- QBTS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1/A Filing

D-Wave Quantum (QBTS) S-1/AIPO registration (amended)

Filed: 19 Oct 22, 5:04pm

Delaware | 7374 | 88-1068854 | ||

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (IRS Employer Identification Number) |

Alan Baratz D-Wave Quantum Inc.3033 Beta Avenue Burnaby, British Columbia V5G 4M9 Canada Tel: (604) 630-1428 | Adam M. Givertz Ian M. Hazlett Christian G. Kurtz Paul, Weiss, Rifkind, Wharton & Garrison LLP 1285 Avenue of the Americas New York, New York 10019-6064 Tel: (212) 373-3000 | Steven McKoen Blake, Cassels & Graydon LLP Suite 2600, 595 Burrard Street Vancouver, British Columbia V7X 1L3, Canada Tel: (604) 631-3300 | ||

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging Growth Company | ☒ | |||||

The information in this prospectus is not complete and may be changed. Neither we nor the selling securityholders may issue or sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 19, 2022

PRELIMINARY PROSPECTUS

D-WAVE QUANTUM INC.

46,147,552 Common Shares

8,000,000 Warrants to Purchase Common Shares

7,352,389 Common Shares Underlying Exchangeable Shares

6,589,154 Common Shares Underlying D-Wave Options

2,889,282 Common Shares Underlying D-Wave Warrants

26,174,387 Common Shares Underlying Warrants

This prospectus relates to the offer and sale from time to time by the selling securityholders named in this prospectus (the “Selling Securityholders”) of:

| • | up to 5,816,528 shares of common stock, par value $0.0001 per share (“Common Shares”) of D-Wave Quantum Inc. (“us”, “we”, “our”, “D-Wave,” “D-Wave Quantum” or the “Company”), purchased in a private placement (the “PIPE Financing” and the Common Shares acquired in the PIPE Financing, the “PIPE Shares”) in connection with the Transaction (as defined below). The PIPE Shares were acquired by the Selling Securityholders at purchase price equivalent to approximately $6.88 per PIPE Share. |

| • | up to 3,015,575 Common Shares issued to the Initial Stockholders (as defined below) and/or their respective affiliates and designees in exchange for the Founder Shares (as defined below) on a one for one basis, which are subject to the Lock-Up Agreement (as defined below). The Founder Shares were acquired by the Initial Stockholders at a purchase price equivalent to approximately $0.008 per share. |

| • | up to 37,315,449 Common Shares issued to D-Wave Equityholders (as defined below) and which are subject to the Lock-Up Agreement (the “D-Wave Equityholder Common Shares”). The D-Wave Equityholder Common Shares were acquired by the Selling Securityholders based on a value of $10.00 per Common Share, however, these shares were issued in exchange for securities of D-Wave Systems (as defined below) that were acquired by employees, investors and others through private placements, equity award grants and other sales at prices that equate to purchase prices of less than $10.00 per share, and, in some cases, including equity securities acquired at purchase prices as low as approximately $0.02 per share; |

| • | up to 7,352,389 Common Shares that we may issue, from time to time, upon exchange, retraction or redemption of exchangeable shares (the “Exchangeable Shares”) of D-Wave Quantum Technologies Inc., an indirect Canadian subsidiary of ours that is referred to in this prospectus as “ExchangeCo,” issued to D-Wave Equityholders and which are subject to the Lock-Up Agreement. The Exchangeable Shares were acquired by the Selling Securityholders based on a value of $10.00 per Exchangeable Share, however, these shares were issued in exchange for securities of D-Wave Systems that were acquired by employees, investors and others through private placements, equity award grants and other sales at prices that equate to purchase prices of less than $10.00 per share, and, in some cases, including equity securities acquired at purchase prices as low as approximately $0.02 per share; |

| • | up to 8,000,000 Warrants (as defined below) issued in exchange for Private Warrants (as defined below) held by CDPM Sponsor Group, LLC (“Sponsor”) which are subject to the Lock-Up Agreement. The Private Warrants were acquired by Sponsor at a purchase price of $1.00 per Private Warrant. Each Warrant is exercisable for 1.4541326 Common Shares at an exercise price of $11.50. |

| • | up to 6,589,154 Common Shares issuable upon the exercise of D-Wave Options (as defined below) beneficially owned by certain current and former directors and officers of D-Wave Quantum and its subsidiaries. The D-Wave Options have exercise prices of $0.81 and $0.82. |

| • | up to 2,889,282 Common Shares issuable upon the exercise of D-Wave Warrants (as defined below). The D-Wave Warrants were purchased at a purchase price of approximately $2.16 per D-Wave Warrant and each D-Wave Warrant is exercisable for one Common Share at an exercise price of $1.92. |

In addition, this prospectus relates to (a) the offer and sale from time to time by the Selling Securityholders of up to 11,633,061 Common Shares issuable upon exercise of the Warrants issued in exchange for Private Warrants (b) the issuance by us of up to 7,352,389 Common Shares that are issuable by us upon exchange, retraction or redemption of the Exchangeable Shares and (c) the issuance by us of up to 26,174,387 Common Shares that are issuable by us upon the exercise of Warrants. The Warrants each entitle the holder thereof to purchase one Common Share for $11.50 per share.

The Selling Securityholders may offer, sell or distribute all or a portion of the securities registered hereby publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of the Common Shares or Warrants, except with respect to amounts we may receive upon the exercise of the Warrants. Whether warrantholders will exercise their Warrants, and therefore the amount of cash proceeds we would receive upon exercise, is dependent upon the trading price of the Common Shares, the last reported sales price for which was $5.23 per share on October 18, 2022. Each Warrant is exercisable for 1.4541326 Common Shares at an exercise price of $11.50. Therefore, if and when the trading price of the Common Shares is less than approximately $7.91, the effective exercise price of the Warrants per one Common Share, we expect that warrantholders would not exercise their Warrants. We could receive up to an aggregate of approximately $207 million if all of the Warrants are exercised for cash, but we would only receive such proceeds if and when the warrantholders exercise the Warrants. The Warrants may not be or remain in the money during the period they are exercisable and prior to their expiration, and the Warrants may not be exercised prior to their maturity on August 5, 2027, even if they are in the money, and as such, the Warrants may expire worthless and we may receive minimal proceeds, if any, from the exercise of Warrants. To the extent that any of the Warrants are exercised on a “cashless basis,” we will not receive any proceeds upon such exercise. As a result, we do not expect to rely on the cash exercise of Warrants to fund our operations. Instead, we intend to rely on other sources of cash discussed elsewhere in this prospectus to continue to fund our operations. See “Risk Factors—Risks Related to D-Wave Quantum’s Financial Condition and Status as an Early-Stage Company—We have a history of losses and expect to incur significant expenses and continuing losses for the foreseeable future” and “D-Wave Systems Inc.’s Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

We will bear all costs, expenses and fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue sky” laws. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their sale of Common Shares or Warrants. See “Plan of Distribution.”

Due to the significant number of shares of DPCM Class A Common Stock (as defined below) that were redeemed in connection with the Transaction, the number of Common Shares that the Selling Securityholders can sell into the public markets pursuant to this prospectus may exceed our public float. As a result, the resale of Common Shares pursuant to this prospectus could have a significant negative impact on the trading price of the Common Shares. This impact may be heightened by the fact that, as described above, certain of the Selling Securityholders purchased, or are able to purchase, Common Shares at prices that are well below the current trading price of the Common Shares. The 89,152,764 Common Shares (including Common Shares underlying Warrants and Common Shares underlying Exchangeable Shares) that may be resold pursuant to this prospectus represent approximately 81% of the Common Shares outstanding as of August 5, 2022 (approximately 58% on a fully diluted basis). In addition, we have filed a separate registration statement, or the Lincoln Park Registration Statement, registering the resale by Lincoln Park (as defined below) of up to 15,500,000 Common Shares pursuant to the Purchase Agreement (as defined below). On a combined basis with the 89,152,764 Common Shares being registered on this registration statement, we are registering 104,652,764 Common Shares that may be resold pursuant to the registration statements from time to time representing approximately 95% of the Common Shares (including Common Shares underlying Exchangeable Shares) outstanding as of August 5, 2022 (approximately 69% on a fully-diluted basis). Any sales of such Common Shares by Lincoln Park could similarly have a significant negative impact on the trading price of Common Shares.

