Exhibit 99.2 DECEMBER 2021 LiveWire Investor Presentation

Forward-Looking Statements This communication may contain a number of “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information concerning Harley-Davidson, Inc. (“H-D”)’s, LiveWire EV, LLC (“LiveWire”)’s or AEA-Bridges Impact Corp. (“ABIC”)’s possible or assumed future results of operations, business strategies, debt levels, competitive position, industry environment, potential growth opportunities and the effects of regulation, including whether the Business Combination will generate returns for shareholders. These forward- looking statements are based on H-D’s, LiveWire’s or ABIC’s management’s current expectations, estimates, projections and beliefs, as well as a number of assumptions concerning future events. When used in this communication, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside H-D’s, LiveWire’s or ABIC’s management’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. These risks, uncertainties, assumptions and other important factors include, but are not limited to: (a) the occurrence of any event, change or other circumstances that could give rise to the termination of negotiations and any subsequent definitive agreements with respect to the Business Combination; (b) the outcome of any legal proceedings that may be instituted against H-D, LiveWire, ABIC or others following the announcement of the Business Combination and any definitive agreements with respect thereto; (c) the inability to complete the Business Combination due to the failure to obtain approval of the shareholders of ABIC, to obtain financing to complete the Business Combination or to satisfy other conditions to closing; (d) changes to the proposed structure of the Business Combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the Business Combination; (e) the ability to meet the applicable stock exchange listing standards following the consummation of the Business Combination; (f) the inability to complete the private placement transactions or the backstop facility contemplated by the Business Combination Agreement and related agreements, as applicable; (g) the risk that the Business Combination disrupts current plans and operations of LiveWire or its subsidiaries as a result of the announcement and consummation of the transactions described herein; (h) the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of LiveWire to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (i) costs related to the Business Combination; (j) changes in applicable laws or regulations, including legal or regulatory developments (including, without limitation, accounting considerations) which could result in the need for ABIC to restate its historical financial statements and cause unforeseen delays in the timing of the Business Combination and negatively impact the trading price of ABIC’s securities and the attractiveness of the Business Combination to investors; (k) the possibility that H-D, LiveWire and ABIC may be adversely affected by other economic, business, and/or competitive factors; (l) H-D’s ability to execute its business plans and strategies, including The Hardwire; (m) LiveWire’s estimates of expenses and profitability and (n) other risks and uncertainties indicated from time to time in the final prospectus of ABIC, including those under “Risk Factors” therein, and other documents filed or to be filed with the SEC by H-D, LW EV Holdings, Inc. (“HoldCo”) or ABIC. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and H-D, LiveWire, HoldCo and ABIC assume no obligation and, except as required by law, do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither H-D, LiveWire, HoldCo nor ABIC gives any assurance that either LiveWire or ABIC will achieve its expectations. Additional Information and Where to Find It In connection with the Business Combination, HoldCo and ABIC intend to file a registration statement on Form S-4 (as may be amended from time to time, the “Registration Statement”) as co-registrants that includes a preliminary proxy statement/prospectus of ABIC and a preliminary prospectus of HoldCo, and after the Registration Statement is declared effective, ABIC will mail a definitive proxy statement/prospectus relating to the Business Combination to ABIC’s shareholders. The Registration Statement, including the proxy statement/prospectus contained therein, when declared effective by the Securities and Exchange Commission (“SEC”), will contain important information about the Business Combination and the other matters to be voted upon at a meeting of ABIC’s shareholders to be held to approve the Business Combination (and related matters). This Current Report on Form 8- K does not contain all the information that should be considered concerning the Business Combination and other matters and is not intended to provide the basis for any investment decision or any other decision in respect of such matters. H-D, HoldCo and ABIC may also file other documents with the SEC regarding the Business Combination. ABIC shareholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus and other documents filed in connection with the Business Combination, as these materials will contain important information about H-D, LiveWire, HoldCo, ABIC and the Business Combination. When available, the definitive proxy statement/prospectus and other relevant materials for the Business Combination will be mailed to ABIC shareholders as of a record date to be established for voting on the Business Combination. Shareholders will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus and other documents filed or that will be filed with the SEC by ABIC through the website maintained by the SEC at www.sec.gov, or by directing a request to AEA-Bridges Impact Corp., PO Box 1093, Boundary Hall, Cricket Square, Grand Cayman KY1-1102 Cayman Islands. Participants in the Solicitation H-D, LiveWire, ABIC and their respective directors and officers may be deemed participants in the solicitation of proxies of ABIC shareholders in connection with the Business Combination. ABIC shareholders and other interested persons may obtain, without charge, more detailed information regarding the directors and officers of ABIC. A description of their interests in ABIC is contained in ABIC’s final prospectus related to its initial public offering, dated October 1, 2021 and in ABIC’s subsequent filings with the SEC. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to ABIC shareholders in connection with the Business Combination and other matters to be voted upon at the ABIC shareholder meeting will be set forth in the Registration Statement for the Business Combination when available. Additional information regarding the interests of participants in the solicitation of proxies in connection with the Business Combination will be included in the Registration Statement that ABIC and HoldCo intend to file with the SEC. You may obtain free copies of these documents as described in the preceding paragraph. Financial Information The financial information and data contained in this presentation is unaudited and does not conform to Regulation S-X promulgated under the Securities Act of 1933, as amended. Such information and data may not be included in, may be adjusted in or may be presented differently in, the Registration Statement and the proxy statement/prospectus contained therein. Industry and Market Data In this presentation, H-D, LiveWire and ABIC rely on and refer to certain information and statistics obtained from third-party sources which H-D, LiveWire and ABIC believe to be reliable. While H-D, LiveWire and ABIC believe such third-party information is reliable, there can be no assurance as to the accuracy or completeness of the indicated information, and the H-D and LiveWire have not independently verified the accuracy or completeness of any such information. Trademarks This presentation contains trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. H-D and LiveWire’s use thereof does not imply an affiliation with, or endorsement by, the owners of such trademarks, service marks, trade names and copyrights. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this presentation may be listed without the TM, SM © or ® symbols, but the Company will assert, to the fullest extent under applicable law, the rights of the applicable owners to these trademarks, service marks, trade names and copyrights. 2

Today’s Presenters John Garcia Jochen Zeitz Ryan Morrissey Gina Goetter Chairman and Co-CEO, Chairman and Acting President, LiveWire Acting CFO, LiveWire AEA-Bridges CEO, LiveWire 3

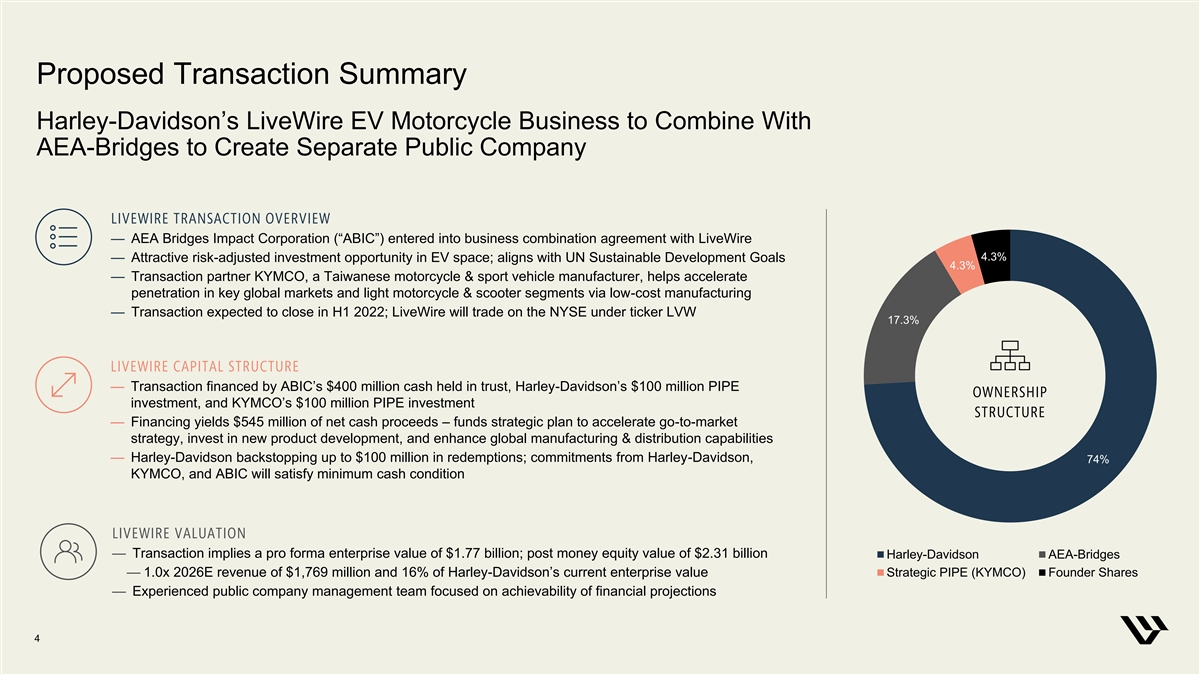

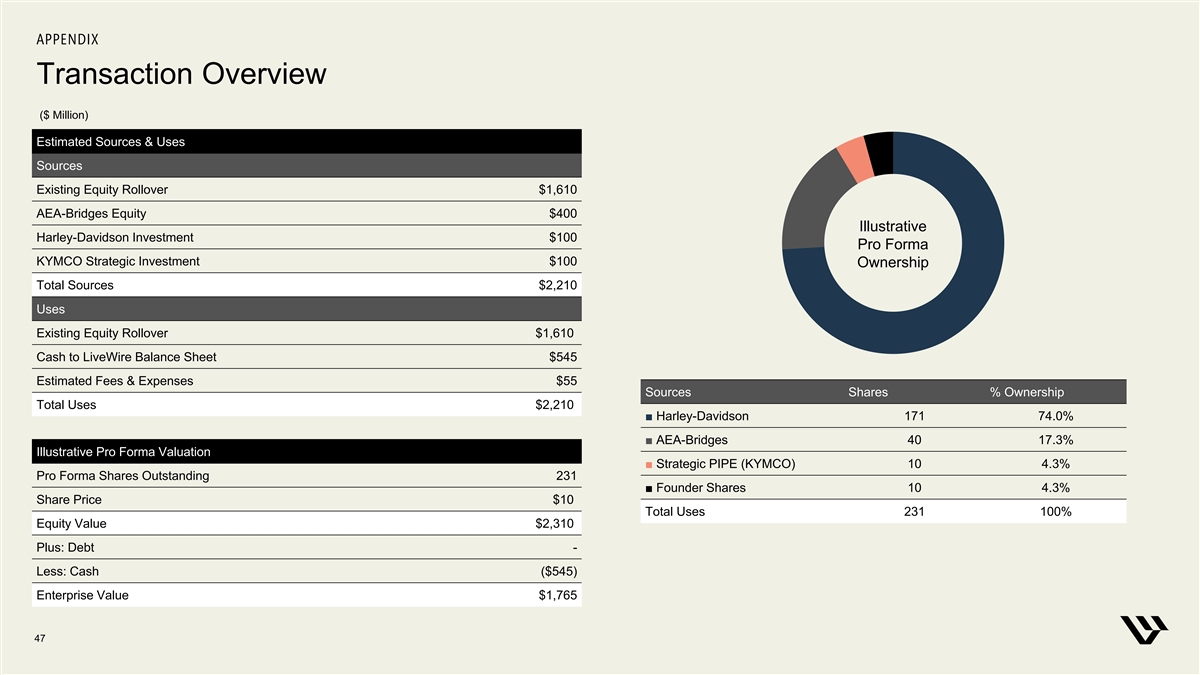

Proposed Transaction Summary Harley-Davidson’s LiveWire EV Motorcycle Business to Combine With AEA-Bridges to Create Separate Public Company LIVEWIRE TRANSACTION OVERVIEW — AEA Bridges Impact Corporation (“ABIC”) entered into business combination agreement with LiveWire 4.3% — Attractive risk-adjusted investment opportunity in EV space; aligns with UN Sustainable Development Goals 4.3% — Transaction partner KYMCO, a Taiwanese motorcycle & sport vehicle manufacturer, helps accelerate penetration in key global markets and light motorcycle & scooter segments via low-cost manufacturing — Transaction expected to close in H1 2022; LiveWire will trade on the NYSE under ticker LVW 17.3% LIVEWIRE CAPITAL STRUCTURE — Transaction financed by ABIC’s $400 million cash held in trust, Harley-Davidson’s $100 million PIPE OWNERSHIP investment, and KYMCO’s $100 million PIPE investment STRUCTURE — Financing yields $545 million of net cash proceeds – funds strategic plan to accelerate go-to-market strategy, invest in new product development, and enhance global manufacturing & distribution capabilities — Harley-Davidson backstopping up to $100 million in redemptions; commitments from Harley-Davidson, 74% KYMCO, and ABIC will satisfy minimum cash condition LIVEWIRE VALUATION — Transaction implies a pro forma enterprise value of $1.77 billion; post money equity value of $2.31 billion Harley-Davidson AEA-Bridges Strategic PIPE (KYMCO) Founder Shares — 1.0x 2026E revenue of $1,769 million and 16% of Harley-Davidson’s current enterprise value — Experienced public company management team focused on achievability of financial projections 4

