This is a confidential draft submission to the U.S. Securities and Exchange Commission pursuant to Section 106(a) of the Jumpstart our Business Startups Act of 2012 on March 2, 2023 and is not being filed publicly under the Securities Act of 1933, as amended.

Registration No.

An Offering Statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the Offering Statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the Offering Statement in which such Final Offering Circular was filed may be obtained.

PART II – INFORMATION REQUIRED IN OFFERING CIRCULAR

PRELIMINARY OFFERING CIRCULAR | | SUBJECT TO COMPLETION | | DATED MARCH 2, 2023 |

| | | | | |

Invest Inc.

Up to 3,000,000 Shares of Common Stock

11500 W Olympic Blvd. Suite 562

Los Angeles, California 90064

Invest Inc., a Wyoming corporation (“we,” “us,” “our,” or the “Company”), is offering up to 3,000,000 shares of our common stock (the “Offering”). The initial price per share is $6.00 for an Offering amount of up to $18,000,000 (the “Maximum Offering”) on a best efforts basis. There is no required minimum number of securities or amount of proceeds that must be sold as a condition to completion of the Offering.

We may conduct an initial closing (the “Initial Closing”) at any time (the “Initial Closing Date”) provided that the Offering Statement has been qualified by the Securities and Exchange Commission (the “Commission”). Thereafter, this Offering will terminate at the earlier of: (1) the date at which the Maximum Offering has been sold; (2) the date which is one year after this Offering being qualified by the Commission; or (3) the date on which this Offering is earlier terminated by us in our sole discretion (the “Termination Date”).

If, on the Initial Closing Date, we have sold less than the Maximum Offering, then we may hold one or more additional closings for additional sales (each an “Additional Closing”) until the Termination Date. We will consider various factors in determining the timing of any Additional Closings, including but not limited to the amount of proceeds received at the Initial Closing, any Additional Closings that have already been held, and indications of interest shown by any additional prospective investors.

From the date of qualification until the Initial Closing Date, and thereafter pending any Additional Closings on subsequent closing dates (“Additional Closing Dates,”) and with the Initial Closing Date, a “Closing Date”) the proceeds from the Offering will be kept in an escrow account. Upon the Initial Closing Date and upon each Additional Closing Date, if any, the proceeds therefrom will be distributed to us and the associated securities will be issued to the investors therein. We have engaged tZERO ATS, LLC, a Commission-registered broker dealer and member of FINRA and SIPC to act as our escrow agent for the Offering (the “Escrow Agent”). We will pay the Escrow Agent a $1,000 fee for its services for the Offering. If the Initial Closing never occurs, any proceeds from the Offering will be promptly returned to investors by the Escrow Agent, without deduction or interest. (See “Plan of Distribution.”)

The minimum purchase requirement per investor is $600 or 100 shares of common stock; however, we can waive the minimum purchase requirement on a case-by-case basis in our sole discretion. We expect to commence the sale of the shares as of the date on which the Offering Statement, of which this Offering Circular is a part, is qualified by the Commission.

Our common stock will initially not be listed for trading on any national securities exchange. After the Final Closing, we intend to make our common stock available for trading on the alternative trading system operated by tZERO ATS, LLC (the “tZERO ATS”), subject to tZERO ATS, LLC’s due diligence and on-boarding procedures. However, we cannot provide any assurance that we will be successful in making our common stock available to trade on the tZERO ATS.

Currently, our officers and directors own 60% of our common stock After the Offering, assuming all of the shares being offered are sold, our officers and directors will hold 50% of the voting power of our outstanding common stock.

We are an “emerging growth company” under the federal securities laws. (See “Offering Circular Summary—Implications of Being an Emerging Growth Company.”)

Investing in our common stock involves a high degree of risk. (See “Risk Factors” beginning on page 7.)

This Offering will terminate at the earlier of (i) the date at which the Maximum Offering amount set forth above has been sold, or (ii) the date at which this Offering is earlier terminated by us at our sole discretion. At least every 12 months after this Offering has been qualified by the Securities and Exchange Commission, we will file a post-qualification amendment to include our recent financial statements.

The United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered or the terms of the Offering, nor does it pass upon the accuracy or completeness of any Offering Circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the Commission; however, the Commission has not made an independent determination that the securities offered are exempt from registration.

Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. (See “Plan of Distribution—Investment Limitations.”) Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

The securities described in this Offering Circular (the “Offering Circular”) may not be sold until qualified by the Commission. This Offering Circular is not an offer to sell, nor solicitation of an offer to buy, any of our securities in any state or other jurisdiction in which such sale is prohibited. This Offering Circular follows the disclosure format prescribed by Part I of Form S-1 pursuant to the general instructions of Part II(a)(1)(ii) of Form 1-A.

For more information concerning the procedures of the Offering, please refer to “Plan of Distribution” beginning on page 59.

The date of this Offering Circular is [ ], 2023

TABLE OF CONTENTS

ABOUT THIS OFFERING STATEMENT

As used in this Offering Circular, unless the context otherwise requires or indicates, references to the “Company,” “we,” “our,” “ourselves,” and “us” refer to Invest Inc.

You should rely only on the information contained in this Offering Circular prepared by us or on our behalf that we have referred you to. We have not authorized anyone to provide you with additional or different information. If anyone provides you with additional, different, or inconsistent information, you should not rely on it. We take no responsibility for, and can provide no assurance as to, the reliability of any other information that others may give you. This Offering Circular is an offer to sell only the shares offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. We are offering to sell and seeking offers to buy our common stock only in jurisdictions where offers and sales are permitted. We are not making an offer of these securities in any state, country, or other jurisdiction where the offer is not permitted. You should not assume that the information in this Offering Circular is accurate as of any date other than the date of the applicable document regardless of its time of delivery or the time of any sales of our common stock. Our business, financial condition, results of operations and cash flows may have changed since the date of the applicable document.

This Offering Circular describes the specific details regarding this Offering and the terms and conditions of our common stock being offered hereby and the risks of investing in our common stock. For additional information, please see the section entitled “Where You Can Find More Information.”

You should not interpret the contents of this Offering Circular to be legal, tax advice, business, or financial advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business, financial, and other issues that you should consider before investing in our common stock.

MARKET AND INDUSTRY DATA

This Offering Circular includes industry and trade association data, forecasts, and information that we have prepared based, in part, upon data, forecasts, and information obtained from independent trade associations, industry publications and surveys, government agencies, and other independent information publicly available to us. Statements as to our market position are based on market data currently available to us. Industry publications, surveys, and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe these sources are reliable, we have not independently verified the information obtained from these sources. Some data is also based on our good faith estimates, which are derived from management’s knowledge of the industry and independent sources.

We believe our internal research is reliable, even though such research has not been verified by any independent sources. While we are not aware of any misstatements regarding our industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this Offering Circular.

In addition, forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this Offering Circular. Trademarks used in this Offering Circular are the property of their respective owners, although for presentational convenience we may not use the ® or the ™ symbols to identify such trademarks. In addition, certain market and industry data has been obtained from publicly available industry publications. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but that the accuracy and completeness of the information are not guaranteed. We have not independently verified the data obtained from these sources. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this Offering Circular.

