united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-23773 |

| Cantor Fitzgerald Infrastructure Fund |

| (Exact name of registrant as specified in charter) |

| 110 E. 59th Street, New York, NY | 10022 |

| (Address of principal executive offices) | (Zip code) |

| Corporation Services Company |

| 251 Little Falls Drive, Wilmington, Delaware 19808 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | (212) 915-1722 | |

| Date of fiscal year end: | 3/31 | |

| | | |

| Date of reporting period: | 9/30/24 | |

Item 1. Reports to Stockholders.

(a) Not applicable

(b) Not applicable

Item 2. Code of Ethics.

Not applicable for semi-annual reports

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports

Item 5. Audit Committee of Listed Registrants.

Not applicable

Item 6. Investments.

The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a)

Electronic Reports Disclosure

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will not be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary (such as a broker-dealer, registered investment advisor, or bank). Instead, the reports will be made available on the Fund’s website (www.cantorinfrastructurefund.com), and you will be notified electronically or by mail, depending on your elections, each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper, free of charge. If you invest directly with the Fund, you can call the Fund toll-free at 855-9-CANTOR / 855-922-6867 or visit https://www.cantorinfrastructurefund.com/ and select “Login” followed by “Investor Access” to inform the Fund that you wish to start receiving paper copies of your shareholder reports. If you invest through a financial intermediary, you can contact your financial intermediary to request that you start to receive paper copies of your shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund sponsor if you invest directly with a fund.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by: (i) calling the Fund toll-free at 855-9-CANTOR / 855-922-6867 or visiting https://www.cantorinfrastructurefund.com/ and select “Login” followed by “Investor Access”, if you invest directly with the Fund, or (ii) contacting your financial intermediary, if you invest through a financial intermediary. Please note that not all financial intermediaries offer this service.

Table of Contents

| Shareholder Letter | 4 |

| | |

| Portfolio Review | 11 |

| | |

| Schedule of Investments | 12 |

| | |

| Statement of Assets and Liabilities | 15 |

| | |

| Statement of Operations | 16 |

| | |

| Statement of Changes in Net Assets | 17 |

| | |

| Financial Highlights | 20 |

| | |

| Notes to Financial Statements | 24 |

| | |

| Expense Examples | 37 |

| | |

| Additional Information | 38 |

| | |

| Privacy Policy | 41 |

| |

| Cantor Fitzgerald Infrastructure Fund | 3 |

| |

Dear Shareholders:

We are pleased to present the semi-annual report for Cantor Fitzgerald Infrastructure Fund (the “Fund”) covering the period from April 1, 2024, through September 30, 2024.

The Fund is a continuously offered, non-diversified, closed-end interval fund registered under the Investment Company Act of 1940, as amended, that commenced operations on June 30, 2022. The Fund’s investment objective is to maximize total return, with an emphasis on current income, while seeking to invest in issuers that are helping to address certain United Nations Sustainable Goals through their products and services.

The Fund pursues its investment objective by strategically investing in a portfolio of private institutional infrastructure investment funds as well as public infrastructure securities. The Fund’s strategy is centered around three global megatrends expected to shape our future markets: (i) digital transformation, (ii) energy transition, and (iii) the enhancement of aging infrastructure.

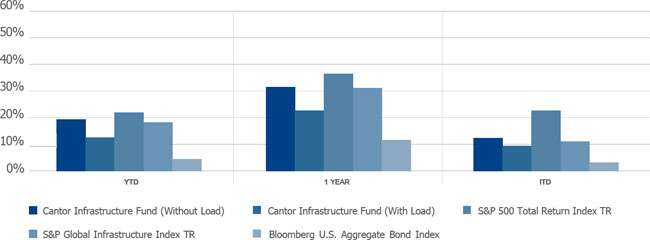

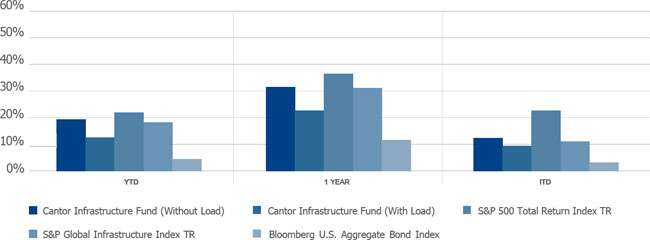

During the semi-annual period ending September 30, 2024, the Fund’s load-waived Class A shares (NASDAQ: CAFIX) delivered a total return of 12.30% compared to the Standard & Poor’s (“S&P”) 500 Index, which returned 10.42%, Standard & Poor’s (“S&P”) Global Infrastructure Index which returned 16.46%, and the Bloomberg U.S. Aggregate Bond Index which returned 5.26% (without deduction for fees, expenses or taxes). The Fund announced a third-quarter distribution of $0.1170 per Class A share (NASDAQ: CAFIX), $0.1156 per Class C share (NASDAQ: CFCIX), $0.1174 per Class I share (NASDAQ: CFIIX), and $0.1174 per Class S share (NASDAQ: CFISX) representing a 4.00% annualized distribution rate based on the average daily NAV/share over the quarter. The Fund’s distribution rate since inception is 4.68%.1,2,3

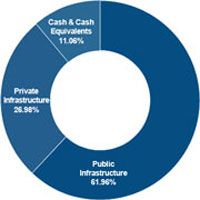

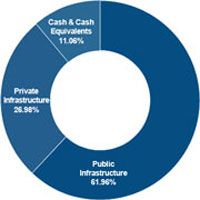

As of September 30, 2024, 88.94% of the Fund’s net assets were invested in infrastructure investments with 61.96% in publicly traded infrastructure holdings and 26.98% in private infrastructure holdings. The remaining 11.06% of net assets were in short-term instruments and other assets.

The overall focus of capital markets and the U.S. Federal Reserve gradually shifted over the six months ending September 30, 2024, from taming inflation to the pace of job growth in the U.S., as measured by CPI inflation dropped during this period from 3.5% to 2.4%, and payroll growth fell to an average of 166,000 jobs per month, down from 230,000 per month. The 10-year U.S. Treasury interest rate responded to the slowing economy when the Federal Reserve decided to cut the benchmark interest rate range by 50 basis points. The Federal Reserve joined over 50% of other global central banks in cutting benchmark interest rates by mid-year, compared to none at the start of 2024. Interest-sensitive market sectors such as utilities, real estate, homebuilders, and financials had already begun discounting the expected September rate cut well before it was implemented. Long-duration assets, like large-capitalization growth stocks, continued their strong relative performance. Nevertheless, there were positive signs that the market was beginning to broaden, including other sectors.

While the decline in interest rates helped the utility group’s relative performance, the improving macro backdrop for the utility industry was key. Power demand in the U.S. is accelerating for the first time in decades due to the electrification of the country and the expansion of artificial intelligence (AI) data centers. The Fund’s largest holdings in the sector, including Constellation Energy, Vistra, and NextEra Energy all gained during the period. There is an underlying tailwind in performance from these names, which have positive exposure to growing demand and a tightening supply/demand fundamental for power. Moreover, as a matter of national security policy, we expect that the U.S. government will continue to prioritize energy security and AI dominance, benefiting the sector regardless of the outcome of the upcoming November elections.

The Fund’s continued overweight to independent power producers (IPPs) provided a material boost to the fund. Texas IPPs performed well due to volatile energy markets in their service territories and recent power auctions held in Texas, which priced future power delivery at twice current rates. Over the six months ending September 30, 2024, several purchase power agreements (PPAs) were signed by nuclear power utilities with hyper-scalers like Microsoft, Amazon, Meta, and Google to provide clean energy for AI-driven data centers. A top Fund holding Constellation Energy appreciated 41.1% in the six months ending September 30, 2024, primarily due to their new agreement with Microsoft to provide clean nuclear power to new data centers. This follows closely an agreement between Amazon Web Services and Talen Nuclear facility to provide power for data centers. Forward power prices surged in Texas as AI-driven data centers needed to back up clean power sources with more traditional sources like natural gas. Our two Fund holdings in midstream energy companies, DT Midstream and Williams Co. also contributed to relative Fund performance as the value of their existing natural gas pipeline networks grows to support natural gas-fired co-generation units. We expect this dynamic to continue as Texas emerges as the second-largest home to AI-powered data centers, which require substantially more power compared to traditional data centers. Overall power demand in the U.S. is expected to increase significantly versus past decades as electrification and energy transition macro trends proceed. This should benefit U.S. utilities broadly, as revenue growth accelerates and supports strong dividend growth.