LiveWire Presents an Attractive Risk- Adjusted Investment Opportunity in EV AUTO EMERGING OEMS EV OEMS Already Deep Technological Underpinning Commercially Viable Product Available Today accelerating Large Addressable Market towards a Long-Term Growth Potential Attractive Industry Competitive Dynamics successful Established Global Market Position future Heritage of Manufacturing at Scale Ability to Leverage Established Distribution & Dealership Network and Finance Company Funded Business Plan 5

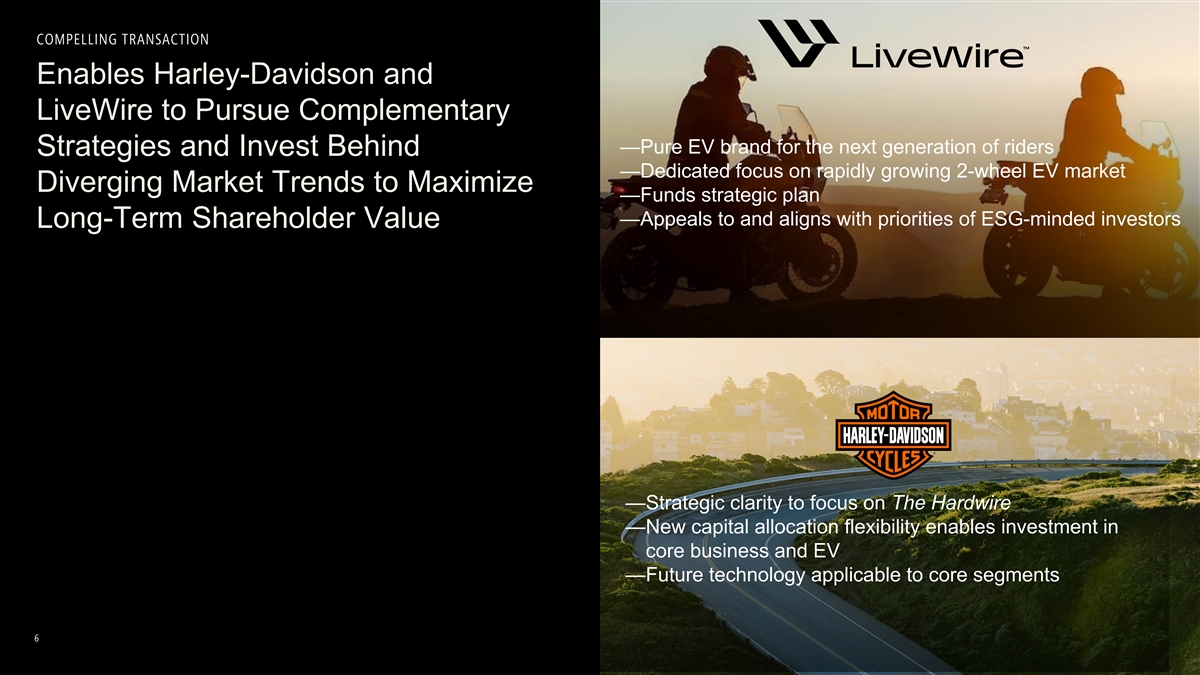

COMPELLING TRANSACTION Enables Harley-Davidson and LiveWire to Pursue Complementary —Pure EV brand for the next generation of riders Strategies and Invest Behind —Dedicated focus on rapidly growing 2-wheel EV market Diverging Market Trends to Maximize —Funds strategic plan —Appeals to and aligns with priorities of ESG-minded investors Long-Term Shareholder Value —Strategic clarity to focus on The Hardwire —New capital allocation flexibility enables investment in core business and EV —Future technology applicable to core segments 6

SUPPORT FROM FINANCIAL AND STRATEGIC PARTNERS Significant Investment and The most desirable motorcycle brand built on global capabilities and Support From Partners a 118-year heritage Positions LiveWire to Extend Lead in the EV Motorcycle Market One of the leading players built to compete in lighter, lower-cost 2W products Formed by executives of two leading global investment firms to invest through lens of UN Sustainable Development Goals 7

INCLUSIVE STAKEHOLDER APPROACH LiveWire Operates With an Foundation in Harley-Davidson’s Inclusive Stakeholder Approach Inclusive Stakeholder Approach Prioritizing Long-Term Profitable Growth for Our People, Our Planet, and Our Communities Inclusive Stakeholder LIVEWIRE’S SUSTAINABILITY PRIORITIES Management — Providing a Sustainable Mobility Option – lowering carbon emissions, improving air quality and minimizing noise pollution in urban environments and beyond — Creating a Path to Net Zero – determine path to net zero by 2035 With an ambitious goal to through designing for sustainability, decarbonizing LiveWire operations achieve net zero by 2035 and supply chain, and influencing for greener electricity for consumers — Lifting Our People – promoting workplace flexibility and increasing 7 11 12 diversity among employees — Driving Positive Change in our Communities – making wherever we work a great place to live, work and play Affordable Sustainable Responsible and Clean Cities and Consumption — Operating With Transparency – aligning interests of stakeholders, with Energy Communities and Production ESG reporting transparency leveraging SASB and TCFD and incorporating insights from the emerging ISSB framework 8

A Decade in the Making, LiveWire Leads the Premium Two-Wheel EV Transition Project Harley-Davidson LiveWire Hacker LiveWire ONE 2010-2014 2015-2020 2021+ 9

LiveWire: a Soulful Connection Between Human and Technology Future Forward Elevating the connection between rider and bike, enabled by lineage and innovation Change Agent A strong proponent of the environment, leading positive change by means of undiminished experiences Purposeful & Authentic Guided by a core set of design principles, elevating the brand and bringing emotion, style, and personality to electric Soulful Experience Defined by golden hour – evoking a day spent in the new experience of speed and sound 10

The best sport-bike riding experience in the world.” WALL STREET JOURNAL 11

LIVEWIRE KEY INVESTMENT HIGHLIGHTS A Visionary Investment Opportunity Rapidly growing market 1 Large global market in the early stages of secular shift to EV powertrains Leading the transformation of motorcycling 2 Production vehicle in market, years ahead of traditional OEMs Differentiated expertise in key technologies 3 Proprietary modular scalable EV system technology and software capabilities Transformative go-to-market model 4 Tech-forward sales and service, combining digital technologies and local expertise Backed by world-class partners 5 Harley-Davidson and KYMCO support at scale manufacturing and global expansion Product roadmap to drive rapid growth 6 Positioned to capture global share with a pipeline of standout products Mission-driven leadership team with a strong track record 7 Management team blends the strength of an incumbent with the spirit of a disruptor 12

1: RAPIDLY GROWING MARKET Converging Trends are Accelerating Market Growth Customer Preferences Government Support & Regulation — Awareness / recognition of EV benefits — Stricter regional emission regulations — Consideration of EV products growing (ICE bans in the longer term) — Public perception shifting in favor of EV — Substantial monetary incentives for rider EV Market Acceleration Charging Network & Product Availability & Desirability EV Technology — Expanding range of compelling products — Charging infrastructure expanding — Transformative riding experience — Battery and EV component — Integrated software solutions performance up, and cost down 13

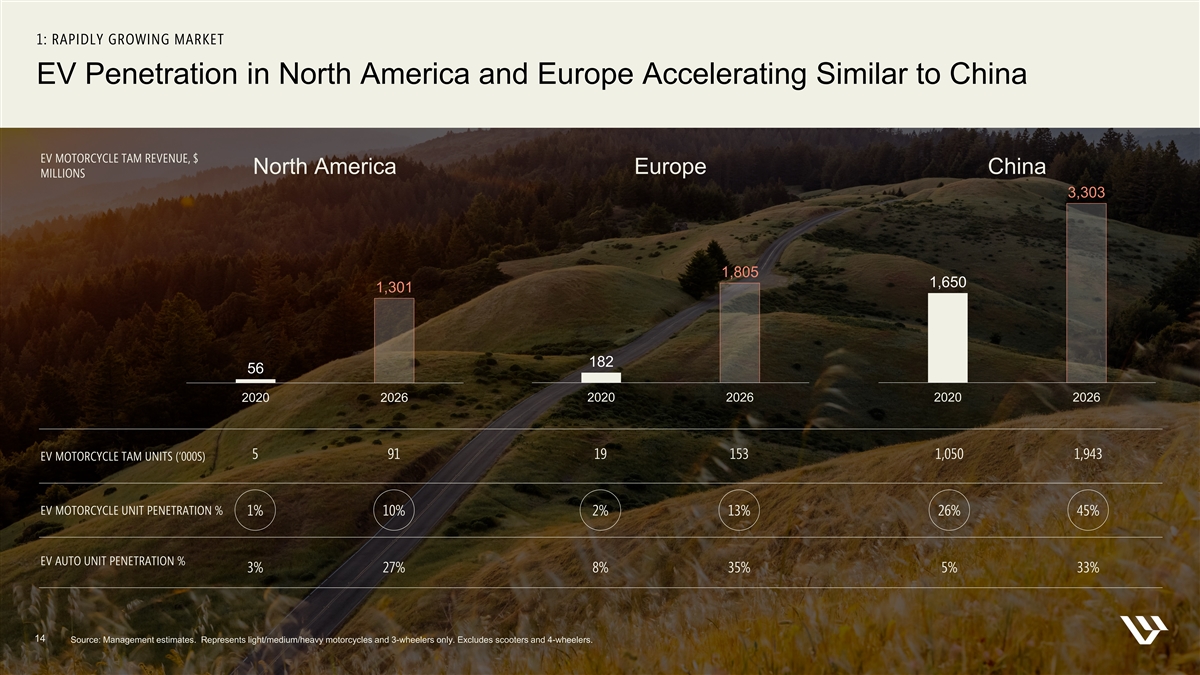

1: RAPIDLY GROWING MARKET EV Penetration in North America and Europe Accelerating Similar to China EV MOTORCYCLE TAM REVENUE, $ North America Europe China MILLIONS 3,303 1,805 1,650 1,301 182 56 2020 2026 2020 2026 2020 2026 5 91 19 153 1,050 1,943 EV MOTORCYCLE TAM UNITS (‘000S) EV MOTORCYCLE UNIT PENETRATION % 1% 10% 2% 13% 26% 45% EV AUTO UNIT PENETRATION % 3% 27% 8% 35% 5% 33% 14 Source: Management estimates. Represents light/medium/heavy motorcycles and 3-wheelers only. Excludes scooters and 4-wheelers.

