Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

NYAX similar filings

- 1 Feb 24 Nayax Appoints Aaron Greenberg as Chief Strategy Officer

- 4 Dec 23 Nayax Appoints New Chief Information Officer

- 30 Nov 23 Nayax Completes Acquisition of Retail Pro International

- 7 Nov 23 Current report (foreign)

- 7 Nov 23 Nayax Reports Third Quarter 2023 Financial Results

- 30 Oct 23 Nayax Enters Definitive Agreement to Acquire Retail Pro International

- 18 Oct 23 Nayax Provides a Business Operations Update

Filing view

External links

Exhibit 99.1

Nayax Q3 Earnings Presentation Nov 7, 2023

Important Disclosure This presentation is intended to provide general information only and is not, and should not be considered, as an offer to purchase or sell the Company’s securities, or a proposal to receive such offers. In addition, this presentation is not an offer to the public of the Company’s securities. By attending or viewing this presentation, each attendee (“Attendee”) agrees that he or she (i) has read this disclaimer, (ii) is bound by the restrictions set out herein, (iii) is permitted, in accordance with all applicable laws, to receive such information, (iv) is solely responsible for his or her own assessment of the business and financial position of the Company and (v) will conduct his or her own analysis and be solely responsible for forming the Attendee's view of the potential future performance of the Company’s business. The information in this presentation is provided for convenience only. It does not contain comprehensive information, but merely summary information in a condensed form. This presentation does not and is not intended to replace a careful inspection of the Company's Financial Statements and other public filings, as reported or will be reported to the Israeli Securities Authority and the Securities and Exchange Commission (the "Company's Reports"). In case of any inconsistencies between the information provided in this presentation and the Company's Reports, the latter will prevail. The information in this presentation is not a basis and should not be used as a basis for making any decisions in relation to the Company, including any decision to purchase securities of the Company. Any such decision should be based on the Company's Reports and following the receipt of appropriate professional advice. The information provided in this presentation is not, and should not be considered to be, a recommendation or an opinion of any kind in relation to an investment in the Company, whether legal, financial, tax, economic or otherwise. This presentation does not replace the need for a potential investor to collect and analyze further independent information for their due consideration. Every potential investor must obtain their own independent advice and guidance, in connection with a potential investment in the Company, including tax advice which takes into account the investor’s own tax position. This presentation includes projections, guidance, forecasts, estimates, assessments and other information pertaining to future events and/or matters, whose materialization is uncertain and is beyond the Company’s control, and which constitute forward looking statements (within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Israeli Securities Law, 5728-1968). Many of the forward-looking statements contained in this presentation can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate” and “potential,” among others. Forward-looking statements include, but are not limited to, expectations and evaluations relating to the Company’s business targets and strategy, the success of trials and the integration of the Company’s technology in various systems and industries, the advantages of the Company’s existing and future products, timetables regarding completion of the Company’s developments and the expected commencement of production, sales and distribution of the Company’s products and technology, the Company’s intentions in relation to various industries, the Company’s intentions in relation to the creation of collaborations and engagements in licensing agreements, production and distribution in various countries, and other statements regarding our intent, belief or current expectations. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to of various factors, including, but not limited to: our expectations regarding general market conditions, including as a result of the COVID-19 pandemic, geopolitical events and conflict, such as the war between Israel and Hamas, and other global economic trends; changes in consumer tastes and preferences; fluctuations in inflation, interest rate and exchange rates in the global economic environment over the world; the availability of qualified personnel and the ability to retain such personnel; changes in commodity costs, labor, distribution and other operating costs; our ability to implement our growth strategy; changes in government regulation and tax matters; other factors that may affect our financial condition, liquidity and results of operations; general economic, political, demographic and business conditions in Israel; the success of operating initiatives, including advertising and promotional efforts and new product and concept development by us and our competitors; and other risk factors discussed under “Risk Factors” in our annual report on Form 20-F filed with the SEC on March 1, 2023 (our “Annual Report"). The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. These statements are only estimates based upon our current expectations and projections about future events. There are important factors that could cause our actual results, levels of activity, performance or achievements to differ materially from the results, levels of activity, performance or achievements expressed or implied by the forward-looking statements. In particular, you should consider the risks provided under “Risk Factors” in our Annual Report. You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Each forward-looking statement speaks only as of the date of the particular statement. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason, to conform these statements to actual results or to changes in our expectations. In addition, the presentation includes data published by various bodies, and data provided to the Company in the framework of cooperation engagements, concerning the industry, competitive position and the markets in which the Company operates, whose content was not independently verified by the Company, such that the Company is not responsible for the accuracy or completeness of such date or whether the data is up-to-date, and Company takes no responsibility for any reliance on the data. Management estimates contained in this presentation are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from the Company's internal research, and are based on assumptions made by the Company upon reviewing such data, and the Company's experience in, and knowledge of, such industry and markets, which the Company believes to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which the Company operates and the Company's future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in the estimates made by independent parties and by the Company. Industry publications, research, surveys and studies generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this presentation. In addition to various operational metrics and financial measures in accordance with accounting principles generally accepted under International Financial Reporting Standards, or IFRS, this presentation contains Adjusted EBITDA, a non-IFRS financial measure, as a measure to evaluate our past results and future prospects. Please refer to the Appendix for a definition of Adjusted EBITDA and for a reconciliation of Adjusted EBITDA to net income (loss). The Company does not confirm or undertake that the information appearing in this presentation is complete or accurate. The Company, its employees, officers and its shareholders will not be responsible for damages and/or losses which may arise as a result of the use of the information contained in this presentation. The Company is not responsible for any changes to the economic, financial or legal situation relating to the Company and its business. The Company does not undertake to update and/or change forecasts and/or evaluations included in the presentation in order that they will reflect events and/or circumstances which apply after the date of the presentation’s preparations. No persons have been authorized to make any representations regarding the information contained in this presentation, and if given or made, such representations should not be considered as authorized. The content of this presentation does not bind the Company or its managers and they have the right to change any item described in the presentation relating to the Company, at their sole discretion. The Company and its licensors have proprietary rights to trademarks used in this Presentation. Solely for convenience, trademarks and trade names referred to in this Presentation may appear without the “®” or “™” symbols, but the lack of such references is not intended to indicate, in any way, that the Company will not assert, to the fullest extent possible under applicable law, its rights or the rights of the applicable licensor to these trademarks and trade names. This Presentation also contains trademarks, trade names and service marks of other companies, which are the property of their respective owners and are used for reference purposes only. Such use of other parties’ trademarks, trade names or service marks should not be construed to imply, a relationship with, or an endorsement or sponsorship of the Company by any other party.

