NOTICE OF GENERAL MEETING

Notice is hereby given that the general meeting of shareholders of IperionX Limited (Company) will be held at the Conference Room, Ground Floor, 28 The Esplanade, Perth WA 6000 on Thursday, 27 October 2022 at 9:00am (AWST) (Meeting).

If it becomes necessary or appropriate to make alternative arrangements to those detailed in this Notice, Shareholders will be updated via the ASX announcements platform and on the Company’s website at www.iperionx.com.

The Explanatory Memorandum provides additional information on matters to be considered at the Meeting. The Explanatory Memorandum and the Proxy Form form part of this Notice.

The Directors have determined pursuant to regulation 7.11.37 of the Corporations Regulations 2001 (Cth) that the persons eligible to vote at the Meeting are those who are registered as Shareholders on Tuesday, 25 October 2022 at 5:00pm (AWST).

The Company advises that a poll will be conducted for all Resolutions.

Terms and abbreviations used in this Notice (including the Explanatory Memorandum) are defined in Schedule 1.

AGENDA

| 1 | Resolution 1 – Ratify the Issue of Placement Shares under Listing Rule 7.1 |

To consider and, if thought fit, to pass, with or without amendment, the following resolution as an ordinary resolution:

“That, pursuant to and in accordance with Listing Rule 7.4 and for all other purposes, Shareholders approve and ratify the prior issue of 14,064,951 Shares under Listing Rule 7.1 at an issue price of $0.80 per Share on the terms and conditions in the Explanatory Memorandum.”

Voting Exclusion

The Company will disregard any votes cast in favour of this Resolution by or on behalf of a person who participated in the Placement or an associate of those persons.

However, this does not apply to a vote cast in favour of this Resolution by:

| (a) | a person as proxy or attorney for a person who is entitled to vote on this Resolution, in accordance with directions given to the proxy or attorney to vote on this Resolution in that way; or |

| (b) | the Chair as proxy or attorney for a person who is entitled to vote on this Resolution, in accordance with a direction given to the Chair to vote on this Resolution as the Chair decides; or |

| (c) | a holder acting solely in a nominee, trustee, custodial or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met: |

| (i) | the beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting, on this Resolution; and |

| (ii) | the holder votes on this Resolution in accordance with directions given by the beneficiary to the holder to vote in that way. |

| 2 | Resolution 2 – Ratify the Issue of Placement Shares under Listing Rule 7.1A |

To consider and, if thought fit, to pass, with or without amendment, the following resolution as an ordinary resolution:

“That, pursuant to and in accordance with Listing Rule 7.4 and for all other purposes, Shareholders approve and ratify the prior issue of 14,060,049 Shares under Listing Rule 7.1A at an issue price of $0.80 per Share on the terms and conditions in the Explanatory Memorandum.”

Voting Exclusion

The Company will disregard any votes cast in favour of this Resolution by or on behalf of a person who participated in the Placement or an associate of those persons.

However, this does not apply to a vote cast in favour of this Resolution by:

| (a) | a person as proxy or attorney for a person who is entitled to vote on this Resolution, in accordance with directions given to the proxy or attorney to vote on this Resolution in that way; or |

| (b) | the Chair as proxy or attorney for a person who is entitled to vote on this Resolution, in accordance with a direction given to the Chair to vote on this Resolution as the Chair decides; or |

| (c) | a holder acting solely in a nominee, trustee, custodial or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met: |

| (i) | the beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting, on this Resolution; and |

| (ii) | the holder votes on this Resolution in accordance with directions given by the beneficiary to the holder to vote in that way. |

| 3 | Resolution 3 – Issue of Placement Shares to Todd Hannigan |

To consider and, if thought fit, to pass with or without amendment, the following resolution as an ordinary resolution:

“That, pursuant to and in accordance with Listing Rule 10.11 and for all other purposes, Shareholders approve the issue of 1,875,000 Shares at an issue price of $0.80 per Share to Mr Todd Hannigan (and/or his nominees) on the terms and conditions in the Explanatory Memorandum.”

Voting Exclusion

The Company will disregard any votes cast in favour of this Resolution by or on behalf of Mr Todd Hannigan (and/or his nominees) and any other person who will obtain a material benefit as a result of the issue of the securities (except a benefit solely by reason of being a holder of ordinary securities in the Company) or an associate of those persons.

