August 22, 2022

Via EDGAR

Mr. Corey Jennings

Special Counsel

Division of Corporation Finance

Office of International Corporate Finance

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Re: | Vox Royalty Corp. |

| | Form 40FR12B filed June 27, 2022 |

| | File No. 001-41437 |

Dear Mr. Jennings:

On behalf of Vox Royalty Corp. (the “Company”), set forth below is the response of the Company to the comments received by the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) in the supplemental comment letter dated August 5, 2022 (the “Comment Letter”) regarding the above-referenced registration statement on Form 40-F that was filed via EDGAR on June 27, 2022. For ease of reference, the text of the Staff’s comment is reproduced in bold-face type below, followed by the Company’s response.

Form 40FR12B

General

| 1. | We note your assertion that “royalty, stream, and other interests” comprise approximately 74.6%, 77.7%, and 100% of the total assets of SilverStream SEZC, Vox Royalty Australia Pty Ltd, and Vox Royalty Canada Ltd. (collectively, the “Owning Subsidiaries”). Please identify each constituent part of the numerators and denominators for your calculations. In your response, please also (i) explain why you believe each asset included in such numerators, including each asset comprising “other interests,” is a qualifying asset under section 3(c)(9) of the Investment Company Act of 1940 (the “1940 Act”), and (ii) describe the intercompany debt referenced in your response letter, including its value (as that term is defined in section 2(a)(41) of the 1940 Act) and the counterparties. Please base these calculations on values, as that term is defined in section 2(a)(41) of the 1940 Act, as of the end of the last preceding fiscal quarter. |

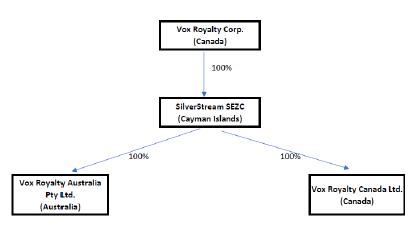

Response: The Company is a mineral royalty and streaming company that is engaged, including through its three direct and indirect wholly-owned subsidiaries, solely in the business of owning or holding mineral royalties or leases, or fractional interests therein, or certificates of interest or participation in or investment contracts relative to such royalties, leases, or fractional interests (including streams and an option to acquire additional mineral royalties). As shown in the organizational chart below, SilverStream SEZC (“SilverStream”) is a direct wholly-owned subsidiary of the Company, and each of Vox Royalty Australia Pty Ltd. (“Vox Australia”) and Vox Royalty Canada Ltd. (“Vox Canada”) is a wholly-owned subsidiary of SilverStream (and thus an indirect wholly-owned entity of the Company).

Vox Royalty Corp.

66 Wellington Street West, Suite 5300, TD Bank Tower, Toronto, Ontario M5K 1E6

Page 1

The mineral royalties, streams and option to acquire additional mineral royalties currently held by the Owning Subsidiaries are on precious minerals (e.g., gold and silver), base metals (e.g., copper, zinc, nickel, iron ore), diamonds and/or other minerals. The Owning Subsidiaries do not own any investment interests other than interests relating to mineral royalties and streams.

The Company, not any of the Owning Subsidiaries, is the issuer of the securities to which the registration statement on Form 40-F relates. As such, we note that, on a consolidated basis, approximately 81.0% of the Company’s total assets, exclusive of cash, was comprised of mineral royalties as of March 31, 2022, and approximately 85.2% of the Company’s total assets, exclusive of cash, was comprised of mineral royalties as of June 30, 2022. On a consolidated basis, during the three months ended March, 31, 2022, 100% of the Company’s revenue was derived from mineral royalties (excluding a one-time contractual breakage fee resulting from a mineral royalty acquisition transaction’s failure to close in accordance with the purchase agreement), and during the three months ended June 30, 2022, 100% of the Company’s revenue was derived from mineral royalties. This is clearly consistent with the business operations of a company relying on the Section 3(c)(9) exclusion.

As presented in the Company’s response letter dated July 22, 2022, as of March 31, 2022, approximately 74.6% of SilverStream’s total assets was comprised of mineral royalties; approximately 77.7% of Vox Australia’s total assets was comprised of mineral royalties; and 100% of Vox Canada’s total assets was comprised of mineral royalties. In each instance, in performing the calculations, (i) the numerator was comprised solely of the value of the royalties on gold, silver, copper, zinc, nickel, diamonds, iron ore and/or other minerals, as applicable, held by each Owning Subsidiary; and (ii) the denominator was comprised of the value of all assets of the applicable Owning Subsidiary (excluding the amount of any inter-company loans, which are eliminated in the Company’s consolidated Statements of Financial Position (i.e., balance sheet) as balances owed to or from an Owning Subsidiary.1

1 These loans are used primarily as an internal mechanism through which working capital is allocated among the Company and Owning Subsidiaries in order to facilitate the acquisition of royalties by an Owning Subsidiary.