OFFERING CIRCULAR SUMMARY

This summary highlights information contained elsewhere in this Offering Circular, but it does not contain all of the information that you may consider important in making your investment decision. Therefore, you should read this entire Offering Circular carefully, including, in particular, the “Risk Factors” section of this Offering Circular.

Our Company

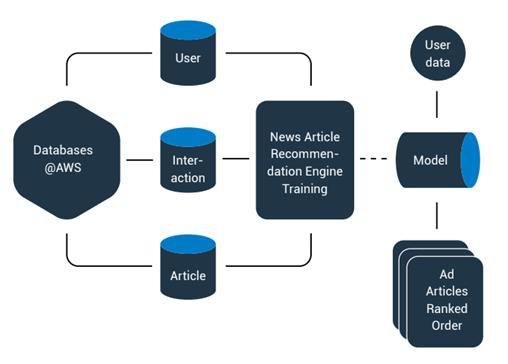

Invest Inc. was formed on October 7, 2020 as a Wyoming corporation. We have developed a platform named “Invest.inc,” an investment research platform that provides retail investors access to personalized institutional-level market information and tools to make well-researched, educated investment decisions for their portfolios. In addition to serving retail investors, we provide public companies with an enterprise solution for media buying, allowing issuers to utilize a robust advertising platform to reach their target audiences.

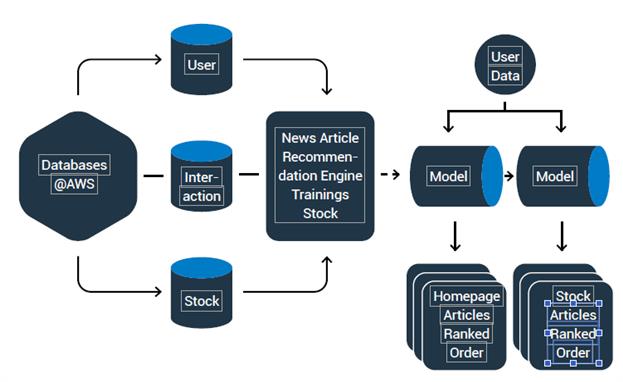

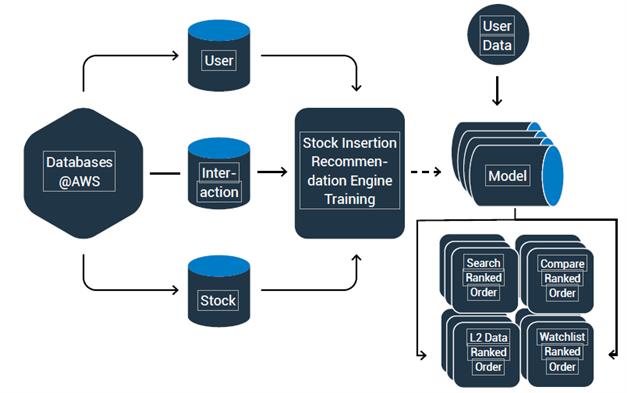

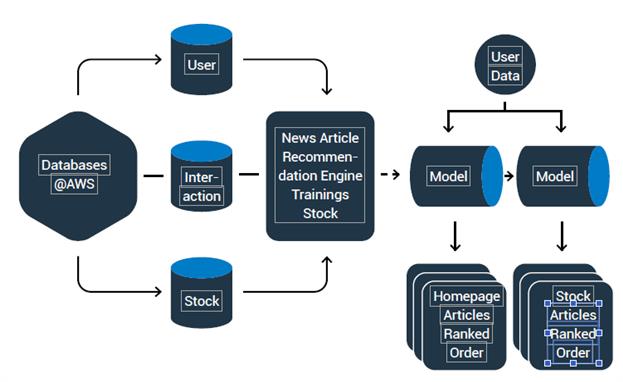

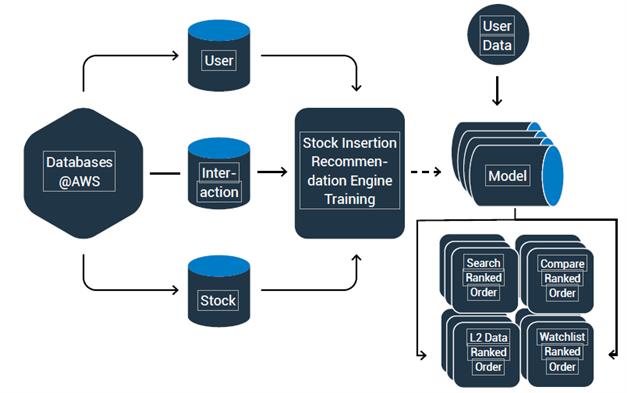

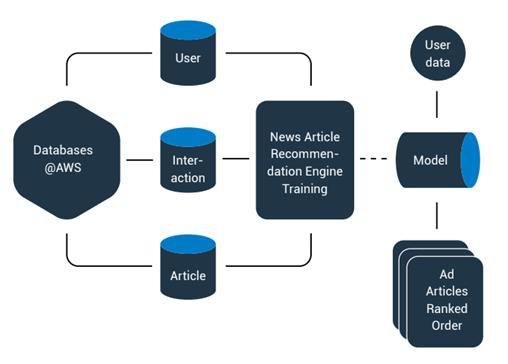

The vision of Invest.inc is to provide our users with an innovative machine-learning (“ML”) platform that is intended to curate useful, personalized, and functional investment news recommendations. The platform is being designed to provide investors with personalized, high-quality investment content through an easy-to-use interface. The system is planned to use supervised and unsupervised ML algorithms that draw from user behavior data, content analysis of investment news articles, and other external factors such as market trends and economic indicators.

Currently, to the best of our knowledge, there is no other machine-learning-first-designed investment platform like the one we have planned. We believe that our proposed sleek design and utility could generate a high level of engagement from the investment sector, while also drawing in a highly sought-after user base for advertisers. Thus, companies seeking brand awareness may be willing to pay to advertise on our platform.

Our Industry

Prior experiment results show that recommendation systems can increase site visit lengths by 2.5 times and result in 35% more clicks,1 increasing traffic, engagement, and revenue. We plan to have a powerful and ML-based recommendation engine developed to help investors make the most informed decisions about their investments, while alleviating them from the time-consuming search for information relevant to them.

The financial services sector has experienced a rapid digital transformation in recent years, and we believe that fintech, in particular, is poised for significant growth.

Fintech opportunities in retail investing have expanded as the space has attracted an influx of new participants who have a growing influence on global markets. Roughly six million Americans downloaded trading apps in January 2021 alone, with retail brokerages seeing daily volumes for equity and options trades reach record highs.2 One structure analyst at Bloomberg Intelligence estimated that retail investors accounted for an average of 23% of all U.S. equity trading in 2021, more than doubling the share they held in 2019.3

As interest in retail investing has skyrocketed, interest from venture capital (“VC”) firms in fintech has accelerated with a flurry of deal activity. In the first quarter of 2022 alone, fintech companies raised more than $29.3 billion across more than 1,200 deals.4 The median pre-money valuation for VC-backed, late-stage fintech companies increased 44.5% to $257.5 million in Q1 2022,5 while early-stage median pre-money valuations increased by 50% to $45 million.6

Given this backdrop, we aim to capitalize on emerging trends in the equities markets by becoming a leader in a rapidly growing sector that needs a functional, artificial intelligence (“AI”) native platform for high-quality, personalized investment content and ads. We want our product to provide institutional-level financial information, to allow all investors to be as informed in the decision-making process as possible.

