| PRESS RELEASE | NASDAQ: IPX | ASX: IPX

October 26, 2022 |

SEPTEMBER 2022 QUARTERLY REPORT

IperionX Limited (ASX: IPX) (the “Company”), is pleased to provide its quarterly report for the period ended September 30, 2022. Highlights during the quarter included:

Titanium Demonstration Facility – Halifax County Virginia

IperionX selected Halifax County, Virginia, as the preferred location for the development of its first commercial scale 100% recycled, low carbon titanium metal powder operation.

| ◾ | The Titanium Demonstration Facility will be the first American titanium metal operation using 100% recycled titanium metal scrap as raw material feedstock and is an important step in advancing IperionX’s plans to re-shore an all-American source of low carbon titanium metal. |

| ◾ | The ready-made building at the Southern Virginia Technology Park, near South Boston, provides IperionX with an outstanding location to scale up its low carbon titanium metal production, with direct access to major highways, a large talent pool, high quality infrastructure and access to 100% renewable power. |

| ◾ | Potential incentives from Virginia include a construction allowance of US$4 million from the Halifax Industrial Development Authority to upfit the site to be ‘development ready’, a US$300,000 grant from the Virginia Commonwealth’s Opportunity Fund and a grant for US$573,000 from the Tobacco Region Opportunity Fund. |

Figure 1: Titanium Demonstration facility site at the Southern Virginia Technology Park, South Boston, Virginia

IperionX and Panerai partner to develop sustainable titanium watches

| ◾ | IperionX and Panerai, a maison of Richemont, signed a commercial partnership agreement to produce luxury, sustainable, Panerai watches using IperionX's low carbon titanium. |

| ◾ | Panerai and Richemont are first movers in the sustainable luxury goods market and IperionX provides the only commercially available closed loop, low carbon titanium. |

| Corporate Office | Tennessee Office | Salt Lake City Office |

| 129 W Trade St, Suite 1405 Charlotte, NC 28202 | 279 West Main St, Camden, TN 38320 | 1782 W 2300 S, West Valley City, UT 84119 |

| ◾ | IperionX has worked with Panerai to prototype watch cases using advanced additive manufacturing methods that have passed the rigorous metallographic testing and surface quality requirements for the luxury market. |

| ◾ | The partnership agreement represents a significant milestone for IperionX in the fast growing, US$236 billion global luxury goods market, which is focused on securing low carbon, fully circular and closed loop materials that can meet the demanding quality specifications for their customer base. |

| ◾ | IperionX believes that successfully additively manufacturing and selling final production titanium watch blanks using 100% recycled titanium is an important long term competitive advantage. It demonstrates that IperionX’s titanium can meet the challenging quality and strength parameters required for a demanding customer base – and one that increasingly views sustainability as core to luxury. |

| ◾ | These same parameters are required for success in the consumer electronics and the automotive sectors and there are few global companies that offer strong, lightweight and eternal metals produced from a 100% circular low carbon process. |

