Exhibit 99.4

ELECTRA BATTERY MATERIALS CORPORATION

(Formerly First Cobalt Corp.)

ANNUAL INFORMATION FORM

For the fiscal year ended December 31, 2021

Dated April 8, 2022

401 Bay Street, 6th Floor

Toronto, Ontario, M5H 2Y4

TABLE OF CONTENTS

| PRELIMINARY NOTES | 1 |

| Date of Information | 1 |

| Cautionary Notes to U.S. Investors Concerning Resource Estimates | 1 |

| Currency | 1 |

| Forward-Looking Information | 1 |

| Future-Oriented Financial Information (FOFI) | 2 |

| Certain Other Information | 3 |

| CORPORATE STRUCTURE | 3 |

| Name, Address and Incorporation | 3 |

| Intercorporate Relationships | 3 |

| GENERAL DEVELOPMENT OF THE BUSINESS | 4 |

| Three Year History | 4 |

| 2019 Developments | 4 |

| 2020 Developments | 5 |

| 2021 Developments | 6 |

| Subsequent Events | 8 |

| Selected Financings | 9 |

| THE BUSINESS | 10 |

| Background | 10 |

| Specialized Skills and Knowledge | 13 |

| Competitive Conditions | 14 |

| Components | 14 |

| Business Cycles | 14 |

| Environmental Protection | 14 |

| Environmental and Social Governance | 14 |

| Glencore Loan Agreement and Amended Glencore Loan Agreement | 15 |

| Employees | 15 |

| Reorganizations | 15 |

| Foreign Operations | 15 |

| REFINERY | 15 |

| IRON CREEK PROJECT | 24 |

| RISK FACTORS | 31 |

| DIVIDENDS AND DISTRIBUTIONS | 43 |

| CAPITAL STRUCTURE | 43 |

| MARKET FOR SECURITIES | 43 |

| Trading Price and Volume | 43 |

| Prior Sales | 44 |

| ESCROWED SECURITIES AND SECURITIES SUBJECT TO CONTRACTUAL RESTRICTIONS ON TRANSFER | 44 |

| DIRECTORS AND OFFICERS | 44 |

| Name, Province or State, Country of Residence and Offices Held | 44 |

| Shareholdings of Directors and Officers | 46 |

| Cease Trade Orders, Bankruptcies, Penalties or Sanctions | 46 |

| Conflicts of Interest | 46 |

| Management | 47 |

| PROMOTERS | 49 |

| AUDIT COMMITTEE | 49 |

| Composition of the Audit Committee | 49 |

| Relevant Education and Experience | 49 |

| Audit Committee Oversight | 50 |

| Reliance on Certain Exemptions | 50 |

| Pre-approval Policies and Procedures | 50 |

| External Auditor Service Fees (by Category) | 50 |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 50 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 50 |

| AUDITORS, TRANSFER AGENT AND REGISTRAR | 51 |

| Auditors | 51 |

| Transfer Agents, Registrars or Other Agents | 51 |

| MATERIAL CONTRACTS | 51 |

| INTEREST OF EXPERTS | 51 |

| ADDITIONAL INFORMATION | 51 |

PRELIMINARY NOTES

Date of Information

All information in this Annual Information Form (“AIF”) is as of April 8, 2022, unless otherwise indicated.

Cautionary Notes to U.S. Investors Concerning Resource Estimates

This AIF was prepared in accordance with Canadian standards for reporting of mineral resource estimates, which differ in some respects from United States standards. In particular, and without limiting the generality of the foregoing, the terms “inferred mineral resources,” “indicated mineral resources,” and “mineral resources” used or referenced in this AIF are Canadian mineral disclosure terms as defined in accordance with NI 43-101 under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum Standards for Mineral Resources and Mineral Reserves, Definitions and Guidelines, May 2014 (the “CIM Standards”). Until recently, the CIM Standards differed significantly from standards in the United States. The U.S. Securities and Exchange Commission (the “SEC”) has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the property disclosure requirements for mining registrants that were included in SEC Industry Guide 7, which will be rescinded from and after the required compliance date of the SEC Modernization Rules. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the corresponding definitions under the CIM Standards that are required under NI 43-101. Investors are cautioned that while the above terms are “substantially similar” to the corresponding CIM Definition Standards, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the mineral reserve or mineral resource estimates under the standards adopted under the SEC Modernization Rules. Readers are cautioned that “inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies, except in limited circumstances. The term “resource” does not equate to the term “reserves”. Readers should not assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves. Readers are also cautioned not to assume that all or any part of an inferred mineral resource exists or is economically mineable.

Currency

Except where otherwise indicated, all references to currency in this AIF are to thousands of Canadian Dollars (“$”).

Forward-Looking Information

Except for statements of historical fact, this AIF contains certain “forward-looking information” within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of applicable United States securities legislation, together “forward-looking information”. Forward-looking statements include, but are not limited to, statements regarding anticipated burn rate and operations; planned exploration and development programs and expenditures; the Glencore Loan Agreement (as defined below); commercial agreements with respect to feedstock supply with Glencore (as defined below) and other parties; the Stratton Offtake Agreement (as defined below); the Glencore Offtake Agreement (as defined below); timelines and milestones with respect to the Refinery and the Battery Materials Park (as defined below); anticipated expenditures and programs at the Refinery, Iron Creek Project and Cobalt Camp (each as defined below); impact of COVID-19 on the Company; the estimation of mineral resources; magnitude or quality of mineral deposits; anticipated advancement of mineral properties and programs; future exploration prospects; proposed exploration plans and expected results of exploration; the Company’s ability to obtain licenses, permits and regulatory approvals required to implement expected future exploration plans; changes in commodity prices and exchange rates; future growth potential of Electra; future development plans; and currency and interest rate fluctuations. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, identified by words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “potential”, “possible” or variations thereof or stating that certain actions, events, conditions or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of fact and may be forward-looking statements. In particular, forward-looking information in this AIF includes, but is not limited to, statements with respect to future events and is subject to certain risks, uncertainties and assumptions. Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance or achievements. Consequently, there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking information.

Forward-looking statements are necessarily based upon a number of factors and assumptions that, if untrue, could cause actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such statements. Forward-looking statements are based upon a number of estimates and assumptions that, while considered reasonable by the Company at this time, are inherently subject to significant business, economic and competitive uncertainties and contingencies that may cause the Company’s actual financial results, performance, or achievements to be materially different from those expressed or implied herein. Some of the risks and other factors that could cause results to differ materially from those expressed in the forward-looking statements include, but are not limited to: the Refinery and general expectations with respect to the development of the Refinery; general economic conditions in Canada, the United States and globally; industry conditions, including the state of the electric vehicle (“EV”) market; governmental regulation of the mining industry, including environmental regulation; geological, technical and drilling problems; unanticipated operating events; competition for and/or inability to retain drilling rigs and other services; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; volatility in market prices for commodities; liabilities inherent in the mining industry; changes in tax laws and incentive programs relating to the mining industry; the future price of cobalt; anticipated costs and the Company’s ability to fund its programs; the Company’s ability to carry on exploration and development activities; the timing and results of drilling programs; the discovery of additional mineral resources on the Company’s mineral properties; the timely receipt of required approvals and permits, including those approvals and permits required for successful project permitting, construction and operation of projects; the costs of operating and exploration expenditures; the Company’s ability to operate in a safe, efficient and effective manner; the potential impact of natural disasters; the Company’s ability to obtain financing as and when required and on reasonable terms; the impacts and ongoing developments of the COVID-19 global pandemic and the Russo-Ukrainian war and the other factors described herein under “Risk Factors”, as well as in our public filings available at www.sedar.com. Readers are cautioned that this list of risk factors should not be construed as exhaustive.

The forward-looking information contained in this AIF is expressly qualified by this cautionary statement. We undertake no duty to update any of the forward-looking information to conform such information to actual results or to changes in our expectations, except as otherwise required by applicable securities legislation. Readers are cautioned not to place undue reliance on forward-looking information.