Vox Royalty Corp.

66 Wellington Street West, Suite 5300, TD Bank Tower, Toronto, Ontario M5K 1E6

Page 2

For SilverStream, the numerator was $5,879,527 (comprising the value of the mineral royalties held by SilverStream), and the denominator was $7,881,759 (comprising the value of the mineral royalties, cash, accounts receivable, prepaid expenses, intangible assets2, and deferred royalty acquisitions). For Vox Australia, the numerator was $10,506,320 (comprising the value of the mineral royalties held by Vox Australia), and the denominator was $13,519,867 (comprising the value of the mineral royalties, cash and accounts receivable). For Vox Canada, the numerator was $933,116 (comprising the value of the mineral royalties held by Vox Canada), and the denominator was $933,116 (comprising the value of the mineral royalties held by Vox Canada).3 If, consistent with the calculations typically performed for purposes of Section 3(a)(1)(C) of the Investment Company Act of 1940, as amended (the “1940 Act”) and by issuers seeking no action or exemptive relief under Section 3(c)(9) (discussed herein), cash were also excluded from the denominator, then as of March 31, 2022, approximately 76.9% of SilverStream’s total assets would have been comprised of mineral royalties; approximately 92.6% of Vox Australia’s total assets would have been comprised of mineral royalties; and 100% of Vox Canada’s total assets would have been comprised of mineral royalties.

As of June 30, 2022, and using the same components for each numerator and denominator, approximately 77.5% of SilverStream’s total assets was comprised of mineral royalties; approximately 87.7% of Vox Australia’s total assets was comprised of mineral royalties; and 100% of Vox Canada’s total assets was comprised of mineral royalties. If cash had been excluded from the denominator, then as of June 30, 2022, approximately 77.8% of SilverStream’s total assets would have been comprised of mineral royalties; approximately 87.9% of Vox Australia’s total assets would have been comprised of mineral royalties; and 100% of Vox Canada’s total assets would have been comprised of mineral royalties.

We note that cash seems to have been deducted from the denominator when presenting percentage information in requests for no-action relief and exemptive applications relating to Section 3(c)(9). For example, one company calculated the percentage of its assets consisting of mineral rights and leases based on total assets exclusive of cash and land. (Columbia Ventures, Inc., 1940 Act Release No. 21058 (May 10, 1995 (Order), and 1940 Act Release No. 21009 (Apr. 14, 1995)). In another instance, the portion of assets comprised of working interests in oil and gas leases was based on company assets exclusive of cash and government securities (In the Matter of Pantepec Int’l, Inc., Exchange Act Release No. 17908, (Dec. 20, 1990) (Order), and Exchange Act Release No. 17595, (July 18, 1990) (Application) (“Pantepec”)).

2 As noted herein, the intangible asset held by SilverStream is a mineral royalty database necessary to support the business.

3 The value ascribed to each mineral royalty, stream and an option to acquire additional mineral royalties held by an Owning Subsidiary, for which market quotations are not readily available, was (i) determined in accordance with International Financial Reporting Standards, and (ii) reflected in the consolidated financial statements approved by the Company’s board of directors. The value ascribed to any intercompany debt was the principal amount owed on the loan.

Vox Royalty Corp.

66 Wellington Street West, Suite 5300, TD Bank Tower, Toronto, Ontario M5K 1E6

Page 3

Section 3(c)(9) of the 1940 Act provides that “any person substantially all of whose business consists of owning or holding oil, gas, or other mineral royalties or leases, or fractional interests therein, or certificates of interest or participation in or investment contracts relative to such royalties, leases, or fractional interests” (emphasis added) is not an investment company. By definition, each asset included in the numerator (i.e., royalties on gold, silver and other minerals) are “mineral royalties” and therefore qualifying assets under Section 3(c)(9) of the 1940 Act. Accordingly, each asset included in each numerator is clearly a qualifying asset for purposes of Section 3(c)(9).4

