UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-23776

HARTFORD SCHRODERS PRIVATE OPPORTUNITIES FUND

(Exact name of registrant as specified in charter)

690 Lee Road, Wayne, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Thomas R. Phillips, Esquire

Hartford Funds Management Company, LLC

690 Lee Road

Wayne, Pennsylvania 19087

(Name and Address of Agent for Service)

Copy to:

John V. O’Hanlon, Esquire

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, Massachusetts 02110-2605

Registrant’s telephone number, including area code: (610) 386-4068

Date of fiscal year end: March 31

Date of reporting period: March 31, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a)

Hartford Schroders

Private Opportunities Fund

Annual Report

March 31, 2024

A MESSAGE FROM THE PRESIDENT

Dear Shareholders

Thank you for investing in the Hartford Schroders Private Opportunities Fund. The following is the Fund’s Annual Report that covers the period from July 31, 2023 (commencement of operations), through March 31, 2024.

Market Review

During the 12 months ended March 31, 2024, U.S. stocks, as measured by the S&P 500 Index (the “Index”),1 gained 29.88%. The period covered by this report marked the return of a new bull market for stocks, propelled in large part by a combination of optimism over moderating inflation, the continuing resilience of the U.S. economy, the increasing appetite among investors for stocks in the tech sector, and a strong belief that the Federal Reserve (Fed) is still on track to cut interest rates sometime in 2024.

Equities have come a long way from the 12-month bottom recorded on April 26, 2023, when the Index closed at 4,055.99. By March 28, 2024, near the period’s end, the Index had soared to a record close of 5,254.35. The Dow and Nasdaq indices also hit new record highs during the period as investors sensed that the Fed may have succeeded in achieving the sought-after soft-landing scenario of lower inflation without a recession.

The long bounce-back from the April 2023 bottom came in fits and starts. A short-lived early-summer tech-stock rally was followed by a late-summer slump triggered by rising US Treasury rates. But November 2023 brought a more lasting change in market sentiment as a stream of strong economic data began to bring investors off the sidelines. By December 2023, optimism surged again as the Fed held its federal funds rate steady while publicly hinting at the possibility of up to three rate cuts in 2024.

As markets rallied on hopes of imminent rate cuts, Fed Chair Jerome Powell sought to dampen expectations by emphasizing the Fed’s need for data-driven evidence of progress toward achieving its 2% inflation target. Powell’s remarks in late January 2024 also took a hoped-for March 2024 rate cut off the table. In addition, the months of January and February 2024 saw the release of two consecutive Consumer Price Index (CPI)2 reports showing that inflation had been stickier than expected, with prices for housing, travel, services, and energy staying stubbornly high.

With inflation a continuing concern, some analysts—so-called “no-landing” proponents—were even suggesting that the Fed might not cut rates in 2024 at all. Undeterred, investors continued to place big bets on artificial intelligence by pouring billions into the stocks of the so-called Magnificent Seven (Apple, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla).

In the aftermath of the Federal Open Market Committee’s March 2024 decision to keep the federal funds rate anchored in the 5.25-5.50% range, Chair Powell appeared to reaffirm the Fed’s intention to begin relaxing its tight-money policy after mid-2024, but with the caveat that incoming economic data would have to continue showing progress in getting to 2% inflation.

In the weeks and months ahead, markets will likely be focused on the timing of the Fed’s expected interest-rate pivot as well as the potential impacts of geopolitical events in the Middle East and a looming U.S. presidential election. With market volatility likely to persist, it’s more important than ever to maintain a strong relationship with your financial professional.

Thank you again for investing in the Hartford Schroders Private Opportunities Fund. For the most up-to-date information on our funds, please take advantage of all the resources available at hartfordfunds.com.

James Davey

President

Hartford Funds

| 1 | S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. Indices are unmanaged and not available

for direct investment. Past performance does not guarantee future results. |

| 2 | The Consumer Price Index is defined by the Bureau of Labor Statistics as a measure of the average change over time in the prices paid by urban consumers

for a market basket of consumer goods and services. |

Hartford Schroders Private Opportunities Fund

Table of Contents

The views expressed in the Fund’s Manager Discussion contained in the Fund Overview section are views of the Fund’s portfolio manager(s) through the end of the period and are subject to change based on market and other conditions, and we disclaim any responsibility to update the views contained herein. These views may contain statements that are “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Fund’s Manager Discussion is for informational purposes only and does not represent an offer, recommendation or solicitation to buy, hold or sell any security. The specific securities identified and described, if any, do not represent all of the securities purchased or sold and you should not assume that investments in the securities identified and discussed will be profitable. Holdings and characteristics are subject to change. Fund performance reflected in the Fund’s Manager Discussion reflects the returns of the Fund’s Class A shares, before sales charges. Returns for the Fund’s other classes differ only to the extent that the classes do not have the same expenses.

Hartford Schroders Private Opportunities Fund

Fund Overview (Consolidated)

March 31, 2024 (Unaudited)

Inception 07/31/2023

Sub-advised by Schroder Investment Management North America Inc. and its sub-sub-adviser, Schroders Capital Management (US), Inc. | Investment objective – The Fund seeks to provide long-term capital appreciation. |

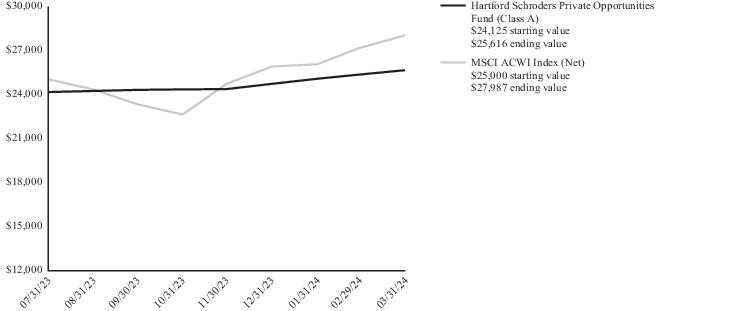

Comparison of Change in Value of $25,000 Investment (07/31/2023 - 03/31/2024)

The chart above represents the hypothetical growth of a $25,000 investment in Class A, which includes the maximum sales charge applicable to Class A shares. Returns for the Fund’s other classes will vary from what is seen above due to differences in the expenses charged to those share classes.

| Cumulative Total Returns |

| for the Period Ended 03/31/2024 |

| | Since

Inception1 |

| Class A2 | 6.18% |

| Class A3 | 2.47% |

| Class I2 | 6.20% |

| Class SDR2 | 6.20% |

| MSCI ACWI Index (Net) | 11.95% |

| 1 | Inception: 07/31/2023 |

| 2 | Without sales charge |

| 3 | Reflects maximum sales charge of 3.50% |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when repurchased, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the repurchase or sale of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns presented above were calculated using the applicable class' net asset value available to shareholders for sale of Fund shares on 03/31/2024. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

You cannot invest directly in an index.

See "Index Definition" for index description.

Performance information may reflect expense waivers/reimbursements without which performance would have been lower. For information on current expense waivers/reimbursements, please see the prospectus.

| Operating Expenses* | Gross | Net |

| Class A | 4.99% | 2.26% |

| Class I | 4.39% | 1.66% |

| Class SDR | 4.14% | 1.41% |

| * | Expenses as shown in the Fund’s most recent prospectus. Gross expenses do not reflect contractual fee waivers or expense reimbursement arrangements. Net expenses reflect such arrangements in instances when they reduce gross expenses. These arrangements remain in effect until 09/30/2024 unless the Fund’s Board of Trustees approves an earlier termination. Expenses shown include acquired fund fees and expenses. Actual expenses may be higher or lower. Please see accompanying Financial Highlights for expense ratios for the period ended 03/31/2024. |

Hartford Schroders Private Opportunities Fund

Fund Overview (Consolidated) – (continued)

March 31, 2024 (Unaudited)

The Fund’s sub-adviser is Schroder Investment Management North America Inc. and its sub-sub-adviser is Schroders Capital Management (US) Inc.

