UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23762

Fidelity Greenwood Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | January 31 |

|

|

Date of reporting period: | January 31, 2024 |

Item 1.

Reports to Stockholders

Fidelity® Hedged Equity Fund

Annual Report

January 31, 2024

Includes Fidelity and Fidelity Advisor share classes

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you're an individual investing directly with Fidelity, call 1-800-835-5092 if you're a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you're an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2024 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns |

| | | | |

Periods ended January 31, 2024 | Past 1 year | Life of Fund A |

Class A (incl. 5.75% sales charge) | 7.40% | 4.73% |

Class M (incl. 3.50% sales charge) | 9.66% | 6.19% |

Class C (incl. contingent deferred sales charge) | 12.13% | 8.35% |

| Fidelity® Hedged Equity Fund | 14.22% | 9.42% |

| Class I | 14.22% | 9.42% |

| Class Z | 14.30% | 9.47% |

A From September 1, 2022

Class C shares' contingent deferred sales charges included in the past one year and life of fund total return figures are 1% and 0%, respectively.

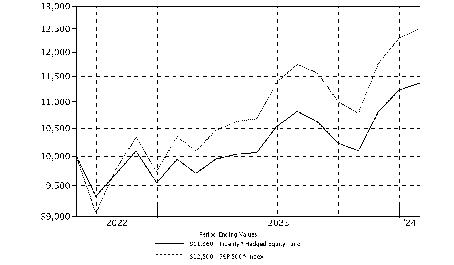

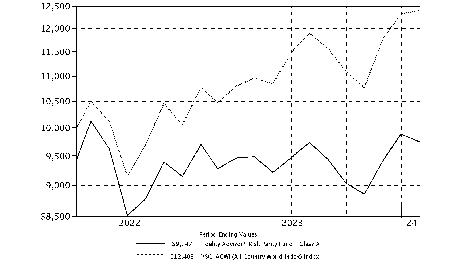

| $10,000 Over Life of Fund |

| |

Let's say hypothetically that $10,000 was invested in Fidelity® Hedged Equity Fund, a class of the fund, on September 1, 2022, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period. |

|

|

Market Recap:

U.S. equities gained 20.82% for the 12 months ending January 31, 2024, according to the S&P 500® index, as a slowing in the pace of inflation and resilient late-cycle expansion of the U.S. economy provided a favorable backdrop for higher-risk assets for much of the period. The upturn was driven by a narrow set of firms in the information technology and communication services sectors, largely due to excitement for generative artificial intelligence. Monetary tightening by the U.S. Federal Reserve continued until late July, when the Fed said it was too soon to tell if its latest hike would conclude a series of increases aimed at cooling the economy and bringing down inflation. Since March 2022, the Fed has raised its benchmark interest rate 11 times before pausing and four times deciding to hold rates at a 22-year high while it observes inflation and the economy. After the Fed's November 1 meeting, when the central bank hinted it might be done raising rates, the S&P 500® reversed a three-month decline and gained 14.09% through year-end. The index added 1.68% in January, finishing the period just shy of a record close set on January 29. By sector for the full 12 months, tech (+53%) and communication services (+43%) led the way, followed by consumer discretionary (+20%). Industrials rose about 13% and the rate-sensitive financials sector gained 10%. In sharp contrast, utilities (-8%) and energy (-4%) lagged most, with the latter hampered by lower oil prices. Real estate (-2%) and materials (-1%) also lost ground.

Comments from Co-Portfolio Managers Eric Granat, Mitch Livstone and Zach Dewhirst:

For the year ending January 31, 2024, the fund's share classes gained 13% to 14%, about in line with the 14.80% return for the CBOE S&P 500 5% Put Protection Index and underperforming the 20.82% advance of the broad-based S&P 500 Index. The fund's slight underperformance relative to its supplemental benchmark, CBOE Put Protection Index, was attributable to its typically larger allocation to the protective put options compared to the index, which resulted in higher carrying cost during the period. The fund's relative underperformance against the S&P 500 Index was primarily due to the on-going cost to hedge the downside risk of the portfolio during a period of strong appreciation for the broader market. However, during the volatile month of October, the fund's defensive allocation to put options reduced unwanted exposure to market downside and dampened overall portfolio volatility.

Note to Shareholders:

On November 30, 2023, the Cboe S&P 500 5% Put Protection Index was added as a supplemental benchmark. This benchmark better reflects the fund's hedged S&P 500 strategy and will help investors assess fund performance. The Cboe S&P 500 5% Put Protection Index is designed to track the performance of a hypothetical risk-management strategy that consists of a long position indexed to the S&P 500 Index and a long position in the monthly 5% Out-of-the-Money SPX Put options.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Top Holdings (% of Fund's net assets) |

