Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-266294

PROSPECTUS

Up to 15,306,122 Ordinary Shares

This prospectus relates to the resale of up to 15,306,122 Ordinary Shares, $0.01 nominal value per share (the “Ordinary Shares”), by YA II PN, LTD., a Cayman Islands exempt limited partnership (“Yorkville”). The shares included in this prospectus consist of Ordinary Shares that we may, in our discretion, elect to issue and sell to Yorkville, from time to time after the date of this prospectus, pursuant to a standby equity purchase agreement we entered into with Yorkville on April 18, 2022 (the “SEPA”), in which Yorkville has committed to purchase from us, at our direction, up to $150,000,000 of our Ordinary Shares, subject to terms and conditions specified in the SEPA. As of the date of this prospectus, we have not issued any Ordinary Shares to Yorkville. See the section entitled “Committed Equity Financing” for a description of the SEPA and the section entitled “Selling Securityholder” for additional information regarding Yorkville.

Our registration of the securities covered by this prospectus does not mean that Yorkville will offer or sell any of the Ordinary Shares. Yorkville may offer, sell or distribute all or a portion of their Ordinary Shares publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any proceeds from the sale of Ordinary Shares by Yorkville pursuant to this prospectus. However, we may receive up to $150,000,000 in aggregate gross proceeds from sales of our Ordinary Shares to Yorkville that we may, in our discretion, elect to make, from time to time after the date of this prospectus, pursuant to the SEPA. We provide more information about how Yorkville may sell or otherwise dispose of our Ordinary Shares in the section entitled “Plan of Distribution.” Yorkville is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended.

We are a “foreign private issuer” under applicable Securities and Exchange Commission (the “SEC”) rules and an “emerging growth company” as that term is defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and are eligible for reduced public company disclosure requirements.

Our Ordinary Shares and warrants are listed on The Nasdaq Global Market (“Nasdaq”) under the symbols “ALVO” and “ALVOW,” respectively. On September 13, 2022, the closing price of our Ordinary Shares was $7.54. Our Ordinary Shares are also listed on the Nasdaq First North Growth Market (“Nasdaq First North”) under the ticker symbol “ALVO,” and to ensure compliance with applicable Icelandic and European securities rules and regulations, due to the listing of our Ordinary Shares on Nasdaq First North, this Registration Statement on Form F-1 will be published on Nasdaq First North’s website as well.

You should read this prospectus and any prospectus supplement or amendment carefully before you invest in our securities. Investing in our securities involves risks. See “Risk Factors” beginning on page 11 of this prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is September 21, 2022.

Table of Contents

| Page | ||||

| i | ||||

IMPORTANT INFORMATION ABOUT IFRS AND NON-IFRS FINANCIAL MEASURES | i | |||

| ii | ||||

| iii | ||||

| vi | ||||

| vi | ||||

| 1 | ||||

| 8 | ||||

| 9 | ||||

| 11 | ||||

| 78 | ||||

| 83 | ||||

| 83 | ||||

| 85 | ||||

| 86 | ||||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 132 | |||

| 164 | ||||

| 174 | ||||

| 193 | ||||

| 204 | ||||

| 206 | ||||

| 207 | ||||

| 213 | ||||

| 218 | ||||

| 220 | ||||

SERVICE OF PROCESS AND ENFORCEMENT OF CIVIL LIABILITIES UNDER U.S. SECURITIES LAWS | 220 | |||

| 221 | ||||

| 221 | ||||

| 221 | ||||

| F-1 | ||||

Table of Contents

You should rely only on the information contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by us or on our behalf. Any amendment or supplement may also add, update or change information included in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such amendment or supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. See “Where You Can Find More Information.”

Neither we nor Yorkville have authorized any other person to provide you with different or additional information. Neither we nor Yorkville take responsibility for, nor can we provide assurance as to the reliability of, any other information that others may provide. The information contained in this prospectus is accurate only as of the date of this prospectus or such other date stated in this prospectus, and our business, financial condition, results of operations and/or prospects may have changed since those dates. This prospectus contains summaries of certain provisions contained in some of the documents described in this prospectus, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to in this prospectus have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described under “Where You Can Find More Information.”

Neither we nor Yorkville are making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. Except as otherwise set forth in this prospectus, neither we nor Yorkville have taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

On June 15, 2022, Alvotech consummated the transactions contemplated by the Business Combination Agreement by and among OACB, Alvotech Holdings and Alvotech. For more information about the Business Combination, see the section “Explanatory Note” in the 20-F filed by Alvotech with the SEC on June 22, 2022.

This prospectus contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend our use or display of other companies’ trade name or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Certain amounts that appear in this prospectus may not sum due to rounding.

IMPORTANT INFORMATION ABOUT IFRS AND NON-IFRS FINANCIAL MEASURES

Alvotech’s historical consolidated financial statements are prepared in accordance with IFRS.

Certain of the measures included in this prospectus may be considered non-IFRS financial measures. Non-IFRS financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with IFRS, and non-IFRS financial measures as used by Alvotech may not be comparable to similarly titled amounts used by other companies.

i

Table of Contents

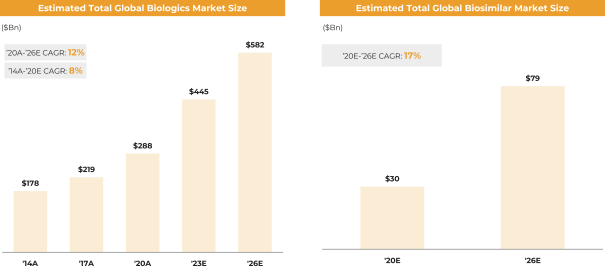

This prospectus contains estimates, projections, and other information concerning Alvotech’s industry and business, as well as data regarding market research, estimates, and forecasts prepared by Alvotech’s management. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. The industry in which Alvotech operates is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors.” Unless otherwise expressly stated, Alvotech obtained this industry, business, market, and other data from reports, research surveys, studies, and similar data prepared by market research firms and other third parties, industry and general publications, government data, and similar sources. In some cases, Alvotech does not expressly refer to the sources from which this data is derived. In that regard, when Alvotech refers to one or more sources of this type of data in any paragraph, you should assume that other data of this type appearing in the same paragraph is derived from sources which Alvotech paid for, sponsored, or conducted, unless otherwise expressly stated or the context otherwise requires. While Alvotech has compiled, extracted, and reproduced industry data from these sources, Alvotech has not independently verified the data. Forecasts and other forward-looking information with respect to industry, business, market, and other data are subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this prospectus. See “Cautionary Note Regarding Forward-Looking Statements.”

ii

Table of Contents

In this prospectus:

“Alvogen” means Alvogen Lux Holdings S.à r.l., a limited liability company (Société à responsabilité limitée) incorporated and existing under the laws of the Grand Duchy of Luxembourg having its registered office at 5, Rue Heienhaff, L-1736 Senningerberg, Grand Duchy of Luxembourg and registered with the Luxembourg Trade and Company Register (Registre de Commerce et des Sociétés, Luxembourg) under number B 149045.

“Alvogen-Aztiq Loan Advance Conversion” means the private placement dated July 12, 2022, pursuant to which Alvogen and Aztiq subscribed to 2,500,000 Ordinary Shares each, for a subscription price of $10.00 per share.

“Alvotech” means as the context requires, (a) the registrant, a legal entity named Alvotech, previously known as Alvotech Lux Holdings S.A.S., a public limited liability company (société anonyme) incorporated and existing under the laws of the Grand Duchy of Luxembourg having its registered office at 9, Rue de Bitbourg, L-1273 Luxembourg, Grand Duchy of Luxembourg, registered with the Luxembourg Trade and Company Register (Registre de Commerce et des Sociétés, Luxembourg) under number B258884, individually or together with its consolidated subsidiaries; or (b) Alvotech Holdings.

