upon completion of this offering, we will have two classes of common stock, Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting and conversion. Each share of Class A common stock is entitled to one vote per share. Each share of Class B common stock is entitled to votes per share. Holders of our Class A common stock and Class B common stock vote together as a single class on all matters, except as otherwise set forth in this prospectus or as required by applicable law. Each outstanding share of Class B common stock will convert automatically into one share of Class A common stock upon any transfer, except for certain exceptions and permitted transfers described in our amended and restated certificate of incorporation. Upon the completion of this offering, all shares of Class B common stock will be held by John Paulson and certain affiliated entities (as defined below), which will collectively represent approximately % of the total combined voting power of our outstanding common stock following this offering (or approximately % of the total combined voting power of our outstanding common stock if the underwriters exercise in full their option to purchase additional shares of our Class A common stock).

Prior to this offering, there has been no public market for our Class A common stock. We intend to apply to list our Class A common stock on , under the symbol “ .”

We anticipate that the initial public offering price for our Class A common stock will be between $ and $ per share.

After the completion of this offering, we will be a “controlled company” within the meaning of the corporate governance standards of .

We are an “emerging growth company” under the federal securities laws and, as such, may elect to comply with certain reduced public reporting requirements. See “Prospectus Summary—Implications of Being an Emerging Growth Company.”

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 30 of this prospectus to read about factors you should consider before buying shares of our Class A common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

Initial public offering price | $ | $ | ||||||

Underwriting discounts and commissions(1) | $ | $ | ||||||

Proceeds, before expenses, to the selling stockholders | $ | $ | ||||||

| (1) | See “Underwriters” for a description of the compensation payable to the underwriters. |

At our request, an affiliate of BofA Securities, Inc., a participating underwriter, has reserved for sale, at the initial public offering price, up to 5% of the shares of Class A common stock offered by this prospectus for sale to some of our directors, officers, employees, distributors, dealers, business associates and related persons through a reserved share program (the “Reserved Share Program”). For additional information, see “Underwriting—Reserved Share Program.”

The underwriters also may purchase up to additional shares of Class A common stock from the selling stockholders at the initial offering price less the underwriting discounts and commissions, within 30 days from the date of this prospectus.

The underwriters expect to deliver the shares to purchasers on or about , 2022.

| Goldman Sachs & Co. LLC | BofA Securities | Barclays |

Prospectus dated , 2022.

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

| ii | ||||

| 1 | ||||

| 30 | ||||

| 82 | ||||

| 84 | ||||

| 85 | ||||

| 86 | ||||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 88 | |||

| 111 | ||||

| 143 | ||||

| 149 | ||||

| 154 | ||||

| 156 | ||||

| 158 | ||||

| 166 | ||||

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS | 169 | |||

| 173 | ||||

| 180 | ||||

| 180 | ||||

| 180 | ||||

| F-1 |

We have not, and the selling stockholders and the underwriters have not, authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus and any related free writing prospectus prepared by or on behalf of us and the selling stockholders. We, the selling stockholders and the underwriters take no responsibility for, and can provide no assurances as to the reliability of, any information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is only accurate as of the date of this prospectus, regardless of the time of delivery of this prospectus and any sale of shares of our Class A common stock.

For investors outside the United States: We, the selling stockholders and the underwriters have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our Class A common stock and the distribution of this prospectus outside the United States.

i

Table of Contents

We use the following capitalized terms in this prospectus:

| • | “ABL Facility” means our senior secured asset-based revolving credit facility, as described under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Debt.” |

| • | “Credit Facilities” means, collectively, our First Lien Term Loan Facility, ABL Facility and foreign credit facilities (as defined below). |

| • | “common stock” means our Class A common stock and our Class B common stock, collectively. |

| • | “First Lien Term Loan Facility” means our senior secured first lien term loan facility, as described under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Debt.” |

| • | “foreign credit facilities” means our foreign term loan, German ABL Facility and Japanese Revolving Credit Facility, each as described under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Debt.” |

| • | “Parent” means Paulson Pianissimo LLC, a Delaware limited liability company that, prior to this offering, directly owned 100% of our capital stock. |

| • | “Paulson & Co.” means Paulson & Co. Inc. |

| • | “John Paulson and certain affiliated entities” means John Paulson, Paulson Advantage Master Ltd. and Paulson Advantage Plus Master Ltd., which are the selling stockholders in this offering. |

| • | “selling stockholders” means John Paulson and certain affiliated entities. |

| • | “SMI” mean Steinway Musical Instruments, Inc. |

| • | “Stockholders Agreement” means the stockholders agreement to be effective upon the consummation of this offering, by and between John Paulson and certain affiliated entities, Benjamin Steiner and the Company. |

| • | “we,” “us,” “our,” the “Company,” or “Steinway” mean Steinway Musical Instruments Holdings, Inc. and its consolidated subsidiaries, unless the context refers only to Steinway Musical Instruments Holdings, Inc. as a corporate entity. |

MARKET AND INDUSTRY DATA

This prospectus contains estimates, projections and information concerning our industry, our business and the market size and growth rates of the markets in which we participate. Some data and statistical and other information are based on independent reports from third parties, including from Euromonitor International Ltd, The Wealth Report 2021, Technavio and IHS Markit, as well as industry and general publications and research, surveys and studies conducted by third parties which we have not independently verified. The content of the foregoing sources, publications and reports, except to the extent specifically set forth in this prospectus, does not constitute part of this prospectus and is not incorporated herein. Some data and statistical and other information are based on internal estimates and calculations that are derived from publicly available information, research we conducted, internal surveys, our management’s knowledge of our industry and their assumptions based on such information and knowledge, which we believe to be reasonable. In each case, this information and data

ii

Table of Contents

involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such information, estimates or projections. Industry publications and other reports we have obtained from independent parties may state that the data contained in these publications or other reports have been obtained in good faith or from sources considered to be reliable, but they do not guarantee the accuracy or completeness of such data. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Special Note Regarding Forward-Looking Statements.” These and other factors could cause our future performance to differ materially from the assumptions and estimates made by third parties and us.

SERVICE MARKS, TRADEMARKS AND TRADE NAMES

Steinway, Steinway & Sons, Spirio, Spirio | r , Spiriocast, Boston, Essex, Conn-Selmer, Bach, C.G. Conn, King, Selmer, Ludwig, Leblanc, Armstrong, Musser, Holton, Glaesel, Scherl & Roth and WM Lewis & Son and our logos and our other registered or common law trade names, trademarks or service marks appearing in this prospectus are the property of Steinway Musical Instruments Holdings, Inc. This prospectus contains additional trade names, trademarks and service marks of other companies that are the property of their respective owners. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies. Solely for convenience, our trade names, trademarks and service marks referred to in this prospectus appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trade names, trademarks and service marks.

BASIS OF PRESENTATION

Certain monetary amounts, percentages, and other figures included elsewhere in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables or charts may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

iii

Table of Contents

The following summary highlights selected information contained in this prospectus. Because this is only a summary, it does not contain all of the information you should consider before investing in our Class A common stock. You should carefully read this entire prospectus, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as our consolidated financial statements included elsewhere in this prospectus, before making an investment decision. For the definitions of certain capitalized terms used in this prospectus, please refer to “General Information.”

