- QBTS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B3 Filing

D-Wave Quantum (QBTS) 424B3Prospectus supplement

Filed: 13 Jul 23, 4:31pm

| • | the expected benefits of the Merger (as defined below); |

| • | D-Wave Quantum’s future growth and innovations; |

| • | the increased adoption of quantum computing solutions and expansion of related market opportunities and use cases; |

| • | the estimated total addressable market (“TAM”) for quantum computing and expectations regarding product development and functionality; |

| • | D-Wave Quantum’s financial and business performance following the Merger, including financial projections and business metrics; |

| • | changes in D-Wave Quantum’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects and plans; |

| • | the ability of D-Wave Quantum’s products and services to meet customers’ compliance and regulatory needs; |

| • | D-Wave Quantum’s ability to attract and retain qualified employees and management; |

| • | D-Wave Quantum’s ability to develop and maintain its brand and reputation; |

| • | developments and projections relating to D-Wave Quantum’s products, competitors and industry; |

| • | the impact of the current economic environment due to inflation, increased interest rates, Ukraine/Russia conflict, and any evolutions thereof; |

| • | D-Wave Quantum’s expectations regarding its ability to obtain and maintain intellectual property protection and not infringe on the rights of others; |

| • | expectations regarding the time during which we will be an emerging growth company under the Jumpstart Our Business Startups Act (the ‘‘JOBS Act”); |

| • | D-Wave Quantum’s future capital requirements and sources and uses of cash; |

| • | statements regarding the reseller agreement with Davidson Technologies, Inc. (“Davidson”), and Davidson’s and D-Wave’s collaboration on an initiative to support classified quantum-hybrid applications; |

| • | D-Wave Quantum’s ability to obtain funding for its operations and future growth; and |

| • | D-Wave Quantum’s business, expansion plans and opportunities. |

| • | anticipated trends, growth rates, and challenges in companies that are engaged in the business of quantum computing, such as D-Wave Quantum, and in the markets in which they operate; |

| • | the risk that D-Wave Quantum’s securities will not maintain a listing on the NYSE; |

| • | D-Wave Quantum’s ability to recognize the anticipated benefits of the Merger, which may be affected by, among other things, competition and the ability of D-Wave Quantum to grow and achieve and maintain profitability following the Merger; |

| • | risks related to the uncertainty of the unaudited prospective forecasted financial information; |

| • | risks related to the performance of D-Wave Quantum’s business and the timing of expected business or financial milestones; |

| • | unanticipated technological or project development challenges, including with respect to the cost and or timing thereof; |

| • | the performance of D-Wave Quantum’s products and services; |

| • | the effects of competition on D-Wave Quantum’s business; |

| • | changes in the business of D-Wave Quantum and D-Wave Quantum’s market, financial, political and legal conditions; |

| • | the risk that D-Wave Quantum will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; |

| • | the risk that D-Wave Quantum may never achieve or sustain profitability; |

| • | the risk that D-Wave Quantum is unable to secure or protect its intellectual property; |

| • | changes in applicable laws or regulations; |

| • | the effect of the current economic environment due to inflation, increased interest rates, Ukraine/Russia conflict, geopolitical events, natural disasters, wars, terrorist acts or a combination of these factors on D-Wave Quantum’s business and the economy in general; |

| • | the ability of D-Wave Quantum to execute its business model, including market acceptance of its planned products and services; |

| • | D-Wave Quantum’s ability to raise capital, including under the Purchase Agreement (as defined below) with Lincoln Park Capital Fund, LLC (“Lincoln Park”); |

| • | D-Wace Quantum’s ability to obtain funds under the Term Loan (as defined below); |

| • | the possibility that D-Wave Quantum may be negatively impacted by other economic, business, and/or competitive factors; |

| • | risks stemming from inflation; |

| • | any changes to applicable tax laws, including U.S. tax laws; and |

| • | other risks and uncertainties described in this prospectus, including those under the section titled “Risk Factors.” |

| • | The sale or issuance of Common Shares to Lincoln Park may cause dilution and the sale of the Common Shares by Lincoln Park that it acquires pursuant to the Purchase Agreement, or the perception that such sales may occur, could cause the price of Common Shares to decrease. In addition, certain of the Selling Securityholders purchased, or are able to purchase, Common Shares at prices that are well below the current trading price of the Common Shares. As a result, the Selling Securityholders may effect sales of Common Shares well below prices significantly below the current market price, which could cause market prices to decline further. |

| • | D-Wave Quantum is in its growth stage which makes it difficult to forecast its future results of operations and its funding requirements. |

| • | D-Wave Quantum has a history of losses and expects to incur significant expenses and continuing losses for the foreseeable future. |

| • | D-Wave Quantum may be unable to maintain a listing on the NYSE, and such a delisting will likely make it more difficult for us to raise capital on favorable terms in the future, would likely have a negative effect on the price of our securities and would impair your ability to sell or purchase our shares when you wish to do so. |

| • | If D-Wave Quantum does not adequately fund its research and development efforts or use research and development teams effectively or build a sufficient number of annealing quantum computer production systems, it may not be able to achieve its technological goals, meet customer and market demand, or compete effectively and D-Wave Quantum’s business and operating results may be harmed. |

| • | D-Wave Quantum depends on its ability to retain existing senior management and other key employees and qualified, skilled personnel and to attract new individuals to fill these roles as needed. If D-Wave Quantum is unable to do so, such failure could adversely affect its business, results of operations and financial condition. |

| • | D-Wave Quantum expects to require additional capital to pursue its business objectives, growth strategy and respond to business opportunities, challenges or unforeseen circumstances, and it may be unable to raise capital or additional financing when needed on acceptable terms, or at all. |

| • | D-Wave Quantum’s industry is competitive on a global scale, from both quantum and classical competitors, and D-Wave Quantum may not be successful in competing in this industry or establishing and maintaining confidence in its long-term business prospects among current and future partners and customers, which would materially harm its reputation, business, results of operations and financial condition. |

| • | Any cybersecurity-related attack, significant data breach or disruption of the information technology systems, infrastructure, network, third-party processors or platforms on which D-Wave Quantum relies could damage D-Wave Quantum’s reputation and adversely affect its business and financial results. |

| • | Market adoption of cloud-based online quantum computing platform solutions is relatively new and unproven and may not grow as D-Wave Quantum expects and, even if market demand increases, the demand for D-Wave Quantum’s QCaaS may not increase, or certain customers may be reluctant to use a cloud-based QCaaS for applications, all of which may harm D-Wave Quantum’s business and results of operations. |

| • | D-Wave Quantum may, in the future, be adversely affected by continuation or worsening of the global COVID-19 pandemic, various COVID-19 strains or future pandemics. |

| • | Unfavorable conditions in D-Wave Quantum's industry or the global economy, including uncertain geopolitical conditions such as inflation, recessions and war, among others, could limit D-Wave Quantum's ability to grow the business and negatively affect D-Wave Quantum's results of operations. |

| • | System failures, interruptions, delays in service, catastrophic events, inadequate infrastructure and resulting interruptions in the availability or functionality of D-Wave Quantum’s products and services could harm its reputation or subject D-Wave Quantum to significant liability, and adversely affect its business, financial condition and operating results. |

| • | D-Wave Quantum may be unable to obtain, maintain and protect its intellectual property or prevent third parties from making unauthorized use of its intellectual property, which could cause it to lose the competitive advantage resulting from its intellectual property. |

| • | D-Wave Quantum’s patent applications may not result in issued patents or its patent rights may be contested, circumvented, invalidated or limited in scope, any of which could have a material adverse effect on D-Wave Quantum’s ability to prevent others from interfering with the commercialization of its products and services. |

| • | D-Wave Quantum may face patent infringement and other intellectual property claims that could be costly to defend and may result in injunctions and significant damage awards or other costs. If third parties claim that D-Wave Quantum infringes upon or otherwise violates their intellectual property rights, D-Wave Quantum’s business could be adversely affected. |

| • | If the Merger's benefits do not meet the expectations of investors or securities analysts, the market price of D-Wave Quantum’s securities may decline. |

| • | Uncertainty about the effect of the Merger may affect D-Wave Quantum’s ability to retain key employees, integrate management structures and may materially impact the management, strategy and results of its operation as a combined company. |

| • | Financial projections with respect to D-Wave Quantum may not prove to be reflective of actual financial results. |

| • | The historical financial results of D-Wave Quantum and unaudited pro forma financial information included elsewhere in this prospectus may not be indicative of what D-Wave Quantum's actual financial position or results of operations would have been if it were a public company. |

| • | D-Wave Quantum may be required to take write-downs or write-offs, or D-Wave Quantum may be subject to restructuring, impairment or other charges that could have a significant negative effect on D-Wave Quantum’s financial condition, results of operations and the price of D-Wave Quantum’s securities, which could cause you to lose some or all of your investment. |

| • | The price of D-Wave Quantum's Common Shares has been and may continue to be volatile or may decline regardless of our operating performance. |

| • | D-Wave Quantum may amend the terms of the Warrants in a manner that may be adverse to holders with the approval by the holders of at least a majority of the then outstanding Warrants. |

| • | D-Wave Quantum may issue additional Common Shares or other equity securities without your approval, which would dilute your ownership interests and may depress the market price of the Common Shares. |

| • | The D-Wave Quantum Charter contains anti-takeover provisions that could adversely affect the rights of our stockholders. |

| • | 16,965,849 shares reserved under the 2022 Equity Incentive Plan (the “2022 Plan”); |

| • | 8,036,455 shares reserved under the 2022 Employee Stock Purchase Plan (the “ESPP”); |

| • | 2,889,282 Common Shares underlying D-Wave Warrants; |

| • | 26,053,126 Common Shares underlying Warrants; and |

| • | 11,949,501 Common Shares underlying outstanding D-Wave Options. |

| | | March 31, | | | December 31, | |

(In thousands of U.S. dollars, except share and per share data) | | | 2023 | | | 2022 |