“Alvotech Holdings” means Alvotech Holdings S.A., a public limited liability company (société anonyme) incorporated under the laws of the Grand Duchy of Luxembourg having its registered office at 9, Rue de Bitbourg, L-1273 Luxembourg, Grand Duchy of Luxembourg and registered with the Luxembourg Trade and Company Register (Registre de Commerce et des Sociétés, Luxembourg) under number B 229193, individually or together with its consolidated subsidiaries.

“Alvotech Holdings Class A Ordinary Shares” means the Class A Ordinary Shares, with a nominal value of $0.01 per share, of Alvotech Holdings, which converted into Ordinary Shares at the closing of the Business Combination.

“Alvotech Holdings Class B Shares” means the Class B Shares, with a nominal value of $0.01 per share, of Alvotech Holdings, which converted into Ordinary Shares at the closing of the Business Combination.

“Alvotech Holdings Ordinary Shares” means the Alvotech Holdings Class A Ordinary Shares and the Alvotech Holdings Class B Shares, collectively.

“Alvotech Holdings Shareholders” means the holders of Alvotech Holdings Ordinary Shares.

“Aztiq” means Aztiq Pharma Partners S.à r.l., a limited liability company (Société à responsabilité limitée) incorporated and existing under the laws of the Grand Duchy of Luxembourg having its registered office at 5, Rue Heienhaff, L-1736 Senningerberg, Grand Duchy of Luxembourg and registered with the Luxembourg Trade and Company Register (Registre de Commerce et des Sociétés, Luxembourg) under number B 147728.

“Business Combination” means the transactions contemplated by the Business Combination Agreement, including the Mergers.

“Business Combination Agreement” means the Business Combination Agreement, dated as of December 7, 2021 as may be amended, by and among OACB, Alvotech Holdings and Alvotech.

“Closing” means the consummation of the Business Combination, which occurred on June 15, 2022.

“Closing Date” means June 15, 2022, the date upon which the Closing occurred.

“Code” means the Internal Revenue Code of 1986, as amended.

iii

Table of Contents

“Combined Company” means Alvotech and its consolidated subsidiaries after giving effect to the Business Combination.

“Conversion” means the change of Alvotech’s legal form from a simplified joint stock company (société par actions simplifiée) to a public limited liability company (société anonyme) under Luxembourg law immediately after the effectiveness of the First Merger and the Redemption.

“Election” means the election on Internal Revenue Service Form 8832 pursuant to Treasury Regulations Section 301.7701-3(c), effective as of the date of the First Merger Effective Time, for Alvotech to be classified as an association taxable as a corporation for U.S. federal income tax purposes.

“EMA” means the European Medicines Agency.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“FDA” means the U.S. Food and Drug Administration.

“First Merger” means when OACB merges with and into Alvotech, with Alvotech as the surviving company.

“First Merger Effective Time” means the date and time at which the notarial deed of the sole shareholder’s resolutions of Alvotech approving the First Merger becomes effective, upon its publication in the Recueil Electronique des Sociétés et Associations (the Luxembourg legal gazette), subject to the execution of a plan of merger between OACB and Alvotech and the filing and registration of such Plan of First Merger and such other documents as required under the Companies Act (as amended) of the Cayman Islands.

“GAAP” means United States generally accepted accounting principles.

“IFRS” means the International Financial Reporting Standards as adopted by the International Accounting Standards Board.

“Initial Shareholders” means the holders of the OACB Class B Ordinary Shares.

“IPO” means OACB’s initial public offering of units, consummated on September 21, 2020.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012, as amended.

“Luxembourg Company Law” means the Luxembourg law of August 10, 1915 on commercial companies, as amended.

“Mergers” means the First Merger and the Second Merger collectively.

“Nasdaq” means The Nasdaq Stock Market LLC.

“Nasdaq First North” means the Nasdaq First North Growth Market.

“OACB” means Oaktree Acquisition Corp. II, a Cayman Islands exempted company.

“OACB Class A Ordinary Shares” means the Class A ordinary shares, par value 0.0001 per share, of OACB, which converted into Ordinary Shares at the closing of the Business Combination.

“OACB Class B Ordinary Shares” or “Founder Shares” means the 6,250,000 Class B ordinary shares, par value $0.0001 per share, of OACB, which were issued to the Sponsor in a private placement prior to OACB’s initial public offering and converted into Ordinary Shares at the closing of the Business Combination.

iv

Table of Contents

“OACB Ordinary Shares” means the OACB Class A Ordinary Shares and the OACB Class B Ordinary Shares, collectively.

“OACB Private Placement Warrants” means the warrants to purchase OACB Class A Ordinary Shares purchased in a private placement in connection with the IPO, which automatically ceased to represent a right to acquire purchase OACB Class A Ordinary Shares and automatically represented a right to acquire Ordinary Shares at the Closing of the Business Combination.

“OACB Public Warrants” means each whole warrant of OACB entitling the holder to purchase one OACB Class A Ordinary Share at a price of $11.50 per share, which automatically ceased to represent a right to acquire purchase OACB Class A Ordinary Shares and automatically represented a right to acquire Ordinary Shares at the closing of the Business Combination.

“OACB Warrants” means the OACB Public Warrants and the OACB Private Placement Warrants.

“Ordinary Shares” means the ordinary shares, with a nominal value of $0.01 per share, of Alvotech.

“PIPE Financing” means the private placement pursuant to which the Subscribers subscribed to Ordinary Shares, for a subscription price of $10.00 per share.

“Public Shares” means the OACB Class A Ordinary Shares issued as part of the units sold in the IPO, which converted into Ordinary Shares at the closing of the Business Combination.

“Public Shareholders” means the holders of the OACB Class A Ordinary Shares, which converted into Ordinary Shares at the closing of the Business Combination.

“Public Warrants” means the former OACB Public Warrants converted at the First Merger Effective Time into a right to acquire one Ordinary Share on substantially the same terms as were in effect immediately prior to the First Merger Effective Time under the terms of the Warrant Agreement.

“Redemption” means Alvotech’s redemption and cancellation of the initial shares held by the initial sole shareholder of Alvotech pursuant to a share capital reduction of Alvotech immediately after the effectiveness of the First Merger but prior to the Conversion.

“SEC” means the U.S. Securities and Exchange Commission.

“Second Merger” means when Alvotech Holdings merges with and into Alvotech, with Alvotech as the surviving company.

“Second Merger Effective Time” means the date and time at which the Second Merger becomes effective, on the Closing Date immediately after giving effect to the First Merger, the Redemption, the Conversion and the PIPE Financing.

“Securities Act” means the Securities Act of 1933, as amended.

“Sponsor” means Oaktree Acquisition Holdings II, L.P., a Cayman Islands exempted limited partnership.

“Sponsor Letter Agreement” means the Sponsor Agreement, dated as of December 7, 2021, by and among OACB, Alvotech and Sponsor.

“Subscribers” means the institutional investors that have committed to subscribe to Ordinary Shares in the PIPE Financing.

v

Table of Contents

“Trust Account” means the trust account that held a portion of the proceeds of the IPO and the concurrent sale of the Private Placement Warrants prior to the Closing.

“Warrants” means the former OACB Warrants converted at the First Merger Effective Time into a right to acquire one Ordinary Share on substantially the same terms as were in effect immediately prior to the First Merger Effective Time under the terms of the Warrant Agreement.

“Warrant Agreement” means the warrant agreement, dated September 21, 2020 by and between OACB and Continental Stock Transfer & Trust Company, as warrant agent, governing OACB’s outstanding warrants, which was assigned to and assumed by Alvotech pursuant to that certain Assignment, Assumption and Amendment Agreement dated as of June 15, 2022.

“Yorkville” means YA II PN, LTD., a Cayman Islands exempt limited partnership.