Future-Oriented Financial Information (FOFI)

This AIF also contains future-oriented financial information and outlook information (collectively, “FOFI”) about the Refinery and results of the Refinery Study. This information is subject to the same assumptions, risk factors, limitations and qualifications as set forth below in the below paragraphs. FOFI contained in this AIF is made as of the date of this AIF and is being provided for the purpose of providing further information with respect to the Refinery and results of the Refinery Study. The Company disclaims any intention or obligation to update or revise any FOFI contained in this AIF, whether as a result of new information, future events or otherwise, unless required pursuant to applicable law. Readers are cautioned that FOFI contained in this AIF should not be used for purposes other than for which it is disclosed herein.

Certain Other Information

Certain information in this AIF is obtained from third party sources, including public sources, and there can be no assurance as to the accuracy or completeness of such information. Although believed to be reliable, management of the Company has not independently verified any of the data from third party sources unless otherwise stated.

CORPORATE STRUCTURE

Name, Address and Incorporation

Electra Battery Materials Corporation (“Electra” or the “Company”) was incorporated under the provisions of the Business Corporations Act (British Columbia) (the “BCBCA”) on July 13, 2011 under the name Patrone Gold Corp. and became a reporting issuer in British Columbia and Alberta upon completion of an arrangement with Unity Energy Corp. on October 2, 2012. On October 3, 2013, the Company changed its name from Patrone Gold Corp. to Aurgent Gold Corp. On March 11, 2014, the Company changed its name from Aurgent Gold Corp. to Aurgent Resource Corp., and on September 22, 2016, the Company changed its name from Aurgent Resource Corp. to First Cobalt Corp. On October 26, 2017, shareholders of the Company approved a continuation under the Canada Business Corporations Act (the “CBCA”). The Company’s continuation under the CBCA was implemented as of September 4, 2018. On December 2, 2021, the Company changed its name from First Cobalt Corp. to Electra Battery Materials Corporation.

Electra is in the business of battery materials refining and the acquisition and exploration of resource properties. The Company is focused on building a diversified portfolio of assets that are highly leveraged to the cobalt market with assets located primarily in North America with the intent of providing a North American supply of battery materials.

Electra is planning to build a fully integrated, localized and environmentally sustainable battery materials park. Leveraging the Company’s own mining assets and business partners, the Battery Materials Park (as defined below) will host cobalt and nickel sulfate production plants, a large-scale lithium-ion battery recycling facility, and battery precursor materials production, which will serve both North American and global customers.

Electra has two significant North American assets:

| (1) | The only permitted cobalt refinery in North America capable of producing battery materials, (the “Refinery”); and |

| (2) | The Iron Creek Project in Idaho, the Company’s flagship mineral project (the “Iron Creek Project”). |

Electra is listed on the TSX Venture Exchange (“TSXV”) as a Tier 2 mining issuer, and trades under the symbol “ELBM” and on the OTCQX under the symbol “ELBMF”. The Company is a reporting issuer in all of the provinces and territories of Canada and files its continuous disclosure documents with the Canadian Securities Authorities in such jurisdictions. Such documents are available on SEDAR at www.sedar.com. Electra’s filings through SEDAR are not incorporated by reference in this AIF.

The Company’s registered office is located at Suite 2400, Bay Adelaide Centre, 333 Bay Street, Toronto, Ontario, M5H 2T6. The Company’s corporate head office is located at 401 Bay Street, 6th Floor, Toronto, Ontario, M5H 2Y4.

Intercorporate Relationships

Electra has four direct subsidiaries, being, Cobalt Industries of Canada Inc., Cobalt Projects International Corp. (“Cobalt Projects”), both of which are incorporated under the laws of the Province of Ontario, Canada, U.S. Cobalt Inc. (“US Cobalt”), which is incorporated under the laws of the Province of British Columbia, Canada, and Cobalt One Limited (“Cobalt One”), an Australian corporation. Electra is the registered and beneficial owner of all of the outstanding share capital in all four direct subsidiaries.

The following shows the Company’s intercorporate relationships. Electra owns, directly or indirectly, 100% of each subsidiary unless otherwise indicated.

Electra Battery Materials Corporation (Ontario)

(I) Cobalt Industries of Canada Inc. (Ontario)

(II) Cobalt Projects International Corp. (Ontario)

(III) U.S. Cobalt Inc. (British Columbia)

(i) Scientific Metals (Delaware) Corp. (Delaware)

(ii) 1086370 B.C. Ltd. (British Columbia)

(a) Idaho Cobalt Company (Idaho)

(iii) Orion Resources NV (Nevada)

(IV) Cobalt One Limited (Australia)

| (i) | Cobalt Camp Refinery Ltd. (British Columbia) |

| (ii) | Cobalt Camp Ontario Holdings Corp. (Ontario) |

| (iii) | Acacia Minerals Pty Ltd (Australia) |

| (iv) | Ophiolite Consultants Pty Ltd (Australia) |

Effective March 1, 2021, Electra transferred ownership of CobalTech Mining Inc. (“CobalTech”) to Kuya Silver Corporation (“Kuya”). Electra originally retained certain rights associated with a class of outstanding preferred shares of CobalTech but such rights were extinguished in September 2021 when the preferred shares were redeemed. Prior to the transfer, CobalTech was a wholly-owned subsidiary of Electra. This transfer of ownership was in connection with completion of the sale to Kuya of a portion of its exploration assets in the Cobalt Camp in Ontario (the “Cobalt Camp”). See “General Development of the Business – 2021 Developments” below.

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

2019 Developments

On January 16, 2019, the Company announced the departure of Jeff Swinoga from the Company’s Board of Directors.

On February 21, 2019, the Company announced the appointment of three-term former Idaho Governor C.L. “Butch” Otter to its Board of Directors. Gov. Otter has had a long and prominent political career including both federal and state positions, as well as a more than 30-year career as a business leader.

On April 3, 2019, the Company announced that it had successfully produced a battery grade cobalt sulfate using the Refinery flowsheet. This was a significant milestone which brings the Company closer to recommissioning the only permitted primary cobalt refinery in North America. SGS Canada performed the testing using cobalt hydroxide as the feedstock. The test work concluded that processing cobalt hydroxide feed would not require the reactivation of the Refinery’s autoclaves, providing an opportunity for higher production potential than projected in the independent study prepared by Primero Group in 2018.

On May 1, 2019, the Company acquired, by way of a private share purchase agreement, a total of 9,640,500 common shares of eCobalt Solutions Inc. for investment purposes. In consideration for the private share purchase, the Company issued 21,265,809 common shares in the capital of the Company (“Common Shares”).

On May 10, 2019, the Australian Securities Exchange (the “ASX”) approved the Company’s request to voluntarily de-list. The Company delisted due to low ASX trading volumes compared to the TSXV, to reduce compliance costs, and because it has no material Australian cobalt projects or business operations.

On May 21, 2019, the Company announced it had signed a memorandum of understanding with Glencore AG (“Glencore”) to supply feedstock and financing to recommission the Refinery.

On May 28, 2019, the Company announced the results of an Ausenco Engineering Canada Inc. (“Ausenco”) scoping study, which concluded that by eliminating the Refinery’s autoclave circuit and addressing production constraints, annual production could reach over 5,000 tonnes of cobalt per annum, more than double previous estimates. The total capital costs associated with this production level is estimated as US$37.5M, representing only US$7.5M of incremental capital costs over previous estimates in order to double production.

On July 15, 2019, the Company announced an agreed term sheet with Glencore which outlined the framework to collaboratively recommission and expand the Refinery. The term sheet outlined Glencore’s support, subject to conditions, to provide funding for metallurgical testing, engineering and permitting work associated with the Refinery and to work towards forming a collaborative long-term relationship to supply refined cobalt to the North American market.

On August 26, 2019, the Company finalized a loan agreement with Glencore (the “Glencore Loan Agreement”) for a US$5M loan to support the next phase of Refinery advancement work, which entails metallurgical testing, engineering, cost estimating, field work and permitting activities to recommission the Refinery, including a definitive feasibility study for a 55 tpd Refinery expansion. The agreement also provides a framework for a fully funded, phased approach to recommissioning and expanding the Refinery. This could involve an interim step where the Refinery is recommissioned at 12 tpd in 2020 then expanded to 55 tpd in 2021 utilizing the current site infrastructure and buildings.

