Exhibit 99.1

| PRESS RELEASE | NASDAQ: IPX | ASX: IPX |

|

|

| April 27, 2023 |

IPERIONX PLANS TO BUILD THE WORLD’S LARGEST 100% RECYCLED TITANIUM METAL POWDER FACILITY BY 2025

| ◾ | Final engineering and design for the 125 tpa Titanium Demonstration Facility (“TDF”) in Virginia is nearly complete, and first titanium powder production is targeted for Q1 2024 |

| ◾ | Once the TDF is successfully in operation, there are defined plans for a simple modular expansion into the Titanium Commercial Facility (“TCF-1”) with production capacity of 1,125 tpa in 2025 |

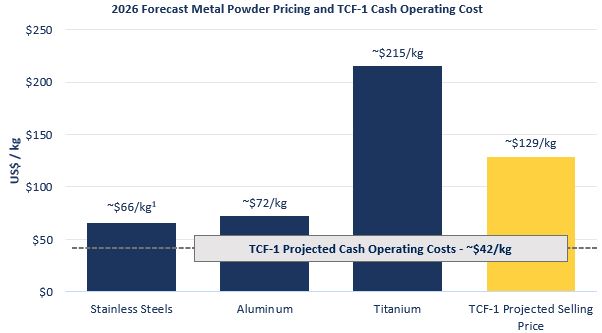

| ◾ | TCF-1 expansion provides a pathway for a step change in reducing the cost of titanium, with projected cash costs of ~US$42/kg compared to a current third-party forecast titanium powder market price of ~US$200/kg |

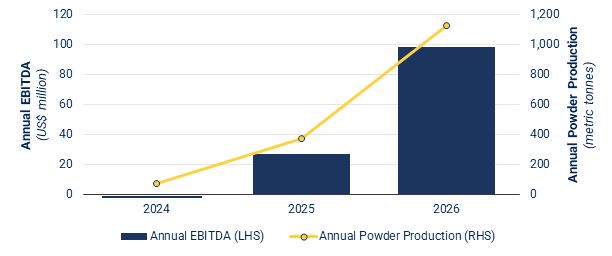

| ◾ | Forecast 2026 EBITDA from TCF-1 is ~US$100 million based on key operating assumptions and using a conservative titanium metal powder price of ~US$130/kg |

| ◾ | IperionX continues to receive significant interest for the commercial supply of titanium powders and is in advanced discussions with customers across various industries |

| ◾ | The development of the TDF & TCF-1 will position the Company as the largest global supplier of 100% recycled, low cost and low carbon titanium metal powders. |

IperionX Limited (“IperionX” or “Company”) (NASDAQ: IPX, ASX: IPX) is pleased to announce that it has completed detailed engineering design for the planned 125 metric tonnes per annum (“tpa”) Titanium Demonstration Facility (“TDF”), previously announced in September 2022, and a Techno-Economic Assessment for an expansion into the Company’s first Titanium Commercial Facility (“TCF-1”) of 1,125 tpa located at the Southern Virginia Technology Park in Halifax County, Virginia.

The TDF and TCF-1 will utilize the breakthrough Hydrogen Assisted Metallothermic Reduction (“HAMR”) technologies to produce titanium metal powder. Development of the TCF-1 to 1,125 tpa production capacity would furnish IperionX with the largest recycled titanium metal powder production capacity globally, the only titanium production facility using 100% titanium metal scrap as a feedstock. This will also be the only such facility with zero Scope 1 & 2 emissions with the lowest carbon intensity for any commercial titanium metal powder product.

Commenting on the completion of the scale up plans and testing, Anastasia Arima, Co-founder & CEO said:

“We have now developed plans for the world’s first and largest recycled titanium powder facility, with initial production from the first stage 125 tpa TDF forecast to come online in early 2024 with a simple and modular expansion to a 1,125 tpa TCF-1 by the end of 2025.

The pathway for the development of the TDF and TCF-1 build upon the learnings from our current Industrial Pilot Facility operations in Utah where we have been producing circular titanium metal since early 2022. The development of the TDF & TCF-1 will scale our production to commercial quantities of 100% recycled titanium metal while also reducing the cost providing the potential for titanium to compete on price with other metals, including stainless steel and aluminum.

The U.S. is a tier 1 fiscal and manufacturing operating environment with a large pipeline of government incentives potentially available to IperionX. We look forward to rapidly advancing our developments through 2023 and moving towards scaled up production to secure a U.S. supply chain of this critical metal.”

| North Carolina | Tennessee | Virginia | Utah |

129 W Trade Street, Suite 1405 Charlotte, NC 28202 | 279 West Main Street Camden, TN 38320 | 1030 Confroy Drive South Boston, VA 24592 | 1782 W 2300 S West Valley City, UT 84119 |

Titanium Metal Powder Production Scale-Up

The TDF is expected to begin commissioning in Q4 2023 and be operational by Q1 2024, targeting a run-rate of 125 tpa by Q3 2024. Development of the TDF remains subject to successful Board approval for a final investment decision, expected in Q3 2023.

The TDF is projected to initially produce ~15 tpa of spherical titanium metal powder and ~110 tpa of angular titanium metal powder. IperionX then plans to install additional equipment at the facility to allow for the operational flexibility to produce 125 tpa of either 100% angular titanium metal powder or 100% spherical titanium metal powder for an incremental capital cost of US$6.9 million. Cash costs for 125 tpa of spherical titanium powder production at the TDF are projected to be ~US$72/kg before contingencies.

Figure 1: IperionX Titanium Metal Powder projected production scale up and revenue generation

The larger capacity TCF-1 could be operational by Q4 2025 if long lead time items are ordered in Q3 2024. The TCF-1 is designed to produce 1,125 tpa of angular or spherical titanium metal powder. Capital costs for this expansion would be ~US$70 million, with ~US$48 million needed for long lead time orders and the remaining US$22 million needed during commissioning in 2025.

Assuming a conservative spherical titanium metal powder price of ~US$130/kg (vs. current estimated market pricing of ~US$200/kg), and using key operating assumptions, the TCF-1 has the potential to generate revenue of ~US$145 million and EBITDA of ~US$100 million in 2026.

This announcement has been authorized for release by the CEO.

