Confidential | for discussion purposes only GOLUB CAPITAL DIRECT LENDING UNLEVERED CORPORATION EARNINGS PRESENTATION QUARTER ENDED JUNE 30, 2024

2 Such forward-looking statements may include statements preceded by, followed by or that otherwise include the words “may,” “might,” “will,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “predict,” “potential,” “plan” or similar words. We have based the forward-looking statements included in this presentation on information available to us on the date of this presentation. Actual results could differ materially from those anticipated in our forward-looking statements and future results could differ materially from historical performance. We undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to consult any additional disclosures that we make directly to you or through reports that we have filed or in the future file with the Securities and Exchange Commission (“SEC”), including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. This presentation contains statistics and other data that have been obtained from or compiled from information made available by third-party service providers. We have not independently verified such statistics or data. In evaluating prior performance information in this presentation, you should remember that past performance is not a guarantee, prediction, or projection of future results, and there can be no assurance that we will achieve similar results in the future. Some of the statements in this presentation constitute forward-looking statements, which relate to future events or our future performance or financial condition. The forward-looking statements contained in this presentation involve risks and uncertainties, including statements as to: our future operating results; our business prospects and the prospects of our portfolio companies, including our and their ability to achieve our respective objectives due to disruptions, including those caused by global health pandemics, such as the COVID-19 pandemic, or other large scale events; the effect of investments that we expect to make and the competition for those investments; completion of a public offering of our securities or other liquidity event; our contractual arrangements and relationships with third parties; actual and potential conflicts of interest with GC Advisors LLC ("GC Advisors"), our investment adviser, and other affiliates of Golub Capital LLC (collectively, "Golub Capital"); the dependence of our future success on the general economy and its effect on the industries in which we invest; the ability of our portfolio companies to achieve their objectives; the use of borrowed money to finance a portion of our investments; the adequacy of our financing sources and working capital; the timing of cash flows, if any, from the operations of our portfolio companies; general economic and political trends and other external factors, changes in political, economic or industry conditions, the interest rate environment or conditions affecting the financial and capital markets that could result in changes to the value of our assets; elevating levels of inflation, and its impact on us, on our portfolio companies and on the industries in which we invest; the ability of GC Advisors to locate suitable investments for us and to monitor and administer our investments; the ability of GC Advisors or its affiliates to attract and retain highly talented professionals; the ability of GC Advisors to continue to effectively manage our business due to disruptions, including those caused by global health pandemics, such as the COVID-19 pandemic, or other large scale events; turmoil in Ukraine and Russia, including sanctions related to such turmoil, and the potential for volatility in energy prices and other supply chain issues and any impact on the industries in which we invest; our ability to qualify and maintain our qualification as a regulated investment company and as a business development company; the impact of information technology systems and systems failures, including data security breaches, data privacy compliance, network disruptions, and cybersecurity attacks; general price and volume fluctuations in the stock markets; the impact on our business of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules and regulations issued thereunder and any actions toward repeal thereof; and the effect of changes to tax legislation and our tax position. Disclaimer

