UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-23783

(Investment Company Act file number)

Opportunistic Credit Interval Fund

(Exact name of Registrant as specified in charter)

650 Madison Avenue, 3rd Floor

New York, NY 10022

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporation Trust Center, 1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 891-2880

Date of fiscal year end: September 30

Date of reporting period: October 1, 2023- September 30, 2024

Item 1. Reports to Stockholders.

Table of Contents

| Shareholder Letter | 1 |

| Portfolio Update | 14 |

| Consolidated Schedule of Investments | 16 |

| Consolidated Statement of Assets and Liabilities | 23 |

| Consolidated Statement of Operations | 24 |

| Consolidated Statements of Changes in Net Assets | 25 |

| Consolidated Statement of Cash Flows | 26 |

| Financial Highlights | |

| Class I | 27 |

| Notes to Consolidated Financial Statements | 28 |

| Report of Independent Registered Public Accounting Firm | 41 |

| Additional Information | 42 |

| Trustees & Officers | 43 |

| Privacy Notice | 45 |

| Opportunistic Credit Interval Fund | Shareholder Letter |

September 30, 2024 (Unaudited)

Dear Shareholders:

It is our pleasure to provide our shareholders with the annual shareholder letter from the Opportunistic Credit Interval Fund (ticker: SOFIX) for the year ended September 30, 2024. The Fund posted a total return of 7.3% for the fiscal year, driven by gains across the portfolio.i

Given divergent signals in the market, we view this as an opportune time to share our views about the macroeconomic backdrop.

Public investors have unambiguously embraced a bullish outlook. The S&P 500ii has delivered the strongest rolling year to date performance of the 21st Century in 2024.1

Similarly, corporate credit spreads continue to push lower, with spreads for Investment Grade the narrowest since March 2005 and the non-financial sub-index the tightest since 2000. Hight Yield spreads have dropped to post-GFC lows.2

While there are some merits to the optimistic viewpoint (which we highlight below), we nevertheless believe markets risk overlooking certain fissures in the U.S. economy.

Macro Backdrop: The Concerning

With U.S. manufacturing in prolonged contraction (as reflected by ISM data), U.S. GDP will live and die with the consumer. Fraying by certain segments—particularly economically sensitive households—represents an underpriced risk, in our view.

For perspective, the fiscal response to COVID was roughly four times greater than the stimulus provided by the American Recovery and Reinvestment Act of 2009.3 The resulting wage and balance sheet growth have helped drive our post-pandemic recovery.

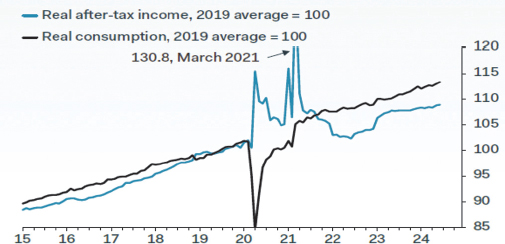

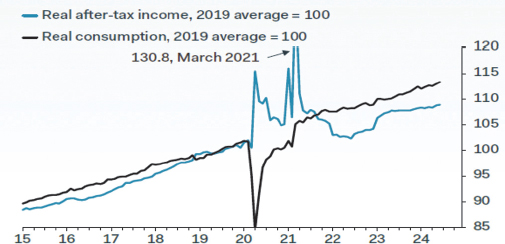

The fading impact of stimulus and inflation have combined to erode real wages. Nevertheless, consumers have maintained their elevated pace of spending—now far outpacing real income:

Real after-tax income vs. Real consumption

Source: Pantheon Macro (8/7/2024)

In short, this dynamic is not sustainable. Consumers can fund this income/spending gap through lower savings rates and/or borrowing, but there are limits to both. After those thresholds have been reached, households will be forced to cut spending, which, in time, will drag on GDP.

| 1 | Bloomberg and Deutsche Bank (10/8/2024) |

| 2 | Spread Strategy Spotlight: “’Just Enough’ or ‘Just Can’t Get Enough’” JP Morgan (10/22/2024) |

| 3 | Carola Binder, Shock Values: Prices and Inflation in American Democracy, page 263 (New York City, U Chicago Press, 2024). |

| Annual Report | September 30, 2024 | 1 |

| Opportunistic Credit Interval Fund | Shareholder Letter |

September 30, 2024 (Unaudited)

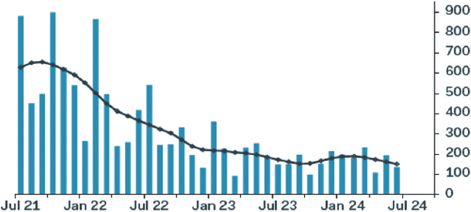

Consumer credit stress presents a further risk. With credit card rates roughly 23% higher than historical levels, St. Louis Federal Reserve data reflects that delinquencies have risen dramatically across income cohorts:4

Share of People in Delinquency (log scale)

Source: St. Louis Federal Reserve (6/6/2024)

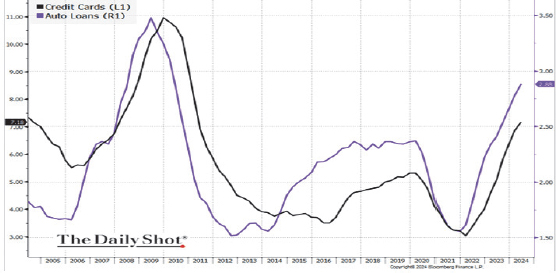

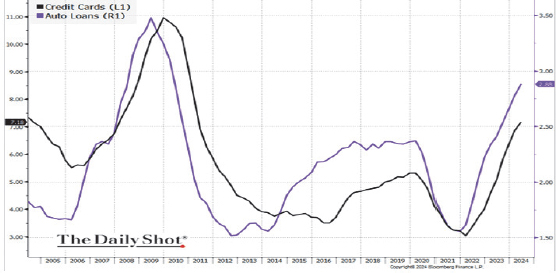

Further Fed analysis shows that serious delinquencies for auto loans and credit cards (+90 days) have reached the highest levels of the post-GFC era:

New York Fed / Equifax U.S. Transitions into Serious Delinquincy (+90 days)

Source: New York Federal Reserve and Equifax (8/2/2024)

Relatedly, the New York Fed’s Debt Delinquency Expectation Survey measures consumers’ perceived risk of missing a debt payment within the next three months. The September reading of 14.2% (vs. 13.6% in August) is the highest since April 2020 (the peak of COVID panic) and above the ten-year average (2013-2023) of 12.1%5

| 4 | The Daily Dash (7/9/2024) |

| 5 | Federal Reserve Bank of New York (10/15/2024) |

| 2 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Shareholder Letter |

September 30, 2024 (Unaudited)

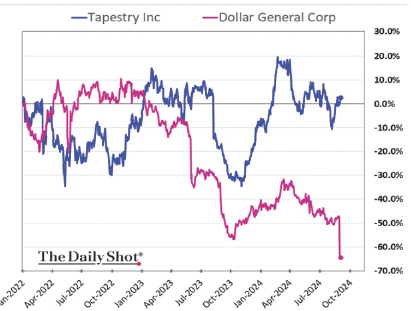

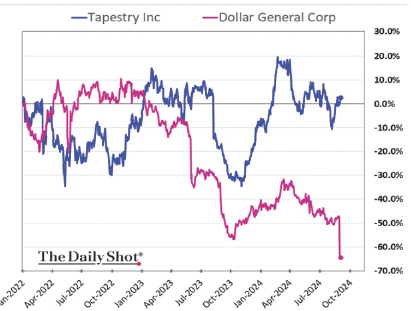

A telling picture of the U.S. consumer following: below compares the stock performance of Tapestry (the maker of high-end apparel under the Coach and Kate Spade brands) vs. discount chain Dollar General:

Trading Prices of Tapestry vs. Dollar General

Source: The Daily Shot (9/5/2024)

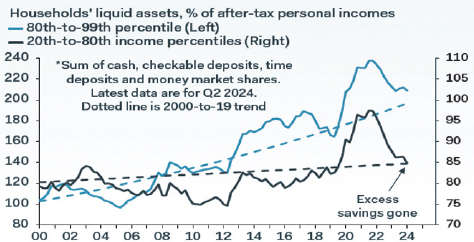

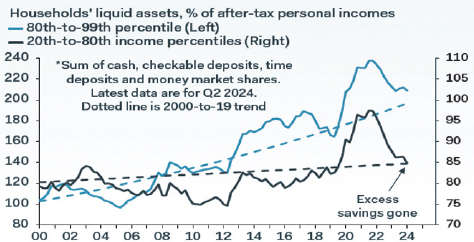

In short, we have a deeply bifurcated consumer economy right now. Liquid assets (which represent proximal potential spending) have become constraints for the vast majority of households:

Households’ liquidity assets (as % of after-tax income), by percentile

Source: Pantheon Macro (10/21/2024)

Although (intuitively) wealthy Americans drive most consumption, the bottom 40% of earnings still account for 22% of spending.6 The vulnerability of this segment presents a threat to our economy writ large.

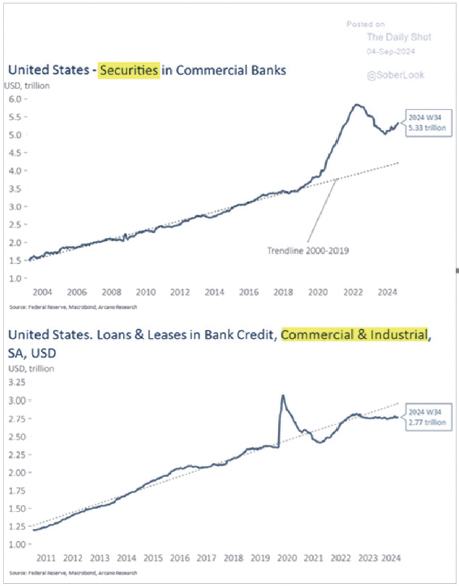

Bank lending—or rather, the continued lack thereof—represents another overhang for our economy.

| 6 | Pantheon Macro (9/11/2024) |

| Annual Report | September 30, 2024 | 3 |

| Opportunistic Credit Interval Fund | Shareholder Letter |

September 30, 2024 (Unaudited)

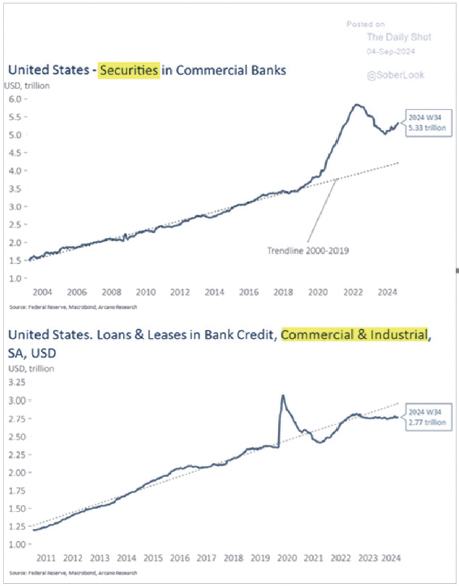

As previously highlighted, traditional banks are facing a crush of obstacles: market-to-market losses, CRE uncertainty, depositor flight and Basel III End Game, being the most salient. Amid the shadows of uncertainty, banks, rather than performing their core lending function, have retrenched by hoarding cash. As the following graphs detail, banks are holding securities on balance sheets well above historical norms and providing loans well below trend:

Securities Held by Commercial Banks vs. C&I Loans by Commercial Banks

Source: Arcano Economics (9/4/2024)

| 4 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Shareholder Letter |

September 30, 2024 (Unaudited)

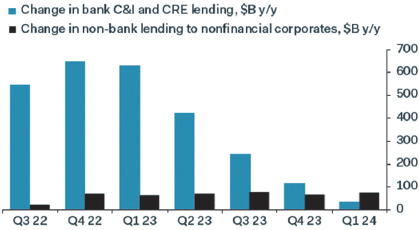

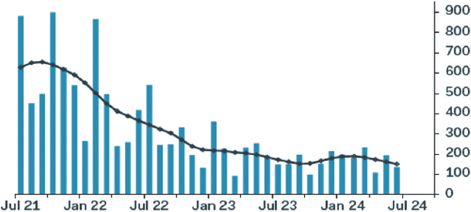

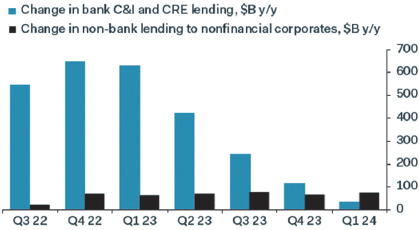

Further emphasizing the point, the following chart further underscores the literal and figurative flatlining of bank lending:

Source: The Daily Shot and Truist Advisory (10/07/2024)

Banks pulling back has provided more opportunities for non-traditional capital providers (like the Opportunistic Credit Interval Fund), but private markets represent a metaphorical ripple compared to the waves of capital historically provided by banks.

