ENERFLEX LTD.

ANNUAL INFORMATION FORM

For the year ended December 31, 2024

Dated February 27, 2025

Enerflex Ltd. Annual Information Form

For the Year Ended December 31, 2024

TABLE OF CONTENTS

Enerflex Ltd. Annual Information Form

For the Year Ended December 31, 2024

ABOUT ENERFLEX

Enerflex is a premier integrated global provider of energy infrastructure and energy transition solutions, deploying natural gas, low-carbon, and treated water solutions – from individual, modularized products and services to integrated custom solutions. With over 4,600 engineers, manufacturers, technicians, professionals, and innovators, Enerflex is bound together by a shared vision: Transforming Energy for a Sustainable Future. The Company remains committed to the future of natural gas and the critical role it plays, while focused on sustainability offerings to support the energy transition and growing decarbonization efforts.

CORPORATE STRUCTURE

Name, Address, and Incorporation

Enerflex Ltd. is a corporation existing under the Canada Business Corporations Act. The principal corporate and registered office of the Company is located at Suite 904 – 1331 Macleod Trail S.E., Calgary, Alberta, Canada, T2G 0K3. Additional information about Enerflex is available at www.enerflex.com or under the electronic profile of the Company on SEDAR+ and EDGAR.

Enerflex Common Shares trade on the Toronto Stock Exchange under the symbol EFX and on the New York Stock Exchange under the symbol EFXT.

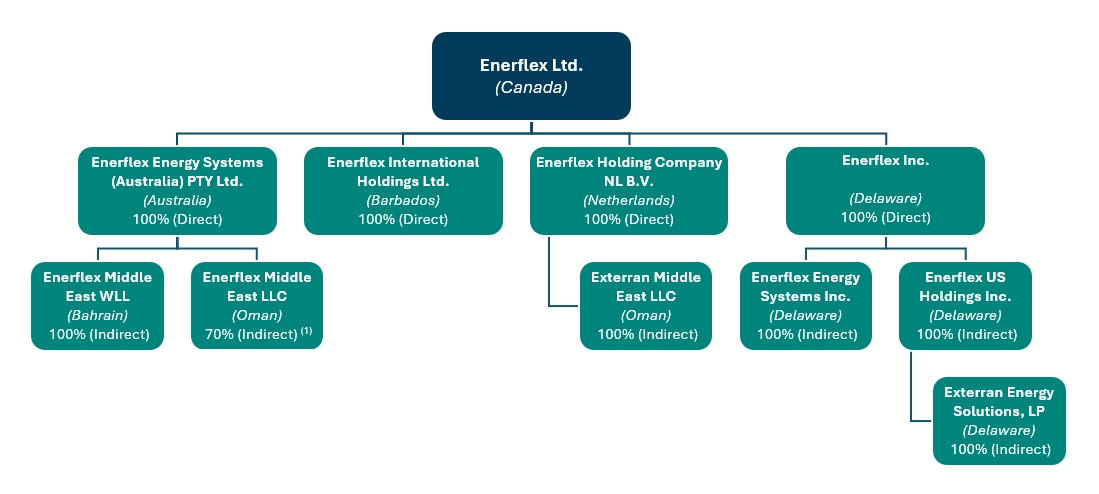

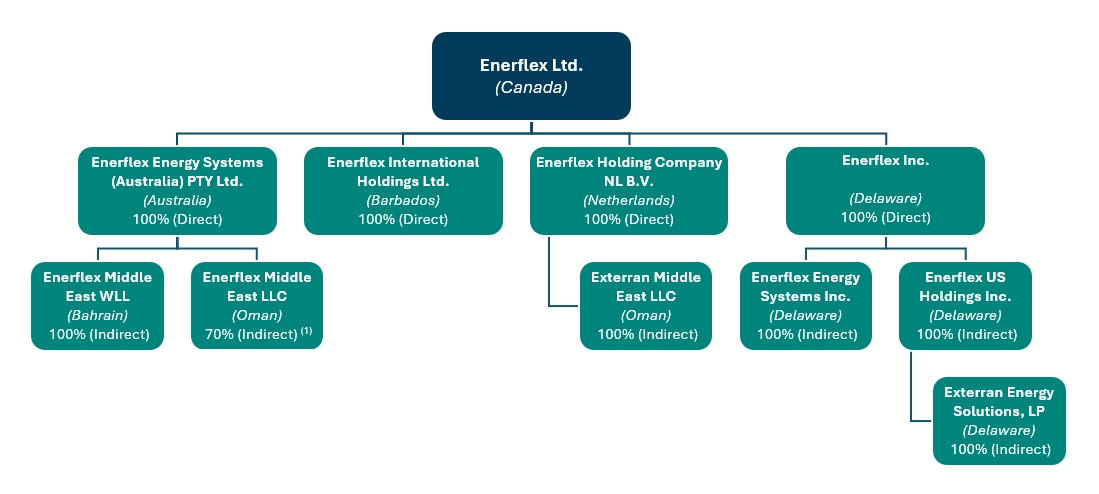

Inter-Company Relationships

The principal subsidiaries of the Company, their jurisdictions of incorporation or formation, and the percentage of voting securities and restricted securities beneficially owned or controlled by the Company, are set out below. For simplification, non-material subsidiaries are excluded.

Note:

(1)Enerflex Ltd. holds 100 percent of the beneficial interest.

| |

| 2 |

GENERAL DEVELOPMENT OF THE BUSINESS

Three-year History

The following describes the significant events of the last three financial years with respect to Enerflex and its business.

2024 Highlights and Developments

For the 2024 financial year, the Board of Directors approved and declared quarterly dividends to shareholders in the amount of CAD $0.025 per Enerflex Common Share for the first and second quarter and CAD $0.0375 per Enerflex Common Share for the third and fourth quarter, with the fourth quarter dividend being approved and declared on February 26, 2025. The total annual dividend for 2024 was CAD $0.125 per Enerflex Common Share.

In addition, the following significant events occurred:

| |

February | On February 15, 2024, Enerflex announced the appointment of Mr. Preet S. Dhindsa as Senior Vice President and Chief Financial Officer of the Company, effective March 1, 2024. Prior to his appointment, Mr. Dhindsa was the Interim Chief Financial Officer of the Company. See “Executive Officers”. |

March | On March 11, 2024, Enerflex announced the appointment of Mr. Thomas B. Tyree, Jr. as a director of the Company. Subsequent to his appointment, Mr. Tyree was appointed as a member on the Audit Committee. See “Board of Directors”. |

April | On April 29, 2024, the Tenth Circuit Collegiate Court on Labor Matters in Mexico published a decision setting aside a January 31, 2022 decision of a Labor Board in the State of Tabasco, Mexico that had ordered subsidiaries of Exterran (now subsidiaries of Enerflex) to pay a former employee MXN$2,152 million (approximately $125 million) plus other benefits in connection with a dispute relating to the employee’s severance pay following termination of his employment in 2015. |

June | On June 26, 2024, Enerflex entered into an agreement to extend the maturity date of its Revolving Credit Facility by one year, to October 13, 2026. Availability under the extended Revolving Credit Facility was also increased to $800 million from $700 million. In conjunction with the extension of the Revolving Credit Facility, Enerflex repaid the higher cost Term Loan Facility which had a balance of $120 million at March 31, 2024. See “Material Contracts - Revolving Credit Facility”. |

October | On October 1, 2024, Enerflex announced that it had issued a notice of partial redemption for $62.5 million (or 10 percent of the aggregate principal amount originally issued) of its 9.00 percent Notes. The redemption was completed on October 11, 2024 (the Redemption Date) at a redemption price of 103 percent of the principal amount of the notes being redeemed, plus accrued and unpaid interest up to, but excluding, the Redemption Date. |

November | On November 25, 2024, Enerflex announced the appointment of Mr. Ben Cherniavsky as a director of the Company. Subsequent to his appointment, Mr. Cherniavsky was appointed as a member of the Audit Committee. See “Board of Directors”. |

| |

| 3 |

| |

| Following suspension of activity at a modularized cryogenic natural gas processing facility in Kurdistan (the EH Cryo project) during the second quarter of 2024, Enerflex announced on November 27, 2024 that it had provided its customer with formal notice of termination, due to continuing Force Majeure and circumstances that made it impossible for Enerflex to fulfill its obligations under the EH Cryo project contract. See “Changes to Contracts” and “Legal Proceedings”. |

December | On December 17, 2024, Enerflex announced the upcoming retirement of W. Byron Dunn and Michael A. Weill from its Board of Directors, effective January 1, 2025, pursuant to the term limits set in the Company’s Board Retirement Policy (the Retirement Policy). On the same date, Enerflex announced the reconstitution of the standing committees of the Board, including the appointment of Joanne Cox as Chair of the HRC Committee and Thomas B. Tyree, Jr. as Chair of the NCG Committee. See “Board of Directors”. |

2023 Highlights and Developments

For the 2023 financial year, the Board of Directors approved and declared quarterly dividends to shareholders in the amount of CAD $0.025 per Enerflex Common Share for the first, second, third, and fourth quarters of 2023, with the fourth quarter dividend being approved and declared on February 28, 2024. The total annual dividend for 2023 was CAD $0.10 per Enerflex Common Share.