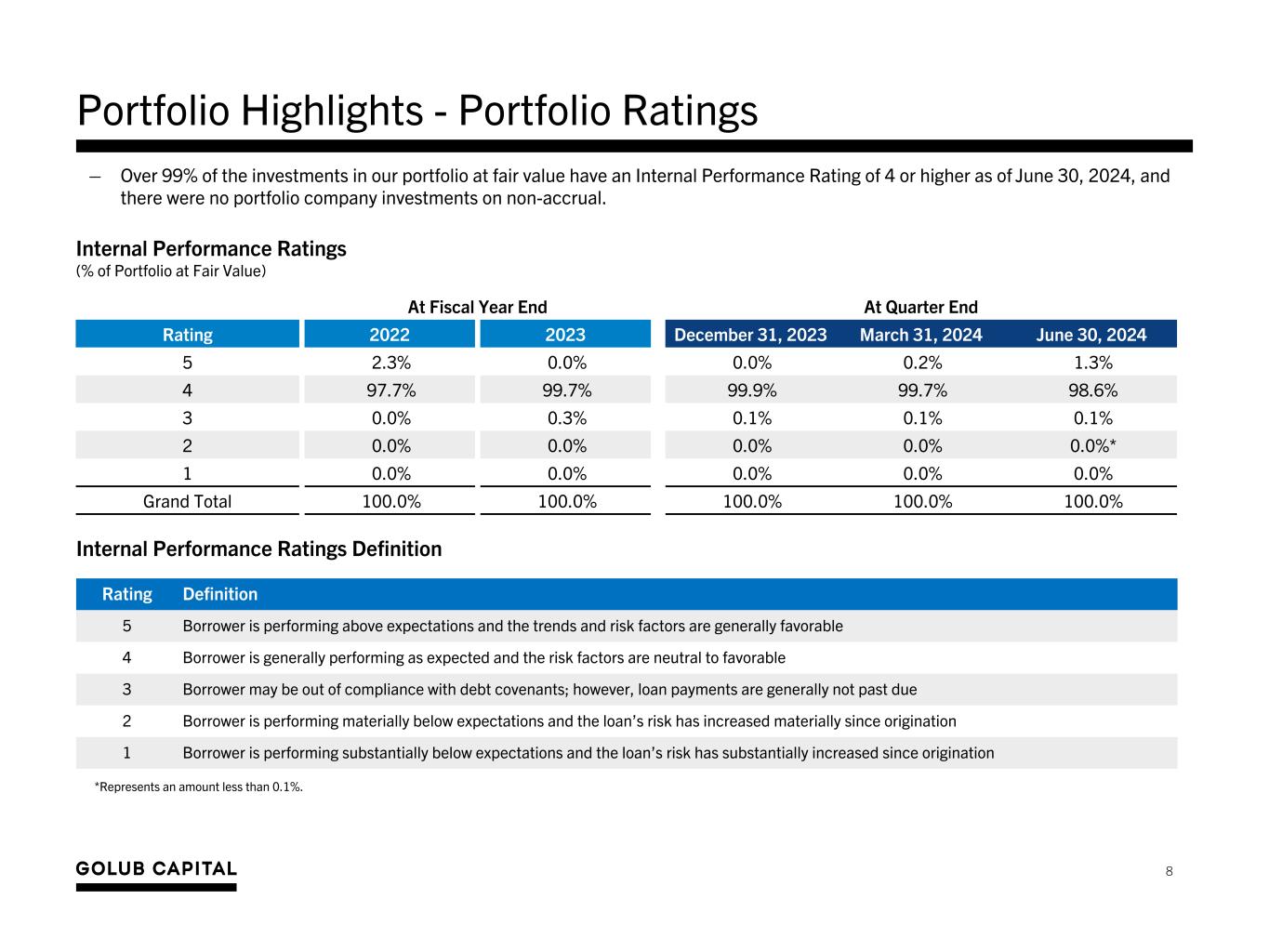

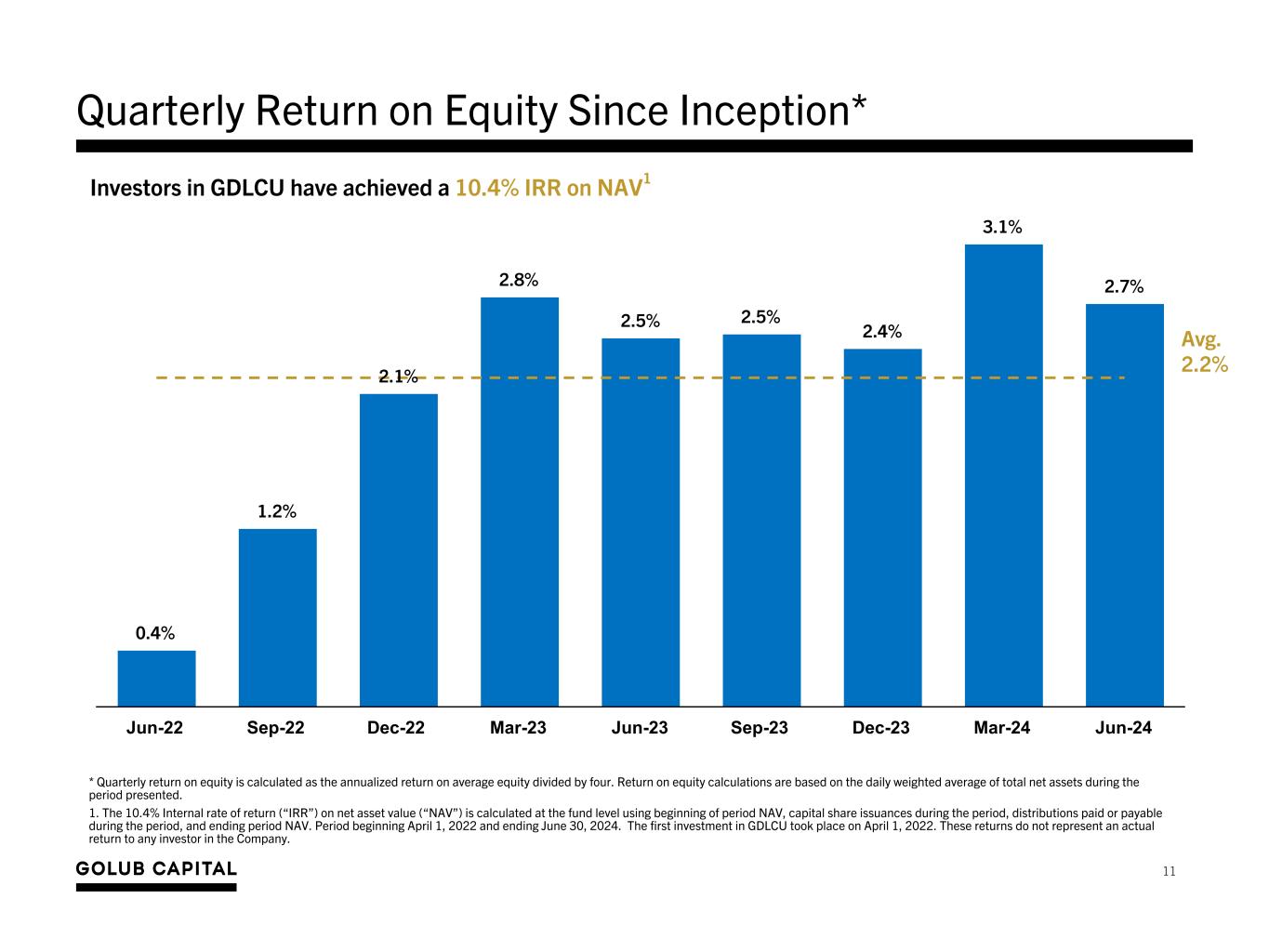

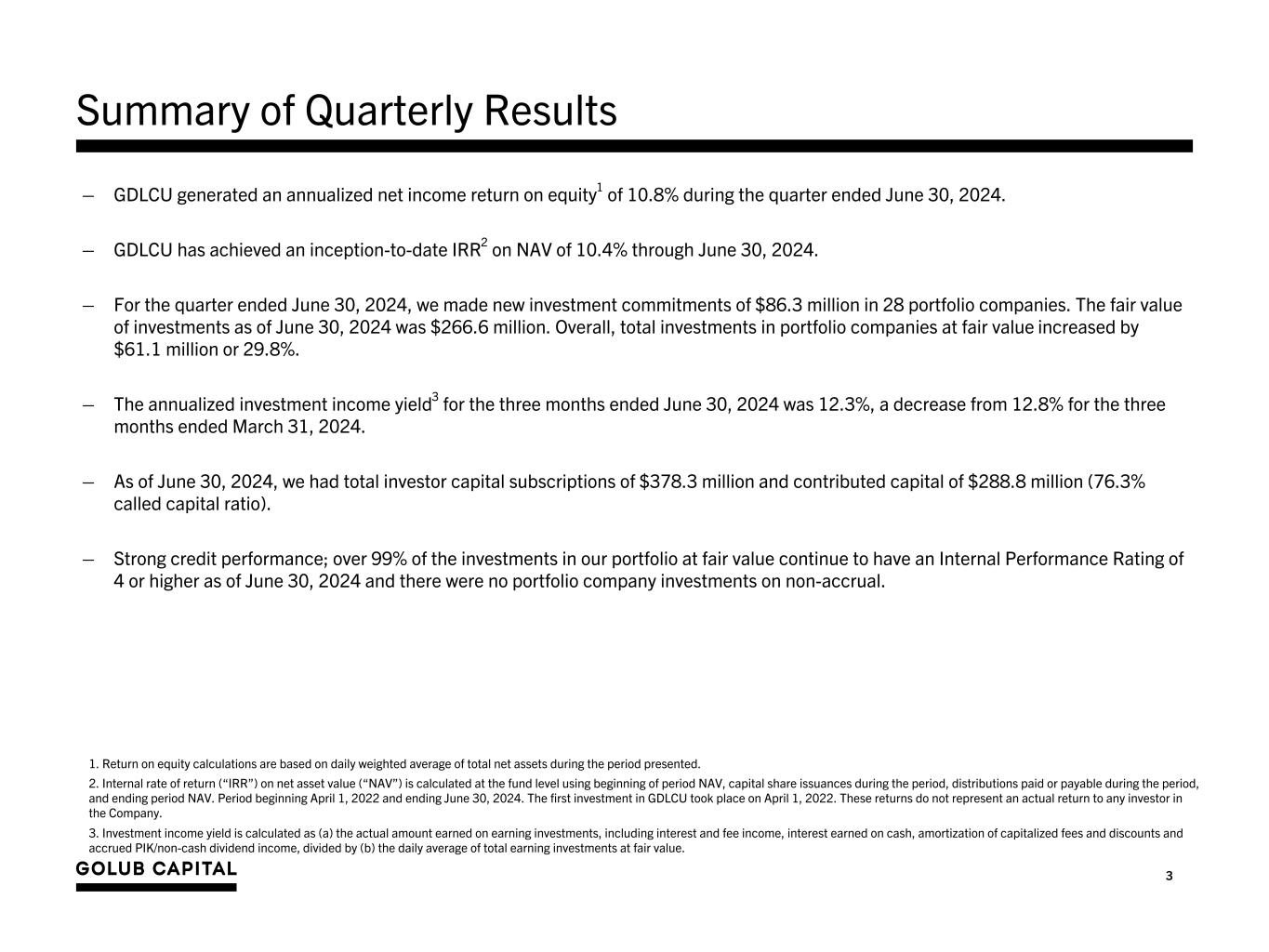

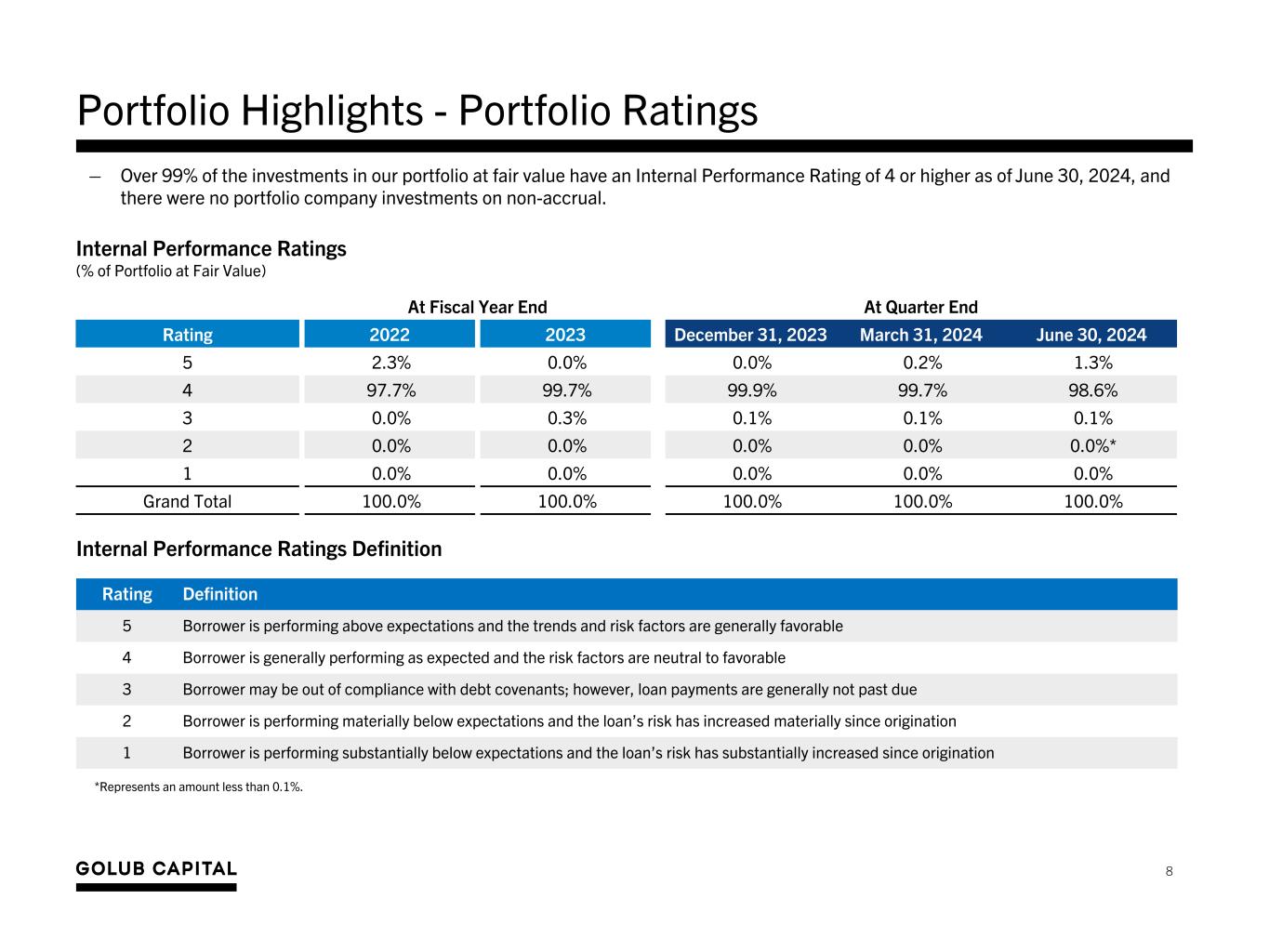

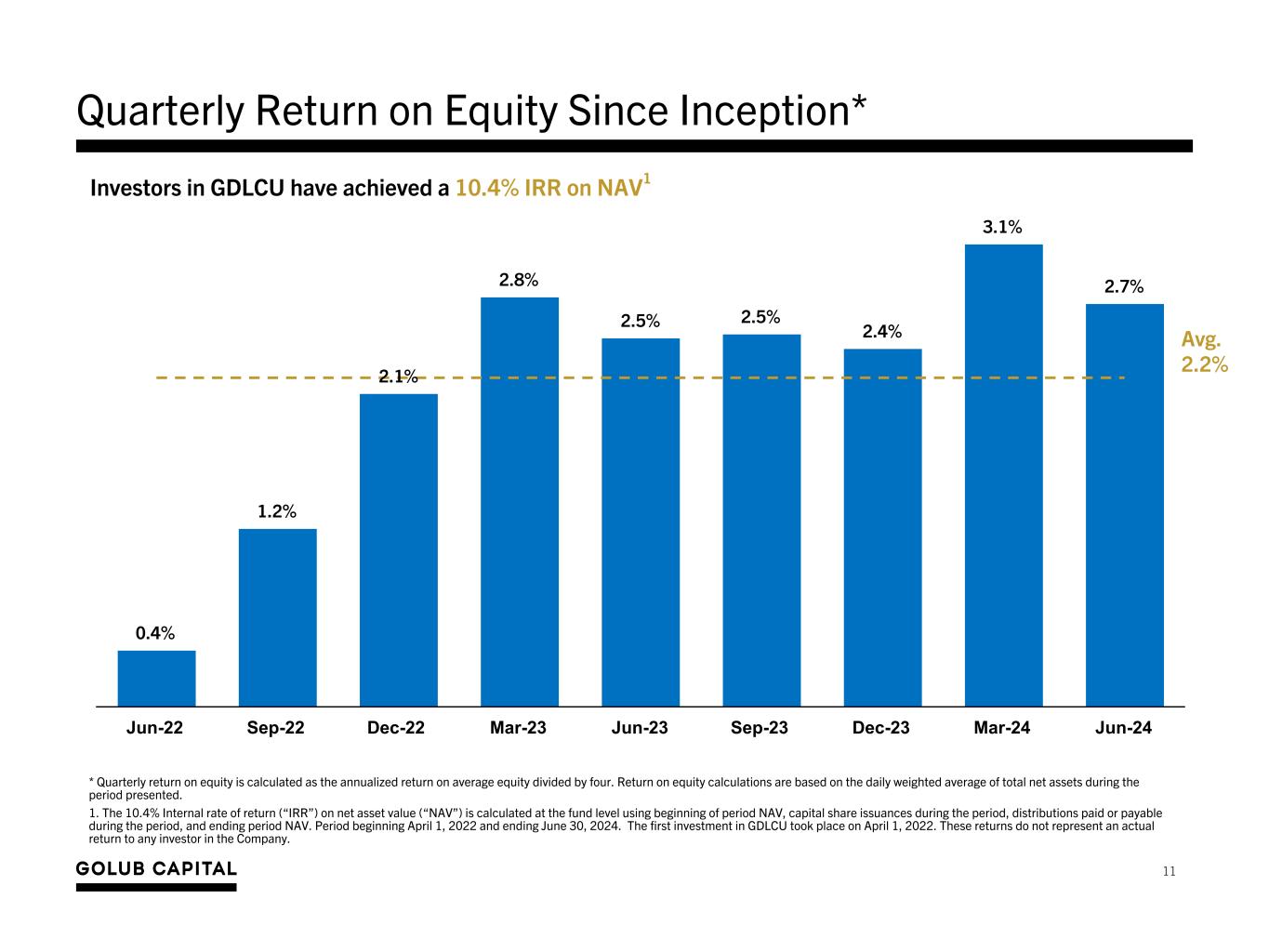

3 Summary of Quarterly Results – GDLCU generated an annualized net income return on equity1 of 10.8% during the quarter ended June 30, 2024. – GDLCU has achieved an inception-to-date IRR2 on NAV of 10.4% through June 30, 2024. – For the quarter ended June 30, 2024, we made new investment commitments of $86.3 million in 28 portfolio companies. The fair value of investments as of June 30, 2024 was $266.6 million. Overall, total investments in portfolio companies at fair value increased by $61.1 million or 29.8%. – The annualized investment income yield3 for the three months ended June 30, 2024 was 12.3%, a decrease from 12.8% for the three months ended March 31, 2024. – As of June 30, 2024, we had total investor capital subscriptions of $378.3 million and contributed capital of $288.8 million (76.3% called capital ratio). – Strong credit performance; over 99% of the investments in our portfolio at fair value continue to have an Internal Performance Rating of 4 or higher as of June 30, 2024 and there were no portfolio company investments on non-accrual. 1. Return on equity calculations are based on daily weighted average of total net assets during the period presented. 2. Internal rate of return (“IRR”) on net asset value (“NAV”) is calculated at the fund level using beginning of period NAV, capital share issuances during the period, distributions paid or payable during the period, and ending period NAV. Period beginning April 1, 2022 and ending June 30, 2024. The first investment in GDLCU took place on April 1, 2022. These returns do not represent an actual return to any investor in the Company. 3. Investment income yield is calculated as (a) the actual amount earned on earning investments, including interest and fee income, interest earned on cash, amortization of capitalized fees and discounts and accrued PIK/non-cash dividend income, divided by (b) the daily average of total earning investments at fair value.