1: RAPIDLY GROWING MARKET Large Core Addressable Market With Significant Upside Global Electric Motorcycle Total Addressable $28B Market (TAM), 2021E-30E + UPSIDE CASE $20.4B $17.9B $15.7B $12.3B $10.3B BASE $7.7B $6.1B ‘21-30 TAM CAGR of 26% $4.0B $3.2B 2030 Auto EV Adoption Forecast $2.5B at 40-55% Across Regions 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 MOTORCYCLE GLOBAL 6% 8% 9% 14% 15% 17% 19% 23% 24% 25% EV UNIT PENETRATION Source: Management estimates. Note: Global electric motorcycle TAM includes light/medium/heavy motorcycles and 3-wheelers only. Excludes scooters and 4-wheelers. Includes North America, Europe, China and Rest of Asia. 15 Upside reflects high EV adoption case.

2: LEADING THE TRANSFORMATION OF MOTORCYCLING LiveWire Uniquely Positioned Versus Traditional OEMs and Startups 4-5 YEAR HEAD START SIGNIFICANT TRUST ADVANTAGE / ABILITY TO SCALE Commitment to Electric 16 Based on product in market, expected time to market, and results in market. Global Capabilities to Startup and Scale

LiveWire ONE 2: LEADING THE TRANSFORMATION OF MOTORCYCLING IN MARKET (1) PRICE: $19,800 Embraced By Early Adopters and High-Profile Riders — Patented haptic heartbeat tech connects rider and motorcycle — Immediate, linear power eliminates traditional shifting — No heat or vibration, and silent at idle S2 Del Mar First Production Model Built on Arrow S2 Architecture 17 (1) MSRP of $21,999 less federal tax credits.

2: LEADING THE TRANSFORMATION OF MOTORCYCLING Disrupting the Industry with Well-Received Products It's hard to LiveWire is setting itself up as a forward-thinking disruptor in the electric space.” ignore how the VISORDOWN I almost felt like the speedometer on the digital screen was LiveWire looks. lying to me because the launch feels so…. calm. So relaxed. It felt like I couldn’t possibly have reached these speeds so quickly, so calmly.” It is, to my eyes, ELECTREK I found the electric bike electrifying. It handled well, took a gorgeous corners at speed, responded with precision to braking inputs, and offered ergonomics comfortable enough that after a couple of hours on the bike, I was ready and even machine.” eager for more.” LOS ANGELES TIMES CNET ROAD SHOW This motorcycle is Harley’s commitment to a new segment of the two-wheel market, and if it predicts anything about the future, it’s something to be electrified about.” CYCLEWORLD 18

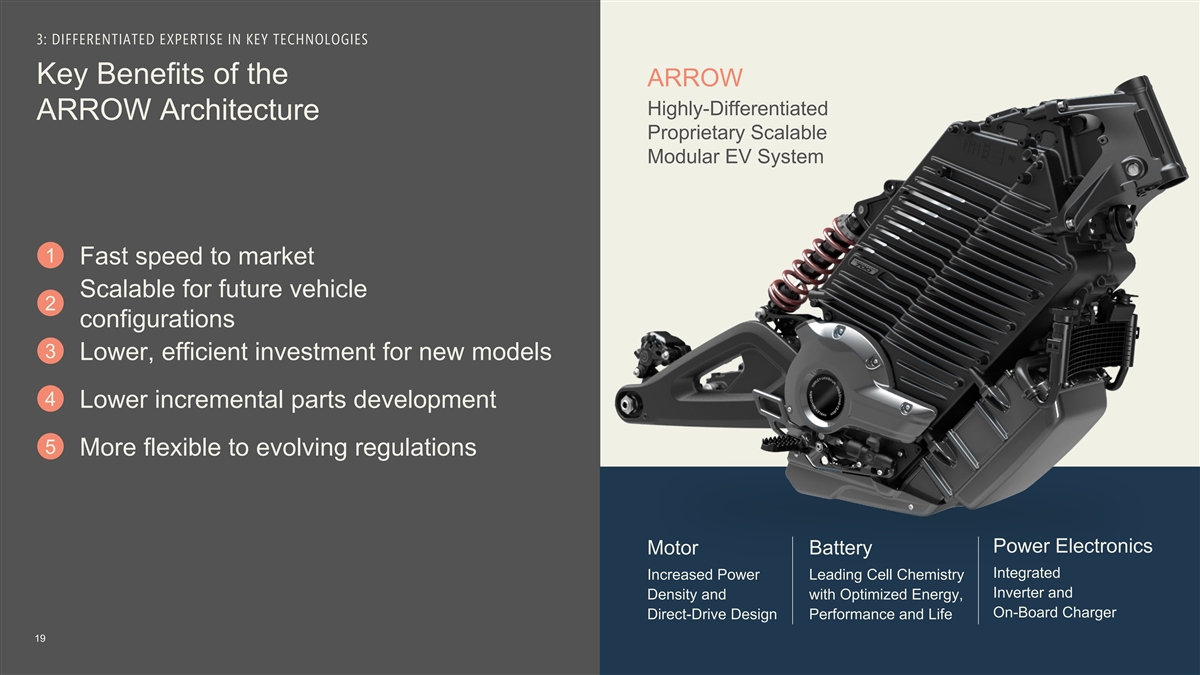

3: DIFFERENTIATED EXPERTISE IN KEY TECHNOLOGIES Key Benefits of the ARROW Highly-Differentiated ARROW Architecture Proprietary Scalable Modular EV System 1 Fast speed to market Scalable for future vehicle 2 configurations 3 Lower, efficient investment for new models 4 Lower incremental parts development 5 More flexible to evolving regulations Power Electronics Motor Battery Integrated Increased Power Leading Cell Chemistry Inverter and Density and with Optimized Energy, On-Board Charger Direct-Drive Design Performance and Life 19

3: DIFFERENTIATED EXPERTISE IN KEY TECHNOLOGIES Unique Customer Experience Using Breakthrough Technology Built-in cellular Customizable Advanced control connectivity and GPS ride modes technology LiveWire app Over-the-Air 20

4: TRANSFORMATIVE GO-TO-MARKET MODEL Combining the Best of Digital and Physical DIGITAL FIRST: FLEXIBLE PATHS TO PURCHASE — Scale central platform that forms the digital-first foundation of the consumer journey — Replacing the fragmentation of hundreds of individual digital front-ends by centralizing development into a single environment to support our retail partners — Unlocks the experience customers expect from a modern retailer and the efficiency to boost the channel economics Showroom 21

4: TRANSFORMATIVE GO-TO-MARKET MODEL Combining the Best of Digital and Physical THE HYBRID MODEL BLENDS DIGITAL WITH FOUR STRATEGIC RETAIL FORMATS — Store-in-Store: LiveWire concepts built into EV-ready retail partner locations — Gallery: Concept spaces for complete immersion into the brand and lifestyle of LiveWire — Pop-Up Retail: Short-term presence in key markets to build brand identity and support local retail partners — LiveWire on the Road: Bring LiveWire to the rider, using test rides to introduce the brand and experience Showroom 22

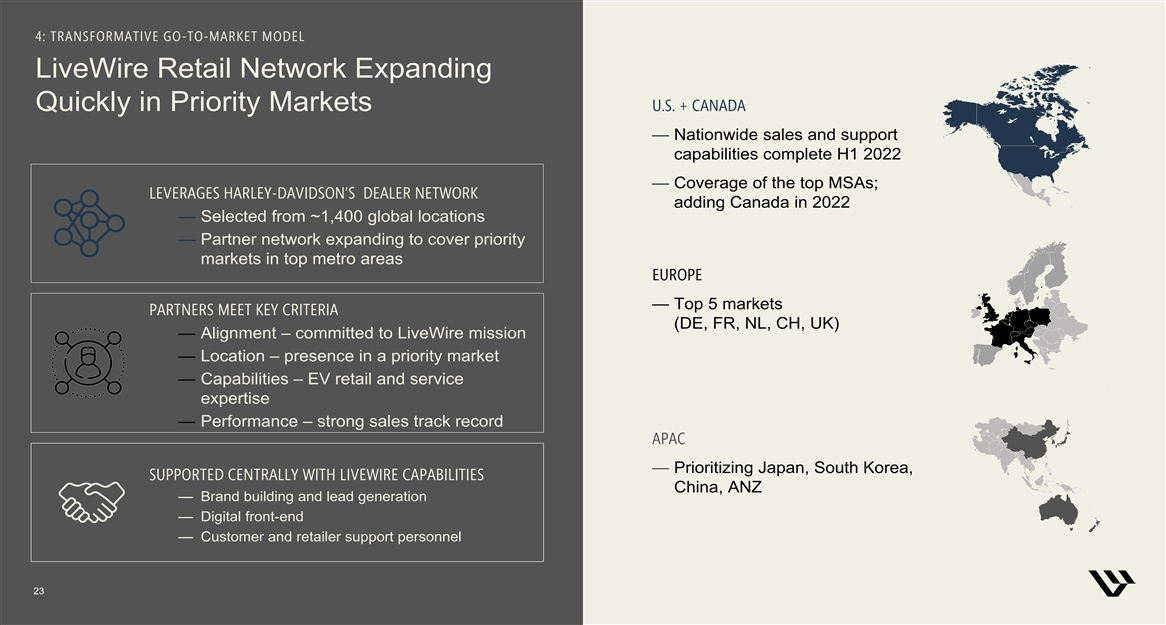

4: TRANSFORMATIVE GO-TO-MARKET MODEL LiveWire Retail Network Expanding Quickly in Priority Markets U.S. + CANADA — Nationwide sales and support capabilities complete H1 2022 — Coverage of the top MSAs; LEVERAGES HARLEY-DAVIDSON’S DEALER NETWORK adding Canada in 2022 — Selected from ~1,400 global locations — Partner network expanding to cover priority markets in top metro areas EUROPE — Top 5 markets PARTNERS MEET KEY CRITERIA (DE, FR, NL, CH, UK) — Alignment – committed to LiveWire mission — Location – presence in a priority market — Capabilities – EV retail and service expertise — Performance – strong sales track record APAC — Prioritizing Japan, South Korea, SUPPORTED CENTRALLY WITH LIVEWIRE CAPABILITIES China, ANZ — Brand building and lead generation — Digital front-end — Customer and retailer support personnel 23

5: BACKED BY WORLD-CLASS PARTNERS Harley-Davidson and KYMCO Strategic Support Creates Rapid Scale for LiveWire Without Asset-Intense Investments Technical Services Brand Association Leverage Harley-Davidson’s Strategically linking to the technical expertise and KYMCO’s Harley-Davidson brand digital / IoT capabilities Distribution & Retail Manufacturing Local presence for test rides, sales, Harley-Davidson and KYMCO delivery and service, leveraging support global at-scale manufacturing Harley-Davidson’s ~1,400 global while minimizing investment dealers Financial Services Supply Chain Integrated access to a full suite of Harley-Davidson and KYMCO’s supply custom financing and insurance chains generate economies of scale, FINANCIAL SERVICES products during purchase purchasing efficiencies in priority markets 24

6: PRODUCT PORTFOLIO TO DRIVE RAPID GROWTH Poised to Grow the Market by …with a Compelling Future Product Set Underpinning 100k Unit Projection Expanding the Product Portfolio… Demonstrating the breakthrough capabilities of a LIVEWIRE ONE premium electric motorcycle Extending the portfolio to a range of middleweight applications LIVEWIRE S2 MODELS Scaling down the Arrow architecture to a platform of lightweight LIVEWIRE S3 MODELS 2-wheelers; partnering with KYMCO Leveraging latest technologies to address heavyweight LIVEWIRE S4 MODELS motorcycles with expected improvements in range and charging capabilities 25

