Megawatt hours generated increased from approximately 2,033,126 MWh for the year ended December 31, 2020, to approximately 2,417,803 MWh for the year ended December 31, 2021, primarily due to the increased number of operating solar energy systems in our fleet.

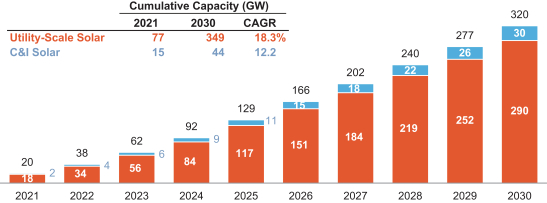

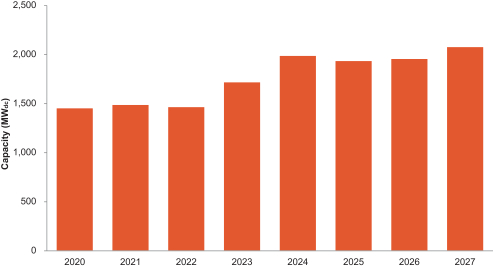

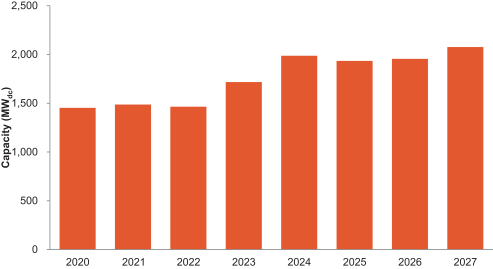

Megawatt Capacity

Megawatt capacity represents the maximum output of electricity produced during the period indicated.

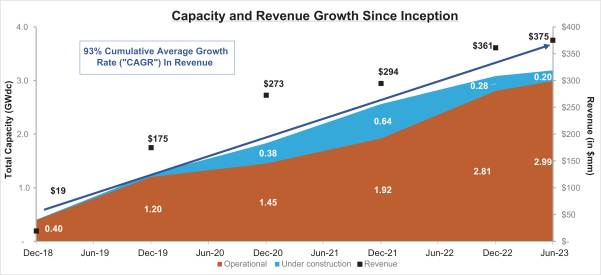

Megawatt capacity increased from approximately 2,035 MW as of June 30, 2022, to approximately 2,724 MW as of June 30, 2023, primarily due to the increased number of operating solar energy systems in our fleet.

Megawatt capacity increased from approximately 1,709 MW as of December 31, 2021, to approximately 2,540 MW as of December 31, 2022, primarily due to the increased number of operating solar energy systems in our fleet.

Megawatt capacity increased from approximately 1,455 MW as of December 31, 2020, to approximately 1,709 MW as of December 31, 2021, primarily due to the increased number of operating solar energy systems in our fleet.

Storage

Megawatt Hours Capacity of Energy Storage

Megawatt hours capacity of energy storage represents the total amount of energy that can be discharged by the energy storage systems in our fleet.

Megawatt hours capacity of energy storage was unchanged with approximately 1,065 MWh as of June 30, 2023 and 2022.

Megawatt hours capacity of energy storage increased from approximately 504 MWh as of December 31, 2021, to approximately 1,065 MWh as of December 31, 2022, primarily due to the increased number of operating energy storage systems in our fleet.

Megawatt hours capacity of energy storage increased from approximately 4 MWh as of December 31, 2020, to approximately 504 MWh as of December 31, 2021, primarily due to the increased number of operating energy storage systems in our fleet.

Non-GAAP Financial Measures

Adjusted EBITDA is net income (loss) before income tax expense (benefit), interest expense, net, depreciation, amortization and accretion, contract amortization, (gain) loss on sale-leaseback buyouts and terminated obligations, gain on sale of business, legal settlements, loss on extinguishment of debt, equity compensation, adjustments to reflect pro-rata share of Adjusted EBITDA from equity investments, restructuring costs and acquisition and development costs. We define Project Contribution Margin as gross margin, adding contract amortization and depreciation, amortization and accretion expense, less operations and maintenance, excluding depreciation, amortization and accretion.

See “Summary Historical and Pro Forma Condensed Consolidated Financial and Operational Data—Non-GAAP Financial Measures” for additional information, including reconciliations to net income (loss) and operating revenues, the most directly comparable GAAP measures, respectively.

92