Assets | | | | | ||

Current assets: | | | | | ||

Cash | | | $8,988 | | | $7,065 |

Trade accounts receivable, net | | | 542 | | | 757 |

Inventories | | | 2,240 | | | 2,196 |

Prepaid expenses and other current assets | | | 3,142 | | | 3,907 |

Total current assets | | | $14,912 | | | $13,925 |

Property and equipment, net | | | 2,041 | | | 2,294 |

Operating lease right-of-use assets | | | 8,927 | | | 9,133 |

Intangible assets, net | | | 228 | | | 244 |

Other noncurrent assets | | | 1,351 | | | 1,351 |

Total assets | | | $27,459 | | | $26,947 |

Liabilities and stockholders’ (deficit) equity | | | | | ||

Current liabilities: | | | | | ||

Trade accounts payable | | | 5,608 | | | 3,756 |

Accrued expenses and other current liabilities | | | 9,859 | | | 8,640 |

Loans payable, current | | | 790 | | | 1,671 |

Deferred revenue, current | | | 1,827 | | | 1,781 |

Total current liabilities | | | 18,084 | | | 15,848 |

Warrant liabilities | | | 1,254 | | | 1,892 |

Operating lease liabilities, net of current portion | | | 7,165 | | | 7,301 |

Loans payable, noncurrent | | | 8,260 | | | 7,811 |

Deferred revenue, noncurrent | | | 9 | | | 9 |

Total liabilities | | | $34,772 | | | $32,861 |

Commitments and contingencies (Note 11) | | | | | ||

Stockholders’ (deficit) equity: | | | | | ||

Common stock par value $0.0001 per share; 675,000,000 shares authorized at March 31, 2023 and December 31, 2022, respectively; 127,173,552 shares and 113,335,530 shares issued and outstanding as of March 31, 2023 and December 31, 2022, respectively. | | | 12 | | | 11 |

Additional paid-in capital | | | 404,501 | | | 381,274 |

Accumulated deficit | | | (401,405) | | | (376,797) |

Accumulated other comprehensive loss | | | (10,421) | | | (10,402) |

Total stockholders’ (deficit) equity | | | $(7,313) | | | $(5,914) |

Total liabilities and stockholders’ equity | | | $27,459 | | | $26,947 |

| | | Three months ended March 31, | | | Year ended December 31, | ||||||||||

(In thousands, except share and per share data) | | | 2023 | | | 2022 | | | 2022 | | | 2021 | | | 2020 |

Revenue | | | $1,583 | | | $1,713 | | | $7,173 | | | $6,279 | | | $5,160 |

Cost of revenue | | | 1,162 | | | 616 | | | 2,923 | | | 1,750 | | | 915 |

Total gross profit | | | 421 | | | 1,097 | | | 4,250 | | | 4,529 | | | 4,245 |

Operating expenses: | | | | | | | | | | | |||||

Research and development | | | 10,915 | | | 6,802 | | | 32,101 | | | 25,401 | | | 20,411 |

General and administrative | | | 11,296 | | | 3,646 | | | 21,539 | | | 11,897 | | | 11,587 |

Sales and marketing | | | 2,900 | | | 1,600 | | | 10,068 | | | 6,179 | | | 3,714 |

Total operating expenses | | | 25,111 | | | 12,048 | | | 63,708 | | | 43,477 | | | 35,712 |

Loss from operations | | | (24,690) | | | (10,951) | | | (59,458) | | | (38,948) | | | (31,467) |

Other income (expense), net: | | | | | | | | | | | |||||

Interest expense | | | (454) | | | (525) | | | (4,633) | | | (1,728) | | | (5,257) |

Government assistance | | | — | | | — | | | | | 7,167 | | | 12,027 | |

Non-cash interest income on SIF | | | — | | | — | | | 5,673 | | | — | | | — |

Gain on debt extinguishment | | | — | | | — | | | | | — | | | 3,873 | |

Gain on settlement of warrant liability | | | — | | | — | | | | | — | | | 7,836 | |

Gain on investment in marketable securities | | | — | | | — | | | | | 1,163 | | | — | |

Change in fair value of warrant liabilities | | | 638 | | | — | | | 6,173 | | | — | | | — |

Lincoln Park Purchase Agreement issuance costs | | | — | | | — | | | (629) | | | — | | | — |

Other income (expense), net | | | (102) | | | (181) | | | 1,345 | | | 801 | | | 2,969 |

Total other income (expense), net | | | 82 | | | (706) | | | 7,929 | | | 7,403 | | | 21,448 |

Net loss | | | $(24,608) | | | $(11,657) | | | $(51,529) | | | $(31,545) | | | $(10,019) |

Net loss per share, basic and diluted | | | $(0.20) | | | $(0.09) | | | $(0.43) | | | $(0.25) | | | $(0.08) |

Weighted-average shares * used in computing net loss per share, basic and diluted | | | 123,144,097 | | | 125,385,841 | | | 119,647,777 | | | 125,342,746 | | | 127,161,731 |

Comprehensive loss: | | | | | | | | | | | |||||

Net loss | | | $(24,608) | | | $(11,657) | | | $(51,529) | | | $(31,545) | | | $(10,019) |

Foreign currency translation adjustment, net of tax | | | (19) | | | (70) | | | 41 | | | 15 | | | (82) |

Net comprehensive loss | | | $(24,627) | | | $(11,727) | | | $(51,488) | | | $(31,530) | | | $(10,101) |

Assumed Average Purchase Price Per Share | | | Number of Common Shares that may be Issued in this Offering if Full Purchases Made under the Purchase Agreement(1) | | | Proceeds from the Sale of Common Shares to Lincoln Park Under the Purchase Agreement(2) |

$14.00 | | | 9,292,857 | | | $150,000,000 |

$13.00 | | | 10,007,692 | | | $150,000,000 |

$12.00 | | | 10,841,666 | | | $150,000,000 |

$11.00 | | | 11,827,272 | | | $150,000,000 |

$10.00 | | | 13,010,000 | | | $150,000,000 |

$9.00 | | | 14,455,555 | | | $150,000,000 |

$8.00 | | | 16,262,500 | | | $150,000,000 |

$7.00 | | | 18,585,714 | | | $150,000,000 |

Assumed Average Purchase Price Per Share | | | Number of Common Shares that may be Issued in this Offering if Full Purchases Made under the Purchase Agreement(1) | | | Proceeds from the Sale of Common Shares to Lincoln Park Under the Purchase Agreement(2) |

$6.00 | | | 21,683,333 | | | $150,000,000 |

$5.00 | | | 26,020,000 | | | $150,000,000 |

$4.00 | | | 32,525,000 | | | $150,000,000 |

$3.00 | | | 35,000,000 | | | $124,900,000 |

$2.00 | | | 35,000,000 | | | $89,900,000 |

$1.98(3) | | | 35,000,000 | | | $89,200,000 |

$1.00(4) | | | 35,000,000 | | | $54,900,000 |

| (1) | Excludes the 381,540 Commitment Shares previously issued to Lincoln Park. |

| (2) | Includes the $19.9 million in proceeds previously received from issuing Common Shares to Lincoln Park. |

| (3) | The closing price of our Common Shares on July 6, 2023. |

| (4) | The Floor Price under the Purchase Agreement. |

| • | holders of Common Shares’ proportionate ownership interest in D-Wave Quantum would decrease; |

| • | the amount of cash available per share, including for payment of dividends (if any) in the future, may decrease; |

| • | the relative voting strength of each previously outstanding share of Common Shares may be diminished; and |

| • | the market price of the Common Shares may decline. |

| • | effectively manage organizational change; |

| • | design scalable processes; |

| • | accelerate and/or refocus research and development activities; |

| • | expand supply chain and distribution capacity, and ultimately expand manufacturing capacity; |

| • | increase sales and marketing efforts; |

| • | scale and manage our professional services; |

| • | broaden customer-support and services capabilities; |

| • | maintain or increase operational efficiencies; |

| • | scale support operations in a cost-effective manner; |

| • | implement appropriate operational and financial systems; and |

| • | maintain effective financial disclosure controls and procedures. |

| • | large, well-established tech companies that generally compete in all of our markets, including Google, Quantinuum, IBM, Microsoft and AWS; |

