UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-23773 |

| Cantor Select Portfolios Trust |

| (Exact name of registrant as specified in charter) |

| 110 E. 59th Street, New York, NY | 10022 |

| (Address of principal executive offices) | (Zip code) |

| Corporation Services Company |

| 251 Little Falls Drive, Wilmington, Delaware 19808 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | (212) 915-1722 | |

| Date of fiscal year end: | 12/31 | |

| Date of reporting period: | 12/31/24 | |

Item 1. Reports to Stockholders.

Cantor Fitzgerald Equity Opportunity Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about Cantor Fitzgerald Equity Opportunity Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at https://equityopportunityfund.cantorassetmanagement.com/. You can also request this information by contacting us at (833) 764-2266. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $212 | 2.03% |

|---|

How did the Fund perform during the reporting period?

For the year ended December 31, 2024, the Cantor Fitzgerald Equity Opportunity Fund (the “Fund”) Institutional shares Class (ATGAX) generated a 9.0% return, underperforming the 15.3% return of the CRSP (Center for Research in Security Prices) US Mid Cap Index. The underperformance of the Fund can be largely attributed to an economy showing robust growth with a resilient labor market, inflation that retreated from recent highs and the Federal Reserve reducing rates by 100 basis points during the year, public companies reporting relatively solid profitability, and investors’ appetite for developments related to Artificial Intelligence (AI). This resulted in sectors such as Financials, Utilities, and Information Technology (IT) posting the best returns in the benchmark. While the Fund had significant exposure to IT, it failed to offset the underexposure to Financials and Utilities during the year. Within the Fund, the Consumer Staples sector provided the best relative performance as underweight exposure at 1.2% compared to a 4.9% weight in the benchmark was beneficial. It was the second worst performing sector in the benchmark with a –7.5% return, thus the Fund’s underweight exposure resulted in a 0.8% positive relative performance. The discount retailer Dollar Tree, which was not held in the Fund, was a big contributor to the negative performance for the sector in the benchmark with the shares declining 47.0% during the year. The Fund’s holdings in the Communication Services sector were the largest contributor to negative relative performance. The Fund’s carried a large position in ZoomInfo that averaged a 4.1% weight in the portfolio for the year. The company, a provider of technology to facilitate remote meeting activities that were in great demand during the pandemic, declined 43.2% during the period, causing 2.6% of negative relative performance. Finally of note, the Fund was managed by Aquila Investment Management into the fourth quarter of the year. Cantor Fitzgerald Investment Advisors assumed management of the Fund starting October 18, 2024.

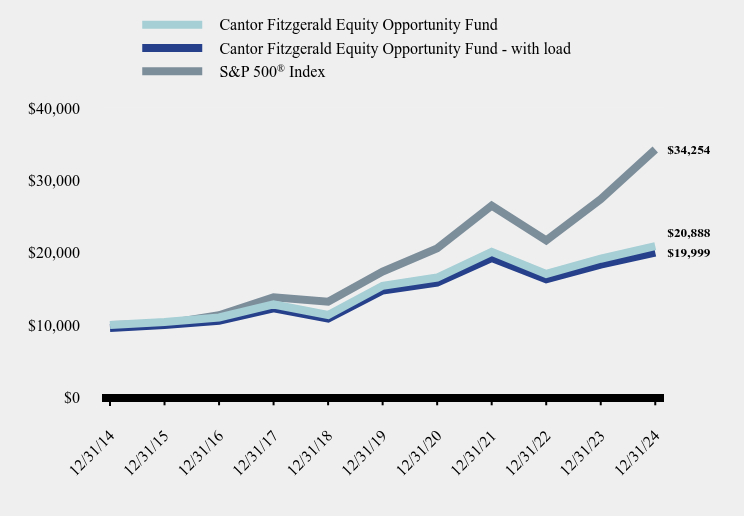

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Cantor Fitzgerald Equity Opportunity Fund | Cantor Fitzgerald Equity Opportunity Fund - with load | S&P 500® Index |

|---|

| 12/31/14 | $10,000 | $9,575 | $10,000 |

|---|

| 12/31/15 | $10,421 | $9,978 | $10,138 |

|---|

| 12/31/16 | $11,030 | $10,561 | $11,351 |

|---|

| 12/31/17 | $12,834 | $12,288 | $13,829 |

|---|

| 12/31/18 | $11,378 | $10,894 | $13,223 |

|---|

| 12/31/19 | $15,413 | $14,758 | $17,386 |

|---|

| 12/31/20 | $16,552 | $15,848 | $20,585 |

|---|

| 12/31/21 | $20,114 | $19,259 | $26,494 |

|---|

| 12/31/22 | $17,048 | $16,323 | $21,696 |

|---|

| 12/31/23 | $19,156 | $18,342 | $27,399 |

|---|

| 12/31/24 | $20,888 | $19,999 | $34,254 |

|---|

Average Annual Total Returns

|

|---|

| |

|---|

| |

|---|

| 1 Year | 5 Years | 10 Years |

|---|

| Cantor Fitzgerald Equity Opportunity Fund | | | |

|---|

| Without Load | 9.04% | 6.27% | 7.64% |

|---|

| With Load | 4.40% | 5.35% | 7.18% |

|---|

| S&P 500 Index | 25.02% | 14.53% | 13.10% |

|---|

| CRSP MidCap Core Index | 15.25% | 9.86% | 9.57% |

|---|

| | | |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $78,593,470 |

|---|

| Number of Portfolio Holdings | 57 |

|---|

| Advisory Fee | $922,917 |

|---|

| Portfolio Turnover | 44% |

|---|

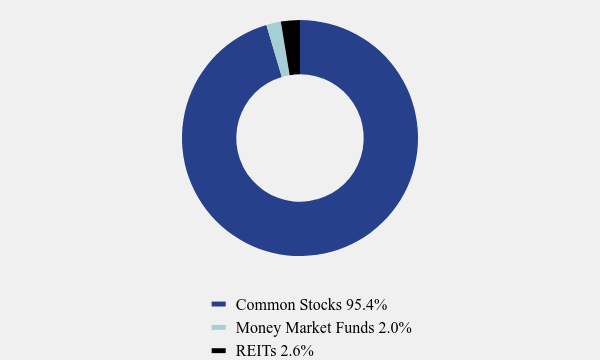

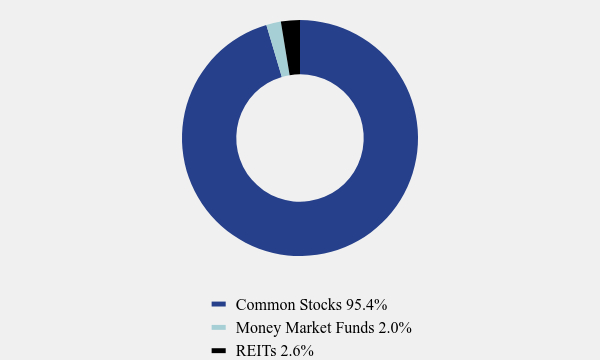

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 95.4% |

| Money Market Funds | 2.0% |

| REITs | 2.6% |

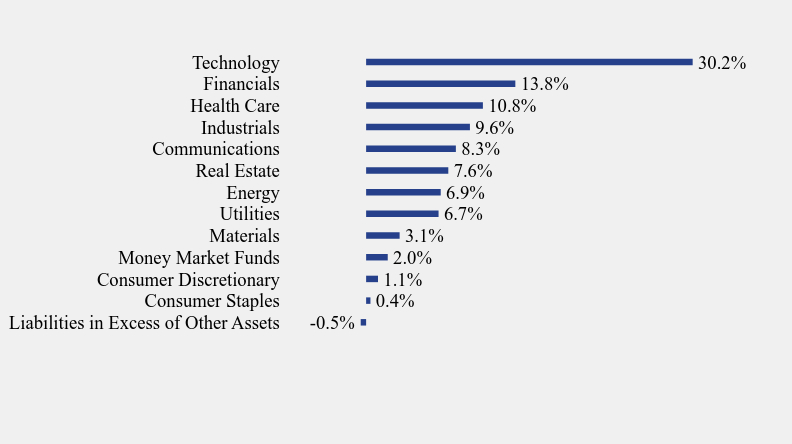

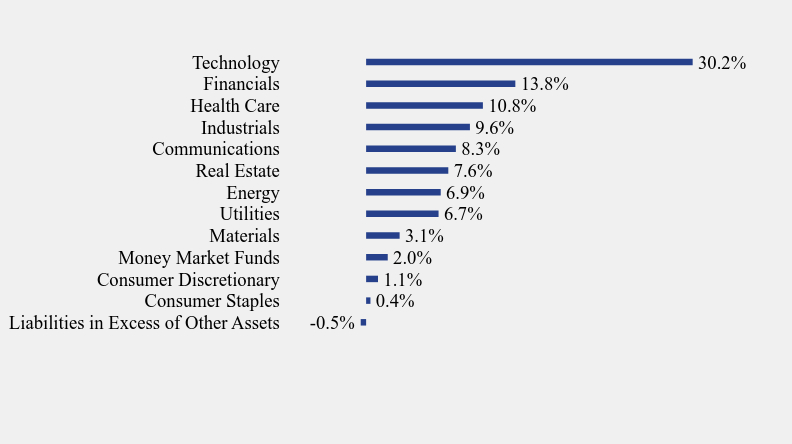

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.5% |

| Consumer Staples | 0.4% |

| Consumer Discretionary | 1.1% |

| Money Market Funds | 2.0% |

| Materials | 3.1% |

| Utilities | 6.7% |

| Energy | 6.9% |

| Real Estate | 7.6% |

| Communications | 8.3% |

| Industrials | 9.6% |

| Health Care | 10.8% |

| Financials | 13.8% |

| Technology | 30.2% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

|---|

| Arista Networks Inc | 4.9% |

|---|

| ROBLOX Corporation - Class A | 4.6% |

|---|

| Elastic N.V. | 4.3% |

|---|

| Illumina, Inc. | 4.3% |

|---|

| DexCom, Inc. | 4.2% |

|---|

| Coherent Corporation | 3.9% |

|---|

| ARM Holdings plc - ADR | 3.8% |

|---|

| Take-Two Interactive Software, Inc. | 3.7% |

|---|

| Cadence Design Systems, Inc. | 3.4% |

|---|

| WEC Energy Group, Inc. | 3.4% |

|---|

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by May 1, 2025 at https://equityopportunityfund.cantorassetmanagement.com/ or upon request at (833) 764-2266. As described more fully in Note 1 of the Annual Financial Statements for the Fund, effective as of the close of business on November 22, 2024, each Fund received all of the assets and liabilities of the corresponding fund of the Aquila Funds Trust (each, a “Predecessor Fund”) (the “Reorganization”). Each Predecessor Fund’s investment objective, policies, and limitations were substantially similar to those of the corresponding Fund, each with no operations before the Reorganization. For financial reporting purposes, the Predecessor Fund’s operating history before the Reorganization is reflected in the corresponding Fund’s financial statements and financial highlights. On November 21, 2024, Tair Weller & Baker LLP (“Tait”) resigned as the independent registered public accounting firm of the Funds, and the AuditCommittee of the Board of Trustees approved Cohen & Company, Ltd. to serve as the independent registered public accounting firm of the Funds. There were no disagreements with EY during the Funds' two most recent fiscal years or any subsequent interim period.

