Table of Contents

As filed with the U.S. Securities and Exchange Commission on September 12, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MN8 Energy, Inc.

(Exact Name of Registrant as Specified in its Charter)

Delaware | 4931 | 87-4650748 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (IRS Employer Identification No.) |

1155 Avenue of the Americas, 27th Floor New York, NY 10036 (212) 902-8890

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of registrant’s principal executive offices)

Jon Yoder

President and Chief Executive Officer 1155 Avenue of the Americas, 27th Floor New York, NY 10036 (212) 902-8890

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Douglas E. McWilliams Sarah K. Morgan Vinson & Elkins L.L.P. | Gregory P. Rodgers Brittany D. Ruiz Latham & Watkins LLP | |||

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information contained in this preliminary prospectus is not complete and may be changed. No securities may be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated , 2022

Shares

MN8 Energy, Inc.

Common Stock

This is an initial public offering of shares of common stock of MN8 Energy, Inc.

Prior to this offering, there has been no public market for shares of our common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . We intend to list our common stock on the New York Stock Exchange (the “NYSE”) under the symbol “MNX”.

See “Risk Factors” beginning on page 32 to read about risks you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

Initial public offering price | $ | $ | ||||||

Underwriting discount | $ | $ | ||||||

Proceeds, before expenses, to us | $ | $ | ||||||

| (1) | See the section titled “Underwriting (Conflicts of Interest)” for additional information regarding compensation payable to the underwriters. |

To the extent that the underwriters sell more than shares of common stock, the underwriters have a 30-day option to purchase up to an additional shares of common stock from us at the public offering price less underwriting discounts and commissions.

The underwriters expect to deliver the shares of common stock against payment therefor on or about , 2022.

Book-Running Managers

| Goldman Sachs & Co. LLC | BofA Securities | J.P. Morgan | HSBC | Wells Fargo Securities |

| Jefferies | Wolfe | Nomura Alliance |

Co-Managers

| Cowen | KeyBanc Capital Markets | CIBC Capital Markets | PNC Capital Markets LLC | Drexel Hamilton | Siebert Williams Shank |

Prospectus dated , 2022

Table of Contents

Table of Contents

Table of Contents

Prospectus

| ii | ||||

| ii | ||||

| iii | ||||

| iii | ||||

| 1 | ||||

| 32 | ||||

| 69 | ||||

| 73 | ||||

| 74 | ||||

| 75 | ||||

| 77 | ||||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 79 | |||

| 114 | ||||

| 137 | ||||

| 148 | ||||

| 157 | ||||

| 161 | ||||

Security Ownership of Certain Beneficial Owners and Management | 166 | |||

| 167 | ||||

| 172 | ||||

Material U.S. Federal Income Tax Considerations for Non-U.S. Holders of Our Common Stock | 174 | |||

| 179 | ||||

| 183 | ||||

| 192 | ||||

| 192 | ||||

| 192 | ||||

| F-1 |

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by us or on behalf of us or the information which we have referred you. Neither we nor the underwriters have authorized anyone to provide you with information different from that contained in this prospectus and any free writing prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell shares of common stock and seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Please see “Risk Factors” and “Cautionary Language Regarding Forward-Looking Statements.”

Through and including , 2022 (the 25th day after the date of this prospectus), all dealers effecting transactions in our shares, whether or not participating in this offering, may be required to deliver a prospectus. This requirement is in addition to the dealers’ obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

i

Table of Contents

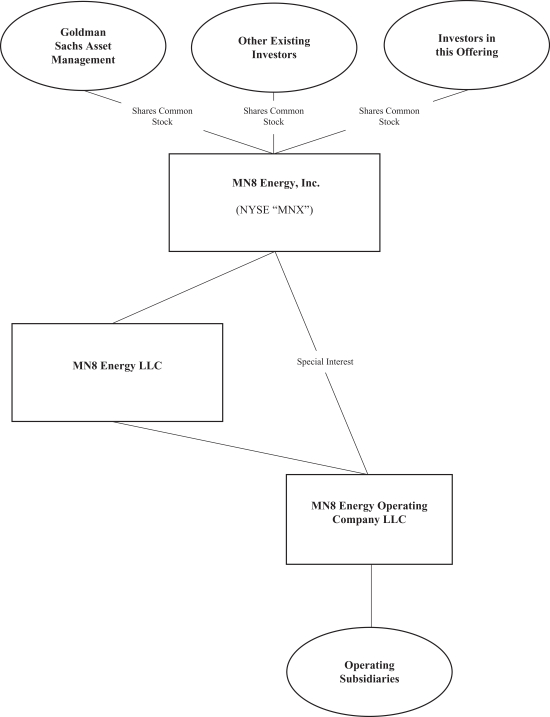

Unless otherwise indicated, the historical financial and operating information presented in this prospectus is that of MN8 Energy LLC (f/k/a Goldman Sachs Renewable Power LLC), our “predecessor” for financial reporting purposes, and its subsidiaries. Prior to the closing of this offering, MN8 Energy LLC will become a wholly owned subsidiary of MN8 Energy, Inc., a newly incorporated Delaware corporation formed for the purpose of effectuating this offering and the transactions related thereto.

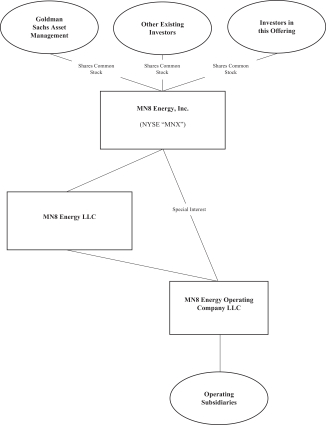

All existing holders of limited liability company interests of MN8 Energy LLC will become holders of shares of common stock of MN8 Energy, Inc., as described under the heading “Internalization Transaction and Corporate Reorganization.” In this prospectus, we refer to the merger of MergerCo, a wholly owned subsidiary of MN8 Energy, Inc. into MN8 Energy LLC, with MN8 Energy LLC surviving such merger as a wholly owned subsidiary of MN8 Energy, Inc., as the “Merger”, to the exchange by an affiliate of GSAM (as defined herein) of an incentive interest in the nature of a profits interest in OpCo (as defined herein) for shares of common stock of MN8 Energy, Inc. in connection with the Merger as the “Special Interest Exchange”, and to the Merger and Special Interest Exchange and all related transactions as the “Corporate Reorganization”. We expect that the Corporate Reorganization will not have a material effect on our consolidated financial statements.

Unless otherwise indicated, references in this prospectus to our financial information on a “pro forma basis” refer to the historical financial information of MN8 Energy LLC, as adjusted to give pro forma effect to (i) the Internalization Transaction (as defined herein), (ii) the Corporate Reorganization and (iii) this offering and the application of the net proceeds from this offering as if they had been completed as of January 1, 2021, in the case of statement of operations data, or June 30, 2022, in the case of balance sheet data. References in this prospectus to our financial or operating information “as adjusted for the NES Acquisition” or similar such phrasing refers to the financial or operating information of us or our Predecessor, as applicable, adjusted to give effect to the NES Acquisition and/or the financing therefor as if such transactions had been completed as of June 30, 2022.

For historical non-controlling interests associated with OpCo, net income was allocated in the consolidated statements of members’ equity first in an amount equal to the OpCo Incentive Allocation (as defined herein) held by GSAM that was earned during the reporting period, with the remaining income allocated using the profit and loss percentages contained in the OpCo LLC Agreement (as defined herein). The non-controlling interest associated with OpCo is expected to be eliminated in connection with the Corporate Reorganization. For additional information regarding the OpCo Incentive Allocation and the transactions pursuant to which it was eliminated, see the section of this prospectus titled “Internalization Transaction and Corporate Reorganization.”

The financial information and certain other information presented in this prospectus have been rounded to the nearest whole number or the nearest decimal. Therefore, the sum of the numbers in a column may not conform exactly to the total figure given for that column in certain tables in this prospectus. In addition, certain percentages presented in this prospectus reflect calculations based upon the underlying information prior to rounding and, accordingly, may not conform exactly to the percentages that would be derived if the relevant calculations were based upon the rounded numbers or may not sum due to rounding.

Certain market and industry data and forecasts used in this prospectus have been obtained from the following independent industry publications or reports: BloombergNEF, International Council on

ii

Table of Contents

Clean Transportation, RE100, S&P Global Market Intelligence, Solar Energy Industries Association, Target Sustainability Strategy and Wood Mackenzie.

