NOTICE OF ANNUAL GENERAL AND

SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that an Annual General and Special Meeting (the “Meeting”) of the shareholders (the “Shareholders”) of ELECTRA BATTERY MATERIALS CORPORATION (the “Company”) will be held on Tuesday, October 24, 2023, at 11:00 a.m. (Toronto time), for the following purposes:

| 1. | To receive the audited financial statements of the Company for the year ended December 31, 2022, together with the report of the Auditors thereon; |

| 2. | To appoint MNP LLP as the Auditor of the Company for the ensuing year, and to authorize the directors to fix the remuneration to be paid to the Auditor; |

| 3. | To elect directors of the Company for the ensuing year; |

| 4. | To consider and, if deemed advisable, to approve with or without variation, an ordinary resolution of disinterested Shareholders to approve the 2022 Amended and Restated LTIP, as more particularly described in the accompanying management information circular of the Company dated September 5, 2023 (the “Circular”); |

| 5. | To consider and, if deemed advisable, to approve with or without variation, an ordinary resolution of disinterested Shareholders to approve the ESP Plan, as more particularly described in the accompanying Circular; and |

| 6. | To transact such further or other business as may properly come before the meeting or any adjournment or adjournments thereof. |

All Shareholders are strongly encouraged to vote in advance of the Meeting using the proxy form or the voting instruction form provided to them with the Meeting materials.

Date: Tuesday, October 24, 2023

Time: 11:00 a.m. (Toronto time)

Location: York Room in the Sheraton Centre Toronto Hotel located at123 Queen Street W, Toronto, Ontario, M5H 2M9

All resolutions require a simple majority of the votes cast at the Meeting, whether in person or by proxy. A “special resolution” is a resolution passed by a majority of not less than two-thirds of the votes cast by Shareholders (in person or by proxy) in respect of that resolution at the Meeting. The resolutions to approve the 2022 Amended and Restated LTIP and the ESP Plan require a simple majority of the votes cast at the Meeting by disinterested Shareholders. The text of these resolutions has been provided in the Circular.

The nature of the business to be transacted at the Meeting is described in further detail in the Circular, which forms part of this Notice and provides additional information relating to the matters to be dealt with at the Meeting.

You are entitled to vote at the Meeting and any postponement or adjournment thereof if you owned Common Shares of the Company at the close of business on September 5, 2023 (the record date). For information on how you may vote, please refer to Part 1 of this Circular.

Toronto, Ontario

September 5, 2023

| By Order of the Board of Directors, |

| |

| “Trent Mell” |

| |

| Trent Mell |

| President and Chief Executive Officer |

MANAGEMENT PROXY CIRCULAR

This management proxy circular (the “Circular”) is provided in connection with the solicitation of proxies by the management (“Management”) of Electra Battery Materials Corporation (the “Company” or “Electra”) for use at the annual general and special meeting (the “Meeting”) of the holders of common shares of the Company (the “Common Shares” and the holders of the Common Shares, the “Shareholders”) to be held on Tuesday, October 24, 2023 at the time and place and for the purposes outlined in the accompanying Notice of Annual General and Special Meeting of Shareholders and at any adjournment thereof. Unless otherwise noted, information in this Circular is given as at September 5, 2023.

All Shareholders are strongly encouraged vote in advance of the Meeting using the proxy form or the voting instruction form provided to them with the Meeting materials.

Date: Tuesday, October 24, 2023

Time: 11:00 a.m. (Toronto time)

Location: York Room in the Sheraton Centre Toronto Hotel located at 123 Queen Street W, Toronto, Ontario, M5H 2M9

Solicitation of Proxies

It is expected that the solicitation of proxies will be primarily by mail, however, proxies may also be solicited by the officers, directors and employees of the Company by telephone, electronic mail, telecopier or personally. These persons will receive no compensation for such solicitation other than their regular fees or salaries. The cost of soliciting proxies in connection with the Meeting will be borne directly by the Company.

Notice-and-Access

The Company is availing itself of the “notice-and-access” provides in section 9.1.1 of National Instrument 51-102 – Continuous Disclosure Obligations (“NI 51-102”), in the case of Registered Shareholders (as defined below) and section 2.7.1 of National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”), in the case of Non-Registered Shareholders (as defined below), which allow the Company to deliver this Circular and other proxy-related materials to Shareholders via certain specified electronic means, provided that the conditions of NI 51-102 and NI 54-101 are met.

The Company will deliver this Circular and other proxy-related materials to Shareholders by posting it on its website at https://electrabmc.com/news/agm-materials/. These materials will be available on the Company’s website as of September 21, 2023 and will remain on the website for one full year thereafter. The materials will also be available under the Company’s profile on SEDAR+ at www.sedarplus.ca as of September 21, 2023. Shareholders may contact the Company’s transfer agent, TSX Trust Company (Canada) (“TSX Trust”), at 1-888-433-6443 or by email at tsxt-fulfilment@tmx.com to request a paper copy of the Circular and other proxy-related materials. Shareholders with questions on notice-and-access may also contact TSX Trust.

The Company will not use the procedure known as “stratification” about the use of notice-and-access provisions. Stratification occurs when a reporting issuer using the notice-and-access provisions provides a paper copy of the Circular to certain Shareholders with the notice package.

PART 1: VOTING INFORMATION

Who can vote?

Registered and Non-Registered Shareholders

You have the right to receive notice of and vote at the Meeting, or any adjournment or postponement thereof, if you owned Common Shares of the Company as of the close of business (Toronto time) on September 5, 2023 (the “Record Date”). Each Common Share you own entitles you to one vote in person or by proxy at all meetings of the Shareholders. Except as otherwise noted in this Circular, a simple majority of the votes cast at the Meeting, whether in person, by proxy or otherwise, will constitute approval of any matter submitted to a vote.

You are a registered Shareholder (a “Registered Shareholder”) if the Common Shares are registered in your name. This means that your name appears in the Shareholders’ register maintained by Electra’s transfer agent, TSX Trust. You are a non-registered (or beneficial) Shareholder (a “Non-Registered Shareholder”) if your bank, trust company, securities broker or other financial institution or intermediary (your nominee) holds your Common Shares for you in a nominee account.

Common Shares outstanding and principal holders of Common Shares

On April 5, 2022, the Company announced a share consolidation of its Common Shares (the “Consolidation”) on the basis of one new post-Consolidation Common Share for every 18 pre-Consolidation Common Shares issued and outstanding on the effective date of the Consolidation. The Consolidation was effected on April 13, 2022 and resulted in the number of issued and outstanding Common Shares being reduced from approximately 562 million to approximately 31 million, on a non-diluted basis. In addition, the exercise price and the number of Common Shares issuable upon the exercise of outstanding stock options (“Options”), Common Share purchase warrants (“Warrants”) and other outstanding convertible securities were proportionately adjusted to reflect the Consolidation the Company underwent with the terms of such securities for the holders of such instruments. All equity figures in this Circular are reflected on a post-Consolidation basis.

On September 5, 2023, the Company had 55,841,329 Common Shares issued and outstanding.

To the knowledge of the directors and executive officers of the Company, as of September 5, 2023, no person beneficially owns, directly or indirectly, or exercises control or direction over, 10% or more of the issued and outstanding Common Shares.

How to vote?

You can vote via the internet, fax, mail or email. You may elect to vote by proxy. Voting by proxy means you are giving someone else the authority to vote your shares for you (called your proxyholder).

Completing the Proxy Form

This package includes a proxy form (for Registered Shareholders) (the “Proxy Form”) that includes the names of Electra officers or directors who are proxyholders. When you vote by proxy, you are giving them the authority to vote your shares for you according to your instructions. If you return your Proxy Form and do not specify how you want to vote your Common Shares, one of these officers or directors will vote your Common Shares in favour of the items listed in the Notice of Annual General and Special Meeting of Shareholders.

You can also appoint someone else to be your proxyholder. Print his or her name in the space provided on the Proxy Form, or by completing another Proxy Form and providing proper instructions to vote your Common Shares. This person does not need to be a Shareholder. Your vote can only be counted if he or she attends the Meeting and votes your Common Shares, or if they are pre-registered to attend the Meeting by conference call using the link provided above. You may pre-register them or provide them with the link to pre-register themselves before the deadline.