In addition, the following significant events occurred:

| |

January | On January 20, 2023, Enerflex announced the appointment of Ms. Laura Folse as a director of the Company. Subsequent to her appointment, Ms. Folse was appointed as a member on the NCG Committee and subsequently, the HRC Committee. Ms. Folse did not stand for re-election to the Board at the annual meeting of shareholders held on May 7, 2024. |

March | On March 19, 2023, Enerflex announced the departure of its Chief Financial Officer and the appointment of Mr. Matthew Lemieux as Interim Chief Financial Officer of the Company. Prior to his appointment, Mr. Lemieux held the position of Vice President, Corporate Development and Treasury. |

June | On June 28, 2023, Enerflex announced the appointment of Mr. Rodney D. Gray as Senior Vice President and Chief Financial Officer of the Company. Concurrent with the appointment of Mr. Gray, Mr. Lemieux reassumed his previous position. |

August | On August 9, 2023, Enerflex announced the appointment of Ms. Joanne Cox as a director of Enerflex and a member of the Audit Committee. In addition, Enerflex announced the retirement of Ms. Maureen Cormier Jackson, a director and chair of the Audit Committee, and that in conjunction with Ms. Jackson’s retirement, Ms. Mona Hale had assumed the role of chair of the Audit Committee. |

| |

| 4 |

| |

October | On October 1, 2023, Enerflex announced the resignation of Mr. Rodney D. Gray as Senior Vice President and Chief Financial Officer of the Company, and in connection therewith, that the Company had commenced a search for a new chief financial officer. On October 13, 2023, Enerflex announced the appointment of Mr. Preet S. Dhindsa as Interim Chief Financial Officer of the Company. |

2022 Highlights and Developments

For the 2022 financial year, the Board of Directors approved and declared quarterly dividends to shareholders in the amount of CAD $0.025 per Enerflex Common Share for the first, second, third, and fourth quarters of 2022. The total annual dividend for 2022 was CAD $0.10 per Enerflex Common Share.

In addition, the following significant events occurred:

| |

January | Enerflex entered into an agreement and plan of merger with Enerflex US Holdings Inc., a Delaware corporation and a direct, wholly owned subsidiary of Enerflex, and Exterran, a Delaware corporation, pursuant to which, among other things, Enerflex US Holdings Inc. agreed, subject to certain conditions, to merge with and into Exterran, with Exterran surviving the transaction as a direct, wholly owned subsidiary of Enerflex (the Transaction). |

September | Enerflex received conditional approval from the NYSE for the listing of Enerflex Common Shares on the NYSE under the symbol EFXT. Additionally, the SEC declared the registration statement on Form F-4 dated September 8, 2022, effective. Receipt of these approvals satisfied the final regulatory requirements pursuant to the Transaction documents to the calling of the respective special meetings of the shareholders of Enerflex and Exterran to consider the Transaction. |

October | Enerflex and Exterran each held their special meeting of shareholders at which the shareholders of Enerflex approved the issuance of Enerflex Common Shares to former shareholders of Exterran, and shareholders of Exterran approved the Transaction and all matters contemplated in connection therewith. Following receipt of the respective approvals from the Enerflex shareholders and Exterran shareholders, Enerflex announced that it had secured committed financing for the combined entity resulting from the Transaction consisting of: •the net proceeds of a private offering of $625 million aggregate principal amount of 9.00 percent Notes; •the $150 million Term Loan Facility; and •the $700 million 2022 Revolving Credit Facility. |

| |

| 5 |

| |

| Enerflex used the net proceeds from the private offering of 9.00 percent Notes, together with the Term Loan Facility, an initial draw under the 2022 Revolving Credit Facility, and cash on hand, to fully repay the existing Enerflex and Exterran notes and revolving credit facilities (including the Bank Facility and Senior Notes), pay the cash portion of the consideration for the Transaction and pay fees and expenses incurred in connection with the Transaction. Upon closing, Enerflex US Holdings Inc. merged with and into Exterran, with Exterran surviving the Transaction as a direct, wholly owned subsidiary of Enerflex. Enerflex appointed Mr. James Gouin, a former director and audit committee member of Exterran, to the Board of Directors and a member of the Audit Committee. Enerflex Common Shares opened for trading on the NYSE under the symbol EFXT. Additional information concerning Enerflex, Exterran, and the Transaction, including the expected effects of the Transaction on Enerflex's financial performance and financial position, may be found in Form 51-102F4 – Business Acquisition Report of Enerflex filed on November 3, 2022, under the electronic profile of the Company on SEDAR+. |

DESCRIPTION OF THE BUSINESS

Enerflex’s Business

Enerflex deploys and services high-quality sustainable energy infrastructure. The Company’s comprehensive portfolio includes compression, processing, cryogenic, and treated water solutions, spanning all phases of a project's lifecycle, from front-end engineering and design to after-market services. Enerflex is optimally positioned to its serve client partners in core markets, enhancing long-term shareholder value through sustainable improvements in efficiency, profitability, and cash flow generation.

Headquartered in Calgary, Alberta, Canada, the Company has a long and proud history dating back to 1980 and has operations in 17 countries across North America, Latin America, and the Eastern Hemisphere. With over 700,000 sq. ft. of manufacturing capability in Calgary, Alberta, Canada; Houston, Texas, USA; and Broken Arrow, Oklahoma, USA, Enerflex delivers high-quality, standard or custom, long-life operating systems.

Enerflex’s stable Energy Infrastructure business generates steady, recurring revenue. It is through this offering Enerflex owns, operates, and manages critical infrastructure under contract to its client partners’ operations. The Engineered Systems product line is the sale of customized modular natural gas-handling and produced water solutions, enabling removal of NGLs, oil processing technology, and treated water applications. After-Market Services includes installation, commissioning, operations and maintenance, and parts sales, along with global support for all product lines. Through its Energy Infrastructure and After-Market Services product lines, Enerflex continues to build an increasingly resilient and sustainable business, stabilizing cash flows over the long term and reducing cyclicality in the business.

| |

| 6 |

Enerflex’s expert teams of professionals, industry-certified mechanics and technicians, and tradespeople cover the key disciplines of engineering, design, manufacturing, construction, commissioning, asset maintenance, and service, and are strategically situated across a network of locations globally.

PRODUCT LINES

Energy Infrastructure

Enerflex's Energy Infrastructure business allows the Company to withstand the cyclical nature of the energy markets. The product line within this portfolio includes energy infrastructure solutions under contract for natural gas processing, compression, and treated water equipment. Enerflex’s infrastructure is deployed across the globe and provides comprehensive contract operations services to clients, including trained personnel, equipment, tools, materials, and supplies to meet their natural gas needs, as well as designing, sourcing, installing, operating, servicing, repairing, and maintaining equipment owned by the Company that is necessary to provide these services. Client partners range from independent producers and regionally significant players to some of the world's largest energy producers, including national energy companies.

Contract Compression

Enerflex is one of the leading suppliers of natural gas compression infrastructure within the USA, Canada, Latin America, and the Middle East, managing a global fleet of approximately 1.6 million horsepower.