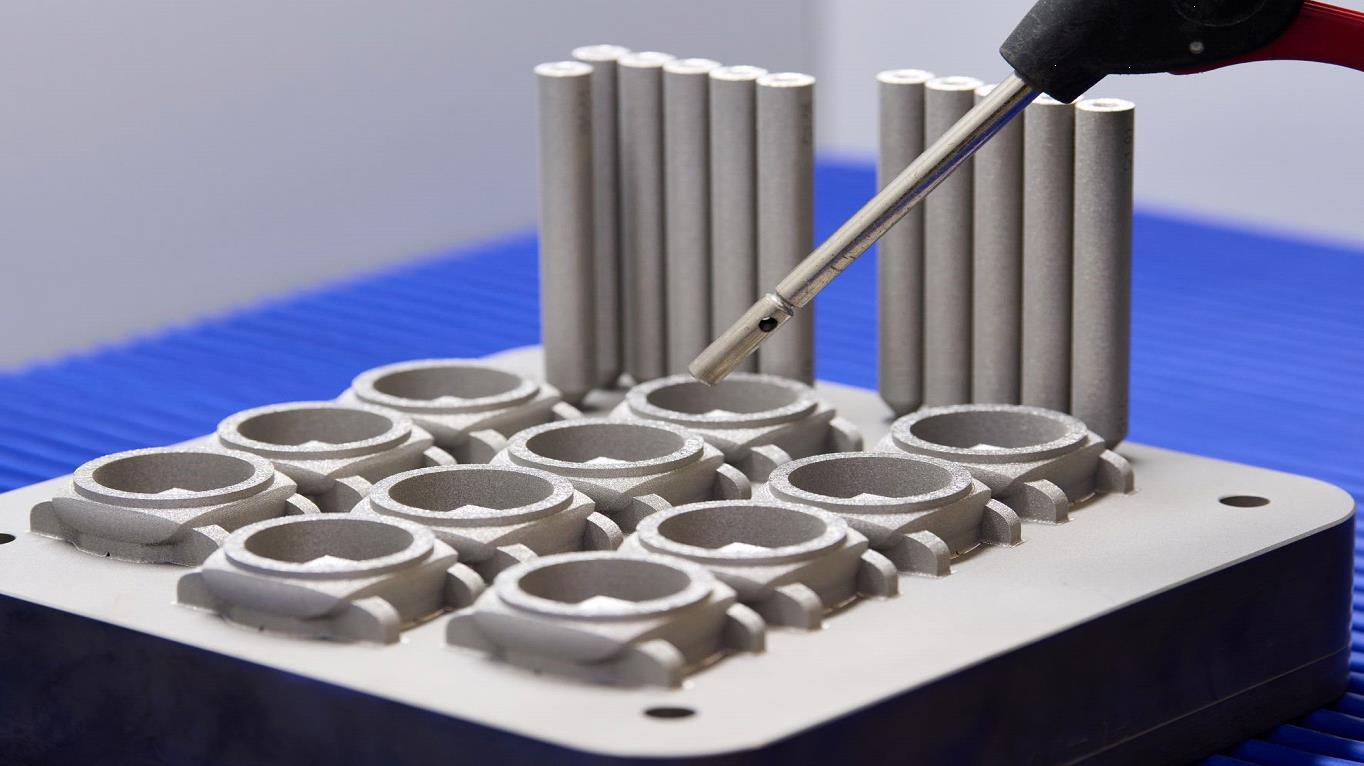

Figure 2: Cleaning Panerai prototype watch blanks after printing

IperionX produces the first titanium metal made from Tennessee minerals

| ◾ | IperionX successfully applied patented technologies to produce the first low-carbon spherical titanium, aluminum and vanadium alloy (“Ti-6Al-4V” or “Ti64”) powder using titanium minerals from Tennessee as feedstock. |

| ◾ | Testing confirmed that IperionX’s Ti64 powder meets important Grade 5 quality specifications, which accounts for ~50% of global titanium metal use, including in aerospace turbines, structures and engine components. |

| ◾ | The patented titanium technologies have the potential to significantly lower the energy consumption, costs and carbon emissions versus the incumbent Kroll process used to create titanium metal sponge and then refined into titanium alloys. |

IperionX successfully develops low carbon titanium enrichment process

| ◾ | IperionX successfully developed an innovative low carbon titanium mineral enrichment technology that upgrades lower content titanium dioxide ilmenite minerals into a high titanium synthetic rutile product. |

| ◾ | This low carbon synthetic rutile product has been tested and evaluated by customers, which confirmed the potential to produce a high-quality, high grade titanium feedstock with scope to be a more sustainable product than other upgraded titanium feedstocks, including titanium slag. |

| ◾ | IperionX's patented low carbon titanium enrichment process eliminates the use of carbon reductants, including coal, which are typically used to upgrade low grade titanium feedstocks into high value, high grade titanium feedstocks. |

| ◾ | IperionX intends to commercialize this low carbon, high grade titanium synthetic rutile product and has commenced feasibility studies for a synthetic rutile production pilot plant at the Titan Project in Tennessee. |