Your proxyholder will vote according to your instructions on these items and on any ballot that may be called for. If you do not specify how you want to vote your Common Shares, your proxyholder can vote as he or she sees fit. If there are changes or new items, your proxyholder has the discretionary authority to vote your Common Shares as he or she sees fit.

Returning your Proxy Form

To be effective, TSX Trust must receive your completed Proxy Form no later than 11:00 a.m. (Toronto time) on Friday, October 20, 2023.

If the Meeting is postponed or adjourned, we must receive your completed Proxy Form by 11:00 a.m. (Toronto time), two (2) full business days before any adjourned or postponed Meeting at which the proxy is to be used. Late proxies may be accepted or rejected by the Chair of the Meeting at his or her discretion and he or she is under no obligation to accept or reject a late proxy. The Chair of the Meeting may waive or extend the proxy cut-off without notice.

Exercise of discretion

Concerning matters specified in the proxy, if no voting instructions are provided, the nominees named in the accompanying Proxy Form will vote Common Shares represented by the proxy FOR the approval of such matter.

The nominee named in your Proxy Form will vote or withhold from voting per your instructions on any ballot that may be called for and if the Shareholder specifies a choice concerning any matter to be acted upon, the Common Shares will be voted accordingly. The proxy will confer discretionary authority on the nominee with respect to matters identified in the Proxy Form for which a choice is not specified and any other matter that may properly come before the Meeting or any postponement or adjournment thereof, whether or not the matter is routine and whether or not the matter is contested.

As of the date of this Circular, Management is not aware of any amendment, variation or other matter that may come before the Meeting. If any amendment, variation or other matter properly comes before the Meeting, the nominee intends to vote in accordance with the nominee’s best judgment.

Registered Shareholders

Registered Shareholders can vote by proxy or in person in one of the following ways:

Voting by proxy

Internet

Go to www.meeting-vote.com and follow the instructions on the screen. You will need your control number, which appears below your name and address on the proxy form.

Fax and Email

Complete both sides of the proxy form, sign and date it and fax both sides to the Company’s transfer agent, TSX Trust Company, Attention: Proxy Department, to 416-595-9593 or scan and email to proxyvote@tmx.com.

Mail

Complete, sign and date the Proxy Form and return it in the envelope provided, or send it to: TSX Trust, Attention: Proxy Department, P.O. Box 721, Agincourt, Ontario, M1S 0A1, Canada.

As noted above, shareholders, employees and other stakeholders, the Company encourages Shareholders to vote in advance of the Meeting using the Proxy Form or the voting instruction form provided to them with the Meeting materials.

Non-Registered Shareholders

The information outlined in this section is of significant importance to many Shareholders, as a substantial number of Shareholders do not hold Common Shares in their name. Shareholders who hold their Common Shares through their brokers, intermediaries, trustees or other persons, or who otherwise do not hold their Common Shares in their own name should note that only proxies deposited by Registered Shareholders will be recognized and acted upon at the Meeting. If Common Shares are listed in an account statement provided to a Non-Registered Shareholder by a broker, then those Common Shares will, in all likelihood, not be registered in the Shareholder’s name. Such Common Shares will more likely be registered under the name of the Shareholder’s broker or an agent of that broker. In Canada, the vast majority of such Common Shares are registered under the name of CDS & Co. (the registration name for CDS Clearing and Depository Services Inc., which acts as nominee fa or many Canadian brokerage firms). In the United States, the vast majority of such shares are registered under the name of Cede & Co. (the registration name for The Depository Trust Company, which acts as nominee for many United States brokerage firms). Common Shares held by brokers (or their agents or nominees) on behalf of a broker’s client can only be voted or withheld at the direction of the Non-Registered Shareholder. Without specific instructions, brokers and their agents and nominees are prohibited from voting shares for the broker’s clients. Therefore, each Non-Registered Shareholder should ensure that voting instructions are communicated to the appropriate person well in advance of the Meeting.

Existing regulatory policy requires brokers and other intermediaries to seek voting instructions from Non-Registered Shareholders in advance of Shareholder meetings. The various brokers and other intermediaries have their own mailing procedures and provide their own return instructions to clients, which should be carefully followed by Non-Registered Shareholders to ensure that their Common Shares are voted at the Meeting. The form of instrument of proxy supplied to a Non-Registered Shareholder by its broker (or the agent of the broker) is substantially similar to the Proxy Form provided directly to Registered Shareholders by the Company. However, its purpose is limited to instructing the Registered Shareholder (i.e., the broker or agent of the broker) how to vote on behalf of the Non-Registered Shareholder. The vast majority of brokers now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions Inc. (“Broadridge”) in Canada. Broadridge typically prepares a machine-readable voting instruction form, provides those forms to Non-Registered Shareholders and asks Non-Registered Shareholders to return the voting instruction forms to Broadridge, or otherwise communicate voting instructions to Broadridge (by way of the internet or telephone, for example). Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at the Meeting. A Non-Registered Shareholder who receives a voting instruction form cannot use that form to vote Common Shares directly at the Meeting. The voting instruction forms must be returned to Broadridge (or instructions respecting the voting of Common Shares must otherwise be communicated to Broadridge) well in advance of the Meeting to have the Common Shares voted. If you have any questions respecting the voting of Common Shares held through a broker or other intermediary, please contact that broker or other intermediary for assistance.

Non-Registered Shareholders fall into two (2) categories—those who object to their identity being known to the issuers of securities which they own (“OBOs”) and those who do not object to their identity being made known to the issuers of the securities which they own (“NOBOs”). Subject to the provisions of NI 54-101, issuers may request and obtain a list of their NOBOs from intermediaries directly or via their transfer agent and may obtain and use the NOBO list for the distribution of proxy-related materials directly (not via Broadridge) to such NOBOs. The Company will not be sending proxy-related materials directly to NOBOs.

The Company’s OBOs can expect to be contacted by Broadridge or their brokers or their broker’s agents as set out above. The Company does not intend to pay for intermediaries to deliver proxy-related materials to OBOs and accordingly, if the OBO’s intermediary does not assume the costs of delivery of those documents if the OBO wishes to receive them, the OBO may not receive the documentation.

As noted above, a Non-Registered Shareholder receiving a voting instruction form cannot use that voting instruction form to vote the Common Shares directly at the Meeting or any adjournment or postponement thereof. Although a Non-Registered Shareholder may not be recognized directly at the Meeting to vote Common Shares registered in the name of his or her broker, a Non-Registered Shareholder may obtain a legal proxy from such broker, or Broadridge as the agent for that broker, to attend the Meeting as a proxyholder for the Registered Shareholder and vote their Common Shares in that capacity. To do this, a Non-Registered Shareholder must enter their own name in the blank space on the voting instruction form indicating that they or their appointee are going to attend and vote at the Meeting and return the voting instruction form to their broker or Broadridge per the instructions provided well in advance of the Meeting. The Non-Registered Shareholder will also need to complete the pre-registration steps noted above in advance of the 11:00 a.m. (Toronto time) on Friday, October 20, 2023 deadline to receive a separate phone number and a unique PIN for registration purposes at the Meeting. Non-Registered Shareholders who have not duly appointed themselves and have not completed the pre-registration steps will be able to attend the Meeting as guests, but guests will not be able to vote or ask questions at the Meeting.

All references to Shareholders in the Notice of Annual General and Special Meeting of Shareholders, Circular and the accompanying Proxy Form are to Registered Shareholders of the Company as set forth on the list of Registered Shareholders of the Company as maintained by the registrar and transfer agent of the Company, TSX Trust, unless specifically stated otherwise.