We are an “emerging growth company” under applicable Securities and Exchange Commission (“SEC”) rules and, as such, have elected to comply with certain reduced public company disclosure requirements for this prospectus and future filings. See “Prospectus Summary—Implications of Being an Emerging Growth Company.”

Our Common Shares and Warrants are listed on the New York Stock Exchange (the “NYSE”) under the symbols “QBTS” and “QBTS.WT”, respectively. On October 18, 2022, the last reported sales prices of the Common Shares and the Warrants on the NYSE were $5.23 and $0.27, respectively.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 23 of this prospectus, and under similar headings in any amendments or supplements to this prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022.

TABLE OF CONTENTS

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 8 | ||||

| 11 | ||||

| 22 | ||||

| 23 | ||||

| 64 | ||||

| 65 | ||||

| 66 | ||||

| 78 | ||||

| 97 | ||||

| 112 | ||||

| 114 | ||||

| 122 | ||||

| 129 | ||||

| 138 | ||||

| 152 | ||||

| 154 | ||||

| 158 | ||||

| 160 | ||||

| 170 | ||||

| 175 | ||||

| 177 | ||||

| 177 | ||||

| 177 | ||||

| F-1 | ||||

| II-1 | ||||

1

ABOUT THIS PROSPECTUS

This Prospectus is part of a registration statement on Form S-1 that we filed with the SEC. The Selling Securityholders may offer, sell or distribute all or a portion of the Common Shares and Warrants hereby registered publicly or through private transactions at prevailing market prices or at negotiated prices, from time to time in one or more offerings as described in this prospectus. We will not receive any of the proceeds from such sales of the Common Shares or Warrants, except with respect to amounts received by us upon the exercise of the Warrants. We will bear all costs, expenses and fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue sky” laws. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their sale of Common Shares or Warrants. See “Plan of Distribution.”

We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part that may contain material information relating to these offerings. The prospectus supplement or post-effective amendment may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. Before purchasing any securities, you should carefully read this prospectus, any post-effective amendment, and any applicable prospectus supplement, together with the additional information described in the “Where You Can Find More Information” section of this prospectus.

Neither we nor the Selling Securityholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus, any post-effective amendment, or any applicable prospectus supplement prepared by or on behalf of us or to which we have referred you. We and the Selling Securityholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the Selling Securityholders will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus, any post-effective amendment and any applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus contains, and any post-effective amendment or any prospectus supplement may contain, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included in this prospectus, any post-effective amendment or any prospectus supplement may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed in the “Risk Factors” section of this prospectus, any post-effective amendment and the applicable prospectus supplement. Accordingly, investors should not place undue reliance on this information.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

We and our respective subsidiaries own or have rights to trademarks, trade names and service marks that we use in connection with the operation of our business. In addition, their names, logos and website names and addresses are their trademarks or service marks. Other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners. Solely for convenience, in some cases, the trademarks, trade names and service marks referred to in this prospectus are listed without the applicable ®, ™ and SM symbols, but they will assert, to the fullest extent under applicable law, their rights to these trademarks, trade names and service marks.

2

INDUSTRY AND MARKET DATA

In this prospectus, we present industry data, information and statistics regarding the markets in which we compete as well as publicly available information, industry and general publications and research and studies conducted by third parties. This information is supplemented where necessary with our own internal estimates and information obtained from discussions with our customers, taking into account publicly available information about other industry participants and our management’s judgment where information is not publicly available. This information appears in “Business” and other sections of this prospectus.

Industry publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable. However, forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in any forecasts or estimates.

3

FREQUENTLY USED TERMS

Unless otherwise stated or unless the context otherwise requires, the terms “D-Wave Quantum,” “D-Wave,” “Company,” “the registrant,” “we,” “us” and “our” refers to D-Wave Quantum Inc., a Delaware corporation, together with its subsidiaries.

In addition, in this prospectus:

“Amended and Restated Sponsor Support Agreement” means the letter agreement, dated as of June 16, 2022, by and among DPCM, the Sponsor, D-Wave Systems and D-Wave Quantum, which superseded and replaced the letter agreement, dated as of February 7, 2022, by and among DPCM, the Sponsor, D-Wave and D-Wave Quantum.

“Assignment, Assumption and Amendment Agreement” means that certain Assignment, Assumption and Amendment Agreement, entered into immediately prior to the Effective Time, by and among DPCM, D-Wave Quantum, Continental Stock Transfer & Trust Company, as the existing warrant agent, and Computershare, as the successor warrant agent.

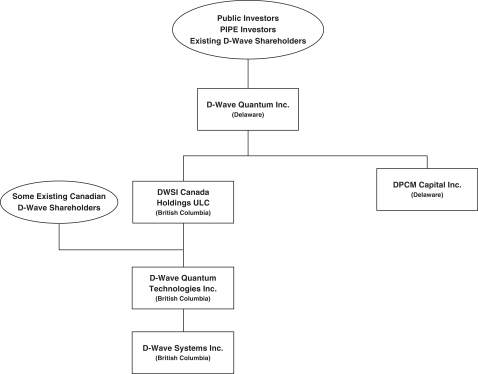

“CallCo” means DWSI Canada Holdings ULC, a British Columbia unlimited liability company and a direct, wholly-owned subsidiary of D-Wave Quantum.

“Common Shares” means the shares of the common stock, par value $0.0001 per share, of D-Wave Quantum.

“Computershare” means, together, Computershare Inc., a Delaware corporation and its affiliate, Computershare Trust Company, N.A., a federally chartered trust company.

“Court of Chancery” means the Court of Chancery of the State of Delaware.

“D-Wave Equityholders” means the shareholders of D-Wave Systems and the holders of other equity interests in D-Wave Systems (including D-Wave Options and D-Wave Warrants), in each case, prior to the Effective Time.

“D-Wave Option” means each option to purchase shares of common stock of D-Wave Systems issued and outstanding under D-Wave’s 2020 Equity Incentive Plan that, at the Effective Time, became exercisable for a Common Share.

“D-Wave Shares” means shares of D-Wave Systems Inc. outstanding prior to the consummation of the Transaction.

“D-Wave Quantum” means D-Wave Quantum Inc., a Delaware corporation.

“D-Wave Quantum Charter” means the amended and restated certificate of incorporation of D-Wave Quantum.

“D-Wave Systems” means D-Wave Systems Inc., a British Columbia corporation.

“D-Wave Warrants” means the warrants exercisable for D-Wave Systems preferred stock that were outstanding as of immediately prior to the consummation of the Transaction, that, at the Effective Time, became exercisable for Common Shares.

“DGCL” means the Delaware General Corporation Law.

“DPCM” means DPCM Capital, Inc., a Delaware corporation and a direct, wholly-owned subsidiary of D-Wave Quantum Inc.

4

“DPCM Board” means the board of directors of DPCM.

“DPCM Class A Common Stock” means the shares of DPCM’s Class A common stock, par value $0.0001 per share.

“DPCM Class B Common Stock” means the shares of DPCM’s Class B common stock, par value $0.0001 per share.

“DPCM Common Stock” means the DPCM Class A Common Stock and DPCM Class B Common Stock.

“DPCM IPO” means DPCM’s initial public offering, consummated on November 17, 2020, through the sale of 30,000,000 DPCM Units at $10.00 per DPCM Unit.

“DPCM Merger” means the merger of Merger Sub with and into DPCM.

“DPCM Public Stockholders” means holders of Public Shares, including the Initial Stockholders to the extent the Initial Stockholders hold Public Shares; provided, that the Initial Stockholders are considered a “DPCM Public Stockholder” only with respect to any Public Shares held by them.