Enerflex’s contract compression fleet of low- to high-horsepower packages are typically used in natural gas gathering systems, gas-lift, wellhead, and other applications primarily in connection with natural gas, NGLs, and oil production, and are made available to client partners on a contracted basis. When the Company enters into a contract compression arrangement with a client partner, the initial term of the commitment generally ranges between one to five years, however, in some cases, initial terms or extensions to initial terms can result in arrangements of greater than 10 years. These contracts typically require Enerflex to provide all the engineering, design, and installation services to bring the equipment online, and may require Enerflex to make a significant investment in equipment, facilities, and related installation costs. Client partners generally pay a monthly service fee even during periods of limited or disrupted production, which enhances the stability and predictability of the Company’s cash flows. Additionally, the Company does not have direct exposure to the fluctuations in commodity prices since Enerflex provides an up-time guarantee and does not take title to the hydrocarbon being compressed, processed, or treated.

The demand for Enerflex's products and services is driven by production of natural gas and crude oil, where compression is typically required to move produced volumes from the wellhead and through gathering systems. In addition, compression can also improve performance in maturing fields.

Build-Own-Operate-Maintain Solutions

Enerflex leverages its extensive expertise in engineering, designing, manufacturing, construction, commissioning, and operating and maintaining natural gas compression, processing, and treated water infrastructure solutions on a Build-Own-Operate-Maintain (BOOM) basis. Enerflex’s BOOM model provides client partners with an operational partnership that mitigates risk while keeping objectives aligned. Through this model, Enerflex handles all phases of a project, including the up-front cost of, and responsibility for, construction and commissioning, ensuring quality, safety, and

| |

| 7 |

reliability are consistent through the project life. Clients then pay Enerflex a monthly fee to benefit from world-class facilities, without the challenges typically posed by ownership, operations, and maintenance. Enerflex’s success with BOOM projects stems from its collaborative approach to delivering reliable solutions with reduced risk for its partners.

After-Market Services

Enerflex's After-Market Services product line delivers comprehensive mechanical services to client partners worldwide, including parts distribution; operations and maintenance solutions; equipment optimization and maintenance programs; manufacturer warranties; exchange components; long-term service agreements; and technical services. Utilizing an extensive network of branch offices, the product line primarily operates at client partner locations through trained technicians and mechanics. Enerflex’s After-Market service and support business includes distribution and remanufacturing facilities, with significant presence in active natural gas producing areas.

Enerflex services a large base of natural gas compression and storage facilities installed in North America, Latin America, and the Eastern Hemisphere. In addition, the Company provides contract operations and maintenance for large natural gas facilities in the Middle East, Latin America, and other markets.

Enerflex's client partners range from independent producers, regionally significant players, and some of the world's largest energy producers, to midstream companies who service these oil and gas explorers and producers. Maintenance contracts are managed by a team of dedicated engineers and planners using remote monitoring and on-site specialist personnel to carry out the work required. With its After-Market Service offering, the Company drives recurring revenue through an increased focus on long-term service agreements for compression, processing, and electric power solutions.

Engineered Systems

Engineered Systems involves the sale of modular natural gas-handling and low-carbon solutions that are engineered, designed, fabricated, and assembled by the Company. Products include applications for: gas processing, including cryogenic solutions; gas compression systems; CCUS; water treatment; and electric power generation systems. Enerflex can combine one or more product offerings into an integrated solution, simplifying clients’ supply chain, eliminating interface risk, and reducing the concept-to-commissioning cycle time of major projects.

Processing

Enerflex engineers, designs, fabricates, constructs, commissions, operates, and services hydrocarbon processing equipment. Complete processing modules are designed and fabricated at Enerflex’s manufacturing facilities. Modular fabrication facilitates delivery to a global market from these facilities. Enerflex also provides supervision and project management services across the world with respect to the installation, commissioning, and start-up of such products and facilities. Process applications include dehydration, NGLs recovery, refrigeration, cryogenic processing, condensate stabilization, dew point control, and amine sweetening.

Processing prepares natural gas for transportation by pipeline for end-use consumption. Substantially all newly produced natural gas requires the removal of water, CO2, and other impurities. Gas containing NGLs (ethane, propane, butane, and condensate) typically requires more complex processing. The North American producing sector's increased focus on liquids-rich gas opportunities has generated new demand for top-tier processing facilities, including cryogenic

| |

| 8 |

processing facilities, which are manufactured at the Company’s Broken Arrow, Oklahoma, USA facility.

Compression

Enerflex is a leading supplier of natural gas compression packages, which are powered by natural gas-fuelled engines or electric motors. These natural gas compression packages typically consist of reciprocating or screw compressors, cooling fans, piping, and instrumentation and controls. Applications include natural gas gathering and compression, gas lift compression, inlet and residue compression in processing facilities, compression for natural gas storage, and pipeline compression. Enerflex offers compression packages from 20 horsepower to 10,000-plus horsepower, ranging from low-specification field compressors to high-specification process compressors for onshore and offshore applications.

Enerflex also provides re-engineering and refurbishment of existing compression equipment at client partner field locations, as well as in its own global facilities.

Enerflex serves a global client partner base across all major natural gas basins. Client partners are diverse, including small independent producers, majors, national energy companies, and midstream and third-party processing providers.

Electric Power

The Company provides electric power solutions and after-market services required for on-going life cycle support of this equipment. Enerflex's typical power generation units range from 20 kilowatts to 100 megawatts. The Company provides field construction, installation, and commissioning for an integrated electric power solution, taking advantage of Enerflex's reputation in gas-fuelled engines and its skills in modular engineering, fabrication, and after-market support. Enerflex's electric power solutions cover the oil and gas, industrial, institutional, greenhouse, data centres, mining, renewables, and agriculture sectors across the world. Client partners range from pulp and paper mills, landfill sites, hospitals, city facilities, beverage facilities, greenhouses, utilities and power companies, and a range of oil and gas producers.

Low-Carbon Solutions

Building on the Company’s strong foundation of technical excellence in modular equipment, Enerflex implements its core competencies to support the industry’s decarbonization goals with its low-carbon solutions. Since the early 1980s, Enerflex has deployed low-carbon equipment and infrastructure solutions, including projects related to CCUS, renewable natural gas, electrification, and hydrogen.

Enerflex’s deep relationships with client partners and understanding of their business presents an opportunity to design and fabricate solutions to help them achieve their decarbonization goals.

To date, Enerflex has completed over 150 CCUS projects globally. CCUS is a key avenue to achieve deep decarbonization, and technology is rapidly advancing.

Bioenergy is a form of renewable energy that is derived from organic materials known as biomass. Enerflex has successfully implemented many bioenergy solutions, utilizing fuel gas from organic material such as landfill waste.

| |

| 9 |

Hydrogen is seen as another prospective avenue to achieving industry decarbonization targets. There are many developments geared towards unlocking new markets for hydrogen, including steel manufacturing, clean ammonia, and heavy-duty trucks. Compression solutions are required across the hydrogen value chain and Enerflex brings global knowledge of this solution, having installed over 100,000 horsepower in its history.

In addition, Enerflex is active in the e-compression space, having packaged over 3 million horsepower of electric drive compression, and completed a multitude of retrofits. This space consists of a growing list of client partners who are looking to decarbonize their facilities with low-carbon new builds and includes Enerflex’s own growing electric motor drive fleet.

Treated Water Solutions

Enerflex designs and commissions facilities for efficient produced water treatment, incorporating industry-leading technologies to cover primary, secondary, and tertiary treatment methods to separate oils. The Company’s focus is on providing comprehensive solutions through research and development, water studies, and flexible contract models, underscoring its commitment to evolving industry needs.

Enerflex effectively handles and treats produced water ranging in volumes up to 120,000 m3 per day. Enerflex’s expertise extends from lab-scale testing, research, and development to providing complete BOOM solutions, allowing the Company to support its partners through every project phase. By working together and utilizing Enerflex’s patented technologies, the Company has treated over eight billion barrels of produced water to date for client partners.

Enerflex treated water solutions are differentiated through technology innovation, simplified processes and facility design, and a deep understanding of its clients’ produced water challenges. Enerflex continuously innovates to optimize the water treatment process so it can be reused or injected back into the ground in a sustainable manner. Enerflex’s technologies elevate industry standard methods by lowering operating costs, increasing production, and optimizing operations for its client partners. The Company has experience treating difficult fluids, including heavy oils, emulsions, high viscosities, polymer water, and shale play applications, and its focus on building sustainable facilities make it a leader in the industry.