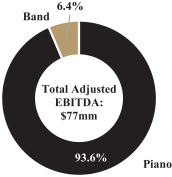

Our Company

We are a company that has been forged on, and has pushed the boundaries of, the credo of our founder, Henry Engelhard Steinway: “To build the best piano possible.” Since 1853, generation after generation, we have made and continue to make what we believe are the world’s finest musical instruments. With this expertise and heritage, we believe we have created and sustained one of the best regarded luxury brands in the world. We strive to further our legacy by advancing the standards of modern musical instrument manufacturing with our enduring dedication to quality, artisanship, elegance, style and beauty.

Our masterfully crafted pianos are designed to meet the demands of a diverse range of music enthusiasts—from providing renowned concert pianists and pop culture icons, including Lang Lang, Yuja Wang and Billy Joel, an instrument to fully express their indelible artistry, to encouraging early-stage learners discovering the first joys of piano playing, to inspiring the most discerning listeners with the distinct musical experience of a Steinway Spirio piano in their own home, which we believe is indistinguishable from a live performance. Our ultimate goal is to foster and enrich the global musical community by continuing to provide the world’s finest pianos and musical instruments shaped by our unwavering commitment to innovation, improvement and technological preeminence.

Who We Are

We are a leading manufacturer of high-performance musical instruments, boasting a brand renowned worldwide. Steinway is one of the longest-lasting and most storied brands in the music industry and beyond.

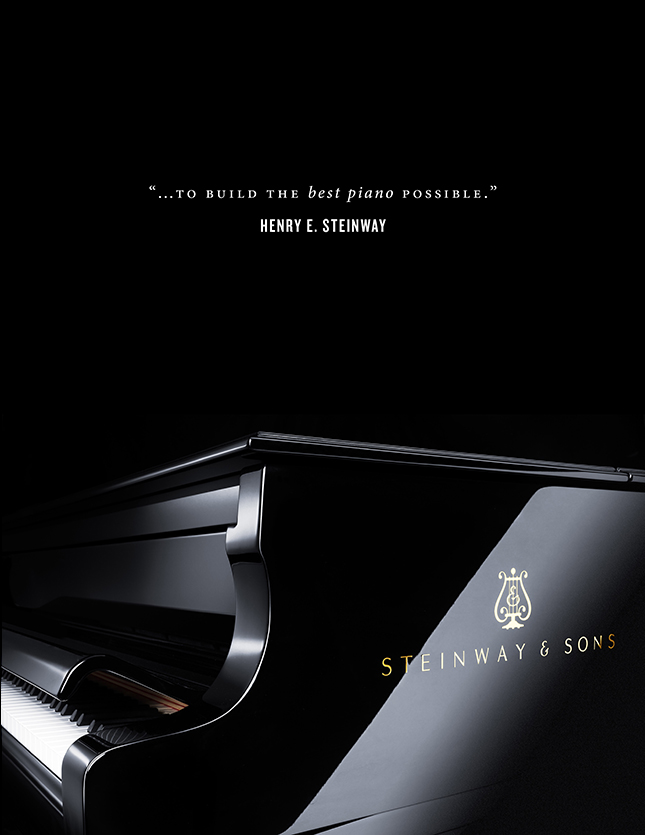

Our legacy began in 1853 in New York City when German immigrant Henry Engelhard Steinway developed the first Steinway piano in a Manhattan loft on Varick Street. Over the next thirty years, Henry and his sons laid the foundation for modern grand piano building. They built their instruments one at a time, applying skills handed down from master to apprentice, generation after generation, and we have followed in their footsteps ever since.

Thereafter, our innovative designs, attention to detail and exacting quality have redefined and broken new ground in the market for ultra-premium pianos. With our 168-year history, we believe we have been setting the standard for innovation in our industry for longer than most public companies have been in existence.

We produce a full line of grand and upright acoustic pianos at our manufacturing facilities in Astoria, New York; and Hamburg, Germany. We also offer exclusive, limited-edition pianos, as well as unique, fully customized models for the most discerning customers. We have mastered the end-to-end process that brings a Steinway piano to market, and we own and perfect each of the key components that complete our brand. At each step, our highly trained craftsmen ensure that every Steinway piano meets our high standard of excellence.

1

Table of Contents

In addition to our long history of craftsmanship, we continue to innovate and integrate state-of-the art technology into our timeless foundation. In 2015, we introduced the Steinway Spirio, the world’s first high-resolution player piano. A masterpiece of artistry and engineering, Spirio pianos, playable like any other Steinway piano, also play themselves, enabling consumers to enjoy recorded performances by renowned pianists in their own homes, with what we believe to be the same nuance, power and passion as a live performance. In 2019, we further advanced our technology and offerings by introducing Spirio | r, which enables recording and high-resolution editing in addition to playback capabilities. In 2021, we launched our Spiriocast software feature, which permits customers to instantly stream live performances, synched with video and audio, from one Spirio | r piano to others across the world.

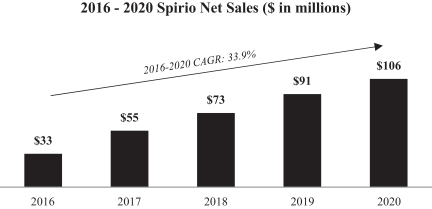

The Spirio piano significantly expands our potential target market to include non-piano players and enhances our relevance to recreational music consumers, as well as amateur and professional musicians. Furthermore, Spirio pianos sell at a premium to our traditional Steinway piano models. Sales of our Spirio and Spirio | r pianos have grown to represent approximately 50% of our total Steinway piano net sales for fiscal year 2020, increasing our average selling price and improving our gross profit margin as a result. In creating and continuously adding to our expansive Spirio library, we regularly engage with a wide range of artists to record new tracks, strengthening our connection to the diverse community of professional artists. Spirio strengthens our brand by appealing to luxury consumers and reinforcing our reputation for quality and innovation.

A deep connection to the artist community has been at the core of our identity since our founding. For decades, we have used our Steinway Artist program to cultivate special relationships with the best pianists from a wide array of genres. This program forms a celebrated community of approximately 1,900 of today’s most acclaimed pianists, including Martha Argerich, Ahmad Jamal, Billy Joel, Diana Krall, Charlie Puth and Yuja Wang. These and other musical greats consistently choose Steinway when performing on the biggest stages. In fact, approximately 97% of pianists chose a Steinway piano when performing with orchestras across the globe during the 2018–2019 concert season, which was the last full concert season prior to the date of this prospectus due to the COVID-19 pandemic. Each Steinway Artist is vetted through a highly selective process. To be considered for that process, they must independently own a Steinway piano; we do not provide a piano to our Steinway Artists in exchange for an endorsement. We believe the timeless quality and excellent performance of Steinway pianos are recognized and appreciated by artists across generations, geographies and cultures, with pianists in orchestras on every continent performing on Steinway pianos.

We also invest in building relationships with the next generation of artists through our All-Steinway school program. This program partners with institutions and schools across the globe to provide students and faculties with our high-quality pianos. By furnishing these institutions and schools exclusively with Steinway instruments, we enable our All-Steinway schools to offer premier music education on some of the finest piano models.

Our pianos are sold through 33 company-owned retail showrooms, strategically located across the world. This direct-to-consumer channel allows us to fully manage the luxury customer experience and our brand narrative. We also distribute our pianos through a global, expansive network of approximately 180 experienced dealers with intimate local market knowledge and close ties to local musical communities. Our comprehensive product portfolio allows us to serve as an exclusive supplier to many of our Steinway dealers. We seek to further optimize our distribution through ongoing retail showroom expansion in regions where we see opportunity for growth or improved performance. We continue to support dealer initiatives and implement unique distribution methods to reach smaller,

2

Table of Contents

previously untouched markets, including through our team of Educational Sales Managers that travel and sell direct to institutions and customers in territories not represented by a retail store or a dealer.