CONVENTIONS WHICH APPLY TO THIS PROSPECTUS

In this prospectus, unless otherwise specified or the context otherwise requires:

“$,” “USD” and “U.S. dollar” each refers to the United States dollar; and

“€,” “EUR” and “euro” each refers to the lawful currency of certain participating member states of the European Union.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements in this prospectus constitute forward-looking statements that do not directly or exclusively relate to historical facts. You should not place undue reliance on such statements because they are subject to numerous uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control. Forward-looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategy. These statements are often, but not always, made through the use of words or phrases such as “believe,” “anticipate,” “could,” “may,” “would,” “should,” “intend,” “plan,” “potential,” “predict,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy,” “outlook,” “continue,” “possible,” “might” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results to differ materially from the results expressed in the statements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are the following:

| • | the benefits of the Business Combination; |

| • | Alvotech’s financial performance following the Business Combination; |

| • | the ability to maintain the listing of the Ordinary Shares or Warrants on Nasdaq and Nasdaq First North, following the Business Combination; |

| • | changes in Alvotech’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects and plans; |

| • | Alvotech’s strategic advantages and the impact those advantages will have on future financial and operational results; |

| • | Alvotech’s expansion plans and opportunities; |

| • | Alvotech’s ability to grow its business in a cost-effective manner; |

| • | the implementation, market acceptance and success of Alvotech’s business model; |

vi

Table of Contents

| • | developments and projections relating to Alvotech’s competitors and industry, including the estimated growth of the industry; |

| • | Alvotech’s approach and goals with respect to technology; |

| • | Alvotech’s expectations regarding its ability to obtain and maintain intellectual property protection and not infringe on the rights of others; |

| • | the impact of the COVID-19 pandemic or the occurrence of unforeseen geopolitical events such as the Russia-Ukraine conflict on Alvotech’s business; |

| • | changes in applicable laws or regulations; |

| • | the outcome of any known and unknown litigation and regulatory proceedings, including legal proceedings, directly or through its partners, adverse to AbbVie; |

| • | Alvotech’s ability to obtain and maintain regulatory approval for its product candidates of the FDA, European Commission and comparable national or regional authorities; |

| • | Alvotech’s ability to comply with all applicable laws and regulations; |

| • | Alvotech’s ability to successfully launch its products in certain markets after obtaining regulatory approval for such market; |

| • | Alvotech’s estimates of expenses and profitability; |

| • | Alvotech’s ability to identify and successfully develop new product candidates; |

| • | Alvotech’s relationship with third party providers for clinical and non-clinical studies, supplies, and manufacturing of its products; |

| • | Alvotech’s ability to manage its manufacturing risks; |

| • | Alvotech’s relationship with partners for the commercialization of its product candidates; |

| • | Alvotech’s ability to meet the conditions precedent to issue Ordinary Shares to Yorkville under the SEPA; |

| • | the volatility of the price of Ordinary Shares that may result from sales of Ordinary Shares by Yorkville; and |

| • | the dilution of holders of Ordinary Shares resulting from Alvotech’s issuance Ordinary Shares to Yorkville. There can be no guarantee that how many Ordinary Shares Alvotech will issue under the SEPA, if at all. |

These forward-looking statements are based on information available as of the date of this prospectus, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

You should not place undue reliance on these forward-looking statements in deciding to invest in our securities. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include:

| • | the outcome of any legal proceedings that may be instituted against Alvotech following the Closing; |

| • | the outcome of any legal or regulatory proceedings; |

| • | the ability to maintain the listing of the Ordinary Shares on Nasdaq and Nasdaq First North; |

vii

Table of Contents

| • | the risk that the consummation of the Business Combination and related transactions disrupts current plans and operations of Alvotech; |

| • | our ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition and the ability of Alvotech to grow and manage growth profitably following the Business Combination; |

| • | changes in applicable laws or regulations; |

| • | the effects of the COVID-19 pandemic on Alvotech’s business; |

| • | the effects of competition on Alvotech’s future business; |

| • | Alvotech’s position in the market against current and future competitors; |

| • | Alvotech’s expansion into new products, services, technologies or geographic regions; |

| • | the ability to implement business plans, forecasts, and other expectations, and identify and realize additional opportunities and to continue as a going concern; |

| • | the risk of downturns and the possibility of rapid change in the highly competitive industry in which Alvotech operates; |

| • | the risk that Alvotech and its current and future commercial partners are unable to successfully develop, seek marketing approval for, and commercialize Alvotech’s products or services, or experience significant delays in doing so; |

| • | the risk that the Combined Company may never achieve or sustain profitability; |

| • | the risk that the Combined Company will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; |

| • | the risk that the Combined Company experiences difficulties in managing its growth and expanding operations; |

| • | the risk that Alvotech has identified a material weakness in its internal control over financial reporting which, if not corrected, could affect the reliability of Alvotech’s financial statements; |

| • | the risk that Alvotech is unable to secure or protect its intellectual property; |

| • | the risk that estimated growth of the industry does not occur, or does not occur at the rates or timing Alvotech has assumed based on third-party estimates and its own internal analyses; |

| • | the possibility that Alvotech may be adversely affected by other economic, business, and/or competitive factors; and |

| • | other risks and uncertainties described in this prospectus, including those under the section entitled “Risk Factors.” |

viii

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our securities. Before making an investment decision, you should read this entire prospectus carefully, especially “Risk Factors” and the financial statements and related notes thereto, and the other documents to which this prospectus refers. Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements” for more information.

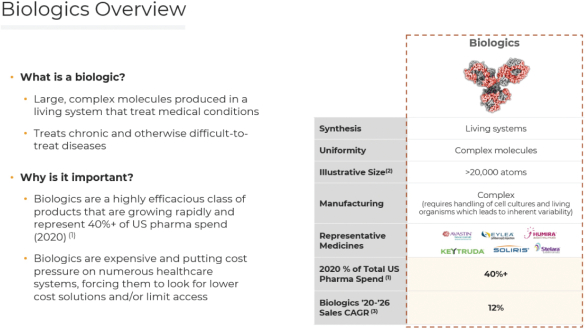

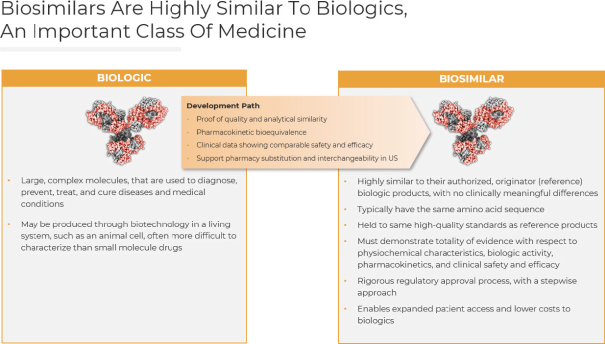

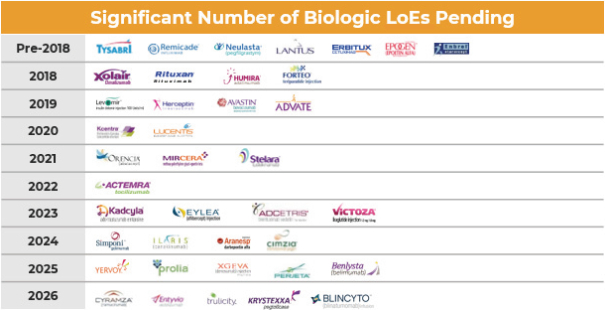

Alvotech

Alvotech is a highly integrated biotech company focused solely on the development and manufacture of biosimilar medicines for patients worldwide. Our purpose is to improve the health and quality of life of patients around the world by improving access to proven treatments for various diseases. Since our inception, we have built our company with key characteristics we believe will help us capture the substantial global market opportunity in biosimilars: a leadership team that has brought numerous successful biologics and biosimilars to market around the world; a purpose-built biosimilars R&D and manufacturing platform; top commercial partnerships in global markets; and a diverse, expanding pipeline addressing many of the biggest disease areas and health challenges globally. Alvotech is a company committed to constant innovation: we focus our platform, people and partnerships on finding new ways to drive access to more affordable biologic medicines.