Revoking Your Proxy

Registered Shareholders can revoke a vote you made by proxy in one of two (2) ways:

| 1. | Complete a new Proxy Form that is dated later than the Proxy Form you want to revoke, and then mail it to TSX Trust, so they receive it by 11:00 a.m. (Toronto time) on Friday, October 20, 2023; or |

| 2. | Send a notice in writing to the registered office of the Company at 133 Richmond Street West, Suite 602, Toronto, Ontario, M5H 2L3 so that it is received by 11:00 a.m. (Toronto time) on Friday, October 20, 2023 or, if the Meeting is adjourned, the last business day preceding the day of the postponed Meeting. |

PART 2: BUSINESS OF THE MEETING

The Meeting will be held to:

| 1. | To receive the audited financial statements of the Company for the year ended December 31, 2022, together with the report of the Auditors thereon; |

| 2. | To appoint MNP LLP as the Auditor of the Company for the ensuing year, and to authorize the directors to fix the remuneration to be paid to the Auditor; |

| 3. | To elect directors of the Company for the ensuing year; |

| 4. | To consider and, if deemed advisable, to approve with or without variation, an ordinary resolution of disinterested Shareholders to approve the 2022 Amended and Restated LTIP, as more particularly described herein; |

| 5. | To consider and, if deemed advisable, to approve with or without variation, an ordinary resolution of disinterested shareholders authorizing the ESP Plan for the Company, as more particularly described herein; and |

| 6. | To transact such further or other business as may properly come before the meeting or any adjournment or adjournments thereof. |

| 1. | Receipt of Financial Statements |

The audited financial statements of the Company for the year ended December 31, 2022 together with the report of the Auditors thereon, will be presented to the Shareholders at the Meeting. Copies of the financial statements, the Auditors’ report and management’s discussion and analysis for the year ended December 31, 2022, have been mailed to all Registered Shareholders and Non-Registered Shareholders who have opted to receive such materials. These documents can also be found on the Company’s website at www.ElectraBMC.com and are also available on SEDAR+ at www.sedarplus.ca.

No formal action will be taken at the Meeting to approve the financial statements. If any Shareholder has questions regarding such financial statements, such questions may be brought forward at the Meeting.

Although the auditor of the Company remains KPMG LLP as of the date hereof, the Company has been in discussions with MNP LLP to engage the firm as successor auditor of the Company. It is anticipated that the change in auditor will be made effective in advance of the Meeting date and, therefore, Shareholders are being asked to vote for the election of MNP LLP as successor auditor. As soon as the appointment is made effective, the Company will file a notice of change of auditor in respect of each of KPMG LLP and MNP LLP, as well as confirmation letters from each auditor, on SEDAR+ at www.sedarplus.ca in accordance with applicable securities laws. The Company does not anticipate receiving any “reservations” in KPMG LLP’s reports on the Company’s financial statements or “reportable events”, as defined in section 4.11 of NI 51-102.

Management of the Company has recommended to the Board that the Company propose MNP LLP to the Shareholders for election as the Company’s auditors.

The Board recommends that Shareholders vote FOR the appointment of MNP LLP. Accordingly, unless such authority is withheld, the persons named in the accompanying proxy intend to vote FOR the appointment of MNP LLP, as Auditors of the Company for the ensuing year, until the close of the next annual meeting of Shareholders, at a remuneration to be fixed by the directors.

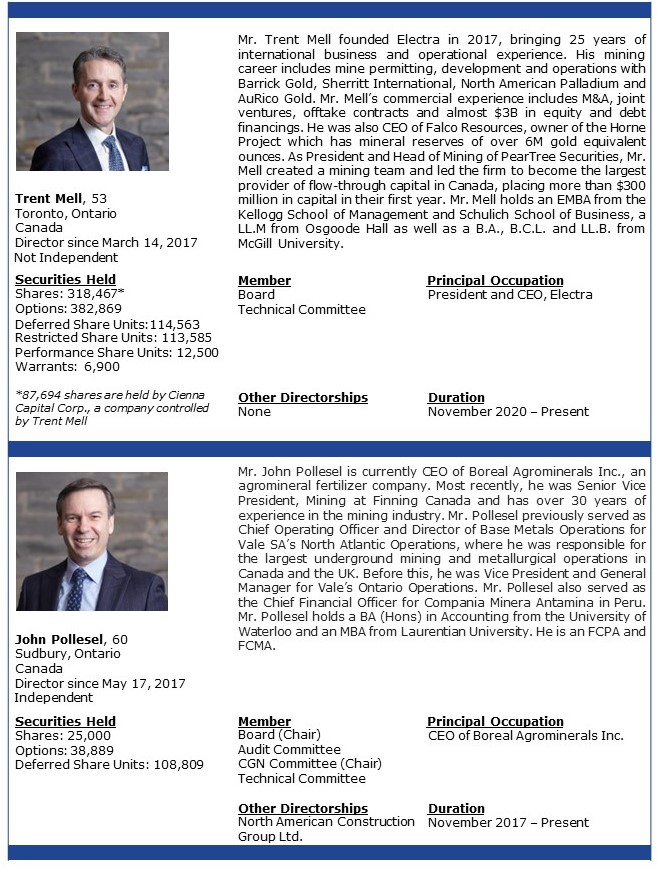

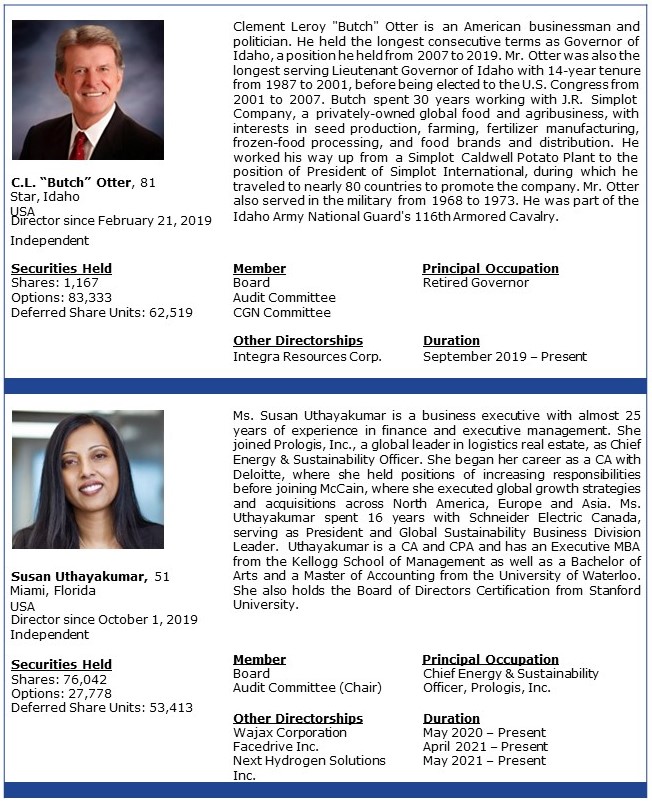

Nominees for the Board of Directors

The Board is currently comprised of four (4) directors, all of whom are being put forth for re-election. Shareholders will also be asked to elect the four (4) directors to serve until the next annual meeting of Shareholders. The term of office for each of the Company’s present directors expires after the Meeting.

Management of the Company has nominated John Pollesel, Trent Mell, Susan Uthayakumar and C.L. “Butch” Otter, each a current director of the Company, for re-election. Garett Macdonald, former director of the Company, resigned on May 17, 2023.

The Board recommends that Shareholders vote FOR the election of each of the nominees. Accordingly, unless such authority is withheld, the persons named in the accompanying proxy intend to vote FOR the election of each of the nominees.

The Company expects all its directors to demonstrate leadership and integrity and to conduct themselves in a manner that reinforces the Company’s corporate values and culture of transparency, teamwork and individual accountability. Above all, the Company expects that all directors will exercise their good judgment in a manner that keeps the interests of Shareholders at the forefront of decisions and deliberations. Each candidate must have a demonstrated track record in several of the skills and experience requirements deemed important for a balanced and effective Board.

Director Independence

A director is not independent if he or she has a direct or indirect relationship that the Board believes could reasonably be expected to interfere with his ability to exercise independent judgment. The Board has determined that it is in the best interests of the Company to ensure a majority independent Board at all times.

As of the date of this Circular, three of the Company’s four directors are independent and would be considered independent in the event they are duly re-elected to the Board. Trent Mell is the Company’s President and Chief Executive Officer (“CEO”) and is therefore not considered independent.