In addition to our ultra-premium piano offerings under our Steinway brand and our mid-range offerings under our Boston and Essex brands, we also sell musical instruments and accessories through our Band segment under our highly regarded Conn-Selmer umbrella of brands. For over 100 years, Conn-Selmer’s complete lines of brass, woodwind, percussion and string instruments, including Bach trumpets, C.G. Conn French horns, King trombones, Selmer saxophones, and Ludwig percussion instruments, have shaped the musical landscape through innovation and sophisticated musical performance. The C.G. Conn brand, with a legacy in music education, has been and continues to be one of the top choices for educators and marching band programs in the United States today. Most top orchestras and symphonies carry the sound of our Bach brass instruments. Ludwig, one of the world’s most recognized names in drums, is a leading fixture on the marching field and on rock-and-roll’s biggest stages. As such, our Conn-Selmer division caters to around 1,300 notable percussion, brass, and woodwind artists, including drummers such as Anderson Paak, Questlove and Alex Van Halen; saxophonist Kenny Garret; and trumpet players Sean Jones, Rashawn Ross and Michael Sachs.

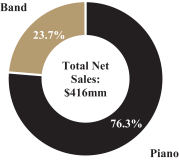

We operate in two reporting segments, Piano (Steinway & Sons) and Band (Conn-Selmer). In fiscal year 2020, our Piano and Band segments generated net sales of $317.4 million and $98.4 million, respectively. In fiscal year 2020, our Piano and Band segments generated Adjusted EBITDA of $72.1 million and $4.9 million, respectively. Below is a breakdown of our consolidated net sales and Adjusted EBITDA by segment for fiscal year 2020.

| 2020 Consolidated Net Sales | 2020 Consolidated Adjusted EBITDA | |

|

|

For a reconciliation of Adjusted EBITDA to its most directly comparable GAAP financial measure, information about why we consider Adjusted EBITDA useful and a discussion of the material risks and limitations of this measure, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures.”

Our Piano segment primarily includes sales of pianos offered under the Steinway brand as well as our Boston and Essex brands. Boston and Essex pianos are designed and engineered using the Steinway experience, expertise, specifications, and patents to achieve optimal performance. Boston and Essex models are built in Asia to maximize manufacturing efficiencies, but benefit from Steinway & Sons quality control and oversight. Boston competes in the upper-middle market segment, while Essex participates in the middle market segment. Both provide a level of performance and quality we believe is highly favorable to others competing in their respective price ranges, giving a wide range of consumers access to pianos with genuine world-class tone and responsiveness.

The Boston and Essex lines provide a broader range of consumers with an introduction into the Steinway & Sons family. Our Boston and Essex pianos come with the Steinway Promise—a trade-up

3

Table of Contents

program that varies across regions and channels but generally allows Boston and Essex pianos to be traded up for more expensive Steinway pianos, with a trade-in credit up to an amount equal to the original purchase price. This trade-in option allows our company to increase market share over time as our customers enter our community on lower-priced models, before trading up to our higher-priced models as they acquire wealth. With this family of products, we can offer our dealers a full line of our products at multiple price points, enabling us to replace lower priced product lines and to facilitate more exclusive arrangements with our dealers. This comprehensive suite of piano offerings has also allowed us to better penetrate schools and music learning centers. Our Boston line has been utilized by prominent institutions to build a strong foundation for a quality music education.

For fiscal year 2020, approximately 65% of net sales in the Piano segment were under the Steinway brand.

Our Band segment manufactures, markets and distributes a diverse portfolio of instruments and brands for student, amateur and professional use that have leading market shares in each of their musical instrument categories, including brass (trumpets, trombones, French horns), woodwinds (saxophones, flutes, clarinets), percussion (drums) and strings (violins, cellos, bass).

Through the Conn-Selmer family of brands, we offer a portfolio of individual brands that represent innovation, entrepreneurship and a focus on musical excellence. Emphasizing quality craftsmanship above all else, Conn-Selmer operates U.S. production facilities in Elkhart, Indiana; Eastlake, Ohio; and Monroe, North Carolina to create exceptional instruments.

Over 45% of Conn-Selmer sales in fiscal year 2020 were generated through our preferred dealer network to schools and families who participate in beginning music education programs. Of the remaining sales, many are used by students in marching bands, concert bands, orchestras, and other school-related performances. Our Conn-Selmer Division of Education was created to proactively engage with music students and educators and has become an industry leader in providing programs, services, and advocacy tailored to the growth and development of music education worldwide. Our educational team is committed to ensuring that every student and educator not only has access to a

4

Table of Contents

quality music education and support for their professional development, but also to the tools necessary to help them achieve their highest musical potential.

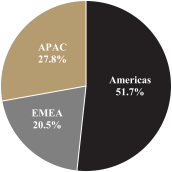

Our business is global and aims to serve consumers wherever they are. As of fiscal year end 2020, we distribute our instruments in approximately 85 countries throughout the Americas, the Asia-Pacific (“APAC”) region and the Europe, Middle East and Africa (“EMEA”) region. Below is a geographic breakdown of our consolidated net sales and our net sales for each of our segments for fiscal year 2020.

| 2020 Consolidated Net Sales | ||

| ||

We were acquired by John Paulson and certain affiliated entities in 2013, and under John Paulson’s stewardship, we have increased our commitment to quality while honoring our legacy, expanding our business, and strengthening our technological capabilities. As a custodian of Steinway, John Paulson has focused on investing in our business, including in technology, company-owned showrooms, our manufacturing processes and machinery, and in training our workforce to create a stronger team. We believe these commitments have made us better equipped than ever before to bolster our reputation as one of the industry’s finest instrument manufacturers. Over the course of the last decade, we have strategically expanded the international scope of our business, launched our Spirio technology, earned 18 new patents, and improved manufacturing quality. The results of these initiatives are reflected in our growth over the past few years, during which time we have grown our APAC region net sales at a 12.6% compound annualized growth rate (“CAGR”) from fiscal year 2016 to fiscal year 2020, released Steinway Spirio and Spirio | r player pianos and also the Spiriocast feature for Spirio | r models, built a team dedicated to limited-edition and bespoke pianos, and implemented manufacturing advances, such as the adoption of new machinery in our factories that raise our standards of precision and quality even higher than previously possible.

5

Table of Contents

To push our boundaries and build on the strong foundation laid over a century ago, we operate with six primary objectives and guiding principles:

| • | Advance excellence in manufacturing and strive to consistently improve quality so that the newest Steinway remains the best Steinway. |

| • | Continue to engage our customers directly through retail showroom expansion, thereby broadening our local presence and presenting a consistent luxury brand narrative and experience across all markets. |

| • | Cultivate and nurture innovation, further developing the infrastructure and technological advancements paved by Spirio. |

| • | Continue to increase geographic penetration, aligning our business with the fastest-growing markets, such as China. |

| • | Leverage our pricing power and favorable luxury-market dynamics. |

| • | Reinforce our brand advantage through introducing a greater mix of special, limited-edition and bespoke products. |

Our Industry

We operate within two distinct markets that partially overlap each other: the global personal luxury goods market and the global musical instruments market.

Global Personal Luxury Goods

Steinway competes in the fast-growing and highly attractive global personal luxury goods market. This market, which includes both hard and soft personal luxury goods, premium and luxury cars, is expected to grow from $780 billion in 2020 to $1,238 billion in 2025 globally, representing an 9.7% CAGR, according to Euromonitor estimates.*

The factors driving this growth include higher demand for experiential luxury, increased spending and influence of millennials, and the rise in discretionary spending in China. Historically, the global personal luxury goods market has experienced strong growth, with a 5.0% CAGR from 2016 to 2019 according to Euromonitor.