Portfolio Managers

Rainer Ender, CFA

Global Head of Private Equity

Nils Rode

Chief Investment Officer

Lee Gardella

Head of Buyout Investments Americas

Tim Creed

Head of Private Equity Investments

Ethan Vogelhut

Head of Buyout Investments Americas

Benjamin Alt

Head of Global Private Equity Portfolios

Manager Discussion

How did the Fund perform during the period?

Class A Shares of the Hartford Schroders Private Opportunities Fund returned 6.18% before sales charges, for the period from July 31, 2023 (the Fund’s commencement of operations) through March 31, 2024, underperforming the MSCI ACWI Index (Net) which returned 11.95% for the same period. The MSCI ACWI Index (Net) does not serve as a benchmark for the Fund and is presented for illustrative purposes only. The index performance shown is not intended to be indicative of the Fund’s investment strategies as the Fund is solely in private equity and only holds a few current positions. The Fund is currently in its investment ramp-up phase and the Fund's cash holdings have been a drag on performance. The outsized cash position will continue until the Fund is fully invested when cash will represent 10 – 20% of the Fund.

Why did the Fund perform this way?

Four investments in the portfolio - Greenbelt Capital Partners Saber LP, Procemsa Build-Up SCSp, TRP Continuation Fund (Genox) LP, and VSC EV3 (Parallel) LP - have been marked up in value primarily due to solid revenue and operating cash flow growth. All investments are performing at or above the portfolio managers’ expectations.

Greenbelt Capital Partners Saber LP has experienced robust revenue and operating income growth since the Fund's investment closed. The company reported earnings before interest, taxes depreciation, and amortization (EBITDA) for the year ended March 31, 2024 that is in-line with investing parameters and is projecting further momentum for the remainder of 2024. The investment was initially marked up in December 2023 due to EBITDA outperformance relative to underwriting and has subsequently been marked up in both February

and March 2024 for continued outperformance. In aggregate, our investment in Greenbelt Capital Partners Saber LP has increased 28% since entry.

Procemsa Build-Up SCSp valuation increased ~39% in January 2024 due to several factors. The company completed a highly positive add-on acquisition of the second largest Eastern European vitamins and supplements contract development and manufacturing organization providing further international expansion, increased manufacturing capacity through two additional Poland-based facilities, as well as revenue and cost synergies. In addition, the company signaled strong 2024 guidance for EBITDA growth. Lastly, public comparables traded favorably since entry, driving modest multiple expansion.

TRP Continuation Fund (Genox) LP was re-valued up more than 15% in February 2024 as a result of positive EBITDA developments between the continuation fund reference date of the first quarter 2023 and the closing date of the first quarter 2024, as well as improvements in public comparables during the same period.

Similar to TRP Continuation Fund (Genox LP), VSC EV3 (Parallel) LP was re-valued up ~9% in December 2023 as a result of positive EBITDA development between the continuation fund reference date of the first quarter 2023 and the valuation date of the fourth quarter 2023, as well as public comparables valuation improvements during the same period.

Derivatives were not used in the Fund during the period and, therefore, had no impact on Fund performance.

Hartford Schroders Private Opportunities Fund

Fund Overview (Consolidated) – (continued)

March 31, 2024 (Unaudited)

What is the outlook as of the end of the period?

Over the coming fiscal year, the Fund expects to add new investments as appropriate opportunities are identified and become available, and the current holdings are expected to continue executing on general partner value creation plans. The portfolio is early in its development and may continue to grow as new investments are added and additional capital becomes available. Although the portfolio managers do not currently expect to make follow-on investments in the existing companies in the portfolio, it is possible that certain investment funds will call on a portion of the unfunded commitments as acquisitions are a key part of the growth strategy. Lastly, the portfolio managers do not currently anticipate exiting any investments in the coming fiscal year as the Fund is in its first full year of operations and the Fund expects to hold most investments for three to six years.

The Fund currently has several investment opportunities in the closing process and more in the active consideration and diligence phase. We believe that current market conditions are favorable for new investments. Today’s private equity environment is considerably different from a few years ago when low interest rates, quantitative easing and yield curve control coincided with fiscal stimulus leading to excess liquidity and multiple expansion. Most of these trends reversed with the onset of inflation and the subsequent response by the U.S. Federal Reserve of raising interest rates. While the rate increases temporarily tightened new private equity investment activity, the transaction market has begun to improve as valuation and interest rate volatility has subsided, as of the end of the reporting period, providing the market with confidence for new investment commitments.

The Fund is primarily focused on the small and middle market buyout segment, which continues to see steady deal flow. We believe that current supply/demand dynamics coupled with slowing fundraising will continue to lead to attractive entry prices and increasing opportunities for co-investments and GP-led secondary investments.

Important Risks

The Fund is a newly organized, non-diversified, closed-end management investment company with limited operating history that may be subject to additional risks. Security prices fluctuate in value depending on general market and economic conditions and the prospect of individual companies. • Private equity investments involve a high degree of business and financial risk that can result in substantial losses. The valuation of private equity investments is complex and is typically based on fair value as determined in good faith by the Fund according to the Fund’s valuation procedures. The Fund’s net asset value could be adversely affected if the Fund’s determination regarding the fair value of the Fund’s investments were materially higher than the values that the Fund ultimately realizes upon disposal of such investment. • Illiquid and restricted securities may be difficult to dispose of at a fair price at the times when the Fund believes it is desirable to do so. A particular investment may become illiquid, making it difficult for the Fund to sell that investment at an advantageous time or price. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse political, economic, and regulatory developments. • Small-cap and Mid-cap securities can have greater risks and volatility than large-cap companies. • Leverage can increase market exposure, magnify investment risks, and cause losses to be realized more quickly. • Obligations of U.S. Government agencies are supported by varying degrees of credit but are generally not backed by the full faith and credit of the U.S. Government. • Because the Fund is non-diversified, it may invest in a smaller number of issuers, and may be more exposed to risks and volatility than a more broadly diversified fund. • To the extent the Fund focuses on one or more sectors, the Fund may be subject to increased volatility and risk of loss if adverse developments occur. • Financially material environmental, social and/or governance (ESG) characteristics are one of several factors that may be considered and as a result, the investment process may not work as intended.

| Composition by Strategy |

| as of 03/31/2024 |

| Category | Percentage of

Net Assets |

| Direct Investments | |

| Direct Equity | 19.7% |

| Secondary Direct Equity | 14.2 |

| Total | 33.9% |

| Other Assets & Liabilities | 66.1 |

| Total | 100.0% |

Hartford Schroders Private Opportunities Fund

Index Definition (Unaudited)

| MSCI ACWI Index (Net) (reflects reinvested dividends net of withholding taxes but reflects no deduction for fees, expenses or other taxes) is designed to capture large and mid cap securities across developed markets and emerging markets countries. |

Additional Information Regarding MSCI Indices.

Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent. |

Hartford Schroders Private Opportunities Fund

Schedule of Investments (Consolidated)

March 31, 2024

| Investments †—33.9% | | Investment

Type | | | Acquisition

Date | | Cost | | Fair

Value |

| Direct Investments—33.9% |

| Direct Equity—19.7% |

| Germany—4.4% |

| Information Technology—4.4% |

| Fremman 1 MM Co-investment 7 Rocket SCSp*(1)(2)(3)(4)(5) | | Limited Partnership Interest | 02/13/2024 | | $ 951,727 | | $ 936,131 |

| Luxembourg—4.8% |

| Information Technology—4.8% |

| Stirling Square Capital Partners Eagle Co-Investment SCSp*(2)(3)(4)(5) | | Limited Partnership Interest | 11/13/2023 | | 1,012,232 | | 1,012,622 |

| United States—10.5% |

| Health Care—3.1% |

| Resurgens II Co-Invest C LP*(2)(3)(4)(5) | | Limited Partnership Interest | 11/15/2023 | | 654,762 | | 653,206 |

| Utilities—7.4% |

| Greenbelt Capital Partners Saber LP*(1)(2)(4)(5) | | Limited Partnership Interest | 10/25/2023 | | 1,250,000 | | 1,576,587 |

| | | | | | | | 3,868,721 | | 4,178,546 |

| Secondary Direct Equity—14.2% |

| Luxembourg—4.4% |

| Health Care—4.4% |

| Procemsa Build-Up SCSp*(1)(2)(3)(4)(5) | | Limited Partnership Interest | 11/16/2023 | | 702,997 | | 939,994 |

| United States—9.8% |

| Industrials—9.8% |

| VSC EV3 (Parallel) LP*(1)(2)(3)(4)(5) | | Limited Partnership Interest | 12/19/2023 | | 734,376 | | 797,136 |

| TRP Continuation Fund (Genox) LP*(1)(2)(3)(4)(5) | | Limited Partnership Interest | 02/22/2024 | | 1,095,745 | | 1,263,035 |

| | | | | | | | 2,533,118 | | 3,000,165 |

| Total Investments (Cost $6,401,839) | | $ 7,178,711 |

| Other Assets and Liabilities – 66.1% | | 13,969,919 |

| Total Net Assets – 100.0% | | $ 21,148,630 |

| * | Non-income producing. |

| (1) | Investment valued using significant unobservable inputs. |

| (2) | All or a portion of this security is held through Hartford Funds SPV, LLC, a wholly-owned subsidiary of the Fund (See Note 1). |

| (3) | Investment has been committed to but has not been fully funded by the Fund. |

| (4) | Investment does not allow redemptions or withdrawals except at discretion of its general partner, manager or advisor. |

| (5) | Restricted security. |

† Direct Investments are investments directly (or indirectly through special purpose vehicles) into privately held operating companies. The Fund’s Direct Investments will typically be in the form of co-investments, which involve the Fund acquiring an interest in a single operating company alongside an investment by a private equity firm. Secondary Investments entail acquiring an interest in one or more assets from private equity fund investors and/or direct equity participants through a negotiated transaction in which the private equity majority manager managing the asset remains the same.

The accompanying notes are an integral part of these financial statements.

Hartford Schroders Private Opportunities Fund

Schedule of Investments (Consolidated) – (continued)

March 31, 2024

Fair Value Summary

The following is a summary of the fair valuations according to the inputs used as of March 31, 2024 in valuing the Fund’s investments.

| Description | | Total | | Level 1 | | Level 2 | | Level 3 |

| Assets | | | | | | | | |

| Direct Investments | | $ 5,512,883 | | $ — | | $ — | | $ 5,512,883 |

| Total | | $ 5,512,883 | | $ — | | $ — | | $ 5,512,883 |

In accordance with Accounting Standards Update (“ASU”) No. 2015-07, Fair Value Measurements (Topic 820): Disclosure for Investments in Certain Entities that Calculate Net Asset Value per Share (or Its Equivalent), certain Investments fair valued using net asset value (or its equivalent) as a practical expedient are not included in the fair value hierarchy. As such, investments in securities with a fair value of $1,665,828 are excluded from the fair value summary as of March 31, 2024.

| | Direct Investments | | Total | | | | |

| Beginning balance | $ — | | $ — | | | | |

| Purchases | 4,734,845 | | 4,734,845 | | | | |

| Sales | — | | — | | | | |

| Total realized gain/(loss) | — | | — | | | | |

| Net change in unrealized appreciation/(depreciation) | 778,038 | | 778,038 | | | | |

| Transfers into Level 3 | — | | — | | | | |

| Transfers out of Level 3 | — | | — | | | | |

| Ending balance | $ 5,512,883 | | $ 5,512,883 | | | | |

| The change in net unrealized appreciation/(depreciation) relating to the Level 3 investments held at March 31, 2024 was $778,038. | |

The accompanying notes are an integral part of these financial statements.

Hartford Schroders Private Opportunities Fund

GLOSSARY: (abbreviations used in preceding Schedule of Investments)

| Other Abbreviations: |

| SCSp | Société en Commandite Cpéciale |

Hartford Schroders Private Opportunities Fund

Statement of Assets and Liabilities (Consolidated)

March 31, 2024

| Assets: | |

| Investments in securities, at market value | $ 7,178,711 |

| Cash | 14,269,021 |

| Foreign currency | 75 |

| Other assets | 18,085 |

| Total assets | 21,465,892 |

| Liabilities: | |

| Payables: | |

| To affiliates (("Investment Manager") see Note 6) | 13,898 |

| Investment management fees | 4,446 |

| Transfer agent fees | 13,044 |

| Accounting services fees | 48,083 |

| Board of Trustees' fees | 20,155 |

| Audit and tax fees | 128,171 |

| Pricing fees | 56,700 |

| Legal fees | 31,080 |

| Accrued expenses | 1,685 |

| Total liabilities | 317,262 |

| Commitments and contingencies (see Note 10) | |

| Net assets | $ 21,148,630 |

| Summary of Net Assets: | |

| Capital stock and paid-in-capital | $ 20,250,000 |

| Distributable earnings (loss) | 898,630 |

| Net assets | 21,148,630 |

| Class A: Net asset value per share | $ 10.52 |

| Shares outstanding | 100,963 |

| Net Assets | $ 1,061,819 |

| Class I: Net asset value per share | $ 10.49 |

| Shares outstanding | 101,253 |

| Net Assets | $ 1,061,983 |

| Class SDR: Net asset value per share | $ 10.49 |

| Shares outstanding | 1,813,894 |

| Net Assets | $ 19,024,828 |

| Cost of investments | $ 6,401,839 |

| Cost of foreign currency | $ 75 |

The accompanying notes are an integral part of these financial statements.

Hartford Schroders Private Opportunities Fund

Statement of Operations (Consolidated)

For the Period July 31, 2023 (commencement of operations) through March 31, 2024

| Investment Income: | |

| Interest | $ 487,878 |

| Total investment income, net | 487,878 |

| Expenses: | |

| Investment management fees | 163,156 |

| Transfer agent fees | |

| Class A | 4,048 |

| Class I | 4,050 |

| Class SDR | 44,181 |

| Distribution fees | |

| Class A | 4,755 |

| Custodian fees | 750 |

| Registration and filing fees | 36,532 |

| Accounting services fees | 129,833 |

| Board of Trustees' fees | 53,669 |

| Chief Compliance Officer fees | 7 |

| Audit and tax fees | 132,750 |

| Legal fees | 59,093 |

| Pricing fees | 56,700 |

| Other expenses | 5,932 |

| Total expenses (before waivers and reimbursements) | 695,456 |

| Expense reimbursements | (445,967) |

| Investment management fee waivers | (135,963) |

| Distribution fee reimbursements | (4,755) |

| Total waivers and reimbursements | (586,685) |

| Total expenses | 108,771 |

| Net Investment Income (Loss) | 379,107 |

| Net Realized Gain (Loss) on Foreign Currency Transactions on: | |

| Other foreign currency transactions | (7,349) |

| Net Realized Gain (Loss) on Foreign Currency Transactions | (7,349) |

| Net Changes in Unrealized Appreciation (Depreciation) of: | |

| Investments | 776,872 |

| Net Changes in Unrealized Appreciation (Depreciation) | 776,872 |

| Net Gain (Loss) on Investments and Foreign Currency Transactions | 769,523 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ 1,148,630 |

The accompanying notes are an integral part of these financial statements.

