Exhibit 99.1

IPERIONX LIMITED

ABN 84 618 935 372

Interim Financial Report

for the Six Months Ended

December 31, 2023

| North Carolina | Tennessee | Virginia | Utah |

129 W Trade Street, Suite 1405 Charlotte, NC 28202 | 279 West Main Street Camden, TN 38320 | 1080 Confroy Drive South Boston, VA 24592 | 1782 W 2300 S West Valley City, UT 84119 |

DIRECTORS

Mr. Todd Hannigan – Executive Chairman Mr. Anastasios Arima – CEO & Managing Director Ms. Lorraine Martin – Independent Non-Executive Director Mr. Vaughn Taylor – Independent Non-Executive Director Ms. Melissa Waller – Independent Non-Executive Director Ms. Beverly Wyse – Independent Non-Executive Director

COMPANY SECRETARY

Mr Gregory Swan

OFFICES

North Carolina 129 W Trade Street, Suite 1405 Charlotte, NC 28202, UNITED STATES

Tennessee 279 West Main Street Camden, TN 38320, UNITED STATES

Virginia 1080 Confroy Drive South Boston, VA 24592, UNITED STATES

Utah 1782 W 2300 S West Valley City, UT 84119, UNITED STATES

Registered office 28 The Esplanade, Level 9 Perth, WA 6000, AUSTRALIA | WEBSITE

www.iperionx.com

STOCK EXCHANGE LISTINGS

Nasdaq Capital Market: American depositary shares (NASDAQ: IPX)

Australian Securities Exchange: Fully paid ordinary shares (ASX: IPX)

SHARE REGISTRY

Automic Pty Ltd T: 1300 288 664 (within Australia) T: +61 2 9698 5414 (international)

LAWYERS United States Gibson, Dunn & Crutcher Johnston Allison & Hord

Australia Thomson Geer Lawyers

AUDITOR PricewaterhouseCoopers |

| CONTENTS |

|

| | Page |

| Directors’ Report | 1 |

| Auditor’s Independence Declaration | 8 |

| Condensed Consolidated Statement of Profit or Loss and Other Comprehensive Income | 9 |

| Condensed Consolidated Statement of Financial Position | 10 |

| Condensed Consolidated Statement of Changes in Equity | 11 |

| Condensed Consolidated Statement of Cash Flows | 12 |

| Notes to the Condensed Consolidated Financial Statements | 13 |

| Directors’ Declaration | 19 |

| Independent Auditor’s Review Report | 20 |

|

The Directors of IperionX Limited (“IperionX” or “Company”) present their report on IperionX and the entities it controlled (“Consolidated Entity” or “Group”) during the interim six-month period ended December 31, 2023.

DIRECTORS

The names of the Directors of IperionX in office during the interim period and until the date of this report are:

| Mr. Todd Hannigan | Executive Chairman |

| Mr. Anastasios Arima | Chief Executive Officer & Managing Director |

| Ms. Lorraine Martin | Independent Non-Executive Director |

| Mr. Vaughn Taylor | Independent Non-Executive Director |

| Ms. Melissa Waller | Independent Non-Executive Director |

| Ms. Beverly Wyse | Independent Non-Executive Director |

Unless otherwise shown, all Directors were in office from the beginning of the interim period until the date of this report.

OPERATING AND FINANCIAL REVIEW

Our Mission

IperionX aims to be a leading American producer of titanium alloys, titanium products, and critical minerals. Founded in 2020, IperionX is a public company listed on both the Nasdaq and the ASX.

We plan to re-shore critical material supply chains in the United States, starting with an ‘end-to-end’ titanium supply chain solution. This ‘end-to-end’ titanium supply solution is underpinned by a range of patented titanium technologies that are important to manufacturing high-performance titanium products.

IperionX has the exclusive option to acquire the intellectual property rights of Blacksand Technology LLC (“Blacksand”), which has patents over titanium and metal alloy production technologies (the “Technologies”). The Technologies have demonstrated the ability to make titanium products from either titanium metal scrap or titanium mineral feedstocks.