| |

| Microsoft Corp. | 7.2 | |

| Apple, Inc. | 6.7 | |

| NVIDIA Corp. | 3.8 | |

| Alphabet, Inc. Class A | 3.8 | |

| Amazon.com, Inc. | 3.4 | |

| Meta Platforms, Inc. Class A | 2.1 | |

| Berkshire Hathaway, Inc. Class B | 1.9 | |

| JPMorgan Chase & Co. | 1.5 | |

| iShares S&P 500 Index ETF | 1.4 | |

| Broadcom, Inc. | 1.4 | |

| | 33.2 | |

| |

| Market Sectors (% of Fund's net assets) |

| |

| Information Technology | 29.1 | |

| Financials | 12.9 | |

| Health Care | 12.3 | |

| Consumer Discretionary | 9.8 | |

| Communication Services | 8.5 | |

| Industrials | 8.0 | |

| Consumer Staples | 6.0 | |

| Energy | 3.6 | |

| Utilities | 2.3 | |

| Real Estate | 2.2 | |

| Materials | 2.1 | |

| Investment Companies | 1.4 | |

| |

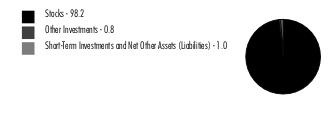

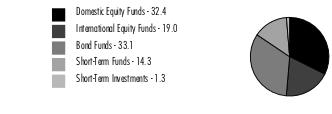

Asset Allocation (% of Fund's net assets) |

|

|

Showing Percentage of Net Assets

| Common Stocks - 96.8% |

| | | Shares | Value ($) |

| COMMUNICATION SERVICES - 8.5% | | | |

| Diversified Telecommunication Services - 0.8% | | | |

| Frontier Communications Parent, Inc. (a) | | 2,693 | 66,329 |

| Iridium Communications, Inc. | | 795 | 28,827 |

| Verizon Communications, Inc. | | 37,618 | 1,593,122 |

| | | | 1,688,278 |

| Entertainment - 1.2% | | | |

| Liberty Media Corp. Liberty Formula One Class A | | 983 | 60,051 |

| Madison Square Garden Sports Corp. (a) | | 255 | 47,201 |

| Netflix, Inc. (a) | | 2,432 | 1,371,916 |

| Spotify Technology SA (a) | | 248 | 53,407 |

| The Walt Disney Co. | | 12,514 | 1,201,970 |

| TKO Group Holdings, Inc. | | 571 | 47,787 |

| | | | 2,782,332 |

| Interactive Media & Services - 5.9% | | | |

| Alphabet, Inc. Class A (a) | | 59,778 | 8,374,898 |

| IAC, Inc. (a) | | 583 | 29,272 |

| Meta Platforms, Inc. Class A | | 12,083 | 4,714,062 |

| Pinterest, Inc. Class A (a) | | 1,463 | 54,819 |

| | | | 13,173,051 |

| Media - 0.6% | | | |

| Comcast Corp. Class A | | 26,732 | 1,244,107 |

| Liberty Media Corp. Liberty SiriusXM Class A | | 2,109 | 64,093 |

| Nexstar Media Group, Inc. Class A | | 345 | 61,310 |

| The Trade Desk, Inc. (a) | | 470 | 32,162 |

| | | | 1,401,672 |

TOTAL COMMUNICATION SERVICES | | | 19,045,333 |

| CONSUMER DISCRETIONARY - 9.8% | | | |

| Automobile Components - 0.1% | | | |

| Autoliv, Inc. | | 587 | 62,879 |

| Gentex Corp. | | 1,694 | 56,122 |

| Lear Corp. | | 660 | 87,714 |

| Visteon Corp. (a) | | 258 | 29,745 |

| | | | 236,460 |

| Automobiles - 1.4% | | | |

| Ford Motor Co. | | 37,010 | 433,757 |

| Rivian Automotive, Inc. (a) | | 1,109 | 16,979 |

| Tesla, Inc. (a) | | 14,818 | 2,775,263 |

| | | | 3,225,999 |

| Broadline Retail - 3.4% | | | |

| Amazon.com, Inc. (a) | | 48,559 | 7,536,357 |

| Distributors - 0.2% | | | |

| Genuine Parts Co. | | 2,150 | 301,495 |

| LKQ Corp. | | 4,855 | 226,583 |

| | | | 528,078 |

| Diversified Consumer Services - 0.1% | | | |

| H&R Block, Inc. | | 1,158 | 54,241 |

| Service Corp. International | | 1,529 | 102,626 |

| | | | 156,867 |

| Hotels, Restaurants & Leisure - 1.9% | | | |

| Aramark | | 3,127 | 90,933 |

| Booking Holdings, Inc. (a) | | 206 | 722,539 |

| Boyd Gaming Corp. | | 2,314 | 146,916 |

| Choice Hotels International, Inc. (b) | | 732 | 88,660 |

| Churchill Downs, Inc. | | 747 | 90,365 |

| Domino's Pizza, Inc. | | 601 | 256,158 |

| Doordash, Inc. (a) | | 635 | 66,167 |

| Draftkings Holdings, Inc. (a) | | 901 | 35,184 |

| Hyatt Hotels Corp. Class A | | 1,190 | 152,760 |

| Light & Wonder, Inc. Class A (a) | | 1,089 | 87,534 |

| Marriott Vacations Worldwide Corp. | | 490 | 41,106 |

| McDonald's Corp. | | 5,829 | 1,706,265 |

| MGM Resorts International (a) | | 4,488 | 194,645 |

| Penn Entertainment, Inc. (a) | | 1,548 | 34,907 |

| Planet Fitness, Inc. (a) | | 554 | 37,539 |

| Texas Roadhouse, Inc. Class A | | 1,587 | 199,518 |

| Vail Resorts, Inc. | | 295 | 65,490 |

| Wendy's Co. | | 4,668 | 89,065 |

| Wingstop, Inc. | | 249 | 69,996 |

| Wyndham Hotels & Resorts, Inc. | | 1,023 | 79,722 |

| Wynn Resorts Ltd. | | 1,134 | 107,084 |

| | | | 4,362,553 |

| Household Durables - 0.4% | | | |

| Leggett & Platt, Inc. | | 1,780 | 41,314 |

| NVR, Inc. (a) | | 70 | 495,270 |

| Taylor Morrison Home Corp. (a) | | 790 | 41,191 |

| Tempur Sealy International, Inc. | | 1,898 | 94,691 |

| Toll Brothers, Inc. | | 1,454 | 144,455 |

| TopBuild Corp. (a) | | 158 | 58,323 |

| | | | 875,244 |

| Specialty Retail - 1.9% | | | |

| AutoNation, Inc. (a) | | 454 | 63,406 |

| Burlington Stores, Inc. (a) | | 411 | 78,563 |

| Five Below, Inc. (a) | | 207 | 37,148 |

| Floor & Decor Holdings, Inc. Class A (a) | | 609 | 61,241 |

| Gap, Inc. | | 1,783 | 33,324 |

| Lithia Motors, Inc. Class A (sub. vtg.) | | 212 | 62,508 |

| Murphy U.S.A., Inc. | | 276 | 97,296 |

| Penske Automotive Group, Inc. | | 617 | 91,544 |

| RH (a) | | 266 | 67,426 |

| Ross Stores, Inc. | | 4,770 | 669,136 |

| The Home Depot, Inc. | | 6,929 | 2,445,660 |

| Ulta Beauty, Inc. (a) | | 660 | 331,353 |

| Valvoline, Inc. (a) | | 1,265 | 46,160 |

| Williams-Sonoma, Inc. | | 318 | 61,498 |

| | | | 4,146,263 |

| Textiles, Apparel & Luxury Goods - 0.4% | | | |

| NIKE, Inc. Class B | | 7,831 | 795,081 |

| Ralph Lauren Corp. | | 1,159 | 166,514 |

| | | | 961,595 |

TOTAL CONSUMER DISCRETIONARY | | | 22,029,416 |

| CONSUMER STAPLES - 6.0% | | | |

| Beverages - 1.8% | | | |

| Brown-Forman Corp. Class B (non-vtg.) | | 5,714 | 313,699 |

| Keurig Dr. Pepper, Inc. | | 16,591 | 521,621 |

| PepsiCo, Inc. | | 9,744 | 1,642,156 |

| The Coca-Cola Co. | | 27,505 | 1,636,272 |

| | | | 4,113,748 |

| Consumer Staples Distribution & Retail - 1.9% | | | |

| Albertsons Companies, Inc. | | 2,508 | 53,220 |

| BJ's Wholesale Club Holdings, Inc. (a) | | 1,232 | 79,267 |

| Casey's General Stores, Inc. | | 348 | 94,433 |

| Costco Wholesale Corp. | | 2,619 | 1,819,891 |

| Performance Food Group Co. (a) | | 876 | 63,668 |

| Target Corp. | | 3,930 | 546,584 |