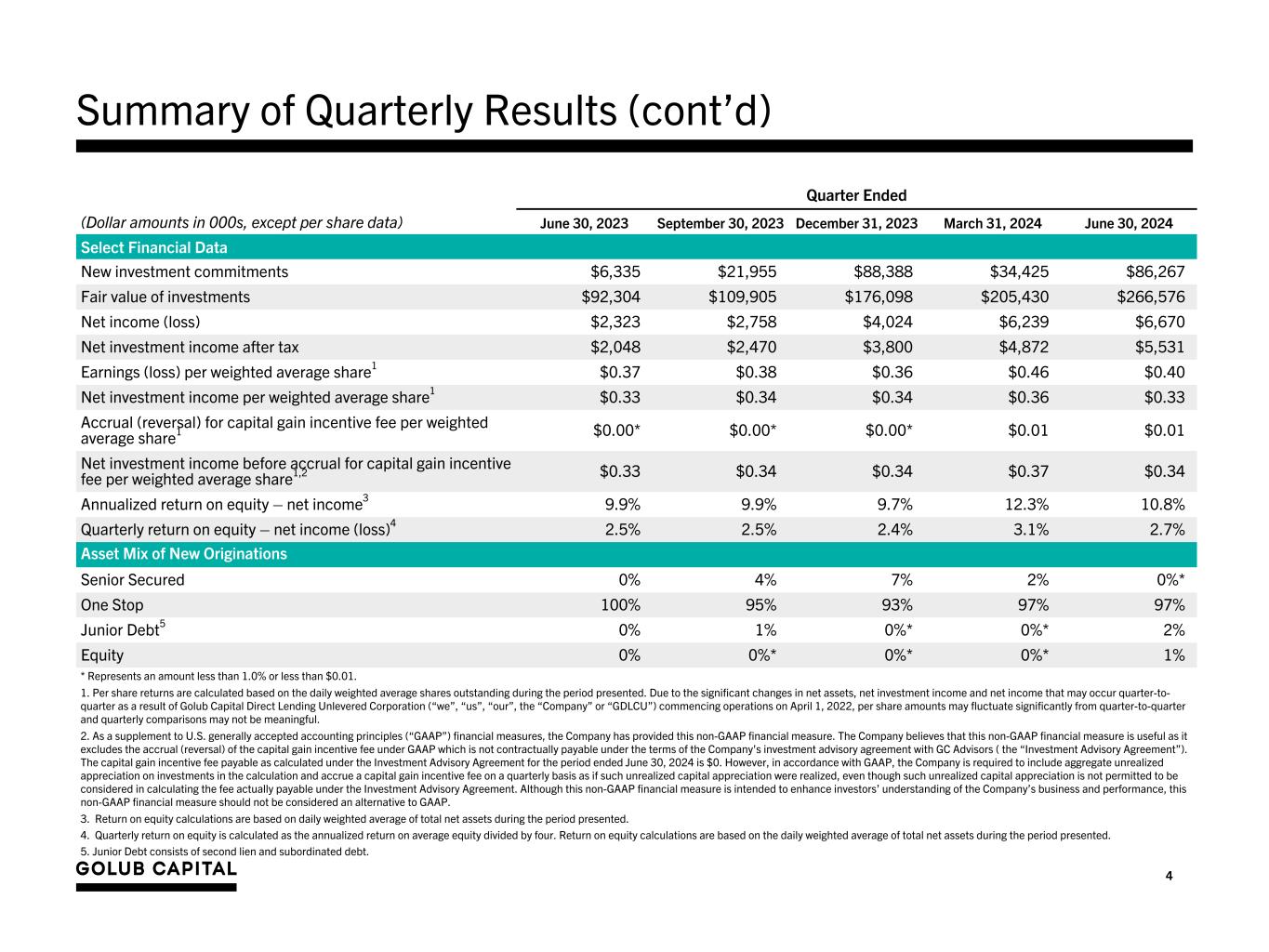

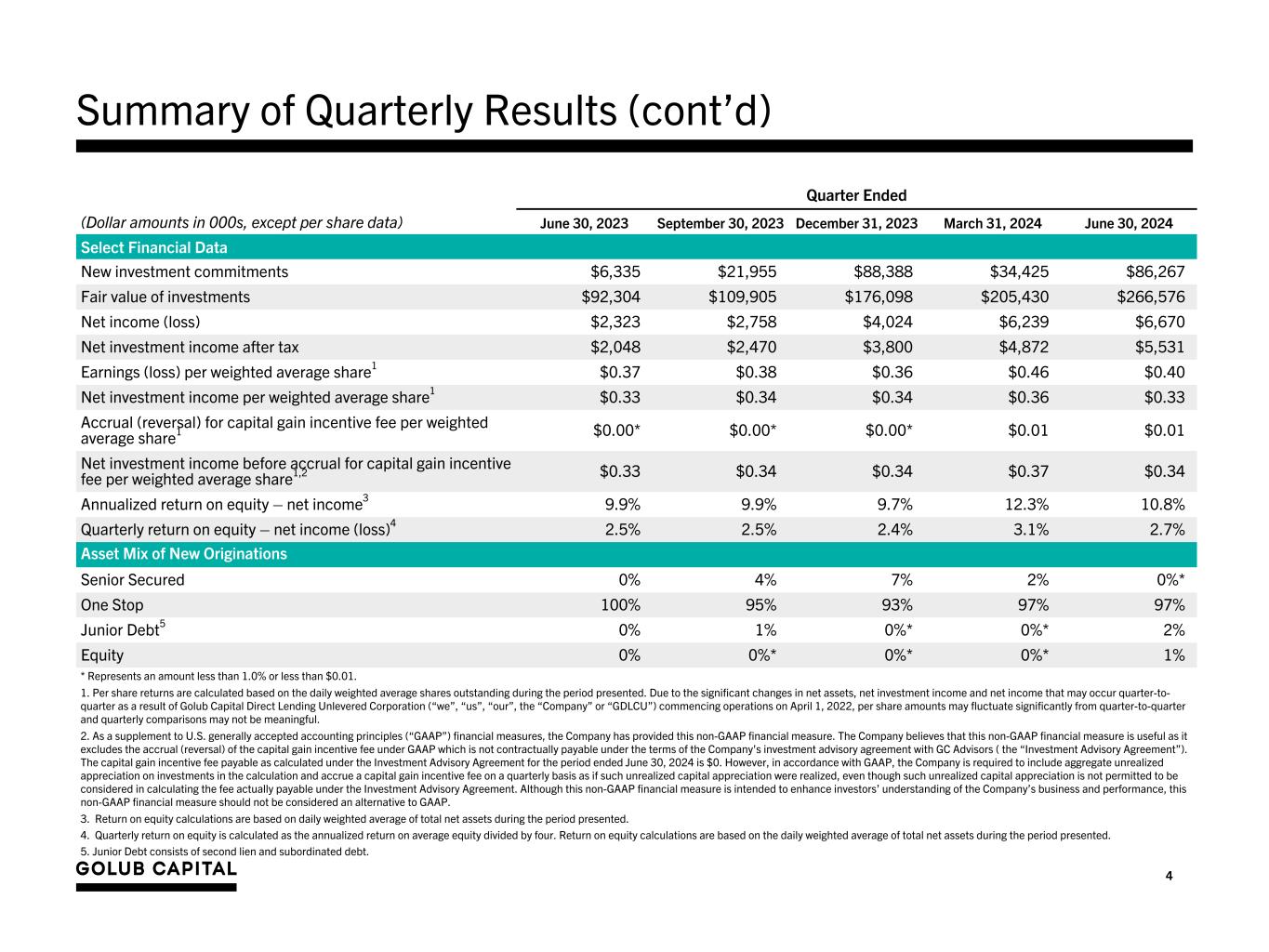

4 Summary of Quarterly Results (cont’d) * Represents an amount less than 1.0% or less than $0.01. 1. Per share returns are calculated based on the daily weighted average shares outstanding during the period presented. Due to the significant changes in net assets, net investment income and net income that may occur quarter-to- quarter as a result of Golub Capital Direct Lending Unlevered Corporation (“we”, “us”, “our”, the “Company” or “GDLCU”) commencing operations on April 1, 2022, per share amounts may fluctuate significantly from quarter-to-quarter and quarterly comparisons may not be meaningful. 2. As a supplement to U.S. generally accepted accounting principles (“GAAP”) financial measures, the Company has provided this non-GAAP financial measure. The Company believes that this non-GAAP financial measure is useful as it excludes the accrual (reversal) of the capital gain incentive fee under GAAP which is not contractually payable under the terms of the Company’s investment advisory agreement with GC Advisors ( the “Investment Advisory Agreement”). The capital gain incentive fee payable as calculated under the Investment Advisory Agreement for the period ended June 30, 2024 is $0. However, in accordance with GAAP, the Company is required to include aggregate unrealized appreciation on investments in the calculation and accrue a capital gain incentive fee on a quarterly basis as if such unrealized capital appreciation were realized, even though such unrealized capital appreciation is not permitted to be considered in calculating the fee actually payable under the Investment Advisory Agreement. Although this non-GAAP financial measure is intended to enhance investors’ understanding of the Company’s business and performance, this non-GAAP financial measure should not be considered an alternative to GAAP. 3. Return on equity calculations are based on daily weighted average of total net assets during the period presented. 4. Quarterly return on equity is calculated as the annualized return on average equity divided by four. Return on equity calculations are based on the daily weighted average of total net assets during the period presented. 5. Junior Debt consists of second lien and subordinated debt. Quarter Ended (Dollar amounts in 000s, except per share data) June 30, 2023 September 30, 2023 December 31, 2023 March 31, 2024 June 30, 2024 Select Financial Data New investment commitments $6,335 $21,955 $88,388 $34,425 $86,267 Fair value of investments $92,304 $109,905 $176,098 $205,430 $266,576 Net income (loss) $2,323 $2,758 $4,024 $6,239 $6,670 Net investment income after tax $2,048 $2,470 $3,800 $4,872 $5,531 Earnings (loss) per weighted average share1 $0.37 $0.38 $0.36 $0.46 $0.40 Net investment income per weighted average share1 $0.33 $0.34 $0.34 $0.36 $0.33 Accrual (reversal) for capital gain incentive fee per weighted average share1 $0.00* $0.00* $0.00* $0.01 $0.01 Net investment income before accrual for capital gain incentive fee per weighted average share1,2 $0.33 $0.34 $0.34 $0.37 $0.34 Annualized return on equity – net income3 9.9 % 9.9 % 9.7 % 12.3 % 10.8 % Quarterly return on equity – net income (loss)4 2.5 % 2.5 % 2.4 % 3.1 % 2.7 % Asset Mix of New Originations Senior Secured 0% 4% 7% 2% 0%* One Stop 100% 95% 93% 97% 97% Junior Debt5 0% 1% 0%* 0%* 2% Equity 0% 0%* 0%* 0%* 1%