| • | countries such as China, Russia, Canada, the United States, Australia and the United Kingdom, and those in the European Union as of the date of this prospectus and we believe additional countries in the future; |

| • | less-established public and private companies with competing technology, including companies located outside the United States; |

| • | existing or new entrants seeking to enter the quantum annealing space; and |

| • | new or emerging entrants seeking to develop competing technologies. |

| • | our inability to enter into agreements with suppliers on commercially reasonable terms, or at all; |

| • | difficulties of suppliers ramping up their supply of materials to meet our requirements; |

| • | a significant increase in the price of one or more components, including due to industry consolidation occurring within one or more component supplier markets or as a result of decreased production capacity at manufacturers; |

| • | any reductions or interruption in supply, including due to technological problems, equipment malfunctions, regulatory actions or disruptions on our global supply chain as a result of large scale public health restrictions or geopolitical factors, which we have experienced, and may in the future experience; |

| • | financial problems of either contract manufacturers or component suppliers; |

| • | significantly increased freight charges, or raw material costs and other expenses associated with our business; |

| • | a failure to develop our supply chain management capabilities and recruit and retain qualified professionals; |

| • | a failure to adequately authorize procurement of inventory; |

| • | a failure to adequately maintain our or our suppliers’ manufacturing equipment; or |

| • | a failure to appropriately cancel, reschedule, or adjust our requirements based on our business needs. |

| • | lack of familiarity and burdens and complexity involved with complying with multiple, conflicting and changing foreign laws, standards, regulatory requirements, tariffs, export controls and other barriers; |

| • | difficulties in ensuring compliance with countries’ multiple, conflicting and changing privacy, data security, international trade, customs and sanctions laws; |

| • | differing technology standards; and |

| • | new and uncertain protection for intellectual property rights in some countries. |

| • | use of resources that are needed in other areas of our business; |

| • | in the case of an acquisition, implementation or remediation of controls, procedures and policies of the acquired company; |

| • | in the case of an acquisition, difficulty integrating the accounting systems and operations of the acquired company, including potential risks to our corporate culture; |

| • | in the case of an acquisition, coordination of product, engineering and selling and marketing functions, including difficulties and additional expenses associated with supporting legacy services and products and hosting infrastructure of the acquired company, as applicable, difficulties associated with supporting new products or services, difficulty converting the customers of the acquired company onto our platform and difficulties associated with contract terms, including disparities in the revenues, licensing, support or professional services model of the acquired company; |

| • | in the case of an acquisition, retention and integration of employees from the acquired company; |

| • | in the case of an acquisition, past intellectual property infringement or data security issues arising from the acquired company; |

| • | unforeseen costs or liabilities; |

| • | adverse effects on our existing business relationships with customers as a result of the acquisition or investment; |

| • | the possibility of adverse tax consequences; |

| • | litigation or other claims arising in connection with the acquired company or investment; and |

| • | in the case of foreign acquisitions, the need to integrate operations across different cultures and languages and to address the particular economic, currency, political and regulatory risks associated with specific countries. |

| • | be expensive and time consuming to defend; |

| • | cause us to cease making, licensing or using our platform or products that incorporate the challenged intellectual property; |

| • | require us to modify, redesign, reengineer or rebrand our platform or products, if feasible; |

| • | cause significant delays in introducing new or enhanced services or technology; |

| • | divert management’s attention and resources; or |

| • | require us to enter into royalty or licensing agreements in order to obtain the right to use a third party’s intellectual property. |

| • | actual or anticipated fluctuations in its revenue or other operating metrics; |

| • | changes in the financial guidance provided to the public or D-Wave Quantum’s failure to meet this guidance; |

| • | failure of securities analysts to initiate or maintain coverage of D-Wave Quantum, changes in financial estimates by any securities analysts who follow D-Wave Quantum, or its failure to meet the estimates or the expectations of investors; |

| • | changes in accounting standards, policies, guidelines, interpretations, or principles; |

| • | the economy as a whole and market conditions in its industry; |

| • | rumors and market speculation involving D-Wave Quantum or other companies in its industry; |

| • | announcements by D-Wave Quantum or its competitors of significant innovations, acquisitions, strategic partnerships, joint ventures, or capital commitments; |

| • | new laws or regulations or new interpretations of existing laws or regulations applicable to its business; |

| • | lawsuits threatened or filed against us; |

| • | other events or factors, including those resulting from war, incidents of terrorism, or responses to these events; |

| • | the expiration of contractual lock-up or market standoff agreements; and |

| • | sales of additional Common Shares by D-Wave Quantum or its stockholders. |

| • | provisions that authorize its board of directors, without action by its stockholders, to issue additional Common Shares and preferred stock with preferential rights determined by its board of directors; |

| • | provisions that permit only a majority of its board of directors, the chairperson of the board of directors or the chief executive officer to call stockholder meetings and therefore do not permit stockholders to call special meetings of the stockholders; |

| • | provisions generally eliminating stockholders’ ability to act by written consent; |

| • | provisions requiring a two-thirds super majority vote to remove a director; and |

| • | provisions requiring certain amendments to our governing documents be made by a two-thirds super majority vote. |

| • | allocation of expenses to and among different jurisdictions; |

| • | changes in the valuation of our deferred tax assets and liabilities; |

| • | expected timing and amount of the release of any tax valuation allowances; |

| • | tax effects of stock-based compensation; |

| • | costs related to intercompany restructurings; |

| • | changes in tax laws, tax treaties, regulations or interpretations thereof; or |

| • | lower than anticipated future earnings in jurisdictions where we have lower statutory tax rates and higher than anticipated future earnings in jurisdictions where we have higher statutory tax rates. |

| • | actual or anticipated fluctuations in our quarterly financial results or the quarterly financial results of companies perceived to be similar to it; |

| • | changes in the market’s expectations about our operating results; |

| • | success of competitors; |

| • | our operating results failing to meet the expectation of securities analysts or investors in a particular period; |

| • | changes in financial estimates and recommendations by securities analysts concerning D-Wave Quantum or the industries in which D-Wave Quantum operates; |

| • | operating and share price performance of other companies that investors deem comparable to D-Wave Quantum; |

| • | D-Wave Quantum’s ability to market new and enhanced products and technologies on a timely basis; |

| • | changes in laws and regulations affecting our business; |

| • | our ability to meet compliance requirements; |

| • | commencement of, or involvement in, litigation involving D-Wave Quantum; |

| • | changes in D-Wave Quantum’s capital structure, such as future issuances of securities or the incurrence of additional debt; |

| • | the volume of Common Shares available for public sale; |

| • | any changes in our board of directors or management; |

| • | sales of substantial amounts of Common Shares by our directors, executive officers or significant stockholders or the perception that such sales could occur; and |

| • | general economic and political conditions such as recessions, interest rates, international currency fluctuations and acts of war or terrorism. See “—Risks Related to D-Wave Quantum’s Business and Industry” |

| • | the requirement that a majority of our board of directors consist of “independent directors” as defined under the rules of the NYSE; |

| • | the requirement that we have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; |

| • | the requirement that we have a nominating and corporate governance committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and |

| • | the requirement for an annual performance evaluation of the compensation and nominating and corporate governance committees. |

| • | 16,965,849 shares reserved under the 2022 Plan; |

| • | 8,036,455 shares reserved under the ESPP; |

| • | 2,889,282 Common Shares underlying outstanding D-Wave Warrants; |

| • | 26,053,126 Common Shares underlying outstanding Warrants; and |

| • | 11,949,501 Common Shares underlying outstanding D-Wave Options. |

| • | the accompanying notes to the unaudited pro forma condensed combined statements of operations; |

| • | the historical unaudited financial statements of DPCM as of and for the six months ended June 30, 2022 and the related notes included elsewhere in this prospectus; |

| • | the historical audited consolidated financial statements of D-Wave Quantum for the year ended December 31, 2022 and the related notes included elsewhere in this prospectus; and |

| • | the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contained in D-Wave Quantum’s annual report on Form 10-K for the year ended December 31, 2022, filed with the SEC on April 18, 2023. |