1 Florent Garcent, Boi Faltings, Oliver Donatsch et al., “Offline and Online Evaluation of News Recommender Systems at swissinfo.ch,” ACM Conference on Recommender Systems (2014).

2 Maggie Fitzgerald, “Retail investor ranks in the stock market continue to surge,” CNBC, March 10, 2021.

3 Katie Martin, “Rise of the retail army: the amateur traders transforming markets,” Financial Times, March 8, 2021.

4 Priyamvada Mathur, “Five charts that show fintech investment trends in Q1,” Pitchbook, May 11, 2022.

5 Mathur, “Five charts.” Id.

6 Hannah Zhang, “Valuations on Early Stage Companies Are Holding Up — But Will It Last?,” Institutional Investor, November 8, 2022.

Summary Risk Factors

An investment in our securities involves risks. You should consider carefully the risks discussed below and described more fully along with other risks under “Risk Factors” in this Offering Circular before investing in our securities.

| ● | | This is a highly speculative investment. |

| | | |

| ● | | There is currently no public market for shares of our common stock, a trading market for our common stock may never develop following this Offering, and our common stock prices may be volatile and could decline substantially following this Offering. |

| | | |

| ● | | If you purchase common stock in this Offering, you will experience immediate dilution. |

| | | |

| ● | | Our executive officers and directors will control us. |

| | | |

| ● | | We have inadequate capital and need additional financing to accomplish our business and strategic plans. The terms of subsequent financings, if any, may adversely impact your investment. |

| | | |

| ● | | If we are unable to attract new customers, retain customers, expand our products and services offerings, or identify areas of higher growth, our revenue growth and profitability will be harmed. |

| | | |

| ● | | Our efforts to expand our service offerings and to develop and integrate our existing services in order to keep pace with policy, regulatory, political, and technological developments may not succeed. |

| | | |

| ● | | We rely on third parties, including public sources, for data, information, and other products and services, and our relationships with such third parties may not be successful or may change, which could adversely affect our results of operations. |

| | | |

| ● | | Our ability to introduce new features, integrations, capabilities, and enhancements is dependent on adequate research and development resources. If we do not adequately fund our research and development efforts, or if our research and development investments do not translate into material enhancements to our products and services, we may not be able to compete effectively, and our business, financial condition, results of operations, and prospects may be adversely affected. |

| | | |

| ● | | Larger and more well-funded companies with access to significant resources and sophisticated technologies may shift their business model to become our direct competitors. |

| | | |

| ● | | Issues in the use of artificial intelligence (including machine learning) in our platforms may result in reputational harm or liability. |

| | | |

| ● | | Our use of any “open-source” software under restrictive licenses could: (i) adversely affect our ability to license and commercialize certain elements of our proprietary code based on the commercial terms of our choosing; (ii) result in a loss of our trade secrets or other intellectual property rights with respect to certain portions of our proprietary code; and (iii) subject us to litigation and other disputes. |

| | | |

| ● | | We have entered into certain licensing agreements and other strategic relationships with third parties. These agreements and relationships may not continue and we may not be successful in entering into other similar agreements and relationships. If we fail to maintain our current licensing agreements or establish new relationships, it could result in loss of revenue and harm our business and financial condition or inability for us to use the intellectual property licensed to us by the applicable third party. |

Corporate Information

We were formed as a Wyoming company in October 2020 under the name Invest Inc. Our principal executive offices are located at 11500 W Olympic Blvd., Suite 562, Los Angeles, California.

Our main telephone number is 801-503-6130. Our website is www.invest.inc. The information contained on, or that can be accessed through, our website is not incorporated by reference and is not a part of this Offering Circular.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies.” These provisions include, among other matters:

| ● | | an exemption to provide fewer years of financial statements and other financial data; |

| | | |

| ● | | an exemption from the auditor attestation requirement in the assessment of the emerging growth company’s internal control over financial reporting; |

| | | |

| ● | | an exemption from new or revised financial accounting standards until they would apply to private companies and from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation; |

| | | |

| ● | | reduced disclosure about the emerging growth company’s executive compensation arrangements; and |

| | | |

| ● | | no requirement to seek non-binding advisory votes on executive compensation or golden parachute arrangements. |

We have elected to adopt the reduced disclosure requirements available to emerging growth companies. As a result of these elections, the information that we provide in this Offering Circular may be different than the information you may receive from other public companies.

We would cease to be an “emerging growth company” upon the earliest of: (i) the end of the fiscal year following the fifth anniversary of this Offering, (ii) the first fiscal year after our annual gross revenues are $1.235 billion or more, (iii) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities or (iv) as of the end of any fiscal year in which the market value of our common stock held by non-affiliates exceeded $700,000,000 as of the end of the second quarter of that fiscal year.

THE OFFERING

Common stock offered by us | | Up to 3,000,000 shares (the “Maximum Offering”). |

Common stock to be outstanding after this Offering | | 17,782,450 shares (assuming we sell the Maximum Offering amount). |

Use of proceeds | | We expect to receive net proceeds from this Offering of approximately $18,000,000 (assuming we sell the Maximum Offering amount), We intend to use the net proceeds from this Offering for engaging additional contractor engineers, research and development, Offering expenses, working capital, and marketing competitive trading tournaments. (See “Use of Proceeds.”) |

Dividend policy | | We currently intend to retain our future earnings, if any, to finance the development and expansion of our business. The determination to pay dividends will be at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements, restrictions contained in any financing instruments, and such other factors as our board of directors deems relevant in its discretion. (See “Dividend Policy.”) |

Control | | Upon completion of this Offering, Jacob Fernane, our President and Chairman of the board of directors will control more than 50% of the voting power of our outstanding common stock. (See “Management.”) |

Risk factors | | Investing in our common stock involves a high degree of risk. (See “Risk Factors.”) |

No listing on a national securities exchange; Potential secondary trading solely through tZERO ATS | | Our common stock will not be initially be listed or traded on any national securities exchange or over-the-counter trading system. We expect to make our common stock available for secondary trading on an alternative trading system (the “tZERO ATS”) operated by tZERO ATS, LLC, a Commission-registered broker dealer and member of FINRA and SIPC. Orders may be entered on the tZERO ATS by investors that maintain an account with tZERO ATS, LLC. Orders properly submitted to the tZERO ATS are matched by tZERO ATS’ order matching system in accordance with its trading rules, and tZERO ATS, LLC clears transactions effected on the tZERO ATS, as the clearing and carrying broker-dealer for all securities traded on the tZERO ATS. |

Except as otherwise indicated, all information in this Offering Circular is based on 14,782,450 shares outstanding as of the date of this Offering Circular, and:

| | ● | excludes 10,000,000 shares of our common stock reserved for future issuance in connection with awards under our 2022 Incentive and Nonstatutory Stock Option Plan (our “2022 Stock Option Plan”) (pursuant to which we have issued to our employees, officers, and directors options exercisable for 1,408,500 shares of common stock as of the date of this Offering Circular); and |

| | | |

| | ● | excludes 2,885,000 shares of our outstanding Series A Preferred Stock which is convertible to up to 3,548,550 shares of common stock. |

(See “Description of Capital Stock.”)

