As filed with the Securities and Exchange Commission on May 12, 2023.

Registration No. 333-

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM S-1 |

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |

| |

| Treasure Global Inc |

| (Exact name of registrant as specified in its charter) |

| Delaware | 7389 | 36-4965082 |

(State or Other Jurisdiction of

Incorporation or Organization) | (Primary Standard Industrial

Classification Code Number) | (I.R.S. Employer Identification No.) |

| 276 5th Avenue, Suite 704 #739 |

| New York, New York 10001 |

| +6012 643 7688 |

| (Address, including zip code, and telephone number, including area code, |

| of registrant’s principal executive offices) |

| Chong Chan “Sam” Teo |

| Chief Executive Officer |

| Treasure Global Inc |

| 276 5th Avenue, Suite 704 #739 |

| New York, New York 10001 |

| +6012 643 7688 |

| (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copies to:

Carmel, Milazzo & Feil LLP

55 West 39th Street, 4th Floor

New York, New York 10018 USA

(646) 838-1310

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| | Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ¨

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated May 12, 2023

PRELIMINARY PROSPECTUS

22,880,000 Shares of Common Stock

This prospectus relates to the offer and sale from time to time of up to 22,880,000 shares of our common stock, par value $0.00001 per share, by YA II PN, Ltd., a Cayman Islands exempt limited partnership (the “Selling Stockholder”) which may be issued upon conversion of unsecured convertible debentures in the aggregate principal amount of $5,500,000 which the Selling Stockholder agreed to purchase from us in a private placement pursuant to a Securities Purchase Agreement, dated as of February 28, 2023, that we entered into with the Selling Stockholder.

The convertible debentures consist of two tranches. The first tranche was issued in the principal amount of $2,000,000 (the “First Convertible Debenture”) on February 28, 2023 and the second tranche will be issued in the principal amount of $3,500,000 (the “Second Convertible Debenture” and together with the First Convertible Debenture, the “Convertible Debentures”) shortly after the effective date of the registration statement related to this prospectus, in each case, to the Selling Stockholder in reliance upon an exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”) pursuant to Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D thereunder. Upon the conversion of the Convertible Debentures the shares of common stock offered by this prospectus have been or will be issued in reliance upon an exemption from the registration requirements of the Securities Act pursuant to Section 3(a)(9) of the Securities Act. We are registering the offer and resale of the Shares to satisfy our obligations under a registration rights agreement that we entered into with the Selling Stockholder.

No underwriter or other person has been engaged to facilitate the sale of the common stock in this offering. The Selling Stockholder may offer all or part of the common stock for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. The shares of common stock offered by the Selling Stockholder are being registered to permit the Selling Stockholder to sell such shares from time to time, in amounts, at prices and on terms determined at the time of offering.

The Selling Stockholder may sell these shares of common stock through ordinary brokerage transactions, directly to market makers of our common stock or through any other means described in the section entitled “Plan of Distribution” herein. In connection with any sales of common stock offered hereunder, the Selling Stockholder, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (“Securities Act”). We do not know when or in what amounts the Selling Stockholder may offer any common stock for sale. The Selling Stockholder may sell any, all or none of the securities offered by this prospectus. All of the common stock offered by the Selling Stockholder pursuant to this prospectus will be sold by the Selling Stockholder for its account.

We will not receive any proceeds from the sale of any common stock by the Selling Stockholder. We will pay certain expenses associated with the registration of the securities covered by this prospectus, as described in the section entitled “Plan of Distribution.”

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), and are subject to reduced public company reporting requirements. This prospectus complies with the requirements that apply to an issuer that is an emerging growth company.

Our common stock is listed on The Nasdaq Capital Market (“Nasdaq”) under the symbol “TGL.” The last reported sale price of one common share on the Nasdaq on May 11, 2023 was $1.58.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required by applicable law or regulation. In addition, certain information is incorporated into, and made a part of, this prospectus. You should read this entire prospectus and any amendments or supplements, plus all incorporated information carefully before you make your investment decision.

We will bear all costs, expenses and fees in connection with the registration of the shares of common stock. The Selling Stockholder will bear all commissions and discounts, if any, attributable to their sales of the shares of common stock.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 10 of this prospectus for a discussion of information that should be considered in connection with an investment in our common stock.

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated [*], 2023

Table of Contents

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment. Neither we, nor the Selling Stockholders, have authorized any other person to provide you with any information or to make any representations other than those contained in this prospectus, any post-effective amendment, or any applicable prospectus supplement prepared by or on behalf of us or to which we have referred you. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor the Selling Stockholders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should assume that the information contained in this prospectus, any post-effective amendment, or any applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of any securities in any jurisdiction in which such offer is unlawful.

No action is being taken in any jurisdiction outside the United States to permit a public offering of our common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this public offering and the distribution of this prospectus applicable to that jurisdiction.

ABOUT THIS PROSPECTUS

Throughout this prospectus, unless otherwise designated or the context suggests otherwise,

| | ● | all references to the “Company,” “TGI,” the “registrant,” “we,” “our,” or “us” in this prospectus mean Treasure Global Inc and its subsidiaries; |

| | ● | “year” or “fiscal year” means the year ending June 30th; |

| | ● | all dollar or $ references, when used in this prospectus, refer to United States dollars; and |

| | ● | all RM or MYR references, when used in this prospectus, refer to Malaysian Ringgit. |

We own or have rights to trademarks, trade names and service marks that we use in connection with the operation of our business. In addition, our name, logos and website name and address are our trademarks or service marks. Solely for convenience, in some cases, the trademarks, trade names and service marks referred to in this prospectus are listed without the applicable ®, ™, but we will assert, to the fullest extent under applicable law, our rights to these trademarks, trade names and service marks. Other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

MARKET INFORMATION

Our common stock is listed on Nasdaq under the symbols “TGL.” As of May 12, 2023, there were approximately 28 holders of record of our common stock.

PROSPECTUS SUMMARY

This summary provides a brief overview of the key aspects of our business and our securities. The reader should read the entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors.” Some of the statements contained in this prospectus, including statements under “Summary” and “Risk Factors” as well as those noted in the documents incorporated herein by reference, are forward-looking statements and may involve a number of risks and uncertainties. Our actual results and future events may differ significantly based upon a number of factors. The reader should not put undue reliance on the forward-looking statements in this document, which speak only as of the date on the cover of this prospectus.

Solely for convenience, our trademarks and tradenames referred to in this registration statement, may appear without the ® or ™ symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights to these trademarks and tradenames. All other trademarks, service marks and trade names included in this prospectus are the property of their respective owners.

Our Mission

Our mission is to bring together the worlds of online e-commerce and offline physical retailers; widening consumer choice and rewarding loyalty, while sustaining and enhancing our earning potential.

Our Company

We have created an innovative online-to-offline (“O2O”) e-commerce platform business model offering consumers and merchants instant rebates and affiliate cashback programs, while providing a seamless e-payment solution with rebates in both e-commerce (i.e., online) and physical retailers/merchant (i.e., offline) settings.

Our proprietary product is an internet application (or “App”) branded “ZCITY App”, which was developed through our wholly owned subsidiary, Gem Reward Sdn. Bhd. (“GEM”). The ZCITY App was successfully launched in Malaysia in June 2020. GEM is equipped with the know-how and expertise to develop additional/add-on technology-based products and services to complement the ZCITY App, thereby growing its reach and user base.