Residential solar company SolarEdge Technologies was the largest detractor from the Fund’s relative performance over the period ending September 30, 2024, as supply chain issues and changes in California residential solar incentives resulted in excess inventories and the need to work down those inventories at the expense of current sales demand. Atlantica Sustainable Infrastructure Company also detracted from Fund performance during the period due to the company initiating an evaluation process to determine if shareholders were better served by going private. Ultimately, the company decided against it, and the shares declined materially.

Consistent with the theme of Enhancement of Aging Infrastructure, during the period the Fund made its first co-investment in a private senior secured facility plus warrants co-investment opportunity with Irradiant Orchid Partners, LP. This investment recapitalizes the leading provider of vehicle emissions testing services and equipment in the U.S., Opus Inspection Inc., and supports the Fund’s allocation to transportation infrastructure.

Consistent with the theme of Energy Transition, the Fund completed its largest co-investment alongside Blackstone Infrastructure Partners’ flagship renewables platform in Invenergy, the leading independent renewables energy developer in the U.S. Invenergy develops, builds, owns, and operates power generation and energy storage projects across the Americas, Europe, and Asia, including wind, solar, and natural gas power generation facilities.

Having invested in Digital Bridge Credit Fund L.P., which closed in November of 2023 and consistent with the investment theme of Digital Transformation the Fund committed to DigitalBridge Credit Fund II, L.P. which primarily targets private direct lending to companies operating in digital infrastructure focused on edge computing, last-mile connectivity, and cloud- enabled technologies. Additionally, the Fund added its first secondary market transaction in Peppertree Fund VIII, LP, as well as an investment in Peppertree Fund X, LP. Peppertree Capital Management, Inc. is a private equity firm focused on making investments in communication infrastructure companies, with more than $6.5 billion under management. Formed in 2004, the company has invested in the development or acquisition of more than 8,000 communication infrastructure assets, as well as making fiber and spectrum investments.

We have positioned the portfolio consistent with such megatrends and are strategically adding to investments that we believe have attractive growth and income potential.

We believe the Fund is well-positioned to benefit from the enduring and fundamental needs of today’s global population and deliver on its stated investment objective through measured and mindful infrastructure investing. We value your trust and confidence and thank you for your continued support.

Sincerely,

Michael D. Underhill

Co-Portfolio Manager, Cantor Fitzgerald Infrastructure Fund

Chris A. Milner

Investment Committee Member, Cantor Fitzgerald Infrastructure Fund

Managing Director, Cantor Fitzgerald

| 1 | The Fund’s distribution policy is to make quarterly distributions to shareholders. The level of quarterly distributions (including any return of capital) is not fixed, and this distribution policy is subject to change. Shareholders should not assume that the source of a distribution from the Fund is net profit. All or a portion of the distributions consist of a return of capital based on the character of the distributions received from the underlying holdings. The final determination of the source and tax characteristics of all distributions will be made after the end of each year. Shareholders should note that return of capital will reduce the tax basis of their shares and potentially increase the taxable gain, if any, upon disposition of their shares. There is no assurance that the Fund will continue to declare distributions or that they will continue at these rates. There can be no assurance that any investment will be effective in achieving the Fund’s investment objectives, delivering positive returns, or avoiding losses. The Fund accrues distributions daily. The current distribution rate is calculated by annualizing the daily accrual rate of the Fund as of the date listed. The Fund’s distribution policy is to make quarterly distributions to its shareholders, but the amount of such distributions is not fixed. A portion of the distributions since inception has included a return of capital (non-dividend distributions) based on the character of the distributions received from the underlying holdings and may do so in the future. Please refer to the Fund’s most recent Section 19(a) notice for an estimate of the composition of the Fund’s most recent distribution, available at www.cantorinfrastructurefund.com/literature. The actual components of the Fund’s distributions for U.S. tax reporting purposes can only be determined as of the end of each calendar year and will be reported on Form 1099-DIV. A distribution comprised in whole or in part by a return of capital does not necessarily reflect the Fund’s investment performance and should not be confused with yield, income, or net profit. |

| 2 | The total annual fund operating expense ratio, gross of any fee waivers or expense reimbursements, is 11.12% for Class A, 11.87% for Class C, and 10.87% for Class I. The Adviser and the Fund have entered into an expense limitation and reimbursement agreement (the “Expense Limitation Agreement”) under which the Adviser has contractually agreed to waive its fees and to pay or absorb the ordinary operating expenses of the Fund (including all organizational and offering expenses, but excluding interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses), to the extent that such expenses exceed 2.50%, 3.25%, and 2.25% per annum of the Fund’s average daily net assets attributable to Class A, C, and I shares, respectively (the “Expense Limitation”). The Expense Limitation Agreement will remain in effect at least until July 31, 2025, unless and until the Board approves its modification or termination for Class A, C, and I shares. |

| 3 | The Fund’s inception date was June 30, 2022, and its initial net asset value was $10.00. |

| |

| Cantor Fitzgerald Infrastructure Fund | 5 |

| |

Performance Metrics1

As of September 30, 2024 (Unaudited)

| 1 | The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted above. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Fund performance based on load-waived Class A shares and does not reflect any sales charge but does reflect management fees and other expenses. The maximum sales charge for Class A shares is 5.75%. If the data reflected the deduction of such charges, the performance would be lower. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. For current performance information, visit www.cantorinfrastructurefund.com. |

Due to financial statement adjustments, performance information presented herein for the Fund may differ from the Fund’s financial highlights, which are prepared in accordance with U.S. GAAP. Such differences generally are attributable to valuation adjustments to certain of the Fund’s investments, which are reflected in the financial statements.

Inception Date: June 30, 2022

Gross Expense Ratio: 4.98% Net Expense Ratio: 3.01% (inclusive of estimated Acquired Fund Fees & Expenses)

The Adviser and the Fund have entered into an expense limitation and reimbursement agreement to the extent that they exceed 2.50% per annum of the Fund’s average daily net assets (the Expense Limitation). In consideration of the Adviser’s agreement to limit the Fund’s expenses, the Fund has agreed to repay the Adviser in the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: (1) the reimbursement for fees and expenses will be made only if payable not more than three years from the date in which they were incurred; and (2) the reimbursement may not be made if it would cause the lesser of the Expense Limitation in place at the time of waiver or at the time of reimbursement to be exceeded. The Expense Limitation Agreement will remain in effect at least until June 30, 2024, unless and until the Board approves its modification or termination. This agreement may be terminated only by the Fund’s Board on 60 days’ written notice to the Adviser.

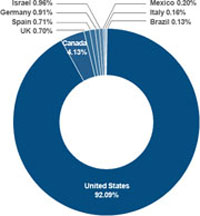

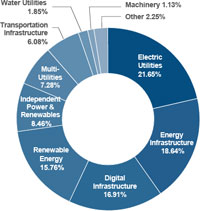

Portfolio Composition

| | | | | UNDERLYING | UNDERLYING |

| | ANNUALIZED | | | PRIVATE FUNDS | PRIVATE FUNDS |

| TOTAL NET | DISTRIBUTION | PUBLIC | PRIVATE | INFRASTRUCTURE | GROSS ASSET |

| ASSETS | RATE4,5,6 | HOLDINGS | FUNDS | INVESTMENTS7 | VALUE7 |

| $210M | 4.00% | 48 | 9 | 11,243 | $6.0B |

| PRIVATE INFRASTRUCTURE | TYPE | COUNTRY | WEIGHTING8 |

| Blackstone Infrastructure Partners / Invenergy | Energy - Equity | United States | 12.16% |

| Peppertree Capital - Fund VIII QP LP | Digital - Equity | United States | 6.92% |

| Irradiant Orchid Investors LP / Opus | Energy - Debt | United States | 2.21% |

| IPCC Fund L.P. | Energy - Debt | United States | 1.86% |

| Rockland Power Partners IV | Energy - Equity | United States | 1.65% |

| DigitalBridge Credit (Onshore) LP | Digital - Debt | United States | 1.16% |

| Peppertree Capital Fund X QP LP | Digital - Equity | United States | 0.42% |

| CoreWeave Credit Agreement | Digital - Debt | United States | 0.40% |

| DigitalBridge Credit II (Onshore) LP | Digital - Debt | United States | 0.20% |