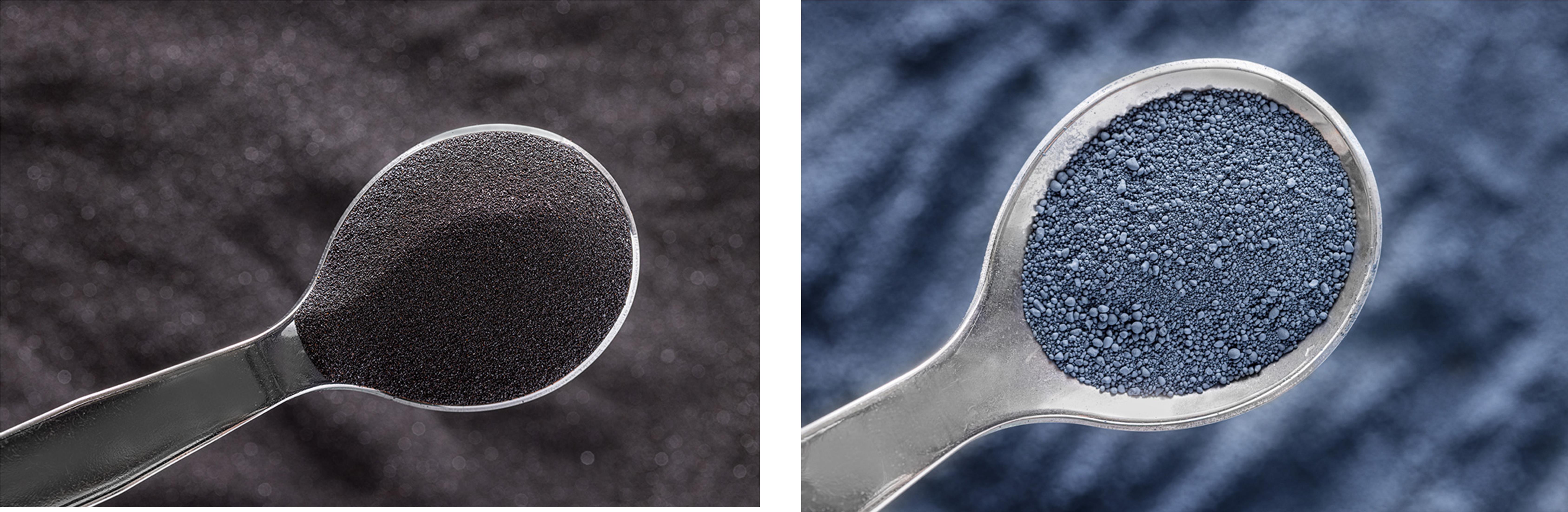

Figure 3: IperionX Titan Project ilmenite (LHS) prior to conversion to low carbon, high grade synthetic rutile (RHS)

IperionX and Oak Ridge National Laboratory technical collaboration

| ◾ | IperionX and Oak Ridge National Laboratory agreed to collaborate to develop low-cost titanium alloys for additive manufacturing (3D printing) using IperionX’s titanium metal powders. |

| ◾ | A U.S. Department of Energy approved User Agreement was executed to advance work between Oak Ridge National Laboratory and IperionX at their Manufacturing Demonstration Facility, a 110,000 sq. ft. user facility that is the nation’s only large-scale open-access facility for demonstrating R&D manufacturing technologies and optimizing critical processes. |

Completion of A$24 million placement led by B. Riley Principal Investments and Fidelity International

| ◾ | Completion of a placement of 30 million shares at an issue price of A$0.80 per share to institutional, sophisticated and professional investors to raise gross proceeds of A$24 million before costs. |

| ◾ | The Placement was led by cornerstone investors B. Riley Principal Investments, a wholly owned subsidiary of B. Riley Financial, Inc., and Fidelity International Ltd, a global asset manager. |

| ◾ | The Company’s largest shareholder, Fidelity Management & Research Company agreed to subscribe for shares to maintain its pro-rata position, confirming its continued support for the Company. |

| ◾ | Mr. Todd Hannigan, Executive Chairman of IperionX, also plans to participate in the Placement by subscribing for a total of 1,875,000 shares, subject to Shareholder approval. |

For further information and enquiries please contact:

investorrelations@iperionx.com

+1 704 461 8000

TITANIUM DEMONSTRATION FACILITY – SELECTION OF HALIFAX COUNTY VIRGINIA AS PREFERRED LOCATION

During the quarter, IperionX announced that it selected the Southern Virginia Technology Park, in Halifax County, Virginia, near South Boston, as the preferred location for the development of America’s first 100% recycled, low carbon titanium manufacturing development (“Titanium Demonstration Facility”).

IperionX undertook an extensive site selection process across the continental U.S. to secure the ideal site for the development of the Titanium Demonstration Facility. Over 250 sites in over 30 states were evaluated for cost, site readiness, expansion capability, access to infrastructure and potential financial incentives.

The site at the Southern Virginia Technology Park provides IperionX with an excellent location to scale up its titanium metal production, with direct access to major highways, a large talent pool, high quality infrastructure and 100% renewable power. The state, county and local authorities have provided an attractive incentive package to locate the site in Halifax County, VA.

Virginia & Halifax Proposed Incentive Package

The Virginia Economic Development Partnership worked with Halifax County, the Southern Virginia Regional Alliance, the Virginia Department of Environmental Quality, and Virginia Department of Energy to develop an incentive package for IperionX to locate the Titanium Demonstration Facility in Halifax County Virginia.

The Governor of Virginia, Mr. Glenn Youngkin, approved a US$300,000 grant from the Virginia Commonwealth’s Opportunity Fund to assist Halifax County with the project. The Virginia Tobacco Region Revitalization Commission approved a grant for US$573,000 from the Tobacco Region Opportunity Fund for the project.

IperionX is eligible to receive state benefits from the Virginia Enterprise Zone Program that includes funding and services to support employee training. The Virginia Department of Environmental Quality, Virginia Department of Energy, and Virginia Clean Cities also oversee financial incentive programs that can support the IperionX’s commitment to decarbonization and the circular economy.