Change in Bank C&I and CRE vs. Change in Non-Bank Lending to Non-Financial

Source: Pantheon Macro Research (7/11/2024)

Simply put, the U.S. economy cannot continue to grow without credit availability and private markets cannot fully replace traditional banks. Recent rate cuts have loosened credit conditions (more below), but that benefit has accrued to larger corporations, not the small and medium-sized businesses reliant on bank funding.

Jobs represent another concern worth noting.

First, layoffs have remained muted, consistent with our expectations. Businesses will be slow, in our view, to fire the workforce they struggled to build post-pandemic. Peak profit margins may further enable companies to delay the reflective layoffs evident in downturns.

| Annual Report | September 30, 2024 | 5 |

| Opportunistic Credit Interval Fund | Shareholder Letter |

September 30, 2024 (Unaudited)

Nevertheless, our concern centers on the unambiguous downshift in job creation, as shown in the following graphs:

Private Non-Farm payrolls and trends

Source: Pantheon Macro Research (7/11/2024)

3-Month Average Payrolls

Source: BLS, Haver, Deutsche Bank (9/17/2024)

Forgive the cliché, but the “trend is not our friend” when it comes to jobs.

It is historically rare for the job market to regain momentum. Plus, jobs are often strong up until the point of a recession; then, the collapse is both sudden and severe. For example, on the eve of the GFC, U.S. unemployment was just 4.4% in May 2007 before a steady climb to a 10% peak.7

Headline job numbers have remained firm—particularly the blockbuster September report—but underlying data portends trouble ahead. Labor Differentials (the difference between “jobs are plentiful” and “jobs are hard to get” as measured by Consumer Confidence surveys) fell to 12.6 in September (from 15.9)—levels not seen since 2017.8

Our last concern to highlight relates to AI, which has been a key driver of the market’s furious ascent. Guessing the future of artificial intelligence is (thankfully) far beyond our purview, but we note some potentially troubling data related to AI.

Technology newsletter The Information reported last month that just 0.1% - 1.0% of Microsoft’s roughly 440mn users have subscribed to its AI add-on, Copilot.9 Further, estimates of total revenue from all LLM (large language model) remains just $10bn.10 For perspective, that is roughly the annual sales of Sketchers. Apple’s new “AI enabled phone” has been met with a collective shrug by consumer, with the company cutting order by nearly 10mn units.11

| 7 | U.S. Bureau of Labor Statistics |

| 8 | Pantheon Macro Research (9/11/2024) |

| 9 | “Hail Mary,” MacroStrategy Partnership (10/11/2024) |

| 10 | “Hail Mary,” MacroStrategy Partnership (10/11/2024) |

| 11 | “Apple Cuts Back iPhone Orders. Why Demand Fears Are Mounting,” Barron’s (10/24/2024) |

| 6 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Shareholder Letter |

September 30, 2024 (Unaudited)

The New York Times recently disclosed that market-leader Open-AI is expected to burn $5bn of cash in 2024 on an estimated $3.7bn sales.12 Relatedly, in a report this summer, tech investor Sequoia Capital calculated that AI companies would need to generate revenue of $600bn simply to payback capex spent thus far (including spending on GPU’s, energy, building, back-up generators).13

As for AI valuations, a recent report heighted that NVIDIA’s market cap exceeded the equity capitalization of five G7 countries: Canada, UK, France, Germany and Italy.14 For perspective, these countries generated GDP in 2023 of $2.1T, $3.3T, $3.0T, $4.5T and $2.2T, respective, compared to NVIDIA’s trailing twelve-month revenue of ~$96bn.15 This clearly seems out of whack.

It is far too early to characterize AI as the next Oculus or Google Glasses, but roughly two years into its investment cycle, AI has yet to demonstrate a mass market application despite massive investment by titans Amazon, Apple, Google and Microsoft.

We are not doubting the long-term path of AI per se, but the hype cycle is in jeopardy. Again, math always wins in the end. AI’s “rounding error” revenue despite massive capital investment and having captured cultural zeitgeist echoes of the Dot.com era.

Much as the gravitational pull of artificial intelligence has lifted asset prices, doubts about the technology, should they emerge, would weigh like an anvil on markets.

Macro Backdrop: The Good

Reversing gears, there are many positive economic signals underpinning the public markets cheery outlook.

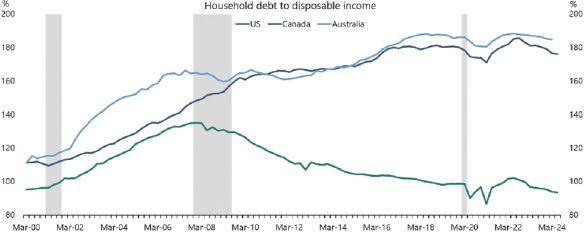

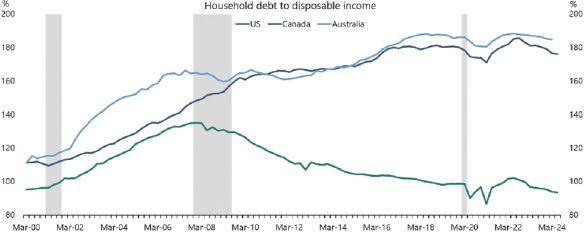

As noted, economically sensitive consumers are struggling, but aggregate household balance sheets are remarkably healthy:

Household debt to disposal income

Source: Apollo Group (10/15/2024)

Lifted by post-pandemic wealth effects, U.S. net worth and the growth of net worth as measured by Oxford Economics’ consumer health monitor are nearing all-time highs.16

Much of these gains are concentrated, however. Affluent households disproportionately benefit from wealth effects; those without assets, see none. Aggregate data may therefore overstate their potential economic benefit, but the figures remain noteworthy.

| 12 | “OpenAI Is Growing Fast and Burning Through Piles of Money” New York Times (9/27/2024) |

| 13 | Sequia, “AI’s $600B Question.” (06/20/2024) |

| 14 | Apollo Chief Economist (10/24/2024) |

| 15 | https://data.worldbank.org/indicator/NY.GDP.MKTP.CD and Bloomberg |

| 16 | Oxford Economics (10/17/2024) |

| Annual Report | September 30, 2024 | 7 |

| Opportunistic Credit Interval Fund | Shareholder Letter |

September 30, 2024 (Unaudited)

Corporate balances sheets are also strikingly strong, with interest payments plumbing modern era lows:

Non-Financial Corporate Interest Payments

Source: Oxford Economics (10/17/2024)

The low interest burden has, in turn, contributed to declines in default rates as well:

Trialing three-month default rate, U.S. High Yield and Levered Loans

Source: Moody’s S&P, LDC, Bloomberg, Morgan Stanley (8/14/2024)

No conversation about markets would be complete without a discussion of interest rates.

First, the Fed’s 50 basis point17 cut in September may, in time, provide an economic boost. However, much like the lagging impact of hikes, cuts will take time to flow through to the economy. Importantly, the long end of the curve (which mortgage rates closely track) is higher since the September cuts (reflecting bullish expectations), which may mute the near-term benefit of lower Fed Funds.

| 17 | One basis point is equal to 0.01%, or 1/100th of 1%. |

| 8 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Shareholder Letter |

September 30, 2024 (Unaudited)

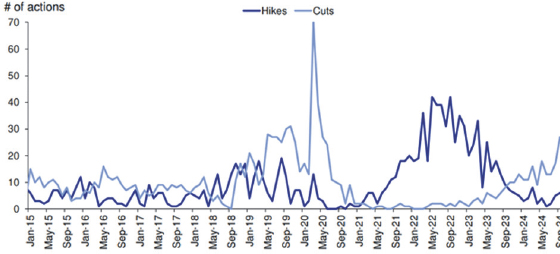

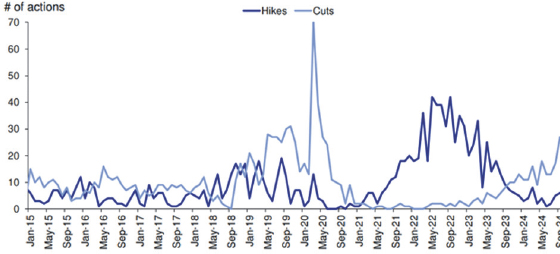

More notably, as seen below, the Fed’s cuts may accelerate a global easing cycle:

Number of global hikes vs. cuts since January 2015

Source: Havner Analytics and Deutsche Bank (10/02/2024)

The recent surge in the dollar, in part, reflects market expectations that global easing may outpace the U.S.

Adding fuel, China recently announced a range of measures to jumpstart its economy—specifically trying to raise asset prices to lift consumer confidence. The size of these programs is larger than any Chinese government stimulus of the previous two years.18 The country also cut its one-year rate to 3.1% from 3.35%, the largest reduction ever.19

Highlighting the global connectedness of easing, China timed these moves in the wake of the Fed’s cuts to minimize the risk of capital flight. Herein lies the potential flywheel of stimulus as U.S. cuts beget easing around globe.