Cantor Fitzgerald Equity Opportunity Fund - Class A (ATGAX)

Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://equityopportunityfund.cantorassetmanagement.com/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Cantor Fitzgerald Equity Opportunity Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about Cantor Fitzgerald Equity Opportunity Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at https://equityopportunityfund.cantorassetmanagement.com/. You can also request this information by contacting us at (833) 764-2266. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $180 | 1.72% |

|---|

How did the Fund perform during the reporting period?

For the year ended December 31, 2024, the Cantor Fitzgerald Equity Opportunity Fund (the “Fund”) Institutional shares Class (ATGYX) generated a 9.5% return, underperforming the 15.3% return of the CRSP (Center for Research in Security Prices) US Mid Cap Index. The underperformance of the Fund can be largely attributed to an economy showing robust growth with a resilient labor market, inflation that retreated from recent highs and the Federal Reserve reducing rates by 100 basis points during the year, public companies reporting relatively solid profitability, and investors’ appetite for developments related to Artificial Intelligence (AI). This resulted in sectors such as Financials, Utilities, and Information Technology (IT) posting the best returns in the benchmark. While the Fund had significant exposure to IT, it failed to offset the underexposure to Financials and Utilities during the year. Within the Fund, the Consumer Staples sector provided the best relative performance as underweight exposure at 1.2% compared to a 4.9% weight in the benchmark was beneficial. It was the second worst performing sector in the benchmark with a –7.5% return, thus the Fund’s underweight exposure resulted in a 0.8% positive relative performance. The discount retailer Dollar Tree, which was not held in the Fund, was a big contributor to the negative performance for the sector in the benchmark with the shares declining 47.0% during the year. The Fund’s holdings in the Communication Services sector were the largest contributor to negative relative performance. The Fund’s carried a large position in ZoomInfo that averaged a 4.1% weight in the portfolio for the year. The company, a provider of technology to facilitate remote meeting activities that were in great demand during the pandemic, declined 43.2% during the period, causing 2.6% of negative relative performance. Finally of note, the Fund was managed by Aquila Investment Management into the fourth quarter of the year. Cantor Fitzgerald Investment Advisors assumed management of the Fund starting October 18, 2024.

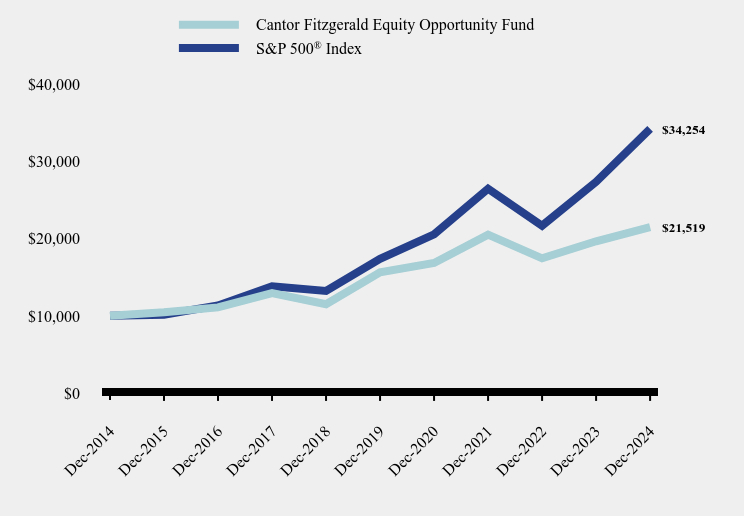

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Cantor Fitzgerald Equity Opportunity Fund | S&P 500® Index |

|---|

| Dec-2014 | $10,000 | $10,000 |

|---|

| Dec-2015 | $10,452 | $10,138 |

|---|

| Dec-2016 | $11,096 | $11,351 |

|---|

| Dec-2017 | $12,949 | $13,829 |

|---|

| Dec-2018 | $11,513 | $13,223 |

|---|

| Dec-2019 | $15,646 | $17,386 |

|---|

| Dec-2020 | $16,853 | $20,585 |

|---|

| Dec-2021 | $20,541 | $26,494 |

|---|

| Dec-2022 | $17,464 | $21,696 |

|---|

| Dec-2023 | $19,677 | $27,399 |

|---|

| Dec-2024 | $21,519 | $34,254 |

|---|

Average Annual Total Returns

|

|---|

| |

|---|

| |

|---|

| 1 Year | 5 Years | 10 Years |

|---|

| | | |

|---|

| Cantor Fitzgerald Equity Opportunity Fund | 9.36% | 6.58% | 7.96% |

|---|

| S&P 500 Index | 25.02% | 14.53% | 13.10% |

|---|

| CRSP MidCap Core Index | 15.25% | 9.86% | 9.57% |

|---|

| | | |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $78,593,470 |

|---|

| Number of Portfolio Holdings | 57 |

|---|

| Advisory Fee | $922,917 |

|---|

| Portfolio Turnover | 44% |

|---|

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 95.4% |

| Money Market Funds | 2.0% |

| REITs | 2.6% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.5% |

| Consumer Staples | 0.4% |

| Consumer Discretionary | 1.1% |

| Money Market Funds | 2.0% |

| Materials | 3.1% |

| Utilities | 6.7% |

| Energy | 6.9% |

| Real Estate | 7.6% |

| Communications | 8.3% |

| Industrials | 9.6% |

| Health Care | 10.8% |

| Financials | 13.8% |

| Technology | 30.2% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

|---|

| Arista Networks Inc | 4.9% |

|---|

| ROBLOX Corporation - Class A | 4.6% |

|---|

| Elastic N.V. | 4.3% |

|---|

| Illumina, Inc. | 4.3% |

|---|

| DexCom, Inc. | 4.2% |

|---|

| Coherent Corporation | 3.9% |

|---|

| ARM Holdings plc - ADR | 3.8% |

|---|

| Take-Two Interactive Software, Inc. | 3.7% |

|---|

| Cadence Design Systems, Inc. | 3.4% |

|---|

| WEC Energy Group, Inc. | 3.4% |

|---|

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by May 1, 2025 at https://equityopportunityfund.cantorassetmanagement.com/ or upon request at (833) 764-2266. As described more fully in Note 1 of the Annual Financial Statements for the Fund, effective as of the close of business on November 22, 2024, each Fund received all of the assets and liabilities of the corresponding fund of the Aquila Funds Trust (each, a “Predecessor Fund”) (the “Reorganization”). Each Predecessor Fund’s investment objective, policies, and limitations were substantially similar to those of the corresponding Fund, each with no operations before the Reorganization. For financial reporting purposes, the Predecessor Fund’s operating history before the Reorganization is reflected in the corresponding Fund’s financial statements and financial highlights. On November 21, 2024, Tair Weller & Baker LLP (“Tait”) resigned as the independent registered public accounting firm of the Funds, and the AuditCommittee of the Board of Trustees approved Cohen & Company, Ltd. to serve as the independent registered public accounting firm of the Funds. There were no disagreements with EY during the Funds' two most recent fiscal years or any subsequent interim period.

Cantor Fitzgerald Equity Opportunity Fund - Institutional (ATGYX)

Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://equityopportunityfund.cantorassetmanagement.com/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Cantor Fitzgerald High Income Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about Cantor Fitzgerald High Income Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at https://highincomefund.cantorassetmanagement.com/. You can also request this information by contacting us at (833) 764-2266. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $123 | 1.20% |

|---|

How did the Fund perform during the reporting period?

For the year ended December 31, 2024, the Cantor Fitzgerald High Income Fund (the “Fund”) Class A (ATPAX) generated a 5.76% total return, underperforming the 8.19% return of the Bloomberg U.S. Corporate High Yield Index (the “High Yield Index or Index”). The underperformance of ATPAX in 2024 may be attributed to the strategy’s focus on higher quality credits and shorter duration, among other factors. After impressive performance in 2023, where the Index rose over 13% during the year, investors continued to be in a risk-taking mood, although most of the positive total return experienced in the High Yield sector was seen in the second half of the year. Investors had an insatiable demand for yield and underlying credit fundamentals remained stable to improving, making lower-rated credits the clear winner in 2024. Bonds rated CCC returned 15.1%, well out-pacing those rated BB (6.3%) and B-rated issues (7.4%). As the Fund maintained a very conservative risk profile related to credit quality throughout 2024, the average underweight position in CCC-rated issues during the period (3.6% vs. 10.9%) was a clear detraction to Fund performance. However, security selection in bonds rated single-B and BB provided some positive attribution, as Fund holdings rated B were up 7.8% vs. 7.6% for B-rated issuers in the Index. In addition, BB-rated Fund holdings increased 6.4% compared to the 6.2% for the Index. Finally, as the Fund’s weighted average duration remained at least a half-year shorter than the Index, the tightening in High Yield credit spreads provided a further detraction in performance in 2024. Throughout the year, the Option Adjusted Spread on the Index moved from 323 basis points (“bps”) to 287 bps, although the Yield-to-Worst only declined about 10 bps. Although the US Treasury market saw a rise in rates of about 60-90 bps across the yield curve since the Federal Reserve cut the Federal Funds rate in September, the risk-on tone, combined with favorable supply/demand dynamics in the High Yield market, provided some of the catalyst for credit spread tightening and another year of positive total return.