However, this does not apply to a vote cast in favour of this Resolution by:

| (a) | a person as proxy or attorney for a person who is entitled to vote on this Resolution, in accordance with directions given to the proxy or attorney to vote on this Resolution in that way; or |

| (b) | the Chair as proxy or attorney for a person who is entitled to vote on this Resolution, in accordance with a direction given to the Chair to vote on this Resolution as the Chair decides; or |

| (c) | a holder acting solely in a nominee, trustee, custodial or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met: |

| (i) | the beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting, on this Resolution; and |

| (ii) | the holder votes on this Resolution in accordance with directions given by the beneficiary to the holder to vote in that way. |

BY ORDER OF THE BOARD

Gregory Swan

Company Secretary

Dated: 23 September 2022

IPERIONX LIMITED

ACN 618 935 372

EXPLANATORY MEMORANDUM

This Explanatory Memorandum has been prepared for the information of Shareholders in connection with the business to be conducted at the Meeting.

This Explanatory Memorandum should be read in conjunction with and forms part of the Notice. The purpose of this Explanatory Memorandum is to provide information to Shareholders in deciding whether or not to pass the Resolutions.

This Explanatory Memorandum includes the following information to assist Shareholders in deciding how to vote on the Resolutions:

Section 1 | Introduction |

| | |

Section 2 | Action to be taken by Shareholders |

| | |

Section 3 | Resolutions 1 and 2 – Ratify the Issue of Placement Shares |

| | |

Section 4 | Resolution 3 – Issue of Placement Shares to Mr Todd Hannigan |

| | |

Schedule 1 | Definitions |

A Proxy Form is located at the end of this Explanatory Memorandum.

| 2 | Action to be taken by Shareholders |

Shareholders should read the Notice including this Explanatory Memorandum carefully before deciding how to vote on the Resolutions.

The Company advises that a poll will be conducted for all Resolutions.

A Proxy Form is attached to the Notice. This is to be used by Shareholders if they wish to appoint a representative (a ‘proxy’) to vote in their place. All Shareholders are invited and encouraged to attend the Meeting or, if they are unable to attend in person, sign and return the Proxy Form to the Company in accordance with the instructions thereon. Returning the Proxy Form will not preclude a Shareholder from attending and voting at the Meeting in person.

Please note that:

| (a) | a member of the Company entitled to attend and vote at the Meeting is entitled to appoint a proxy; |

| (b) | a proxy need not be a member of the Company; and |

| (c) | a member of the Company entitled to cast two or more votes may appoint two proxies and may specify the proportion or number of votes each proxy is appointed to exercise. Where the proportion or number is not specified, each proxy may exercise half of the votes. |

Proxy Forms must be received by the Company no later than 9:00am (AWST) on Tuesday, 25 October 2022, being at least 48 hours before the Meeting.

The Proxy Form provides further details on appointing proxies and lodging Proxy Forms.

To vote in person, Shareholders are able to attend the Meeting at the time, date and place set out above. Based on the best information available to the Board at the time of the Notice, the Board considers it will be in a position to hold an ‘in-person’ meeting to provide Shareholders with a reasonable opportunity to participate in and vote at the Meeting. If it becomes necessary or appropriate to make alternative arrangements to those detailed in this Notice, Shareholders will be updated via the ASX announcements platform and on the Company’s website at www.iperionx.com.

| 3 | Resolutions 1 and 2 – Ratify the Issue of Placement Shares |

| 3.1 | Background to Placement |

On 8 September 2022, the Company announced a capital raising comprising of a placement to institutional, professional and sophisticated investors (Placement Participants) and, subject to Shareholder approval, participation of Mr Todd Hannigan (Executive Chairman) to raise approximately $24,000,000 (before costs) (Placement).

The Placement comprises the issue of 30,000,000 Shares at an issue price of $0.80 per Share as follows:

| (a) | 28,125,000 Shares (Placement Shares) issued to institutional, professional and sophisticated investors identified by the Company under the Company’s existing Listing Rule 7.1 and Listing Rule 7.1A placement capacity as follows: |

| (i) | 14,064,951 Shares issued under the Company’s Listing Rule 7.1 placement capacity; and |

| (ii) | 14,060,049 Shares issued under the Company’s Listing Rule 7.1A placement capacity; and |

| (b) | 1,875,000 Shares issued to Mr Todd Hannigan (Executive Chairman), subject to Shareholder approval pursuant to Resolution 3. |

The Placement Shares were issued on 14 September 2022.