On October 1, 2019, the Company named John Pollesel as non-executive Chairman of the Board of Directors and Susan Uthayakumar as a new Director. John Pollesel has over 30 years of experience in mining and was previously COO and Director of Base Metals Operations for Vale’s North Atlantic Operations, where he was responsible for the largest underground mining and metallurgical operations in Canada. Prior to this, he was Vice President and General Manager for Vale’s Ontario Operations. More recently, he was Senior Vice President, Mining at Finning Canada. Mr. Pollesel also served as CFO for Compania Minera Antamina in Peru, responsible for executive management in one of the largest copper/zinc mining and milling operations in the world. Susan Uthayakumar is President of Schneider Electric Canada, a French-headquartered Fortune Global 500 company and a global leader in digital transformation of energy management and automation. As the Company transitions to a cobalt refiner and active operations, the global management experience of the updated Board will provide valuable contributions to the Company.

2020 Developments

On January 15, 2020, the Company announced a new mineral resource estimate for the Iron Creek Project in Idaho, USA. The new mineral resource estimate was based on infill drilling and limited step-out drilling which included the conversion of 49% of resources from the inferred mineral resource category to the indicated mineral resource category while also increasing the overall tonnage. The indicated mineral resource is now 2.2M tonnes grading 0.32% cobalt equivalent (0.26% cobalt and 0.61% copper) containing 12.3M pounds of cobalt and 29.1M pounds of copper. The inferred mineral resource is now 2.7M tonnes grading 0.28% cobalt equivalent (0.22% cobalt and 0.68% copper) for an additional 12.7M pounds of cobalt and 39.9M pounds of copper. See “Iron Creek Project” below.

On March 30, 2020, the Company announced it had produced battery grade cobalt sulfate using the Refinery flowsheet again, using cobalt alloy as the feedstock.

On April 15, 2020, the Company announced that it increased the size of its Idaho cobalt land position by 50%. The expanded property contains the Iron Creek cobalt-copper deposit, the Ruby target and several other surface exposures of cobalt-copper mineralization. A total of 43 new claims were staked to the west of the Iron Creek Project, expanding the total area from 1,700 acres to over 2,600 acres.

On May 4, 2020, the Company announced positive results from an independent engineering study on the Refinery. The study, titled “First Cobalt Refinery Project – AACE Class 3 Feasibility Study” (the “Refinery Study”), was prepared by Ausenco under the definitions of an Association for the Advancement of Cost Engineering (AACE) Class 3 Feasibility Study is dated July 9, 2020 and was filed on SEDAR under the Company’s profile at www.sedar.com. The Refinery Study contemplates expanding the existing facility and adapting it to be North America’s first producer of cobalt sulfate, an essential component in the manufacturing of batteries for EVs.

On August 17, 2020, the Company announced the appointment of Mark Trevisiol as Vice-President, Project Development. Mr. Trevisiol is a professional engineer with 30 years of experience in mineral processing, mining, capital project and executive management.

On September 24, 2020, the Company announced initial results from ongoing optimization programs with respect to the Refinery.

On October 19, 2020, the Company announced the resumption of exploration activities at the Iron Creek Project. The Company commenced geophysical surveys to trace extensions of mineralization and will follow up on geophysical anomalies detected by its previous work on the Iron Creek Project.

On November 10, 2020, the Company announced that it had re-focused commercial arrangements with Glencore towards a long-term feed purchase contract rather than a tolling arrangement. The Company also announced that it had extended the maturity date on the Glencore Loan Agreement by a year from August 23, 2021 to August 23, 2022.

On November 23, 2020, the Company announced that it had filed amended and restated audited consolidated financial statements for the year-ended December 31, 2019 and amended and restated condensed interim consolidated financial statements for the interim periods ended March 31, 2020 and June 30, 2020, along with amended and restated management discussion and analysis for these periods.

On November 26, 2020, the Company filed a final short form base shelf prospectus (the “Base Prospectus”) with the securities regulators in all provinces and territories of Canada. The Base Prospectus allows the Company to make offerings of Common Shares, subscription receipts, warrants, units or any combination thereof for up to an aggregate total of $20,000 during the 25-month period that the Base Prospectus remains effective. The specific terms of any offering of securities, including the use of proceeds from any offering, will be set forth in a shelf prospectus supplement.

On December 16, 2020, the Company entered into contribution agreements with the Government of Canada and the Government of Ontario to receive $10,000 in public funding pursuant to the Federal Economic Development Initiative for Northern Ontario and the Northern Ontario Heritage Fund Corporation, respectively. The funding is anticipated to be used for recommissioning and expansion of the Refinery. The funding from the Government of Canada is a $5,000 zero-interest loan. This loan will be repaid starting one year after production is commenced at the Refinery and must be repaid within 5 years from the first payment date. The funding from the Government of Ontario is a $5,000 non-repayable grant.

On December 18, 2020, the Company filed a Notice of Change of Auditors on SEDAR in connection with a change of the Company’s auditors from MNP LLP, Chartered Professional Accountants (“MNP”) to KPMG LLP, Chartered Professional Accountants (“KPMG”) effective December 10, 2020.

2021 Developments

On January 12, 2021, the Company announced long-term cobalt hydroxide feed arrangements with Glencore and IXM SA (“IXM”), a fully owned subsidiary of China Molybdenum Co., Ltd (“CMOC”), which will provide a total of 4,500 tonnes of contained cobalt per year to the Refinery commencing in late 2022. The contained cobalt will be provided from Glencore’s KCC mine and CMOC’s Tenke Fungurume mine and represents 90% of the projected capacity of the Refinery.

On January 26, 2021, the Company announced that it has commenced certain pre-construction activities for the Refinery, including detailed engineering and the tendering process for long lead equipment items. The vendor for the cobalt crystallizer, a critical piece of equipment in the expanded Refinery, has been selected and the equipment engineering work has started.

On February 9, 2021, the Company announced the appointment of Regan Watts as Vice-President, Corporate Affairs and Dr. George Puvvada as its Refinery Technical Manager.

On February 22, 2021, the Company filed a supplement to its Base Prospectus to establish an at-the-market equity program that allowed the Company to issue up to $10,000 of Common shares from treasury to the public from time to time, at the Company’s discretion. Distributions of Common shares through the at-the-market equity program were made pursuant to the terms of an equity distribution agreement between the Company and Cantor Fitzgerald Canada Corporation (“Cantor”). On August 23, 2021, in the context of arranging for the US$45,000 combined secured convertible debt and brokered equity financing, as further described under the heading “Selected Financings” below, the Company provided notice to Cantor of the Company’s intention to terminate the at-the-market equity program. The Company raised a total of $686 under the at-the-market equity program. Effective as of September 2, 2021, all sales under the at-the-market equity program were suspended.

On March 1, 2021, the Company announced that it completed its transaction with Kuya to sell a portion of its silver and cobalt exploration assets in the Cobalt Camp and form a joint venture to advance the remaining mineral assets. Kuya acquired a 100% interest in the properties located in the Kerr silver district as consideration for which the Company received $1,000 in cash and 1,437,470 common shares of Kuya. Kuya also acquired an option to earn a 70% interest in the remainder of the Cobalt Camp assets in exchange for staged payments totaling a further $2,000 ($1,000 of which has been paid) and expenditures aggregating to $4,000 in advance of September 1, 2024. Kuya is to make a milestone payment of $2,500 upon completion of a maiden mineral resource estimate of at least 10,000,000 silver equivalent ounces on either of the Kerr area properties or the remaining Cobalt Camp assets. The quantum of the payment increases to $5,000 should the resource exceed 25,000,000 silver equivalent ounces. The Company will have a right of first offer to refine base metal concentrates produced at the Refinery as well as a back-in right for any discovery of a primary cobalt deposit on the remaining Cobalt Camp assets.