“DPCM Unit” means one share of DPCM Class A Common Stock and one-third of one warrant of DPCM, whereby each whole warrant entitled the holder thereof to purchase one share of DPCM Class A Common Stock at an exercise price of $11.50 per share of DPCM Class A Common Stock, sold in the DPCM IPO.

“DPCM Warrants” means, collectively, the Public Warrants and the Private Warrants.

“Effective Time” means the time the Certificate of Merger in respect of the DPCM Merger became effective in accordance with the DGCL.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, together with the rules and regulations promulgated thereunder.

“Exchange Ratio” means 1.4541326 Common Shares received by non-redeeming DPCM Public Stockholders for each share of DPCM Class A Common Stock exchanged in the Transaction.

“Exchangeable Shares” means the exchangeable shares in the capital of ExchangeCo.

“ExchangeCo” means D-Wave Quantum Technologies Inc., a British Columbia corporation and a direct, wholly-owned subsidiary of CallCo.

“Forfeited Shares” means 4,484,425 shares of DPCM Class B Common Stock that Sponsor will irrevocably forfeit and surrender immediately prior to the Closing for no consideration as a contribution to the capital of DPCM, in accordance with the Amended and Restated Sponsor Support Agreement.

“Founder Shares” means the 7,500,000 shares of DPCM Class B Common Stock that were owned by the Initial Stockholders prior to the Transaction.

“GAAP” means generally accepted accounting principles in the United States.

“Initial Stockholders” means the Sponsor and certain of DPCM’s former officers, directors and other special advisors.

“IRS” means the U.S. Internal Revenue Service.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012.

“Merger Sub” means DWSI Holdings Inc., a Delaware corporation and a direct, wholly-owned subsidiary of D-Wave Quantum.

5

“NYSE” means the New York Stock Exchange.

“PIPE Financing” means the sale to the PIPE Investors of an aggregate number of Common Shares in exchange for an aggregate purchase price of $40.0 million pursuant to the PIPE Subscription Agreements.

“PIPE Investors” means persons that entered into subscription agreements to purchase Common Shares pursuant to the PIPE Subscription Agreements on or prior to the date of the Transaction Agreement, which included certain D-Wave Equityholders and certain Initial Stockholders.

“PIPE Subscription Agreements” means those certain subscription agreements executed by PIPE Investors on or before the date of the Transaction Agreement in connection with the PIPE Financing.

“Private Warrants” means the warrants held by the Sponsor that were issued to the Sponsor at the closing of the DPCM IPO, each of which was exercisable, at an exercise price of $11.50, for one share of DPCM Class A Common Stock, in accordance with its terms, prior to the consummation of the Transaction.

“Public Shares” means the DPCM Class A Common Stock included in the DPCM Units issued in the DPCM IPO.

“Public Warrants” means the warrants included in the DPCM Units issued in the DPCM IPO, each of which was exercisable, at an exercise price of $11.50, for one share of DPCM Class A Common Stock, in accordance with its terms, prior to the consummation of the Transaction.

“QCaaS” means quantum computing as a service.

“Registration Rights and Lock-Up Agreement” means that certain Registration Rights and Lock-Up Agreement, deemed to be entered into among D-Wave Quantum, certain holders of DPCM Class B Common Stock, and certain shareholders of D-Wave pursuant to the Plan of Arrangement.

“Registration Rights Holders” means certain former holders of DPCM Class B Common Stock, and certain former shareholders of D-Wave.

“Rule 144” means Rule 144 under the Securities Act.

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002.

“SEC” means the United States Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Sponsor” means CDPM Sponsor Group, LLC, a Delaware limited liability company.

“Transaction” means the transactions contemplated by the Transaction Agreement, including, among other things, the DPCM Merger and the Arrangement, whereby DPCM and D-Wave became subsidiaries of D-Wave Quantum.

“Transaction Agreement” means, as amended, amended and restated, supplemented or otherwise modified from time to time, the Transaction Agreement, dated as of February 7, 2022, by and among DPCM, D-Wave Quantum, Merger Sub, CallCo, ExchangeCo and D-Wave.

“Trust Account” means the trust account of DPCM that held the proceeds from the DPCM IPO.

“Trustee” or “Transfer Agent,” as applicable, means Computershare.

“U.S. Tax Code” means the U.S. Internal Revenue Code of 1986, as amended.

6

“Warrant Agreement” means the Warrant Agreement, by and between DPCM and Continental Stock Transfer & Trust Company, as warrant agent, dated as of October 20, 2020, which was amended and supplemented by the Assignment, Assumption and Amendment Agreement.

“Warrants” means the Warrants of D-Wave Quantum, which are exercisable for Common Shares.

7

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this prospectus may constitute “forward-looking statements” for purposes of the federal securities laws. Our forward-looking statements include, but are not limited to, statements regarding D-Wave Quantum’s and D-Wave Quantum’s management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. In some cases, you can identify forward-looking statements by the following words: “believe,” “may,” “will,” “could,” “would,” “should,” “would,” “expect,” “intend,” “plan,” “anticipate,” “trend,” “believe,” “estimate,” “predict,” “project,” “potential,” “seem,” “seek,” “future,” “outlook,” “forecast,” “projection,” “continue,” “ongoing,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. These statements involve risks, uncertainties, and other factors that may cause actual results, levels of activity, performance, or achievements to be materially different from the information expressed or implied by these forward-looking statements. We caution you that these statements are based on a combination of facts and factors currently known by us and our projections of the future, which are subject to a number of risks. Forward-looking statements in this prospectus may include, for example, statements about:

| • | the expected benefits of the Transaction; |

| • | D-Wave Quantum’s future growth and innovations; |

| • | the increased adoption of quantum computing solutions and expansion of related market opportunities and use cases; |

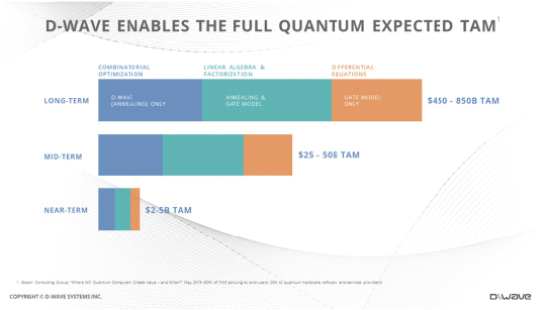

| • | the estimated total addressable market (“TAM”) for quantum computing and expectations regarding product development and functionality; |

| • | D-Wave Quantum’s financial and business performance following the Transaction, including financial projections and business metrics; |

| • | changes in D-Wave Quantum’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects and plans; |

| • | the ability of D-Wave Quantum’s products and services to meet customers’ compliance and regulatory needs; |

| • | D-Wave Quantum’s ability to attract and retain qualified employees and management; |

| • | D-Wave Quantum’s ability to develop and maintain its brand and reputation; |

| • | developments and projections relating to D-Wave Quantum’s competitors and industry; |

| • | the impact of health epidemics, including the COVID-19 pandemic, on D-Wave Quantum’s business and the actions D-Wave may take in response thereto; |

| • | D-Wave Quantum’s expectations regarding its ability to obtain and maintain intellectual property protection and not infringe on the rights of others; |

| • | expectations regarding the time during which we will be an emerging growth company under the JOBS Act; |

| • | D-Wave Quantum’s future capital requirements and sources and uses of cash; |

| • | D-Wave Quantum’s ability to obtain funding for its operations and future growth; and |

| • | D-Wave Quantum’s business, expansion plans and opportunities. |

These forward-looking statements are based on information available as of the date of this prospectus, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties and are not predictions of actual performance. Accordingly, forward-looking statements should not be relied upon as

8

representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

You should not place undue reliance on these forward-looking statements in making an investment decision with respect to the securities offered under this prospectus. These forward-looking statements are not intended to serve as, and must not be relied on as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability regarding future performance, events or circumstances. Many of the factors affecting actual performance, events and circumstances are beyond the control of D-Wave and D-Wave Quantum. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements.