RISK FACTORS

An investment in our common stock involves a high degree of risk and should be considered highly speculative. Before making an investment decision, you should carefully consider the following risk factors, which address the material risks concerning our business and an investment in our common stock, together with the other information contained in this Offering Circular. If any of the risks discussed in this Offering Circular occur, our business, prospects, liquidity, financial condition, and results of operations could be materially and adversely affected. Some statements in this Offering Circular, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Cautionary Note Concerning Forward-Looking Statements.”

Risks Related to Our Business

We have limited operating history.

We were formed on October 7, 2020, and have no operating history upon which investors may evaluate our prospects or performance. We can provide no assurances that our operations will ever be profitable. Our prospects must be considered considering the risks, uncertainties, expenses, and difficulties frequently encountered by companies in their early stages of development. There can be no assurance that we will be successful in accomplishing any of our goals, and the failure to do so could have a material adverse effect on our business, results of operations, and financial condition.

If we fail to manage our growth effectively, our business, financial condition, results of operations and prospects could be materially and adversely affected.

The rapid growth we may experience in our business, both organically and inorganically, may place significant demands on our operational infrastructure. As usage of our products and services grows, we will need to devote additional resources to improving and maintaining our infrastructure and integrating with third-party applications, including open-source software. In addition, we will need to appropriately scale our internal business systems and our services organization to serve our growing customer base. Any failure of or delay in these efforts could lead to impaired system performance and reduced customer satisfaction, resulting in decreased sales to customers, lower dollar-based net retention rates, which would hurt our revenue growth and our reputation. Even if we are successful in our expansion efforts, they will be expensive and complex, and require the dedication of significant management time and attention. We could also face inefficiencies or service disruptions as a result of our efforts to scale our internal infrastructure. We cannot be sure that the expansion of and improvements to our internal infrastructure will be effectively implemented on a timely basis, if at all, and such failures could harm our business, financial condition and results of operations.

We have a history of net losses and anticipate increasing operating expenses in the future, and may not be able to achieve and, if achieved, maintain profitability.

We have operated at a net loss since our inception. We may not achieve or maintain profitability in the future. Because the market for our products and services is rapidly evolving, it is difficult for us to predict our future results of operations or the limits of our market opportunity. We expect our operating expenses to significantly increase over the next several years as we hire additional personnel, expand our partnerships, operations and infrastructure, and continue to enhance our products and services and develop and expand their features, integrations, and capabilities. We also intend to continue to build and enhance our platforms through both internal research and development and possible pursuing acquisitions that can contribute to the capabilities of our platforms. If our revenue does not increase to offset the expected increases in our operating expenses, we may not be profitable in future periods. In future periods, our revenue growth could slow or our revenue could decline for a number of reasons, including any failure to increase the number of companies wanting to advertise on our platform or grow the size of our engagements with new and existing customers, a decrease in the growth of our overall market, our failure, for any reason, to continue to capitalize on growth opportunities, slowing demand for our products, additional regulatory burdens, or increasing competition. As a result, our past financial performance may not be indicative of our future performance.

If we are unable to attract new customers, retain existing customers, expand our products and services offerings with existing customers, or identify areas of higher growth, our revenue growth and profitability will be harmed.

Our success depends on our ability to acquire new customers, retain existing customers, expand our engagements with existing customers, and identify areas of higher growth, and to do so in a cost-effective manner. We have made significant investments related to customer acquisition and retention, expect to continue to spend significant amounts on these efforts in future periods, and cannot guarantee that the revenue from new or existing customers will ultimately exceed the costs of these investments.

Additionally, if we fail to deliver a quality user experience, or if customers do not perceive the products and services we offer to be of high value and quality, we may be unable to acquire or retain customers. Additionally, if we are unable to acquire or retain customers to a level that where our revenues will exceed our losses from the user side, , we may be unable to achieve our operational objectives. Consequently, our prices may increase, or may not decrease to levels sufficient to generate customers’ interest, our revenue may decrease, our margins may decline, and we may not achieve or maintain profitability. As a result, our business, financial condition, and results of operations may be materially and adversely affected.

Our efforts to expand our service offerings and to develop and integrate our existing services in order to keep pace with policy, regulatory, political and technological developments may not succeed.

Our efforts to expand our current service offerings may not succeed and, as a result, we may not achieve profitability or the revenue growth rate we expect. In addition, the markets for certain of our offerings remain relatively new and it is uncertain whether our efforts, and related investments, will ever result in significant revenue for us. We may be required to continuously enhance our technology platforms, including artificial intelligence (“AI”) and machine learning (“ML”) capabilities and algorithms, to maintain and improve the quality of our products and services in order to remain competitive with alternatives. Further, the introduction of significant platform changes and upgrades, may not succeed and early-stage interest and adoption of such new services may not result in long term success or significant revenue for us. Additionally, if we fail to anticipate or identify significant technology trends and developments early enough, or if we do not devote appropriate resources to adapting to such trends and developments, our business could be harmed.

If we are unable to develop or acquire enhancements to, and new features for, our existing or new services that keep pace with rapid technological developments, our business could be harmed. The success of enhancements and new or acquired products and services depends on several factors, including the timely completion, introduction and market acceptance of the feature, service or enhancement by customers, administrators and developers, as well as our ability to seamlessly integrate all of our product and service offerings and develop adequate selling capabilities in new markets. Failure in this regard may significantly impair our revenue growth as well as negatively impact our operating results if the additional costs are not offset by additional revenues. We may not be successful in either developing or acquiring these enhancements and new products and services or effectively bringing them to market.

Furthermore, uncertainties about the timing and nature of new services or technologies, or modifications to existing services or technologies, or changes in customer usage patterns thereof, could increase our research and development or service delivery expenses or lead to our increased reliance on certain vendors. Any failure of our services to operate effectively with future network platforms and technologies could reduce the demand for our services, result in customer dissatisfaction and harm our business.

If we have overestimated the size of its total addressable market, our future growth rate may be limited.

It is difficult to accurately estimate the size of the investment information services and legal and regulatory information markets and predict with certainty the rate at which the market for our services will grow, if at all. While our market size estimate was made in good faith and is based on assumptions and estimates we believe to be reasonable, this estimate may not be accurate. If our estimates of the size of our addressable market are not accurate, our potential for future growth may be less than we currently anticipate, which could have a material adverse effect on our business, financial condition, and results of operations.

We rely on third parties, including public sources, for data, information and other products and services, and our relationships with such third parties may not be successful or may change, which could adversely affect our results of operations.