On March 29, 2021, the Company announced that it had signed a flexible, long-term, offtake agreement (the “Stratton Offtake Agreement”) with Stratton Metal Resources Limited (“Stratton Metals”) for the sale of future cobalt sulfate production from the Refinery. The Company will have the option to sell up to 100% of its annual cobalt sulfate production to Stratton Metals, subject to a minimum annual quantity. The Stratton Offtake Agreement has a five year term, with quantities to be determined by Electra in advance of each calendar year, and subject to a minimum annual quantity. Pricing will be based on prevailing market prices at the time of the shipment.

Effective April 7, 2021, the Company executed a loan amendment agreement with Glencore to repay the full amount of the existing loan, approximately US$5,506 inclusive of capitalized interest, by issuing common shares of the Company. The amendment and settlement were made via a “shares for debt” provision under TSXV rules. Therefore, the Glencore loan payable and associated derivative liability were settled and derecognized for accounting purposes in the second quarter of 2021, with a resulting loss booked by the Company at that time. The shares were issued at a 15% discount to market, consistent with the original loan agreement terms which gave Glencore the right to convert the balance owing to shares of Electra at a discount of 15% at maturity. A total of 23,849,737 shares were issued to Glencore at a deemed price of $0.29 per share.

On April 7, 2021, the Company announced the appointment of Michael Insulan as Vice President, Commercial. Mr. Insulan has nearly 20 years of experience across oil and gas, bulk commodities, base and minor metals. He has worked for Royal Dutch Shell, CRU, and Eurasian Resources Group. He holds a PhD in Economics, focused on the extractive industries.

On April 28, 2021, the Company announced it had been awarded funding from the US Department of Energy’s Critical Materials Institute (CMI) to research innovative mineral processing techniques for the Iron Creek project. The funding from CMI will consist of US$600 over a two-year period, with an in-kind match from the Company, as part of a total US$1.2 million program.

On May 11, 2021 the Company announced it had acquired additional mining claims known as the West Fork Property to the west of the Iron Creek Project. This transaction effectively doubled the Company’s Idaho land position. Geophysical surveys will be conducted at the West Fork property to test for cobalt and copper mineralization extensions.

On May 25, 2021, the Company announced another transaction, acquiring the Redcastle property to the east of the Iron Creek Project to further expand its land position in Idaho.

On September 1, 2021, Kuya exercised its option to earn up to a 70% interest in the Remaining Assets. To exercise the option, Kuya issued 671,141 common shares at a 20-day VWAP of $1.49 per common share. Over a 3-year earn-in period, Kuya will be required to make $1,000 in additional payments to the Company and invest $4,000 in exploration activities on the properties to earn a 70% interest. Additional milestone payments would be made to the Company in the event a significant silver mineral resource estimate is completed.

On October 5, 2021, the Company announced that it awarded a contract to Metso Outotec for the design and manufacturing for the design and manufacturing of solvent extraction cells as well as technical support for the layout of a new solvent extraction plant and its process control.

On November 30, 2021, the Company announced that it had filed an amendment to the Base Prospectus to increase the total offering price of the securities of the Company that may be offered from time to time under the Prospectus from $20,000 to $70,000 (or the equivalent thereof in U.S. dollars or other currencies).

On December 30, 2021, the Company announced it signed a five-year cobalt tolling contract and amended the previous concluded five-year cobalt hydroxide feed purchase agreement with Glencore.

Subsequent Events

On January 13, 2022, the Company filed a prospectus supplement announced that it has established an at-the-market equity program that allows the Company to issue up to $20,000 of Common Shares from the treasury to the public from time to time, at the Company’s discretion (the “ATM Program”). Distributions of the Common Shares through the ATM Program, if any, will be made pursuant to the terms of an equity distribution agreement (the “ATM Distribution Agreement”) between the Company and CIBC Capital Markets (“CIBC”). The volume and timing of distributions under the ATM Program, if any, will be determined at the Company’s sole discretion. The Company is not obligated to make any sales of Common Shares under the ATM Program. The ATM Program will be effective until the earlier of the issuance and sale of all of the Common Shares issuable pursuant to the ATM Program and December 26, 2022, unless terminated prior to such date by the Company or the Agent. The ATM Program is being facilitated pursuant to a prospectus supplement dated January 13, 2022 to the Company’s base shelf prospectus dated November 26, 2020 as amended pursuant to amendment no. 1 dated November 30, 2021 filed with the securities commissions in each of the provinces of Canada, which are available online under the Company’s profile on SEDAR at www.sedar.com.

On January 19, 2022, the Company announced that it signed a battery recycling and cobalt sulfate supply agreement with Japanese conglomerate Marubeni Corporation.

On February 10, 2022, the Company announced that it received its Industrial Sewage Works Environmental Compliance Approval from the Ontario Ministry of the Environment, Conservation and Parks, and that it has filed its final closure plan for the Refinery.

On February 23, 2022, the Company announced that it was partnering with the Government of Ontario, Glencore plc and Talon Metals Corp., to launch a battery materials park study. The partners will collaborate on engineering, permitting, socio-economic and cost studies associated with the construction of a nickel sulfate plant as well as a battery precursor cathode materials (PCAM) plant adjacent to the Refinery.

On March 1, 2022, the Company announced a financial commitment of $250 from the Government of Ontario in support of the study.

On March 4, 2022, the Company’s closure plan for its Refinery received final approval.

On April 5, 2022, the Company announced its intention to submit a formal application to list its Common Shares on the Nasdaq Stock Market LLC.

On April 5, 2022, the Company announced that it would be undertaking a consolidation of its share capital on the basis of eighteen (18) existing Common Shares for one (1) new Common Shares. The Company anticipates that the consolidation will take effect on or about April 11, 2022.

On April 6, 2022, the Company announced that it had entered into an offtake agreement (the “Glencore Offtake Agreement”) for nickel and cobalt produced from a battery recycling plant that it expects to commission in 2023 at its Battery Materials Park (as defined below). Under the agreement, Glencore will purchase nickel and cobalt products until the end of 2024 on market-based terms.

Selected Financings

The Company has completed the following financings over the last three completed financial years.

On March 29, 2019, the Company completed a non-brokered private placement of 8,913,251 units at a price of $0.18 per unit for gross proceeds of $1,604. Each unit consists of one Common Share and one Common Share purchase warrant. Each warrant entitles the holder thereof to purchase one additional Common Share at a price of $0.27 for a period of two years. The warrants are subject to an acceleration clause such that, if the closing price of the Common Share is equal to or greater than $0.37 per Common Share for a period of ten consecutive trading days, the Company shall have the option, but not the obligation, to effect an accelerated expiration date that shall be 20 calendar days from the issuance of a notice of acceleration.

On February 5, 2020, the Company completed a non-brokered private placement by issuing 15,097,430 units at a price of $0.14 per unit for gross proceeds of $2,114. Each unit consists of one Common Share and one Common Share purchase warrant. Each warrant entitles the holder thereof to purchase one additional Common Share at a price of $0.21 for a period of two years. The warrants are subject to an acceleration clause such that, if the closing price of the Common Shares is equal to or greater than $0.37 per share for a period of 10 consecutive trading days, the Company shall have the option, but not the obligation, to effect an accelerate expiration date that shall be 20 calendar days from the issuance of a notice of acceleration.

On August 28, 2020, the Company announced the closing of a non-brokered private placement of 8,225,000 units at a price of $0.14 per unit and 8,528,643 flow-through units at a price of $0.16 per flow-through unit for aggregate gross proceeds of $2,510. Each unit consists of one Common Share and one warrant. Each flow-through unit consists of one Common Share qualifying as a ‘flow-through share’ and one half of one warrant. The warrants issued in connection with the units and flow-through units entitle the holder to purchase a Common Share at a price of $0.21 per Common Share for a period of 24 months from the date of issuance.

On January 22, 2021, the Company completed a bought deal prospectus offering, pursuant to a prospectus supplement to the Base Prospectus, of 31,533,000 units at a price of $0.31 per unit for gross proceeds of $9,775. Each unit consists of one Common Share and one-half of one Common Share purchase warrant. Each whole warrant is exercisable into one Common Share at an exercise price of $0.50 per Common Share for a period of 24 months from the closing of the offering. The underwriters received a cash commission equal to 6% of the gross proceeds of the offering and 1,891,980 compensation warrants, each compensation warrant being exercisable to acquire one Common Share at $0.31 per Common Share, for a period of 24 months from the closing of the offering.