GEOGRAPHIC MARKETS

Enerflex has three reportable segments:

•North America – comprised of operations in Canada and the USA.

•Latin America – comprised of operations in Argentina, Bolivia, Brazil, Colombia, Mexico, and Peru.

•Eastern Hemisphere – comprised of operations in the Middle East, Africa, Europe, and Asia Pacific.

North America

In North America, Enerflex provides natural gas solutions to support upstream and midstream activities required to meet local demand. The Company benefits from increasing domestic demand and a growing liquified natural gas export industry in North America.

| |

| 10 |

Energy Infrastructure

In the USA, Enerflex operates a contract compression rental fleet of approximately 428,000 horsepower, with the largest portion operating in the Permian Basin. Enerflex has responded to customer demand for lower carbon solutions, with electric drive representing approximately 20 percent of the Company’s fleet. The Company benefits from vertical integration with its Engineered Systems business, providing cost and timing efficiencies compared to its peers.

After-Market Services

Enerflex provides mechanical services and parts to a large installed base of critical natural gas equipment across key resource plays in the USA and Canada. The Company looks to secure service contracts with client partners as a means of enabling recurring business.

Engineered Systems

Enerflex holds a market leading position for the engineering and manufacturing of modularized solutions for natural gas processing and compression. With three state-of-the-art manufacturing facilities, Enerflex maintains high standards, ensuring client partners receive unparalleled service and product excellence. The Company’s solutions are delivered both domestically and internationally, highlighting its direct sales approach to the Eastern Hemisphere and Latin America.

Latin America

In Latin America, Enerflex focuses primarily on long-term opportunities through Energy Infrastructure ownership and After-Market Services support. The Company also serves the Latin America region through its Engineered Systems manufacturing facility located in Houston.

Energy Infrastructure

Enerflex targets long-term contract compression solutions and modularized energy infrastructure to support increasing natural gas production across the region, with a focus on Argentina, Brazil, and Mexico.

After-Market Services

Leveraging its Energy Infrastructure footprint, Enerflex focuses on after-market services, parts, operations, maintenance, and overhaul services. Latin America has eight fully equipped workshops providing coverage across the region to best serve client partners.

Eastern Hemisphere

Across the Eastern Hemisphere region, Enerflex focuses primarily on long-term opportunities through Energy Infrastructure ownership and After-Market Services support. Enerflex’s core operating countries in this region include Oman and Bahrain.

Energy Infrastructure

Enerflex invests in long-term infrastructure assets to support the Company’s ongoing strategy to grow the recurring nature of its business. Projects cover compression, processing, and treated water solutions.

| |

| 11 |

After-Market Services

Leveraging its Energy Infrastructure footprint in the region, Enerflex continues to grow its After-Market Services capabilities. The team delivers comprehensive mechanical services, including parts distribution, operations and maintenance, and equipment optimization.

SEGMENTED REVENUE DETAILS

Enerflex's 2024 and 2023 revenue, by business segment and product line, is set forth in the following table.

| | | | | | | | | | | | | | | | |

$ millions as at December 31 | | 2024 Revenue

$M | | | % Split | | | 2023 Revenue

$M | | | % Split | |

Business Segment | | | | | | | | | | | | |

North America | | | 1,564 | | | | 65 | | | | 1,413 | | | | 60 | |

Latin America | | | 407 | | | | 17 | | | | 350 | | | | 15 | |

Eastern Hemisphere | | | 443 | | | | 18 | | | | 580 | | | | 25 | |

Total | | | 2,414 | | | | 100 | | | | 2,343 | | | | 100 | |

| | | | | | | | | | | | |

Product Line | | | | | | | | | | | | |

Energy Infrastructure | | | 668 | | | | 28 | | | | 576 | | | | 24 | |

After-Market Services | | | 508 | | | | 21 | | | | 483 | | | | 21 | |

Engineered Systems | | | 1,238 | | | | 51 | | | | 1,284 | | | | 55 | |

Total | | | 2,414 | | | | 100 | | | | 2,343 | | | | 100 | |

| | | | | | | | | | | | | | | | |

Product Line | | 2024 Revenue

$M | | | % Split | | | 2023 Revenue

$M | | | % Split | |

Energy Infrastructure | | | | | | | | | | | | |

North America | | | 146 | | | | 22 | | | | 127 | | | | 22 | |

Latin America | | | 257 | | | | 38 | | | | 248 | | | | 43 | |

Eastern Hemisphere | | | 265 | | | | 40 | | | | 201 | | | | 35 | |

| | | 668 | | | | 100 | | | | 576 | | | | 100 | |

After-Market Services | | | | | | | | | | | | |

North America | | | 279 | | | | 55 | | | | 286 | | | | 59 | |

Latin America | | | 70 | | | | 14 | | | | 57 | | | | 12 | |

Eastern Hemisphere | | | 159 | | | | 31 | | | | 140 | | | | 29 | |

| | | 508 | | | | 100 | | | | 483 | | | | 100 | |

Engineered Systems | | | | | | | | | | | | |

North America | | | 1,139 | | | | 92 | | | | 1,000 | | | | 78 | |

Latin America | | | 80 | | | | 6 | | | | 45 | | | | 3 | |

Eastern Hemisphere | | | 19 | | | | 2 | | | | 239 | | | | 19 | |

| | | 1,238 | | | | 100 | | | | 1,284 | | | | 100 | |

Total | | | 2,414 | | | | 100 | | | | 2,343 | | | | 100 | |

| |

| 12 |

ENERFLEX FACILITIES

Enerflex has over 70 locations globally. The Company has locations in Canada, several of which are in Alberta, including the head office, the Treated Water office and lab, and a manufacturing facility which primarily serves the Canadian market. Enerflex has several locations throughout the USA, including the Company’s manufacturing facility located in Houston, Texas, serving the USA and international markets, and an additional facility in Broken Arrow, Oklahoma, serving the global cryogenic market. In Latin America, Enerflex has locations in Argentina, Brazil, Bolivia, Colombia, Mexico, and Peru. In Asia Pacific, Enerflex has several locations including a facility in Brisbane, Australia, that is devoted to retrofit, services, and overhaul activities. There are additional locations throughout the Middle East and Africa, and one location in Europe. See “Geographic Markets” for further details.

ENERFLEX’S CLIENT PARTNERS

The Enerflex client partner base consists primarily of companies engaged in the energy industry, including small to large independent energy producers, integrated energy companies, midstream and petrochemical companies, power generation companies, users of natural gas-fired electric power, and carbon capture players.

COMPETITIVE CONDITIONS

The demand for Enerflex's products and services is influenced by several factors, including: the price of, and demand for, crude oil and natural gas; demand for associated infrastructure; transportation availability and costs; access to qualified personnel; the availability and pricing of materials and component parts; the availability and access to capital; geopolitical factors; regional and global economic conditions; local, national, and international laws and regulations including taxation, royalty frameworks, and environmental laws and regulations and the introduction of new laws and regulations to which Enerflex and its client partners are subject; and commodity price speculation in the financial markets.

As a result, Enerflex's client partners are constantly assessing ways to execute their business priorities more efficiently. To accommodate client needs and demand for Enerflex's products and services, Enerflex regularly reviews its business strategy and product offerings in the markets in which it operates.

Enerflex’s scale of operations and depth of technical expertise provides an advantage over competitors. Enerflex believes it will be successful at increasing its market share by providing quality products and services, negotiating fair prices for its products and services, developing and maintaining relationships with key client partners and suppliers, maintaining and enhancing the skill levels of its employees, and adjusting to the practices of competitors. The ability to meet these competitive pressures within a reasonable cost structure will continue to be key to Enerflex's future success.

In addition to the various business risk factors outlined in the “Risk Factors” section of this AIF, and specifically the competitive risks, investors should be aware of the following competitive conditions applicable to the Company’s operations both generally, and in each of the North America, Latin America, and Eastern Hemisphere markets.

General

The availability of major components used in the fabrication of Enerflex's products and access to skilled personnel to meet the technical and trade requirements for designing, fabricating, operating and

| |

| 13 |

maintaining these products are under increasing pressure on a worldwide basis. The Company’s global footprint assists Enerflex in managing these issues by broadening the markets in which personnel can be accessed and allowing the Company to manage its inventory levels on a larger scale, thereby improving its supply chain efficiency and security.