Director Profiles

The following table sets out the names of the nominees for election as directors, the offices they hold within the Company, their occupations, the length of time they have served as directors of the Company, and the number of securities of the Company which each beneficially owns, directly or indirectly, or over which control or direction is exercised, as of the date hereof.

The Company does not have an executive committee of its Board.

Except as set out herein, no proposed director is being elected under any arrangement or understanding between the proposed director and any other person or company.

Corporate Cease Trade Orders

To the knowledge of the Company, no proposed director is, as at the date of this Circular, or has been, within 10 years before the date of this Circular, a director, chief executive officer or chief financial officer of any company (including the Company) that:

| a) | was subject to a cease trade order, an order similar to a cease trade order, or an order that denied the relevant company access to any exemption under applicable securities legislation, and which in all "cases was in effect for a period of more than 30 consecutive days (an “Order”), which Order was issued while the proposed director was acting in the capacity as a director, chief executive officer or chief financial officer of such company; or |

| b) | was subject to an Order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as a director, chief executive officer or chief financial officer of such company. |

The foregoing information, not being within the knowledge of the Company, has been furnished by the proposed directors.

Bankruptcies, or Penalties or Sanctions

To the knowledge of the Company, no proposed director:

| a) | is, as at the date of this Circular, or has been within 10 years before the date of this Circular, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; |

| b) | has, within 10 years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or become subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold his assets; |

| c) | has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or |

| d) | has been subject to any penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director. |

Advance Notice Provision

The Company’s by-laws contain advance notice provisions (the “Advance Notice Provision”), which require that advance notice be given to the Company in circumstances where nominations of persons for election to the Board are made by Shareholders other than under: (i) a requisition of a meeting made under the provisions of the Canada Business Corporations Act (“CBCA”); or (ii) a Shareholder proposal made pursuant to the provisions of the CBCA.

Among other things, the Advance Notice Provision fixes a deadline by which holders of Common Shares must submit director nominations to the Company before any annual or special meeting of Shareholders and sets forth the minimum information that a Shareholder must include in the notice to the Company for the notice to be in proper written form.

The Advance Notice Provision will allow the Company to receive adequate prior notice of director nominations, as well as sufficient information on the nominees. The Company will thus be able to evaluate the proposed nominees’ qualifications and suitability as directors. It will also facilitate an orderly and efficient meeting process.

The Company did not receive notice of a nomination in compliance with the Advance Notice Provision, and as such, any nominations other than nominations by or at the direction of the Board or an authorized officer of the Company will be disregarded at the Meeting.

| 4. | 2022 Amended and Restated LTIP |

At the Meeting, Shareholders will be asked to consider and, if deemed advisable, to approve with or without variation, an ordinary resolution of disinterested Shareholders in the form set out below (the “LTIP Resolution”), to approve the 2022 amended and restated LTIP (the “2022 Amended and Restated LTIP”).

The 2022 Amended and Restated LTIP was last approved by Shareholders on November 10, 2022 and the LTIP Resolution does not amend the 2022 Amended and Restated LTIP, other than increasing the number of Options, PSUs, RSUs and DSUs from 1,416,667 Options to 3,000,000 Options; from 277,778 PSUs to 350,000 PSUs; from 250,000 RSUs to 350,000 RSUs; and from 388,888 DSUs to 400,000 DSUs, such that the maximum number of Common Shares to be reserved for issuance under the 2022 Amended and Restated LTIP be revised from 2,333,333 Common Shares to 4,100,000 Common Shares.

The TSXV has conditionally approved the 2022 Amended and Restated LTIP subject to disinterested Shareholder approval at the Meeting. If, at the Meeting, the Company does not obtain disinterested Shareholder approval of the 2022 Amended and Restated LTIP, the Company’s 2022 Amended and Restated LTIP will continue to remain in place without change.

The purpose of the 2022 Amended and Restated LTIP is to align the interests of those directors, employees and consultants designated by the Board as being eligible to participate in the 2022 Amended and Restated LTIP with those of the Company and its Shareholders and to assist in attracting, retaining and motivating key employees by making a portion of the incentive compensation of participating employees directly dependent upon the achievement of key strategic, financial and operational objectives that are critical to ongoing growth and increasing the long-term value of the Company. In particular, the 2022 Amended and Restated LTIP is designed to allow the Board to grant Awards to promote the long-term success of the Company and the creation of Shareholder value by: (a) encouraging the attraction and retention of directors, key employees and consultants of the Company and its subsidiaries; (b) encouraging such directors, key employees and consultants to focus on critical long-term objectives; and (c) promoting greater alignment of the interests of such directors, key employees and consultants with the interests of the Company. Historically, the Company has made use of long-term incentive grants as an alternative to cash bonuses and salary increases as a means of conserving capital, rewarding performance, retaining personnel and aligning behaviour with Shareholder interests.

An “Award” means an option (“Option”), performance share unit (“PSU”), restricted share unit (“RSU”) and deferred share unit (“DSU”) granted under the 2022 Amended and Restated LTIP.

The following table summarizes the key provisions of the 2022 Amended and Restated LTIP. Defined terms used below not otherwise defined in the Circular shall have the meaning set out in the 2022 Amended and Restated LTIP.

Eligible Participants | For all Awards, any director, officer, employee or consultant of the Company or any subsidiary of the Company who is eligible to receive Awards under the 2022 Amended and Restated LTIP. |

Types of Awards | Options, PSUs, RSUs and DSUs. |

Number of Securities Issued and Issuable | The aggregate number of Common Shares to be reserved and set aside for issue upon the exercise or redemption and settlement for all Awards granted under the 2022 Amended and Restated LTIP, together with all other established security-based compensation arrangements of the Company, shall be not more than 4,100,000 Common Shares. In addition to the foregoing, assuming the LTIP Resolution obtains shareholder approval: • up to a maximum of 350,000 Common Shares may be reserved for issuance upon conversion of RSUs;

• up to a maximum of 350,000 Common Shares may be reserved for issuance upon conversion of PSUs;

• up to a maximum of 400,000 Common Shares may be reserved for issuance upon conversion of DSUs; and

• up to a maximum of 3,000,000 Commons Shares may be reserved for issuance upon the exercise of Options. |

| Plan Limits | When combined with all of the Company’s other previously established security-based compensation arrangements, including the limitation imposed on the maximum number of Common Shares which may be issued pursuant to the exercise or redemption and settlement of DSUs, PSUs, RSUs and Options set out above, the 2022 Amended and Restated LTIP shall not result in the grant: • to any one person in any 12-month period which could, when exercised, result in the issuance of Common Shares exceeding 5% of the issued and outstanding Common Shares, calculated at the date of grant, unless the Company has obtained the requisite disinterested shareholder approval to the grant;

• to any one consultant in any 12-month period which could, when exercised, result in the issuance of Common Shares exceeding 2% of the issued and outstanding Common Shares, calculated at the date of grant;

• of Options in any 12-month period, to persons employed or engaged by the Company to perform Investor Relations Activities which could, when exercised, result in the issuance of Common Shares exceeding, in aggregate, 2% of the issued and outstanding Common Shares, calculated at the date of grant; or

• of RSUs, PSUs or DSUs to persons employed or engaged by the Company to perform Investor Relations Activities. |

Definition of Market Price | “Market Price” at any date in respect of the Common Shares shall be, the closing trading price of such Common Shares on the TSXV on the last trading day immediately before the date on which the Market Price is determined. In the event that the Common Shares are not then listed and posted for trading on a TSXV, the Market Price shall be the fair market value of such Common Shares as determined by the Board in its sole discretion. |

| Assignability | An Award may not be assigned, transferred, charged, pledged or otherwise alienated, other than to a participant’s representatives. |

Amending Procedures | The Board may at any time or from time to time, in its sole and absolute discretion and without shareholder approval, amend, suspend, terminate or discontinue the 2022 Amended and Restated LTIP and may amend the terms and conditions of any Awards granted thereunder, provided that no amendment may materially and adversely affect any Award previously granted to a participant without the consent of the participant. Provided that any amendments made to the 2022 Amended and Restated LTIP shall be made following TSXV requirements. By way of example, amendments that do not require shareholder approval and that are within the authority of the Board include but are not limited to: • Amendments of a “housekeeping nature”;