| U.S. Foods Holding Corp. (a) | | 1,701 | 78,263 |

| Walmart, Inc. | | 8,490 | 1,402,973 |

| | | | 4,138,299 |

| Food Products - 0.8% | | | |

| Campbell Soup Co. | | 8,352 | 372,750 |

| Darling Ingredients, Inc. (a) | | 609 | 26,370 |

| Flowers Foods, Inc. | | 3,536 | 80,621 |

| Ingredion, Inc. | | 407 | 43,781 |

| Kellanova | | 10,952 | 599,732 |

| Post Holdings, Inc. (a) | | 1,561 | 144,970 |

| The Hershey Co. | | 3,202 | 619,715 |

| | | | 1,887,939 |

| Household Products - 1.5% | | | |

| Colgate-Palmolive Co. | | 12,046 | 1,014,273 |

| Procter & Gamble Co. | | 14,521 | 2,281,830 |

| | | | 3,296,103 |

TOTAL CONSUMER STAPLES | | | 13,436,089 |

| ENERGY - 3.6% | | | |

| Energy Equipment & Services - 0.3% | | | |

| Championx Corp. | | 1,568 | 42,979 |

| Schlumberger Ltd. | | 10,722 | 522,161 |

| TechnipFMC PLC | | 2,871 | 55,525 |

| Valaris Ltd. (a) | | 776 | 48,011 |

| Weatherford International PLC (a) | | 657 | 58,834 |

| | | | 727,510 |

| Oil, Gas & Consumable Fuels - 3.3% | | | |

| Antero Midstream GP LP | | 5,075 | 62,118 |

| Antero Resources Corp. (a) | | 1,888 | 42,178 |

| Cheniere Energy, Inc. | | 663 | 108,725 |

| Chesapeake Energy Corp. | | 623 | 48,040 |

| Chevron Corp. | | 12,418 | 1,830,786 |

| Chord Energy Corp. | | 502 | 77,188 |

| CNX Resources Corp. (a) | | 2,265 | 45,753 |

| Diamondback Energy, Inc. | | 3,812 | 586,057 |

| DT Midstream, Inc. | | 742 | 39,838 |

| Exxon Mobil Corp. | | 27,115 | 2,787,693 |

| Kinder Morgan, Inc. | | 37,173 | 628,967 |

| Marathon Oil Corp. | | 18,312 | 418,429 |

| Matador Resources Co. | | 1,353 | 74,266 |

| Murphy Oil Corp. | | 2,511 | 97,176 |

| Occidental Petroleum Corp. | | 6,023 | 346,744 |

| Ovintiv, Inc. | | 2,149 | 91,161 |

| Range Resources Corp. | | 1,648 | 47,858 |

| Southwestern Energy Co. (a) | | 6,407 | 41,325 |

| | | | 7,374,302 |

TOTAL ENERGY | | | 8,101,812 |

| FINANCIALS - 12.9% | | | |

| Banks - 3.0% | | | |

| Bank of America Corp. | | 56,568 | 1,923,878 |

| Bank OZK | | 1,057 | 47,681 |

| BOK Financial Corp. | | 467 | 39,153 |

| Columbia Banking Systems, Inc. | | 2,432 | 49,029 |

| Commerce Bancshares, Inc. | | 1,086 | 56,602 |

| Cullen/Frost Bankers, Inc. | | 518 | 54,970 |

| First Citizens Bancshares, Inc. | | 31 | 46,810 |

| First Horizon National Corp. | | 4,122 | 58,697 |

| JPMorgan Chase & Co. | | 19,029 | 3,317,896 |

| New York Community Bancorp, Inc. | | 4,348 | 28,132 |

| Old National Bancorp, Indiana | | 2,480 | 40,846 |

| Pinnacle Financial Partners, Inc. | | 1,192 | 105,349 |

| Prosperity Bancshares, Inc. | | 1,028 | 65,699 |

| Synovus Financial Corp. | | 1,320 | 49,711 |

| U.S. Bancorp | | 15,722 | 653,092 |

| Wintrust Financial Corp. | | 841 | 81,560 |

| | | | 6,619,105 |

| Capital Markets - 1.9% | | | |

| Affiliated Managers Group, Inc. | | 274 | 40,782 |

| Ameriprise Financial, Inc. | | 1,480 | 572,508 |

| Ares Management Corp. | | 1,553 | 188,658 |

| Blackstone, Inc. | | 5,287 | 657,967 |

| Carlyle Group LP | | 2,931 | 117,299 |

| Charles Schwab Corp. | | 9,491 | 597,174 |

| Evercore, Inc. Class A | | 671 | 115,231 |

| Franklin Resources, Inc. | | 8,639 | 230,057 |

| Houlihan Lokey | | 383 | 45,876 |

| Interactive Brokers Group, Inc. | | 944 | 83,780 |

| Jefferies Financial Group, Inc. | | 3,143 | 128,109 |

| KKR & Co. LP | | 2,150 | 186,147 |

| Lazard, Inc. Class A | | 1,192 | 46,464 |

| LPL Financial | | 270 | 64,581 |

| Morgan Stanley | | 12,122 | 1,057,523 |

| SEI Investments Co. | | 1,508 | 95,366 |

| Stifel Financial Corp. | | 1,138 | 83,017 |

| Virtu Financial, Inc. Class A | | 2,042 | 34,285 |

| | | | 4,344,824 |

| Consumer Finance - 0.5% | | | |

| Ally Financial, Inc. | | 3,161 | 115,945 |

| American Express Co. | | 4,913 | 986,236 |

| OneMain Holdings, Inc. | | 856 | 40,746 |

| SLM Corp. | | 2,459 | 48,885 |

| | | | 1,191,812 |

| Financial Services - 5.1% | | | |

| Apollo Global Management, Inc. | | 1,265 | 127,006 |

| Berkshire Hathaway, Inc. Class B (a) | | 11,269 | 4,324,366 |

| Block, Inc. Class A (a) | | 570 | 37,056 |

| Equitable Holdings, Inc. | | 3,573 | 116,801 |

| Fidelity National Information Services, Inc. | | 5,146 | 320,390 |

| FleetCor Technologies, Inc. (a) | | 1,103 | 319,793 |

| MasterCard, Inc. Class A | | 5,909 | 2,654,500 |

| PayPal Holdings, Inc. (a) | | 7,666 | 470,309 |

| Visa, Inc. Class A | | 10,891 | 2,976,075 |

| Voya Financial, Inc. | | 1,244 | 90,028 |

| WEX, Inc. (a) | | 213 | 43,535 |

| | | | 11,479,859 |

| Insurance - 2.2% | | | |

| AFLAC, Inc. | | 8,591 | 724,565 |

| American Financial Group, Inc. | | 979 | 117,872 |

| Arch Capital Group Ltd. (a) | | 4,618 | 380,662 |

| Arthur J. Gallagher & Co. | | 3,863 | 896,834 |

| Fidelity National Financial, Inc. | | 1,744 | 87,252 |

| Loews Corp. | | 5,857 | 426,741 |

| Markel Group, Inc. (a) | | 113 | 169,210 |

| Old Republic International Corp. | | 2,928 | 82,101 |

| Prudential Financial, Inc. | | 8,286 | 869,450 |

| Reinsurance Group of America, Inc. | | 304 | 52,863 |

| RenaissanceRe Holdings Ltd. | | 228 | 52,173 |

| Unum Group | | 1,038 | 50,177 |

| W.R. Berkley Corp. | | 6,613 | 541,472 |

| Willis Towers Watson PLC | | 1,539 | 379,056 |

| | | | 4,830,428 |

| Mortgage Real Estate Investment Trusts - 0.2% | | | |

| AGNC Investment Corp. (b) | | 5,703 | 54,064 |

| Annaly Capital Management, Inc. | | 4,008 | 76,914 |

| Rithm Capital Corp. | | 8,135 | 87,045 |

| Starwood Property Trust, Inc. | | 9,311 | 189,293 |

| | | | 407,316 |

TOTAL FINANCIALS | | | 28,873,344 |

| HEALTH CARE - 12.3% | | | |

| Biotechnology - 2.1% | | | |

| AbbVie, Inc. | | 10,737 | 1,765,163 |

| Alnylam Pharmaceuticals, Inc. (a) | | 288 | 49,798 |

| BioMarin Pharmaceutical, Inc. (a) | | 1,147 | 101,028 |

| Exelixis, Inc. (a) | | 1,802 | 39,212 |

| Gilead Sciences, Inc. | | 10,788 | 844,269 |

| Moderna, Inc. (a) | | 2,578 | 260,507 |

| Neurocrine Biosciences, Inc. (a) | | 527 | 73,659 |