Some factors that could cause actual results to differ include:

| • | anticipated trends, growth rates, and challenges in companies, such as D-Wave Quantum, that are engaged in the business of quantum computing and in the markets in which it operates; |

| • | the risk that D-Wave Quantum’s securities will not maintain a listing on the NYSE; |

| • | D-Wave Quantum’s ability to recognize the anticipated benefits of the Transaction, which may be affected by, among other things, competition and the ability of D-Wave Quantum to grow and achieve and maintain profitably following the Transaction; |

| • | risks related to the uncertainty of the unaudited prospective forecasted financial information; |

| • | risks related to the performance of D-Wave Quantum’s business and the timing of expected business or financial milestones; |

| • | unanticipated technological or project development challenges, including with respect to the cost and or timing thereof; |

| • | the performance of D-Wave Quantum’s products and services; |

| • | the effects of competition on D-Wave Quantum’s business; |

| • | changes in the business of D-Wave Quantum and D-Wave Quantum’s market, financial, political and legal conditions; |

| • | the risk that D-Wave Quantum will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; |

| • | the risk that D-Wave Quantum may never achieve or sustain profitability; |

| • | the risk that D-Wave Quantum is unable to secure or protect its intellectual property; |

| • | changes in applicable laws or regulations; |

| • | the effect of the COVID-19 pandemic, geopolitical events, natural disasters, wars, terrorist acts or a combination of these factors on D-Wave Quantum’s business and the economy in general; |

| • | the ability of D-Wave Quantum to execute its business model, including market acceptance of its planned products and services; |

| • | D-Wave Quantum’s ability to raise capital; |

| • | the possibility that D-Wave Quantum may be negatively impacted by other economic, business, and/or competitive factors; |

| • | risks stemming from inflation; |

| • | any changes to applicable tax laws, including U.S. tax laws; and |

| • | other risks and uncertainties described in this prospectus, including those under the section titled “Risk Factors.” |

9

In addition, statements that “D-Wave believes” or “D-Wave Quantum believes” and similar statements reflect D-Wave Quantum’s beliefs and opinions on the relevant subject. These statements are based upon information available to D-Wave Quantum as of the date of this prospectus, and while D-Wave Quantum believes such information forms a reasonable basis for such statements, such information may be limited or incomplete, and such statements should not be read to indicate that such party has conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

10

PROSPECTUS SUMMARY

This summary highlights selected information from this prospectus and does not contain all of the information that is important to you in making an investment decision. This summary is qualified in its entirety by the more detailed information included in this prospectus. Before making your investment decision with respect to our securities, you should carefully read this entire prospectus, including the information under “Risk Factors,” “D-Wave Systems Inc.’s Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “D-Wave Quantum Inc.’s Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the financial statements included elsewhere in this prospectus.

Unless otherwise indicated or the context otherwise requires, references in this prospectus to “Company”, “D-Wave Quantum,” “D-Wave,” “we,” “our,” “us” and other similar terms refer to D-Wave Quantum Inc. and our consolidated subsidiaries.

General

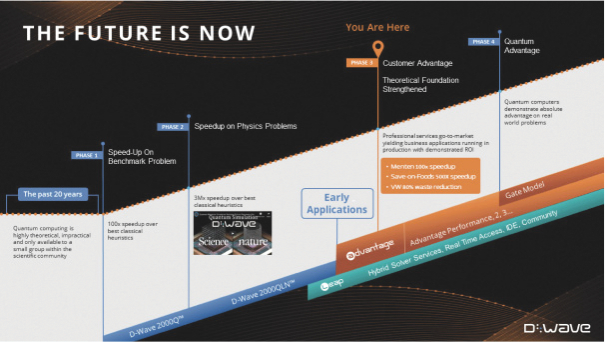

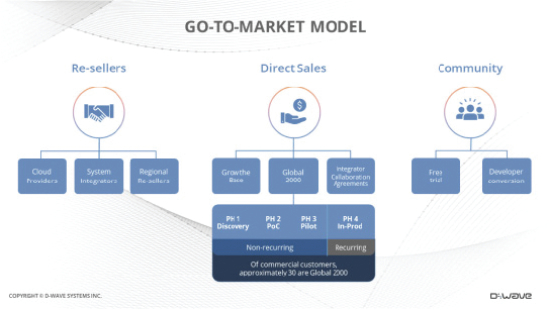

D-Wave Quantum Inc., a Delaware corporation, is the parent holding company of D-Wave Systems Inc., a leader in the development and delivery of quantum computing systems, software and services, and is the world’s first commercial supplier of quantum computers—and the only company developing both annealing quantum computers and gate-model quantum computers. Its mission is to unlock the power of quantum computing today to benefit business and society. D-Wave does this by delivering customer value with practical quantum applications for problems as diverse as logistics, artificial intelligence, materials sciences, drug discovery, scheduling, cybersecurity, fault detection, and financial modeling. D-Wave’s systems are being used by some of the world’s most advanced organizations, including NEC Corporation, Volkswagen, DENSO, Lockheed Martin, Forschungszentrum Jülich, University of Southern California, and Los Alamos National Laboratory. With headquarters and the Quantum Engineering Center of Excellence based near Vancouver, Canada, D-Wave’s U.S. operations are based in Palo Alto, California. D-Wave has a blue-chip investor base that includes the Public Sector Pension Investment Board (“PSP”), Goldman Sachs, BDC Capital, NEC Corp., Aegis Group Partners, and In-Q-Tel.

On February 7, 2022, D-Wave entered into the transaction agreement (as amended by the Amendment to the Transaction Agreement dated June 16, 2022, the “Transaction Agreement”) with DPCM, D-Wave Systems, Merger Sub, CallCo, and ExchangeCo. Pursuant to the Transaction Agreement, in a series of transactions including the Arrangement (as defined below), among other things, Merger Sub merged with and into DPCM (the “DPCM Merger”) with DPCM surviving the merger, as a result of which DPCM became a direct, wholly-owned subsidiary of D-Wave, with the stockholders of DPCM receiving Common Shares, and D-Wave Systems became an indirect subsidiary of D-Wave, as detailed below. On August 5, 2022 (the “Closing Date”), the Transaction and the Arrangement were consummated (the “Closing”).

Immediately following the DPCM Merger, the parties proceeded to effect the Arrangement on the terms and subject to the conditions set forth in the Plan of Arrangement and the Transaction Agreement or made at the direction of the Court in accordance with the Interim Order or the Final Order (as defined below). Pursuant to the Plan of Arrangement, (i) CallCo acquired a portion of the issued and outstanding D-Wave Shares from certain holders in exchange for Common Shares in the D-Wave Quantum Share Exchange (as defined below), (ii) CallCo contributed such D-Wave Shares to ExchangeCo in exchange for ExchangeCo Common Shares, (iii) following the D-Wave Quantum Share Exchange, ExchangeCo acquired the remaining issued and outstanding D-Wave Shares from the remaining holders of D-Wave Shares in exchange for Exchangeable Shares and (iv) as a result of the foregoing, D-Wave become a wholly-owned subsidiary of ExchangeCo. The holders of the Exchangeable Shares have certain rights as specified in the Exchangeable Share Support Agreement and the Voting and Exchange Trust Agreement, including the right to exchange Exchangeable Shares for Common

11

Shares, subject to the terms and conditions of the Exchangeable Shares (the “Arrangement”). In addition, pursuant to and following the Arrangement, D-Wave Options and D-Wave Warrants became exercisable for Common Shares.

On February 7, 2022, concurrently with the execution of the Transaction Agreement, the PIPE Investors entered into PIPE Subscription Agreements pursuant to which the PIPE Investors committed to purchase a number of PIPE Shares equal to the aggregate purchase price for all Common Shares subscribed for by each PIPE Investor, divided by $10.00 and multiplied by the Exchange Ratio, for an aggregate purchase price of $40.0 million. On the Closing Date 5,816,528 Common Shares were issued the PIPE Investors in the PIPE Financing, which closed substantially concurrently with Closing.