North America

The Engineered Systems market in the USA and Canada is highly competitive.

The Company encounters several global competitors in the compression and processing fabrication business, and a number of smaller regional competitors. Larger companies operate across more regions while offering products and services that compete with Enerflex, whereas smaller companies typically focus their resources on one competitive offering within a specific region.

Enerflex is able to effectively leverage its North American Engineered Systems capabilities to serve global customers with modular solutions. Enerflex expects the USA market to continue providing the Company with opportunities to supply compression, processing, low-carbon, and electric power solutions, from its Houston and Broken Arrow fabrication facilities. In Canada, an anticipated increase in gas egress capacity is expected to yield opportunities for Enerflex’s Engineered Systems business, however a reduction in near-term investments by some of the Company’s client partners has reduced demand for capital equipment, thereby heightening competitive pressures in this market.

Similar to the Engineered Systems business, the Energy Infrastructure market in the USA is highly competitive. By continuing to offer contract compression clients competitively priced and readily available equipment, availability guarantees, exceptional service, and flexibility, the Company expects to continue to grow its market share in the US Energy Infrastructure business.

In Canada and the USA, the Company has also developed expertise in electric power solutions. This expertise has been leveraged to secure natural gas-fired power generation opportunities in the oil and gas industry, as well as non-related industries, such as greenhouses, malting applications, and landfill gas-to-power. Enerflex has the experience and expertise to reconfigure or retrofit, replace, or upgrade natural gas-fired engines, electric motors, and compression equipment to optimize performance.

Enerflex is a market leader in the North American After-Market Services market with an extensive branch network to maintain proximity to client partner locations.

Latin America

In Latin America, the development of natural gas production and buildout of natural gas infrastructure in key gas producing markets such as Argentina, Mexico, Brazil, and the Andean countries (Colombia, Bolivia, and Peru), provide opportunities for Enerflex to further expand all product offerings. The Company believes that Latin America will continue to offer opportunities to expand as client partners look to grow natural gas production for both domestic consumption and export, but it is facing increasing competition from new market entrants. Enerflex sees opportunities for projects related to gas compression, treatment and processing, and electric power generation.

Eastern Hemisphere

In the Eastern Hemisphere, Enerflex generally faces the same competitors as in North America, with many significant North American compression and processing equipment fabricators pursuing international opportunities. In addition, the Company faces increased competition from new players operating in the Eastern Hemisphere.

| |

| 14 |

Enerflex’s operations in the Eastern Hemisphere are underpinned by its Engineered Systems products, which are offered to client partners either as sales offerings or BOOM projects with associated operations and maintenance contracts. In addition, the Company’s operations in the Eastern Hemisphere include Water Treatment projects. Enerflex anticipates growth in the Middle East and Africa market, with opportunities in Energy Infrastructure and Engineered Systems, as well as After-Market Service opportunities. Enerflex is well positioned to offer Energy Infrastructure solutions, equipment and facility sales, and After-Market Services, including operations and maintenance contracts, through its branch network covering the region.

In Asia Pacific, Enerflex remains well-positioned to service and maintain the compression equipment installed in the region and to capitalize on the expanding natural gas infrastructure and power generation needs of the region.

INTANGIBLE PROPERTIES

Internally developed product designs, specifications, fabrication processes and techniques, technologies, and client relationships are of significant value to Enerflex. These intangible assets combine to form the intrinsic value associated with the various products and brand names employed by Enerflex. The effectiveness of Enerflex's business and, indirectly, the brand and product names, are reflected in the revenue and gross margin attained in the corresponding business units.

CYCLES AND SEASONALITY

While demand for Enerflex's products and services is largely a function of the supply, demand, and price of natural gas and other commodities, other factors may affect the business, either positively or negatively. See “Risk Factors”.

Natural gas prices are determined by supply, demand, and government regulations relating to natural gas production and processing. The market for capital goods used by natural gas producers is cyclical and, at times, highly volatile. Enerflex is structured to be profitable in both high and low periods of the energy cycle due to the recurring nature of its business, product breadth, international diversification, and flexible workforce.

The energy service sector in Canada and in northern USA has a distinct seasonal trend in activity levels which results from well-site access and drilling pattern adjustments to take advantage of weather conditions. The southern USA, Eastern Hemisphere, and Latin America segments are not significantly impacted by seasonal variations. As a result of such seasonal variations, Enerflex’s Engineered Systems product line has experienced higher revenue in the fourth quarter of each year while Energy Infrastructure and After-Market Services product line revenue tend to be more stable throughout the year. Energy Infrastructure revenue is also impacted by both the Company’s and its client partners’ capital investment decisions. Variations from these trends usually occur when hydrocarbon energy fundamentals are either improving or deteriorating.

ECONOMIC DEPENDENCE

For the year ended December 31, 2024, the Company had no individual client partner which accounted for more than 10 per cent of its revenue. Enerflex is committed to building strong relationships with suppliers and recognizes that success is achieved by fostering trust and respect between the parties. Enerflex has

| |

| 15 |

developed an effective, competitive bidding process to provide opportunities for all new and existing suppliers. Enerflex is not substantially dependent on any single supplier.

CHANGES TO CONTRACTS

No aspect of the Company's business is reasonably expected to be materially affected by renegotiation or termination of contracts or sub-contracts.

In the second quarter of 2024, Enerflex issued a notice of Force Majeure to a customer following a drone attack that resulted in fatalities in proximity to a cryo project in Kurdistan, Northern Iraq. Work at the site was suspended and Enerflex demobilized its personnel.

In the following months, Enerflex worked collaboratively with its customer to evaluate the situation and assess potential options to complete the project notwithstanding the prevailing security situation at the project site. Despite these efforts, Enerflex received notice in August 2024 that its customer intended to terminate the EH Cryo project contract with effect as of September 8, 2024. Enerflex views the purported termination as a wrongful attempt by its customer to circumvent Enerflex’s contractual rights to suspend performance while the project site was unsafe; a conclusion that was supported by expert security input. In November 2024, Enerflex provided its customer with formal notice of termination of the project contract. Enerflex is seeking recovery of amounts owing in connection with the EH Cryo project. See “Legal Proceedings”.

EMPLOYEES

Enerflex had approximately 4,600 active employees worldwide as at December 31, 2024.

BOOKINGS AND BACKLOG

This section contains references to the terms “Engineered Systems bookings and backlog” and “Energy Infrastructure contract backlog”, which are not recognized measures and have no standard meaning under IFRS and are unlikely to be comparable to similar measures presented by other issuers. See “Non-IFRS Measures”. Additional disclosures regarding these non-IFRS measures are provided in the MD&A for the year ended December 31, 2024, which is available on Enerflex’s website and under the electronic profile of the Company on SEDAR+ and EDGAR, and are incorporated by reference in this AIF.

Engineered Systems Bookings and Backlog

Enerflex monitors its Engineered Systems bookings and backlog as indicators of future revenue generation and business activity levels for the Engineered Systems product line. Engineered Systems bookings are recorded in the period when a firm commitment or order is received from clients. Bookings increase backlog in the period they are received, while revenue recognized on Engineered Systems products decrease backlog in the period the revenue is recognized. Accordingly, Engineered Systems backlog is an indication of revenue to be recognized in future periods. Revenue from contracts that have been classified as finance leases for newly built equipment is recorded as Engineered Systems bookings. The full amount of revenue is removed from backlog at commencement of the lease.

Enerflex recorded bookings of $1.4 billion during the twelve months ended December 31, 2024, increasing from the $1.3 billion recorded during the twelve months ended December 31, 2023.

| |

| 16 |

Engineered Systems backlog of $1.3 billion at December 31, 2024, increased from a backlog of $1.1 billion at December 31, 2023, attributable to steady client activities in the Engineered Systems business. Processing orders represent approximately 45 percent of Enerflex’s backlog at December 31, 2024.

Enerflex’s backlog of $1.3 billion as at December 31, 2024, provides strong visibility for the Engineered Systems business and the Company expects near-term revenue for the Engineered Systems business to remain steady. Enerflex is encouraged by initial customer response to improved natural gas prices in North America and the medium-term outlook for Engineered Systems products and services continues to be attractive, driven by expected increases in natural gas and produced water volumes across Enerflex’s global footprint. Engineered Systems bookings and backlog by reporting segment are disclosed in the “Segmented Results” section of the MD&A for the year ended December 31, 2024.