| | | | |

| PUBLIC INFRASTRUCTURE | TYPE | COUNTRY | WEIGHTING8 |

| Vistra Energy Corp. | Utilities | United States | 4.55% |

| NextEra Energy Inc. | Utilities | United States | 4.15% |

| Constellation Energy Corp. | Utilities | United States | 3.68% |

| Southern Co. | Utilities | United States | 3.68% |

| Cheniere Energy Inc. | Energy | United States | 3.30% |

| Williams Cos Inc. | Energy | United States | 3.26% |

| American Tower Corp. | Digital Infrastructure | United States | 3.14% |

| EQT Corp. | Energy | United States | 2.86% |

| Sempra Energy | Utilities | United States | 2.09% |

| AES Corp. | Utilities | United States | 1.90% |

| Schlumberger Ltd. | Energy | United States | 1.88% |

| NRG Energy Inc. | Utilities | United States | 1.79% |

| SBA Communications Corp. | Digital Infrastructure | United States | 1.64% |

| Canadian Pacific Kansas City Ltd. | Industrials | Canada | 1.60% |

| Public securities of weightings less than 1.60% | | | 22.43% |

| 4 | The Fund’s distribution policy is to make quarterly distributions to shareholders. The level of quarterly distributions (including any return of capital) is not fixed, and this distribution policy is subject to change. Shareholders should not assume that the source of a distribution from the Fund is net profit. All or a portion of the distributions consist of a return of capital based on the character of the distributions received from the underlying holdings. The final determination of the source and tax characteristics of all distributions will be made after the end of each year. Shareholders should note that return of capital will reduce the tax basis of their shares and potentially increase the taxable gain, if any, upon disposition of their shares. There is no assurance that the Fund will continue to declare distributions or that they will continue at these rates. There can be no assurance that any investment will be effective in achieving the Fund’s investment objectives, delivering positive returns, or avoiding losses. The Fund accrues distributions daily. The current distribution rate is calculated by annualizing the daily accrual rate of the Fund as of the date listed. A portion of the distributions since inception has included a return of capital (non-dividend distributions) based on the character of the distributions received from the underlying holdings and may do so in the future. Please refer to the Fund’s most recent Section 19(a) notice for an estimate of the composition of the Fund’s most recent distribution, available at www.cantorinfrastructurefund.com/literature. The actual components of the Fund’s distributions for U.S. tax reporting purposes can only be determined as of the end of each calendar year and will be reported on Form 1099-DIV. A distribution comprised in whole or in part by a return of capital does not necessarily reflect the Fund’s investment performance and should not be confused with yield, income, or net profit. |

| 5 | The Fund’s inception date was March 20, 2023, and its initial net asset value was $10.00. |

| 6 | The total annual fund operating expense ratio, gross of any fee waivers or expense reimbursements for Class I is 4.42%. The Adviser and the Fund have entered into an expense limitation and reimbursement agreement (the “Expense Limitation Agreement”) under which the Adviser has contractually agreed to waive its fees and to pay or absorb the ordinary operating expenses of the Fund (including all organizational and offering expenses, but excluding interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses), to the extent that such expenses exceed 2.25% per annum of the Fund’s average daily net assets attributable to Class I shares (the “Expense Limitation”). The Expense Limitation Agreement will remain in effect at least until July 31, 2025, unless and until the Board approves its modification or termination. |

| 7 | Metrics express the Fund’s portfolio allocated to private funds in which the underlying holdings of such private funds generally consist of infrastructure related interests that are not publicly traded as of the most recent available data. Holdings are subject to change without notice. |

| 8 | As a percent of total assets. |

| 9 | As a percent of invested assets and incorporates the most recent available data from the underlying investment. Excludes cash and cash equivalents. Amount shown for private infrastructure investments reflects the NAV of the Fund’s interests in the underlying private fund. |

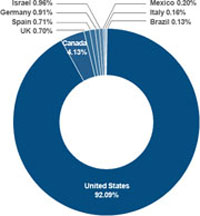

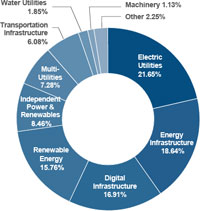

Portfolio Exposure

ASSET TYPE8

GEOGRAPHY9

INFRASTRUCTURE TYPE9

| |

| Cantor Fitzgerald Infrastructure Fund | 7 |

| |

Investment Management Team (Unaudited)

ADVISER

| Cantor Fitzgerald Investment Advisors, L.P. (the “Adviser”) serves as the adviser to the Fund and is a wholly-owned subsidiary of Cantor Fitzgerald, L.P. (together with its affiliates, “Cantor Fitzgerald”) and a division of Cantor Fitzgerald Asset Management, which provides investment management, asset management and advisory services to investors in global fixed income, equity, and real assets markets through the use of mutual funds, exchange traded funds, interval funds, separately managed accounts, core real estate funds, opportunity zone funds and other private investment vehicles. |

CANTOR FITZGERALD

A Tradition of Excellence Since 1945

| Global Footprint | | Expansive Team |

| More than 160 offices in 22 countries | | Over 12,500 employees worldwide |

| | | |

| Primary Dealer | | Investment Grade |

| One of the 24 primary dealers authorized to transact business with the Federal Reserve Bank of New York | | Maintains an investment-grade credit rating by Standard & Poor’s and Fitch |

| | | |

| Real Assets Expertise | | |

| Over $100 billion in real assets-related transactions in 20231 | | |

| 1 | Includes originated debt and non-originated debt placement transactions. |

Cantor refers to Cantor Fitzgerald, L.P., its subsidiaries, including Cantor Fitzgerald & Co., and its affiliates including BGC Group, Inc. (NASDAQ: BGC) and Newmark (NASDAQ: NMRK). The Adviser is a wholly- owned subsidiary of Cantor.

SUB-ADVISER

| Capital Innovations, LLC (the “Sub-Adviser”) is a private investment firm specializing in private and public market real assets strategies including infrastructure, real estate, and natural resources. The Sub-Adviser was fosunded in 2007 to enable investors to benefit form the transition to a resource constrained economy. |

CAPITAL INNOVATIONS

A Real Assets Specialist

| Infrastructure Expertise | | Sustainability Focused |

| Advised on or invested in more than $9 billion of infrastructure opportunities in both public and private markets | | Incorporated sustainability and environmental, social, and governance (“ESG”) standards into their investment process since inception |

| | | |

| Time-Tested Approach | | Experienced Team |

| Experience through multiple market cycles and economic environments | | Decades of infrastructure, real assets and portfolio management experience |

Glossary (Unaudited)

NASDAQ: An electronic stock market listing over 5,000 companies. The NASDAQ stock market comprises two separate markets, namely the Nasdaq National Market, which trades large, active securities and the NASDAQ Capital Market that trades emerging growth companies.

S&P 500 Total Return Index: The Standard & Poor’s index calculated on a total return basis. This index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large cap segment of the market, with over 80% coverage of U.S. equities, it also serves as a proxy for the total market. The total return calculation provides investors with a price plus gross cash dividend return. Gross cash dividends are applied on the ex date of the dividend.

S&P Global Infrastructure Index TR: This index tracks 75 publicly traded companies from around the world representing the listed infrastructure industry while maintaining liquidity and tradability. To create diversified exposure, the index includes three distinct infrastructure clusters: energy, transportation, and utilities.

Bloomberg U.S. Aggregate Bond Index: A broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. Investors frequently use the index as a stand-in for measuring the performance of the US bond market.

| |

| Cantor Fitzgerald Infrastructure Fund | 9 |

| |

Important Disclosures (Unaudited)

The information contained herein is not an offer to sell or a solicitation of an offer to buy the securities described herein. Such an offer or solicitation can be made only through the prospectus relating to the offering, which is always controlling and supersedes the information contained herein in its entirety. The prospectus may be obtained by calling (855) 9-CANTOR / (855) 922-6867.

The Fund defines an infrastructure company as a company that derives at least 50% of its revenues or profits from, or devotes at least 50% of its assets to, the ownership, management, development, construction, renovation, enhancement, or operation of infrastructure assets or the provision of services to companies engaged in such activities. Infrastructure assets may include, among other asset types, regulated assets (such as electricity generation, transmission and distribution facilities, gas transportation and distribution systems, water distribution, and wastewater collection and processing facilities), transportation assets (such as toll roads, airports, seaports, railway lines, intermodal facilities), renewable power generation (wind, solar and hydropower) and communications assets (including broadcast and wireless towers, fiber, data centers, distributed network systems and satellite networks).

Investing involves risk, including loss of principal. There is no guarantee that the Fund will meet its investment objective. There is no guarantee that any investing strategy will be successful. The Fund is a closed-end investment company.

ESG and sustainable investing may take into consideration factors beyond traditional financial information to select securities, which could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. Further, ESG and Sustainable investing strategies may rely on certain values-based criteria to eliminate exposures found in similar strategies or broad market benchmarks, which could also result in relative investment performance deviating. There is no assurance that employing ESG and sustainable strategies will result in more favorable investment performance.