The Halifax Industrial Development Authority has proposed a construction allowance of US$4 million to fit-out the site to meet the needs of the Titanium Demonstration Facility.

Final confirmation of the site selection and financial offer is subject to the negotiation and execution of a binding performance agreement between the Commonwealth of Virginia, the Virginia Economic Development Partnership and IperionX, anticipated to be finalized in the coming months.

Titanium Demonstration Facility

IperionX’s Titanium Demonstration Facility will be the first titanium manufacturing plant in the U.S. utilizing 100% recycled titanium scrap as feedstock and the only All-American source of low carbon titanium metal. The first phase of the Titanium Demonstration Facility is expected to have an initial production capacity of 125 tonnes per annum (“tpa”) of titanium metal powder. The current pricing for spherical titanium metal powders used in additive manufacturing applications today is approximately US$250 per kg.

The forecast capital cost to build the first phase of the Titanium Demonstration Facility is US$20 million with an associated forecast operating cost of US$120kg (further information can be found in Appendix A). Development of the Titanium Demonstration Facility is anticipated to generate significant employment opportunities in the U.S., with a first phase headcount estimate of 31 employees, estimated to scale to over 100 employees.

IperionX has commenced early design and engineering for a modular expansion of the Titanium Demonstration Facility to a commercial scale to meet potential market demand.

IperionX has a large number of potential development funding pathways for the first phase of the Titanium Demonstration Facility, including commercial and U.S. Government opportunities, such as funding through U.S. Federal budgets, U.S. Federal funding bills and specific U.S. Federal agency funding programs.

Figure 4: Phase 1 Titanium Demonstration Facility isometric view

IPERIONX & PANERAI PARTNER TO DEVELOP SUSTAINABLE TITANIUM WATCHES

The Company announced the execution of a commercial partnership agreement with Officine Panerai (“Panerai”), a branch of Compagnie Financière Richemont SA (“Richemont”) (SWX: CFR, market capitalization US$57 billion) to produce unique high-end timepieces from sustainable, fully recycled titanium, using IperionX’s patented technologies.

IperionX worked closely with Panerai’s product and technical teams to identify watch designs to be produced using IperionX’s low-carbon, circular titanium metal powders via additive manufacturing methods.

IperionX produced prototype watch blanks for Panerai and will commence manufacturing of a watch case for a limited edition design that will be released to market in 2023. IperionX, Panerai and the Richemont group continue to work on other watch models that would provide additional sales agreements.

This agreement represents an important milestone for IperionX to enter the fast-growing luxury goods market. Importantly for IperionX, the demanding specifications, advanced alloys and manufacturing techniques used in the luxury goods market transfers directly into titanium applications for the high growth smart watch, wearable device and smartphone market which is now approaching ~US$500 billion annual sales. IperionX sees significant potential to establish a low carbon, closed loop and circular supply of titanium, which is superior to existing aluminum and stainless steel applications in these markets.

Figure 5: Prototype Panerai watch blanks printed using IperionX powder

IPERIONX PRODUCES TITANIUM METAL FROM TENNESSEE MINERALS

IperionX successfully applied patented low-carbon titanium metal technologies to upgrade Tennessee titanium minerals into high grade +99% TiO2 and then into a high-quality spherical titanium alloy powder. Testing confirmed successful production of a spherical Ti-6Al-4V powder with aluminum and vanadium uniformly distributed within the sample and meeting industrial specifications, and oxygen content meeting Grade 5 specification (<0.2 wt%).

The low-carbon titanium spherical powder was produced by using a range of patented technologies, including;

| ◾ | Medium grade titanium minerals (ilmenite) sourced from IperionX’s Titan Project were upgraded to a +99% titanium dioxide feedstock using the proprietary Synthetic Rutile and Alkaline Roasting and Hydrolysis (“ARH”) process technologies. |

| ◾ | The high-grade titanium feedstock was blended with oxides of the alloying elements and then reduced with using the patented Hydrogen Assisted Metallothermic Reduction (“HAMR”) technology to produce low-carbon angular titanium powders. |

| ◾ | The patented Granulation Sintering Deoxygenation (“GSD”) technology was used to produce a high-quality spherical titanium powder alloy Ti64. |

Ti64 is a widely used alloy of titanium, aluminum and vanadium that provides high strength-to-weight ratio, excellent corrosion resistance and biocompatibility. Spherical Ti64 powders are used to manufacture advanced components with additive manufacturing / 3D printing.

Titanium alloy powders are currently produced with the Kroll process to firstly create titanium metal sponge, which is then refined via a series of high energy titanium melt processes to produce large batch titanium alloys as ingots. These ingots are then processed into titanium alloy wire/rod, which are feedstocks for high energy plasma / gas atomization that produces spherical titanium alloy powders.