Hartford Schroders Private Opportunities Fund

Statement of Changes in Net Assets (Consolidated)

| | For the

Period Ended

March 31,

2024(1) |

| Operations: | |

| Net investment income (loss) | $ 379,107 |

| Net realized gain (loss) on foreign currency transactions | (7,349) |

| Net changes in unrealized appreciation (depreciation) of investments | 776,872 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 1,148,630 |

| Distributions to Shareholders: | |

| Class A | (9,760) |

| Class I | (12,701) |

| Class SDR | (227,539) |

| Total distributions | (250,000) |

| Capital Share Transactions: | |

| Sold | 20,000,000 |

| Issued on reinvestment of distributions | 250,000 |

| Net increase (decrease) from capital share transactions | 20,250,000 |

| Net Increase (Decrease) in Net Assets | 21,148,630 |

| Net Assets: | |

| Beginning of period | — |

| End of period | $ 21,148,630 |

| (1) | Commenced operations on July 31, 2023. |

The accompanying notes are an integral part of these financial statements.

Hartford Schroders Private Opportunities Fund

Statement of Cash Flows (Consolidated)

For the Period Ended March 31, 2024(1)

| Increase (decrease) in cash | |

| Cash flows from operating activities | |

| Net increase in net assets resulting from operations | $ 1,148,630 |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used for operating activities: | |

| Purchases of investment securities | $ (6,401,839) |

| Increase in other assets | (18,085) |

| Increase in investment management fees payables | 4,446 |

| Increase in accounting services fees payables | 48,083 |

| Increase in payable to affiliates ("Investment Manager") | 13,898 |

| Increase in transfer agent fees payable | 13,044 |

| Increase in Board of Trustees' fees payables | 20,155 |

| Increase in audit and tax fees payable | 128,171 |

| Increase in pricing fees payable | 56,700 |

| Increase in legal fees payable | 31,080 |

| Increase in accrued expenses | 1,685 |

| Net change in unrealized appreciation (depreciation) of investments in securities | (776,872) |

| Net Cash used for operating activities | $ (5,730,904) |

| Cash flows from financing activities | |

| Proceeds from shares sold | $ 20,000,000 |

| Net cash provided by financing activities | $ 20,000,000 |

| Net increase in cash and foreign currency | $ 14,269,096 |

| Cash and foreign currency, beginning of period | $ — |

| Cash and foreign currency, end of period | $ 14,269,096 |

| Supplemental disclosure of cash flow information: | |

| Reinvestment of dividends | $ 250,000 |

| (1) Commenced operations on July 31, 2023. | |

The accompanying notes are an integral part of these financial statements.

Hartford Schroders Private Opportunities Fund

Financial Highlights (Consolidated)

| | | — Selected Per-Share Data(1) — | | — Ratios and Supplemental Data — |

| Class | | Net

Asset

Value at

Beginning

of Period | | Net

Investment

Income

(Loss) | | Net

Realized

and

Unrealized

Gain (Loss)

on

Investments | | Total from

Investment

Operations | | Dividends

from Net

Investment

Income | | Distributions

from

Capital

Gains | | Total

Dividends

and

Distributions | | Net

Asset

Value at

End of

Period | | Total

Return(2) | | Net

Assets

at End

of Period

(000s) | | Ratio of

Expenses

to

Average

Net

Assets

Before

Adjust-

ments(3) | | Ratio of

Expenses

to

Average

Net

Assets

After

Adjust-

ments(3) | | Ratio of

Net

Investment

Income

(Loss) to

Average

Net Assets | | Portfolio

Turnover |

| Hartford Schroders Private Opportunities Fund(4) |

| For the Period Ended March 31, 2024 |

| A | | $ 10.00 | | $ 0.27 | | $ 0.35 | | $ 0.62 | | $ (0.10) | | $ — | | $ (0.10) | | $ 10.52 | | 6.18% (5) | | $ 1,062 | | 7.67% (6) | | 1.00% (6) | | 3.59% (6) | | 0.00% (7) |

| I | | 10.00 | | 0.27 | | 0.35 | | 0.62 | | (0.13) | | — | | (0.13) | | 10.49 | | 6.20 (5) | | 1,062 | | 6.98 (6) | | 1.00 (6) | | 3.59 (6) | | 0.00 (7) |

| SDR | | 10.00 | | 0.26 | | 0.36 | | 0.62 | | (0.13) | | — | | (0.13) | | 10.49 | | 6.20 (5) | | 19,025 | | 6.26 (6) | | 1.00 (6) | | 3.45 (6) | | 0.00 (7) |

| FINANCIAL HIGHLIGHTS FOOTNOTES |

| (1) | Information presented relates to a share outstanding throughout the indicated period. Net investment income (loss) per share amounts are calculated based on average shares outstanding unless otherwise noted. |

| (2) | Total return is calculated assuming a hypothetical purchase of beneficial shares on the opening of the first day at the net asset value and a sale on the closing of the last day at the net asset value of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation, to be reinvested at net asset value at the end of the distribution day. |

| (3) | Adjustments include waivers and reimbursements, if applicable. (see Expenses in the accompanying Notes to Financial Statements). |

| (4) | Commenced operations on July 31, 2023. |

| (5) | Not annualized. |

| (6) | Annualized. Ratios do not reflect the proportionate share of income and expenses of the underlying Investment Funds. |

| (7) | Reflects the Fund's portfolio turnover for the period July 31, 2023 through March 31, 2024. |

The accompanying notes are an integral part of these financial statements.

Hartford Schroders Private Opportunities Fund

Notes to Financial Statements (Consolidated)

March 31, 2024

| 1. | Organization: |

| | Hartford Schroders Private Opportunities Fund (the "Fund") is organized as a Delaware statutory trust that is registered under the Investment Company Act of 1940, as amended (the "1940 Act"). The Fund operates as a closed-end, tender offer fund pursuant to which it may conduct quarterly tender offers for the repurchase of the Fund’s outstanding common shares of beneficial interest at net asset value. The investment objective of the Fund is to seek to provide long-term capital appreciation. The Fund commenced operations on July 31, 2023. |

| | The Fund offers three separate classes of shares: Class A, Class I and Class SDR. Class A Shares, Class I Shares and Class SDR Shares are subject to different fees and expenses. The Fund's prospectus provides description of each share class expenses, sales charges and minimum investments. |

| | The Fund may invest in the shares of one or more wholly owned and controlled Subsidiaries (each, a “Subsidiary”). Investments in a Subsidiary are expected to provide the Fund with exposure to investments within the limitations of Subchapter M of the Internal Revenue Code of 1986, as amended (the "Code"). Each Subsidiary is managed pursuant to compliance policies and procedures that are the same, in all material respects, as the policies and procedures adopted by the Fund. However, unlike the Fund, a Subsidiary is not subject to diversification requirements. The Fund is the sole shareholder of each Subsidiary, and shares of a Subsidiary are not sold or offered to other investors. |

| | As of March 31, 2024, there is one active Subsidiary: the Hartford Funds SPV, LLC, registered in Delaware on December 16, 2022. The Schedule of Investments (Consolidated), Statement of Assets and Liabilities (Consolidated), Statement of Operations (Consolidated), Statements of Changes in Net Assets (Consolidated), Statement of Cash Flows (Consolidated) and Financial Highlights (Consolidated) of the Fund include the accounts of the Subsidiary. All inter-company accounts and transactions have been eliminated in the consolidation for the Fund. As of March 31, 2024, total assets of the Fund were $21,465,892, of which $7,178,711 or 33.4% was held in the Hartford Funds SPV, LLC. |

