As filed with the Securities and Exchange Commission on February 22, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Beamr Imaging Ltd.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| State of Israel | 7372 | Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

10 HaManofim Street

Herzeliya, 4672561, Israel

Tel: +1-888-520-8735

(Address, including zip code, and telephone number, including

area code, of Registrant’s principal executive offices)

Beamr, Inc.

16185 Los Gatos Blvd

Ste 205

Mailbox 12

Los Gatos, CA 95032

Tel: (650) 961-3098

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Mark Selinger, Esq. Gary Emmanuel, Esq. Eyal Peled, Esq. | Ronen Kantor, Esq. Doron Tikotzky Kantor Gutman Nass & Amit Gross Law Offices BSR 4, 7 Metsada Street Bnei Brak, Israel 5126112 Telephone: 972.3.6109100 | Oded Har-Even, Esq. 1633 Broadway New York, NY 10019 | Reut Alfiah, Adv. Sullivan & Worcester Israel (Har-Even & Co.) HaArba’a Towers - 28 North Tower, 35th Floor Tel-Aviv, Israel 6473925 Tel: +972.74.758.0480 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date hereof.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED FEBRUARY 22, 2022 |

Ordinary Shares

Beamr Imaging Ltd.

This is a firm commitment initial public offering of ordinary shares, par value NIS 0.01 per share, of Beamr Imaging Ltd. Prior to this offering, there has been no public market for our ordinary shares. We anticipate that the initial public offering price will be between $ and $ per ordinary share.

We have applied to list our ordinary shares on under the symbol “BMR.” It is a condition to the closing of this offering that our ordinary shares qualify for listing on a national securities exchange.

We are both an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and a “foreign private issuer,” as defined under the U.S. federal securities laws, and as such, are eligible for reduced public company reporting requirements.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 11.

Neither the Securities and Exchange Commission (or the SEC) nor any state or other foreign securities commission has approved nor disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price | $ | $ | ||||||

| Underwriting discounts and commissions (1) | $ | $ | ||||||

| Proceeds to us, before expenses | $ | $ | ||||||

| (1) | We have agreed to reimburse the underwriter for certain expenses and the underwriter will receive compensation in addition to underwriting discounts and commissions. See the section titled “Underwriting” beginning on page 119 of this prospectus for additional disclosure regarding underwriter compensation and offering expenses. |

We have granted a 45-day option to the representative of the underwriters to purchase up to additional ordinary shares solely to cover over-allotments, if any.

The underwriters expect to deliver the ordinary shares on or about , 2022.

ThinkEquity

The date of this prospectus is , 2022.

TABLE OF CONTENTS

i

You should rely only on the information contained in this prospectus or in any related free-writing prospectus. We and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectus prepared by us or on our behalf or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any information that others may give you. This prospectus is an offer to sell only the ordinary shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. We are not making an offer to sell these ordinary shares in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale. The information contained in this prospectus is current only as of the date of the front cover of the prospectus. Our business, financial condition, operating results and prospects may have changed since that date.

Persons who come into possession of this prospectus and any applicable free writing prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction. See “Underwriting” for additional information on these restrictions.

Until and including , 2022 (the 25th day after the date of this prospectus), all dealers effecting transactions in our ordinary shares, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

For investors outside of the United States: Neither we nor any of the underwriters have taken any action to permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

The terms “shekel,” “Israeli shekel” and “NIS” refer to New Israeli Shekels, the lawful currency of the State of Israel, and the terms “dollar,” “U.S. dollar” or “$” refer to United States dollars, the lawful currency of the United States of America. All references to “shares” in this prospectus refer to ordinary shares of Beamr Imaging Ltd., par value NIS 0.01 per share.

We are incorporated under Israeli law and under the rules of the U.S. Securities and Exchange Commission, or the SEC, we are currently eligible for treatment as a “foreign private issuer.” As a foreign private issuer, we will not be required to file periodic reports and financial statements with the SEC as frequently or as promptly as domestic registrants whose securities are registered under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

For purposes of this Registration Statement on Form F-1, “Company”, “Beamr”, “we” or “our” refers to Beamr Imaging Ltd. and its subsidiaries unless otherwise required by the context.

ii

INDUSTRY AND MARKET DATA

This prospectus includes statistical, market and industry data and forecasts which we obtained from publicly available information and independent industry publications and reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy or completeness of the information. Although we are responsible for all of the disclosures contained in this prospectus, including such statistical, market and industry data, we have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. In addition, while we believe the market opportunity information included in this prospectus is generally reliable and is based on reasonable assumptions, such data involves risks and uncertainties, including those discussed under the heading “Risk Factors.”

PRESENTATION OF FINANCIAL INFORMATION

Our financial statements were prepared in accordance with generally accepted accounting principles in the United States, or U.S. GAAP. We present our consolidated financial statements in U.S. dollars.

Our fiscal year ends on December 31 of each year. Our most recent fiscal year ended on December 31, 2021.

Certain figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

TRADEMARKS AND TRADE NAMES

We own or have rights to trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate name, logos and website names. Other trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners. Solely for convenience, some of the trademarks, service marks and trade names referred to in this prospectus are listed without the ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and trade names.

iii

GLOSSARY OF INDUSTRY TERMS AND CONCEPTS

The following is a list of certain industry terms and concepts that are used in this prospectus:

“API” means application programming interface, which is a software intermediary that allows two applications to talk to each other.

“ASIC” means an application-specific integrated circuit which is an integrated circuit chip customized for a particular use, rather than intended for general-purpose use.

“AVC” means advanced video coding, also referred to as H.264 or MPEG-4 Part 10, which is a video compression standard based on block-oriented, motion-compensated integer-discrete cosine transform coding.

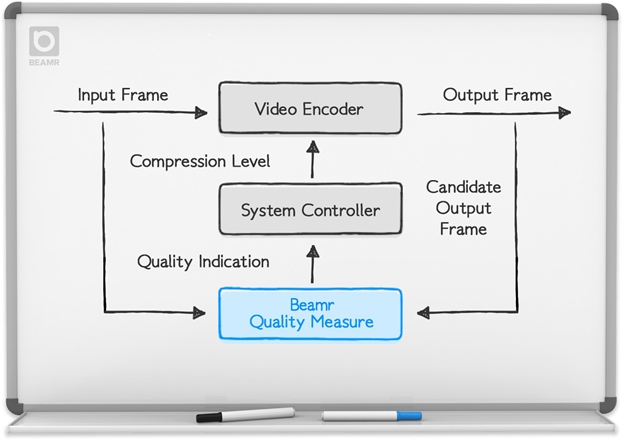

“BQM” means the proprietary Beamr quality measure which is an artificial intelligence trained computer vision processing architecture.