For more information about Alvotech, see the sections entitled “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation.”

Committed Equity Financing

On April 18, 2022, we entered into the Standby Equity Purchase Agreement (“SEPA”) with Yorkville pursuant to which we have the right to sell to Yorkville up to $150,000,000 of our Ordinary Shares, subject to certain limitations and conditions set forth in the SEPA, from time to time during the term of the SEPA. Sales of Ordinary Shares to Yorkville under the SEPA, and the timing of any such sales, are at our option, and we are under no obligation to sell any securities to Yorkville under the SEPA. In accordance with our obligations under the SEPA, we have filed the registration statement that includes this prospectus with the SEC to register under the Securities Act the resale by Yorkville of up to 15,306,122 Ordinary Shares that we may elect, in our sole discretion, to issue and sell to Yorkville, under the SEPA.

Upon the satisfaction of the conditions to Yorkville’s purchase obligation set forth in the SEPA, including that the registration statement of which this prospectus forms a part be declared effective by the SEC and the final form of this prospectus is filed with the SEC, we will have the right, but not the obligation, from time to time at our discretion until the first day of the month following the 36-month period after the date of the SEPA, to direct Yorkville to purchase a specified amount of Ordinary Shares (each such sale, an “Advance”) by delivering written notice to Yorkville (each, an “Advance Notice”). While there is no mandatory minimum amount for any Advance, it may not exceed the lesser of (i) $20,000,000 in respect of an Advance Notice in which the Company elects a one-day pricing period or (ii) $60 million in respect of an Advance Notice in which the Company elects a three-day pricing period.

The per share subscription price Yorkville will pay for the Ordinary Shares will be 98.0% of the market price during a one- or three-day pricing period elected by Alvotech. The “Market Price” is defined in the SEPA as the lowest daily VWAPs (as defined below) during one trading day, in the case of a one-day pricing period, or of the three consecutive trading days, in the case of a three-day pricing period, commencing on the trading day following the date Alvotech submits an Advance Notice to Yorkville. “VWAP” means, for any trading day, the

1

Table of Contents

daily volume weighted average price of the Ordinary Shares for such date on NASDAQ as reported by Bloomberg L.P. during regular trading hours. There is no upper limit on the subscription price per share that Yorkville could be obligated to pay for the Ordinary Shares.

We will control the timing and amount of any sales of Ordinary Shares to Yorkville. Actual sales of our Ordinary Shares to Yorkville under the SEPA will depend on a variety of factors to be determined by us from time to time, which may include, among other things, market conditions, the trading price of our Ordinary Shares and determinations by us as to the appropriate sources of funding for our business and its operations.

Yorkville will not be obligated to subscribe to any Ordinary Shares under the SEPA which, when aggregated with all other Ordinary Shares then beneficially owned by Yorkville and its affiliates (as calculated pursuant to Section 13(d) of the Exchange Act, and Rule 13d-3 promulgated thereunder), would result in the beneficial ownership by Yorkville and its affiliates to exceed 9.99% of the outstanding voting power or number of Ordinary Shares (the “Beneficial Ownership Limitation”).

The net proceeds under the SEPA to us will depend on the frequency and prices at which we sell Ordinary Shares to Yorkville. We expect that any proceeds received by us from such sales to Yorkville will be used for working capital and general corporate purposes.

Yorkville has agreed that it and its affiliates will not engage in any short sales of the Ordinary Shares nor enter into any transaction that establishes a net short position in the Ordinary Shares during the term of the SEPA.

The SEPA will automatically terminate on the earliest to occur of (i) the first day of the month next following the 36-month anniversary of the date of the SEPA or (ii) the date on which Yorkville shall have made payment of Advances pursuant to the SEPA for Ordinary Shares equal to $150,000,000. We have the right to terminate the SEPA at no cost or penalty upon five (5) trading days’ prior written notice to Yorkville, provided that there are no outstanding Advance Notices for which Ordinary Shares need to be issued and Alvotech has paid all amounts owed to Yorkville pursuant to the SEPA. We and Yorkville may also agree to terminate the SEPA by mutual written consent. Neither we nor Yorkville may assign or transfer our respective rights and obligations under the SEPA, and no provision of the SEPA may be modified or waived by us or Yorkville other than by an instrument in writing signed by both parties.

As consideration for Yorkville’s commitment to purchase Ordinary Shares at our direction upon the terms and subject to the conditions set forth in the SEPA, we paid YA Global II SPV, LLC, a subsidiary of Yorkville, (i) a structuring fee in the amount of $10,000 and (ii) a commitment fee in the amount of $750,000.

The SEPA contains customary representations, warranties, conditions and indemnification obligations of the parties. The representations, warranties and covenants contained in such agreements were made only for purposes of such agreements and as of specific dates, were solely for the benefit of the parties to such agreements and may be subject to limitations agreed upon by the contracting parties.

We do not know what the subscription price for our Ordinary Shares will be and therefore cannot be certain as to the number of shares we might issue to Yorkville under the SEPA. As of July 14, 2022, there were 248,649,505 Ordinary Shares outstanding (excluding the 27,072,167 Ordinary Shares issued on July 4, 2022 and held in treasury by Alvotech’s subsidiary, Alvotech Manco ehf.). Although the SEPA provides that we may sell up to $150,000,000 of our Ordinary Shares to Yorkville, only 15,306,122 Ordinary Shares are being registered for resale under the registration statement that includes this prospectus.

If and when we elect to issue and sell shares to Yorkville, we may need to register for resale under the Securities Act additional Ordinary Shares in order to receive aggregate gross proceeds equal to the $150,000,000 available

2

Table of Contents

to us under the SEPA, depending on market prices for our Ordinary Shares. If all of the 15,306,122 shares offered by Yorkville for resale under the registration statement that includes this prospectus were issued and outstanding as of the date hereof, such shares would represent approximately 5.8% of the total number of Ordinary Shares outstanding as of July 14, 2022. If we elect to issue and sell more than the 15,306,122 Ordinary Shares offered under this prospectus to Yorkville, we must first register for resale under the Securities Act any such additional shares, which could cause additional dilution to our shareholders. The number of shares ultimately offered for resale by Yorkville is dependent upon the number of Ordinary Shares we may elect to sell to Yorkville under the SEPA.

There are substantial risks to our shareholders as a result of the sale and issuance of Ordinary Shares to Yorkville under the SEPA. These risks include the potential for substantial dilution and significant declines in our share price. See the section entitled “Risk Factors.” Issuances of our Ordinary Shares in this offering will not affect the rights or privileges of our existing shareholders, except that the economic and voting interests of each of our existing shareholders will be diluted as a result of any such issuance. Although the number of Ordinary Shares that our existing shareholders own will not decrease as a result of sales, if any, under the SEPA, the shares owned by our existing shareholders will represent a smaller percentage of our total outstanding shares after any such issuance to Yorkville.

For more detailed information regarding the SEPA, see the section entitled “Committed Equity Financing.”