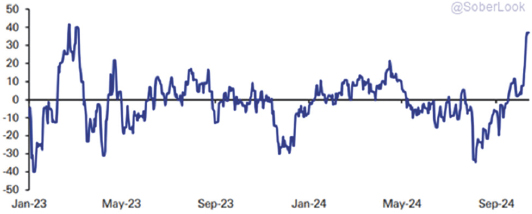

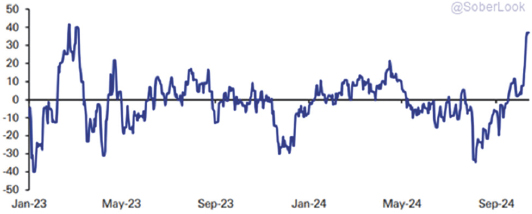

While lower global rates may prolong the current cycle, we note that U.S. 5-year inflation swaps have jumped in recent weeks:

Change (basis point) in the U.S. 5yr inflation swap

Source: Deutsche Bank (10/15/2024)

Ironically, if lower rates reignite inflationary pressures, it may force the Fed to recalibrate the path and magnitude on its easing cycle.

| 18 | “How This Time is Different,” Deutsche Bank (9/30/2024) |

| 19 | The Financial Times, (10/21/2024) |

| Annual Report | September 30, 2024 | 9 |

| Opportunistic Credit Interval Fund | Shareholder Letter |

September 30, 2024 (Unaudited)

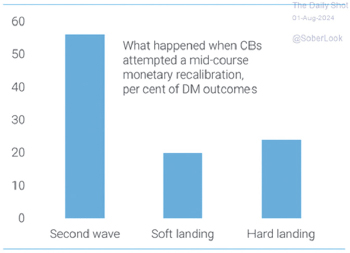

Macro Backdrop: The Opportunity

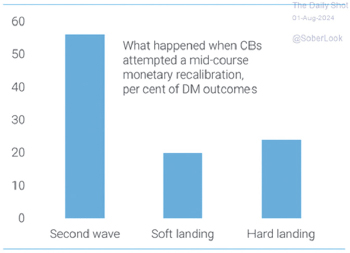

Lofty public values suggest investors have put their faith in a soft landing. However, as reflected below, a benign outcome from mid-cycle cuts by global Central Bank have been historically rare:

Central bank track-record of mid-cycle cuts

Source: Fed study and TS Lombard (8/1/2024)

To be clear, we are unambiguously cheering for a soft landing. If the Fed arrests inflation without recession, Chair Powell would join Paul Volker in the conversation of the greatest Chair ever. (The GFC has de-throned the once lauded Greenspan, in our view).

Nevertheless, with banks sidelined, certain consumers slowing, job creation likely having peaked, we remain skeptical. Geopolitical uncertainty represents yet another overhang.

With public markets having priced the bull-case across many variables, we have a simple response: God Bless the Private Market.

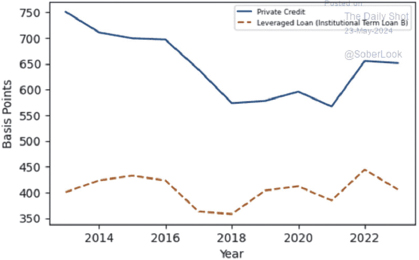

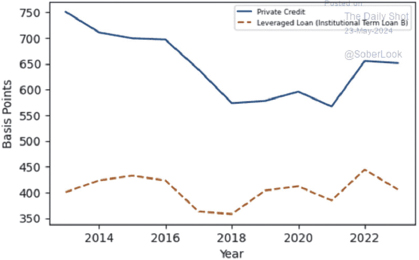

As reflected in the following graphs, middle market private credit continues to command a meaningful yield premium:

Private Credit Spreads vs. Leverage Loan (Term Loan B)

Source: Debtwire (7/11/2024)

| 10 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Shareholder Letter |

September 30, 2024 (Unaudited)

As for why private credit enjoys this advantage, I highlight the following passage from the Fed’s study, “Private Credit: Characteristics and Risks:”

“Given the absence of a liquid secondary market for many private credit instruments, lenders typically hold these loans until maturity or a refinancing event. As a result, these loan contracts can include features uncommon to traditional bank loans, such as a structured equity component, high prepayment penalties, or a role in oversight or management of the company.”20

Don’t fight the Fed when it comes to private market premium…

Again, not all private credit solutions deliver the same benefit. The dawn of monster funds by monster firms, has seen a degradation in segments of this market. Platforms forced to chase large deals must compete against public markets to win deals, resulting in lower yields and fewer investor protections.

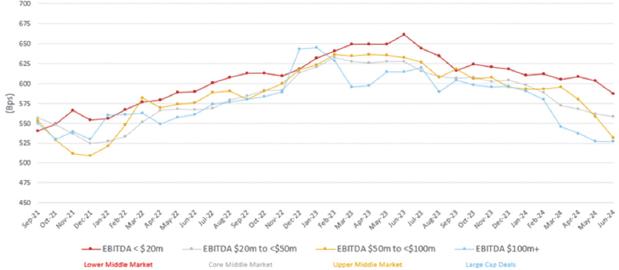

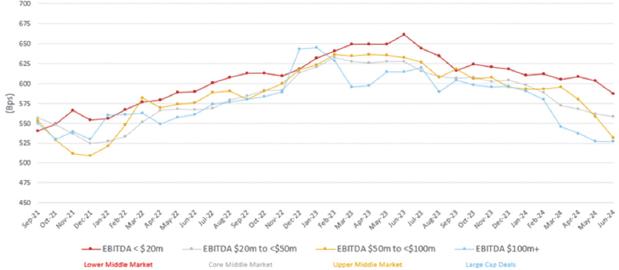

As depicted below, loans to smaller companies enjoy a meaningful yield premium over larger deals:

Private Credit spreads by EBITDA size

Source: KBRA DLD Private Data; 3-month rolling average for first-lien term loans

Again, BC Partners views companies with EBITDA between $10mn to $50mn as our “wheelhouse”—an advantage conveyed by our “Goldilocks” size.

BC Partners and the Opportunistic Credit Interval Fund also focuses on lending to companies without private equity ownership, which often provides greater opportunity to dictate terms.

Sponsor-based transactions often entail aggressive structures (e.g. higher leverage, less amortization and no covenants) that have led, as reflected below, to higher instances of bankruptcy, default and debt exchanges:

Last Twelve-Month Loan Index Defaults

Source: Moody’s S&P, LDC, Bloomberg, Morgan Stanley (8/14/2024)

| 20 | Board of Governors of the Federal Reserve System, “Private Credit: Characteristics and Risks,” 2/23/2024 |

| Annual Report | September 30, 2024 | 11 |

| Opportunistic Credit Interval Fund | Shareholder Letter |

September 30, 2024 (Unaudited)

Firms that measure their AUM in the $10’s of billions cannot participate in the most attractive segments of the private market—smaller and non-sponsored deals—which we consider our playground.

The outlook for large cap private credit appears even more ominous going forward. Lower interest rates have enabled public markets to claw-back market share, as Bloomberg underscored in their recent article “Banks Reclaim $30bn of Debt Deal from Private Credit.”21 For clarity, none of those deals came at the expense of BC Partners.

Fund Performance

The Fund generated a total return of 7.3% for the fiscal year ended September 30, 2024, trailing that of our benchmark (Morningstar LSTA US Leveraged Loan TR USD Indexiii), largely due to cash drag during the period. During fiscal 2024, the Fund grew assets from $37M to $145M and successfully negotiated a multi-currency leverage facility, providing ample dry powder to further diversify the portfolio, support existing portfolio investments in their pursuit of growth initiatives and, to the extent relevant, aggressively deploy capital amidst a volatile market backdrop.

Despite modest underperformance during the year, inception-to-date returns continue to handily outpace the Index (16.7% vs.10.7%).

Among the Fund’s positive contributors were its investment in Smart Start (price appreciation of +26.7%), which was acquired at attractive levels by way of liquidity bid, as well as Camino (+4.0%) and MHS (+3.2%). Software, broadly, traded off during the period and our portfolio was no different – loans to Digicert and Ivanti traded down 7.4% and 1.8%, respectively. Further detracting from performance during fiscal 2024 was our private investment in IFRG Investor III, LP (-22.0%), an SPV designed to participate in the economics of the lead lender supporting the take-private transaction for Franchise Group. Since closing, performance has been affected by management turmoil, subsidiary underperformance and reactive asset sales. We remain in communication with the lender group to determine next steps for the business.

Positioning

This time last year, the Fund found itself ramping capital raising efforts and kicking off a significant phase of growth from roughly $37M of net assets to $145M today. At the time, the primary markets were quiet and remained relatively muted through early 2024, resulting in evenly split allocation across liquid and illiquid credit. As primary markets turned back on, the Fund began leaning into privately originated opportunities – today, over 70% of the portfolio is comprised by private deals.

Despite tightening spreads, we continue to see attractive private opportunities – one being a mid-sized, growing industrial manufacturer & distributor with whom we are aiming to close on a senior term loan priced at S+700 in the coming weeks. Private deals added to the portfolio since our last letter include Coterie Baby, a DTC, subscription-based platform focused on delivering premium diapers, and one of the largest deals in the history of BC Credit – Riddell, the premier designer and manufacturer of American football protective equipment.

Conclusion

The S&P 500 has gained 20% year to date through the third quarter. From this starting point—and with myriad risks in the subtext of our economy—equity markets feel like treacherous waters for investors.

This provides an opportune time to revisit a theme we have been hammering for several quarters: investors must reexamine portfolio construction.

The turbo-charged equity returns that propelled accounts post-GFC will not repeat in the years ahead. Reshoring, energy transition, shifting geopolitical order, aging demographics, spiraling debt-to-GDP, non-zero inflation, “just in case” rather than ‘just in time” inventories, persistent deficits and higher interest rates represent just some of the obstacles that will weigh on markets.

Goldman Sachs recently released a 10-Year forecast for annualized S&P 500 returns of just 3.0% (nominal).22 This represents but one of many market projections, but this outlook could undershoot by 4x and still trail the 16% per annum S&P return from 2009 to 2021.23 Starting valuation and market concentration feature among the largest contributors of the bank’s projections.

With higher returns likely available on a nominal basis, we think fixed income must become a larger share of investors’ assets. From a risk adjusted perspective, the case for fixed income becomes overwhelming.

| 21 | Bloomberg, “Banks Reclaim $30bn of Debt from Private Credit.” (10/03/2024) |

| 22 | Goldman Sachs, Global Strategy Paper #71: (10/18/2024) |

| 23 | Cost of Capital and Capital Allocation, Investment in the Era of ‘Easy Money” Morgan Stanely (2/28/2024) |

| 12 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Shareholder Letter |

September 30, 2024 (Unaudited)

Investors can similarly ill-afford to allocate to the countless mutual funds and ETFs that have historically comprised their credit allocation. The demise of small and medium banks has overwhelming tilted the opportunity towards private markets. Within private credit, investors should seek the most attractive lower middle market and non-sponsored segments—again, the playground of BC Partners.