According to Euromonitor, the APAC region represented approximately 44% of the global personal luxury goods market in 2020, the largest share of any region. Between 2020 and 2025, the APAC region is also expected to be the best-performing region in the world, furthering its lead in the global luxury goods market. China is expected to contribute an outsized share of growth in the luxury category, affording us numerous tailwinds as we continue to expand our presence in the country.

According to The Wealth Report 2021, published by Knight Frank, the number of high-net-worth individuals (“HNWI”) in China (including Mainland China and Hong Kong), those with a net worth of over $1 million, reached 6.2 million in aggregate in 2020, representing a CAGR of 9.3% from 2015 to 2020. Meanwhile, the number of ultra-high-net-worth individuals (“UHNWI”), those with a net worth of

| * | Source: Euromonitor International Ltd., Luxury Goods 2022, y-o-y exchange rates, Retail Value RSP, Current Prices. Hard and soft luxury goods include apparel & footwear, eyewear, jewelry, leather goods, portable consumer electronics, timepieces, writing instruments & stationery, and beauty & personal care. |

6

Table of Contents

over $30 million, has grown 127% from 2015 to 2020 and is expected to continue to grow by 45% from 2020 to 2025. By 2025, it is expected that the number of HNWI and UHNWI in China will reach 9.5 million. While the United States remains home to the largest high-net-worth population, China has the second-largest high-net-worth population.

Global Musical Instruments

In addition to the global personal luxury goods market, we operate in the global musical instruments market, which is also benefiting from numerous secular tailwinds. These include the increasing global appreciation for music and its role across many aspects of life; the growing desire for at-home entertainment, with pianos in particular; and the growing consumer appetite for heirloom products with longstanding interest across generations. We believe Steinway’s products are inherently timeless—and we expect to be a consistent beneficiary of music’s robust and growing importance in daily life and pursuits.

According to Technavio, the global musical instruments market is expected to grow from $7 billion in 2020 to over $7.8 billion in 2025, representing a 2.2% CAGR. The global piano market is expected to reach approximately $2.7 billion by 2025, up from $2.5 billion in 2020. Of that total growth, the APAC region is expected to contribute the most incremental growth.

The piano market in China is the world’s largest, with an average of around 400,000 pianos being sold a year from 2017 to 2020, compared to an average of around 30,000 per year in the United States over the same period.

According to statistics published by the Chinese Musicians’ Association, approximately 30 million children take piano lessons in China, perhaps inspired by famous Chinese Steinway Artists including Lang Lang and Yuja Wang. To further serve the growing population of developing pianists in China, the Juilliard School made one of the largest orders of pianos in Steinway history in 2019 for its first overseas campus in Tianjin, China.

The Chinese musical instrument market in general and the piano market in particular have benefited from continued government support for music and the arts.

| • | China’s 14th Five-Year Plan for the 2021–2025 period emphasizes the importance of cultural development. The Ministry of Culture and Tourism has issued guidelines to promote cultural development, building upon the cultural activities already growing in China. The Chinese government has invested heavily in opening new concert halls in recent years. In fact, the number of concert halls in China that own Steinway pianos has increased from 11 to 134 from 2012 to 2021. |

| • | The government is promoting the development of young talent in music and the arts. As stated by the Opinions on Comprehensively Strengthening and Improving School Aesthetic Education in the New Era (Opinion) published by the Chinese State Council in October 2020, the Ministry of Education seeks to introduce music and the arts as a compulsory examination subject nationwide as part of high school entrance examinations by 2022. Schools are also encouraged to develop a more structured curriculum for music and the arts. |

As China continues to promote classical music and music education, we expect increases in demand for musical instruments across multiple channels, including orchestras, educational institutions, concerts halls, and households.

The United States has also recently exhibited unique support for the arts in its education system through its $13.2 billion Elementary and Secondary School Emergency Relief funds. We believe that

7

Table of Contents

our piano brands and our Conn-Selmer band and orchestra brands are strongly positioned to benefit from these continued investments in music education.

Our Financial Performance

Since our acquisition by John Paulson and certain affiliated entities in 2013, we have been able to achieve consistently strong financial performance. We are proud of our robust growth, consistent profitability, and high cash-flow generation, which demonstrate our pricing power and optimized cost structure. While continuing to invest in innovation, we have also been able to reduce our debt by $160 million since 2016.

Our business demonstrated resilience through the COVID-19 pandemic. The first half of 2020 featured a prolonged closure of our Astoria, New York plant and significantly reduced traffic at Steinway showrooms across the globe. Despite the ongoing challenges of the pandemic, our artisans returned to work once they could do so safely and continued to craft exceptional pianos—as they have done for more than 165 years.

Increased consumer investment in the home and a gradual return to normalcy helped offset COVID-induced headwinds and spurred strong performance in the second half of 2020. The Company rebounded well in 2021 and has exhibited significant growth relative to 2019 levels.

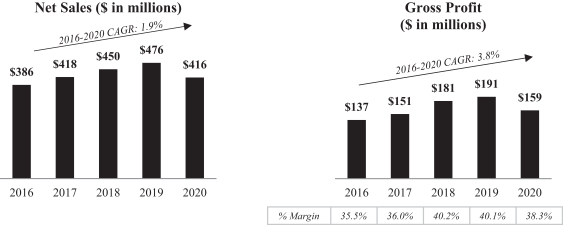

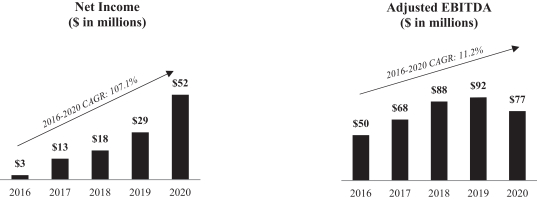

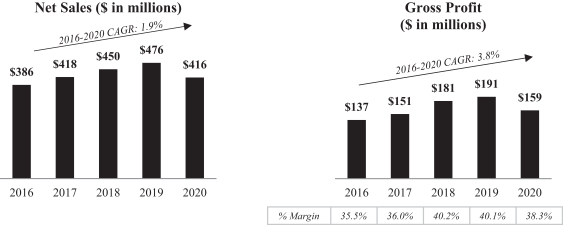

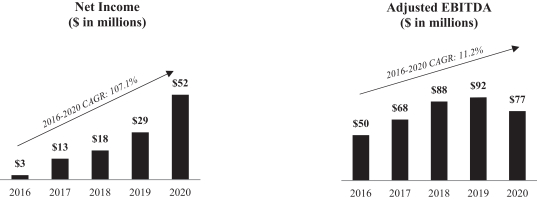

From fiscal year 2016 to fiscal year 2020, we realized the following results on a consolidated basis:

| • | Increased net sales from $386 million to $416 million, representing compound annual growth of 1.9% |

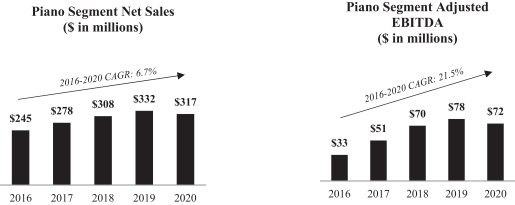

| • | Increased Piano segment net sales from $245 million to $317 million, representing compound annual growth of 6.7% |

| • | Increased Piano segment Adjusted EBITDA from $33 million to $72 million, representing compound annual growth of 21.5% |

| • | Increased gross profit from $137 million to $159 million, representing compound annual growth of 3.8% |

| • | Increased net income from $3 million to $52 million, representing compound annual growth of 107.1% |

| • | Increased Adjusted EBITDA from $51 million to $77 million, representing compound annual growth of 11.2% |

| • | Increased Net Income Margin from 0.7% to 12.5% |

| • | Increased Adjusted EBITDA Margin from 13.1% to 18.5% |

8

Table of Contents

For a reconciliation of Adjusted EBITDA to its most directly comparable GAAP financial measure, information about why we consider Adjusted EBITDA useful and a discussion of the material risks and limitations of this measure, please see “Prospectus Summary—Summary Historical Consolidated Financial Data—Non-GAAP Financial Measures” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures.”