Some market data and statistical information contained in this prospectus are also based on management’s estimates and calculations, which are derived from our review and interpretation of publicly available industry publications, our internal research and our knowledge of the markets in which we currently, and will in the future, operate. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such information. Although we believe these third-party sources to be reliable, we have not independently verified the data obtained from these sources and we cannot assure you of the accuracy or completeness of the data. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus. Statements as to our market position are based on market data currently available to us, as well as management’s estimates and assumptions regarding the size of our markets within our industry. While we are not aware of any misstatements regarding our industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the headings “Risk Factors” and “Cautionary Language Regarding Forward-Looking Statements” in this prospectus. Neither we nor the underwriters can guarantee the accuracy or completeness of such information contained in this prospectus.

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and does not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks, service marks and trade names.

As used in this prospectus, unless the context otherwise requires the terms “we,” “us,” “our,” the “company” and like terms refer (i) prior to the Corporate Reorganization, to MN8 Energy LLC, our predecessor for financial reporting purposes, and (ii) subsequent to the Corporate Reorganization, to MN8 Energy, Inc., of which MN8 Energy LLC will at such time be a wholly owned subsidiary. In addition, the terms below that are used frequently in this prospectus have the following meanings:

| • | “BNEF” refers to the BloombergNEF; |

| • | “C&I” refers to commercial and industrial solar energy and energy storage projects with a generating capacity of between one and fifty megawatts which can either serve our customers on-site (also referred to as “behind the meter”) or deliver electricity to the grid. C&I is also referred to throughout this prospectus as “distributed generation” and “middle-market”; |

| • | “CAISO” refers to California Independent System Operator; |

iii

Table of Contents

| • | “CCA” refers to a community choice aggregation program; |

| • | “CCGT” refers to combined cycle gas turbines; |

| • | “CCUS” refers to carbon capture, utilization, and sequestration; |

| • | “CERCLA” refers to the Comprehensive Environmental Response, Compensation, and Liability Act; |

| • | “Code” refers to the Internal Revenue Code of 1986, as amended; |

| • | “Corporate Reorganization” refers to the Merger, the Special Interest Exchange and all related transactions; |

| • | “COVID-19” refers to the novel coronavirus (2019-nCoV); |

| • | “Curtailment” refers to the reduction of output of a project below what it could have otherwise produced by its off-taker, interconnecting transmission owner, or regional transmission organization, or ISO. A project’s delivery of electricity may be subject to curtailment or other restrictions for various reasons, including for system maintenance or reliability and stability purposes, over-generation, or due to transmission limitations, congestion, emergencies, or force majeure circumstances. Curtailment may be compensated in certain circumstances under a project’s PPA and may be uncompensated in other circumstances; |

| • | “CWA” refers to the Clean Water Act; |

| • | “DSW” refers to Desert Southwest; |

| • | “EHS” refers to environmental, health and safety; |

| • | “EIA” refers to United States Energy Information Administration; |

| • | “ERISA” refers to Title I of the Employee Retirement Income Security Act of 1974, as amended; |

| • | “ESPs” refers to energy service providers; |

| • | “Executive officers” or our “officers” refers to our executive officers following the Internalization Transaction, who, prior to the Internalization Transaction, provided their services to us under the terms of the Management Services Agreement with Goldman Sachs Asset Management, L.P.; |

| • | “Existing Owners” refers to the existing holders of limited liability company interests of MN8 Energy LLC, including GSAM; |

| • | “FATCA” refers to the Foreign Account Tax Compliance Act; |

| • | “FERC” refers to the Federal Energy Regulatory Commission; |

| • | “Fleet” refers to the operating projects or projects under construction that we own and excludes projects in our development pipeline; |

| • | “GHG” refers to greenhouse gas; |

| • | “GS” refers to Goldman Sachs Group; |

| • | “GSAM” refers to Goldman Sachs Asset Management, L.P. and its affiliates, including the Special Interest Member; |

| • | “GW” refers to gigawatt, or one billion watts of electric capacity; |

| • | “GWh” refers to gigawatt hour, a measure of electric output equivalent to one billion watts generated per hour; |

| • | “HLBV” refers to hypothetical liquidation at book value; |

iv

Table of Contents

| • | “Hoshine” refers to Hoshine Silicon Industry Co. Ltd.; |

| • | “ITC” refers to the investment tax credit under Section 48(a) and 48(Y) of the Code; |

| • | “IOUs” refers to Investor-Owned Utilities; |

| • | “ISO-NE” refers to ISO-New England; |

| • | “kWh” refers to kilowatt hours, a measure of electric output equivalent to one thousand watts generated per hour; |

| • | “LCOE” refers to BNEF’s global Levelized Cost of Electricity benchmark for solar projects; |

| • | “LIBOR” refers to London Interbank Offered Rate; |

| • | “Merger” refers to the merger of MergerCo, a wholly owned subsidiary of MN8 Energy, Inc. into MN8 Energy LLC, with MN8 Energy LLC surviving such merger as a wholly owned subsidiary of MN8 Energy, Inc.; |

| • | “MN8 Energy” refers to MN8 Energy, Inc., issuer of the common stock offered hereby; |

| • | “MN8 Energy LLC” refers MN8 Energy LLC (f/k/a Goldman Sachs Renewable Power LLC); |

| • | “MW” refers to megawatts, or one million watts of electric capacity; |

| • | “MWh” refers to megawatt hours, a measure of electric output equivalent to one million watts generated per hour; |

| • | “NEPA” refers to the U.S. National Environmental Policy Act; |

| • | “NES Acquisition” refers to the pending acquisition of a portfolio of solar assets from an affiliate of New Energy Solar, as further described in “Prospectus Summary—Pending NES Acquisition”; |

| • | “O&M” refers to operations and maintenance; |

| • | “OpCo” refers to MN8 Energy Operating Company LLC (f/k/a Goldman Sachs Renewable Power Operating Company LLC), our subsidiary through which we currently operate our business and assets; |

| • | “OpCo Incentive Allocation” refers to the Special Interest Member’s right to receive incentive distributions from OpCo that equate to a percentage of Core Operating Profit, as further described in “Certain Relationships and Related Party Transactions—OpCo LLC Agreement”; |

| • | “OpCo LLC Agreement” refers to the Second Amended and Restated Limited Liability Company Agreement of OpCo, dated August 4, 2022; |

| • | “Operating projects” refers to solar energy and energy storage systems that have reached commercial operations and are producing and/or storing electricity; |

| • | “OSHA” refers to Occupational Safety and Health Act, as amended; |

| • | “PJM” refers to PJM Interconnection; |

| • | “PPA” refers to power purchase agreements, the contracts pursuant to which we sell electricity to customers. We refer to solar energy and/or energy storage systems that have signed PPAs as “contracted” and solar energy and/or energy storage systems without signed PPAs as “uncontracted”; |

| • | “Predecessor” or “our predecessor” refers to MN8 Energy LLC (f/k/a Goldman Sachs Renewable Power LLC), our predecessor for financial reporting purposes; |

| • | “Projects in our development pipeline” or our “pipeline” refer to those solar energy and energy storage projects that we own or have entered into a binding agreement to acquire, which have land rights for the project site or have signed or filed for an interconnection agreement, or both, but are neither in operation nor under construction; |

v

Table of Contents

| • | “Projects under construction” refer to solar energy and energy storage systems where we have begun construction but have not yet reached commercial operations; |

| • | “PTC” refers to the production tax credit under Section 45 and 45(D) of the Code; |

| • | “PV” refers to photovoltaic; |

| • | “QBI” refers to Quality Business Intelligence; |

| • | “RECs” refers to renewable energy certificates or credits, which are renewable energy attributes that are created under the laws of individual states of the United States; |

| • | “RPS” refers to Renewable Portfolio Standards; |

| • | “SEIA” refers to the Solar Energy Industries Association; |

| • | “SP-15” refers to the Southern California market; |

| • | “Special Interest” refers to the incentive interest in the nature of a profits interest in OpCo, which includes the OpCo Incentive Allocation prior to its termination in connection with the closing of the Internalization Transaction; |

| • | “Special Interest Exchange” refers to the exchange by the Special Interest Member of the Special Interest for shares of MN8 Energy common stock in connection with the Corporate Reorganization; |

| • | “Special Interest Member” refers, prior to the Corporate Reorganization and the consummation of this offering and the transactions related thereto, to GSAM Holdings II LLC and, immediately thereafter, to MN8 Energy, Inc.; |

| • | “SREC” refers to solar renewable energy certificates or credits, which are renewable energy attributes that are created under the laws of individual states of the United States; |

| • | “TWh” refers to terawatt hours, a measure of electric output equivalent to one trillion watts generated per hour; |

| • | “UBTI” refers to “unrelated business taxable income”; |

| • | “Uplift” refers to the year-over-year increase in the MWh produced by a solar energy or energy storage system relative to its MWh production prior to repair, enhancement or other improvement; |

| • | “Utility-scale” refers to utility-scale solar energy and energy storage systems with a generating capacity of over fifty megawatts that deliver energy to the grid; |

| • | “U.S.” refers to the United States or the United States of America; |

| • | “UC Regents” refers to The Regents of the University of California; |

| • | “USRPHC” refers to a United States real property holding corporation; |

| • | “VIEs” refer to variable interest entities; |

| • | “WAPA” refers to the Western Area Power Administration; |

| • | “WoodMac” refers to Wood Mackenzie, a global research consultancy business for the natural resources industry; and |

| • | “XUAR” refers to the Xinjiang Uyghur Autonomous Region. |

vi

Table of Contents

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, including the sections titled “Risk Factors,” “Cautionary Language Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision. The information presented in this prospectus assumes, unless otherwise indicated, that the underwriters do not exercise their option to purchase additional shares of common stock.