Regards,

Matthias Ederer

Portfolio Manager

Opportunistic Credit Interval Fund

| i | Fund performance refers to that of Class I. Reflects twelve-month returns through September 30, 2024. Past performance is not indicative of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Performance figures for periods less than one year are not annualized. For performance information current to the most recent month-end, please call toll-free 1-833-404-4103. |

The Adviser and the Fund have entered into an Expense Limitation Agreement under which the Adviser has agreed, until at least February 1, 2025 to waive its management fees (excluding any incentive fee) and to pay or absorb the ordinary annual operating expenses of the Fund (excluding incentive fees, all borrowing costs, dividends, amortization/accretion on securities sold short, brokerage commissions, acquired fund fees and expenses and extraordinary expenses), to the extent that its management fees plus the Fund’s ordinary annual operating expenses exceed 2.50% per annum of the Fund’s average daily net assets attributable to Class I shares. Such Expense Limitation Agreement may not be terminated by the Adviser, but it may be terminated by the Board of Trustees, upon 60 days written notice to the Adviser. Any waiver or reimbursement by the Adviser is subject to repayment by the Fund within the three (3) years from the date the Adviser (or the previous investment adviser) waived any payment or reimbursed any expense, if the Fund is able to make the repayment without exceeding the lesser of the expense limitation in place at the time of the waiver or the current expense limitation and the repayment is approved by the Board of Trustees. See “Management of the Fund.”

| ii | S&P 500 – The S&P 500 is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S. Investors cannot invest directly in an index. |

| iii | Morningstar LSTA US Leveraged Loan TR USD Index - The Morningstar LSTA US Leveraged Loan TR USD Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. Investors cannot invest directly in an index. |

| Annual Report | September 30, 2024 | 13 |

| Opportunistic Credit Interval Fund | Portfolio Update |

September 30, 2024 (Unaudited)

The Fund’s performance figures for the period ended September 30, 2024, compared to its benchmark:

| Opportunistic Credit Interval Fund | 1 Month | Quarter | 6 Month | YTD | 1 Year | Since

Inception | Inception |

Opportunistic Credit Interval Fund - NAV | 0.95% | 2.09% | 3.31% | 5.26% | 7.32% | 16.70% | 7/1/2022 |

Morningstar LSTA US Leveraged Loan TR USD Index | 0.71% | 2.04% | 3.98% | 6.54% | 9.59% | 10.68% | 7/1/2022 |

The Morningstar LSTA US Leveraged Loan TR USD Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. Investors cannot invest directly in an index.

Past performance is not indicative of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Performance figures for periods less than one year are not annualized. As of the Fund’s most recent prospectus dated January 26, 2024, the Fund’s total annual operating expenses, including acquired fund fees and expenses, before fee waivers is 11.17% for Class I. After fee waivers, the Fund’s total annual operating expense is 2.97% for Class I. For performance information current to the most recent month-end, please call toll-free 1-833-404-4103.

| 14 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Portfolio Update |

September 30, 2024 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

Consolidated Portfolio Composition as of September 30, 2024

| Asset Type | Percent of Net Assets |

| Bank Loan | 77.55% |

| Preferred Stock | 10.02% |

| Bonds & Notes | 4.90% |

| Joint Venture | 4.36% |

| Short-Term Investments | 3.27% |

| Equipment Financing | 2.00% |

| Common Equity | 0.67% |

| Warrants | 0.16% |

| Derivatives | 0.00% |

| Total Investments | 102.93% |

| Liabilities in Excess of Other Assets | (2.93%) |

| Net Assets | 100.00% |

Please see the Consolidated Schedule of Investments for a detailed listing of the Fund’s holdings.

| Annual Report | September 30, 2024 | 15 |

| Opportunistic Credit Interval Fund | Consolidated Schedule of Investments |

September 30, 2024

| | | Coupon | | | Reference Rate & Spread | | | Maturity | | | Principal | | | Value | |

| BANK LOANS (77.55%) | | | | | | | | | | | | | | | | | | |

| Communication Services (6.63%) | | | | | | | | | | | | | | | | | | |

| Neptune Bidco US Inc., Second Lien Term Loan(a)(b) | | | 15.15 | % | | 3M SOFR + 9.75%, 0.75% Floor | | | 10/11/2029 | | | $ | 2,000,000 | | | $ | 2,000,000 | |

| Neptune Bidco US Inc., First Lien Term Loan A(a)(b) | | | 10.15 | % | | 3M SOFR + 4.75%, 0.50% Floor | | | 10/11/2028 | | | | 2,488,674 | | | | 2,333,754 | |

| Neptune Bidco US Inc., First Lien Term Loan(a)(b) | | | 10.40 | % | | 3M SOFR + 5.00%, 0.50% Floor | | | 04/11/2029 | | | | 2,633,459 | | | | 2,479,217 | |

| Next Flight Ventures Delayed Draw Term Loan(a)(b)(c)(d) | | | 15.01 | % | | 3M SOFR + 10.00% | | | 12/26/2025 | | | | 110,333 | | | | 107,485 | |

| Next Flight Ventures, First Lien Term Loan, First Lien Term Loan(a)(b)(c) | | | 14.90 | % | | 3M SOFR + 10.00% | | | 12/26/2025 | | | | 1,144,974 | | | | 1,115,319 | |

| Synamedia Americas Holdings, Inc., First Lien Term Loan(a)(b) | | | 12.35 | % | | 3M SOFR + 7.75%, 1.00% Floor | | | 12/05/2028 | | | | 1,653,017 | | | | 1,617,973 | |

| | | | | | | | | | | | | | | | | | 9,653,748 | |

| Consumer Discretionary (1.92%) | | | | | | | | | | | | | | | | | | |

| PMP OPCO, LLC, First Lien Term Loan(a)(b)(e) | | | 13.35 | % | | 1M SOFR + 8.50%, 2.00% Floor | | | 05/31/2029 | | | | 1,968,750 | | | | 1,931,934 | |

| PMP OPCO, LLC, Delayed Draw Term Loan(a)(b)(d)(e) | | | – | % | | 1M SOFR + 8.50%, 2.00% Floor | | | 05/31/2029 | | | | – | | | | (11,419 | ) |

| PMP OPCO, LLC, Revolver(a)(b)(d)(e) | | | – | % | | 1M SOFR + 8.50%, 2.00% Floor | | | 05/31/2029 | | | | – | | | | (4,091 | ) |

| Riddell Inc., First Lien Term Loan(a)(b)(e) | | | 11.17 | % | | 1M SOFR + 6.00%, 1.00% Floor | | | 03/29/2029 | | | | 897,727 | | | | 887,673 | |

| Riddell Inc., Delayed Draw Term Loan(a)(b)(d)(e) | | | – | % | | 1M SOFR + 6.00%, 1.00% Floor | | | 03/29/2029 | | | | – | | | | (1,018 | ) |

| | | | | | | | | | | | | | | | | | 2,803,079 | |

| Consumer Staples (8.93%) | | | | | | | | | | | | | | | | | | |

| Alphia, Inc., First Lien Term Loan(a)(b) | | | 9.85 | % | | 1M SOFR + 5.00% | | | 10/03/2030 | | | | 2,985,000 | | | | 2,836,616 | |

| Florida Food Products LLC, First Lien Term Loan(a)(b) | | | 9.96 | % | | 1M SOFR + 5.00%, 0.75% Floor | | | 10/18/2028 | | | | 4,071,588 | | | | 3,595,090 | |

| Global Integrated Flooring Systems Inc., First Lien Term Loan(a)(b)(c) | | | 14.70 | % | | 3M SOFR + 8.36%, 1.00% PIK | | | 06/30/2025 | | | | 1,247,278 | | | | 677,022 | |

| Global Integrated Flooring Systems Inc., Revolver(a)(b)(c) | | | 13.31 | % | | 1M SOFR + 8.36% | | | 06/30/2025 | | | | 12,163 | | | | 6,602 | |

| Jackson Ranch LLC, First Lien Term Loan(a)(b)(c) | | | 13.00 | % | | 13.00% PIK | | | 09/20/2027 | | | | 1,329,785 | | | | 1,329,785 | |

| SPB C-2024, LLC, First Lien Term Loan(a)(b)(c) | | | 13.00 | % | | 13.00% PIK | | | 08/19/2027 | | | | 4,568,250 | | | | 4,568,250 | |

| | | | | | | | | | | | | | | | | | 13,013,365 | |

| Financials (23.65%) | | | | | | | | | | | | | | | | | | |

| AIS Holdco LLC, First Lien Term Loan(a)(b) | | | 10.60 | % | | 1M SOFR + 6.00%, 1.25% Floor | | | 05/21/2029 | | | | 2,104,000 | | | | 2,072,440 | |

| AIS Holdco LLC, Revolver(a)(b)(d) | | | – | % | | 1M SOFR + 6.00%, 1.25% Floor | | | 05/21/2029 | | | | – | | | | (1,500 | ) |

| BetaNXT, Inc., First Lien Term Loan(a)(b) | | | 10.35 | % | | 3M SOFR + 5.75% | | | 07/01/2029 | | | | 5,369,697 | | | | 5,155,446 | |

| Cor Leonis Limited, Revolver(a)(b)(d) | | | 12.10 | % | | 1M SOFR+ 7.50%, 1.50% Floor | | | 05/15/2028 | | | | 214,890 | | | | 214,523 | |

| Expert Experience Credit Motors, LLC, Revolver(a)(b)(d) | | | 15.67 | % | | 1M SOFR + 10.50% | | | 03/29/2026 | | | | 4,958,139 | | | | 4,958,139 | |

| Fortis Payment Systems, LLC, First Lien Term Loan(a)(b) | | | 9.95 | % | | 3M SOFR + 5.25%, 1.00% Floor | | | 02/13/2026 | | | | 1,865,625 | | | | 1,854,057 | |

| Fortis Payment Systems, LLC, Delayed Draw Term Loan(a)(b)(d) | | | 9.95 | % | | 3M SOFR + 5.25%, 1.00% Floor | | | 02/13/2026 | | | | 272,910 | | | | 272,554 | |

| Lion FIV Debtco Limited, Revolver(a)(b)(d) | | | 16.33 | % | | 3M SOFR + 11.00% | | | 10/18/2024 | | | | 988,180 | | | | 974,355 | |

| Meridian Venture Partners II LP, First Lien Term Loan(a)(b)(c) | | | 15.50 | % | | 15.50% PIK | | | 04/15/2027 | | | | 4,613,135 | | | | 4,498,730 | |

| Resolute Investment Managers, Inc., First Lien Term Loan(a)(b) | | | 11.37 | % | | 3M SOFR + 6.50% | | | 04/30/2027 | | | | 4,994,987 | | | | 4,907,575 | |

See Notes to Consolidated Financial Statements.

| 16 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Consolidated Schedule of Investments |