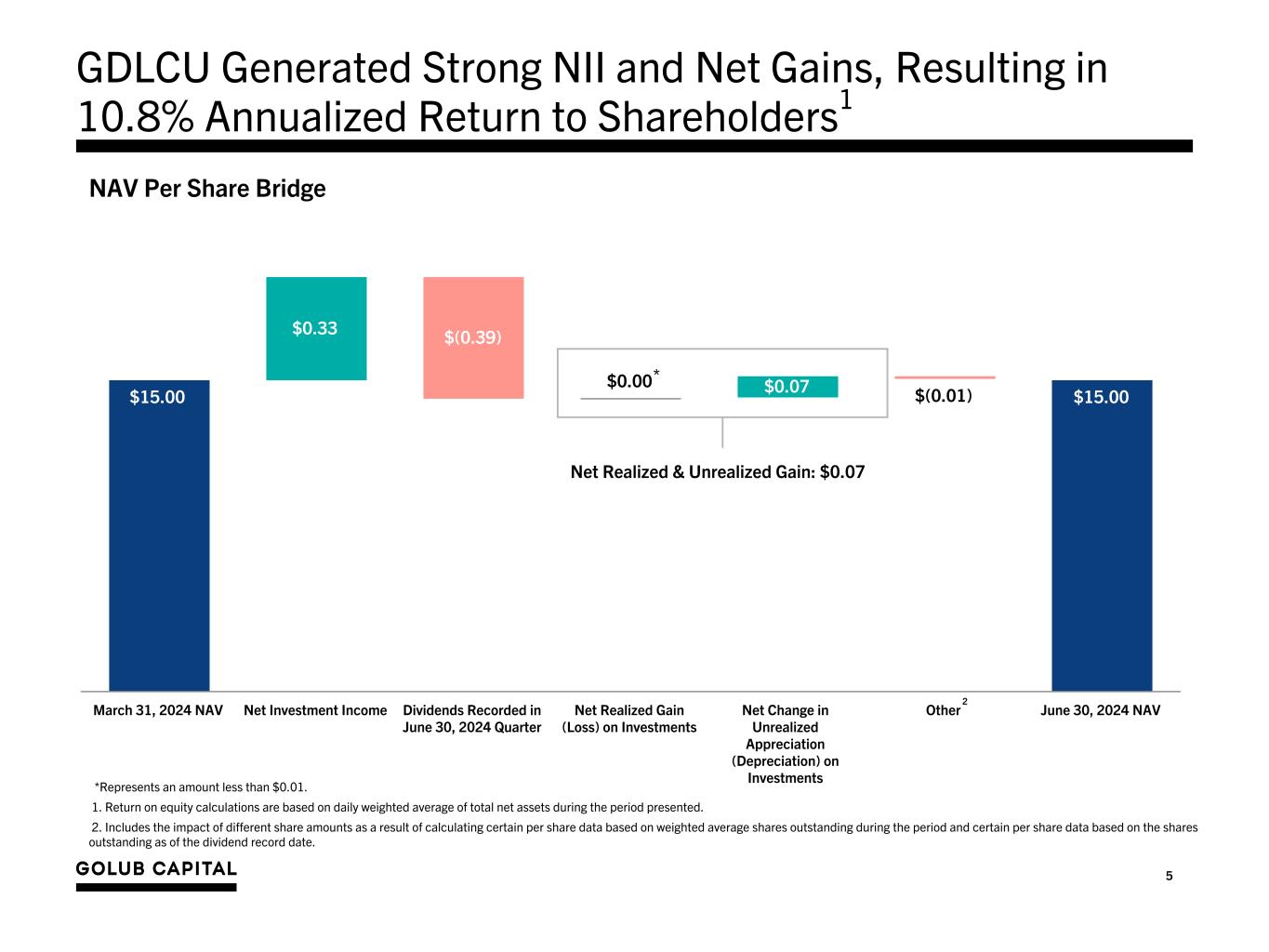

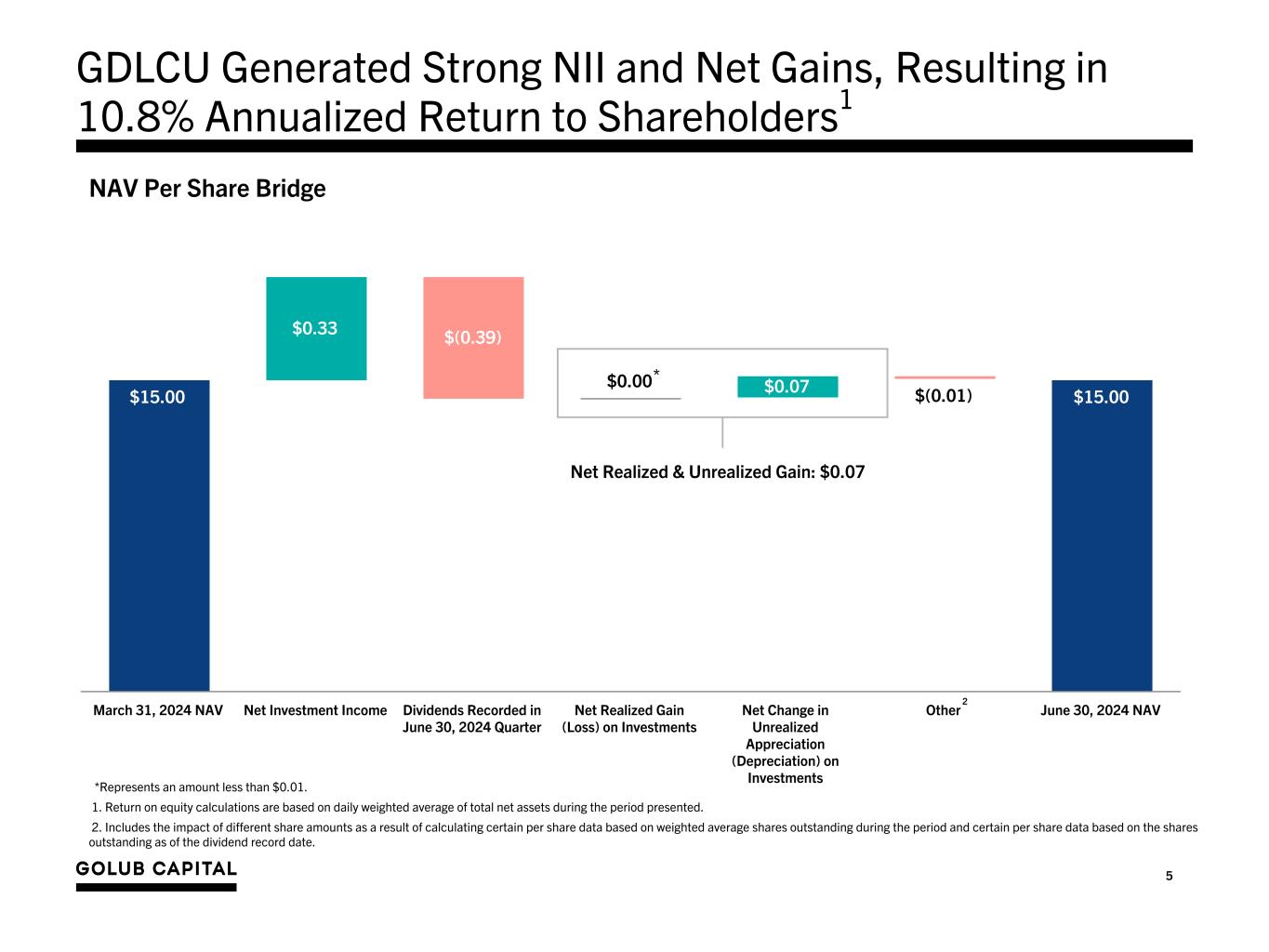

5 GDLCU Generated Strong NII and Net Gains, Resulting in 10.8% Annualized Return to Shareholders1 *Represents an amount less than $0.01. 1. Return on equity calculations are based on daily weighted average of total net assets during the period presented. 2. Includes the impact of different share amounts as a result of calculating certain per share data based on weighted average shares outstanding during the period and certain per share data based on the shares outstanding as of the dividend record date. NAV Per Share Bridge $15.00 $0.33 $(0.39) $0.00 $0.07 $(0.01) $15.00 March 31, 2024 NAV Net Investment Income Dividends Recorded in June 30, 2024 Quarter Net Realized Gain (Loss) on Investments Net Change in Unrealized Appreciation (Depreciation) on Investments Other June 30, 2024 NAV Net Realized & Unrealized Gain: $0.07 2 *

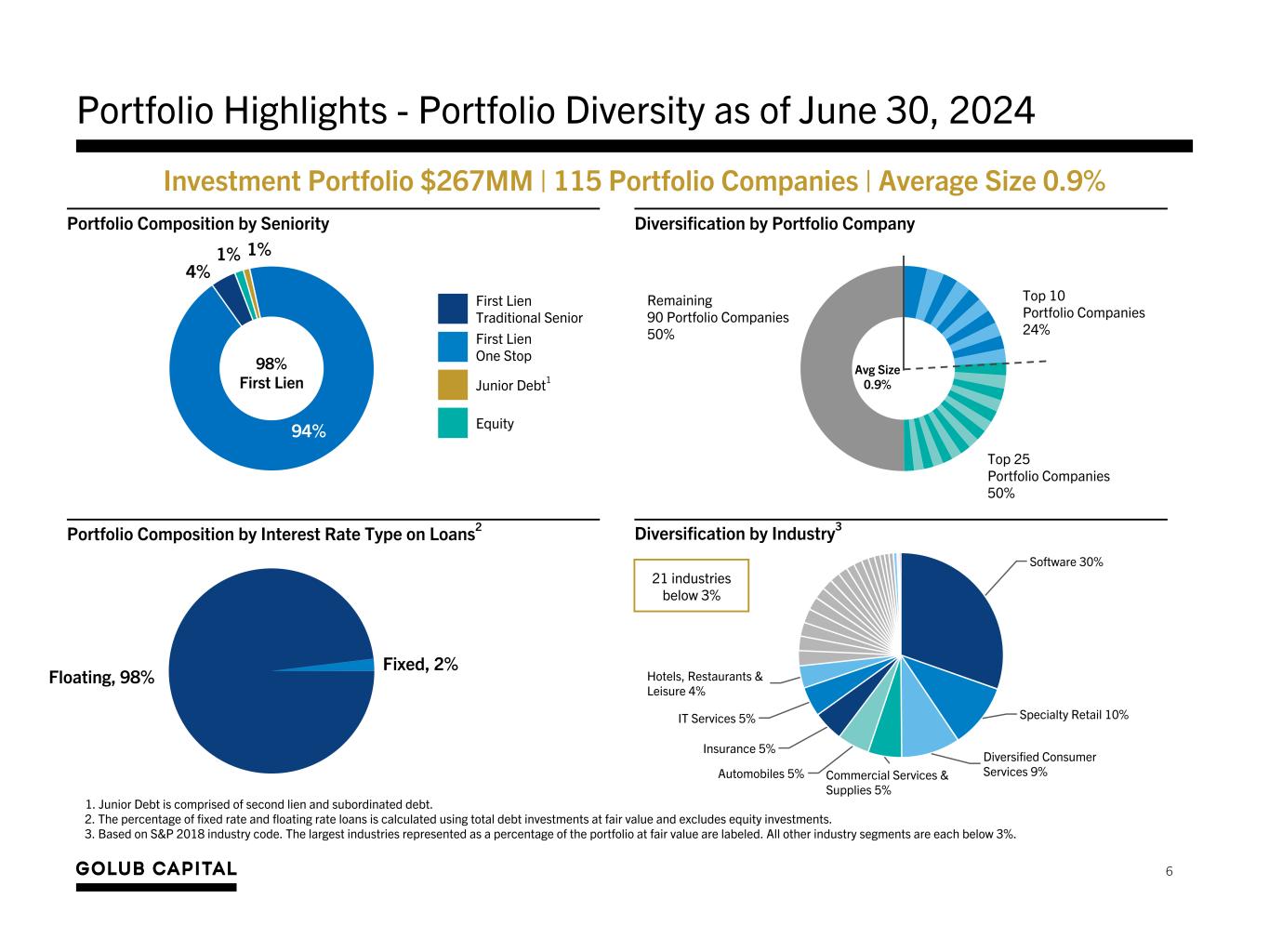

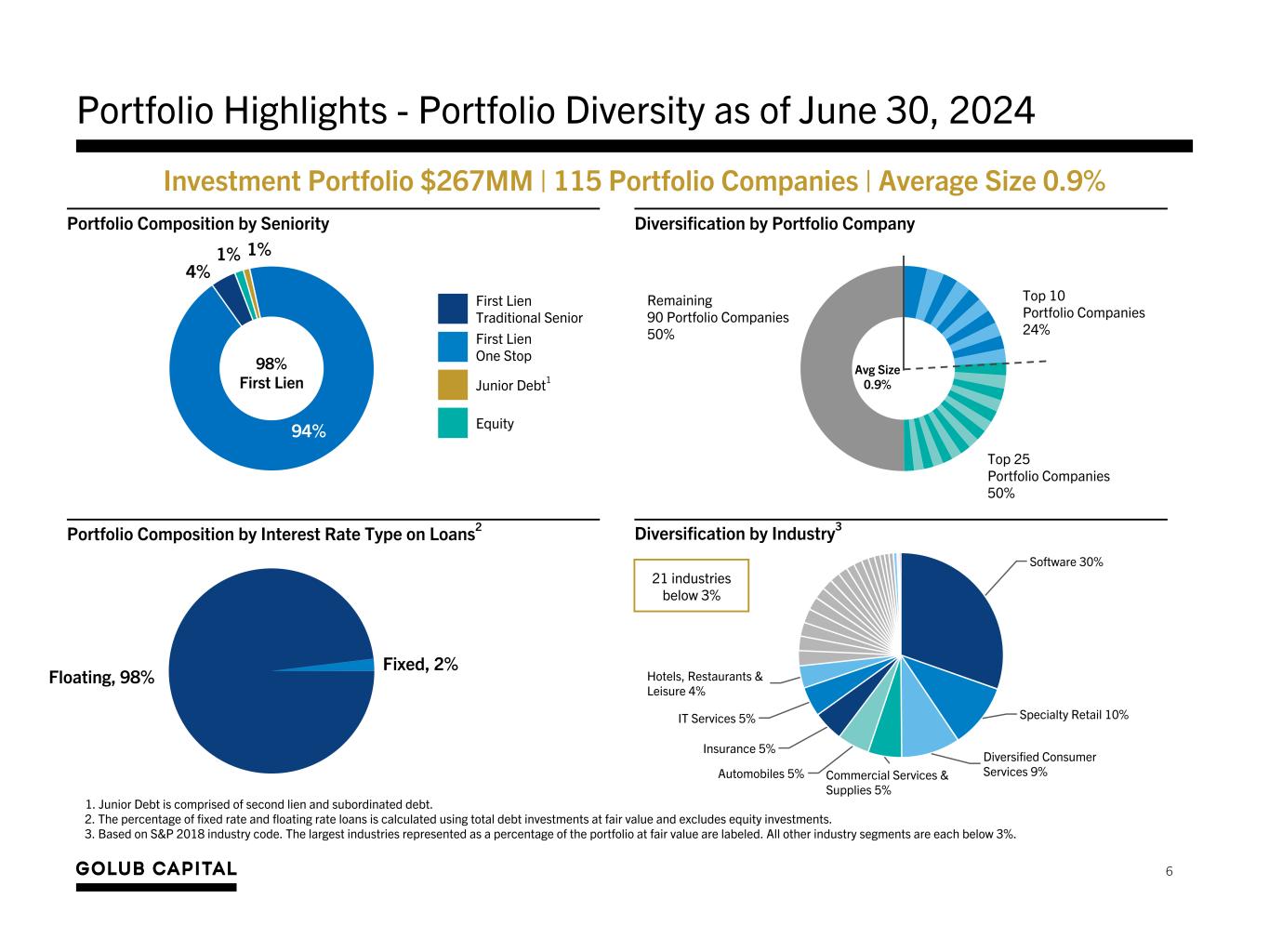

6 Portfolio Highlights - Portfolio Diversity as of June 30, 2024 Portfolio Composition by Seniority 1. Junior Debt is comprised of second lien and subordinated debt. 2. The percentage of fixed rate and floating rate loans is calculated using total debt investments at fair value and excludes equity investments. 3. Based on S&P 2018 industry code. The largest industries represented as a percentage of the portfolio at fair value are labeled. All other industry segments are each below 3%. 1% 1% 94% 4% Investment Portfolio $267MM | 115 Portfolio Companies | Average Size 0.9% First Lien Traditional Senior First Lien One Stop Junior Debt1 Equity 98% First Lien Diversification by Portfolio Company Avg Size 0.9% Top 10 Portfolio Companies 24% Top 25 Portfolio Companies 50% Remaining 90 Portfolio Companies 50% Diversification by Industry3Portfolio Composition by Interest Rate Type on Loans2 Floating, 98% Fixed, 2% Software 30% Specialty Retail 10% Diversified Consumer Services 9%Commercial Services & Supplies 5% Automobiles 5% Insurance 5% IT Services 5% Hotels, Restaurants & Leisure 4% 21 industries below 3%