On August 23, 2021, the Company entered into subscription agreements with certain institutional investors in the United States for US$37,500 principal amount of 6.95% senior secured convertible notes due December 1, 2026 (“Notes”), led by Cantor Fitzgerald Co. as placement agent (the “Note Offering”), and announced a brokered overnight-marketed public offering of Common Shares of approximately $9,500 to be priced in the context of the market (the “Equity Offering”) for aggregate proceeds to the Company of approximately US$45,000. On September 2, 2021 an aggregate of 38,150,000 common shares were issued at a price of $0.25 per share pursuant to the Equity Offering. The investors in the Note Offering also had an option to increase the principal amount of notes subscribed for by up to an additional aggregate amount of US$7,500. This option was exercised in full by the noteholders and the additional Notes were subsequently issued on October 22, 2021. The initial conversion rate of the Notes is 4,058.24 Common Shares per US$1 (equivalent to an initial conversion price of approximately US$0.25 per Common Share), subject to certain adjustments set forth in the indenture governing the Notes.

THE BUSINESS

Background

The Company was incorporated on July 13, 2011 under the BCBCA. On September 4, 2018, the Company was continued under the CBCA. On December 6, 2021, the Company changed its name from “First Cobalt Corp.” to “Electra Battery Materials Corporation”. The Company is in the business of producing battery materials for the electric vehicle supply chain. The Company is focused on building an ethical supply of cobalt, nickel and battery precursor material.

The Company owns two main assets – the Refinery located in Ontario, Canada and the Iron Creek cobalt-copper project located in Idaho, United States. It also controls a number of properties in Ontario known as the Cobalt Camp.

The Company has been progressing plans to recommission and expand the Refinery with a view to becoming the only refiner of battery grade cobalt sulfate in North America. It’s primary focus for 2022 is advancing the expansion and recommissioning of the Company’s Refinery (Phase 1 of the Company’s four-phased approach to build the Battery Materials Park (as defined below)) and continuing to expand its cobalt-copper resource at Iron Creek.

The Refinery and the Battery Materials Park

The Company is working towards restarting its wholly owned cobalt Refinery in Ontario, Canada, as the first phase in a four-phase strategy to create North America’s only fully integrated, localized and environmentally sustainable battery materials park (the “Battery Materials Park”), which will provide battery grade nickel and cobalt, recycled battery materials and precursor material to the North American and global electric vehicle battery market. The Company is pursuing a four-phased approach to build the Battery Materials Park, as follows:

| • | Phase 1 entails an expansion and recommissioning of the Company’s Refinery. The Company anticipates the refinery will produce at an initial rate of 5,000 tonnes per annum of battery cobalt contained in cobalt sulfate from cobalt hydroxide intermediate product supplied from Glencore and CMOC mining operations in the Democratic Republic of Congo. The Company has purchased larger equipment such that a step up in production to 6,500 tonnes per annum in the future is possible. |

| • | Phase 2 entails the recycling of black mass from spent lithium-ion batteries supplied by various black mass producers (battery shredders) in the United States and elsewhere. |

| • | Phase 3 entails the construction of a nickel sulfate plant, thereby providing all of the necessary components (other than manganese) to attract a precursor manufacturer to establish a facility adjacent to these refining operations. |

| • | Phase 4 entails the construction of a precursor cathode active materials facility (“PCAM”), potentially in conjunction with an industry partner, to produce a nickel-cobalt-manganese PCAM product for the electric vehicle supply chain. |

On May 4, 2020, the Company announced positive results from an engineering study performed for the Refinery by Ausenco Engineering Canada (the “Refinery Study”). The Refinery Study outlined the Refinery’s ability to reach annual production of 25,000 tonnes of battery grade cobalt sulfate from third party feed, representing 5% of the total global refined cobalt market and 100% of North American cobalt supply with strong operating cash flows and a globally competitive cost structure.

The Refinery Study was prepared to summarize the results of an engineering study prepared at a feasibility level related to the Refinery. The Company confirms that the report does not constitute a feasibility study within the definition employed by the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”), as it relates to a standalone industrial project and does not concern a mineral project of Electra. As a result, disclosure standards prescribed by NI 43-101 are not applicable to the scientific and technical disclosure in the report. Any references to scoping study, prefeasibility study or feasibility study by Electra, in relation to the Refinery, are not the same as terms defined by the CIM Definition Standards and used in NI 43-101. The Refinery Study is also not based on any existing mineral reserves or mineral resources of the Company and the Company does not contemplate that any of the Company’s current mineral projects will provide a source of feedstock for the Refinery.

Subsequent to the Refinery Study, additional metallurgical testing, engineering work, flow-sheet optimization and market analysis has been completed, certain equipment has been ordered and the Company has entered the full development phase of the refinery expansion project. As the project has progressed and changed from the Refinery Study, the original economic outputs should no longer be relied upon.

Additionally, in response to strong customer demand, the Company has invested in increased capacity for its cobalt crystallizer, which will result in installed capacity of 6,500 tonnes of annual contained cobalt production, a 30% increased from the engineering study design of 5,000 tonnes. Future permit amendments will be sought to permit this increased output level. The Company has also been reviewing opportunities to utilize black mass from recycled lithium-ion batteries as supplemental refinery feedstock, with a scoping study in progress.

The Company has achieved several additional key milestones on its development path for the Refinery, including:

| • | January 2021 | – Feedstock arrangements announced with Glencore and IXM |

| • | January 2021 | – Commencement of detailed engineering and pre-construction activities |

| • | February 2021 | – ATM Program launched for issuance of up to $10,000 of common shares |

| • | March 2021 | – Sale of Cobalt Camp properties to Kuya Silver for $4,000 in cash and shares |

| • | March 2021 | – Warrant exercises of $7.1 million from Dec 2020 through March 2021 |

| • | March 2021 | – Flexible, long-term offtake arrangement for up to 100% of production |

| • | September 2021 | – Convertible note and equity offering for US$45,000 to fund construction |

| • | October 2021 | – Solvent extraction design and manufacturing contract awarded to Metso-Outotec |

| • | October 2021 | – Additional convertible notes of US$7,500 issued |

| • | November 2021 | – Increased cobalt crystallizer capacity and formalized new project capital budget |

| • | December 2021 | – Five-year tolling contract and amended feed purchase agreement with Glencore |

| • | January 2022 | – Establishment of the $20,000 ATM Program with CIBC |

| • | February 2022 | – Receipt of Industrial Sewage Works approval |

| • | March 2022 | – Receipt of final approval for closure plan for the Refinery |

The construction remains on schedule to commission the expanded refinery in Q4 2022 and initially ramp-up to 5,000 tonnes of contained cobalt production per year. Ground excavation has commenced for the solvent extraction facility, and major equipment contracts have been awarded. The project has now advanced beyond the study phase, with detailed engineering now significantly more advanced and numerous equipment orders finalized. Therefore, the Company has completed a new capital budget that is more defined and representative of the project. The updated capital budget is US$67,000, including a contingency amount of US$3,900.

The Company received approval for its Air and Noise permit and its Permit to Take Water, and as noted above, the Company has received final approvals for its Industrial Sewage Works permit amendment and its revised Refinery closure plan. An update to the Permit to Take Water is in progress to ensure the volumes match the Industrial Sewage Works Permit, which will need to be completed in advance of operation.

The current estimated timeline to bring the Refinery into production is outlined below:

| • | Q2 2022 – Receive updated permit to take water |

| • | Q2 2022 to Q4 2022 – On site construction activities |

| • | Q4 2022 – Refinery Commissioning |

The Company continues to make progress towards achieving its objective of providing the world’s most sustainable battery materials for the electric vehicle market. The Company continues to work with engineering firms, its commercial partners, process experts and financial advisers to finalize and execute on the plans for its phase one recommissioning and expansion of the Refinery.

See “Refinery” for more information with respect to the Refinery Study.