• Any amendment for the purpose of curing any ambiguity, error or omission in the 2022 Amended and Restated LTIP or to correct or supplement any provision of the 2022 Amended and Restated LTIP that is inconsistent with any other provision of the 2022 Amended and Restated LTIP;

• An amendment which is necessary to comply with applicable law or the requirements of any stock exchange on which the shares are listed;

• Amendments respecting administration and eligibility for participation under the 2022 Amended and Restated LTIP;

• Changes to the terms and conditions on which Awards may be or have been granted pursuant to the 2022 Amended and Restated LTIP, including changes to the vesting provisions and terms of any Awards;

• Any amendment which alters, extends or accelerates the terms of vesting applicable to any Award;

• Changes to the termination provisions of an Award or the 2022 Amended and Restated LTIP which do not entail an extension beyond the original fixed term. Notwithstanding the foregoing, shareholder approval shall be required for the following amendments (unless such an amendment is prohibited by TSXV requirements in which case such amendment cannot be made): • Reducing the exercise price of Options, or cancelling and reissuing any Options to in effect reduce the exercise price; • Extending (i) the term of an Option beyond its original expiry date, or (ii) the date on which a PSU, RSU or DSU will be forfeited or terminated per its terms, other than in circumstances involving a blackout period; and

• Increasing the fixed maximum number of shares reserved for issuance under the 2022 Amended and Restated LTIP; • Permitting Awards granted under the 2022 Amended and Restated LTIP to be transferable or assignable other than for estate settlement purposes; • Amending the definition of “Eligible Person” to permit the introduction or reintroduction of participants on a discretionary basis; and • Revising any shareholder approval requirements needed under the 2022 Amended and Restated LTIP. |

Financial Assistance | The Company will not provide financial assistance to participants under the 2022 Amended and Restated LTIP. |

| Other | In the event of a change in control, the Board shall have the right, but not the obligation, to permit each participant to exercise all of the participant’s outstanding Options and to settle all of the participant’s outstanding PSUs, RSUs and DSUs, subject to any required approval of the TSXV and subject to completion of the change in control, and has the discretion to accelerate vesting. The 2022 Amended and Restated LTIP further provides that if the expiry date or vesting date of Options is during a blackout period, the expiry date or vesting date, as applicable, will be automatically extended for a period of ten trading days following the end of the blackout period, subject to certain requirements of the TSXV as set out in the 2022 Amended and Restated LTIP. In the case of PSUs, RSUs and DSUs, any settlement that is effected during a blackout period shall be in the form of a cash payment. |

| Description of Awards |

| A. Stock Options |

Stock Option Terms and Exercise Price | The exercise price, vesting, expiry date and other terms and conditions of the Options are determined by the Board. The exercise price shall in no event be lower than the Market Price of the shares at the date of grant, less any allowable discounts. |

| Term | Options shall be for a fixed term and exercisable as determined by the Board, provided that no Option shall have a term exceeding ten years. |

| Vesting | All Options granted under the 2022 Amended and Restated LTIP will be subject to such vesting requirements as may be imposed by the Board, with all Options issued to consultants performing Investor Relations Activities vesting in stages over at least 12 months with no more than 1/4 of the Options vesting in any three-month period. |

Exercise of Option | The participant may exercise Options by payment of the exercise price per Common Share subject to each Option. |

Circumstances Involving Cessation of Entitlement to Participate | Reasons for Termination | | Vesting | Expiry of Vested Options |

| Death | Unvested Options automatically vest as of the date of death | Options expire on the earlier of the scheduled expiry date of the Option and one year following the date of death |

| Disability | Options continue to vest following the terms of the Option until the date that is one year following the date of disability | Options expire on the earlier of the scheduled expiry date of the Option and one year following the date of disability |

| Retirement | Options continue to vest following the terms of the Option until the date that is one year following the date of retirement | Options expire on the earlier of the scheduled expiry date of the Option and one year following the date of retirement |

| Resignation | Unvested Options as of the date of resignation automatically terminate and shall be forfeited | Options expire on the earlier of the scheduled expiry date of the Option and three months following the date of resignation Options granted to Persons engaged primarily to provide Investor Relations Activities expire on the earlier of the scheduled expiry date of the Option and 30 days following the date of resignation |

| | Termination without Cause / Constructive Dismissal (No Change in Control) | Unvested Options granted prior to the Original LTIP Date automatically vest as of the Termination Date Unvested Options granted from and after the Original LTIP Date continue to vest following the terms of the Option until the date that is one year following the Termination Date | Options expire on the earlier of the scheduled expiry date of the Option and one year following the Termination Date |

| Change in Control | Options granted before the Original LTIP Date shall vest and become immediately exercisable, subject to any required approvals of the TSXV Options from and after the Original LTIP Date do not vest and become immediately exercisable upon a change in control, unless: •the successor fails to continue or assume the obligations under the 2022 Amended and Restated LTIP or fails to provide for a substitute Award, or •if the Option is continued, assumed or substituted, the participant is terminated without cause (or constructively dismissed) within two years following the change in control, subject to any required approvals of the TSXV | Options expire on the scheduled expiry date of the Option |

| Termination with Cause | Options granted prior to the Original LTIP Date that are unvested as of the Termination Date automatically terminate and shall be forfeited Options granted from and after the Original LTIP Date, whether vested or unvested as of the Termination Date, automatically terminate and shall be forfeited | Vested Options granted prior to the Original LTIP Date shall expire on the earlier of the scheduled expiry date of the option and three months following the Termination Date Options granted from and after the Original LTIP Date, whether vested or unvested as of the Termination Date, automatically terminate and shall be forfeited |

| B. Performance Share Units |

| PSU Terms | A PSU is a notional security but, unlike other equity-based incentives, vesting is contingent upon achieving certain performance criteria, thus ensuring greater alignment with the long-term interests of shareholders. The terms applicable to PSUs under the 2022 Amended and Restated LTIP (including the performance cycle, performance criteria for vesting and whether dividend equivalents will be credited to a participant’s PSU account) are determined by the Board at the time of the grant. |

| Vesting | PSUs do not vest, and cannot be paid out (settled), until the completion of the performance cycle. For Canadian taxpayers, the performance cycle shall in no case end later than December 31 of the calendar year that is three years after the grant date. |

| Settlement | At the grant date, the Board shall stipulate whether the PSUs are paid in cash, shares, or a combination of both, in an amount equal to the Market Value of the notional shares represented by the PSUs in the holders’ account. |

| C. Restricted Share Units |

| RSU Terms | An RSU is a notional security that entitles the recipient to receive cash or shares at the end of a vesting period. The terms applicable to RSUs under the 2022 Amended and Restated LTIP (including the vesting schedule and whether dividend equivalents will be credited to a participant’s RSU account) are determined by the Board at the time of the grant. |

| Credit to RSU Account | As dividends are declared, additional RSUs may be credited to RSU holders in an amount equal to the greatest whole number which may be obtained by dividing (i) the value of such dividend or distribution on the record date established therefore by (ii) the Market Price of one share on such record date. |

| Vesting | RSUs vest upon lapse of the applicable restricted period. For employees, vesting generally occurs in three equal instalments on the first three anniversaries of the grant date. For directors, one-third of the Award may be immediately vesting, with the balance vesting equally over the first two anniversaries of the grant date. |

| Settlement | At the grant date, the Board shall stipulate whether the RSUs are paid in cash, shares, or a combination of both, in an amount equal to the Market Value of the notional shares represented by the RSUs in the holders’ account. |

| D. Deferred Share Units |

| DSU Terms | A DSU is a notional security that entitles the recipient to receive cash or shares upon resignation from the Board (in the case of directors) or at the end of employment. The terms applicable to DSUs under the 2022 Amended and Restated LTIP (including whether dividend equivalents will be credited to a participant’s DSU account) are determined by the Board at the time of the grant. Typically, DSUs have been granted (i) as a component of a director’s annual retainer, or (ii) as a component of an officer’s annual incentive grant. The deferral feature strengthens alignment with the long-term interests of shareholders. |