The proceeds from the Placement will be used to continue the scale-up and commercialization of the Company’s titanium metal and metal powder technologies (including capital upgrades to our pilot facility, long lead deposits for a proposed demonstration facility, and continued research and development activities) and continue development of the Company’s critical minerals project located in Tennessee (including a pre-feasibility study, permitting, continued exploration, and ongoing land consolidation).

Refer to the Company’s announcement dated 8 September 2022 for further details regarding the Placement.

Resolution 1 seeks Shareholder ratification, pursuant to and in accordance with Listing Rule 7.4 and all other purposes, for the issue of the 14,064,951 Shares (pursuant to the Company’s capacity under Listing Rule 7.1) to the Placement Participants identified by the Company to raise approximately $11,251,960 (before costs) under the Placement.

Resolution 2 seeks Shareholder ratification, pursuant to and in accordance with Listing Rule 7.4 and all other purposes, for the issue of the 14,060,049 Shares (pursuant to the Company’s capacity under Listing Rule 7.1A) to the Placement Participants identified by the Company to raise approximately $11,248,039 (before costs) under the Placement.

Refer to Section 3.1 for details of the Placement. Resolutions 1 and 2 are ordinary resolutions.

The Chair intends to exercise all available proxies in favour of Resolutions 1 and 2.

| 3.3 | Listing Rules 7.1 and 7.1A |

Subject to a number of exceptions, Listing Rule 7.1 limits the amount of equity securities that a listed company can issue without the approval of its shareholders over any 12 month period to 15% of the fully paid ordinary securities it had on issue at the start of that period.

In addition to its 15% placement capacity under Listing Rule 7.1, the Company obtained Shareholder approval pursuant to Listing Rule 7.1A at its 2021 annual general meeting to issue equity securities up to 10% of its issued share capital through placements over a 12 month period after the Company’s 2021 annual general meeting, without needing prior Shareholder approval.

The issue of the Placement Shares did not fit within any of the exceptions to Listing Rule 7.1 and Listing Rule 7.1A and, as it has not yet been approved by Shareholders, it effectively uses up part of the Company’s 15% placement capacity under Listing Rule 7.1 and 10% placement capacity under Listing Rule 7.1A, thereby reducing the Company’s capacity to issue further equity securities without Shareholder approval under Listing Rule 7.1 and Listing Rule 7.1A for the 12 month period following the issue of the Placement Shares

Listing Rule 7.4 provides that if the Company in general meeting ratifies the previous issue of equity securities pursuant to Listing Rule 7.1 and Listing Rule 7.1A (and provided that the previous issue did not breach Listing Rule 7.1 or Listing Rule 7.1A) those equity securities will be deemed to have been made with Shareholder approval for the purposes of Listing Rule 7.1 or Listing Rule 7.1A.

If Resolutions 1 and 2 are passed, the Company will retain the flexibility to issue equity securities in the future up to the 15% placement capacity under Listing Rule 7.1 and the 10% placement capacity under Listing Rule 7.1A, respectively, without the requirement to obtain prior Shareholder approval.

If Resolutions 1 and 2 are not passed, the Placement Shares will be included in the Company’s 15% placement capacity under Listing Rule 7.1 and the Company’s 10% placement capacity under Listing Rule 7.1A, respectively, for the 12 month period following the issue of the Placement Shares.

| 3.4 | Specific information required by Listing Rule 7.5 |

For the purposes of Shareholder ratification of the issue of Placement Shares to the Placement Participants and the requirements of Listing Rule 7.5, the following information is provided:

| (a) | the Placement Shares were issued to professional and sophisticated investors who were identified through a bookbuild process, which involved Ord Minnett Limited and B. Riley Securities, Inc., in consultation with the Company seeking expressions of interest to participate in the Placement from non-related parties of the Company. None of the participants in the Placement are related parties or associates of related parties of the Company other than the participation of Todd Hannigan (subject to Shareholder approval pursuant to Resolution 3); |

| (b) | the Placement Shares were issued on the following basis: |

| (i) | 14,064,951 Placement Shares to be issued pursuant to Listing Rule 7.1 on 14 September 2022; and |

| (ii) | 14,060,049 Placement Shares to be issued pursuant to Listing Rule 7.1A on 14 September 2022; |