9

Table of Contents

Our Strengths

We built a deep competitive moat through our more than century-long track record of creating what we believe to be the world’s finest instruments and through the power of our brand.

For over 165 years, we believe our innovation, commitment to detail and extraordinary quality have established our brand as the standard by which all pianos are measured. We believe our long record of leadership across musical instrument categories places our company alongside some of the most admired American companies, with a luxury brand that transcends its functionality.

The fact that our industry’s most revered artists and musical institutions consistently choose Steinway fortifies our high standing within the music industry. Many musical greats have endorsed the quality of our instruments and personally use our instruments on the brightest stages—classical legends such as Sergei Rachmaninoff and Arthur Rubinstein; some of the biggest classical and pop icons of today, including Lang Lang and Billy Joel; and jazz legends such as Ahmad Jamal and McCoy Tyner all chose Steinway time and again as the desired instrument to express their art. We also lead piano demand among the world’s biggest concert halls, performance venues and educational and cultural institutions.

The prominence of our instruments among the most respected musical authorities informs and influences the purchasing decisions of consumers across the world. When combined with the quality and beauty of our instruments, this reputation allows us to enjoy considerable pricing power while also increasing sales volumes. Between fiscal years 2016 and 2020, the average sales price (“ASP”) generated by our Steinway pianos increased by 41.4%, or at a CAGR of 9.1%.

Our reach is global. Our instruments are desired and sold throughout the world, in approximately 85 countries. Our brands are well-known and universal, with over 800 trademarks registered in countries across the globe. With this reach, our reputation as a preeminent piano manufacturer has allowed us to gain, based on market data and internal estimates, approximately 80% of what we believe is the ultra-premium piano market, measured in terms of production volumes.

Our top-tier Steinway brand provides a professional-level experience, however we also maintain product lines that allow us to serve an array of consumers, including our Boston and Essex pianos which extend our high-quality piano offerings across more affordable price points. The Piano segment is supplemented by our Band segment where, among others, the Conn, Bach, Selmer and Ludwig brands all lead their respective categories and serve a diverse group of educational institutions and instrument consumers.

We are aligned with favorable long-term trends.

There are a number of socioeconomic trends that serve as tailwinds for us, including:

| • | Outsized growth in the population of HNWI and UHNWI, particularly in China. The global population of HNWI and UHNWI has grown at a 2.6% and 5.9% CAGR, respectively, over the past five years, relative to 1.1% compound annual global population growth during the same period. In China, the population of HNWI and UHNWI has grown at a 9.2% and 17.9% CAGR respectively, over the same period, relative to total Chinese population growth of 0.6%. |

| • | Increasing Chinese investment in music education, with music and the arts expected to be a compulsory examination subject nationwide by 2022. |

| • | Unprecedented strength in the housing market, with U.S. housing starts up 135% over the 10 years from 2010 to 2020, representing a CAGR of 8.9% based on U.S. Census data. |

10

Table of Contents

Furthermore, housing sales have increased approximately 35% since 2010 and just over 8% in the past five years, according to IHS Markit data. Median prices for new homes are expected to grow at a CAGR of 5.2% from the final quarter of 2020 to the final quarter of 2025, which is a function of demand. We typically expect demand for our products to track increased activity in the housing market, as consumers are more likely to buy Steinway pianos as they purchase new and higher-end homes. |

| • | A greater consumer focus globally on the home and in-home activities following the onset of the COVID-19 pandemic. |

| • | A growing understanding of the cognitive and developmental benefits associated with music education. |

| • | Record $13.2 billion in U.S. government investment in education with access for music education through Elementary and Secondary School Emergency Relief (ESSER) funds, signed into law in March 2020. |

While we expect these favorable trends to continue, any ebbing or reversal of one or more of these trends could adversely affect the growth of our business. See “Risk Factors—Risks Related to our Business—Unfavorable economic conditions and changes in consumer preferences could adversely affect our business.”

Our manufacturing excellence and commitment to high-performance quality lies at the core of our identity.

For more than 165 years, we have played a key role in the development of the modern grand piano and due to our commitment to sustained advances in manufacturing—as evidenced by our ever-growing patent portfolio—we have remained a leading manufacturer of ultra-premium concert pianos ever since. We manufacture each of our Steinway pianos, one by one, in our historic factories in Astoria, New York; and Hamburg, Germany, through a precise and meticulous artisan process.

These factories and many of our pioneering techniques that we still currently employ date back to the 19th century and have shaped and further elevated the high-end piano manufacturing standards of today. Our integration of time-tested, old-world methods with state-of-the-art technology and investments in advanced machinery coalesce in a production process that requires six months to several years and dozens of artisans to create what we believe is the world’s finest piano.

11

Table of Contents

The quality of our materials and processes results in pianos that can be enjoyed for generations, as evidenced by what has historically been our primary competition, legacy Steinway pianos.

Our company-owned retail showrooms and deep relationships with experienced dealers create a powerful, high-touch distribution model.

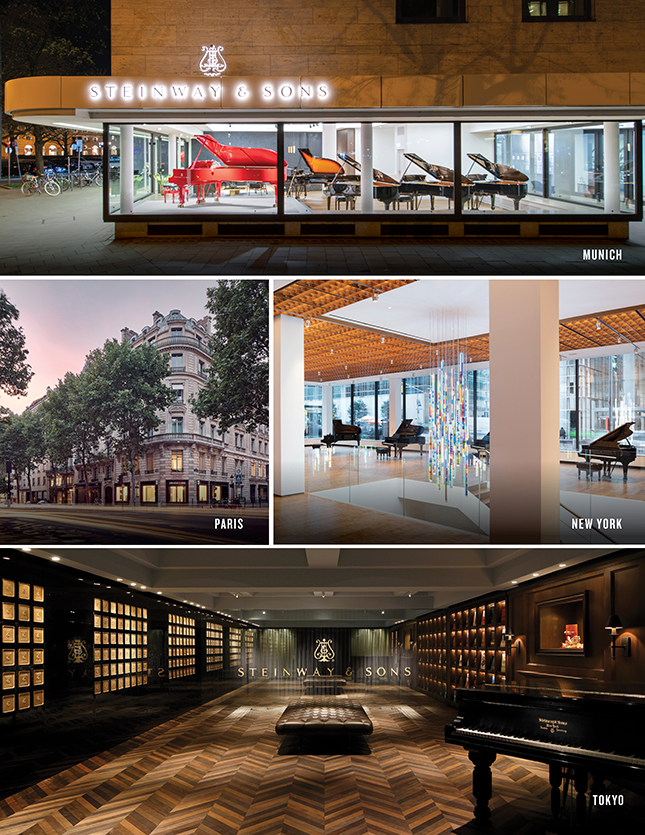

We have established company-owned retail showrooms coast-to-coast in the United States in wealthy metro areas from New York to Beverly Hills, Chicago, San Francisco and Miami; across Europe with locations in cultural hubs including London, Paris, Vienna and throughout Germany; and in key APAC locations including Tokyo and Shanghai and in Beijing, where we launched our APAC flagship store in 2017. Currently, we own 16 retail showrooms in the United States, 11 in Europe and six in the Asia Pacific region. Our 33 company-owned showrooms heighten our brand awareness and allow us to build meaningful relationships directly with our valued customers.