| Regeneron Pharmaceuticals, Inc. (a) | | 810 | 763,652 |

| Sarepta Therapeutics, Inc. (a) | | 338 | 40,219 |

| United Therapeutics Corp. (a) | | 205 | 44,030 |

| Vertex Pharmaceuticals, Inc. (a) | | 1,518 | 657,871 |

| | | | 4,639,408 |

| Health Care Equipment & Supplies - 2.5% | | | |

| Abbott Laboratories | | 12,216 | 1,382,240 |

| Align Technology, Inc. (a) | | 610 | 163,065 |

| Boston Scientific Corp. (a) | | 18,795 | 1,188,972 |

| DexCom, Inc. (a) | | 2,726 | 330,800 |

| Envista Holdings Corp. (a) | | 1,258 | 29,563 |

| GE Healthcare Holding LLC | | 3,997 | 293,220 |

| Globus Medical, Inc. (a) | | 1,115 | 58,861 |

| Haemonetics Corp. (a) | | 677 | 51,763 |

| Hologic, Inc. (a) | | 4,604 | 342,722 |

| ICU Medical, Inc. (a) | | 272 | 24,896 |

| Inspire Medical Systems, Inc. (a) | | 117 | 24,672 |

| Intuitive Surgical, Inc. (a) | | 2,089 | 790,102 |

| Masimo Corp. (a) | | 278 | 35,845 |

| Penumbra, Inc. (a) | | 159 | 40,098 |

| ResMed, Inc. | | 2,011 | 382,492 |

| Shockwave Medical, Inc. (a) | | 278 | 62,898 |

| The Cooper Companies, Inc. | | 872 | 325,282 |

| | | | 5,527,491 |

| Health Care Providers & Services - 2.6% | | | |

| Acadia Healthcare Co., Inc. (a) | | 779 | 63,987 |

| Centene Corp. (a) | | 5,629 | 423,920 |

| Chemed Corp. | | 137 | 81,212 |

| CVS Health Corp. | | 10,842 | 806,320 |

| DaVita, Inc. (a) | | 909 | 98,317 |

| Encompass Health Corp. | | 752 | 53,422 |

| HCA Holdings, Inc. | | 2,397 | 730,845 |

| Humana, Inc. | | 1,361 | 514,540 |

| Tenet Healthcare Corp. (a) | | 557 | 46,086 |

| UnitedHealth Group, Inc. | | 5,945 | 3,042,294 |

| | | | 5,860,943 |

| Health Care Technology - 0.0% | | | |

| Veeva Systems, Inc. Class A (a) | | 449 | 93,127 |

| Life Sciences Tools & Services - 1.3% | | | |

| Avantor, Inc. (a) | | 2,956 | 67,958 |

| Bruker Corp. | | 509 | 36,399 |

| Danaher Corp. | | 4,552 | 1,092,070 |

| ICON PLC (a) | | 310 | 80,870 |

| Medpace Holdings, Inc. (a) | | 247 | 72,020 |

| QIAGEN NV | | 2,292 | 100,069 |

| Thermo Fisher Scientific, Inc. | | 2,567 | 1,383,562 |

| | | | 2,832,948 |

| Pharmaceuticals - 3.8% | | | |

| Eli Lilly & Co. | | 4,527 | 2,922,676 |

| Jazz Pharmaceuticals PLC (a) | | 383 | 47,002 |

| Johnson & Johnson | | 15,841 | 2,517,135 |

| Merck & Co., Inc. | | 16,467 | 1,988,884 |

| Pfizer, Inc. | | 33,702 | 912,650 |

| Royalty Pharma PLC | | 2,805 | 79,634 |

| | | | 8,467,981 |

TOTAL HEALTH CARE | | | 27,421,898 |

| INDUSTRIALS - 8.0% | | | |

| Aerospace & Defense - 1.6% | | | |

| BWX Technologies, Inc. | | 737 | 60,051 |

| Curtiss-Wright Corp. | | 278 | 61,874 |

| HEICO Corp. | | 800 | 143,672 |

| Howmet Aerospace, Inc. | | 8,553 | 481,192 |

| Lockheed Martin Corp. | | 2,346 | 1,007,396 |

| RTX Corp. | | 10,391 | 946,828 |

| The Boeing Co. (a) | | 3,681 | 776,838 |

| Woodward, Inc. | | 413 | 56,899 |

| | | | 3,534,750 |

| Air Freight & Logistics - 0.5% | | | |

| GXO Logistics, Inc. (a) | | 676 | 36,761 |

| United Parcel Service, Inc. Class B | | 7,842 | 1,112,780 |

| | | | 1,149,541 |

| Building Products - 0.5% | | | |

| Advanced Drain Systems, Inc. | | 329 | 42,908 |

| Allegion PLC (b) | | 2,569 | 318,273 |

| Builders FirstSource, Inc. (a) | | 1,071 | 186,065 |

| Carlisle Companies, Inc. | | 523 | 164,358 |

| Fortune Brands Innovations, Inc. | | 1,455 | 112,893 |

| Lennox International, Inc. | | 391 | 167,411 |

| Owens Corning | | 806 | 122,133 |

| Trex Co., Inc. (a) | | 882 | 71,865 |

| | | | 1,185,906 |

| Commercial Services & Supplies - 0.9% | | | |

| Cintas Corp. | | 1,587 | 959,453 |

| Clean Harbors, Inc. (a) | | 285 | 47,869 |

| RB Global, Inc. | | 809 | 51,752 |

| Republic Services, Inc. | | 4,813 | 823,601 |

| Tetra Tech, Inc. | | 658 | 104,082 |

| | | | 1,986,757 |

| Construction & Engineering - 0.1% | | | |

| AECOM | | 1,099 | 96,921 |

| EMCOR Group, Inc. | | 251 | 57,256 |

| Willscot Mobile Mini Holdings (a) | | 889 | 42,050 |

| | | | 196,227 |

| Electrical Equipment - 0.4% | | | |

| AMETEK, Inc. | | 3,596 | 582,732 |

| nVent Electric PLC | | 2,188 | 131,368 |

| Regal Rexnord Corp. | | 491 | 65,529 |

| Sensata Technologies, Inc. PLC | | 1,710 | 61,851 |

| | | | 841,480 |

| Ground Transportation - 0.9% | | | |

| J.B. Hunt Transport Services, Inc. | | 2,011 | 404,171 |

| Knight-Swift Transportation Holdings, Inc. Class A | | 2,548 | 146,204 |

| Landstar System, Inc. | | 989 | 189,611 |

| Ryder System, Inc. | | 594 | 67,461 |

| Saia, Inc. (a) | | 221 | 99,578 |

| Uber Technologies, Inc. (a) | | 14,495 | 946,089 |

| XPO, Inc. (a) | | 758 | 64,764 |

| | | | 1,917,878 |

| Industrial Conglomerates - 0.6% | | | |

| Honeywell International, Inc. | | 6,690 | 1,353,119 |

| Machinery - 1.8% | | | |

| AGCO Corp. | | 313 | 38,289 |

| Caterpillar, Inc. | | 3,818 | 1,146,584 |

| CNH Industrial NV | | 2,609 | 31,308 |

| Donaldson Co., Inc. | | 594 | 38,366 |

| Dover Corp. | | 4,557 | 682,547 |

| Graco, Inc. | | 1,903 | 162,326 |

| IDEX Corp. | | 1,918 | 405,657 |

| ITT, Inc. | | 901 | 108,823 |

| Lincoln Electric Holdings, Inc. | | 676 | 150,221 |

| Middleby Corp. (a) | | 840 | 118,499 |

| Oshkosh Corp. | | 460 | 50,646 |

| PACCAR, Inc. | | 6,375 | 639,986 |

| Timken Co. | | 670 | 54,880 |

| Toro Co. | | 372 | 34,403 |

| Watts Water Technologies, Inc. Class A | | 324 | 64,155 |

| Westinghouse Air Brake Tech Co. | | 2,325 | 305,900 |

| | | | 4,032,590 |

| Passenger Airlines - 0.2% | | | |

| American Airlines Group, Inc. (a) | | 18,503 | 263,298 |

| United Airlines Holdings, Inc. (a) | | 3,217 | 133,119 |

| | | | 396,417 |

| Professional Services - 0.3% | | | |

| Booz Allen Hamilton Holding Corp. Class A | | 1,079 | 151,891 |

| CACI International, Inc. Class A (a) | | 223 | 76,652 |

| Clarivate PLC (a)(b) | | 3,968 | 35,474 |

| Genpact Ltd. | | 1,397 | 50,152 |

| KBR, Inc. | | 1,453 | 75,716 |

| Paylocity Holding Corp. (a) | | 253 | 40,078 |

| Science Applications International Corp. | | 676 | 86,298 |