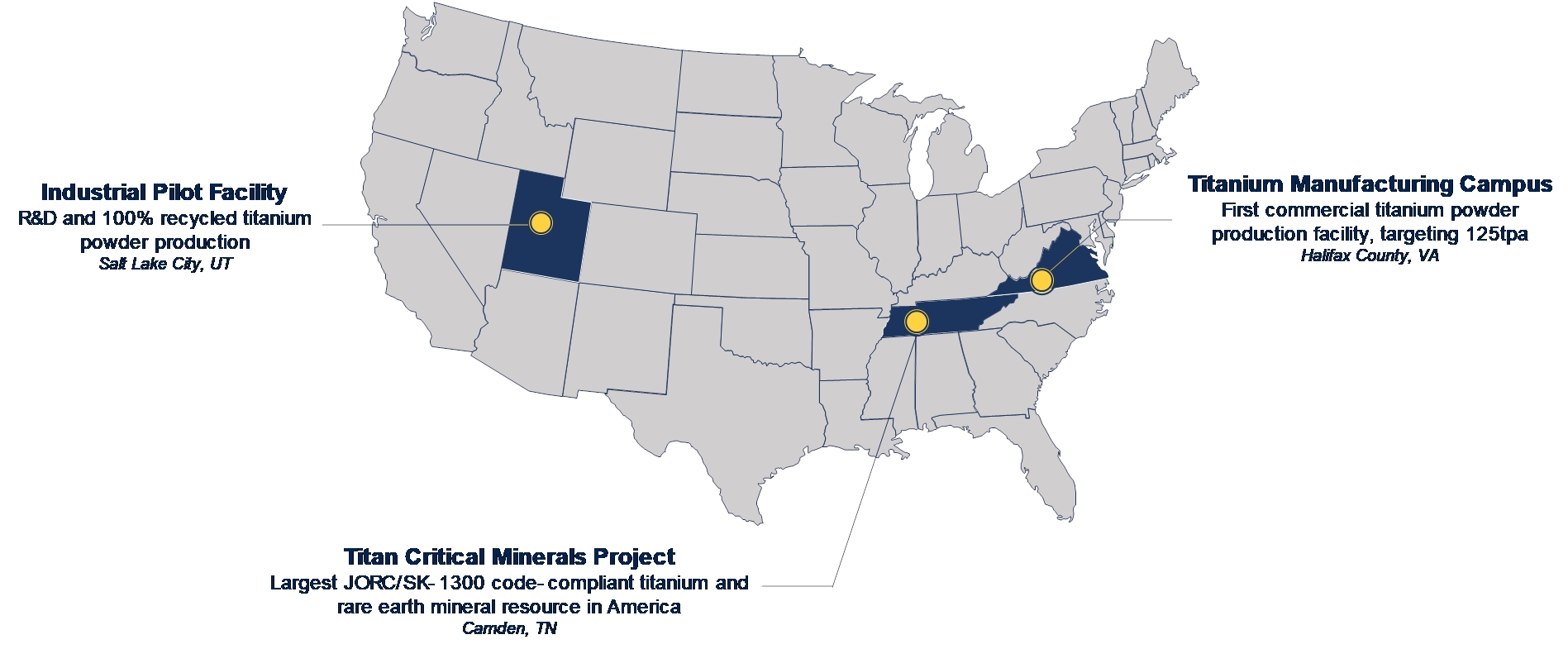

In addition to our metals technologies operations, IperionX also holds a 100% interest in the Titan Project, located near Camden, Tennessee. The Titan Project is currently one of the largest titanium, zircon and rare earth mineral resources, reported in accordance with the JORC Code (2012 Edition), in the United States.

IperionX aims to develop an ‘end-to-end’ titanium supply chain which will include the vertical integration of its technologies and its mineral assets.

Directors’ Report (continued) | |

OPERATING AND FINANCIAL REVIEW (CONTINUED)

Introduction

IperionX aims to develop an ‘end-to-end’ titanium supply chain in the United States from titanium critical minerals to high performance titanium alloys and recycling scrap titanium.