| | The Fund is a non-diversified, closed-end management investment company and applies the specialized accounting and reporting under Accounting Standards Codification ("ASC") Topic 946, “Financial Services – Investment Company.” |

| 2. | Significant Accounting Policies: |

| | The following is a summary of significant accounting policies of the Fund used in the preparation of its financial statements, which are in accordance with United States Generally Accepted Accounting Principles ("U.S. GAAP"). The preparation of financial statements in accordance with U.S. GAAP may require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. |

| a) | Determination of Net Asset Value – The Net Asset Value (“NAV”) per share is determined for each class of the Fund’s shares as of the close of business on the last business day of each calendar month, each date that a Share is offered, as of the date of any distribution and at such other times as the Board shall determine (each, a “Determination Date”). If the New York Stock Exchange (the “Exchange”) is closed due to weather or other extraordinary circumstances on a day it would typically be open for business, the Fund may treat such day as a typical business day and accept purchase and repurchase requests and calculate the Fund’s NAV in accordance with applicable law. In determining its net asset value, the Fund will value its investments as of the relevant Determination Date. The net asset value for each class of shares is determined by dividing the value of the Fund’s net assets attributable to a class of shares by the number of shares outstanding for that class. Information that becomes known to the Fund after the NAV has been calculated on a particular day will not generally be used to retroactively adjust the NAV determined earlier that day. |

| b) | Investment Valuation and Fair Value Measurements – For purposes of calculating the NAV, the Fund will value its investments in Direct Investments, Secondary Investments and Primary Investments (collectively "Investment Funds") at fair value as determined in good faith under the Valuation Procedures (the "Valuation Procedures"). The fair value of such investments as of each Determination Date ordinarily will be the capital account value of the Fund’s interest in such investments as provided by the relevant general partner, managing member or affiliated investment adviser of the Investment Fund (the "Investment Manager") as of or prior to the relevant Determination Date; provided that such values will be adjusted for any other relevant information available at the time the Fund values its portfolio, including capital activity and material events occurring between the reference dates of the Investment Manager’s valuations and the relevant Determination Date. |

| | Certain Investment Funds are valued based on the latest NAV reported by the Investment Manager. This is commonly referred to as using NAV as a practical expedient which allows for estimation of the fair value of a private investment based on NAV or its equivalent if the NAV of the private fund is calculated in a manner consistent with ASC 946. |

Hartford Schroders Private Opportunities Fund

Notes to Financial Statements (Consolidated) – (continued)

March 31, 2024

| | The Fund is designed to invest primarily in private equity investments of various types for which market quotations are not expected to be readily available. With respect to such investments, the Trust's Board of Trustees (the "Board") has designated Hartford Funds Management Company, LLC (the "Investment Manager" or "HFMC") as its valuation designee to determine the fair valuations of such investments pursuant to Rule 2a-5 under the 1940 Act (the "Valuation Designee"). The Valuation Designee determines the fair value of the security or other instrument under policies and procedures established by and under the supervision of the Board of Trustees of the Fund. The Valuation Designee has delegated the day-to-day responsibility for implementing the Valuation Procedures to the Valuation Committee (the "Valuation Committee"). The Valuation Committee will consider all available relevant factors in determining an investment’s fair value. The Valuation Designee reports fair value matters to the Audit Committee of the Fund’s Board of Trustees. The fair value of the Fund’s investments in Investment Funds, determined by the Valuation Committee in accordance with the Valuation Procedures, are estimates. Ordinarily, the fair value of an Investment Fund is based on the net asset value of the Investment Fund reported by its Investment Manager. If the Valuation Committee determines that the most recent net asset value reported by the Investment Manager of the Investment Fund does not represent fair value or if the Investment Manager of the Investment Fund fails to report a net asset value to the Fund, a fair value determination is made by the Valuation Committee in accordance with the Valuation Procedures. In making that determination, the Valuation Committee will consider whether it is appropriate, in light of all relevant circumstances, to value such Investment Fund at the net asset value last reported by its Investment Manager, or whether to adjust such net asset value to reflect a premium or discount (adjusted net asset value). The Valuation Committee uses a variety of methods such as earnings and multiple analysis, discounted cash flow analysis and market data from third party pricing services. The Valuation Committee makes assumptions that are based on market conditions existing at the determination date. |

| | In certain circumstances, the Valuation Committee may determine that cost best approximates the fair value of a particular Investment Fund. |

| | Prices of foreign equities that are principally traded on certain foreign markets will generally be adjusted monthly pursuant to a fair value pricing service in order to reflect an adjustment for the factors occurring after the close of certain foreign markets but before the NYSE Close. Securities and other instruments that are primarily traded on foreign markets may trade on days that are not business days of the Fund. The value of the foreign securities or other instruments in which the Fund invests may change on days when a shareholder will not be able to purchase or request the repurchase of shares of the Fund. |

| | Fixed income investments (other than short-term obligations) and non-exchange traded derivatives held by the Fund are normally valued at prices supplied by independent pricing services in accordance with the Valuation Procedures. Short-term investments maturing in 60 days or less are generally valued at amortized cost, which approximates fair value. |

| | Exchange-traded derivatives, such as options, futures and options on futures, are valued at the last sale price determined by the exchange where such instruments principally trade as of the close of such exchange ("Exchange Close"). If a last sale price is not available, the value will be the mean of the most recently quoted bid and ask prices as of the Exchange Close. If a mean of the bid and ask prices cannot be calculated for the day, the value will be the most recently quoted bid price as of the Exchange Close. Over-the-counter derivatives are normally valued based on prices supplied by independent pricing services in accordance with the Valuation Procedures. |

| | Investments valued in currencies other than U.S. dollars are converted to U.S. dollars using the prevailing spot currency exchange rates obtained from independent pricing services for calculation of the NAV. As a result, the NAV of the Fund’s shares may be affected by changes in the value of currencies in relation to the U.S. dollar. The value of securities or other instruments traded in markets outside the United States or denominated in currencies other than the U.S. dollar may be affected significantly on a day that the Exchange is closed and the market value may change on days when an investor is not able to purchase, or request the repurchase of shares of the Fund. |

| | Foreign currency contracts represent agreements to exchange currencies on specific future dates at predetermined rates. Foreign currency contracts are valued using foreign currency exchange rates and forward rates as provided by an independent pricing service on the Determination Date. |

| | Investments in open-end mutual funds are valued at the respective NAV of each open-end mutual fund on the Determination Date. Shares of investment companies listed and traded on an exchange are valued in the same manner as any exchange-listed equity security. Such open-end mutual funds and listed investment companies may use fair value pricing as disclosed in their prospectuses. |

| | Financial instruments for which prices are not available from an independent pricing service may be valued using quotations obtained from one or more dealers that make markets in the respective financial instrument in accordance with the Valuation Procedures. |

Hartford Schroders Private Opportunities Fund

Notes to Financial Statements (Consolidated) – (continued)