“CABR” means content adaptive bitrate which refers to our technology combined with our BQM that uses a flexible computer vision engine programmed with a high level algorithm description to achieve maximal compression of the video input while maintaining the input video resolution, format, and visual quality.

“Codec” means a device or computer program which encodes or decodes a data stream, bitstream or signal.

“CPU” means central processing unit which is the electronic circuitry in a computer that executes instructions.

“FPGA” means field-programmable gate array which is a hardware circuit that a user can program to carry out one or more logical operations.

“GPU” means graphics processing unit which is a specialized electronic circuit designed to rapidly manipulate and alter memory using parallel computations to accelerate the creation of images in a frame buffer intended for output to a display device.

“HDR” means high dynamic range imaging which is the set of techniques used to reproduce a greater range of luminosity than that which is possible with standard photographic or video graphic techniques.

“HEVC” means high efficiency video coding, also known as H.265 and MPEG-H Part 2, which is a video compression standard designed as part of the MPEG-H project as a successor to the widely used AVC standard.

“HLG” means hybrid log-gamma, an HDR format that uses the HLG transfer function, BT.2020 color primaries and a bit depth of 10-bits.

“JPEG” means joint photographic experts group which is a commonly used format for lossy compression for digital images, particularly for images produced by digital photography.

“ITU BT. 500” is an international standard for testing image quality.

“OTT” means over-the-top which is a means of providing television and film content over the internet at the request and to suit the requirements of the individual consumer. Services like Netflix, ViacomCBS and Wowza are video OTT services.

“PSNR” means peak signal to noise ratio which is a quality measure which represents the ratio between the highest power of an original signal and the power level of the distortion, on logarithmic scale.

“Silicon IP” is a reusable unit of logic, cell, or chip layout design and is also the intellectual property of one party. Silicon IP can be used as building blocks within application-specific integrated circuits (ASIC) chip designs or field programmable gate array (FPGA) logic designs.

“SSIM” means structural similarity index measure which is a technique to predict the perceived quality of digital images and videos.

“UGC” means user generated content which refers to any form of content, such as images, videos, text, and audio, that has been created or posted by users on online platforms.

“VBR” means variable bit rate which relates to the bitrate used in sound or video encoding.

iv

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before deciding to invest in our ordinary shares, you should read this entire prospectus carefully, including the sections of this prospectus entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus. Unless the context otherwise requires, references in this prospectus to the “company,” “Beamr,” “we,” “us,” “our” and other similar designations refer to Beamr Imaging Ltd.

Company Overview

We are an innovator of video encoding, transcoding and optimization solutions that enable high quality, performance, and unmatched bitrate efficiency for video and images. With our Emmy®-winning patented technology and award-winning services, we help our customers realize the potential of video encoding and media optimization to address business-critical challenges. Our customers include tier one over-the-top, or OTT, content distributors, video streaming platforms, and Hollywood studios who rely on our suite of products and expertise to reduce the cost and complexity associated with storing, distributing and monetizing video and images across devices.

At the heart of our patented optimization technology is the proprietary Beamr Quality Measure, or BQM, that is highly correlated with the human visual system. BQM is integrated into our Content Adaptive Bitrate, or CABR, system, which maximizes quality and remove visual redundancies resulting in a smaller file size. The BQM has excellent correlation with subjective results, confirmed in testing under ITU BT.500, an international standard for rigorous testing of image quality. The perceptual quality preservation of CABR has been repeatedly verified using large scale crowd-sourcing based testing sessions, as well as by industry leaders and studio “golden eyes”.

We currently license three core video and image compression products that help our customers use video and images to further their businesses in meaningful ways: (1) a suite of video compression software encoder solutions including the Beamr 4 encoder, Beamr 4X content adaptive encoder, Beamr 5 encoder and the Beamr 5X content adaptive encoder, (2) Beamr JPEGmini photo optimization software solutions for reducing JPEG file sizes, and (3) Beamr Silicon IP block, a hardware solution for integration into dedicated video encoding ASICs, GPUs, and application processors.

According to Fortune Business Insights, the global cloud video storage market is projected to grow from $7.3 billion in 2021 to $13.5 billion in 2025 and to $20.9 billion by 2028, at a compound annual growth rate, or CAGR, of 16% during the forecast period. The fact that video data is often required to be stored and accessed for long periods brings about the problem of lifetime costs associated with the efficient storing and managing of data. While the upfront cost might appear manageable over a period, the rise in data volumes results in the need to pay more in the future to keep the data in the cloud. In today’s environment, with deployment of media and entertainment, user generated content, enterprise video, agricultural technology, or AgTech, and industrial solutions, autonomous vehicles, surveillance and smart cities, the usage of video and its storage on public cloud platforms is expected to increase exponentially. For example, according to Grand View Research, the global enterprise video market size is expected to reach $33.72 billion by 2027, a CAGR of 11.6% from 2020 to 2027 and according to Valuates Reports, the global video surveillance storage market is expected to grow to $33.65 billion by 2026 from $12.21 billion in 2020 at a CAGR of 18.4% (with currently over one billion surveillance camera installed worldwide, according to IHS Markit). As such, we believe that there is an unmet need for video storage optimization solutions that significantly reduce the costs of long term storage.

Our current product line is mainly geared to the high end, high quality media customers and we count among our enterprise customers Netflix, Snapfish, ViacomCBS, Wowza, Microsoft, VMware, Genesys, Deluxe, Vimeo, Encoding.com, Citrix, Walmart, Photobox, Antix, Dalet, and other leading media companies using video and photo solutions. We currently derive a significant portion of our revenue from a limited number of our customers. For the years ended December 31, 2021 and December 31, 2020, our top ten customers (which in 2021 included Netflix, Snapfish, ViacomCBS and Wowza) in the aggregate accounted for approximately 62% of our revenues. Due to the high cost and complexity of deploying our existing software solutions and the long sales lead times, we have a made a strategic decision to focus our resources on the development and commercialization of our next-generation product, the Beamr HW-Accelerated Content Adaptive Encoding solution, a software-as-a-service, or SaaS, solution deployed in the cloud that is designed, based on our own internal testing, to be up to 10x more cost efficient than our existing software-based solutions, resulting in reduced media storage, processing and delivery costs.