IperionX’s technologies avoid the high-cost, high-carbon Kroll process to create titanium sponge, but also bypass the series of energy intensive titanium melt processes, ingot manufacturing, wire production and gas atomization, to produce low carbon and low-cost titanium spherical powders.

IperionX titanium technologies have the potential for up to a 95% reduction in Scope 1 and 2 carbon emissions compared to the incumbent Kroll titanium supply chain. The technologies eliminate the direct carbon emissions from producing titanium, generate no Scope 1 emissions, and by utilizing 100% renewable power in the production process, Scope 2 carbon emissions can also be eliminated.

The technologies can also produce titanium alloys directly from the oxides of the alloy elements. This offers a valuable opportunity to deliver customers a wider range of lower cost, innovative titanium alloys on shorter lead times. This includes the potential to offer titanium alloys which are difficult to produce with incumbent technologies such as Ti-1Al-8V-5Fe (“Ti-185”), which offers high strength and fatigue life for military applications, and Ti-Palladium allow for superior corrosion resistance in demanding applications or luxury goods.

Figure 6: IperionX metal powder production process

Titan ilmenite (~60% TiO2) | +99% TiO2 | Ti-6Al-4V |

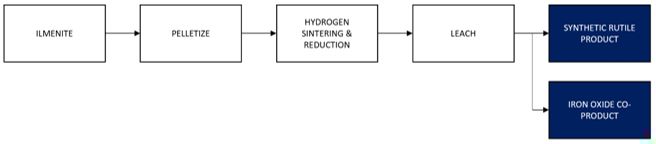

IPERIONX SUCCESSFULLY DEVELOPS LOW CARBON TITANIUM ENRICHMENT PROCESS

IperionX successfully developed high quality, low carbon titanium mineral enrichment technologies, having upgraded ilmenite titanium minerals from the Titan Project in Tennessee into a high-grade titanium synthetic rutile product.

Figure 7: Block flow diagram of IperionX’s synthetic rutile production process

High grade titanium dioxide (+80% TiO2) feedstocks include natural rutile, synthetic rutile and titanium slag, and are primarily used in creating inputs for titanium metal in the form of titanium tetrachloride and paint and pigments in the form of purified TiO2.

Natural rutile is a mineral with TiO2 content of 92%-95%, while synthetic rutile and titanium slag are upgraded high grade TiO2 feedstocks produced from ilmenite, with a TiO2 content of 88%-95% and ~80% respectively. Given their relative scarcity and value in use, high grade TiO2 feedstocks are higher priced products than the more commonly found lower grade ilmenite.

Importantly, the global supply of natural rutile is in significant decline, with other high grade titanium feedstocks including synthetic rutile and titanium slag expected to replace fill the widening supply gap. Synthetic rutile commands a price 4-5x that of ilmenite, which has a typical TiO2 content of 45%-65%. Long term price forecasts for synthetic rutile are ~US$1,000-US$1,200 per ton, compared to ilmenite with a long-term price forecast of ~US$200-US$300 per ton. This price multiple allows for the potential to significantly increase the value of the Titan Project resource base through upgrading of ilmenite to low carbon synthetic rutile.

The majority of global synthetic rutile production occurs in Western Australia by the world’s largest titanium mineral companies, Iluka and Tronox, via processes based upon the Becher Process. The Becher Process consists of roasting low-grade ilmenite using coal in a rotary kiln at temperatures of more than 1,100°C to convert the iron oxide in the ilmenite to metallic iron, and then ‘rusting’ the kiln product in an aerated salt solution to remove most of the metallic iron.

Titanium slag is a widely adopted method to produce high grade titanium feedstocks, which occurs via open arc AC or DC smelting of ilmenite with electricity, using a carbon reactant in the form of coal, to produce titanium slag and pig iron products.

Scope 1 & 2 emissions associated with current production of synthetic rutile and titanium slag are significant, estimated at approximately 3.3 tons and 2.0 tons of CO2 equivalent per ton of product1. In contrast, IperionX’s synthetic rutile process does not use coal as a reductant, and when combined with renewably sourced electricity has the potential to result in very low to net-zero carbon emissions.

IperionX’s synthetic rutile product has been evaluated by customers in the paint and pigment industry and confirmed as a potential high-quality feedstock likely to attract a significant price premium to ilmenite, with the potential to also be a superior and more sustainable product to other titanium feedstocks, including titanium slag.

IPERIONX AND OAK RIDGE NATIONAL LABORATORY ANNOUNCE TECHNICAL COLLABORATION

The U.S. Department of Energy (“DOE”) approved a technical collaboration between IperionX and Oak Ridge National Laboratory (“ORNL”) to advance the application of low cost alloys utilizing spherical powder produced through IperionX’s titanium technologies.