September 30, 2024

| | | Coupon | | | Reference Rate & Spread | | | Maturity | | | Principal | | | Value | |

| RHF VIII Holdings LLC, Revolver(a)(b)(d) | | | –% | | | 3M SOFR+ 7.13%, 2.50% Floor | | | 07/02/2026 | | | $ | 2,950,000 | | | $ | 2,950,000 | |

| Royal Palm Equity Partners I L.P., First Lien Term Loan(a)(b)(c)(d) | | | 12.28 | % | | 3M SOFR + 7.00%, 12.28% PIK, 2.50% Floor | | | 10/24/2033 | | | | 2,119 | | | | 1,673 | |

| Royal Palm Equity Partners I L.P., Delayed Draw Term Loan(a)(b)(c)(d) | | | 12.28 | % | | 3M SOFR + 7.00%, 12.28% PIK, 2.50% Floor | | | 10/24/2033 | | | | 10,595 | | | | 8,366 | |

| Royal Palm Equity Partners I L.P., Initial First Lien Term Loan, First Lien Term Loan(a)(b)(c) | | | 12.28 | % | | 3M SOFR + 7.00%, 12.28% PIK, 2.50% Floor | | | 10/24/2033 | | | | 594,471 | | | | 590,844 | |

| Royal Palm Equity Partners II L.P., First Lien Term Loan(a)(b)(c) | | | 13.28 | % | | 3M SOFR + 8.00%, 13.28% PIK, 2.50% Floor | | | 10/24/2028 | | | | 40,778 | | | | 40,423 | |

| Russell Investments US Institutional Holdco, Inc., First Lien Term Loan(a)(b)(c) | | | 11.75 | % | | 3M SOFR + 5.00%, 1.50% PIK, 1.00% Floor | | | 05/31/2027 | | | | 4,597,128 | | | | 3,992,606 | |

| TA/WEG HOLDINGS, LLC, 2020 Delayed Draw Term Loan(a)(b) | | | 10.52 | % | | 3M SOFR + 5.50%, 1.00% Floor | | | 10/04/2027 | | | | 309,935 | | | | 309,935 | |

| TA/WEG HOLDINGS, LLC, 2021 Delayed Draw Term Loan(a)(b) | | | 10.70 | % | | 3M SOFR + 5.50%, 1.00% Floor | | | 10/04/2027 | | | | 463,361 | | | | 463,361 | |

| TA/WEG HOLDINGS, LLC, 2024 Delayed Draw Term Loan(a)(b)(d) | | | 10.36 | % | | 3M SOFR + 5.50%, 1.00% Floor | | | 10/04/2027 | | | | 720,255 | | | | 720,255 | |

| TA/WEG HOLDINGS, LLC, May 2022 Delayed Draw Term Loan(a)(b) | | | 10.69 | % | | 3M SOFR + 5.50%, 1.00% Floor | | | 10/04/2027 | | | | 464,966 | | | | 464,966 | |

| TA/WEG HOLDINGS, LLC, Revolver(a)(b)(d) | | | – | % | | 3M SOFR + 5.50%, 1.00% Floor | | | 02/02/2032 | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | 34,448,748 | |

| Health Care (8.54%) | | | | | | | | | | | | | | | | | | |

| CCMG Buyer, LLC, First Lien Term Loan(a)(b) | | | 10.61 | % | | 1M SOFR + 5.50%, 1.00% Floor | | | 05/08/2030 | | | | 1,579,375 | | | | 1,575,427 | |

| CCMG Buyer, LLC, Revolver(a)(b)(d) | | | – | % | | 1M SOFR + 5.50%, 1.00% Floor | | | 05/08/2030 | | | | – | | | | (625 | ) |

| Dentive LLC, First Lien Term Loan(a)(b) | | | 11.63 | % | | 3M SOFR + 6.75%, 1.00% Floor | | | 12/26/2028 | | | | 237,619 | | | | 233,460 | |

| Dentive LLC, Delayed Draw Term Loan(a)(b)(d) | | | 11.63 | % | | 3M SOFR + 6.75%, 1.00% Floor | | | 12/26/2028 | | | | 1,471,704 | | | | 1,433,608 | |

| IDC Infusion Services, Inc., First Lien Term Loan(a)(b) | | | 11.55 | % | | 3M SOFR + 6.50%, 1.00% Floor | | | 07/07/2028 | | | | 363,214 | | | | 359,109 | |

| IDC Infusion Services, Inc., Delayed Draw Term Loan(a)(b)(d) | | | – | % | | 3M SOFR + 6.50%, 1.00% Floor | | | 07/07/2028 | | | | – | | | | 1,158 | |

| IDC Infusion Services, Second Amendment First Lien Term Loan(a)(b) | | | 11.33 | % | | 3M SOFR+ 6.00% | | | 07/07/2028 | | | | 3,491,250 | | | | 3,451,799 | |

| PhyNet Dermatology LLC, First Lien Term Loan(a)(b) | | | 11.78 | % | | 6M SOFR + 6.50%, 1.00% Floor | | | 10/20/2029 | | | | 484,104 | | | | 480,473 | |

| PhyNet Dermatology LLC, Delayed Draw Term Loan(a)(b)(d) | | | – | % | | 6M SOFR + 6.50%, 1.00% Floor | | | 10/20/2029 | | | | – | | | | 2,534 | |

| Radiology Partners, Inc, First Lien Term Loan(a)(b)(c) | | | 10.38 | % | | 3M SOFR + 3.50%, 1.50% PIK | | | 01/31/2029 | | | | 2,002,668 | | | | 1,967,631 | |

| South Florida ENT Associates, First Lien Term Loan(a)(b) | | | 11.95 | % | | 3M SOFR + 7.00%, 1.00% Floor | | | 12/31/2025 | | | | 390,498 | | | | 388,506 | |

| South Florida ENT Associates, Delayed Draw Term Loan(a)(b)(d) | | | 11.20 | % | | 1M SOFR + 6.25% | | | 12/31/2025 | | | | 62,058 | | | | 59,730 | |

| USN Opco, LLC, First Lien Term Loan(a)(b) | | | 10.50 | % | | 3M SOFR + 5.75%, 1.00% Floor | | | 12/21/2026 | | | | 2,493,750 | | | | 2,493,750 | |

| | | | | | | | | | | | | | | | | | 12,446,560 | |

| Industrials (8.49%) | | | | | | | | | | | | | | | | | | |

| Accordion Partners, LLC, First Lien Term Loan(a)(b) | | | 10.85 | % | | 3M SOFR + 6.25%, 0.75% Floor | | | 08/29/2029 | | | | 82,323 | | | | 82,010 | |

| Accordion Partners, LLC, Delayed Draw Term Loan A(a)(b) | | | 11.10 | % | | 3M SOFR + 6.50%, 0.75% Floor | | | 08/29/2029 | | | | 7,208 | | | | 7,208 | |

See Notes to Consolidated Financial Statements.

| Annual Report | September 30, 2024 | 17 |

| Opportunistic Credit Interval Fund | Consolidated Schedule of Investments |

September 30, 2024

| | | Coupon | | | Reference Rate & Spread | | | Maturity | | | Principal | | | Value | |

| Accordion Partners, LLC, Delayed Draw Term Loan B(a)(b) | | | 11.50 | % | | 3M SOFR + 6.25%, 0.75% Floor | | | 08/29/2029 | | | $ | 9,056 | | | $ | 9,021 | |

| Accordion Partners, LLC, Third Amendment Delayed Draw Term Loan(a)(b) | | | 11.45 | % | | 3M SOFR + 6.50%, 0.75% Floor | | | 08/29/2029 | | | | 149,855 | | | | 149,855 | |

| Accordion Partners, LLC, Third Amendment First Lien Term Loan, First Lien Term Loan(a)(b) | | | 11.52 | % | | 3M SOFR + 6.50%, 0.75% Floor | | | 08/29/2029 | | | | 98,791 | | | | 98,791 | |

| Astro Acquisition, LLC, First Lien Term Loan(a)(b) | | | 10.10 | % | | 3M SOFR + 5.50%, 1.00% Floor | | | 12/13/2027 | | | | 3,980,000 | | | | 3,953,732 | |

| Inmar, Inc., First Lien Term Loan(a)(b) | | | 10.23 | % | | 3M SOFR + 5.50%, 1.00% Floor | | | 05/01/2026 | | | | 992,462 | | | | 995,524 | |

| Marvel APS, Delayed Draw Term Loan(a)(b)(c)(l) | | | 10.00 | % | | 10.00% PIK | | | 12/21/2027 | | | | 3,281,759 | | | | 3,653,097 | |

| Material Handling Systems, Inc., First Lien Term Loan(a)(b) | | | 10.91 | % | | 3M SOFR + 5.50%, 0.50% Floor | | | 06/08/2029 | | | | 1,567,942 | | | | 1,438,595 | |

| Tactical Air Support, Inc., First Lien Term Loan(a)(b) | | | 13.93 | % | | 3M SOFR + 8.50%, 1.00% Floor | | | 12/22/2028 | | | | 1,714,286 | | | | 1,697,143 | |

| Tactical Air Support, Inc., Delayed Draw Term Loan(a)(b) | | | 13.76 | % | | 1M SOFR + 8.50%, 1.00% Floor | | | 12/22/2028 | | | | 285,714 | | | | 282,857 | |

| | | | | | | | | | | | | | | | | | 12,367,833 | |

| Information Technology (16.13%) | | | | | | | | | | | | | | | | | | |

| Alegeus Technologies Holdings Corp., First Lien Term Loan(a)(b) | | | 13.46 | % | | 3M SOFR + 8.25%, 1.00% Floor | | | 09/04/2026 | | | | 351,313 | | | | 351,313 | |

| Athos Merger Sub LLC, First Lien Term Loan(a)(b) | | | 10.32 | % | | 3M SOFR + 5.00% | | | 07/31/2026 | | | | 234,913 | | | | 218,469 | |

| Athos Merger Sub LLC, Second Lien Term Loan(a)(b) | | | 13.57 | % | | 3M SOFR + 8.25% | | | 07/30/2027 | | | | 160,771 | | | | 145,225 | |

| DCert Buyer, Inc., First Amendment Term Loan Refinancing, Second Lien Term Loan (a)(b) | | | 11.85 | % | | 1M SOFR + 7.00% | | | 02/16/2029 | | | | 3,532,961 | | | | 3,068,642 | |

| DRI Holdings Inc., First Lien Term Loan(a)(b) | | | 10.20 | % | | 1M SOFR + 5.25%, 0.50% Floor | | | 12/15/2028 | | | | 500,743 | | | | 484,887 | |

| Enverus Holdings, Inc., Initial First Lien Term Loan(a)(b) | | | 10.35 | % | | 1M SOFR + 5.50%, 0.75% Floor | | | 12/12/2029 | | | | 809,958 | | | | 802,588 | |

| Enverus Holdings, Inc., Revolver(a)(b)(d) | | | 10.35 | % | | 1M SOFR + 5.50%, 0.75% Floor | | | 12/12/2029 | | | | 4,744 | | | | 4,068 | |

| Global IID Parent LLC, Second Lien Term Loan(a)(b) | | | 12.62 | % | | 3M SOFR + 7.75%, 0.50% Floor | | | 12/16/2029 | | | | 165,000 | | | | 158,879 | |

| Global IID Parent LLC, First Lien Term Loan(a)(b) | | | 9.37 | % | | 3M SOFR + 4.50%, 0.50% Floor | | | 12/08/2028 | | | | 1,730,333 | | | | 1,714,414 | |

| HDC / HW Intermediate Holdings, LLC, First Lien Term Loan A(a)(b)(c) | | | 8.75 | % | | 3M SOFR + 1.00%, 2.50% PIK, 5.25% Floor | | | 06/21/2026 | | | | 932,717 | | | | 794,489 | |

| HDC / HW Intermediate Holdings, LLC, First Lien Term Loan B(a)(b)(c)(j) | | | – | % | | 3M SOFR + 1.00%, 2.50% PIK, 5.25% Floor | | | 06/21/2026 | | | | 646,028 | | | | – | |

| Help Systems Holdings, Inc., First Lien Term Loan(a)(b) | | | 8.95 | % | | 1M SOFR + 4.00%, 0.75% Floor | | | 11/19/2026 | | | | 2,483,103 | | | | 2,374,468 | |

| Ivanti Software, Inc., First Lien Term Loan(a)(b) | | | 9.83 | % | | 3M SOFR + 4.25%, 0.75% Floor | | | 12/01/2027 | | | | 2,450,236 | | | | 2,088,655 | |

| Kofax, Inc., First Lien Term Loan(a)(b) | | | 10.60 | % | | 3M SOFR + 5.25%, 0.50% Floor | | | 07/20/2029 | | | | 2,568,848 | | | | 2,315,444 | |

| Morae Global Holdings Inc., First Lien Term Loan(a)(b) | | | 13.43 | % | | 3M SOFR + 8.00%, 2.00% Floor | | | 10/26/2026 | | | | 1,323,438 | | | | 1,298,688 | |

| Morae Global Holdings Inc., Revolver(a)(b)(d) | | | – | % | | 3M SOFR + 8.00%, 2.00% Floor | | | 10/26/2026 | | | | – | | | | (2,338 | ) |

| PEAK Technology Partners, Inc., First Lien Term Loan(a)(b) | | | 10.51 | % | | 3M SOFR + 5.25%, 1.00% Floor | | | 07/22/2027 | | | | 615,271 | | | | 606,719 | |

| Riskonnect Parent LLC, First Lien Term Loan(a)(b) | | | 10.25 | % | | 3M SOFR + 5.50%, 0.75% Floor | | | 12/07/2028 | | | | 1,219,110 | | | | 1,206,431 | |

| Riskonnect Parent LLC, Delayed Draw Term Loan(a)(b)(d) | | | – | % | | 3M SOFR + 5.50%, 0.75% Floor | | | 12/07/2028 | | | | – | | | | (2,000 | ) |