The Iron Creek Project

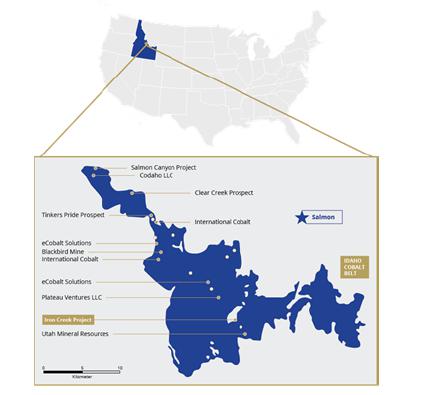

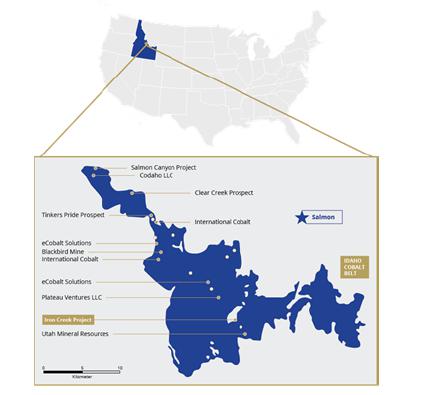

Following the completion of the acquisition of US Cobalt, the Company owns 100% of the Iron Creek Project which is located about 42 kilometres southwest of Salmon, Idaho, within the historic Blackbird cobalt-copper district of the Idaho cobalt belt. The project consists of seven patented Federal lode claims that straddle Iron Creek, and a surrounding group of 83 unpatented Federal lode claims. As noted above, the Company announced a new mineral resource estimate for the Iron Creek Project in Idaho, USA in January 2020. The new mineral resource estimate was based on infill drilling and limited step-out drilling which included the conversion of 49% of resources from the inferred mineral resource category to the indicated mineral resource category while also increasing the overall tonnage. The indicated mineral resource is now 2.2M tonnes grading 0.32% cobalt equivalent (0.26% cobalt and 0.61% copper) containing 12.3M pounds of cobalt and 29.1M pounds of copper. The inferred mineral resource is now 2.7M tonnes grading 0.28% cobalt equivalent (0.22% cobalt and 0.68% copper) for an additional 12.7M pounds of cobalt and 39.9M pounds of copper. In April 2020, the Company announced additional staking added 43 new claims to the Company’s Idaho land package. The Company further increased its property position around Iron Creek in May 2021, with the acquisition of the West Fork Property and the announcement of the Redcastle property earn-in agreement. In June 2021, the Company announced the commencement of its 2021 Idaho exploration program encompassing 4,500 metres of drilling, geophysical surveys and bedrock geological mapping at a budgeted cost of $2.5 million. Together, the patented and unpatented claims cover an area of approximately 5,900 acres. See “Iron Creek Project” for more information with respect to the Iron Creek Project.

The Cobalt Camp

As further discussed under “General Development of the Business – 2021 Developments” above, on March 1, 2021, the Company announced that it completed its transaction with Kuya to sell a portion of its silver and cobalt mineral exploration assets its Cobalt Camp and form a joint venture to advance the remaining mineral assets comprising the Cobalt Camp. The Cobalt Camp is approximately a five-hour drive from Toronto, Ontario. The Cobalt Camp is not material property for the purpose of this AIF.

Specialized Skills and Knowledge

Successful exploration, development and operation of the Company’s cobalt projects will require access to personnel in a wide variety of disciplines, including engineers, geologists, geophysicists, drillers, managers, project managers, accounting, financial and administrative staff, and others. Since the project locations are also in jurisdictions familiar with and friendly to advanced manufacturing and resource extraction, management believes that the Company’s access to the skills and experience needed for success is sufficient.

Competitive Conditions

The Company’s activities are directed towards the potential recommissioning and expansion of the Refinery and the exploration, evaluation and development of mineral deposits. There is no certainty that the expenditures to be made by the Company will result in the recommissioning and expansion of the Refinery or discoveries of commercial quantities of mineral deposits. There is aggressive competition within the mining industry for the discovery and acquisition of properties considered to have commercial potential. The Company will compete with other interests, many of which have greater financial resources than it will have, for the opportunity to participate in promising projects. Significant capital investment is required to achieve commercial production from successful exploration efforts, and the Company may not be able to successfully raise funds required for any such capital investment. See “Risk Factors – Competition” below.

Components

The Company’s Refinery expansion depends on the sourcing, pricing and availability of mine production for refining. Most of the cobalt consumed today is mined in the DRC and then shipped to China for refining. There are no primary cobalt refining facilities operating in North America, which gives the Refinery a strategic advantage in the EV supply chain. The ability of the Refinery to Company produce battery grade cobalt sulfate using different types of feedstock will assist in diversifying sourcing of mine production for the Refinery. As noted above, while the Company and Glencore initially anticipated using the results of the Refinery Study to negotiate the terms of a tolling agreement and financing arrangement, the Company announced that it has since re-focused commercial arrangements with Glencore towards a long-term feed purchase contract rather than a tolling arrangement.

Business Cycles

Mining is a cyclical industry and commodity prices fluctuate according to global economic trends and conditions. See “Risk Factors – Risk Related to the Cyclical Nature of the Mining Business” below.

Environmental Protection

The Company’s Refinery expansion and exploration activities are subject to various levels of federal, provincial, state and local laws and regulations relating to the protection of the environment, including requirements for closure and reclamation of mining properties.

The Refinery has active permits and is subject to a reclamation bond and closure plan. The total provision for reclamation and closure cost obligations at December 31, 2021 was $1,204. The Company submitted a new closure plan, which covers activities still to take place at site, with a total closure cost of $3,450. A surety bond for this same $3,450 amount has been deposited with the Province of Ontario.

The Iron Creek Project is located within Salmon National Forecast, under the administration of the United States Forest Service (“USFS”). The Company manages all activities on site to ensure all work is performed in compliance with existing environmental regulations. It is understood that water and particulates from any drilling or other work should be prevented from entering any body of water without first being treated so there is no sediment or other contaminants entering the water.

Environmental and Social Governance

The Company’s mission is to be one of the most sustainable producers of battery materials.

Cobalt is a key element in fueling the lithium-ion batteries used in electric vehicles and for electric battery storage, both of which are essential technologies in the reduction of global carbon emissions.

The Company strives to be a leader amongst its peer group in the area of Environmental and Social Governance (“ESG”). Cobalt is essential to the global transition to electric mobility and Electra is committed to sustainable production and employing industry leading ESG practices at its Refinery.

The Company will provide a clean and ethical supply of cobalt for the EV market from large, commercial mining operations that provide ethically sourced cobalt and the highest quality cobalt hydroxide globally. As a member of the Cobalt Institute, the Company will follow the Cobalt Industry Responsible Assessment Framework (CIRAF), an industry-wide risk management tool that helps cobalt supply chain players identify production and sourcing related risks. Electra also committed to the Responsible Minerals Initiative, which will include a third-party audit of the systems in place to responsibly source minerals in line with current global standards.

The Refinery is projected to have a lower quartile carbon intensity cobalt by virtue of hydro powered mining operations supplying its hydro powered refining operation. In October 2020, results were released from an independent Life Cycle Assessment (“LCA”) which affirmed the low carbon footprint of the Refinery. The report concluded that the environmental impacts associated with refining cobalt at the Refinery will be materially lower than the published impacts of a leading Chinese refiner.

The Company takes a proactive, risk-based approach to environmental management and human rights with robust measures intended to minimize the environmental impact of operations and prevent the use of child labor at any level in the supply chain. Electra believes that these and other ESG practices will help it establish a premium brand of cobalt sulfate for the electric vehicle market.

