The unaudited pro forma combined statement of profit or loss has been prepared using the assumptions below:

Note 1—Description of the Reverse Asset Acquisition

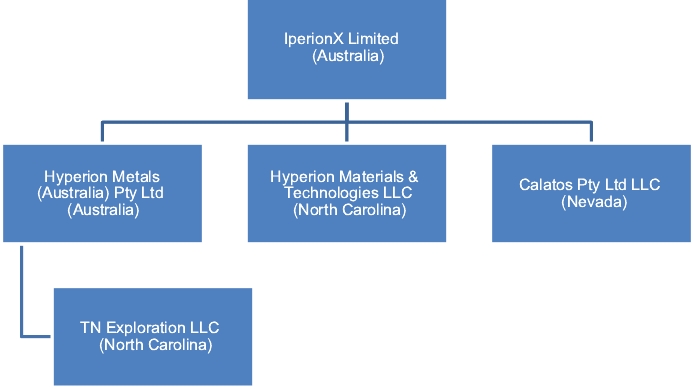

On December 1, 2020, IperionX Limited (formerly Hyperion Metals Limited and Tao Commodities Limited) (the “Company”) completed its acquisition of Hyperion Metals (Australia) Pty Ltd (“HMAPL”) after issuing 26,500,000 ordinary shares, 5,000,000 unlisted options, 8,000,000 performance options and 36,000,000 performance shares in the Company to the vendors, following shareholder approval received at the Company’s general meeting held on November 30, 2020 (the “Reverse Asset Acquisition”).

As a result of the Reverse Asset Acquisition, the former shareholders of HMAPL effectively obtained control of the combined entity. Accordingly, using the reverse acquisition principles of the business combination accounting standard, while the Company is the legal acquirer of HMAPL, for accounting purposes HMAPL is deemed to be the acquirer of the Company.

Therefore, the consolidated financial statements of the Company for the period ended June 30, 2021 have been prepared as a continuation of the consolidated financial statements of HMAPL. The deemed acquirer, HMAPL, has accounted for the acquisition of the Company from December 1, 2020. As HMAPL was only incorporated during the financial period on July 20, 2020, there is no comparative period information for HMAPL.

In addition, at the date of the Reverse Asset Acquisition, it was determined that the Company was not a business as defined under IFRS 3 Business Combinations (which differs to the definition of a business under Article 11 of SEC Regulation S-X as amended by the final rule, Release No. 33-10786). Accordingly, for accounting purposes, the Reverse Asset Acquisition has been treated as a share-based payment transaction.

Note 2—Basis of Presentation

The unaudited pro forma combined statement of profit or loss has been prepared to illustrate the effect of the Reverse Asset Acquisition and has been prepared for informational purposes only.

The unaudited pro forma combined statement of profit or loss of profit or loss for the period ended June 30, 2021 is based on the historical financial statements of TAO and HMAPL. The Acquisition Adjustments consist of those necessary to account for the Reverse Asset Acquisition.

The unaudited pro forma adjustments are based on information currently available, and assumptions and estimates underlying the unaudited pro forma adjustments are described in the accompanying notes. Actual results may differ materially from the assumptions used to present the accompanying unaudited pro forma combined statement of profit or loss.

The Company and HMAPL did not have any historical relationship prior to the Reverse Asset Acquisition. Accordingly, no pro forma adjustments were required to eliminate activities between the companies.

The unaudited pro forma combined statements of profit or loss for the period ended June 30, 2021, presents pro forma effect to the Reverse Asset Acquisition as if it had been completed on July 1, 2020, the beginning of the earliest period presented.

The unaudited pro forma combined statement of profit or loss has been prepared in accordance with Article 11 of SEC Regulation S-X as amended by the final rule, Release No. 33-10786 to reflect the Reverse Asset Acquisition.

The presentation currency for TAO is Australian dollars. The adjusted historical financial statements of profit and loss have been translated into U.S. dollars using the average exchange rate during the period from July 1, 2020 to December 1, 2020, which was 1 AUD = 0.7171 USD.

The unaudited pro forma combined statement of profit or loss for the period ended June 30, 2021 has been prepared using, and should be read in conjunction with, the following:

| • | the audited financial statements of HMAPL for the period from July 20, 2020 to June 30, 2021 and related notes, included elsewhere in this Form 20-F, which have been prepared as a continuation of the financial statements of HMAPL, due to the fact that, for accounting purposes, HMAPL is deemed to be the acquirer of the Company; and |