Through simplifying a user’s e-payment gateway experience, as well as by providing great deals, rewards and promotions with every use, we aim to make the ZCITY App Malaysia’s top reward and payment gateway platform. Our longer-term goal is for the ZCITY App and its ever-developing technology to become one of the most well-known commercialized applications more broadly in Southeast Asia and Japan.

As of March 28, 2023, we had over 2,442,319 registered users and over 2,008 registered merchants.

Our Consumer Business

SEA consumers have access to a plethora of smart ordering, delivery and “loyalty” websites and apps, but in our experience, SEA consumers very rarely receive personalized deals based on their purchases and behavior.

The ZCITY App targets consumers by providing personalized deals based on consumers’ purchase history, location and preferences. Our technology platform allows us to identify the spending trends of our customers (the when, where, why, and how much). We are able to offer these personalized deals through the application of our proprietary artificial intelligence (or “AI”) technology that scours the available database to identify and create opportunities to extrapolate the greatest value from the data, analyze consumer behavior and roll out attractive rewards-based campaigns for targeted audiences. We believe this AI technology is currently a unique market differentiator for the ZCITY App.

We operate our ZCITY App on the hashtag: “#RewardsOnRewards”. We believe this branding demonstrates to users the ability to spend ZCITY App-based Reward Points (or “RP”) and “ZCITY Cash Vouchers” with discount benefits at checkout. Additionally, users can use RP while they earn rewards from selected e-Wallet or other payment methods.

ZCITY App users do not require any on-going credit top-up or need to provide bank card number with their binding obligations. We have partnered with Malaysia’s leading payment gateway, IPAY88, for secure and convenient transactions. Users can use our secure platform and enjoy cashless shopping experiences with rebates when they shop with e-commerce and retail merchants through trusted and leading e-wallet providers such as Touch’n Go eWallet, Boost eWallet, GrabPay eWallet and credit card/online banking like the “FPX” (the Malaysian Financial Process Exchange) as well as more traditional providers such as Visa and Mastercard.

Our ZCITY App also provides the following functions:

| | 1. | Registration and Account verification |

Users may register as a ZCITY App user simply by using their mobile device. They can then verify their ZCITY App account by submitting a valid email address to receive new user “ZCITY Newbie Rewards”.

| | 2. | Geo-location-based Homepage |

Based on users’ location, nearby merchants and exclusive offers are selected and directed to them on their homepage for a smooth, user-friendly interaction.

Our ZCITY App is affiliated with more than 5 local services providers such as Shopee and Lazada. The ZCITY App allows users to enjoy more rewards when they navigate from the ZCITY App to a partner’s website.

| | 4. | Bill Payment & Prepaid service |

Users can access and pay utility bills, such as water, phone, internet and TV bills, while generating instant discounts and rewards points with each payment.

Users can purchase their preferred e-Vouchers with instant discounts and rewards points with each checkout.

| | 6. | User Engagement through Gamification |

Users can earn daily rewards by playing our ZCITY App minigame “Spin & Win” where they can earn further ZCITY RP, ZCITY e-Vouchers as well as monthly grand prizes.

Users can make cashless donations through our ZCITY App to the Kentang Charity, which we have collaborated with, or apply donations to other charitable entities.

ZCITY App offers a “Smart F&B” system that provides a one stop solution and digitalization transformation for all registered Food and Beverage (“F&B”) outlets located in Malaysia. It also allows merchants to easily record transactions with QR Digital Payment technology, set discounts and execute RP redemptions and rewards online on the ZCITY App

Zstore is ZCITY App’s e-mall service that offers group-buys and instant rebate to users with embedded AI and big data analytics to provide an express shopping experience.

Reward Points. Operating under the hashtag #RewardsOnRewards, we believe the ZCITY App reward points program encourages users to sign up on the App, as well as increasing user engagement and spending on purchases/repeat purchases and engenders user loyalty.

Furthermore, we believe the simplicity of the steps to obtaining Reward Points (or “RP”) is an attractive incentive to user participation in that participants receive:

| | ● | 200 RP for registration as a new user; |

| | ● | 100 RP for referral of a new user; |

| | ● | Conversion of Malaysian ringgit spent into RP; |

| | ● | 50% RP of every referred user paid amount as a result of the referral; and |

| | ● | Spin & Win eligibility to receive RP (which may be “doubled up” when participants share the Spin & Win program on social media). |

The key objectives of our RP are:

RP are offered to users for increased social engagement.

RP incentivizes users with every MYR spent in order to increase the spending potential and to build users loyalty.

Drives loyalty and greater customer engagement. Every new user onboarded will get 200 RP as a welcoming gift.

Rewards users with RP when they refer a new user

Offline Merchant

When using our ZCITY App to make payment to a registered physical merchant, the system will automatically calculate the amount of RP to deduct. The deducted RP amount is based on the percentage of profit sharing as with the merchant and the available RP of the user.

Online Merchant

When using our ZCITY App to pay utility bills or purchase any e-vouchers, our system shows the maximum RP deduction allowed and the user determines the amount of discount deducted subject to maximum deductions described below and the number of RP owned by such user.

Different features have different maximum deduction amounts. For example, for bill payments, the maximum deduction is up to 3% of the bill amount. For e-vouchers, the maximum deduction is up to 5% of the voucher amount.

In order to increase the spending power of the user, our ZCITY App RP program will credit RP to the user for all MYR paid.

Merchant Facing Business

At present, our ZCITY merchants are concentrated in the F&B and lifestyle sectors. Moving forward, we plan to expand our product/service offering to include grocery stores, convenience stores, “micro-SME” (“small to medium size enterprises”), loan programs, affiliate programs and advertising agencies.