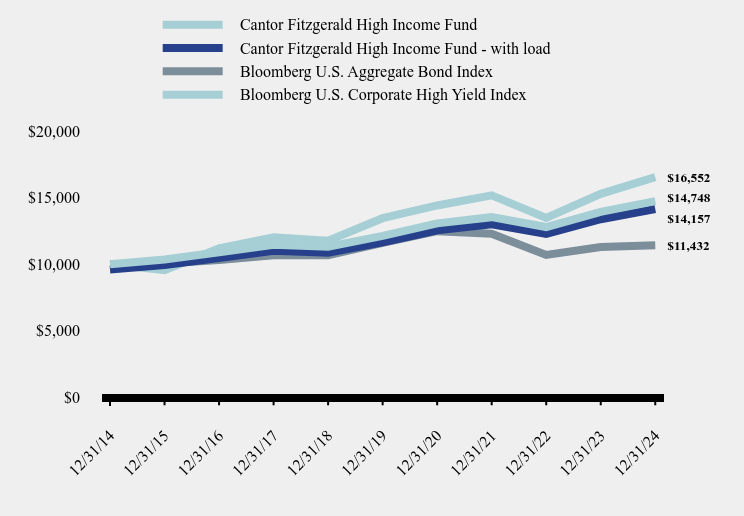

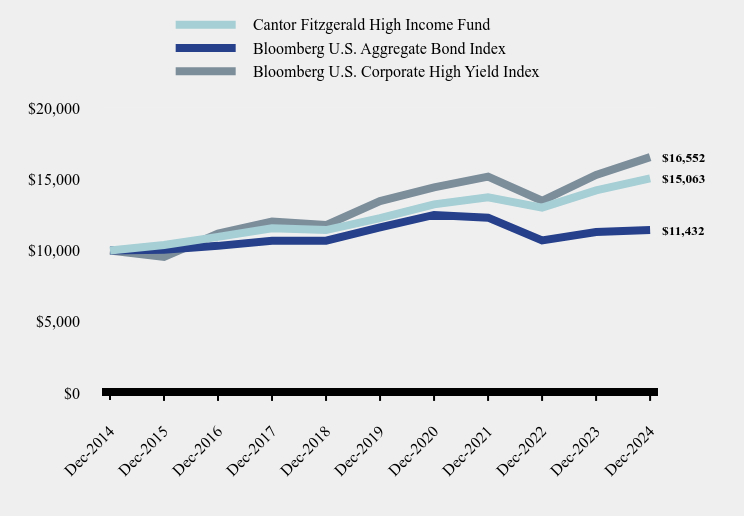

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Cantor Fitzgerald High Income Fund | Cantor Fitzgerald High Income Fund - with load | Bloomberg U.S. Aggregate Bond Index | Bloomberg U.S. Corporate High Yield Index |

|---|

| 12/31/14 | $10,000 | $9,599 | $10,000 | $10,000 |

|---|

| 12/31/15 | $10,358 | $9,943 | $10,055 | $9,553 |

|---|

| 12/31/16 | $10,898 | $10,461 | $10,321 | $11,190 |

|---|

| 12/31/17 | $11,475 | $11,015 | $10,687 | $12,029 |

|---|

| 12/31/18 | $11,327 | $10,873 | $10,688 | $11,779 |

|---|

| 12/31/19 | $12,138 | $11,652 | $11,620 | $13,466 |

|---|

| 12/31/20 | $13,077 | $12,553 | $12,492 | $14,424 |

|---|

| 12/31/21 | $13,543 | $13,000 | $12,299 | $15,185 |

|---|

| 12/31/22 | $12,800 | $12,287 | $10,699 | $13,486 |

|---|

| 12/31/23 | $13,945 | $13,386 | $11,291 | $15,299 |

|---|

| 12/31/24 | $14,748 | $14,157 | $11,432 | $16,552 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Cantor Fitzgerald High Income Fund | | | |

|---|

| Without Load | 5.76% | 3.97% | 3.96% |

|---|

| With Load | 1.52% | 3.13% | 3.54% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 1.25% | -0.33% | 1.35% |

|---|

| Bloomberg U.S. Corporate High Yield Index | 8.19% | 4.21% | 5.17% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $59,517,214 |

|---|

| Number of Portfolio Holdings | 51 |

|---|

| Advisory Fee (net of waivers) | $75,016 |

|---|

| Portfolio Turnover | 33% |

|---|

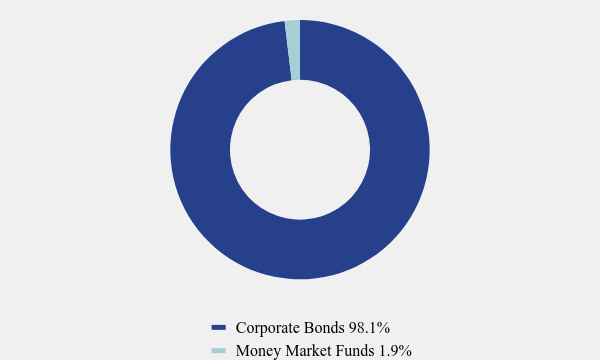

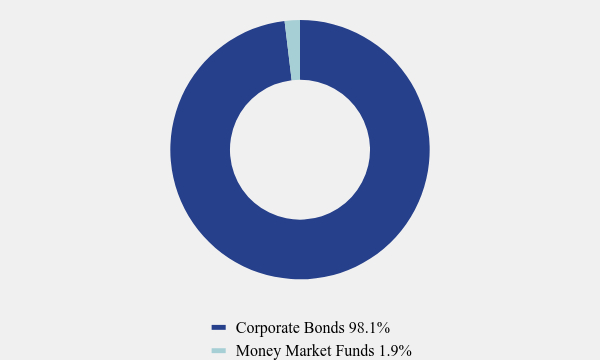

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Corporate Bonds | 98.1% |

| Money Market Funds | 1.9% |

What did the Fund invest in?

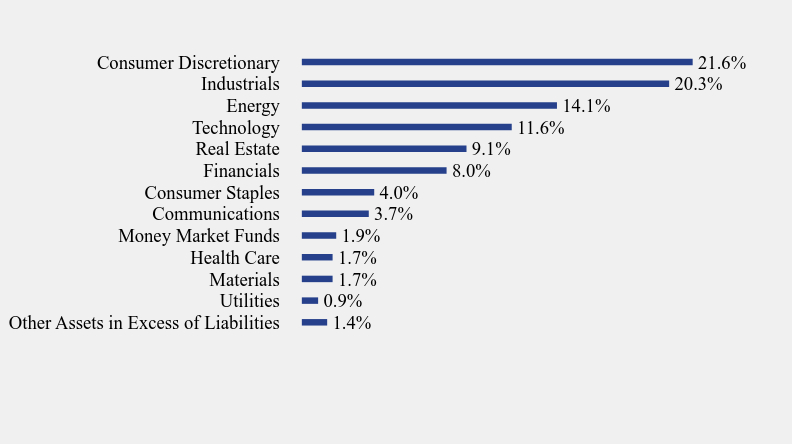

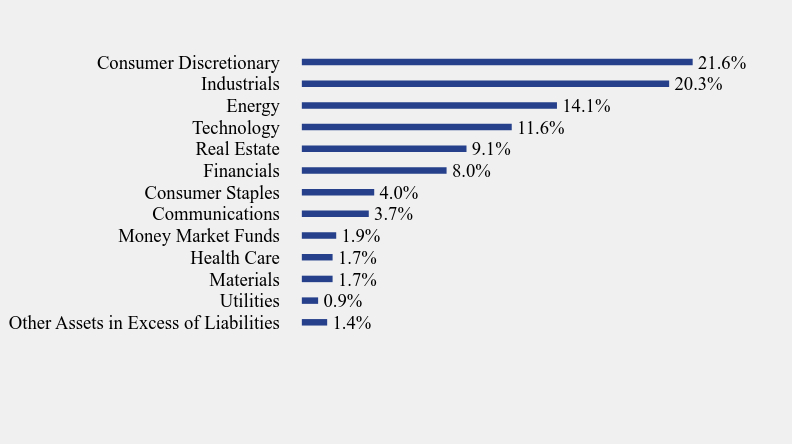

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.4% |

| Utilities | 0.9% |

| Materials | 1.7% |

| Health Care | 1.7% |

| Money Market Funds | 1.9% |

| Communications | 3.7% |

| Consumer Staples | 4.0% |

| Financials | 8.0% |

| Real Estate | 9.1% |

| Technology | 11.6% |

| Energy | 14.1% |

| Industrials | 20.3% |

| Consumer Discretionary | 21.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

|---|

| Rithm Capital Corporation 144A | 3.6% |

|---|

| Transocean Titan Financing Ltd. 144A | 3.0% |

|---|

| ViaSat, Inc. 144A | 3.0% |

|---|

| QVC, Inc. | 2.9% |

|---|

| Tutor Perini Corporation 144A | 2.8% |

|---|

| Venture Global LNG, Inc. 144A | 2.8% |

|---|

| OneMain Finance Corporation | 2.7% |

|---|

| JB Poindexter & Co Inc 144A | 2.7% |

|---|

| USA Compression Partners, L.P. / USA Compression 144A | 2.6% |

|---|

| TransDigm, Inc. 144A | 2.6% |

|---|

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by May 1, 2025 at Fund at https://highincomefund.cantorassetmanagement.com/ or upon request at (833) 764-2266. As described more fully in Note 1 of the Annual Financial Statements for the Fund, effective as of the close of business on November 22, 2024, each Fund received all of the assets and liabilities of the corresponding fund of the Aquila Funds Trust (each, a “Predecessor Fund”) (the “Reorganization”). Each Predecessor Fund’s investment objective, policies, and limitations were substantially similar to those of the corresponding Fund, each with no operations before the Reorganization. For financial reporting purposes, the Predecessor Fund’s operating history before the Reorganization is reflected in the corresponding Fund’s financial statements and financial highlights. On November 21, 2024, Tair Weller & Baker LLP (“Tait”) resigned as the independent registered public accounting firm of the Funds, and the AuditCommittee of the Board of Trustees approved Cohen & Company, Ltd. to serve as the independent registered public accounting firm of the Funds. There were no disagreements with EY during the Funds' two most recent fiscal years or any subsequent interim period.

Cantor Fitzgerald High Income Fund - Class A (ATPAX)

Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://highincomefund.cantorassetmanagement.com/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Cantor Fitzgerald High Income Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about Cantor Fitzgerald High Income Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at https://highincomefund.cantorassetmanagement.com/. You can also request this information by contacting us at (833) 764-2266. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $103 | 1.00% |

|---|

How did the Fund perform during the reporting period?