The qualification of these assets as Section 3(c)(9) assets becomes even more clear when compared to other types of assets that the Staff has previously indicated are eligible for reliance on Section 3(c)(9). For example, the Staff has taken the position that ownership interests in oil and gas properties and working interests in oil and gas leases are eligible interests for Section 3(c)(9) purposes (Offshore Exploration Oil Co., SEC No-Action Letter (May 23, 1973) (“Offshore”). It has also taken the position that interests in drilling ventures and exploratory and concessionary interests in properties are Section 3(c)(9) eligible interests (Pantepec). In contrast to the mineral royalties held by the Owning Subsidiaries, which are expressly referenced in the language of Section 3(c)(9), these ownership and working interests are not identified in the statute. It follows then, that the mineral royalties held by the Owning Subsidiaries, and indirectly by the Company, are unquestionably Section 3(c)(9) interests.

Furthermore, the “intangible asset” held by SilverStream (valued at $1,493,363 as of March 31, 2022 and at $1,447,478 as of June 30, 2022), which is included in the denominator as noted above, is comprised of a mineral royalty database, which is necessary to operate and support the business of owning and holding royalties or leases, or fractional interests therein, or certificates of interest or participation in or investment contracts relative to such royalties, leases, or fractional interests (such as streams and an option to acquire additional mineral royalties); the asset is utilized by employees of the Company and the Owning Subsidiaries solely in connection with and to facilitate this business. In addition, the cash held by SilverStream and Vox Australia, included in the denominator as noted above, is maintained primarily for capital preservation purposes pending a future acquisition, and to fund necessary business expenses. Accordingly, these assets are still related to, and necessary for, the Company’s and the Owning Subsidiaries’ business of owning and holding mineral royalties. As such, it is arguable that such assets could also be viewed as qualifying assets for purposes of Section 3(c)(9), as they have no purpose other than to support the ongoing business of owning and holding mineral royalties.

Intercompany debt is used primarily as an internal mechanism through which working capital is allocated among the Company and Owning Subsidiaries in order to facilitate the acquisition of royalties by an Owning Subsidiary. As an example, in one instance, in exchange for the acquisition of a mineral royalty by an Owning Subsidiary, the Company paid cash and issued common shares in the Company to the assignor of the royalty. In that instance, the resulting “intercompany debt” served to facilitate the purchase of an additional mineral royalty for the Owning Subsidiary, thereby representing yet another source of support necessary to fund and further the mineral royalty business.

4 The Company notes that the term “royalty, stream and other interests” is a balance sheet line item used to describe non-current assets by numerous publicly traded mineral royalty companies. With respect to the Company, this line item shows only the value of mineral royalties; the Owning Subsidiaries do not carry at value in the financial statements for any streams or other interests, such as its option to acquire additional mineral royalties.

Vox Royalty Corp.

66 Wellington Street West, Suite 5300, TD Bank Tower, Toronto, Ontario M5K 1E6

Page 4

As of the end of the last preceding fiscal quarter (June 30, 2022), the value of the intercompany debt owed to the Company is $21,478,324 (the counterparties to which are only the three Owning Subsidiaries); and the value of the intercompany debt owed to SilverStream is $5,836,954 (the counterparties to which are only Vox Australia and Vox Canada).

| 2. | Please describe and identify the value, as that term is defined in section 2(a)(41) of the 1940 Act, of each of the assets held by Vox Royalty Corp. (the “Company”) on an unconsolidated basis, including the common shares (or other assets) representing the Company’s interests in the Owning Subsidiaries. In your response, please specifically identify any qualifying assets under section 3(c)(9) that are directly held by the Company. |

Response: Consistent with other mineral royalty and streaming companies (e.g., Metalla Royalty & Streaming Ltd. (NYSE: MTA) and Maverix Metals Inc. (NYSE: MMX)), the qualifying assets under Section 3(c)(9) are held directly by the Owning Subsidiaries, not the Company. The Section 3(c)(9) assets are held by the Owning Subsidiaries rather than the Company for internal structuring and income tax efficiency purposes. As of June 30, 2022, the Company’s only assets are: (i) its interest in SilverStream (valued at $15,286,390, the value ascribed by the Company to SilverStream’s net assets), (ii) cash (valued at $1,424,104), (iii) accounts receivable relating to a share subscription, ultimately to finance the mineral royalty business (valued at $50,959), (iv) amounts due from intercompany loans made for the acquisition of mineral royalties, as described above (valued at $21,478,324), and (v) prepaid expenses relating to business operations (valued at $232,979). All of these valuations were ascribed by the Company in accordance with International Financial Reporting Standards and are reflected in the consolidated financial statements approved by the Company’s board of directors. As such, although the Company does not directly own or hold the Section 3(c)(9) interests for internal structuring and income tax efficiency purposes, all of the Company’s assets relate solely to the business of owning and holding mineral royalties.