Titanium is prized for its high strength-to-weight ratio, resistance to high temperatures, and resistance to corrosion. Titanium has strength-to-weight and corrosion resistance properties that are prized by many advanced industries, including the consumer electronics, aerospace, space, defense, medical, bicycles, additive manufacturing, hydrogen and automotive sectors.

IperionX aims to manufacture and market titanium alloys and titanium products to customers across these sectors. Our future products may include manufactured titanium components, titanium powders for additive manufacturing and powder metallurgy and traditional titanium plate, bar, rod and wire. We expect to offer a range of titanium alloys, including aerospace grade titanium alloys and other high performance titanium alloys.

Since the 1940’s, titanium has been mass produced using the “Kroll Process”, which is relatively energy and cost-intensive and produces high levels of greenhouse gas emissions. In contrast, IperionX holds an exclusive option to acquire patented titanium technologies which are expected to use less energy to produce high-performance titanium products, at lower costs. These technologies can produce titanium, with zero Scope 1 and 2 emissions, underpinned by the expected use of 100% renewable energy at our facilities (as reported in our recent life cycle assessment announced to the ASX on April 26, 2023).

At this moment, the United States has limited domestic primary titanium metal (titanium sponge) production capacity and the U.S. currently imports over 95% of the titanium sponge required for its advanced industries. We plan to re-shore titanium metal production in the U.S., reduce the acute reliance on primary titanium imports from foreign nations, and strengthen the U.S. domestic ‘end-to-end’ titanium supply chain. To achieve our goals, IperionX currently has two key value drivers:

| • | Titanium: IperionX intends to scale the Technologies to produce high performance titanium alloys and products at lower costs, with zero Scope 1 and 2 emissions, from either scrap titanium or titanium minerals. IperionX currently produces titanium products made from scrap titanium at our Industrial Pilot Facility (“IPF”) in Utah, U.S. and is developing a commercial-scale Titanium Manufacturing Campus in Virginia, U.S.; and |

| • | Critical minerals: IperionX controls the Titan critical minerals project (the “Titan Project”) in Tennessee, U.S., which is currently one of the largest titanium, zircon and rare earth mineral resources, reported in accordance with the JORC Code (2012 Edition), in the United States. |

We expect that the Technologies will allow a low life cycle carbon footprint and a more sustainable production of titanium alloys. IperionX currently produces high performance titanium products made with 100% titanium scrap feedstock at our IPF in Salt Lake City, Utah.

To meet the growing demand for sustainable and lower cost titanium products, IperionX is building a larger titanium production facility in Halifax County, Virginia, with expected production of first titanium in mid-2024. Once commissioned, we intend to scale the capacity of this innovative titanium production facility – in a modular development approach – to higher production levels on the same site in Virginia.

To support the potential future growth in titanium production, we plan to develop the Titan Project in Tennessee to provide low-cost titanium mineral feedstock. In addition, we believe the Titan Project has the potential to be a sustainable, low-cost and globally significant producer of titanium, rare earths and zircon minerals. These minerals are important for advanced U.S. industries including consumer electronics, aerospace, space, defense, medical, bicycles, additive manufacturing, hydrogen and automotive.

Directors’ Report (continued) | |

OPERATING AND FINANCIAL REVIEW (CONTINUED)

Highlights

Highlights during and subsequent to the end of the financial year were as follows:

Titanium Metal Operations

IperionX Drives Towards Commercial Scale Titanium Metal Production

| ■ | In February 2024, IperionX announced significant progress in advancing its commercial-scale titanium metal manufacturing capabilities at IperionX’s Titanium Manufacturing Campus in Virginia, comprising the Titanium Production Facility and the Advanced Manufacturing Center |

GKN Aerospace and IperionX to Advance Sustainable Titanium

| ■ | In October 2023, IperionX agreed to an order with GKN Aerospace for the delivery of titanium plate test components manufactured with IperionX’s advanced titanium technologies. |