For further information and enquiries please contact:

info@iperionx.com

+1 704 461 8000

www.iperionx.com

About IperionX

IperionX’s mission is to be the leading developer of low carbon titanium for advanced industries including space, aerospace, electric vehicles and 3D printing. IperionX holds an exclusive option to acquire breakthrough titanium technologies that can produce titanium products that are low carbon and fully circular. IperionX is producing titanium metal powders from titanium scrap at its operational pilot facility in Utah, and intends to scale production at a Titanium Demonstration Facility in Virginia. IperionX holds a 100% interest in the critical minerals Titan Project, which has the largest JORC resource of titanium, rare earth and zircon rich mineral sands in the U.S.A.

Forward Looking Statements Information included in this release constitutes forward-looking statements. Often, but not always, forward looking statements can generally be identified by the use of forward-looking words such as “may”, “will”, “expect”, “intend”, “plan”, “estimate”, “anticipate”, “continue”, and “guidance”, or other similar words and may include, without limitation, statements regarding plans, strategies and objectives of management, anticipated production or construction commencement dates and expected costs or production outputs.

Forward looking statements inherently involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance, and achievements to differ materially from any future results, performance, or achievements. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licenses and permits and diminishing quantities or grades of reserves, the Company’s ability to comply with the relevant contractual terms to access the technologies, commercially scale its closed-loop titanium production processes, or protect its intellectual property rights, political and social risks, changes to the regulatory framework within which the Company operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation.

Forward looking statements are based on the Company and its management’s good faith assumptions relating to the financial, market, regulatory and other relevant environments that will exist and affect the Company’s business and operations in the future. The Company does not give any assurance that the assumptions on which forward looking statements are based will prove to be correct, or that the Company’s business or operations will not be affected in any material manner by these or other factors not foreseen or foreseeable by the Company or management or beyond the Company’s control. Although the Company attempts and has attempted to identify factors that would cause actual actions, events or results to differ materially from those disclosed in forward looking statements, there may be other factors that could cause actual results, performance, achievements, or events not to be as anticipated, estimated or intended, and many events are beyond the reasonable control of the Company. Accordingly, readers are cautioned not to place undue reliance on forward looking statements. Forward looking statements in these materials speak only at the date of issue. Subject to any continuing obligations under applicable law or any relevant stock exchange listing rules, in providing this information the Company does not undertake any obligation to publicly update or revise any of the forward-looking statements or to advise of any change in events, conditions or circumstances on which any such statement is based. |

Appendix 1: IperionX Titanium Metal Powders Techno-Economic Assessment

The design of the TDF & TCF-1 are based upon a scaled-up version of the current Industrial Pilot Facility (“IPF”) in Salt Lake City, UT which has been successfully operated by IperionX since January 2022 and was an operating R&D facility for 5 years prior. Since taking control of the IPX, IperionX has invested substantial capital in operational improvements and has increased titanium production capacity with improved efficiency and consistency.

The IPF, TDF & TCF-1 utilize the proprietary HAMR titanium metal technologies developed by Dr. Zak Fang at the University of Utah, funded in part by the Department of Energy’s ARPA-E's METALS program.

The TDF & TCF-1 will manufacture titanium metal powders in a comparable, scaled up design to the operational IPF, which uses a simple thermomechanical process and off-the-shelf process equipment to manufacture dense, spherical titanium metal powders which can then be deoxygenated with the HAMR process. This combination of the thermomechanical and HAMR processes is called the granulation, sintering & deoxygenation (“GSD”) process which is also patented and proprietary to IperionX.

The TDF and the planned expansion to TCF-1 output would result in the world’s largest recycled titanium metal powder production facility, the only titanium production facility globally using 100% titanium metal scrap as a feedstock, and zero Scope 1 & 2 emissions with the lowest carbon intensity for any commercial metal powder product.

Consultants

This Techno-Economic Assessment has been completed by IperionX and its engineering and specialist consultants listed below in Table 1. This assessment builds on the in-house knowledge from successfully operating the titanium IPF in Salt Lake City, combined with detailed engineering design and commercial scale furnace testing. The TDF has a detailed engineering design capacity of 125 tpa and preliminary engineering studies for the TCF-1 confirm a target production capacity of 1,125 tpa.

Detailed engineering and design has been led by Performance Industries, Inc., a specialist U.S. engineering firm with a long track record of successfully designing and delivering major industrial manufacturing projects, augmented with specialist consultants to deliver a robust process design and project development plan.

| Consultants |

| Scope of Work |

| Performance Industries |

| Engineering & process design |

| DRA Americas Inc. (DRA) |

| Technical Due Diligence, review of Capex and Opex Estimates |

| Wingens LLC |

| Furnace design & selection |

| Process Safety Core Consulting |

| Process hazard analysis |

| H&E Electric |

| Electrical and Controls Engineering |

| Timmons Group |

| Permitting |

| Dewberry Engineers |

| Building up-fit |

| Integration Engineering |

| Work platforms and structural |

| EHS Compliance Services, Inc. (EHSC) |

| Corporate EHS policies |

Table 1: Core specialist consultants contributing to TDF and TCF engineering and design work

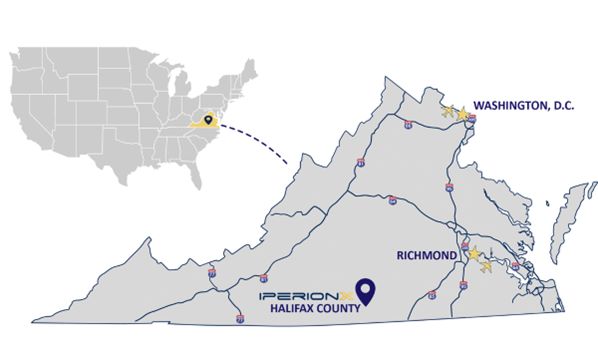

TDF & TCF-1 Location

The TDF and TCF-1 will be located in the Southern Virginia Technology Park industrial complex (“SVTP”) in Halifax County, Virginia. The site hosts an existing 50,000 square foot shell building with sufficient floor space for the planned expansion to 1,125 tpa with the TCF-1. In addition, there is excellent scope to then increase floor space significantly with an additional 100,000 square foot expansion.