1

Recent Developments

We are currently collaborating with NVIDIA, a multinational technology company and a leading developer of GPUs, with an annual revenue of $26.9 billion for the fiscal year 2022, to develop the world’s first GPU accelerated encoding solution that would allow fast and easy end-user deployment combined with superior video compression rates powered with our CABR rate control and BQM quality measure.

Our BQM quality measure software will execute directly on NVIDIA GPU cores and interact with the NVIDIA video accelerator encoder known as NVENC. NVIDIA NVENC is a high-quality, high-performance hardware video encoder that is built into most NVIDIA GPUs. NVENC offloads video encoding to hardware, and provides extreme performance for applications such as live video encoding, cloud gaming and cloud storage. NVIDIA GPUs with NVENC are available on all major cloud platforms.

We initiated the collaboration with NVIDIA on developing the Beamr HW-Accelerated Content Adaptive Encoding solution in January 2021. Our collaboration with NVIDIA is based on a mutual development program that is in advanced stages and that has been approved at senior levels at NVIDIA. While our collaboration has not been reduced to a written agreement, we believe that NVIDIA has a commercial incentive to complete the development and deploy the software update that enables the CABR powered NVENC because of the superior video compression rates of the NVENC when combined with our CABR solution. Since commencing the collaboration, we have successfully completed the following steps: (i) demonstrated proof of concept; (ii) jointly defined the required frame-level APIs that enable our CABR system to determine the optimal tradeoff between bitrate and quality; (iii) NVIDIA has approved the plan of record; (iv) NVIDIA completed delivery of the first version of the APIs; and (v) we verified implementation of the APIs that result in significant reduction of the bitrate of video streams.

With the completion of the foregoing steps, we expect the first version of the integrated video optimization engine to be ready by the end of the second quarter of 2022. Following this, we plan to build out the cloud based SaaS platform and test it with beta customers in the fourth quarter of 2022. Following that, we plan to commercially launch the first release of our cloud based Beamr HW-Accelerated Content Adaptive Encoding solution in the second quarter of 2023 and expect that following release, end-users of the solution will enjoy significant end-user storage cost savings. Using the Beamr HW-Accelerated Content Adaptive Encoding solution will potentially reduce their return on investment for storage optimization to approximately four months, compared to approximately two years with our existing software encoder solutions.

Our Business Strengths

We believe that the following business strengths differentiate us from our competitors and are key to our success:

| ● | We are a recognized video compression market leader. In January 2021 we were recognized with an Emmy® Award for the “Development of Open Perceptual Metrics for Video Encoding Optimization” and in November 2021 we won the Seagate Lyve Innovator of the Year competition. We have over 50 patents, and count among our customers leading content distributors including Netflix, ViacomCBS and Wowza Media Systems. |

| ● | Strong value proposition. We believe our existing video compression encoding solutions are among the fastest software video encoders on the market and provide a lower total cost-of-ownership to our customers by reducing media storage, processing and delivery costs. Upon release of our next generation SaaS solution, the Beamr HW-Accelerated Content Adaptive Encoding, we believe that CABR performance will, based on our own internal testing, be up to 10x more cost efficient than our existing software-based solutions, resulting in even greater reduced media storage, processing and delivery costs. |

| ● | Partnering with leading technology giants to enable the adoption of our video compression solutions. We offer industry proven video optimization solutions and are collaborating in product development with industry giants such as NVIDIA and Allegro DVT that provide incremental improvements to existing products without having to reinvent the wheel. |

| ● | Core technology is powered by proprietary content-adaptive quality measure. Our CABR technology, built over our proprietary BQM, achieves maximal compression of the video input while maintaining the input video resolution, format, and visual quality. The CABR powers our existing video compression encoders as well as our next generation Beamr HW-Accelerated Content Adaptive Encoding service that is currently in development. The BQM has excellent correlation with subjective results, confirmed in testing under ITU BT.500, an international standard for rigorous testing of image quality. The perceptual quality preservation of CABR has been repeatedly verified using large scale crowd-sourcing based testing sessions, as well as by industry leaders and studio “golden eyes”. |

| ● | Our management team has experience building and scaling software companies. Our visionary and experienced management team with best-in-class research and development, or R&D, capabilities and in-depth industry backgrounds and experiences has been leading us since our inception. Members of our senior leadership team have held senior product, business and technology roles at companies such as Scitex, Kodak, Comverse, IBM and Intel. Sharon Carmel, our founder and Chief Executive Officer is a serial entrepreneur with a proven track record in the software space having co-founded Emblaze (LON: BLZ) which developed the Internet’s first vector-based graphics player, preceding Macromedia Flash, and BeInSync, which developed peer-to-peer, or P2P, synchronization and online backup technologies, and was acquired in 2008 by Phoenix Technologies (NASDAQ: PTEC). |

| ● | Ongoing customer-driven development. Through our account managers, support teams, product development teams and regular outreach from senior leadership, we solicit and capture feedback from our customer base for incorporation into ongoing enhancements to our solutions. We regularly provide our customers with enhancements to our products. |

2

Our Growth Strategies

We intend to pursue the following growth strategies:

| ● | Complete development and gain broad market acceptance for our SaaS solution. We are collaborating with NVIDIA in the development of our next generation product, the Beamr HW-Accelerated Content Adaptive Encoding. Upon release, we believe it will provide a simple, easily deployable, fast, scalable, low cost and best-in-class video optimization solution resulting in reduced media storage, processing, and delivery costs. We plan to make our next generation SaaS solution available through public cloud services such as AWS, Azure, and Google Cloud Platform, or GCP, allowing us to potentially access and acquire large numbers of new customers with relatively low sales investment. |

| ● | Expand business growth through collaborations and partnerships with industry-leading solution providers in new verticals. We are currently collaborating with NVIDIA and Allegro DVT and plan to expand our collaborations to develop further market-leading products. We believe that our hardware-accelerated CABR powered video optimization solutions have broad application to a wide array of verticals including UGC, public safety, smart cities, education, enterprise, autonomous vehicles, government and media and entertainment. |

| ● | Continue to innovate and develop new products and features. We continue to invest in research and development to enhance our product offerings and release new products and features. We maintain close relationships with our customer base who provide us with frequent and real-time feedback, which we leverage to rapidly update and further improve our products. |

| ● | Selectively Pursue Acquisitions and Strategic Investments. While we have not identified any specific targets, we plan to selectively pursue acquisitions and strategic investments in businesses and technologies that strengthen our products, enhance our capabilities and/or expand our market presence in our core vertical markets. In 2016, we acquired Vanguard Video, a leading developer of software video encoders. |