Company Overview

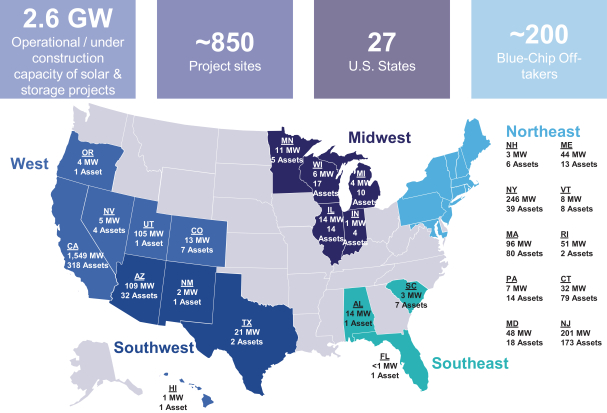

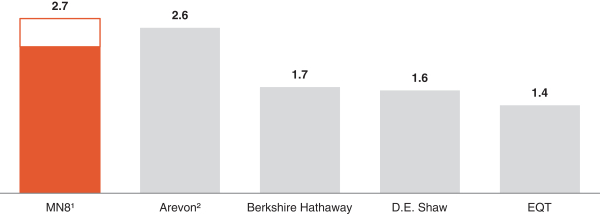

We are a renewable energy company. Our mission is to serve enterprise customers by providing the renewable energy and related services that these customers need on their journey to an electrified, decarbonized world. To achieve this mission, we generate renewable energy with our fleet of solar projects and are able to store energy in our fleet of battery projects, in each case tailored to the needs of individual enterprise customers. In 2021, we were one of the largest independent solar energy and energy storage power producers in the U.S. and one of the top 5 largest solar and storage asset owners overall in the U.S., based on the total gross capacity of our projects that were operating according to S&P Global Market Intelligence. As of June 30, 2022, our fleet was composed of over 850 projects spread across 27 states with an aggregate capacity of approximately 2.3 gigawatts (“GW”) of operating and under construction solar projects and approximately 270 megawatts (“MW”) of operating and under construction battery storage projects. We have a blue-chip set of over 200 enterprise customers, many of whom have bold decarbonization objectives, which we believe will provide us with many add-on commercial opportunities in the years to come.

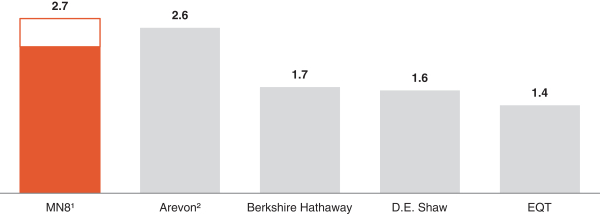

2021 Top 5 U.S. Independent Solar and Storage Energy Producers by Capacity (GW)

(Includes Operating Solar Assets and Energy Storage Capacity)

1

Table of Contents

Source: MN8 Energy metrics as of December 31, 2021, other metrics from S&P Global Market Intelligence as of December 31, 2021.

| (1) | Includes operating solar assets and 0.3 GWAC energy storage capacity. MN8 Energy metrics include the Slate Project. Unshaded bar consists of approximately 442 MW operating assets from the pending NES Acquisition (defined below). |

| (2) | Formerly Capital Dynamics. |

Our Story

We were founded inside of Goldman Sachs Asset Management, L.P. in 2017. At the time, significant declines in the cost of solar modules and equipment had suddenly resulted in a new economic reality: that energy could be produced from the sun in many parts of the U.S. at the same or lower prices as energy produced from fossil fuels. Solar energy also held the distinct advantage of being able to be produced with mature technology that could be deployed in almost any location and in customized sizes. Concurrently, many leading private and public sector enterprises began setting ambitious targets for reducing their carbon emissions. We anticipated that these enterprise customers, which include corporations, federal, state and municipal entities, universities, colleges and school districts, communities (through community choice aggregation programs (“CCAs”)), and utilities, would increasingly prefer to purchase solar energy that was produced on site or in proximity to where these customers were located as a means to lower their cost of energy, meet their carbon reduction targets and exert more control over where and how their energy was being produced. We believed that this provided an opportunity for us to disrupt the energy industry by owning and operating the solar energy facilities needed to meet these customer desires.

We envisioned that over time, as technology improved and costs came down, enterprise customers would want additional renewable energy infrastructure and services, as they adjusted to an electrified, decarbonized world. For example, adding battery storage to solar projects has the potential to capture excess solar power production during daylight hours and provide customers with renewable energy during more hours of the day, as well as to provide resiliency from power outages and the ability to participate in grid services programs. At the time, we did not know when battery storage would become economically viable, but we believed that focusing on long-term contractual relationships with customers would give us the runway to capture these opportunities. Today, with the decline in the cost of battery modules, we are seeing strong customer interest in adding battery storage to solar projects. Looking into the future, we believe that many enterprise customers will soon want to add electric vehicle (“EV”) charging at their facilities as vehicle fleets convert from internal combustion engines to electric motors. We believe that our customer and project footprint is well-positioned to capture these opportunities as well.

Our Business Model

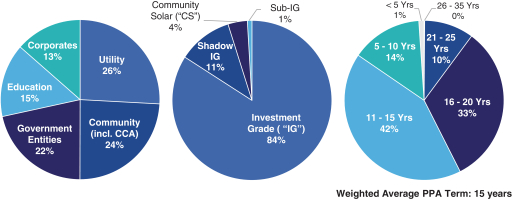

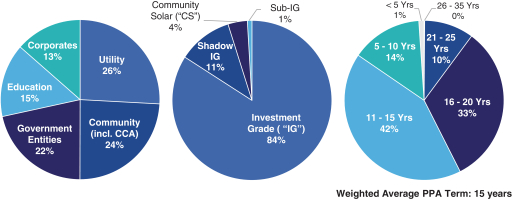

Produce long-term contracted cash flows with high credit quality enterprise customers. Our business model is to develop, own and operate renewable energy assets that serve enterprise customers while simultaneously producing attractive cash flow for our investors by selling energy, storage and related services to high credit quality customers under long-term contracts, typically at fixed prices. The average remaining capacity-weighted life of our existing operational contracts (exclusive of our storage operations) is approximately 15 years as of the date of this prospectus. Our renewable energy generation fleet is currently comprised exclusively of solar projects. We have focused on solar because it is a mature technology that produces a much lower expected energy production volatility than other renewable energy technologies such as wind turbines. The combination of long-term, typically fixed price contracts, limited technology risk and lower energy production volatility from our generation fleet results in recurring revenue and more predictable cash flow for our investors.

2

Table of Contents

Place renewable energy assets in locations where they are likely to have long-term value. We seek to locate our renewable energy assets in locations where we believe they will have a higher value, such as places that have higher prevailing power prices, have strong and consistent solar irradiance, offer additional revenue streams such as renewable energy credits (“RECs”) or have more barriers to operation or development of competing assets. Scaling our fleet of assets in certain desirable markets also provides us with economies of scale in those markets, including more efficient staging of spare parts to reduce project down time and better pricing and faster response times from local vendors who provide services to our fleet.