| 3. | To the extent that you have concluded that (i) less than 100% of the assets held by each of the Owning Subsidiaries are qualifying assets under section 3(c)(9) and/or (ii) less than 100% of the assets held by the Company consist of the Company’s interests in the Owning Subsidiaries and qualifying assets under section 3(c)(9), please explain your basis for concluding that “substantially all” of the businesses of the Owning Subsidiaries and the Company consist of owning or holding qualifying assets. In this regard, we note your assertion in the response letter that the described mix of assets and operations “are indicative of an issuer that would fall within the scope set forth by Section 3(c)(9) of the 1940 Act.” Please explain. |

Response: As indicated above, as of June 30, 2022, approximately 77.8% of SilverStream’s total assets (excluding cash and intercompany debt) was comprised of mineral royalties; approximately 87.9% of Vox Australia’s total assets (excluding cash and intercompany debt) was comprised of mineral royalties; and 100% of Vox Canada’s total assets was comprised of mineral royalties. All of these mineral royalty holdings are qualifying assets under Section 3(c)(9), which refers explicitly to “mineral royalties.” On a consolidated basis, as of June 30, 2022, approximately 85.2% of the Company’s total assets (excluding cash) was comprised of mineral royalties. As discussed in Response 1, the other assets of the Company and the Owning Subsidiaries, such as the mineral royalty database valued at $1,447,478 as of June 30, 2022, are held solely to support and further the business of owning and holding mineral royalties and streams. For example, the Company and the Owning Subsidiaries hold cash pending future royalty acquisitions and to fund business expenses. (We note that the Staff has permitted companies relying on Section 3(c)(9) to hold cash and, for a period of no more than one year, certificates of deposit or other safe, liquid, short-term, fixed-income investments, such as savings and time deposits. (Pantepec and McCulloch Oil and Gas Corp., SEC No-Action Letter (July 14, 1979)). With respect to an asset test alone, it follows that substantially all of the assets of the Company, directly and through its wholly-owned subsidiaries, are comprised of ownership or related to the ownership of mineral royalties or leases, or fractional interests therein, or certificates of interest or participation in or investment contracts relative to such royalties, leases, or fractional interests.

Vox Royalty Corp.

66 Wellington Street West, Suite 5300, TD Bank Tower, Toronto, Ontario M5K 1E6

Page 5

Notably, unlike Section 3(a)(1)(C) of the 1940 Act, Section 3(c)(9) does not refer to a specific percentage, and no rule has been adopted by the Commission to provide a minimum percentage of assets that must be comprised of ownership of mineral royalties to rely on Section 3(c)(9). Neither the Commission nor the Staff appears to have specifically addressed what constitutes “substantially all” of a business for purposes of Section 3(c)(9) with respect to a percentage of assets comprised of oil, gas, or other mineral royalties or leases, or fractional interests therein, or certificates of interest or participation in or investment contracts relative to such royalties, leases, or fractional interests.5 Furthermore, we note that the Staff has taken the position that Section 3(c)(9) may be relied upon by companies that did not, in seeking no action relief, provide information regarding the percentage of assets comprised of Section 3(c)(9) interests. (Belco Petroleum Corp. and Belco 1971 Oil and Gas Fund, Ltd., SEC No-Action Letter (July 15, 1971) (“Belco”)). This indicates that there is no mandatory minimum percentage required to rely on Section 3(c)(9).

Significantly, Section 3(c)(9) refers to the “business” of a company, not its assets, thereby indicating that consideration should be given to the overall business activities and focus of a company. A reasoned analysis of the phrase “substantially all of whose business consists of owning or holding oil, gas, or other mineral royalties” in Section 3(c)(9) would, like the analysis of the term “primarily” by the U.S. Court of Appeals for the Seventh Circuit in SEC v. National Presto Industries, Inc. in the context of Section 3(b)(1) of the 1940 Act, stress and prioritize the term “business.” (SEC v. National Presto Industries, Inc., No. 05-4612 (7th Cir. May 15, 2007)). All revenue currently derived, and anticipated to be derived, by the Company is and will be generated by its indirect ownership (through its wholly-owned subsidiaries) of mineral royalties, streams and options to acquire additional mineral royalties. Neither the Company nor the Owning Subsidiaries is in the business of dealing or trading in mineral royalties or other Section 3(c)(9) assets. The officers, directors and employees of the Company and the Owning Subsidiaries focus all of their attention on the acquisition and ownership of mineral royalties and streams and general management of the business as a public mineral royalty and streaming company. In light of the foregoing, the entire business is unequivocally dedicated to the ownership and holding of mineral royalties and streams.

