Confidential | for discussion purposes only GOLUB CAPITAL DIRECT LENDING UNLEVERED CORPORATION EARNINGS PRESENTATION QUARTER ENDED DECEMBER 31, 2022

2 Such forward-looking statements may include statements preceded by, followed by or that otherwise include the words “may,” “might,” “will,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “predict,” “potential,” “plan” or similar words. We have based the forward-looking statements included in this presentation on information available to us on the date of this presentation. Actual results could differ materially from those anticipated in our forward-looking statements and future results could differ materially from historical performance. We undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to consult any additional disclosures that we may make directly to you or through reports that we have filed or in the future may file with the Securities and Exchange Commission (“SEC”), including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. This presentation contains statistics and other data that have been obtained from or compiled from information made available by third-party service providers. We have not independently verified such statistics or data. In evaluating prior performance information in this presentation, you should remember that past performance is not a guarantee, prediction, or projection of future results, and there can be no assurance that we will achieve similar results in the future. Some of the statements in this presentation constitute forward-looking statements, which relate to future events or our future performance or financial condition. The forward-looking statements contained in this presentation involve risks and uncertainties, including statements as to: our future operating results; our business prospects and the prospects of our portfolio companies including our and their ability to achieve our and their respective objectives as a result of an inflationary environment; the effect of investments that we expect to make and the competition for those investments; our contractual arrangements and relationships with third parties; actual and potential conflicts of interest with GC Advisors LLC ("GC Advisors"), our investment adviser, and other affiliates of Golub Capital LLC (collectively, "Golub Capital"); the dependence of our future success on the general economy and its effect on the industries in which we invest; the ability of our portfolio companies to achieve their objectives; the availability of equity and debt capital and our use of borrowed funds to finance a portion of our investments; the adequacy of our financing sources and working capital; the timing of cash flows, if any, from the operations of our portfolio companies; general economic and political trends and other external factors, changes in political, economic or industry conditions, the interest rate environment or conditions affecting the financial and capital markets that could result in changes to the value of our assets, including changes from the impact of an inflationary economic environment and/or the coronavirus (“COVID-19”) pandemic; the ability of GC Advisors to locate suitable investments for