The SVTP was developed by the Industrial Development Authority (“IDA”) of Halifax County with the goal of advancing industrial business development in the region and securing investment and manufacturing jobs from companies like IperionX. IperionX selected the site after a comprehensive national site selection process in 2022 and secured a range of incentives from the IDA and the Commonwealth of Virginia to locate the TDF and TCF-1 at the SVTP site. IperionX’s decision to select Virginia was announced by Governor Glenn Youngkin of Virginia at a press conference in September 2022 which was attended by important county, state and media representatives.

Figure 1: Location of TDF & TCF-1 site in Halifax County, VA

SVTP Site Infrastructure & Logistics

The SVTP site is an ideal location to scale up IperionX’s titanium manufacturing facilities as it includes direct access to major transportation networks, a large talent pool and access to installed 100% renewable power.

The SVTP site has excellent logistics for the receival of scrap feedstock, key process consumables and access to customer markets. The site is adjacent to U.S. Route 58 which is a major east-west transportation corridor providing direct access into Interstate routes 95, 85, 77 & 81 in addition to providing direct access to the ports at Norfolk, Virginia. Industrial Class 1 rail service is provided by Norfolk Southern Railway located near to the site in South Boston, Virginia on U.S. route 58. Additionally, rail service by CSX Transportation is available due east of the site at Emporia, Virginia.

A large, skilled talent pool is available from neighboring South Boston, from Danville, VA which is within a 30-minute commute and from the high growth Raleigh-Durham, NC area. The Institute for Advanced Learning and Research (“IALR”) at Danville Community College which hosts the U.S. Navy’s Additive Manufacturing Center of Excellence and the Southside Virginia Community College have major workforce support programs that intend to be leveraged by IperionX.

10MW of net-zero carbon power is available from existing overhead power lines just 150 yards south of the site. IperionX is working with Dominion Energy, the electric utility provider in southern VA, to utilize zero-emission wind and solar electricity through their Green Power® 100% Option program. This program provides Green-e Energy® certified renewable energy certificates (RECs) from renewable energy facilities to guarantee the full electrical consumption at the TDF. By participating in this Green Power program, Scope 2 emissions at the TDF will be eliminated.

As part of IperionX’s decarbonization commitment, no natural gas use has been incorporated at the TDF site or process design, eliminating that potential component of IperionX’s Scope 1 emissions. Additionally, alternatives to diesel-powered backup generators are being advanced to potentially eliminate any reliance on diesel fuel, while still providing immediate and reliable backup power.

Industrial Pilot Facility Operations

The existing titanium IPF in Salt Lake City successfully operates as an advanced titanium production facility with rigorous sampling, testing, data collection and analysis. The process is divided into management control segments, with the engineering segment responsible for production quality and yield. All processes are well defined by standard operating procedures.

The IPF produces low volume titanium production runs that are used for commercial sales, such as IperionX’s first commercial customer Officine Panerai, a division of Compagnie Financière Richemont SA, and for securing a range of potential new customers. The core HAMR technology is a metallothermic reduction process which is used at the IPF in a simple top-loading electric retort furnace. The IPF currently produces valuable angular and spherical titanium metal powders in ~50 kg batches. Uniquely, the IPF uses 100% scrap titanium metal as feedstock and uses 100% renewable power to produce high quality titanium powder with zero Scope 1 & 2 emissions. Titanium metal powder qualities consistently meet, or exceed, industry standards including the standards commonly used for Grade 5 and Grade 23 titanium alloy powders.

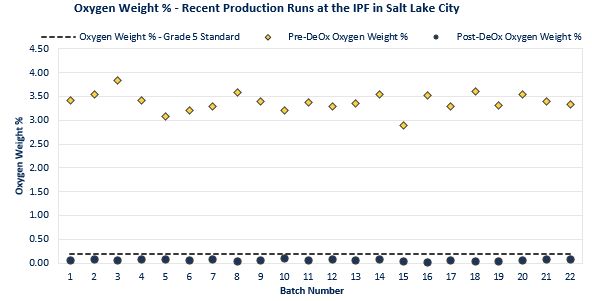

The IPF has successfully proven the ability of the HAMR technology to efficiently and sustainably reduce oxygen content to very low levels in titanium metal. This unique deoxygenation process is what allows IperionX to accept a wide range of titanium scrap material feedstocks to consistently produce high quality titanium powder. Superior deoxygenation performance also unlocks a rage of significant advantages over the traditional Kroll-based titanium production method, including low-temperature processing, high product yields, and more precise final particle size and morphology.

Figure 2: Oxygen content of GSD-HAMR production runs at the IPF, demonstrating the effectiveness and repeatability of the GSD-HAMR process

HAMR Technology - Commercial Scale Furnace Testing

To further de-risk the scale-up of the patented HAMR technology, IperionX recently completed large-scale furnace testing which successfully confirmed that the proprietary HAMR process can consistently refine titanium metal at a production output for the scale to be utilized by both the TDF and TCF-1.

An off-the-shelf bell-style furnace was selected as the optimum furnace technology that could deliver the requisite operating parameters and significantly reduce production cycle times over the IPF. A comprehensive furnace manufacturer selection process was undertaken which resulted in Electron Technologies BV (“Electron”) as the selected furnace supplier.

The preferred Electron furnace model was already manufactured and ready for delivery, with minor modifications, for use by IperionX. Rigorous commercial scale furnace testing was undertaken by Electron in the Netherlands, using similar critical process dimensions and parameters as the TDF and TCF-1 furnace.

The Electron bell-style furnace provides for a significant reduction in the production cycle time over existing operations at the IPF, and this is expected to reduce the cycle time for a HAMR production run from a one-week production turnaround to less than half a day at the TDF and TCF-1. Importantly, the production batch size is significantly increased to over 400 kg per run for the TDF and 1,300 kg per run for the TCF-1 versus just 50 kg per production run for the IPF. The TDF furnace has a cost of ~US$2.7 million, with only one furnace required for the TDF’s designed capacity.

The larger TCF-1 furnace is forecast to cost ~US$5 million per furnace before contingency, with only two furnaces required for each 1,000 tpa module.

Figure 3: Electron bell-type furnace

TDF & TCF-1 Process Design

The commercial scale-up to TDF & TCF-1 production capacity is simplified by the availability of larger and more efficient off-the-shelf industrial process equipment that can deployed at scale. No material changes to pilot-scale operating parameters are required. Furthermore, the HAMR process requires no toxic chemical gases (such as TiCl4) or higher risk, high temperature molten metal operations.