Our products and services rely upon data, information, and services obtained from third-party providers and public sources. Such data, information, and services are made available to our customers or are integrated for our customers’ use through information and technology solutions provided by us and third-party service providers. We have commercial relationships with third-party providers whose capabilities complement our own and, in some cases, these providers are also our competitors. The priorities and objectives of these providers, particularly those that are our competitors, may differ from ours, which may make us vulnerable to unpredicted price increases, unfavorable licensing terms and other adverse circumstances. Agreements with such third-party providers periodically come up for renewal or renegotiation, and there is a risk that such negotiations may result in different rights and restrictions, which could impact or eliminate our customers’ use of the content. In addition, as the number of products and services in our markets increases and the functionality of these products and services further overlaps with third-party products and services, we may become increasingly subject to claims by a third party that our products and services infringe on such party’s IP rights. Moreover, providers that are not currently our competitors may become competitors or be acquired by or merge with a competitor in the future, any of which could reduce our access to the information and technology solutions provided by those companies. If we do not maintain, or obtain the expected benefits from, our relationships with third-party providers or if a substantial number of our third-party providers or any key service providers were to withdraw their services, we may be less competitive, our ability to offer products and services to our customers may be negatively affected, and our results of operations could be adversely impacted.

If we are not able to obtain and maintain accurate, comprehensive, or reliable data, or if the expert analysis we produce contains any material errors or omissions, we could experience reduced demand for our products and services.

Our success depends on our customers’ confidence in the depth, breadth, and accuracy of our data. The task of establishing and maintaining accurate data is challenging and expensive. The depth, breadth, and accuracy of our data differentiates us from our competitors. If our data, including the data we obtain from third parties and our data extraction, structuring, and analytics are not current, accurate, comprehensive, or reliable, or if any expert analysis we produce contains material errors or omissions, customers could have negative experiences, which in turn would reduce the likelihood of customers renewing or upgrading their subscriptions and our reputation could be harmed, making it more difficult to obtain new customers.

Our ability to introduce new features, integrations, capabilities, and enhancements is dependent on adequate research and development resources. If we do not adequately fund our research and development efforts, or if our research and development investments do not translate into material enhancements to our products and services, we may not be able to compete effectively, and our business, financial condition, results of operations and prospects may be adversely affected.

To remain competitive, we must continue to develop new features, integrations, and capabilities to our products and services. This is particularly true as we further expand our ML capabilities. Maintaining adequate research and development resources, such as the appropriate personnel and development technology, to meet the demands of the market is essential. If we are unable to develop features, integrations, and capabilities internally due to certain constraints, such as lack of management ability, or a lack of other research and development resources, our business may be harmed.

Moreover, research and development projects can be technically challenging and expensive. The nature of these research and development cycles may cause us to experience delays between the time we incur expenses associated with research and development and the time we are able to offer compelling features, integrations, capabilities, and enhancements and generate revenue, if any, from such investment. Anticipated demand for a feature, integration, capability, or enhancement we are developing could decrease after the development cycle has commenced, and we would nonetheless be unable to avoid substantial costs associated with the development of any such feature, integration, capability, or enhancement. Additionally, we may experience difficulties with software development, design, or marketing that could affect the length of these research and development cycles that could further delay or prevent our development, introduction, or implementation of features, integrations, capabilities, and enhancements. If we expend a significant amount of resources on research and development and our efforts do not lead to the successful introduction or improvement of features, integrations, and capabilities that are competitive, our business, results of operations, and financial condition could be adversely affected.

Further, our competitors may expend more on their respective research and development programs or may be acquired by larger companies that would allocate greater resources to our competitors’ research and development programs or our competitors may be more efficient or effective in their research and development activities. Our failure to maintain adequate research and development resources or to compete effectively with the research and development programs of our competitors would give an advantage to such competitors and may harm our business, results of operations, and financial condition.

Larger and more well-funded companies with access to significant resources and sophisticated technologies may shift their business model to become our direct competitors.

Companies in related industries, such as Bloomberg, Thomson Reuters, and Standard and Poor’s (“S&P,”) may choose to compete with us and would immediately have access to greater resources and brand recognition. We cannot anticipate how rapidly such a potential competitor could create products or services that would take significant market share from us or even surpass our products or services in quality. The entry of a large, well-funded competitor in our space could reduce demand for our products and services or reduce the price we can demand from new customers or upgrades from existing customers, negatively affecting our revenue and profitability.

If we fail to protect and maintain our brand, our ability to attract and retain customers will be impaired, our reputation may be harmed, and our business, financial condition, results of operations and prospects may suffer.

We believe that maintaining and promoting our brand in a cost-effective manner is critical to expanding our base of customers on both the retail investor side and on the issuer-advertiser side. Maintaining, promoting, and positioning our brand and the reputation of our businesses will depend on our ability to provide useful, reliable information, products, and services.

We may introduce, or make changes to, features, products, services, privacy practices, or terms of service that customers do not like, which may materially and adversely affect our brand. Our brand promotion activities may not generate customer awareness or increase revenue, and even if they do, any increase in revenue may not offset the expenses we incur in building our brand. If we fail to successfully promote and maintain our brand or if we incur excessive expenses in this effort, our business could be materially and adversely harmed.

Harm to our brands can arise from many sources, including failure by us or our partners and service providers to satisfy expectations of service and quality, inadequate protection or misuse of information with respect to customers’ affairs or strategies, personally identifiable information, compliance failures and claims, regulatory inquiries and enforcement, rumors, litigation and other claims, misconduct by our partners, employees or other counterparties, , any of which could lead to a tarnished reputation and loss of customers.

Any negative publicity about our industry or our company, the quality and reliability of our products and services, our compliance and risk management processes, changes to our products and services, our ability to effectively manage and resolve customer complaints, our privacy, data protection, and information security practices, litigation, regulatory licensing and infrastructure, and the experience of our customers with our products or services could adversely affect our reputation and the confidence in and use of our products and services. If we do not successfully maintain a strong and trusted brand, our business, financial condition, and results of operations could be materially and adversely affected.

We rely on the performance of highly skilled personnel, including our management and other key employees, and the loss of one or more of such personnel, or of a significant number of team members, could harm our business.

We believe our success depends on the efforts and talents of senior management and key personnel, including Jacob Fernane, our President and Chairman of the Board and Marc McNeill, our Chief Executive Officer. From time to time, there may be changes in our management team resulting from the hiring or departure of executives and key employees, which could disrupt our business. Our senior management and key employees are employed on an at-will basis. We cannot ensure that we will be able to retain the services of any member of our senior management or other key employees or that we would be able to timely replace members of our senior management or other key employees should any of them depart. The loss of one or more of our senior management or other key employees could harm our business.

If we do not effectively maintain and grow our research and development team with top talent, including employees who are trained in artificial intelligence, machine learning and advanced algorithms, we may be unable to continue to improve our artificial intelligence capabilities, and our revenues and other results of operations could be adversely affected.

Our future success depends on our ability to continue to attract, retain and motivate highly skilled employees, software engineers and other employees or contractors with the technical skills in AI, machine learning, and advanced algorithms that will enable us to deliver effective products and services. Competition for highly skilled engineers and developers in our industry is intense, in particular in the fields of artificial intelligence and machine learning, and larger companies with access to more substantial resources pursue such top talent aggressively.