March 31, 2024

| | U.S. GAAP defines fair value as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants. The U.S. GAAP fair value measurement standards require disclosure of a fair value hierarchy for each major category of assets and liabilities. Various inputs are used in determining the fair value of the Fund’s investments. These inputs are summarized into three broad hierarchy levels. This hierarchy is based on whether the valuation inputs are observable or unobservable. These levels are: |

| • | Level 1 – Quoted prices in active markets for identical investments. Level 1 may include exchange traded instruments, such as domestic equities, some foreign equities, options, futures, mutual funds, exchange traded funds, rights and warrants. |

| • | Level 2 – Observable inputs other than Level 1 prices, such as quoted prices for similar investments; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data. Level 2 may include debt investments that are traded less frequently than exchange traded instruments and which are valued using independent pricing services; foreign equities, which are principally traded on certain foreign markets and are adjusted monthly pursuant to a fair value pricing service in order to reflect an adjustment for the factors occurring after the close of certain foreign markets but before the NYSE Close; senior floating rate interests, which are valued using an aggregate of dealer bids; short-term investments, which are valued at amortized cost; and swaps, which are valued based upon the terms of each swap contract. |

| • | Level 3 – Significant unobservable inputs that are supported by limited or no market activity. Level 3 may include financial instruments whose values are determined using indicative market quotes or require significant management judgment or estimation. These unobservable valuation inputs may include estimates for current yields, maturity/duration, prepayment speed, and indicative market quotes for comparable investments along with other assumptions relating to credit quality, collateral value, complexity of the investment structure, general market conditions and liquidity. This category may include investments where trading has been halted or there are certain restrictions on trading. While these investments are priced using unobservable inputs, the valuation of these investments reflects the best available data and management believes the prices are a reasonable representation of exit price. |

Valuation levels are not necessarily indicative of the risk associated with investing in such investments. Individual investments within any of the above mentioned asset classes may be assigned a different hierarchical level than those presented above, as individual circumstances dictate.

For additional information, refer to the Fair Value Summary and the Level 3 roll-forward reconciliation, if applicable, which follows the Fund's Schedule of Investments.

The following table presents additional quantitative information about valuation methodologies and inputs used for investments that are measured at fair value and categorized within Level 3 as of March 31, 2024:

| Asset Class | | Valuation

Technique | | Unobservable

Input(1) | | Range of

Input | | Fair Value at

March 31, 2024 | | Weighted Average

of Input (2) | | Impact to Valuation

from an Increase

in Input(3) |

| Direct Investments | | Market Comparable Companies | | Enterprise value to EBITDA Multiple | | 11.4x | | $1,576,587 | | N/A | | Increase |

| Direct Investments | | Recent Transaction | | Recent Transaction Price | | N/A | | 936,131 | | N/A | | N/A |

| Secondary Investments | | Market Comparable Companies | | Enterprise value to EBITDA Multiple | | 9.5x - 16.0x | | 3,000,165 | | 12.73x | | Increase |

(1) The Investment Manager considers relevant indications of value that are reasonably and timely available to it in determining the fair value to be assigned to a particular security, such as the type, cost and recent purchases or sales of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security.

(2) Weighted average by the relative Fair Value of the investments in that asset class.

(3) This column represents the directional change in the fair value of the Level 3 investments that would result from an increase to the corresponding unobservable input.

| c) | Investment Transactions and Investment Income – Investment transactions are recorded as of the trade date for financial reporting purposes. |

| | The Fund’s primary sources of income are investment income and gains recognized upon distributions from portfolio investments and unrealized appreciation/depreciation in the fair value of its portfolio investments. The Fund generally recognizes investment income and realized gains/losses based on the characterization of distributions provided by the administrator/investment manager of the portfolio investment on the date notice is received. Distributions often occur at irregular intervals, and the exact timing of distributions from the portfolio investments may not be known until notice is received. It is estimated that distributions will occur over the life of the portfolio investments. |

Hartford Schroders Private Opportunities Fund

Notes to Financial Statements (Consolidated) – (continued)

March 31, 2024

| | Realized gains and losses from the sale of portfolio investments represent the difference between the original cost of the portfolio investments, as adjusted for return of capital distributions (net cost), and the net proceeds received at the time of the sale, disposition or distribution date. The Fund records realized gains and losses on portfolio investments when securities are sold, distributed to the partners or written-off as worthless. The Fund recognizes the difference between the net cost and the estimated fair value of portfolio investments owned as the net change in unrealized appreciation/depreciation on investments in the Consolidated Statement of Operations. |

| | Return of capital distributions received from portfolio investments are accounted for as a reduction to cost. |

| | Interest income, including amortization of premium or discount using the effective interest method and interest on paid-in-kind instruments, is recorded on an accrual basis. Dividend income is recorded on the ex-dividend date or the date the Fund becomes aware of the dividend. |

| | Dividend income from domestic securities is accrued on the ex-dividend date. In general, dividend income from foreign securities is recorded on the ex-date; however, dividend notifications in certain foreign jurisdictions may not be available in a timely manner and as a result, the Fund will record the dividend as soon as the relevant details (i.e., rate per share, payment date, shareholders of record, etc.) are publicly available.Interest income, including amortization of premium, accretion of discounts and additional principal received in-kind in lieu of cash, is accrued on a daily basis. |

| | Idle cash and currency balances may be swept into overnight sweep accounts that earn interest, which are classified as interest income on the Consolidated Statement of Operations. |

| d) | Taxes – The Fund may be subject to taxes imposed on realized gains on securities of certain foreign countries in which the Fund invests. The Fund may also be subject to taxes withheld on foreign dividends and interest from securities in which the Fund invests. The amount of any foreign taxes withheld and foreign tax expense is included on the accompanying Consolidated Statement of Operations as a reduction to net investment income or net realized or unrealized gain (loss) on investments in these securities, if applicable. |

| e) | Foreign Currency Transactions – Assets and liabilities denominated in currencies other than U.S. dollars are translated into U.S. dollars at the exchange rates in effect on the Valuation Date. Purchases and sales of investments, income and expenses are translated into U.S. dollars at the exchange rates on the dates of such transactions. |

| | The Fund does not isolate that portion of portfolio investment valuation resulting from fluctuations in the foreign currency exchange rates from the fluctuations arising from changes in the market prices of investments held. Exchange rate fluctuations are included with the net realized and unrealized gain or loss on investments in the accompanying financial statements. |

| | Net realized foreign exchange gains or losses arise from sales of foreign currencies and the difference between asset and liability amounts initially stated in foreign currencies and the U.S. dollar value of the amounts actually received or paid. Net unrealized foreign exchange gains or losses arise from changes in the value of other assets and liabilities at the end of the reporting period, resulting from changes in the exchange rates. |

| f) | Fund Share Valuation and Dividend Distributions to Shareholders – The Fund intends to distribute substantially all of its net investment income and capital gains to shareholders at least once a year. Dividends, if any, from net investment income of the Fund and capital gains of the Fund are normally declared and paid annually. Payments will vary in amount, depending on investment income received and expenses of operation. It is likely that many of the Investment Funds in whose securities the Fund invests will not pay any dividends, and this, together with the Fund’s relatively high expenses, means that there can be no assurance the Fund will have substantial income or pay dividends. The Fund is not a suitable investment for any investor who requires regular dividend income. |

| g) | Basis for Consolidation – The Fund may invest all of its assets in a wholly-owned subsidiary. All intercompany balances, revenues, and expenses have been eliminated in consolidation. The Subsidiary acts as an investment vehicle in order to enter into certain investments for the Fund consistent with the investment objectives and policies specified in the Prospectus and Statement of Additional Information. |

| 3. | Securities and Other Investments: |

| a) | Restricted Securities – The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities, if applicable, is included at the end of the Fund's Consolidated Schedule of Investments. |

| b) | Direct Investments – The Fund's Direct Investments will typically be in the form of co-investments, which involve the Fund acquiring an interest in a single operating company alongside an investment by a private equity firm or other entity and are generally structured such that the co-investors are passive. |

Hartford Schroders Private Opportunities Fund

Notes to Financial Statements (Consolidated) – (continued)

March 31, 2024

Direct Investments are more concentrated than Primary Investments and Secondary Investments of an investor’s interest in an Investment Fund, which usually hold multiple operating companies.