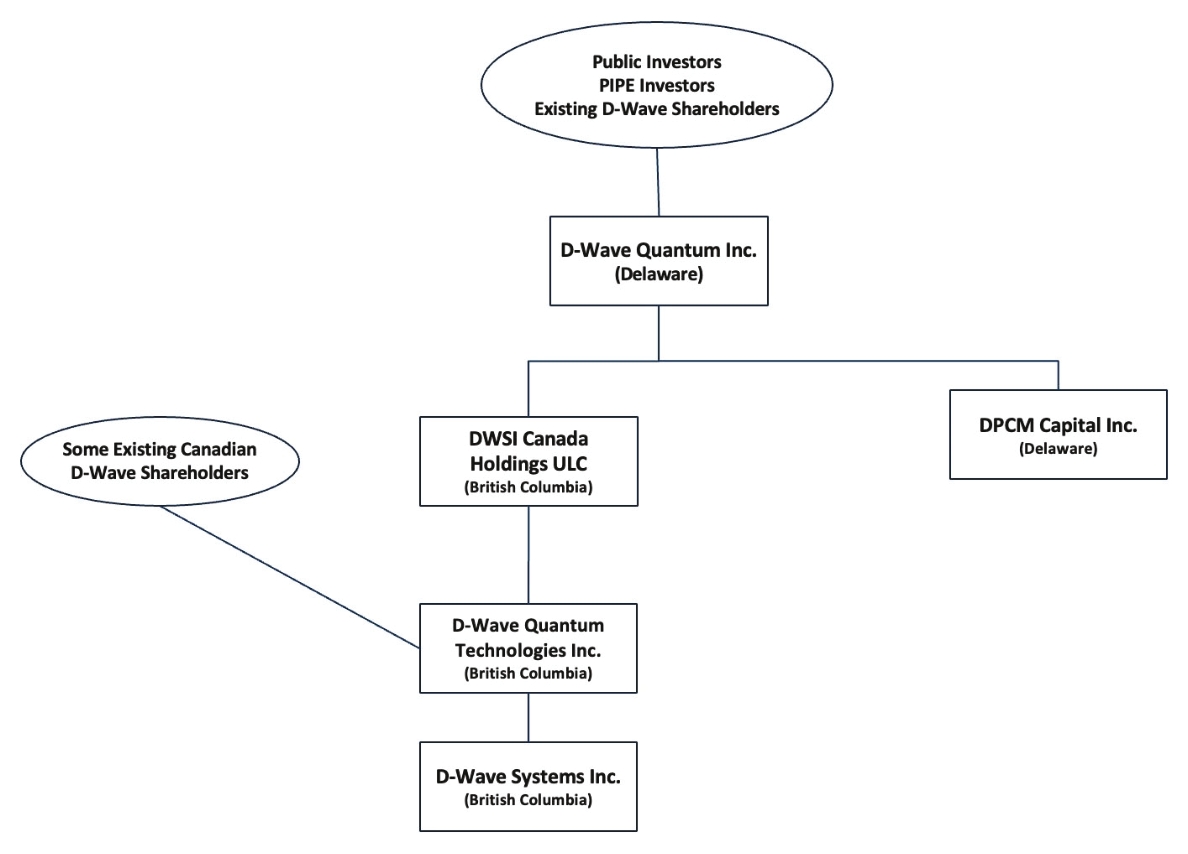

| • | On the Closing Date, the DPCM Merger was consummated; |

| • | At the Effective Time, (a) each issued and outstanding share of DPCM Class A Common Stock (other than any shares of DPCM Class A Common Stock or shares of DPCM’s Class B Common Stock held in DPCM’s treasury or owned by D-Wave or any other wholly-owned subsidiary of D-Wave or DPCM immediately prior to the Effective Time (the “Excluded Shares”)) and after giving effect to the right of the holders of DPCM Class A Common Stock to redeem all or a portion of their DPCM Class A Common Stock was automatically converted into and exchanged for the right to receive from the depositary, for each share of DPCM Class A Common Stock, a number of Common Shares equal to the Exchange Ratio and (b) each issued and outstanding share of DPCM Class B Common Stock (other than any Excluded Shares) was automatically converted into and exchanged for the right to receive from the depositary, one Common Share; |

| • | Immediately following the DPCM Merger, the parties proceeded to effect the Arrangement on the terms and subject to the conditions set forth in the statutory plan of arrangement under the Business Corporations Act (British Columbia) (the “Plan of Arrangement”) and the Transaction Agreement or made at the direction of the Supreme Court of British Columbia (the “Court”) in accordance with the final order of the Court pursuant to Section 291 of the Business Corporations Act (British Columbia), in a form acceptable to D-Wave and DPCM, each acting reasonably, approving the Arrangement with the prior written consent of DPCM and D-Wave, each such consent not to be unreasonably withheld, conditioned, or delayed. Pursuant to the Plan of Arrangement, (i) CallCo acquired a portion of the issued and outstanding D-Wave Shares from certain holders in exchange for Common Shares (the “D-Wave Quantum Share Exchange”), (ii) CallCo contributed such D-Wave Shares to ExchangeCo in exchange for shares of ExchangeCo’s non-par value common stock, (iii) following the D-Wave Quantum Share Exchange, ExchangeCo acquired the remaining issued and outstanding D-Wave Shares from the remaining holders of D-Wave Shares in exchange for Exchangeable Shares and (iv) as a result of the foregoing, D-Wave Systems became a wholly-owned subsidiary of ExchangeCo. The holders of the Exchangeable Shares have certain rights as specified in the Exchangeable Share Support Agreement and the Voting and Exchange Trust Agreement, including the right to exchange Exchangeable Shares for Common Shares; |

| • | Immediately following the consummation of the DPCM Merger, pursuant to the Plan of Arrangement, each outstanding D-Wave Share was automatically converted into and exchanged for the right to receive a number of Common Shares or Exchangeable Shares equal to, in the aggregate, the Per Share D-Wave Stock Consideration (as defined in the Transaction Agreement); |

| • | Concurrently with the execution of the Transaction Agreement, the PIPE Investors entered into the PIPE Subscription Agreements, pursuant to which, among other things, each PIPE Investor subscribed to and agreed to purchase on the Closing Date, and D-Wave Quantum agreed to issue and sell to each such PIPE Investor on the Closing Date, the PIPE Shares; and |

| • | On June 16, 2022, we entered into the Purchase Agreement with Lincoln Park pursuant to which Lincoln Park has agreed to purchase from us, at our option, up to $150,000,000 of Common Shares from time to time over a 36-month period following the Commencement Date. The Purchase Agreement is subject to certain limitations, including the Floor Price Limitation, the Beneficial Ownership Limitation and |

| • | the filing and effectiveness of this registration statement. See “Risk Factors—Risks Related to the Offering—The terms of the Purchase Agreement limit the amount of Common Shares we may sell to Lincoln Park and the trading price of the Common Shares may decline as a result of the sale of Common Shares pursuant to the Purchase Agreement or under the Resale Registration Statement, each of which may limit our ability to utilize the Purchase Agreement to enhance our cash resources”. Pursuant to the Purchase Agreement, we also agreed to pay Lincoln Park the Commitment Fee of $2,625,000. We paid the Commitment Fee entirely in Common Shares, in two tranches consisting of 127,180 and 254,360 Common Shares issued on August 5, 2022 and August 25, 2022, respectively. |

| • | D-Wave Systems’ existing stockholders have the majority of the voting interest in the combined company; |

| • | The combined company’s board of directors has seven board members consisting of one board member designated by DPCM, three board members retained from the D-Wave Systems board, and three additional independent board members; |

| • | D-Wave Systems’ senior management comprises all the senior management of the combined company; and |

| • | D-Wave Systems’ operations comprises the ongoing operations of the combined company. |

| | | Historical | | | | | | | | | ||||||||

| | | DPCM Capital, Inc January 1, 2022 – August 5, 2022 | | | D-Wave Quantum Inc. Year Ended December 31, 2022 | | | Transaction Accounting Adjustments | | | | | D-Wave Quantum Inc. Pro Forma | | | |||

Revenue | | | $— | | | $7,173 | | | $— | | | | | $7,173 | | | ||

Cost of Revenue | | | — | | | 2,923 | | | — | | | | | 2,923 | | | ||

Total gross profit | | | — | | | 4,250 | | | — | | | | | 4,250 | | | ||

Operating expenses: | | | | | | | | | | | | | ||||||

Research and development | | | — | | | 32,101 | | | — | | | | | 32,101 | | | ||

General and administrative | | | 3,366 | | | 21,539 | | | — | | | | | 24,905 | | | ||

Sales and marketing | | | — | | | 10,068 | | | — | | | | | 10,068 | | | ||

Total operating expenses | | | 3,366 | | | 63,708 | | | — | | | | | 67,074 | | | ||

Loss from operations | | | (3,366) | | | (59,458) | | | — | | | | | (62,824) | | | ||

Other income (expense): | | | | | | | | | | | | | ||||||

Interest expense | | | — | | | (4,633) | | | 855 | | | (a) | | | (3,778) | | | |

Non-cash interest income on SIF | | | — | | | 5,673 | | | — | | | | | 5,673 | | | ||

Reduction of deferred underwriting fees | | | 235 | | | — | | | — | | | | | 235 | | | ||

Change in fair value of warrant liabilities | | | 2,687 | | | 6,173 | | | — | | | | | 8,860 | | | ||

Lincoln Park Purchase Agreement issuance costs | | | — | | | (629) | | | — | | | | | (629) | | | ||

Interest earned on marketable securities held in Trust Account | | | 786 | | | — | | | (786) | | | (b) | | | — | | | |

Other income, net | | | — | | | 1,345 | | | — | | | | | 1,345 | | | ||

Total other income, net | | | 3,708 | | | 7,929 | | | 69 | | | | | 11,706 | | | ||