For the year ended December 31, 2024, the Cantor Fitzgerald High Income Fund (the “Fund”) Institutional Class (ATPYX) generated a 5.97% total return, underperforming the 8.19% return of the Bloomberg U.S. Corporate High Yield Index (the “High Yield Index or Index”). The underperformance of ATPYX in 2024 may be attributed to the strategy’s focus on higher quality credits and shorter duration, among other factors. After impressive performance in 2023, where the Index rose over 13% during the year, investors continued to be in a risk-taking mood, although most of the positive total return experienced in the High Yield sector was seen in the second half of the year. Investors had an insatiable demand for yield and underlying credit fundamentals remained stable to improving, making lower-rated credits the clear winner in 2024. Bonds rated CCC returned 15.1%, well out-pacing those rated BB (6.3%) and B-rated issues (7.4%). As the Fund maintained a very conservative risk profile related to credit quality throughout 2024, the average underweight position in CCC-rated issues during the period (3.6% vs. 10.9%) was a clear detraction to Fund performance. However, security selection in bonds rated single-B and BB provided some positive attribution, as Fund holdings rated B were up 7.8% vs. 7.6% for B-rated issuers in the Index. In addition, BB-rated Fund holdings increased 6.4% compared to the 6.2% for the Index. Finally, as the Fund’s weighted average duration remained at least a half-year shorter than the Index, the tightening in High Yield credit spreads provided a further detraction in performance in 2024. Throughout the year, the Option Adjusted Spread on the Index moved from 323 basis points (“bps”) to 287 bps, although the Yield-to-Worst only declined about 10 bps. Although the US Treasury market saw a rise in rates of about 60-90 bps across the yield curve since the Federal Reserve cut the Federal Funds rate in September, the risk-on tone, combined with favorable supply/demand dynamics in the High Yield market, provided some of the catalyst for credit spread tightening and another year of positive total return.

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Cantor Fitzgerald High Income Fund | Bloomberg U.S. Aggregate Bond Index | Bloomberg U.S. Corporate High Yield Index |

|---|

| Dec-2014 | $10,000 | $10,000 | $10,000 |

|---|

| Dec-2015 | $10,377 | $10,055 | $9,553 |

|---|

| Dec-2016 | $10,953 | $10,321 | $11,190 |

|---|

| Dec-2017 | $11,556 | $10,687 | $12,029 |

|---|

| Dec-2018 | $11,431 | $10,688 | $11,779 |

|---|

| Dec-2019 | $12,273 | $11,620 | $13,466 |

|---|

| Dec-2020 | $13,233 | $12,492 | $14,424 |

|---|

| Dec-2021 | $13,732 | $12,299 | $15,185 |

|---|

| Dec-2022 | $13,005 | $10,699 | $13,486 |

|---|

| Dec-2023 | $14,213 | $11,291 | $15,299 |

|---|

| Dec-2024 | $15,063 | $11,432 | $16,552 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Cantor Fitzgerald High Income Fund | 5.97% | 4.18% | 4.18% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 1.25% | -0.33% | 1.35% |

|---|

| Bloomberg U.S. Corporate High Yield Index | 8.19% | 4.21% | 5.17% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $59,517,214 |

|---|

| Number of Portfolio Holdings | 51 |

|---|

| Advisory Fee (net of waivers) | $75,016 |

|---|

| Portfolio Turnover | 33% |

|---|

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Corporate Bonds | 98.1% |

| Money Market Funds | 1.9% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.4% |

| Utilities | 0.9% |

| Materials | 1.7% |

| Health Care | 1.7% |

| Money Market Funds | 1.9% |

| Communications | 3.7% |

| Consumer Staples | 4.0% |

| Financials | 8.0% |

| Real Estate | 9.1% |

| Technology | 11.6% |

| Energy | 14.1% |

| Industrials | 20.3% |

| Consumer Discretionary | 21.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

|---|

| Rithm Capital Corporation 144A | 3.6% |

|---|

| Transocean Titan Financing Ltd. 144A | 3.0% |

|---|

| ViaSat, Inc. 144A | 3.0% |

|---|

| QVC, Inc. | 2.9% |

|---|

| Tutor Perini Corporation 144A | 2.8% |

|---|

| Venture Global LNG, Inc. 144A | 2.8% |

|---|

| OneMain Finance Corporation | 2.7% |

|---|

| JB Poindexter & Co Inc 144A | 2.7% |

|---|

| USA Compression Partners, L.P. / USA Compression 144A | 2.6% |

|---|

| TransDigm, Inc. 144A | 2.6% |

|---|

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by May 1, 2025 at Fund at https://highincomefund.cantorassetmanagement.com/ or upon request at (833) 764-2266. As described more fully in Note 1 of the Annual Financial Statements for the Fund, effective as of the close of business on November 22, 2024, each Fund received all of the assets and liabilities of the corresponding fund of the Aquila Funds Trust (each, a “Predecessor Fund”) (the “Reorganization”). Each Predecessor Fund’s investment objective, policies, and limitations were substantially similar to those of the corresponding Fund, each with no operations before the Reorganization. For financial reporting purposes, the Predecessor Fund’s operating history before the Reorganization is reflected in the corresponding Fund’s financial statements and financial highlights. On November 21, 2024, Tair Weller & Baker LLP (“Tait”) resigned as the independent registered public accounting firm of the Funds, and the AuditCommittee of the Board of Trustees approved Cohen & Company, Ltd. to serve as the independent registered public accounting firm of the Funds. There were no disagreements with EY during the Funds' two most recent fiscal years or any subsequent interim period.

Cantor Fitzgerald High Income Fund - Institutional (ATPYX)

Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://highincomefund.cantorassetmanagement.com/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Item 2. Code of Ethics.

| (a) | The registrant has, as of the end of the period covered by this report, adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. |

| | |

| (b) | Not applicable. |

| | |

| (c) | During the period covered by this report, there were no amendments to any provision of the code of ethics. |

| | |

| (d) | During the period covered by this report, there were no waivers or implicit waivers of a provision of the code of ethics. |

| | |

| (e) | Not applicable. |

| | |

| (f) | See Item 19(a)(1) |

Item 3. Audit Committee Financial Expert.

(a)(1) The registrant’s board of trustees has determined that the registrant has at least one audit committee financial expert serving on the audit committee. (a)(2) Douglas Barnard is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Barnard is independent for purposes of this Item. (a)(3) Not applicable. |

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees. The aggregate fees billed for each of the last two fiscal years for professional services rendered by the registrant’s principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are as follows: |

| Trust Series | | 2024 | |

| Cantor Select Portfolios Trust | | $ | 42,000 | |

| (b) | Audit-Related Fees. There were no fees billed in each of the last two fiscal years for assurances and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item. |

| (c) | Tax Fees - The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance are as follows: |

| Trust Series | | 2024 | |

| Cantor Select Portfolios Trust | | $ | 8,000 | |

Preparation of Federal & State income tax returns, assistance with calculation of required income, capital gain and excise distributions and preparation of Federal excise tax returns.

| (d) | All Other Fees. The aggregate fees billed in each of the last two fiscal years for products and services provided by the registrant’s principal accountant, other than the services reported in paragraphs (a) through (c) of this item were $0 and $0 for the fiscal years ended December 31, 2024 and 2023 respectively. |

| | |

| (e)(1) | The audit committee does not have pre-approval policies and procedures. Instead, the audit committee or audit committee chairman approves on a case-by-case basis each audit or non-audit service before the principal accountant is engaged by the registrant. |

| | |

| (e)(2) | There were no services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| | |

| (f) | Not applicable. |

| | |

| (g) | All non-audit fees billed by the registrant’s principal accountant for services rendered to the registrant for the fiscal years ended December 31, 2024 and 2023 respectively are disclosed in (b)-(d) above. There were no audit or non-audit services performed by the registrant’s principal accountant for the registrant’s adviser. |

| | |

| (h) | Not applicable. |

| | |

| (i) | Not applicable. |

| | |

| (j) | Not applicable. |

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a)

Table of Contents

| Cantor Fitzgerald Equity Opportunity Fund | |

| Schedule of Investments | 1 |

| Statement of Assets and Liabilities | 9 |

| Statement of Operations | 10 |

| Statement of Changes in Net Assets | 11 |

| Financial Highlights | 15 |

| | |

| Cantor Fitzgerald High Income Fund | |

| Schedule of Investments | 5 |

| Statement of Assets and Liabilities | 9 |

| Statement of Operations | 10 |

| Statement of Changes in Net Assets | 13 |

| Financial Highlights | 17 |

| | |

| Cantor Portfolio Select Trust | |

| Notes to Financial Statements | 19 |

| Opinion Letter | 33 |

| Additional Information | 34 |

| | |

| | |

| | |

| CANTOR FITZGERALD EQUITY OPPORTUNITY FUND |

| SCHEDULE OF INVESTMENTS |

| December 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 90.8% | | | | |

| | | | | AEROSPACE & DEFENSE - 1.0% | | | | |

| | 5,000 | | | Aerovironment, Inc.(a) | | $ | 769,450 | |

| | | | | | | | | |

| | | | | AUTOMOTIVE - 0.6% | | | | |

| | 50,000 | | | Ford Motor Company | | | 495,000 | |

| | | | | | | | | |

| | | | | BANKING - 4.2% | | | | |

| | 10,000 | | | Fifth Third Bancorp | | | 422,800 | |

| | 90,000 | | | First Horizon Corporation | | | 1,812,600 | |

| | 53,000 | | | Huntington Bancshares, Inc. | | | 862,310 | |

| | 1,000 | | | M&T Bank Corporation | | | 188,010 | |

| | | | | | | | 3,285,720 | |

| | | | | BIOTECH & PHARMA - 0.4% | | | | |

| | 2,000 | | | Biogen, Inc.(a) | | | 305,840 | |

| | | | | | | | | |

| | | | | CONSTRUCTION MATERIALS - 0.7% | | | | |

| | 2,000 | | | Vulcan Materials Company | | | 514,460 | |

| | | | | | | | | |

| | | | | ELECTRIC UTILITIES - 6.7% | | | | |

| | 5,000 | | | CMS Energy Corporation | | | 333,250 | |

| | 5,000 | | | Consolidated Edison, Inc. | | | 446,150 | |

| | 6,000 | | | Dominion Energy, Inc. | | | 323,160 | |

| | 3,000 | | | DTE Energy Company | | | 362,250 | |

| | 6,000 | | | Entergy Corporation | | | 454,920 | |

| | 11,000 | | | Exelon Corporation | | | 414,040 | |

| | 8,000 | | | FirstEnergy Corporation | | | 318,240 | |

| | 28,000 | | | WEC Energy Group, Inc. | | | 2,633,120 | |

| | | | | | | | 5,285,130 | |

| | | | | ELECTRICAL EQUIPMENT - 1.8% | | | | |

| | 5,000 | | | Rockwell Automation, Inc. | | | 1,428,950 | |

| | | | | | | | | |

| | | | | ENGINEERING & CONSTRUCTION - 2.4% | | | | |

| | 6,000 | | | Quanta Services, Inc. | | | 1,896,300 | |

See accompanying notes which are an integral part of these financial statements.