Credit to DSU Account | As dividends are declared, additional DSUs may be credited to DSU holders in an amount equal to the greatest whole number which may be obtained by dividing (i) the value of such dividend or distribution on the record date established therefore by (ii) the Market Price of one share on such record date. |

| Vesting | DSUs are fully vested upon grant. |

| Settlement | DSUs may only be settled after the date on which the holder ceases to be a director, officer or employee of the Company. At the grant date, the Board shall stipulate whether the DSUs are paid in cash, shares, or a combination of both, in an amount equal to the Market Value of the notional shares represented by the DSUs in the holders’ account. |

| E. PSUs, RSUs and DSUs |

| Circumstances Involving Cessation of Entitlement to Participate | Reason for Termination | Treatment of Awards |

| Death | Outstanding Awards that were vested on or before the date of death shall be settled as of the date of death. Outstanding Awards that were not vested on or before the date of death shall vest immediately and be settled as of the date of death, prorated to reflect (i) in the case of RSUs and DSUs, the actual period between the grant date and date of death, and (ii) in the case of PSUs, the actual period between the commencement of the performance cycle and the date of death, based on the participant’s performance for the applicable performance period(s) up to the date of death. Subject to the foregoing, any remaining Awards shall in all respects terminate as of the date of death. |

| Disability | In the case of RSUs and DSUs, outstanding Awards as of the date of disability shall continue to vest for a period no longer than one year of the date of disability and be set with their terms. In the case of PSUs, outstanding PSUs as of date the of disability shall vest and be settled following their terms based on the participant’s performance for the applicable performance period(s) up to the date of the disability. Subject to the foregoing, any remaining Awards shall in all respects terminate as of the date of disability. |

| Retirement | Outstanding Awards that were vested on or before the date of retirement shall be settled as of the date of retirement. Outstanding Awards that would have vested on the next vesting date following the date of retirement shall be settled as of the earlier of such vesting date and the date that is one year from the date of retirement. Subject to the foregoing, any remaining Awards shall in all respects terminate as of the date of retirement. |

| Resignation | Outstanding Awards that were vested on or before the date of resignation shall be settled as of the date of resignation, after which time the Awards shall in all respects terminate. |

| Termination without Cause / Constructive Dismissal (No Change in Control) | Outstanding Awards that were vested on or before the Termination Date shall be settled as of the Termination Date. Outstanding Awards that would have vested on the next vesting date following the Termination Date (in the case of PSUs, prorated to reflect the actual period between the commencement of the performance cycle and the Termination Date, based on the participant’s performance for the applicable performance period(s) up to the Termination Date), shall be settled as of the earlier of such vesting date and the date that is one year from the Termination Date. Subject to the foregoing, any remaining Awards shall in all respects terminate as of the Termination Date. |

| | Change in Control | Awards do not vest and become immediately exercisable upon a change in control, unless: • the successor fails to continue or assume the obligations under the 2022 Amended and Restated LTIP or fails to provide for a substitute Award, or • if the Award is continued, assumed or substituted, the participant is terminated without cause (or constructively dismissed) within two years following the change in control. |

| Termination with Cause | Outstanding Awards (whether vested or unvested) shall automatically terminate on the Termination Date and be forfeited. |

Any Common Shares subject to an Award which for any reason expires without having been exercised or is forfeited or terminated shall again be available for future Awards under the 2022 Amended and Restated LTIP and any Common Shares subject to an Award that is settled in cash and not Common Shares shall again be available for future Awards under the 2022 Amended and Restated LTIP.

The above summary is subject to the full text of the 2022 Amended and Restated LTIP, which can also be found on the Company’s website at www.ElectraBMC.com and are also available on SEDAR+ at www.sedarplus.ca.

The Board has approved the 2022 Amended and Restated LTIP. The formal adoption of the 2022 Amended and Restated LTIP is subject to disinterested Shareholder approval at the Meeting and final TSXV approval.

The Board recommends that Shareholders vote FOR the LTIP Resolution. Accordingly, unless a disinterested Shareholder specifies in the accompanying proxy that its Common Shares are to be voted against the LTIP Resolution, the persons named in the accompanying proxy intend to vote FOR the LTIP Resolution.

The text of the LTIP Resolution to be submitted to disinterested Shareholders at the Meeting is set forth below:

“NOW THEREFORE BE IT RESOLVED AS AN ORDINARY RESOLUTION OF DISINTERESTED SHAREHOLDERS THAT:

| 1. | the 2022 Amended and Restated LTIP (as defined and described in the Company’s management information circular dated September 5, 2023), be and is hereby ratified, confirmed, authorized and approved; |

| 2. | the form of 2022 Amended and Restated LTIP may be amended to satisfy the requirements or requests of any regulatory authority or stock exchange without requiring further approval of the shareholders of the Company; |

| 3. | the Company be and is hereby authorized to grant stock options, performance share units, restricted share units and deferred share units pursuant and subject to the terms and conditions of the 2022 Amended and Restated LTIP and the Company be and is authorized to issue and allot common shares of the Company on exercise, redemption or settlement of those stock options, performance share units, restricted share units and deferred share units; and |

| 4. | any director or officer of the Company is hereby authorized and directed, acting for, in the name of and on behalf of the Company, to execute or cause to be executed, under the seal of the Company or otherwise and to deliver or to cause to be delivered, all such other deeds, documents, instruments and assurances and to do or cause to be done all such other acts as in the opinion of such director or officer of the Company may be necessary or desirable to carry out the terms of the foregoing resolutions.” |

| 5. | Employee Share Purchase Plan |

At the Meeting, Shareholders will be asked to consider and, if deemed advisable, to approve with or without variation, an ordinary resolution of disinterested Shareholders in the form set out below (the “ESP Plan Resolution”), authorizing the Employee Share Purchase Plan for the Company (the “ESP Plan”).

The ESP Plan was last approved by Shareholders on November 10, 2022 and the ESP Plan Resolution does not amend the ESP Plan.

The TSXV has conditionally approved the ESP Plan subject to disinterested Shareholder approval at the Meeting. If, at the Meeting, the Company does not obtain disinterested Shareholder approval of the ESP Plan, the Company’s ESP Plan will remain in place without change.

The ESP Plan provides eligible employees of the Company and certain of the Company’s designated affiliates, who wish to participate in the ESP Plan (each, an “ESP Plan Participant”), with a cost-efficient vehicle to acquire Common Shares and participate in the equity of the Company through payroll deductions, for: (i) advancing the interests of the Company through the motivation, attraction and retention of employees and officers of the Company and its designated affiliates in a competitive labour market; and (ii) aligning the interests of the employees of the Company with those of the Shareholders through a culture of ownership and involvement.

The following table summarizes the key provisions of the ESP Plan. Defined terms used below not otherwise defined in the Circular shall have the meaning set out in the ESP Plan.

| • | A maximum of 1,000,000 Common Shares, if approved by Shareholders (representing less than 2% of the total issued and outstanding Common Shares as of the date of this Circular, calculated on an undiluted basis) are reserved for issuance under the ESP Plan, provided, however, that the number of Common Shares reserved for issuance under the ESP Plan and under all other security-based compensation arrangements of the Company and its subsidiaries shall, in the aggregate, not exceed 20% of the number of Common Shares then issued and outstanding. In the event there, is any change in the Common Shares, whether by reason of a stock dividend, consolidation, subdivision, reclassification or otherwise, an appropriate adjustment shall be made in the number of Common Shares available under the ESP Plan. |

| • | The Common Shares issuable under the ESP Plan is subject to several restrictions: |

| - | the aggregate number of Common Shares issuable at any time to Insiders (as defined in the ESP Plan) under the ESP Plan and all other security-based compensation arrangements of the Company and its subsidiaries shall not, in the aggregate, exceed 10% of the issued and outstanding Common Shares, calculated on a non-diluted basis; |

| - | within any one-year period, the Company shall not issue to Insiders under the ESP Plan and all other security-based compensation arrangements of the Company and its subsidiaries, in the aggregate, a number of Common Shares exceeding 10% of the issued and outstanding Common Shares, calculated on a non-diluted basis; and |