Net income (loss) before taxes | | | $342 | | | $(51,529) | | | $69 | | | | | $(51,118) | | | ||

Provision for income taxes | | | (147) | | | — | | | — | | | | | (147) | | | ||

Net income (loss) | | | $195 | | | $(51,529) | | | $69 | | | | | $(51,265) | | | ||

Net loss per share, basic and diluted | | | | | $(0.43) | | | | | | | $(0.46) | | | (c) | |||

Net income per share, Class A common stock, basic and diluted | | | $0.01 | | | | | | | | | | | |||||

Net income per share, Class B common stock, basic and diluted | | | $0.01 | | | | | | | | | | | |||||

Weighted-average shares outstanding, basic and diluted | | | | | 119,647,777 | | | | | | | 110,620,638 | | | ||||

Weighted-average shares outstanding, Class A common stock, basic and diluted | | | 30,000,000 | | | | | | | | | | | |||||

Weighted-average shares outstanding, Class B common stock, basic and diluted | | | 7,500,000 | | | | | | | | | | | |||||

| (a) | Reflects the removal of interest expense on a loan with PSP as it is assumed that the loan would have not been entered into if the Merger had occurred on January 1, 2022. |

| (b) | Reflects the elimination of interest income on marketable securities held in the Trust Account. |

| (c) | Reflects the pro forma basic and diluted earnings per share amounts presented in the unaudited pro forma condensed combined statement of operations based upon the number of Common Shares outstanding at the closing of the Merger, assuming the Merger occurred on January 1, 2022. As the unaudited pro forma condensed combined statement of operations is in a loss position, anti-dilutive instruments were not included in the calculation of the diluted weighted-average number of common shares outstanding (the anti-dilutive instruments are described below). |

| | | Year Ended December 31, 2022 | |

(In thousands, except per share data) | | | |

Numerator: | | | |

Pro forma net loss | | | $(51,265) |

| | | ||

Denominator: | | | |

Public Stockholders | | | 1,347 |

PIPE investors | | | 5,817 |

Lincoln Park | | | 536 |

Sponsor shares | | | 2,769 |

Additional Former Class B Holder shares | | | 247 |

D-Wave shareholders | | | 99,905 |

Pro forma weighted-average shares outstanding, basic and diluted | | | 110,621 |

Pro forma basic and diluted net loss per share(1) | | | $(0.46) |

| (1) | Because basic and diluted weighted average shares outstanding are the same in a net loss position, combined pro forma net loss per share excludes public warrants as converted to common shares of 14,420,065, private warrants as converted to common shares of 11,633,060, D-Wave Systems warrant shares as converted to common shares of 2,889,282, and options to purchase common stock as converted to common shares of 13,689,638. |

| • | Volkswagen has investigated multiple use cases, including a commercial application that required live access to a quantum processor. During Web Summit 2019 in Lisbon, Volkswagen’s Quantum Shuttle project combined live Android data from buses, live traffic data, and access to a D-Wave hybrid solver through Leap to optimize bus routes in real time. |

| • | SavantX, a quantum analytics company, worked with the Port of Los Angeles to create a quantum application specific to the port’s third largest terminal - Pier 300 - to optimize cargo handling and truck scheduling using D-Wave’s annealing quantum computer. With the application, truck drivers are directed |

| • | Pattison Food Group, a western Canadian grocery retailer, successfully used our hybrid solver service in Leap, which incorporates the Advantage quantum processing unit (“QPU”), to find solutions to optimization problems in grocery logistics. The company was able to reduce the time needed for one optimization task from 25 hours to less than two minutes per week. Although the gain from the time savings is significant, the real value is in allowing this business optimization process, previously done weekly, to be done in real time, providing optimal solutions to ever-changing inputs and conditions. Pattison Food Group is now looking to apply our hybrid quantum capability to other challenges across its business. |

| • | BBVA, a global financial institution, along with financial quantum applications partner Multiverse Computing, set out to identify management strategies that yield the highest Sharpe ratio—a metric reflecting the rate of return at a given level of risk. An algorithmic solver was used to find the optimal solution to a cost function equation that describes the risk, return, and transaction costs associated with a given portfolio. Utilizing D-Wave’s hybrid solver service, BBVA was able to find the maximum value at the lowest risk in 171 seconds, even with 10382 possible portfolios. In comparison, existing solutions either took an entire day or failed to find a solution. |

| • | Volkswagen identified a commercial optimization application, the binary paint shop problem, which was run on D-Wave’s hybrid solver service. The solver outperformed four purely classical methods on problem sizes at commercial scale (N=3,000). In a separate project, similar inputs were tested using a leading ion trap system, which failed to find any commercial solution. |

| • | Professional services accelerate QCaaS: Our model features a professional-services-enabled approach for application discovery and proof-of-concept development, and a QCaaS model for recurring revenue as applications move to production. This model enables us to capture professional services revenue in the first half of the customer journey and recurring QCaaS revenue in the second half once the application has been built and validated. |

| • | Three-pronged go-to-market model: Our go-to-market model—across direct sales, re-sellers and developers—extends our ability to scale sales. |

| • | Our direct sales strategy involves: (1) growing our existing customer base by accelerating the path from pre-production to in-production application deployment on Leap, our quantum cloud service; and (2) acquiring net new customers using D-Wave Launch, a services-enabled journey to the adoption of quantum technology. For direct to enterprise sales, we sell through a four-phased customer engagement that we call D-Wave Launch. We describe phase 1 as our discovery phase. In this phase, our professional services organization works with customers to identify one or more applications that are valuable for their business and that could be run on one of our quantum hybrid solvers. We describe phase 2 as our proof of concept (“PoC”) phase. In this phase, again our professional services organization works with the customer to build out an actual software implementation and we begin to run the software on the Leap quantum cloud service to test if the implementation works correctly and if the customer begins to see early business value. We describe phase 3 as our pilot deployment phase. In this phase, we expand the implementation to support running the application at business scale. For example: in the case of delivery scheduling, we would add more vehicles to the model, for example from 10 to 100 trucks. Or in the case of a portfolio optimization problem, we would add additional portfolios to test the performance of the quantum hybrid solver at larger business size problems. We describe phase 4 as putting the quantum hybrid application into full production. In this phase, our customer is running the problem in their environment while connected to the Leap quantum cloud service, at full scale, deriving additional business benefits beyond those identified in earlier phases. Phases 1-3 are considered non-recurring revenue per application as they are phases that the customer moves through to get to full production (phase 4). Phase 4 represents recurring revenue as the application in full production consumes QCaaS resources to run the full production application on an ongoing basis. As an application consumes QCaaS resources, D-Wave recognizes the revenue. See “—Our Quantum Computers, Developer Tools and Quantum Hybrid Solvers Delivered via QCaaS—D-Wave Launch™ on-board to quantum computing program”. |

| • | Our partner strategy involves: (1) expanding our reach by enabling AWS customers to purchase Leap and other services through AWS Marketplace; (2) creating new markets and unlocking new use cases via systems consultants and integrators such as Deloitte and Accenture; and (3) building an ecosystem of global re-sellers such as NEC and regional re-sellers such as Strangeworks and Sigma-i. For our partner-led strategy, we work with system integrators, independent software vendors, and cloud providers to resell our Leap quantum cloud service around the globe to scale our business. |

| • | Our developer strategy involves: (1) providing access to a free trial of Leap, our quantum cloud service; (2) driving developer product usage, quantum application development, and community engagement to maximize developer conversions (from free to paid); and (3) lead generation, i.e., engaging our developer base for potential new enterprise customer accounts. We do this by offering free, unlimited access to our Leap quantum cloud service platform. In this platform, users have unlimited “always on” access to demos, code samples, training materials, an integrated developer environment, and a community forum. Initially, they also receive up to one minute of free use of the actual QPUs and additional free time on the quantum hybrid solvers. Because of the speed of the QPU, one minute of QPU time is equal to running between 400 and 4000 different problems. Developers who attach their GitHub account to their Leap sign ups continue to receive one free minute monthly. There is currently no limit to the ability to receive an additional one minute of free time each month, assuming developers continue to open source their work and associate their GitHub account. To date, more than 34,000 developers have joined our ecosystem. |

| • | Win the fast-growing optimization market: Quantum annealing is uniquely suited for solving optimization problems and, as noted above, this problem class is anticipated to comprise $22 billion to $42 billion of the longer-term quantum computing TAM that is available to hardware, software and service providers. As the only company in the world offering quantum annealing, we’ll continue to leverage this competitive position and acquire additional customers with optimization use cases across multiple verticals, including financial services, manufacturing/logistics, mobility, and life sciences/pharmaceuticals. |