A User Agreement was executed to advance work between ORNL and IperionX at DOE’s Manufacturing Demonstration Facility (“MDF”) at ORNL. The MDF is a 110,000 sq. ft. facility that is the nation’s only large-scale open-access user facility for rapidly demonstrating R&D manufacturing technologies and optimizing critical processes (link). Key objectives of the User Agreement include:

| ◾ | Evaluation & characterization of spherical titanium powders produced through IperionX's technologies for use in additive manufacturing / 3D printing, including opportunities to use titanium powders to manufacture parts which currently rely on other metals, including stainless steel and aluminum |

| ◾ | Demonstration that pressed and sintered parts produced using IperionX’s titanium powders have equivalent or better characteristics to parts produced using industry standard titanium powders |

ORNL has been at the forefront of research and development relating to low-cost titanium powder technologies including applications in the automotive, defense and aerospace industries.

As a focus of the collaboration, initially, pressed and sintered parts will be produced and tested at the MDF with the aim of validating that the components fabricated with commercially pure titanium or Ti-6Al-4V alloy produced by IperionX meet the characteristics for light-weighting for the transportation sector, including heavy trucks, aircraft components and other transportation applications where titanium has an advantage over currently used metals such as steel and aluminum.

1 Source: Sovereign Metals, July 7, 2022 (link)The User Agreement will complement IperionX’s ongoing project to qualify and demonstrate the performance of its U.S. produced titanium powder for additively manufactured aerospace parts, supporting a project with the U.S. Navy to test titanium flight critical metal replacement components for the U.S. Department of Defense.

CORPORATE - COMPLETION OF A$24 MILLION PLACEMENT

During the quarter the Company completed a placement 30 million shares at an issue price of A$0.80 per share to institutional, sophisticated and professional investors to raise gross proceeds of A$24 million before costs (“Placement”).

The Placement was led by cornerstone investors B. Riley Principal Investments, a wholly owned subsidiary of B. Riley Financial, Inc., and Fidelity International Ltd (“FIL”), a global asset manager. The Company is pleased that its largest shareholder, Fidelity Management & Research Company (“FMR”), subscribed for shares to maintain its pro-rata position, confirming its continued support for the Company. The Placement also included a dedicated sustainability focused investor based in the United States.

Mr. Todd Hannigan, Executive Chairman of IperionX, also plans to participate in the Placement by subscribing for a total of 1,875,000 shares, subject to Shareholder approval.

Proceeds from the Placement will be used to continue the scale-up and commercialization of IperionX’s titanium metal technologies, including capital upgrades to the existing titanium pilot facility, deposits on long lead time equipment for the titanium demonstration facility, and continued research and development activities. IperionX will also continue development of the Company’s critical minerals project located in Tennessee, including a pre-feasibility study, permitting, and continued exploration.

ASX - ADDITIONAL INFORMATION

Mining properties – Titan Project

At September 30, 2022, the Titan Project comprised of approximately 11,071 acres of surface and associated mineral rights in Tennessee prospective for heavy mineral sands (HMS), rich in minerals critical to the U.S, including titanium, rare earth minerals, high grade silica sand and zircon, of which approximately 453 acres are owned and approximately 10,618 acres are subject to exclusive option agreements. These exclusive option agreements, upon exercise, allow us to lease or, in some cases, purchase the surface property and associated mineral rights.

Mining properties – Milford Project

At September 30, 2022, the Milford Project comprised the following tenements:

| Tenement | Location | Interest |

| ML-001 to ML-100, ML-051a | Utah, USA | 100% |

| Total number of claims | 101 | |

Mining exploration expenditures

During the quarter, the Company made the following payments in relation to mining exploration activities.

| | Activity | US$000 |

| | Drilling and assaying | (172) |

| | Metallurgical test work | (488) |

| | Geological consultants | (165) |

| | Permitting | (61) |

| | Technical studies | (326) |

| | Field supplies, vehicles, travel and other | (407) |

| | Total as reported in Appendix 5B | (1,619) |

There were no mining or production activities or expenses during the quarter.

Related party payments

During the quarter, the Company made payments of approximately US$149,000 to related parties and their associates. These payments relate to executive directors’ remuneration, non-executive directors’ fees, employer 401(k) contributions, superannuation contributions.

About IperionX

IperionX’s mission is to be the leading developer of low-carbon, sustainable, critical material supply chains focused on advanced industries including space, aerospace, electric vehicles and 3D printing. IperionX’s titanium technologies have the potential to produce titanium products which are sustainable, 100% recyclable, low-carbon intensity and at product qualities which exceed current industry standards. The Company also holds a 100% interest in the Titan Project, located in Tennessee, U.S., which is rich in rare earth minerals.