| - | within any one-year period, the Company shall not issue to any one Person (and companies wholly-owned by that Person) under the ESP Plan and all other security-based compensation arrangements of the Company and its Subsidiaries, in the aggregate, a number of Common Shares exceeding five percent (5%) of the issued and outstanding Common Shares, calculated on a non-diluted basis. |

| • | Any eligible employee may elect to participate in the ESP and contribute money (the “Employee Contribution”) to the ESP Plan in any calendar quarter by delivering to the Company a completed and executed “Enrolment and Contribution Election Form” authorizing the Company to deduct the Employee Contribution from the ESP Plan Participant’s Base Annual Salary (as defined in the ESP Plan) in equal instalments beginning in the first quarterly period in which the eligible employee enrolls in the ESP Plan. Such direction will remain effective until: (i) the ESP Plan Participant’s employment is terminated (as described more fully below), (ii) the ESP Plan Participant’s Retirement (as defined in the ESP Plan), (iii) the ESP Plan Participant elects to withdraw from the ESP Plan by delivering a completed and executed “Withdrawal Form”, or (iv) the Board terminates or suspends the ESP Plan, whichever is earlier. |

| • | The Employee Contribution, as determined by the ESP Plan Participant, shall be a minimum of 1% and must not exceed 10% of the ESP Plan Participant’s Base Annual Salary (before deductions). The Employee Contribution may be changed by the ESP Plan Participant once each calendar year by delivering a completed and executed “Contribution Adjustment Form” to the Company. |

| • | For each quarterly period during a calendar year, the Company will credit (or notionally credit) each ESP Plan Participant’s account (each, an “ESP Account”) with an amount equal to 100% of the amount of the Employee Contribution (the “Company Contribution”). |

| • | The Company will credit an ESP Plan Participant’s ESP Account with notional grants of Common Shares for each quarterly period in an amount equal to the quotient obtained when (i) the aggregate contribution then held by the Company in trust for an ESP Plan Participant at the end of each quarterly period, is divided by (ii) the “Market Value” of the Common Shares as at the end of each quarterly period. Appropriate adjustments to ESP Account notional credits will be made in the event of changes in the Common Shares, whether by reason of a stock dividend, consolidation, subdivision, reclassification or otherwise. For purposes of the ESP Plan, “Market Value” means, on any date, the volume weighted average price of the Common Shares traded on the TSXV for the five (5) consecutive trading days prior to such date or, if the Common Shares are not then listed on the TSXV, on such other stock exchange as determined for that purpose by the Board (or such other committee of the directors appointed to administer the ESP Plan) in its discretion. |

| • | Additional notional Common Shares will be credited to an ESP Account in respect of the existing notional Common Shares then credited whenever cash or other dividends are paid on the Common Shares. Additional notional Common Shares credited on this basis shall be an amount equal to the quotient obtained when (i) the aggregate value of the cash or other dividends that would have been paid to such ESP Plan Participant if the notional Common Shares then credited to the ESP Account of such ESP Plan Participant as at the record date for the dividend had been Common Shares, is divided by (ii) the Market Value of the Common Shares as at the date on which the dividend is paid on the Common Shares. |

| • | An ESP Plan Participant shall only be entitled to receive Common Shares upon the notional Common Shares recorded in his or her ESP Account becoming vested. Notional Common Shares credited to the ESP Plan Participant’s ESP Account will vest as follows: |

| - | In respect of the Employee Contribution, notional Common Shares will vest immediately upon the earlier of (i) a Change of Control (as defined in the ESP Plan) of the Company, (ii) the Retirement of the ESP Plan Participant, (iii) the commencement of the total disability of the ESP Plan Participant, (iv) the death of the ESP Plan Participant, and (v) December 31st of any calendar year. |

| - | In respect of the Company Contribution, notional Common Shares will vest on the terms set in the sole discretion of the Board (or such other committee of the directors appointed to administer the ESP Plan). However, if the Board (or such other committee) has not specified the vesting terms of a particular issuance of Common Shares credited to the “ESP Account” of an ESP Plan Participant, such Common Shares shall vest immediately upon the earlier of (i) a Change of Control of the Company, (ii) the Retirement of the ESP Plan Participant, (iii) the commencement of the total disability of the ESP Plan Participant, (iv) the death of the ESP Plan Participant, and (v) December 31st of any calendar year, provided that such ESP Plan Participant has not (a) been terminated by the Company or a designated affiliate (with or without cause), or (b) ceased employment with the Company or a designated affiliate as a result of resignation or some other reason other than Retirement (“Termination” or “Terminated”) before December 31st of such calendar year. |

| - | If an ESP Plan Participant is terminated before the notional Common Shares credited to his or her ESP Account becoming vested, the amount of the Company Contribution shall be credited (or notionally credited) back to the Company. |

| • | To settle notional Common Shares, the Company, in its sole discretion, shall either: |

| - | within ten (10) days from the end of each calendar year, issue for the account of each ESP Plan Participant, fully paid and non-assessable Common Shares equal to the number of notional Common Shares credited to the ESP Account of such ESP Plan Participant as of December 31st of such calendar year; |

| - | within ten (10) days from the end of each calendar year, purchase or arrange for the purchase on the market, on behalf of each ESP Plan Participant, such number of Common Shares equal to the number of notional Common Shares credited to the ESP Account of such ESP Plan Participant as of December 31st of such calendar year; or |

| - | within ten (10) days from the end of each calendar year, settle notional Common Shares by some combination of issuing and purchasing in accordance with the above. |

| • | Common Shares issued to ESP Plan Participants under the ESP Plan may be made subject to any holding period as deemed appropriate or as required under applicable securities laws. |

| • | In the event of the Termination of an ESP Plan Participant, the ESP Plan Participant shall automatically cease to be entitled to participate in the ESP Plan. |

| • | The Board (or such other committee of the directors appointed to administer the ESP Plan) may from time to time amend, suspend or terminate (and re-instate) the ESP Plan in whole or in part without approval of the Shareholders of the Company, but subject to the receipt of all required regulatory approvals including, without limitation, the approval of the TSXV. |

| • | The Board has broad discretion to amend the ESP Plan without seeking the approval of Shareholders, including, without limitation, amendments to the ESP Plan to rectify typographical errors and/or to include clarifying provisions for greater certainty. However, the Company may not make the following amendments to the ESP Plan without the approval of Shareholders and the TSXV: (i) an amendment to remove or exceed the insider participation limit prescribed by the TSXV Corporate Finance Manual; (ii) an amendment to increase the maximum number of Common Shares issuable under the ESP Plan; and (iii) an amendment to an amending provision within the ESP Plan. |

| • | Except as otherwise may be expressly provided for under the ESP Plan or pursuant to a will or by the laws of descent and distribution, no right or interest of an ESP Plan Participant under the ESP Plan is assignable or transferable. |

The above summary is subject to the full text of the ESP Plan, which can also be found on the Company’s website at www.ElectraBMC.com and are also available on SEDAR+ at www.sedarplus.ca.

The Board has approved the ESP Plan. The formal adoption of the ESP Plan is subject to disinterested Shareholder approval at the Meeting and final TSXV approval.

The Board recommends that Shareholders vote FOR the ESP Plan Resolution. Accordingly, unless a disinterested Shareholder specifies in the accompanying proxy that its Common Shares are to be voted against the ESP Plan Resolution, the persons named in the accompanying proxy intend to vote FOR the ESP Plan Resolution.