| CANTOR FITZGERALD EQUITY OPPORTUNITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 90.8% (Continued) | | | | |

| | | | | ENTERTAINMENT CONTENT - 8.3% | | | | |

| | 62,390 | | | ROBLOX Corporation, Class A(a) | | $ | 3,609,885 | |

| | 16,000 | | | Take-Two Interactive Software, Inc.(a) | | | 2,945,280 | |

| | | | | | | | 6,555,165 | |

| | | | | FOOD - 0.4% | | | | |

| | 7,000 | | | The Campbell’s Company | | | 293,160 | |

| | | | | | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 2.0% | | | | |

| | 8,000 | | | IQVIA Holdings, Inc.(a) | | | 1,572,080 | |

| | | | | | | | | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES - 6.5% | | | | |

| | 9,000 | | | Bank of New York Mellon Corporation (The) | | | 691,470 | |

| | 10,000 | | | Cboe Global Markets, Inc. | | | 1,954,000 | |

| | 6,000 | | | CME Group, Inc. | | | 1,393,380 | |

| | 4,000 | | | Northern Trust Corporation | | | 410,000 | |

| | 5,000 | | | State Street Corporation | | | 490,750 | |

| | 1,000 | | | Tradeweb Markets, Inc., Class A | | | 130,920 | |

| | | | | | | | 5,070,520 | |

| | | | | INSURANCE - 3.1% | | | | |

| | 30,000 | | | MetLife, Inc. | | | 2,456,400 | |

| | | | | | | | | |

| | | | | MACHINERY - 0.9% | | | | |

| | 6,000 | | | Xylem, Inc. | | | 696,120 | |

| | | | | | | | | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 8.4% | | | | |

| | 42,000 | | | DexCom, Inc.(a) | | | 3,266,340 | |

| | 25,000 | | | Illumina, Inc.(a) | | | 3,340,750 | |

| | | | | | | | 6,607,090 | |

| | | | | METALS & MINING - 1.6% | | | | |

| | 80,000 | | | Barrick Gold Corporation | | | 1,240,000 | |

See accompanying notes which are an integral part of these financial statements.

| CANTOR FITZGERALD EQUITY OPPORTUNITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 90.8% (Continued) | | | | |

| | | | | OIL & GAS PRODUCERS - 6.9% | | | | |

| | 2,550 | | | ConocoPhillips | | $ | 252,884 | |

| | 9,000 | | | Diamondback Energy, Inc. | | | 1,474,470 | |

| | 10,000 | | | Phillips 66 | | | 1,139,300 | |

| | 14,000 | | | Valero Energy Corporation | | | 1,716,260 | |

| | 15,000 | | | Williams Companies, Inc. (The) | | | 811,800 | |

| | | | | | | | 5,394,714 | |

| | | | | RETAIL - DISCRETIONARY - 0.4% | | | | |

| | 4,000 | | | Best Buy Company, Inc. | | | 343,200 | |

| | | | | | | | | |

| | | | | SEMICONDUCTORS - 10.8% | | | | |

| | 24,000 | | | ARM Holdings plc - ADR(a) | | | 2,960,640 | |

| | 32,000 | | | Coherent Corporation(a) | | | 3,031,360 | |

| | 30,000 | | | Micron Technology, Inc. | | | 2,524,800 | |

| | | | | | | | 8,516,800 | |

| | | | | SOFTWARE - 13.0% | | | | |

| | 9,000 | | | Cadence Design Systems, Inc.(a) | | | 2,704,140 | |

| | 34,400 | | | Elastic N.V.(a) | | | 3,408,351 | |

| | 15,000 | | | IonQ, Inc.(a) | | | 626,550 | |

| | 3,000 | | | Synopsys, Inc.(a) | | | 1,456,080 | |

| | 8,000 | | | Workday, Inc., Class A(a) | | | 2,064,240 | |

| | | | | | | | 10,259,361 | |

| | | | | STEEL - 0.9% | | | | |

| | 6,000 | | | Steel Dynamics, Inc. | | | 684,420 | |

| | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE - 6.3% | | | | |

| | 35,050 | | | Arista Networks Inc(a) | | | 3,874,077 | |

| | 64,000 | | | Extreme Networks, Inc.(a) | | | 1,071,360 | |

| | | | | | | | 4,945,437 | |

See accompanying notes which are an integral part of these financial statements.

| CANTOR FITZGERALD EQUITY OPPORTUNITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 90.8% (Continued) | | | | |

| | | | | TRANSPORTATION EQUIPMENT - 3.5% | | | | |

| | 20,000 | | | Allison Transmission Holdings, Inc. | | $ | 2,161,200 | |

| | 6,000 | | | PACCAR, Inc. | | | 624,120 | |

| | | | | | | | 2,785,320 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $51,476,842) | | | 71,400,637 | |

| | | | | | | | | |

| Shares | | | | | Fair Value | |

| | | | | REITS — 7.7% | | | | |

| | | | | REITS – 7.7% | | | | |

| | 6,000 | | | American Tower Corporation, Class A | | | 1,100,460 | |

| | 20,000 | | | Crown Castle, Inc. | | | 1,815,200 | |

| | 10,000 | | | Iron Mountain, Inc. | | | 1,051,100 | |

| | 70,000 | | | VICI Properties, Inc. | | | 2,044,700 | |

| | | | | | | | | |

| | | | | TOTAL REITS (Cost $5,639,638) | | | 6,011,460 | |

| | | | | | | | | |

| Shares | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENTS — 2.0% | | | | |

| | | | | MONEY MARKET FUNDS - 2.0% | | | | |

| | 1,554,565 | | | Fidelity Investments Money Market Government Portfolio, Class I, 4.35% (Cost $1,554,565)(b) | | | 1,554,565 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 100.5% (Cost $58,671,045) | | $ | 78,966,662 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (0.5)% | | | (373,192 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 78,593,470 | |

| ADR | - American Depositary Receipt |

| | |

| LLC | - Limited Liability Company |

| | |

| LP | - Limited Partnership |

| | |

| NV | - Naamioze Vennootschap |

| | |

| PLC | - Public Limited Company |

| | |

| REIT | - Real Estate Investment Trust |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of December 31, 2024. |

See accompanying notes which are an integral part of these financial statements.

| CANTOR FITZGERALD HIGH INCOME FUND |

| SCHEDULE OF INVESTMENTS |

| December 31, 2024 |

| Principal | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | (%) | | Maturity | | Fair Value | |

| | | | | | | | | | | |

| | | | | CORPORATE BONDS — 96.7% | | | | | | | | |

| | | | | AEROSPACE & DEFENSE — 2.6% | | | | | | | | |

| | 1,500,000 | | | TransDigm, Inc.(a) | | 6.8750 | | 12/15/30 | | $ | 1,522,312 | |

| | | | | | | | | | | | | |

| | | | | AUTOMOTIVE — 2.1% | | | | | | | | |

| | 1,250,000 | | | Ford Motor Company | | 6.1000 | | 08/19/32 | | | 1,243,950 | |

| | | | | | | | | | | | | |

| | | | | ELECTRIC UTILITIES — 0.9% | | | | | | | | |

| | 545,813 | | | Midland Cogeneration Venture LP(a) | | 6.0000 | | 03/15/25 | | | 540,354 | |

| | | | | | | | | | | | | |

| | | | | ENGINEERING & CONSTRUCTION — 2.8% | | | | | | | | |

| | 1,500,000 | | | Tutor Perini Corporation(a) | | 11.8750 | | 04/30/29 | | | 1,658,393 | |

| | | | | | | | | | | | | |

| | | | | ENTERTAINMENT CONTENT — 2.3% | | | | | | | | |

| | 1,500,000 | | | ROBLOX Corporation(a) | | 3.8750 | | 05/01/30 | | | 1,351,720 | |

| | | | | | | | | | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES — 1.7% | | | | | | | | |

| | 1,000,000 | | | IQVIA Inc(a) | | 6.5000 | | 05/15/30 | | | 1,017,571 | |

| | | | | | | | | | | | | |

| | | | | HOME CONSTRUCTION — 2.5% | | | | | | | | |

| | 1,500,000 | | | Century Communities, Inc. | | 6.7500 | | 06/01/27 | | | 1,500,862 | |

| | | | | | | | | | | | | |

| | | | | INTERNET MEDIA & SERVICES — 1.4% | | | | | | | | |

| | 850,000 | | | Cars.com, Inc.(a) | | 6.3750 | | 11/01/28 | | | 844,773 | |

| | | | | | | | | | | | | |

| | | | | LEISURE FACILITIES & SERVICES — 8.5% | | | | | | | | |

| | 1,500,000 | | | Caesars Entertainment, Inc.(a) | | 6.5000 | | 02/15/32 | | | 1,506,770 | |

| | 500,000 | | | Mohegan Gaming & Entertainment(a) | | 8.0000 | | 02/01/26 | | | 497,490 | |

| | 1,026,000 | | | Penn National Gaming, Inc.(a) | | 5.6250 | | 01/15/27 | | | 1,010,202 | |

| | 1,000,000 | | | Royal Caribbean Cruises Ltd.(a) | | 6.0000 | | 02/01/33 | | | 997,625 | |

| | 1,000,000 | | | Vail Resorts Inc(a) | | 6.5000 | | 05/15/32 | | | 1,011,218 | |

| | | | | | | | | | | | 5,023,305 | |

| | | | | LEISURE PRODUCTS — 1.7% | | | | | | | | |

| | 1,000,000 | | | Acushnet Co.(a) | | 7.3750 | | 10/15/28 | | | 1,033,477 | |

See accompanying notes which are an integral part of these financial statements.