| c) | Secondary Investments– Secondary Investments ("secondaries") refer to investments in which one investor acquires another investor's existing interest in a private equity investment through a negotiated transaction in which the private equity manager managing the investment remains the same. In making Secondary Investments, the buyer acquires exposure to one or more existing assets of a private equity fund by either acquiring an interest in a fund created to hold the acquired assets or by acquiring the interests of an existing limited partner of the private equity fund and agreeing to take on future funding obligations in exchange for future returns and distributions. A Secondary Investment that involves acquiring an investor's interests in a private equity fund may be acquired at a discount to an Investment Fund's net asset value. As a result, Secondary Investments acquired at a discount may result in unrealized gains to the Fund at the time the Fund next calculates its monthly net asset value. Because Secondary Investments are generally made after an Investment Fund has deployed capital into portfolio companies, these investments are viewed as more mature and may not exhibit the initial decline in net asset value associated with Primary Investments and may reduce the impact of the J-curve associated with private equity primary fund investing. However, there can be no assurance that any or all Secondary Investments made by the Fund will exhibit this pattern of investment returns, and realization of later gains is dependent upon the performance of each Investment Fund’s portfolio companies. |

| | The market for certain Secondary Investments may be very limited, and the strategies and Investment Funds to which the Fund wishes to allocate capital may not be available for Secondary Investment at any given time. Secondary Investments may be heavily negotiated and may incur additional transaction costs for the Fund. There is a risk that investors exiting an Investment Fund through a secondary transaction may possess superior knowledge regarding the value of their holdings and the portfolio companies of the Investment Fund and the Fund may pay more for a Secondary Investment than it would have if it were also privy to such information. |

| d) | Primary Investments– Primary Investments ("primaries") refer to interests in newly established Investment Funds. Primary Investments are made during the Investment Fund's fundraising period in the form of capital commitments, which are then periodically called by the fund to finance underlying investments in operating companies during a predefined period. A fund's capital account will typically exhibit a "J-curve," undergoing a modest decline in the early portion of its life cycle as expenses outweigh investment gains, with the trend typically reversing in the later portion of its life cycle as underlying investments mature and are eventually realized. There can be no assurance that any or all Primary Investments made by the Fund will exhibit this pattern of investment returns and the realization of investment gains is dependent upon the performance and disposition of each underlying investment. Primary Investments typically range in duration from ten to twelve years, while underlying investments generally range in duration from three to seven years. |

| | Seasoned primaries are primary fund investments made after an Investment Fund has already invested a certain percentage of its capital commitments (e.g., 25%, at the time of closing). Since the Investment Fund contains investments at the time the Fund invests, the Fund is able to accelerate its capital deployment compared to a typical primary fund investment and the Sub-Advisers are able to assess the attractiveness of the investments in the Investment Fund before making a capital commitment thereby reducing the blind-pool risk associated with a typical primary fund investment that has not made any investments. |

| | Typically, private equity fund sponsors will not launch new funds that have the same focus more frequently than every two to four years. Private equity managers pursuing multiple strategies may offer multiple primary new funds each year, but may not offer new funds within a given geography or that pursue a certain strategy in any particular year. Many new funds offered by top-tier private equity firms may be inaccessible due to high demand and, accordingly, may be unavailable for Primary Investments at any given time. As a result, having well-established relationships with fund sponsors is critically important for primary investors. |

The Fund’s investment portfolio will consist of Investment Interests that hold securities issued primarily by privately held companies, and operating results for the portfolio companies in a specified period will be difficult to predict. Such investments involve a high degree of business and financial risk, including those relating to the current global pandemic, which can result in substantial losses.

Investment Interests held by the Fund generally involve capital commitments, with the unfunded component called over time. As a result, the Fund may maintain a sizeable cash and cash equivalent position in anticipation of satisfying capital calls from Investment Interests. The overall impact on performance due to holding a portion of the Fund’s assets in cash and cash equivalents could be negative.

Secondary Investments may be acquired based on incomplete or imperfect information, which may expose the Fund to contingent liabilities, counterparty risks, reputational risks and execution risks. Additionally, the absence of a recognized “market” price means that the Fund cannot be assured that it is paying an appropriate purchase price in connection with Secondary Investments.

Hartford Schroders Private Opportunities Fund

Notes to Financial Statements (Consolidated) – (continued)

March 31, 2024

While the Sub-Advisers will conduct independent due diligence before executing a Direct Investment, the Fund’s ability to realize a profit on Direct Investments will be particularly reliant on the expertise of the lead investor. To the extent that the lead investor assumes control of the operating company, the Fund will be reliant not only upon the lead investor’s ability to research, analyze, negotiate and monitor such investments, but also on the lead investor’s ability to successfully oversee the operations of the operating company. The Fund’s ability to dispose of such investments is typically very limited, both by the fact that the securities are unregistered and illiquid and by contractual restrictions that may preclude the Fund from selling such investment.

The Fund may invest without limit in illiquid securities. The Fund may also invest in restricted securities. Investments in restricted securities could have the effect of increasing the amount of the Fund’s assets invested in illiquid securities, including but not limited to if qualified institutional buyers are unwilling to purchase these securities.

Illiquid and restricted securities may be difficult to dispose of at a fair price at the times when the Fund believes it is desirable to do so. The market price of illiquid and restricted securities generally is more volatile than that of more liquid securities, which may adversely affect the price that the Fund pays for or recovers upon the sale of such securities. Illiquid and restricted securities are also more difficult to value, especially in challenging markets. Liquidity risk may impact the Fund’s ability to meet shareholder repurchase requests and as a result, the Fund may be forced to sell securities at inopportune prices.

The risk that the market for a particular investment or type of investment is or becomes relatively illiquid, making it difficult for the Fund to sell that investment at an advantageous time or price. Illiquidity may be due to events relating to the issuer of the securities, market events, rising interest rates, economic conditions or investor perceptions. Illiquid securities may be difficult to value and their value may be lower than the market price of comparable liquid securities, which would negatively affect the Fund's performance.

A widespread health crisis, such as a global pandemic, could cause substantial market volatility, exchange trading suspensions or restrictions and closures of securities exchanges and businesses, impact the ability to complete repurchases, and adversely impact Fund performance. The outbreak of COVID-19, a respiratory disease caused by a novel coronavirus, negatively affected the worldwide economy, created supply chain disruptions and labor shortages, and impacted the financial health of individual companies and the market in significant and unforeseen ways. The effects to public health, business and market conditions resulting from COVID-19 pandemic have had, and may in the future have, a significant negative impact on the performance of certain investments, including exacerbating other pre-existing political, social and economic risks.

Investments in foreign securities may be riskier, more volatile, and less liquid than investments in U.S. securities. Differences between the U.S. and foreign regulatory regimes and securities markets, including the less stringent investor protection, less stringent accounting, corporate governance, financial reporting and disclosure standards of some foreign markets, as well as political and economic developments in foreign countries and regions and the U.S. (including the imposition of sanctions, tariffs, or other governmental restrictions), may affect the value of the Fund’s investments in foreign securities. Changes in currency exchange rates may also adversely affect the Fund’s foreign investments.