The text of the ESP Plan Resolution to be submitted to disinterested Shareholders at the Meeting is set forth below:

“NOW THEREFORE BE IT RESOLVED AS AN ORDINARY RESOLUTION OF DISINTERESTED SHAREHOLDERS THAT:

| 1. | the ESP Plan (as defined and described in the Company’s management information circular dated September 5, 2023), be and is hereby ratified, confirmed, authorized and approved; |

| 2. | the form of ESP Plan may be amended in order to satisfy the requirements or requests of any regulatory authority or stock exchange without requiring further approval of the shareholders of the Company; |

| 3. | the Company be and is hereby authorized to issue Common Shares pursuant and subject to the terms and conditions of the ESP Plan as fully paid and non-assessable Common Shares of the Company; and |

| 4. | any director or officer of the Company is hereby authorized and directed, acting for, in the name of and on behalf of the Company, to execute or cause to be executed, under the seal of the Company or otherwise and to deliver or to cause to be delivered, all such other deeds, documents, instruments and assurances and to do or cause to be done all such other acts as in the opinion of such director or officer of the Company may be necessary or desirable to carry out the terms of the foregoing resolutions.” |

PART 3: ABOUT ELECTRA

Corporate Governance Practices

Electra believes in the importance of a strong Board and sound corporate governance policies and practices to direct and manage its business affairs. Good corporate governance is essential to retaining the trust of the Shareholders, attracting the right people to the organization and maintaining the Company’s social license in the communities where it works and operates. Electra also believes that good governance enhances its performance.

The Company’s governance framework is evolving as the Company continues to grow. Electra’s governance policies also respect the rights of Shareholders and comply with the rules of the Canadian Securities Administrators, the U.S. Securities and Exchange Commission, the TSXV and the Nasdaq Capital Markets.

The Board has adopted Board and committee mandates as well as other policies and practices. Independent directors are expected to hold in-camera meetings at each quarter-end Board meeting. A copy of the Company’s Code of Business Conduct and Ethics (“Code of Conduct”), as well as Board and committee mandates, are posted on Electra’s website at www.ElectraBMC.com and can be requested from the Company.

The Board has not adopted policies on mandatory retirement or overboarding, on the belief that age, or number of Board seats are not, in themselves, determinants of a director’s ability to make an effective contribution to the Company. Overboarding thresholds will be higher, for instance, for directors who are retired from active employment.

The following discussion outlines some of Electra’s current corporate governance practices, particularly with respect to the matters addressed by National Policy 58-201 – Corporate Governance Guidelines (the “Canadian Guidelines”) and National Instrument 58-101 – Disclosure of Corporate Governance Practices (“NI 58-101”).

Code of Conduct

Electra is committed to adhering to high standards of corporate governance. The Company’s Code of Conduct reflects its commitment to conduct its business in accordance with all applicable laws and regulations and the highest ethical standards. The Code of Conduct has been adopted by the Board and applies to every director, officer and employee of the Company. In addition, directors, officers and employees must also comply with corporate policies, including Electra’s Disclosure Policy and Insider Trading Policy.

The Code of Conduct requires high standards of professional and ethical conduct in the Company’s business dealings. Electra’s reputation for honesty and integrity is integral to the success of its business and no person associated with the Company will be permitted to achieve results through violations of laws or regulations or through unscrupulous dealings. Electra’s business activities are always expected to be conducted with honesty, integrity and accountability.

The Board monitors compliance with the Code of Conduct through its Audit Committee, which oversees the Company’s anonymous whistleblower program. Any incidences of non-compliance would be reviewed by Management and reported to the Audit Committee or the Board.

Activities that may give rise to conflicts of interest are prohibited unless specifically approved by the Board or the Audit Committee. To ensure that directors exercise independent judgment, each director must disclose all actual or potential conflicts of interest or material interest and refrain from voting on matters in which such director has a conflict of interest. The director must also excuse himself or herself from any discussion on the matter.

Role of the Board

The primary responsibility of the Board is to supervise the management of the business and affairs of the Company. In discharging its fiduciary duties, Board members are expected to use their experience and expertise to guide Management and ensure good governance practices are adhered to. The Board oversees the Company’s systems of corporate governance and financial reporting and controls to ensure that the Company reports adequate and reliable financial and other information to Shareholders and engages in ethical and legal conduct.

The Company expects each member of its Board to act honestly and in good faith and to exercise business judgment that is in the best interests of the Company and its stakeholders. The Chair does not have a second or casting vote in the case of equality of votes in any matter brought before the Board.

In addition to possessing the requisite skill and experience required to carry out their functions, directors must demonstrate a track record of honesty, integrity, ethical behaviour, fairness and responsibility and a commitment to representing the long-term interests of Electra’s stakeholders. They must also be able to devote the time required to discharge their duties and responsibilities effectively. New candidates for the Board are identified principally by the CGN Committee. In identifying new candidates for Board nomination, the Company looks for individuals with diverse backgrounds at the executive level. This ensures that best practices and experience across multiple industries can be applied in making strategic decisions for the Company.

In addition to the foregoing, each director is expected to:

| • | Develop an understanding of Electra’s strategy, business environment, the market in which the Company operates and its financial position and performance; |

| • | Be willing to share expertise and experience with Management and fellow directors, and to use a respectful, collegial approach in challenging the views of others; |

| • | Diligently prepare for each Board and committee meeting by reviewing all of the meeting materials in advance of the meeting date; |

| • | Actively and constructively participate in each meeting and seek clarification when necessary to fully understand the issues being considered; |

| • | Leverage experience and wisdom in making sound strategic and operational business decisions; and |

| • | Demonstrate business acumen and a mindset for risk oversight. |

Mandates

A copy of the Mandate of the Board of Directors outlining the role and responsibilities of the Board is included as Schedule 1 to this Circular. In order to delineate their respective roles and responsibilities, written position descriptions for the Chair of the Board and the CEO have been developed.

The responsibilities of the Chair include providing overall leadership to enhance the effectiveness of the Board; assisting the Board, committees and the individual directors in effectively understanding and discharging their duties and responsibilities; overseeing all aspects of the Board and committee functions to ensure compliance with the Company’s corporate governance practices; acting as an adviser and confidant to the CEO and other executive officers; and ensuring effective communications between the Board and Management. The Chair is also required to coordinate and preside at all meetings of the Board and Shareholders.

The responsibilities of the CEO include (subject to the oversight of the Board) general supervision of the business of the Company; providing leadership and vision to the Company; developing and recommending significant corporate strategies and objectives for approval by the Board; developing and recommending annual operating budgets for approval by the Board; and working with the Board on talent development and succession planning. The CEO communicates regularly with the Board to ensure that directors are being provided with timely and relevant information necessary to discharge their duties and responsibilities.

Risk Oversight

The Board oversees an enterprise-wide approach to risk management designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance shareholder value. A fundamental part of risk management is not only understanding the risks a company faces and what steps Management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. The involvement of the full Board in setting the Company’s business strategy is a key part of its assessment of the Board’s appetite for risk and also a determination of what constitutes an appropriate level of risk for the Company.

Board Effectiveness

On an annual basis, directors review the Board’s performance and effectiveness as well as the effectiveness and performance of its committees. Effectiveness is subjectively measured by comparing actual corporate results with stated objectives. The contributions of individual directors are informally monitored by other Board members, bearing to mind the particular credentials of the individual and the purpose of originally nominating the individual to the Board.

The Board believes its corporate governance practices are appropriate and effective for the Company, given its size and scope of activities. The Company’s corporate governance practices allow the Company to operate efficiently, with checks and balances that control and monitor Management and corporate functions without excessive administration burden.

Director Orientation and Continuing Education

At present, the Company does not provide a formal orientation program for new directors. New directors are briefed by the CEO and other officers on the Company’s current business plan, strategic priorities, property holdings, ongoing exploration programs, short, medium- and long-term corporate objectives, financials status, general business risks and mitigation strategies, and existing Company policies. This is appropriate, given the Company’s size and current level of activity, the ongoing interaction amongst the directors and the low director turn-over. However, if the growth of the Company’s operations warrants it, it is possible that a formal orientation process would be implemented.

Continuing education of Board members is achieved through site visits, regular CEO communications on topics deemed relevant and quarterly Board material. The skills and knowledge of the Board is such that no formal continuing education process is currently deemed required. The Board is comprised of individuals with varying backgrounds, who have, both collectively and individually, extensive experience in running and managing public companies, particularly in the natural resource sector. Board members are encouraged to communicate with management, auditors and technical consultants to keep themselves current with industry trends and developments and changes in legislation, with Management’s assistance. The directors are advised that, if a director believes that it would be appropriate to engage in relevant continuing education, the Company will pay for the cost thereof. Board members have full access to the Company’s records. Reference is made to the table under the heading “Election of Directors” for a description of the current principal occupations of the members of the Board.

Committees of the Board