Recent Developments

Business Combination

On June 15, 2022, Alvotech consummated the transactions contemplated by the Business Combination Agreement by and among OACB, Alvotech Holdings and Alvotech. Pursuant to the Business Combination Agreement:

| • | at the First Merger Effective Time, OACB merged with and into Alvotech, whereby (i) all of the outstanding shares of OACB were exchanged for Ordinary Shares on a one-for-one basis, pursuant to a share capital increase of Alvotech, and (ii) all of the outstanding OACB Warrants automatically ceased to represent a right to acquire shares of OACB and automatically represented a right to be issued one Ordinary Share on substantially the same contractual terms and conditions as were in effect immediately prior to the First Merger Effective Time under the terms of the Warrant Agreement, with Alvotech as the surviving company in the merger; |

| • | immediately after the effectiveness of the First Merger but prior to the Conversion, Alvotech redeemed and cancelled the shares held by the initial sole shareholder of Alvotech pursuant to a share capital reduction of Alvotech; |

| • | immediately after the effectiveness of the First Merger and the Redemption, the legal form of Alvotech changed from a simplified joint stock company (société par actions simplifiée) to a public limited liability company (société anonyme) under Luxembourg law; |

| • | immediately after the change of the legal form of Alvotech, Alvotech issued 17,493,000 Ordinary Shares at a price of $10.00 per share pursuant to the PIPE Financing for aggregate gross proceeds of $174,930,000; and |

| • | immediately following the effectiveness of the Conversion and the PIPE Financing, Alvotech Holdings merged with and into Alvotech, whereby all outstanding Alvotech Holdings Ordinary Shares were exchanged for Ordinary Shares, pursuant to a share capital increase of Alvotech, with Alvotech as the surviving company in the merger. |

3

Table of Contents

Concurrently with the execution of the Business Combination Agreement, OACB and the Alvotech entered into the Initial Subscription Agreements with the Initial Subscribers, pursuant to which the Initial Subscribers have agreed to subscribe for, and Alvotech has agreed to issue to the Initial Subscribers, an aggregate of 15,393,000 Ordinary Shares at a price of $10.00 per share, for aggregate gross proceeds of $153,930,000. Subsequent to this Initial PIPE Financing, on January 18, 2022, OACB and Alvotech entered into the Subsequent Subscription Agreements with the Subsequent Subscribers, pursuant to which the Subsequent Subscribers have agreed to subscribe for, and Alvotech has agreed to issue to the Subsequent Subscribers, an aggregate of 2,100,000 Ordinary Shares at a price of $10.00 per share, for aggregate gross proceeds of $21,000,000. The aggregate number of Ordinary Shares to be issued pursuant to the PIPE Financing was 17,493,000 for aggregate gross proceeds of $174,930,000. The Subscription Agreements contain substantially the same terms, except that the investors that entered into the Foreign Subscription Agreement agreed to subscribe for Ordinary Shares at a price that is net of a 3.5% placement fee.

In connection with the Business Combination, holders of 24,023,495 OACB Class A Ordinary Shares, or 96% of the shares with redemption rights, exercised their right to redeem their shares for cash at a redemption price of approximately $10.00 per share, for an aggregate redemption amount of $240,234,950.

On the Closing Date, Alvotech, the Sponsor and certain Alvotech Holdings Shareholders entered into an Investor Rights and Lock-Up Agreement which provides customary demand and piggyback registration rights and which restricts the transfer of the Ordinary Shares during the applicable lock-up periods.

On June 16, 2022, our Ordinary Shares and Warrants began trading on the Nasdaq, under the new ticker symbols “ALVO” and “ALVOW”, respectively. On June 23, 2022, our Ordinary Shares began trading on the Nasdaq First North under the ticker symbol “ALVO” and to ensure compliance with applicable Icelandic and European securities rules and regulations, due to the listing of our Ordinary Shares on Nasdaq First North, this Registration Statement on Form F-1 will be published on Nasdaq First North’s website as well.

In June 2022, Alvotech also announced that its commercial partner, STADA Arzneimittel AG (“STADA”), launched Alvotech’s AVT02 product, a biosimilar to Humira (adalimumab), under the name Hukyndra in selected European countries, including France, Germany, Finland, and Sweden and that launches in further European countries are scheduled over the coming months.

Implications of Being an “Emerging Growth Company” and a “Foreign Private Issuer”

Alvotech qualifies as an “emerging growth company” as defined in the JOBS Act. As an “emerging growth company,” Alvotech may take advantage of certain exemptions from specified disclosure and other requirements that are otherwise generally applicable to public companies. These exemptions include:

| • | not being required to comply with the auditor attestation requirements for the assessment of our internal control over financial reporting provided by Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”); |

| • | reduced disclosure obligations regarding executive compensation; and |

| • | not being required to hold a nonbinding advisory vote on executive compensation or seek shareholder approval of any golden parachute payments not previously approved. |

Alvotech may take advantage of these reporting exemptions until it is no longer an “emerging growth company.”

Alvotech is also considered a “foreign private issuer” and will report under the Exchange Act as a non-U.S. company with “foreign private issuer” status. This means that, even after Alvotech no longer qualifies as an “emerging growth company,” as long as it qualifies as a “foreign private issuer” under the Exchange Act, it will be exempt from certain provisions of the Exchange Act that are applicable to U.S. public companies, including:

| • | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

4

Table of Contents

| • | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| • | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

Alvotech may take advantage of these reporting exemptions until such time that it is no longer a “foreign private issuer.” Alvotech could lose its status as a “foreign private issuer” under current SEC rules and regulations if more than 50% of Alvotech’s outstanding voting securities become directly or indirectly held of record by U.S. holders and any one of the following is true: (i) the majority of Alvotech’s directors or executive officers are U.S. citizens or residents; (ii) more than 50% of Alvotech’s assets are located in the United States; or (iii) Alvotech’s business is administered principally in the United States.

Alvotech may choose to take advantage of some but not all of these reduced burdens. Alvotech has taken advantage of reduced reporting requirements in this prospectus. Accordingly, the information contained in this prospectus may be different from the information you receive from Alvotech’s competitors that are public companies, or other public companies in which you have made an investment.

As a foreign private issuer, Alvotech is permitted to follow certain Luxembourg corporate governance practices in lieu of certain listing rules of Nasdaq, or Nasdaq Listing Rules. Alvotech plans to follow the corporate governance requirements of the Nasdaq Listing Rules, except that it intends to follow Luxembourg practice with respect to quorum requirements for shareholder meetings in lieu of the requirement under Nasdaq Listing Rules that the quorum be not less than 33 1/3% of the outstanding voting shares. Under Alvotech’s articles of association, at an ordinary general meeting, there is no quorum requirement and resolutions are adopted by a simple majority of validly cast votes. In addition, under Alvotech’s articles of association, for any resolutions to be considered at an extraordinary general meeting of shareholders, the quorum shall be at least one half of our issued share capital unless otherwise mandatorily required by law. In addition, three of Alvotech’s eight directors are independent as defined in Nasdaq listing standards and Alvotech currently has only one director who serves on the compensation committee who meets the heightened independence standards for members of a compensation committee.

Summary Risk Factors

Investing in our securities entails a high degree of risk as more fully described under “Risk Factors.” You should carefully consider such risks before deciding to invest in our securities. These risks include, among others:

| • | Alvotech has a limited operating history in a highly regulated environment, has incurred significant losses since its inception, anticipates that it may continue to incur significant losses for the immediate future and may never be profitable. |

| • | The regulatory approval processes of the FDA, European Commission and comparable national or regional authorities are lengthy and time consuming and Alvotech cannot give any assurance that marketing authorization applications for any of its product candidates will receive regulatory approval. |

| • | Alvotech’s product candidates may cause unexpected side effects or have other properties that could delay or prevent their regulatory approval, limit the commercial profile of an approved label or result in significant negative consequences following marketing approval, if granted. |

| • | Even if Alvotech obtains regulatory approval for a product candidate, its products will remain subject to continuous subsequent regulatory obligations and scrutiny. |

| • | Alvotech relies on third parties to conduct its nonclinical and clinical studies, to manufacture aspects of clinical and commercial supplies of its product candidates, and to store critical components of its |