us and to monitor and administer our investments; the ability of GC Advisors or its affiliates to attract and retain highly talented professionals; the ability of GC Advisors to continue to effectively manage our business due to disruptions, including those caused by global health pandemics, such as the COVID-19 pandemic, or other large scale events; our ability to qualify and maintain our qualification as a regulated investment company and as a business development company; the impact of information technology systems and systems failures, including data security breaches, data privacy compliance, network disruptions, and cybersecurity attacks; general price and volume fluctuations in the stock market; the impact on our business of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules and regulations issued thereunder and any actions toward repeal thereof; and the effect of changes to tax legislation and our tax position. Disclaimer

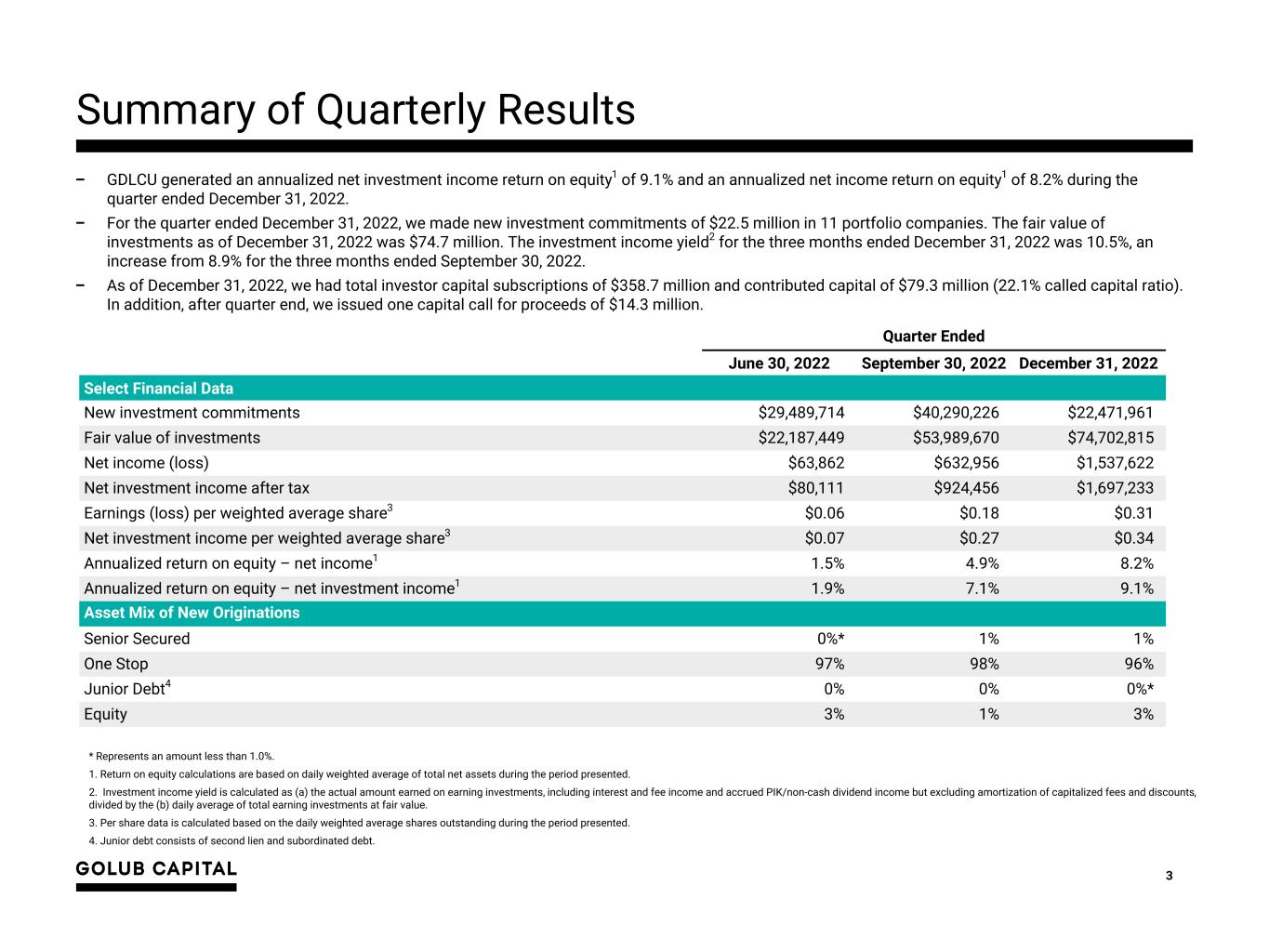

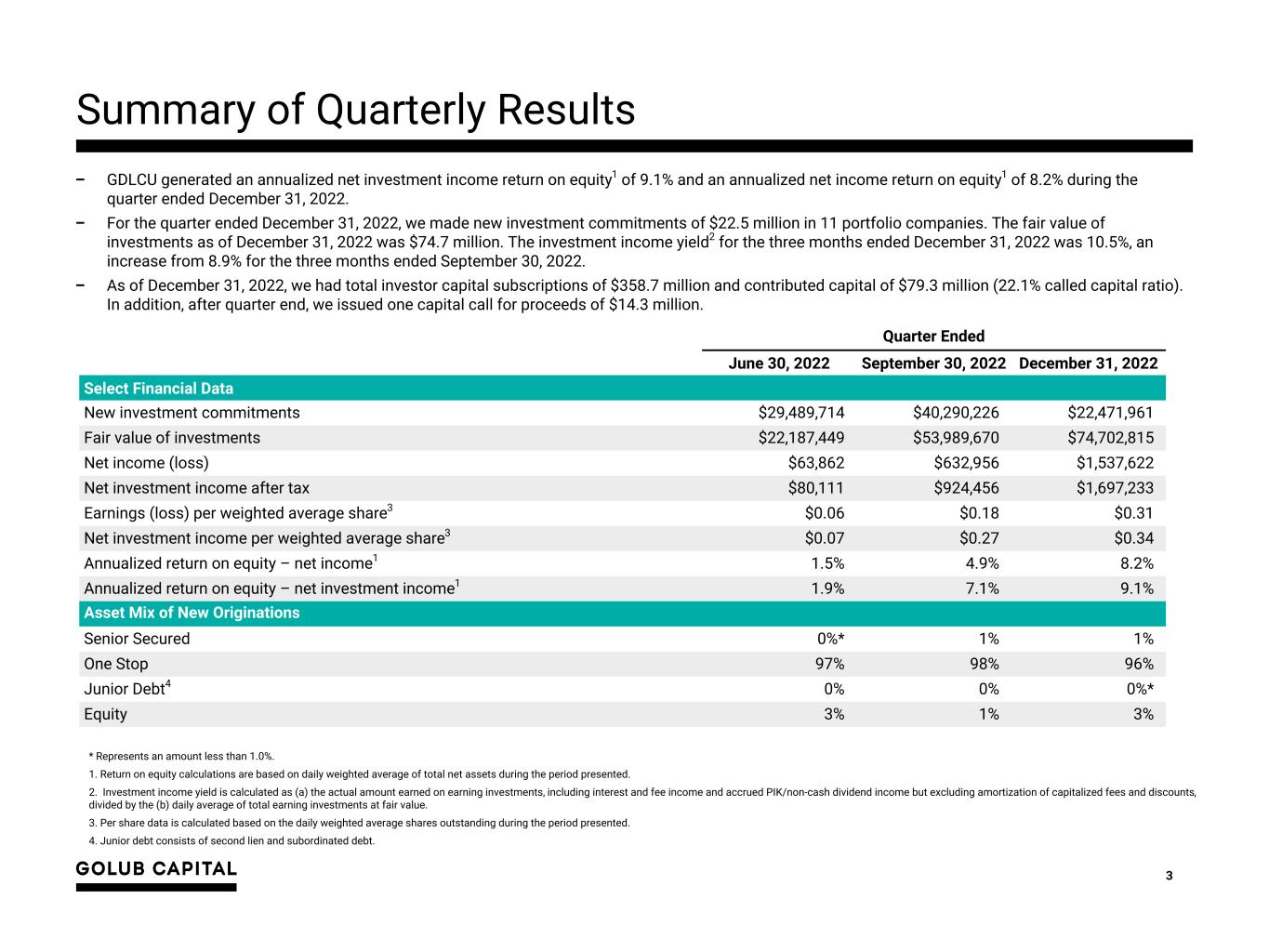

3 Summary of Quarterly Results – GDLCU generated an annualized net investment income return on equity1 of 9.1% and an annualized net income return on equity1 of 8.2% during the quarter ended December 31, 2022. – For the quarter ended December 31, 2022, we made new investment commitments of $22.5 million in 11 portfolio companies. The fair value of investments as of December 31, 2022 was $74.7 million. The investment income yield2 for the three months ended December 31, 2022 was 10.5%, an increase from 8.9% for the three months ended September 30, 2022. – As of