| • | Direct sales, recurring revenue and expanding partner strategy: We’re pursuing multiple revenue streams from our three-pronged go-to-market model. Our main line of business—cloud service—has seen significant year-over-year growth, which we anticipate will continue. Specifically, between 2018, when we introduced our Leap cloud service, and the end of 2022, cloud revenue has grown at a compound annual growth rate of 37 percent. We have two types of cloud revenue contracts: large, multiyear engagements and smaller, recurring contracts that are often multi-month in duration. We continue to acquire net new customers through the D-Wave Launch program and further drive recurring QCaaS revenue by moving existing customers from their pre-production journey into production applications. We recognize professional services revenue from phase 1 (discovery) and phase 2 (PoC) of Launch projects, with many customers initially contracting for both. We’re seeing more than 80 percent of phase 1 (discovery) projects convert into phase 2 (PoC) projects, demonstrating early customer value and continued engagement and retention. We also intend to expand our channel partner and reseller relationships to identify new geographies, customers, and use cases, all of which could potentially utilize our products. We’ve also seen that as businesses identify and build use cases, customers learn more about quantum computing and begin to explore alternative use cases, yielding additional professional services and QCaaS revenues. |

| • | Grow our existing user base and developer ecosystem: Our developer ecosystem is a source of innovation for new quantum applications, extended brand awareness, and new use case discovery. We plan to continue to drive developer community engagement and product adoption to grow the ecosystem. |

| • | Demonstrate the power of our quantum technology through benchmarking: Our annealing quantum computers have outperformed the best classical computers in several specific use cases. As noted in a recent peer-reviewed paper published in Nature Communications, our systems demonstrated a solution to a problem three million times faster than the best-known classical approaches on an application in quantum materials simulation. In the context of real-world applications, our customers have shown material efficiency improvements in solving business problems (for example, up to 500 times faster for Pattison Food Group, as described above). |

| • | Pursue the cutting edge and push the boundaries of quantum knowledge: We plan to continue to create new knowledge in the quantum space that shows the power of our scientific and technological approaches and pushes the frontiers of quantum information science. We have an active research program that focuses on quantifying the increases in performance we achieve with increasingly coherent quantum systems. And we’ve seen promising new results on interesting physics problems, currently in peer-review, because of even greater coherence in our systems. |

| • | Continue to invest in our differentiated quantum annealing technology: As discussed above, while our technology approach encompasses both annealing and gate-model technologies, we are the only company that builds and delivers annealing quantum computers. Our extensive intellectual property portfolio around our annealing systems and 10-year head start in superconducting expertise give us a first-mover advantage, |

| • | Build and deliver a unified quantum platform that offers solutions for broad quantum use cases for customers: The intersection of systems, software, services and tools is familiar to us. We’re utilizing our integrated engineering expertise to build a cross-platform quantum service with both annealing and gate-model systems that we believe will be the first and only quantum computing offering to impact full product lifecycles across multiple industries. |

| • | Extend our track record of continuous innovation, execution, and operational excellence: We have a strong track record of innovation in building and delivering quantum annealing systems to market. From the D-Wave One, D-Wave Two, D-Wave 2X, D-Wave 2000Q, D-Wave 2000Q LN, Advantage and Advantage Performance Update to the forthcoming Advantage 2 system, we have demonstrated a relentless pursuit of increased qubit count, coherence (qubit quality), qubit connectivity, and performance. This has resulted in a rapid increase in the complexity of problems our customers are able to solve. We plan to continue this trajectory and focus on driving additional improvements in coherence and connectivity in our annealing systems to further expand the universe of solvable problems, while utilizing this expertise to build our gate-model system. |

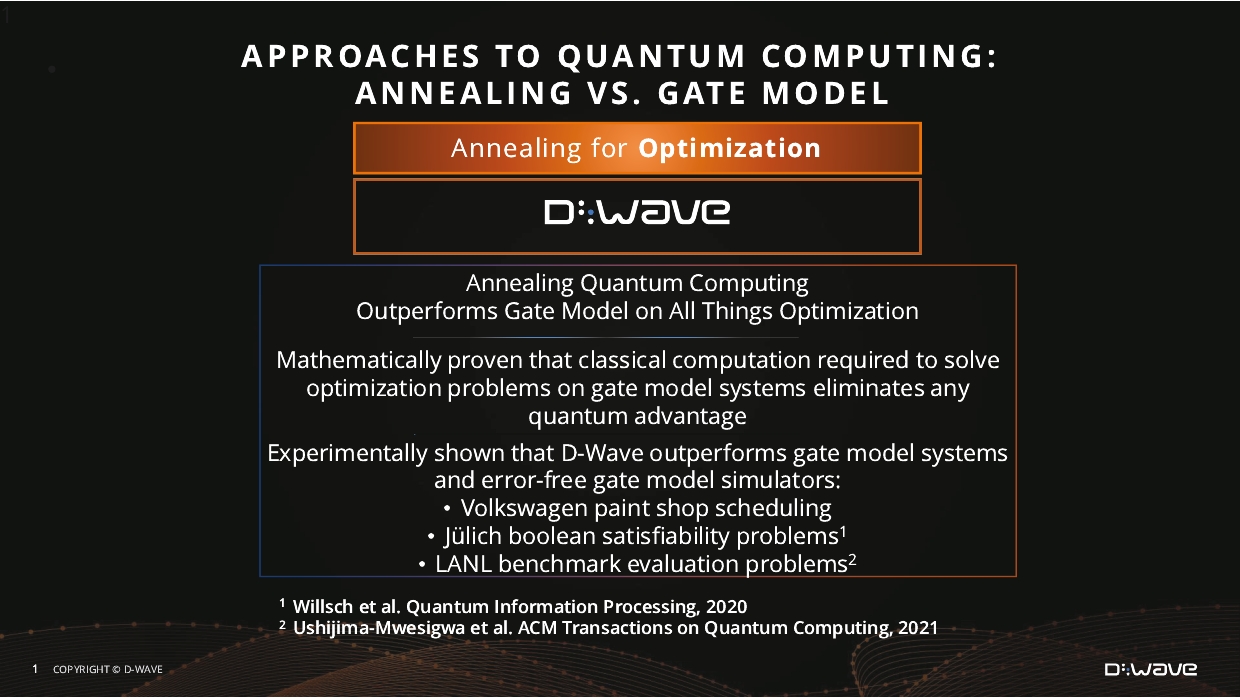

| • | Quantum annealing: Heavily inspired by physics and uniquely effective at solving challenging, ubiquitous optimization problems, quantum annealing is the first and only approach to date that delivers large-scale quantum computing and is a core of our product platform. |

| • | Gate-model computation: Heavily inspired by classical digital computation, gate-model computation replaces classical registers of bits with qubits and performs a series of single and multiqubit operations, or gates, on the registers to run a computation. This includes superconducting, ion trap, and photonic approaches to quantum computing. |

| • | Scaling the quantum system: In addition to the growing number of qubits and couplers, and the increasing complexity of problems our quantum computers can handle, other notable improvements we’ve made while transitioning from the D-Wave 2000Q to the Advantage quantum system (released in October 2020) include the following: |

| • | Increasing the number of qubits from 2,000 to 5,000 (2.5 times) |

| • | Increasing connectivity between qubits from 6 to 15 (2.5 times) |

| • | Increasing problem precision (the precision to which a problem can be posed) by two times |

| • | Reducing problem latency by 60 percent |

| • | An updated processor design that increased problem precision |

| • | Improvements in system control enabled faster anneal times |

| • | An increased yield of qubits and couplers that allows more complex problems to be solved |

| • | Gate-model quantum computing (“GMQC”) theory has matured considerably since 2004. |

| • | Over the past 20 years, we have accrued considerable experience and intellectual property in quantum systems engineering, including cryogenics, environmental control, input/output and filtering, and scalable control and readout of superconducting devices. This can be directly brought to bear on building scalable GMQC technology. |

| • | We have developed a mature superconducting VLSI design and manufacturing capability that can immediately be employed for our gate-model program. This is the only physical implementation of a quantum computing technology that can be utilized for both quantum annealing and gate-model computers. |

| • | Power consumption and refrigeration: Our quantum computers draw 12 kilowatts of nominal power and have used the same-sized dilution refrigerators for cooling since the 2010 release of the original D-Wave One system. The refrigerators’ cryocoolers require the bulk of this power to provide cooling to 4 kelvin. While the computational power of our systems has dramatically increased with each product generation, the power requirements have remained the same and are expected to do so for at least the next two system product generations. This contrasts with competitors that are using and developing massive dilution refrigerators, which will require increasingly more power to continue with technology development. |

| • | The superconducting gate-model approach uses the same basic underlying technology as that found in our qubits. Still, there are significant differences in the details of the implementations, levels of integration, and the performance achieved to date, particularly in optimization and material simulation. |

| • | The ion trap approach uses the state of atoms trapped in electric fields that are manipulated by electric fields and lasers for qubits. Current ion trap systems are in the range of about 20 qubits. While technologies such as optical interconnects have been proposed to connect many ion trap QPUs with high connectivity, this level of integration has not yet been demonstrated at a large enough scale to be used for business-sized problems, and early customer comparisons suggest that such technology is not commercially viable. |

| • | The photonic approach uses photons of light for qubits. These technologies are in the development stage, with little detail available on their level of integration or roadmaps. |

| | | Three Months ended March 31*, | | | Year Ended December 31, | ||||||||||

| | | 2023 | | | 2022 | | | 2022 | | | 2021 | | | 2020 | |

Revenue | | | $1,583 | | | $1,713 | | | $7,173 | | | $6,279 | | | $5,160 |

Cost of revenue | | | 1,162 | | | 616 | | | 2,923 | | | 1,750 | | | 915 |

Total gross profit | | | 421 | | | 1,097 | | | 4,250 | | | 4,529 | | | 4,245 |

Operating expenses: | | | | | | | | | | | |||||

Research and development | | | 10,915 | | | 6,802 | | | 32,101 | | | 25,401 | | | 20,411 |