See Notes to Consolidated Financial Statements.

| 18 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Consolidated Schedule of Investments |

September 30, 2024

| | | Coupon | | | Reference Rate & Spread | | | Maturity | | | Principal | | | Value | |

| Tank Holding Corp., First Lien Term Loan(a)(b) | | | 10.25 | % | | 1M SOFR + 5.75%, 0.75% Floor | | | 03/31/2028 | | | $ | 1,834,179 | | | $ | 1,808,271 | |

| Tank Holding Corp., Revolver(a)(b)(d) | | | 10.75 | % | | 1M SOFR + 5.75%, 0.75% Floor | | | 03/31/2028 | | | | 4,851 | | | | 4,754 | |

| Taoglas Group Holdings Limited, First Lien Term Loan(a)(b) | | | 11.85 | % | | 3M SOFR + 7.25%, 1.00% Floor | | | 02/28/2029 | | | | 309,293 | | | | 295,901 | |

| Taoglas Group Holdings Limited, Revolver(a)(b)(d) | | | 12.35 | % | | 3M SOFR + 7.25%, 1.00% Floor | | | 02/28/2029 | | | | 76,700 | | | | 72,976 | |

| VeriFone Systems, Inc., First Lien Term Loan(a)(b) | | | 9.33 | % | | 3M SOFR + 4.00% | | | 08/20/2025 | | | | 992,105 | | | | 913,109 | |

| Zywave, Inc., First Lien Term Loan(a)(b) | | | 9.25 | % | | 3M SOFR + 4.50%, 0.75% Floor | | | 11/12/2027 | | | | 2,966,699 | | | | 2,777,572 | |

| | | | | | | | | | | | | | | | | | 23,501,624 | |

| Real Estate (3.26%) | | | | | | | | | | | | | | | | | | |

| RHF VI FUNDING LLC, Revolver(a)(b)(d) | | | 12.37 | % | | 3M SOFR+ 7.50% | | | 11/19/2024 | | | | 4,750,000 | | | | 4,750,000 | |

| | | | | | | | | | | | | | | | | | 4,750,000 | |

| | | | | | | | | | | | | | | | | | | |

| TOTAL BANK LOANS | | | | | | | | | | | | | | | | | | |

| (Cost $112,871,201) | | | | | | | | | | | | | | | | | 112,984,957 | |

| | | | | | | | | | | | | | | | | | | |

| BONDS & NOTES (4.90%) | | | | | | | | | | | | | | | | | | |

| Asset Backed Securities (0.23%) | | | | | | | | | | | | | | | | | | |

| Mount Logan Funding 2018-1 LP(a)(b)(e) | | | 22.14 | % | | N/A | | | 01/22/2033 | | | | 479,858 | | | | 340,651 | |

| | | | | | | | | | | | | | | | | | 340,651 | |

| | | | | | | | | | | | | | | | | | | |

| Notes (4.67%) | | | | | | | | | | | | | | | | | | |

| Financials (4.67%) | | | | | | | | | | | | | | | | | | |

| EJF CRT 2024-R1 LLC(a)(b) | | | 12.93 | % | | N/A | | | 12/17/2055 | | | | 6,806,755 | | | | 6,806,755 | |

| | | | | | | | | | | | | | | | | | 6,806,755 | |

| TOTAL BONDS & NOTES | | | | | | | | | | | | | | | | | | |

| (Cost $7,207,753) | | | | | | | | | | | | | | | | | 7,147,406 | |

| | | | | | | | | | | | | | | | | | | |

| EQUIPMENT FINANCING (2.00%) | | | | | | | | | | | | | | | | | | |

| Financials (2.00%) | | | | | | | | | | | | | | | | | | |

| White Oak Equipment Finance 1, LLC(a)(b)(i) | | | 10.75 | % | | N/A | | | 01/01/2027 | | | | 2,912,560 | | | | 2,912,560 | |

| TOTAL EQUIPMENT FINANCING | | | | | | | | | | | | | | | | | | |

| (Cost $2,912,560) | | | | | | | | | | | | | | | | | 2,912,560 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Shares | | | | Value | |

| COMMON EQUITY (0.67%) | | | | | | | | | | | | | | | | | | |

| Communication Services (-%) | | | | | | | | | | | | | | | | | | |

| Next Flight Ventures(a)(f) | | | | | | | | | | | | | 23 | | | | 3,136 | |

| NFV Co-Pilot, Inc.(a)(f) | | | | | | | | | | | | | 114 | | | | 2,457 | |

| | | | | | | | | | | | | | | | | | 5,593 | |

| Consumer Discretionary (0.67%) | | | | | | | | | | | | | | | | | | |

| IFRG Investor III, L.P.(a) | | | | | | | | | | | | | 1,250,000 | | | | 975,000 | |

| | | | | | | | | | | | | | | | | | 975,000 | |

| | | | | | | | | | | | | | | | | | | |

| Information Technology (–%) | | | | | | | | | | | | | | | | | | |

| HDC / HW Intermediate Holdings, LLC(a)(f) | | | | | | | | | | | | | 24,803 | | | | – | |

| | | | | | | | | | | | | | | | | | – | |

| | | | | | | | | | | | | | | | | | |

| TOTAL COMMON EQUITY | | | | | | | | | | | | | | | | | | |

| (Cost $1,259,807) | | | | | | | | | | | | | | | | | 980,593 | |

See Notes to Consolidated Financial Statements.

| Annual Report | September 30, 2024 | 19 |

| Opportunistic Credit Interval Fund | Consolidated Schedule of Investments |

September 30, 2024

| | | | | | | | | | | | | Shares | | | Value | |

| JOINT VENTURE (4.36%) | | | | | | | | | | | | | | | | | | |

| Joint Venture (4.36%) | | | | | | | | | | | | | | | | | | |

| Great Lakes Funding II LLC, Series A(d)(e)(g)(h) | | | | | | | | | | | | | 6,195,218 | | | | 6,350,098 | |

| | | | | | | | | | | | | | | | | | 6,350,098 | |

| TOTAL JOINT VENTURE | | | | | | | | | | | | | | | | | | |

| (Cost $6,195,218) | | | | | | | | | | | | | | | | | 6,350,098 | |

| | | | | | | | | | | | | | | | | | | |

| PREFERRED STOCK (10.02%) | | | | | | | | | | | | | | | | | | |

| Communication Services (1.59%) | | | | | | | | | | | | | | | | | | |

| Highmount DP SPV, LLC, Class A, Preferred(a)(d)(f)(i) | | | | | | | | | | | | | 2,321,429 | | | | 2,321,429 | |

| | | | | | | | | | | | | | | | | | 2,321,429 | |

| | | | | | | | | | | | | | | | | | | |

| Consumer Discretionary (5.97%) | | | | | | | | | | | | | | | | | | |

| EBSC Holdings LLC (Riddell, Inc.), Preferred(a)(b)(c)(e) | | | | | | 10.00% PIK | | | | | | | 5,252,423 | | | | 5,239,292 | |

| Princeton Medspa Partners, LLC, Preferred(a)(b)(c)(e)(i) | | | | | | 12.50% PIK | | | | | | | 3,610,274 | | | | 3,455,844 | |

| | | | | | | | | | | | | | | | | | 8,695,136 | |

| | | | | | | | | | | | | | | | | | | |

| Health Care (2.46%) | | | | | | | | | | | | | | | | | | |

| Epilog Partners SPV III, LLC, Preferred(a)(d)(f)(i) | | | | | | | | | | | | | 3,519,353 | | | | 3,580,632 | |

| | | | | | | | | | | | | | | | | | 3,580,632 | |

| TOTAL PREFERRED STOCK | | | | | | | | | | | | | | | | | | |

| (Cost $14,639,281) | | | | | | | | | | | | | | | | | 14,597,197 | |

| | | | | | | | | | | | | | | | | | | |

| WARRANTS (0.16%) | | | | | | | | | | | | | | | | | | |

| Information Technology (0.16%) | | | | | | | | | | | | | | | | | | |

| Morae Global Holdings Inc., Warrants(a) | | | | | | | | | | | | | 1 | | | | 78,792 | |

| Princeton Medspa Partners, LLC, Warrants(a)(e)(i) | | | | | | | | | | | | | 0.09 | | | | 167,042 | |

| | | | | | | | | | | | | | | | | | 245,834 | |

| TOTAL WARRANTS | | | | | | | | | | | | | | | | | | |

| (COST $52,195) | | | | | | | | | | | | | | | | | 245,834 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Number of

Contracts | | | Value | |

| DERIVATIVES (–%) | | | | | | | | | | | | | | | | | | |

| Epilog Partners SPV III, LLC, Put Option(a)(i) | | | | | | | | | | | | | 3,500,000 | | | | – | |

| Princeton Medspa Partners, LLC, Put Option(a)(e)(i) | | | | | | | | | | | | | 3,500,000 | | | | – | |

| | | | | | | | | | | | | | | | | | | |

| TOTAL DERIVATIVES | | | | | | | | | | | | | | | | | | |

| (Cost $–) | | | | | | | | | | | | | | | | | – | |

| | | | | | | | | | | | | | | | | | | |

| SHORT-TERM INVESTMENT (3.27%) | | | | | | | | | | | | | | | | | | |

| US BANK MMDA - USBGFS 9, 4.70%(k) | | | | | | | | | | | | | 4,758,942 | | | | 4,758,942 | |

| | | | | | | | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENT | | | | | | | | | | | | | | | | | | |

| (Cost $4,758,942) | | | | | | | | | | | | | | | | | 4,758,942 | |

| | | | | | | | | | | | | | | | | | | |

| INVESTMENTS, AT VALUE (102.93%) | | | | | | | | | | | | | | | | | | |

| (Cost $149,896,957) | | | | | | | | | | | | | | | | $ | 149,977,587 | |

| | | | | | | | | | | | | | | | | | | |

| Other Liabilities In Excess Of Other Assets (-2.93%) | | | | | | | | | | | | | | | | | (4,263,573 | ) |

| | | | | | | | | | | | | | | | | | | |

| NET ASSETS (100.00%) | | | | | | | | | | | | | | | | $ | 145,714,014 | |

See Notes to Consolidated Financial Statements.