Yair Nechmad CEO and Co-Founder Today’s Speakers Sagit Manor CFO

Company Overview

Our Vision and Mission OUR VISION Redefining commerce to benefit communities around the world OUR MISSION To simplify commerceand payments for retailers while driving growth, optimizing operations,and enhancing consumer engagement

Recurring revenue includes SaaS revenue and payment processing fees Based on SaaS revenue and payment processing fees. Nayax (Nasdaq & TASE: NYAX) Q3 23 at a Glance Global offices 9 Customer YOY growth 43% Revenue churn 3.6% Markets with distributors 46 Countries with devices 80+ Payment methods 80+ Currencies 50+ Managed and connected devices 874k Sep. 2022 685k End customers 60k Sep. 2022 42k Transactions processed 473m Recurring revenue(1)YoY growth 48% Dollar-basednet retention rate(2) 145% Global Scale Growth

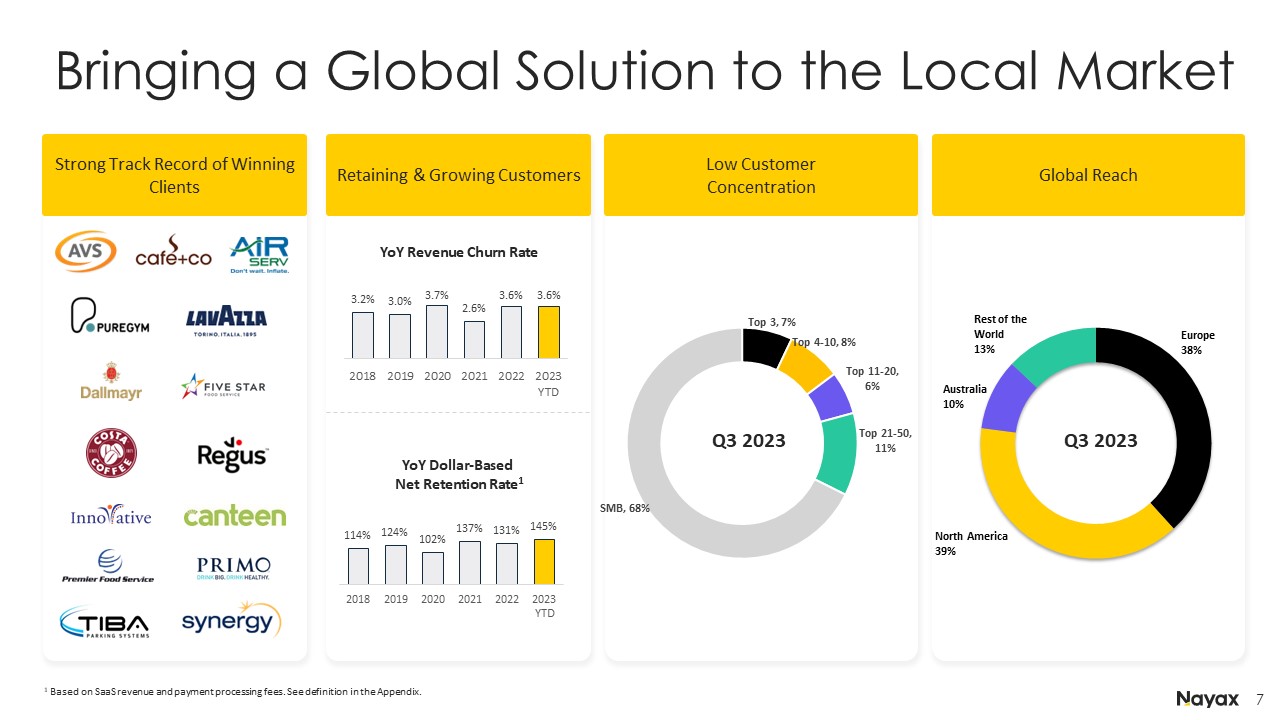

Bringing a Global Solution to the Local Market 1 Based on SaaS revenue and payment processing fees. See definition in the Appendix. YoY Revenue Churn Rate Retaining & Growing Customers YoY Revenue Churn Rate YoY Dollar-Based Net Retention Rate1 Low CustomerConcentration Global Reach Strong Track Record of Winning Clients Q3 2023 Q3 2023

Nayax’s platform increases sales and decreases costs for retailers Telemetry and Software Consumers Omni-Channel Acceptance, Consumer Engagement & Loyalty Increase Sales Pricing Remote Monitoring Reporting Reconciliation Dynamic Routing/ Inventory Management Telemetry / IoT Data Collection Decrease Costs Instant Refunds In-Store Discount Loyalty and Marketing Programs Cashless Acceptance Integrated POS Retailers Suppliers

Recent Key Business Highlights Implemented our first Hospitality solution in the Netherland. Includes a unique offering allowing loyalty to be used between different channels. Recently launched the Food & Beverage (F&B) module in Israel. Won major opportunity with a leading online food ordering platform in the UK. Signed definitive agreement to acquire Retail Pro International. Added a new channel partner, Atlantis Trinkwassertechnik in Germany. The channel will be a reseller for all of Nayax payment and technology solutions. Nayax Shop | Start (nayax-shop.de) Announced a strategic partnership with Giift, a global leader in loyalty technology solutions. This collaboration marks a significant milestone for the loyalty industry by introducing the world’s first open-loop Loyalty to Payments™ solution, powered via CoinBridge by Nayax’s patented technology Nayax and Giift will revolutionize the loyalty experience by seamlessly bridging the gap between loyalty and payment systems. Signed a strategic partnership with Turkey's Duzey, the largest Koç Holding company in the fast-moving consumer goods sector. Partnership was initiated with the installation of Nayax devices on vending machines in public locations and factory locations throughout Turkey Expansion to locations in Europe with the potential to bring tens of thousands of units from offering Nayax's comprehensive technology and solutions to the region. Signed partnership agreement with a leading US automobile manufacturer for EV chargers in each dealership for public usage. Extended existing customer relationship with the largest unattended US retail provider. Rolled out new additional support hub. Retail Pro is expected to become part of the Nayax Attended Retail business post the closing of the acquisition in Q4 2023. The acquisition was announced was announced on October 30, 2023. Additional information can be found on Nayax's investor relations website.