5

Table of Contents

product candidates. If these third parties do not successfully carry out their contractual duties, or are not compliant with regulatory requirements, Alvotech may not be able to obtain regulatory approval for or commercialize its product candidates. |

| • | Alvotech is subject to a multitude of risks related to manufacturing. Any adverse developments affecting the manufacturing operations of Alvotech’s biosimilar products could substantially increase its costs and limit supply for its products, or could affect the approval status of its products. |

| • | Alvotech may not realize the benefits expected through the Joint Venture and the Joint Venture could have adverse effects on Alvotech’s business. |

| • | Alvotech’s biosimilar product candidates, if approved, will face significant competition from the reference products, from other biosimilar products that reference the same reference products including those which may have regulatory exclusivities, and from other medicinal products approved for the same indication(s) as the reference products. Alvotech’s failure to effectively compete may prevent it from achieving significant market penetration and expansion. |

| • | Alvotech currently has no marketing and sales organization. Alvotech is dependent on its partners for the commercialization of its biosimilar products candidates in certain major markets, and their failure to commercialize in those markets could have a material adverse effect on Alvotech’s business and operating results. |

| • | If Alvotech infringes or is alleged to infringe the intellectual property rights of third parties, its business could be harmed. Alvotech is involved in legal proceedings through its partner, JAMP Pharma, adverse to AbbVie that may impact Alvotech’s adalimumab product, AVT02. |

| • | Alvotech’s recurring losses raise substantial doubt as to its ability to continue as a going concern. |

| • | Alvotech has identified material weaknesses in its internal control over financial reporting. If Alvotech is unable to remediate these material weaknesses, or if Alvotech experiences additional material weaknesses in the future or otherwise is unable to develop and maintain an effective system of internal controls in the future, Alvotech may not be able to produce timely and accurate financial statements or comply with applicable laws and regulations. |

| • | The sale and issuance of our Ordinary Shares to Yorkville will cause dilution to our existing shareholders, and the sale of Ordinary Shares acquired by Yorkville, or the perception that such sales may occur, could cause the price of our Ordinary Shares to fall. |

6

Table of Contents

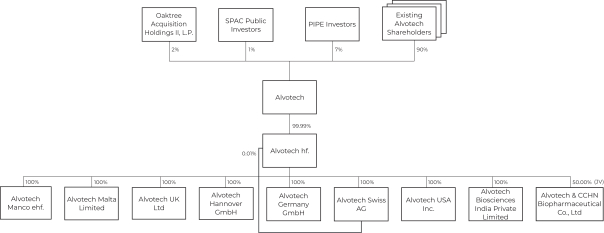

Corporate Structure

The following diagram shows the ownership percentages (excluding the impact of the shares underlying the Warrants) and structure of Alvotech immediately as of June 15, 2022* after the Closing.

| * | Alvotech Manco ehf. and Alvotech Biosciences India Private Limited were incorporated as wholly-owned subsidiaries of Alvotech hf. after the Closing. |

Corporate Information

The legal entity named Alvotech, previously known as Alvotech Lux Holdings S.A.S., was incorporated under the laws of the Grand Duchy of Luxembourg on August 23, 2021 as a simplified joint stock company (société par actions simplifiée) having its registered office at 9, Rue de Bitbourg L-1273 Luxembourg, Grand Duchy of Luxembourg and registered with the Luxembourg Trade and Company Register (Registre de Commerce et des Sociétés, Luxembourg) under number B258884. On February 16, 2022, Alvotech Lux Holdings S.A.S. changed its name to “Alvotech”. On June 15, 2022, Alvotech consummated the Business Combination and changed its legal form from a simplified joint stock company (société par actions simplifiée) to a public limited liability company (société anonyme) under Luxembourg law.

Alvotech’s principal website address is www.alvotech.com. We do not incorporate the information contained on, or accessible through, Alvotech’s websites into this prospectus, and you should not consider it a part of this prospectus.

7

Table of Contents

The summary below describes the principal terms of the offering. The “Description of Securities” section of this prospectus contains a more detailed description of our securities.

We are registering the resale by Yorkville or its permitted transferees of up to 15,306,122 Ordinary Shares.

Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” on page 11 of this prospectus.

Issuer | Alvotech (f/k/a/ Alvotech Lux Holdings S.A.S.) |

Ordinary Shares offered by Yorkville | 15,306,122 Ordinary Shares we may elect, in our discretion, to issue and sell to Yorkville under the SEPA from time to time. |

Ordinary Shares Outstanding as of July 14, 2022 | 248,649,505 Ordinary Shares (excluding the 27,072,167 Ordinary Shares issued on July 4, 2022 and held in treasury by Alvotech’s subsidiary, Alvotech Manco ehf.) |

Ordinary Shares Outstanding After Giving Effect to the Issuance of the Shares Registered Hereunder | 263,955,627 Ordinary Shares (excluding the 27,072,167 Ordinary Shares issued on July 4, 2022 and held in treasury by Alvotech’s subsidiary, Alvotech Manco ehf.) |

Use of Proceeds | We will not receive any proceeds from the resale of Ordinary Shares included in this prospectus by Yorkville. However, we may receive up to $150,000,000 in aggregate gross proceeds under the SEPA from sales of Ordinary Shares that we may elect to make to Yorkville pursuant to the SEPA, if any, from time to time in our discretion. We expect to use the net proceeds that we receive from sales of our Ordinary Shares to Yorkville, if any, under the SEPA for working capital and general corporate purposes. See the section titled “Use of Proceeds.” |

Market for Ordinary Shares | Our Ordinary Shares and Warrants are listed on The Nasdaq Stock Market LLC under the symbols “ALVO” and “ALVOW,” respectively. Our Ordinary Shares are also listed on the Nasdaq First North under the ticker symbol “ALVO.” |

Risk Factors | See the section entitled “Risk Factors” and other information included in this prospectus for a discussion of factors you should consider before investing in our securities. |

8

Table of Contents

SUMMARY HISTORICAL FINANCIAL INFORMATION OF ALVOTECH

The summary historical financial information of Alvotech as of June 30, 2022 and for the six months ended June 30, 2022 and 2021, was derived from the historical unaudited condensed consolidated interim financial statements of Alvotech included elsewhere in this prospectus. The summary historical financial information of Alvotech as of December 31, 2021 and 2020 and for the years ended December 31, 2021, 2020 and 2019, was derived from the historical audited consolidated financial statements of Alvotech included elsewhere in this prospectus.

The following summary historical financial information should be read together with the consolidated financial statements and accompanying notes, “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” appearing elsewhere in this prospectus. The summary historical financial information in this section is not intended to replace Alvotech’s historical consolidated financial statements and the related notes. Alvotech’s historical results are not necessarily indicative of Alvotech’s future results.

Summary Historical Financial Information:

Consolidated Statements of Profit or Loss and Other Comprehensive Income or Loss:

| Six Months Ended June 30, | Year Ended December 31, | |||||||||||||||||||

| USD in thousands, except for per share amounts | 2022 | 2021 | 2021 | 2020 | 2019 | |||||||||||||||

Product revenue | 3,932 | — | — | — | — | |||||||||||||||

License and other revenue | 36,186 | 2,008 | 36,772 | 66,616 | 31,918 | |||||||||||||||

Other income | 142 | 348 | 2,912 | 2,833 | 50,757 | |||||||||||||||

Cost of product revenue | (17,813 | ) | — | — | — | — | ||||||||||||||

Research and development expenses | (86,884 | ) | (90,403 | ) | (191,006 | ) | (148,072 | ) | (95,557 | ) | ||||||||||

General and administrative expenses | (139,147 | ) | (86,360 | ) | (84,134 | ) | (58,914 | ) | (48,566 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Operating loss | (203,584 | ) | (174,407 | ) | (235,456 | ) | (137,537 | ) | (61,448 | ) | ||||||||||

Share of net loss of joint venture | (1,266 | ) | (837 | ) | (2,418 | ) | (1,505 | ) | (192 | ) | ||||||||||

Finance income | 50,968 | 4 | 51,568 | 5,608 | 6,932 | |||||||||||||||

Finance costs | (52,406 | ) | (123,575 | ) | (117,361 | ) | (161,551 | ) | (158,467 | ) | ||||||||||

Exchange rate differences | 4,744 | (3,611 | ) | 2,681 | 3,215 | 3,790 | ||||||||||||||