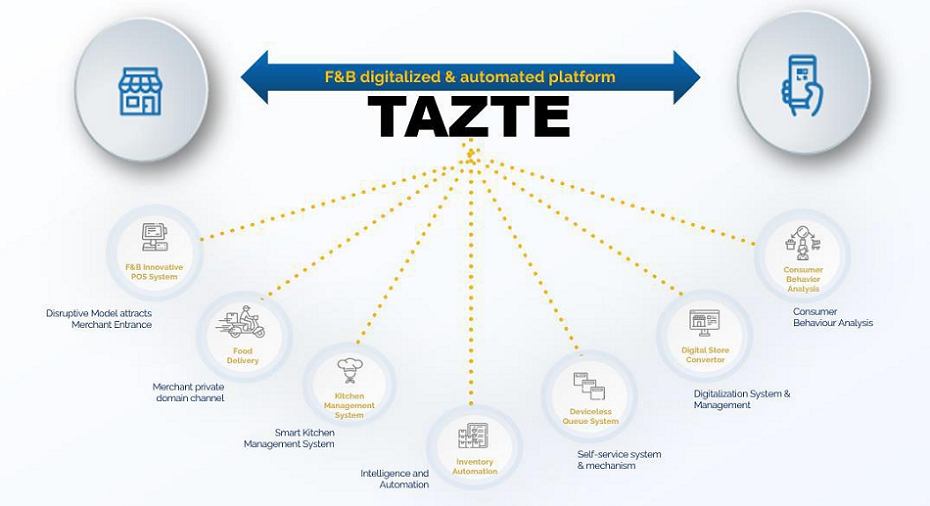

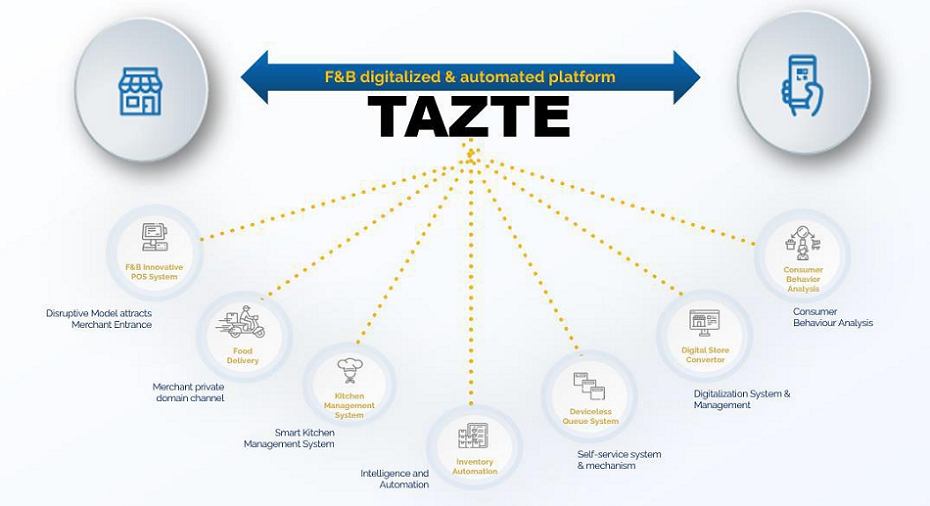

We believe that ZCITY’s TAZTE Smart F&B System, which we launched in fourth quarter of 2022, will provide merchants with a one-stop automated solution to digitalize their business. It will offer an innovative and integrated technology ecosystem that addresses and personalizes each merchant’s technological needs and will be at the forefront of creating a smart consumer experience, thereby eliminating conventional and outdated standalone point of sale (or “POS”) systems.

TAZTE will allow merchants to effortlessly record transactions with online payment or QR digital payment technology, set discounts and execute RP redemptions and rewards online, all via our ZCITY App. It utilizes ZCITY App’s CRM analytics software to attract and retain consumers through personalized, data-driven engagement to generate greater profitability.

TAZTE Smart F&B System will also feature a ‘Deviceless Queue System’ that reduces staff headcount and a private domain delivery service that will allow merchants access to multiple dedicated delivery partners to ensure outstanding delivery service to consumers.

Revenue Model

ZCITY’s revenues are generated from a diversified mix of:

| | ● | e-commerce activities for users; |

| | ● | services to merchants to help them grow their businesses; and |

| | ● | membership subscription fees. |

The revenue streams consist of “Consumer Facing” revenues and “Merchant Facing” revenues.

The revenue streams can be further categorized as following: (1) loyalty program revenue, (2) transaction revenue, (3) agent subscription revenue, and (4) member subscription revenue. Please see “Management’s Discussion and Analysis ̶ Revenue Recognition included in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended December 31, 2022 and filed with the SEC on February 14, 2023”.

Corporate Information

Our principal executive offices are located at 276 5th Avenue, Suite 704 #739, New York, New York 10001 and No.29, Jalan PPU 2A, Taman Perindustrian Pusat Bandar Puchong, 47100 Puchong, Selangor, Malaysia. Our corporate website address is https://treasureglobal.co. Our ZCITY website address is https://zcity.io.

Going Concern

As of December 31, 2022, management has determined there is substantial doubt about the Company’s ability to continue as a going concern. For details on this determination, see “Note 2 to our Unaudited Condensed Consolidated Financial Statements set forth in Item 1 of our Quarterly Report on Form 10-Q for the quarterly period ended December 31, 2022.”

| | ● | Equity financing to support its working capital; |

| | ● | Other available sources of financing (including debt) from Malaysian banks and other financial institutions; and |

| | ● | Financial support and credit guarantee commitments from the Company’s related parties. |

There can be no assurance that the Company will be successful in securing sufficient funds to sustain its operations.

Private Placement of Convertible Debentures

Terms of the Convertible Debentures

On February 28, 2023, we entered into the Securities Purchase Agreement (the “Securities Purchase Agreement”) with the Selling Stockholder, pursuant to which the Selling Stockholder agreed to purchase the Convertible Debentures, in the aggregate principal amount of up to $5,500,000 in a private placement (the “Private Placement”) for a purchase price with respect to each Convertible Debenture of 92% of the initial principal amount of such Convertible Debenture. The purchase by the Selling Stockholder of the First Convertible Debenture which has an initial issuance principal amount of $2,000,000 occurred on February 28, 2023 for a purchase price of $1,840,000 and the closing of the purchase of the Second Convertible Debenture which will have an initial issuance a principal amount of $3,500,000 will occur shortly after the registration statement related to this prospectus being declared effective by the Securities and Exchange Commission (the “SEC”) for a purchase price of $3,220,000. The total purchase price paid to us by the Selling Stockholder for the Convertible Debentures in the Private Placement will be $5,060,000. Prior to the execution of the Securities Purchase Agreement and the issuance of the First Convertible Debenture, we paid the Selling Stockholder a one-time $20,000 due diligence and structuring fee.

Each Convertible Debenture accrues or will accrue interest on its full outstanding principal amount at 4% per annum and has a 12-month term. Assuming no conversions, prepayments or events of default have been made on or occurred with respect to the First Convertible Debenture, on the maturity date thereof, interest of $80,000 shall have accrued and be payable on the First Convertible Debenture. Upon the occurrence and continuance of an Event of Default (as defined below) with respect to any Convertible Debenture, its per annum interest rate will increase to 15%. As of May 8, no Event of Default has occurred under the First Convertible Debenture. Assuming an Event of Default under the First Convertible Debenture does occur on May 28, 2023, and default interest begins to accrue on such date, if the holder did not elect to accelerate repayment or convert any portion of the First Convertible Debenture, accrued interest payable thereon at maturity would be $245,000. With respect to the Second Convertible Debenture, assuming no conversion, prepayment or an Events of Default has been made or occurred with respect thereto, on the maturity date thereof, interest of $140,000 shall have accrued and be payable. Upon the occurrence and continuance of an Event of Default under the Second Convertible Debenture, its per annum interest rate will increase to 15%. Assuming an Event of Default under the Second Convertible Debenture does occur immediately after its issuance, default interest begins to accrue at such time and the holder does not elect to accelerate repayment or convert any portion of the Second Convertible Debenture, accrued interest payable thereon at maturity would be approximately $525,000.

