Exhibit 10.18

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

| confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:03 PM EST |

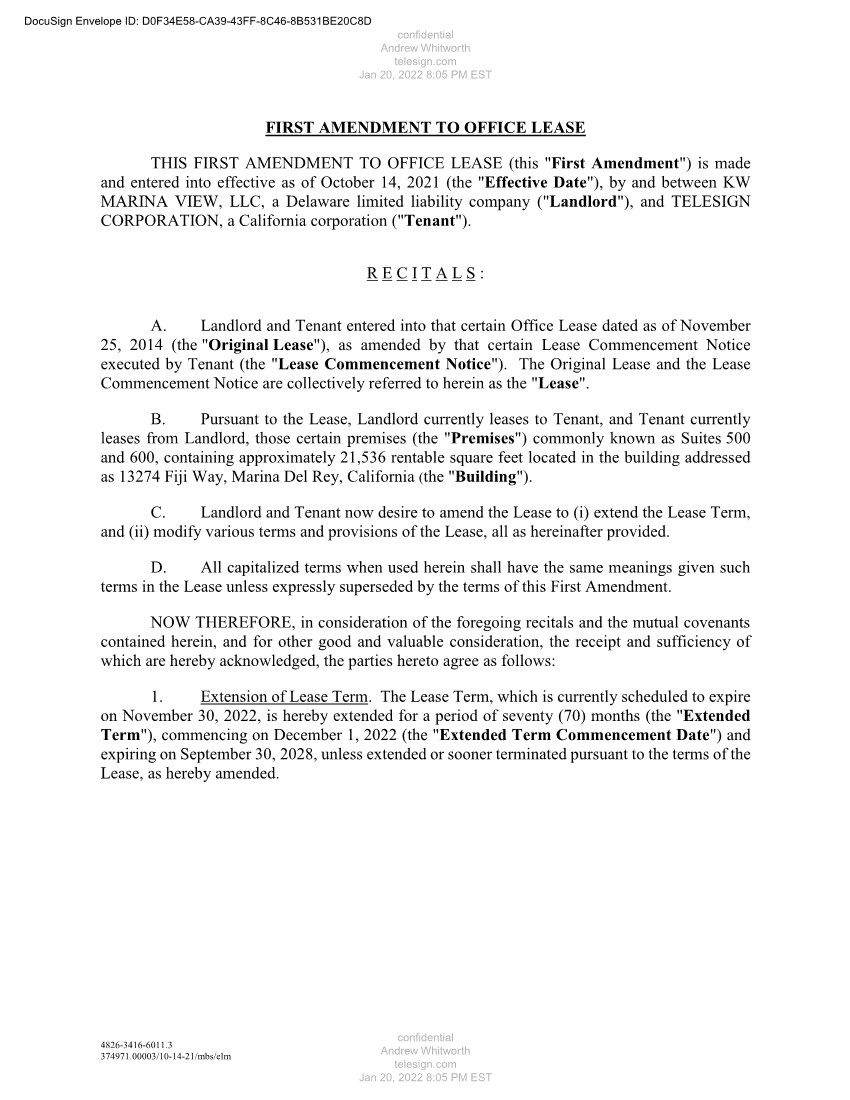

| 4826-3416-6011.3 374971.00003/10-14-21/mbs/elm FIRST AMENDMENT TO OFFICE LEASE THIS FIRST AMENDMENT TO OFFICE LEASE (this "First Amendment") is made and entered into effective as of October 14, 2021 (the "Effective Date"), by and between KW MARINA VIEW, LLC, a Delaware limited liability company ("Landlord"), and TELESIGN CORPORATION, a California corporation ("Tenant"). R E C I T A L S : A. Landlord and Tenant entered into that certain Office Lease dated as of November 25, 2014 (the "Original Lease"), as amended by that certain Lease Commencement Notice executed by Tenant (the "Lease Commencement Notice"). The Original Lease and the Lease Commencement Notice are collectively referred to herein as the "Lease". B. Pursuant to the Lease, Landlord currently leases to Tenant, and Tenant currently leases from Landlord, those certain premises (the "Premises") commonly known as Suites 500 and 600, containing approximately 21,536 rentable square feet located in the building addressed as 13274 Fiji Way, Marina Del Rey, California (the "Building"). C. Landlord and Tenant now desire to amend the Lease to (i) extend the Lease Term, and (ii) modify various terms and provisions of the Lease, all as hereinafter provided. D. All capitalized terms when used herein shall have the same meanings given such terms in the Lease unless expressly superseded by the terms of this First Amendment. NOW THEREFORE, in consideration of the foregoing recitals and the mutual covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows: 1. Extension of Lease Term. The Lease Term, which is currently scheduled to expire on November 30, 2022, is hereby extended for a period of seventy (70) months (the "Extended Term"), commencing on December 1, 2022 (the "Extended Term Commencement Date") and expiring on September 30, 2028, unless extended or sooner terminated pursuant to the terms of the Lease, as hereby amended. DocuSign Envelope ID: D0F34E58-CA39-43FF-8C46-8B531BE20C8D confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST |

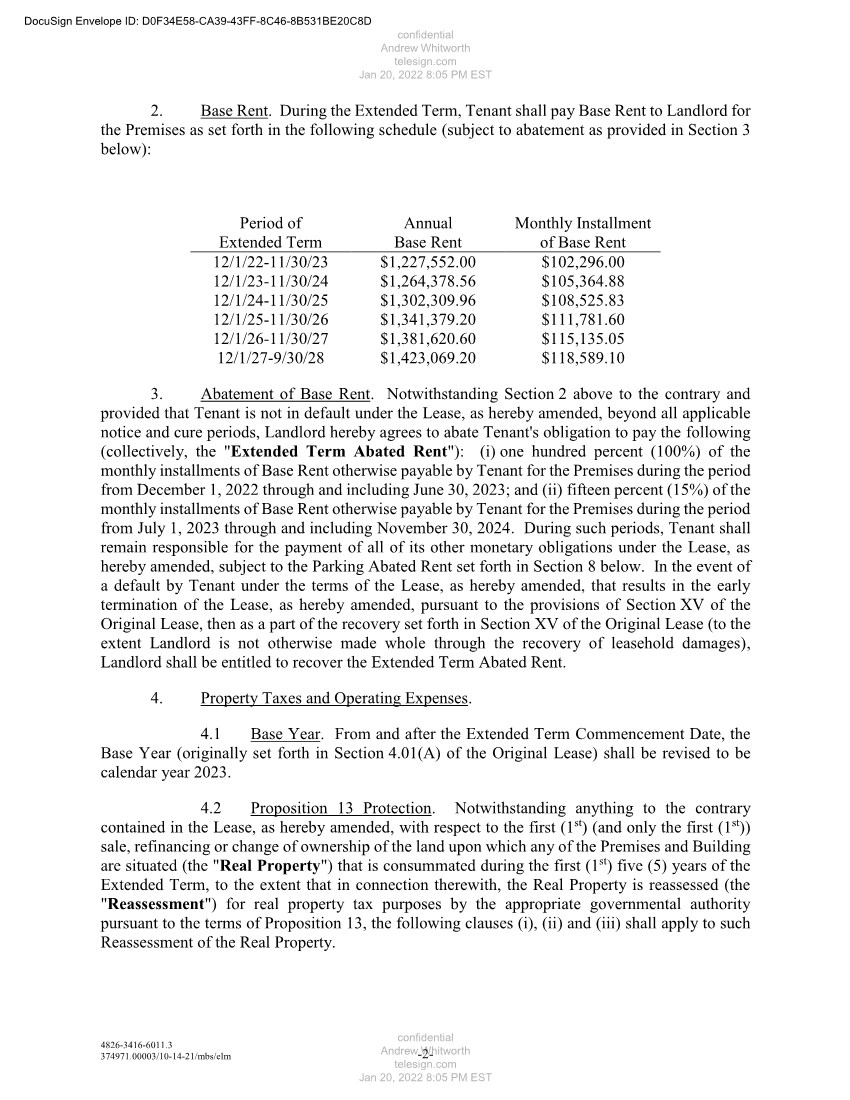

| 4826-3416-6011.3 374971.00003/10-14-21/mbs/elm -2- 2. Base Rent. During the Extended Term, Tenant shall pay Base Rent to Landlord for the Premises as set forth in the following schedule (subject to abatement as provided in Section 3 below): Period of Extended Term Annual Base Rent Monthly Installment of Base Rent 12/1/22-11/30/23 $1,227,552.00 $102,296.00 12/1/23-11/30/24 $1,264,378.56 $105,364.88 12/1/24-11/30/25 $1,302,309.96 $108,525.83 12/1/25-11/30/26 $1,341,379.20 $111,781.60 12/1/26-11/30/27 $1,381,620.60 $115,135.05 12/1/27-9/30/28 $1,423,069.20 $118,589.10 3. Abatement of Base Rent. Notwithstanding Section 2 above to the contrary and provided that Tenant is not in default under the Lease, as hereby amended, beyond all applicable notice and cure periods, Landlord hereby agrees to abate Tenant's obligation to pay the following (collectively, the "Extended Term Abated Rent"): (i) one hundred percent (100%) of the monthly installments of Base Rent otherwise payable by Tenant for the Premises during the period from December 1, 2022 through and including June 30, 2023; and (ii) fifteen percent (15%) of the monthly installments of Base Rent otherwise payable by Tenant for the Premises during the period from July 1, 2023 through and including November 30, 2024. During such periods, Tenant shall remain responsible for the payment of all of its other monetary obligations under the Lease, as hereby amended, subject to the Parking Abated Rent set forth in Section 8 below. In the event of a default by Tenant under the terms of the Lease, as hereby amended, that results in the early termination of the Lease, as hereby amended, pursuant to the provisions of Section XV of the Original Lease, then as a part of the recovery set forth in Section XV of the Original Lease (to the extent Landlord is not otherwise made whole through the recovery of leasehold damages), Landlord shall be entitled to recover the Extended Term Abated Rent. 4. Property Taxes and Operating Expenses. 4.1 Base Year. From and after the Extended Term Commencement Date, the Base Year (originally set forth in Section 4.01(A) of the Original Lease) shall be revised to be calendar year 2023. 4.2 Proposition 13 Protection. Notwithstanding anything to the contrary contained in the Lease, as hereby amended, with respect to the first (1st) (and only the first (1st)) sale, refinancing or change of ownership of the land upon which any of the Premises and Building are situated (the "Real Property") that is consummated during the first (1st) five (5) years of the Extended Term, to the extent that in connection therewith, the Real Property is reassessed (the "Reassessment") for real property tax purposes by the appropriate governmental authority pursuant to the terms of Proposition 13, the following clauses (i), (ii) and (iii) shall apply to such Reassessment of the Real Property. DocuSign Envelope ID: D0F34E58-CA39-43FF-8C46-8B531BE20C8D confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST |

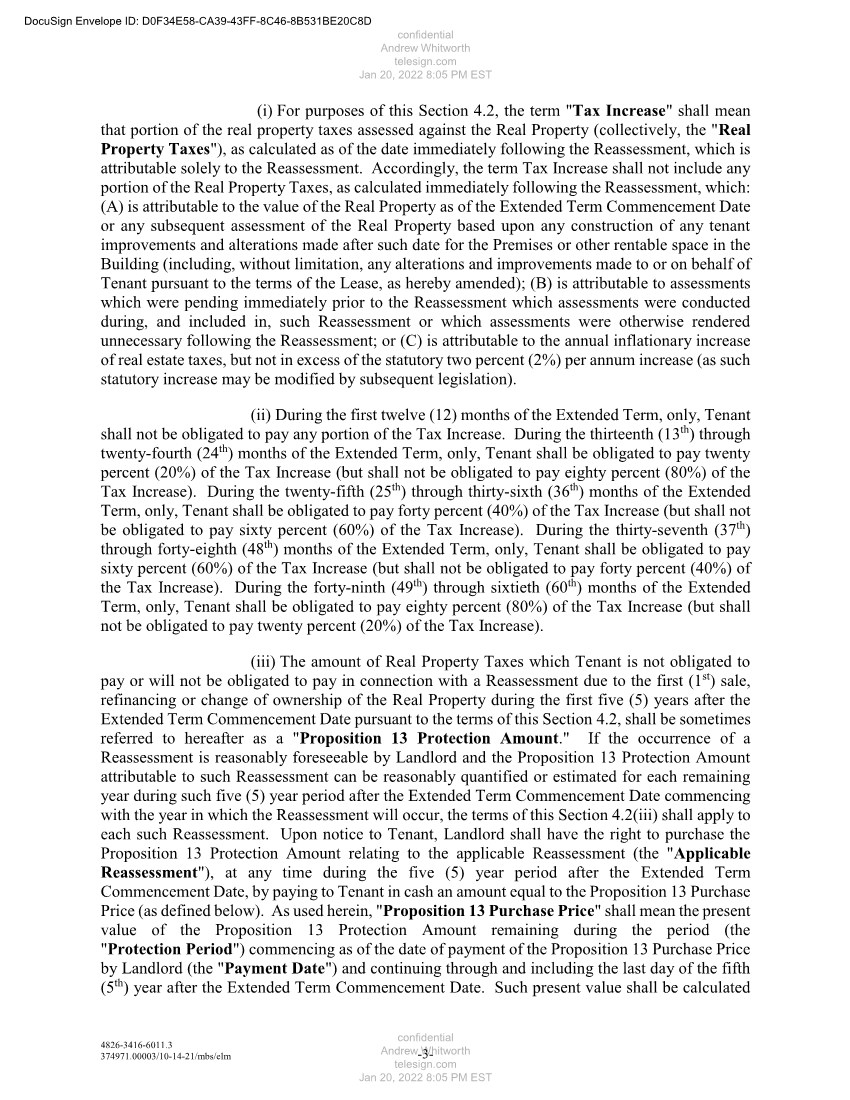

| 4826-3416-6011.3 374971.00003/10-14-21/mbs/elm -3- (i) For purposes of this Section 4.2, the term "Tax Increase" shall mean that portion of the real property taxes assessed against the Real Property (collectively, the "Real Property Taxes"), as calculated as of the date immediately following the Reassessment, which is attributable solely to the Reassessment. Accordingly, the term Tax Increase shall not include any portion of the Real Property Taxes, as calculated immediately following the Reassessment, which: (A) is attributable to the value of the Real Property as of the Extended Term Commencement Date or any subsequent assessment of the Real Property based upon any construction of any tenant improvements and alterations made after such date for the Premises or other rentable space in the Building (including, without limitation, any alterations and improvements made to or on behalf of Tenant pursuant to the terms of the Lease, as hereby amended); (B) is attributable to assessments which were pending immediately prior to the Reassessment which assessments were conducted during, and included in, such Reassessment or which assessments were otherwise rendered unnecessary following the Reassessment; or (C) is attributable to the annual inflationary increase of real estate taxes, but not in excess of the statutory two percent (2%) per annum increase (as such statutory increase may be modified by subsequent legislation). (ii) During the first twelve (12) months of the Extended Term, only, Tenant shall not be obligated to pay any portion of the Tax Increase. During the thirteenth (13th) through twenty-fourth (24th) months of the Extended Term, only, Tenant shall be obligated to pay twenty percent (20%) of the Tax Increase (but shall not be obligated to pay eighty percent (80%) of the Tax Increase). During the twenty-fifth (25th) through thirty-sixth (36th) months of the Extended Term, only, Tenant shall be obligated to pay forty percent (40%) of the Tax Increase (but shall not be obligated to pay sixty percent (60%) of the Tax Increase). During the thirty-seventh (37th) through forty-eighth (48th) months of the Extended Term, only, Tenant shall be obligated to pay sixty percent (60%) of the Tax Increase (but shall not be obligated to pay forty percent (40%) of the Tax Increase). During the forty-ninth (49th) through sixtieth (60th) months of the Extended Term, only, Tenant shall be obligated to pay eighty percent (80%) of the Tax Increase (but shall not be obligated to pay twenty percent (20%) of the Tax Increase). (iii) The amount of Real Property Taxes which Tenant is not obligated to pay or will not be obligated to pay in connection with a Reassessment due to the first (1st) sale, refinancing or change of ownership of the Real Property during the first five (5) years after the Extended Term Commencement Date pursuant to the terms of this Section 4.2, shall be sometimes referred to hereafter as a "Proposition 13 Protection Amount." If the occurrence of a Reassessment is reasonably foreseeable by Landlord and the Proposition 13 Protection Amount attributable to such Reassessment can be reasonably quantified or estimated for each remaining year during such five (5) year period after the Extended Term Commencement Date commencing with the year in which the Reassessment will occur, the terms of this Section 4.2(iii) shall apply to each such Reassessment. Upon notice to Tenant, Landlord shall have the right to purchase the Proposition 13 Protection Amount relating to the applicable Reassessment (the "Applicable Reassessment"), at any time during the five (5) year period after the Extended Term Commencement Date, by paying to Tenant in cash an amount equal to the Proposition 13 Purchase Price (as defined below). As used herein, "Proposition 13 Purchase Price" shall mean the present value of the Proposition 13 Protection Amount remaining during the period (the "Protection Period") commencing as of the date of payment of the Proposition 13 Purchase Price by Landlord (the "Payment Date") and continuing through and including the last day of the fifth (5th) year after the Extended Term Commencement Date. Such present value shall be calculated DocuSign Envelope ID: D0F34E58-CA39-43FF-8C46-8B531BE20C8D confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST |

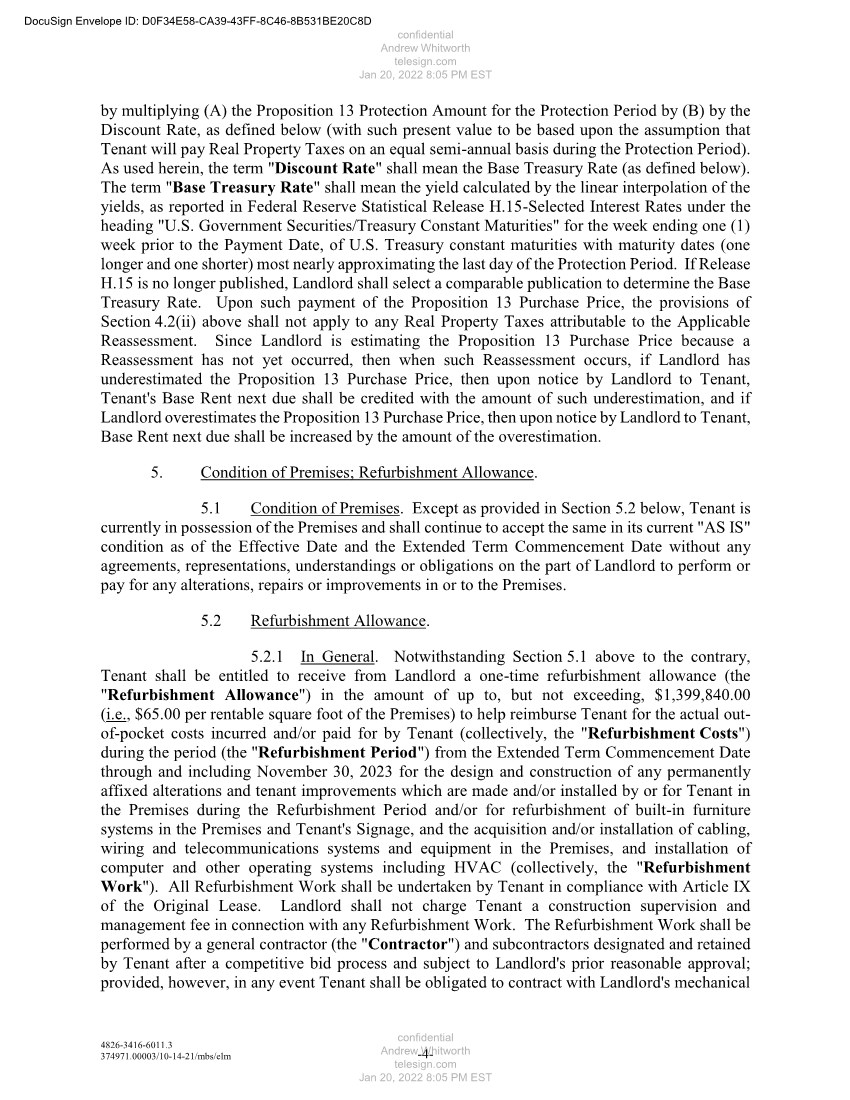

| 4826-3416-6011.3 374971.00003/10-14-21/mbs/elm -4- by multiplying (A) the Proposition 13 Protection Amount for the Protection Period by (B) by the Discount Rate, as defined below (with such present value to be based upon the assumption that Tenant will pay Real Property Taxes on an equal semi-annual basis during the Protection Period). As used herein, the term "Discount Rate" shall mean the Base Treasury Rate (as defined below). The term "Base Treasury Rate" shall mean the yield calculated by the linear interpolation of the yields, as reported in Federal Reserve Statistical Release H.15-Selected Interest Rates under the heading "U.S. Government Securities/Treasury Constant Maturities" for the week ending one (1) week prior to the Payment Date, of U.S. Treasury constant maturities with maturity dates (one longer and one shorter) most nearly approximating the last day of the Protection Period. If Release H.15 is no longer published, Landlord shall select a comparable publication to determine the Base Treasury Rate. Upon such payment of the Proposition 13 Purchase Price, the provisions of Section 4.2(ii) above shall not apply to any Real Property Taxes attributable to the Applicable Reassessment. Since Landlord is estimating the Proposition 13 Purchase Price because a Reassessment has not yet occurred, then when such Reassessment occurs, if Landlord has underestimated the Proposition 13 Purchase Price, then upon notice by Landlord to Tenant, Tenant's Base Rent next due shall be credited with the amount of such underestimation, and if Landlord overestimates the Proposition 13 Purchase Price, then upon notice by Landlord to Tenant, Base Rent next due shall be increased by the amount of the overestimation. 5. Condition of Premises; Refurbishment Allowance. 5.1 Condition of Premises. Except as provided in Section 5.2 below, Tenant is currently in possession of the Premises and shall continue to accept the same in its current "AS IS" condition as of the Effective Date and the Extended Term Commencement Date without any agreements, representations, understandings or obligations on the part of Landlord to perform or pay for any alterations, repairs or improvements in or to the Premises. 5.2 Refurbishment Allowance. 5.2.1 In General. Notwithstanding Section 5.1 above to the contrary, Tenant shall be entitled to receive from Landlord a one-time refurbishment allowance (the "Refurbishment Allowance") in the amount of up to, but not exceeding, $1,399,840.00 (i.e., $65.00 per rentable square foot of the Premises) to help reimburse Tenant for the actual out- of-pocket costs incurred and/or paid for by Tenant (collectively, the "Refurbishment Costs") during the period (the "Refurbishment Period") from the Extended Term Commencement Date through and including November 30, 2023 for the design and construction of any permanently affixed alterations and tenant improvements which are made and/or installed by or for Tenant in the Premises during the Refurbishment Period and/or for refurbishment of built-in furniture systems in the Premises and Tenant's Signage, and the acquisition and/or installation of cabling, wiring and telecommunications systems and equipment in the Premises, and installation of computer and other operating systems including HVAC (collectively, the "Refurbishment Work"). All Refurbishment Work shall be undertaken by Tenant in compliance with Article IX of the Original Lease. Landlord shall not charge Tenant a construction supervision and management fee in connection with any Refurbishment Work. The Refurbishment Work shall be performed by a general contractor (the "Contractor") and subcontractors designated and retained by Tenant after a competitive bid process and subject to Landlord's prior reasonable approval; provided, however, in any event Tenant shall be obligated to contract with Landlord's mechanical DocuSign Envelope ID: D0F34E58-CA39-43FF-8C46-8B531BE20C8D confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST |

| 4826-3416-6011.3 374971.00003/10-14-21/mbs/elm -5- engineer and fire/life-safety subcontractors for any mechanical and/or life-safety work in the Premises. 5.2.2 Disbursement of Refurbishment Allowance. Subject to the limitations set forth in Section 5.2.3 below, Landlord shall disburse the Refurbishment Allowance following completion of the Refurbishment Work, in one lump sum disbursement, but not sooner than thirty (30) days after Landlord has received all of the following (collectively, the "Refurbishment Work Draw Documents"): (i) a request for payment by Tenant certifying that the Refurbishment Work has been completed and all Refurbishment Costs have been paid for; (ii) factually correct invoices and paid receipts for labor and materials rendered in connection with and evidencing the completed Refurbishment Work and the Refurbishment Costs and Tenant's payment thereof; and (iii) executed final, unconditional mechanic's lien releases from all contractors, subcontractors and other persons or entities performing the Refurbishment Work, reasonably satisfactory to Landlord. Tenant's request for payment shall be deemed Tenant's acceptance and approval of the work furnished and/or the materials supplied as set forth in the Refurbishment Work Draw Documents as between Landlord and Tenant. Following Landlord’s receipt of completed Refurbishment Work Draw Documents, Landlord shall deliver a check (the “Disbursement Check”) to Tenant made payable to Tenant in payment of the lesser of: (A) the amounts so requested by Tenant in the applicable Refurbishment Draw Documents therefor, as set forth in hereinabove, and (B) the balance of any remaining available portion of the Refurbishment Allowance, provided that Landlord does not dispute any Refurbishment Work Draw Documents for payment based on non-compliance of any work with Article IX of the Original Lease, or due to any substandard work, or for any other reason. 5.2.3 Limitations on Disbursement. In no event shall Landlord be obligated to make disbursements pursuant to this Section 5.2 in a total amount that exceeds the Refurbishment Allowance. In addition, Landlord shall have no obligation to disburse any portion of the Refurbishment Allowance (i) with respect to any Refurbishment Work that is performed prior to or after the Refurbishment Period, or (ii) with respect to any Refurbishment Work Draw Documents that are delivered by Tenant prior to or after the Refurbishment Period. Except as provided hereinbelow, Tenant shall not be entitled to receive, or have any rights to, any portion of the Refurbishment Allowance that is not used to pay for the Refurbishment Costs of the Refurbishment Work performed during the Refurbishment Period. Notwithstanding the foregoing to the contrary, so long as Tenant is not then in default under the Lease, as amended hereby, beyond any applicable notice and cure periods, Tenant may elect, by written notice (the "Base Rent Credit Notice") delivered to Landlord at any time during the Refurbishment Period, to receive any then unused portion of the Refurbishment Allowance as a credit against the Base Rent next due and payable by Tenant under the Lease, as hereby amended. The Base Rent Credit Notice shall expressly state the exact amount of such then unused portion of the Refurbishment Allowance which Tenant elects to receive as a credit against the Base Rent due and payable by Tenant under the Lease, as hereby amended (the "Base Rent Credit Amount") and the month(s) as to which the Base Rent Credit Amount (or portions thereof) shall be applied. If Tenant properly and timely delivers the Base Rent Credit Notice to Landlord: (A) the Refurbishment Allowance shall be reduced by the Base Rent Credit Amount; and (B) Landlord shall apply the Base Rent Credit Amount as a credit against the monthly installment(s) of Base Rent as and to the extent specified by Tenant in the Base Rent Credit Notice until such Base Rent Credit Amount is exhausted and reduced to $0.00. If Tenant fails to timely provide the Base Rent Credit Notice, then any portion DocuSign Envelope ID: D0F34E58-CA39-43FF-8C46-8B531BE20C8D confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST |

| 4826-3416-6011.3 374971.00003/10-14-21/mbs/elm -6- of the Refurbishment Allowance which remains unused as of the expiration of the Refurbishment Period shall be applied automatically as a credit against Base Rent. 5.2.4 Space Plan Allowance. In addition to and separate and apart from the Refurbishment Allowance, Landlord shall reimburse Tenant in an amount up to, but not exceeding, $3,230.40 (i.e., $0.15 per rentable square foot of the Premises) (the "Space Plan Allowance") for all actual costs (collectively, the "Space Plan Costs") incurred and paid by Tenant in connection with the preparation of the initial test-fit plan for the Refurbishment Work, which reimbursement shall be made by Landlord to Tenant within ten (10) days after Landlord's receipt from Tenant of the following (collectively, a "Space Plan Costs Reimbursement Request"): (i) a request for payment of the Space Plan Costs; and (ii) an invoice and paid receipts evidencing such Space Plan Costs; provided, however, that (A) Tenant shall be responsible for all Space Plan Costs in excess of the Space Plan Allowance (which costs may be paid out of the Refurbishment Allowance), and (B) in no event shall Landlord be obligated to disburse any portion of the Space Plan Allowance and/or pay for any Space Plan Costs to the extent Tenant delivers the Space Plan Reimbursement Request to Landlord after the date that is ninety (90) days after the Extended Term Commencement Date. 6. Option to Extend. During the Extended Term, Tenant shall continue to have the Option set forth in Section 3.02 of the Original Lease, except that all references therein to "Lease Term" shall mean and refer to the "Extended Term." 7. Right of First Offer. During the Extended Term, Tenant shall continue to have the right of first offer set forth in Section 2.03 of the Original Lease, except that (i) all references therein to "Lease Term" shall mean and refer to the "Extended Term", and (ii) the phrase "as of the date of this Lease" in the second (2nd) sentence of Section 2.03 shall be deleted and replaced with: "as of the Extended Term Commencement Date". 8. Parking. During the Extended Term, Tenant shall continue to rent the Parking Passes (and Reserved Parking Passes if elected by Tenant) pursuant to Exhibit F attached to the Original Lease at the then-current monthly charges established from time to time by Landlord for parking; provided, however, so long as Tenant is not in default under the Lease, as hereby amended, beyond all applicable notice and cure periods, Landlord hereby agrees to abate Tenant's obligation to pay the following (collectively, the "Parking Abated Rent"): (i) one hundred percent (100%) of the monthly charges the Parking Passes and Reserved Parking Passes (if applicable) otherwise payable by Tenant during the period from December 1, 2022 through and including June 30, 2023; and (ii) fifteen percent (15%) of the monthly charges for the Parking Passes and Reserved Parking Passes (if applicable) otherwise payable by Tenant for the Premises during the period from July 1, 2023 through and including November 30, 2024. During such periods, Tenant shall remain responsible for the payment of all of its other monetary obligations under the Lease, as hereby amended. In the event of a default by Tenant under the terms of the Lease, as hereby amended, that results in the early termination of the Lease, as hereby amended, pursuant to the provisions of Section XV of the Original Lease, then as a part of the recovery set forth in Section XV of the Original Lease (to the extent Landlord is not otherwise made whole through the recovery of leasehold damages), Landlord shall be entitled to recover the Parking Abated Rent. DocuSign Envelope ID: D0F34E58-CA39-43FF-8C46-8B531BE20C8D confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST |

| 4826-3416-6011.3 374971.00003/10-14-21/mbs/elm -7- 9. Letter of Credit. On or before the date which is the earlier of (i) one hundred twenty (120) days prior to the expiration of the existing Letter of Credit in the amount of $266,189.96, and (ii) July 31, 2022, Tenant shall deliver to Landlord a certificate of renewal or extension of such Letter of Credit to Landlord (or a new Letter of Credit in the same amount); such Letter of Credit must satisfy the requirements set forth in Article V of the Original Lease and Exhibit H attached thereto, except that the final date of expiration for such Letter of Credit shall be one hundred twenty (120) days after the expiration of the Extended Term (provided, however, if Tenant exercises its Option pursuant to Section 3.02 of the Original Lease then, not later than one hundred twenty (120) days prior to the commencement of the Option Term, Tenant shall deliver to Landlord a new Letter of Credit or certificate of renewal or extension evidencing the Letter of Credit expiration date as one hundred twenty (120) days after the expiration of such Option Term). 10. Permitted Dogs. Notwithstanding anything to the contrary contained in the Lease, from and after the Effective Date through and including the Extended Term (as may be extended), Tenant's employees shall be permitted to bring into the Premises on a daily basis (during those times in which Tenant is present in the Premises) up to an aggregate of ten (10) fully-domesticated, fully-vaccinated, trained dogs under twenty-five (25) pounds that are kept by such employees as pets (collectively, the "Permitted Dogs"), subject to the following terms and conditions: 10.1 all Permitted Dogs shall be strictly controlled at all times, shall not be left unattended in the Premises or the Building at any time, shall not be permitted to walk or otherwise roam through the Building unattended or off-leash and shall not be permitted to foul, damage or otherwise mar any part of the Premises or the Building; 10.2 all Permitted Dogs shall be on a leash at all times that they are not entirely within the Premises; 10.3 Tenant shall not bring the Permitted Dogs to the Building if any of the Permitted Dogs become ill or contract a disease that could potentially threaten the health or well- being of any tenant or occupant of the Building (which diseases shall include, without limitation, rabies, leptospirosis, flea infestation and lyme disease); 10.4 the Permitted Dogs may use the elevators servicing the Building to access the Premises; provided, however, that the Permitted Dogs may not use the elevator serving the parking deck; 10.5 Tenant shall be responsible for any additional cleaning costs and all other costs which may arise from the presence of the Permitted Dogs at the Building in excess of the costs that would have been incurred had the Permitted Dogs not been allowed in or around the Building; 10.6 Tenant assumes responsibility for, and agrees at the sole discretion of Landlord to indemnify, defend and hold Landlord and Landlord's agents, employees and partners harmless from, any and all Claims, arising from, resulting from or connected with any and all acts of, or the presence of, any Permitted Dogs in, on or about the Building (including but not limited to biting or causing bodily injury to any other tenant, subtenant, occupant, licensee or invitee of the Building, or damage to the Premises (including any tenant improvements therein), the Building DocuSign Envelope ID: D0F34E58-CA39-43FF-8C46-8B531BE20C8D confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST |

| 4826-3416-6011.3 374971.00003/10-14-21/mbs/elm -8- and/or the property of, Landlord or any other tenant, subtenant, occupant, licensee or invitee of the Building); 10.7 Tenant shall immediately remove any waste and excrement of any Permitted Dogs from the Building and properly clean the affected area; 10.8 any Permitted Dogs shall not bark excessively or otherwise create a nuisance (e.g., jump on any tenant, subtenant, occupant, licensee or invitee of the Building, or growl) at the Building; 10.9 the Permitted Dogs shall not be allowed in the Common Areas, except en route to or from the Premises; 10.10 Tenant shall provide Landlord with evidence reasonably satisfactory to Landlord that Tenant's liability insurance provided pursuant to Section 10.03(A) of the Lease covers dog-related injuries and damage; and 10.11 Tenant shall comply with all Applicable Laws associated with or governing the presence of the Permitted Dogs within the Building and all additional rules and regulations as may be adopted by Landlord from time to time and/or as required by Landlord's lender, and such presence shall not violate the certificate of occupancy for the Building. Landlord shall have the unilateral right at any time to rescind Tenant's right to have any dogs in the Premises (other than service animals in accordance with the Rules and Regulations attached to the Lease as Exhibit C), if in Landlord's good faith determination, there is a legitimate business reason not to continue to allow any such dogs into the Building, including, without limitation, if (i) the Permitted Dogs are, in Landlord's reasonable judgment, a substantial nuisance to the Building (for purposes hereof, the causes for which the Permitted Dogs may be found to be a "substantial nuisance" include but are not limited to (A) Tenant's failure to remove any waste and excrement of any Permitted Dogs from the Building and properly clean the affected area, (B) the Permitted Dogs damaging or destroying property in the Building), or (C) Permitted Dogs that jump on others, bark regularly, growl at others or otherwise exhibit unreasonably problematic behavior, or (ii) other tenants or occupants of the Building complain about the Permitted Dogs. The rights granted herein with respect to the Permitted Dogs shall not apply or be transferable to any other animal, and in the event Tenant wishes to bring an animal or dog other than the Permitted Dogs (or service animals) into the Building, Tenant shall submit a written request to Landlord for its approval, which approval may be withheld in Landlord's sole and absolute discretion. 11. California Accessibility Disclosure. The following notice is hereby provided pursuant to Section 1938(e) of the California Civil Code: "A Certified Access Specialist (CASp) can inspect the subject premises and determine whether the subject premises comply with all of the applicable construction-related accessibility standards under state law. Although state law does not require a CASp inspection of the subject premises, the commercial property owner or Landlord may not prohibit the Tenant or tenant from obtaining a CASp inspection of the subject premises for the occupancy or potential occupancy of the Tenant or tenant, if requested by the Tenant or tenant. The parties shall mutually agree on the arrangements for the time and manner DocuSign Envelope ID: D0F34E58-CA39-43FF-8C46-8B531BE20C8D confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST |

| 4826-3416-6011.3 374971.00003/10-14-21/mbs/elm -9- of the CASp inspection, the payment of the fee for the CASp inspection, and the cost of making any repairs necessary to correct violations of construction-related accessibility standards within the premises." In furtherance of and in connection with such notice: (i) Tenant, having read such notice and understanding Tenant's right to request and obtain a CASp inspection and with advice of counsel, hereby elects not to obtain such CASp inspection and forever waives its rights to obtain a CASp inspection with respect to the Premises, Building and/or Real Property to the extent permitted by applicable laws now or hereafter in effect; and (ii) if the waiver set forth in clause (i) hereinabove is not enforceable pursuant to applicable laws now or hereafter in effect, then Landlord and Tenant hereby agree as follows (which constitute the mutual agreement of the parties as to the matters described in the last sentence of the foregoing notice): (A) Tenant shall have the one-time right to request for and obtain a CASp inspection of the Premises, which request must be made, if at all, in a written notice delivered by Tenant to Landlord on or before the Extended Term Commencement Date; (B) any CASp inspection timely requested by Tenant shall be conducted (1) between the hours of 9:00 a.m. and 5:00 p.m. on any business day, (2) only after ten (10) days' prior written notice to Landlord of the date of such CASp inspection, (3) in a professional manner by a CASp designated by Landlord and without any testing that would damage the Premises, Building or Real Property in any way, and (4) at Tenant's sole cost and expense, including, without limitation, Tenant's payment of the fee for such CASp inspection, the fee for any reports prepared by the CASp in connection with such CASp inspection (collectively, the "CASp Reports") and all other costs and expenses in connection therewith; (C) Tenant shall deliver a copy of any CASp Reports to Landlord within three (3) business days after Tenant's receipt thereof; (D) Tenant, at its sole cost and expense, shall be responsible for making any improvements, alterations, modifications and/or repairs to or within the Premises to correct violations of construction-related accessibility standards disclosed by such CASp inspection; and (E) if such CASp inspection identifies any improvements, alterations, modifications and/or repairs necessary to correct violations of construction-related accessibility standards relating to those items of the Building and Real Property located outside the Premises that are Landlord's obligation to repair as set forth in Section 6.02(c) of the Original Lease, then Landlord shall perform such improvements, alterations, modifications and/or repairs as and to the extent required by applicable laws to correct such violations, and Tenant shall reimburse Landlord for the cost of such improvements, alterations, modifications and/or repairs within ten (10) business days after Tenant's receipt of an invoice therefor from Landlord. 12. Miscellaneous Modifications. Section 3.03 of the Original Lease is hereby deleted and of no further force or effect. From and after the Extended Term Commencement Date, the numbers "Two Million Dollars ($2,000,000)" and "Three Million Dollars ($3,000,000)" set forth in Section 10.03(A) of the Original Lease shall each be deleted and replaced with: "Five Million Dollars ($5,000,000)". Landlord acknowledges and agrees that Tenant's insurance requirements may be satisfied through an umbrella policy in an amount not less than Five Million Dollars ($5,000,000). 13. Landlord's Notice Address. Landlord's address for notices is hereby revised to be: c/o Kennedy-Wilson Properties, Ltd. 13274 Fiji Way, Suite 320 DocuSign Envelope ID: D0F34E58-CA39-43FF-8C46-8B531BE20C8D confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST |

| 4826-3416-6011.3 374971.00003/10-14-21/mbs/elm -10- Marina Del Rey, California 90292 Attn: Property Manager-Marina View with a copy to: c/o Kennedy-Wilson Properties, Ltd. 151 S. El Camino Drive Beverly Hills, California 90212 Attn: Kelly Pucci and KW Marina View, LLC c/o Kennedy-Wilson Properties, Ltd. 151 S. El Camino Drive Beverly Hills, California 90212 Attn: General Counsel 14. Brokers. Landlord and Tenant each hereby represents and warrants to the other party that it has had no dealings with any real estate broker or agent in connection with the negotiation of this First Amendment, except for First Property Realty Corporation, representing Landlord, and CBRE, Inc., representing Tenant (collectively, the "Brokers") and that it knows of no other real estate broker or agent who is entitled to a commission in connection with this First Amendment. Each party agrees to indemnify and defend the other party against and hold the other party harmless from all claims, demands, losses, liabilities, lawsuits, judgments, and costs and expenses (including, without limitation, reasonable attorneys' fees) with respect to any leasing commission or equivalent compensation alleged to be owing on account of any breach of the foregoing representation and warranty by the indemnifying party in connection with this First Amendment. 15. No Further Modification. Except as set forth in this First Amendment, all of the terms and provisions of the Lease shall remain unmodified and in full force and effect. 16. Counterparts. This First Amendment may be executed in multiple counterparts, each of which is to be deemed original for all purposes, but all of which together shall constitute one and the same instrument. 17. Electronic Signatures. Each of the parties to this First Amendment (i) has agreed to permit the use from time to time, where appropriate, of telecopy or other electronic signatures (including, without limitation, DocuSign) in order to expedite the transaction contemplated by this First Amendment, (ii) intends to be bound by its respective telecopy or other electronic signature, (iii) is aware that the other will rely on such telecopied or other electronically transmitted signature, and (iv) acknowledges such reliance and waives any defenses to the enforcement of this First Amendment and the documents affecting the transaction contemplated by this First Amendment based on the fact that a signature was sent by telecopy or electronic transmission only. [SIGNATURES ON FOLLOWING PAGE] DocuSign Envelope ID: D0F34E58-CA39-43FF-8C46-8B531BE20C8D confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST |

| 4826-3416-6011.3 374971.00003/10-14-21/mbs/elm -11- IN WITNESS WHEREOF, the parties have caused this First Amendment to be duly executed by their duly authorized representatives as of the date first above written. LANDLORD: KW MARINA VIEW, LLC, a Delaware limited liability company By: Name: Its: TENANT: TELESIGN CORPORATION, a California corporation By: Name: Its: DocuSign Envelope ID: D0F34E58-CA39-43FF-8C46-8B531BE20C8D 10/15/2021 Joe Burton CEO President Kent Mouton confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST confidential Andrew Whitworth telesign.com Jan 20, 2022 8:05 PM EST |