| SS&C Technologies Holdings, Inc. | | 3,083 | 188,125 |

| TransUnion | | 1,114 | 77,078 |

| | | | 781,464 |

| Trading Companies & Distributors - 0.2% | | | |

| Air Lease Corp. Class A | | 890 | 37,211 |

| Ferguson PLC | | 1,167 | 219,233 |

| GATX Corp. | | 547 | 67,090 |

| MSC Industrial Direct Co., Inc. Class A | | 384 | 37,893 |

| SiteOne Landscape Supply, Inc. (a) | | 219 | 33,846 |

| Watsco, Inc. | | 241 | 94,226 |

| WESCO International, Inc. | | 317 | 55,006 |

| | | | 544,505 |

TOTAL INDUSTRIALS | | | 17,920,634 |

| INFORMATION TECHNOLOGY - 29.1% | | | |

| Communications Equipment - 0.8% | | | |

| Ciena Corp. (a) | | 1,047 | 55,491 |

| Cisco Systems, Inc. | | 32,919 | 1,651,875 |

| Ubiquiti, Inc. (b) | | 213 | 26,783 |

| | | | 1,734,149 |

| Electronic Equipment, Instruments & Components - 0.5% | | | |

| Amphenol Corp. Class A | | 9,707 | 981,378 |

| Arrow Electronics, Inc. (a) | | 646 | 71,803 |

| TD SYNNEX Corp. | | 708 | 70,786 |

| | | | 1,123,967 |

| IT Services - 1.6% | | | |

| Accenture PLC Class A | | 4,259 | 1,549,765 |

| Amdocs Ltd. | | 972 | 89,113 |

| Cloudflare, Inc. (a) | | 858 | 67,825 |

| Cognizant Technology Solutions Corp. Class A | | 5,490 | 423,389 |

| GoDaddy, Inc. (a) | | 1,189 | 126,819 |

| IBM Corp. | | 6,636 | 1,218,768 |

| MongoDB, Inc. Class A (a) | | 106 | 42,455 |

| Snowflake, Inc. (a) | | 242 | 47,345 |

| Twilio, Inc. Class A (a) | | 831 | 58,444 |

| | | | 3,623,923 |

| Semiconductors & Semiconductor Equipment - 8.5% | | | |

| Advanced Micro Devices, Inc. (a) | | 10,008 | 1,678,242 |

| Amkor Technology, Inc. | | 1,240 | 39,258 |

| Broadcom, Inc. | | 2,632 | 3,105,760 |

| Cirrus Logic, Inc. (a) | | 813 | 62,764 |

| Entegris, Inc. | | 1,317 | 155,011 |

| GlobalFoundries, Inc. (a) | | 583 | 32,053 |

| Intel Corp. | | 25,578 | 1,101,900 |

| Lam Research Corp. | | 1,531 | 1,263,335 |

| Lattice Semiconductor Corp. (a) | | 1,378 | 83,865 |

| MACOM Technology Solutions Holdings, Inc. (a) | | 448 | 38,631 |

| Micron Technology, Inc. | | 9,006 | 772,265 |

| MKS Instruments, Inc. | | 763 | 81,221 |

| NVIDIA Corp. | | 13,662 | 8,405,819 |

| Onto Innovation, Inc. (a) | | 467 | 75,421 |

| Power Integrations, Inc. | | 859 | 64,391 |

| Qualcomm, Inc. | | 8,052 | 1,195,803 |

| Rambus, Inc. (a) | | 990 | 67,845 |

| Skyworks Solutions, Inc. | | 3,944 | 411,990 |

| Synaptics, Inc. (a) | | 439 | 46,890 |

| Teradyne, Inc. | | 3,748 | 362,019 |

| Universal Display Corp. | | 372 | 63,154 |

| Wolfspeed, Inc. (a) | | 456 | 14,843 |

| | | | 19,122,480 |

| Software - 11.0% | | | |

| Adobe, Inc. (a) | | 2,615 | 1,615,495 |

| Atlassian Corp. PLC (a) | | 270 | 67,438 |

| Bentley Systems, Inc. Class B | | 718 | 36,187 |

| Bill Holdings, Inc. (a) | | 503 | 39,259 |

| Crowdstrike Holdings, Inc. (a) | | 510 | 149,175 |

| Datadog, Inc. Class A (a) | | 449 | 55,874 |

| DocuSign, Inc. (a) | | 1,001 | 60,981 |

| Dolby Laboratories, Inc. Class A | | 398 | 33,106 |

| Dropbox, Inc. Class A (a) | | 3,746 | 118,673 |

| Dynatrace, Inc. (a) | | 1,024 | 58,368 |

| Five9, Inc. (a) | | 469 | 35,578 |

| Guidewire Software, Inc. (a) | | 560 | 62,541 |

| HubSpot, Inc. (a) | | 192 | 117,312 |

| Intuit, Inc. | | 1,720 | 1,085,888 |

| Manhattan Associates, Inc. (a) | | 590 | 143,110 |

| Microsoft Corp. | | 40,541 | 16,118,272 |

| Oracle Corp. | | 10,093 | 1,127,388 |

| Palantir Technologies, Inc. (a) | | 2,895 | 46,581 |

| Palo Alto Networks, Inc. (a) | | 2,082 | 704,778 |

| Qualys, Inc. (a) | | 373 | 70,560 |

| Salesforce, Inc. (a) | | 5,540 | 1,557,239 |

| ServiceNow, Inc. (a) | | 1,291 | 988,131 |

| Splunk, Inc. (a) | | 425 | 65,182 |

| Unity Software, Inc. (a) | | 843 | 27,313 |

| Workday, Inc. Class A (a) | | 482 | 140,296 |

| Zoom Video Communications, Inc. Class A (a) | | 936 | 60,475 |

| Zscaler, Inc. (a) | | 377 | 88,848 |

| | | | 24,674,048 |

| Technology Hardware, Storage & Peripherals - 6.7% | | | |

| Apple, Inc. | | 80,907 | 14,919,251 |

TOTAL INFORMATION TECHNOLOGY | | | 65,197,818 |

| MATERIALS - 2.1% | | | |

| Chemicals - 1.5% | | | |

| Ashland, Inc. | | 638 | 59,730 |

| Axalta Coating Systems Ltd. (a) | | 4,311 | 139,763 |

| Celanese Corp. Class A | | 2,280 | 333,541 |

| Dow, Inc. | | 11,153 | 597,801 |

| Eastman Chemical Co. | | 2,935 | 245,219 |

| Element Solutions, Inc. | | 2,073 | 46,083 |

| Linde PLC | | 3,982 | 1,612,033 |

| Olin Corp. | | 1,087 | 56,600 |

| RPM International, Inc. | | 1,302 | 138,871 |

| Westlake Corp. | | 396 | 54,787 |

| | | | 3,284,428 |

| Construction Materials - 0.1% | | | |

| Eagle Materials, Inc. | | 673 | 152,286 |

| Containers & Packaging - 0.2% | | | |

| Aptargroup, Inc. | | 638 | 82,863 |

| Berry Global Group, Inc. | | 1,293 | 84,640 |

| Crown Holdings, Inc. | | 1,244 | 110,094 |

| Graphic Packaging Holding Co. | | 2,996 | 76,428 |

| Sealed Air Corp. | | 2,025 | 69,964 |

| Silgan Holdings, Inc. | | 934 | 42,908 |

| Sonoco Products Co. | | 1,063 | 60,485 |

| | | | 527,382 |

| Metals & Mining - 0.3% | | | |

| Alcoa Corp. | | 1,397 | 41,561 |

| Cleveland-Cliffs, Inc. (a) | | 2,471 | 49,544 |

| Newmont Corp. | | 10,627 | 366,738 |

| Reliance Steel & Aluminum Co. | | 206 | 58,797 |

| Royal Gold, Inc. | | 264 | 30,199 |

| Southern Copper Corp. | | 1,075 | 88,258 |

| United States Steel Corp. (b) | | 1,634 | 76,831 |

| | | | 711,928 |

TOTAL MATERIALS | | | 4,676,024 |

| REAL ESTATE - 2.2% | | | |

| Equity Real Estate Investment Trusts (REITs) - 2.2% | | | |

| Agree Realty Corp. | | 906 | 54,007 |

| American Homes 4 Rent Class A | | 4,584 | 160,669 |

| American Tower Corp. | | 3,912 | 765,383 |

| Americold Realty Trust | | 1,432 | 39,380 |

| Apartment Income (REIT) Corp. | | 1,207 | 39,457 |

| Brixmor Property Group, Inc. | | 3,190 | 71,584 |

| Camden Property Trust (SBI) | | 3,592 | 337,073 |

| CubeSmart | | 1,502 | 64,916 |

| EastGroup Properties, Inc. | | 406 | 72,037 |

| Equity Lifestyle Properties, Inc. | | 2,309 | 156,296 |