We may be unable to attract or retain such highly skilled personnel who are critical to our success, which could hinder our ability to keep pace with innovation and technological change in our industry or result in harm to our key customer relationships, loss of key information, expertise or proprietary knowledge and unanticipated recruitment and training costs. The loss of the services of such key employees could make it more difficult to successfully operate our business and pursue our business goals.

Issues in the use of artificial intelligence (including machine learning) in our platforms may result in reputational harm or liability.

AI is or will be enabled by or integrated into our platform and is a significant and potentially growing element of our business. As with many developing technologies, AI presents risks and challenges that could affect its further development, adoption, and use, and therefore our business. Further, there is a risk that AI algorithms may be flawed and datasets may be insufficient, of poor quality, or contain biased information. In addition, inappropriate or controversial data practices by data scientists, engineers, and end-users of our systems could impair the acceptance of AI solutions. If the recommendations, forecasts, or analyses that AI applications assist in producing are deficient or inaccurate, we could be subjected to competitive harm, potential legal liability, and brand or reputational harm. Further, some AI scenarios may present ethical issues. Though our technologies and business practices are designed to mitigate many of these risks, if we enable or offer AI solutions that are controversial because of their purported or real impact on human rights, privacy, employment, or other social issues, we may experience brand or reputational harm.

Our use of any “open-source” software under restrictive licenses could: (i) adversely affect our ability to license and commercialize certain elements of our proprietary code base on the commercial terms of our choosing; (ii) result in a loss of our trade secrets or other intellectual property rights with respect to certain portions of our proprietary code; and (iii) subject us to litigation and other disputes.

We have incorporated certain third-party “open-source” software (“OSS”) or modified OSS into elements of our proprietary code base in connection with the development of our products and services. In general, this OSS has been incorporated and is used pursuant to ‘permissive’ OSS licenses, which are designed to be compatible with our use and commercialization of our own proprietary code base. However, we have also incorporated and use some OSS under restrictive OSS licenses. Under these restrictive OSS licenses, we could be required to release to the public the source code of certain elements of our proprietary software that: (i) incorporate OSS or modified OSS in a certain manner; and (ii) have been conveyed or distributed to the public, or with which the public interacts. Although we monitor our use of OSS, in addition to the use of OSS that we are aware of, there is a risk that OSS will be inadvertently or impermissibly incorporated into our software, including by our developers or service providers. In some cases, we may be required to ensure that elements of our proprietary software are licensed to the public on the terms set out in the relevant OSS license or at no cost. This could allow competitors to use certain elements of our proprietary software on a relatively unrestricted basis, or develop similar software at a lower cost. In addition, open-source licensors generally do not provide warranties for their open-source software, and the open-source software may contain security vulnerabilities that we must actively manage or patch. It may be necessary for us to commit substantial resources to remediate our use of OSS under restrictive OSS licenses, for example by engineering alternative or work-around code.

There is an increasing number of open-source software license types, and the terms under many of these licenses are unclear or ambiguous, and have not been interpreted by U.S. or foreign courts, and therefore, the potential impact of such licenses on our business is not fully known or predictable. As a result, these licenses could be construed in a way that could impose unanticipated conditions or restrictions on our ability to commercialize our own proprietary code (and in particular the elements of our proprietary code which incorporates OSS or modified OSS). Furthermore, we could become subject to lawsuits or claims challenging our use of open-source software or compliance with open-source license terms. If unsuccessful in these lawsuits or claims, we could face IP infringement or other liabilities, be required to seek costly licenses from third parties for the continued use of third-party IP, be required to re-engineer elements of our proprietary code base (e.g., for the sake of avoiding third-party IP infringement), discontinue or delay the use of infringing aspects of our proprietary code base (such as if re-engineering is not feasible), or disclose and make generally available, in source code form, certain elements of our proprietary code. Any such re-engineering or other remedial efforts could require significant additional research and development resources, and we may not be able to successfully complete any such re-engineering or other remedial efforts.

More broadly, the use of OSS can give rise to greater risks than the use of commercially acquired software, since open-source licensors usually limit their liability in respect of the use of the OSS, and do not provide support, warranties, indemnifications or other contractual protections regarding the use of the OSS, which would ordinarily be provided in the context of commercially acquired software.

Any of the foregoing could adversely impact the value of certain elements of our proprietary code base, and its ability to enforce its intellectual property rights in such code base against third parties. In turn, this could materially adversely affect our business, financial condition, results of operations and prospects.

We may not be able to adequately obtain, maintain, protect and enforce our proprietary and intellectual property rights in our data or technology.

Our success depends in part on our and our licensors’ success in obtaining and maintaining effective intellectual property protection. We may be unsuccessful in adequately protecting our intellectual property. We may not be able to file, prosecute, maintain, enforce or license all necessary or desirable intellectual property applications at a reasonable cost or in a timely manner, or in all jurisdictions. Any failure to obtain or maintain patent and other intellectual property protection may harm our business, financial condition and results of operations.

We depend on our proprietary technology, intellectual property and services for our success and ability to compete. We rely and expect to continue to rely on a combination of non-disclosure and confidentiality agreements with our employees, consultants and other parties with whom we have relationships and who may have access to confidential or other protectable aspects of our research and development outputs, as well as trademark, copyright, patent and trade secret protection laws, to protect our proprietary rights. We cannot guarantee employees, consultants, or other parties will comply with confidentiality, non-disclosure, or invention assignment agreements or that such agreements will otherwise be effective in controlling access to and distribution of our products and services, or certain aspects of our products and services, and proprietary information. Additionally, we may be subject to claims from third parties challenging our ownership interest in or inventorship of intellectual property we regard as our own, for example, based on claims that its agreements with employees or consultants obligating them to assign intellectual property to us are ineffective or in conflict with prior or competing contractual obligations to assign inventions to another employer, to a former employer, or to another person or entity. Further, these agreements do not prevent our competitors from independently developing products and services that are substantially equivalent or superior to our products and services. Additionally, certain unauthorized use of our intellectual property may go undetected, or we may face legal or practical barriers to enforcing our legal rights even where unauthorized use is detected.

We may rely upon trademarks to build and maintain the integrity of our brands. Our trademarks or trade names may be challenged, infringed, circumvented, declared unenforceable or determined to be violating or infringing on other intellectual property rights. We may not be able to sufficiently protect or successfully enforce our rights to these trademarks and trade names.

Current law may not provide for adequate protection of our data or technology. In addition, legal standards relating to the validity, enforceability, and scope of protection of proprietary rights in internet-related businesses are uncertain and evolving, and changes in these standards may adversely impact the viability or value of our proprietary rights. Some license provisions protecting against unauthorized use, copying, transfer, and disclosure of our technology, or certain aspects of our technology, or our data may be unenforceable under the laws of certain jurisdictions. Further, the laws of some countries do not protect proprietary rights to the same extent as the laws of the United States, and mechanisms for enforcement of intellectual property rights in some foreign countries may be inadequate. To the extent we expand our international activities, our exposure to unauthorized copying and use of our data or technology, or certain aspects of our data or technology, may increase. Further, competitors, foreign governments, foreign government-backed actors, criminals, or other third parties may gain unauthorized access to our data and technology. Accordingly, despite our efforts, we may be unable to prevent third parties from infringing upon or misappropriating our intellectual property.