Production of Titanium Plate for U.S. Army Testing

| ■ | In September 2023, IperionX announced that it had executed a Test Services Agreement with the U.S. Army for metal characterization and ballistic testing properties of IperionX’s high-strength titanium plate components. |

Agreement with Heroux-Devtek for Titanium Recycling

| ■ | In September 2023, IperionX announced that it had signed an agreement with Heroux-Devtek to underpin a 100% recycled titanium supply chain using scrap titanium metal from the aerospace industry. |

Agreement to Produce Titanium Plate for Lockheed Martin

| ■ | In August 2023, IperionX announced that it had agreed to an order with Lockheed Martin for the delivery of titanium plate components produced using IperionX’s low-carbon, U.S. manufactured titanium. |

Partnership with Aperam to Create Circular Titanium Supply Chain

| ■ | In July 2023, IperionX announced that it would partner with Aperam Recycling, through its American entity ELG Utica Alloys (“ELG”), to create a low-carbon 100% recycled titanium supply chain. |

Titan Minerals Project

Receipt of Key Permits for Titan Project Development

| ■ | In August 2023, IperionX announced that the Titan Project had received all key permits for development and operations, had received positive feasibility study metallurgical test work results, and was advancing customer offtake and strategic financing partnerships. |

Titan Critical Minerals Project - Strategic & Offtake Partners

| ■ | During the period, a number of parties have expressed interest in sales, marketing, and investment proposals focused on the offtake of titanium and rare earth minerals from the Titan Project. |

Corporate

IperionX receives US$12.7 million U.S. Department of Defense funding for domestic titanium production

| ■ | In November 2023, the U.S. Department of Defense (“DoD”) contracted to award IperionX US$12.7 million in funding under the Defense Production Act (DPA) Title III authorities to address U.S. titanium supply chain vulnerabilities. |

Completion of A$26.3 million placement

| ■ | In November 2023, IperionX completed a placement of 21 million new fully paid ordinary shares at an issue price of A$1.25 per share to institutional, sophisticated and professional investors to raise gross proceeds of A$26.3 million (approximately US$17.1 million). |

Directors’ Report (continued) | |

OPERATING AND FINANCIAL REVIEW (CONTINUED)

Highlights (continued)

Corporate (continued)

IperionX receives US$11.5 million LOI from EXIM Bank for U.S. titanium production

| ■ | In October 2023, IperionX received a Letter of Interest from the Export-Import Bank (“EXIM”) of the United States for US$11.5 million for development of IperionX’s Titanium Production Facility. |

IperionX FY2023 Sustainability Report

| ■ | In November 2023, IperionX released its FY2023 Sustainability Report, which shares our Environment, Social, and Governance (“ESG”) vision and execution. |

Why Titanium?

Titanium is a strong, lightweight metal with important material properties for applications in the consumer electronics, aerospace, space, defense, medical, bicycles, additive manufacturing, hydrogen and automotive sectors. A range of titanium alloys are recognized for high strength-to-weight ratio and excellent corrosion resistance that exceed many alloys of stainless steel and aluminum. However, titanium’s high production and manufacturing cost has historically been a major factor in hindering its application versus other structural metals such as stainless steel and aluminum.

Currently, primary titanium metal is largely produced by the Kroll Process, invented in the 1940s. The Kroll Process works by reducing titanium from titanium tetrachloride with magnesium in a capital and energy intensive batch process.

After primary titanium is produced with the Kroll Process, it must be melted, alloyed and remelted into ingots. The ingots are then processed in a series of manufacturing steps to produce mill products, including consecutive rolling steps, extruding and forging. Mill products can be machined into parts using subtractive methods where large portions of the titanium metal are machined away into scrap. Some mill products are drawn into wire and used in a gas atomization process to produce spherical titanium powders.

Absent any substantial domestic titanium sponge production capacity, the United States depends on imported titanium to support its defense and critical infrastructure needs. In 2018, Russian and Chinese titanium sponge producers controlled 61% of the world’s titanium sponge production. By 2020, Russia and China’s control of global titanium sponge production had increased to approximately 70%.