Energy Infrastructure Contract Backlog

The Company’s Energy Infrastructure contract backlog is recognized from lease agreements executed with clients for leasing and/or operations and maintenance of the Company’s Energy Infrastructure assets. Lease agreements executed during the period increases Energy Infrastructure contract backlog while revenue recognized on Energy Infrastructure products decreases the Energy Infrastructure contract backlog in the period the revenue is recognized.

Enerflex has lease agreements with clients for Energy Infrastructure assets with initial terms ranging from one to 10 years.

The following table sets forth Energy Infrastructure contract backlog by reporting segment:

| | | | | | | | | | | | |

| | December 31, 2024 | | | December 31, 2023 | | | January 1, 2023 | |

$ millions | | ($) | | | ($) | | | ($) | |

North America | | | 136 | | | | 83 | | | | 60 | |

Latin America | | | 458 | | | | 496 | | | | 783 | |

Eastern Hemisphere | | | 951 | | | | 1,121 | | | | 1,275 | |

Total Energy Infrastructure contract backlog | | | 1,545 | | | | 1,700 | | | | 2,118 | |

Enerflex reported Energy Infrastructure contract backlog of $1.5 billion at December 31, 2024, a decrease when compared to the backlog of $1.7 billion at December 31, 2023. The decrease is largely due to conversion of an operating lease that is now accounted for as a finance lease due to a contract extension and modification in the first quarter of 2024 in the Eastern Hemisphere, and revenue recognition from existing contracts in the Eastern Hemisphere and Latin America. North America’s backlog increased as a result of new contracts.

SUSTAINABILITY

The demand for reliable and innovative energy infrastructure is increasing globally – and Enerflex’s natural gas and treated water solutions support its client partners through this changing landscape. Deploying sustainable energy solutions is key to Enerflex’s strategy, which is reinforced by its strong governance practices and dedicated focus on ESG performance.

In 2024, Enerflex published its first stand-alone Sustainability Report. The most recent Sustainability Report, showcasing Enerflex’s progress towards its ESG commitments and the significance of sustainability to Enerflex’s business and stakeholders, may be found on Enerflex’s website at www.enerflex.com.

| |

| 17 |

The Energy Transition

Natural Gas in the Energy Transition

Enerflex is committed to helping the energy sector transform for a sustainable future. As global energy demand continues to outpace supply from new renewable capacity, Enerflex firmly believes that natural gas will play a critical role in the ongoing energy transition resulting from its reliability, abundance, affordability, and efficiency.

Enerflex’s Low-Carbon Solutions

Enerflex’s expertise in modularized gas-handling solutions extends to a 45-year history in designing and fabricating low-carbon infrastructure, including for CCUS, electrification, bioenergy, methane management, and hydrogen solutions. Having executed over 175 low-carbon projects, Enerflex remains a trusted partner in supporting its clients’ decarbonization ambitions.

ESG at Enerflex

Stakeholder Engagement

Stakeholder engagement is essential to understanding mutual interests, fortifying relationships, and identifying priorities. Enerflex is committed to understanding the implications of its operations and managing them responsibly. The Company actively engages with a broad spectrum of stakeholders, including employees, investors, client partners, and local communities, utilizing a variety of communication channels. Whether through social media, the website, press releases, in-person meetings, employee townhalls, or webcasts, Enerflex prioritizes transparent and consistent communication.

Specific to sustainability initiatives, as part of a recent sustainability materiality assessment Enerflex engaged with and gathered insights from over 130 stakeholders, including employees, client partners, and investors, to understand how they prioritize various sustainability topics and how impactful each topic was to Enerflex. One-on-one interviews were conducted with select stakeholders to further understand their priorities and identify emerging trends. The results of the materiality assessment were reviewed by the Executive Management Team and the Board of Directors, and the feedback was utilized to further develop the Company’s sustainability strategy.

Sustainability Committee

In further support of Enerflex’s journey towards a sustainable future, the Company has established a Sustainability Committee. This team, comprising of members from various regions and functional groups and from across the Company, is focused on ESG initiatives, ensuring that sustainability is woven into Enerflex’s operations. The Committee meets quarterly to discuss ongoing projects and to plan strategic steps forward.

Environmental

Emissions Management

Enerflex’s emissions management strategy follows the GHG Protocol - Corporate Accounting and Reporting Standard (the GHG Protocol), focusing on reducing enterprise-wide emissions and Enerflex’s global emissions profile. Enerflex has established 2023 as the base year for reporting verifiable emissions, reflecting typical operations post-integration of Exterran in October 2022. Direct Scope 1 emissions primarily stem from owned and controlled assets, including combustion sources and fugitive emissions (cars and refrigerants). Indirect Scope 2 emissions are calculated from electricity purchased for consumption by Enerflex. Enerflex’s Scope 2 emission data is based

| |

| 18 |

on the GHG Protocol’s recommended location-based method with country-specific factors and province or state-specific factors for Canada and the United States, respectively. All emissions from Enerflex’s contract compression fleet and BOOM facilities are controlled by the client partners who use and control the operation of the assets.

Enerflex collects emissions data across all its locations and centrally aggregates it for analysis, verification, and completeness. CO2, CH4, and N2O emissions are monitored using IPCC AR5 factors. Enerflex limits its GHG emissions wherever possible.

To reduce its emissions, Enerflex prioritizes actions like purchasing low VOC paint and implementing enterprise-wide policies to limit standby running of vehicles and equipment. Enerflex does not currently exceed the applicable thresholds for mandatory emissions reporting or reduction initiatives in its jurisdictions of operations. The Company’s internal ESG commitments include voluntary reporting on its GHG emissions in accordance with the methodologies described above.

Chemicals Management

Enerflex’s operations utilize chemicals commonly used in standard manufacturing and after-market services activities. Chemicals are handled, labeled, and stored within controlled environments to prevent contamination, spills, and other hazards aligned with applicable regulations and Company standards. In addition, Spill Prevention and Response Policies and Procedures are implemented throughout the organization to effectively manage the prevention of spills and releases and provide response strategies to minimize environmental impact. Spill kits are available at Enerflex sites to control, contain, and clean-up material released from containment to ensure swift remediation action. In the event of a spill or release, incidents are documented and reported in accordance with local requirements. Employee training is provided and varies based on type of chemical exposure by job position or specific workplace to ensure adequate chemical management skills and knowledge.

Environmental Impact

To promote sustainability and environmental stewardship, Enerflex has launched several initiatives across its global operations. This commitment is crucial not only in the projects undertaken with client partners but also in assessing Enerflex’s operational footprint, which notably does not demand extensive land use.

Minimizing the environmental impact of its activities is important to the Company’s pursuit of sustainable value creation for all stakeholders, including the local communities within which Enerflex operate. The Company’s locations take various steps to uphold this commitment. For example, where underground storage tanks are required for new Energy Infrastructure projects in Latin America, Enerflex specifications mandate the use of double-walled tanks. Compliance with regional environmental regulations is a priority for all Enerflex locations and is closely monitored to proactively comply with applicable regulations and any changes or updates.

Energy Use

Eliminating energy waste and maximizing efficient energy use are crucial steps in Enerflex’s sustainability efforts and the Company actively works to minimize waste wherever possible, contributing to a more sustainable future.

Biodiversity

Understanding the importance of biodiversity, Enerflex has implemented educational programs to ensure local environmental considerations and regulations are understood by employees in

| |

| 19 |

ecologically sensitive locations. Through these initiatives, the Company can partner with clients from the initial design phase to determine areas to eliminate or limit impacts on local environments.

Water Management

Water management is a principal focus for Enerflex, both in its own facilities and in the operations at client partners’ facilities. Leading by example through water conservation measures at select locations, including through water recycling, Enerflex continues to innovate in its efforts to ensure responsible water usage. Enerflex recognizes the value of water conservation and has implemented initiatives to reduce freshwater consumption and repurpose alternative water sources across its operations.