To protect our intellectual property rights, we may be required to spend significant resources to monitor and protect these rights, and we may or may not be able to detect infringement by our customers or third parties. Litigation has been and may be necessary in the future to enforce our intellectual property rights. Such litigation could be costly, time consuming, and distracting to management and could result in the impairment or loss of portions of our intellectual property. Furthermore, our efforts to enforce our intellectual property rights may be met with defenses, counterclaims, and countersuits attacking the validity and enforceability of our intellectual property rights. Our inability to protect our proprietary technology against unauthorized copying or use, as well as any costly litigation or diversion of our management’s attention and resources, could delay further sales or the implementation of our products and services, impair the functionality of our products and services, delay introductions of new features, integrations, and capabilities, result in our substituting inferior or more costly technologies, or injure our reputation. In addition, we may be required to license additional technology from third parties to develop and market new features, integrations, and capabilities, and we cannot be certain that we could license that technology on commercially reasonable terms or at all, and our inability to license this technology could harm our ability to compete.

We may in the future be sued by third parties for various claims including alleged infringement, misappropriation or other violation of proprietary intellectual property rights.

Our success depends, in part, on our ability to operate without infringing, misappropriating or otherwise violating the patents and other proprietary intellectual property rights of third parties. This is generally referred to as having the “freedom to operate.” Because we have only conducted routine searches related to third party patent filings and publications and have not conducted an in-depth freedom to operate search, which is time consuming and costly, we may not be aware of issued patents that a third party might assert are infringed by our current products and services, which could materially impair our ability to commercialize our current or any future products and services. Even if we diligently search third-party intellectual property for potential infringement by our current or any future products and services, we may not successfully find intellectual property that our current or any future products and services may infringe. If we are unable to secure and maintain the freedom to operate, third parties could preclude us from commercializing our current or future products and services. There is considerable patent and other intellectual property development activity in our market, and litigation, based on allegations of infringement or other violations of intellectual property, is frequent in internet-based industries. We may receive communications from third parties, including practicing entities and non-practicing entities, claiming that we has infringed their intellectual property rights.

In addition, we may be sued by third parties for breach of contract, defamation, negligence, unfair competition, or patent, copyright, trademark or other intellectual property infringement, misappropriation or other violation, or claims based on other theories, which may or may not be brought without merit. We could also be subject to claims based upon the content that is accessible from our website and other outlets through links to other websites or information on our website or other outlets supplied by third parties or claims that our alleged collection of information from third-party sites without a license violates certain federal or state laws or website terms of use. We could also be subject to claims that the collection or provision of certain information breached laws or regulations relating to privacy or data protection. The defense and prosecution of intellectual property claims, interference proceedings and related legal and administrative proceedings, both in the United States and internationally, involve complex legal and factual questions. As a result, such proceedings are lengthy, costly and time-consuming, and their outcome is highly uncertain. We may become involved in protracted and expensive litigation in order to determine the enforceability, scope and validity of the proprietary rights of others, or to determine whether we have the freedom to operate with respect to the intellectual property rights of others.

If we are found to infringe a third-party’s intellectual property rights, we could be required to obtain a license from such third-party to continue developing and marketing our current and any future products or services. We may also elect to enter into such a license to settle pending or threatened litigation. However, we may not be able to obtain any required license on commercially reasonable terms, or at all. Even if we were able to obtain a license, it could be non-exclusive, thereby giving our competitors access to the same technologies licensed to us and could require us to pay significant royalties and other fees. We could be forced, including by court order, to cease commercializing the infringing products or services. In addition, we could be found liable for monetary damages, which may be significant. If we are found to have willfully infringed a third-party patent, we could be required to pay treble damages and attorneys’ fees. A finding of infringement could prevent us from commercializing our planned products or services in commercially important jurisdictions, or force us to cease some of our business operations, which could harm our business.

Even if we are successful in defending against intellectual property claims, litigation or other legal proceedings relating to such claims may cause us to incur significant expenses and could distract our technical and management personnel from their normal responsibilities.

Furthermore, our agreements with some of our customers, suppliers or other entities with whom we do business may require us to defend or indemnify these parties to the extent they become involved in infringement claims, including the types of claims described above. We could also voluntarily agree to defend or indemnify third parties in instances where we are not obligated to do so if we determine it would be beneficial to our business relationships. If any of these claims succeed or settle, we may be forced to pay damages or settlement payments on behalf of our customers, suppliers or other entities, or may be required to obtain licenses. If we cannot obtain all necessary licenses on commercially reasonable terms, our customers may be forced to stop using our products or services. If we are required or agree to defend or indemnify third parties in connection with any infringement claims, we could incur significant costs and expenses that could adversely affect our business, operating results or financial condition.

Additionally, there are potential issues around possible ownership rights in personal data, which is subject to evolving regulatory oversight. As a result of any claims against us regarding suspected infringement, our technologies may be subject to injunction, we may be required to pay damages, or we may have to seek a license to continue certain practices (which may not be available on reasonable terms, if at all), all of which may significantly increase our operating expenses or may require us to restrict our business activities and limit our ability to deliver our products and services and/or certain features, integrations, and capabilities of our products and services. As a result, we may also be required to develop alternative non-infringing technology, which could require significant effort and expense and/or cause it to alter our products or services, which could negatively affect our business. Further, many of our subscription agreements require us to indemnify our customers for third-party intellectual property infringement claims, so any alleged infringement by us resulting in claims against such customers would increase our liability.

Our exposure to risks associated with various claims, including the use of intellectual property, may increase due to acquisitions of other companies. For example, we may have a lower level of visibility into the development process with respect to intellectual property or the care taken to safeguard against infringement risks with respect to the acquired company or technology. In addition, third parties may make infringement and similar or related claims after we have acquired technology that had not been asserted prior to such acquisition.

We have entered into certain licensing agreements and other strategic relationships with third parties. These agreements and relationships may not continue and we may not be successful in entering into other similar agreements and relationships. If we fail to maintain our current licensing agreements or establish new relationships, it could result in loss of revenue and harm our business and financial condition or inability for us to use the intellectual property licensed to us by the applicable third party.

We have licensed certain components of our technologies from third parties and rely upon such licenses, in part, for the successful development and commercialization of our products and services. The success of certain of our products and services may depend on maintaining successful relationships with our third-party license partners. If such license agreements were to terminate prematurely or if we breach the terms of any licenses or otherwise fails to maintain such licenses, we may lose the ability to offer certain products and services that use such licenses. If there are no active statements of work, counterparties may have the right to terminate such license agreements for its convenience. In addition, we may need to obtain licenses to additional technologies in the future in order to keep our products and services competitive. If we fail to license or otherwise acquire and maintain necessary technologies, we may not be able to develop new products and services necessary to remain competitive.