12

Table of Contents

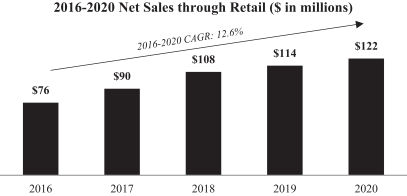

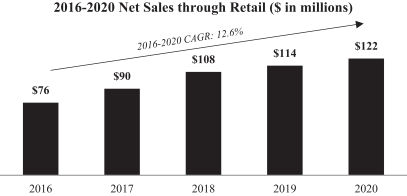

Our platform of company-owned retail locations has bolstered our sales from retail operations, which have increased by a CAGR of 12.6% between fiscal years 2016 and 2020, reaching 38.4% of our total Piano segment net sales for fiscal year 2020. The outsized growth of this channel has ushered in higher profitability, as pianos sold through direct channels capture a significantly larger share of margin compared to sales through traditional wholesale channels, with the added benefit that we build stronger, longer-lasting ties directly with our customers.

In addition to our company-owned retail showrooms, we depend on a network of independent dealers and distributors to distribute a majority of our pianos and all of our band instruments. We believe that we have a robust network of dealers and distributors with deep knowledge of the markets in which they operate. However, there is no assurance that they will continue to generate sales at historical levels. See “Risk Factors—Risks Related to Our Reliance on Third Parties—We generate most of our sales through independent dealers and distributors.” The comprehensive family of brands we offer allows us to serve as the exclusive supplier to many of our piano dealers, and our dealers are also awarded exclusive territories to promote robust marketing and sales programs, promotional expenditures and loyalty. We also bolster our dealers through the provision of marketing and sales programs and materials, inventory management support, sales training, customer service and technical assistance.

Finally, we are finding new and relevant ways to sell to smaller, previously unrepresented territories. We have created a team of Educational Sales Managers that travel and sell direct to institutions and customers in territories not represented by a retail store or a dealer.

13

Table of Contents

Within our Band segment, our Conn-Selmer Department of Education maintains close connections to educational institutions, often the ultimate customers of our band and orchestral instruments. Conn-Selmer is an industry leader in providing support and advocacy tools specifically tailored to music education through our educational outreach team. Through our coast-to-coast School Partnership program, Conn-Selmer maintains a specialized team of educational support managers who provide personalized service and support, customized lease and purchase programs, as well as artist and clinician funding. Conn-Selmer also provides partnering schools with free access to our instrument inventory management system, which helps customers manage their long-term supply needs and track inventory age and condition. These initiatives serve to deepen our institutional relationships and supplement demand for our instruments.

Our vertically-integrated supply chain affords numerous operational advantages.

Our commitment to quality extends throughout our entire supply chain. Historically, we have partnered with some of the most respected suppliers in the industry. To streamline our process, better control quality of production and ensure continuity in vendor business, at opportune times, we have strategically acquired significant key parts suppliers: Kluge GmbH, the largest piano keys manufacturer in Europe; O.S. Kelly, the largest piano plate manufacturer in the United States; and most recently in 2019, Louis Renner, which we believe is one of the world’s finest and most widely respected producer of piano action parts.

By integrating these suppliers into our controlled manufacturing process, we can ensure that Steinway-caliber quality is preserved and more seamlessly improved upon across our key components. In addition, with these acquisitions, we are now the primary supplier of spare parts for used Steinway pianos, giving us the opportunity to reach a broader array of customers through the sale, rebuilding and restoration of certified pianos and set the standards for quality in the resale market.

We have a long history of innovation and have developed what we believe to be the premier technology in the piano industry.

We continue to innovate, adding 18 new patents to our portfolio in the last decade to reach a current total of over 150 patents over the course of our history. The Steinway pianos we produce today are the best and most advanced pianos we have ever produced.

The introduction of the Steinway Spirio in 2015 was a culmination of years of investment, research and development and technological expertise. We consider the Spirio technology to be a masterpiece of artistry and engineering, delighting listeners with recorded performances of artists, with what we believe to be the same level of intimacy and nuance as a live performance. We further enhanced Spirio in 2019 with the introduction of Spirio | r, which enables recording, high-resolution editing, and playback, providing educational institutions and professional artists with new tools and opportunities and to seamlessly connect and integrate with multiple musical environments. In 2021 we released our latest Spirio feature, Spiriocast, which allows for performances to be streamed live, in sync with video and audio, from one Spirio | r piano to others anywhere in the world.

Our Spirio technology provides access to our large and diverse Spirio music library, which includes performances recorded exclusively for Spirio and produced by us, offering performances from an incredible roster of hundreds of Steinway Artists. A collection of these recorded works is also synched with video for an even more engaging and unique performance at home. In addition, we pioneered technology that allows Spirio pianos to showcase historical performances, synched with

14

Table of Contents

video, by Steinway Immortals including Glenn Gould, Duke Ellington and Vladimir Horowitz. Each month, the Spirio Spotlight showcases all new content—music, videos and curated playlists—which is automatically downloaded to every Spirio piano, allowing us to drive value for and deepen our connection to our customers.

These innovations fortify our reputation as an industry leader in musical instrument manufacturing and strengthen our offerings relative to our competition, including legacy Steinway pianos. With the evolution of our Spirio technology, we have built an experienced, high-tech, cutting-edge Music and Technology team that we continue to leverage for future opportunities, technological advancements, and product offerings, always striving to create new avenues to grow our brands and product portfolio. Our recent investments in innovation have dramatically expanded our target audience, increased our relevance to consumers and artists, and entrenched our leading competitive position in the piano market.

We are the clear brand of choice among the professional community.

The Steinway piano was the instrument of choice for approximately 97% of concert pianists when performing with orchestras across the globe during the 2018–2019 concert season, none of whom are compensated to use or endorse Steinway. These artists, many of whom perform at the pinnacle of the music industry, influence consumption trends across our customer base. For decades, we have cultivated relationships with the most talented pianists from nearly every genre, including Jon Batiste, Billy Joel, Lang Lang and Regina Spektor.

15

Table of Contents

We continue to source and grow these relationships through our Steinway Artists program. This program encompasses all genres of music and includes renowned musicians such as Martha Argerich, Ahmad Jamal, Diana Krall, Charlie Puth and Yuja Wang. We select our Steinway Artists through a rigorous application process that can last up to a year, requires applicants to already own a Steinway piano and have a recommendation from an existing Steinway Artist or a Steinway & Sons dealer. For our Steinway Artists, we have a concert and artist bank of Steinway pianos, many of which are permanently located at leading concert venues. We also transport our pianos to any location where a Steinway Artist is performing, ranging from the biggest music festivals to the hardest-to-reach locations, including an iceberg in the Arctic Ocean. These programs strengthen our relationships and standing with the professional community and also allow us to constantly solicit feedback from the most qualified sources: top concert pianists.