| Federal Realty Investment Trust (SBI) | | 2,114 | 215,057 |

| First Industrial Realty Trust, Inc. | | 1,294 | 66,667 |

| Gaming & Leisure Properties | | 4,056 | 185,156 |

| Healthcare Trust of America, Inc. | | 2,797 | 45,060 |

| Healthpeak Properties, Inc. | | 18,511 | 342,454 |

| Kite Realty Group Trust | | 2,104 | 45,026 |

| Lamar Advertising Co. Class A | | 922 | 96,515 |

| Medical Properties Trust, Inc. (b) | | 4,276 | 13,256 |

| Mid-America Apartment Communities, Inc. | | 3,783 | 478,096 |

| NNN (REIT), Inc. | | 2,967 | 119,689 |

| Omega Healthcare Investors, Inc. | | 2,007 | 58,203 |

| Prologis, Inc. | | 8,343 | 1,056,975 |

| Realty Income Corp. | | 873 | 47,482 |

| Rexford Industrial Realty, Inc. | | 1,458 | 76,676 |

| Stag Industrial, Inc. | | 3,013 | 111,300 |

| Sun Communities, Inc. | | 1,118 | 140,141 |

| WP Carey, Inc. | | 2,159 | 133,772 |

| | | | 4,992,327 |

| Real Estate Management & Development - 0.0% | | | |

| Jones Lang LaSalle, Inc. (a) | | 82 | 14,519 |

TOTAL REAL ESTATE | | | 5,006,846 |

| UTILITIES - 2.3% | | | |

| Electric Utilities - 1.1% | | | |

| Exelon Corp. | | 18,936 | 659,162 |

| NextEra Energy, Inc. | | 15,656 | 917,911 |

| OGE Energy Corp. | | 5,489 | 182,454 |

| Xcel Energy, Inc. | | 12,561 | 752,027 |

| | | | 2,511,554 |

| Gas Utilities - 0.0% | | | |

| National Fuel Gas Co. | | 773 | 36,455 |

| Independent Power and Renewable Electricity Producers - 0.0% | | | |

| Vistra Corp. | | 1,283 | 52,641 |

| Multi-Utilities - 1.1% | | | |

| Ameren Corp. | | 8,986 | 625,156 |

| CMS Energy Corp. | | 11,327 | 647,451 |

| DTE Energy Co. | | 6,519 | 687,233 |

| NiSource, Inc. | | 17,545 | 455,644 |

| | | | 2,415,484 |

| Water Utilities - 0.1% | | | |

| Essential Utilities, Inc. | | 4,539 | 162,769 |

TOTAL UTILITIES | | | 5,178,903 |

| TOTAL COMMON STOCKS (Cost $188,676,100) | | | 216,888,117 |

| | | | |

| Money Market Funds - 1.2% |

| | | Shares | Value ($) |

| Fidelity Cash Central Fund 5.39% (c) | | 1,999,877 | 2,000,277 |

| Fidelity Securities Lending Cash Central Fund 5.39% (c)(d) | | 585,216 | 585,275 |

| TOTAL MONEY MARKET FUNDS (Cost $2,585,552) | | | 2,585,552 |

| | | | |

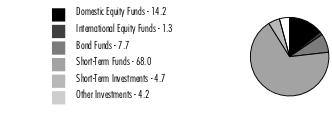

| Equity Funds - 1.4% |

| | | Shares | Value ($) |

| Domestic Equity Funds - 1.4% | | | |

iShares S&P 500 Index ETF (Cost $2,979,503) | | 6,407 | 3,108,676 |

| | | | |

| Purchased Options - 0.8% |

| | Counterparty | Number of Contracts | Notional Amount($) | Exercise Price ($) | Expiration Date | Value ($) |

| Put Options | | | | | | |

| S&P 500 Index | Chicago Board Options Exchange | 171 | 82,860,615 | 3,100 | 11/15/24 | 294,975 |

| S&P 500 Index | Chicago Board Options Exchange | 177 | 85,768,005 | 4,340 | 02/16/24 | 34,958 |

| S&P 500 Index | Chicago Board Options Exchange | 155 | 75,107,575 | 3,200 | 12/20/24 | 347,975 |

| S&P 500 Index | Chicago Board Options Exchange | 184 | 89,159,960 | 4,490 | 03/15/24 | 240,120 |

| S&P 500 Index | Chicago Board Options Exchange | 141 | 68,323,665 | 3,250 | 01/17/25 | 365,895 |

| S&P 500 Index | Chicago Board Options Exchange | 170 | 82,376,050 | 4,560 | 04/19/24 | 574,600 |

| | | | | | | |

| | | | | | | 1,858,523 |

TOTAL PURCHASED OPTIONS (Cost $4,226,131) | | | | | | 1,858,523 |

For the period, the average monthly notional amount at value for purchased options in the aggregate was $343,830,579.

| TOTAL INVESTMENT IN SECURITIES - 100.2% (Cost $198,467,286) | 224,440,868 |

NET OTHER ASSETS (LIABILITIES) - (0.2)% | (454,791) |

| NET ASSETS - 100.0% | 223,986,077 |

| | |

Security Type Abbreviations

Legend

| (b) | Security or a portion of the security is on loan at period end. |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| (d) | Investment made with cash collateral received from securities on loan. |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.39% | 575,547 | 166,377,517 | 164,952,787 | 66,330 | - | - | 2,000,277 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 5.39% | - | 28,150,251 | 27,564,976 | 10,454 | - | - | 585,275 | 0.0% |

| Total | 575,547 | 194,527,768 | 192,517,763 | 76,784 | - | - | 2,585,552 | |

| | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts in the dividend income column for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of January 31, 2024, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Equities: | | | | |

Communication Services | 19,045,333 | 19,045,333 | - | - |

Consumer Discretionary | 22,029,416 | 22,029,416 | - | - |

Consumer Staples | 13,436,089 | 13,436,089 | - | - |

Energy | 8,101,812 | 8,101,812 | - | - |

Financials | 28,873,344 | 28,873,344 | - | - |

Health Care | 27,421,898 | 27,421,898 | - | - |

Industrials | 17,920,634 | 17,920,634 | - | - |

Information Technology | 65,197,818 | 65,197,818 | - | - |

Materials | 4,676,024 | 4,676,024 | - | - |

Real Estate | 5,006,846 | 5,006,846 | - | - |

Utilities | 5,178,903 | 5,178,903 | - | - |

|

| Money Market Funds | 2,585,552 | 2,585,552 | - | - |

|

| Equity Funds | 3,108,676 | 3,108,676 | - | - |

|

| Purchased Options | 1,858,523 | 1,858,523 | - | - |

| Total Investments in Securities: | 224,440,868 | 224,440,868 | - | - |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of January 31, 2024. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

Primary Risk Exposure / Derivative Type | Value |

| Asset ($) | Liability ($) |

| Equity Risk | | |

Purchased Options (a) | 1,858,523 | 0 |

| Total Equity Risk | 1,858,523 | 0 |

| Total Value of Derivatives | 1,858,523 | 0 |

(a)Gross value is presented in the Statement of Assets and Liabilities in the Investments in Securities at value line-item.

| Statement of Assets and Liabilities |

| | | | January 31, 2024 |

| | | | | |

| Assets | | | | |

| Investment in securities, at value (including securities loaned of $560,939) - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $195,881,734) | $ | 221,855,316 | | |