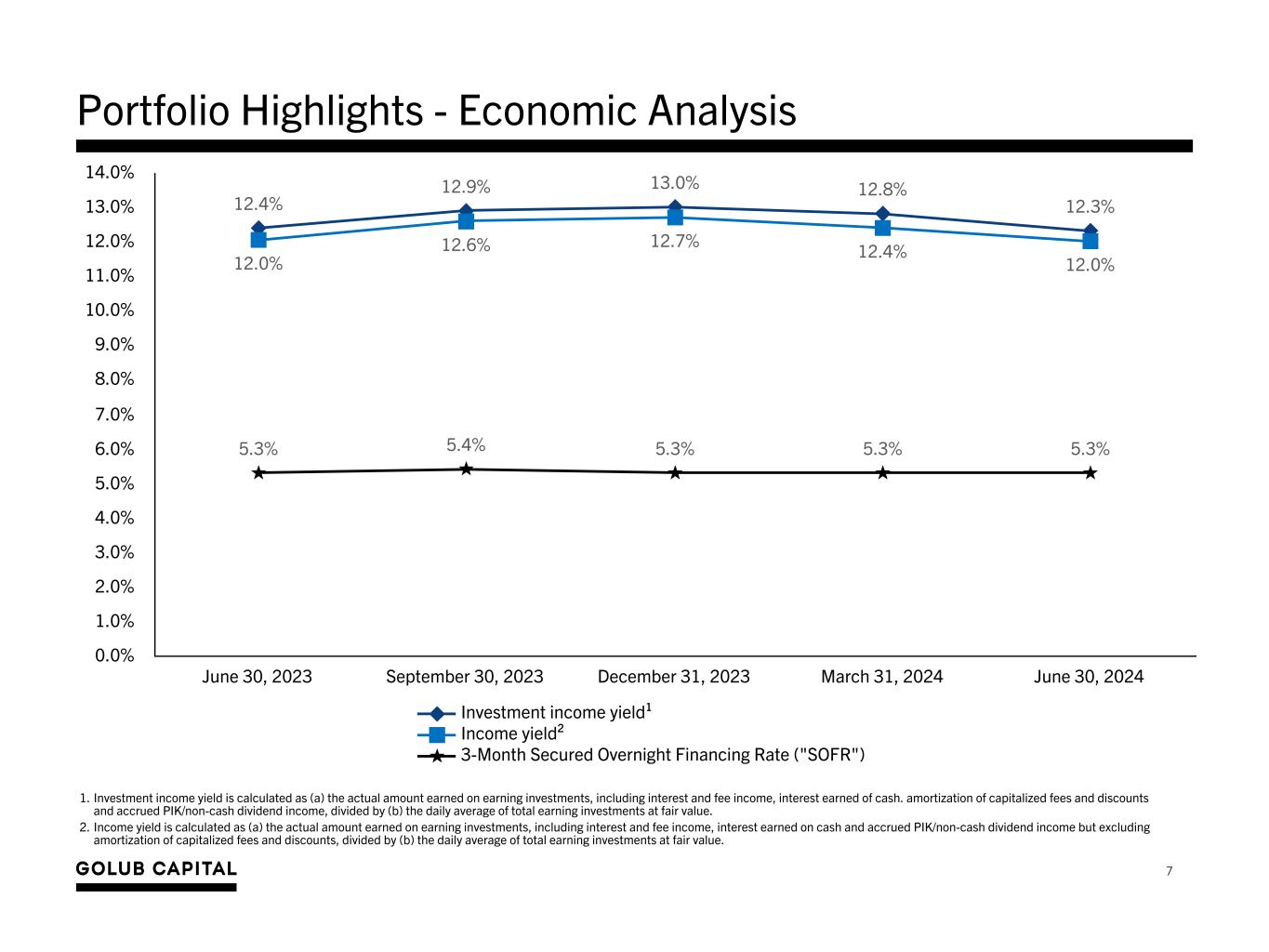

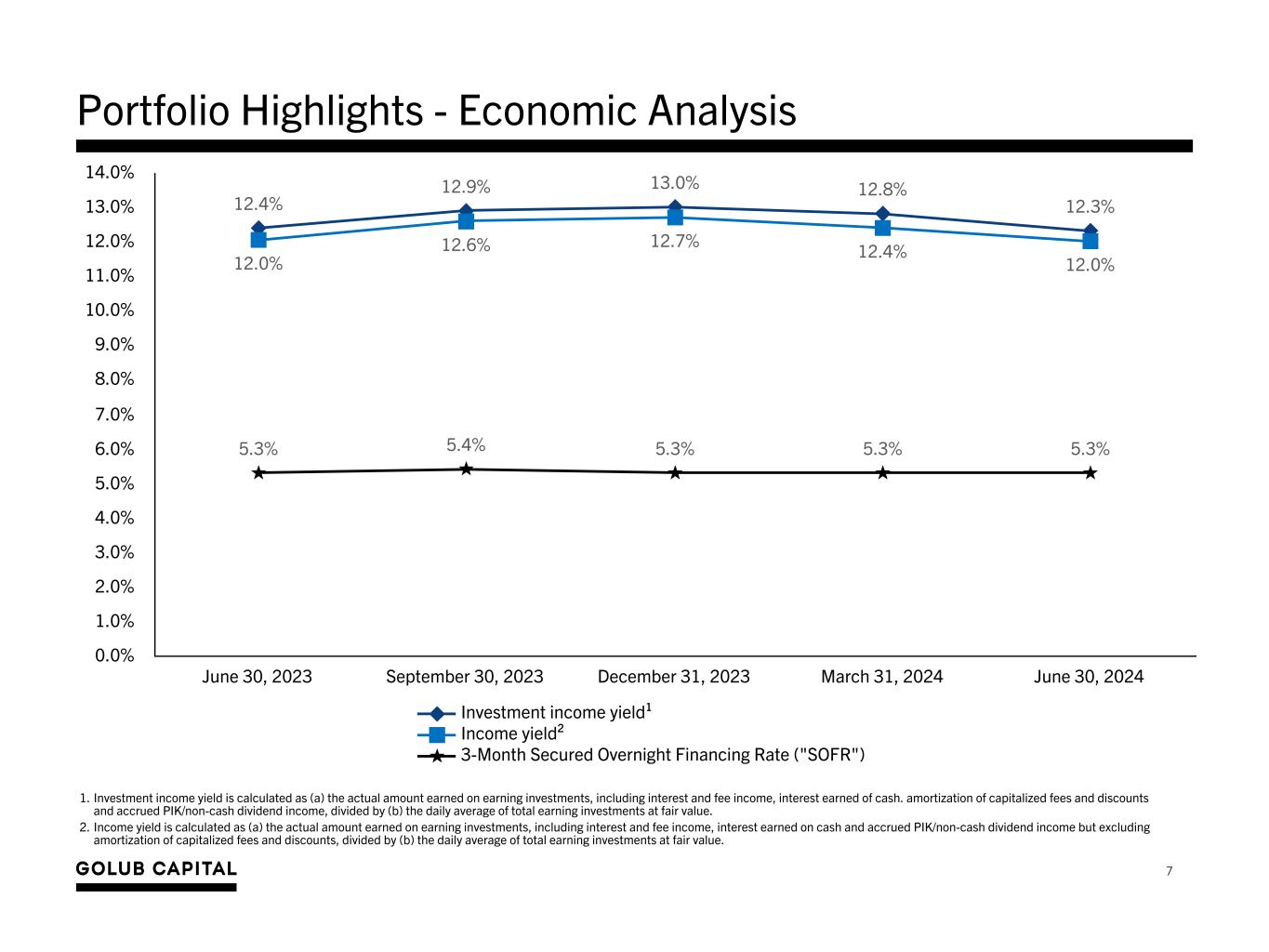

7 Portfolio Highlights - Economic Analysis 1. Investment income yield is calculated as (a) the actual amount earned on earning investments, including interest and fee income, interest earned of cash. amortization of capitalized fees and discounts and accrued PIK/non-cash dividend income, divided by (b) the daily average of total earning investments at fair value. 2. Income yield is calculated as (a) the actual amount earned on earning investments, including interest and fee income, interest earned on cash and accrued PIK/non-cash dividend income but excluding amortization of capitalized fees and discounts, divided by (b) the daily average of total earning investments at fair value. 12.4% 12.9% 13.0% 12.8% 12.3% 12.0% 12.6% 12.7% 12.4% 12.0% 5.3% 5.4% 5.3% 5.3% 5.3% Investment income yield¹ Income yield² 3-Month Secured Overnight Financing Rate ("SOFR") June 30, 2023 September 30, 2023 December 31, 2023 March 31, 2024 June 30, 2024 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% 14.0%

8 Portfolio Highlights - Portfolio Ratings Internal Performance Ratings (% of Portfolio at Fair Value) At Fiscal Year End At Quarter End Rating 2022 2023 December 31, 2023 March 31, 2024 June 30, 2024 5 2.3% 0.0% 0.0% 0.2% 1.3% 4 97.7% 99.7% 99.9% 99.7% 98.6% 3 0.0% 0.3% 0.1% 0.1% 0.1% 2 0.0% 0.0% 0.0% 0.0% 0.0%* 1 0.0% 0.0% 0.0% 0.0% 0.0% Grand Total 100.0% 100.0% 100.0% 100.0% 100.0% Internal Performance Ratings Definition Rating Definition 5 Borrower is performing above expectations and the trends and risk factors are generally favorable 4 Borrower is generally performing as expected and the risk factors are neutral to favorable 3 Borrower may be out of compliance with debt covenants; however, loan payments are generally not past due 2 Borrower is performing materially below expectations and the loan’s risk has increased materially since origination 1 Borrower is performing substantially below expectations and the loan’s risk has substantially increased since origination – Over 99% of the investments in our portfolio at fair value have an Internal Performance Rating of 4 or higher as of June 30, 2024, and there were no portfolio company investments on non-accrual. *Represents an amount less than 0.1%.