“Event of Default” means with respect to any Convertible Debenture: (i) the Company’s failure to pay to amounts due under such Convertible Debenture; (ii) the Company or any subsidiary of the Company is subject to bankruptcy or insolvency proceeding or similar proceeding and such proceedings remain undismissed for a period of sixty one (61) days; (iii) the Company or any subsidiary of the Company shall default in any of its payment obligations under any debenture, mortgage, credit agreement or other facility, indenture agreement, factoring agreement or other instrument under which there may be issued, or by which there may be secured or evidenced any indebtedness for borrowed money or money due under any long term leasing or factoring arrangement of the Company in an amount exceeding $100,000 and such default shall result in the full amount of such indebtedness becoming or being declared due and payable and such default is not thereafter cured within five (5) Business Days; (iv) the Company’s common stock shall cease to be quoted or listed for trading, as applicable, on any national exchange for a period of ten (10) consecutive trading days; (v) the Company shall be a party to certain change of control transactions (unless in connection with such change of control transaction such Convertible Debenture is retired; (vi) the Company’s (A) failure to deliver required number of shares of common stock as required under such Convertible Debenture or (B) notice, written or oral, to any holder of such Convertible Debenture of the Company’s intention not to comply with a request for conversion of such Convertible Debenture; (vii) the Company shall fail for any reason to deliver the payment in cash pursuant to a Buy-In (as defined in the Convertible Debenture) within five (5) Business Days after such payment is due; (viii) the Company’s failure to timely file with the SEC any of its periodic reports and such default is not thereafter cured within five (5) business days; (ix) any representation or warranty made or deemed to be made by or on behalf of the Company in or in connection with such Convertible Debenture or any of the other documents related to the Private Placement, or any waiver hereunder or thereunder, shall prove to have been incorrect in any material respect (or, in the case of any such representation or warranty already qualified by materiality, such representation or warranty shall prove to have been incorrect) when made or deemed made; (x) any material provision of any Transaction Document, at any time after its execution and delivery and for any reason other than as expressly permitted hereunder or thereunder, ceases to be in full force and effect; or the Company or any other person or entity contests in writing the validity or enforceability of any provision of any Convertible Debenture or any of the other documents related to the Private Placement; or the Company denies in writing that it has any or further liability or obligation under any Convertible Debenture or any of the other documents related to the Private Placement, or purports in writing to revoke, terminate (other than in line with the relevant termination provisions) or rescind any Convertible Debenture or any of the other documents related to the Private Placement; (xi) the Company uses the proceeds of the issuance of such Convertible Debenture, whether directly or indirectly, and whether immediately, incidentally or ultimately, to purchase or carry margin stock (within the meaning of Regulations T, U and X of the Federal Reserve Board, as in effect from time to time and all official rulings and interpretations thereunder or thereof), or to extend credit to others for the purpose of purchasing or carrying margin stock or to refund indebtedness originally incurred for such purpose; or (xii) any Event of Default (as defined in the other Convertible Denture or in any other documents related to the Private Placement) occurs with respect to any other Convertible Debenture, or any breach of any material term of any other debenture, note, or instrument held by the holder of such Convertible Debenture in the Company or any agreement between or among the Company and such holder; or (xiii) the Company shall fail to observe or perform any material covenant, agreement or warranty contained in, or otherwise commit any material breach or default of any provision of such Convertible Debenture (except as may be covered by another Event of Default) or any other any other document related to the Private Placement) which is not cured or remedied within the time prescribed or if no time is prescribed within ten (10) business days of notification thereof.

If any Event of Default has occurs under a Convertible Debenture (other than an event with respect to a bankruptcy or insolvency), at the Selling Stockholder election, all amounts owing in respect thereof, to the date of acceleration shall become immediately due and payable in cash; provided that, in the case of a bankruptcy or insolvency of the Company, all amounts owing in respect thereof, to the date of acceleration shall automatically become immediately due and payable in cash, in each case without presentment, demand, protest or other notice of any kind, all of which are hereby waived by the Company. The Selling Stockholder will also have the right to convert such Convertible Debenture at the applicable conversion price.

The Convertible Debentures provide a conversion right, in which any portion of the principal amount of the Convertible Debentures, together with any accrued but unpaid interest, may be converted into our common stock at a conversion price equal to the lower of (i) $1.6204 (the “Fixed Price”) or (ii) 93% of the lowest daily volume weighted average price (the “VWAP”) of the common stock during the ten (10) trading days immediately preceding the date of conversion (but not lower than a floor price of $0.25).

If a Trigger Event occurs, then the Company shall make monthly payments beginning on the 10th calendar day after the date on which a Trigger Event occurs and then on the same day of each successive calendar month. Each monthly payment shall be in an amount equal to the sum of (i) the lesser of (x) $1,000,000 and (y) the outstanding principal of the Convertible Debentures (the “Triggered Principal Amount”), plus (ii) a redemption premium of 7% of such Triggered Principal Amount, plus (iii) accrued and unpaid interest hereunder as of each payment date. The obligation of the Company to make monthly payments shall cease if any time after the Trigger Date the daily VWAP is greater than the Floor Price for a period of 5 of 7 consecutive Trading Days in the event of a Floor Price Trigger unless a new Trigger Event occurs.

“Trigger Event” means the daily VWAP is less than the $0.25 for five Trading Days during a period of any 5 of 7 consecutive trading days.

Under the Convertible Debentures, the Company has the right, but not the obligation, to redeem (“Optional Redemption”) early a portion or all amounts outstanding under the Convertible Debentures; provided that (i) the closing price of the Company’s common stock on the date of such Optional Redemption is less than $1.6204 and (ii) the Company provides the Holder with at least 5 business days’ prior written notice (each, a “Redemption Notice”) of its desire to exercise an Optional Redemption. The “Redemption Amount” shall be equal to the outstanding Principal balance being redeemed by the Company, plus a 10% premium on the principal amount being redeemed, plus all accrued and unpaid interest. If we elect to redeem the full $5,500,0000 principal amount of the Convertible Debentures, such premium payable will equal $550,000.

The registration statement of which this prospectus forms a part registers the resale by the Selling Stockholder of up to 22,880,000 shares of common stock that can be issuable upon the conversion of the Convertible Debentures. The number of shares being registered was calculated by dividing (x) the sum of the aggregate principal amount of Convertible Debentures ($5,500,000) plus one year of accrued interest on the Convertible Debentures ($220,000) by (y) the conversion floor price ($0.25), which is the lowest possible conversion price pursuant to the terms of the Convertible Debentures. As of February 28, 2023 (the date of the initial issuance of the Convertible Debentures), the total value of the 22,880,000 shares of common stock being registered was $35,692,800.

Potential Charges to the Company Under the Convertible Debentures

Shortly after the effectiveness of the registration statement related to this prospectus, we will have sold an aggregate of $5,500,000 of the Convertible Debentures and received a purchase price of $5,060,000 from the Selling Stockholder. The total charges paid to the holder of a Convertible Debenture during its term will depend on the amount converted and whether or not an Event of Default occurs and is continuing. If no conversions or events of default occur on the Convertible Debentures, we will incur charges of $1,230,000 on gross proceeds of $5,500,000. These charges include (i) $440,000 of original issue discount (“OID”); $220,000 of accrued interest (at 4% per annum); (iii) $550,000 cash redemption premium payable in respect of Optional Redemptions and (iv) $20,000 due diligence and structuring fee. This represents annualized interest of approximately 24.3% on gross proceeds of $5,060,000. If an Event of Default does occur on May 28, 2023, and default interest accrues on the Convertible Debentures from such date as described above under “—Terms of the Convertible Debentures” the accrued interest charge would increase from $220,000 to $673,750. The actual amount of interest accrued interest charges and redemption premium charges could be less depending on the actual amount and timing of redemptions and conversions.

If we fail to convert the Convertible Debentures and issue the applicable shares of our common stock to the Selling Stockholder within three trading days after we receive a conversion notice from the Selling Stockholder, and if on or after the date on which such shares of common stock are required to be issued, the Selling Stockholder purchases (in an open market transaction or otherwise) our common stock to deliver in satisfaction of a sale by the Selling Stockholder of our common stock that was issuable upon such conversion (a “Buy-In”), then the Company shall be required if requested by the Selling Stockholder to pay cash to the Selling Stockholder in an amount equal to the Selling Stockholder’s total purchase price (including brokerage commissions and other out of pocket expenses, if any) for the shares of our common stock so purchased. We do not anticipate any Buy-Ins and view any occurrence of a Buy-In as unlikely.