Figure 4: Simplified process flow diagram showing key process steps

HAMR deoxygenation is the key technological process that is the foundation of the commercial scale-up at the TDF & TCF-1. No significant changes to key process parameters are required to scale from the current IPF output to the TDF & TCF-1 production capacity. This includes no changes in reagent parameters, cycle times for reduction (not including furnace dead cycle time, or heat up and cool down), nor changes to the critical dimensions for furnace operations (e.g., powder bed thickness). Due to the benefits of the low temperature reaction for the HAMR process, and the lack of highly toxic or corrosive chemical reagents, the selection of furnace construction materials was simplified (e.g., no requirement for high temperature alloys). These factors combine to mitigate technical process scale-up risks and costs.

The scale-up of remaining core production process steps from industrial pilot scale to the TDF & TCF-1 scale is based on the mature operating procedures at the IPF, adapted for higher target production capacity. TDF design and site selection have been undertaken with near-term modular expansion in mind, with TDF layout and process design allowing ample space for additional equipment to expand to TCF-1 scale capacity. A sample 3D layout of the TDF is shown in Figure 5.

Figure 5: Isometric view of TDF 3D model, showing the spray drying and furnace areas with generic equipment for confidentiality reasons

The key process and core steps are protected by a large number of patents and trade secrets, but a summary overview of the process is shown in Figure 4 with a description of the core steps to produce spherical titanium metal powder as follows:

1. Titanium metal scrap is sourced and cleaned before hydrogenating to embrittle the titanium metal (a common process completed across a variety of metals, including titanium).

2. Hydrogenated titanium metal scrap is then crushed and milled into a slurry which is then agglomerated to produce “green” spherical titanium metal powders.

3. These “green” powders then go through a de-bind and sintering process in a standard vacuum furnace to produce dense spherical titanium metal powders but with very high oxygen content.

4. These powders are then processed via the patented HAMR deoxygenation process to produce a “cake” of low oxygen titanium powder.

5. The “cake” is then placed into a proprietary leaching process which removes impurities before drying and dehydrogenation.

6. The titanium powders then go through a rigorous quality control program before being packaged for delivery to powder customers or to be used by IperionX to additively manufacture high value titanium components for customers.

The production process can be modified to produce angular titanium powder with less process steps and lower capital intensity.

Titanium Scrap Market

The U.S. Geological Survey estimates that the size of the U.S. titanium scrap market in 2020 was 45,000 metric tonnes, down from the pre-pandemic peak of 69,600 metric tonnes in 2017. Beginning in 2021, USGS began withholding titanium scrap market data to avoid disclosing company proprietary data.

The U.S. is the largest importer of titanium scrap globally, importing between 10,000 and 30,000 metric tonnes annually since 2010. Imports in 2022 were ~19,000 metric tonnes.

| U.S. titanium scrap summary | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2019 | | | 2020 | |

| (Metric tonnes) | | | | | | | | | | | | | | | | | | | | | |

| Total titanium scrap in circulation | | | 63,100 | | | | 62,900 | | | | 64,560 | | | | 69,600 | | | | 61,500 | | | | 62,000 | | | | 45,000 | |

| Titanium scrap used in ingot feed | | | 50,000 | | | | 51,000 | | | | 53,000 | | | | 58,000 | | | | 50,000 | | | | 50,000 | | | | 35,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Titanium scrap used in other Industries | | | 13,100 | | | | 11,900 | | | | 11,560 | | | | 11,600 | | | | 11,500 | | | | 12,000 | | | | 10,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Scrap generated in titanium industry | | | 47,210 | | | | 48,064 | | | | 55,214 | | | | 67,700 | | | | 48,460 | | | | N/A | 1 | | | N/A | 1 |

| Scrap consumed in titanium Industry | | | 32,000 | | | | 32,100 | | | | 30,300 | | | | 31,600 | | | | 24,000 | | | | N/A | 1 | | | N/A | 1 |

| Scrap exported | | | 4,610 | | | | 6,860 | | | | 9,720 | | | | 9,450 | | | | 11,900 | | | | 15,000 | | | | N/A | 1 |

| Implied FerroTi scrap consumption | | | 0 | | | | 1,200 | | | | 2,000 | | | | 4,400 | | | | 2,100 | | | | N/A | 1 | | | N/A | 1 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Est. titanium industry unused scrap | | | 10,600 | | | | 7,904 | | | | 13,194 | | | | 22,250 | | | | 10,460 | | | | N/A | 1 | | | N/A | 1 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Titanium industry scrap recirculation rate | | | 78 | % | | | 84 | % | | | 76 | % | | | 67 | % | | | 78 | % | | | N/A | 1 | | | N/A | 1 |

| Titanium scrap consumption as % of scrap in circulation | | | 49 | % | | | 49 | % | | | 53 | % | | | 55 | % | | | 61 | % | | | N/A | 1 | | | N/A | 1 |

| |

Table 2: Company estimates for titanium scrap market flows from 2014-2020, using USGS published data

In recent quarters, U.S. titanium scrap prices have risen from the COVID-related multi-year lows in 2020 and they currently sit near multi-year highs, driven in part by the Russia-Ukraine conflict and resultant supply chain disruptions. Traditional U.S. titanium ingot manufacturers have increased production over the past 24 - 36 months in response to a strong aerospace market recovery and, in doing so, have increased their scrap and sponge consumption driving domestic prices higher.

IperionX estimates that initial TDF titanium scrap demand of 125 tpa is less than 1% of the U.S. titanium scrap market, while demand of 1,125 tpa will be less than 5%. IperionX is in advanced commercial negotiations with a large number of titanium scrap suppliers for the TDF and TCF-1 feedstock requirements.

To date, IperionX titanium scrap metal requirements have been met by a number of well-established scrap suppliers, with over ~4 metric tonnes purchased for the IPF so far. IperionX has also completed an extensive successful test program of over 20 varieties of scrap samples from target industries, and importantly, across a wide range of titanium scrap qualities.

IperionX plans to source titanium metal scrap from a range of large segments of the scrap market, across a wide band of quality specifications, to lower its scrap input costs and to achieve an aim of 100%, circularity in the titanium metal supply chain.