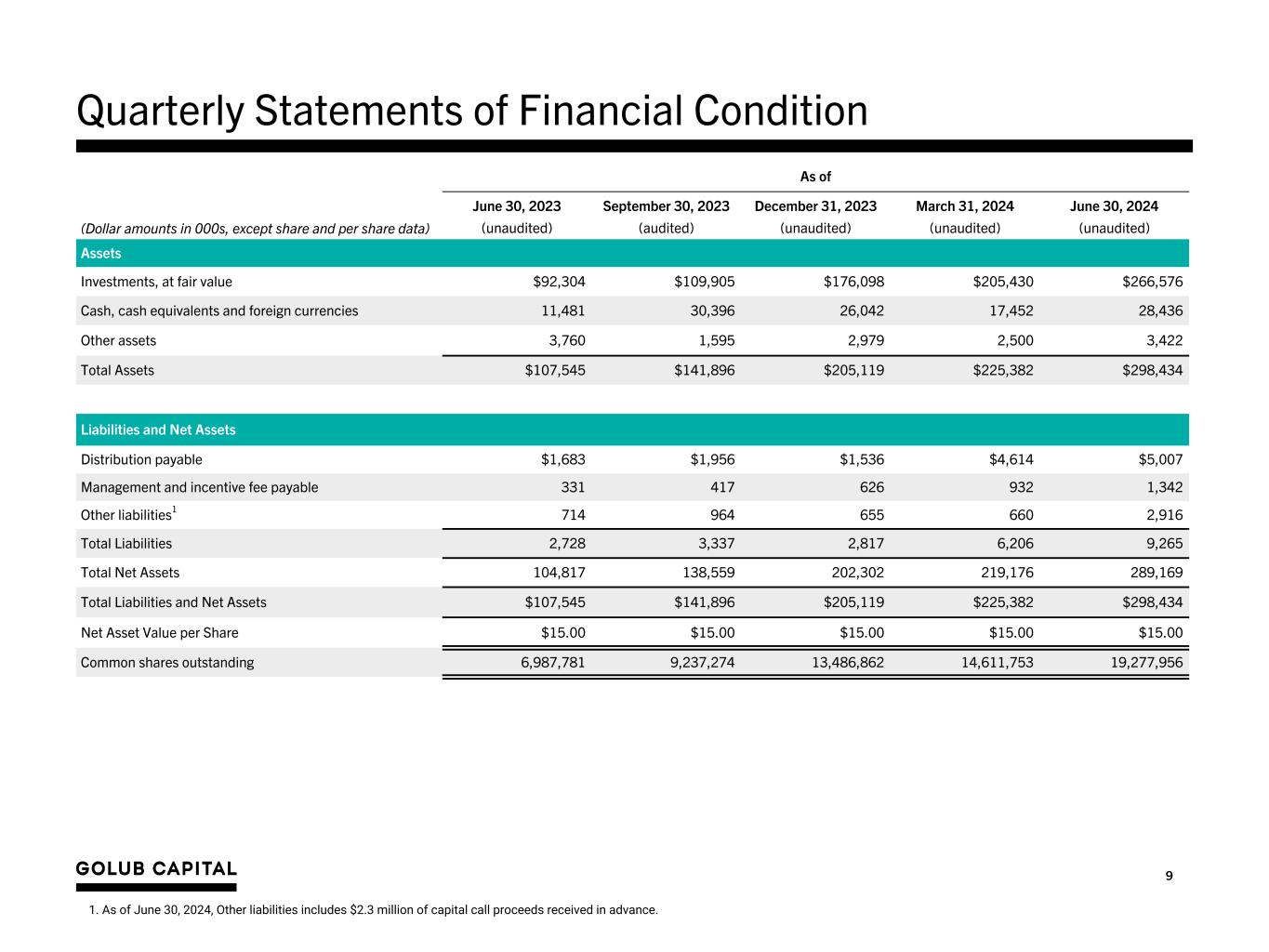

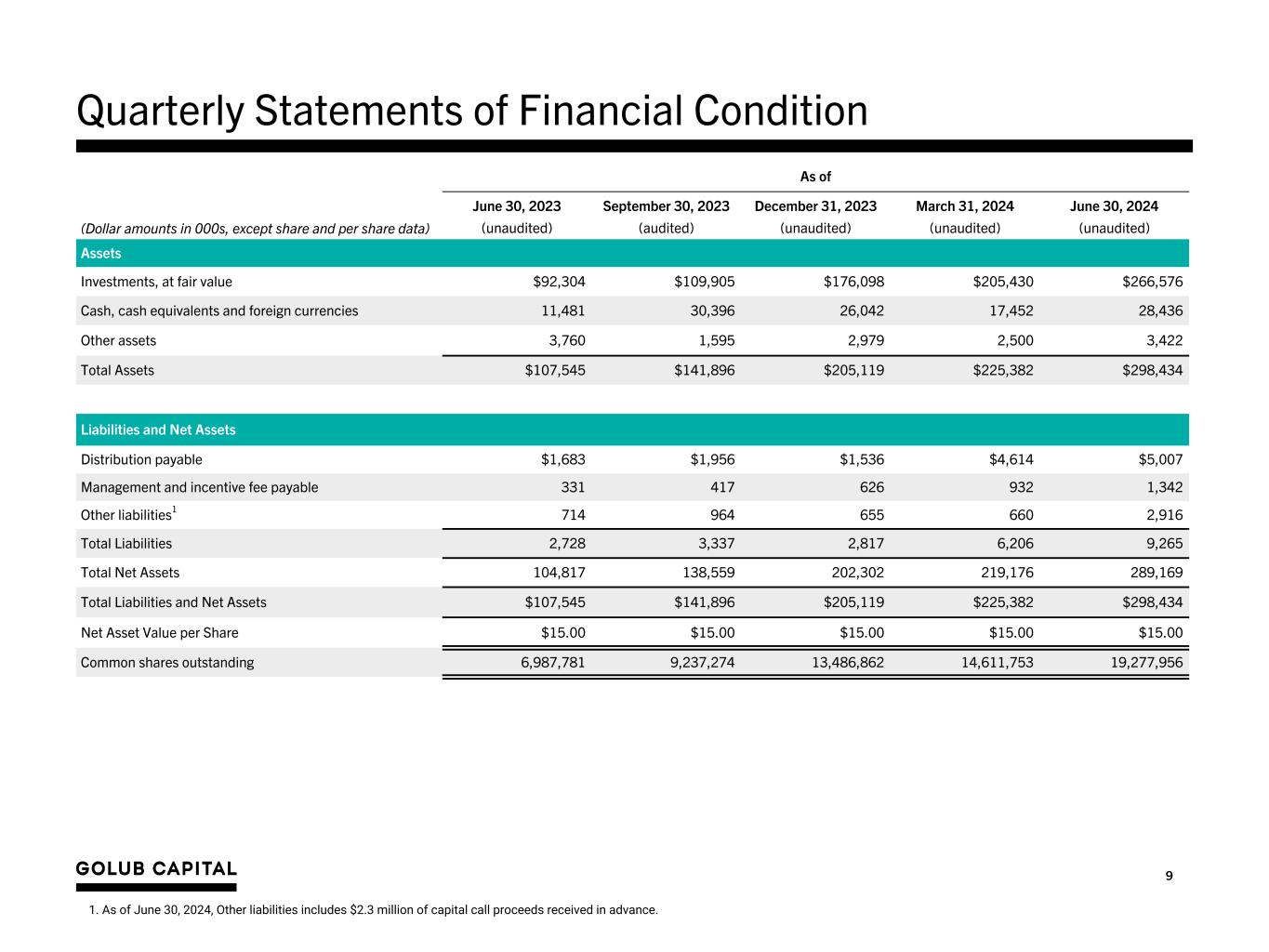

9 Quarterly Statements of Financial Condition As of (Dollar amounts in 000s, except share and per share data) June 30, 2023 September 30, 2023 December 31, 2023 March 31, 2024 June 30, 2024 (unaudited) (audited) (unaudited) (unaudited) (unaudited) Assets Investments, at fair value $92,304 $109,905 $176,098 $205,430 $266,576 Cash, cash equivalents and foreign currencies 11,481 30,396 26,042 17,452 28,436 Other assets 3,760 1,595 2,979 2,500 3,422 Total Assets $107,545 $141,896 $205,119 $225,382 $298,434 Liabilities and Net Assets Distribution payable $1,683 $1,956 $1,536 $4,614 $5,007 Management and incentive fee payable 331 417 626 932 1,342 Other liabilities1 714 964 655 660 2,916 Total Liabilities 2,728 3,337 2,817 6,206 9,265 Total Net Assets 104,817 138,559 202,302 219,176 289,169 Total Liabilities and Net Assets $107,545 $141,896 $205,119 $225,382 $298,434 Net Asset Value per Share $15.00 $15.00 $15.00 $15.00 $15.00 Common shares outstanding 6,987,781 9,237,274 13,486,862 14,611,753 19,277,956 1. As of June 30, 2024, Other liabilities includes $2.3 million of capital call proceeds received in advance.