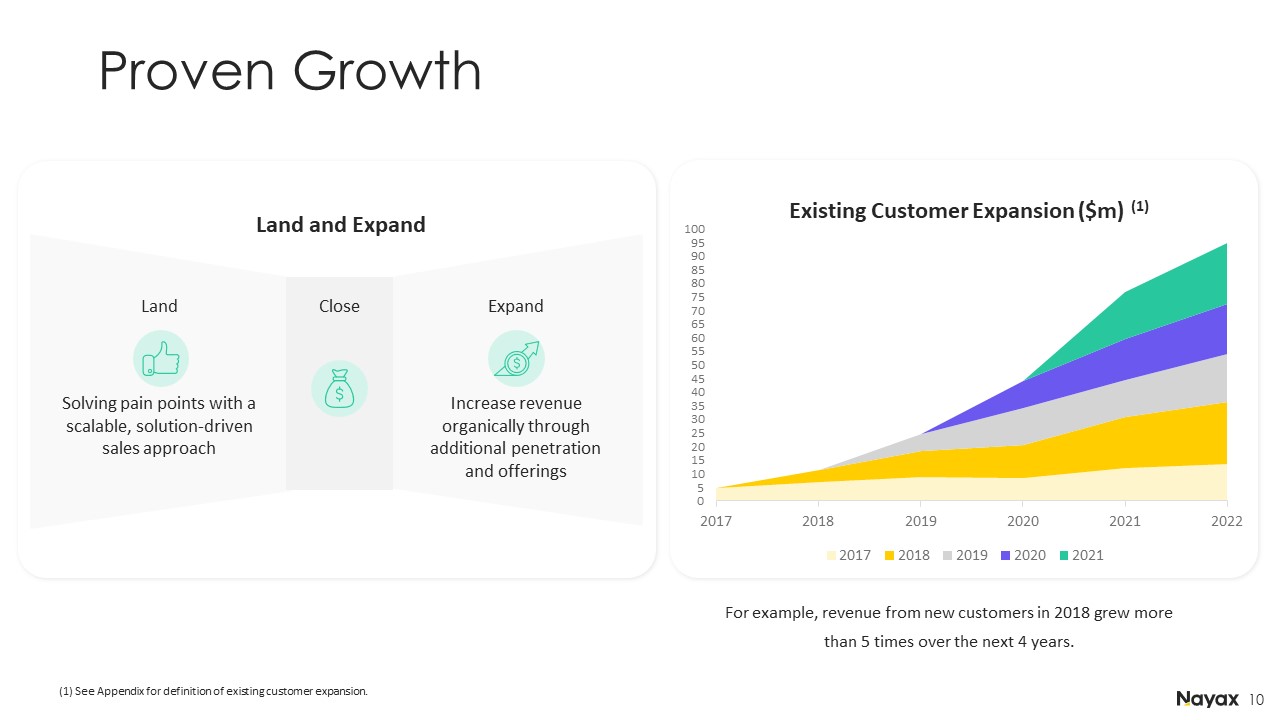

Proven Growth Existing Customer Expansion ($m) (1) (1) See Appendix for definition of existing customer expansion. For example, revenue from new customers in 2018 grew more than 5 times over the next 4 years. Land and Expand Solving pain points with a scalable, solution-driven sales approach Increase revenue organically through additional penetration and offerings Land Close Expand