IperionX plans to re-shore titanium production in the United States by vertically integrating the Technologies and the Titan Project to make sustainable, lower cost titanium.

Re-Shoring U.S. Titanium Metal Production with Production Technologies

IperionX holds exclusive commercialization rights to a range of patented technologies for producing titanium metal powders and products. These Technologies were initially developed by Dr. Z. Zak Fang and his team at the University of Utah, and were further developed at Blacksand Technology, LLC (“Blacksand”), Dr. Fang’s research and development entity. At Blacksand, Dr. Fang’s team further developed and tested the Technologies at lab scale over a 10-year period, funded in part with approximately $10 million from the U.S. Department of Energy’s (“DoE”) ARPA-E program as well as industry partners Boeing and Arconic. IperionX is now Blacksand’s exclusive commercial partner for scaling the Technologies.

Progress has been made with the Technologies over the past decade of development, including improving product chemistries, flowability, and morphology. Additional complementary technologies have been developed, patented, and proven at pilot-scale, including the ARH process, to produce a low-carbon TiO2 powder feedstock for the HAMR process, and HSPT, for heat treatment of parts consolidated from titanium powder to directly obtain wrought or forged-like characteristics, without the need for thermo- mechanical processing. These technologies have been demonstrated to convert titanium mineral ore to high-quality titanium products with low CO2 emissions.

Directors’ Report (continued) | |

OPERATING AND FINANCIAL REVIEW (CONTINUED)

Re-Shoring U.S. Titanium Metal Production with Production Technologies (continued)

IperionX has demonstrated that the Technologies can produce titanium at industrial pilot scale outputs. To meet the growing demand for sustainable and lower cost titanium products, IperionX is developing a larger, commercial-scale Titanium Production Facility in Halifax County, Virginia with first production expected in 2024. Once commissioned, we intend to rapidly scale the capacity of this titanium production facility – in a modular, brownfield development approach – to the higher throughput facility on the same site in Virginia. We expect this plant to use 100% scrap titanium as the key feedstock for titanium production.

Re-shoring U.S. Critical Mineral Production Through IperionX’s Titan Critical Mineral Project

IperionX holds a 100% interest in the Titan Project, covering more than 11,000 acres of mineral properties in western Tennessee, which is currently one of the largest titanium, zircon and rare earth mineral resources, reported in accordance with the JORC Code (2012 Edition), in the United States.

While IperionX plans to initially use 100% recycled titanium metal scrap as feedstock for the production of titanium products at the Titanium Manufacturing Campus in Virginia, we eventually intend to support expected demand growth with titanium mineral feedstock from our Titan Project in Tennessee. We believe that the Titan Project also has the potential to be a low-cost and globally significant producer of titanium, rare earth and zircon minerals. All of these are minerals required for advanced U.S. industries, including consumer electronics, aerospace, space, defense, medical, bicycles, additive manufacturing, hydrogen and automotive.

The Titan Project covers over 11,000 acres in western Tennessee, and we consider it to be prospective for critical minerals including titanium, rare earth elements, and zircon. The Titan Project’s location provides access to a range of strategic infrastructure, with nearby access to roads, rail, river, power and skilled labor.

Future development of the Titan Project could provide a source for resource-efficient titanium feedstocks that, combined with the Technologies, could help establish a fully integrated U.S.-based titanium mineral supply chain. We believe that having vertical integration of the Technologies along with a U.S. supply of critical minerals including titanium offers a potential competitive advantage.

Our Production Facilities

Our IPF, located in Salt Lake City, Utah, has been producing titanium powder with the Technologies since 2019. IperionX began managing the IPF in January 2022 and we are currently producing angular and spherical titanium powders there in approximately 50-kilogram batches. We use scrap titanium as feedstock and renewable power to produce our high-quality titanium powder.