Summary of Risks Associated with our Business

Our business is subject to a number of risks of which you should be aware before making a decision to invest in our ordinary shares. You should carefully consider all the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth in the sections titled “Risk Factors” before deciding whether to invest in our ordinary shares. Among these important risks are, but not limited to, the following:

Risks Related to Our Business and Industry

| ● | We have a history of losses and may not be able to achieve or maintain profitability. |

| ● | We will need to raise additional capital to meet our business requirements in the future, and such capital raising may be costly or difficult to obtain and could dilute our shareholders’ ownership interests. |

| ● | To support our business growth we are expanding our product offering to include the Beamr HW-Accelerated Content Adaptive Encoding solution, a new SaaS solution, the development and commercialization of which may not be successful. This change in our products and services also makes it difficult to evaluate our current business and future prospects and may increase the risk that we will not be successful. |

3

| ● | We may not be successful in establishing and maintaining strategic partnerships, which could adversely affect our ability to develop and commercialize our SaaS solution and other future products. |

| ● | Our future growth depends in part upon the successful deployment of the Beamr HW-Accelerated Content Adaptive Encoding solution in the cloud. |

| ● | The failure to effectively develop and expand our marketing and sales capabilities could harm our ability to increase our customer base and achieve broader market acceptance of our offerings. |

| ● | Our business and operations have experienced growth, and if we do not appropriately manage this growth and any future growth, or if we are unable to improve our systems, processes and controls, our business, financial condition, results of operations and prospects will be adversely affected. |

| ● | The ongoing COVID-19 pandemic could adversely affect our business, financial condition and results of operations. |

| ● | The markets for our offerings are new and evolving and may develop more slowly or differently than we expect. Our future success depends on the growth and expansion of these markets and our ability to adapt and respond effectively to evolving market conditions. |

| ● | Our results of operations are likely to fluctuate from quarter to quarter and year to year, which could adversely affect the trading price of our ordinary shares. |

| ● | The loss of one or more of our significant customers, or any other reduction in the amount of revenue we derive from any such customer, would adversely affect our business, financial condition, results of operations and growth prospects. |

| ● | If we are not able to keep pace with technological and competitive developments and develop or otherwise introduce new products and solutions and enhancements to our existing offerings, our offerings may become less marketable, less competitive or obsolete, and our business, financial condition and results of operations may be adversely affected. |

| ● | If we are not able to maintain and expand our relationships with third-party technology partners to integrate our offerings with their products and solutions, our business, financial condition and results of operations may be adversely affected. |

| ● | We may not be able to compete successfully against current and future competitors, some of whom have greater financial, technical, and other resources than we do. If we do not compete successfully, our business, financial condition and results of operations could be harmed. |

| ● | We depend on our management team and other key employees, and the loss of one or more of these employees or an inability to attract and retain highly skilled employees could adversely affect our business. |

| ● | Our international operations and expansion expose us to risk. |

| ● | Currency exchange rate fluctuations affect our results of operations, as reported in our financial statements. |

Risks Related to Information Technology, Intellectual Property and Data Security and Privacy

| ● | A real or perceived bug, defect, security vulnerability, error, or other performance failure involving our products and services could cause us to lose revenue, damage our reputation, and expose us to liability. |

| ● | If we or our third-party service providers experience a security breach, data loss or other compromise, including if unauthorized parties obtain access to our customers’ data, our reputation may be harmed, demand for our products and services may be reduced, and we may incur significant liabilities. |

| ● | Insufficient investment in, or interruptions or performance problems associated with, our technology and infrastructure, including in connection with our Beamr HW-Accelerated Content Adaptive Encoding solution which is to be deployed on a public cloud infrastructure, and our reliance on technologies from third parties, may adversely affect our business operations and financial results. |

| ● | Failure to protect our proprietary technology, or to obtain, maintain, protect and enforce sufficiently broad intellectual property rights therein, could substantially harm our business, financial condition and results of operations. |

| ● | We could incur substantial costs and otherwise suffer harm as a result of any claim of infringement, misappropriation or other violation of another party’s intellectual property or proprietary rights. |

| ● | We could incur substantial costs and otherwise suffer harm as a result of patent royalty claims, in particular patents related to the implementation of image and video standards. |

| ● | We rely on software and services licensed from other parties. The loss of software or services from third parties could increase our costs and limit the features available in our products and services. |

4

Risks Related to Other Legal, Regulatory and Tax Matters

| ● | Changes in laws and regulations related to the internet or video standards, changes in the internet infrastructure itself, or increases in the cost of internet connectivity and network access may diminish the demand for our offerings and could harm our business. |

| ● | Changes in U.S. and foreign tax laws could have a material adverse effect on our business, cash flow, results of operations or financial conditions. |

| ● | Our corporate structure and intercompany arrangements are subject to the tax laws of various jurisdictions, and we could be obligated to pay additional taxes, which would adversely affect our results of operations. |

Risks Related to Our Operations in Israel and Russia

| ● | Political, economic and military conditions in Israel could materially and adversely affect our business. |

| ● | Political or other risks in Russia could adversely affect our business. |

| ● | Economic and other risks in Russia could adversely affect our business. |

Risks Related to this Offering and Ownership of our Ordinary Shares

| ● | The market price for our ordinary shares may be volatile or may decline regardless of our operating performance and you may not be able to resell your shares at or above the initial public offering price. |

| ● | Our shareholders may not be able to resell their shares at or above the initial public offering price. |

| ● | No public market for our ordinary shares currently exists, and an active public trading market may not develop or be sustained following this offering. |

| ● | Our principal shareholders will continue to have significant influence over us. |

| ● | You will experience immediate and substantial dilution in the net tangible book value of the ordinary shares you purchase in this offering and may experience further dilution in the future. |

| ● | Your ownership and voting power may be diluted by the issuance of additional shares of our ordinary shares in connection with financings, acquisitions, investments, our equity incentive plans or otherwise. |

● | Our management team has limited experience managing a public company, and the requirements of being a public company may strain our resources, divert management’s attention, and affect our ability to attract and retain qualified board members. | |

| ● | We will incur significant increased costs as a result of operating as a public company, and our management will be required to devote substantial time to new compliance initiatives. | |

| ● | We have identified a material weakness in our internal control over financial reporting, and we may not be able to successfully implement remedial measures. |

Corporate Information

We are an Israeli corporation based in Herzeliya, Israel. We were incorporated in Israel on October 1, 2009. Our principal executive offices are located at 10 HaManofim Street, Herzeliya, 4672561, Israel. Our telephone number is +1-888-520-8735. Our website address is beamr.com. The information contained on our website and available through our website is not incorporated by reference into and should not be considered a part of this prospectus, and the reference to our website in this prospectus is an inactive textual reference only.

