Property, plant and equipment assets were €411.4 million as of December 31, 2021, a decrease of €51.9 million, or 11%, compared with €463.3 million as of December 31, 2020. The decrease was primarily attributable to regular depreciation, additional impairment of right of use assets in Austria and reclassification to investment property.

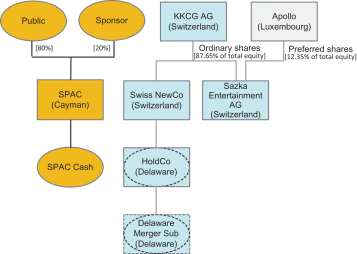

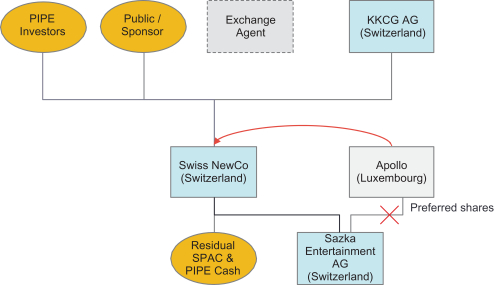

Total assets were €6,524.4 million as of December 31, 2021, an increase of €537.5 million, or 9%, compared with €5,986.9 million as of December 31, 2020. The increase was primarily attributable to increase in cash equivalents and an investment into preferred shares of the Company by funds advised by Apollo Management.

Liabilities

Non-current loans and borrowings as of December 31, 2021 were €2,259.5 million, a decrease of €273.8 million, or 11%, compared with €2,533.3 million as of December 31, 2020. The decrease was primarily attributable to reclassification of bonds maturing in 2022 to current loans and borrowings.

Non-current trade and other payables as of December 31, 2021 were €42.2 million, a decrease of €92.2 million, or 69%, compared with €134.4 million as of December 31, 2020. The decrease was primarily attributable to reclassification of payables due in 2022 to from non-current to current trade and other payables.

Current tax liability as of December 31, 2021 was €112.8 million, an increase of €44.2 million, or 64%, compared with €68.6 million as of December 31, 2020. The increase was primarily attributable to increase in taxable profits in 2021.

Total liabilities as of December 31, 2021 were €5,169.3 million, an increase of €694.4 million, or 15.5%, compared with €4,474.9 million as of December 31, 2020. The increase was primarily attributable to investment into preferred shares of SAZKA Entertainment by funds advised by Apollo Management.

Comparison of Financial Position as of December 31, 2020 to December 31, 2019

Assets

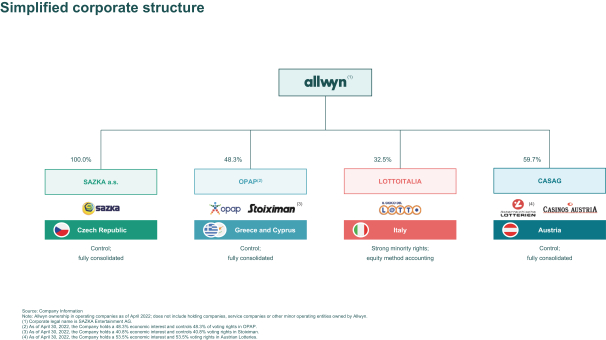

Intangible assets were €2,660.0 million as of December 31, 2020, an increase of €780.9 million, or 41.6%, compared with €1,879.1 million as of December 31, 2019. The increase was primarily attributable to the full consolidation of CASAG Group following the acquisition of additional CASAG shares in June 2020.

Goodwill was valued at €1,035.8 million as of December 31, 2020, an increase of €435.2 million, or 72.5%, compared with €600.6 million as of December 31, 2019. The increase was primarily attributable to the full consolidation of CASAG Group and Stoiximan in 2020.

Property, plant and equipment assets were €463.3 million as of December 31, 2020, an increase of €268.6 million, or 138.0%, compared with €194.7 million as of December 31, 2019. The increase was primarily attributable to the property, plant and equipment of CASAG Group being consolidated on our balance sheet as of December 31, 2020 (rather than this line item being held as an equity method investee as it was in previous years).

Total assets were €5,986.9 million as of December 31, 2020, an increase of €1,548.7 million, or 34.9%, compared with €4,438.2 million as of December 31, 2019. The increase was primarily attributable to CASAG Group being consolidated on our balance sheet as of December 31, 2020.

Liabilities

Non-current loans and borrowings as of December 31, 2020 were €2,533.3 million, an increase of €280.8 million, or 12.5%, compared with €2,252.5 million as of December 31, 2019. The increase was primarily attributable to €1,424.9 million of new borrowings, which was partially offset by €1,286.6 million in borrowings repaid, and the €184.1 million impact of loans obtained on the consolidation of CASAG Group.

258