Waste Management

Enerflex is dedicated to implementing waste management practices that meet or exceed regulatory standards and exemplify the Company’s commitment to environmental responsibility and sustainability. This includes an approach to hazardous and non-hazardous waste management that ensures compliance with regulations. Additionally, Enerflex is proactive in reducing waste through state-of-the-art print authentication technologies, and encourages employees to adopt sustainable habits, such as using reusable water bottles and recycling and composting where available. These initiatives, adapted to address the specific environmental challenges and opportunities of each region in which the Company operates, underscore its dedication to sustainable practices across all areas of the business.

Social

Health and Safety

At Enerflex, commitment to health and safety is a team effort and is supported at every level—from the boardroom to the frontline. Acknowledging regional regulatory variations, Enerflex strategically capitalizes on its scale of experience and commonalities throughout its global operations, fostering collaboration and sharing knowledge across diverse regions. With the support of the Board of Directors, the Company’s approach is promoted by the Senior Vice President and General Counsel who, as executive sponsor of the HSE group, is dedicated to leading collaboration among HSE teams.

Health and Safety Teams

Enerflex’s approach to health and safety is integrated into its operations, with dedicated HSE teams situated in each region supporting local personnel and operations. These teams, led by experienced leaders familiar with Enerflex’s standards, regional safety regulations, and other requirements, report directly to the Regional Presidents. This structure ensures the Company’s commitment to HSE standards is consistently upheld and engrained in its operations.

Health and Safety Management System

Enerflex is committed to safety excellence across all its operations. The Company’s Occupational Health and Safety Management Systems in each region adhere to internationally recognized risk management standards organized and implemented in a way to ensure all Company, customer, and local, state, and national regulatory requirements are met. Maintaining thirteen certifications in ISO 45001 throughout its operations in 2024 ensures Enerflex’s compliance with a robust management system framework designed to systematically assess workplace hazards and implement risk controls measures to protect employees and continually improve performance.

| |

| 20 |

Enerflex encourages a culture of safety leadership and accountability from all employees and has assigned roles and responsibilities in health, safety, and environmental requirements to achieve leadership and ownership at all levels of the organization.

Safety Meetings

Safety meetings allow communication between workers and management and create opportunities for employees and contractors to raise concerns, discuss improvement ideas, and provide feedback on HSE matters. At Enerflex, these meetings come in a variety of forms, including job hazard assessments, daily facility or kick-off meetings, site toolbox or tail gate meetings, weekly/bi-weekly/monthly management meetings, and HSE Committee meetings.

Safety and Welfare Committees throughout the organization encourage worker participation. The committees are made up of representatives from all levels at the applicable site, including management. They meet at regularly scheduled intervals to review and discuss incidents, inspection findings, Aware Card observations, training, trends, and recommendations.

HSE Audits and Inspections

Regular HSE audits and inspections are an integral part of Enerflex’s operations, with responsibilities shared by all employees. From informal daily inspections to external ISO certification audits, several types of audits and inspections are periodically conducted to ensure continued compliance with applicable regulations, client partner expectations, and the Company’s own standards.

Hazard Identification

Enerflex’s risk assessment and job hazard analysis procedures are grounded in a systematic, task-based approach that involves continually identifying and mitigating hazards and the risks they present. Through these processes, the Company seeks out, assesses, controls, monitors, reduces, and eliminates hazards and risks. As a result, controls, safe work practices, operating procedures, and safeguards are implemented based on an evaluation of potential elimination, substitution, isolation, engineering changes, and administrative options for minimizing known risks. Leadership teams regularly participate in and review the results of these processes to ensure quality and continued improvement.

Catastrophic Risk Mitigation

Enerflex implements quality management systems at all manufacturing facilities to reduce the probability that equipment may be involved in catastrophic events that could impact human health, local communities, and/or the environment. These systems are certified to ASME Section VIII to ensure that Enerflex produces safe, operable equipment and packages in accordance with the governing standards and client partner specifications. At Enerflex manufacturing facilities, all welders and weld procedures are certified to the requirements of ASME Section IX. Process pipe is designed and fabricated to ASME B31.3, pressure vessels are designed and fabricated to ASME Section VIII, and both process piping and pressure vessels undergo non-destructive testing as well as pressure testing. Numerous quality checks of critical items are conducted and documented during the fabrication, assembly, coating, and shipping of Enerflex equipment.

For BOOM projects requiring installation in the field, Enerflex designs and installs safety systems in adherence with client partner requirements and the applicable design codes.

Emergency Readiness & Crisis Management

Enerflex’s comprehensive and dynamic approach to managing the risks associated with its operations includes robust preparedness and emergency response policies, plans, and procedures

| |

| 21 |

implemented throughout all operating regions to ensure standardized on-site emergency response and management.

Although most incidents are managed at a local level, others might expand to multi-disciplinary levels requiring additional resources and operational support provided by the Company’s Global Emergency Response and Preparedness Policy, initiation of which would engage executive leadership to ensure sufficient resources are available to support in the event of an incident.

Aware Card Program

Enerflex’s Aware Card Program plays a crucial role in its hazard identification and risk assessment process. This Behavior-Based Safety initiative allows employees at all levels to report safe and unsafe conditions related to work and behavior. It encourages open conversations or interventions to either correct or affirm behaviors, thereby promoting a culture of transparency and improvement.

Reporting and Investigation

Enerflex has a robust reporting system for all unplanned events, incidents, occupational illnesses, and near misses. Policies and procedures are in place establishing requirements for reporting and investigating incidents, completing root cause analyses, implementing corrective actions, and communicating lessons learned. These integrated processes are key to reducing or eliminating hazards and systematic causes and preventing recurring or future incidents.

Safety Performance Evaluation

Evaluating Enerflex’s safety performance is an integral part of the Company’s approach to its Environmental, Social, and Governance responsibilities. The Company’s occupational health and safety performance is monitored, reviewed, and continually improved by utilizing investigation and audit learnings, and evaluating industry best practices.

Driver Safety

With hundreds of vehicles on the road, and over 30 million kilometers driven in 2024, safe driving practices are a key area of focus for Enerflex’s operational and HSE teams across the globe.

The Company has established policies, procedures, and standards for journey management and safe vehicle operation, training employees comprehensively. Regular inspections and maintenance keep vehicles in top condition, ensuring safety for drivers. Telematics, including in-vehicle monitoring systems, track driver performance and can target speeding, harsh driving behaviors, and use of seatbelts. This approach not only bolsters driver safety with targeted coaching and recognition programs but also supports compliance, cuts down on maintenance expenses, minimizes violations, and reduces incident risks.

Talent Management

In 2024, employees participated in approximately 2,100 hours of leadership training, skills, and career development courses.

Strong human capital resources are critical to Enerflex’s success. The Company demonstrates its commitment to its employees by its efforts in recruiting, retention, and development.

Attract

Enerflex recognizes that its employees are its most valuable assets and essential to its success. The Company is committed to attracting top talent through a robust referral network, engaging recruitment experiences, and a global presence that appeals to diverse talent pools. These efforts underscore Enerflex’s goal to foster growth, innovate, and collaborate across its global teams.

| |

| 22 |

Enerflex invests significantly in talent attraction strategies to maintain its competitive edge. By leveraging its strong employer brand, the Company has positioned itself as an employer of choice in the energy sector.

Enerflex recognizes the importance of building a sustainable talent pipeline through partnerships with educational institutions. Across its operating regions, the Company collaborates with universities and trade schools to connect with emerging talent, offering internships, co-op programs, apprenticeships, and sponsorship opportunities. These partnerships not only provide students with valuable industry experience but also position Enerflex as an employer of choice among future professionals.

Retain

Enerflex’s commitment to employee retention is reflected in its ability to cultivate a supportive and rewarding work environment, resulting in a 2024 average enterprise employee tenure of over eight years. Enerflex’s total rewards strategy is designed to attract, motivate, and retain employees through a balanced mix of monetary and non-monetary benefits. The Company’s regionally-tailored strategy, aligned with its vision and values, includes competitive compensation, performance and recognition programs, benefits programs, employee pension and savings plans, development opportunities, and work-life effectiveness. By linking rewards to performance and aligning employees’ interests with those of shareholders, Enerflex cultivates a culture of excellence and growth.