In the normal course of its business the Fund holds cash, including foreign currencies, in short-term interest-bearing deposit accounts to provide liquidity pending investment in Investment Funds. At times, the amounts held in these accounts may exceed applicable federally insured limits. The Fund has not experienced any losses in these accounts and does not believe that it is exposed to significant credit risk in these accounts.

| a) | The Fund intends to continue to qualify as a Regulated Investment Company ("RIC") under Subchapter M of the Internal Revenue Code ("IRC") by distributing substantially all of its taxable net investment income and net realized capital gains to its shareholders each year. The Fund has distributed substantially all of its income and capital gains in prior years, if applicable, and intends to distribute substantially all of its income and capital gains during the calendar year. Accordingly, no provision for federal income or excise taxes has been made in the accompanying financial statements. Distributions from short-term capital gains are treated as ordinary income distributions for federal income tax purposes. |

| b) | Net Investment Income (Loss), Net Realized Gains (Losses) and Distributions – Net investment income (loss) and net realized gains (losses) may differ from financial statements and tax purposes primarily because of adjustments related to certain derivatives and partnerships. The character of distributions made during the year from net investment income or net realized gain may differ from their ultimate characterization for federal income tax purposes. Also, due to the timing of the dividend distributions, the fiscal year in which amounts are distributed may differ from the year the income or realized gains (losses) were recorded by the Fund. |

Hartford Schroders Private Opportunities Fund

Notes to Financial Statements (Consolidated) – (continued)

March 31, 2024

| c) | Distributions and Components of Distributable Earnings - The Fund's tax year end is September 30 and the tax character of the current year distributions and current components of accumulated earnings (deficit) will be determined at the end of the current tax year. As of the Fund's tax year end September 30, 2023, the Fund did not make a distribution. |

| | As of the Fund's tax year end of September 30, 2023, the components of total accumulated earnings (deficit) for the Fund on a tax basis are as follows: |

| | |

Undistributed

Ordinary

Income | | Other

Temporary

Differences | | Unrealized

Appreciation

(Depreciation)

on Investments | | Total

Accumulated

Earnings

(Deficit) |

| $ 93,277 | | $ (5,840) | | $ — | | $ 87,437 |

| d) | Capital Loss Carryforward – Under the Regulated Investment Company Modernization Act of 2010, funds are permitted to carry forward capital losses for an unlimited period of time. The Fund commenced operations after its fiscal year end, but before the Fund's tax year end of September 30, 2023. At September 30, 2023, the Fund had no capital loss carryover. |

| e) | Tax Basis of Investments – The aggregate cost of investments for federal income tax purposes at March 31, 2024 was substantially the same for book purposes. The net unrealized appreciation/(depreciation) on investments, which consists of gross unrealized appreciation and depreciation, is disclosed below: |

| | |

| Tax Cost | | Gross Unrealized

Appreciation | | Gross Unrealized

(Depreciation) | | Net Unrealized

Appreciation

(Depreciation) |

| $ 6,401,839 | | $ 794,024 | | $ (17,152) | | $ 776,872 |

| a) | Investment Management Agreement – HFMC serves as the Fund’s investment manager. The Fund has entered into an Investment Management Agreement with HFMC. HFMC is an indirect subsidiary of The Hartford Financial Services Group, Inc. ("The Hartford"). HFMC has overall investment supervisory responsibility for the Fund. In addition, HFMC provides administrative personnel, services, equipment, facilities and office space for proper operation of the Fund. HFMC has contracted with Schroder Investment Management North America Inc. ("SIMNA") under a sub-advisory agreement and SIMNA has contracted with Schroders Capital Management (US), Inc. (“Schroders Capital” and, collectively with SIMNA, the "Sub-Advisers") under a sub-sub-advisory agreement. The Fund pays a fee to HFMC. HFMC pays a sub-advisory fee to SIMNA out of its management fee. SIMNA pays the sub-sub-advisory fees to Schroders Capital. |

| | The Fund pays a monthly management fee in arrears to HFMC at the annual rate of 1.50% of the average month end value of the Fund's net assets (a portion of which will be waived for the first twelve months following the Fund's commencement of operations). HFMC, not the Fund, pays the sub-advisory fees to SIMNA at the annual rate of 1.00% of the average month end value of the Fund’s net assets (a portion of which will be waived for the first twelve months following the Fund’s commencement of operations). SIMNA, not the Fund or HFMC, pays the sub-sub-advisory fees to Schroders Capital. The sub-sub-advisory fee paid by SIMNA to Schroders Capital is determined at the end of each month based on the internal Schroders Group Transfer Pricing Policy then in effect. HFMC has contractually agreed to waive the Fund’s management fee in the amount of 1.25% for the first twelve months following the Fund’s commencement of operations. For the period ended, March 31, 2024, the Fund has reimbursed the Investment Manager for operating expenses as reflected on the Consolidated Statement of Assets and Liabilities. |

| b) | Accounting Services Agreement – HFMC provides the Fund with accounting services pursuant to a fund accounting agreement by and between the Fund and HFMC. HFMC has delegated certain accounting and administrative service functions to State Street Bank and Trust Company ("State Street"). In consideration of services rendered and expenses assumed pursuant to the fund accounting agreement, the Fund pays HFMC a fee. The fund accounting fee for the Fund shall equal the sum of (i) the sub-accounting fee payable by HFMC with respect to the Fund; (ii) the fee payable for tax preparation services for the Fund; and (iii) the amount of expenses that HFMC allocates for providing the fund accounting services to the Fund; plus a target profit margin. |

| c) | Operating Expenses – Allocable expenses incurred by the Fund are allocated to each class within the Fund, in proportion of the average monthly net assets of the Fund and classes, except where allocation of certain expenses is more fairly made directly to the Fund or to specific classes within the Fund. Closing costs associated with the purchase of Direct Investments, Secondary Investments and Primary Investments are included in the cost of the investment. Professional fees relating to investments, including expenses of consultants, investment bankers, attorneys, accountants, and other experts is included in Legal Fees on the Consolidated Statement of Operations. As of March 31, 2024, HFMC has contractually agreed to reimburse expenses to limit total net operating expenses (excluding management fees, Rule 12b-1 distribution and service fees, sub-transfer agency fees payable by Hartford Administrative Services Company (“HASCO”) |

Hartford Schroders Private Opportunities Fund

Notes to Financial Statements (Consolidated) – (continued)

March 31, 2024

| | to the extent that such sub-transfer agency fees are a component of the transfer agency fee payable by the Fund to HASCO, acquired fund fees and expenses, interest expenses, and certain extraordinary expenses) to no more than 0.75% of the Fund’s average monthly net assets. This contractual arrangement will remain in effect at least until September 30, 2024 unless the Fund’s Board of Trustees approves its earlier termination. |

| d) | Sales Charges and Distribution and Service Plan for Class A Shares – Hartford Funds Distributors, LLC ("HFD"), an indirect subsidiary of The Hartford, is the principal underwriter and distributor of the Fund. The Distributor will also act as agent for the Fund in connection with repurchases of Shares. |

| | For the period ended March 31, 2024, HFD did not receive sales charges for the Fund. |

| | The Board has approved the adoption by the Fund of a distribution plan (the "Plan") pursuant to Rule 12b-1 under the 1940 Act for Class A Shares. Under the Plan, Class A Shares of the Fund bear distribution and/or service fees paid to HFD, some of which may be paid to select broker-dealers. Total compensation under the Plan may not exceed the maximum cap imposed by FINRA with respect to asset-based sales charges. Distribution fees paid to HFD may be spent on any activities or expenses primarily intended to result in the sale of the Fund’s Shares. Under the Plan, the Fund pays HFD the entire fee, regardless of HFD's expenditures. Even if HFD's actual expenditures exceed the fee payable to HFD at any given time, the Fund will not be obligated to pay more than that fee. If HFD's actual expenditures are less than the fee payable to HFD at any given time, HFD may realize a profit from the arrangement. Pursuant to the Class A Plan, the Fund may pay HFD a fee of up to 0.70% of the average monthly net assets attributable to Class A Shares for distribution financing activities, and up to 0.25% may be used for shareholder account servicing activities. |

| | No market currently exists for the Fund's Shares. The Fund's Shares are not listed and the Fund does not currently intend to list its Shares for trading on any securities exchange, and the Fund does not anticipate that any secondary market will develop for its Shares. Neither HFMC nor HFD intends to make a market in the Fund's Shares. |