This announcement has been authorized for release by the CEO and Managing Director.

Forward Looking Statements

Information included in this release constitutes forward-looking statements. Often, but not always, forward looking statements can generally be identified by the use of forward-looking words such as “may”, “will”, “expect”, “intend”, “plan”, “estimate”, “anticipate”, “continue”, and “guidance”, or other similar words and may include, without limitation, statements regarding the timing of any Nasdaq listing, plans, strategies and objectives of management, anticipated production or construction commencement dates and expected costs or production outputs.

Forward looking statements inherently involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance, and achievements to differ materially from any future results, performance, or achievements. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licenses and permits and diminishing quantities or grades of reserves, political and social risks, changes to the regulatory framework within which the Company operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation, as well as other uncertainties and risks summarized in filings made by the Company from time to time with the Australian Securities Exchange and in the Form 20-F filed with the U.S. Securities and Exchange Commission.

Forward looking statements are based on the Company and its management’s assumptions relating to the financial, market, regulatory and other relevant environments that will exist and affect the Company’s business and operations in the future. The Company does not give any assurance that the assumptions on which forward looking statements are based will prove to be correct, or that the Company’s business or operations will not be affected in any material manner by these or other factors not foreseen or foreseeable by the Company or management or beyond the Company’s control.

There may be other factors that could cause actual results, performance, achievements, or events not to be as anticipated, estimated or intended, and many events are beyond the reasonable control of the Company. Accordingly, readers are cautioned not to place undue reliance on forward looking statements. Forward looking statements in these materials speak only at the date of issue. Except as required by applicable law or stock exchange listing rules, the Company does not undertake any obligation to publicly update or revise any of the forward-looking statements or to advise of any change in events, conditions or circumstances on which any such statement is based.

Competent Persons Statement

The information in this announcement that relates to Production Targets, Process Design, Mine Design, Cost estimates and Financial Analysis is extracted from IperionX’s ASX Announcement dated June 30, 2022 (“Original ASX Announcement”) which is available to view at IperionX’s website at www.iperionx.com. IperionX confirms that a) it is not aware of any new information or data that materially affects the information included in the Original ASX Announcement; b) all material assumptions included in the Original ASX Announcement continue to apply and have not materially changed; and c) the form and context in which the relevant Competent Persons’ findings are presented in this report have not been materially changed from the Original ASX Announcement.

The information in this announcement that relates to Mineral Resources is extracted from IperionX’s ASX Announcement dated October 6, 2021 (“Original ASX Announcement”) which is available to view at IperionX’s website at www.iperionx.com. IperionX confirms that a) it is not aware of any new information or data that materially affects the information included in the Original ASX Announcement; b) all material assumptions included in the Original ASX Announcement continue to apply and have not materially changed; and c) the form and context in which the relevant Competent Persons’ findings are presented in this report have not been materially changed from the Original ASX Announcement.

|

Appendix 5B

Mining exploration entity or oil and gas exploration entity quarterly cash flow report

| Name of entity |

| IperionX Limited |

| ABN | | Quarter ended (“current quarter”) |

| 84 618 935 372 | | 30 September 2022 |

| Consolidated statement of cash flows | Current quarter USD$’000 | Year to date (3 months) USD$’000 |

| 1. | Cash flows from operating activities | - | - |

| 1.1 | Receipts from customers |

| 1.2 | Payments for | (1,619) | (1,619) |

| | (a) exploration & evaluation |

| | (b) development | - | - |

| | (c) production | - | - |

| | (d) staff costs | (1,199) | (1,199) |

| | (e) administration and corporate costs | (1,007) | (1,007) |

| 1.3 | Dividends received (see note 3) | - | - |

| 1.4 | Interest received | 5 | 5 |

| 1.5 | Interest and other costs of finance paid | - | - |

| 1.6 | Income taxes paid | - | - |

| 1.7 | Government grants and tax incentives | - | - |

| 1.8 | Other (provide details if material): (a) business development | (397) | (397) |

| 1.9 | Net cash from / (used in) operating activities | (4,217) | (4,217) |

| 2. | Cash flows from investing activities | - | - |

| 2.1 | Payments to acquire: |

| | (a) entities |

| | (b) tenements | (278) | (278) |

| | (c) property, plant and equipment | (527) | (527) |

| | (d) exploration & evaluation | - | - |

| | (e) investments | - | - |

| Consolidated statement of cash flows | Current quarter USD$’000 | Year to date (3 months) USD$’000 |