The key titanium metal scrap sources for the TDF and TCF-1 will be:

1. Aerospace titanium grade turnings where the OEM wants to improve circularity and sustainability.

2. Non-aerospace grade turnings with higher oxygen levels and potentially higher concentrations of deleterious elements that need additional cleaning but would otherwise go to the lower value ferro-titanium market.

3. Additive manufacturing titanium scrap including scrap powders, residual build elements, support structures and failed manufacturing builds which can be used by IperionX with minimal preparation.

4. End-of-life titanium metal scrap, including cast components (e.g. U.S. Navy impellers, turbine components, and hydrogen electrolyzer components) which would otherwise go to the ferro-titanium market.

5. Landfilled titanium metal scrap that is significantly lower-quality material that would otherwise be un-used (e.g. grindings), requiring additional cleaning and potentially additional pre-processing steps.

Titanium Metal Powder Market

The target customer verticals for IperionX’s low-cost, low-carbon 100% recycled titanium metal powder are extensive and range from automotive, consumer electronics, green hydrogen electrolyzers, hydrogen fuel cells and luxury goods to aerospace/defense.

The metal additive manufacturing market is high growth and is forecast to continue multiply in size and value over the next decade. The estimated market size in 2021 and forecast for 2030 are shown in Figure 6. IperionX’s forecast selling price for the TCF-1’s 1,125 tpa spherical powder production and estimated cash operating costs are shown in Figure 7.

Figure 6: Forecasted global market growth for metal AM powders (Source: SmarTech Analysis)

1. Pricing for standard steel of $39.5/kg was grossed up and adjusted for stainless steel density (60%) to approximate stainless steel pricing.

Figure 7: 2026 forecast metal powder market prices vs. IperionX's forecast TCF-1 selling price and cash operating cost (Source: SmarTech Analysis).

Titanium has superior strength-to-weight with higher corrosion resistance than stainless steel or aluminum and with a lower cost, it would be the preferred metal for many applications. In addition, many leading companies want to reduce their impact on the environment and IperionX titanium uniquely offers them a superior low-carbon metal, with greater durability and strength, that can be sustainably recycled at the end of the product life. These compelling advantages have secured extensive interest from a wide range of leading companies for the supply of IperionX titanium.

A select summary of secure and highly prospective customers is shown below. Examples of additively manufactured watch blanks for Panerai, a subsidiary of Compagnie Financière Richemont SA, produced using recycled titanium powders from the IPF, are shown in Figure 8 below.

| | Industry / Prospective Customer | Target Market | Product Interest | Potential Size |

| | Low volume production runs and/or prototyping agreements |

| | Canyon Bicycles GmbH |

| Bicycles & Micro Mobility |

| 3D printed bike frames & parts | 100+ tpa |

| | SLM Solutions Group AG |

| Additive Manufacturing |

| Circular powder supply chain | 100+ tpa |

| | Compagnie Financière Richemont SA |

| Luxury Goods |

| 3D printed watches & jewellery | 10+ tpa |

| | Air Force Research Laboratory |

| Defense |

| Circular powder supply chain | 10+ tpa |

| | Carver Pump Company, Inc. |

| Marine & Industrial |

| 3D printed pump parts | 10+ tpa |

| | Advanced discussions and/or prototype trials |

| | EU Manufacturing Conglomerate |

| Industrial & Hydrogen |

| Circular powder supply chain | 1,000+ tpa |

| | EU AM & PM manufacturer |

| Hydrogen |

| Circular powder supply chain | 200+ tpa |

| | U.S. Automotive OEM |

| Automotive |

| 3D printed automotive parts | 250+ tpa |

| | Multiple Consumer Electronic OEM’s |

| Consumer Electronics |

| Circular powder supply chain | 1,000+ tpa |

| | U.S. Aerospace OEM |

| Aerospace |

| Circular powder supply chain | 100+ tpa |

Table 3: Summary of interested commercial counterparties

Figure 8: 3D printed watch cases for Officine Panerai, a subsidiary of Compagnie Financière Richemont, using IperionX’s low-carbon, 100% recycled titanium powders

Operating Cost Estimates

IperionX has extensive knowledge of the operating costs required for the HAMR process from the successful scale-up and operating performance of the IPF in Salt Lake City. Plant process flow diagrams, along with mass and energy balances have been developed from IPF operating experience and information provided by key equipment suppliers. These formed the basis of the detailed operating cost estimates developed by IperionX and validated by DRA. A second leading international consulting firm has also conducted an independently commissioned review of the TDF costs and proposed scale-up, and confirmed that there are no red flag risks, validating the cost estimates.

Materials and consumables consumption are based upon the requirements calculated by the mass balance and the historical consumption at IPF operations. Labor costs were forecast by applying the deep operating experience at the IPF and adjusting for higher production output with modifying factors deemed necessary by IperionX and its consultants. Power requirements were forecast based upon the loads expected from the installed equipment and ancillary building power requirements. Maintenance costs were forecast as a percentage of the total mechanical equipment cost.

G&A and Waste Disposal costs include all Waste Disposal, Outside Services, Laboratory Expenses, Product Packaging, Office and IT Equipment Supplies, EHS Supplies, Asset Insurance, and Equipment Leases.

The summary of the forecast operating cash costs for the TDF and TCF-1 are shown below.

| Operating Cost Estimates (US$/kg) | | TDF (125 tpa) | | | TCF-1 (1,125 tpa) | |

Materials & Consumables | | | 17.7 | | | | 17.6 | |

Power | | | 3.8 | | | | 3.8 | |

Labor | | | 28.8 | | | | 7.9 | |

Maintenance | | | 4.9 | | | | 2.1 | |

G&A and Waste Disposal | | | 16.1 | | | | 10.3 | |

| Total Projected Cash Operating Costs | | | 71.4 | | | | 41.8 | |

Table 4: Forecast operating costs for 125 tpa TDF and 1,125 tpa TCF-1. Numbers may not add due to rounding.