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. In particular, as an emerging growth company, we:

| ● | may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations disclosure in our initial registration statement; |

5

| ● | are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives, which is commonly referred to as “compensation discussion and analysis; |

| ● | are not required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on frequency” and “say-on-golden-parachute” votes); |

| ● | will not be required to conduct an evaluation of our internal control over financial reporting; |

| ● | are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and chief executive officer pay ratio disclosure; and |

| ● | are exempt from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002. |

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company upon the earlier to occur of: (1) the last day of the fiscal year in which we have total annual gross revenues of $1.07 billion or more; (2) the date on which we have issued more than $1.0 billion in nonconvertible debt during the previous three years; or (3) the date on which we are deemed to be a large accelerated filer under the rules of the SEC. We may choose to take advantage of some but not all of these reduced burdens, and therefore the information that we provide holders of our ordinary shares may be different than the information you might receive from other public companies in which you hold equity. In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards applicable to public companies. We have elected to opt out of taking advantage of the extended transition period to comply with new or revised accounting standards.

Foreign Private Issuer

Upon consummation of this offering, we will report under the Exchange Act, as amended, or the Exchange Act, as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we continue to qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| ● | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations with respect to a security registered under the Exchange Act; |

| ● | the sections of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| ● | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial statements and other specified information, and current reports on Form 8-K upon the occurrence of specified significant events. |

We will be required to file an annual report on Form 20-F within four months of the end of each fiscal year. In addition, we intend to publish our results on a quarterly basis through press releases, distributed pursuant to the rules and regulations of the Nasdaq. Press releases relating to financial results and material events will also be furnished to the SEC on Form 6-K. However, the information we are required to file with or furnish to the SEC will be less extensive and less timely compared to that required to be filed with the SEC by U.S. domestic issuers. As a result, you may not be afforded the same protections or information, which would be made available to you, were you investing in a U.S. domestic issuer.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of our executive officers or directors are U.S. citizens or residents; (ii) more than 50% of our assets are located in the United States; or (iii) our business is administered principally in the United States.

Both foreign private issuers and emerging growth companies are also exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company, but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are neither an emerging growth company nor a foreign private issuer.

6

| Ordinary shares offered by us | ordinary shares | |

| Ordinary shares to be issued and outstanding after this offering | ordinary shares, or ordinary shares if the underwriter exercises in full the over-allotment option to purchase additional ordinary shares. | |

| Over-allotment option | We have granted the underwriter an option for a period of up to 45 days to purchase, at the public offering price, up to additional ordinary shares, less underwriting discounts and commissions, to cover over-allotments, if any. | |

| Use of proceeds | We expect to receive approximately $ million in net proceeds from the sale of ordinary shares offered by us in this offering (approximately $ million if the underwriter exercises its over-allotment option in full), based upon an assumed public offering price of $ per ordinary share, which is the midpoint of the price range set forth on the cover page of this prospectus, and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the net proceeds from this offering, for our research and development efforts, sales and marketing activities, as well as general and administrative corporate purposes, including working capital and capital expenditures. See “Use of Proceeds” for more information about the intended use of proceeds from this offering.

The amounts and schedule of our actual expenditures will depend on multiple factors. As a result, our management will have broad discretion in the application of the net proceeds of this offering. | |

| Risk factors | Investing in our securities involves a high degree of risk. You should read the “Risk Factors” section starting on page 11 of this prospectus for a discussion of factors to consider carefully before deciding to invest in the ordinary shares. | |

| Proposed symbol: | We have applied to list the ordinary shares on the under the symbol “BMR”. |

7

The number of ordinary shares that will be outstanding after this offering is which is based on ordinary shares outstanding as of , 2022 after giving effect to a reverse share split effected on , 2022 at a ratio of 1-for- and the immediate conversion immediately prior to the closing of this offering of (i) convertible ordinary shares and convertible preferred shares on a one (1) for one (1) basis into ordinary shares, and (ii) ordinary shares issuable upon the automatic conversion of advance investment agreements at a conversion price equal to $ , the midpoint of the price range set forth on the cover page of this prospectus, and excludes:

| ● | ordinary shares issuable upon the exercise of warrants outstanding as of such date, at an exercise price of $ , all of which vested as of such date; |

| ● | ordinary shares issuable upon the exercise of options to directors, employees and consultants under our incentive option plans outstanding as of such date, at a weighted average exercise price of $ , of which were vested as of such date; |

| ● | ordinary shares reserved for future issuance under our incentive option plans; and |

| ● | ordinary shares issuable upon exercise of the warrants to purchase our ordinary shares at $ per share to be issued to the representative of the underwriter. |

Unless otherwise indicated, all information in this prospectus assumes or gives effect to:

| ● | no exercise of the warrants or options, as described above; |

| ● | no exercise by the underwriter of its option to purchase up to an additional ordinary shares from us in this offering to cover over-allotments, if any; |

| ● | no exercise of the representative’s warrants to be issued upon consummation of this offering; |

● | a reverse share split effected on , 2022 at a ratio of 1-for- ; | |

| ● | automatic conversion of advance investment agreements at a conversion price equal to $ , the midpoint of the price range on the cover page of this prospectus; and |

| ● | that the assumed offering price is $ which is the midpoint of the range of the estimated offering price described on the cover page of this prospectus; |

See “Description of Share Capital” for additional information.

8

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table summarizes our financial data. We have derived the following statements of operations and comprehensive loss data for the years ended December 31, 2021 and 2020 from our audited consolidated financial statements included elsewhere in this prospectus. Such financial statements have been prepared in accordance with U.S. GAAP. Our historical results are not necessarily indicative of the results that may be expected in the future. The following summary financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

| (U.S. dollars in thousands, except share and per share data) | Year Ended December 31, | |||||||

| 2021 | 2020 | |||||||

| Revenues | $ | 3,300 | $ | 3,176 | ||||

| Cost of revenues | $ | (90 | ) | $ | (94 | ) | ||

| Gross profit | $ | 3,210 | $ | 3,082 | ||||

| Research and development expenses | $ | (2,032 | ) | $ | (2,727 | ) | ||

| Sales and marketing expenses | $ | (959 | ) | $ | (1,371 | ) | ||

| General and administrative expenses | $ | (773 | ) | $ | (671 | ) | ||

| Other income | $ | 129 | $ | 20 | ||||

| Operating loss | $ | (425 | ) | $ | (1,667 | ) | ||

| Financing expenses, net | $ | (475 | ) | $ | (697 | ) | ||

| Taxes on income | $ | (52 | ) | $ | (95 | ) | ||

| Net loss and comprehensive loss | $ | (952 | ) | $ | (2,459 | ) | ||

| Basic and diluted loss per share | $ | (0.07 | ) | $ | (0.19 | ) | ||

| Weighted average number of shares outstanding used in computing basic and diluted loss per share | 12,893,800 | 12,874,066 | ||||||