On June 16, 2022, D-Wave, D-Wave Systems and DPCM entered into a purchase agreement (the “Purchase Agreement”) with Lincoln Park Capital Fund, LLC (“Lincoln Park”) pursuant to which Lincoln Park has agreed to purchase from D-Wave, at the option of D-Wave, up to $150,000,000 of Common Shares from time to time over a 36-month period following the Closing and upon the satisfaction of certain other conditions set forth in the Purchase Agreement (the “Commencement Date”). In accordance with the Lincoln Park Purchase Agreement, on the Closing Date, D-Wave issued 127,180 Common Shares to Lincoln Park in respect of $875,000 of the total Commitment Fee (as defined below). See “—Lincoln Park Transaction” below.

Prior to Closing, DPCM Public Stockholders exercised their redemption rights in respect of 29,097,787 shares of DPCM Class A Common Stock. As a result, immediately prior to the Closing, there were 902,213 shares of DPCM Class A Common Stock outstanding.

As a result of the Transaction, (i) each outstanding unit of DPCM was separated immediately prior to the Effective Time into one share of DPCM Class A Common Stock and one-third of one warrant exercisable for one share of DPCM Class A Common Stock (each whole warrant, a “Public Warrant”), (ii) immediately prior to Closing, Sponsor forfeited 4,484,425 of its 7,252,500 shares of Class B Common Stock, and, at the Effective Time, each remaining outstanding share of Class B Common Stock was converted into and exchanged for the right to receive one newly issued Common Share, (iii) at the Effective Time, each outstanding share of Class A Common Stock was converted into and exchanged for the right to receive 1.4541326 newly issued Common Shares and (iv) at the Effective Time, pursuant to the Warrant Agreement, as amended by the Assignment, Assumption and Amendment Agreement, each Public Warrant and Private Warrant was converted into a Warrant, with each warrant exercisable for 1.4541326 Common Shares for $11.50 per share, subject to adjustment, with the exercise period beginning on September 4, 2022, the date that is 30 days following the Closing Date.

Following the closing of the PIPE Financing, and after giving pro forma effect to redemptions of shares by DPCM Public Stockholders and the payment of transaction expenses, excluding repayments for loans and promissory notes, the transactions described above generated approximately $34.3 million for D-Wave Quantum.

The Common Shares and Warrants are traded on the NYSE under the ticker symbols “QBTS” and “QBTS.WT,” respectively.

The mailing address of D-Wave’s principal office is 3033 Beta Avenue, Burnaby, British Columbia, V5G 4M9 Canada and its telephone number is (604) 630-1428.

Registration Rights and Lock-Up Agreement

Registration Rights and Lock-Up Agreement. At the Closing, D-Wave Quantum, Sponsor, the other holders of DPCM Class B Common Stock and each D-Wave Shareholder (such stockholders, the “Registration Rights

12

Holders”), pursuant to the Plan of Arrangement, became parties to the Registration Rights and Lock-Up Agreement, pursuant to which, among other things, D-Wave Quantum is obligated to file a registration statement to register the resale of certain equity securities of D-Wave Quantum held by the Registration Rights Holders. The Registration Rights and Lock-Up Agreement also provides the Registration Rights Holders with demand registration rights and “piggy-back” registration rights, in each case, subject to certain requirements and customary conditions. Subject to certain exceptions, the Registration Rights and Lock-Up Agreement further provides for the securities of D-Wave Quantum held by the Registration Rights Holders to be locked-up for a period of time as set forth below.

D-Wave Lock-up Period. The D-Wave Lock-Up Period applies to the former shareholders of D-Wave Systems who received Common Shares or Exchangeable Shares pursuant to the Transaction Agreement and refers to the period ending on the earlier of (A) February 5, 2023, the date that is six (6) months following the Closing and (B) the date on which (x) the last reported sale price of the Common Shares equals or exceeds $12.00 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) for any twenty (20) trading days within any thirty (30) consecutive trading day period commencing after the ninetieth (90th) day following the Closing or (y) the completion by D-Wave Quantum of a liquidation, merger, stock exchange, reorganization or other similar transaction that results in all of D-Wave Quantum’s public shareholders having the right to exchange their Common Shares for cash, securities or other property.

Founder Lock-up Period. The Founder Lock-Up Period applies to the former holders of shares of DPCM Class B Common Stock who received Common Shares pursuant to the Transaction Agreement and refers to (i) with respect to the Founder Shares, the period ending on the earlier of (A) August 5, 2023, the date that is one (1) year following the Closing and (B) the date on which (x) the last reported sale price of the Common Shares equals or exceeds $12.00 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) for any twenty (20) trading days within any thirty (30) consecutive trading day period commencing after the one hundred and fiftieth (150th) day following the Closing, or (y) the completion by D-Wave Quantum of a liquidation, merger, stock exchange, reorganization or other similar transaction that results in all of D-Wave Quantum’s public shareholders having the right to exchange their Common Shares for cash, securities or other property, and (ii) with respect to the Private Warrants, thirty (30) days after the Closing.

PSP Side Letter Agreement

On September 26, 2022, D-Wave Quantum and PSP entered into an amended and restated side letter agreement (the “PSP Side Letter Agreement”) pursuant to which PSP agreed that for so long as PSP beneficially owns, directly or indirectly, Common Shares and Exchangeable Shares representing 50% or more of the rights to vote at a meeting of the stockholders of D-Wave Quantum, whether directly or indirectly, including through any voting trust (i) PSP will not exercise the voting rights attached to any of such shares that would result in PSP voting, whether directly or indirectly, including through any voting trust, more than 49.99% of the voting interests eligible to vote at any meeting of the stockholders of D-Wave Quantum and (ii) PSP will vote such shares in favor of the election of the directors that are nominated by the board of directors of D-Wave Quantum or a duly authorized committee thereof.

Use of Proceeds

The Selling Securityholders may offer, sell or distribute all or a portion of the securities registered hereby publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of the Common Shares or Warrants, except with respect to amounts we may receive upon the exercise of the Warrants. Whether warrantholders will exercise their Warrants, and therefore the amount of cash proceeds we would receive upon exercise, is dependent upon the trading price of the Common Shares, the last reported sales price for which was $5.23 per share on October 18, 2022. Each Warrant is

13

exercisable for 1.4541326 Common Shares at an exercise price of $11.50. Therefore, if and when the trading price of the Common Shares is less than approximately $7.91, the effective exercise price of the Warrants per one Common Share, we expect that warrantholders would not exercise their Warrants. We could receive up to an aggregate of approximately $207 million if all of the Warrants are exercised for cash, but we would only receive such proceeds if and when the warrantholders exercise the Warrants. The Warrants may not be or remain in the money during the period they are exercisable and prior to their expiration, and the Warrants may not be exercised prior to their maturity on August 5, 2027, even if they are in the money, and as such, the Warrants may expire worthless and we may receive minimal proceeds, if any, from the exercise of Warrants. To the extent that any of the Warrants are exercised on a “cashless basis,” we will not receive any proceeds upon such exercise. As a result, we do not expect to rely on the cash exercise of Warrants to fund our operations. Instead, we intend to rely on other sources of cash discussed elsewhere in this prospectus to continue to fund our operations. See “Risk Factors—Risks Related to D-Wave Quantum’s Financial Condition and Status as an Early-Stage Company—We have a history of losses and expect to incur significant expenses and continuing losses for the foreseeable future” and “D-Wave Systems Inc.’s Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