The TDF scale operating costs are based upon 100% spherical powder production

DRA concluded that there are a range of high priority potential optimization opportunities to reduce operating costs. Core opportunities for optimization and lower operating costs include:

1. Economies of scale as fixed costs are spread over higher production output;

2. Potential for significantly lower titanium scrap, argon, and magnesium feedstock costs; and

3. Potential for recycling of key material feedstocks including argon and magnesium.

Capital Cost Estimates

A process plant equipment list was generated from the process flow diagram, which in turn includes all major HAMR process equipment. Budgetary figures and lead time estimates were sourced from a number of potential suppliers. Certain direct and indirect capital costs have been calculated using industry standard factors. The resulting capital cost estimates and schedules have been validated by DRA. A second leading international consulting firm has also conducted an independently commissioned review of the TDF costs and proposed scale-up, and confirmed that there are no red flag risks, validating the cost estimates.

A detailed equipment list was created from process flow diagrams which includes all HAMR process equipment. Budget figures and lead time estimates were sourced from a number of equipment suppliers. Hourly labor rates for southern Virginia were used to estimate forecast labor costs. A contingency factor of 22.5% was applied to the 125 tpa and 1,125 tpa capital estimates.

Approximately 93% of the TDF equipment cost estimate is backed by vendor quotes. Most notably, the single largest equipment capital line item, the HAMR furnace, has been purchased from Electron representing approximately 24% of equipment capital costs with an initial down payment of ~US$0.3m already made.

Total estimated capital costs for the 125 tpa TDF and the expansion capital needed to scale to the 1,125 tpa TCF-1 are shown in the following table.

| Capital Cost Estimates – US$ millions | |

| Item | | TDF (125 tpa) | | | TCF-1 (1,125 tpa) | |

| | | Angular + Spherical 1st Stage | | | Expansion to Spherical | | | Total Cumulative 125 tpa CAPEX | | | Incremental CAPEX

100% Spherical | |

Total Direct Cost | | | 13.6 | | | | 4.5 | | | | 18.1 | | | | 47.8 | |

Total Indirect Costs | | | 2.8 | | | | 0.8 | | | | 3.6 | | | | 8.1 | |

Owner's Cost | | | 1.1 | | | | 0.4 | | | | 1.5 | | | | 1.2 | |

Contingency | | | 3.9 | | | | 1.3 | | | | 5.2 | | | | 12.9 | |

Projected Development Capital, before VA Incentives1 | | | 21.5 | | | | 6.9 | | | | 28.4 | | | | 70.0 | |

State of VA incentives1 | | | | | | | | | | | (4.9 | ) | | TBD | |

Projected Development Capital, after VA Incentives1 | | | | | | | | | | | 23.4 | | | | 70.0 | |

Note: Numbers may not sum due to rounding. 1. Incentives from VA state include a construction allowance of US$4m from the Halifax County Industrial Development Authority, a US$300k grant from the Virginia Commonwealth Opportunity Fund, and a US$573k grant from the Tobacco Region Opportunity Fund. See ASX Announcement dated September 28, 2022 for details. | |

Table 5: Projected capital cost estimates for 125 tpa TDF and incremental capital for 1,125 tpa TCF-1 expansion

Capital costs to bring initial production in 2024 to 125 tpa of total powder production capacity (15 tpa spherical and 110 tpa angular) are forecast to be US$21.5 million. A further US$6.9 million could be spent in late 2024 to allow for 100% spherical powder production by 2025.

Environmental, Health and Safety

Protecting the health and safety of employees, stakeholders, and communities surrounding its operations is a core company value and fundamental to our ongoing success. IperionX is proud to report zero recordable health and safety incidents involving employees or in our communities to date.

IperionX aims to create a performance workplace culture where employees lead the way to ensure a productive and safe work environment. Part of this initiative is to ensure that employees have the training, knowledge, and tools they need to safely complete their work tasks and to identify, assess, and control risks that reduce the potential for occupational illness or injury.

In 2022, IperionX progressed the establishment of an Environmental Health and Safety Management System following the international guidelines of ISO 45001. This management system includes the objectives and policies used by IperionX to identify, assess, and control risks that can negatively impact the health and safety of workers, the environment, and corporate reputation. The Environmental Health and Safety Management System aims to ensure that IperionX remains in full compliance with all applicable occupational and environmental health and safety laws and regulations governing its operations, and that it will proactively manage and improve the health and safety system.

The work completed to date, and planned to be completed, for the Environmental Health and Safety Management system includes:

| ◾ | Gap Assessment: This assessment proactively identified the level of compliance of IperionX operations to the critical elements of the Environmental Health and Safety Management System |

| ◾ | Implementation Plan: A detailed implementation plan to accomplish an Environmental Health and Safety Management System |

| ◾ | Compliance Obligations: Identification of all legal requirements that operations need to comply with as the business grows and evolves |

| ◾ | Development and Implementation: The focus of efforts in FY23 to further develop and implement all elements of the Environmental Health and Safety Management System |

Process risks at the TDF are managed systematically using a Process Safety Management framework that includes Process Hazard Analyses, Hazard and Operability Studies (“HAZOP”), Layer of Protection Analyses (“LOPA”) and Failure Modes and Effect Analysis.

All operating structures and grounds are incorporated into a Dust Hazard Analysis and a Hazard Area Classification Study. HAZOP LOPAs are being conducted for all project segments that contain combustible dusts, liquids or vapors. The HAZOP LOPAs for the key areas include the Electron Furnace, Mill/Spray Dryer, Debind Sinter Crushing, have been completed.

Preliminary process safety management studies are actioned with multiple work streams to ensure full compliance with applicable federal, state, and local safety regulations, and the adoption of industry best practices with ongoing continual improvement processes.

Permitting

Permitting requirements for the TDF and TCF-1 are well advanced and limited in scope. A New Source Review permit will be required for the Virginia DEQ, and has been submitted. No Title V air permit will be required. Process wastewater will be treated on site and discharged to the Municipal sanitary sewer system, requiring a standard Waste Water Discharge permit, which has also been submitted. Permit requirements, along with regulator and estimated application times, are summarized below.

| Permit Description | | Regulator | | Submitted | Est. Processing Time |

| Waste Water Discharge Permit | | Halifax County Service Authority |

| April 2023 | 90 days |

| New Source Review | | Virginia Department of Environmental Quality |

| April 2023 | 90 days |

Table 6: Summary of permitting requirements for the TDF and TCF-1

Project Schedule

Subject to the final investment decision and approval by the IperionX Board of Directors, the delivery of major process equipment is expected to begin in Q3 2023 and commissioning is expected to commence in Q1 2024.