December 31, 2022, we had total investor capital subscriptions of $358.7 million and contributed capital of $79.3 million (22.1% called capital ratio). In addition, after quarter end, we issued one capital call for proceeds of $14.3 million. * Represents an amount less than 1.0%. 1. Return on equity calculations are based on daily weighted average of total net assets during the period presented. 2. Investment income yield is calculated as (a) the actual amount earned on earning investments, including interest and fee income and accrued PIK/non-cash dividend income but excluding amortization of capitalized fees and discounts, divided by the (b) daily average of total earning investments at fair value. 3. Per share data is calculated based on the daily weighted average shares outstanding during the period presented. 4. Junior debt consists of second lien and subordinated debt. Quarter Ended June 30, 2022 September 30, 2022 December 31, 2022 Select Financial Data New investment commitments $29,489,714 $40,290,226 $22,471,961 Fair value of investments $22,187,449 $53,989,670 $74,702,815 Net income (loss) $63,862 $632,956 $1,537,622 Net investment income after tax $80,111 $924,456 $1,697,233 Earnings (loss) per weighted average share3 $0.06 $0.18 $0.31 Net investment income per weighted average share3 $0.07 $0.27 $0.34 Annualized return on equity – net income1 1.5% 4.9% 8.2% Annualized return on equity – net investment income1 1.9% 7.1% 9.1% Asset Mix of New Originations Senior Secured 0%* 1% 1% One Stop 97% 98% 96% Junior Debt4 0% 0% 0%* Equity 3% 1% 3%

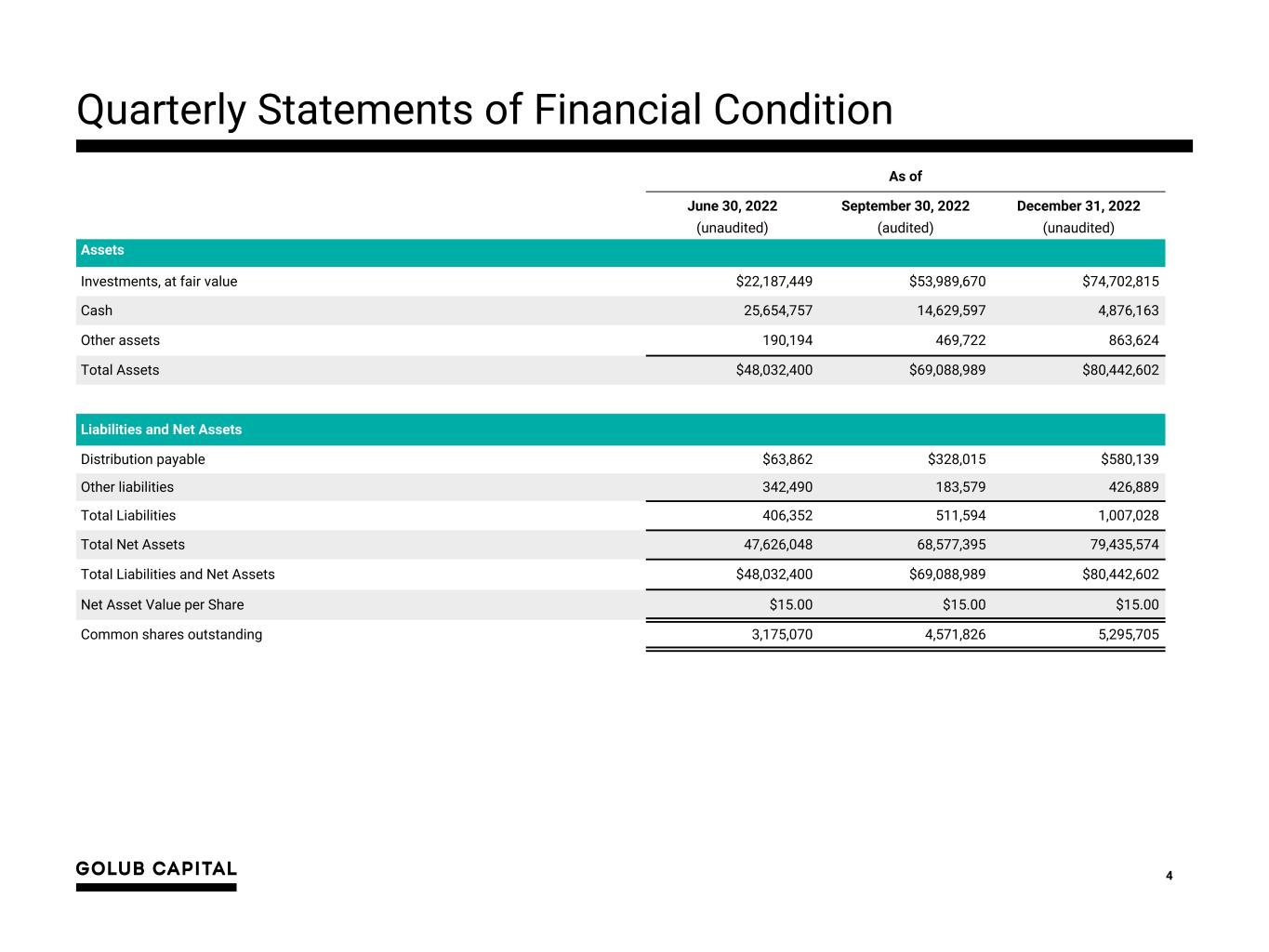