Summary Risk Factors

You should consider all the information contained in this prospectus in making an investment decision with respect to the securities offered under this prospectus. The occurrence of one or more of the events or circumstances described in the section titled “Risk Factors,” alone or in combination with other events or circumstances, may harm D-Wave Quantum’s business, financial condition and operating results. Such risks include, but are not limited to:

| • | Due to the significant number of shares of DPCM Class A Common Stock that were redeemed in connection with the Transaction, the number of Common Shares that the Selling Securityholders can sell into the public markets pursuant to this prospectus may exceed our public float. As a result, the resale of Common Shares pursuant to this prospectus could have a significant negative impact on the trading price of our Common Shares. In addition, certain of the Selling Securityholders purchased, or are able to purchase, Common Shares at prices that are well below the current trading price of the Common Shares. As a result, the Selling Securityholders may effect sales of Common Shares at prices significantly below the current market price, which could cause market prices to decline further. |

| • | D-Wave Quantum is in its growth stage which makes it difficult to forecast its future results of operations and its funding requirements. |

| • | D-Wave Systems has a history of losses and expects to incur significant expenses and continuing losses for the foreseeable future. |

| • | If D-Wave Quantum does not adequately fund its research and development efforts or use research and development teams effectively or build a sufficient number of annealing quantum computer production systems, it may not be able to achieve its technological goals, meet customer and market demand, or compete effectively and D-Wave Quantum’s business and operating results may be harmed. |

| • | D-Wave Quantum depends on its ability to retain existing senior management and other key employees and qualified, skilled personnel and to attract new individuals to fill these roles as needed. If D-Wave Quantum is unable to do so, such failure could adversely affect its business, results of operations and financial condition. |

| • | D-Wave Quantum expects to require additional capital to pursue its business objectives, growth strategy and respond to business opportunities, challenges or unforeseen circumstances, and it may be unable to raise capital or additional financing when needed on acceptable terms, or at all. |

14

| • | D-Wave Quantum’s industry is competitive on a global scale, from both quantum and classical competitors, and D-Wave Quantum may not be successful in competing in this industry or establishing and maintaining confidence in its long-term business prospects among current and future partners and customers, which would materially harm its reputation, business, results of operations and financial condition. |

| • | Any cybersecurity-related attack, significant data breach or disruption of the information technology systems, infrastructure, network, third-party processors or platforms on which D-Wave Quantum relies could damage D-Wave Quantum’s reputation and adversely affect its business and financial results. |

| • | Market adoption of cloud-based online quantum computing platform solutions is relatively new and unproven and may not grow as D-Wave Quantum expects and, even if market demand increases, the demand for D-Wave Quantum’s QCaaS may not increase, or certain customers may be reluctant to use a cloud-based QCaaS for applications, all of which may harm D-Wave Quantum’s business and results of operations. |

| • | D-Wave Quantum may in the future be adversely affected by continuation or worsening of the global COVID-19 pandemic, its various strains or future pandemics. |

| • | System failures, interruptions, delays in service, catastrophic events, inadequate infrastructure and resulting interruptions in the availability or functionality of D-Wave Quantum’s products and services could harm its reputation or subject D-Wave Quantum to significant liability, and adversely affect its business, financial condition and operating results. |

| • | D-Wave Quantum may be unable to obtain, maintain and protect its intellectual property or prevent third parties from making unauthorized use of its intellectual property, which could cause it to lose the competitive advantage resulting from its intellectual property. |

| • | D-Wave Quantum’s patent applications may not result in issued patents or its patent rights may be contested, circumvented, invalidated or limited in scope, any of which could have a material adverse effect on D-Wave Quantum’s ability to prevent others from interfering with the commercialization of its products and services. |

| • | D-Wave Quantum may face patent infringement and other intellectual property claims that could be costly to defend, result in injunctions and significant damage awards or other costs. If third parties claim that D-Wave Quantum infringes upon or otherwise violates their intellectual property rights, D-Wave Quantum’s business could be adversely affected. |

| • | If the Transaction’s benefits do not meet the expectations of investors or securities analysts, the market price of D-Wave Quantum’s securities, may decline. |

| • | Uncertainty about the effect of the Transaction may affect D-Wave Quantum’s ability to retain key employees and integrate management structures and may materially impact the management, strategy and results of its operation as a combined company. |

| • | Financial projections with respect to D-Wave Quantum may not prove to be reflective of actual financial results. |

| • | The historical financial results of D-Wave and unaudited pro forma financial information included elsewhere in this prospectus may not be indicative of what D-Wave’s actual financial position or results of operations would have been if it were a public company. |

| • | D-Wave Quantum may be required to take write-downs or write-offs, or D-Wave Quantum may be subject to restructuring, impairment or other charges that could have a significant negative effect on D-Wave Quantum’s financial condition, results of operations and the price of D-Wave Quantum’s securities, which could cause you to lose some or all of your investment. |

| • | The stock price of Common Shares may be volatile or may decline regardless of its operating performance. |

15

| • | D-Wave Quantum may amend the terms of the Warrants in a manner that may be adverse to holders with the approval by the holders of at least a majority of the then outstanding Warrants. |

| • | D-Wave Quantum may issue additional Common Shares or other equity securities without your approval, which would dilute your ownership interests and may depress the market price of the Common Shares. |

| • | The amended and restated certificate of incorporation of D-Wave Quantum (the “D-Wave Quantum Charter”) contains anti-takeover provisions that could adversely affect the rights of its stockholders. |

Implications of Being an Emerging Growth Company

In April 2012, the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, was enacted. Section 107 of the JOBS Act provides that an “emerging growth company” may take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. Therefore, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected to avail ourselves of this extended transition period and, as a result, we will not adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies. In addition, as an emerging growth company, we may take advantage of certain reduced disclosure and other requirements that are otherwise applicable generally to public companies. D-Wave Quantum will take advantage of these exemptions until such earlier time that it is no longer an emerging growth company. D-Wave Quantum will cease to be an emerging growth company on the date that is the earliest of (i) the last day of the fiscal year following the fifth anniversary of the date of our first public offering of securities; (ii) the last day of the fiscal year in which our total annual gross revenue is equal to or more than $1.07 billion; (iii) the date on which we have issued more than $1.0 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the SEC.

Lincoln Park Transaction

As described above, on June 16, 2022, we entered into the Purchase Agreement with Lincoln Park, pursuant to which Lincoln Park has agreed to purchase from us up to an aggregate of $150,000,000 of Common Shares (subject to certain limitations) from time to time over the term of the Purchase Agreement. Also on June 16, 2022, we entered into the Registration Rights Agreement, pursuant to which we have filed with the SEC a separate registration statement that includes a prospectus to register for resale under the Securities Act the Common Shares that have been or may be issued to Lincoln Park under the Purchase Agreement (the “Lincoln Park Registration Statement”). We have separately filed a prospectus forming part of the Lincoln Park Registration Statement that covers the resale by the Lincoln Park of up to 15,500,000 Common Shares, comprised of: (i) 381,540 Common Shares that we already issued, at an effective issuance price of 6.88 per Common Share, to Lincoln Park (the “Commitment Shares”) as a commitment fee under the Purchase Agreement and (ii) an additional 15,118,460 Common Shares we may sell to Lincoln Park under the Purchase Agreement from time to time from and after the Commencement Date, as defined below. All sales are at our sole discretion.

Other than the 381,540 Commitment Shares, we do not have the right to commence any sales of Common Shares to Lincoln Park under the Purchase Agreement until the date on which all of the conditions set forth in the Purchase Agreement have been satisfied, including that the SEC has declared effective the Lincoln Park Registration Statement (the “Commencement Date”). After the Commencement Date, we have the right, but not the obligation, from time to time to direct Lincoln Park to purchase Common Shares having a value of up to $250,000 on any business day (the “Purchase Date”), which may be increased to up to $1,000,000 depending on certain conditions as set forth in the Purchase Agreement (and subject to adjustment for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction as provided in the Purchase Agreement) (each, a “Regular Purchase”). The purchase price per Common Share for a Regular

16

Purchase will be the lower of: (i) the lowest trading price for Common Shares on the applicable Purchase Date and (ii) the average of the three lowest closing sale prices for Common Shares during the ten consecutive business days ending on the business day immediately preceding such Purchase Date. The purchase price per Common Share will be equitably adjusted for any reorganization, recapitalization, non-cash dividend, forward or reverse stock split, or other similar transaction occurring during the business days used to compute such price.