General and administrative | | | 11,296 | | | 3,646 | | | 21,539 | | | 11,897 | | | 11,587 |

Sales and marketing | | | 2,900 | | | 1,600 | | | 10,068 | | | 6,179 | | | 3,714 |

Total operating expenses | | | 25,111 | | | 12,048 | | | 63,708 | | | 43,477 | | | 35,712 |

Loss from operations | | | (24,690) | | | (10,951) | | | (59,458) | | | (38,948) | | | (31,467) |

Other income (expense), net: | | | | | | | | | | | |||||

Interest expense | | | (454) | | | (525) | | | (4,633) | | | (1,728) | | | (5,257) |

Government assistance | | | — | | | — | | | — | | | 7,167 | | | 12,027 |

Non-cash interest income on SIF | | | — | | | — | | | 5,673 | | | — | | | — |

Gain on debt extinguishment | | | — | | | — | | | — | | | — | | | 3,873 |

Gain on settlement of warrant liability | | | — | | | — | | | — | | | — | | | 7,836 |

Gain on investment in marketable securities | | | — | | | — | | | — | | | 1,163 | | | — |

Change in fair value of warrant liabilities | | | 638 | | | — | | | 6,173 | | | — | | | — |

Lincoln Park Purchase Agreement issuance costs | | | — | | | — | | | (629) | | | — | | | — |

Other income (expense), net | | | (102) | | | (181) | | | 1,345 | | | 801 | | | 2,969 |

Total other income (expense), net | | | $82 | | | $(706) | | | $7,929 | | | $7,403 | | | $21,448 |

Net loss | | | $(24,608) | | | $(11,657) | | | $(51,529) | | | $(31,545) | | | $(10,019) |

Foreign currency translation adjustment, net of tax | | | (19) | | | (70) | | | 41 | | | 15 | | | (82) |

Net comprehensive loss | | | $(24,627) | | | $(11,727) | | | $(51,488) | | | $(31,530) | | | $(10,101) |

| * | Our results of operations for the three months ended March 31, 2023 and 2022 are unaudited. |

| • | An increase in personnel-related costs of $0.3 million related to higher salaries; and |

| • | An increase of $0.3 million related to stock-based compensation expense. |

| | | Three months ended March 31, | | | Change | |||||||

| | | 2023 | | | 2022 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Research and development | | | $10,915 | | | $6,802 | | | $4,113 | | | 60% |

| | | Three months ended March 31, | | | Change | |||||||

| | | 2023 | | | 2022 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

General and administrative | | | $11,296 | | | $3,646 | | | $7,650 | | | 210% |

| | | Three months ended March 31, | | | Change | |||||||

| | | 2023 | | | 2022 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Sales and marketing | | | $2,900 | | | $1,600 | | | $1,300 | | | 81% |

| | | Three months ended March 31, | | | Change | |||||||

| | | 2023 | | | 2022 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Interest expense | | | $454 | | | $525 | | | $(71) | | | (14)% |

| | | Three months ended March 31, | | | Change | |||||||

| | | 2023 | | | 2022 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Change in fair value of warrant liabilities | | | $638 | | | $— | | | $638 | | | 100% |

| | | Three months ended - March 31st | | | Change | |||||||

| | | 2023 | | | 2022 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Other income (expense), net | | | $(102) | | | $(181) | | | $79 | | | (44)% |

| • | An increase in personnel-related costs of $0.5 million associated with the growth of our QCaaS revenue; |

| • | An increase of $0.3 million related to stock-based compensation expense; |

| • | An increase of $0.1 million related to the maintenance and repair of our quantum systems; and |

| • | An increase of $0.1 million related to the increase of depreciation of our quantum systems. |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2022 | | | 2021 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Research and development | | | $32,101 | | | $25,401 | | | $6,700 | | | 26% |

| • | An increase of $2.8 million in stock-based compensation expense primarily relating to new stock option and restricted stock unit awards; |

| • | An increase in personnel-related costs of $1.5 million relating to higher salaries and an increase in headcount; |

| • | An increase in research and development expenditures of $1.5 million resulting from a reduction in Scientific Research and Experimental Development expenditure credits during the year due to the Company’s loss of Canadian Controlled Private Corporation (“CCPC”) status after becoming a public company; |

| • | An increase of $0.6 million in wafer fabrication costs due to increased activity demands; and |

| • | An increase of $0.3 million associated with the increase in third party professional services for various research and development initiatives as we continue to develop new products and enhance existing products, services and technologies. |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2022 | | | 2021 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

General and administrative | | | $21,539 | | | $11,897 | | | $9,642 | | | 81% |

| • | An increase of $4.5 million in third party professional services from legal and accounting consultants, including $0.2 million in transfer agent fees; |

| • | An increase of $1.5 million in stock-based compensation due to the issuance of stock option and restricted stock unit awards; |

| • | An increase of $2.1 million in personnel-related expenses due to an increase in headcount and higher salaries; |

| • | An increase of $1.2 million related to the increase in Directors and Officers insurance costs; |

| • | An increase of $0.3 million related to an increase from software licensing fees; and |

| • | An increase of $0.1 million related to other operating costs. |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2022 | | | 2021 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Sales and marketing | | | $10,068 | | | $6,179 | | | $3,889 | | | 63% |

| • | An increase of $2.8 million in stock-based compensation due to the issuance of stock option and restricted stock unit awards; |

| • | An increase of $0.9 million in personnel-related costs resulting from an increase in headcount and higher salaries; |

| • | An increase of $0.4 million in public relations, advertising, and marketing costs; |

| • | An increase of $0.3 million in other expenses; with |

| • | The above increases partially offset by a decrease of $0.5 million in promotion and conference costs. |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2022 | | | 2021 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Interest expense | | | $(4,633) | | | $(1,728) | | | $(2,905) | | | 168% |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2022 | | | 2021 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Government assistance | | | $— | | | $7,167 | | | $(7,167) | | | (100)% |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2022 | | | 2021 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Non-cash interest income on SIF | | | $5,673 | | | $— | | | $5,673 | | | 100% |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2022 | | | 2021 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Gain on investment in marketable securities | | | $— | | | $1,163 | | | $(1,163) | | | -100% |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2022 | | | 2021 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Change in fair value of warrant liabilities | | | $6,173 | | | $— | | | $6,173 | | | 100% |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2022 | | | 2021 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Lincoln Park Purchase Agreement issuance costs | | | $(629) | | | $— | | | $(629) | | | 100% |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2022 | | | 2021 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Other income, net | | | $1,345 | | | $801 | | | $544 | | | 68% |

| • | An increase of $1.4 million in professional services revenue related to the completion of certain customer deliverables of our remote systems; |

| • | An increase of $0.1 million in our QCaaS revenue; with |

| • | The above increases partially offset by a decrease of $0.4 million in other revenue mainly due to the completion of a customer contract during the year ended December 31, 2020. |

| • | An increase of personnel-related costs of $0.9 million associated with providing services as a result of the growth of our professional services and our QCaaS offerings during the year ended December 31, 2021; |

| • | Offset by a reduction of $0.1 million in other costs during the year ended December 31, 2021. |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2021 | | | 2020 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Research and development | | | $25,401 | | | $20,411 | | | $4,990 | | | 24% |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2021 | | | 2020 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

General and administrative | | | $11,897 | | | $11,587 | | | $310 | | | 3% |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2021 | | | 2020 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Sales and marketing | | | $6,179 | | | $3,714 | | | $2,465 | | | 66% |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2021 | | | 2020 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Interest expense | | | $(1,728) | | | $(5,257) | | | $3,529 | | | (67)% |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2021 | | | 2020 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Government assistance | | | $7,167 | | | $12,027 | | | $(4,860) | | | (40)% |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2021 | | | 2020 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Gain on debt extinguishment | | | $— | | | $3,873 | | | $(3,873) | | | (100)% |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2021 | | | 2020 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Gain on settlement of warrant liability | | | $— | | | $7,836 | | | $(7,836) | | | (100)% |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2021 | | | 2020 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Gain on investment in marketable securities | | | $1,163 | | | $— | | | $1,163 | | | 100% |

| | | Year Ended December 31, | | | Change | |||||||

| | | 2021 | | | 2020 | | | Amount | | | % | |

| | | (In thousands, except percentages) | ||||||||||

Other income, net | | | $801 | | | $2,969 | | | $(2,168) | | | (73)% |

| | | Three Months Ended March 31, | | | Year Ended December 31, | ||||||||||

| | | 2023 | | | 2022 | | | 2022 | | | 2021 | | | 2020 | |

Net cash (used in) provided by: | | | | | | | | | | | |||||

Operating Activities | | | $(13,574) | | | $(9,509) | | | $(45,226) | | | $(34,800) | | | $(29,287) |