| (c) | the Placement Shares comprise fully paid ordinary shares of the Company ranking equally with all other fully paid ordinary shares of the Company; |

| (d) | the Placement Shares were issued at $0.80 per Share to raise approximately $22,500,000 (before costs); |

| (e) | the purpose of the issue of the Placement Shares is to raise approximately $22,500,000 (before costs) and the funds raised from the issue will primarily be applied towards the scale-up and commercialization of the Company’s titanium metal and metal powder technologies and continued development of the Company’s critical minerals project located in Tennessee (refer to Section 3.1 for further details); |

| (f) | the Placement Shares were issued under short form subscription letters pursuant to which the Placement Participants received Shares at an issue price of $0.80 per Share; |

| (g) | Ord Minnett Limited acted as lead manager and B. Riley Securities, Inc acted as financial advisor to the Placement pursuant to engagement letters on standard terms and conditions for a capital raising engagement letter. Ord Minnett Limited received a fee of approximately A$339,200 and B. Riley Securities, Inc received a fee of approximately A$1,014,000 and 1,000,000 Options at the exercise price of $1.10 and expiring 3 years from the date of issue; and |

| (h) | a voting exclusion statement is included in the Notice for Resolutions 1 and 2. |

The Board recommends that Shareholders approve Resolutions 1 and 2.

| 4 | Resolution 3 – Issue of Placement Shares to Todd Hannigan |

Resolution 3 seeks Shareholder approval, pursuant to and in accordance with Listing Rule 10.11 and for all other purposes, for the issue of 1,875,000 Shares to Mr Todd Hannigan to raise $1,500,000 under the Placement (Director Shares).

Refer to Section 3.1 for details of the Placement.

In accordance with Listing Rule 10.11, the Company must not issue securities to a related party of the Company unless it obtains Shareholder approval.

Mr Todd Hannigan is a related party of the Company by virtue of being Director.

Resolution 3 is an ordinary resolution.

The Chair intends to exercise all available proxies in favour of Resolution 3.

The Company is proposing to issue 1,875,000 Shares to Mr Todd Hannigan to raise $1,500,000 under the Placement (the Issue).

Listing Rule 10.11 provides that unless one of the exceptions in Listing Rule 10.2 applies, a listed company must not issue or agree to issue equity securities to:

| 10.11.2 | a person who is, or was at any time in the 6 months before the issue or agreement, a substantial (30%+) holder in the company; |

| 10.11.3 | a person who is, or was at any time in the 6 months before the issue or agreement, a substantial (10%+) holder in the company and who was nominated a director to the board of the company pursuant to a relevant agreement which gives them a right or expectation to do so; |

| 10.11.4 | an associate of a person referred to in Listing Rules 10.11.1 to 10.11.3; or |

| 10.11.5 | a person whose relationship with the company or a person referred to in Listing Rules 10.11.1 to 10.11.4 is such that, in ASX’s opinion, the issue or agreement should be approved by its Shareholders, unless it obtains the approval of its Shareholders. |

The issue of the Director Shares to Mr Todd Hannigan falls within Listing Rule 10.11.1 and does not fall within any of the exceptions in Listing Rule 10.12. It therefore requires the approval of the Company’s Shareholders under Listing Rule 10.11.

As Shareholder approval is sought under Listing Rule 10.11, approval under Listing Rule 7.1 is not required. Accordingly, the grant of 1,875,000 Shares to Mr Todd Hannigan (and/or his respective nominees) pursuant to Resolution 3 will not reduce the Company’s 15% placement capacity for the purposes of Listing Rule 7.1 Exception 14.

The effect of passing Resolution 3 will allow the Company to issue 1,875,000 Shares to Mr Todd Hannigan (and/or his respective nominees) without using up the Company’s 15% placement capacity under Listing Rule 7.1.

If Resolution 3 is passed, the Company will proceed with the issue of the Director Shares no later than 1 month after the Meeting (or such longer period of time as ASX may in its discretion allow).