Actively manage our renewable energy assets to maximize revenue, minimize expenses and harness technological improvements. We are intensely focused on our fleet of solar energy and energy storage systems. Our plant operations center continuously seeks to enhance revenue through proactive performance monitoring, customized preventative maintenance schedules and system design improvements, while our power markets and commodities team seek additional revenue sources, such as qualifying our assets for an additional incentive program or marketable capability. We also seek to minimize the expenses of operating our assets, such as by leveraging our increasing scale to drive better vendor pricing, utilizing the strength of our balance sheet to eliminate security deposit requirements and working with local authorities to manage property tax liabilities. In addition, we constantly scout and evaluate new or improved technologies that we can incorporate to either increase revenues or reduce expenses. For example, we have incorporated a program of periodic flyovers of our solar arrays by either planes or drones to perform thermal imaging analysis that can identify underperforming or internally damaged solar modules. With this information we can improve revenue by replacing or repairing affected solar modules. Another example is our use of improved inverter technology that allows us to perform more routine trouble shooting items remotely from our plant operations center, thereby eliminating the expense of sending a technician to the site.

Finance renewable energy assets with long-term debt designed to minimize refinancing and interest rate risk. With long-term, fixed-price contracts and minimal technology risk, we have developed a clean and simplified approach to financing large and diversified project portfolios with primarily low-cost, long-term, fixed-rate fully amortizing debt accessed through the institutional green bond market. This approach allows for financial flexibility to incorporate tax-equity financings at the project level while also increasing debt capacity every year—with $418.3 million amortizing over the next five years. As of June 30, 2022, our total debt (excluding discounts and premiums) was $2,070.4 million. Of this amount, approximately 17.2% is project-level, fully-amortizing debt which we expect to pay off in full by 2038. To manage medium-term development and construction needs, we utilize our $500.0 million Warehouse facility that matures in 2026.

Leverage our customer relationships to provide additional renewable energy and related services as their decarbonization goals advance. We believe that there is significant value embedded in our direct customer relationships. Customers are using renewable energy for only a fraction of their total energy needs, providing us with an opportunity to scale our relationship. We also see customers increasingly focused on the transition to EVs, and we believe this focus will continue in part due to the EV tax credits for new and used EVs contained in the Inflation Reduction Act. Additional EVs will require both additional charging infrastructure as well as increased on-site energy. We believe that many of our customers will want to use renewable energy to power their EV charging infrastructure. In many cases, the ability to store power in batteries will be helpful or required in order to provide the power needed to charge EVs and add a resiliency solution in the face of potential grid reliability issues. We believe that these trends will provide us with an opportunity to offer renewable energy, EV charging infrastructure and batteries on a bundled or individual basis to service our customers.

3

Table of Contents

Our Team

To execute our business, we have built a team composed of approximately 140 professionals by combining accomplished personnel from Goldman Sachs with extensive investment, finance and commodity expertise with seasoned personnel from the renewable energy industry with extensive expertise spanning the renewable project life-cycle, including project development, engineering and design, procurement, construction oversight, operations and maintenance (“O&M”) oversight, and asset management. We believe this combination of skill sets, drawn from world class institutions, is a key differentiator and sets the foundation for success. Our team deploys a differentiated approach to developing, owning and operating renewable projects utilizing a purpose-built, end to end software solution. At our inception, there were no third-party platforms or software packages that allowed us to track a project from origination through operation and to optimize performance. As such, we partnered with Quality Business Intelligence (“QBI”) to develop such a platform. The QBI software provides us with a data-driven operating system that improves efficiency and decision making through automation, strengthens data integrity and enhances performance by providing powerful data analytics. The skill and experience of our team, combined with the QBI operating system, has been crucial to building a robust pipeline of both development and acquisition opportunities and operating our portfolio with a high level of availability, strong performance and thoughtful expense management.

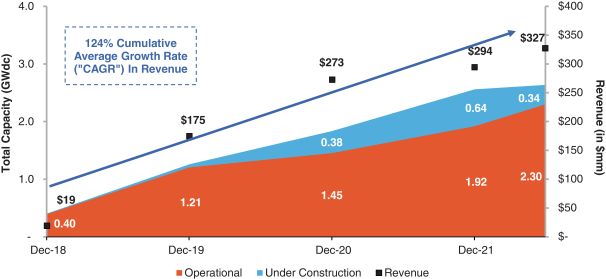

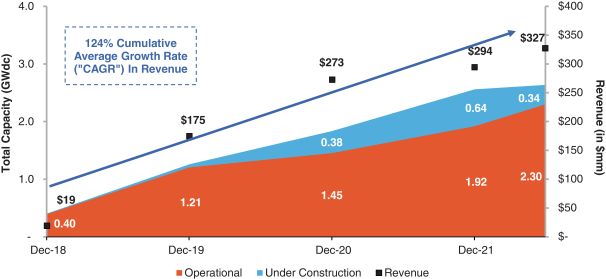

We have experienced significant growth. The chart below shows the growth of our fleet since our inception, both in total capacity and operating revenues.

Capacity and Operating Revenue Growth Since Inception

Note: June 30, 2022 revenues reflect trailing twelve months.

4

Table of Contents

Current Operations

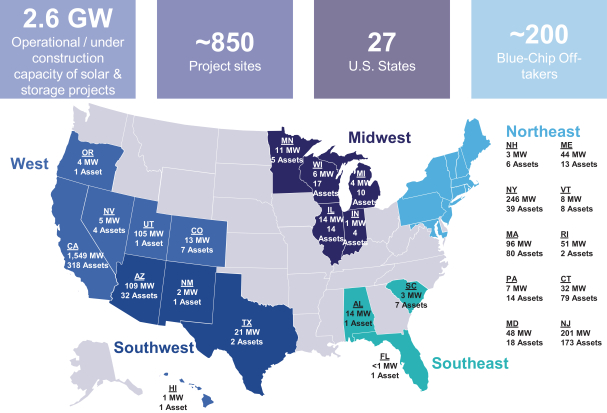

As of June 30, 2022, our fleet consists of approximately 2.0 GW of operating and 0.3 GW of under construction solar projects as well as approximately 270 MW of operating and 0 MW of under construction energy storage projects. The fleet is strategically located primarily in places with well established, deregulated electricity markets and having strong support for renewable energy, often through renewable power generation requirements or targets. It is also primarily located in places with high prevailing power prices and barriers to operation or development of competing assets. These barriers include limited available land for development of energy projects, limited transmission capacity or formidable regulatory hurdles. We believe that strategic locations of our fleet preserve and build long term value.

Our fleet is diversified with projects located across over 850 project sites in 27 U.S. states and anchored by long-term off-take agreements with over 200 enterprise customers. We believe that the geographic dispersion of the fleet, including scaled presences on both U.S. coasts supports more consistent financial performance by reducing the impact of adverse regional weather patterns and natural disaster events. It also reduces the impact of adverse regulatory or market changes made by a particular state or regional transmission organization. Our large roster of enterprise customers is a mitigant to individual customer credit risk. The solar modules, inverters, racking and other equipment used in our fleet are also diversified by manufacturer which we believe meaningfully limits our exposure to serial manufacturing defects and design risks. We are purposeful in creating significant diversification across many metrics in an effort to produce greater financial stability with our fleet.

In originating our fleet, we are focused on the needs of our enterprise customers. We do not define our focus as “utility-scale” or “C&I” or “distributed generation” projects. Rather, we recognize that our customers have a wide range of needs including both smaller scale, on-site power generation, such as rooftop, canopy or carport projects, and larger scale, off site power generation, such as ground mounted projects covering many acres of land. As a result of our customer driven approach, our fleet comprises a wide range of sizes for customized solutions.

5

Table of Contents

The following map provides an overview of our current fleet as of June 30, 2022:

6

Table of Contents

The following pie charts provide an overview of our fleet’s customer characteristics as of June 30, 2022:

| Customer Type (% by Total MW) | Customer Credit Quality (% by Total MW) | PPA Term Remaining (% by Total MW) | ||||||

Note: “Shadow IG” refers to unofficial investment grade ratings that are not publicly announced. Excludes <1% of Not Rated customers. Customer credit ratings only shown for operating assets.

In addition to our current fleet, we have a large, diversified pipeline of projects in development. As of June 30, 2022, the projects in our development pipeline had an aggregate capacity of approximately 5.1 GW, which is made up of approximately 4.0 GW of solar generation projects and approximately 1.1 GW of energy storage projects. These projects are primarily located in well-established, deregulated electricity markets with strong support for renewable energy, that have characteristics similar to those of our current fleet, supporting the creation of long-term value. The projects in our pipeline are in various stages of the development process. Among our total pipeline of projects, we expect approximately 109 MW to reach Notice to Proceed (“NTP”) by December 31, 2022. These projects, along with the approximately 297 MW of solar and storage projects that are under construction as of June 30, 2022 and the Slate Project represent the primary pathway to our EBITDA growth over the next two years. The other approximately 4.9 GW of projects in our pipeline are expected to reach NTP after December 31, 2022. We are targeting commercial operation of these projects between 2023 and 2028, with up to 799 MW of projects expected to reach commercial operation in 2022 and 2023, which would result in a 31% increase in our operating and under construction MWs.