The following table sets out the payments we have made and may have to make (other than in the unlikely event of a Buy-In) in connection with the sale of $5,500,000 of Convertible Debentures.

| | | No Event of Default

Occurs | | | Event of Default

Occurs | |

| OID | | $ | 440,000 | (1) | | $ | 440,000 | (1) |

| Interest Payments (2) | | $ | 220,000 | (3) | | $ | 673,750 | (4) |

| Due Diligence Fee | | $ | 20,000 | | | $ | 20,000 | |

| Redemption Premium (6) | | $ | 550,000 | (5) | | $ | 550,000 | (5) |

| Total: | | $ | 1,230,000 | | | $ | 1,683,750 | |

| (1) | $160,000 for the First Convertible Denture and $280,000 for the Second Convertible Debenture. |

| | |

| (2) | Each Convertible Debenture matures on the one-year anniversary date of the issuance of such Convertible Debenture and bears interest at a rate of 4% per annum on its outstanding principal amount and in case of an Event of Default that is continuing its interest rate increases to 15% per annum |

| | |

| (3) | $80,000 for the First Convertible Denture and $140,000 for the Second Convertible Debenture. |

| (4) | Assumes Default interest accrues from May 28,2023. $245,000 for the First Convertible Denture and $428,750 for the Second Convertible Debenture. Calculated as follows: for the Frist Convertible Debenture, $2,000,000 x .04 x 3/12 plus $2,000,000 x .15 x 9/12 and for the Second Convertible Debenture, $3,500,000 x .04 x 3/12 plus $3,500,000 x .15 x 9/12 |

| (5) | $200,000 for the First Convertible Denture and $350,000 for the Second Convertible Debenture. |

| (6) | Assumes 100% of the principal on the Convertible Debentures is redeemed pursuant to one or more Optional Redemptions. The redemption premium is based on 10% of the $5,500,000 aggregate principal amount of the Convertible Dentures and not their aggregate purchase price. The redemption premium of 7% payable on Triggered Principal Amounts as described under “--Terms of the Convertible Debentures” is not included because the redemption premium payable on a redemption of the principal of a Convertible Debenture results in each case from either an Optional Redemption or a Trigger Event, but not both and the redemption premium payable in respect of a Trigger Event is lower than the redemption premium payable in respect of an Optional Redemption. If 100% of the principal on the Convertible Debentures became Triggered Principal Amounts (which could only happen if no Optional Redemptions occur), the redemption premium payable would be $385,000. |

Apart from the amounts discussed above, we have not made, and do not need to make (other than amounts payable to the Selling Stockholder in the unlikely event of a Buy-In), any payments to the Selling Shareholder under the Convertible Debentures or otherwise in connection with the Private Placement.

Purchase Price of the Convertible Debentures Received by the Company Compared to Potential Charges

The following sets forth the gross proceeds paid or payable to us in connection with our issuance of the Convertible Debentures, all payments that have been made or that may be required to be made by us in connection with the issuance of the Convertible Debentures, our resulting net proceeds and the combined total possible profit to be realized as a result of any conversion discounts regarding the shares underlying the Convertible Debentures.

| | | No Event of Default occurs | | Event of Default Occurs |

| Initial principal amount of the Convertible Debentures | | $ | 5,500,000 | | | $ | 5,500,000 | |

| Purchase price of the Convertible Debentures (proceeds to the Company) | | $ | 5,060,000 | | | $ | 5,060,000 | |

| | | | | | | | | |

All payments that have been made or that may be required to be made by the Company to the Selling Stockholder in connection with the Private Placement | | $ | 1,230,000 | | | $ | 1,683,750 | |

| | | | | | | | | |

| Net proceeds to the Company if we make all such payments to the Selling Shareholder | | $ | 4,270,000 | | | $ | 3,816,250 | |

| | | | | | | | | |

All payments that have been made or that may be required to be made by the Company to the Selling Stockholder as a percentage of the purchase price | | | 24.3 | % | | | 33.3 | % |

| | | | | | | | | |

| Profit to be realized as a result of conversion discounts (1) | | $ | 1,235,452 | | | | N/A | |

| | | | | | | | | |

Profit on conversions as a percentage of the purchase price of the Convertible Debentures | | | 24.3 | % | | | N/A | % |

| (1) | As calculated under the section headed “Selling Stockholder--Potential Conversion Profits to Selling Shareholder--Scenario 2. Conversion on May 1, 2023” we have assumed the issuance of the Second Convertible Debenture on the date of the Securities Purchase Agreement and used May 1, 2023, as the conversion date for all principal and interest under both Convertible Debentures. Actual profit resulting from the conversion discount cannot be calculated until the actual conversion occurs as the conversion price depends on market prices during the 10 trading days before conversion, and actual profit may be significantly greater. |

Initial Public Offering

On August 15, 2022, we consummated our initial public offering of 2.3 million shares of our common stock and received approximately $8.2 million in net proceeds from the initial public offering after deducting the underwriting discount and commission and other initial public offering expenses. In connection with our initial public offering we also issued 4,442,865 shares of our common stock which included (i) 1,403,083 shares of our common stock that were issued upon the listing of our common stock on Nasdaq as a result of the automatic conversion of our convertible notes; (ii) 2,756,879 shares of our common stock that were issued upon the closing of our initial public offering of our common stock as a result of the automatic conversion of the amounts due under the loan facilities using the conversion price of $3.20 per share; (iii) 109,833 shares issued to Exchange Listing, LLC, pursuant to anti-dilution protection provided to them in their consulting agreement and (iv) 15,927 shares of our common stock that were issued to Space Capital Berhad as a fee under their note. We also issued the underwriters warrants to purchase a total of 100,000 shares of the Company’s common stock. The warrants are exercisable at any time at an exercise price of $5.00 per share and expire on the fifth anniversary of the commencement of sales under the initial public offering.

Summary Risk Factors

Our business is subject to a number of risks. You should be aware of these risks before making an investment decision. These risks are summarized and discussed more fully in the “Summary Risk Factors” and “Risk Factors” sections of our most recent Annual Report on Form 10-K filed with the SEC and incorporated by reference into this prospectus. This offering and the ownership of our common stock is subject to a number of risks. You should be aware of these risks before making an investment decision. These risks are discussed more fully in the “Risk Factor section of this Prospectus. These risks include, among others, that:

| | ● | A large number of shares of our common stock issuable upon conversion of the Convertible Debentures may be sold in the market, which may depress the market price of our common stock and substantially dilute stockholders’ voting power; |

| | ● | If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline; |

| | ● | We may not be able to continue to satisfy listing requirements of Nasdaq to maintain a listing of our common stock; |

| | ● | If there is no viable public market for our common stock, you may be unable to sell your shares at or above your purchase price; |

Corporate Information

Our principal executive offices are located at 276 5th Avenue, Suite 704 #739, New York, New York 10001 and No.29, Jalan PPU 2A, Taman Perindustrian Pusat Bandar Puchong, 47100 Puchong, Selangor, Malaysia. Our corporate website address is https://treasureglobal.co. Our ZCITY website address is https://zcity.io.The information included on our websites is not part of this prospectus.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jobs Act. We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act; (ii) the last day of the fiscal year in which we have total annual gross revenues of $1.235 billion or more; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under applicable SEC rules. We expect that we will remain an emerging growth company for the foreseeable future, but cannot retain our emerging growth company status indefinitely and will no longer qualify as an emerging growth company on or before the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure requirements that are applicable to other public companies that are not emerging growth companies.