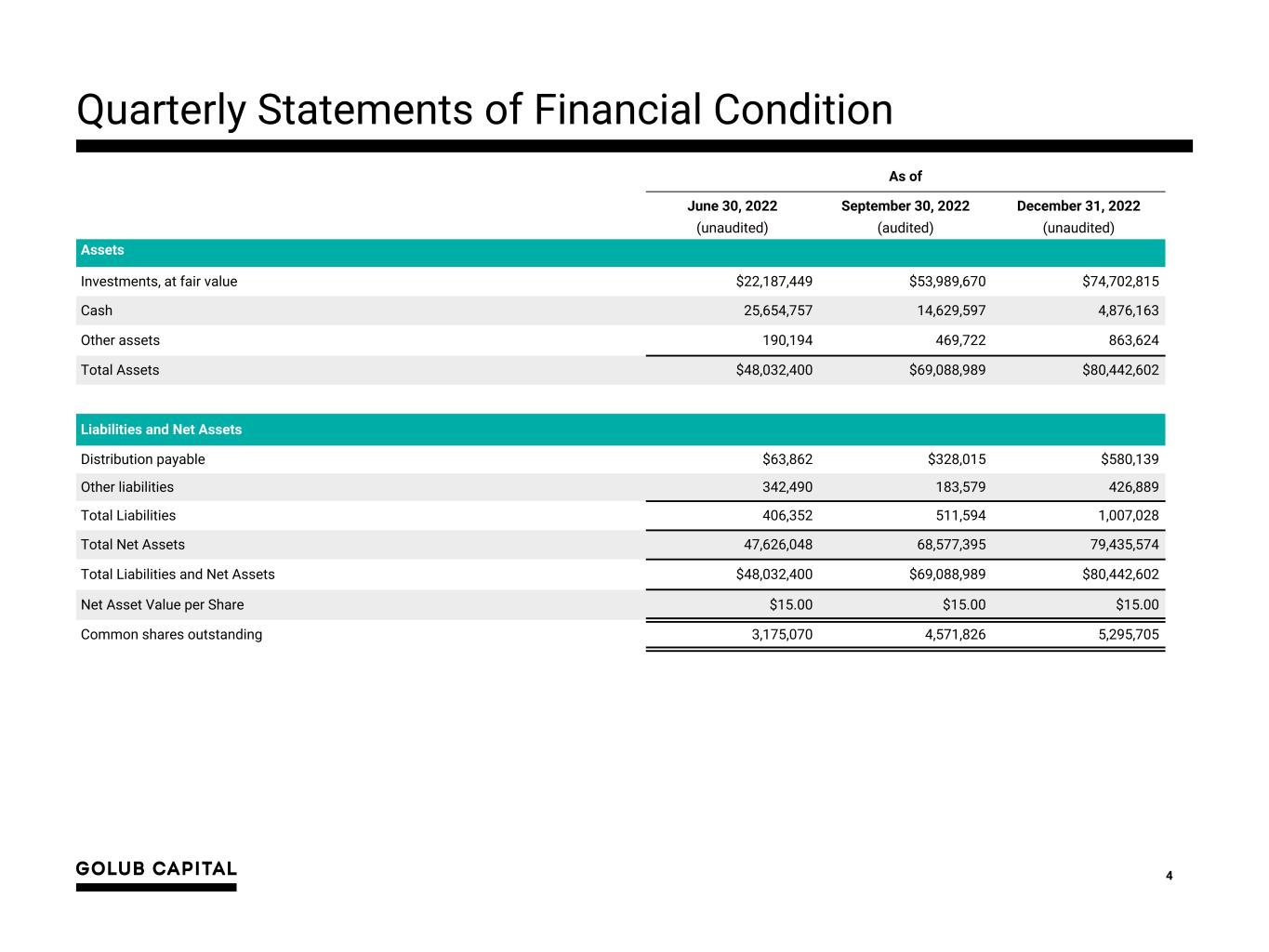

4 Quarterly Statements of Financial Condition As of June 30, 2022 September 30, 2022 December 31, 2022 (unaudited) (audited) (unaudited) Assets Investments, at fair value $22,187,449 $53,989,670 $74,702,815 Cash 25,654,757 14,629,597 4,876,163 Other assets 190,194 469,722 863,624 Total Assets $48,032,400 $69,088,989 $80,442,602 Liabilities and Net Assets Distribution payable $63,862 $328,015 $580,139 Other liabilities 342,490 183,579 426,889 Total Liabilities 406,352 511,594 1,007,028 Total Net Assets 47,626,048 68,577,395 79,435,574 Total Liabilities and Net Assets $48,032,400 $69,088,989 $80,442,602 Net Asset Value per Share $15.00 $15.00 $15.00 Common shares outstanding 3,175,070 4,571,826 5,295,705

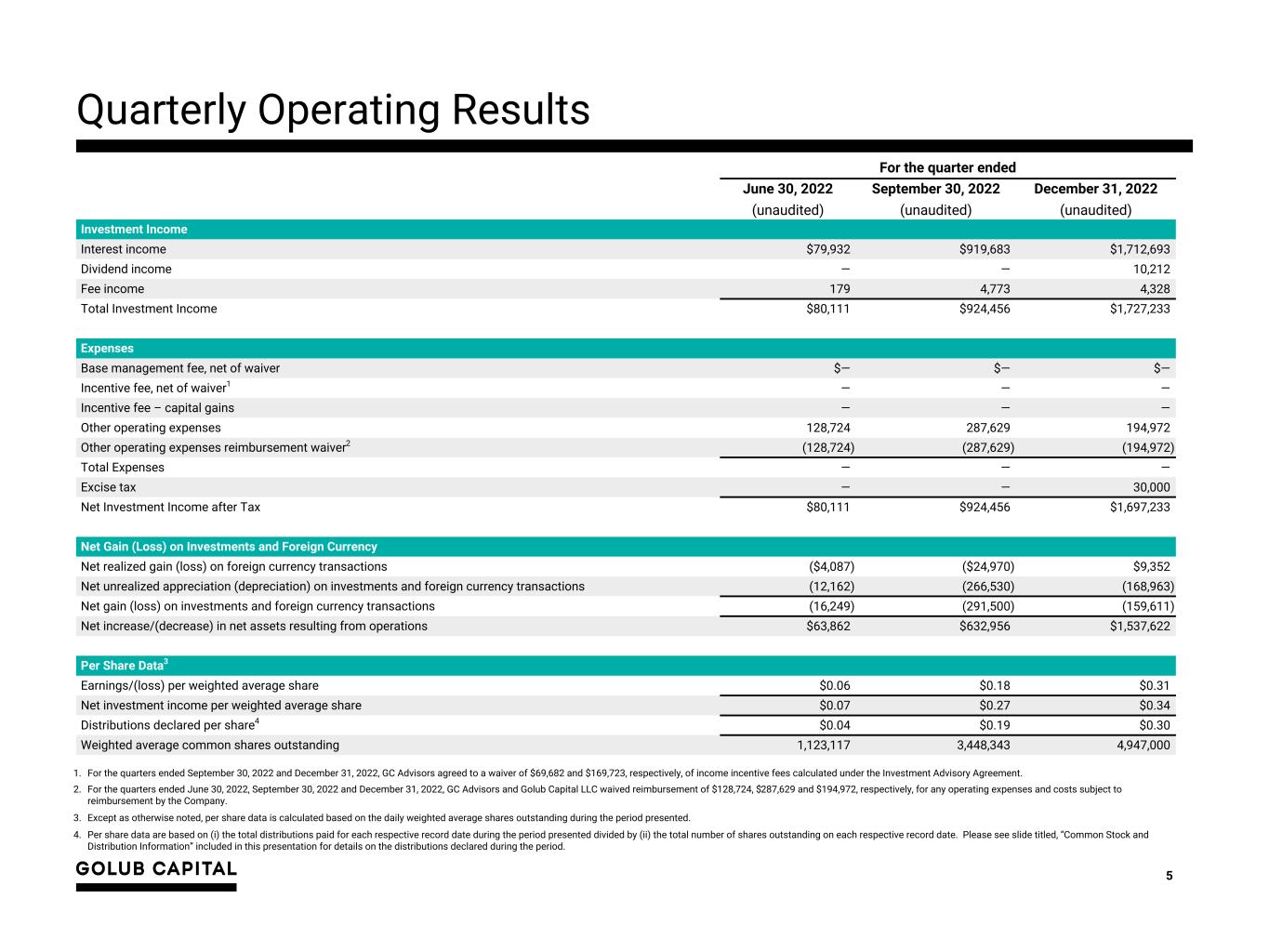

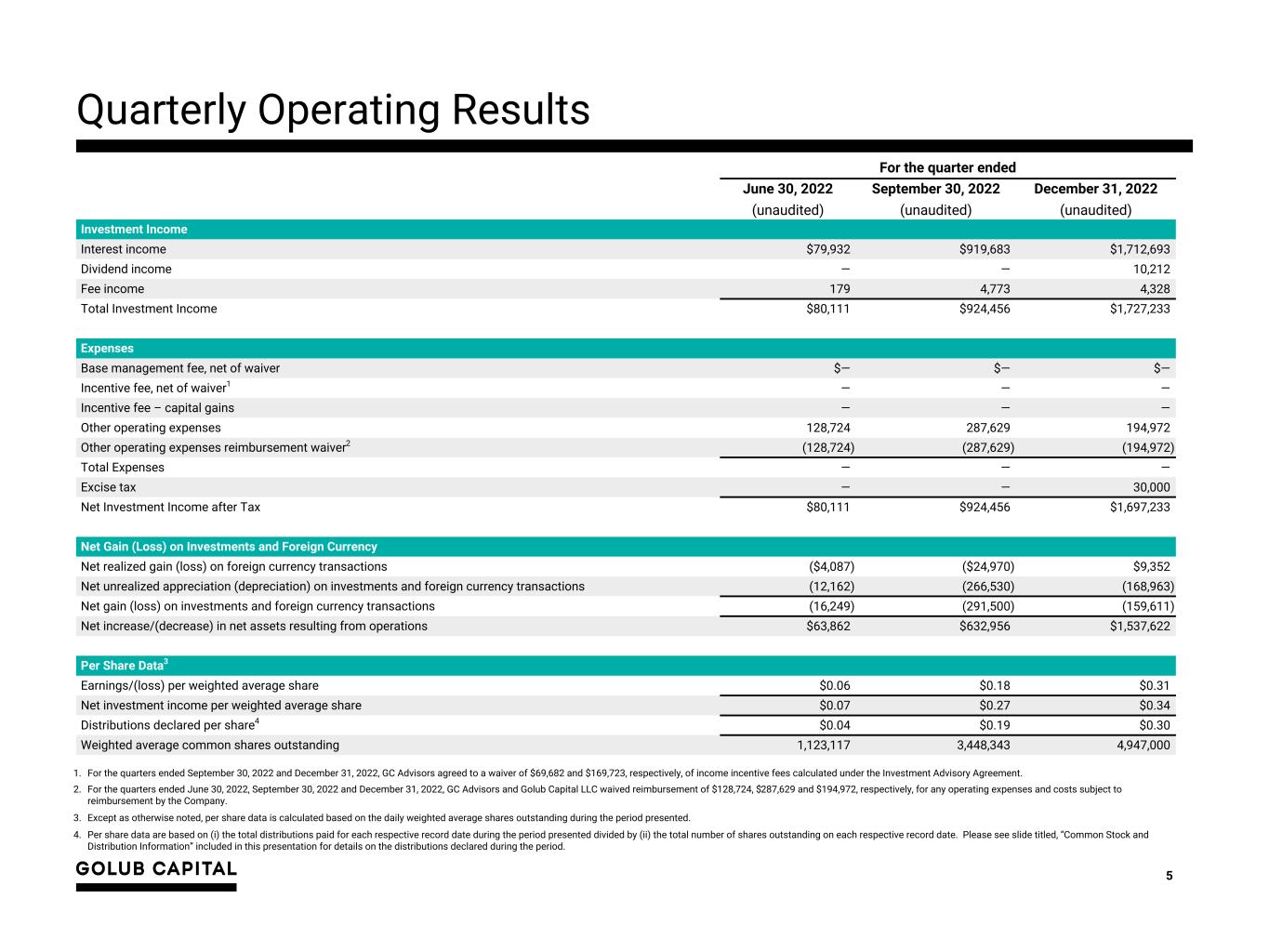

5 Quarterly Operating Results For the quarter ended June 30, 2022 September 30, 2022 December 31, 2022 (unaudited) (unaudited) (unaudited) Investment Income Interest income $79,932 $919,683 $1,712,693 Dividend income — — 10,212 Fee income 179 4,773 4,328 Total Investment Income $80,111 $924,456 $1,727,233 Expenses Base management fee, net of waiver $— $— $— Incentive fee, net of waiver1 — — — Incentive fee – capital gains — — — Other operating expenses 128,724 287,629 194,972 Other operating expenses reimbursement waiver2 (128,724) (287,629) (194,972) Total Expenses — — — Excise tax — — 30,000 Net Investment Income after Tax $80,111 $924,456 $1,697,233 Net Gain (Loss) on Investments and Foreign Currency Net realized gain (loss) on foreign currency