Pending NES Acquisition

On August 19, 2022, the Company entered into a membership interest purchase agreement (the “NES MIPA”) with an affiliate of New Energy Solar (“NES”) for the acquisition (the “NES Acquisition”) of a portfolio of solar assets of approximately 442 MW situated in California, Nevada, North Carolina and Oregon. During 2021, the portion of the revenues and expenses attributable to our anticipated investments in, and basis of presentation for, the assets to be acquired were approximately $44 million of revenues and approximately $14 million in operating expenses, excluding depreciation and amortization expense.

7

Table of Contents

We expect the aggregate purchase price for the NES Acquisition to be approximately $245 million in cash, subject to purchase price adjustments, which we expect to fund prior to the consummation of this offering via capital contributions from the Existing Owners. The NES MIPA contains customary representations and warranties, covenants and indemnification provisions. We expect the NES Acquisition to close in the late third or early fourth quarter of 2022, subject to the satisfaction of customary closing conditions, including FERC and Hart-Scott-Rodino Antitrust Improvements Act of 1976 (“HSR”) approvals and the approval of NES’s shareholders. This offering is not conditioned on the consummation of the NES Acquisition, and the NES Acquisition is not conditioned on the consummation of this offering.

Our Market Opportunity

Today, the demand for sustainable, efficient, and reliable electricity in the U.S. continues to accelerate as governments and corporations establish renewable targets and decarbonization goals. We expect electricity generated by renewables to not only replace that generated by the burning of fossil fuels, but also to be utilized to meet growing electricity demand as transportation, heating, and cooking–all once powered primarily by fossil fuels–are electrified.

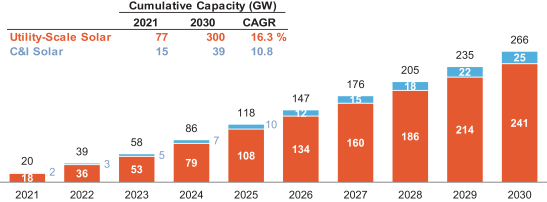

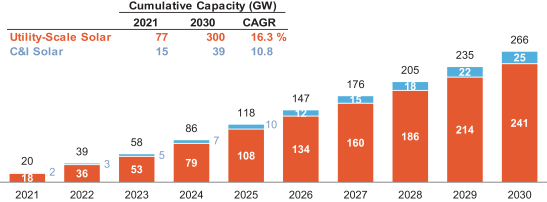

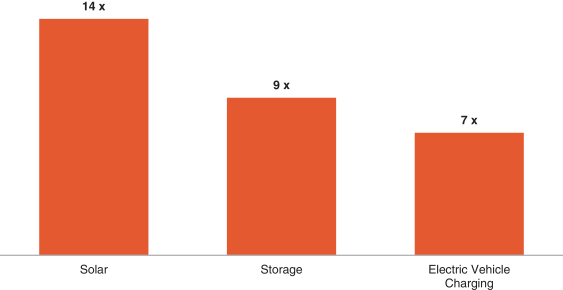

Solar is the fastest growing form of new electricity generation in the U.S. According to the Solar Energy Industries Association (“SEIA”), installed solar capacity in the U.S. has experienced an average annual growth rate of 33% in the past decade. During each of the last nine years, solar has been either the first or second source of new electric capacity additions. In 2021, 46% of all new electric capacity added to the grid came from solar, the largest such share in history and the third year in a row that solar added the most generating capacity to the grid. We believe the growth of solar installations is poised to continue. According to BloombergNEF (“BNEF”) in an October 2021 report, the U.S. had approximately 72 GW of combined utility-scale and commercial and industrial (“C&I”) solar capacity as of 2020 and capacity is expected to grow by 276 GW to approximately 350 GW, or approximately 15%, implying an approximately 15% compound annual growth rate (“CAGR”) by 2030. These new capacity additions represent the total addressable market (“TAM”) for our renewable generation business, with the charts below demonstrating the expected incremental growth in capacity expected year-over-year and the overall expected growth of our key focus areas.

2021—2030 Cumulative U.S. Utility-Scale and C&I Solar Capacity Additions (GW)

Source: BloombergNEF, first half of 2022 U.S. Renewable Energy Market Outlook.

8

Table of Contents

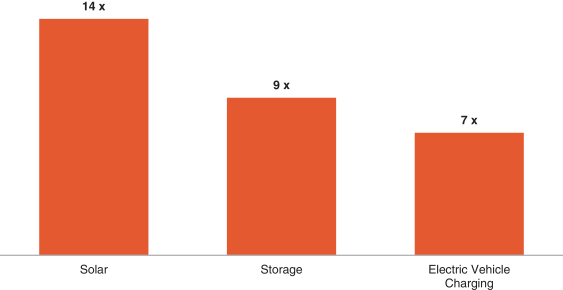

Growth in U.S. Total Addressable Market

(MW or Number of Chargers)

Source: BloombergNEF, first half of 2022 U.S. Renewable Energy Market Outlook, first half of 2022 Energy Storage Market Outlook; International Council on Clean Transportation, Charging up America: Addressing the Growing Need for U.S. Charging Infrastructure through 2030, as of July 2021.

National governments have encouraged the ongoing energy transition, setting ambitious climate targets and providing attractive incentives for renewable energy producers. The recently enacted Inflation Reduction Act of 2022 (the “Inflation Reduction Act”) positions the U.S. to reach net-zero emissions by no later than 2050 through a combination of investments in the domestic production of solar panels and batteries, extensions and expansions of existing tax credits and providing capital to innovative green technologies.

In particular, the Inflation Reduction Act has (i) extended the ITC for solar to at least 2032, providing significant runway and certainty on the tax incentives that will be available to our projects in the future, (ii) expanded the ITC to include stand-alone energy storage projects so that such storage projects may claim the ITC without being integrated into a solar facility, (iii) allowed solar to claim the PTC that is a production based credit that extends for 10 years following the placed-in-service date of the facility, which provides for greater flexibility for different financing structures, including having a solar plus storage project take advantage of the PTC for solar and the ITC for storage, (iv) revised tax credits for EV charging infrastructure and new EVs and introduced tax credits for used EVs and commercial EVs, and (v) introduced the concept of transferability of tax credits, providing an additional option to monetize such credits. We believe the Inflation Reduction Act will increase demand for our services due to the extensions and expansions of various tax credits that are critical for financing our business and may provide more flexibility in the various financing structures we can now use while also providing more certainty in and visibility into the supply chain for materials and components for solar and energy storage systems. However, the impact of the Inflation Reduction Act cannot be known with any certainty and we may not achieve any or all of the expected benefits of Inflation Reduction Act.

9

Table of Contents

The commercial enterprise solar market continues to be boosted by corporate clean energy and decarbonization goals. According to a Wood Mackenzie (“WoodMac”) report for SEIA, C&I renewable demand in the U.S. is expected to drive approximately 10 to 13 GW of new solar generation from 2022 through 2026.