These exemptions include:

| ● | being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| ● | not being required to comply with the requirement of auditor attestation of our internal controls over financial reporting; |

| ● | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| ● | reduced disclosure obligations regarding executive compensation; and |

| ● | not being required to hold a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

We have taken advantage of certain reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

An emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected to avail ourselves of this extended transition period and, as a result, we will not be required to adopt new or revised accounting standards on the dates on which adoption of such standards is required for other public reporting companies.

We are also a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies.

| SUMMARY OF THE OFFERING |

| | |

| Common stock offered by the Selling Stockholder | 22,880,000 shares. |

| | |

| Selling Stockholder | YA II PN, Ltd. |

| | |

| Use of Proceeds | We will not receive any proceeds from the sale of shares by the Selling Stockholder. |

| | |

| Nasdaq symbol for our common stock | TGL |

| | |

| Risk Factors | You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 10 of this prospectus and under “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended June 30, 2022 that is incorporated by reference into this prospectus before deciding whether or not to invest in shares of our common stock. |

RISK FACTORS

Investing in our securities involves a high degree of risk. Before making an investment decision with respect to our securities, we urge you to carefully consider the risks described in the “Risk Factors” sections of our most recent Annual Report on Form 10-K filed with the SEC and incorporated by reference into this prospectus. In addition, the following risk factors present material risks and uncertainties associated with this offering. The risks and uncertainties incorporated by reference into this prospectus or described below are not the only ones we face. Additional risks and uncertainties not presently known or which we consider immaterial as of the date hereof may also have an adverse effect on our business. If any of the matters discussed in the following risk factors were to occur, our business, financial condition, results of operations, cash flows or prospects could be materially and adversely affected, the market price of our common stock could decline and you could lose all or part of your investment in our securities.

Risks Related to this Offering and Ownership of our Common Stock

A large number of shares of our common stock issuable upon conversion of the Convertible Debentures may be sold in the market, which may depress the market price of our common stock and substantially dilute stockholders’ voting power.

A total of 22,880,000 shares of common stock issuable upon conversion of the Convertible Debentures is being registered for resale by the Selling Stockholder, subject to the limitation that the Selling Stockholder may not convert those securities to the extent that the Selling Stockholder would own more than 4.99% of our outstanding common stock immediately after conversion. However, this limitation does not prevent the Selling Stockholder from selling shares of our common stock and then receive additional shares of our common stock through a subsequent conversion. In this way, the selling stockholder could acquire and sell more than 4.99% of the outstanding common stock in a relatively short time frame while never holding more than 4.99% at one time. Further since the exercise price under the Convertible Debentures is based on market prices of our common stock during the ten trading days prior to each conversion, declines in the market price of our common stock down to the conversion floor price ($0.25 per share) result in, subject to the floor price, higher conversion rates and consequently higher rates of dilution to stockholders for each dollar of principal of a Convertible Debenture being converted during such declines. As of May 12, 2023 there were 17,573,830 shares of common stock outstanding and 11,235,348 shares of common stock owned by non-affiliates. Sales of a substantial number of shares of our common stock in the public markets could depress the market price of our common stock, cause substantial dilution to stockholders’ voting power and impair our ability to raise capital through the sale of additional equity securities. If all 22,880,000 shares of common stock that could potentially be underlying the Convertible Debentures are issued, the percentage of our common stock held by the existing non-affiliate stockholders would be reduced from approximately 63.9% to approximately 27.7%. We cannot predict the effect that future sales of our common stock by the Selling Stockholder or others would have on the market price of our common stock.

Investors who buy the common stock at different times will likely pay different prices and may experience different levels of dilution.

If and when the Selling Stockholder elects to sell shares of our common stock after conversion of the Convertible Debentures at the discounted conversion price, the Selling Stockholder may resell all, some or none of such shares at any time or from time to time in its discretion and at different prices. As illustrated under “Selling Stockholder—Potential Conversion Profits to Selling Stockholder” changes in market price conditions will affect the conversion price, subject to the conversion floor price of $0.25 and the maximum conversion price of $1.6204, or the Fixed Price, and the conversion price will determine the profit relative to the market price of our common stock on the conversion date achieved by the Selling Stockholder. The amount of profit achieved by the Selling Stockholder on conversions of the Convertible Debentures may be a factor in the price the Selling Stockholder is willing to sell our common stock. As a result, investors who purchase shares from the Selling Stockholder in this offering at different times will likely pay different prices for those shares, and so may experience different levels of dilution and in some cases substantial dilution and different outcomes in their investment results. Moreover, if the market price of our common stock exceeds the maximum conversion price of $1.6204, further increases in the price of our common stock would increase the profitability of conversions by the Selling Stockholders and the amount of profit that can be obtained by the Selling Stockholder from conversions would be unlimited if our common stock price continued to increase. Any investor who purchases shares from the Selling Stockholder at a price that that is in excess of the maximum conversion price will experience immediate and possibly significant dilution in the book value of their shares depending on the amount of such excess. Investors may also experience a decline in the value of the shares they purchase from the Selling Stockholder in this offering as a result of future sales made by us to the Selling Stockholder at prices lower than the prices such investors paid for their shares in this offering. In addition, if we issue a substantial number of shares to the Selling Stockholder under the Convertible Debentures, or if investors expect that the Selling Stockholder will require more conversions, the actual issuance of shares or the mere existence of the Convertible Debentures may make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect such sales.

The Occurrence of a Trigger Event or an Event of Default under a Convertible Debenture could lead to increased amounts payable under the Convertible Debentures and could cause an acceleration of the Convertible Debentures and materially and adversely affect our operations.

If the price of our company stock closes at a price of less than $0.25 on 5 of 7 consecutive trading days, a Trigger Even will have occurred and will be required to pay, on a monthly basis, to the Selling Stockholder the Trigger Premium Amount, a 7% redemption premium and accrued and unpaid interest on the Convertible Debentures. The Events of Default contained in the Convertible Debentures (as described under “Prospectus Summary—Private Placement of the Convertible Debentures—Terms of the Convertible Debentures”) are customary events of default with acceleration rights. If an event of default occurs and is continuing , the per annum interest rate on the Convertible Debentures will increase from 4% to 15 % and the Selling Stockholder will be entitled to declare the full unpaid principal amount of the Convertible Debentures, together with interest and other amounts owing in respect thereof, immediately due and payable in cash; provided that an Event of Default that occurs because of the bankruptcy or insolvency of the Company shall be automatic. If a Trigger Event, an Event of Default or both occur, our costs related to the Convertible Debentures could substantially increase and we may not have the funds required to repay the Selling Stockholder the accelerated amounts due under the Convertible Debentures, which could lead to the Selling Stockholder to take action against the Company such as commencing litigation which could have material adverse effects on our business and prospects.

Stockholders may experience future dilution as a result of this and future equity offerings.

In order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock. Investors purchasing our shares or other securities in the future could have rights superior to existing common stockholders, and the price per share at which we sell additional shares of our common stock or other securities convertible into or exchangeable for our common stock in future transactions may be higher or lower than the price per share in this offering.

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline.

The trading market for our common stock will depend in part on the research and reports that securities or industry analysts publish about us or our business. Several analysts may cover our stock. If one or more of those analysts downgrade our stock or publish inaccurate or unfavorable research about our business, our stock price would likely decline. If one or more of these analysts cease coverage of our company or fail to publish reports on us regularly, demand for our stock could decrease, which might cause our stock price and trading volume to decline.