Gain on extinguishment of financial liabilities | — | 2,561 | 151,788 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Non-operating profit / (loss) | 2,040 | (125,458 | ) | 86,258 | (154,233 | ) | (147,937 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Loss before taxes | (201,544 | ) | (299,865 | ) | (149,198 | ) | (291,770 | ) | (209,385 | ) | ||||||||||

Income tax benefit / (expense) | 17,073 | 25,918 | 47,694 | 121,726 | (491 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Loss for the period | (184,471 | ) | (273,947 | ) | (101,504 | ) | (170,044 | ) | (209,876 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Other comprehensive income / (loss) | ||||||||||||||||||||

Item that will be reclassified to profit or loss in subsequent periods: | ||||||||||||||||||||

Exchange rate differences on translation of foreign operations | (4,243 | ) | 243 | (305 | ) | 5,954 | (1,468 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total comprehensive loss | (188,714 | ) | (273,704 | ) | (101,809 | ) | (164,090 | ) | (211,344 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Loss per share | ||||||||||||||||||||

Basic and diluted loss for the period per share | (1.02 | ) | (2.77 | ) | (12.29 | ) | (24.32 | ) | (30.77 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

9

Table of Contents

Consolidated Statements of Financial Position Data:

USD in thousands | As of June 30, | As of December 31, | ||||||||||

| 2022 | 2021 | 2020 | ||||||||||

Total assets | 774,497 | 597,977 | 474,422 | |||||||||

Total equity | (296,221 | ) | (135,612 | ) | (867,243 | ) | ||||||

Total liabilities | 1,070,718 | 733,589 | 1,341,665 | |||||||||

Consolidated Statements of Cash Flows Data:

USD in thousands | Six Months Ended June 30, | Year Ended December 31, | ||||||||||||||||||

| 2022 | 2021 | 2021 | 2020 | 2019 | ||||||||||||||||

Net cash used in operating activities | (141,156 | ) | (84,734 | ) | (228,170 | ) | (74,295 | ) | (88,548 | ) | ||||||||||

Net cash used in investing activities | (41,504 | ) | (6,972 | ) | (40,633 | ) | (16,903 | ) | (12,876 | ) | ||||||||||

Net cash generated from financing activities | 293,535 | 102,001 | 254,831 | 55,402 | 116,370 | |||||||||||||||

10

Table of Contents

An investment in our securities carries a significant degree of risk. In addition to the other information contained in this prospectus, including the matters addressed under the heading “Forward-Looking Statements,” you should carefully consider the following risk factors in deciding whether to invest in our securities. The occurrence of one or more of the events or circumstances described in these risk factors, alone or in combination with other events or circumstances, may have a material adverse effect on our business, reputation, revenue, financial condition, results of operations and future prospects, in which event the market price of our securities could decline, and you could lose part or all of your investment. Additional risks and uncertainties of which we are not presently aware or that we currently deem immaterial could also affect our business operations and financial condition.

Risks Related to Our Financial Position and Need for Capital

Alvotech has a limited operating history in a highly regulated environment on which to assess its business, has incurred significant losses since its inception and anticipates that it may continue to incur significant losses for the immediate future.

Alvotech is a biotech company with a limited operating history. Alvotech has incurred a loss for the period in each year since its inception in 2013, including losses of $101.5 million, $170.0 million and $209.9 million for the years ended December 31, 2021, 2020 and 2019, respectively, and a loss for the period of $184.5 million and $273.9 million for the six months ended June 30, 2022 and 2021, respectively. Alvotech had an accumulated deficit of $1,325.0 million as of June 30, 2022.

Alvotech has devoted substantially all of its financial resources to identify and develop its product candidates, including conducting, among other things, analytical characterization, process development and manufacture, formulation and clinical studies and providing general and administrative support for these operations. To date, Alvotech has financed its operations primarily through the sale of equity securities, debt financing by way of shareholder loans (convertible and non-convertible) and the issuance of bond instruments to third party investors, as well as through milestone payments under certain license and development agreements with its partners, for example Teva Pharmaceuticals International GmbH (“Teva”) and STADA. The amount of its future net losses will depend, in part, on the rate of its future expenditures and its ability to obtain funding through equity or debt financings or strategic collaborations. Biopharmaceutical product development is a highly speculative undertaking and involves a substantial degree of risk.

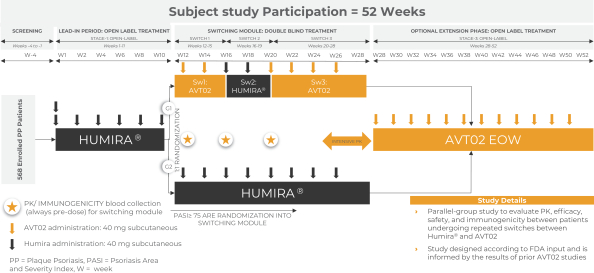

| • | For AVT02, a biosimilar to Humira (adalimumab), Alvotech received regulatory approval in the European Union in November 2021, and in Canada and the UK in January 2022. In April 2022, Alvotech’s commercial partner, JAMP Pharma, launched AVT02 under the name SIMLANDI in Canada. In June 2022, Alvotech’s commercial partner, STADA, launched AVT02 under the name Hukyndra in selected European countries, including France, Germany, Finland, and Sweden. Commercial launches in further European countries are scheduled over the coming months. Alvotech’s biologics license application (“BLA”) supporting biosimilarity was filed with the FDA in 2020, and its BLA supporting interchangeability was accepted for review in February 2022. In September 2022, Alvotech announced that it had received communication from the FDA detailing its assessment of the March 2022 inspection of Alvotech’s manufacturing facility in Reykjavik, Iceland and Alvotech’s subsequent written responses to the FDA. The FDA’s complete response letter to the initial biosimilar BLA for AVT02 noted certain deficiencies related to the Reykjavik facility and stated that satisfactory resolution of the deficiencies is required before FDA may approve this first-filed BLA. Alvotech is working collaboratively with FDA to resolve these issues. |

| • | For AVT04, a proposed biosimilar to Stelara (ustekinumab), Alvotech reported positive topline results from two clinical studies for its second product candidate in May 2022 and expects to file for regulatory approval in the second half of 2022, and |

11

Table of Contents

| • | Alvotech is in the earlier stages of development for its other lead product candidates, namely AVT03, a biosimilar candidate to Prolia / Xgeva (denosumab) for which Alvotech initiated clinical trials in July 2022, AVT05, a biosimilar candidate to Simponi and Simponi Aria (golimumab), AVT06, a biosimilar candidate to Eylea (aflibercept) for which Alvotech initiated clinical trials in July 2022, and AVT23, a biosimilar candidate to Xolair (omalizumab) for which Alvotech has not yet commenced clinical trials. |

If Alvotech obtains regulatory approval to market a biosimilar product candidate, its future revenue will depend upon the therapeutic indications for which approval is granted, the size of any markets in which its product candidates may receive approval and its ability to achieve sufficient market acceptance, pricing, reimbursement from third-party payors and adequate market share for its product candidates in those markets. However, even if one or more of Alvotech’s product candidates gains regulatory approval and is commercialized, Alvotech may never become profitable.