| CANTOR FITZGERALD HIGH INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2024 |

| Principal | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 96.7% (Continued) | | | | | | | | |

| | | | | OIL & GAS PRODUCERS — 7.4% | | | | | | | | |

| | 500,000 | | | Cheniere Energy, Inc. | | 4.6250 | | 10/15/28 | | $ | 489,155 | |

| | 1,175,000 | | | Global Partners, L.P. / GLP Finance Corporation | | 7.0000 | | 08/01/27 | | | 1,179,036 | |

| | 1,000,000 | | | Occidental Petroleum Corporation | | 7.5000 | | 05/01/31 | | | 1,093,259 | |

| | 1,500,000 | | | Venture Global LNG, Inc.(a) | | 9.8750 | | 02/01/32 | | | 1,645,919 | |

| | | | | | | | | | | | 4,407,369 | |

| | | | | OIL & GAS SERVICES & EQUIPMENT — 6.7% | | | | | | | | |

| | 750,000 | | | Nabors Industries, Inc.(a) | | 8.8750 | | 08/15/31 | | | 696,440 | |

| | 1,750,000 | | | Transocean Titan Financing Ltd.(a) | | 8.3750 | | 02/01/28 | | | 1,785,659 | |

| | 1,500,000 | | | USA Compression Partners, L.P. / USA Compression(a) | | 7.1250 | | 03/15/29 | | | 1,526,471 | |

| | | | | | | | | | | | 4,008,570 | |

| | | | | REAL ESTATE INVESTMENT TRUSTS — 5.3% | | | | | | | | |

| | 1,000,000 | | | Iron Mountain, Inc.(a) | | 5.2500 | | 03/15/28 | | | 978,209 | |

| | 1,265,000 | | | RHP Hotel Properties LP / RHP Finance Corp(a) | | 4.5000 | | 02/15/29 | | | 1,194,321 | |

| | 1,000,000 | | | VICI Properties, L.P. / VICI Note Company, Inc.(a) | | 4.6250 | | 12/01/29 | | | 957,835 | |

| | | | | | | | | | | | 3,130,365 | |

| | | | | REAL ESTATE OWNERS & DEVELOPERS — 2.0% | | | | | | | | |

| | 1,230,000 | | | Howard Hughes Corporation (The)(a) | | 5.3750 | | 08/01/28 | | | 1,194,742 | |

| | | | | | | | | | | | | |

| | | | | REAL ESTATE SERVICES — 1.8% | | | | | | | | |

| | 1,100,000 | | | Cushman & Wakefield US Borrower, LLC(a) | | 6.7500 | | 05/15/28 | | | 1,100,999 | |

| | | | | | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY — 6.9% | | | | | | | | |

| | 870,000 | | | Bath & Body Works, Inc. | | 6.6940 | | 01/15/27 | | | 888,512 | |

| | 1,503,000 | | | Builders FirstSource, Inc.(a) | | 5.0000 | | 03/01/30 | | | 1,428,777 | |

| | 1,750,000 | | | QVC, Inc. | | 4.4500 | | 02/15/25 | | | 1,738,667 | |

| | | | | | | | | | | | 4,055,956 | |

| | | | | SEMICONDUCTORS — 2.0% | | | | | | | | |

| | 1,250,000 | | | Coherent Corp(a) | | 5.0000 | | 12/15/29 | | | 1,192,866 | |

| | | | | | | | | | | | | |

| | | | | SOFTWARE — 5.1% | | | | | | | | |

| | 250,000 | | | Cloud Software Group, Inc.(a) | | 9.0000 | | 09/30/29 | | | 253,823 | |

| | 1,500,000 | | | Elastic N.V.(a) | | 4.1250 | | 07/15/29 | | | 1,390,599 | |

| | 1,500,000 | | | ZoomInfo Technologies, LLC/ZoomInfo Finance(a) | | 3.8750 | | 02/01/29 | | | 1,363,163 | |

| | | | | | | | | | | | 3,007,585 | |

See accompanying notes which are an integral part of these financial statements.

| CANTOR FITZGERALD HIGH INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2024 |

| Principal | | | | | Coupon Rate | | | | | |

| Amount ($) | | | | | (%) | | Maturity | | Fair Value | |

| | | | | CORPORATE BONDS — 96.7% (Continued) | | | | | | | | |

| | | | | SPECIALTY FINANCE — 8.0% | | | | | | | | |

| | 1,000,000 | | | Fortress Transportation and Infrastructure(a) | | 7.0000 | | 06/15/32 | | $ | 1,019,710 | |

| | 1,500,000 | | | OneMain Finance Corporation | | 9.0000 | | 01/15/29 | | | 1,590,555 | |

| | 2,163,000 | | | Rithm Capital Corporation(a) | | 6.2500 | | 10/15/25 | | | 2,161,336 | |

| | | | | | | | | | | | 4,771,601 | |

| | | | | STEEL — 1.6% | | | | | | | | |

| | 1,000,000 | | | Cleveland-Cliffs, Inc.(a) | | 6.7500 | | 04/15/30 | | | 977,844 | |

| | | | | | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE — 3.0% | | | | | | | | |

| | 1,800,000 | | | ViaSat, Inc.(a) | | 5.6250 | | 09/15/25 | | | 1,783,738 | |

| | | | | | | | | | | | | |

| | | | | TECHNOLOGY SERVICES — 1.5% | | | | | | | | |

| | 1,000,000 | | | Iron Mountain Information Management Services,(a) | | 5.0000 | | 07/15/32 | | | 920,371 | |

| | | | | | | | | | | | | |

| | | | | TRANSPORTATION & LOGISTICS — 8.4% | | | | | | | | |

| | 1,000,000 | | | American Airlines, Inc./AAdvantage Loyalty IP Ltd.(a) | | 5.5000 | | 04/20/26 | | | 996,767 | |

| | 500,000 | | | Bristow Group, Inc.(a) | | 6.8750 | | 03/01/28 | | | 497,391 | |

| | 750,000 | | | Genesee & Wyoming, Inc.(a) | | 6.2500 | | 04/15/32 | | | 754,522 | |

| | 750,000 | | | JetBlue Airways Corp / JetBlue Loyalty, L.P.(a) | | 9.8750 | | 09/20/31 | | | 796,790 | |

| | 1,000,000 | | | United Airlines, Inc.(a) | | 4.3750 | | 04/15/26 | | | 983,259 | |

| | 1,000,000 | | | Watco Cos LLC / Watco Finance Corp(a) | | 7.1250 | | 08/01/32 | | | 1,030,749 | |

| | | | | | | | | | | | 5,059,478 | |

| | | | | TRANSPORTATION EQUIPMENT — 6.5% | | | | | | | | |

| | 1,250,000 | | | Allison Transmission, Inc.(a) | | 5.8750 | | 06/01/29 | | | 1,241,783 | |

| | 1,500,000 | | | JB Poindexter & Co Inc(a) | | 8.7500 | | 12/15/31 | | | 1,578,940 | |

| | 1,000,000 | | | Trinity Industries, Inc.(a) | | 7.7500 | | 07/15/28 | | | 1,037,732 | |

| | | | | | | | | | | | 3,858,455 | |

| | | | | WHOLESALE - CONSUMER STAPLES — 4.0% | | | | | | | | |

| | 1,000,000 | | | Performance Food Group, Inc.(a) | | 4.2500 | | 08/01/29 | | | 927,833 | |

| | 1,500,000 | | | US Foods, Inc.(a) | | 4.7500 | | 02/15/29 | | | 1,436,512 | |

| | | | | | | | | | | | 2,364,345 | |

| | | | | | | | | | | | | |

| | | | | TOTAL CORPORATE BONDS (Cost $57,130,390) | | | | | | | 57,571,001 | |

See accompanying notes which are an integral part of these financial statements.

| CANTOR FITZGERALD HIGH INCOME FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2024 |

| Shares | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENTS — 1.9% | | | | |

| | | | | MONEY MARKET FUNDS - 1.9% | | | | |

| | 1,129,388 | | | Fidelity Investments Money Market Government Portfolio, Class I, 4.35% (Cost $1,129,388)(b) | | $ | 1,129,388 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 98.6% (Cost $58,259,778) | | $ | 58,700,389 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES- 1.4% | | | 816,825 | |

| | | | | NET ASSETS - 100.0% | | $ | 59,517,214 | |

| LLC | - Limited Liability Company |

| | |

| LP | - Limited Partnership |

| | |

| NV | - Naamioze Vennootschap |

| (a) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933. The security may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of December 31, 2024 the total market value of 144A securities is $47,847,005 or 80.4% of net assets. |

| (b) | Rate disclosed is the seven day effective yield as of December 31, 2024. |

See accompanying notes which are an integral part of these financial statements.

| CANTOR FITZGERALD FUNDS |

| STATEMENTS OF ASSETS AND LIABILITIES |

| December 31, 2024 |

| | | Cantor Fitzgerald | | | Cantor Fitzgerald | |

| | | Equity Opportunity | | | High Income | |

| | | Fund | | | Fund | |

| ASSETS | | | | | | | | |

| At cost | | $ | 58,671,045 | | | $ | 58,259,778 | |

| At value | | $ | 78,966,662 | | | $ | 58,700,389 | |

| Dividends & interest receivable | | | 147,348 | | | | 1,012,442 | |

| Receivable for capital shares sold | | | 529 | | | | 87,482 | |

| Prepaid expenses and other assets | | | 6,866 | | | | 19,902 | |

| TOTAL ASSETS | | | 79,121,405 | | | | 59,820,215 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Payable to Advisor | | | 148,424 | | | | 38,675 | |

| Payable for capital shares redeemed | | | 246,106 | | | | 102,864 | |

| Dividends payable | | | — | | | | 47,177 | |

| Accrued 12b-1 fees - Class A | | | 17,479 | | | | 7,086 | |

| Payable to administrator | | | 9,503 | | | | 18,416 | |

| Other accrued expenses and liabilities | | | 106,423 | | | | 88,783 | |

| TOTAL LIABILITIES | | | 527,935 | | | | 303,001 | |

| | | | | | | | | |

| NET ASSETS | | $ | 78,593,470 | | | $ | 59,517,214 | |

| | | | | | | | | |

| NET ASSETS CONSISTS OF | | | | | | | | |

| Paid-in capital | | $ | 60,649,198 | | | $ | 68,617,574 | |

| Accumulated earnings (losses) | | | 17,944,272 | | | | (9,100,360 | ) |

| Net Assets | | $ | 78,593,470 | | | $ | 59,517,214 | |

| | | | | | | | | |

| Class A: | | | | | | | | |

| Net Assets | | $ | 43,316,955 | | | $ | 25,510,672 | |

| Shares of beneficial interest outstanding, unlimited authorization, no par value | | | 1,242,718 | | | | 3,127,692 | |

| Net asset value per share | | $ | 34.86 | | | $ | 8.16 | |

| Sales Charge | | | 5.75 | % | | | 4.00 | % |

| Offering price per share, equal to net asset value per share/(1-sales charge) | | $ | 36.99 | | | $ | 8.50 | |

| | | | | | | | | |

| Institutional Class: | | | | | | | | |

| Net Assets | | $ | 35,276,515 | | | $ | 34,006,542 | |

| Shares of beneficial interest outstanding, unlimited authorization, no par value | | | 840,888 | | | | 4,164,757 | |

| Net asset value per share | | $ | 41.95 | | | $ | 8.17 | |

See Accompanying Notes to Financial Statements.