Leading educational institutions also choose Steinway, and we maintain relationships with nearly all of the top music schools across the world—which we believe cements our position as the world’s premier piano manufacturer and instills young artists globally with a devotion to Steinway pianos at the onset of their careers. Our All-Steinway schools provide pianos that inspire students to realize their artistic talents and best prepare them to compete at the highest level in the professional world. In addition, we maintain a dedicated institutional sales team that provides a suite of customized resources to colleges, universities and conservatories, including inventory analysis tools, fundraising programs, lease-to-own options, factory seminars and technical service guidelines.

We are proud of our strong market share among professionals and institutions, and believe this validates our meticulous artisan process and the quality products we produce. This endorsement by the professional and institutional community informs and drives consumer demand of individuals searching for high quality pianos for the home.

We have an experienced management team and shareholder group committed to serving as stewards of our brands.

Our management team, led by our Chief Executive Officer, Benjamin Steiner, has extensive industry experience and global expertise and is committed to preserving and further expanding the legacy of our brands. The management team represents a broad foundation of experiences spanning expertise in sales, marketing, manufacturing, technology and innovation and strives to conserve a deep continuity with Steinway’s rich heritage. In addition, our Americas, EMEA and APAC regional

16

Table of Contents

leaders have intimate local knowledge of their respective geographies, allowing us to navigate the nuances of the piano market across all of our operations.

Our Chief Executive Officer, Mr. Steiner, led the investment by John Paulson and certain affiliated entities in 2013 and has been associated with our company ever since, joining the Steinway team in 2016 and subsequently being appointed as Chief Executive Officer in August 2021. During his years with our company, Mr. Steiner has connected John Paulson’s vision with our management team’s industry and institutional knowledge, strengthening our business through operational and digital innovation while enhancing our stature within the music industry.

The talent and industry expertise of the members of our management team make our company well positioned to realize its growth potential. Our President of Steinway Asia Pacific, Wei Wei, brings a deep knowledge of the region and marketing expertise from her past experience as Director of Marketing and Sales to her current position overseeing this particularly fast-growing region. Eric Feidner serves as our Chief Technology and Innovation Officer managing the teams responsible for music technology in product development. With his accomplished background in technology, music and e-commerce, having previously founded ArkivMusic and served in executive positions at start-ups N2K, Inc. and Winstar Communications, Eric Feidner is expected to help expand the market for Steinway pianos. Our Chief Financial Officer, Maia Moutopoulos, also brings years of expertise to our management team. Before joining Steinway’s corporate finance team in 2014, Maia Moutopoulos served for eight years as the Accounting Manager at Steinway Inc., our Americas piano division, bringing an intimate knowledge of the company’s financial structure to her role.

Furthermore, John Paulson, founder of Paulson & Co., is one of the most prominent names in the financial industry. John Paulson’s reputation and knowledge—both operationally and financially—have proven to be key assets for Steinway and our people. John Paulson’s primary goal has been to ensure the long-term success of our business and the continued preeminence of the Steinway brand, and as our controlling stockholders, John Paulson and certain affiliated entities play a central role in creating our strategic vision and setting our long-term trajectory. As testament to this commitment, one of the first initiatives undertaken by John Paulson post-acquisition was to fortify our technological capabilities with significant investment in music technology, resulting in the successful launch of the Steinway Spirio piano, and our total capital expenditures have increased 39% since 2013. After this offering, John Paulson and certain affiliated entities will hold a significant portion of our common stock, including all of our Class B common stock, will control the direction of our business, and so long as they do so, will prevent you and other stockholders from influencing significant decisions of our business.

Our Growth Strategies

Innovate in technology, including through Spirio.

We believe our Steinway Spirio high-resolution player pianos are revolutionary for our industry and we have consistently advanced the technology since its original debut in 2015. We built upon our initial launch of Spirio with the introduction of Spirio | r in 2019, which enabled recording, high-resolution editing and playback capabilities. In 2021, we released a new software feature, Spiriocast, which allows instant streaming of live performances, perfectly in sync with audio and video, from one Spirio | r piano to others around the world. Our Spirio instruments play back the performances of renowned concert pianists, record and replay a consumer’s own performances, and also allow for high-resolution editing of such recordings. Our Spirio music library includes thousands of exclusive performances by hundreds of artists, many of which are synched with video, all accessed with the

17

Table of Contents

touch of an iPad and enjoyed in a consumer’s own home. Our Spirio music library is expanded monthly and automatically updated, increasing consumer value over time while also deepening our connection to our consumers.

With this evolution, enabled through Spirio technology, we believe the Steinway piano has been recast—not only as the preeminent high-performance piano, but also as a unique luxury entertainment system for the home. Our target market has expanded significantly with this development to now include recreational music lovers who may not play the piano but can nonetheless enjoy a moving musical experience at home. We have also increased our brand’s relevance to customers and artists, differentiating our product from older Steinway models that may have been considered by customers on the used market.

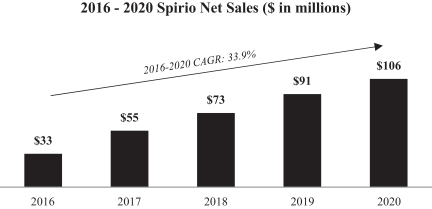

We have seen significant demand for our Steinway Spirio player pianos; sales of our Spirio and Spirio | r pianos grew at a CAGR of over 30% between fiscal years 2016 and 2020 and represented approximately 50% of Steinway piano net sales in fiscal year 2020. We believe there is still significant room for growth in Steinway Spirio sales. Our Spirio player pianos sell at a premium to other Steinway models, leading to increased net sales and profit per unit sold.

We continue to advance the depth and breadth of our technology, with each Spirio generation continually improving on the last. In addition, the investments we have made in our technical capabilities have allowed our company to build an infrastructure of technological expertise, laying the foundation for further innovation across our instrument portfolio and potentially in adjacent markets.

Our Conn-Selmer business also continues to invest in digital technology to strengthen our relationships with music educators and students. Our recently acquired MusicProfessor digital lesson platform gives music educators a suite of teaching aids for in person, hybrid, and remote learning as well as a pedagogically-driven experience for new players without formal guidance.

Expand our company-owned retail locations and improve distribution.

We are driving top-line growth by building out our company-owned retail showroom presence in strategic high-growth metropolitan areas, providing the opportunity to cultivate deeper and more durable relationships directly with our end customers and to strengthen our ability to manage our luxury brand image. In addition, increasing sales through our direct outlets allows us to realize a larger share of margin compared to sales through wholesale channels.

To capitalize on this higher profit opportunity, we have improved many of our existing direct outlets and opened new locations, which feature high quality buildouts, curated merchandise and knowledgeable and effective sales employees. These retail stores are strategically located across the United States, including locations in New York, Beverly Hills, Chicago, San Francisco and Miami; in cultural hubs in Europe such as London, Paris, Berlin and Vienna; and also in key APAC metros that include Shanghai, Beijing, Xi’an and Tokyo.

These initiatives have increased the percentage of sales that come from our retail operations over time, representing approximately 38.4% of all Piano segment sales in fiscal year 2020. We believe that continuing to expand our network of retail showrooms will enable us to increase the demand for our pianos, while also improving our margins, strengthening customer relationships and expanding our customer reach.

Wholesale distribution remains our largest channel by volume of instruments. Many of our dealers have been in the business for almost as long as we have, and we always encourage exclusive

18

Table of Contents

relationships with us. They have intimate knowledge of their local markets and deep connections within their musical communities. We work with our dealers to further elevate their operations, including by providing retail design templates, encouraging location optimization, offering enhanced sales training, providing promotional materials and sales leads, and arranging ongoing technical support. These initiatives fortify our relationships with our dealers and also ensure a Steinway—level customer experience across our network. In addition, we continue to evaluate underperforming territories for further potential retail expansion.