| (U.S. dollars in thousands, except share and per share data) | As of December 31, 2021 | |||||||||||

| Actual | Pro Forma (1) | Pro Forma As Adjusted (2) | ||||||||||

| Balance Sheet Data: | ||||||||||||

| Cash and cash equivalents | $ | 1,028 | $ | $ | ||||||||

| Trade receivable | $ | 891 | $ | $ | ||||||||

| Other current assets | $ | 66 | $ | $ | ||||||||

| Total current assets | $ | 1,985 | $ | $ | ||||||||

| Total non-current assets | $ | 4,702 | $ | $ | ||||||||

| Total current liabilities | $ | 1,413 | $ | $ | ||||||||

| Total non-current liabilities | $ | 4,820 | $ | $ | ||||||||

| Accumulated deficit | $ | 29,721 | $ | $ | ||||||||

| Total shareholders’ equity | $ | 454 | $ | $ | ||||||||

9

| (1) | Pro Forma data gives effect to the following events as if each event had occurred on December 31, 2021: the conversion of all of our outstanding convertible ordinary shares and convertible preferred shares as of December 31, 2021 into an aggregate of ordinary shares and the automatic conversion of advance investment agreements into ordinary shares at a conversion price equal to $ , the midpoint of the price range set forth on the cover page of this prospectus, as if such conversions had occurred on December 31, 2021. |

| (2) | Pro Forma As Adjusted data gives additional effect to the sale of ordinary shares in this offering at an initial public offering price of $ per ordinary share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, as if the sale had occurred on December 31, 2021. |

The adjusted information discussed above is illustrative only and will be adjusted based on the actual initial public offering price and other terms of our initial public offering determined at pricing. Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, would increase (decrease) the pro forma as adjusted amount of each of cash, cash equivalents and short-term deposits, total assets and shareholders’ equity (deficiency) by $ million, assuming that the number of ordinary shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase (decrease) of 1.0 million shares in the number of ordinary shares offered by us at the assumed initial public offering price would increase (decrease) each of cash, cash equivalents and short-term deposits, total assets and shareholders’ equity (deficiency) by $ million.

10

Investing in our ordinary shares involves a high degree of risk. You should carefully consider the risks and uncertainties described below, in addition to the other information set forth in this prospectus, including the consolidated financial statements and the related notes included elsewhere in this prospectus, before purchasing our ordinary shares. If any of the following risks actually occurs, our business, financial condition, cash flows and results of operations could be negatively impacted. In that case, the trading price of our ordinary shares would likely decline and you might lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this prospectus. See “Special Note Regarding Forward-Looking Statements.”

Risks Related to Our Business and Industry

We have a history of losses and may not be able to achieve or maintain profitability.

We have incurred losses in each year since our incorporation in 2009, including net losses of $0.9 million and $2.4 million in the years ended December 31, 2021 and 2020, respectively. As a result, we had an accumulated deficit of $29.7 million as of December 31, 2021. We intend to continue to expend substantial financial and other resources on, among other things:

| ● | extending our product leadership by investing in our video storage optimization products and services, and other recently introduced offerings, as well as by developing new products, expanding our platform into additional industries and enhancing our offerings with additional core capabilities and technologies; |

| ● | sales and marketing expenses by hiring customer success personnel and investment in online marketing to attract new customers; |

| ● | augmenting our current offerings by increasing the breadth of our technology partnerships and exploring potential transactions that may enhance our capabilities or increase the scope of our technology footprint; and |

| ● | general administration, including legal, accounting, and other expenses related to our transition to being a new public company. |

These efforts may prove more expensive than we currently anticipate, and we may not succeed in increasing our revenue sufficiently, or at all, to offset these higher expenses. In addition, to the extent we are successful in increasing our customer base, we may also incur increased losses because of unforeseen costs. If our revenue does not increase to offset our operating expenses, we will not achieve profitability in future periods and our net losses may increase. Revenue growth may slow or revenue may decline for a number of possible reasons, many of which are beyond our control, including inability to penetrate new markets, slowing demand for our products and services, increasing competition, or any of the other factors discussed in this Risk Factors section. Any failure to increase our revenue as we grow our business could prevent us from achieving profitability at all or on a consistent basis, which would cause our business, financial condition and results of operations to suffer and the market price of our ordinary shares to decline.

11

We will need to raise additional capital to meet our business requirements in the future, and such capital raising may be costly or difficult to obtain and could dilute our shareholders’ ownership interests.

In order for us to pursue our business objectives, we will need to raise additional capital, which additional capital may not be available on reasonable terms or at all. Any additional capital raised through the sale of equity or equity-backed securities may dilute our shareholders’ ownership percentages and could also result in a decrease in the market value of our equity securities. The terms of any securities issued by us in future capital transactions may be more favorable to new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect on the holders of any of our securities then outstanding. In addition, we may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we issue, such as convertible notes and warrants, which may adversely impact our financial condition.

Our indebtedness could adversely affect our ability to raise additional capital to fund operations, limit our ability to react to changes in the economy or our industry and prevent us from meeting our financial obligations.

We currently have an outstanding loan with the Silicon Valley Bank, or SVB, from February 2017, in the original principal amount of $3.0 million which is secured by all our assets, and on February 17, 2022 entered into an additional loan agreement with SVB providing for acredit line against accounts receivables, as further described in “Management’s Discussion & Analysis—Liqudity and Resources—Loan and Security Agreement” which will be secured by all our assets. As of February 22, 2022, the outstanding balance of loans to SVB is approximately $0.3 million. If we cannot generate sufficient cash flow from operations to service our debt, we may need to further refinance our debt, dispose of assets or issue equity to obtain necessary funds. We do not know whether we will be able to do any of this on a timely basis, on terms satisfactory to us, or at all. Our indebtedness could have important consequences, including:

| ● | our ability to obtain additional debt or equity financing for working capital, capital expenditures, debt service requirements, acquisitions and general corporate or other purposes may be limited; |

| ● | a portion of our cash flows from operations will be dedicated to the payment of principal and interest on the indebtedness and will not be available for other purposes, including operations, capital expenditures and future business opportunities; |

| ● | our ability to adjust to changing market conditions may be limited and may place us at a competitive disadvantage compared to less-leveraged competitors; and |

| ● | we may be vulnerable during a downturn in general economic conditions or in our business, or may be unable to carry on capital spending that is important to our growth. |

To support our business growth we are expanding our product offering to include the Beamr HW-Accelerated Content Adaptive Encoding solution, a new SaaS solution, the development and commercialization of which may not be successful. This change in our products and services also makes it difficult to evaluate our current business and future prospects and may increase the risk that we will not be successful.