Strategy for Sustained Long-term Growth Retain and grow with existing customers Continue to innovate and develop new solutions Win new large enterprise and SME customers globally Pursue targeted and strategic M&A Continue to expand internationally Enter emerging, high-growth verticals Nayax continues to execute its strategic growth plan while remaining focused on balancing top line growth with a path to profitability

"One Nayax" Strategy Accelerates Execution of Growth Strategy "One Nayax” Embedded payment solution Embedded payment solution Embedded financing solution Embedded payment solution Converting loyalty assets to currency Embedded payment solution Omni channel marketing platform New Innovative platform for Family Entertainment Centers and amusement Attended Retail Electric vehicle platform Retail Pro is expected to become part of the Nayax Attended Retail business post the closing of the acquisition in Q4 2023. The acquisition was announced was announced on October 30, 2023. Additional information can be found on Nayax's investor relations website.

Financial Overview

Powerful business model built on solid recurring revenue Source: company data Multi Layers of Value Creation ~60% Recurring Revenue Processing fee as % of transaction volume Monthly Subscription Fee (SaaS) per connected POS Purchase fee per sold connected POS “Lock in” Consistently growing recurring revenue base Superior payment processing economics 2.5%+ Take Rate Embedded Payment Hardware SaaS Payments Rapidly Growing Recurring Revenue Base