Fidelity Central Funds (cost $2,585,552) | | 2,585,552 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $198,467,286) | | | $ | 224,440,868 |

| Cash | | | | 6 |

| Receivable for fund shares sold | | | | 89,167 |

| Dividends receivable | | | | 141,470 |

| Distributions receivable from Fidelity Central Funds | | | | 6,945 |

| Receivable from investment adviser for expense reductions | | | | 6,803 |

| Other receivables | | | | 171 |

Total assets | | | | 224,685,430 |

| Liabilities | | | | |

| Payable for fund shares redeemed | $ | 7,083 | | |

| Accrued management fee | | 100,897 | | |

| Distribution and service plan fees payable | | 1,068 | | |

| Other affiliated payables | | 5,030 | | |

| Collateral on securities loaned | | 585,275 | | |

| Total Liabilities | | | | 699,353 |

| Net Assets | | | $ | 223,986,077 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 202,796,609 |

| Total accumulated earnings (loss) | | | | 21,189,468 |

| Net Assets | | | $ | 223,986,077 |

| | | | | |

| Net Asset Value and Maximum Offering Price | | | | |

| Class A : | | | | |

Net Asset Value and redemption price per share ($1,292,316 ÷ 115,006 shares)(a) | | | $ | 11.24 |

| Maximum offering price per share (100/94.25 of $11.24) | | | $ | 11.93 |

| Class M : | | | | |

Net Asset Value and redemption price per share ($644,871 ÷ 57,420 shares)(a) | | | $ | 11.23 |

| Maximum offering price per share (100/96.50 of $11.23) | | | $ | 11.64 |

| Class C : | | | | |

Net Asset Value and offering price per share ($678,318 ÷ 60,556 shares)(a) | | | $ | 11.20 |

| Fidelity Hedged Equity Fund : | | | | |

Net Asset Value, offering price and redemption price per share ($219,075,549 ÷ 19,500,754 shares) | | | $ | 11.23 |

| Class I : | | | | |

Net Asset Value, offering price and redemption price per share ($984,292 ÷ 87,616 shares) | | | $ | 11.23 |

| Class Z : | | | | |

Net Asset Value, offering price and redemption price per share ($1,310,731 ÷ 116,570 shares) | | | $ | 11.24 |

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| Statement of Operations |

| | | | Year ended January 31, 2024 |

| Investment Income | | | | |

| Dividends | | | $ | 2,284,805 |

| Income from Fidelity Central Funds (including $10,454 from security lending) | | | | 76,784 |

| Total Income | | | | 2,361,589 |

| Expenses | | | | |

| Management fee | $ | 804,545 | | |

| Distribution and service plan fees | | 11,681 | | |

| Independent trustees' fees and expenses | | 97,955 | | |

| Total expenses before reductions | | 914,181 | | |

| Expense reductions | | (98,515) | | |

| Total expenses after reductions | | | | 815,666 |

| Net Investment income (loss) | | | | 1,545,923 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | (3,975,632) | | |

| Total net realized gain (loss) | | | | (3,975,632) |

| Change in net unrealized appreciation (depreciation) on investment securities | | | | 23,819,426 |

| Net gain (loss) | | | | 19,843,794 |

| Net increase (decrease) in net assets resulting from operations | | | $ | 21,389,717 |

| Statement of Changes in Net Assets |

| |

| | Year ended January 31, 2024 | | For the period September 1, 2022 (commencement of operations) through January 31, 2023 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 1,545,923 | $ | 183,275 |

| Net realized gain (loss) | | (3,975,632) | | (831,002) |

| Change in net unrealized appreciation (depreciation) | | 23,819,426 | | 2,154,156 |

| Net increase (decrease) in net assets resulting from operations | | 21,389,717 | | 1,506,429 |

| Distributions to shareholders | | (1,544,823) | | (161,856) |

| | | | | |

| Share transactions - net increase (decrease) | | 153,894,084 | | 48,902,526 |

| Total increase (decrease) in net assets | | 173,738,978 | | 50,247,099 |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 50,247,099 | | - |

| End of period | $ | 223,986,077 | $ | 50,247,099 |

| | | | | |

| | | | | |

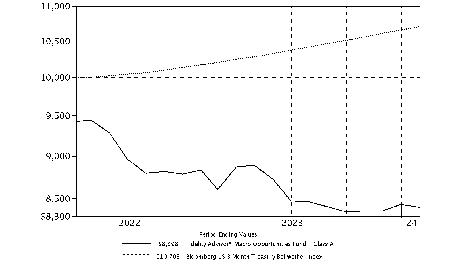

Financial Highlights

| Fidelity Advisor® Hedged Equity Fund Class A |

| |

| Years ended January 31, | | 2024 | | 2023 A |

Selected Per-Share Data | | | | |

| Net asset value, beginning of period | $ | 9.91 | $ | 10.00 |

| Income from Investment Operations | | | | |

Net investment income (loss) B,C | | .08 | | .04 |

| Net realized and unrealized gain (loss) | | 1.30 | | (.10) |

| Total from investment operations | | 1.38 | | (.06) |

| Distributions from net investment income | | (.05) | | (.03) |

| Total distributions | | (.05) | | (.03) |

| Net asset value, end of period | $ | 11.24 | $ | 9.91 |

Total Return D,E,F | | 13.95% | | (.59)% |

Ratios to Average Net Assets C,G,H | | | | |

| Expenses before reductions | | .89% | | 1.34% I |

| Expenses net of fee waivers, if any | | .80% | | .80% I |

| Expenses net of all reductions | | .80% | | .79% I |

| Net investment income (loss) | | .81% | | .90% I |

| Supplemental Data | | | | |

| Net assets, end of period (000 omitted) | $ | 1,292 | $ | 1,317 |

Portfolio turnover rate J | | 38% | | 21% K |

AFor the period September 1, 2022 (commencement of operations) through January 31, 2023.

BCalculated based on average shares outstanding during the period.

CNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

DTotal returns for periods of less than one year are not annualized.

ETotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

FTotal returns do not include the effect of the sales charges.

GFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

HExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

IAnnualized.

JAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

KAmount not annualized.

| Fidelity Advisor® Hedged Equity Fund Class M |

| |

| Years ended January 31, | | 2024 | | 2023 A |

Selected Per-Share Data | | | | |

| Net asset value, beginning of period | $ | 9.91 | $ | 10.00 |

| Income from Investment Operations | | | | |

Net investment income (loss) B,C | | .06 | | .03 |

| Net realized and unrealized gain (loss) | | 1.29 | | (.10) |

| Total from investment operations | | 1.35 | | (.07) |

| Distributions from net investment income | | (.03) | | (.02) |

| Total distributions | | (.03) | | (.02) |

| Net asset value, end of period | $ | 11.23 | $ | 9.91 |

Total Return D,E,F | | 13.64% | | (.71)% |

Ratios to Average Net Assets C,G,H | | | | |

| Expenses before reductions | | 1.14% | | 1.54% I |

| Expenses net of fee waivers, if any | | 1.05% | | 1.05% I |

| Expenses net of all reductions | | 1.05% | | 1.04% I |

| Net investment income (loss) | | .56% | | .65% I |

| Supplemental Data | | | | |

| Net assets, end of period (000 omitted) | $ | 645 | $ | 509 |

Portfolio turnover rate J | | 38% | | 21% K |

AFor the period September 1, 2022 (commencement of operations) through January 31, 2023.

BCalculated based on average shares outstanding during the period.

CNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

DTotal returns for periods of less than one year are not annualized.

ETotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

FTotal returns do not include the effect of the sales charges.

GFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

HExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

IAnnualized.

JAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

KAmount not annualized.

| Fidelity Advisor® Hedged Equity Fund Class C |

| |

| Years ended January 31, | | 2024 | | 2023 A |

Selected Per-Share Data | | | | |

| Net asset value, beginning of period | $ | 9.90 | $ | 10.00 |

| Income from Investment Operations | | | | |

Net investment income (loss) B,C | | .01 | | .01 |

| Net realized and unrealized gain (loss) | | 1.29 | | (.11) |

| Total from investment operations | | 1.30 | | (.10) |

| Distributions from net investment income | | - | | - D |

| Net asset value, end of period | $ | 11.20 | $ | 9.90 |

Total Return E,F,G | | 13.13% | | (.97)% |

Ratios to Average Net Assets C,H,I | | | | |

| Expenses before reductions | | 1.64% | | 2.04% J |

| Expenses net of fee waivers, if any | | 1.55% | | 1.55% J |

| Expenses net of all reductions | | 1.55% | | 1.54% J |

| Net investment income (loss) | | .06% | | .15% J |

| Supplemental Data | | | | |

| Net assets, end of period (000 omitted) | $ | 678 | $ | 526 |

Portfolio turnover rate K | | 38% | | 21% L |

AFor the period September 1, 2022 (commencement of operations) through January 31, 2023.