6: PRODUCT PORTFOLIO TO DRIVE RAPID GROWTH STACYC: The Premier Electric Bikes for Kids Attracting new riders and building brand allegiance — The brand that defines the space — Steep trajectory with a clear path to continued growth Scaling retail / distribution network — Access to 1000+ bike, powersports and motorcycle dealers in U.S. — Demand growing in Europe Taking the brand into new segments — Meeting customer demand for bikes for older kids outgrowing the first models — Model opens up several high-potential growth vectors 26

6: PRODUCT PORTFOLIO TO DRIVE RAPID GROWTH Multiple Growth Vectors Beyond Motorcycles LiveWire Motorcycle-Related Solutions Software and Financing and Subscriptions Protection Innovative solutions FINANCIAL Consumer financing SERVICES to riders with with a custom menu of powerful software solutions that leverages Harley- capabilities Davidson Financial Services General Parts and Merchandise Accessories Building the brand Service, upgrades through complementary and compelling apparel and equipment options for products customization Adjacent Segments Extending the Arrow architecture and EV systems to more distant 2W segments and related powersports categories 27 27

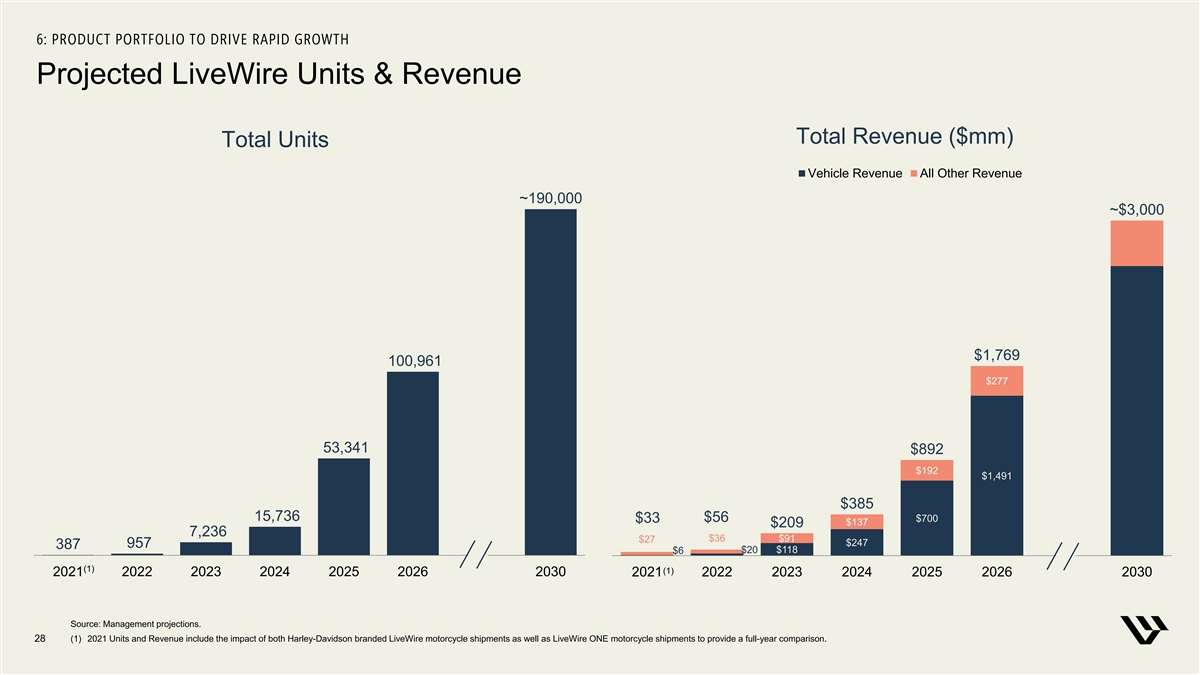

6: PRODUCT PORTFOLIO TO DRIVE RAPID GROWTH Projected LiveWire Units & Revenue Total Revenue ($mm) Total Units Vehicle Revenue All Other Revenue ~190,000 ~$3,000 $1,769 100,961 $277 53,341 $892 $192 $1,491 $385 15,736 $56 $700 $33 $137 $209 7,236 $36 $91 $27 $247 957 387 $20 $118 $6 (1) (1) 2021 2022 2023 2024 2025 2026 2030 2021 2022 2023 2024 2025 2026 2030 Source: Management projections. (1) 2021 Units and Revenue include the impact of both Harley-Davidson branded LiveWire motorcycle shipments as well as LiveWire ONE motorcycle shipments to provide a full-year comparison. 28

FINANCIAL OVERVIEW Financial Targets 2026 Long-Term Forecast Target 18.6% 25-30% GROSS MARGIN GROSS MARGIN 6.1% 15-20% EBITDA MARGIN EBITDA MARGIN 29

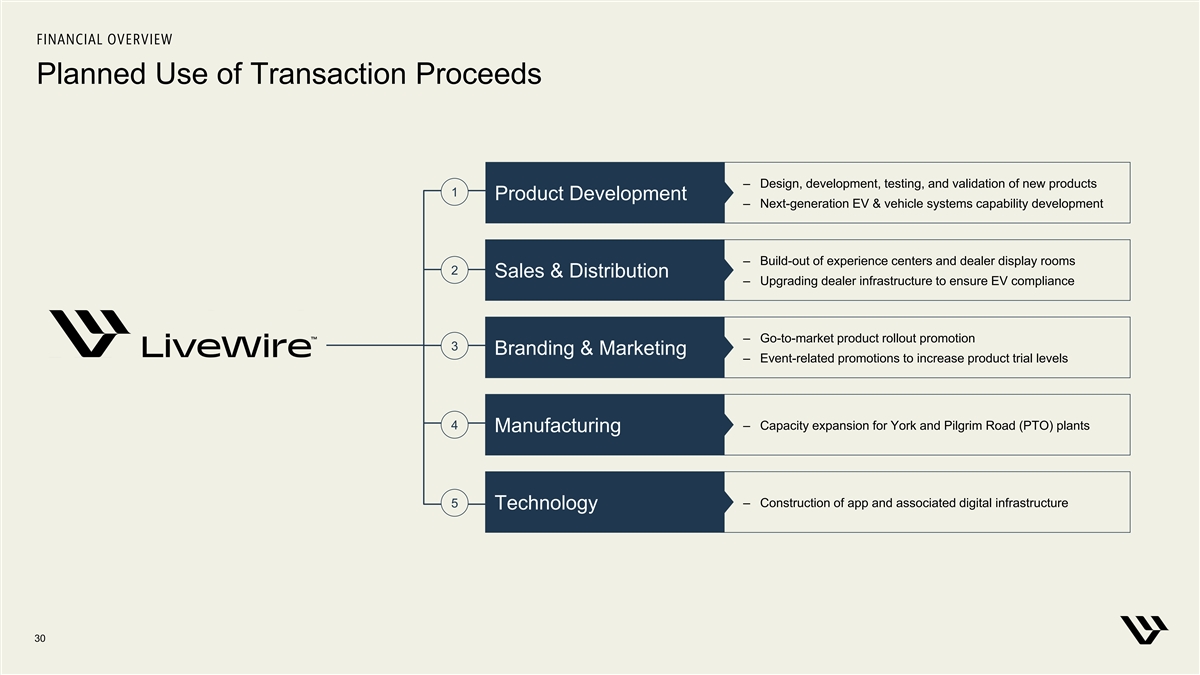

FINANCIAL OVERVIEW Planned Use of Transaction Proceeds ‒ Design, development, testing, and validation of new products 1 Product Development ‒ Next-generation EV & vehicle systems capability development ‒ Build-out of experience centers and dealer display rooms 2 Sales & Distribution ‒ Upgrading dealer infrastructure to ensure EV compliance ‒ Go-to-market product rollout promotion 3 Branding & Marketing ‒ Event-related promotions to increase product trial levels 4 ‒ Capacity expansion for York and Pilgrim Road (PTO) plants Manufacturing ‒ Construction of app and associated digital infrastructure 5 Technology 30

FINANCIAL OVERVIEW Disruptive EV Growth, Support EV PEERS (1) EV Peers Traditional OEMs of Two Well-Established OEMs OEMS MOTORCYCLES - De-Risks LiveWire Business Plan INFRASTRUCTURE AUTOS Market-leading EV technology Independent management, public SIMILARITIES TO EV PEERS SIMILARITIES TO TRADITIONAL OEMS company experience —Paving path to EV transition —Large, established distribution and Asset light model manufacturing footprint —Benefits from growing EV infrastructure —Deep technology underpinning Global partnership-enabled capabilities ADVANTAGES TO EV PEERS ADVANTAGES TO TRADITIONAL OEMS Compelling risk-adjusted valuation —Scaled OEM partners bring —Significant “head start” vs. others operational and manufacturing in two-wheel space support —Production and sales ramping —Leverage existing global with significant long term growth distribution footprint and finance potential $1.77B VALUATION company —No head-to-head OEM competition 31 (1) Over $300B in traditional auto OEMs commitments towards EV transition through 2025.

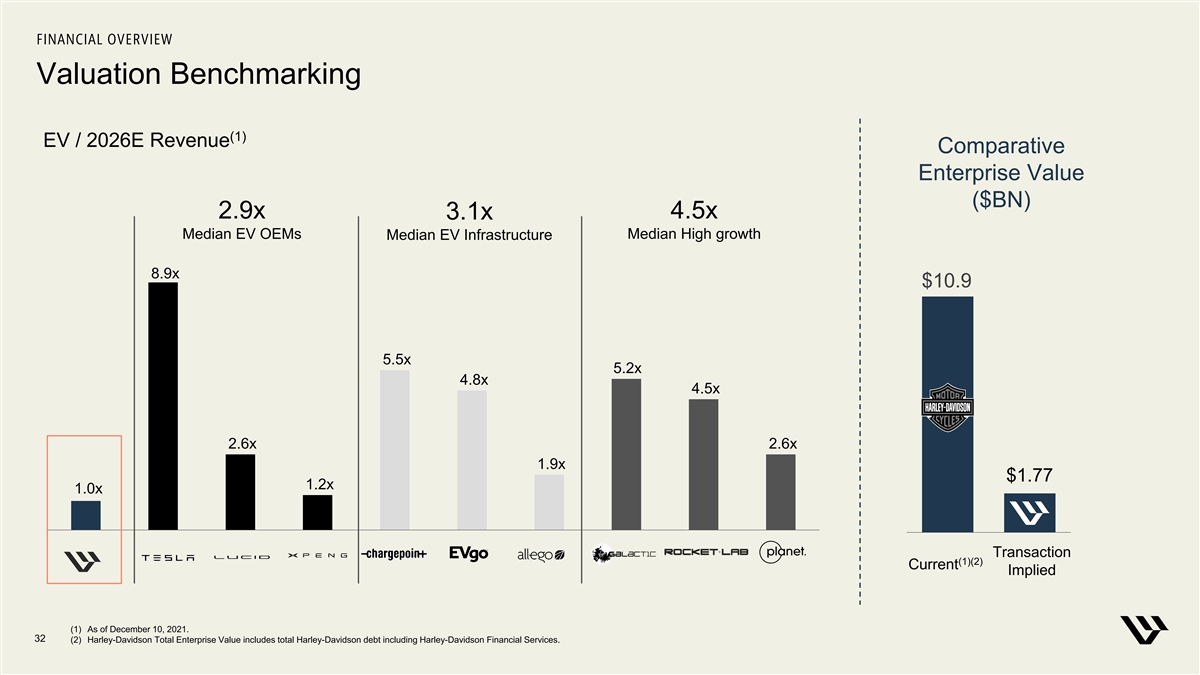

FINANCIAL OVERVIEW Valuation Benchmarking (1) EV / 2026E Revenue Comparative Enterprise Value ($BN) 2.9x 4.5x 3.1x Median EV OEMs Median High growth Median EV Infrastructure 8.9x $10.9 5.5x 5.2x 4.8x 4.5x 2.6x 2.6x 1.9x $1.77 1.2x 1.0x 2026 2026 2026 2026 2026 2026 2026 2026 2026 2026 Transaction (1)(2) Current Implied (1) As of December 10, 2021. 32 (2) Harley-Davidson Total Enterprise Value includes total Harley-Davidson debt including Harley-Davidson Financial Services.