The Fund is subject to the risks associated with investment in infrastructure- related companies. Risks associated with infrastructure-related companies include: (a) realized revenue volume may be significantly lower than projected and/or there will be cost overruns; (b) infrastructure project sponsors will alter their terms making a project no longer economical; (c) macroeconomic factors such as low gross domestic product growth or high nominal interest rates will raise the average cost of infrastructure funding; (d) government

regulation may affect rates charged to infrastructure customers; (e) government budgetary constraints will impact infrastructure projects; (f) special tariffs will be imposed; and (g) changes in tax laws, regulatory policies or accounting standards could be unfavorable. Other risks include environmental damage due to a company’s operations or an accident, a natural disaster, changes in market sentiment towards infrastructure and terrorist acts. Any of these events could cause the value of the Fund’s investments in infrastructure- related companies to decline.

By investing in the Fund, a shareholder will not be deemed to be an investor in any underlying fund and will not have the ability to exercise any rights attributable to an investor in any such underlying fund related to their investment. The Fund’s investment in Private Investment Funds will require it to bear a pro rata share of the vehicles’ expenses, including management and performance fees. Also, once an investment is made in a Private Investment Fund, neither the Adviser nor any Sub-Adviser will be able to exercise control over investment decisions made by the Private Investment Fund. The Fund may invest in securities of other investment companies, including ETFs. The Fund will indirectly bear its proportionate share of any management fees and other expenses paid by investment companies in which it invests, in addition to the management fees (and other expenses) paid by the Fund.

Cantor Fitzgerald Infrastructure Fund

Portfolio Review (Unaudited)

September 30, 2024

Average Annual Total Return through September 30, 2024*, as compared to its benchmark:

| | Six Months | One Year | Inception through

September 30, 2024 |

| Cantor Fitzgerald Infrastructure Fund Class A** | 12.13% | 30.14% | 12.37% |

| Cantor Fitzgerald Infrastructure Fund Class A with load** | 5.71% | 22.65% | 9.45% |

| Cantor Fitzgerald Infrastructure Fund Class C*** | 11.76% | 29.21% | 16.40% |

| Cantor Fitzgerald Infrastructure Fund Class I*** | 12.30% | 30.46% | 17.54% |

| Cantor Fitzgerald Infrastructure Fund Class S**** | N/A | N/A | 8.15% |

| S&P 500® Index(a)***** | 10.42% | 36.35% | 22.43%**/29.86%***/9.11%**** |

| S&P Global Infrastructure Index****** | 16.46% | 4.12% | 10.98%**/15.49%***/10.12%**** |

| * | The performance data quoted here represents past performance. The performance comparison includes reinvestment of all dividends and capital gains and has been adjusted for the Class A maximum applicable sales charge of 5.75%. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Performance figures for periods greater than 1 year are annualized. The Fund’s adviser has contractually agreed to waive its fees and to pay or absorb the ordinary annual operating expenses of the Fund (including all organizational and offering expenses, but excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses), to the extent that they exceed 2.50%, 3.25%, 2.25%, and 1.25% per annum of the Fund’s average daily net asssets attributable to Class A, Class C, Class I, and Class S respectively. The Fund’s total annual operating expenses, before fee waiver and/or reimbursements, is 4.98%, 5.26%, 4.42%, and 4.42% for Class A, Class C, Class I, and Class S, respectively, per the most recent prospectus. After fee waivers and/or reimbursements, the Fund’s net operating expense is 3.01%, 3.76%, 2.76%, and 1.76% for Class A, Class C, Class I, and Class S shares, repsectively. For performance information current to the most recent month-end, please call toll-free 1-855-9-CANTOR. |

| ** | Inception date is June 30, 2022. |

| *** | Inception date is March 20, 2023. |

| **** | Inception date is May 22, 2024. |

| ***** | The S&P 500® Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. You cannot invest directly in an index and unmanaged index returns do not reflect any fees, expenses or sales charges. |

| ****** | The S&P Global Infrastructure Index is designed to track 75 companies from around the world chosen to represent the listed infrastructure industry while maintaining liquidity and tradability. You cannot invest directly in an index and unmanaged index returns do not reflect any fees, expenses or sales charges. |

| (a) | The Cantor Fitzgerald Infrastracture Fund replaced the S&P Global Infrastracture Index with the S&P 500® Index as its primary index. The S&P Global Infrastracture Index is now the secondary index. |

| Holdings by Industry as of September 30, 2024 | | % of Net Assets | |

| Electric Utilities | | | 32.7 | % |

| Private Investments | | | 27.0 | % |

| Energy | | | 13.7 | % |

| Communication Services | | | 4.7 | % |

| Transportation and Logistics | | | 3.3 | % |

| Gas & Water Utilities | | | 2.0 | % |

| Oil & Gas Services & Equipment | | | 1.1 | % |

| Machinery | | | 1.0 | % |

| Specialty REIT | | | 0.9 | % |

| Other Investments | | | 1.8 | % |

| Short-Term Investment | | | 11.0 | % |

| Other Assets in Excess of Liabilities | | | 0.8 | % |

| | | | 100.0 | % |

Please refer to the Schedule of Investments in this semi-annual report for a detailed listing of the Fund’s holdings.

| |

| Cantor Fitzgerald Infrastructure Fund | 11 |

| |

| Cantor Fitzgerald Infrastructure Fund |

| Schedule of Investments (Unaudited) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 61.2% | | | | |

| | | | | COMMERCIAL SUPPORT SERVICES - 0.7% | | | | |

| | 6,982 | | | Waste Management, Inc. | | $ | 1,449,463 | |

| | | | | | | | | |

| | | | | COMMUNICATION SERVICES - 4.7% | | | | |

| | 28,548 | | | American Tower Corporation, A | | | 6,639,124 | |

| | 14,369 | | | SBA Communications Corporation, A | | | 3,458,618 | |

| | | | | | | | 10,097,742 | |

| | | | | DATA CENTER REIT - 0.3% | | | | |

| | 4,059 | | | Digital Realty Trust, Inc. | | | 656,868 | |

| | | | | | | | | |

| | | | | ELECTRIC UTILITIES - 32.7% | | | | |

| | 199,526 | | | AES Corporation (The) | | | 4,002,492 | |

| | 23,867 | | | American Electric Power Company, Inc. | | | 2,448,754 | |

| | 20,495 | | | CMS Energy Corporation | | | 1,447,562 | |

| | 29,894 | | | Constellation Energy Corporation | | | 7,773,038 | |

| | 55,106 | | | Dominion Resources, Inc. | | | 3,184,576 | |

| | 6,717 | | | DTE Energy Company | | | 862,530 | |

| | 20,420 | | | Duke Energy Corporation | | | 2,354,426 | |

| | 7,918 | | | Edison International | | | 689,579 | |

| | 45,779 | | | Enel - Societa per Azioni - ADR(a) | | | 364,401 | |

| | 1,559 | | | Entergy Corporation | | | 205,180 | |

| | 12,559 | | | Exelon Corporation | | | 509,267 | |

| | 36,288 | | | FirstEnergy Corporation | | | 1,609,373 | |

| | 24,485 | | | Iberdrola SA - ADR | | | 1,517,825 | |

| | 18,770 | | | National Grid PLC - ADR | | | 1,307,706 | |

| | 103,756 | | | NextEra Energy, Inc. | | | 8,770,495 | |

| | 41,381 | | | NRG Energy, Inc. | | | 3,769,809 | |

| | 24,168 | | | Public Service Enterprise Group, Inc. | | | 2,156,027 | |

| | 42,529 | | | RWE AG - ADR | | | 1,548,438 | |

| | 52,820 | | | Sempra Energy | | | 4,417,337 | |

| | 86,162 | | | Southern Company (The) | | | 7,770,089 | |

| | 69,595 | | | TRANSALTA CORP. | | | 721,004 | |

| | 81,013 | | | Vistra Energy Corporation | | | 9,603,280 | |

| | 43,850 | | | Xcel Energy, Inc. | | | 2,863,405 | |

| | | | | | | | 69,896,593 | |

| | | | | ENERGY - 13.7% | | | | |

| | 38,775 | | | Cheniere Energy, Inc. | | | 6,973,296 | |

| | 18,829 | | | DT Midstream, Inc. | | | 1,481,089 | |

| | 51,823 | | | Enbridge, Inc. | | | 2,104,532 | |

| | 164,884 | | | EQT Corporation | | | 6,041,350 | |

| | 94,522 | | | Schlumberger Ltd. | | | 3,965,198 | |

| | 30,376 | | | TC Energy Corporation | | | 1,444,379 | |

| | 64,000 | | | Ultrapar Participacoes S.A. - ADR | | | 248,320 | |

| | 150,551 | | | Williams Companies, Inc. (The) | | | 6,872,653 | |

| | | | | | | | 29,130,817 | |

| Cantor Fitzgerald Infrastructure Fund |

| Schedule of Investments (Unaudited) (Continued) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 61.2% (Continued) | | | | |