Enerflex’s performance management practices focus on fostering a culture of continuous improvement and meaningful dialogue between employees and their leaders. The process is fair and transparent, with regular one-on-one conversations between managers and employees to discuss successes, challenges, and development opportunities. These high-quality discussions align individual contributions with Enerflex’s strategic goals, supporting employee growth and strengthening talent retention. Enerflex ensures employees not only feel valued but also see a clear path for their future within the organization.

Career Development Program

Enerflex is invested in the professional growth of its employees. The Career Development Program reflects the Company’s commitment to building a high-performing, engaged workforce. It focuses on offering tailored learning opportunities to meet diverse employee needs. From robust technical training to leadership programs, employees have access to a variety of development resources designed to foster professional and personal growth. By offering equitable opportunities for growth and leadership development, the Company ensures employees have the tools they need to thrive, which contributes to both individual and organizational success.

To ensure the Company’s values are reflected in every decision, Enerflex makes Values-Based Decision-Making training available to all employees. This program equips the team with the tools needed to navigate complex decisions and align outcomes with Enerflex’s core values, while maintaining the highest ethical standards. It encourages employees to ask, "Is this the right thing to do?" and sets an example for others to follow.

Engagement

Employee engagement is at the heart of Enerflex’s people strategy, fostering a workplace where individuals feel valued, connected, and motivated to contribute their best. Through numerous regional and global initiatives such as recognition programs, scholarships, community involvement, team building activities, and wellness support, Enerflex builds a culture of collaboration and mutual respect. These efforts not only enhance job satisfaction but also strengthen bonds among

| |

| 23 |

employees, creating a unified and purpose-driven workforce. By prioritizing engagement, Enerflex ensures every team member is empowered to thrive both personally and professionally.

Diversity, Equity & Inclusion

Enerflex believes that diversity, equity, and inclusion are fundamental to building a thriving and innovative workforce. With operations in more than 70 locations and employees spanning diverse backgrounds, cultures, and experiences, Enerflex cares deeply about fostering an inclusive environment where every individual feels valued and respected – balancing the approach with both fairness and meritocracy. Enerflex is committed to eliminating barriers, celebrating differences, and empowering all employees to reach their full potential as they contribute to Enerflex’s success.

Enerflex is also committed to providing employees with a safe and respectful workplace, fostering an environment conducive to meaningful contributions. The Company’s global Respectful Workplace Policy outlines Enerflex's expectations for a workplace free from harassment, discrimination, and violence.

Enerflex takes great pride in celebrating its global diversity through community engagement and cultural celebrations. These events strengthen bonds among employees and reinforce Enerflex’s commitment to inclusivity. With a workforce spanning multiple continents, the Company embraces the rich traditions and cultures that each region brings to its global identity. Enerflex actively promotes initiatives that encourage cultural exchange and understanding, creating an environment where employees feel valued for their unique contributions.

Supply Chain Management

Enerflex prioritizes the integrity and sustainability of its supply chain, believing that a strong and resilient supply chain is critical to delivering sustainable value to stakeholders. Oversight is a key component of the Company’s strategy for its supply chain, with Regional Supply Chain personnel, adapting their approach based on region size and business priority, and subsequently dividing responsibilities into distinct business units.

Enerflex’s supplier onboarding process involves due diligence, including, where appropriate, an examination of OSHA standards, safety protocols, and quality benchmarks before engagement. International suppliers undergo further assessments to ensure alignment with legal, social, safety, and environmental policies. Each region maintains standards for purchase orders and supplier engagement. Additionally, a formal documentation process is in place for quality assurance, enabling a proactive approach to addressing any quality issues that may arise with suppliers. Lastly, periodic site visits and audits are conducted for select suppliers, affirming Enerflex’s dedication to upholding the highest standards in its supply chain practices.

Modern Slavery and Human Rights

In line with a broader dedication to fostering ethical business practices and prioritizing employee well-being, Enerflex is committed to preventing the occurrence of modern slavery in its supply chains and business operations. Upholding human rights aligns seamlessly with the Company’s core values and informs its operations. The Company’s Modern Slavery and Human Trafficking Policy solidifies its pledge to abstain from knowingly participating in modern slavery, encompassing various forms of exploitation like human trafficking, forced or involuntary labor, unlawful recruitment, and slavery-like practices such as debt-bondage and servitude.

Enerflex publishes a report on the steps taken to prevent and reduce the risk that forced labour or child labour is used at any step of the production of goods in Canada by Enerflex or of goods imported

| |

| 24 |

into Canada by Enerflex. A current copy of the full report may be found on Enerflex’s website at www.enerflex.com.

Community Engagement

Enerflex is dedicated to making a lasting positive impact in communities in which it operates. Through three pillars of support—Education, Childhood Cancer, and Local Communities—the Company aims to help create a brighter future. These pillars show Enerflex’s commitment to giving back and its belief in the power of sustainable practices to improve the communities Enerflex proudly serves.

Governance

Board of Directors

Enerflex and its culture of operational excellence are built upon a solid foundation of robust governance policies and practices. This foundation is upheld by a skilled, experienced, and diverse Board of Directors. The Board plays a crucial role in overseeing and guiding the Company’s strategic direction.

The Board has three standing committees:

•Human Resource and Compensation Committee

•Nominating and Corporate Governance Committee

Governance Structure

See “Board of Directors”.

Audit Committee

The Audit Committee oversees Enerflex’s financial statements and related disclosures, reports to shareholders, continuous disclosures, and other related communications. The Audit Committee also establishes appropriate financial policies, ensures the integrity of accounting systems and internal controls, and monitors and directs, as appropriate, the activities of the internal audit group. The Audit Committee oversees the work of and approves all audit and non-audit services provided by the independent auditor and consults directly with the auditor (independent of Management) as required. Finally, the Audit Committee is also responsible for overseeing Enerflex’s compliance, cybersecurity, and information technology programs. Each member of the Audit Committee is independent. See “Audit Committee” on page 55.

HRC Committee

The HRC Committee is responsible for reviewing and making recommendations as to the compensation of executive officers and other senior management, and as to the Company’s short- and long-term incentive programs, pension, and other benefit plans. Compliance with the Code of Conduct, Respectful Workplace Policy, and HSE programs, is also an oversight responsibility of the HRC Committee. Further, the HRC Committee oversees executive officer appointments, performance evaluations of the Chief Executive Officer, and executive development. On an annual basis, it receives a detailed presentation concerning succession planning for the Executive Management Team and development of key talent within each region as well as at the corporate head office. Each member of the HRC Committee is independent.

| |

| 25 |

NCG Committee

The NCG Committee plays a crucial role in corporate governance by assessing the effectiveness of the Board of Directors, its size and composition, and its committees, reviewing the competencies, skills, and diversity (including, but not limited to, business experience, geography, age, gender, and ethnicity) necessary for the Board as a whole to possess, and assessing the Board’s relationship to Management. The NCG Committee evaluates director compensation and oversees both the training and orientation of new directors and the continuing education of current directors under applicable Enerflex policies. The NCG Committee reviews regulatory changes and governance best practices, aligning Enerflex’s governance policies and practices as appropriate. Finally, the NCG Committee also oversees Enerflex’s ESG and sustainability disclosures in advance of full Board consideration. The Chair of the NCG Committee assesses the individual performance and contributions of the Chair of the Board, with the assessment of the individual performance and contributions of the remaining independent directors overseen by the Chair of the Board. Each member of the NCG Committee is independent.

Sustainability Governance

The Board of Directors adopts a collaborative and forward-thinking approach to the oversight of sustainability matters, acknowledging their far-reaching impact that transcends conventional corporate structures. The Board integrates sustainability oversight into its existing framework, enabling a thorough evaluation of risks and opportunities that align with the mandates of relevant board committees. This collective effort ensures comprehensive oversight of the Company’s sustainability practices and policies, encompassing disclosures, strategies, programs, initiatives, and practices.

Risk Management

Enterprise Risk Management (ERM) is a fundamental driver of sustainable value for the Company and its stakeholders. The Board has the responsibility to oversee and monitor risk across the organization and ensure implementation of appropriate ERM systems to monitor and manage those risks with a view to the long-term viability of the Company. The Board oversees management’s identification and evaluation of Enerflex’s principal risks and the implementation of policies, processes, and systems to manage or mitigate the risks, to achieve an appropriate balance between the risks incurred and potential benefits to the Company’s stakeholders.