| 20 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Consolidated Schedule of Investments |

September 30, 2024

Investment Abbreviations:

SOFR - Secured Overnight Financing Rate

PIK - Payment in-kind

Libor Rates:

1M US SOFR - 1 Month US SOFR as of September 30, 2024 was 4.85%

3M US SOFR - 3 Month US SOFR as of September 30, 2024 was 4.59%

6M US SOFR - 6 Month US SOFR as of September 30, 2024 was 4.25%

| (a) | As a result of the use of significant unobservable inputs to determine fair value, these investments have been classified as Level 3 assets. |

| (b) | Variable rate investment. Interest rates reset periodically. Interest rate shown reflects the rate in effect at September 30, 2024. For securities based on a published reference rate and spread, the reference rate and spread are indicated in the description above. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

| (c) | Payment in kind security which may pay interest in additional par. |

| (d) | All or a portion of this commitment was unfunded as of September 30, 2024. |

| (f) | Non-income producing security. |

| (h) | During the period ended September 30, 2024, the Fund invested $6,935,694 in Great Lakes Funding II, LLC - Series A units, received a return of capital distribution of $836,672, and reported change in unrealized appreciation of $156,973 on Great Lakes Funding II, LLC - Series A units. Additionally, Great Lakes Funding II LLC - Series A declared distributions of $787,378 during the period ended September 30, 2024. |

| (i) | Investment is held through SOFIX Master Blocker, LLC, wholly owned subsidiary. |

| (k) | Money market fund; interest rate reflects seven-day effective yield on September 30, 2024. |

| (l) | Principal balance denominated in euros. |

See Notes to Consolidated Financial Statements.

| Annual Report | September 30, 2024 | 21 |

| Opportunistic Credit Interval Fund | Consolidated Schedule of Investments |

September 30, 2024

Additional information on investments in private investment funds:

| Security | | Value | | Redemption Frequency | | Redemption Notice(Days) | | Unfunded Commitments as of September 30, 2024 |

| Great Lakes Funding II LLC, Series A | | $ | 6,350,098 | | | N/A | | N/A | | $ | 1,803,730 | |

| Total | | $ | 6,350,098 | | | | | | | $ | 1,803,730 | |

Unfunded Commitments:

| Security | | Value | | Maturity Date | | Unfunded Balance |

| AIS Holdco, LLC, Revolver | | $ | (1,500 | ) | | 05/21/2029 | | $ | 100,000 | |

| CCMG Buyer, LLC, Revolver | | | (625 | ) | | 05/08/2030 | | | 250,000 | |

| Cor Leonis Limited, Revolver | | | 214,523 | | | 05/15/2028 | | | 368 | |

| Dentive LLC, Delayed Draw Term Loan | | | 1,433,608 | | | 12/26/2028 | | | 1,645,500 | |

| Enverus Holdings, Inc., Revolver | | | 4,068 | | | 12/12/2029 | | | 69,580 | |

| Epilog Partners SPV III, LLC, Preferred | | | 3,580,632 | | | N/A | | | 260,647 | |

| Expert Experience Credit Motors, LLC, Revolver | | | 4,958,139 | | | 03/29/2026 | | | 291,861 | |

| Fortis Payment Systems, LLC, Delayed Draw Term Loan | | | 272,554 | | | 02/13/2026 | | | 351,563 | |

| Highmount DP SPV, LLC | | | 2,321,429 | | | N/A | | | 2,678,571 | |

| IDC Infusion Services, Inc., Delayed Draw Term Loan | | | 1,158 | | | 07/07/2028 | | | 133,117 | |

| Lion FIV Debtco Limited, Revolver | | | 974,355 | | | 10/18/2024 | | | 761,820 | |

| Morae Global Corporation, Revolver | | | (2,338 | ) | | 10/26/2026 | | | 125,000 | |

| Next Flight Ventures, Delayed Draw Term Loan | | | 107,485 | | | 12/26/2025 | | | 203,363 | |

| PhyNet Dermatology LLC, Delayed Draw Term Loan | | | 2,534 | | | 10/20/2029 | | | 1,013,464 | |

| PMP OPCO, LLC, Delayed Draw Term Loan | | | (11,419 | ) | | 05/31/2029 | | | 1,312,500 | |

| PMP OPCO, LLC, Revolver | | | (4,091 | ) | | 05/31/2029 | | | 218,750 | |

| RHF VI FUNDING LLC, Revolver | | | 4,750,000 | | | 11/19/2024 | | | 250,000 | |

| RHF VIII Holdings LLC, Revolver | | | 2,950,000 | | | 07/02/2026 | | | 2,050,000 | |

| Riddell Inc., Delayed Draw Term Loan | | | (1,018 | ) | | 03/29/2029 | | | 90,909 | |

| Riskonnect Parent LLC, Delayed Draw Term Loan | | | (2,000 | ) | | 12/07/2028 | | | 5,000,000 | |

| Royal Palm Equity Partners I L.P., Delayed Draw Term Loan | | | 8,366 | | | 10/24/2033 | | | 354,814 | |

| Royal Palm Equity Partners I L.P., First Lien Term Loan | | | 1,673 | | | 10/24/2033 | | | 70,963 | |

| South Florida ENT Associates, Delayed Draw Term Loan | | | 59,730 | | | 12/31/2025 | | | 107,744 | |

| TA/WEG HOLDINGS, LLC, 2024 Delayed Draw Term Loan | | | 720,255 | | | 10/04/2027 | | | 1,743,593 | |

| TA/WEG HOLDINGS, LLC, Revolver | | | - | | | 10/04/2027 | | | 207,900 | |

| Tank Holding Corp., Revolver | | | 4,754 | | | 03/31/2028 | | | 1,997 | |

| Taoglas Group Holdings Limited, Revolver | | | 72,976 | | | 02/28/2029 | | | 9,297 | |

| | | | | | | | | | | |

| Total | | $ | 22,415,248 | | | | | $ | 19,303,321 | |

| Total Unfunded Commitments | | | | | | $ | 21,107,051 | |

See Notes to Consolidated Financial Statements.

| 22 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Consolidated Statement of Assets and Liabilities |

September 30, 2024

| ASSETS | | |

| Investments, at value (Cost $131,688,097) | | $ | 131,621,581 | |

| Affiliated investments, at value (Cost $18,208,860) | | | 18,356,006 | |

| Foreign cash, at value (Cost $15,249) | | | 16,974 | |

| Interest and distributions receivable | | | 1,634,187 | |

| Receivable for fund shares sold | | | 554,020 | |

| Prepaid expenses and other assets | | | 390,846 | |

| Total assets | | $ | 152,573,614 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for investments purchased | | | 2,256,000 | |

| USB Credit Facility | | | 3,562,086 | |

| Interest and borrowing costs payable | | | 54,157 | |

| Due to Custodian | | | 1,085 | |

| Due to Adviser | | | 47,520 | |

| Administration fees payable | | | 199,491 | |

| Incentive fees payable | | | 491,584 | |

| Transfer agency fees payable | | | 79,269 | |

| Accrued expenses and other liabilities | | | 168,408 | |

| Total liabilities | | | 6,859,600 | |

| NET ASSETS | | $ | 145,714,014 | |

| | | | | |

| NET ASSETS CONSISTS OF | | | | |

| Paid-in capital | | $ | 146,441,432 | |

| Total distributable earnings | | | (727,418 | ) |

| NET ASSETS | | $ | 145,714,014 | |

| | | | | |

| Common Shares: | | | | |

| Institutional | | | | |

| Net assets | | $ | 145,714,014 | |

| Shares of beneficial interest outstanding (no par value; unlimited shares) | | | 12,613,050 | |

| Net asset value | | $ | 11.55 | |

See Notes to Consolidated Financial Statements.

| Annual Report | September 30, 2024 | 23 |

| Opportunistic Credit Interval Fund | Consolidated Statement of Operations |

For the Year Ended September 30, 2024

| INVESTMENT INCOME | | |

| Interest – Affiliates | | $ | 238,559 | |

| Interest – Non-Affiliates | | | 9,137,498 | |

| Dividends – Affiliates | | | 787,378 | |

| Dividends – Non-Affiliates | | | 296,067 | |

| Payment-in-kind interest – Affiliates | | | 362,697 | |

| Payment-in-kind interest – Non-Affiliates | | | 1,212,298 | |

| Other income | | | 438,108 | |

| Total investment income | | | 12,472,605 | |

| EXPENSES | | | | |

| Investment advisory fees (Note 4) | | | 1,288,741 | |

| Incentive fees (Note 4) | | | 1,162,184 | |

| Administrative fees | | | 487,375 | |

| Sub-administrative fees (Note 4) | | | 371,933 | |

| Transfer agent fees | | | 304,310 | |

| Interest expense and borrowing costs (Note 8) | | | 121,411 | |

| Professional fees | | | 362,942 | |

| Printing fees | | | 32,280 | |

| Registration fees | | | 37,239 | |

| Custody fees | | | 13,380 | |

| Insurance expense | | | 163,408 | |

| Trustee fees and expenses | | | 40,592 | |

| Other expenses | | | 165,323 | |

| Total expenses | | | 4,551,118 | |

| Fees waived/expenses reimbursed by Adviser (Note 4) | | | (838,851 | ) |

| Total net expenses | | | 3,712,267 | |

| NET INVESTMENT INCOME | | | 8,760,338 | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | | | | |

| Net realized loss on investments – Non-Affiliates | | | (837,251 | ) |

| Net realized loss on investments – Affiliates | | | - | |

| Net realized gain on foreign currency transactions | | | 18,869 | |

| Total net realized loss | | | (818,382 | ) |

| Net change in unrealized depreciation on investments – Non-Affiliates | | | (743,982 | ) |

| Net change in unrealized appreciation on debt | | | (107,519 | ) |

| Net change in unrealized appreciation on investments – Affiliates | | | 118,422 | |

| Net change in unrealized depreciation on translation of assets and liabilities in foreign currencies | | | (31 | ) |

| Total net change in unrealized depreciation | | | (733,110 | ) |

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | (1,551,492 | ) |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 7,208,846 | |

See Notes to Consolidated Financial Statements.