transactions ($4,087) ($24,970) $9,352 Net unrealized appreciation (depreciation) on investments and foreign currency transactions (12,162) (266,530) (168,963) Net gain (loss) on investments and foreign currency transactions (16,249) (291,500) (159,611) Net increase/(decrease) in net assets resulting from operations $63,862 $632,956 $1,537,622 Per Share Data3 Earnings/(loss) per weighted average share $0.06 $0.18 $0.31 Net investment income per weighted average share $0.07 $0.27 $0.34 Distributions declared per share4 $0.04 $0.19 $0.30 Weighted average common shares outstanding 1,123,117 3,448,343 4,947,000 1. For the quarters ended September 30, 2022 and December 31, 2022, GC Advisors agreed to a waiver of $69,682 and $169,723, respectively, of income incentive fees calculated under the Investment Advisory Agreement. 2. For the quarters ended June 30, 2022, September 30, 2022 and December 31, 2022, GC Advisors and Golub Capital LLC waived reimbursement of $128,724, $287,629 and $194,972, respectively, for any operating expenses and costs subject to reimbursement by the Company. 3. Except as otherwise noted, per share data is calculated based on the daily weighted average shares outstanding during the period presented. 4. Per share data are based on (i) the total distributions paid for each respective record date during the period presented divided by (ii) the total number of shares outstanding on each respective record date. Please see slide titled, “Common Stock and Distribution Information” included in this presentation for details on the distributions declared during the period.