We may not be able to continue to satisfy listing requirements of Nasdaq to maintain a listing of our common stock.

Our common stock is currently listed on Nasdaq and we must meet certain financial and liquidity criteria to maintain such listing. If we violate the maintenance requirements for continued listing of our common stock, our common stock may be delisted. In addition, our board may determine that the cost of maintaining our listing on a national securities exchange outweighs the benefits of such listing. A delisting of our common stock from Nasdaq may materially impair our stockholders’ ability to buy and sell our common stock and could have an adverse effect on the market price of, and the efficiency of the trading market for, our common stock. In addition, the delisting of our common stock could significantly impair our ability to raise capital.

If there is no viable public market for our common stock, you may be unable to sell your shares at or above your purchase price.

Although our common stock is listed on Nasdaq, an active trading market for our shares may not be sustained following the purchase of your common stock. You may be unable to sell your shares quickly or at the market price if trading in shares of our common stock is not active. Further, an inactive market may also impair our ability to raise capital by selling shares of our common stock and may impair our ability to enter into strategic partnerships or acquire companies or products by using our shares of common stock as consideration.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements.” Forward-looking statements reflect the current view about future events. When used in this prospectus, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions, as they relate to us or our management, identify forward-looking statements. Such statements, include, but are not limited to, statements contained in this prospectus relating to our business strategy, our future operating results and liquidity and capital resources outlook. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation:

| | ● | Our ability to effectively operate our business segments; |

| | ● | Our ability to manage our research, development, expansion, growth and operating expenses; |

| | ● | Our ability to evaluate and measure our business, prospects and performance metrics; |

| | ● | Our ability to compete, directly and indirectly, and succeed in a highly competitive and evolving industry; |

| | ● | Our ability to respond and adapt to changes in technology and customer behavior; |

| | ● | Our ability to protect our intellectual property and to develop, maintain and enhance a strong brand; and |

| | ● | Other factors (including the risks contained in the section of this prospectus entitled “Risk Factors”) relating to our industry, our operations and results of operations. |

Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

USE OF PROCEEDS

We will not receive any proceeds from the sale of common stock by the Selling stockholder.

The Selling Stockholders will pay any underwriting discounts and commissions and expenses incurred by them for brokerage, accounting, tax or legal services or any other expenses incurred by them in disposing of the shares. We will bear all other costs, fees and expenses incurred in effecting the registration of the shares covered by this prospectus, including, without limitation, all registration and filing fees and fees and expenses of our counsel and our accountants.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Our common stock is listed on the Nasdaq Capital Market under the symbol “TGL.”

As of May 12, 2023, 17,573,830 shares of our common stock were issued and outstanding and were held by 28 stockholders of record.

We also have outstanding:

| | ● | Warrants to purchase 100,000 shares of our common stock issued to the underwriter in our initial public offering. The warrant has an exercise price of $5.00 per share. |

DIVIDEND POLICY

We have not declared any cash dividends since inception and we do not anticipate paying any dividends in the foreseeable future. Instead, we anticipate that all of our earnings will be used to provide working capital, to support our operations, and to finance the growth and development of our business. The payment of dividends is within the discretion of the Board and will depend on our earnings, capital requirements, financial condition, prospects, applicable Delaware law, which provides that dividends are only payable out of surplus or current net profits, and other factors our Board might deem relevant. There are no restrictions that currently limit our ability to pay dividends on our common stock other than those generally imposed by applicable state law.

SELLING STOCKHOLDER

This prospectus relates to the resale of up to 22,880,000 shares of our common stock by the Selling Stockholder, which may be issued upon the conversion of the Convertible Debentures. See the section entitled “Prospectus Summary—Recent Developments—Private Placement of Convertible Debentures” for more information regarding the issuance of the Convertible Debentures. We are registering the shares of common stock included in this prospectus pursuant to the provisions of the Registration Rights Agreement, permitting the Selling Stockholder to offer the shares of common stock included in this prospectus for resale from time to time.

The table below presents information regarding the Selling Stockholder and the shares of common stock that may be resold by the Selling Stockholder from time to time under this prospectus. This table is prepared based on information supplied to us by the Selling Stockholder, and reflects holdings as of May 12, 2023. The number of shares in the column “Maximum Number of Shares Being Offered” represents all of the shares of common stock being offered for resale by the Selling Stockholder under this prospectus. The Selling Stockholder may sell some, all or none of the shares of common stock being offered for resale in this offering. We do not know how long the Selling Stockholder will hold the shares of common stock before selling them, and we are not aware of any existing arrangements between the Selling Stockholder and any other stockholder, broker, dealer, underwriter or agent relating to the sale or distribution of the shares of our common stock being offered for resale by this prospectus.

Beneficial ownership is determined in accordance with Rule 13d-3(d) promulgated by the SEC under the Exchange Act, and includes shares of common stock with respect to which the Selling Stockholder has sole or shared voting and investment power. The percentage of shares of common stock beneficially owned by the Selling Stockholder prior to the offering shown in the table below is based on an aggregate of 17,573,830 shares of our common stock outstanding on May 12, 2023. Because the conversion price to be paid by the Selling Stockholder for shares of common stock will be determined on the date of conversion of the Convertible Debentures, the actual number of shares of common stock that we may issue to the Selling Stockholder may be fewer than the number of shares being offered for resale under this prospectus. The fourth column assumes the resale by the Selling Securityholder of all of the shares of common stock being offered for resale pursuant to this prospectus.

| | | | | | | | | | | | Common Stock

Beneficially Owned

After this Offering(1) | |

| Name of Selling Stockholder | | | Number of Shares Beneficially Owned Prior to this Offering | | | | Maximum Number of Shares Being Offered | | | | Number of Shares | | | | Percent

of Class | |

| YA II PN, Ltd. (2) | | | 922,991 | (3) | | | 22,880,000 | | | | — | | | | — | |

| (1) | Assumes all of the shares of common stock offered by the Selling Stockholders pursuant to the prospectus are sold and that the Selling Stockholder buy or sell no additional shares of common stock prior to the completion of this offering. The registration of these shares does not necessarily mean that the Selling Stockholder will sell all or any portion of the shares covered by this prospectus. |

| (2) | The Selling Stockholder is a fund managed by Yorkville Advisors Global, LP (“Yorkville LP”). Yorkville Advisors Global II, LLC (“Yorkville LLC”) is the General Partner of Yorkville LP. All investment decisions for Selling Stockholder are made by Yorkville LLC’s President and Managing Member, Mr. Mark Angelo. The business address of Yorkville is 1012 Springfield Avenue, Mountainside, New Jersey 07092. |

| (3) | Includes shares of common stock that the Selling Stockholder has the right to acquire within 60 days. Under the terms of the Convertible Debentures, we are prohibited from issuing shares of common stock to the Selling Stockholder to the extent that it would cause the aggregate number of shares of our common stock beneficially owned by the Selling Stockholder and its affiliates to exceed 4.99% of our outstanding common stock, and under the terms of the Convertible Debentures, the Selling Stockholder may not convert the Convertible Debentures to the extent such conversion would cause the aggregate number of shares of common stock beneficially owned by the Selling Stockholder and its affiliates to exceed 4.99% of our outstanding common stock (the Authorized Share Cap”). The amounts in the table give effect to the Authorized Share Cap. Based on 17,573,830 shares of common stock issued and outstanding as of May 12, 2023. Assumes the number of shares issuable pursuant to the Convertible Debentures prior to the offering is at least 4.99% of the sum of our outstanding shares of common stock after taking into consideration the issuance of such shares. |

