The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED May 4, 2022

Comera Life Sciences Holdings, Inc.

5,817,757 Shares of Common

Stock issuable upon

exercise of warrants

13,207,540 Shares of Common Stock and 11,041,432

Warrants to Purchase Common Stock

offered by Selling Securityholders

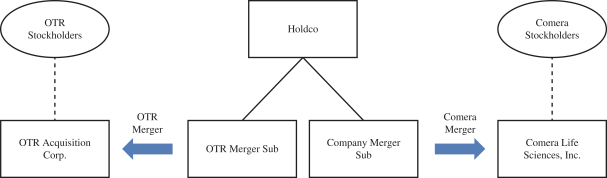

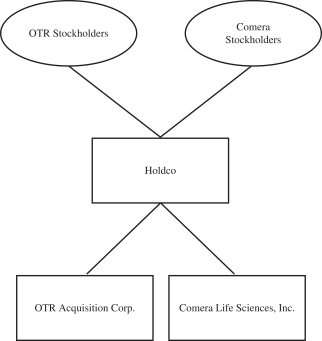

This prospectus relates to the offer and sale from time to time by the selling securityholders named in this prospectus (the “Selling Securityholders”), or their permitted transferees, of up to (a) 19,025,297 shares of common stock, $0.0001 par value (the “Holdco Common Stock”), of Comera Life Sciences Holdings, Inc. (“Holdco”), which include: (i) 1,226,558 shares of Holdco Common Stock issued to former stockholders (“Comera stockholders”) of Comera Life Sciences, Inc. (“Comera”) at an effective price of $0.48 per share, (ii) 58,337 shares of Holdco Common Stock issued to Comera stockholders at an effective price of $0.51 per share, (iii) 575,164 shares of Holdco Common Stock issued to Comera stockholders at an effective price of $1.18 per share, (iv) 3,266,755 shares of Holdco Common Stock issued to Comera stockholders at an effective price of $1.29 per share, (v) 3,831,728 shares of Holdco Common Stock issued to Comera stockholders at an effective price of $1.48 per share, (vi) 1,269,056 shares of Holdco Common Stock issued to Comera stockholders at an effective price of $2.05 per share, (vii) 39,721 shares of Holdco Common Stock issued to Comera stockholders at an effective price of $2.52 per share, (viii) 42,334 shares of Holdco Common Stock issued to Comera stockholders at an effective price of $2.89 per share, (ix) 286,049 shares of Holdco Common Stock issued to Comera stockholders at an effective price of $3.19 per share, (x) 2,611,838 shares of Holdco Common Stock issuable to OTR Acquisition Sponsor LLC (the “Sponsor”) in exchange for the Sponsor’s shares of Class B common stock of OTR Acquisition Corp. (“OTR”) acquired in connection with the formation of OTR at a price of approximately $0.01 per share, (xi) 5,817,757 shares of Holdco Common Stock issuable to Sponsor upon exercise of the warrants to purchase Holdco Common Stock at an exercise price of $11.50 per share (“Holdco Warrants”) acquired in connection with the initial public offering of OTR at a price of $1.00 per warrant and (b) 11,041,432 Holdco Warrants. The Holdco Warrants were originally issued by OTR and will convert into warrants to purchase Holdco Common Stock on the closing of the business combination among us, OTR, CLS Sub Merger 1 Corp., CLS Sub Merger 2 Corp., and Comera Life Sciences, Inc. (the “Business Combination”). The Holdco Common Stock and Holdco Warrants to be resold under this prospectus are to be issued either in connection with the closing of the Business Combination or upon exercise of the Holdco Warrants. The Business Combination is described in greater detail in this prospectus. See “Prospectus Summary – The Business Combination.”

As described herein, the Selling Securityholders may sell from time to time 11,041,432 Holdco Warrants and 19,025,297 shares of Holdco Common Stock, including up to 5,817,757 shares of Holdco Common Stock issuable upon exercise of the Holdco Warrants.

We will receive up to an aggregate of $126,976,468 if all of the Holdco Warrants registered hereby are exercised to the extent such Holdco Warrants are exercised for cash. However, we will only receive such proceeds if and when the Holdco Warrant holders exercise the Holdco Warrants. If the market price for Holdco Common Stock following the Business Combination does not increase from the current price of OTR Common Stock, there is a small likelihood that any of the Holdco Warrants will be exercised. We expect to use the net proceeds from the exercise of the Holdco Warrants for general corporate purposes and to implement our business plan although we believe we can fund our operations and business plan with cash on hand. We will bear all costs, expenses and fees in connection with the registration of Holdco Common Stock and Holdco Warrants and will not receive any proceeds from the sale of Holdco Common Stock and Holdco Warrants. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their respective sales of Holdco Common Stock and Holdco Warrants.

Our registration of the Holdco Common Stock and Holdco Warrants covered by this prospectus does not mean that either we or the Selling Securityholders will issue, offer or sell, as applicable, any of the Holdco Common Stock or Holdco Warrants. The Selling Securityholders may offer and sell the Holdco Common Stock and Holdco Warrants covered by this prospectus in a number of different ways and at varying prices, subject to, in certain circumstances, applicable lock-up restrictions. As described above, the Selling Securityholders purchased the Holdco Common Stock covered by this prospectus for prices ranging from $0.48 to $11.50, which is at or below the $10.00 per unit purchased by public investors in the OTR initial public offering. The closing price of OTR’s common stock and OTR’s warrants on Nasdaq on April 29, 2022 was $10.25 and $0.30, respectively. Consequently, the Selling Securityholders may realize a positive rate of return on the sale of their shares of Holdco Common Stock covered by this prospectus even if the market price of Holdco Common Stock is below $10.00 per share, in which case the public stockholders may experience a negative rate of return on their investment.

We provide more information about how the Selling Securityholders may sell the Holdco Common Stock and Holdco Warrants in the section entitled “Plan of Distribution.”

We are an “emerging growth company” as defined under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in Holdco Common Stock and Holdco Warrants is highly speculative and involves a high degree of risk. See “Risk Factors.”

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the Holdco Common Stock or Holdco Warrants or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is [●], 2022