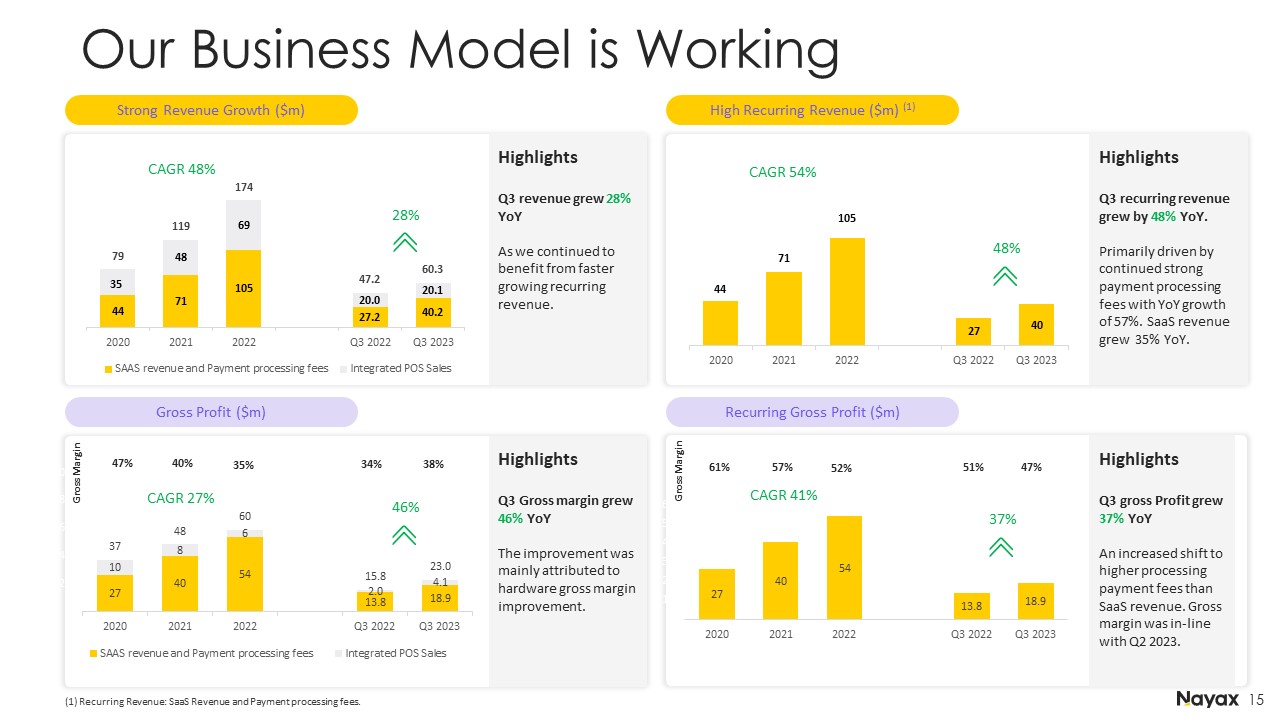

Highlights Q3 gross Profit grew 37% YoY An increased shift to higher processing payment fees than SaaS revenue. Gross margin was in-line with Q2 2023. Highlights Q3 Gross margin grew 46% YoY The improvement was mainly attributed to hardware gross margin improvement. Highlights Q3 recurring revenue grew by 48% YoY. Primarily driven by continued strong payment processing fees with YoY growth of 57%. SaaS revenue grew 35% YoY. Our Business Model is Working (1) Recurring Revenue: SaaS Revenue and Payment processing fees. Highlights Q3 revenue grew 28% YoY As we continued to benefit from faster growing recurring revenue. Gross Margin Gross Margin Strong Revenue Growth ($m) High Recurring Revenue ($m) (1) Gross Profit ($m) Recurring Gross Profit ($m) 28% CAGR 48% CAGR 54% 48% 47% 40% 34% 38% 35% 46% CAGR 27% 61% 57% 51% 47% 52% 37% CAGR 41%

Highlights Adjusted EBITDA was a positive $3.5 million, a marked improvement of $7.2 million to Adjusted EBITDA compared to negative $3.7 million in Q3 2022. Depreciation and Amortization ($m) Highlights Increase in Q3 2023 YoY primarily due to investment in automation. Highlights 4% Increase in Q3 2023 YoY Reflects investment in talent acquisition, customer base expansion, and higher go-to-market expenses. Highlights 11% Reduction in Q3 2023 YoY Primarily due to higher capitalization of development expenditure Improved Profitability from Moderating Expenses and Higher Operating Efficiencies (1) Excluding share-based compensation and Amortization (2) For historical years comparison (2020-2022), when excluding (i) product costs increase due to global components shortage (ii) bonus plan for non-sales employees that was introduced in Q3 2021, Adjusted EBITDA for Q3 2022 and Q2 2023 improved to $0.5M and $6.1M respectively. R&D Expense ($m) (1) SG&A Expense ($m) (1) Adjusted EBITDA ($m) (2) 11% 4%

Consistent Track Record Of Expanding Footprint Highlights Q3 2023 reflects momentum in customer base, with YoY growth of 43%, across all geographies Significantly increasing and retaining customer base with high net retention rate at 145% and low churn rate at 3.6% Number of Customers (thousands) Number of Managed and Connected Devices (thousands) Highlights Reaching another record number of 874,000 managed and connected devices across all geographies Grew by 28% YoY 43% CAGR 57% 28% CAGR 40%