First commercial titanium production is expected by late Q1 2024 and the designed ramp-up in production to 125 tpa is targeted by the end of Q3 2024; this will comprise approximately 15 tpa of spherical titanium powder and 110 tpa of angular titanium powder. IperionX then has the option to expand production to 125 tpa of spherical powder. A summary of core TDF engineering milestones is shown in the table below.

| | Milestone |

| Status |

| | Block Flow Diagram |

| Complete |

| | Process Flow Diagram |

| Complete |

| | Mass Balance |

| Complete |

| | P&ID |

| Complete |

| | Process Hazard Analysis |

| ~40% Complete |

| | Dust Hazard Analysis and Hazard Area Classification |

| ~70% Complete |

| | Building Layout |

| ~90% Complete |

| | Equipment List |

| ~95% Complete |

| | Controls Plan |

| ~20% Complete |

| | Power Plan (Single Line Drawing) |

| ~10% Complete |

| | Piping Plan |

| ~10% Complete |

| | Structural Plan (Platforms and Crane) |

| ~10% Complete |

Table 7: Summary of major engineering milestones at the TDF.

Subject to the final investment decision and approval by the IperionX Board of Directors, the production expansion to 1,125 tpa via the TCF-1 could be achieved during Q3 2025 at a run rate of 1,125 tpa of spherical or angular titanium metal powder production.

Royalties and Taxes

Federal corporate income tax rates are 21% and the corporate income tax in the Commonwealth of Virginia is 6%. Under the incentives provided for by the Commonwealth of Virginia this corporate income tax rate could potentially be reduced over the first 6 years of production. Additionally, there are a range of federal corporate income tax incentives available which are detailed in Table 8 below.

Royalties are payable to Blacksand Technologies, LLC (holding company of Dr. Zak Fang) of 0.5% on net sales that are more than US$300.0 million in annual revenue.

Project Funding

To achieve the range outcomes indicated in the Techno-Economic Assessment, funding in the order of US$23.8 million will likely be required for the TDF and US$70.0 million will likely be required for the TCF-1.

An assessment of various funding alternatives available to the Company has been made based on precedent transactions that have occurred in the industrial and metals sectors. The assessment indicates that, given the nature of the TDF and TCF-1, funding is likely to be available from a combination of government grant and loan programs (discussed below), project level debt financing, equipment financing, traditional equity, offtake prepayments and streams, royalty prepayments and streams, and strategic equity, at either the Company and/or project level.

Given the capital requirements of the TDF, IperionX is confident in its ability to fund the development via equity capital markets in the event that no government incentives or debt financing options are available.

In the development of the TCF-1, the Company is confident in its ability to secure a combination of U.S. government funding and debt capital markets for either project level financing or equipment financing for a portion of the development, especially post a successful TDF commissioning. Additionally, given the strong margins and low operating costs of the TCF-1 operations the Company is also confident in its ability to fund the development via equity capital markets in the event that no government funding or debt financing options are available.

Investors should note that there is no certainty that the Company will be able to raise the amount of funding when needed. It is also possible that such funding may only be available on terms that may be dilutive to or otherwise affect the value of the Company’s existing shares.

IperionX has an experienced and qualified Board and management team with respected executives with extensive technical, financial, commercial and capital markets experience. As a result, IperionX believes that it has a reasonable basis to expect it will be able to secure funding to develop the TDF and TCF-1 when a final positive investment decision is made on those projects. This reasonable basis includes consideration of factors such as:

| ◾ | Attractive investment parameters for the TDF and TCF-1 |

| ◾ | Low estimated capital cost relative to comparable titanium metal production plants |

| ◾ | Low relative operating costs |

| ◾ | Range of U.S. government funding opportunities |

| ◾ | Extensive customer interest from a wide range of leading companies |

| ◾ | Access to US and Australian capital markets |

U.S. Government Funding Opportunities

IperionX has not yet reached a final investment decision for commencement of the construction of the TDF or TCF-1. Final detailed engineering works are being completed, contractor and vendor bids are to be finalized, requisite permits are to be secured, and a final investment decision and approval by the IperionX Board of Directors is yet to occur.

IperionX has advanced a range of attractive funding opportunities at both the state and federal level, however these are not yet finalized. These funding opportunities include grant and loan programs provided by the U.S. government and State of Virginia, some of which IperionX has already applied for, and others are in progress. Many of these government funding programs were established or expanded by landmark U.S. legislation passed in 2021 and 2022 intended to promote clean energy, support domestic critical mineral production, and address U.S. supply chain vulnerabilities caused by foreign reliance. A sample of active incentives that IperionX is eligible for are listed below in Table 8.

Tax credits established under the historic Inflation Reduction Act could provide the company with substantial tax savings. The TDF is a new industrial facility engaged in critical material recycling and could qualify for the

Qualifying Advanced Energy Project Credit, valued at up to 30% of the company’s eligible capex investments necessary to commission the facility. Should IperionX’s application be approved by the U.S. government, IperionX could claim this tax credit once the TDF begins production. Separately, the

Advanced Manufacturing Production Credit could provide IperionX with a tax credit valued at 10% of the cost of producing high-purity titanium. Importantly, taxpayers cannot claim both credits. The U.S. Internal Revenue Service is expected to publish additional guidance soon, which will help the company understand what types of investments and production costs can be claimed under the new tax credits.

| Name | Government Body | Type of Incentive | Value of Incentive |

| New Company Incentive Program | State of Virginia | Tax Benefit | Potentially reduces corporate income tax liability to the state for up to 6 years |

| Domestic Near Net Shape Manufacturing to Enable a Clean and Competitive Economy | U.S. Department of Energy | Grant | US$5-10 million per award |

| Industrial Decarbonization and Emissions Reduction Demonstration-to-Deployment | U.S. Department of Energy | Grant | US$75-500 million per award |

| Loan Program Office: Title XVII and Advanced Technology Vehicles Manufacturing | U.S. Department of Energy | Loan | Variable (generally +US$100 million per award) |

| Small Business Innovation Research Program | U.S. Department of Defense | Grant / Contract | Up to US$1 million |

| Defense Logistics Agency Broad Agency Announcement on Qualification | U.S. Department of Defense | Contract | Up to US$3 million |

| Business and Industry Loan Guarantees | U.S. Department of Agriculture | Loan | Up to US$25 million |

| Make More in America Initiative | Export Import Bank of the U.S. | Loan | Variable (each job year created allows for up to US$189k in financing) |

| Qualifying Advanced Energy Project Credit | U.S. Department of the Treasury | Tax Credit | 10% of cost incurred by taxpayer during production of critical minerals, including titanium |

| Advanced Manufacturing Production Credit | U.S. Department of the Treasury | Tax Credit | Up to 30% of “Qualified Investment” of taxpayer’s “Qualified Advanced Energy Project” |