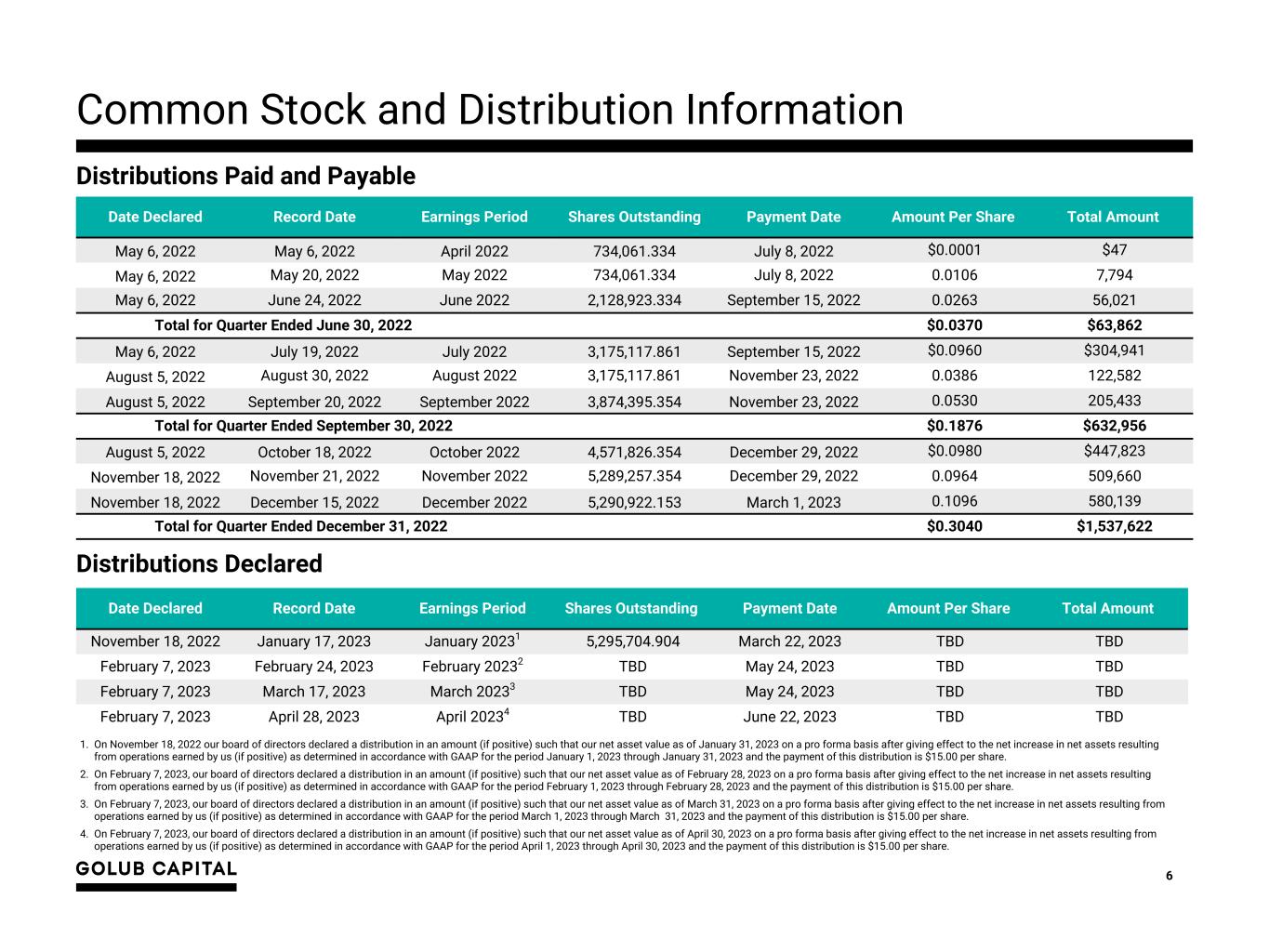

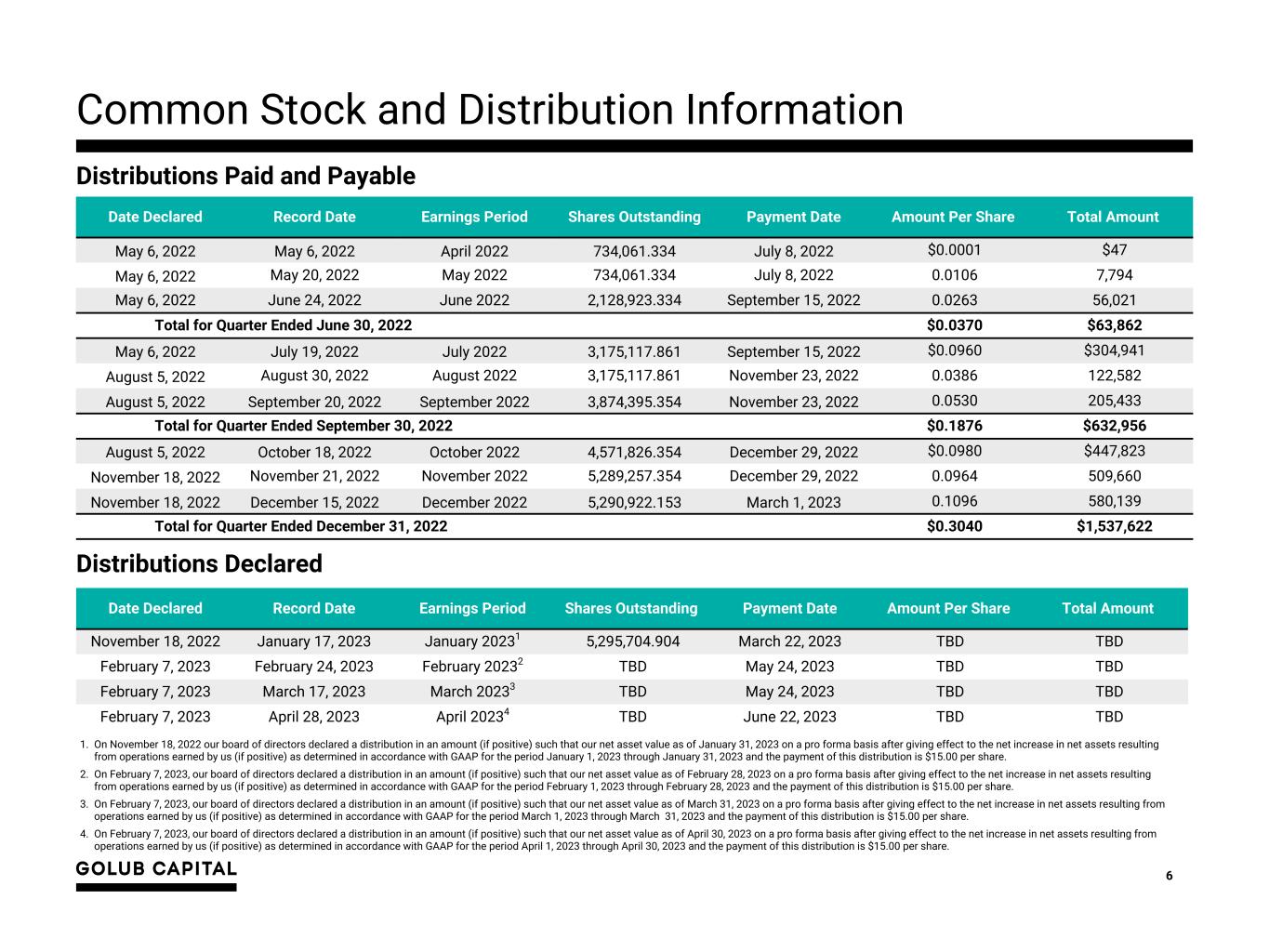

6 Common Stock and Distribution Information Distributions Paid and Payable Date Declared Record Date Earnings Period Shares Outstanding Payment Date Amount Per Share Total Amount May 6, 2022 May 6, 2022 April 2022 734,061.334 July 8, 2022 $0.0001 $47 May 6, 2022 May 20, 2022 May 2022 734,061.334 July 8, 2022 0.0106 7,794 May 6, 2022 June 24, 2022 June 2022 2,128,923.334 September 15, 2022 0.0263 56,021 Total for Quarter Ended June 30, 2022 $0.0370 $63,862 May 6, 2022 July 19, 2022 July 2022 3,175,117.861 September 15, 2022 $0.0960 $304,941 August 5, 2022 August 30, 2022 August 2022 3,175,117.861 November 23, 2022 0.0386 122,582 August 5, 2022 September 20, 2022 September 2022 3,874,395.354 November 23, 2022 0.0530 205,433 Total for Quarter Ended September 30, 2022 $0.1876 $632,956 August 5, 2022 October 18, 2022 October 2022 4,571,826.354 December 29, 2022 $0.0980 $447,823 November 18, 2022 November 21, 2022 November 2022 5,289,257.354 December 29, 2022 0.0964 509,660 November 18, 2022 December 15, 2022 December 2022 5,290,922.153 March 1, 2023 0.1096 580,139 Total for Quarter Ended December 31, 2022 $0.3040 $1,537,622 Distributions Declared Date Declared Record Date Earnings Period Shares Outstanding Payment Date Amount Per Share Total Amount November 18, 2022 January 17, 2023 January 20231 5,295,704.904 March 22, 2023 TBD TBD February 7, 2023 February 24, 2023 February 20232 TBD May 24, 2023 TBD TBD February 7, 2023 March 17, 2023 March 20233 TBD May 24, 2023 TBD TBD February 7, 2023 April 28, 2023 April 20234 TBD June 22, 2023 TBD TBD 1. On November 18, 2022 our board