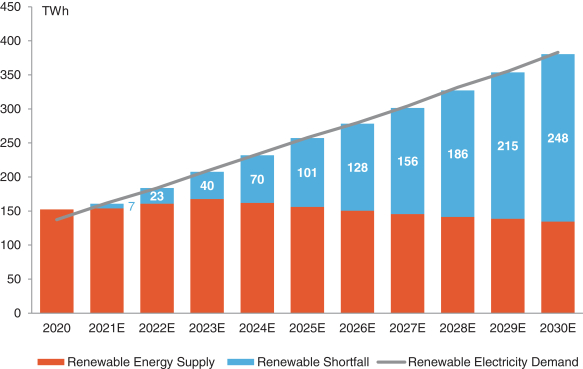

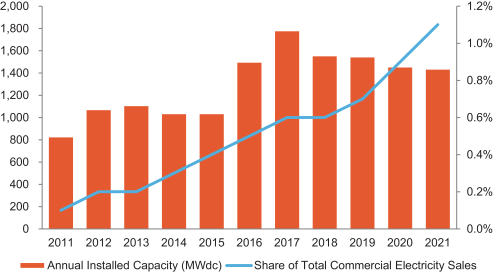

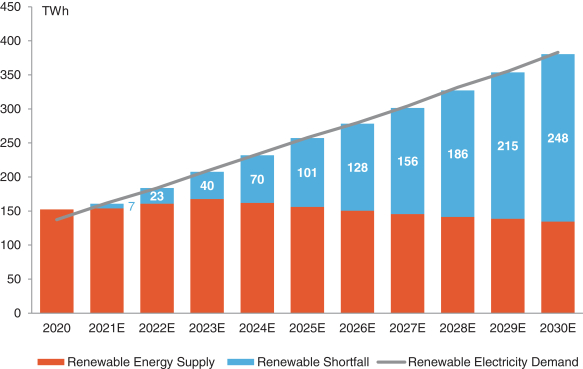

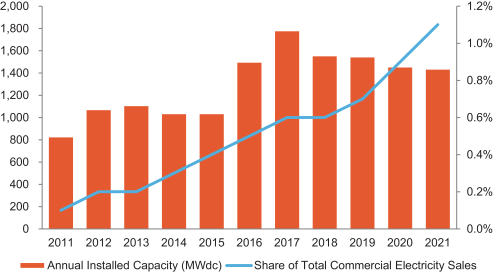

The number of companies making commitments to clean energy has also been growing steadily, increasing the size of the market opportunity. RE100, a global initiative that brings together corporations committed to sourcing 100% of their energy needs from renewable sources by or before 2050, has grown from 13 members at the end of the year of its founding in 2014, to 378 members by August 2022, and includes a number of Fortune 500 companies that are already our customers. This organization alone represents hundreds of annual terawatt hours (“TWh”) of demand for renewable energy, and it is estimated that RE100 members’ renewable energy demand will exceed supply by as much as 248 TWh by 2030 without significant investment in additional renewable energy supply. Further, approximately 1.2% of commercial electricity demand is served by on-site solar according to SEIA, as of December 31, 2021. This shortfall, combined with low-levels of market penetration for on-site solar creates a huge opportunity for further growth in the segment.

RE100 Member Companies Cumulative Growth (number of members at year-end)

Source: RE100 as of August 2022.

10

Table of Contents

Projected Renewable Shortfall for RE100 Members

Source: BloombergNEF, Bloomberg Terminal, The Climate Group, company sustainability reports, RE100, SEIA as of December 31, 2021.

On-Site Commercial Solar Installations and Penetration Growth

Source: SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insight, 2021 Year in Review.

Note: Excludes commercial electricity demand met by utility-scale or other off-site generation.

11

Table of Contents

As solar module prices have continued to fall, commercial solar installations have grown rapidly and have diversified to include everything from rooftop systems, solar parking canopies, and large off-site installations. Average commercial system sizes have also been growing over time, primarily driven by falling prices and more financing flexibility. With corporate renewable and decarbonization goals continuing to increase, we believe this growth in average system size is likely to continue.

In addition to the diversification in types of solar installations, enterprises are also increasingly looking for solar systems paired with battery storage. According to SEIA, by 2025, over 29% of all behind-the-meter solar systems will be paired with storage, compared to less than 11% in 2021. Larger scale solar projects are also more frequently being paired with storage, with over 45 GW of commissioned or announced projects paired with storage, representing over 50 GWh of storage capacity. In an analysis of long-term projected capacity additions through 2050 done by the U.S. Energy Information Administration (“EIA”), large-scale battery storage energy capacity is projected to grow to 235 GWh (59 GW power capacity of four-hour duration systems) by 2050, which would include 153 GWh (38 GW) of storage paired with solar. In the nearer term, BNEF expects the U.S. to add approximately 32 GW of utility-scale and approximately 1 GW of C&I storage capacity between 2021 and 2025. We consider this to be our TAM for battery storage during this time period.

2021—2025 U.S. Storage Capacity Additions (GWh)

Source: BloombergNEF, first half of 2022 Energy Storage Market Outlook.

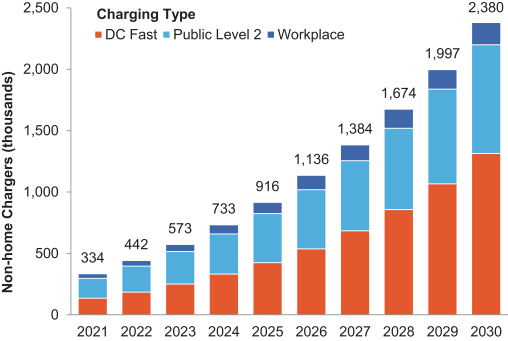

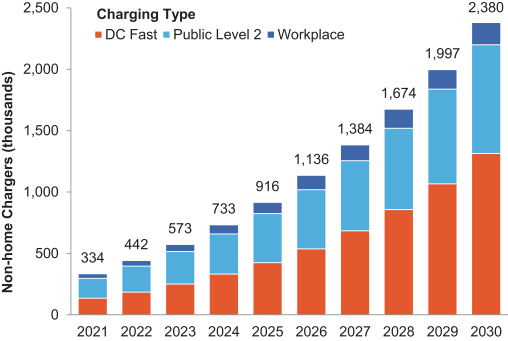

As major auto manufacturers have committed to electrification, we believe that EV charging presents a significant opportunity to serve enterprise customers. Due to rising policy and customer support, new battery technologies and lower costs, we believe the next 20 years will bring significant changes as EVs reshape automotive and freight industries. This will also bring a substantial need for EV charging infrastructure, as fleet operators and businesses prepare for this transition. Although the EV charging market is relatively new, the significant increase in projected EV sales in the near-term illustrates the growing need for EV charging infrastructure. Prior to the modification to the new EV tax credit and the introduction of the tax credits for used EVs and commercial EVs in the Inflation Reduction Act, BNEF had estimated that by 2025, EV’s share of new passenger vehicle sales will be approximately 12.5%, compared to less than 5% in 2021. To support the additional EVs on the road, the annual investment required in EV charging infrastructure will need to increase from approximately $1 billion in 2021 to greater than $4 billion by 2030, according to the International Council on Clean Transportation. This investment will likely be aided by the tax credit for EV charging infrastructure, as modified by the Inflation Reduction Act. The chart below illustrates the number of non-home EV chargers that are expected to be needed to meet demand through 2030.

12

Table of Contents

Non-home EV Chargers

Source: International Council on Clean Transportation, Charging up America: Addressing the Growing Need for U.S. Charging Infrastructure through 2030, as of July 2021.

Key Growth Drivers

We believe the key factors that will continue to drive growth in U.S. solar generation include the following:

| • | increasing economic competitiveness of solar with fossil generation sources; |

| • | accelerating demand for and deployment of cost effective battery energy storage; |

| • | growing corporate and investor support for decarbonization of energy; |

| • | government policies and incentives, including Renewable Portfolio Standards (“RPSs”), which require that a certain percentage of electricity come from renewable energy resources, and |

| • | the Inflation Reduction Act, which incentivizes investment in renewable power and related technologies through a combination of investments in the domestic production of solar panels and batteries, extensions and expansions of existing tax credits, new tax credits, an option to transfer tax credits and providing capital to innovative green technologies. |

Our Competitive Strengths

We have several key competitive strengths that differentiate us from our peers, including:

Differentiated partner for our customers. In 2021, we were one of the largest independent solar energy and energy storage power producers in the U.S. and one of the top 5 largest solar and

13

Table of Contents

storage asset owners overall in the U.S., based on the total gross capacity of our projects that were operating according to S&P Global Market Intelligence. Our role as a large, stable asset owner provides us with advantages in attracting off-takers who know that we will be the long-term owner of the asset and not someone whose business model is to “develop and flip” or whose capital base will require a divestiture prior to the end of the off-take contract. We have found this consistency in counterparty to be important to our customers. We believe this has been key in enabling us to win projects and has earned us a reputation among customers as a credible developer and owner and made us a partner of choice. We believe these key qualities are part of the reason that approximately 50% of our customers have more than one project contracted with us as of June 30, 2022.

Our customers are diverse and creditworthy, which reduces the risk of our portfolio. Our over 200 customers are corporations, federal, state and municipal entities, universities, college, and school districts, communities (through CCAs), and utilities. Some are among the largest and most creditworthy entities in the world. As of June 30, 2022, approximately 84% of our contracted operational MW’s are with investment grade rated customers, approximately 11% are with unrated customers whose credit risk we view as equivalent to investment grade, and approximately 4% are from community solar, a credit diversified portfolio. The combination of this counterparty diversification and high credit quality reduces the risk of defaults and allows us to maximize the predictability of our cash flows over the long term.