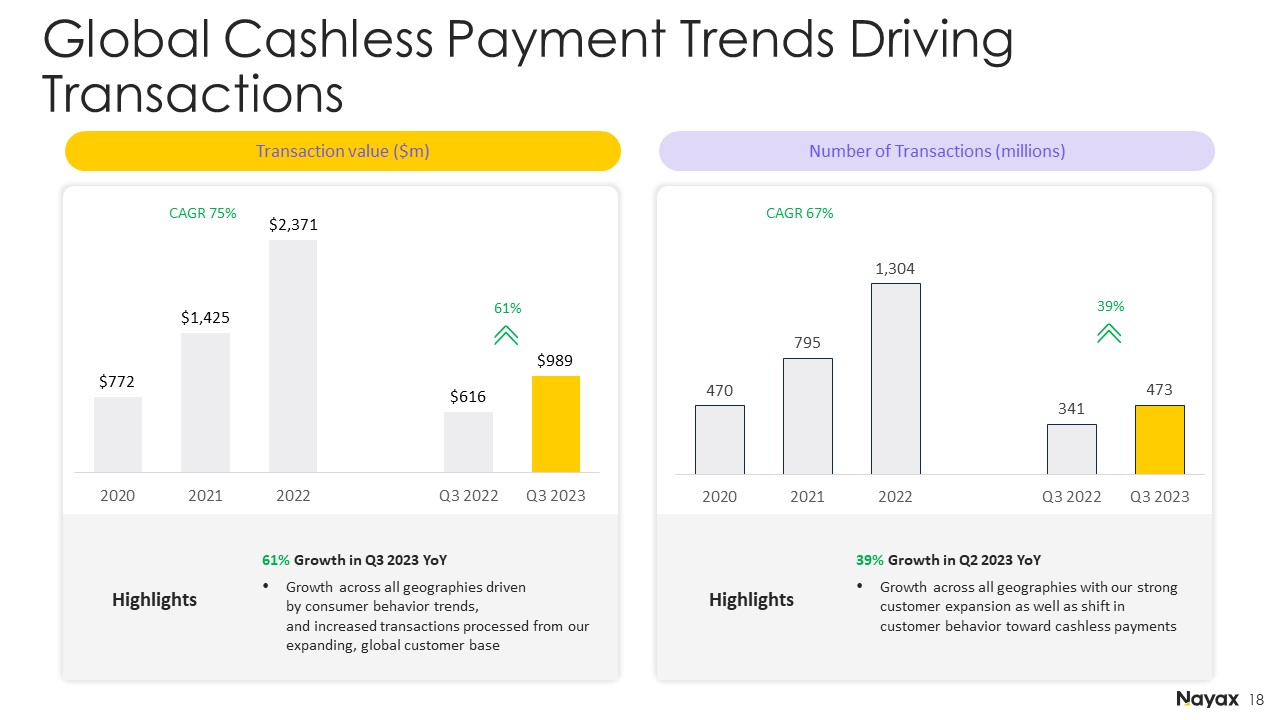

Global Cashless Payment Trends Driving Transactions Transaction value ($m) Highlights 61% Growth in Q3 2023 YoY Growth across all geographies driven by consumer behavior trends, and increased transactions processed from our expanding, global customer base Number of Transactions (millions) Highlights 39% Growth in Q2 2023 YoY Growth across all geographies with our strong customer expansion as well as shift in customer behavior toward cashless payments 39% CAGR 67% 61% CAGR 75%

2023 Outlook (1) We cannot reconcile expected 2023 Adjusted EBITDA to expected net income without unreasonable effort because certain items that impact net income and other reconciling metrics are out of our control and/or cannot be reasonably predicted at this time, which unavailable information could have a significant impact on our IFRS financial results. Guidance as of November 7, 2023. Any usage of slide on a subsequent date does not constitute guidance re-confirmation as of such subsequent date. Refer to Cautionary Statement for a discussion of factors that could cause actual results to differ materially from outlook. See Appendix for details related to constant currency. Metric FY 2023 Revenue (constant currency) $235 - $240M Revenue Growth YoY At least 35% Operating expenses Remain flat from Q4 2022 annualized run rate Adjusted EBITDA – raising the lower end of the guidance range $4 - $7M Guidance Assumptions Continued execution of strategic growth plans; benefits of secular trends in digital payments. Customer demand continues to be strong Assumes no material changes in macroeconomic conditions

Summary Founder-led mentality with a mission and performance culture. Growth exposure to large and underpenetrated global markets for cashless payment adoption and secular tailwinds driving growth in our core unattended market. Ability to expand total addressable market and drive additional SaaS revenue from our emerging growth engines. Diverse business model across revenue, customer and geography with high recurring revenue. Seasoned management team with deep Payment industry experience. Accelerated path to profitability driven by revenue outperformance and focused cost management.

Looking ahead, we remain excited about our strong long-term growth drivers and the large market opportunities ahead of us. Our durable business model is demonstrated by our diverse customers, verticals and geographies. With strong secular tailwinds and with our high net revenue retention rate, we believe we have a clear opportunity to drive revenue growth in the future. Mid-Term and Long-Term Outlook Mid-Term Outlook Revenue Growth Reaffirming mid-term outlook of 35% annual growth, driven by organic growth initiatives and strategic M&A. Growth Drivers Customer growth, market penetration, continued expansion of our integrated payments platform as well as our growth engines. Guidance as of November 7, 2023. Any usage of slide on a subsequent date does not constitute guidance re-confirmation as of such subsequent date. Refer to Cautionary Statement for a discussion of factors that could cause actual results to differ materially from outlook. Mid-term defined as over the next 3-5 years. Long-Term Outlook Revenue Growth Reaffirming long-term outlook of 35% annual growth, driven by organic growth initiatives and strategic M&A. Gross Margins Target of 50% Main drivers: providing leasing options for IoT POS, growing SaaS revenue and payment processing fees and services offering through our growth engine initiatives. Adjusted EBITDA Target of 30%.