| | | | | GAS & WATER UTILITIES - 2.0% | | | | |

| | 16,493 | | | American Water Works Company, Inc. | | $ | 2,411,936 | |

| | 3,537 | | | Atmos Energy Corporation | | | 490,617 | |

| | 27,350 | | | Essential Utilities, Inc. | | | 1,054,890 | |

| | 8,452 | | | NiSource, Inc. | | | 292,862 | |

| | | | | | | | 4,250,305 | |

| | | | | MACHINERY - 1.0% | | | | |

| | 15,670 | | | Xylem, Inc. | | | 2,115,920 | |

| | | | | | | | | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 1.1% | | | | |

| | 81,944 | | | Halliburton Company | | | 2,380,473 | |

| | | | | | | | | |

| | | | | RENEWABLE ENERGY - 0.8% | | | | |

| | 10,850 | | | Enphase Energy, Inc.(a) | | | 1,226,267 | |

| | 23,883 | | | SolarEdge Technologies, Inc.(a) | | | 547,160 | |

| | | | | | | | 1,773,427 | |

| | | | | SPECIALTY REIT - 0.9% | | | | |

| | 57,069 | | | Hannon Armstrong Sustainable Infrastructure Capital, Inc. | | | 1,967,168 | |

| | | | | | | | | |

| | | | | TRANSPORTATION & LOGISTICS - 3.3% | | | | |

| | 39,551 | | | Canadian Pacific Kansas City Ltd. | | | 3,383,192 | |

| | 1,350 | | | Grupo Aeroportuario del Centro Norte S.A.B. de - ADR | | | 91,557 | |

| | 830 | | | Grupo Aeroportuario del Sureste S.A.B. de C.V. - ADR | | | 234,691 | |

| | 13,668 | | | Union Pacific Corporation | | | 3,368,889 | |

| | | | | | | | 7,078,329 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $111,928,401) | | | 130,797,105 | |

| |

| Cantor Fitzgerald Infrastructure Fund | 13 |

| |

| Cantor Fitzgerald Infrastructure Fund |

| Schedule of Investments (Unaudited) (Continued) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | PRIVATE INVESTMENT FUNDS — 27.0% | | | | |

| | 25,000,000 | | | Blackstone Infrastructure Partners IRH-G L.P.(b)(c)(d)(e) | | $ | 25,696,369 | |

| | 838,217 | | | CoreWeave Credit Agreement(b)(c)(d)(e) | | | 850,981 | |

| | 2,592,910 | | | DigitalBridge Credit (Onshore), LP(b)(c)(d)(e) | | | 2,482,512 | |

| | 431,792 | | | DigitalBridge Credit II (Onshore), LP(b)(c)(d)(e) | | | 411,335 | |

| | 4,241,287 | | | IPCC Fund L.P.(b)(c)(d)(e) | | | 3,940,390 | |

| | 5,000,000 | | | Irradiant Orchid Investors, LP(b)(c)(d)(e) | | | 4,810,020 | |

| | 12,252,854 | | | Peppertree Capital Fund VIII QP, LP(b)(c)(d)(e) | | | 15,158,869 | |

| | 876,377 | | | Peppertree Capital Fund X QP, LP(b)(c)(d)(e) | | | 1,002,915 | |

| | 3,223,099 | | | Rockland Power Partners IV LP(b)(c)(d)(e)(f)(g) | | | 3,276,317 | |

| | | | | | | | | |

| | | | | TOTAL PRIVATE INVESTMENT FUNDS (Cost $53,060,093) | | | 57,629,708 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENT — 11.0% | | | | |

| | | | | MONEY MARKET FUND - 11.0% | | | | |

| | 23,361,876 | | | Morgan Stanley Institutional Liquidity Funds, Institutional Class, 4.54% (Cost $23,361,876)(h) | | | 23,361,876 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 99.2% (Cost $188,350,370) | | $ | 211,788,689 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 0.8% | | | 1,794,454 | |

| | | | | NET ASSETS - 100.0% | | $ | 213,583,143 | |

ADR – American Depositary Receipt

LTD – Private Limited Company

LP – Limited Partnership

PLC – Public Limited Company

SA – Société Anonyme

| (a) | Non-income producing security. |

| (b) | Illiquid security. The total fair value of these securities as of September 30, 2024, was $57,629,708, representing 27.0% of net assets. |

| (d) | Investment is valued using net asset value (or its equivalent) as a practical expedient. Total value of all such securities as of September 30, 2024, amounted to $57,629,708, which represents approximately 27.0% of the net assets of the Fund. |

| (e) | Investment has been committed to but has not been fully funded by the Fund at September 30, 2024. See Note 2 for total unfunded investment commitments. |

| (f) | All or a portion of this security is custodied with CF IIX Holdings LLC at September 30, 2024. |

| (g) | Investment does not allow redemptions or withdrawals except at discretion of its general partner, manager or advisor. |

| (h) | Rate disclosed is the seven-day effective yield as of September 30, 2024. |

| Cantor Fitzgerald Infrastructure Fund |

| Consolidated Statement of Assets and Liabilities (Unaudited) |

| September 30, 2024 |

| ASSETS | | | | |

| Investments in securities at fair value (cost $188,350,370) | | $ | 211,788,689 | |

| Cash | | | 279,066 | |

| Receivable for Fund shares sold | | | 2,008,499 | |

| Dividends receivable | | | 267,340 | |

| Prepaid expenses | | | 259,363 | |

| TOTAL ASSETS | | | 214,602,957 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for Fund shares redeemed | | | 390,220 | |

| Payable to investment advisory fee | | | 311,730 | |

| Payable for distributions | | | 114,317 | |

| Payable for distribution fees, Class C | | | 21,322 | |

| Payable for shareholder servicing fees, Class A | | | 2,699 | |

| Payable for shareholder servicing fees, Class C | | | 6,868 | |

| Payable to Administrator | | | 47,514 | |

| Other accrued expenses | | | 125,144 | |

| TOTAL LIABILITIES | | | 1,019,814 | |

| NET ASSETS | | $ | 213,583,143 | |

| | | | | |

| Net Assets Consist Of: | | | | |

| Paid-in capital | | $ | 192,902,164 | |

| Accumulated earnings | | | 20,680,979 | |

| NET ASSETS | | $ | 213,583,143 | |

| | | | | |

| Class A | | | | |

| Net Assets | | $ | 21,439,261 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 1,732,161 | |

| Net asset value, offering and redemption price per share | | $ | 12.38 | |

| Maximum offering price (net asset value plus maximum sales charge of 5.75%) | | $ | 13.14 | |

| | | | | |

| Class C | | | | |

| Net Assets | | $ | 5,198,033 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 425,370 | |

| Net asset value, offering and redemption price per share(a) | | $ | 12.22 | |

| | | | | |

| Class I | | | | |

| Net Assets | | $ | 73,489,541 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 5,923,530 | |

| Net asset value, offering and redemption price per share | | $ | 12.41 | |

| | | | | |

| Class S | | | | |

| Net Assets | | $ | 113,456,308 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 9,111,341 | |

| Net asset value, offering and redemption price per share | | $ | 12.45 | |

| (a) | Class C shareholders may be subject to a contingent deferred sales charge on shares repurchased during the first 365 days after their purchase. |

See accompanying notes which are an integral part of these financial statements.