Investing Activities | | | (76) | | | (144) | | | (498) | | | (1,999) | | | (789) |

Financing Activities | | | 15,592 | | | 17,872 | | | 43,265 | | | 24,913 | | | 43,144 |

Effect of exchange rate changes on cash and cash equivalents | | | (19) | | | (41) | | | 41 | | | 34 | | | (13) |

Net (decrease) increase in cash and cash equivalents | | | $1,923 | | | $8,178 | | | $(2,418) | | | $(11,852) | | | $13,055 |

| | | Payments due by period (3) | |||||||||||||

| | | Total | | | Less than 1 year | | | 1 - 3 year | | | 4 - 5 year | | | More than 5 years | |

Lease commitment(1) | | | $14,227 | | | $1,533 | | | $2,478 | | | $2,367 | | | $7,849 |

Promissory note – related party(2) | | | 420 | | | 420 | | | — | | | — | | | $— |

Total | | | $14,647 | | | $1,953 | | | $2,478 | | | $2,367 | | | $7,849 |

| (1) | Includes operating lease liabilities for certain of our offices and facilities. |

| (2) | Promissory notes – related party are described in Note 13, Promissory note – related party of the Notes to Consolidated Financial Statements included herein. |

| (3) | Excludes the Venture Loan entered into on March 3, 2022 by and between the Borrowers, and PSPIB, as the loan has since been repaid. |

| • | identify the contract with the customers |

| • | identify the performance obligations; |

| • | determine the transaction price; |

| • | allocate the transaction price to the performance obligations; and |

| • | recognize revenue when (or as) the entity satisfies a performance obligation. |

| • | Alan E. Baratz, President, Chief Financial Officer and Director; |

| • | John M. Markovich, Chief Financial Officer; and |

| • | Victoria Brydon, Chief People Officer |

Name and Principal Position | | | Year | | | Salary ($) | | | Stock Awards ($)(1) | | | Option Awards ($)(2) | | | Non-Equity Incentive Plan Compensation ($)(3) | | | All Other Compensation ($)(4) | | | Total ($) |

Alan E. Baratz President & Chief Executive Officer, Director | | | 2022 | | | 491,667 | | | 10,050,000 | | | — | | | 273,333 | | | 1,348 | | | 10,816,348 |

| | 2021 | | | 450,000 | | | — | | | — | | | 144,000 | | | 1,329 | | | 595,329 | ||

John M. Markovich(5) Chief Financial Officer | | | 2022 | | | 350,000 | | | 3,517,500 | | | — | | | 144,000 | | | 51 | | | 4,011,551 |

| | 2021 | | | 118,834 | | | — | | | 5,161,080 | | | 30,294 | | | — | | | 5,310,208 | ||

Victoria Brydon Chief People Officer | | | 2022 | | | 191,528 | | | 818,432 | | | 537,600 | | | 60,871 | | | 122 | | | 1,608,553 |

| (1) | The amounts reported in this column reflect the grant date fair value of restricted share unit awards made under the 2022 Plan (as defined below) to the NEOs listed in this table, computed in accordance with FASB ASC Topic 718 for stock-based compensation transactions. Assumptions used in the calculation of these amounts are included in note 2 to our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2022. |

| (2) | The amounts reported in this column reflect the grant date fair value of stock option awards made under the 2022 Plan and 2020 Plan (as defined below) to the NEOs, computed in accordance with ASC 718 for stock-based compensation transactions. Assumptions used in the calculation of these amounts are included in note 12 to our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2022. These amounts do not reflect the actual economic value that will be realized by the NEO upon the vesting of the stock options, the exercise of the stock options, or the sale of the Common Shares underlying such stock options. |

| (3) | For 2022, the amounts reported in this column reflect annual cash incentive earned by each NEO determined by the Company’s Compensation Committee. |

| (4) | For 2022 and 2021, the amounts reported in this column represent life insurance premiums paid by D-Wave for the benefit of the NEOs and represent a reimbursement to Dr. Baratz for tax accounting expenses. |

| (5) | Mr. Markovich commenced employment on August 20, 2021. |

| | | Option Awards | | | Stock Awards | |||||||||||||

Name | | | Number of Securities Underlying Unexercised Options (#) Exercisable(1) | | | Number of Securities Underlying Unexercised Options (#) Unexercisable(1) | | | Option Exercise Price ($) | | | Option Expiration Date | | | Number of Shares or Units of Stock That Have Not Vested (#) | | | Market Value of Shares or Units of Stock That Have Not Vested ($)(8) |

Alan E. Baratz | | | 2,920,208 | | | — | | | 0.81 | | | 5/5/2030 | | | 2,500,000(5) | | | 3,600,000 |

John M. Markovich | | | 500,498 | | | 1,000,888(2) | | | 0.82 | | | 8/20/2031 | | | 875,000(6) | | | 1,260,000 |

Victoria Brydon | | | 159,283 | | | — | | | 0.81 | | | 5/05/30 | | | 203,590(7) | | | 293,170 |

| | 68,666 | | | 37,648(3) | | | 0.81 | | | 5/05/30 | | | | | ||||

| | — | | | 120,000(4) | | | 10.07 | | | 8/18/32 | | | | | ||||

| (1) | Except as otherwise noted, these amounts represent Common Shares issuable upon exercise of previously granted options of D-Wave Systems, following the Merger. |

| (2) | The remaining portion of the option vests in equal monthly installments on the 20th of each month through August 20, 2025. |

| (3) | The remaining portion of the option vests in equal monthly installments on the 5th of each month through May 5, 2024. |

| (4) | The option vested as to 30,000 shares on February 16, 2023, with the remaining portion of the option vesting in equal monthly installments on the 16th of each month through February 16, 2026. |

| (5) | 1,000,000 of these restricted share units vest at a rate of 50% on the first and second anniversaries of the grant date of October 27, 2022. 1,500,000 of these restricted share units vest at a rate of 50% on the first anniversary and then 25% on each of the second and third anniversaries of the grant date of October 27, 2022. |

| (6) | 875,000 of these restricted shares vest at a rate of 50% on the first anniversary of the grant date and then 25% on each of the second and third anniversaries of the grant date of October 27, 2022. |

| (7) | 203,590 of these restricted shares will vest at a rate of 50% on the first anniversary of the grant date and then 25% on each of the second and third anniversaries of the grant date of October 27, 2022. |

| (8) | The market value of these shares is based on the closing price of D-Wave Quantum on December 30, 2022 ($1.44 per share). |

Name | | | Fees Earned or Paid in Cash ($)(1) | | | Stock Awards ($)(2) | | | All Other Compensation ($) | | | Total ($) |

Amy Cappellanti-Wolf | | | 48,333 | | | 146,814 | | | — | | | 195,147 |

Emil Michael | | | 35,833 | | | 116,664 | | | — | | | 152,497 |

Michael Rogers | | | 42,500 | | | 146,814 | | | — | | | 189,314 |

Steven M. West | | | 60,833 | | | 116,664 | | | — | | | 177,497 |

Roger Biscay | | | 45,833 | | | 146,814 | | | — | | | 192,647 |

Eduard van Gelderen(3) | | | — | | | — | | | — | | | — |

| (1) | Cash retainers were prorated from August 2022 through May 2023. |

| (2) | RSUs awarded and vest 100% at the Annual Meeting. |

| (3) | Mr. van Gelderen was not eligible to be compensated for his board position. |

Name | | | Shares Underlying Options Outstanding at Fiscal Year End (#) | | | Stock Awards Outstanding at Fiscal Year End (#)(1) |

Amy Cappellanti-Wolf | | | — | | | 36,521 |

Emil Michael | | | — | | | 29,021 |

Michael Rogers | | | — | | | 36,521 |

Steven M. West | | | 311,973 | | | 29,021 |

Roger Biscay | | | — | | | 36,521 |

Eduard van Gelderen(2) | | | — | | | — |

| (1) | RSUs awarded and vest 100% at the Annual Meeting. |

| (2) | Mr. van Gelderen was not eligible to be compensated for his board position. |

Name | | | Age | | | Position |

Executive Officers | | | | | ||

Alan Baratz | | | 68 | | | President, Chief Executive Officer and Director |

John M. Markovich | | | 67 | | | Chief Financial Officer |

Victoria Brydon | | | 49 | | | Chief People Officer |

Diane Nguyen | | | 38 | | | General Counsel and Corporate Secretary |

Non-Employee Directors | | | | | ||

Steven M. West | | | 67 | | | Chair |

Emil Michael | | | 50 | | | Director |

Roger Biscay | | | 55 | | | Director |

Amy Cappellanti-Wolf | | | 58 | | | Director |

Michael Rogers | | | 59 | | | Director |

Ziv Ehrenfeld | | | 48 | | | Director |