Finally, we have seen successful sales results with our recently launched Steinway Educational Sales Manager program, which sends Steinway-trained sales managers to institutions in territories that are not represented by a dealer or a company-owned retail store. We continue to consider and implement new methods to reach underpenetrated markets.

Expand in China, a vast and rapidly growing market for our products.

China represents a unique market for Steinway due to two primary cultural and structural factors: a deep-rooted reverence for classical music, specifically piano music, and a sizeable and rapidly expanding middle and upper class with an appetite for luxury Western products. China is the largest global market for pianos and has approximately 40 million practicing pianists, roughly seven times the number of practicing pianists in the United States. Currently there are approximately 30 million children in China taking piano lessons, compared to less than 10 million in the rest of the world, suggesting that the majority of children playing the piano globally are in China. Initiatives pursued by the Chinese central authorities to promote traditional forms of childhood recreation further bolster these organic dynamics, which we expect to provide further tailwinds to our business in the region.

In addition to these favorable trends, the Steinway brand is revered in China, where all of the 11 national conservatories use Steinway pianos with four conservatories serving as All-Steinway schools. We have taken steps to continue building our brand resonance in the region by actively partnering with celebrity Chinese concert pianists, such as Lang Lang, opening company-owned retail showrooms in strategic Chinese metro areas, promoting a full and diverse sales and marketing events calendar nationwide and adding new tracks to our Spirio library that cater to the Chinese consumer.

Despite the prevalence of piano playing in China and our brand strength in the region, we have historically been underpenetrated in the country, selling less than half as many Steinway grand pianos in China as in the U.S. market. However, as China continues to develop and accumulate wealth, we will seek to capture the growing demand for ultra-premium pianos. The Wealth Report 2021, published by Knight Frank, forecasts the number of UHNWI in China to grow by 45% over the 5 years to 2025 while the combined population of UHNWI and HNWI is expected to reach 9.5 million, representing the second-largest wealth market globally. Our and third-party forecasts of growth in China are based on a number of assumptions, and should be read in conjunction with “Risk Factors—Risks Related to Our Business—Our estimates of market opportunity and forecasts of market growth, including in China, may prove to be inaccurate and there is no guarantee that demand for our products will grow as expected, or that we will be able to grow our business at similar rates, if at all.”

19

Table of Contents

We have begun to see these dynamics play out as we have grown our net sales in China at an 17.7% CAGR from $46.0 million in fiscal year 2016 to $88.2 million in fiscal year 2020.

Grow our average net sales per unit by expanding our special, limited-edition and bespoke instrument business.

The investments we have made in our manufacturing facilities have made our factories nimbler and more efficient, allowing us to increase our range of stock keeping units (“SKUs”). We have built a team dedicated to creating new and exceptional design concepts, sourcing unique luxury materials and collaborating with specialty artisans to produce the most exquisite Steinway pianos. We have a long legacy of producing custom pianos, and with our advances in manufacturing capability and our investment in the right team, we are now able to produce a significantly larger number and spectacularly varied array of custom models. These include our Bespoke and Art Case custom Steinway pianos, our limited-edition Steinway pianos, our Crown Jewel Steinway collection of exotic wood veneers, and our special collections. These products not only increase the selection offered to our most discerning customers, but also allow us to drive meaningful increases in average selling price.

We believe we can further increase our average net sales per unit through greater customer adoption of our special instruments, including by: (1) continuing to expand our range of special and custom instruments; (2) investing in our manufacturing capabilities to increase capacity and decrease lead times for these instruments; (3) honing our marketing efforts for such instruments; and (4) capitalizing on the growing population of UHNWI, particularly in China. Our manufacturing advances to date have allowed us to increase the percentage of special pianos produced as part of total Steinway grand pianos manufactured at our Hamburg factory, which supplies our growing business in China, from 6% to 10% between fiscal years 2016 and 2020.

Our Band segment has also made strides in building demand for premium instruments offered within our Conn-Selmer family of brands. We have launched over 120 new or improved products since 2020, including our re-imagination of the most coveted line of trumpets on the market, the Bach 170, 180, and 190 series and the release of new Ludwig hardware to expand our growing Ludwig acoustic drum market. Alongside our Artist Select program, a celebration of our best horns which are hand-selected by our master artists, we have recently launched ConnSonic—a proprietary suite of processes for optimizing musical instrument acoustics. We believe instruments created using ConnSonic feature greater depth and efficiency of tone production than conventional instruments.

20

Table of Contents

Summary Risk Factors

We are subject to a number of risks, including risks that may prevent us from achieving our business objectives or that may adversely affect our business, financial condition and results of operations. You should carefully consider the risks discussed in the section titled “Risk Factors,” including the following risks, before investing in our Class A common stock:

| • | Our business is dependent upon the distinctive appeal of the Steinway brand. |

| • | Competition within the luxury goods and broader music industry is intense and our existing and potential customers may be attracted to competing forms of products. |

| • | Since we have a limited number of facilities, any loss of use of any of our facilities, or those of our third-party suppliers, could adversely affect our operations. |

| • | Our estimates of market opportunity and forecasts of market growth, including in China, may prove to be inaccurate and there is no guarantee that demand for our products will grow as expected, or that we will be able to grow our business at similar rates, if at all. |

| • | Unfavorable economic conditions and changes in consumer preferences could adversely affect our business. |

| • | Any disruption in the supply of raw materials and components we and our key manufacturers need to manufacture our musical instruments could harm our business, financial condition and results of operations. |

| • | We operate in competitive markets. |

| • | We depend on skilled craftspeople to develop and create our pianos and a skilled sales force to sell our pianos. |

| • | The loss of one or more members of our senior management team could adversely affect our business. |

| • | Our primary manufacturing facilities in Astoria, New York and Hamburg, Germany are expensive to operate, and subject us to high labor, tax and other expenses. |

| • | The artists who play and promote our instruments are an important aspect of our brands’ images and the loss of the support of artists may harm our business. |

| • | Our internal computer systems, or those of any of our third-party service providers, may fail or suffer security breaches. |

| • | We may be unable to strategically expand our showroom footprint, and maintaining our brand image and desirability to consumers requires significant investment in showroom construction, maintenance and periodic renovation. |

| • | Our international operations are exposed to risks associated with exchange rate fluctuations and customs, regulations, trade restrictions and political, economic and social instability. |

| • | Evolving U.S. and European trade regulations and policies, including with China, have in the past and may in the future have a material and adverse effect on our business. |

| • | Failure of our new products to gain market acceptance, or the obsolescence of our existing products, may adversely affect our operating results. |

| • | Our operations may subject us to liabilities for environmental or other regulatory matters, the costs of which could be material. |

| • | We generate most of our sales through independent dealers and distributors. |

21

Table of Contents

| • | Any significant disruption in our supply from key suppliers could delay production. |

| • | Our third-party manufacturers and suppliers may not continue to manufacture products that are consistent with our standards and our quality control measures may be inadequate. |

| • | John Paulson and certain affiliated entities will hold a significant portion of our common stock, including all of our Class B common stock, will control the direction of our business, and so long as they do so, will prevent you and other stockholders from influencing significant decisions. |

| • | We will be a “controlled company” under the corporate governance rules of and, as a result, will qualify for, and intend to rely on, exemptions from certain corporate governance requirements. You will not have the same protections afforded to stockholders of companies that are subject to such requirements. |