| |

| Cantor Fitzgerald Infrastructure Fund | 15 |

| |

| Cantor Fitzgerald Infrastructure Fund |

| Consolidated Statement of Operations (Unaudited) |

| For the Six Months Ended September 30, 2024 |

| INVESTMENT INCOME | | | | |

| Dividend Income (net of foreign taxes withheld of $39,330) | | $ | 1,900,732 | |

| TOTAL INVESTMENT INCOME | | | 1,900,732 | |

| | | | | |

| EXPENSES | | | | |

| Investment adviser fees | | | 1,010,265 | |

| Distribution fees, Class C | | | 2,224 | |

| Shareholder servicing fees, Class A | | | 10,936 | |

| Shareholder servicing fees, Class C | | | 2,591 | |

| Transfer agent fees | | | 60,111 | |

| Printing and postage expenses | | | 50,597 | |

| Registration fees | | | 45,750 | |

| Legal fees | | | 45,316 | |

| Administration fees | | | 37,336 | |

| Trustees fees | | | 32,587 | |

| Insurance expenses | | | 27,450 | |

| Third party administrative servicing fees | | | 26,958 | |

| Audit and tax preparation fees | | | 26,952 | |

| Compliance service fees | | | 23,967 | |

| Custodian fees | | | 21,040 | |

| Fund accounting fees | | | 18,727 | |

| Miscellaneous expenses | | | 60,475 | |

| TOTAL EXPENSES | | | 1,503,282 | |

| Fees contractually waived by Adviser | | | (123,495 | ) |

| NET OPERATING EXPENSES | | | 1,379,787 | |

| NET INVESTMENT INCOME | | | 520,945 | |

| | | | | |

| NET REALIZED AND CHANGE IN UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | |

| Net realized loss on: | | | | |

| Investment securities | | | (117,127 | ) |

| Foreign currency translations | | | (92 | ) |

| | | | | |

| Net change in unrealized appreciation/(depreciation) on: | | | | |

| Investment securities transactions | | | 18,947,910 | |

| Foreign currency translations | | | (39 | ) |

| NET REALIZED AND CHANGE IN UNREALIZED GAIN ON INVESTMENTS | | | 18,830,652 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 19,351,597 | |

See accompanying notes which are an integral part of these financial statements.

| Cantor Fitzgerald Infrastructure Fund |

| Consolidated Statement of Changes in Net Assets |

| | | For the | | | For the | |

| | | Six Months Ended | | | Year Ended | |

| | | September 30, 2024 | | | March 31, 2024 | |

| | | (Unaudited) | | | | |

| INCREASE (DECEREASE) IN NET ASSETS DUE TO: | | | | | | | | |

| OPERATIONS | | | | | | | | |

| Net investment income | | $ | 520,945 | | | $ | 413,543 | |

| Net realized gain (loss) on investment securities transactions and foreign currency translations | | | (117,219 | ) | | | 23,396 | |

| Net change in unrealized appreciation of investments securities and foreign currency translations | | | 18,947,871 | | | | 4,273,742 | |

| Net increase in net assets resulting from operations | | | 19,351,597 | | | | 4,710,681 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM EARNINGS (Note 2) | | | | | | | | |

| Net investment income | | | | | | | | |

| Class A | | | (352,684 | ) | | | (270,400 | ) |

| Class C | | | (72,305 | ) | | | (29,923 | ) |

| Class I | | | (1,792,192 | ) | | | (519,944 | ) |

| Class S(a) | | | (498,044 | ) | | | — | |

| Return of Capital Distributions | | | | | | | | |

| Class A | | | — | | | | (124,592 | ) |

| Class C | | | — | | | | (6,018 | ) |

| Class I | | | — | | | | (125,016 | ) |

| Net decrease in net assets resulting from distributions | | | (2,715,225 | ) | | | (1,075,893 | ) |

| | | | | | | | | |

| CAPITAL TRANSACTIONS Class A | | | | | | | | |

| Proceeds from shares sold | | | 4,648,006 | | | | 12,210,396 | |

| Reinvestment of distributions | | | 159,049 | | | | 205,724 | |

| Amount paid for shares redeemed | | | (390,749 | ) (c) | | | (4,581,793 | ) (d) |

| Total - Class A | | | 4,416,306 | | | | 7,834,327 | |

| CAPITAL TRANSACTIONS Class C | | | | | | | | |

| Proceeds from shares sold | | | 2,549,137 | | | | 1,926,525 | |

| Reinvestment of distributions | | | 57,395 | | | | 22,703 | |

| Amount paid for shares redeemed | | | (2,000 | ) | | | — | |

| Total - Class C | | | 2,604,532 | | | | 1,949,228 | |

| CAPITAL TRANSACTIONS Class I | | | | | | | | |

| Proceeds from shares sold | | | 109,992,345 | (c) | | | 29,764,913 | (d) |

| Reinvestment of distributions | | | 800,334 | | | | 283,767 | |

| Amount paid for shares redeemed | | | (84,031,138 | ) (e) | | | (555,239 | ) |

| Total - Class I | | | 26,761,541 | | | | 29,493,441 | |

| CAPITAL TRANSACTIONS Class S(a) | | | | | | | | |

| Proceeds from shares sold | | | 108,386,810 | (b)(e) | | | — | |

| Reinvestment of distributions | | | 28,942 | | | | — | |

| Amount paid for shares redeemed | | | (202,906 | ) | | | — | |

| Total - Class S | | | 108,212,846 | | | | — | |

| Net increase in net assets resulting from capital transactions | | | 141,995,225 | | | | 39,276,996 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 158,631,597 | | | | 42,911,784 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year/period | | | 54,951,546 | | | | 12,039,762 | |

| End of year/period | | $ | 213,583,143 | | | $ | 54,951,546 | |

See accompanying notes which are an integral part of these financial statements.

| |

| Cantor Fitzgerald Infrastructure Fund | 17 |

| |

| Cantor Fitzgerald Infrastructure Fund |

| Consolidated Statement of Changes in Net Assets (Continued) |

| | | For the | | | For the | |

| | | Six Months Ended | | | Year Ended | |

| | | September 30, 2024 | | | March 31, 2024 | |

| | | (Unaudited) | | | | |

| SHARE TRANSACTIONS CLASS A | | | | | | | | |

| Shares sold | | | 402,269 | | | | 1,172,910 | |

| Shares issued in reinvestment of distributions | | | 13,380 | | | | 19,533 | |

| Shares redeemed | | | (34,310 | ) (c) | | | (444,005 | ) (d) |

| Total - Class A | | | 381,339 | | | | 748,438 | |

| | | | | | | | | |

| SHARE TRANSACTIONS CLASS C | | | | | | | | |

| Shares sold | | | 222,694 | | | | 185,985 | |

| Shares issued in reinvestment of distributions | | | 4,862 | | | | 2,140 | |

| Shares redeemed | | | (165 | ) | | | — | |

| Total - Class C | | | 227,391 | | | | 188,125 | |

| | | | | | | | | |

| SHARE TRANSACTIONS CLASS I | | | | | | | | |

| Shares sold | | | 9,559,983 | (c) | | | 2,866,740 | (d) |

| Shares issued in reinvestment of distributions | | | 66,478 | | | | 26,766 | |

| Shares redeemed | | | (7,089,985 | ) (e) | | | (51,084 | ) |

| Total - Class I | | | 2,536,476 | | | | 2,842,422 | |

| | | | | | | | | |

| SHARE TRANSACTIONS CLASS S(a) | | | | | | | | |

| Shares sold | | | 9,125,412 | (b)(e) | | | — | |

| Shares issued in reinvestment of distributions | | | 2,346 | | | | — | |

| Shares redeemed | | | (16,417 | ) | | | — | |

| Total - Class S | | | 9,111,341 | | | | — | |

| (a) | Class S commenced operations on May 22, 2024. |

| (b) | Beginning capital of $100,000 was contributed by fund management of Cantor Fitzgerald Investment Advisors, L.P., investment advisor to the Fund, in exchange for 8,598 shares of the Class S in connection with the seeding of the Fund. |

| (c) | 21,146 Class A shares were redeemed to purchase 21,128 Class I shares amounting to $239,131 during the six months ended September 30, 2024. |

| (d) | 268,455 Class A shares were redeemed to purchase 268,614 Class I shares amounting to $2,708,022 during the year ended March 31, 2024. |

| (e) | 7,039,296 Class I shares were redeemed to purchase 7,020,235 Class S shares amounting to $83,425,135 during the six months ended September 30, 2024. |

See accompanying notes which are an integral part of these financial statements.