Our current product line is mainly geared to the high end, high quality media customers and we count among our customers Netflix, ViacomCBS, Snapfish, Wowza and other leading media companies using video and photo solutions. This product line involves high cost and complexity of deploying our existing software solutions and the long sales lead times.

12

In order to grow our business, in 2019, we resolved to build a lower cost offering which requires hardware acceleration and started to integrate with hardware encoders. In the first quarter of 2020, we introduced our first proof of concept results with Intel’s GPU. Then, we made a strategic decision to focus our resources on the development and commercialization of our next-generation product, the Beamr HW-Accelerated Content Adaptive Encoding solution, a SaaS solution that is designed, based on our own internal testing, to provide up to 10x cost-effective video optimization than existing solutions to an industry agnostic target market. This change in strategy and these efforts may prove more expensive than we currently anticipate, or may require longer development and deployment times, and we may not succeed in fully developing and implementing our SaaS solution sufficiently, or at all.

We may not be successful in establishing and maintaining strategic partnerships, which could adversely affect our ability to develop and commercialize our SaaS solution and other future products.

To successfully develop and commercialize our Beamr HW-Accelerated Content Adaptive Encoding solution and other product offerings, we will need substantial financial resources as well as expertise and physical resources and systems. We may elect to develop some or all of these physical resources and systems and expertise ourselves, or we may seek to collaborate with another company or companies that can provide some or all of such physical resources and systems as well as financial resources and expertise. For example, we are collaborating with NVIDIA, a leading developer of GPUs, in the development of our next generation product, the Beamr HW-Accelerated Content Adaptive Encoding solution, and we are collaborating with Allegro DVT in the development the world’s first content-adaptive silicon IP encoder.

We face significant competition in seeking appropriate partners for our products, and the negotiation process is time-consuming and complex. In order for us to successfully develop and commercialize our products with a strategic partner, potential partners must view our products as economically valuable in markets they determine to be attractive in light of the terms that we are seeking and other available products for licensing by other companies. Even if we are successful in our efforts to establish strategic partnerships, the terms that we agree upon may not be favorable to us, and we may not be able to maintain such strategic partnerships if, for example, development of a product is delayed or sales of a product are disappointing. Any delay in entering into strategic partnership agreements related to our products could delay the development and commercialization of our products and reduce their competitiveness even if they reach the market. If we fail to establish and maintain strategic partnerships related to our products, we will bear all of the risk and costs related to the development and commercialization of our products, and we will need to seek additional financing, hire additional employees and otherwise develop expertise which we do not have and for which we have not budgeted.

The risks in a strategic partnership include the following:

| ● | the strategic partner may not apply the expected financial resources, efforts, or required expertise in developing the physical resources and systems necessary to successfully develop and commercialize a product; |

| ● | the strategic partner may not invest in the development of a sales and marketing force and the related infrastructure at levels that ensure that sales of the products reach their full potential; |

| ● | we may be required to undertake the expenditure of substantial operational, financial, and management resources; |

13

| ● | we may be required to issue equity securities that would dilute our existing shareholders’ percentage ownership; |

| ● | we may be required to assume substantial actual or contingent liabilities; |

| ● | strategic partners could decide to withdraw a development program or a collaboration, or move forward with a competing product developed either independently or in collaboration with others, including our competitors; |

| ● | disputes may arise between us and a strategic partner that delay the development or commercialization or adversely affect the sales or profitability of the product; or |

| ● | the strategic partner may independently develop, or develop with third parties, products that could compete with our products. |

In addition, a strategic partner for one or more of our products may have the right to terminate the collaboration at its discretion. For example, our collaboration with NVIDIA is based on a mutual development program of our Beamr HW-Accelerated Content Adaptive Encoding solution that is in advanced stages and that has been approved at senior levels at NVIDIA however our collaboration has not been reduced to a written agreement and we have not signed any agreement with NVIDIA, which exposes us to the risk of termination of our collaboration at any time for any or no reason. Any early termination of our collaboration in a manner adverse to us could have a material adverse effect on our liquidity, financial condition and results of operations. Any termination may require us to seek a new strategic partner or partners, which we may not be able to do on a timely basis, if at all, or require us to delay or scale back our development and commercialization efforts. The occurrence of any of these events could adversely affect the development and commercialization of our products or product candidates and materially harm our business and share price by delaying the development of our products, and the sale of any products, by slowing the growth of such sales, by reducing the profitability of the product and/or by adversely affecting the reputation of the product.

Further, a strategic partner may breach an agreement with us, and we may not be able to adequately protect our rights under these agreements. Furthermore, a strategic partner will likely negotiate for certain rights to control decisions regarding the development and commercialization of our products and may not conduct those activities in the same manner as we would do so.

Our future growth depends in part upon the successful deployment of the Beamr HW-Accelerated Content Adaptive Encoding solution in the cloud.

Our current business is based on software licensing and is not capital intensive, usually paid for by our customers upfront on an annual basis. We are planning to expand our product offering with the Beamr HW-Accelerated Content Adaptive Encoding solution, a SaaS solution which is to be deployed on cloud platforms (e.g., AWS, Azure, and GCP) and will be volume-based solutions. Future payments that we will make to cloud platforms and payments we will receive from customers are hard to predict and will be based on different terms and conditions. We may also be at risk if there will be gaps between account receivables and account payables. In addition, attracting new customers to our SaaS offering may involve evaluation processes that prospects may not be willing to cover before experiencing satisfying results with our products and services, while we will continue to accrue cloud platform service costs.

We expect our SaaS operation will be based on spreads in which we first pay for computing platforms (e.g. GPU instances), and then we sell storage/bandwidth savings (e.g., AWS S3, CloudFront). Any future margins may be at risk if computing platform costs increase and storage/bandwidth costs decrease. In addition, our ability to grow and maintain customer base and revenue also depends on achieving significant storage/bitrate savings, translating into superior total cost of ownership and return on investment for our customers. While we believe that the Beamr HW-Accelerated Content Adaptive Encoding solution will result in significant savings for our customers, there is a risk that our savings for the customers might not be significant.