BCalculated based on average shares outstanding during the period.

CNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

DAmount represents less than $.005 per share.

ETotal returns for periods of less than one year are not annualized.

FTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

GTotal returns do not include the effect of the contingent deferred sales charge.

HFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

IExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

JAnnualized.

KAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

LAmount not annualized.

| Fidelity® Hedged Equity Fund |

| |

| Years ended January 31, | | 2024 | | 2023 A |

Selected Per-Share Data | | | | |

| Net asset value, beginning of period | $ | 9.91 | $ | 10.00 |

| Income from Investment Operations | | | | |

Net investment income (loss) B,C | | .11 | | .05 |

| Net realized and unrealized gain (loss) | | 1.30 | | (.10) |

| Total from investment operations | | 1.41 | | (.05) |

| Distributions from net investment income | | (.09) | | (.04) |

| Total distributions | | (.09) | | (.04) |

| Net asset value, end of period | $ | 11.23 | $ | 9.91 |

Total Return D,E | | 14.22% | | (.54)% |

Ratios to Average Net Assets C,F,G | | | | |

| Expenses before reductions | | .61% | | 1.12% H |

| Expenses net of fee waivers, if any | | .55% | | .55% H |

| Expenses net of all reductions | | .55% | | .54% H |

| Net investment income (loss) | | 1.06% | | 1.15% H |

| Supplemental Data | | | | |

| Net assets, end of period (000 omitted) | $ | 219,076 | $ | 46,678 |

Portfolio turnover rate I | | 38% | | 21% J |

AFor the period September 1, 2022 (commencement of operations) through January 31, 2023.

BCalculated based on average shares outstanding during the period.

CNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

DTotal returns for periods of less than one year are not annualized.

ETotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

FFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

GExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

HAnnualized.

IAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

JAmount not annualized.

| Fidelity Advisor® Hedged Equity Fund Class I |

| |

| Years ended January 31, | | 2024 | | 2023 A |

Selected Per-Share Data | | | | |

| Net asset value, beginning of period | $ | 9.91 | $ | 10.00 |

| Income from Investment Operations | | | | |

Net investment income (loss) B,C | | .11 | | .05 |

| Net realized and unrealized gain (loss) | | 1.30 | | (.10) |

| Total from investment operations | | 1.41 | | (.05) |

| Distributions from net investment income | | (.09) | | (.04) |

| Total distributions | | (.09) | | (.04) |

| Net asset value, end of period | $ | 11.23 | $ | 9.91 |

Total Return D,E | | 14.22% | | (.54)% |

Ratios to Average Net Assets C,F,G | | | | |

| Expenses before reductions | | .63% | | 1.04% H |

| Expenses net of fee waivers, if any | | .55% | | .55% H |

| Expenses net of all reductions | | .55% | | .55% H |

| Net investment income (loss) | | 1.06% | | 1.15% H |

| Supplemental Data | | | | |

| Net assets, end of period (000 omitted) | $ | 984 | $ | 497 |

Portfolio turnover rate I | | 38% | | 21% J |

AFor the period September 1, 2022 (commencement of operations) through January 31, 2023.

BCalculated based on average shares outstanding during the period.

CNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

DTotal returns for periods of less than one year are not annualized.

ETotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

FFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

GExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

HAnnualized.

IAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

JAmount not annualized.

| Fidelity Advisor® Hedged Equity Fund Class Z |

| |

| Years ended January 31, | | 2024 | | 2023 A |

Selected Per-Share Data | | | | |

| Net asset value, beginning of period | $ | 9.91 | $ | 10.00 |

| Income from Investment Operations | | | | |

Net investment income (loss) B,C | | .12 | | .05 |

| Net realized and unrealized gain (loss) | | 1.29 | | (.10) |

| Total from investment operations | | 1.41 | | (.05) |

| Distributions from net investment income | | (.08) | | (.04) |

| Total distributions | | (.08) | | (.04) |

| Net asset value, end of period | $ | 11.24 | $ | 9.91 |

Total Return D,E | | 14.30% | | (.54)% |

Ratios to Average Net Assets C,F,G | | | | |

| Expenses before reductions | | .59% | | 1.01% H |

| Expenses net of fee waivers, if any | | .50% | | .50% H |

| Expenses net of all reductions | | .50% | | .50% H |

| Net investment income (loss) | | 1.11% | | 1.20% H |

| Supplemental Data | | | | |

| Net assets, end of period (000 omitted) | $ | 1,311 | $ | 720 |

Portfolio turnover rate I | | 38% | | 21% J |

AFor the period September 1, 2022 (commencement of operations) through January 31, 2023.

BCalculated based on average shares outstanding during the period.

CNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

DTotal returns for periods of less than one year are not annualized.

ETotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

FFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

GExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

HAnnualized.

IAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

JAmount not annualized.

For the period ended January 31, 2024

1. Organization.

Fidelity Hedged Equity Fund (the Fund) is a fund of Fidelity Greenwood Street Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware statutory trust. The Fund offers Class A, Class M, Class C, Fidelity Hedged Equity Fund, Class I and Class Z shares, each of which has equal rights as to assets and voting privileges. Class A, Class M, Class C, and Class I and Class Z are Fidelity Advisor classes. Each class has exclusive voting rights with respect to matters that affect that class. Class C shares will automatically convert to Class A shares after a holding period of eight years from the initial date of purchase, with certain exceptions.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense RatioA |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

A Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, and are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The Fund's Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has designated the Fund's investment adviser as the valuation designee responsible for the fair valuation function and performing fair value determinations as needed. The investment adviser has established a Fair Value Committee (the Committee) to carry out the day-to-day fair valuation responsibilities and has adopted policies and procedures to govern the fair valuation process and the activities of the Committee. In accordance with these fair valuation policies and procedures, which have been approved by the Board, the Fund attempts to obtain prices from one or more third party pricing services or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with the policies and procedures. Factors used in determining fair value vary by investment type and may include market or investment specific events, transaction data, estimated cash flows, and market observations of comparable investments. The frequency that the fair valuation procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee manages the Fund's fair valuation practices and maintains the fair valuation policies and procedures. The Fund's investment adviser reports to the Board information regarding the fair valuation process and related material matters.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - unadjusted quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Exchange-Traded Funds (ETFs) are valued at their last sale price or official closing price as reported by a third party pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day but the exchange reports a closing bid level, ETFs are valued at the closing bid and would be categorized as Level 1 in the hierarchy. In the event there was no closing bid, ETFs may be valued by another method that the Board believes reflects fair value in accordance with the Board's fair value pricing policies and may be categorized as Level 2 in the hierarchy.

Exchange-traded options are valued using the last sale price or, in the absence of a sale, the last offering price and are categorized as Level 1 in the hierarchy. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of January 31, 2024 is included at the end of the Fund's Schedule of Investments.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost. Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of a fund include an amount in addition to trade execution, which may be rebated back to a fund. Any such rebates are included in net realized gain (loss) on investments in the Statement of Operations. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of a fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of a fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred, as applicable. Certain expense reductions may also differ by class, if applicable. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expenses included in the accompanying financial statements reflect the expenses of that fund and do not include any expenses associated with any underlying mutual funds or exchange-traded funds (ETFs). Although not included in a fund's expenses, a fund indirectly bears its proportionate share of these expenses through the net asset value of each underlying mutual fund or exchange-traded fund (ETF). Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of January 31, 2024, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to options, partnerships, capital loss carryforwards and losses deferred due to option transactions and wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $33,090,465 |

| Gross unrealized depreciation | (4,952,930) |

| Net unrealized appreciation (depreciation) | $28,137,535 |

| Tax Cost | $196,303,333 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed ordinary income | $21,842 |

| Capital loss carryforward | $(6,844,800) |

| Net unrealized appreciation (depreciation) on securities and other investments | $28,012,426 |

Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. The capital loss carryforward information presented below, including any applicable limitation, is estimated as of fiscal period end and is subject to adjustment.

| Short-term | $(1,879,602) |

| Long-term | (4,965,198) |