| Cantor Fitzgerald Infrastructure Fund |

| Consolidated Statement of Cash Flows (Unaudited) |

| For the Six Months Ended September 30, 2024 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | |

| Net increase in net assets resulting from operations | | $ | 19,351,597 | |

| | | | | |

| ADJUSTMENTS TO RECONCILE NET INCREASE IN NET ASSETS RESULTING FROM | | | | |

| OPERATIONS TO NET CASH USED IN OPERATING ACTIVITIES: | | | | |

| Purchases of long-term portfolio investments | | | (126,741,334 | ) |

| Proceeds from sales of long-term portfolio investments | | | 1,025,201 | |

| Purchases of short-term portfolio investments | | | (109,065,746 | ) |

| Proceeds from sales of short-term portfolio investments | | | 96,049,305 | |

| Net realized loss from investment transactions | | | 117,127 | |

| Net realized loss from foreign currency translations | | | 92 | |

| Return of capital from investments | | | 933,432 | |

| Net change in unrealized appreciation/depreciation on investments | | | (18,947,910 | ) |

| Net change in unrealized appreciation/depreciation on foreign currency translations | | | 39 | |

| Change in assets and liabilities: | | | | |

| Increase in dividends receivable | | | (172,940 | ) |

| Increase in Investment Adviser fees | | | 281,189 | |

| Increase in prepaid expenses and other assets | | | (193,794 | ) |

| Increase in payable for distribution fees | | | 14,683 | |

| Decrease in payable for administration fees | | | (23,849 | ) |

| Increase in income payable | | | 83,971 | |

| Increase in payable for fund shares redeemed | | | 390,220 | |

| Increase in accrued expenses and other liabilities | | | 78,682 | |

| | | | | |

| Net cash used in operating activities | | | (136,820,035 | ) |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

| Proceeds from shares sold, net | | | 223,833,847 | |

| Cash distributions to shareholders, net | | | (1,669,517 | ) |

| Payment on Fund shares redeemed, net* | | | (85,361,412 | ) |

| Net cash provided by financing activities | | | 136,802,918 | |

| | | | | |

| Net change in cash | | | (17,117 | ) |

| Cash held at beginning of period | | | 296,183 | |

| Cash held at end of period | | $ | 279,066 | |

| | | | | |

| SUPPLEMENTAL DISCLOSURE OF NON-CASH ACTIVITY: | | | | |

| Reinvestment of distributions | | $ | 1,045,720 | |

| * | Includes exchange redemptions of $83,664,266 |

See accompanying notes which are an integral part of these financial statements.

| |

| Cantor Fitzgerald Infrastructure Fund | 19 |

| |

| Cantor Fitzgerald Infrastructure Fund – Class A |

| Consolidated Financial Highlights |

| (For a share outstanding during the year/period) |

| | | | | | | | | (Not Consolidated) | |

| | | For the | | | For the | | | For the | |

| | | Six Months Ended | | | Year Ended | | | Period Ended | |

| | | September 30, 2024 | | | March 31, 2024 | | | March 31, 2023(a) | |

| | | (Unaudited) | | | | | | | |

| Net asset value, beginning of year/period | | $ | 11.10 | | | $ | 10.42 | | | $ | 10.00 | |

| Investment operations: | | | | | | | | | | | | |

| Net investment income (loss)(b) | | | 0.02 | | | | 0.13 | | | | 0.05 | |

| Net realized and unrealized gain (loss) on investments | | | 1.49 | | | | 0.86 | | | | 0.40 | |

| Total from investment operations | | | 1.51 | | | | 0.99 | | | | 0.45 | |

| Less distributions to shareholders from: | | | | | | | | | | | | |

| Net investment income | | | (0.23 | ) | | | (0.30 | ) | | | (0.03 | ) |

| Return of capital | | | — | | | | (0.01 | ) | | | — | |

| Total distributions | | | (0.23 | ) | | | (0.31 | ) | | | (0.03 | ) |

| Net asset value, end of year/period | | $ | 12.38 | | | $ | 11.10 | | | $ | 10.42 | |

| Total return(c) | | | 12.67 | % (d)(h) | | | 9.86 | % (h) | | | 4.53 | % (d) |

| Net assets, at end of year/period (000s) | | $ | 21,439 | | | $ | 14,990 | | | $ | 6,137 | |

| Ratio of expenses to average net assets after expense waiver(f) | | | 2.38 | % (e) | | | 2.50 | % | | | 2.50 | % (e) |

| Ratio of net expenses to average net assets before expense waiver(f) | | | 2.38 | % (e) | | | 4.47 | % | | | 11.92 | % (e) |

| Ratio of net investment income (loss) to average net assets after expense waiver(g) | | | 0.42 | % (e) | | | 1.23 | % | | | 0.68 | % (e) |

| Portfolio Turnover Rate | | | 1 | % (d) | | | 1 | % | | | 8 | % (d) |

| (a) | For the period June 30, 2022 (commencement of operations) to March 31, 2023. |

| (b) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the year/period. |

| (c) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (f) | Does not include the Fund’s share of the expenses of the underlying investment companies in which the Fund invests. |

| (g) | The recognition of investment income (loss) by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (h) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

See accompanying notes which are an integral part of these financial statements.

| Cantor Fitzgerald Infrastructure Fund – Class C |

| Consolidated Financial Highlights |

| (For a share outstanding during the year/period) |

| | | | | | | | | (Not Consolidated) | |

| | | For the | | | For the | | | For the | |

| | | Six Months Ended | | | Year Ended | | | Period Ended | |

| | | September 30, 2024 | | | March 31, 2024 | | | March 31, 2023(a) | |

| | | (Unaudited) | | | | | | | |

| Net asset value, beginning of year/period | | $ | 11.04 | | | $ | 10.40 | | | $ | 10.17 | |

| Investment operations: | | | | | | | | | | | | |

| Net investment income (loss)(b) | | | (0.02 | ) | | | 0.04 | | | | 0.01 | |

| Net realized and unrealized gain (loss) on investments | | | 1.43 | | | | 0.91 | | | | 0.24 | |

| Total from investment operations | | | 1.41 | | | | 0.95 | | | | 0.25 | |

| Less distributions to shareholders from: | | | | | | | | | | | | |

| Net investment income | | | (0.23 | ) | | | (0.30 | ) | | | (0.02 | ) |

| Return of capital | | | — | | | | (0.01 | ) | | | — | |

| Total distributions | | | (0.23 | ) | | | (0.31 | ) | | | (0.02 | ) |

| Net asset value, end of year/period | | $ | 12.22 | | | $ | 11.04 | | | $ | 10.40 | |

| Total return(c) | | | 12.22 | % (d)(h) | | | 9.47 | % (h) | | | 2.49 | % (d) |

| Net assets, at end of year/period (000s) | | $ | 5,198 | | | $ | 2,186 | | | $ | 102 | |

| Ratio of expenses to average net assets after expense waiver(f) | | | 3.13 | % (e) | | | 3.25 | % | | | 3.25 | % (e) |

| Ratio of net expenses to average net assets before expense waiver(f) | | | 3.13 | % (e) | | | 4.75 | % | | | 12.67 | % (e) |

| Ratio of net investment income (loss) to average net assets after expense waiver(g) | | | (0.33 | )% (e) | | | 0.40 | % | | | 1.73 | % (e) |

| Portfolio Turnover Rate | | | 1 | % (d) | | | 1 | % | | | 8 | % (d) |

| (a) | For the period March 20, 2023 (commencement of operations) to March 31, 2023. |

| (b) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the year/period. |

| (c) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (f) | Does not include the Fund’s share of the expenses of the underlying investment companies in which the Fund invests. |

| (g) | The recognition of investment income (loss) by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (h) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

See accompanying notes which are an integral part of these financial statements.

| |

| Cantor Fitzgerald Infrastructure Fund | 21 |

| |

| Cantor Fitzgerald Infrastructure Fund – Class I |

| Consolidated Financial Highlights |

| (For a share outstanding during the year/period) |

| | | | | | | | | (Not Consolidated) | |

| | | For the | | | For the | | | For the | |

| | | Six Months Ended | | | Year Ended | | | Period Ended | |

| | | September 30, 2024 | | | March 31, 2024 | | | March 31, 2023(a) | |

| | | (Unaudited) | | | | | | | |

| Net asset value, beginning of year/period | | $ | 11.15 | | | $ | 10.40 | | | $ | 10.17 | |

| Investment operations: | | | | | | | | | | | | |

| Net investment income (loss)(b) | | | 0.04 | | | | 0.14 | | | | 0.01 | |

| Net realized and unrealized gain (loss) on investments | | | 1.45 | | | | 0.92 | | | | 0.25 | |

| Total from investment operations | | | 1.49 | | | | 1.06 | | | | 0.26 | |

| Less distributions to shareholders from: | | | | | | | | | | | | |

| Net investment income | | | (0.23 | ) | | | (0.30 | ) | | | (0.03 | ) |

| Return of capital | | | — | | | | (0.01 | ) | | | — | |

| Total distributions | | | (0.23 | ) | | | (0.31 | ) | | | (0.03 | ) |

| Net asset value, end of year/period | | $ | 12.41 | | | $ | 11.15 | | | $ | 10.40 | |