Strong balance sheet provides ability to deliver on commitments. We typically enter into solar generation contracts with a term of 15 years or longer. The average remaining capacity-weighted life of our existing operational contracts (exclusive of our storage operations) is approximately 15 years as of the date of this prospectus. These long-term contracts with our diverse and highly-rated customers create consistent cash flows that have allowed us to build a strong balance sheet and the financial wherewithal to deliver on our commitments to customers and for our long-term growth. We have a repeat track record of financing large and diversified project portfolios through the institutional green bond market. Since 2019, we have executed $1.3 billion of financings in the green bond market, including $252 million in senior secured notes due 2047 that were issued in April 2022. These financings are fixed rate and fully amortizing, with a 25-year tenor, and a weighted average cost of debt of 3.4%. They represent some of the lowest costs ever achieved in the green bond market. In addition, this strategy has mitigated both interest rate and refinancing risk. As we focus on 100% ownership of our projects, these larger financings allow for a more simplified capital structure with increased flexibility for tax-equity financings and capital capacity due to their self-amortizing debt.

Industry-leading operator of solar assets. We believe our team’s intense focus on details has allowed us to outperform customer expectations while remaining cost-conscious, which we believe will generate value for our shareholders. From our plant operations center, our asset operations team closely monitors our assets and continually pursues opportunities to optimize costs, while our technical team monitors asset performance and pursues opportunities to enhance project performance. These teams, and our origination and project management teams, leverage QBI, an industry-leading asset management software and valuable tool we use to manage and optimize our portfolio. Some examples of our operational capabilities include:

| • | creation of an algorithm to estimate soiling on solar modules based on geographical information, meteorological conditions and the most recent cleansing rainfall. This information is used to inform decisions on when to perform washings of solar modules to maximize energy production and has led to a 3% Uplift in production in applicable projects; |

| • | re-engineering of solar projects in areas that experience regular seasonal snowfall to limit the potential for damaging spikes in electric current that can occur when solar irradiance is |

14

Table of Contents

magnified by reflections from snow cover which has led to a 1% Uplift in applicable projects; and |

| • | development of data analytics to uncover correlations that can be used to predict and avoid equipment failures which has led to a 0.7% Uplift in applicable projects. |

Exceptional team with experience across the renewable asset life-cycle. Our team of approximately 140 highly-skilled professionals combines investing, finance and commodities expertise honed at Goldman Sachs with renewable energy industry expertise across all phases of a project’s lifecycle: development, engineering and design, procurement, construction oversight, O&M oversight, and asset management. These in-house capabilities provide execution certainty to our customers. Collectively, our team has over 475 years of experience in the renewable energy industry and has developed or operated over 150 GW of projects. The expertise of our team has also allowed us to find opportunities where we can invest capital for a higher rate of return than we might find in a one-off project. We have embraced a “Land and Expand” strategy that leverages existing infrastructure and customers to introduce further product offerings and add significant value to existing assets. A few selected examples of this include:

| • | asset upsizing and retrofitting: when CAISO began to require load serving entities to produce capacity, we brought a solution to one of our customers by adding an additional battery. This asset enhancement is strongly accretive to the underlying solar project. As a result, we were also able to enter into a long-term tolling agreement with one of the customers; |

| • | adding revenue streams: we developed an innovative solution to reduce electricity costs and carbon emissions, and to qualify for California’s low-carbon fuel standard (“LCFS”) credits. By leveraging existing energy infrastructure as well as state and federal decarbonization incentives, we created significant value for the customer; and |

| • | expanding relationship with an existing customer: from 2019 to early 2021, we increased our project count with one of our key customers from eight to 18 projects. The customer is a subsidiary of a Fortune 10 company and has approximately 500 retail locations in North America. The majority of our projects with this customer are located in California. Our position as a first-mover in providing solar and storage solutions drove our ability grow the relationship. In addition to delivering carbon-reduction benefits, these projects have produced savings for our customer versus grid prices and provide resiliency through the added storage. |

Our Growth Strategy

Executing on our pipeline of projects in development. We have a robust pipeline of existing projects in various stages of development. As of June 30, 2022, the pipeline of pre-operational projects was made up of 4.0 GW of solar projects and 1.1 GW of energy storage projects. This represents projects that are pre-construction. We have a strong track record of executing on projects in our pipeline to accomplish our growth objectives. In addition, we will look to continuously grow our pipeline going forward by adding projects sourced both from development and merger and acquisition opportunities.

Continue to grow business with existing customer base. As our customers continue to decarbonize their businesses, we strive to be their go-to providers for energy transition solutions, capturing the market share of some of the largest enterprise customers and finding opportunities for cross-sell opportunities. In order to fulfill our mission of serving our customers and assisting them in their energy-transition journey to an electrified, decarbonized world, we maintain an ongoing dialogue with our existing customers in order to understand their current and anticipated future energy needs and look to position ourselves to help them find the most efficient and relevant solutions. We believe

15

Table of Contents

that many customers will want more renewable energy and battery storage. Our existing long-term contractual relationships with our customers provides both the relationship and the runway to meet these needs. Many of our existing customers have committed to decarbonization goals that will require them to procure more of their power from renewables in the coming years, creating additional opportunities for us to partner. As an example, Target, which is one of our larger corporate customers, has committed to purchasing 100% of its electricity from renewable sources by 2030. Today, the projects and partnerships it has put in place to source this electricity will result in Target purchasing approximately 38% of its electricity from renewable sources in 2020, leaving substantial capacity still to be sourced by 2030 according to Target’s 2021 Target Corporate Responsibility Report.

Growth of potential customer base. The number of enterprise customers seeking to decarbonize their operations continues to accelerate. As an example of this growth, RE100, a global initiative that brings together corporations committed to sourcing 100% of their energy needs from renewable sources by or before 2050, has grown from 13 members at the end of the year of its founding in 2014, to 378 members as of August 2022. Our business development team is focused on growing our customer base through participating in requests for proposals and developing new relationships with these customers through bilateral dialogue. Our successful track record and reputation as an industry-leading operator positions us well to win new business against other competitors in the space.

Expansion of product offerings. We recognize our customers’ needs are evolving beyond solar energy power purchase agreements and we expect to meet their needs in adjacent areas. As we consider areas for product and service expansion, we will continue to look for opportunities that meet the following key attributes: scalability, strong margins and growth runway, recurring revenue, long-term value and products and services where we have a competitive advantage. As customers are increasingly seeking reliability and resiliency in their renewable energy procurement, we are continuing to grow our battery storage portfolio and offer our customers various energy storage solutions. We are also developing solutions for EV infrastructure needs such as charging stations for enterprise fleets and customer and employee use. We view both of these product offerings as having the key attributes that are core to our business strategy. In particular, we view EV charging infrastructure as a service that has synergies with our existing generation and storage business as our customers view it as part of a comprehensive solution, alongside renewable generation and storage, that will allow them to pursue decarbonization of this full application.

In March 2022, we announced our first partnership in the EV infrastructure space, a key milestone for our growth plans in this product area. We have entered into a Project Development Agreement (“PDA”) with ChargePoint, Inc. (NYSE:CHPT) (“ChargePoint”), a leading EV charging network, to introduce new tailored solutions that will allow us to offer comprehensive EV charging solutions to enterprise customers. The PDA establishes a framework through which we will jointly originate and develop EV charging station project opportunities with ChargePoint. We will own the project assets, be responsible for the financing of the assets, engage and liaise with the customers. ChargePoint will supply the EV charging equipment and certain cloud-based application services and provide certain warranty, operations and maintenance services for the charging stations. This partnership will allow us to provide turnkey charging solutions, which will enable our customers to host a station at zero upfront cost to them. The partnership aligns with our goal to provide customers with a broader variety of solutions to meet their evolving decarbonization needs. These new offerings will make it easier for enterprise customers to electrify their fleets, and for employers and businesses to provide the increasing number of employees and customers driving EVs with on-site charging solutions. Under the terms of the PDA, we have the option to commit capital to developing EV charging station projects and will do so as opportunities arise. To date, we have deployed an immaterial amount of capital in developing such projects.

16

Table of Contents

In addition, we are evaluating a variety of emerging technologies in order to continue to meet our enterprise customers’ needs. For example, we may expand our product offerings with clean hydrogen facilities and, when such technology becomes available, 24/7 clean energy solutions for our enterprise customers.