If Resolution 3 is not passed, the Company will not proceed with the issue of Director Shares.

| 4.3 | Specific information required by Listing Rule 10.13 |

For the purposes of Shareholder approval of the issue of Director Shares and the requirements of Listing Rule 10.13, the following information is provided:

| (a) | the Company intends to issue 1,875,000 Shares under the Placement to Mr Todd Hannigan (and/or his nominees), a Director; |

| (b) | Mr Todd Hannigan falls within Listing Rule 10.11.1 by virtue of being a Director; |

| (c) | a maximum of 1,875,000 Shares will be issued to Mr Todd Hannigan; |

| (d) | the Director Shares are all fully paid ordinary shares in the Company and will rank equally in all respects with the Company’s existing Shares on issue; |

| (e) | the Shares will be issued no later than 1 month after the date of the Meeting (or such longer period of time as ASX may in its discretion allow); |

| (f) | the Director Shares will be issued at an issue price of $0.80 per Share (the same as the issue price under the Placement) to raise approximately $1,500,000; |

| (g) | the purpose of the issue of the Director Shares is to raise approximately $1,500,000 (before costs) and the funds raised from the issue will primarily be applied towards the scale-up and commercialization of the Company’s titanium metal and metal powder technologies and continued development of the Company’s critical minerals project located in Tennessee (refer to Section 3.1 for further details); |

| (h) | the Director Shares will be issued under a short form subscription letter pursuant to which Mr Todd Hannigan will receive, subject to Shareholder approval, Director Shares at an issue price of $0.80 per Share; and |

| (i) | a voting exclusion statement is included in the Notice for Resolution 3. |

The Board (excluding Mr Todd Hannigan) recommends that Shareholders approve Resolution 3.

Schedule 1

Definitions

In the Notice and this Explanatory Memorandum words importing the singular include the plural and vice versa.

A$ means Australian Dollars.

15% Placement Capacity has the meaning given in Section 3.3.

ASIC means the Australian Securities and Investments Commission.

ASX means ASX Limited (ACN 008 624 691) and, where the context permits, the Australian Securities Exchange operated by ASX.

AWST means Australian Western Standard Time, being the time in Perth, Western Australia.

Board means the board of Directors.

Chairman means the person appointed to chair the Meeting, or any part of the Meeting, convened by the Notice.

Closely Related Party means:

| (a) | a spouse or child of the member; or |

| | (b) | has the meaning given in section 9 of the Corporations Act. |

Company means IperionX Limited (ACN 618 935 372).

Corporations Act means the Corporations Act 2001 (Cth).

Director means a director of the Company.

Equity Security has the same meaning as in the Listing Rules.

Explanatory Memorandum means the explanatory memorandum which forms part of the Notice.

Listing Rules means the listing rules of ASX.

Meeting has the meaning in the introductory paragraph of the Notice.

Notice means the notice of meeting which comprises of the notice, agenda, Explanatory Memorandum and Proxy Form.

Option means an option which entitles the holder to subscribe for a Share in the capital of the Company.

Placement has the meaning given in Section 3.1.

Placement Shares has the meaning given in Section 3.1.

Placement Participants has the meaning given in Section 3.1.

Proxy Form means the proxy form attached to the Notice.

Related Body Corporate has the meaning given in section 9 of the Corporations Act.

Resolution means a resolution contained in the Notice.

Schedule means a schedule to this Explanatory Memorandum or the New Constitution (as applicable).

Section means a section of this Explanatory Memorandum.

Security means a security in the Company.

Share means a fully paid ordinary share in the capital of the Company.

Shareholder means a shareholder of the Company.