Glencore Loan Agreement and Amended Glencore Loan Agreement

On August 26, 2019, the Company finalized the Glencore Loan Agreement to fund the next phase of activities required to advance the Refinery, which included metallurgical testing, engineering, cost estimating, field work and permitting activities to recommission the Refinery, including an engineering study for a 55 tpd Refinery expansion. While the maturity date on the Glencore Loan Agreement was extended by a year from August 23, 2021 to August 23, 2022, the Company then entered an amending agreement, pursuant to which Electra had the right to repay the loan by issuing Common Shares. In particular, the Company and Glencore agreed that, subject to the terms of the amended Glencore Loan Agreement, the Company would repay the loan, which represented an outstanding debt of US$5,506 by issuing 23,849,737 Common Shares at a deemed price of $0.29 (being a 15% discount to the market price on the TSXV on March 24, 2021). The Common Shares were issued on April 7, 2021 and the loan has now been fully repaid. The U.S. dollar denominated debt was converted from United States dollars into Canadian dollars using an exchange rate of US$1.00 = $1.2562.

Employees

As of December 31, 2021, the Company had 19 staff members made up of full-time employees and contractors.

Reorganizations

There have been no corporate reorganizations of the Company.

Foreign Operations

The Company’s Iron Creek Project is located in Idaho, U.S. Mineral exploration and mining activities in the United States may be affected in varying degrees by government regulations to the mining industry. Any changes in regulations or shifts in political conditions may adversely affect the Company’s business. Operations may be affected in varying degrees by government restrictions on permitting, production, price controls, income taxes, expropriation of property, environmental legislation and mine safety. The Refinery is likely to also rely substantially on mine production from foreign jurisdictions. As such, the Company may indirectly be exposed to various levels of political, economic and other risks and uncertainties associated with operations in a foreign jurisdiction.

REFINERY

The Refinery

The Refinery is 100% owned by Cobalt Camp Refinery Limited (“CCRL”), a subsidiary of Electra. The Refinery is currently under development with permit amendments mostly complete. The refinery business plan involves modifying the existing flowsheet to treat cobalt hydroxide feed material to produce cobalt sulphate used in the manufacture of batteries for electric vehicles. The flowsheet changes from the feasibility study were supported by bench and pilot scale metallurgical test work. It is proposed to refurbish and expand the refinery to produce 6,500 tpa (6.5 thousand tpa) of cobalt contained in cobalt sulfate.

Refinery Description and Location

The Refinery is located at approximately 47.40640° north and 79.62225° west in Lorrain Township near the town of North Cobalt, Ontario. The Refinery is located approximately 1.5 km east of the town of North Cobalt, along Highway 567, locally referred to as “Silver Centre Road”.

The facility was permitted in 1996 with a nominal throughput of 12 tpd and operated intermittently until 2015, producing a cobalt carbonate product along with nickel carbonate and silver precipitate. The facility is located on approximately 250 acres, with two settling ponds and an autoclave pond. The current footprint also includes a large warehouse building that once housed a conventional mill.

Infrastructure and Physiography

The Refinery is located near the town of North Cobalt and the city of Temiskaming Shores. Temiskaming Shores is an amalgamation of the towns of New Liskeard, Dymond, Haileybury and North Cobalt. Geographically, the Refinery is closest to the town of North Cobalt approximately 140 km north of the city of North Bay. The Refinery is accessed from the town of North Cobalt via an all-weather road from Silver Centre Road (Highway 567).

The region experiences a typical continental-style climate, with cold winters and warm summers. Daily average temperature ranges from -15°C in January to 18.3°C in July. The coldest months are December to March, during which the temperature is often below -20°C and can fall below -30°C. During summer, temperatures can exceed 30°C. Snow accumulation begins in November and generally remains until the spring thaw in mid-March to April, with the average monthly snowfall peaking at 40 cm in January and a yearly average of 181 cm.

Basic services are available locally in Temiskaming Shores, and further services are available in Sudbury. Sudbury is located 200 km by road southwest of the Refinery, and is considered a world-class mining centre and major hub for retail, economic, health, and education sectors in Northern Ontario. Most of the resources for the restart of the Refinery will likely be provided from the local townships, Sudbury, and North Bay areas.

Power for the refinery is provided from the grid by Hydro One through 115 kV and 230 kV transmission lines. The feeder to the Refinery is 44 kV. Fresh water is sourced from the nearby Lake Timiskaming. Many roads, trails, and powerlines span the area. Ontario Northland Railway services the town of North Cobalt, linking North Bay with the rest of north-eastern Ontario. Ontario Northland’s rail line passes approximately 2 km west-northwest of the refinery road. An existing road provides access to the site.

The Refinery is located within a well-established site. Local topography is dominated by Lake Temiskaming and the Montreal River, both of which are within the Ottawa River watershed. Topography within the property boundaries of the refinery is generally flat. General physiography is typical of the Precambrian Shield in north-eastern Ontario, with rocky, rolling bedrock hills with locally steep ledges and cliffs, separated by valleys filled with clay, glacial material, swamps and streams. Given the presence of the Clay Belt, some farms are present nearby. In this boreal region, coniferous and mixed-wood forests dominate. The main conifer species are black and white spruce, jack pine, balsam fir, tamarack and eastern white cedar. The predominant deciduous (hardwood) species are poplar and white birch. Swampy low-lying areas contain abundant tag alders.

History

In the 1980s, the location was the site of the Hellens-Eplett underground mine, which featured a traditional silver and cobalt mill that was quite common in the historic Cobalt Mining Camp. The property and mill were purchased by Cobatec Ltd. in the 1990s and construction of the refinery took place in 1994 and 1995. The integrated mining, milling and refining operation processed ore from the mine in the mill to produce concentrate, and then produce a refined cobalt and silver product from the concentrate in the Refinery. Initial start-up was in 1996. The Refinery was built with a nominal 12 tpd feed rate and made a cobalt-carbonate product from four feedstocks over different periods. Cobatec eventually shut down the Refinery on January 2, 1999. The Refinery was operational for approximately one of the three years between start-up and shutdown.

The Refinery was subsequently owned and operated by several owners until Electra entered into a 50-50 joint venture with Australian-listed Cobalt One Limited to acquire the Refinery in 2017.

The previous owners included:

| • | 1999-2003: Canmine Resources Corporation |

| • | 2003-2012: Yukon Refinery AG |

| • | 2012-2015: United Commodities |

| • | 2015-2017: Yukon Refinery AG |

Metallurgical Testing

Phase I – Initial Testing

Metallurgical testing was completed at SGS Canada Inc. (“SGS”) between Q4 2018 and Q2 2020. The test work program was managed by Electra with input from Ausenco. For purposes of the Refinery Study, the initial phase of test work was conducted under 17070-01 and 17070-03 programs.

The programs evaluated two different cobalt hydroxide feed materials. The composition of each feed material is summarized in the table below.

Cobalt Hydroxide Feed Sample Analysis

| Program | | | Co

% | | | Cu

% | | | Fe

% | | | Mn

% | | | Mg

% | | | Si

% | | | Zn

g/t | | | Ni

g/t | | | Al

g/t | | | Cr

g/t | |

| | 17070-01 | | | | 23.2 | | | | 1.61 | | | | 2.39 | | | | 3.27 | | | | 3.45 | | | | 1.05 | | | | 1920 | | | | 3870 | | | | 6390 | | | | 52 | |

| | 17070-03 | | | | 29.2 | | | | 0.46 | | | | 0.12 | | | | 4.85 | | | | 5.67 | | | | 0.77 | | | | 403 | | | | 9410 | | | | 1200 | | | | <100 | |

The 17070-01 sample had a lower cobalt content (23.2% dry weight (“w/w”)) than the 17070-03 sample (29.2% w/w), as well as higher levels of copper, iron, silica, zinc and aluminium all of which are impurities. The source of the 17070-01 was from an operation in the DRC. The source of the 17070-03 sample was Glencore’s Mutanda operation in the DRC and a mass of 570 kg (gross) was supplied.

The purpose of the 17070-01 campaign was to demonstrate that battery-grade cobalt sulphate could be produced from a cobalt hydroxide feedstock using most of the current flowsheet at the refinery. The definition of a battery-grade cobalt sulphate product was based on specifications received by Electra from potential end users.

The program achieved a high purity cobalt sulphate product with a cobalt grade of 20.8 %w/w, with impurity levels that we within range of lithium-ion battery market specifications.