| 24 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Consolidated Statements of Changes in Net Assets |

| | | For the Year Ended September 30, 2024 | | For the Year Ended September 30, 2023* |

| OPERATIONS | | | | | | | | |

| Net investment income | | $ | 8,760,338 | | | $ | 1,658,486 | |

| Net realized loss on investments | | | (837,251 | ) | | | 408,898 | |

| Net realized gain on foreign currency transactions | | | 18,869 | | | | – | |

| Net change in unrealized depreciation on investments | | | (625,560 | ) | | | 725,907 | |

| Net change in unrealized appreciation on debt | | | (107,519 | ) | | | – | |

| Net change in unrealized depreciation on translation of assets and liabilities in foreign currencies | | | (31 | ) | | | – | |

| Net increase in net assets resulting from operations | | | 7,208,846 | | | | 2,793,291 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From Distributable Earnings | | | | | | | | |

| Institutional | | | (8,708,286 | ) | | | (1,944,979 | ) |

| From return of capital: | | | | | | | | |

| Institutional | | | (1,379,220 | ) | | | – | |

| Total distributions to shareholders | | | (10,087,506 | ) | | | (1,944,979 | ) |

| | | | | | | | | |

| COMMON SHARE TRANSACTIONS | | | | | | | | |

| Institutional | | | | | | | | |

| Proceeds from sales of shares | | | 118,846,338 | | | | 34,341,560 | |

| Distributions reinvested | | | 984,406 | | | | 427,622 | |

| Cost of shares redeemed | | | (9,133,342 | ) | | | (46,039 | ) |

| Net increase from share transactions | | | 110,697,402 | | | | 34,723,143 | |

| Total net increase from net assets | | | 107,818,742 | | | | 35,571,455 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 37,895,272 | | | | 2,323,817 | |

| End of year | | $ | 145,714,014 | | | $ | 37,895,272 | |

| | | | | | | | | |

| OTHER INFORMATION | | | | | | | | |

| Common Shares Transactions | | | | | | | | |

| Institutional | | | | | | | | |

| Issued | | | 10,108,535 | | | | 2,942,117 | |

| Distributions reinvested | | | 84,977 | | | | 38,178 | |

| Redeemed | | | (786,520 | ) | | | (3,945 | ) |

| Net increase in shares | | | 9,406,992 | | | | 2,976,350 | |

| * | These balances do not represent consolidated numbers. |

See Notes to Consolidated Financial Statements.

| Annual Report | September 30, 2024 | 25 |

| Opportunistic Credit Interval Fund | Consolidated Statement of Cash Flows |

For the Year Ended September 30, 2024

| CASH FLOWS FROM OPERATING ACTIVITIES: | | |

| Net increase in net assets from operations | | $ | 7,208,846 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | | |

| Purchase of investment securities | | | (143,004,874 | ) |

| Proceeds from sale of investment securities | | | 17,203,234 | |

| Purchase of short-term investment securities - net | | | 16,295,533 | |

| Amortization of premium and accretion of discount on investments | | | (979,376 | ) |

| Payment-in-kind income | | | (1,574,995 | ) |

| Net realized (gain)/loss on: | | | | |

| Investments | | | 818,382 | |

| Net change in unrealized (appreciation)/depreciation on: | | | | |

| Investments | | | 733,110 | |

| (Increase)/Decrease in assets: | | | | |

| Due from advisor | | | 196,349 | |

| Interest and distributions receivable | | | (1,307,816 | ) |

| Prepaid expenses and other assets | | | (208,738 | ) |

| Increase/(Decrease) in liabilities: | | | | |

| Due to Adviser | | | 47,520 | |

| Interest and borrowing costs payable | | | 54,157 | |

| Administration fees payable | | | 75,080 | |

| Transfer agency fees payable | | | 79,269 | |

| Due to custodian | | | 1,085 | |

| Incentive fees payable | | | 453,187 | |

| Accrued expenses and other liabilities | | | (170,104 | ) |

| Net cash used in operating activities | | | (104,080,151 | ) |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Proceeds from sales of shares | | | 118,860,162 | |

| Cost of shares redeemed | | | (9,133,342 | ) |

| Borrowings on US Bank Line of Credit | | | 3,662,027 | |

| Repayment on US Bank Line of Credit | | | (208,210 | ) |

| Cash distributions paid | | | (9,103,100 | ) |

| Net cash provided by financing activities | | | 104,077,537 | |

| | | | | |

| Net change in cash & cash equivalents | | | (2,614 | ) |

| | | | | |

| Effect of exchange rate changes on cash | | $ | 19,588 | |

| Restricted and unrestricted cash, beginning of period | | $ | – | |

| Restricted and unrestricted cash, end of period | | $ | 16,974 | |

| | | | | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | | | | |

| Cash paid for interest: | | $ | 67,254 | |

| | | | | |

| SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING TRANSACTIONS | | | | |

| Reinvestment of distributions: | | $ | 984,406 | |

See Notes to Consolidated Financial Statements.

| 26 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | | Year Ended September 30, 2024 | | | | Year Ended September 30, 2023 | | | | For the Period Ended September 30, 2022(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 11.82 | | | $ | 10.12 | | | $ | 10.00 | |

| | | | | | | | | | | | | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS | | | | | | | | | | | | |

| Net investment income(b) | | | 1.04 | | | | 1.49 | | | | 0.05 | |

| Net realized and unrealized gain/(loss) on investments | | | (0.21 | ) | | | 1.48 | (c) | | | 0.07 | |

| Total income from investment operations | | | 0.83 | | | | 2.97 | | | | 0.12 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | |

| From net investment income | | | (0.94 | ) | | | (1.27 | ) | | | – | |

| From net realized gain on investments | | | – | | | | – | | | | – | |

| From return of capital | | | (0.16 | ) | | | – | | | | – | |

| Total distributions | | | (1.10 | ) | | | (1.27 | ) | | | – | |

| INCREASE/(DECREASE) IN NET ASSET VALUE | | | (0.27 | ) | | | 1.70 | | | | 0.12 | |

| NET ASSET VALUE, END OF PERIOD | | $ | 11.55 | | | $ | 11.82 | | | $ | 10.12 | |

| | | | | | | | | | | | | |

| TOTAL RETURN(d) | | | 7.32 | %(e) | | | 30.31 | %(e) | | | 1.20 | % |

| | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 145,714 | | | $ | 37,895 | | | $ | 2,324 | |

| | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS(f) | | | | | | | | | | | | |

| Including incentive fees, interest expense and interest amortization/accretion on securities sold short: | | | | | | | | | | | | |

| Expenses, gross | | | 4.58 | % | | | 11.00 | % | | | 58.09 | %(g) |

| Expenses, net of fees waived/expenses reimbursed by Adviser | | | 3.74 | % | | | 2.80 | % | | | 2.50 | %(g) |

| Excluding incentive fees, interest expense and interest amortization/accretion on securities sold short: | | | | | | | | | | | | |

| Expenses, gross | | | 3.34 | % | | | 10.70 | % | | | 58.09 | %(g) |

| Expenses, net of fees waived/expenses reimbursed by Adviser | | | 2.50 | % | | | 2.50 | % | | | 2.50 | %(g) |

| Net investment income | | | 8.84 | % | | | 12.79 | % | | | 2.24 | %(g) |

| | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 18 | % | | | 63 | % | | | 106 | %(g) |

| | | | | | | | | | | | | |

| BORROWINGS AT END OF YEAR | | | | | | | | | | | | |

| Aggregate amount outstanding (000s) | | $ | 3,562 | | | | – | | | | – | |

| Asset coverage per $1,000 (000s) | | $ | 41,907 | | | | – | | | | – | |

| (a) | The Fund's Class I commenced operations on July 5, 2022. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | The amount shown for a share outstanding throughout the period is not indicative of the aggregate net realized and unrealized gain on investments for that period because of the timing of sales and repurchases of the Fund shares in relation to fluctuating market value of the investments in the Fund. |

| (d) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Returns shown exclude applicable sales charges. |

| (e) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from net asset values and returns for shareholder transactions. |

| (f) | Ratios do not include expenses of underlying investment companies and private investment funds in which the Fund invests. |

See Notes to Consolidated Financial Statements.

| Annual Report | September 30, 2024 | 27 |

| Opportunistic Credit Interval Fund | Notes to Consolidated Financial Statements |

September 30, 2024

1. ORGANIZATION

Opportunistic Credit Interval Fund (the “Fund”) is a closed-end, diversified management Investment Company that is registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund is structured as an interval fund and continuously offers its shares. The Fund was organized as a Delaware statutory trust on January 21, 2022. The Fund inception date was July 1, 2022 and commenced operations on July 5, 2022.

The Fund may issue an unlimited number of shares of beneficial interest. All shares of the Fund have equal rights and privileges. Each share of the Fund is entitled to one vote on all matters as to which shares are entitled to vote. In addition, each share of the Fund is entitled to participate, equally with other shares (i) in dividends and distributions declared by the Fund and (ii) upon liquidation, in the distribution of its proportionate share of the assets remaining after satisfaction of outstanding liabilities. Shares of the Fund are fully paid, non-assessable and fully transferable when issued and have no pre-emptive, conversion or exchange rights. Fractional shares have proportionately the same rights, including voting rights, as are provided for a full share. The Fund offers one class of shares: Class I shares.

The Fund’s investment objectives are to produce current income and capital appreciation. The Fund will seek to meet its investment objectives by investing primarily in credit-related instruments of North American and European issuers. The Fund defines credit-related instruments as debt, loans, loan participations, credit facility commitments, asset and lease pool interests, mortgage servicing rights, preferred shares, and swaps linked to credit-related instruments. The Fund’s investments will focus on privately originated credit investments as well as secondary credit investments. The Fund does not invest in instruments of emerging market issuers. The Fund will invest without restriction as to an instrument’s maturity, structure, seniority, interest rate formula, currency, and without restriction as to issuer capitalization or credit quality. Lower credit quality debt instruments, such as leveraged loans and high yield bonds, are commonly referred to as “junk” bonds. The Fund defines junk bonds as those rated lower than Baa3 by Moody’s Investors Services, Inc. (“Moody’s”) or lower than BBB by Standard and Poor’s Rating Group (“S&P”), or, if unrated, determined by the Adviser to be of similar credit quality.

Under normal circumstances, the Fund will invest at least 80% of its net assets, plus borrowings for investment purposes, in credit-related instruments. The Fund defines credit-related instruments as debt, loans, loan participations, credit facility commitments, asset and lease pool interests, mortgage servicing rights, preferred shares, and swaps linked to credit-related instruments.

Mount Logan Management LLC (the “Adviser”) serves as the Fund’s investment adviser.

On January 16, 2024, the Fund formed a wholly-owned taxable subsidiary, SOFIX Master Blocker, LLC (the “Taxable Subsidiary”), a Delaware limited liability company, which is taxed as a corporation for U.S. federal income tax purposes. The Taxable Subsidiary allows the Fund to make equity investments in companies organized as pass-through entities while continuing to satisfy the requirements of a Regulated Investment Company under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”).

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in preparation of its consolidated financial statements. These policies are in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”). The Fund is an investment company and follows the accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services – Investment Companies. These consolidated financial statements reflect adjustments that in the opinion of the Fund are necessary for the fair presentation of the financial position and results of operations as of and for the periods presented herein.

The Fund is considered an investment company for financial reporting purposes under U.S. GAAP and therefore applies the accounting and reporting guidance applicable to investment companies. The preparation of the consolidated financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the year. Actual results could differ from those estimates, and such difference could be material. In accordance with U.S. GAAP guidance on consolidation, the Fund will generally not consolidate its investment in a portfolio company other than an investment company subsidiary or a controlled operating company whose business consists of providing services to the Fund. Accordingly, the Fund consolidated the accounts of the Fund’s wholly-owned subsidiary, the Taxable Subsidiary, in its consolidated financial statements. All significant intercompany balances and transactions have been eliminated in consolidation. All references made to the “Fund” herein include Opportunistic Credit Interval Fund and its consolidated subsidiary, except as stated otherwise.

Securities Transactions and Investment Income – Investment transactions are recorded on the trade date. Realized gains or losses on investments are calculated using the specific identification method for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Premiums on securities are amortized to the earliest call date and purchase discounts are accreted over the life of the respective securities using the effective interest method.

| 28 | www.opportunisticcreditintervalfund.com |

| Opportunistic Credit Interval Fund | Notes to Consolidated Financial Statements |

September 30, 2024