Forward-Looking Statements This presentation may contain statements

that are not historical in nature and are intended to be, and are

hereby identified as, forward-looking statements for purposes of the

safe harbor provided by Section 21E of the Securities Exchange

Act of 1934, as amended. The words “may,” “will,”

“anticipate,” “should,” “would,” “believe,” “contemplate,” “expect

,” “aim,” “plan,” “estimate,” “continue,” and “intend,” as well as other

similar words and expressions of the future, are intended to identi

fy forward-looking statements. These forward-looking statements

include statements related to our projected growth, anticipated future

financial performance, and management’s long-term performance

goals, as well as statements relating to the anticipated effects on results

of operations and financial condition from expected developments

or events, or business and growth strategies, including anticipated

internal growth. These forward-looking statements involve significant

risks and uncertainties that could cause our actual results to differ

materially from those anticipated in such statements. Potential risks and

uncertainties include, but are not limited to: • the strength of the

United States economy in general and the strength of the local economies

in which we conduct operations; • the continuation of the COVID-19

pandemic and its impact on us, our employees, customers and

third-party service providers, and the ultimate extent of the impacts

of the pandemic and related government stimulus programs;

• our ability to successfully manage interest rate risk, credit risk,

liquidity risk, and other risks inherent to our industry; • the accu

racy of our financial statement estimates and assumptions, including the

estimates used for our credit loss reserve and deferred

tax asset valuation allowance; • the efficiency and effectiveness

of our internal control environment; • our ability to comply with the

extensive laws and regulations to which we are subject, including the

laws for each jurisdiction where we operate; • legislative or regulatory

changes and changes in accounting principles, policies, practices

or guidelines, including the effects of the forthcoming implementation

of the Current Expected Credit Losses (“CECL”) standard; •

the effects of our lack of a diversified loan portfolio and concentration

in the South Florida market, including the risks of geographic,

depositor, and industry concentrations, including our concentration

in loans secured by real estate; • the concentration of ownership of our

Class A common stock; • fluctuations in the price of our Class A common

stock; • our ability to fund or access the capital markets at attractive

rates and terms and manage our growth, both organic growth as

well as growth through other means, such as future acquisitions; •

inflation, interest rate, unemployment rate, market, and

monetary fluctuations; • increased competition and its effect

on the pricing of our products and services as well as our margin; •

the effectiveness of our risk management strategies, including operational

risks, including, but not limited to, client, employee, or third

-party fraud and security breaches; and • other risks described

in this presentation and other filings we make with the Securities

and Exchange Commission (“SEC”). All forward-looking statements

are necessarily only estimates of future results, and there

can be no assurance that actual results will not differ materially from expectations.