of directors declared a distribution in an amount (if positive) such that our net asset value as of January 31, 2023 on a pro forma basis after giving effect to the net increase in net assets resulting from operations earned by us (if positive) as determined in accordance with GAAP for the period January 1, 2023 through January 31, 2023 and the payment of this distribution is $15.00 per share. 2. On February 7, 2023, our board of directors declared a distribution in an amount (if positive) such that our net asset value as of February 28, 2023 on a pro forma basis after giving effect to the net increase in net assets resulting from operations earned by us (if positive) as determined in accordance with GAAP for the period February 1, 2023 through February 28, 2023 and the payment of this distribution is $15.00 per share. 3. On February 7, 2023, our board of directors declared a distribution in an amount (if positive) such that our net asset value as of March 31, 2023 on a pro forma basis after giving effect to the net increase in net assets resulting from operations earned by us (if positive) as determined in accordance with GAAP for the period March 1, 2023 through March 31, 2023 and the payment of this distribution is $15.00 per share. 4. On February 7, 2023, our board of directors declared a distribution in an amount (if positive) such that our net asset value as of April 30, 2023 on a pro forma basis after giving effect to the net increase in net assets resulting from operations earned by us (if positive) as determined in accordance with GAAP for the period April 1, 2023 through April 30, 2023 and the payment of this distribution is $15.00 per share.