At the IPF, we have demonstrated that the Technologies can reduce oxygen content to low levels in titanium metal. This unique deoxygenation process allows us to accept a wide range of titanium scrap material feedstocks to consistently produce high quality titanium powder. Superior deoxygenation performance may also unlock a range of advantages over the traditional Kroll Process, including low-temperature processing, high product yields, and more precise final particle size and morphology.

We are currently constructing a commercial-scale Titanium Manufacturing Campus in Virginia, comprising the Titanium Production Facility and the Advanced Manufacturing Center.

We have completed detailed engineering design for a planned 125 metric tons per annum (“tpa”) capacity Titanium Production Facility and a techno-economic assessment for a further planned modular expansion to a 1,125 tpa capacity focussed on spherical powder production.

We also recently announced that the Titanium Production Facility has the potential to produce 2,000 tpa assuming the plant output is solely focussed on angular titanium powder. The production of angular powder significantly reduces the estimated operating costs at the full capacity of 2,000 tpa.

The designs for the Titanium Production Facility are based on a scaled-up version of our operational IPF. The Titanium Production Facility is located in Halifax County, Virginia. The site hosts an existing 50,000 square foot shell building with sufficient floor space for the planned expansion with the Titanium Production Facility. In addition, there is potential scope to increase floor space with an additional 100,000 square foot expansion.

Directors’ Report (continued) | |

OPERATING AND FINANCIAL REVIEW (CONTINUED)

Our Production Facilities (continued)

The Titanium Production Facility plans to manufacture titanium powders in a comparable, scaled up design to the operational IPF, which uses a thermomechanical process to manufacture titanium powders which can then be deoxygenated with the HAMR process. This combination of the thermomechanical and HAMR processes is called the granulation, sintering & deoxygenation (“GSD”) process which is also patented and proprietary to IperionX.

We believe the planned Titanium Production Facility, once operational, would be the world’s largest recycled titanium powder production facility that can potentially use 100% titanium scrap as a feedstock. This titanium production facility is designed to produce titanium with zero Scope 1 & 2 emissions, and it is expected to have the lowest carbon intensity for commercial titanium products. Construction of the Titanium Production Facility is advancing to schedule, with the HAMR titanium furnace expected to be commissioned and to produce first titanium in mid-2024.

Construction of the Advanced Manufacturing Center is anticipated to be commissioned during the second quarter of 2024. This advanced manufacturing unit will utilize angular and spherical titanium powders from the Titanium Production Facility to manufacture a wide range of low-cost and high-performance titanium products using powder metallurgy, HSPT forging and additive manufacturing/3D printing. It will also leverage CNC machining, post-processing equipment and advanced R&D laboratories to support customer and government engagement.

IperionX’s Commitment to Sustainability

IperionX believes the global transition towards a green economy and the technologies of the future may drive increased demand for critical minerals and metals, including titanium and rare earth elements. We believe demand may increase for critical minerals and metals required to support advanced technologies.

The Technologies, which employ a novel method of producing titanium, bypass the high-cost, high-carbon Kroll Process and its energy intensive titanium melt processes and forging. By utilizing titanium metal scrap, the Technologies can potentially provide a more sustainable titanium metal supply chain with zero Scope 1 and 2 emissions, driven by the expected use of 100% renewable energy at our facilities (as reported in our independent third party life cycle assessment announced to the ASX on April 26, 2023), compared to the current high carbon titanium supply chain.

Operating Results

The Group’s net loss after tax for the six months ended December 31, 2023 was US$10,495,019 (December 31, 2022: US$8,754,077). This loss is partly attributable to:

| (a) | exploration and evaluation expense of US$1,458,125 (December 31, 2022: US$1,517,474), which is attributable to the Group’s accounting policy of expensing exploration and evaluation expenditure (other than expenditures incurred in the acquisition of the rights to explore, including option payments to landowners) incurred by the Group in the period subsequent to the acquisition of the rights to explore and up to the successful completion of definitive feasibility studies for each separate area of interest; |

| (b) | research and development costs of US$3,763,468 (December 31, 2022: US$2,099,309) which is attributable to the Group’s accounting policy of expensing research and development, or R&D, expenses incurred by the Group in connection with the R&D of the Group’s titanium processing technologies, including salaries and related personnel expenses, subcontractor expenses, patent registration expenses, materials, and other related R&D expenses associated with processing operations at our IPF in Utah and Titanium Manufacturing Campus in Virginia; and |

| (c) | equity settled share-based payment expenses of US$1,108,090 (December 31, 2022: US$1,566,231) which is attributable to expensing the value (estimated using an option pricing model) of incentive securities granted to key employees, consultants and advisors. The value is measured at grant date and recognised over the period during which the option holders become unconditionally entitled to the options. |