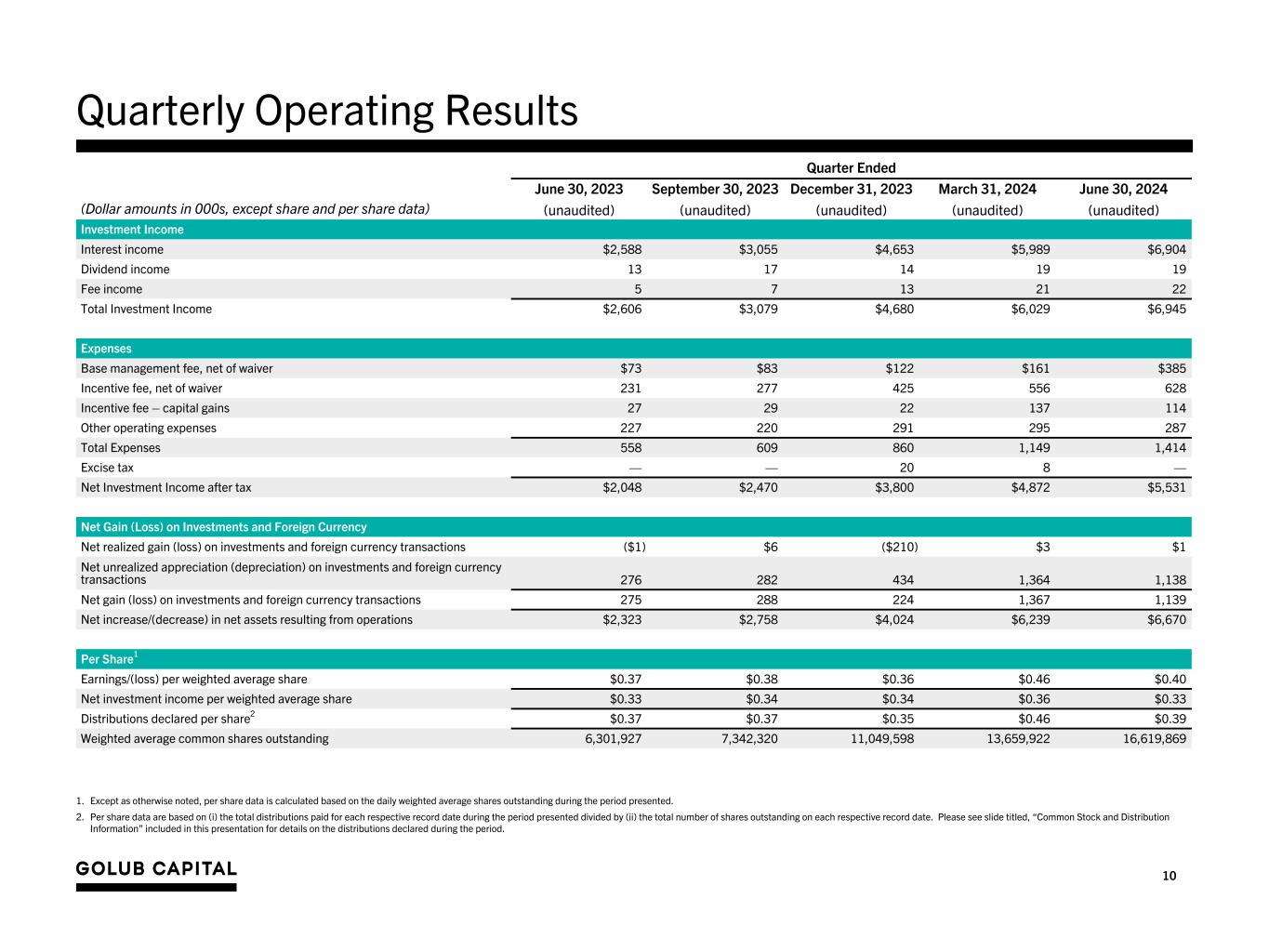

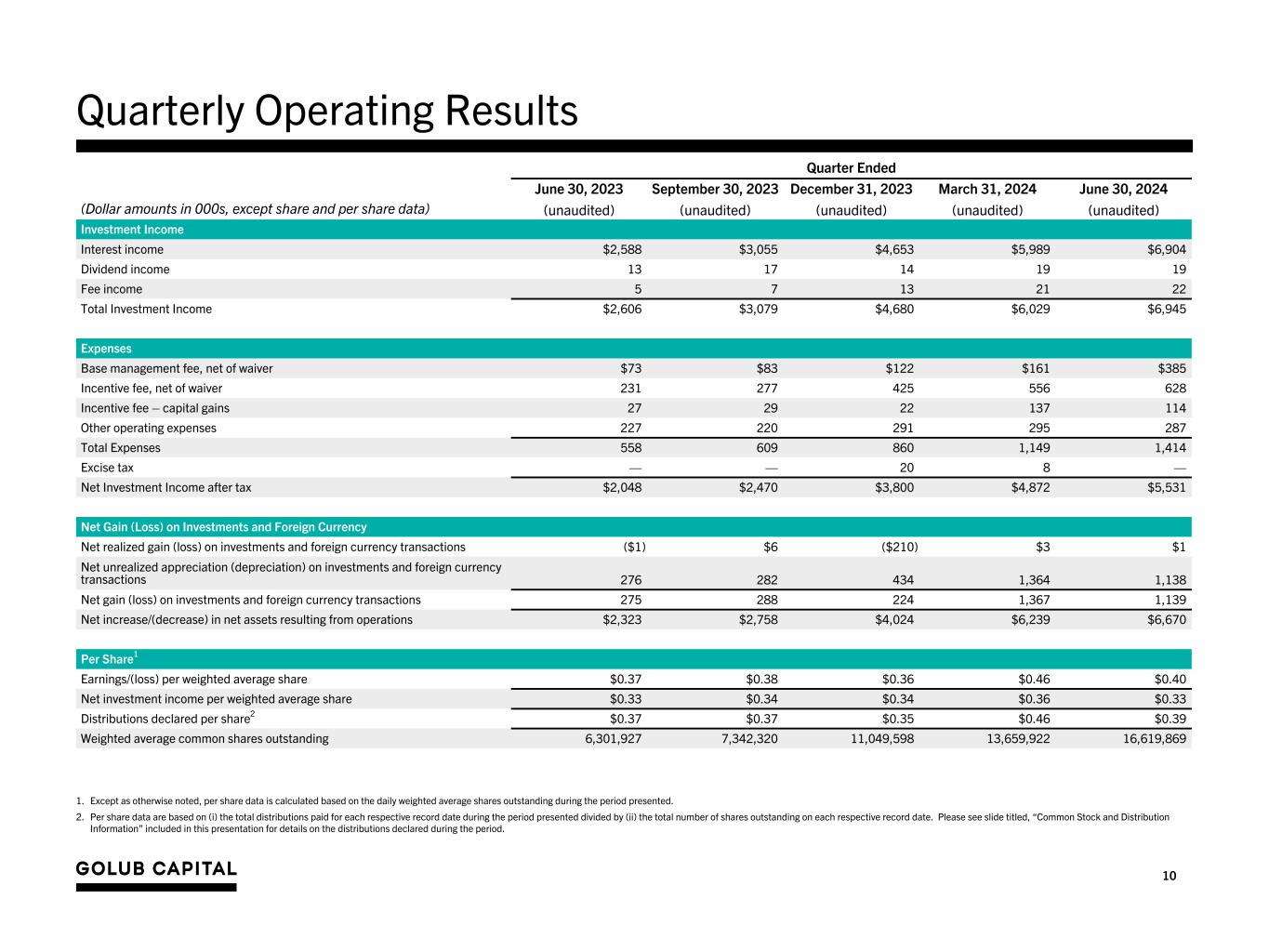

10 Quarterly Operating Results Quarter Ended (Dollar amounts in 000s, except share and per share data) June 30, 2023 September 30, 2023 December 31, 2023 March 31, 2024 June 30, 2024 (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) Investment Income Interest income $2,588 $3,055 $4,653 $5,989 $6,904 Dividend income 13 17 14 19 19 Fee income 5 7 13 21 22 Total Investment Income $2,606 $3,079 $4,680 $6,029 $6,945 Expenses Base management fee, net of waiver $73 $83 $122 $161 $385 Incentive fee, net of waiver 231 277 425 556 628 Incentive fee – capital gains 27 29 22 137 114 Other operating expenses 227 220 291 295 287 Total Expenses 558 609 860 1,149 1,414 Excise tax — — 20 8 — Net Investment Income after tax $2,048 $2,470 $3,800 $4,872 $5,531 Net Gain (Loss) on Investments and Foreign Currency Net realized gain (loss) on investments and foreign currency transactions ($1) $6 ($210) $3 $1 Net unrealized appreciation (depreciation) on investments and foreign currency transactions 276 282 434 1,364 1,138 Net gain (loss) on investments and foreign currency transactions 275 288 224 1,367 1,139 Net increase/(decrease) in net assets resulting from operations $2,323 $2,758 $4,024 $6,239 $6,670 Per Share1 Earnings/(loss) per weighted average share $0.37 $0.38 $0.36 $0.46 $0.40 Net investment income per weighted average share $0.33 $0.34 $0.34 $0.36 $0.33 Distributions declared per share2 $0.37 $0.37 $0.35 $0.46 $0.39 Weighted average common shares outstanding 6,301,927 7,342,320 11,049,598 13,659,922 16,619,869 1. Except as otherwise noted, per share data is calculated based on the daily weighted average shares outstanding during the period presented. 2. Per share data are based on (i) the total distributions paid for each respective record date during the period presented divided by (ii) the total number of shares outstanding on each respective record date. Please see slide titled, “Common Stock and Distribution Information” included in this presentation for details on the distributions declared during the period.

11 Quarterly Return on Equity Since Inception* * Quarterly return on equity is calculated as the annualized return on average equity divided by four. Return on equity calculations are based on the daily weighted average of total net assets during the period presented. 1. The 10.4% Internal rate of return (“IRR”) on net asset value (“NAV”) is calculated at the fund level using beginning of period NAV, capital share issuances during the period, distributions paid or payable during the period, and ending period NAV. Period beginning April 1, 2022 and ending June 30, 2024. The first investment in GDLCU took place on April 1, 2022. These returns do not represent an actual return to any investor in the Company. 0.4% 1.2% 2.1% 2.8% 2.5% 2.5% 2.4% 3.1% 2.7% Jun-22 Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Avg. 2.2% Investors in GDLCU have achieved a 10.4% IRR on NAV1