Internalization Transaction

Prior to August 4, 2022, we did not have any employees but had rather been externally managed by Goldman Sachs Asset Management, L.P. (“GSAM”), a wholly owned subsidiary of The Goldman Sachs Group, Inc. (“GS”). GSAM is a highly diversified global investment management firm supervising over $2 trillion in assets as of June 30, 2022. With more than 2,000 professionals across 31 offices worldwide, GSAM provides investment and advisory solutions for institutional and individual investors across multiple asset classes.

Under a Management Services Agreement, GSAM historically dedicated to us a team of approximately 100 professionals with extensive experience spanning transaction sourcing and financial analysis, power markets and physical asset analysis in the solar industry. In addition to this dedicated team, GSAM had risk management, legal, accounting, tax, information technology and compliance personnel, among others, who provided services to us. Under the Management Services Agreement, GSAM was entitled to certain administrative fees and management fees for the services provided to us. See “Certain Relationships and Related Party Transactions—Management Services Agreement.”

In addition, under the terms of the limited liability company agreement of MN8 Energy Operating Company LLC (f/k/a Goldman Sachs Renewable Power Operating Company LLC) (“OpCo”), GSAM Holdings II LLC (the “Special Interest Member”) holds the Special Interest, which for periods prior to the closing on August 4, 2022, of the Internalization Transaction described below included the right to receive the OpCo Incentive Allocation, the value of which was based on certain operational and financial metrics as further described in “Certain Relationships and Related Party Transactions—OpCo LLC Agreement.”

On May 18, 2022, we entered into an agreement (the “Internalization Agreement”) with OpCo, MN8 Energy, GSAM and the Special Interest Member to engage in an internalization transaction (“Internalization Transaction”), which we closed on August 4. 2022. Pursuant to the Internalization Transaction, among other things:

| • | the Management Services Agreement was terminated and GSAM is no longer entitled to management fees or administrative fees from us; |

| • | we agreed to directly employ the approximately 100 professionals previously employed by GSAM that were dedicated to our business under the Management Services Agreement; |

| • | we entered into a transition services agreement with MN8 Energy, OpCo and GSAM that provides for the provision of certain administrative services by GSAM to MN8 Energy, OpCo and us for a specified period of time following the closing of the Internalization Transaction; |

| • | the OpCo Incentive Allocation was terminated; |

| • | OpCo and its subsidiaries made an aggregate payment of $30 million (less $3.0 million in cash signing bonuses to be paid to former GSAM employees) to the Special Interest Member and affiliates thereof, and $4 million of such payment was credited against, and reduced, the purchase price payable to GSAM Holdings LLC (“GSAM Holdings”) pursuant to the QBI Solutions Share Purchase Agreement; |

| • | the parties agreed that, in connection with the Corporate Reorganization, the Special Interest will be exchanged (the “Special Interest Exchange”) by the Special Interest Member for a number of shares of common stock of MN8 Energy (the “Special Interest Shares”) calculated in |

17

Table of Contents

the manner further described in “Internalization Transaction and Corporate Reorganization”, which calculation is derived from an implied equity value for our company before giving effect to this offering based on the initial public offering price per share set forth on the cover of this prospectus and takes into account prior distributions, including the cash payment to the Special Interest Member described above; using an assumed initial public offering price for our common stock of $ per share (the midpoint of the price range set forth on the cover of this prospectus), we would issue Special Interest Shares; |

| • | we are subject to non-competition covenants under the Internalization Agreement, which may limit our operations in certain respects; |

| • | the parties agreed that GSAM will have the right to one board seat until such time following the Corporate Reorganization as GSAM’s ownership of MN8 Energy’s common stock falls below five percent of the common stock then outstanding; and |

| • | the parties agreed that The Regents of the University of California (the “UC Regents”) has the option to appoint a board observer until the earlier of (i) prior to the initial public offering, the UC Regents no longer owning 10% of MN8 Energy LLC or (ii) after the initial public offering, the UC Regents no longer owning 10% of MN8 Energy’s common stock. |

Corporate Reorganization

MN8 Energy LLC (f/k/a Goldman Sachs Renewable Power LLC) was formed in Delaware on September 19, 2017. Prior to this offering, in the Merger, a wholly owned subsidiary of MN8 Energy, Inc. (“MN8 Energy”), a newly incorporated Delaware corporation formed for the purpose of effecting this offering and the transactions related thereto, will merge into MN8 Energy LLC, with MN8 Energy LLC surviving such Merger, and all outstanding limited liability company interests in MN8 Energy LLC will be exchanged for shares of common stock of MN8 Energy, with each member entitled to receive its pro rata portion of such shares of common stock based on such member’s rights to distributions from MN8 Energy LLC. In connection with the Merger and the Special Interest Exchange, an aggregate of shares of common stock of MN8 Energy will be issued to the Existing Owners and the Special Interest Member of which, based on the an initial public offering price of $ per common share (the midpoint of the price range on the cover of this prospectus), shares will be issued to the Existing Owners in the Merger and shares will be issued to the Special Interest Member in the Special Interest Exchange. Following the Merger and the Special Interest Exchange, MN8 Energy will issue shares of common stock to the public in this offering in exchange for the proceeds of this offering.

After giving effect to the Merger and the Special Interest Exchange, which we refer to as the “Corporate Reorganization,” the Internalization Transaction and the offering contemplated by this prospectus, and assuming no exercise of the underwriters’ option to purchase additional shares:

| • | GSAM (including through the Special Interest Member) will own of our shares of common stock, which, based on an initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus), representing an aggregate illustrative value of approximately $ and approximately % of the voting power thereof; |

| • | the Existing Owners other than GSAM will own of our shares of common stock, which, based on an initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus), representing an aggregate illustrative value of approximately $ and approximately % of the voting power thereof; and |

| • | investors in this offering will own of our shares of common stock, representing which, based on an initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus), representing an aggregate illustrative value of approximately $ and % of the voting power thereof. |

18

Table of Contents

The following diagram indicates our simplified ownership structure immediately following the Internalization Transaction, the Corporate Reorganization and the consummation of this offering and the transactions related thereto (assuming the underwriters’ option to purchase additional shares is not exercised).

19

Table of Contents

The ownership figures set forth above assume an initial public offering price of $ per common share, which is the midpoint of the price range set forth on the cover of this prospectus. Any increase or decrease (as applicable) of the assumed initial public offering price will result in an increase or decrease, respectively, in the number of Special Interest Shares to be issued to GSAM, and an equivalent decrease or increase, respectively, in the number of shares of common stock to be received by the other Existing Owners of MN8 Energy LLC. Accordingly, any such change in our initial public offering price will not affect the aggregate number of shares of common stock held collectively by the Existing Owners (including GSAM) and the public. See “Internalization Transaction and Corporate Reorganization—Existing Owners’ Ownership.”

Summary Risk Factors

Investing in our common stock involves risks that relate to, among other things, our business, our dealers, market factors, governmental policies and regulation, competition, the pace of technological innovations, the credit risk of our customers, our ability to raise financing and the level of our indebtedness. The risks described under the heading “Risk Factors” included elsewhere in this prospectus may cause us not to realize the full benefits of our strengths or may cause us to be unable to successfully execute all or part of our strategy. Some of the most significant challenges and risks we face include the following:

Risks Related to Our Industry and Operations

| • | Changes to irradiance at our solar facilities or weather conditions generally, as a result of climate change or otherwise, at any of our solar facilities could materially adversely affect our operations. |

| • | Supply and demand in the energy market is volatile, and such volatility could have an adverse impact on electricity prices and a material adverse effect on our assets, liabilities, business, financial condition, results of operations and cash flow. |

| • | As our contracts expire, we may not be able to replace them with agreements on similar terms. |

| • | We may not be able to obtain long-term contracts for the sale of power produced by our projects on favorable terms and we may not meet certain milestones and other performance criteria under existing PPAs. |

| • | A portion of our operating revenues is attributable to the sale of SRECs, which are renewable energy attributes that are created under the laws of individual states of the U.S., and our failure to be able to sell such SRECs at attractive prices, or at all, could materially adversely affect our business, financial condition and results of operation. |

| • | Disruptions in our supply chain for materials and components, alongside increased logistics costs, have adversely affected our business and may continue to do so. |

| • | We face competition from traditional utilities and renewable energy companies. |

| • | Advances in technology could impair or eliminate the competitive advantage of our projects. |

| • | The amount of uncontracted generation in our portfolio may increase. |

| • | There is a risk that our concessions and licenses will not be renewed. |

| • | Our use and enjoyment of real property rights for our solar facilities may be adversely affected by the rights of lienholders and leaseholders that are superior to those of the grantors of those real property rights to us. |

20

Table of Contents