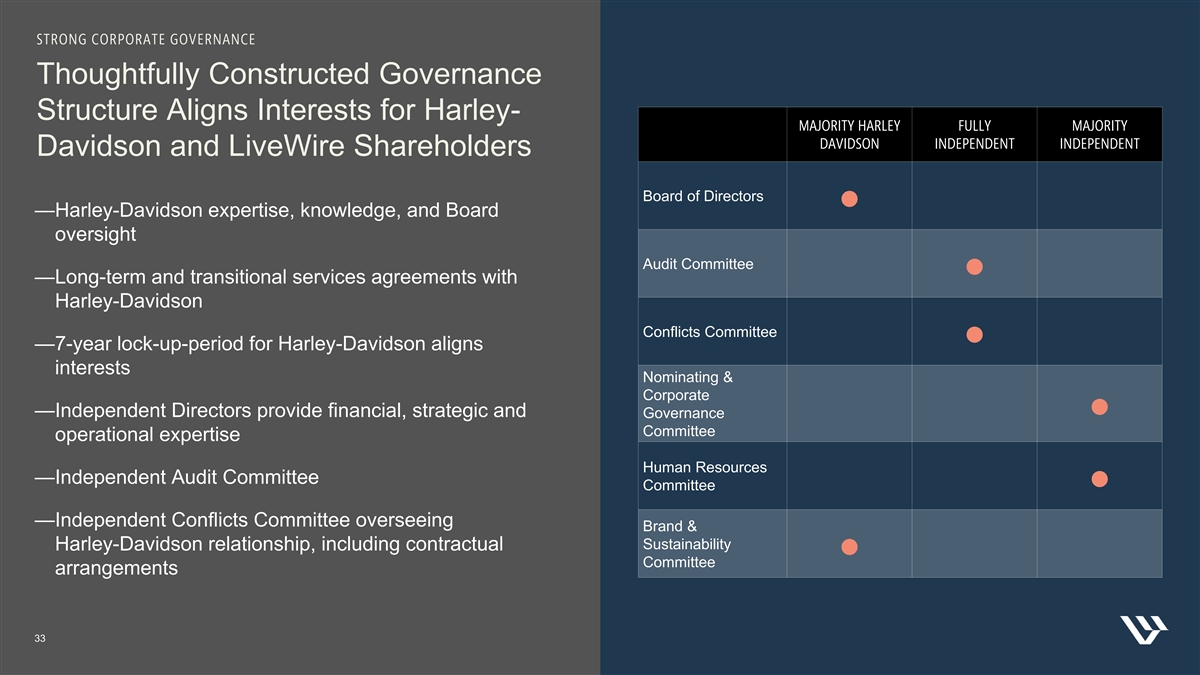

STRONG CORPORATE GOVERNANCE Thoughtfully Constructed Governance Structure Aligns Interests for Harley- MAJORITY HARLEY FULLY MAJORITY DAVIDSON INDEPENDENT INDEPENDENT Davidson and LiveWire Shareholders Board of Directors ● —Harley-Davidson expertise, knowledge, and Board oversight Audit Committee ● —Long-term and transitional services agreements with Harley-Davidson Conflicts Committee ● —7-year lock-up-period for Harley-Davidson aligns interests Nominating & Corporate —Independent Directors provide financial, strategic and ● Governance Committee operational expertise Human Resources —Independent Audit Committee ● Committee —Independent Conflicts Committee overseeing Brand & Sustainability Harley-Davidson relationship, including contractual ● Committee arrangements 33

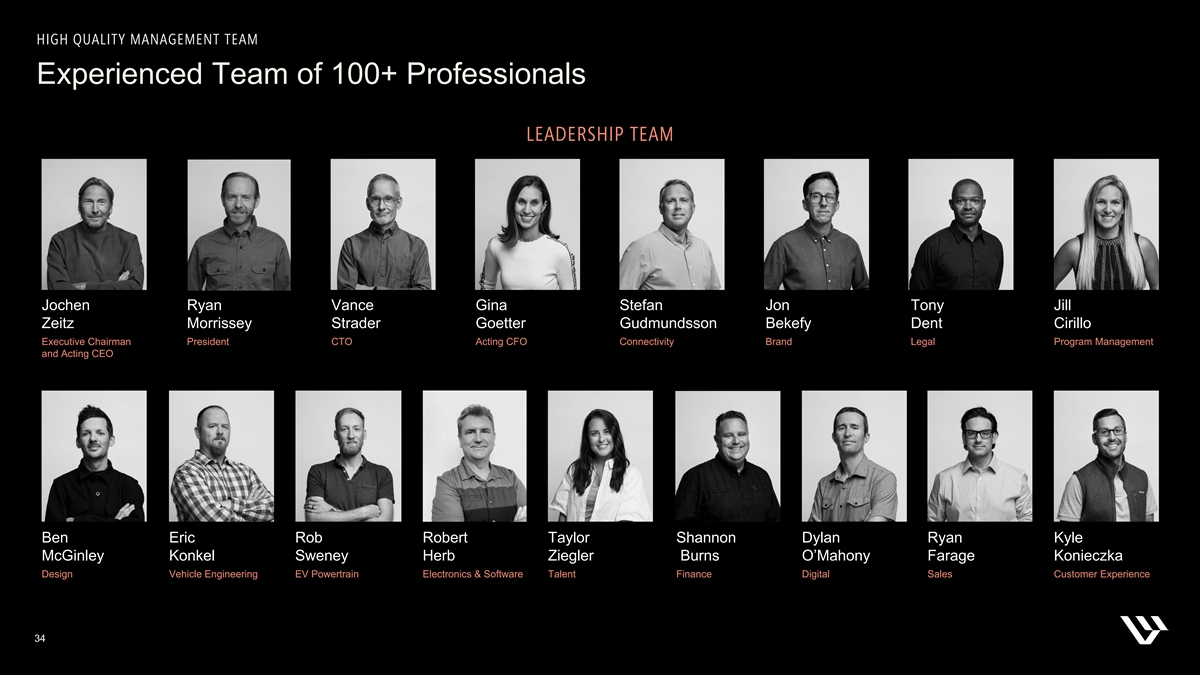

HIGH QUALITY MANAGEMENT TEAM Experienced Team of 100+ Professionals LEADERSHIP TEAM Jochen Ryan Vance Gina Stefan Jon Tony Jill Zeitz Morrissey Strader Goetter Gudmundsson Bekefy Dent Cirillo Executive Chairman President CTO Acting CFO Connectivity Brand Legal Program Management and Acting CEO Ben Eric Rob Robert Taylor Shannon Dylan Ryan Kyle McGinley Konkel Sweney Herb Ziegler Burns O’Mahony Farage Konieczka Design Vehicle Engineering EV Powertrain Electronics & Software Talent Finance Digital Sales Customer Experience 34

Q&A

APPENDIX AEA-Bridges Impact Corp.: A Special Purpose Acquisition Company That Completed Its $400 Million IPO on October 1, 2020 A pioneer and thought-leader in sustainable and A leading global private investment firm founded in 1968 by impact investment founded in 2002 by Sir Ronald the Rockefeller, Mellon and Harriman family interests and Cohen, Michele Giddens, and Philip Newborough S.G. Warburg & Co 100+ 40 $15B £1.0B 300+ 160+ INVESTMENT INVESTMENT AUM AUM INVESTMENTS INVESTMENTS PROFESSIONALS PROFESSIONALS Impact / ESG Management Private Equity Value Creation — Best-in-class standards — Organizational & strategy alignment — Strategic advice — M&A growth focus — Materiality assessment — Relationship network — Capital markets expertise — Impact & ESG improvement initiatives — Operational, commercial & carve out — Targets, tracking, reporting & benchmarking Board of Directors John Garcia Michele Giddens Ramzi Gedeon Brian Trelstad John Replogle George Serafeim Steven DeCillis Chairman & Co-CEO Director & Co-CEO Director & CFO Director Director Director Director 37

APPENDIX Harley-Davidson: World’s Leading The Global RepTrak 100 Motorcycle Company With a 118- 1 Year Legacy as a Premium Brand – Leading the Industry Through 2 Innovation and Focused on Driving 3 LiveWire’s Success 4 — Industry leader – motorcycles, parts, accessories and apparel 5 — U.S. market share leader of heavyweight motorcycles with 45% share 6 — Global, world-class capabilities in design, engineering, 7 manufacturing and distribution — ~1,400 global independent dealers 8 — Financial services leader – $3 billion in loans financed annually 9 10 38

APPENDIX KYMCO: One of World’s Leading Powersports Brands, and Top-Tier Partner With Significant Experience and Greater Electric Ambitions — Founded in 1964 in partnership with Honda — Visionary approach, led by Allen Ko, Chairman iONEX Scooter F9 Sports Scooter — Over $1 billion in annual sales, 10 million units produced and sold in 100 countries — 20-year track record as global leader in mobility products — Low-cost and high-quality manufacturing capabilities relative to Asian competitors — IONEX swappable battery platform - high urban and Asia market potential; offers B2B opportunity — Supported global OEMs – BMW, Kawasaki, Arctic Cat and Textron, among others AK550 Maxi-Scooter RevoNEX 39

APPENDIX A Decade in the Making, Leading the Premium Two-Wheel EV Transition Project Hacker Harley-Davidson LiveWire LiveWire ONE 2010-2014 2015-2019 2020-2021+ 2011 2017 2021 2019 First ‘Hacker EV’ Prototypes are Operational Work on Proprietary Architecture Begins LiveWire Launches Harley-Davidson Deliveries Begin (becomes today’s ‘Arrow’) — 7.9kWh pouch cell pack; 50 miles range — Becomes a stand-alone — 15.5kWh prismatic pack; 146 miles range — 21700-based structural battery pack division of Harley-Davidson — Oil-cooled induction motor — Water-cooled IPM motor — Modular, scalable vehicle and EV — Offboard charger — Onboard charger with DCFC systems architectures 2010 2014 2018 2021 Harley-Davidson Announces LiveWire ONE launches The ‘LiveWire Experience’ Roadshow Begins LiveWire Labs Opens in Silicon Valley, Employing top EV Talent Electric Motorcycle Initiative July 2021 — Bikes revealed for public experience — Battery cell, module, pack and BMS development — MSRP of $21,999 — 8kWh prismatic pack; 53 miles range — Power electronics development (inverter, OBC, DC-DC) — Oil-cooled induction motor — Motor development — Off-board charger — EV software development 40

APPENDIX Battery Elements of ARROW Architecture Motor Battery — Leading cell chemistry with optimized energy, performance and life, internally validated in real-world accelerated characterization — High-volume 21700 format cells enable rapid adoption of multiple suppliers’ advancements — Standardized building blocks support broad range of motorcycle-optimized shapes and system voltages (50/100/350/400+) — Flexible thermal management approach – air, liquid or refrigerant — Manufacturing and assembly equipment and processes optimized for modularity/scalability across full portfolio Power Electronics — Integrated inverter and On-Board Charger with shared cooling circuit, minimizing complexity, connections, size and mass — Reduced number of (and common) microprocessors — Optimized cooling system – liquid or air-cooled Motor — Increased power density with proprietary magnetics and direct-drive design — Common scalable configuration across portfolio, tailored to each application for desired performance and maximum efficiency — Housing fully integrated into chassis and suspension to optimize space, stiffness and weight with internal high-voltage connections — Manufacturing and assembly equipment and processes optimized for modularity/scalability across full portfolio Power — Air or liquid-cooled, as needed per application Electronics 41