Potential Conversion Profits to Selling Stockholder

The tables below quantify under three different market price scenarios the resulting profit to the Selling Stockholder from a conversion of all amounts underlying the Convertible Debentures at the conversion discount price. Each table assumes on the conversion date that (i) both Convertible Debentures are issued and outstanding in full and (ii) except for Scenario 1, where conversion takes place on issuance date, a full year of interest equal to $220,000 has been accrued and remains unpaid. We will not actually know the conversion price for the Convertible Debentures until, and if, we receive a conversion notice from the Selling Stockholder. Because the Selling Stockholder may not convert the Convertible Debentures to the extent (but only to the extent) it or any of its affiliates would beneficially own a number of shares of common stock which would exceed 4.99% of the total shares of common stock issued and outstanding as of the date of such conversion, we do not believe that it is likely that all of the Convertible Debentures could be converted in any one given day.

Scenario 1. Conversion on the initial issuance date.

Assumes conversion on February 28, 2023, the first date of issuance of the Convertible Debentures. On such date the closing price of our common stock was $1.56 per share (the “Initial Market Price”) and the lowest VWAP for any trading day during the prior 10 trading days was $1.6668 per share.

| | | $2,000,000

First

Convertible Debenture | | $3,500,000

Second

Convertible Debenture |

| | | | | |

| Initial Market Price | | $ | 1.56 | | | | 1.56 | |

| | | | | | | | | |

| Conversion price per share on date of issuance | | $ | 1.55 | (1) | | | 1.55 | (1) |

| | | | | | | | | |

| Conversion shares issued to Selling Stockholder based on the conversion price | | | 1,290,323 | (2) | | | 2,258,065 | (3) |

| | | | | | | | | |

| Total market price of the shares underling the Convertible Debenture | | $ | 2,012,904 | (4) | | | 3,522,581 | (4) |

| | | | | | | | | |

| Total conversion price of the shares underling the Convertible Debenture | | $ | 2,000,000 | (5) | | | 3,500,000 | (5) |

| | | | | | | | | |

| Total possible profit that could be realized as a result of the conversion discount as of the date of sale of the Convertible Debentures | | $ | 12,904 | (6) | | | 22,581 | (6) |

| (1) | Lowest VWAP during last 10 trading days multiplied by 0.93. |

| (2) | $2,000,000 divided by the conversion price per share. |

| (3) | $3,500,000 divided by the conversion price per share. |

| (4) | Conversion shares multiplied by market price per share. |

| (5) | Conversion shares multiplied by conversion price per share. |

| (6) | Total market price minus total conversion price. |

Scenario 2. Conversion on May 1, 2023

Assumes conversion on May 1, 2023. On such date the closing price of our common stock was $1.48 per share and the lowest VWAP for any trading day during the prior 10 trading days was $1.3026 per share.

| | | $2,000,000

First

Convertible Debenture | | $3,500,000

Second

Convertible Debenture |

| | | | | |

| Market price per share on date of conversion | | $ | 1.48 | | | $ | 1.48 | |

| | | | | | | | | |

| Conversion price per share on date of conversion | | $ | 1.21 | (1) | | $ | 1.21 | (1) |

| | | | | | | | | |

| Conversion shares issued to Selling Stockholder based on the conversion price | | | 1,663,912 | (2) | | | 2,911,845 | (3) |

| | | | | | | | | |

| Total market price of the shares underling the Convertible Debenture | | $ | 2,462,588 | (4) | | $ | 4,309,530 | (4) |

| | | | | | | | | |

| Total conversion price of the shares underling the Convertible Debenture | | $ | 2,013,333 | (5) | | $ | 3,523,333 | (5) |

| | | | | | | | | |

| Total possible profit that could be realized as a result of the conversion discount as of the date of conversion | | $ | 449,255 | (6) | | $ | 786,197 | (6) |

| (1) | $1.3026 (lowest VWAP during last 10 trading days prior to conversion) multiplied by 0.93. |

| (2) | ($2,000,000 plus $13,333 (two months of accrued interest at 4% per annum)) divided by $1.21 (the conversion price per share). |

| (3) | ($3,500,000 plus $23,333 (two months of accrued interest at 4% per annum)) divided by $1.21 (the conversion price per share). |

| (4) | Conversion shares multiplied by market price per share. |

| (5) | Conversion shares multiplied by conversion price per share. |

| (6) | Total market price minus total conversion price. |

Scenario 3 Conversion based on a market price above the Fixed Price of $1.6204

Assumes the market price is $3.00 on the conversion date and that 93% of the lowest VWAP of the common stock during the 10 trading days prior to the conversion date is equal to or above $1.6204.

| | | $2,000,000

First

Convertible Debenture | | $3,500,000

Second

Convertible Debenture |

| | | | | |

| Market price per share on date of conversion | | $ | 3.00 | | | | 3.00 | |

| | | | | | | | | |

| Conversion price per share on date of conversion | | $ | 1.6204 | (1) | | | 1.6204 | (1) |

| | | | | | | | | |

| Conversion shares issued to Selling Stockholder based on the conversion price | | | 1,283,634 | (2) | | | 2,246,359 | (3) |

| | | | | | | | | |

| Total market price of the shares underling the Convertible Debenture | | $ | 3,850,899 | (4) | | | 6,739,077 | (4) |

| | | | | | | | | |

| Total conversion price of the shares underling the Convertible Debenture | | $ | 2,080,000 | (5) | | | 3,640,000 | (5) |

| | | | | | | | | |

| Total possible profit that could be realized as a result of the conversion discount as of the date of conversion | | $ | 1,770,899 | (6) | | | 3,099,077 | (6) |

| (1) | Maximum conversion price (or Fixed Price). |

| (2) | ($2,000,000 plus $80,000 (12 months of accrued interest at 4% per annum)) divided by conversion price per share. |

| (3) | ($3,500,000 plus $140,000 (12 months of accrued interest at 4% per annum)) divided by conversion price per share. |

| (4) | Conversion shares multiplied by market price per share. |

| (5) | Conversion shares multiplied by conversion price per share. |

| (6) | Total market price minus total conversion price. |

As the conversion price can never be greater than $1.6204, any time the market price exceeds $1.6204 the total possible profit that the Selling Stockholder can realize on a per share basis will be equal to the market price at such time minus the conversion price of $1.6204. There is no upper limit on the potential profit that the Selling Shareholder can realize in such cases.

MANAGEMENT

The following are our executive officers and directors and their respective ages and positions as of May 12, 2023.

| Name | Age | Position |

| Chong Chan “Sam” Teo | 40 | Chief Executive Officer, Director |

| Su Chen “Chanell” Chuah | 44 | Chief Operating Officer |

| Yee Fei “Jaylvin” Chan | 35 | Chief Financial Officer |

| Su Huay “Sue” Chuah | 41 | Chief Marketing Officer |

| Chen Hoe “Samuel” Sam | 42 | Chief Technology Officer |

| Jau Long “Jerry” Ooi | 41 | Vice President |

| Ho Yi Hui | 45 | Executive Director |

| Joseph R. “Bobby” Banks | 61 | Director |

| Marco Baccanello | 61 | Director |

| Jeremy Roberts | 50 | Director |