Alvotech expects to continue to incur significant expenses, which could lead to increasing operating losses for the immediate future. Alvotech anticipates that its expenses will increase substantially if and as Alvotech:

| • | continues its analytical, nonclinical and clinical development of its product candidates; |

| • | incurs costs associated with becoming a public company; |

| • | expands the scope of its current clinical studies for its product candidates; |

| • | advances its programs into more expensive clinical studies; |

| • | initiates additional analytical, nonclinical, clinical or other studies for its product candidates; |

| • | changes or adds contract manufacturers, clinical research service providers, testing laboratories, device suppliers, legal service providers or other vendors or suppliers; |

| • | establishes a sales and marketing infrastructure; |

| • | seeks to identify, assess, acquire and/or develop other biosimilar product candidates or products that may be complementary to its products; |

| • | makes upfront, milestone, royalty or other payments under any license agreements; |

| • | seeks to create, maintain, protect, expand and enforce its intellectual property portfolio; |

| • | engages legal counsel and technical experts to help evaluate and avoid infringing any valid and enforceable intellectual property rights of third parties; |

| • | engages in litigation including patent litigation with reference product companies or others that may hold patents allegedly infringed by Alvotech; |

| • | seeks to attract and retain skilled personnel; |

| • | creates additional infrastructure to support its operations as a public company and its product development and planned future commercialization efforts; and |

| • | experiences any delays or encounters issues with any of the above, including but not limited to failed studies, conflicting results, safety issues, delays due to the COVID-19 pandemic, litigation or regulatory challenges that may require longer follow-up of existing studies, additional major studies or additional supportive studies in order to obtain marketing approval. |

Further, the net losses Alvotech incurs may fluctuate significantly from quarter-to-quarter and year-to-year such that a period-to-period comparison of its results of operations may not be a good indication of its future performance quarter-to-quarter and year-to-year due to factors including the timing of clinical trials, any litigation that Alvotech may file or that may be filed against Alvotech, the execution of collaboration, licensing or other agreements and the timing of any payments Alvotech makes or receives thereunder.

12

Table of Contents

Alvotech has never generated any substantial revenue from product sales and may never be profitable.

Although Alvotech has received upfront payments, milestone and other contingent payments and/or funding for development from some of its collaboration and license agreements, Alvotech never generated substantial revenue from product sales and only launched AVT02 in Canada and select European markets in 2022. Alvotech’s ability to generate revenue and achieve profitability depends on its ability, alone or with strategic collaboration partners, to successfully complete the development of, and obtain the regulatory and marketing approvals necessary to commercialize, as well as successfully commercialize, one or more of its product candidates. Alvotech cannot predict if and when it will begin generating revenue from product sales outside of Canada and select European markets, as this depends heavily on its success in many areas, including but not limited to:

| • | completing analytical, nonclinical and clinical development of its product candidates; |

| • | developing and testing of its product formulations; |

| • | obtaining and retaining regulatory and marketing approvals for product candidates for which Alvotech completes clinical studies; |

| • | developing a sustainable and scalable manufacturing process for any approved product candidates that is compliant with regulatory manufacturing requirements and establishing and maintaining supply and manufacturing relationships with third parties that can conduct the process and provide adequate (in amount and quality) products to support clinical development and the market demand for its product candidates, if approved; |

| • | launching and commercializing product candidates for which Alvotech obtains regulatory and marketing approval, either directly or with collaboration partners or distributors; |

| • | obtaining adequate third-party payor coverage and reimbursements for its products; |

| • | obtaining market acceptance of biosimilar pharmaceuticals and its product candidates as viable treatment options; |

| • | addressing any competing technological and market developments; |

| • | identifying, assessing and developing (or acquiring/in-licensing) new product candidates; |

| • | negotiating favorable or commercially reasonable terms in any collaboration, licensing or other arrangements into which Alvotech may enter; |

| • | maintaining, protecting and expanding its portfolio of intellectual property rights, including patents, trade secrets and know-how; |

| • | attracting, hiring and retaining qualified personnel; and |

| • | the result of potential litigation including patent litigation with reference product companies or others that may allegedly infringement by Alvotech. |

Even if one or more of the product candidates that Alvotech develops is approved for commercial sale, Alvotech may incur significant costs in order to manufacture and commercialize any such product. Its expenses could increase beyond its expectations if Alvotech is required by the FDA, the European Commission, the EMA, other regulatory agencies, domestic or foreign, or by any unfavorable outcomes in intellectual property litigation filed against Alvotech, to change its manufacturing processes or assays or to perform clinical, nonclinical, analytical or other types of studies in addition to those that Alvotech currently anticipates. In cases where Alvotech is successful in obtaining regulatory approvals to market one or more of its product candidates, its revenue will be dependent, in part, upon the size of the markets in the territories for which Alvotech gains regulatory approval, the timing of Alvotech’s entry into a particular market or territory, the number of biosimilar competitors in such markets and whether any have regulatory exclusivity, the national laws governing substitution, the accepted price for the product, the ability to get reimbursement at any price, the nature and degree of competition from the

13

Table of Contents

reference product and other biosimilar companies (including competition from large pharmaceutical companies entering the biosimilar market that may be able to gain advantages in the sale of biosimilar products based on brand recognition and/or existing relationships with customers and payors), Alvotech’s ability to manufacture sufficient quantities of the product of sufficient quality and at a reasonable cost and whether Alvotech owns (or has partnered to own) the commercial rights for that territory. If the market for its product candidates (or its share of that market) is not as significant as Alvotech expects, the regulatory approval is narrower in scope than Alvotech expects (e.g., for a narrow indication or set of indications) or the reasonably accepted population for treatment is narrowed by competition, physician choice or treatment guidelines, Alvotech may not generate significant revenue from sales of such products, even if approved. If Alvotech is unable to successfully complete development and obtain regulatory approval for its lead products, namely AVT02 (outside of the European Union, Canada and the UK, where it received approval), AVT03, AVT04, AVT05, AVT06 and AVT23, its business may suffer. Additionally, if Alvotech is not able to generate revenue from the sale of any approved products or the costs necessary to generate revenues increase significantly, Alvotech may never become profitable.

Alvotech’s operating and financial results are subject to concentration risk.

Alvotech’s operational and financial results are subject to concentration risk. Alvotech’s success will depend significantly on the development of a limited number of product candidates, their regulatory approval in a limited number of jurisdictions and their commercialization by a limited number of commercial partners. Even if Alvotech is successful in developing and commercializing all of these products, its revenue will be dependent on a limited number of products that would account for a significant majority of its revenues. This concentration risk would increase to the extent Alvotech is successful in developing and commercializing fewer products as it would be dependent on a lower number of products for the significant majority of its revenues. Unfavorable changes or the non-occurrence of certain anticipated events with respect to any of these limited number of products, jurisdictions or commercial partners may disproportionally affect Alvotech’s global results. See also “—Alvotech is dependent on its partners, such as Teva and STADA, for the commercialization of its biosimilar products candidates in certain major markets, and their failure to commercialize in those markets could have a material adverse effect on Alvotech’s revenue, business and operating results.”

Alvotech may be unable to generate sufficient cash flow to satisfy its significant debt service obligations, which would adversely affect its financial condition and results of operations.

Alvotech’s ability to make principal and interest payments on and to refinance its indebtedness will depend on its ability to generate cash in the future. This, to a certain extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors that may be beyond Alvotech’s control. If Alvotech’s business does not generate sufficient cash flow, if currently anticipated costs and revenues are not realized on schedule, in the amounts projected or at all, or if future borrowings are not available to Alvotech in amounts sufficient to enable Alvotech to pay its indebtedness or to fund its other liquidity needs, Alvotech’s financial condition and results of operations may be adversely affected. If Alvotech cannot generate sufficient cash flow to make scheduled principal and interest payments on its debt obligations in the future, Alvotech may need to refinance all or a portion of its indebtedness on or before maturity, sell assets, delay capital expenditures or seek additional equity. If Alvotech is unable to refinance any of its indebtedness on commercially reasonable terms or at all or to effect any other action relating to its indebtedness on satisfactory terms or at all, Alvotech may be forced to reduce or discontinue operations or seek protection of the bankruptcy laws, its business may be harmed and its securityholders may lose some or all of their investment.

14

Table of Contents

Alvotech may need to raise substantial additional funding from shareholders or third parties. This additional funding may not be available on acceptable terms or at all. Failure to obtain such necessary capital when needed may force Alvotech to delay, limit or terminate its product development efforts or other operations.

Developing Alvotech’s product candidates is expensive, and Alvotech expects its research and development expenses to increase substantially in connection with its ongoing activities, particularly as Alvotech advances its product candidates through clinical studies.

As of June 30, 2022, Alvotech had cash and cash equivalents, excluding restricted cash, of $128.4 million.