APPENDIX State-of-the-Art Manufacturing and Supply Chain — LiveWire benefits from Harley-Davidson existing scale manufacturing via contract manufacturing agreement — Craftsmanship and quality management are paramount to production – asset light model gives LiveWire years of head start on competition — LiveWire ONE, S2 and S1 bikes assembled at Harley- Davidson facility in York, PA – initial 5 year exclusivity period — Arms-length terms with market-standard cost-plus pricing, with LiveWire funding EV specific plant equipment, tooling and installation expense — Joint operating committee oversees contract execution, including annual planning of volumes and unit pricing Harley-Davidson Size Capacity Employees York Facility 660,000 153,000 1,440 Key Stats sq. ft. bikes / year FTEs 42

APPENDIX Large Global Market for Motorcycles Primed for Electric Transition North 2020 Revenue Major Players Europe China Total (in B’s) America Small Scooters & Mopeds Hero, KYMCO, Segway $0.1 $4.4 $4.7 $9.1 Large Scooters Hero, KYMCO $0.0 $1.3 $0.2 $1.5 Honda, KTM, Hero, QJ, Light Motorcycles $1.5 $3.2 $4.5 $9.2 LiveWire Yamaha LiveWire Core & Capability Medium & Heavy Harley-Davidson, Polaris, Strategic $5.6 $7.9 $3.2 $16.6 Motorcycles BMW Partner Enabled 3-Wheeler Polaris, BRP $1.4 $0.4 $0.1 $1.9 Side-by-Side & Polaris, BRP $2.0 $0.1 $0.0 $2.1 4-Wheeler TOTAL OPPORTUNITY $10.5 $17.2 $12.7 $40.4 LIVEWIRE OPPORTUNITY $7.1 $11.1 $7.7 $25.9 43 Source: Management estimates.

APPENDIX Consumers Across Geographies Showing Increasing Preference for EV as Next Purchase Vehicle Type Buy/Lease Next by Country 51% 43% 42% 42% 36% 31% 27% 27% 26% 24% 22% 21% 19% 18% 17% 11% 10% 7% 5% 5% 5% 4% 3% 2% 1% US UK Germany China TOTAL Petrol/Gas/Diesel Vehicle Electric Vehicle Hybrid (Electric Fuel) Compressed Natural Gas Vehicle I do not plan to buy or lease a vehicle Chinese Consumers are Leading the EV Transition Followed by Europeans and Americans 44 Source: Alphawise; Morgan Stanley Sustainable Consumption Survey (Oct-21)

APPENDIX Customer Insights Show the Opportunity to Expand the Market With Younger, New-to-Sport Riders DIGITAL FORWARD “Early adopter” profile that values a more digital- Once aware of technology, customers are captivated and friendly, technology-rich experience more likely to consider an electric motorcycle than an ICE motorcycle RESEARCH SAVVY Preference for younger Preference for Knowledgeable buyers who respond better to buyers (under 45) New-to-Sport buyers education and excitement over sales push ~50% ~40% EV AWARE ~25% Already own, have close friends that own, or are ~20% otherwise partial to EV products, often heaviest in major metros Premium pure play Traditional heavy ICE Premium pure play Traditional heavy ICE electric motorcycle electric motorcycle 45

APPENDIX Poised to Capture Market Share Consistent With First Scale Mover Advantage and Historical Share North America Europe APAC 2026 Unit Market 2026 Unit Market 2026 Unit Market Share Share Share TAM: 91K TAM: 153K TAM: 4.7M 43% 24% 0.4% LiveWire Share LiveWire Share LiveWire Share Within the 601+cc ICE motorcycles segment, Harley-Davidson holds: ~45% ~6% ~68% Unit market share Unit market share Unit market share in North America in Europe in China 46 Source: Management estimates. Represents light/medium/heavy motorcycles and 3-wheelers only. Excludes scooters and 4-wheelers.

APPENDIX Transaction Overview ($ Million) Estimated Sources & Uses Sources Existing Equity Rollover $1,610 AEA-Bridges Equity $400 Illustrative Harley-Davidson Investment $100 Pro Forma KYMCO Strategic Investment $100 Ownership Total Sources $2,210 Uses Existing Equity Rollover $1,610 Cash to LiveWire Balance Sheet $545 Estimated Fees & Expenses $55 Sources Shares % Ownership Total Uses $2,210 ■ Harley-Davidson 171 74.0% ■ AEA-Bridges 40 17.3% Illustrative Pro Forma Valuation ■ Strategic PIPE (KYMCO) 10 4.3% Pro Forma Shares Outstanding 231 ■ Founder Shares 10 4.3% Share Price $10 Total Uses 231 100% Equity Value $2,310 Plus: Debt - Less: Cash ($545) Enterprise Value $1,765 47

APPENDIX Comparative Benchmarking Revenue CAGR Gross profit margin Average EV OEMs: 23% Average EV Infrastructure: 40% Average High Growth: 55% Average EV OEMs: 84% Average EV Infrastructure: 84% Average High Growth: 108% 226% 70% 50% 45% 129% 44% 43% 123% 120% 35% 88% 25-30% 29% 75% 65% 22% 58% 20% 50% 41% 31% 20A-'26E 26E-'30E 20A-'25E '21E-'23E '20A-'25E '21E-'25E '20A-'25E '20A-'25E '21E-'25E '21E-'25E '21E-'25E Long Term 2025E 2025E 2025E 2025E 2025E 2025E 2025E 2025E 2025E FCF margin EBITDA margin (1) Average EV OEMs: 12% Average EV Infrastructure: 24% Average High Growth: 15% Long Term: 16% Average EV OEMs: 9% Average EV Infrastructure: (8%) Average High Growth: 7% 40% 30% 25% 20% 16% 15-20% 15% 12% 17% 7% 10% 5% 9% 8% 5% 2% (1%) (6%) (10%) (11%) Long Term 2025E 2025E 2025E 2025E 2025E 2025E 2025E 2025E 2025E Long Term 2025E 2025E 2025E 2025E 2025E 2025E 2025E 2025E 2025E 48 (1) Harley Davidson long term average EBITDA margins for the past 5 years.

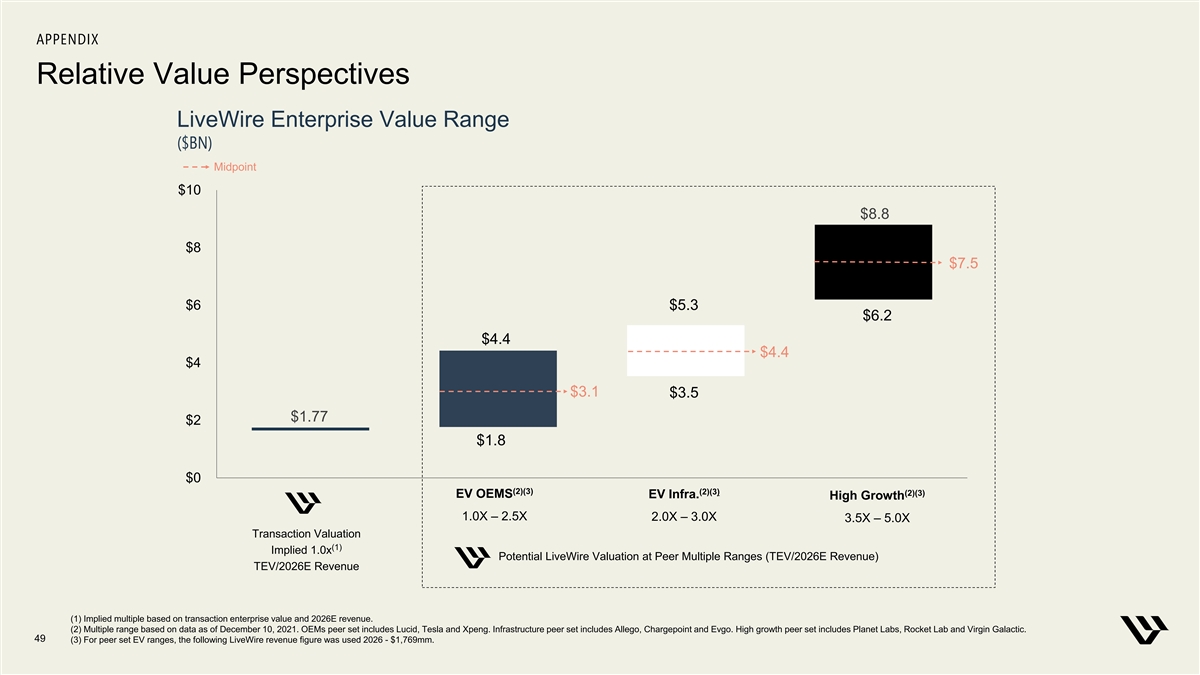

APPENDIX Relative Value Perspectives LiveWire Enterprise Value Range ($BN) Midpoint $10 $8.8 $8 $7.5 $6 $5.3 $6.2 $4.4 $4.4 $4 $3.1 $3.5 $1.77 $2 $1.8 $0 (2)(3) (2)(3) (2)(3) EV OEMS EV Infra. High Growth 1.0X – 2.5X 2.0X – 3.0X 3.5X – 5.0X Transaction Valuation (1) Implied 1.0x Potential LiveWire Valuation at Peer Multiple Ranges (TEV/2026E Revenue) TEV/2026E Revenue (1) Implied multiple based on transaction enterprise value and 2026E revenue. (2) Multiple range based on data as of December 10, 2021. OEMs peer set includes Lucid, Tesla and Xpeng. Infrastructure peer set includes Allego, Chargepoint and Evgo. High growth peer set includes Planet Labs, Rocket Lab and Virgin Galactic. 49 (3) For peer set EV ranges, the following LiveWire revenue figure was used 2026 - $1,769mm.

APPENDIX Summary P&L ($ Million) (1) 2021E 2022E 2023E 2024E 2025E 2026E Units 387 957 7,236 15,736 53,341 100,961 % Growth NA 261% 656% 117% 239% 89% Vehicle revenue $6 $20 $118 $247 $700 $1,491 All other 27 36 91 137 192 277 Revenue $33 $56 $209 $385 $892 $1,769 % Growth NA 63% 270% 84% 132% 98% COGS $33 $56 $196 $341 $743 $1,439 Gross Margin $0 $0 $13 $44 $149 $330 % of Revenue 0% 0% 6% 11% 17% 19% EBITDA ($53) ($98) ($112) ($114) ($20) $107 % of Revenue NM NM NM NM NM 6% EBIT ($60) ($111) ($137) ($146) ($55) $64 % of Revenue NM NM NM NM NM 4% Free Cash Flow ($88) ($120) ($139) ($152) ($89) $56 50 Source: Management projections. (1) 2021 financials include the impact of both Harley-Davidson branded LiveWire motorcycle shipments as well as LiveWire ONE motorcycle shipments to provide a full-year comparison.