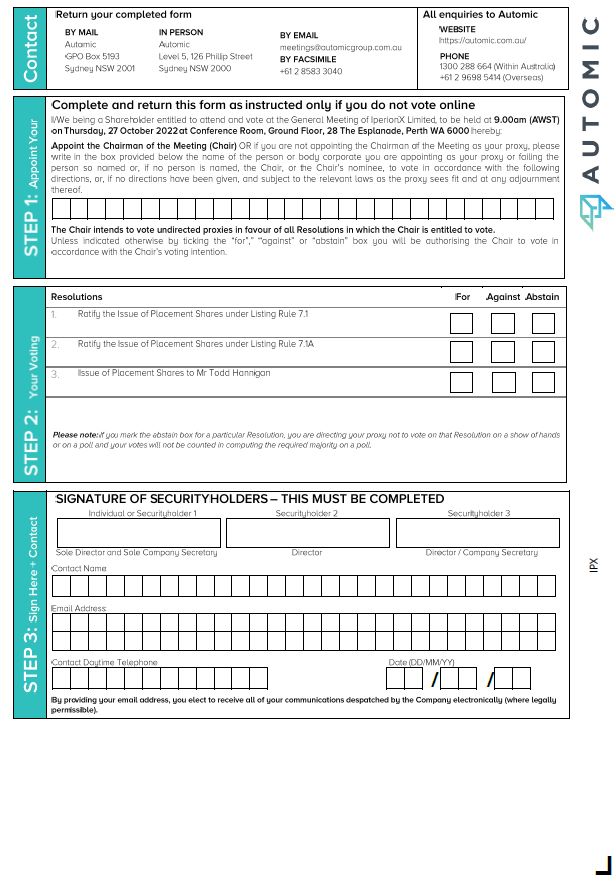

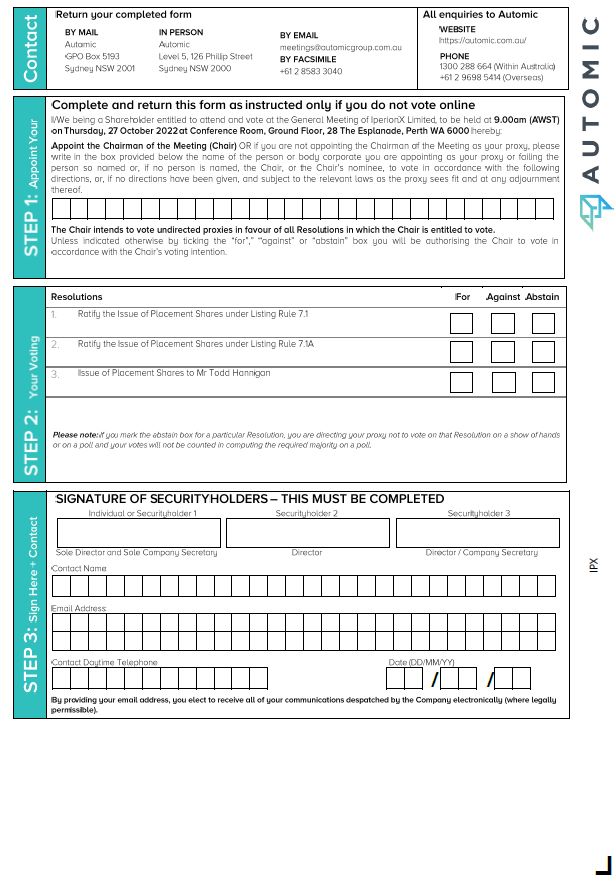

Proxy Voting Form If you are attending the meeting in person, please bring this with you for Securityholder registration. Holder Number: Your proxy voting instruction must be received by 9:00am (AWST) on Tuesday, 25 October 2022, being not later than 48 hours before the commencement of the Meeting. Any Proxy Voting instructions received ofter that time will not be valid for the scheduled Meeting. SUBMIT YOUR PROXY VOTE ONLINE Vote online at https://investor.automic.com.au/#/loginsah Login & Click on ‘Meetings’. Use the Holder Number as shown at the top of this Proxy Voting form. Save Money: help minimise unnecessary print and mail costs for the Com pany. It’s Quick and Secure: provides you with greater privacy. eliminates any postal delays and the risk of potentially getting lost in transit. Receive Vote Confirmation: instant confirmation that your vote has been processed. It also allows you to amend your vote if required. SUBMIT YOUR PROXY VOTE BY PAPER Complete the form overleaf in accordance with the instructions set out below. YOUR NAME AND ADDRESS The name and address shown above is as it appears on the Company•s shore register. If this information is incorrect, and you have an Issuer Sponsored holding, you can update your address through the investor portal: https://investor.automic.com.au/#/home Shareholders sponsored by a broker should advise their broker of any changes. STEP 1 - APPOINT A PROXY If you wish to appoint someone other than the Chair of the Meeting as your proxy), please write the name of that Individual or body corporate. A proxy) need not be a Shareholder of the Com pany. Otherwise if you leave this box blank, the Chair of the Meeting will be appointed as your proxy) by default. DEFAULT TO THE CHAIR OF THE MEETING Any directed proxies that ore not voted on a poll at the Meeting will default to the Chair of the Meeting, who is required to vote these proxies as directed. Any undirected proxies that default to the Chair of the Meeting will be voted according to the instructions set out in this Proxy Voting Form, including where the Resolutions ore connected directly or indirectly with the remuneration of KMP. STEP 2 - VOTES ON ITEMS OF BUSINESS You may direct your proxy) how to vote by marking one of the boxes opposite each item of business. All your shores will be voted in accordance with such a direction unless you indicate only a portion of voting rights ore to be voted on any item by inserting the percentage or number of shores you wish to vote in the appropriate box or boxes. If you do not mark any of the boxes on the items of business, your proxy may vote as he or she chooses. If you mark more than one box on an item your vote on that item will be invalid. APPOINTMENT OF SECOND PROXY You may appoint up to two proxies. If you appoint two proxies, you should complete two separate Proxy) Voting Forms and specify the percentage or number each proxy) may exercise. If you do not specify a percentage or number, each proxy) may exercise half the votes. You must return both Proxy) Voting Forms together. If you require an additional Proxy) Voting Form, contact Automic Registry Services. SIGNING INSTRUCTIONS Individual: Where the holding is in one name, the Shareholder must sign. Joint holding: Where the holding is in more than one name, all Shareholders should sign. Power of attorney: If you have not already lodged the power of attorney with the registry. please attach a certified photocopy of the power of attorney to this Proxy) Voting Form when you return it. Companies: To be signed in accordance with your Constitution. Please sign in the appropriate box which indicates the office held by you. Email Address: Please provide your email address in the space provided. By providing your email address, you elect to receive all communications despatched by the Company electronically (where legally permissible) such as a Notice of Meeting, Proxy Voting Form and Annual Report via email. CORPORATE REPRESENTATIVES If a representative of the corporation is to attend the Meeting the appropriate ‘Appointment of Corporate Representative’ should be produced prior to admission. A form may be obtained from the Company’s share registry on line at https://automic.com.au.