14

In addition, the Beamr HW-Accelerated Content Adaptive Encoding solution is based on hardware acceleration of our core technology. While we successfully tested our technology and our technology and software libraries have matured, the new implementation of the Beamr HW-Accelerated Content Adaptive Encoding has only been tested in limited proof of concept testing, and there is a technical risk when we transition to ultra-high volume production and utilizing platforms that were not tested.

There is a risk that we may not win customers that moved their long-tail assets to cold, or off-line storage services (e.g., Amazon S3 Glacier) for reduced storage costs. In addition, improvements in general encoding solutions that are based on “content-adaptive” or “content-aware” technologies may reduce the savings which our products and services can provide. Moreover, if the public cloud data services that utilize NVIDIA GPUs (e.g., Amazon, GCP, Azure) do not adopt, or take significant time to adopt, the Nvidia driver and firmware with our new capabilities, that could adversely affect our market penetration and future revenue growth.

We believe any future revenue growth will depend on a number of factors, including, among other things, our ability to:

| ● | continually enhance and improve our products and services, including the features, integrations and capabilities we offer, and develop or otherwise introduce new products and solutions; |

| ● | attract new customers and maintain our relationships with, and increase revenue from, our existing customers; |

| ● | provide excellent customer and end user experiences; |

| ● | maintain the security and reliability of our products and services; |

| ● | introduce and grow adoption of our offerings in new markets outside the United States; |

| ● | hire, integrate, train and retain skilled personnel; |

| ● | adequately expand our sales and marketing force and distribution channels; |

| ● | obtain, maintain, protect and enforce intellectual property protection for our platform and technologies; |

| ● | expand into new technologies, industries and use cases; |

| ● | expand and maintain our partner ecosystem; |

| ● | comply with existing and new applicable laws and regulations, including those related to data privacy and security; |

| ● | price our offerings effectively and determine appropriate contract terms; |

| ● | determine the most appropriate investments for our limited resources; |

| ● | successfully compete against established companies and new market entrants; and |

| ● | increase awareness of our brand on a global basis. |

If we are unable to accomplish any of these objectives, any revenue growth will be impaired. Many factors may contribute to declines in growth rate, including increased competition, slowing demand for our offerings, a failure by us to continue capitalizing on growth opportunities, the maturation of our business, and global economic downturns, among others. If our growth rate declines as a result of this or any of the other factors described above, investors’ perceptions of our business and the market price of our ordinary shares could be adversely affected.

Our ability to forecast our future results of operations is subject to a number of uncertainties, including our ability to effectively plan for and model future growth. We have encountered in the past, and may encounter in the future, risks and uncertainties frequently experienced by growing companies in rapidly changing industries that may prevent us from achieving the objectives outlined herein. If we fail to achieve the necessary level of efficiency in our organization as it grows, or if we are not able to accurately forecast future growth, our business would be adversely affected. Moreover, if the assumptions that we use to plan our business are incorrect or change in reaction to changes in our market, or if we are unable to maintain consistent revenue or revenue growth, the market price of our ordinary shares could be volatile, and it may be difficult to achieve and maintain profitability.

15

The failure to effectively develop and expand our marketing and sales capabilities could harm our ability to increase our customer base and achieve broader market acceptance of our offerings.

Our ability to increase our customer base and achieve broader market acceptance of our products and services and in particular the Beamr HW-Accelerated Content Adaptive Encoding solution will depend to a significant extent on our ability to expand our sales and marketing operations. As part of our growth strategy, we plan to dedicate significant resources to our marketing programs. All of these efforts will require us to invest significant financial and other resources. Our business will be harmed if our efforts do not generate a correspondingly significant increase in revenue.

Our business and operations have experienced growth, and if we do not appropriately manage this growth and any future growth, or if we are unable to improve our systems, processes and controls, our business, financial condition, results of operations and prospects will be adversely affected.

We plan to make continued investments in the growth and expansion of our business and customer base including in particular substantial investment of resources in the development and commercialization of our next-generation product, the Beamr HW-Accelerated Content Adaptive Encoding solution. The growth and expansion of our business places a continuous and significant strain on our management, operational, financial and other resources. In addition, as customers adopt our offerings for an increasing number of use cases, we have had to support more complex commercial relationships. In order to manage our growth effectively, we must continue to improve and expand our information technology and financial infrastructure, our security and compliance requirements, our operating and administrative systems, our customer service and support capabilities, our relationships with various partners and other third parties, and our ability to manage headcount and processes in an efficient manner.

We may not be able to sustain the pace of improvements to our products and services, or the development and introduction of new offerings, successfully, or implement systems, processes, and controls in an efficient or timely manner or in a manner that does not negatively affect our results of operations. Our failure to improve our systems, processes, and controls, or their failure to operate in the intended manner, may result in our inability to manage the growth of our business and to forecast our revenue, expenses, and earnings accurately, or to prevent losses.

As we continue to expand our business and operate as a public company, we may find it difficult to maintain our corporate culture while managing our employee growth. Any failure to manage our anticipated growth and related organizational changes in a manner that preserves our culture could negatively impact future growth and achievement of our business objectives. Additionally, our productivity and the quality of our offerings may be adversely affected if we do not integrate and train our new employees quickly and effectively. Failure to manage our growth to date and any future growth effectively could result in increased costs, negatively affect customer satisfaction and adversely affect our business, financial condition, results of operations and growth prospects.

The ongoing COVID-19 pandemic could adversely affect our business, financial condition and results of operations.

In December 2019, an outbreak of a novel coronavirus disease, or COVID-19, was first identified and began to spread across the globe and, in March 2020, the World Health Organization declared it a pandemic. This contagious disease has spread across the globe and is impacting economic activity and financial markets worldwide, including countries in which our end users and customers are located, as well as the United States and Israel where we have business operations. As a result of the COVID-19 pandemic, government authorities around the world have ordered schools and businesses to close, imposed restrictions on non-essential activities and required people to remain at home while imposing significant restrictions on traveling and social gatherings.

In light of the uncertain and rapidly evolving situation relating to the spread of COVID-19, as well as government mandates, we took precautionary measures intended to minimize the risk of the virus to our employees, our customers, our partners and the communities in which we operate, which could negatively impact our business. In the first quarter of 2020, we temporarily closed all of our offices and enabled our entire workforce to work remotely. We also suspended all travel worldwide for our employees for non-essential business. While we subsequently reopened our offices, most of our employees continued to work remotely, a majority of whom continue to do so as of the date of this prospectus. These changes could extend into future quarters.

16