From and after the Commencement Date, we also have the right, but not the obligation, to direct Lincoln Park on each Purchase Date to make “accelerated purchases” on the following business day (the “Accelerated Purchase Date”) up to the lesser of (i) 300% of the number of Common Shares purchased pursuant to a Regular Purchase or (ii) 30% of the total number (or volume) of Common Shares traded on the NYSE during the period on the applicable Accelerated Purchase Date beginning at the Accelerated Purchase Commencement Time (as defined below) for such Accelerated Purchase and ending at the Accelerated Purchase Termination Time (as defined below) for such Accelerated Purchase, at a purchase price equal to the lesser of 95% of (x) the closing sale price of Common Shares on the Accelerated Purchase Date and (y) of the volume weighted average price of Common Shares on the Accelerated Purchase Date (during a time period between the Accelerated Purchase Commencement Time and the Accelerated Purchase Termination Time) (each, an “Accelerated Purchase”). We have the right in our sole discretion to set a minimum price threshold for each Accelerated Purchase in the notice provided with respect to such Accelerated Purchase and we may direct multiple Accelerated Purchases in a day provided that delivery of Common Shares has been completed with respect to any prior Regular Purchases and Accelerated Purchases that Lincoln Park has purchased.

“Accelerated Purchase Commencement Time” means the period beginning at 9:30:01 a.m., Eastern time, on the applicable Accelerated Purchase Date, or such other time publicly announced by the NYSE as the official open (or commencement) of trading on the NYSE on such applicable Accelerated Purchase Date.

“Accelerated Purchase Termination Time” means the earliest of (A) 4:00:00 p.m., Eastern time, on such applicable Accelerated Purchase Date, or such other time publicly announced by the NYSE as the official close of trading on the NYSE on such applicable Accelerated Purchase Date, (B) such time, from and after the Accelerated Purchase Commencement Time for such Accelerated Purchase, that the total number (or volume) of Common Shares traded on the NYSE has exceeded the number of Common Shares equal to (i) the applicable Accelerated Purchase Share Amount (as defined below) to be purchased by the Investor pursuant to the applicable purchase notice delivered for such Accelerated Purchase (the “Accelerated Purchase Notice”), divided by (ii) 30%, and (C) such time, from and after the Accelerated Purchase Commencement Time for such Accelerated Purchase, that the trade price for the Common Shares on the NYSE as reported by the NYSE, has fallen below the applicable minimum per share price threshold set forth in the applicable Accelerated Purchase Notice.

“Accelerated Purchase Share Amount” means, with respect to an Accelerated Purchase, the number of Common Shares directed by the Company to be purchased by Lincoln Park in an Accelerated Purchase Notice, which number of Common Shares shall not exceed the lesser of (i) 300% of the number of Common Shares directed by the Company to be purchased by Lincoln Park pursuant to the corresponding notice for the corresponding Regular Purchase and (ii) an amount equal to (A) 30% multiplied by (B) the total number (or volume) of Common Shares traded on the NYSE during the period on the applicable Accelerated Purchase Date beginning at the Accelerated Purchase Commencement Time for such Accelerated Purchase and ending at the Accelerated Purchase Termination Time for such Accelerated Purchase.

The Purchase Agreement may be terminated by us at any time after the Commencement Date, at our sole discretion, without any cost or penalty, by giving one business day notice to Lincoln Park to terminate the Purchase Agreement.

Actual sales of Common Shares to Lincoln Park under the Purchase Agreement will depend on a variety of factors to be determined by us from time to time, including (among others) market conditions, the trading price

17

of Common Shares and determinations by us as to available and appropriate sources of funding for our operations. The Purchase Agreement prohibits us from issuing or selling and Lincoln Park from acquiring any Common Shares if (i) the closing price of the Common Shares is less than the Floor Price of $1.00 (the “Floor Price”) or (ii) those Common Shares, when aggregated with all other Common Shares then beneficially owned by Lincoln Park and its affiliates, would result in Lincoln Park and its affiliates having beneficial ownership of more than 9.9% of the then issued and outstanding Common Shares, as calculated pursuant to Section 13(d) of the Exchange Act and Rule 13d-3 promulgated thereunder.

Immediately following the closing of the Transaction on August 5, 2022, there were 110,389,512 Common Shares outstanding, including the Exchangeable Shares and including 127,180 Common Shares that we have already issued to Lincoln Park under the Purchase Agreement. Although the Purchase Agreement provides that we may sell up to an aggregate of $150,000,000 of Common Shares to Lincoln Park, only 15,500,000 Common Shares are being offered under the prospectus forming a part of the Lincoln Park Registration Statement to Lincoln Park, which represents the 381,540 Commitment Shares that we have already issued to Lincoln Park under the Purchase Agreement and 15,118,460 additional Common Shares which may be issued to Lincoln Park in the future under the Purchase Agreement, if and when we sell Common Shares to Lincoln Park under the Purchase Agreement. Depending on the market prices of Common Shares at the time we elect to issue and sell shares to Lincoln Park under the Purchase Agreement, we may need to register for resale under the Securities Act additional Common Shares in order to receive aggregate gross proceeds equal to the $150,000,000 total commitment available to us under the Purchase Agreement. At an assumed average purchase price equal to the Floor Price of $1.00, we would need to register an additional 134,881,540 Common Shares, to bring the total number of shares issued to Lincoln Park to 150,381,540 in order to sell the entire $150 million of Common Shares to Lincoln Park under the Purchase Agreement. However, we are not required to register any additional Common Shares.

If all of the 15,500,000 Common Shares offered by Lincoln Park under the prospectus forming part of the Lincoln Park Registration Statement were issued and outstanding as of the date hereof, such Common Shares would represent less than 15% of the total number of Common Shares (including Exchangeable Shares) outstanding as of the date hereof (approximately 10% on a fully-diluted basis). If we elect to issue and sell more than the 15,500,000 Common Shares offered under the Lincoln Park Registration Statement to Lincoln Park, which we have the right, but not the obligation, to do, we must first register for resale under the Securities Act any such additional Common Shares, which could cause additional substantial dilution to our stockholders. The number of Common Shares ultimately offered for resale by Lincoln Park is dependent upon the number of Common Shares we sell to Lincoln Park under the Purchase Agreement. On a combined basis with the 89,152,764 Common Shares being registered on this registration statement, we are registering 104,652,764 Common Shares that may be resold pursuant to the registration statements from time to time representing approximately 95% of the Common Shares (including Common Shares underlying Exchangeable Shares) outstanding as of August 5, 2022 (approximately 69% on a fully-diluted basis). Any sales of such Common Shares by Lincoln Park could similarly have a significant negative impact on the trading price of Common Shares.

The number of Common Shares ultimately offered for resale by Lincoln Park is dependent upon the number of Common Shares we sell to Lincoln Park under the Purchase Agreement.

The Purchase Agreement specifically provides that we may not issue or sell any Common Shares under the Purchase Agreement if such issuance or sale would breach any applicable rules or regulations of the NYSE.

Issuances of Common Shares pursuant to the Purchase Agreement will not affect the rights or privileges of our existing stockholders, except that the economic and voting interests of each of our existing stockholders will be diluted as a result of any such issuance. Although the number of Common Shares that our existing

18

stockholders own will not decrease, the Common Shares owned by our existing stockholders will represent a smaller percentage of our total outstanding shares after any such issuance to Lincoln Park.

Other than as described above, there are no trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing and amount of any sales of Common Shares to Lincoln Park.

The Purchase Agreement contains customary representations, warranties, covenants, closing conditions and indemnification provisions by, among and for the benefit of the parties. Lincoln Park has agreed that neither it nor any of its agents, representatives or affiliates will enter into or effect, directly or indirectly any short selling or hedging that establishes a net short position with respect to the Common Shares. There are no limitations on the use of proceeds, financial or business covenants, restrictions on future financings (other than restrictions on our ability to enter into a similar type of agreement or equity line of credit during the term of the Purchase Agreement, excluding an At-The-Market transaction with a registered broker-dealer), rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement.