Directors’ Report (continued) | |

OPERATING AND FINANCIAL REVIEW (CONTINUED)

Operating Results (continued)

The ongoing operation of the Group remains dependent upon raising further additional funding from shareholders or other parties. In light of the future expenditures to be incurred in executing on the Group’s current strategic plans to commercialize the Group’s titanium technologies and develop economically recoverable mineral deposits from the Group’s exploration properties, the Group is dependent on obtaining financing through equity financing, debt financing or other means. In the longer term, if the Group’s exploration, appraisal, and pilot activities are ultimately successful, additional funds will be required to develop the Group’s titanium technologies and exploration properties and commence commercial production. The ability to arrange such funding in the future will depend in part upon the prevailing capital market conditions as well as the business performance of the Group. There is no assurance that the Group will be successful in its efforts to raise additional funding on terms satisfactory to the Group. If the Group does not obtain additional funding, the Group may be required to delay, reduce the scope of, or eliminate its current or future exploration, appraisal, and pilot activities or relinquish rights to certain of its interests.

These matters indicate that there is a material uncertainty related to events or conditions that may cast significant doubt about the Group’s ability to continue as a going concern and therefore the Group may be unable to realize its assets and discharge its liabilities in the normal course of business. However, the Directors are of the view that the Group will be able to raise additional funds as required to meet its obligations as and when they fall due and that the use of the going concern basis remains appropriate.

The attached half-year financial report for the six months ended 31 December 2023 contains an independent auditor’s review report which highlights the existence of a material uncertainty that may cast significant doubt about the Group’s ability to continue as a going concern. For further information, refer to Note 1 in the half-year financial report, together with the auditor’s review report.

SIGNIFICANT POST BALANCE DATE EVENTS

| (a) | On January 30, 2024, the Company issued 3,006,163 shares to nominees of Blacksand Technology LLC (“Blacksand”) in lieu of future cash option payments totaling US$2,000,000 owed to Blacksand under the option agreement between the Company and Blacksand pursuant to which the Company has the exclusive option to acquire the intellectual property rights of Blacksand to certain patented titanium technologies. |

Other than as outlined above, at the date of this report there are no other significant events occurring after balance date requiring disclosure.

AUDITOR’S INDEPENDENCE DECLARATION

A copy of the auditor’s independence declaration as required under section 307C of the Corporations Act 2001 is set out on page 8.

Signed in accordance with a resolution of Directors.

ANASTASIOS (TASO) ARIMA

CEO & Managing Director

March 14, 2024

Auditor’s Independent

Declaration | |

Auditor’s Independence Declaration

As lead auditor for the review of IperionX Limited for the half-year ended 31 December 2023, I declare that to the best of my knowledge and belief, there have been:

| (a) | no contraventions of the auditor independence requirements of the Corporations Act 2001 in relation to the review; and |

| (b) | no contraventions of any applicable code of professional conduct in relation to the review. |

This declaration is in respect of IperionX Limited and the entities it controlled during the period.

| /s/ Craig Heatley |

|

Craig Heatley | Perth |

Partner | 14 March 2024 |

PricewaterhouseCoopers |

|

PricewaterhouseCoopers, ABN 52 780 433 757

Brookfield Place, 125 St Georges Terrace, PERTH WA 6000, GPO Box D198, PERTH WA 6840

T: +61 8 9238 3000, F: +61 8 9238 3999, www.pwc.com.au

Liability limited by a scheme approved under Professional Standards Legislation.