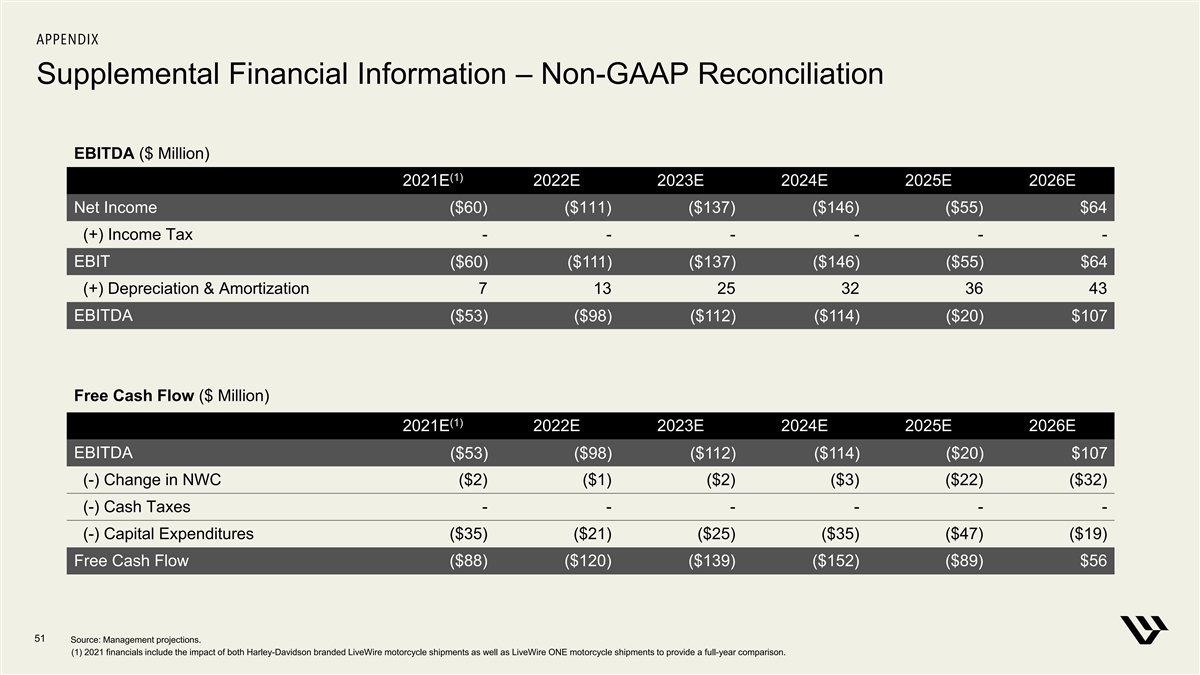

APPENDIX Supplemental Financial Information – Non-GAAP Reconciliation EBITDA ($ Million) (1) 2021E 2022E 2023E 2024E 2025E 2026E Net Income ($60) ($111) ($137) ($146) ($55) $64 (+) Income Tax - - - - - - EBIT ($60) ($111) ($137) ($146) ($55) $64 (+) Depreciation & Amortization 7 13 25 32 36 43 EBITDA ($53) ($98) ($112) ($114) ($20) $107 Free Cash Flow ($ Million) (1) 2021E 2022E 2023E 2024E 2025E 2026E EBITDA ($53) ($98) ($112) ($114) ($20) $107 (-) Change in NWC ($2) ($1) ($2) ($3) ($22) ($32) (-) Cash Taxes - - - - - - (-) Capital Expenditures ($35) ($21) ($25) ($35) ($47) ($19) Free Cash Flow ($88) ($120) ($139) ($152) ($89) $56 51 Source: Management projections. (1) 2021 financials include the impact of both Harley-Davidson branded LiveWire motorcycle shipments as well as LiveWire ONE motorcycle shipments to provide a full-year comparison.

Risk Factors RISKS RELATED TO LIVEWIRE’S BUSINESS AND INDUSTRY • Our business plans require a significant amount of capital. In addition, our future capital needs may require us to issue additional equity or debt securities that may dilute our shareholders or introduce covenants that may restrict our operations or our ability to pay dividends. • We are a new entrant into a new space. As we scale and expand our business, we may not be able to adequately control the costs of our operation. • The EV sector is rapidly growing and our products and services are and will be subject to strong competition from a growing list of established and new competitors. • We have an established standard of quality and associated consumer expectations through our H-D motorcycle lineage. If we are unable to continue providing quality services and customer service, our business and reputation may be materially and adversely affected. • Our future growth and success are dependent upon consumers’ adoption of, and their demand for, two- and three-wheeled electric vehicles in a motorcycle sector that is generally competitive, cyclical and volatile. • Our business and prospects depend significantly on our ability to build the LiveWire brand and consumers' recognition, acceptance, and adoption of the LiveWire brand. We may not succeed in continuing to maintain and strengthen the LiveWire brand. • Our relationship to H-D and the H-D brand presents potential opportunities, synergies, and risks. Our brand and reputation could be harmed if we fail to realize those synergies, through negative publicity regarding H-D, and its products and services, or if we fail to effectively and appropriately separate the LiveWire brand from the H-D brand. • We depend on suppliers, including critical and single sourced suppliers, to deliver components according to schedules, prices, quality, and volumes that are acceptable to us. We may be unable to effectively manage these suppliers. Uncertainties in the global economy may negatively impact suppliers and other business partners, which may interrupt the supply chain and require other changes to operations. These and other factors may adversely impact revenues and operating income. • Electric motorcycles are inherently new products. We may experience significant delays in the design, manufacture, production, and launch of LiveWire motorcycles, which could harm our business, prospects, financial condition, and operating results. • We may be unable to develop and manufacture electric vehicles of sufficient quality, and on schedule and scale, that would appeal to a large customer base. • Our limited operating history makes evaluating our business and future prospects difficult and may increase the risk of your investment. • Increases in costs, disruption of supply or shortage of materials, in particular for lithium-ion battery cells and electronics subcomponents could harm our business. • Leveraging contract manufacturers, including H-D and other partners, to contract manufacture motorcycles is subject to risks, including costs, manufacturing footprint, and manufacturing capabilities. • If LiveWire dealers, drawn from H-D’s traditional motorcycle dealer network, are unable or ineffective in establishing or maintaining relationships with customers for EV motorcycles, it may adversely impact our business. • Our research and development efforts may not yield the expected results and results on expected timelines or at expected costs. • We may face challenges in expanding our business and operations internationally and our ability to conduct business in international markets may be adversely affected by legal, regulatory, political, and economic risks. 52

Risk Factors (continued) RISKS RELATED TO LIVEWIRE’S BUSINESS AND INDUSTRY (CONTINUED) • If our vehicle owners modify our vehicles regardless of whether third-party aftermarket products are used, the vehicle may not operate properly, which may create negative publicity and could harm our business. • If we are unable to establish and maintain confidence in our long-term business prospects among customers and analysts and within our industry or are subject to negative publicity, then our financial condition, operating results, business prospects, and access to capital may suffer materially. • We may choose to or be compelled to undertake product recalls or take other similar actions, which could adversely affect our brand image, business, and results of operations. • Our warranty reserves may be insufficient to cover future warranty claims which could adversely affect our financial performance. • Our financial results may vary significantly from period to period due to fluctuations in our operating costs, product demand, and other factors. • We retain certain information about our users, which may subject us to user concerns or various privacy and consumer protection laws. • The battery's range and life will deteriorate with usage and time, which if material could negatively influence potential customers’ decisions to purchase our electric vehicles. • Our industry and its technology are rapidly evolving and may be subject to unforeseen changes. Developments in alternative technologies or improvements in current and future enabling and competitive technologies may adversely affect the demand for our electric vehicles. • Our business may suffer if our products or features contain defects or fail to perform as expected. • We are subject to cybersecurity risks to our various systems and software and any material failure, weakness, interruption, cyber event, incident or breach of security could prevent us from effectively operating our business. • Vehicle retail sales depend heavily on affordable interest rates, credit risk, and availability of credit for vehicle financing and a substantial increase in interest rates or decrease in availability of credit could materially and adversely affect our business, prospects, financial condition, results of operations, and cash flows. • Our vehicles make use of lithium-ion battery cells. When not properly managed, lithium-ion battery cells have been observed to catch fire or vent smoke and flame on rare occasions. If our vehicles exhibit those conditions, it could have a negative affect on our reputation and business. • We may become subject to product liability claims, which could harm our financial condition and liquidity if we are not able to successfully defend or insure against such claims. • We may be subject to class actions in the ordinary course of our business. If the outcomes of these proceedings are adverse to us, it could have a material adverse effect on our business, results of operations, and financial condition. • Our Company's association to H-D may make it a target in lawsuits and from regulatory agencies, both domestically and internationally, which may have a negative impact on our business. • If LiveWire is not permitted to operate as a brand separate from H-D, it could negatively impact the Company’s go-to-market plan and overall business. • We are subject to substantial regulation and unfavorable changes to, or failure by us to comply with, current or future regulations could substantially harm our business and operating results. Increased safety, emissions, or other regulations may result in higher costs, cash expenditures, and/or sales restrictions. • We are subject to anti-corruption, anti-bribery, anti-money laundering, financial and economic sanctions and similar laws, and noncompliance with such laws can subject us to administrative, civil and criminal fines and penalties, collateral consequences, remedial measures and legal expenses, all of which could adversely affect our business, results of operations, financial condition, and reputation. 53

Risk Factors (continued) RISKS RELATED TO LIVEWIRE’S BUSINESS AND INDUSTRY (CONTINUED) • We, our outsourcing partners, and our suppliers are subject to numerous regulations. Unfavorable changes to, or failure by us, our outsourcing partners or our suppliers to comply with these regulations could substantially harm our business and operating results. • We are or may be subject to risks associated with strategic alliances or acquisitions. • Changes in U.S. or international trade policy, including the continuation or imposition of tariffs and the resulting consequences, could adversely affect our business, prospects, financial condition, and operating results. • Any financial or economic crisis, or perceived threat of such a crisis, including a significant decrease in consumer confidence, may materially and adversely affect our business, financial condition, and results of operations. • If we fail to implement and maintain an effective system of internal control over financial reporting, we may be unable to accurately report our results of operations, meet our reporting obligations, or prevent fraud. • Our insurance coverage strategy may not be adequate to protect us from all business risks. • The success of our business depends on the availability of power and charging infrastructure for electric vehicles. Limitations on that infrastructure may negatively impact our business. • Unexpected termination of leases, failure to renew the lease of our existing premises or to renew such leases at acceptable terms could materially and adversely affect our business. • Unanticipated changes in effective tax rates or adverse outcomes resulting from examination of our income or other tax returns could adversely affect our results of operations and financial condition. • Changes in tax laws or regulations that are applied adversely to us or our customers may materially adversely affect our business, prospects, financial condition, and operating results. • We may seek to obtain future financing through the issuance of debt or equity, which may have an adverse effect on our shareholders or may otherwise adversely affect our business. • A market for LiveWire's securities may not continue, which would adversely affect the liquidity and price of its securities. • If securities or industry analysts do not publish or cease publishing research or reports about LiveWire, its business, or its market, or if they change their recommendations regarding common stock adversely, then the price and trading volume of common stock could decline. • We may grant options and other types of awards under our share incentive plan, which may result in increased share-based compensation expenses. • LiveWire may be unable to complete ESG initiatives, in whole or in part, which could lead to less opportunity for LiveWire to have ESG investors and partners and could negatively impact ESG-focused investors when evaluating LiveWire. • Our business, financial condition and results of operations may be adversely affected by pandemics (including COVID-19) and epidemics, natural disasters, terrorist activities, political unrest, and other outbreaks. • We may need to defend ourselves against intellectual property right infringement claims, which may be time-consuming and would cause us to incur substantial costs. The Company may incur significant costs and expenses in connection with protecting and enforcing its intellectual property rights, including through litigation. • If we are unable to protect or enforce our rights in our proprietary technology, brands or other intellectual property, our competitive advantage, business, financial condition and results of operations could be harmed. 54