The purpose of the 17070-03 program was to provide data for the Refinery Study, such as process conditions and operating targets for the various unit operations. The tests conducted included re-leaching and neutralisation, impurity solvent extraction (“ISX”), CoSX, solid/liquid separation testing, environmental and tailings testing.

Following the SX testwork performed at SGS and METSIM™ modelling by Ausenco, results were provided to Solvay to evaluate the SX processes on a continuous basis. The modelling results were incorporated into the basis of design.

Environmental testwork was also conducted to determine operating parameters for the effluent treatment circuit. Synthetic solutions were prepared based on compositions predicted in the METSIM™ model and were supplied to Story Environmental Inc. (“SEI”) for effluent treatment testing and Aquatox Testing and Consulting Inc. for toxicity testing.

Key results from the testwork program and Solvay modelling are listed in the table below:

Key Results from the 17070-03 Testwork Program & Solvay Modelling

| Description | | Unit | | Value | |

| Re-leach and neutralisation recovery | | % | | | 93.5 | |

| Neutralisation pH | | - | | | 5.0 | |

| Average sulphuric acid addition | | kg/t (dry basis) | | | 633 | |

| Limestone addition | | kg/t (dry basis) | | | 161 | |

| ISX configuration | | extract / scrub / strip | | | 3 / 2 / 2 | |

| ISX extractant concentration | | % | | | 20 | |

| ISX cobalt recovery (to extraction raffinate) | | % | | | 99.6 | |

| CoSX configuration | | extract / scrub / strip | | | 3 / 6 / 2 | |

| CoSX extractant concentration | | % | | | 40 | |

| CoSX cobalt recovery (to strip solution) | | % | | | 99.6 | |

| Effluent treatment final pH | | - | | | 11.0 | |

Based on the results of the Solvay modelling, it was determined that ion exchange and manganese precipitation would not be required.

The testwork demonstrated that high-purity, battery-grade cobalt sulphate can be produced from the cobalt hydroxide samples that were provided. The overall cobalt recovery of the process was 93% based on the testwork results conducted. The final cobalt sulfate produced in this test work graded 21.4% cobalt, exceeding the minimum cobalt specification for battery grade cobalt sulfate.

Phase II – Testing and Piloting

Subsequent to the Refinery Study, the Company continued to advance metallurgical testwork with SGS, including pilot plant testing using new sample material from Kamoto Copper Company SARL (“KCC”; majority owned by Glencore’s Katanga Mining) in the DRC, which better represents the material that would be expected to be processed through the refinery when in operation. This testwork yielded recoveries significantly higher than those from the Refinery Study analysis.

The pilot study consisted of the following unit operations such as a) Leaching; b) Solvent Extraction; and c) Effluent Treatment.

The solvent extraction pilot study resulted in removing the impurities from the leach liquor and generating a concentrated cobalt sulfate product solution that is used to produce battery grade cobalt sulfate crystals. The waste streams of the solvent extraction pilot were treated using lime in a separate continuous pilot run, and the effluent generated from this study was found to meet the discharge limits prescribed by the Ontario Ministry of Environment, Conservation and Parks. The gypsum residue generated as a solid waste will be stored in the on-site tailings storage facility.

Recovery Methods

The refinery takes in cobalt hydroxide feed containing anywhere from 30 to 50% of contained cobalt. The refinery uses sulfuric acid to leach the cobalt hydroxide material into solution. Following the leaching process the liquor is neutralized before being sent to solvent extraction circuits where further impurities are removed. The final liquid from solvent extraction contains a high percentage of cobalt and that product is put through a crystallization process where battery grade cobalt sulphate is produced as the plants final product which then goes to market.

The process design is consistent with other operations, including:

| • | Vale, Long Harbour: impurity SX followed by CoSX |

| • | WMC, Bulong Refinery: CoSX with Cyanex 272 followed by sulphide precipitation and impurity SX with D2EHPA |

| • | Finland, Terrafame: crystallisation of high purity cobalt sulphate heptahydrate |

Process Description

Cobalt hydroxide is received on site at 66% w/w moisture in 1-tonne bulk bags and stored in the warehouse. The bags are lifted by forklift and broken in a bag breaker before being fed into a storage bin by conveyors. The material is fed into a re-pulper where it is mixed with recycled water into a slurry and stored in a feed tank.

The slurry is pumped to a leach tank and leached with sulphuric acid to solubilise cobalt and other metals. The leach slurry then gravity flows to pre neutralisation tanks where process steps such as a) water dilution and b) removal of impurities take place. The pre-neutralised slurry would then advance to thickeners and the thickener underflow is filtered using plate and frame filter presses. The leach thickener overflow and the leach filtrate would advance to secondary neutralisation stage.

The overflow of the neutralisation thickener is filtered to remove suspended solids. This filtrate is the feed stock for solvent extraction plant for further purification.

The solvent extraction step consists of two phases, the impurity solvent extraction (ISX) and cobalt solvent extraction (CoSX). The feed solution initially processed through ISX which consists of extraction, scrubbing, and stripping stages to separate various impurities. The cobalt-rich ISX raffinate reports to CoSX, while the impurities report to effluent treatment.

The ISX raffinate reports to CoSX and is processed through extraction, scrubbing and stripping stages to separate impurities from the cobalt. The CoSX raffinate is treated in the effluent treatment plant, while the cobalt-rich strip solution is sent to crystallisation.

The strip solution from CoSX reports to the forced circulation mechanical vapour recompression cobalt sulphate crystalliser. Cobalt sulphate is crystallised and subsequently dewatered in a thickener, centrifuge and fluid bed dryer. The dry product is then bagged and stored in the warehouse prior to shipment.

Some of the reagents used in the process include:

| • | flocculant, including a mixing and dosing system for the residue and effluent thickeners |

| • | sulphuric acid, including a storage tank, dilution and dosing system |

| • | lime (CaO), including a storage silo, slaker and ring main |

| • | sodium hydroxide, including a heated storage tank, dilution and dosing system |

Services supplied to the process include:

| • | fire water and fire suppression systems |

| • | plant and instrument air |

Process Design Criteria

The design criteria are based on data supplied by Electra, bench and pilot test work, vendor data and modelling, industry standards and HATCH’s in-house database.

Site Infrastructure

The major project facilities include the existing refinery building with expanded facilities, a new SX building and three existing ponds.

Power to the Refinery is provided via an existing 44 kV feeder from the Hydro One grid. It is then stepped down via a 2.5 MVA 44kV/600V transformer for distribution throughout the facilities.

Fresh water is supplied to the refinery from Lake Timiskaming by an overland pipeline and pumping system. The pumphouse contains two freshwater pumps in a duty/standby configuration. Water is pumped 2.5 km through a buried pipeline, in an existing easement, to the Refinery site, where it is stored in the filtered water tank. The water is predominantly used for cooling and does not touch the process liquids. The warm water is returned to Lake Timiskaming through a similar buried pipeline along the same easement.

Market Studies and Commercial Contracts

Electra has retained numerous firms to provide market studies and battery metals industry outlooks and expertise. Subsequent to the Refinery Study and in the normal course of business, Electra has now entered into the following contracts:

| • | a 5-year contract for the purchase of cobalt hydroxide feedstock from Glencore’s KCC mine |

| • | a 5-year cobalt tolling agreement with Glencore for material from the KCC mine, |

| • | a 5-year contract IXM SA for the purchase of cobalt hydroxide feedstock from the Tenke Fungurume mine |

| • | a flexible, long-term cobalt sulfate offtake agreement with Stratton Metals for the sale of finished product from the refinery. |

All of these arrangements are linked to future benchmark cobalt prices, with the exception of the cobalt tolling agreement which stipulates a tolling fee to Electra.

Demand

Cobalt is used in a range of applications, but the largest single market is lithium-ion (Li-ion) batteries. The three primary segments for Li-ion batteries are consumer electronic devices, electric vehicles and both stationary and grid energy storage. All three segments have a strong growth profile over the coming years and as such, the market for Li-ion batteries is expected to grow sharply. EVs are forecast to be the largest market for Li-ion batteries.