| CANTOR FITZGERALD FUNDS |

| STATEMENTS OF OPERATIONS |

| | | Cantor Fitzgerald | | | Cantor Fitzgerald | |

| | | Equity Opportunity | | | High Income | |

| | | Fund | | | Fund | |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | December 31, 2024 | | | December 31, 2024 | |

| INVESTMENT INCOME | | | | | | | | |

| Dividends | | $ | 1,437,155 | | | $ | — | |

| Interest | | | — | | | | 4,956,625 | |

| Less: Foreign withholding taxes | | | (7,200 | ) | | | — | |

| TOTAL INVESTMENT INCOME | | | 1,429,955 | | | | 4,956,625 | |

| | | | | | | | | |

| EXPENSES | | | | | | | | |

| Advisor fees | | | 922,917 | | | | 510,491 | |

| Distribution fees - Class A | | | 173,566 | | | | 67,303 | |

| Administration and accounting fees | | | 61,778 | | | | 66,819 | |

| Transfer agent fees | | | 163,073 | | | | 142,809 | |

| Audit and tax services fees | | | 28,400 | | | | 20,900 | |

| Printing and mailing expense | | | 29,317 | | | | 20,793 | |

| Trustee fees | | | 127,411 | | | | 99,482 | |

| Registration fees | | | 64,794 | | | | 66,570 | |

| Compliance services fees | | | 8,265 | | | | 8,261 | |

| Legal fees | | | 330,927 | | | | 255,847 | |

| Custodian and bank service fees | | | 7,638 | | | | 5,074 | |

| Insurance expense | | | 14,645 | | | | 10,795 | |

| Shareholder servicing fees - Class A | | | 523 | | | | 458 | |

| Others fees | | | 24,453 | | | | 5,107 | |

| Total Operating Expenses | | | 1,957,707 | | | | 1,280,709 | |

| TOTAL EXPENSES | | | 1,957,707 | | | | 1,280,709 | |

| Fees reduced by the Manager | | | — | | | | (435,475 | ) |

| NET EXPENSES | | | 1,957,707 | | | | 845,234 | |

| | | | | | | | | |

| NET INVESTMENT INCOME (LOSS) | | | (527,752 | ) | | | 4,111,391 | |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | | | | | |

| Net realized gain (loss) from: | | | | | | | | |

| Investment transactions | | | 18,919,322 | | | | (491,921 | ) |

| | | | | | | | | |

| Net change in unrealized appreciation (depreciation) from: | | | | | | | | |

| Investment transactions | | | (8,573,574 | ) | | | 976,206 | |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | 10,345,748 | | | | 484,285 | |

| | | | | | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 9,817,996 | | | $ | 4,595,676 | |

See Accompanying Notes to Financial Statements.

| CANTOR FITZGERALD FUNDS |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Cantor Fitzgerald Equity Opportunity Fund | |

| | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | |

| | | 2024 (a) | | | 2023 | |

| OPERATIONS | | | | | | | | |

| Net investment income (loss) | | $ | (527,752 | ) | | $ | 173,690 | |

| Net realized gain (loss) from: | | | | | | | | |

| Investment transactions | | | 18,919,322 | | | | (898,526 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

| Investment transactions | | | (8,573,574 | ) | | | 14,413,404 | |

| Net increase in net assets resulting from operations | | | 9,817,996 | | | | 13,688,568 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Distributed earnings: | | | | | | | | |

| Class A | | | (10,266,418 | ) | | | — | |

| Class Y | | | (110,279 | ) | | | — | |

| Institutional Class | | | (7,193,448 | ) | | | — | |

| | | | (17,570,145 | ) | | | — | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | | | | | | |

| Class A | | | 950,069 | (b) | | | 2,711,892 | |

| Class C | | | 110,414 | | | | 58,114 | |

| Class I | | | 70,805 | | | | 129,777 | |

| Class Y | | | 2,013,998 | | | | 5,443,207 | |

| Institutional Class | | | 511,465 | (c) | | | — | |

| | | | 3,656,751 | | | | 8,342,990 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | | | | | | |

| Class A | | | 9,383,125 | | | | — | |

| Class Y | | | 103,918 | | | | — | |

| Institutional Class | | | 6,572,517 | | | | — | |

| | | | 16,059,560 | | | | — | |

| Payments for shares redeemed | | | | | | | | |

| Class A | | | (23,597,814 | ) | | | (14,817,808 | ) |

| Class C | | | (1,858,440 | ) (b) | | | (2,413,028 | ) |

| Class I | | | (229,667 | ) (b) | | | (853,168 | ) |

| Class Y | | | (22,647,068 | ) (c) | | | (16,658,620 | ) |

| Institutional Class | | | (2,950,830 | ) | | | — | |

| | | | (51,283,819 | ) | | | (34,742,624 | ) |

| | | | | | | | | |

| Net decrease in net assets from capital share transactions | | | (31,567,508 | ) | | | (26,399,634 | ) |

| | | | | | | | | |

| TOTAL DECREASE IN NET ASSETS | | | (39,319,657 | ) | | | (12,711,066 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 117,913,127 | | | | 130,624,193 | |

| End of year | | $ | 78,593,470 | | | $ | 117,913,127 | |

| (a) | Effective close of business on November 22, 2024, shares of Aquila Opportunity Growth Fund were reorganized into shares of Cantor Fitzgerald Equity Opportunity Fund. See notes to the financial statements. |

| (b) | Includes exchanges from Aquila Opportunity Growth Fund Class C and Class I to Cantor Fitzgerald Equity Opportunity Fund Class A upon conversion of shares on November 22, 2024. |

| (c) | Includes exchanges from Aquila Opportunity Growth Fund Class Y to Cantor Fitzgerald Equity Opportunity Fund Institutional Class upon conversion of shares on November 22, 2024. |

See Accompanying Notes to Financial Statements.

| CANTOR FITZGERALD FUNDS |

| STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

| | | Cantor Fitzgerald Equity Opportunity Fund | |

| | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | |

| | | 2024(a) | | | 2023 | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold: | | | | | | | | |

| Class A | | | 56,274 | (b) | | | 72,561 | |

| Class C | | | 4,339 | | | | 2,495 | |

| Class I | | | 1,628 | | | | 3,288 | |

| Class Y | | | 41,037 | | | | 126,665 | |

| Institutional Class | | | 753,060 | (c) | | | — | |

| | | | 856,338 | | | | 205,009 | |

| Shares reinvested: | | | | | | | | |

| Class A | | | 259,145 | | | | — | |

| Class I | | | 17 | | | | — | |

| Class Y | | | 2,061 | | | | — | |

| Institutional Class | | | 150,970 | | | | — | |

| | | | 412,193 | | | | — | |

| Shares redeemed: | | | | | | | | |

| Class A | | | (557,557 | ) | | | (399,273 | ) |

| Class C | | | (103,847 | ) (b) | | | (103,616 | ) |

| Class I | | | (5,218 | ) (b) | | | (21,214 | ) |

| Class Y | | | (1,195,422 | ) (c) | | | (389,405 | ) |

| Institutional Class | | | (74,931 | ) | | | — | |

| | | | (1,936,975 | ) | | | (913,508 | ) |

| | | | | | | | | |

| Net decrease in shares outstanding | | | (668,444 | ) | | | (708,499 | ) |

| Shares outstanding, beginning of year | | | 2,752,050 | | | | 3,460,549 | |

| Shares outstanding, end of year | | | 2,083,606 | | | | 2,752,050 | |

| (a) | Effective close of business on November 22, 2024, shares of Aquila Opportunity Growth Fund were reorganized into shares of Cantor Fitzgerald Equity Opportunity Fund. See notes to the financial statements. |

| (b) | Includes exchanges of 33,646 shares from Aquila Opportunity Growth Fund Class C and 11,789 shares from Aquila Opportunity Growth Fund Class I to 33,418 shares of Cantor Fitzgerald Equity Opportunity Fund Class A upon conversion on November 22, 2024. |

| (c) | Includes exchanges of 743,262 shares from Aquila Opportunity Growth Fund Class Y to Cantor Fitzgerald Equity Opportunity Fund Institutional Class upon conversion on November 22, 2024. |

See Accompanying Notes to Financial Statements.

| CANTOR FITZGERALD FUNDS |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Cantor Fitzgerald High Income Fund | |

| | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | |

| | | 2024 (a) | | | 2023 | |

| OPERATIONS | | | | | | | | |

| Net investment income | | $ | 4,111,391 | | | $ | 4,382,117 | |

| Net realized loss from: | | | | | | | | |

| Investment transactions | | | (491,921 | ) | | | (3,670,772 | ) |

| Net change in unrealized appreciation on: | | | | | | | | |

| Investment transactions | | | 976,206 | | | | 7,662,642 | |

| Net increase in net assets resulting from operations | | | 4,595,676 | | | | 8,373,987 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Distributed earnings: | | | | | | | | |

| Class A | | | (1,521,986 | ) | | | (1,501,842 | ) |

| Class C | | | (37,307 | ) | | | (43,925 | ) |

| Class I | | | (23,304 | ) | | | (30,069 | ) |

| Class Y | | | (2,377,096 | ) | | | (3,006,909 | ) |

| Institutional Class | | | (228,661 | ) | | | — | |

| | | | (4,188,354 | ) | | | (4,582,745 | ) |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | | | | | | |

| Class A | | | 1,034,020 | (b) | | | 3,094,440 | |

| Class C | | | 94,776 | | | | 218,949 | |

| Class I | | | 3,418 | | | | 7,843 | |

| Class Y | | | 5,785,030 | | | | 14,789,939 | |

| Institutional Class | | | 70,737 | (c) | | | — | |

| | | | 6,987,981 | | | | 18,111,171 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | | | | | | |

| Class A | | | 1,291,927 | | | | 1,351,964 | |

| Class C | | | 34,279 | | | | 42,446 | |

| Class I | | | 19,517 | | | | 25,216 | |

| Class Y | | | 2,064,432 | | | | 2,583,564 | |

| Institutional Class | | | 196,352 | | | | — | |

| | | | 3,606,507 | | | | 4,003,190 | |

| Payments for shares redeemed | | | | | | | | |

| Class A | | | (10,035,574 | ) | | | (9,355,639 | ) |

| Class C | | | (324,667 | ) (b) | | | (569,210 | ) |

| Class I | | | (247,363 | ) (b) | | | (216,025 | ) |

| Class Y | | | (33,864,641 | ) (c) | | | (22,385,976 | ) |

| Institutional Class | | | (1,771,675 | ) | | | — | |

| | | | (46,243,920 | ) | | | (32,526,850 | ) |

| | | | | | | | | |

| Net decrease in net assets from capital share transactions | | | (35,649,432 | ) | | | (10,412,489 | ) |

| | | | | | | | | |

| TOTAL DECREASE IN NET ASSETS | | | (35,242,110 | ) | | | (6,621,247 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 94,759,324 | | | | 101,380,571 | |

| End of year | | $ | 59,517,214 | | | $ | 94,759,324 | |

| (a) | Effective close of business on November 22, 2024, shares of Aquila High Income Fund were reorganized into shares of Cantor Fitzgerald High Income Fund. See notes to the financial statements. |

| (b) | Includes exchanges from Aquila High Income Fund Class C and Aquila High Income Fund Class I to Cantor Fitzgerald High Income Fund Class A upon conversion of shares on November 22, 2024. |

| (c) | Includes exchanges from Aquila High Income Fund Class Y to Cantor Fitzgerald High Income Fund Institutional Class upon conversion of shares on November 22, 2024. |