| Total return(c) | | | 12.84 | % (d)(h) | | | 10.57 | % (h) | | | 2.51 | % (d) |

| Net assets, at end of year/period (000s) | | $ | 73,490 | | | $ | 37,775 | | | $ | 5,649 | |

| Ratio of expenses to average net assets after expense waiver(f) | | | 2.13 | % (e) | | | 2.25 | % | | | 2.25 | % (e) |

| Ratio of net expenses to average net assets before expense waiver(f) | | | 2.13 | % (e) | | | 3.91 | % | | | 11.67 | % (e) |

| Ratio of net investment income (loss) to average net assets after expense waiver(g) | | | 0.67 | % (e) | | | 1.40 | % | | | 2.87 | % (e) |

| Portfolio Turnover Rate | | | 1 | % (d) | | | 1 | % | | | 8 | % (d) |

| (a) | For the period March 20, 2023 (commencement of operations) to March 31, 2023. |

| | |

| (b) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the year/period. |

| | |

| (c) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| | |

| (d) | Not annualized. |

| | |

| (e) | Annualized. |

| | |

| (f) | Does not include the Fund’s share of the expenses of the underlying investment companies in which the Fund invests. |

| | |

| (g) | The recognition of investment income (loss) by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| | |

| (h) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

See accompanying notes which are an integral part of these financial statements.

| Cantor Fitzgerald Infrastructure Fund – Class S |

| Consolidated Financial Highlights |

| (For a share outstanding during the period) |

| | | For the Period | |

| | | Ended | |

| | | September 30(a) | |

| | | (Unaudited) | |

| Net asset value, beginning of period | | $ | 11.63 | |

| Investment operations: | | | | |

| Net investment income (loss)(b) | | | 0.07 | |

| Net realized and unrealized gain (loss) on investments | | | 0.91 | |

| Total from investment operations | | | 0.98 | |

| Less distributions to shareholders from: | | | | |

| Net investment income | | | (0.16 | ) |

| Total distributions | | | (0.16 | ) |

| Net asset value, end of period | | $ | 12.45 | |

| Total return(c) | | | 8.58 | % (d)(h) |

| Net assets, at end of period (000s) | | $ | 113,456 | |

| Ratio of expenses to average net assets after expense waiver(f) | | | 1.13 | % (e) |

| Ratio of net expenses to average net assets before expense waiver(f) | | | 2.13 | % (e) |

| Ratio of net investment income (loss) to average net assets after expense waiver(g) | | | 1.67 | % (e) |

| Portfolio Turnover Rate | | | 1 | % (d) |

| (a) | For the period May 22, 2024 (commencement of operations) to September 30, 2024. |

| (b) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the year/period. |

| (c) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (f) | Does not include the Fund’s share of the expenses of the underlying investment companies in which the Fund invests. |

| (g) | The recognition of investment income (loss) by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (h) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

See accompanying notes which are an integral part of these financial statements.

| |

| Cantor Fitzgerald Infrastructure Fund | 23 |

| |

| Cantor Fitzgerald Infrastructure Fund |

| Consolidated Notes to Financial Statements (Unaudited) |

| September 30, 2024 |

Cantor Fitzgerald Infrastructure Fund (the “Fund”) was organized as a Delaware statutory trust on December 16, 2021 and is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”), as a continuously offered, non-diversified, closed-end management investment company. The Fund is an interval fund that will provide limited liquidity by offering to make quarterly repurchases of shares at net asset value (“NAV”), which will be calculated on a daily basis. The Fund’s investment objective is to maximize total return, with an emphasis on current income, while seeking to invest in issuers that are helping to address certain United Nations Sustainable Development Goals (“SDGs”) through their products and services.

The Fund currently offers four classes of shares: Class A, Class C, Class I, and Class S shares. Class A shares commenced operations on June 30, 2022, Class C and I commenced operations on March 20, 2023, and Class S commenced operations on May 22, 2024. Class A shares are offered at net asset value plus a maximum sales charge of 5.75%, while Class C and I are not subject to a sales load.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 946 “Financial Services – Investment Companies”.

Consolidation of Subsidiaries: The Fund may make investments through wholly owned subsidiaries (each a “Subsidiary” and together, the “Subsidiaries”). Such Subsidiaries will not be registered under the Investment Company Act; however, the Fund will wholly own and control any Subsidiaries. The Board of Trustees (“Board”) has oversight responsibility for the investment activities of the Fund, including its investment in any Subsidiary, and the Fund’s role as sole shareholder owner of any Subsidiary. To the extent applicable to the investment activities of a Subsidiary, the Subsidiary will follow the same compliance policies and procedures as the Fund. The Fund would “look through” any such Subsidiary to determine compliance with its investment policies. The Fund complies with Section 8 of the 1940 Act governing investment policies on an aggregate basis with any Subsidiary. The Fund also complies with Section 18 of the 1940 Act governing capital structure and leverage on an aggregate basis with each Subsidiary so that the Fund treats a Subsidiary’s debt as its own for purposes of Section 18. Further, each Subsidiary complies with the provisions of Section 17 of the 1940 Act relating to affiliated transactions and custody. Any Subsidiary would use UMB Bank, n.a. as custodian. The Fund will not create or acquire primary control of any entity which engages in investment activities in securities or other assets, other than entities wholly owned by the Fund.

As of September 30, 2024, there is one active Subsidiary: CF IIX Holdings LLC (the “Sub Fund”), formed in Delaware. The Subsidiary has the same investment objective as the Fund. The Consolidated Schedule of Investments, Consolidated Statement of Assets and Liabilities, Consolidated Statement of Operations, Consolidated Statements of Changes in Net Assets, and Consolidated Financial Highlights of the Fund include the accounts of the Subsidiary. All inter company accounts and transactions have been eliminated in the consolidation for the Fund.

As of September 30, 2024, the total value of investments held by the Sub Fund is $3,276,317 or approximately 1.5% of the Fund’s net assets.

| Cantor Fitzgerald Infrastructure Fund |

| Consolidated Notes to Financial Statements (Unaudited) (Continued) |

| September 30, 2024 |

Securities Valuation – The Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities will be valued using the “fair value” procedures approved by the Board. The Board has delegated execution of these procedures to the Cantor Fitzgerald Investment Advisors, L.P. (the “Adviser”) as its valuation designee (the “Valuation Designee”). The Board may also enlist third party consultants such a valuation specialist at a public accounting firm, valuation consultant or financial officer of a security issuer on an as-needed basis to assist the Valuation Designee in determining a security-specific fair value. The Board is responsible for reviewing and approving fair value methodologies utilized by the Valuation Designee, which approval shall be based upon whether the Valuation Designee followed the valuation procedures established by the Board.

Valuation of Public Securities – Readily marketable portfolio securities listed on a public exchange are valued at their current market values determined on the basis of market quotations obtained from independent pricing services approved by the Board. Such quotes typically utilize official closing prices, generally the last sale price, reported to the applicable securities exchange if readily available. Portfolio securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined as reflected by the exchange representing the principal market for such securities. Securities trading on NASDAQ are valued at NASDAQ official closing price.

If market or dealer quotations are not readily available or deemed unreliable, the Adviser will determine in good faith, the fair value of such securities. For securities that are fair valued in the ordinary course of Fund operations, the Board has designated the performance of fair value determinations to the Adviser as valuation designee, subject to the Board’s oversight. The Adviser has established a Valuation Committee to help oversee the implementation of procedures for fair value determinations. In determining the fair value of a security for which there are no readily available market or dealer quotations, the Adviser and the Valuation Committee, will take into account all reasonably available information that may be relevant to a particular security including, but not limited to: pricing history, current market level, supply and demand of the respective security; the enterprise value of the portfolio company; the portfolio company’s ability to make payments and its earnings and discounted cash flow, comparison to the values and current pricing of publicly traded securities that have comparable characteristics; comparison to publicly traded securities including factors such as yield, maturity, and credit quality; knowledge of historical market information with respect to the security; fundamental analytical data, such as periodic financial statements, and other factors or information relevant to the security, issuer, or market. Fair valuation involves subjective judgments, and it is possible that the fair value determined for a security may differ materially from the value that could be realized upon the sale of the security.

Valuation of Private Investment Funds – The Fund’s allocation to Private Investment Funds generally includes open end private institutional infrastructure investment funds that invest in the ownership, management, development, construction, renovation, enhancement, or operation of infrastructure assets or the provision of services to companies engaged in such activities. The Private Investment Funds have generally adopted valuation practices consistent with the valuation standards and techniques established by the FASB Auditing Standards Codification.