Therefore, you are cautioned not to place undue reliance

on any forward-looking statements. Further, forward-looking

statements included in this presentation are made only as of the

date hereof, and we undertake no obligation to update or revise any

forward-looking statement to reflect events or circumstances

after the date on which the statement is made or to reflect the occurrence

of

unanticipated events, unless required to do so under the federal securities

laws. You should also review the risk factors described in

the reports USCB Financial Holdings, Inc. filed or will file with the

SEC and, for periods prior to the completion of the bank holding company

reorganization in December 31, 2021, U.S Century Bank filed

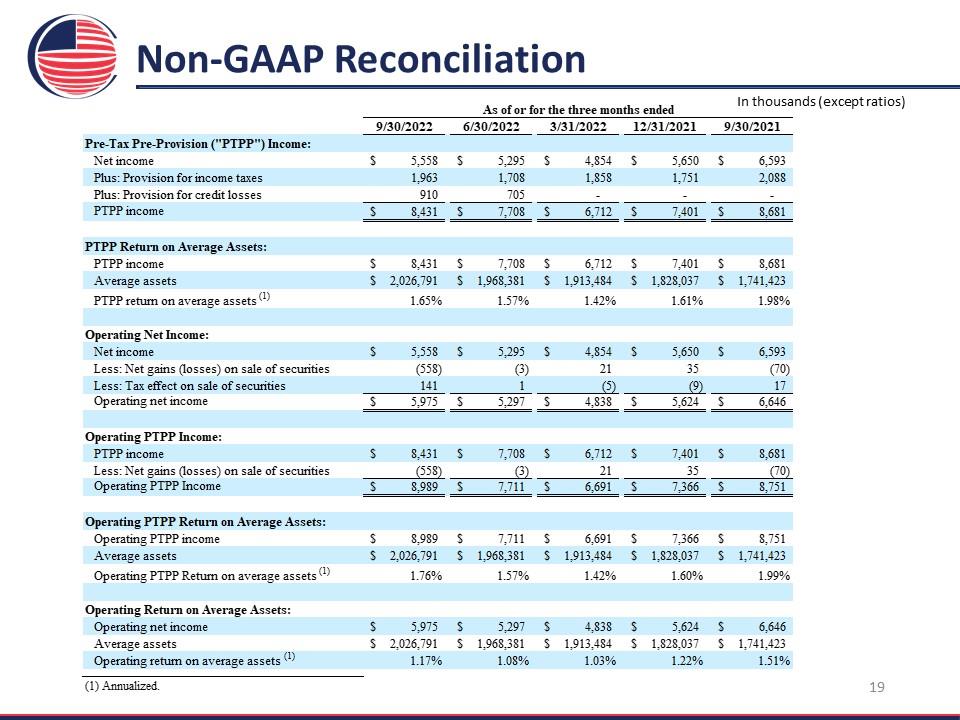

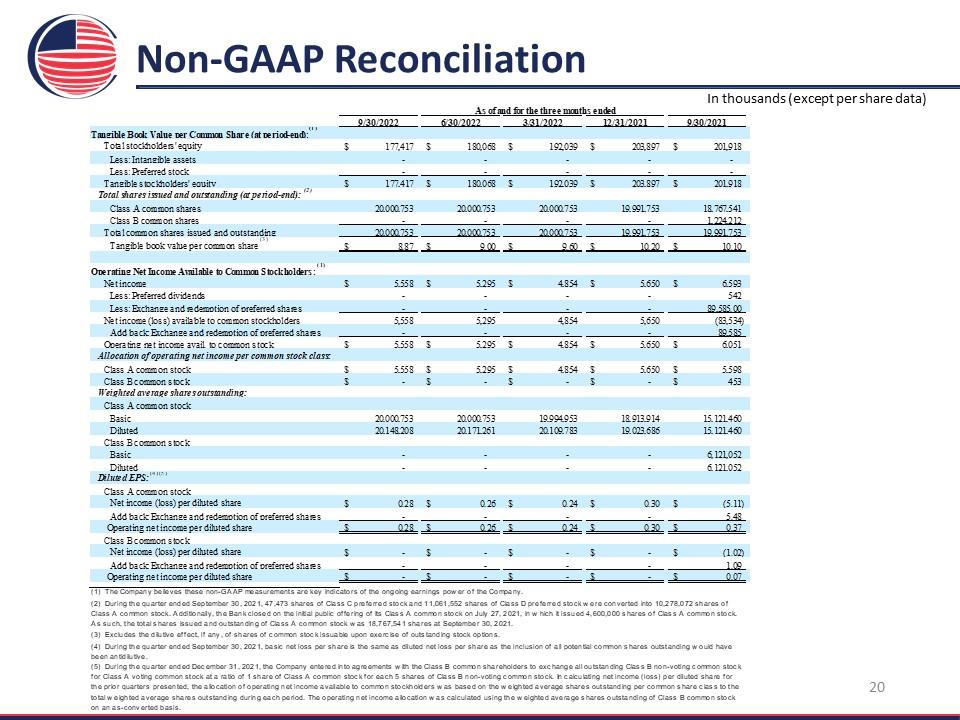

with the FDIC. Non-GAAP Financial Measures This presentation

includes financial information determined by methods other than

in accordance with generally accepted accounting principles (“GAAP”).

This financial information includes certain operating performance

measures. Management has included these non-GAAP measures because

it believes these measures may provide useful supplemental information

for evaluating the Company’s underlying performance

trends. Further, management uses these measures in managing and evaluating

the Company’s business and intends to refer to them in discussions

about our operations and performance. Operating performance

measures should be viewed in addition to, and not as an alternative to

or substitute for, measures determined in accordance

with GAAP, and are not necessarily comparable to non-GAAP measures

that may be presented by other companies. To the extent

applicable, reconciliations of these non-GAAP measures to the

most directly comparable GAAP measures can be found in the ‘Non-GAAP

Reconciliation Tables’ included in the presentation. You

should assume that all numbers are unaudited unless otherwise

noted. 2