Return your completed form BY MAIL Automic GPO Box 5193 Ss1dnes1 NSW 2001 IN PERSON Automic Level 5, 126 Phillip Street Sydney NSW 2000 BY EMAIL meetings@automicgroup.com.au BY FACSIMILE +61 2 8583 3040 All enquiries to Automic WEBSITE https:/ /a utom ic.com.au/ PHONE 1300 288 664 (Within Australia) +61 2 9698 5414 (Overseas) Complete and return this form as instructed only if you do not vote online I/We being a Shareholder entitled to attend and vote at the General Meeting of lperionX Limited, to be held at 9.00am (AWST) on Thursday, 27 October 2022 at Conference Room, Ground Floor, 28 The Esplanade, Perth WA 6000 herebs1: Appoint the Chairman of the Meeting (Chair) OR if YOU are not appointing the Chairman of the Meeting as YOUr proxy, please write in the box provided below the name of the person or bod!d corporate YOU are appointing as YOUr proxy or failing the person so named or, if no person is named, the Chair, or the Chair’s nominee, to vote in accordance with the following directions, or, if no directions have been given, and subject to the relevant laws as the prox!d sees fit and at any adjournment thereof. I I I I I I I I I I I I I I I I I I I I I I I I I I I I I The Chair intends to vote undirected proxies in favour of all Resolutions in which the Chair is entitled to vote. Unless indicated otherwise by ticking the “for”,” “against” or “abstain” box YOU will be authorising the Chair to vote in accordance with the Chair’s voting intention. Resolutions For Against Abstain 1. Ratif!d the Issue of Placement Shares under Listing Rule 7.1 □□□ 2. Ratify the Issue of Placement Shares under Listing Rule 7.1A □□□ 3. Issue of Placement Shares to Mr Todd Hannigan □□□ Please note: If you mark the abstain box for a particular Resolution, you are directing your proxy not to vote on that Resolution on a show of hands or on a poll and your votes will not be counted in computing the required majority on a poll. SIGNATURE OF SECURITYHOLDERS - THIS MUST BE COMPLETED Individual or Securityholder 1 Securitμholder 2 Securitμholder 3 ._____ ______.I ,___I ___ ___.I ,___I __ ___. Sole Director and Sole Company Secretars1 Director Director/ Company Secretary Contact Name: I I I I I I I I I I I I I I I I I I I I I I I I I I I I I Email Address: I I I I I I I I I I I I I I I I I I I I I I I I I I I I Contact Daytime Telephone Date (DD/MM/YY) I I I I I I I I I I I I I [IJ[IJ[IJ By providing your email address, you elect to receive all of your communications despatched by the Company electronically (where Legally