5 While neither the Commission nor the Staff have provided this guidance, the Internal Revenue Code offers some parameters. For example, under the opportunity zone rules relating to the definition of a Qualified Opportunity Zone Business, “substantially all” means (in part) 70% of the tangible property owned or leased. Under the C-reorganization rules, where a company needs to acquire “substantially all” of a target company’s assets for the transaction to qualify as a C-reorganization, an IRS ruling standard includes a requirement that 70% of the fair market value of the target company’s gross assets will be acquired in the transaction. This supports the assertion that, for at least some Internal Revenue Code rules, based on an asset test alone, “substantially all” can mean 70%. The IRS noted in setting its ruling standards that neither the Code nor the regulations set a minimum requirement for the “substantially all” test and, depending on the facts and circumstances, a lower percentage could satisfy the requirement.

Vox Royalty Corp.

66 Wellington Street West, Suite 5300, TD Bank Tower, Toronto, Ontario M5K 1E6

Page 6

This sole business focus of the Company contrasts with the diverse range of activities engaged in by other companies relying on Section 3(c)(9). For example, the Staff has taken the position that a company relying on Section 3(c)(9) may engage in exploring, developing and operating oil and natural gas properties, mining and purchasing coal for resale, importing crude oil and marketing refined petroleum products (Belco), activities that are clearly not “owning or holding oil, gas, or other mineral royalties or leases, or fractional interests therein, or certificates of interest or participation in or investment contracts relative to such royalties, leases, or fractional interests.” In addition, the Staff took the position that a company whose “primary investment objective” was to “engage in all aspects of exploration, production and recovery of nature resources” could rely on Section 3(c)(9) (Pantepec), and a company that acquired oil and gas properties and explored for, produced and sold oil, gas, and other hydrocarbon substances could rely on Section 3(c)(9) (Offshore). If these entities, which engaged in numerous business activities other than that of owning and holding the interests described in Section 3(c)(9) were determined to be eligible for the Section 3(c)(9) exclusion, then it seems unequivocally clear that the Company, which engages in no business activities other than those directly related to owning mineral royalties and streams, would be eligible for such exclusion.

| 4. | It appears that most, if not all, of the royalties and streams held by the Owning Subsidiaries were entered into when mines were not producing, such that no metals could yet have been sold. It would, therefore, appear that any obligations acquired by the Owning Subsidiaries (e.g., the obligation of the miner to deliver metals or revenue to the Owning Subsidiaries) do not relate to any sale of merchandise. Accordingly, the facts presented in your response do not appear to demonstrate a direct nexus between obligations acquired by the Owning Subsidiaries and the sale of any specific merchandise. To the extent you believe the exemption at section 3(c)(5)(A) is available to the Owning Subsidiaries (or the Company), please supplement your analysis to address each requirement of the exemption, including (i) what specific note, draft, acceptance, open accounts receivable, or other obligation has been acquired and (ii) how such an asset “represent[s] part or all of the sales price of merchandise, insurance, [or] services.” Please also explain your analogy to Royalty Pharma, in light of the fact that, in that case, products sold could be matched to specific royalty obligations being purchased; whereas, here, no actual sales have been identified. |

Response: The Company believes that Section 3(c)(9) is a more appropriate exclusion than the Section 3(c)(5)(A) exclusion to the definition of “investment company.”

| 5. | Note: Please upload documentation for the consultation with IM staff and that they provided recommended comments. |

Response: Per our telephone conversation with the Staff on August 17, 2022, this comment was inadvertently given to the Company and has been waived.

Vox Royalty Corp.

66 Wellington Street West, Suite 5300, TD Bank Tower, Toronto, Ontario M5K 1E6

Page 7

****

Should you have additional questions or comments, please contact the undersigned at (949) 500-1572.

| | Sincerely, |

| | |

| | /s/ Kyle Floyd |

| | Kyle Floyd |

| | For Vox Royalty Corp. |

| cc: | Adrian Cochrane, Vox Royalty Corp. |

Vox Royalty Corp.

66 Wellington Street West, Suite 5300, TD Bank Tower, Toronto, Ontario M5K 1E6

Page 8