| | (f) other non-current assets | - | - |

| 2.2 | Proceeds from the disposal of: | - | - |

| | (a) entities |

| | (b) tenements | - | - |

| | (c) property, plant and equipment | - | - |

| | (d) investments | - | - |

| | (e) other non-current assets | - | - |

| 2.3 | Cash flows from loans to other entities | - | - |

| 2.4 | Dividends received (see note 3) | - | - |

| 2.5 | Other (provide details if material): (a) cash acquired on asset acquisition | - | - |

| 2.6 | Net cash from / (used in) investing activities | (805) | (805) |

| |

| 3. | Cash flows from financing activities | 15,143 | 15,143 |

| 3.1 | Proceeds from issues of equity securities (excluding convertible debt securities) |

| 3.2 | Proceeds from issue of convertible debt securities | - | - |

| 3.3 | Proceeds from exercise of options | 121 | 121 |

| 3.4 | Transaction costs related to issues of equity securities or convertible debt securities | (948) | (948) |

| 3.5 | Proceeds from borrowings | - | - |

| 3.6 | Repayment of borrowings | - | - |

| 3.7 | Transaction costs related to loans and borrowings | - | - |

| 3.8 | Dividends paid | - | - |

| 3.9 | Other (provide details if material) | - | - |

| 3.10 | Net cash from / (used in) financing activities | 14,316 | 14,316 |

| 4. | Net increase / (decrease) in cash and cash equivalents for the period | | |

| 4.1 | Cash and cash equivalents at beginning of period | 5,659 | 5,659 |

| 4.2 | Net cash from / (used in) operating activities (item 1.9 above) | (4,217) | (4,217) |

| Consolidated statement of cash flows | Current quarter USD$’000 | Year to date (3 months) USD$’000 |

| 4.3 | Net cash from / (used in) investing activities (item 2.6 above) | (805) | (805) |

| 4.4 | Net cash from / (used in) financing activities (item 3.10 above) | 14,316 | 14,316 |

| 4.5 | Effect of movement in exchange rates on cash held | (80) | (80) |

| 4.6 | Cash and cash equivalents at end of period | 14,873 | 14,873 |

| 5. | Reconciliation of cash and cash equivalents at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts | Current quarter USD$’000 | Previous quarter USD$’000 |

| 5.1 | Bank balances | 13,571 | 2,473 |

| 5.2 | Call deposits | 1,302 | 3,186 |

| 5.3 | Bank overdrafts | - | - |

| 5.4 | Other (provide details) | - | - |

| 5.5 | Cash and cash equivalents at end of quarter (should equal item 4.6 above) | 14,873 | 5,659 |

| 6. | Payments to related parties of the entity and their associates | Current quarter USD$’000 |

| 6.1 | Aggregate amount of payments to related parties and their associates included in item 1 | (149) |

| 6.2 | Aggregate amount of payments to related parties and their associates included in item 2 | - |

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments |

| 7. | Financing facilities Note: the term “facility’ includes all forms of financing arrangements available to the entity. Add notes as necessary for an understanding of the sources of finance available to the entity. | Total facility amount at quarter end USD$’000 | Amount drawn at quarter end USD$’000 |

| 7.1 | Loan facilities | - | - |

| 7.2 | Credit standby arrangements | - | - |

| 7.3 | Other (please specify) | - | - |

| 7.4 | Total financing facilities | - | - |

| 7.5 | Unused financing facilities available at quarter end | - |

| 7.6 | Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. |

| Not applicable |

| 8. | Estimated cash available for future operating activities | USD$’000 |

| 8.1 | Net cash from / (used in) operating activities (item 1.9) | (4,217) |

| 8.2 | (Payments for exploration & evaluation classified as investment activities) (item 2.1(d)) | - |

| 8.3 | Total relevant outgoings (item 8.1 + item 8.2) | (4,217) |

| 8.4 | Cash and cash equivalents at quarter end (item 4.6) | 14,873 |

| 8.5 | Unused finance facilities available at quarter end (item 7.5) | - |

| 8.6 | Total available funding (item 8.4 + item 8.5) | 14,873 |

| 8.7 | Estimated quarters of funding available (item 8.6 divided by item 8.3) | 3.5 |

Note: if the entity has reported positive relevant outgoings (ie a net cash inflow) in item 8.3, answer item 8.7 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.7.

| 8.8 | 8.8.1. Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? |

Not applicable.

| | 8.8.2. | Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? |

Not applicable.

| 8.8.3. | Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? |

Not applicable.

Note: where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered.

Compliance statement

| 1 | This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A. |

| 2 | This statement gives a true and fair view of the matters disclosed. |

Authorised by: | Company Secretary | |

| | |

| | (Name of body or officer authorising release – see note 4) |

Notes

| 1. | This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so. |

| 2. | If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report. |

| 3. | Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity. |

| 4. | If this report has been authorised for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert here: “By the [name of board committee – eg Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”. |

| 5. | If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively. |