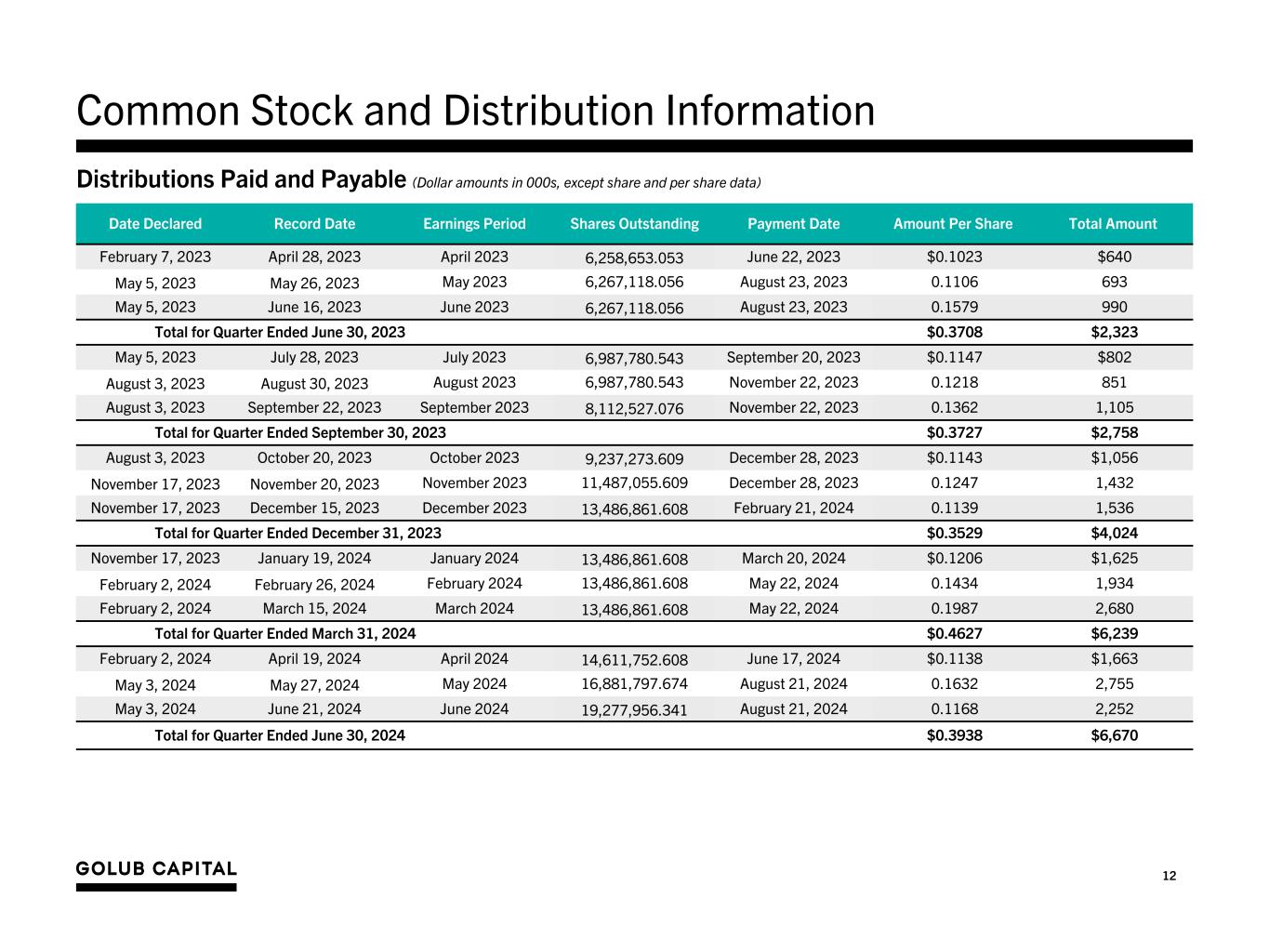

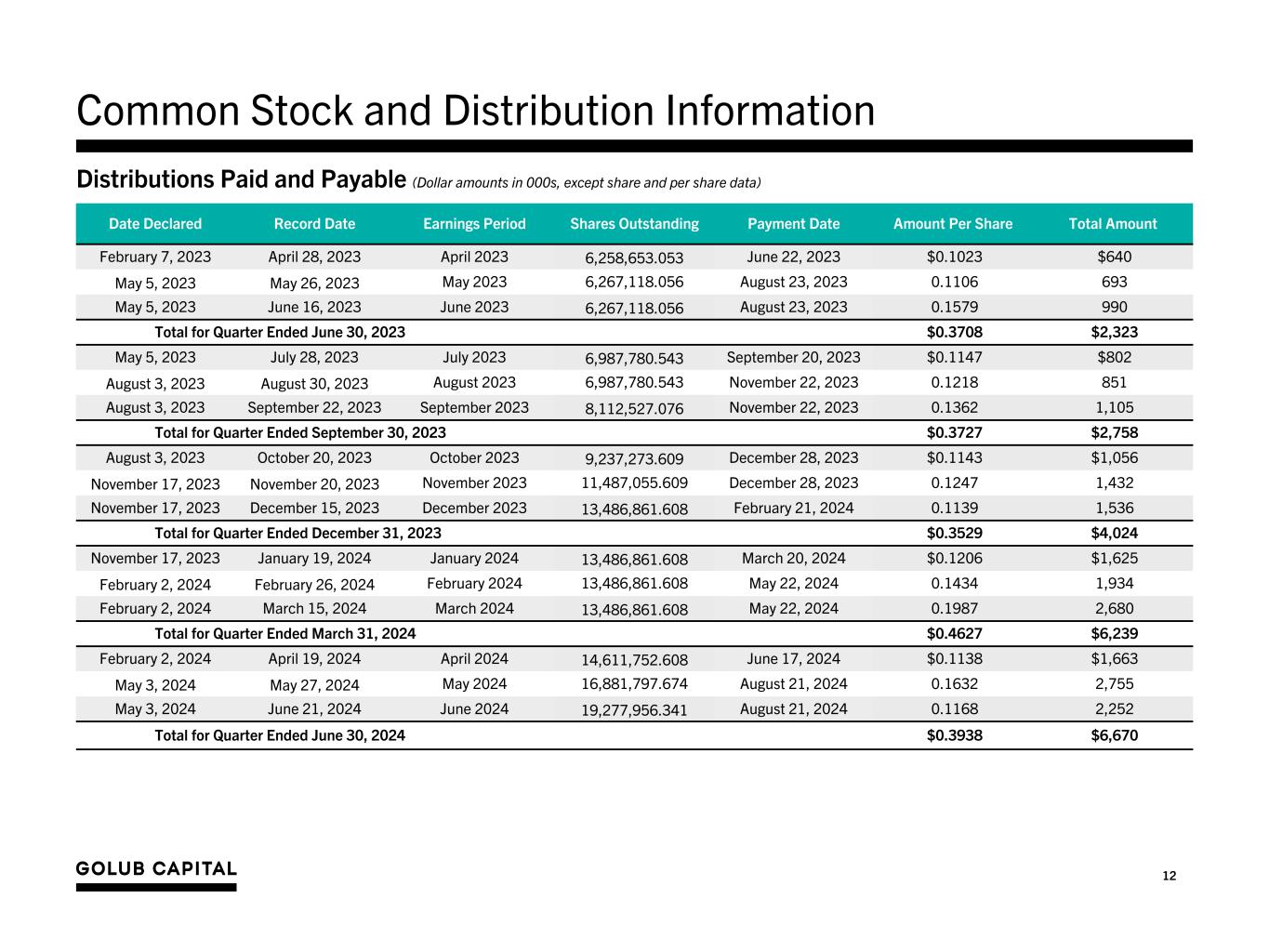

12 Common Stock and Distribution Information Distributions Paid and Payable (Dollar amounts in 000s, except share and per share data) Date Declared Record Date Earnings Period Shares Outstanding Payment Date Amount Per Share Total Amount February 7, 2023 April 28, 2023 April 2023 6,258,653.053 June 22, 2023 $0.1023 $640 May 5, 2023 May 26, 2023 May 2023 6,267,118.056 August 23, 2023 0.1106 693 May 5, 2023 June 16, 2023 June 2023 6,267,118.056 August 23, 2023 0.1579 990 Total for Quarter Ended June 30, 2023 $0.3708 $2,323 May 5, 2023 July 28, 2023 July 2023 6,987,780.543 September 20, 2023 $0.1147 $802 August 3, 2023 August 30, 2023 August 2023 6,987,780.543 November 22, 2023 0.1218 851 August 3, 2023 September 22, 2023 September 2023 8,112,527.076 November 22, 2023 0.1362 1,105 Total for Quarter Ended September 30, 2023 $0.3727 $2,758 August 3, 2023 October 20, 2023 October 2023 9,237,273.609 December 28, 2023 $0.1143 $1,056 November 17, 2023 November 20, 2023 November 2023 11,487,055.609 December 28, 2023 0.1247 1,432 November 17, 2023 December 15, 2023 December 2023 13,486,861.608 February 21, 2024 0.1139 1,536 Total for Quarter Ended December 31, 2023 $0.3529 $4,024 November 17, 2023 January 19, 2024 January 2024 13,486,861.608 March 20, 2024 $0.1206 $1,625 February 2, 2024 February 26, 2024 February 2024 13,486,861.608 May 22, 2024 0.1434 1,934 February 2, 2024 March 15, 2024 March 2024 13,486,861.608 May 22, 2024 0.1987 2,680 Total for Quarter Ended March 31, 2024 $0.4627 $6,239 February 2, 2024 April 19, 2024 April 2024 14,611,752.608 June 17, 2024 $0.1138 $1,663 May 3, 2024 May 27, 2024 May 2024 16,881,797.674 August 21, 2024 0.1632 2,755 May 3, 2024 June 21, 2024 June 2024 19,277,956.341 August 21, 2024 0.1168 2,252 Total for Quarter Ended June 30, 2024 $0.3938 $6,670

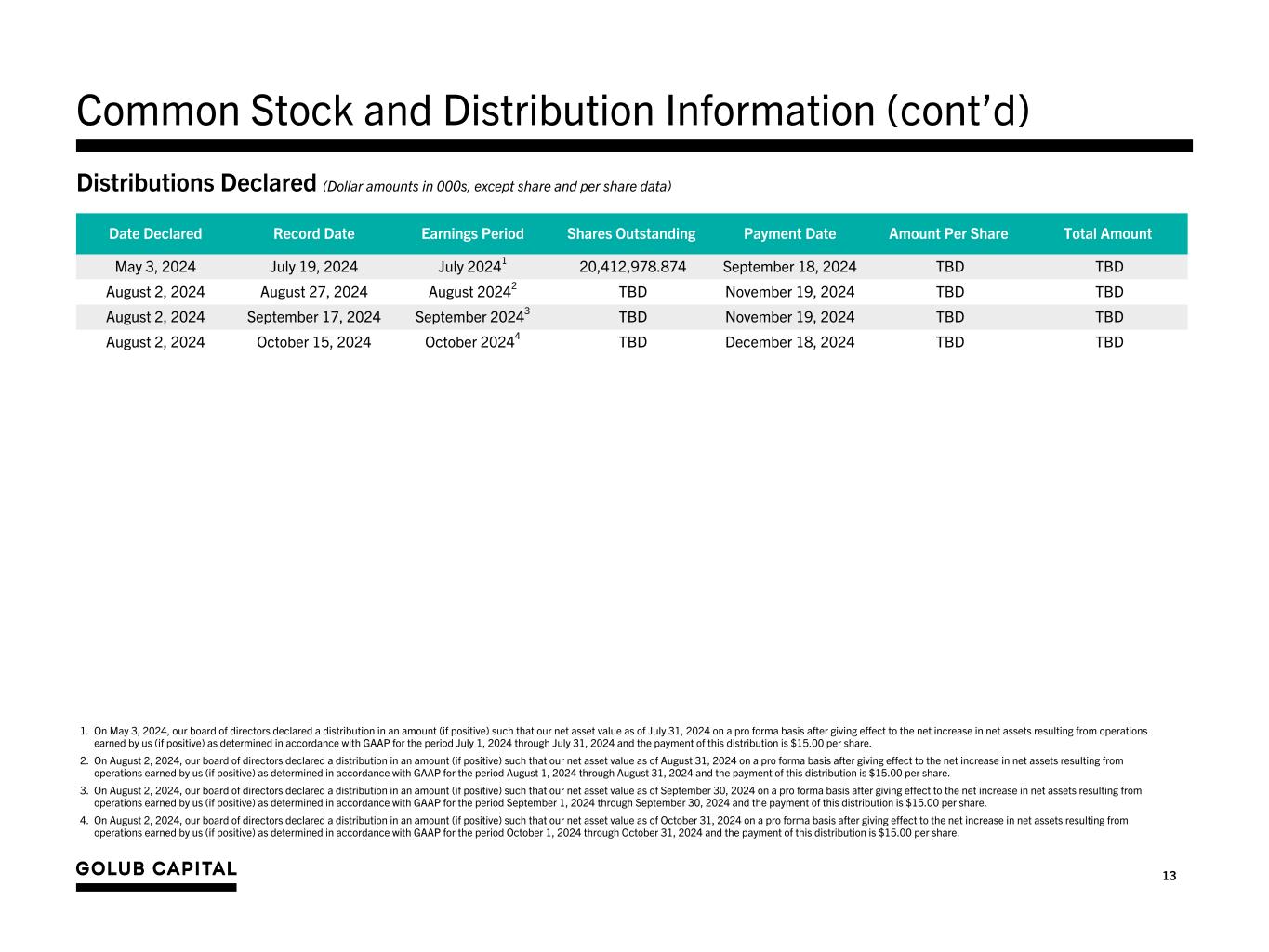

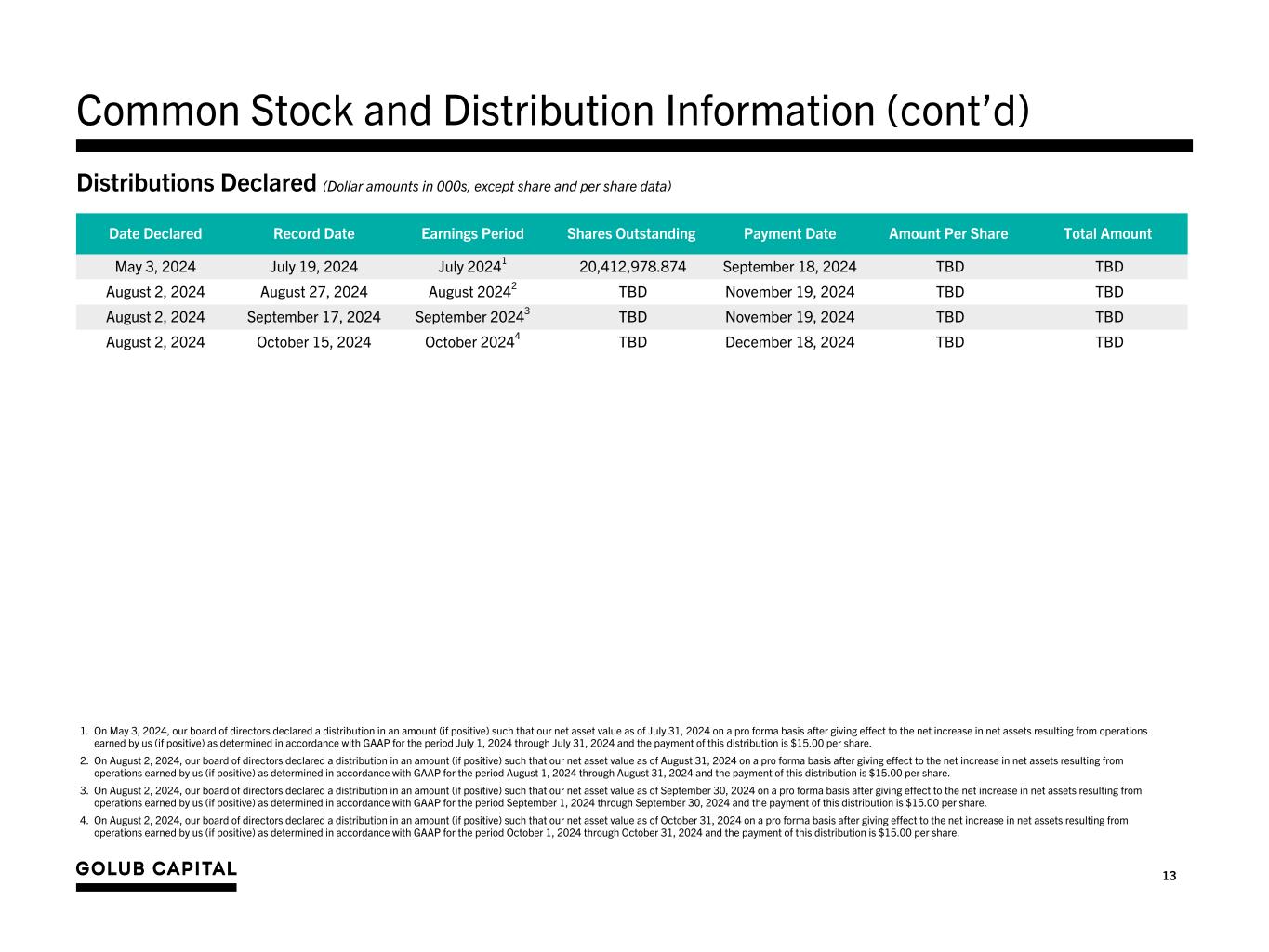

13 Common Stock and Distribution Information (cont’d) Distributions Declared (Dollar amounts in 000s, except share and per share data) Date Declared Record Date Earnings Period Shares Outstanding Payment Date Amount Per Share Total Amount May 3, 2024 July 19, 2024 July 20241 20,412,978.874 September 18, 2024 TBD TBD August 2, 2024 August 27, 2024 August 20242 TBD November 19, 2024 TBD TBD August 2, 2024 September 17, 2024 September 20243 TBD November 19, 2024 TBD TBD August 2, 2024 October 15, 2024 October 20244 TBD December 18, 2024 TBD TBD 1. On May 3, 2024, our board of directors declared a distribution in an amount (if positive) such that our net asset value as of July 31, 2024 on a pro forma basis after giving effect to the net increase in net assets resulting from operations earned by us (if positive) as determined in accordance with GAAP for the period July 1, 2024 through July 31, 2024 and the payment of this distribution is $15.00 per share. 2. On August 2, 2024, our board of directors declared a distribution in an amount (if positive) such that our net asset value as of August 31, 2024 on a pro forma basis after giving effect to the net increase in net assets resulting from operations earned by us (if positive) as determined in accordance with GAAP for the period August 1, 2024 through August 31, 2024 and the payment of this distribution is $15.00 per share. 3. On August 2, 2024, our board of directors declared a distribution in an amount (if positive) such that our net asset value as of September 30, 2024 on a pro forma basis after giving effect to the net increase in net assets resulting from operations earned by us (if positive) as determined in accordance with GAAP for the period September 1, 2024 through September 30, 2024 and the payment of this distribution is $15.00 per share. 4. On August 2, 2024, our board of directors declared a distribution in an amount (if positive) such that our net asset value as of October 31, 2024 on a pro forma basis after giving effect to the net increase in net assets resulting from operations earned by us (if positive) as determined in accordance with GAAP for the period October 1, 2024 through October 31, 2024 and the payment of this distribution is $15.00 per share.