Appendix

Highlights 13% Growth YOY in Q3 2023 Primarily due to additional capitalized development expenditure Higher CAPEX Capex ($m) 13%

IFRS to Non-IFRS (1) Equity method investee is related to our 2021 investment in Tigapo. (2) For historical years comparison (2020-2022), when excluding (i) product costs increase due to global components shortage (ii) bonus plan for non-sales employees that was introduced in Q3 2021, Adjusted EBITDA for Q3 2022 and Q3 2023 improved to $0.5M and $6.1M respectively. The following is a reconciliation of loss for the period, the most directly comparable IFRS financial measure, to Adjusted EBITDA for each of the periods indicated. Quarter ended as of (U.S. dollars in thousands) Sep 30, 2023 Sep 30, 2022 Loss for the period (3,094) (9,867) Finance expense, net 1,237 531 Tax expense 384 159 Depreciation and amortization 3,219 2,357 EBITDA 1,746 (6,820) Expenses in respect of share-based compensation 1,279 1,835 Non-Recurring issuance costs - 824 Share of loss of equity method investee (1) 503 428 ADJUSTED EBITDA (2) 3,528 (3,733)

Historical 2020-2022 IFRS to Non-IFRS Consists primarily of (i) fees and expenses, other than underwriter discount and commissions, incurred in connection with our May 2021 initial public offering on the TASE and (ii) expenses incurred in connection with our listing on Nasdaq in September 2022. Equity method investee grew due to our 2021 investment in Tigapo. The following is a reconciliation of loss for the period, the most directly comparable IFRS financial measure, to Adjusted EBITDA for each of the periods indicated. Year ended as of (U.S. dollars in thousands) Dec 31, 2020 Dec 31, 2021 Dec 31, 2022 Loss for the period (6,083) (24,769) (37,509) Finance expense, net 3,874 1,655 3,021 Tax expense (15) 632 451 Depreciation and amortization 5,908 7,198 9,028 EBITDA 3,684 (15,284) (25,009) Expenses in respect of share-based compensation 2,965 8,850 8,747 Non-Recurring Issuance costs(1) - 1,879 1,790 Share of loss of equity method investee(2) - 538 1,794 ADJUSTED EBITDA 6,649 (4,017) (12,678)

Key Definitions Managed and ConnectedDevices that are operated by our customers. End CustomersCustomers that contributed to Nayax revenue in the last 12 months. Recurring RevenueSAAS revenue and payment processing fees. Dollar-based net retention rateMeasured as a percentage of revenue from returning customers in a given year as compared to the revenue from such customers in the prior year, which reflects the increase in revenue and the rate of losses from customer churn. Revenue ChurnThe percentage of revenue lost as a result of customers leaving our platform in the last 12 months. Existing Customer ExpansionRevenue generated within a given cohort over the years presented. Each cohort represents customers from whom we received revenue for the first time, in a given year. Constant CurrencyNayax presents constant currency information to provide a framework for assessing how our underlying businesses performed excluding the effect of foreign currency rate fluctuations. Future expected results for transactions in currencies other than United States dollars are converted into United States dollars using the exchange rates in effect in the last month of the reporting period. Nayax provides this financial information to aid investors in better understanding our performance. These constant currency financial measures presented in this release should not be considered as a substitute for, or superior to, the measures of financial performance prepared in accordance with IFRS. Adjusted EBITDAAdjusted EBITDA is a non-IFRS financial measure that we define as loss for the period plus finance expenses, tax expense (benefit), depreciation and amortization, share-based compensation costs, non-recurring issuance costs and our share in losses of associates accounted for by the equity method.

Thank you! IR Contact: Virginea Stuart Gibson VP, Investor Relations virgineas@nayax.com Virgineas@nayax.com Virgineas@nayax.com Website: ir@nayax.com