Table 8: Select potential government incentive opportunities for which IperionX is eligible

EBITDA Sensitivity Analysis

Indicative EBITDA sensitivity analyses were completed based on projections for the 125 tpa TDF in 2025 and the 1,125 tpa TCF-1 in 2026, across key variables including OPEX, production rates, and selling prices, shown in the figures below.

Figure 9: Indicative 2025 EBITDA sensitivity analysis

Figure 10: Indicative 2026 EBITDA sensitivity analysis. The company aims to have TCF-1 operational in 2026, producing 100% spherical powders

Conclusions and Next Steps

This Techno-Economic Assessment demonstrates a robust technical and economic case for IperionX to become the leading developer of low-carbon, environmentally sustainable and low-cost titanium for the U.S.

The company aims to undertake the following activities during 2023:

| ◾ | Complete engineering design |

| ◾ | Receive and finalize contractor and vendor bids |

| ◾ | Continue permitting activities associated with the TDF |

| ◾ | Continue titanium scrap and consumables supply discussions |

| ◾ | Continue titanium powder offtake discussions |

| ◾ | Prepare for final investment decision and Board approval |

| ◾ | Commence construction and commissioning of the project |

Material Assumptions and Cautionary Statements

The Techno-Economic Assessment referred to in this announcement has been undertaken to determine the potential viability of the Company’s proposed TDF and TCF-1 facilities to produce titanium metal powder. The results should not be considered a profit forecast or a production forecast.

The Techno-Economic Assessment is based on the material assumptions outlined below and elsewhere in this announcement. These include assumptions about the availability of funding. While the Company considers all of the material assumptions to be based on reasonable grounds, there is no certainty that they will prove to be correct or that the range of outcomes indicated by the Techno-Economic Assessment will be achieved.

Estimates for capital and operating costs are subject to a variety of potential variances including, but not limited to, price of labor, price of consumables, foreign exchange impacts, and raw material prices.

To achieve the range outcomes indicated in the Techno-Economic Assessment, funding in the order of US$23.8 million will likely be required for the TDF and ~US$70.0 million will likely be required for the TCF-1. Investors should note that there is no certainty that the Company will be able to raise that amount of funding when needed. It is also possible that such funding may only be available on terms that may be dilutive to or otherwise affect the value of the Company’s existing shares.

It is also possible that the Company could pursue other ‘value realization’ strategies such as joint venture or partnership of the TDF and/or TCF-1. If it does, this could materially reduce the Company’s proportionate ownership of the TDF and/or TCF-1.

Given the uncertainties involved, investors should not make any investment decisions based solely on the results of the Techno-Economic Assessment.

| Item | Assumption |

| Comment |

| Annual Capacities (Cumulative) | TDF Phase 1 | 15 tpa spherical only |

| Based on IPX's proprietary detailed engineering & design for an initial facility with room for modular expansion. Initial phases of production before full facility is built-out and operational. |

| TDF Phase 2 | 15 tpa spherical; 110 tpa angular |

| Based on IPX's proprietary detailed engineering & design for an initial facility with room for modular expansion. Fully built and operational facility capacity. |

| TCF-1 | 1,125 tpa spherical only |

| Based on IPX's proprietary engineering and design for a 1,000 tpa modular expansion at Phase 1 facility location. |

| Procurement Start- up Date and Construction/ Installation Duration | TDF Phase 1 | 2023 through 2024 |

| Based on reasonable assumptions for completion of financing, procurement of long-lead time items, and project permitting |

| TDF Phase 2 | 2024 through Q3 2024 |

| Based on reasonable assumptions for completion of financing, procurement of long-lead time items, and installation time for major equipment |

| TCF-1 | Q4 2025 |

| Based on reasonable assumptions for completion of detailed engineering, financing, procurement of long-lead time items, and installation time of major equipment |

| Operational Commissioning | TDF Phase 1 | Q1 2024 |

| Based on reasonable assumptions for commissioning under IperionX’s proprietary detailed engineering and design plans |

| TDF Phase 2 | Q3 2024 |

| TCF-1 | Q4 2025 |

| Spherical Powder Pricing | TDF Phase 1 | US$132/kg

(discounted from US$219/kg forecast) |

| Based on implied forecast pricing from SmarTech Analysis, with assumed 40% reduction in prevailing market prices to account for: a) IPX selling powder below market prices to capture market share; and b) to account for significant implied increase in powder supply from IPX production relative to market forecasts. Implied pricing forecasts from SmarTech Analysis calculated as SmarTech’s forecasted Titanium Metal Powder market size divided by SmarTech’s forecasted Titanium Metal Powder tonnage. |

| TDF Phase 2 | US$130/kg

(discounted from US$216/kg forecast) |

| TCF-1 | US$129/kg

(discounted from US$215/kg forecast) |

| Angular Powder Pricing | TDF Phase 1 | US$88/kg

(discounted from US$219/kg forecast) |

| Assumed 60% discount to forecasted spherical powder pricing. |

| TDF Phase 2 | US$86/kg

(discounted from US$216/kg forecast) |

| TCF-1 | US$86/kg

(discounted from US$215/kg forecast) |

| Assumed Scrap Feedstock Pricing | All Phases | US$7.06/kg Ti-64 Scrap feedstock |

| Based on conversations with scrap suppliers and purchases made to date. Assumes that a 70/30% blend of high-quality (lower oxygen content, higher cost) and low-quality (higher oxygen content, lower cost) titanium scrap is purchased and processed. |

Table 9: Material assumptions underpinning revenue and EBITDA forecast for 125 tpa TDF and 1,125 tpa TCF-1