Events of default under the Purchase Agreement include the following:

| • | the effectiveness of the Lincoln Park Registration Statement lapses for any reason (including, without limitation, the issuance of a stop order), or any required prospectus supplement and accompanying prospectus are unavailable for the resale by Lincoln Park of Common Shares offered under such prospectus, and such lapse or unavailability continues for a period of ten consecutive business days or for more than an aggregate of 30 business days in any 365-day period; |

| • | suspension by our principal market of Common Shares from trading for a period of one business day (other than in connection with a general suspension of trading on such market); |

| • | the delisting of the Common Shares from the NYSE (or nationally recognized successor thereto), provided, however, that the Common Shares is not immediately thereafter trading on The Nasdaq Capital Market, The Nasdaq Global Market, The Nasdaq Global Select Market, the NYSE American, the NYSE Arca, the OTC Bulletin Board, the OTCQX operated by the OTC Markets Group, Inc., the OTCQB operated by the OTC Markets Group, Inc. or such other nationally recognized trading market (or nationally recognized successor to any of the foregoing); |

| • | the failure of our transfer agent to issue to Lincoln Park Common Shares within three business days after the applicable date on which Lincoln Park is entitled to receive such shares; |

| • | any breach of the representations or warranties or covenants contained in the Purchase Agreement or Registration Rights Agreement that has or could have a material adverse effect on us and, in the case of a breach of a covenant that is reasonably curable, that is not cured within five business days; |

| • | any voluntary or involuntary participation or threatened participation in insolvency or bankruptcy proceedings by or against us; |

| • | a court of competent jurisdiction enters an order or decree under any bankruptcy law that (i) is for relief against us in an involuntary case, (ii) appoints a Custodian for us or for all or substantially all of our property, or (iii) orders the liquidation of us or our subsidiaries; or |

| • | if at any time we are not eligible to transfer Common Shares electronically as DWAC shares. |

Lincoln Park does not have the right to terminate the Purchase Agreement upon any of the events of default set forth above. During an event of default following any applicable grace or cure period, all of which are outside of Lincoln Park’s control, we may not direct Lincoln Park to purchase any Common Shares under the Purchase Agreement.

Lincoln Park has agreed that neither it nor any of its affiliates shall engage in any direct or indirect short-selling or hedging of Common Shares during any time prior to the termination of the Purchase Agreement.

19

There are no restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement or Registration Rights Agreement other than a prohibition on entering into a “Variable Rate Transaction,” as defined in the Purchase Agreement.

All 15,500,000 Common Shares to be registered on the initial Lincoln Park Registration Statement which have been or may be issued or sold by us to Lincoln Park under the Purchase Agreement are expected to be freely tradable. It is anticipated that Common Shares registered pursuant to the Lincoln Park Registration Statement will be sold over a period of up to 36-months commencing on the Commencement Date. The sale by Lincoln Park of a significant amount of Common Shares registered pursuant to the Lincoln Park Registration Statement at any given time could cause the market price of Common Shares to decline and to be highly volatile. Sales of Common Shares to Lincoln Park, if any, will depend upon market conditions and other factors to be determined by us. We may ultimately decide to sell to Lincoln Park all, some or none of the additional Common Shares that may be available for us to sell pursuant to the Purchase Agreement.

If and when we do sell shares to Lincoln Park, after Lincoln Park has acquired the Common Shares, Lincoln Park may resell all, some or none of those Common Shares at any time or from time to time in its discretion. Therefore, sales to Lincoln Park by us under the Purchase Agreement may result in substantial dilution to the interests of other holders of Common Shares. In addition, if we sell a substantial number of Common Shares to Lincoln Park under the Purchase Agreement, or if investors expect that we will do so, the actual sales of Common Shares or the mere existence of our arrangement with Lincoln Park may make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect such sales. However, we have the right to control the timing and amount of any additional sales of Common Shares to Lincoln Park and the Purchase Agreement may be terminated by us at any time at our discretion without any cost to us.

The following table sets forth the amount of gross proceeds we would receive from Lincoln Park from our sale of Common Shares to Lincoln Park under the Purchase Agreement at varying purchase prices:

Assumed Average Purchase Price Per Share | Number of Registered Common Shares to be Issued if Full Purchase(1) | Percentage of Outstanding Common Shares After Giving Effect to the Issuance to Lincoln Park(2) | Proceeds from the Sale of Common Shares to Lincoln Park Under the Purchase Agreement(1) | |||||||||

$14.00 | 11,095,825 | 9.2 | % | $ | 149,999,990 | |||||||

$13.00 | 11,920,001 | 9.8 | % | $ | 149,999,993 | |||||||

$12.00 | 12,881,540 | 10.5 | % | $ | 150,000,000 | |||||||

$11.00 | 14,017,903 | 11.3 | % | $ | 149,999,993 | |||||||

$9.92(3) | 15,500,000 | 12.3 | % | $ | 149,975,123 | |||||||

$8.53(4) | 15,500,000 | 12.3 | % | $ | 128,960,463 | |||||||

$7.00 | 15,500,000 | 12.3 | % | $ | 105,829,220 | |||||||

$6.00 | 15,500,000 | 12.3 | % | $ | 90,710,760 | |||||||

$5.00 | 15,500,000 | 12.3 | % | $ | 75,592,300 | |||||||

$4.00 | 15,500,000 | 12.3 | % | $ | 60,473,840 | |||||||

$3.00 | 15,500,000 | 12.3 | % | $ | 45,355,380 | |||||||

$2.00 | 15,500,000 | 12.3 | % | $ | 30,236,920 | |||||||

$1.00(5) | 15,500,000 | 12.3 | % | $ | 15,118,460 | |||||||

| (1) | The Purchase Agreement provides that we may sell up to $150 million of Common Shares to Lincoln Park; however, we are initially registering 15,500,000 Common Shares under the Lincoln Park Registration Statement, including 381,540 Commitment Shares, which leaves a maximum of 2,404,904 additional |

20

| Common Shares to be issued for future purchases, assuming an average purchase price per Common Share of $8.53, the closing price of our Common Shares on August 25, 2022, the business day before the Lincoln Park Registration Statement was initially filed. Accordingly, depending on the prices at which such Common Shares are sold, we may or may not be able to ultimately sell to Lincoln Park a number of Common Shares with a total value of $150 million under the Lincoln Park Registration Statement, unless such registration statement is amended. |

| (2) | The numerator is based on the number of shares issuable at the corresponding assumed purchase price as set forth in the adjacent column plus the 381,540 Commitment Shares. The denominator is based on 110,007,972 Common Shares (which number includes 48,409,641 Exchangeable Shares) outstanding immediately following the closing of the Transaction on August 5, 2022 (which includes 127,180 of the Commitment Shares) adjusted to include the number of Common Shares set forth in the adjacent column which we would have sold to Lincoln Park, assuming the purchase price in the adjacent column. The numerator is based on the number of Common Shares issuable under the Purchase Agreement at the corresponding assumed purchase price set forth in the adjacent column without giving effect to the Beneficial Ownership Limitation. |

| (3) | The approximate minimum average purchase price per share at which the current Lincoln Park Registration Statement, registering 15,500,000 Common Shares, would be sufficient to sell the entirety of the $150 million of Common Shares to Lincoln Park, without requiring the registration of additional Common Shares. At a lower average purchase price per share the registration of additional Common Shares would be required. At an assumed average purchase price equal to the Floor Price of $1.00, we would need to register an additional 134,881,540 Common Shares (or 150,381,540 in aggregate) in order to sell the entire $150 million of Common Shares to Lincoln Park under the Purchase Agreement. We are not required to register any additional Common Shares. |

| (4) | The closing sale price of our shares on August 25, 2022. |