See Accompanying Notes to Financial Statements.

| CANTOR FITZGERALD FUNDS |

| STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

| | | Cantor Fitzgerald High Income Fund | |

| | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | |

| | | 2024 (a) | | | 2023 | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold: | | | | | | | | |

| Class A | | | 284,940 | (b) | | | 390,650 | |

| Class C | | | 11,688 | | | | 27,580 | |

| Class I | | | 422 | | | | 995 | |

| Class Y | | | 711,220 | | | | 1,869,993 | |

| Institutional Class | | | 4,342,522 | (c) | | | — | |

| | | | 5,350,792 | | | | 2,289,218 | |

| Shares reinvested: | | | | | | | | |

| Class A | | | 157,011 | | | | 170,936 | |

| Class C | | | 4,200 | | | | 5,368 | |

| Class I | | | 2,397 | | | | 3,192 | |

| Class Y | | | 252,960 | | | | 326,344 | |

| Institutional Class | | | 24,000 | | | | — | |

| | | | 440,568 | | | | 505,840 | |

| Shares redeemed: | | | | | | | | |

| Class A | | | (1,227,289 | ) | | | (1,184,456 | ) |

| Class C | | | (146,480 | ) (b) | | | (72,165 | ) |

| Class I | | | (30,364 | ) (b) | | | (27,375 | ) |

| Class Y | | | (8,479,449 | ) (c) | | | (2,838,986 | ) |

| Institutional Class | | | (265,560 | ) | | | — | |

| | | | (10,149,142 | ) | | | (4,122,982 | ) |

| | | | | | | | | |

| Net decrease in shares outstanding | | | (4,357,782 | ) | | | (1,327,924 | ) |

| Shares outstanding, beginning of year | | | 11,650,231 | | | | 12,978,155 | |

| Shares outstanding, end of year | | | 7,292,449 | | | | 11,650,231 | |

| (a) | Effective close of business on November 22, 2024, shares of Aquila High Income Fund were reorganized into shares of Cantor Fitzgerald High Income Fund. See notes to the financial statements. |

| (b) | Includes exchanges of 106,571 shares from Aquila High Income Fund Class C and 50,100 shares from Aquila High Income Fund Class I to 156,636 shares of Cantor Fitzgerald High Income Fund Class A upon conversion on November 22, 2024. |

| (c) | Includes exchanges of 4,333,935 shares from Aquila High Income Fund Class Y to Cantor Fitzgerald High Income Fund Institutional Class upon conversion on November 22, 2024. |

See Accompanying Notes to Financial Statements.

| CANTOR FITZGERALD EQUITY OPPORTUNITY FUND |

| FINANCIAL HIGHLIGHTS |

| |

| Selected Per Share Data for a Share Outstanding Throughout each Year Presented: |

| | | Class A | |

| | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2024 (a) | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| Net asset value, beginning of year | | $ | 40.70 | | | $ | 36.22 | | | $ | 46.98 | | | $ | 51.86 | | | $ | 50.62 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (b) | | | (0.27 | ) | | | 0.01 | | | | (0.08 | ) | | | (0.48 | ) | | | (0.29 | ) |

| Net realized and unrealized gains (losses) on investments | | | 4.30 | | | | 4.47 | | | | (6.97 | ) | | | 10.56 | | | | 3.94 | |

| Total from investment operations | | | 4.03 | | | | 4.48 | | | | (7.05 | ) | | | 10.08 | | | | 3.65 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.05 | ) | | | — | | | | — | | | | — | | | | — | |

| Net realized gains | | | (9.82 | ) | | | — | | | | (3.71 | ) | | | (14.96 | ) | | | (2.41 | ) |

| Total distributions | | | (9.87 | ) | | | — | | | | (3.71 | ) | | | (14.96 | ) | | | (2.41 | ) |

| Net asset value at end of year | | $ | 34.86 | | | $ | 40.70 | | | $ | 36.22 | | | $ | 46.98 | | | $ | 51.86 | |

| Total return (c) | | | 9.04 | % | | | 12.37 | % | | | (15.25 | )% | | | 21.53 | % | | | 7.39 | % |

| Net assets at end of year (000’s) | | $ | 43,317 | | | $ | 60,429 | | | $ | 65,619 | | | $ | 86,364 | | | $ | 76,508 | |

| Ratio of net expenses to average net assets (d)(f) | | | 2.03 | % | | | 1.75 | % | | | 1.67 | % | | | 1.49 | % | | | 1.54 | % |

| Ratio of net investment income (loss) to average net assets (d)(f) | | | -0.65 | % | | | 0.02 | % | | | -0.19 | % | | | -0.88 | % | | | -0.63 | % |

| Portfolio turnover rate (e) | | | 44 | % | | | 107 | % | | | 102 | % | | | 99 | % | | | 69 | % |

| (a) | Effective close of business on November 22, 2024, Class A, Class C and Class I shares of Aquila Opportunity Growth Fund were reorganized into Class A shares of Cantor Fitzgerald Equity Opportunity Fund. See notes to the financial statements. The Class A shares’ financial highlights for the periods prior to November 22, 2024 reflect the performance of Aquila Opportunity Growth Fund Class A. |

| (b) | Calculated using average shares outstanding. |

| (c) | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. |

| (d) | Ratios were determined after advisory fee waivers/reductions by the Advisor. |

| (e) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

| (f) | Does not include the Fund’s share of the expenses of the underlying investment companies in which the Fund invests. |

See Accompanying Notes to Financial Statements.

| CANTOR FITZGERALD EQUITY OPPORTUNITY FUND |

| FINANCIAL HIGHLIGHTS |

| |

| Selected Per Share Data for a Share Outstanding Throughout each Year Presented: |

| | | Institutional Class | |

| | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2024 (a) | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| Net asset value, beginning of year | | $ | 47.12 | | | $ | 41.82 | | | $ | 53.42 | | | $ | 57.00 | | | $ | 55.24 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (b) | | | (0.17 | ) | | | 0.14 | | | | 0.04 | | | | (0.37 | ) | | | (0.17 | ) |

| Net realized and unrealized gains (losses) on investments | | | 4.93 | | | | 5.16 | | | | (7.93 | ) | | | 11.75 | | | | 4.34 | |

| Total from investment operations | | | 4.76 | | | | 5.30 | | | | (7.89 | ) | | | 11.38 | | | | 4.17 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.11 | ) | | | — | | | | — | | | | — | | | | — | |

| Net realized gains | | | (9.82 | ) | | | — | | | | (3.71 | ) | | | (14.96 | ) | | | (2.41 | ) |

| Total distributions | | | (9.93 | ) | | | — | | | | (3.71 | ) | | | (14.96 | ) | | | (2.41 | ) |

| Net asset value at end of year | | $ | 41.95 | | | $ | 47.12 | | | $ | 41.82 | | | $ | 53.42 | | | $ | 57.00 | |

| Total return (c) | | | 9.36 | % | | | 12.67 | % | | | (14.98 | )% | | | 21.88 | % | | | 7.71 | % |

| Net assets at end of year (000’s) | | $ | 35,277 | | | $ | 54,301 | | | $ | 59,173 | | | $ | 105,557 | | | $ | 126,001 | |

| Ratio of net expenses to average net assets (d)(f) | | | 1.72 | % | | | 1.45 | % | | | 1.36 | % | | | 1.19 | % | | | 1.23 | % |

| Ratio of net investment income (loss) to average net assets (d)(f) | | | -0.35 | % | | | 0.32 | % | | | 0.09 | % | | | -0.60 | % | | | -0.33 | % |

| Portfolio turnover rate (e) | | | 44 | % | | | 107 | % | | | 102 | % | | | 99 | % | | | 69 | % |

| (a) | Effective close of business on November 22, 2024, Class Y shares of Aquila Opportunity Growth Fund were reorganized into Institutional Class shares of Cantor Fitzgerald Equity Opportunity Fund. See notes to the financial statements. The Institutional Class shares’ financial highlights for the periods prior to November 22, 2024 reflect the performance of Aquila Opportunity Growth Fund Class Y. |

| (b) | Calculated using average shares outstanding. |

| (c) | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. |

| (d) | Ratios were determined after advisory fee waivers/reductions by the Advisor. |

| (e) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

| (f) | Does not include the Fund’s share of the expenses of the underlying investment companies in which the Fund invests. |

See Accompanying Notes to Financial Statements.

| CANTOR FITZGERALD HIGH INCOME FUND |

| FINANCIAL HIGHLIGHTS |

| |

| Selected Per Share Data for a Share Outstanding Throughout each Year Presented: |

| | | Class A | |

| | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2024 (a) | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| Net asset value, beginning of year | | $ | 8.13 | | | $ | 7.81 | | | $ | 8.61 | | | $ | 8.69 | | | $ | 8.39 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (b) | | | 0.41 | | | | 0.34 | | | | 0.30 | | | | 0.30 | | | | 0.30 | |

| Net realized and unrealized gains (losses) on investments | | | 0.05 | | | | 0.34 | | | | (0.77 | ) | | | 0.00 | | | | 0.33 | |

| Total from investment operations | | | 0.46 | | | | 0.68 | | | | (0.47 | ) | | | 0.30 | | | | 0.63 | |