Risk Factors (continued) RISKS RELATED TO LIVEWIRE’S BUSINESS AND INDUSTRY (CONTINUED) • Our use of “open source” software could subject our proprietary software to general release, adversely affect our ability to sell our products and services, and subject us to possible litigation, claims or proceedings • We cannot be certain that our products and our business do not, or will not, infringe the intellectual property rights of third parties. We are from time to time, and may in the future become, subject to patent, trademark or other intellectual property infringement claims, which may be time-consuming, cause us to incur significant liability and increase our costs of doing business. • If our trademarks, patents, or other intellectual property expire or are not maintained, or if our patent applications are not granted or patent rights are contested, circumvented, invalidated or limited in scope, we may not be able to prevent others from selling, developing or exploiting competing technologies or products, which could have a material and adverse effect on our business, prospects, financial condition, results of operations and cash flows. • We depend on revenue generated from a limited number of models and in the foreseeable future will be significantly dependent on a limited number of models. • We are an early stage company with a history of losses and expect to incur significant expenses and continuing losses for several years. We have yet to achieve positive operating cash flow and, given our projected funding needs, our ability to generate positive cash flow is uncertain. • As we continue to grow, we may not be able to effectively manage our growth, which could negatively impact our brand and financial performance. • The unavailability, reduction or elimination of government and economic incentives or government policies which are favorable for electric vehicles and domestically produced vehicles could have a material adverse effect on our business, financial condition, operating results, and prospects. • If dealers are unwilling to participate in the Company's go-to-market business model, it may have negative impacts on the Company's business. • Issues with our StaCyc products and business, two-wheeled EV bikes for kids, present reputational, business, and financial risk that could negatively impact the Company. • We face challenges providing charging solutions for our vehicles • The U.S. government’s pending rules and regulations concerning mandatory COVID-19 vaccination of U.S.-based employees of companies that work on or in support of federal contracts, or have 100 or more employees, could materially and adversely affect our results of operations, financial condition, and cash flows. • The Company's inability to retain and/or obtain necessary licenses and permits to operate the business may negatively impact the Company's financial results. RISKS RELATED TO THE CARVE-OUT TRANSACTION • Our business and that of H-D overlap. H-D's competition with us and use of our intellectual property in certain markets may affect our ability to build and maintain relationships with partners, dealers, suppliers, and customers. • Our inability to maintain a strong relationship with H-D or to resolve favorably any disputes that may arise between us and H-D could result in a significant reduction of our revenue. • In connection with the carve-out, we will not have our own manufacturing capability, and will receive contract manufacturing services exclusively from H-D to make many of our products for a certain period of time. If the Contract Manufacturing Agreement with H-D terminates, we will have to engage another third party contract manufacturer or build our own in-house manufacturing capability to make our products, which could cause us to incur significant cost and expense. 55

Risk Factors (continued) RISKS RELATED TO THE CARVE-OUT TRANSACTION (CONTINUED) • After this offering, we will be a smaller company relative to H-D which could result in increased costs because of a decrease in our purchasing power and difficulty maintaining existing customer relationships and obtaining new customers. • We are dependent on H-D for a number of services, including services relating to quality and safety testing. If those service arrangements terminate, it will require significant investment for us to build our own safety and testing facilities, or we may be required to obtain such services from another third-party at increased costs. Any obligation for LiveWire to electrify H-D products may consume valuable resources that could negatively impact development of LiveWire vehicles expected to deliver targeted revenues and operating income. • Our accounting and other management systems and resources may not be adequately prepared to meet the financial reporting and other requirements to which we will be subject following the Business Combination. • The transitional services H-D has agreed to provide us may not be sufficient for our needs. In addition, we or H-D may fail to perform under various transaction agreements that will be executed as part of the carve-out or we may fail to have necessary systems and services in place when certain of the transaction agreements expire. • Our ability to successfully effect the Business Combination and successfully operate the business thereafter will depend largely upon the efforts of certain key personnel, including the continuing services of Jochen Zeitz, our acting CEO. The loss of such key personnel (including Jochen Zeitz) could adversely affect the operations and profitability of our business. • LiveWire will be required to make payments to H-D under the Contract Manufacturing Agreement, Tax Matters Agreement, Master Services Agreement, Transition Services Agreement and certain other agreements, and the amounts of such payments could be significant. • Transfer or assignment to us of certain contracts, investments in joint ventures, and other assets may require the consent of a third party. If such consent is not given, we may not be entitled to the benefit of such contracts, investments, and other assets in the future. • Third parties may seek to hold us responsible for liabilities of H-D which could result in a decrease in our income. • As the post-combination Company will be a “controlled company” within the meaning of the New York Stock Exchange listing standards and intends to rely on exemptions from certain corporate governance requirements, its shareholders may not have the same protections afforded to shareholders of companies that are subject to all New York Stock Exchange corporate governance requirements. • LiveWire may not be successful as an independent, publicly traded company, and we will not enjoy the same benefits that we did as a wholly-owned subsidiary of H-D. • In connection with the carve-out, H-D will indemnify us for certain liabilities and we will indemnify H-D for certain liabilities. If we are required to act on these indemnities for the benefit of H-D, we may need to divert cash to meet those obligations and our financial results could be negatively impacted. Additionally, any indemnity from H-D may not be sufficient to insure us against the full amount of liabilities for which we may be allocated responsibility, and H-D may not be able to satisfy its indemnification obligations in the future. • We may not be sufficiently protected by our parent company against potential liabilities arising from product liability or regulatory claims that could materialize in the future. • Some of our directors and executive officers own restricted stock in H-D that fluctuate in accordance with the value of H-D's share price and other performance metrics, which could cause conflicts of interest that could result in us not acting on opportunities we otherwise may have. • H-D holds the direct contractual relationship with many key suppliers required for LiveWire to produce its vehicles. Disputes between H-D and critical suppliers for the LiveWire business may negatively impact vehicle production. 56

Risk Factors (continued) RISKS RELATED TO THE BUSINESS COMBINATION • We will be controlled by H-D, whose interests may conflict with our interests and, after the completion of the Business Combination transaction, the interests of other shareholders. Upon the completion of the Business Combination, H-D may be able to control our strategic direction and exert substantial influence over all matters submitted to our stockholders for approval, including the election of directors and amendments of our organizational documents, and an approval right over any acquisition or liquidation of LiveWire. • Historically, our business was operated as a business segment of H-D and our historical financial information is not necessarily representative of the results that we would have achieved as an independent public company and may not be a reliable indicator of our future results. • H-D and some of its directors and executive officers have interests in the Business Combination that are different from or are in addition to other stockholders in recommending that stockholders vote in favor of approval of the Business Combination proposal and approval of the other proposals described in this proxy statement/prospectus. • Following the completion of the Business Combination, LiveWire and H-D will have dual-CEOs. • Future sales, or the perception of future sales, by LiveWire stockholders, including by H-D, in the public market following the Business Combination could cause the market price for LiveWire common stock to decline. • Following the completion of the Business Combination, LiveWire will incur significant increased expenses and administrative burdens as a public company, which could negatively impact its business, financial condition and results of operations. RISKS RELATED TO ABIC AND THE BUSINESS COMBINATION • The ABIC sponsor has agreed to vote in favor of the Business Combination, regardless of how AEA-Bridges Impact Corporation’s (“ABIC”) public shareholders vote. • ABIC, the ABIC sponsor, certain members of the ABIC board and ABIC officers have interests in the Business Combination that are different from or are in addition to other shareholders in recommending approving the Business Combination and the other matters that will be described in a proxy statement/prospectus that will be filed in connection with the Business Combination. Such conflicts of interest include that the ABIC sponsor and ABIC’s officers and directors may lose their entire investment in ABIC if the Business Combination is not completed. • Because the post-combination Company will be a publicly listed company by virtue of a merger as opposed to an underwritten initial public offering (which uses the services of one or more underwriters), less due diligence on the post-combination Company may have been conducted as compared to an underwritten initial public offering. • ABIC’s shareholders will experience dilution as a consequence of the issuance of post-combination Company securities as consideration in the Business Combination and may experience dilution from several additional sources in connection with and after the Business Combination, including any future issuances or resales of the post-combination Company securities. Having a minority share position may reduce the influence that ABIC’s shareholders have on the management of the post-combination Company. 57

Risk Factors (continued) RISKS RELATED TO ABIC AND THE BUSINESS COMBINATION (CONTINUED) • ABIC and LiveWire expect to incur significant transaction costs in connection with the Business Combination. Whether or not the Business Combination is completed, the incurrence of these costs will reduce the amount of cash available to be used for corporate purposes by ABIC if the Business Combination is not completed. • ABIC has no operating history and is subject to a mandatory liquidation and subsequent dissolution requirement. As such, there is a risk that ABIC will be unable to continue as a going concern if ABIC does not consummate an initial business combination by October 5, 2022. Unless ABIC amends its amended and restated memorandum and articles of association and amends certain other agreements into which it has entered to extend the life of ABIC, if ABIC is unable to effect an initial business combination by October 5, 2022, it will be forced to liquidate and the ABIC warrants will expire worthless. • If third parties bring claims against ABIC, the proceeds held in the trust account could be reduced and the per-share redemption amount received by ABIC’s shareholders may be less than $10.00 per share. • During the interim period, ABIC is prohibited from entering into certain transactions that might otherwise be beneficial to it or its respective shareholders. • As a private company, LiveWire not been required to document and test its internal controls over financial reporting, nor has management been required to certify the effectiveness of its internal controls, and its auditors have not been required to opine on the effectiveness of its internal control over financial reporting. As such, the post-combination Company may identify material weaknesses in its internal control over financial reporting which could lead to errors in the post-combination Company’s financial reporting, which could adversely affect the post-combination Company’s business and the market price of the post-combination Company’s securities. • ABIC may, in accordance with their terms, redeem unexpired ABIC warrants prior to their exercise at a time that is disadvantageous to holders of ABIC warrants. • ABIC’s founders, directors, officers, advisors and their affiliates may elect to purchase ABIC Class A ordinary shares or ABIC warrants from public shareholders, which may influence the vote on the Business Combination and reduce the public “float” of ABIC’s Class A ordinary shares. • Even if ABIC the Business Combination, there can be no assurance that ABIC’s public warrants will be in the money during their exercise period, and they may expire worthless. • The ability of ABIC’s shareholders to exercise redemption rights with respect to a large number of outstanding ABIC Class A ordinary shares could increase the probability that the Business Combination would not occur. • The ABIC board has not obtained (as of the date of this presentation) a third-party valuation or financial opinion in determining whether to proceed with the Business Combination, and may not obtain such a valuation or opinion. • LiveWire’s operating and financial forecasts, which were presented to the ABIC board, may not prove accurate. • The Business Combination is subject to conditions, including certain conditions that may not be satisfied on a timely basis, if at all. • Past performance by ABIC, including its management team, may not be indicative of future performance of an investment in ABIC or the post-combination Company. 58

Risk Factors (continued) RISKS RELATED TO ABIC’S SECURITIES • If the Business Combination’s benefits do not meet the expectations of investors, shareholders or financial analysts, the market price of ABIC’s securities may decline after the closing of the Business Combination. • An active trading market for ABIC’s Class A ordinary shares may not be available on a consistent basis to provide shareholders with adequate liquidity. The share price may be extremely volatile, and shareholders could lose a significant part of their investment. • ABIC Class A ordinary shares may fail to meet the continued listing standards of the New York Stock Exchange, and additional shares may not be approved for listing on the New York Stock Exchange. • Because LiveWire has no current plans to pay cash dividends for the foreseeable future, you may not receive any return on investment unless you sell your shares for a price greater than that which you paid for them. • If, following the Business Combination, securities or industry analysts do not publish or cease publishing research or reports about LiveWire, its business, or its market, or if they change their recommendations regarding LiveWire’s securities adversely, the price and trading volume of LiveWire’s securities could decline. 59