Our risk management processes and procedures may not be effective.

We have not formally adopted comprehensive risk management processes and procedures. We are subject to liquidity risk, strategic risk, operational risk, cybersecurity risk, and reputational risk. Even if we establish processes and procedures to monitor or control such risks, those procedures may not be effective.

Risk is inherent in our business, and therefore, despite our efforts to manage risk, there can be no assurance that we will not sustain unexpected losses. We could incur substantial losses and our business operations could be disrupted to the extent our business model, operational processes, control functions, technological capabilities, risk analyses, and business/product knowledge do not adequately identify and manage potential risks associated with our strategic initiatives. There also may be risks that exist, or that develop in the future, that we have not appropriately anticipated, identified or mitigated, including when processes are changed or new products and services are introduced. If our risk management framework does not effectively identify and control its risks, we could suffer unexpected losses or be adversely affected, which could have a material adverse effect on our business, financial condition, and results of operations.

We depend on third parties for data, information and other services, and our ability to serve our customers could be adversely impacted if such third parties fail to fulfill their obligations, if we are unable to effectively manage and minimize errors, failures, interruptions or delays caused by third parties or if our arrangements with them are terminated and suitable replacements cannot be found on commercially reasonable terms or at all.

Interruptions or delays in services from third parties, including data center hosting facilities, internet infrastructure, cloud computing platform providers, and other hardware and software vendors, or our inability to adequately plan for and manage service interruptions or infrastructure capacity requirements, could impair the delivery of our services and harm its business.

We currently serve our customers through the use of third-party hosting facilities and cloud computing platform providers. Damage to, or failure of, these systems, or systems upon which they depend such as internet infrastructure, could cause interruptions in our services. Such interruptions may cause customers to terminate their agreements, and adversely affect our customers and our ability to attract new customers, all of which would reduce our revenue. Our business would also be harmed if our customers and potential customers believe our services are unreliable.

We do not control the operation of third-party facilities, and they may be vulnerable to damage or interruption from earthquakes, floods, fires, power loss, telecommunications failures, and similar events. They may also be subject to break-ins, sabotage, intentional acts of vandalism, and similar misconduct, as well as local administrative actions, changes to legal or permitting requirements, and litigation to stop, limit, or delay operation. The occurrence of a natural disaster or an act of terrorism, a decision to close the facilities without adequate notice, or other unanticipated problems at these facilities could result in lengthy interruptions in our services.

These hardware, software, data, and cloud computing systems may not continue to be available at reasonable prices, on commercially reasonable terms, or at all. Any loss of the right to use any of these hardware, software, or cloud computing systems could significantly increase our expenses and otherwise result in delays in the provisioning of our services until equivalent technology is either developed by us, or, if available, is identified, obtained through purchase or license, and integrated into our services.

Technical problems or disruptions affecting customers’ access to our services, or the software, internal applications, databases, and network systems underlying our services, could damage our reputation and brands and lead to reduced demand for our products and services, lower revenues, and increased costs.

Our business, brand, reputation, and ability to attract and retain users and customers depend upon the satisfactory performance, reliability, and availability of our products and services, which in turn depend upon the availability of the internet and our service providers. Interruptions in these systems, whether due to system failures, computer viruses, software errors, physical or electronic break-ins, or malicious hacks or attacks on our systems (such as denial of service attacks), could affect the security and availability of our products and services on its websites and prevent or inhibit the ability of users to access our products and services. In addition, the software, internal applications, and systems underlying our products and services are complex and may not be error-free. We may encounter technical problems when it attempts to enhance its products, services and systems. Any inefficiencies, errors, or technical problems with our systems could reduce the quality of our products and services or interfere with our customers’ use of our products and services, which could reduce demand, lower our revenues, and increase our costs.

Our systems and operations are vulnerable to damage or interruption from fire, flood, power loss, security breaches, computer viruses, telecommunications failure, terrorist attacks, acts of war, electronic and physical break-ins, earthquakes, and similar events. The occurrence of any of the foregoing events could result in damage to or failure of our systems. These risks may be heightened for operations at facilities outside of our direct control.

Acts of war or terrorism may seriously harm our business.

Acts of war, any outbreak or escalation of hostilities between the United States and any foreign power, or acts of terrorism may cause disruption to the U.S. economy and cause economic changes that we cannot anticipate.

Risks Related to Our Organization and Structure

We depend on key personnel.

Our success depends to a significant degree upon the contributions of certain key personnel including, but not limited to, Jacob Fernane, our President and Chairman of our board of directors, and Marc McNeill, our Chief Executive Officer, both of whom would be difficult to replace. If any of our key personnel were to cease employment with us, our operating results could suffer. Further, the process of attracting and retaining suitable replacements for key personnel whose services we may lose would result in transition costs and would divert the attention of other members of our senior management from our existing operations. The loss of services from key personnel or a limitation in their availability could materially and adversely impact our business, prospects, liquidity, financial condition, and results of operations. Further, such a loss could be negatively perceived in the capital markets. We have not obtained and do not expect to obtain key man life insurance that would provide us with proceeds in the event of death or disability of any of our key personnel.

We may not be able to successfully operate our business.

We have only been conducting operations since 2020. We cannot assure you that our past experience will be sufficient to enable us to operate our business successfully or implement our operating policies and business strategies as described in this Offering Circular. Furthermore, we may not be able to generate sufficient operating cash flows to pay our operating expenses or service our indebtedness. You should not rely upon the past performance of our management team as past performance may not be indicative of our future results.

Our executive officers and directors may exert control over us.

Our officers and board members presently beneficially own and control 60% of our voting power and control, and will continue to control us even if the Offering is completed. Therefore, our officers and directors control all matters which require shareholder approval, including the election of directors and approval of corporate transactions, such as a sale or change of control transaction of the Company. This concentration of control could have the effect of delaying or preventing a change in control or otherwise discourage a potential acquirer from attempting to obtain control over us, which in turn could have a material adverse effect on the market value of our common stock.

Our corporate organizational documents and provisions of state law to which we are subject contain certain provisions that could have an anti-takeover effect and may delay, make more difficult, or prevent an attempted acquisition that you may favor or an attempted replacement of our board of directors or management.

Our governing documents have anti-takeover effects and may delay, discourage, or prevent an attempted acquisition or change of control or a replacement of our incumbent board of directors or management. Our governing documents include provisions that:

| | ● | empower our board of directors, without stockholder approval, to issue our preferred stock, the terms of which, including voting power, are to be set by our board of directors; |

| | | |

| | ● | eliminate cumulative voting in elections of directors; |

| | | |

| | ● | permit our board of directors to alter, amend, or repeal our Bylaws or to adopt new Bylaws; |

| | | |

| | ● | prior to going public, require the request of holders of at least 10% of the outstanding shares of our capital stock entitled to vote at a meeting to call a special shareholders’ meeting and after going public; |

| | | |

| | ● | require shareholders that wish to bring business before annual meetings of shareholders, or to nominate candidates for election as directors at our annual meeting of shareholders, to provide timely notice of their intent in writing; and |

| | | |

| | ● | enable our board of directors to increase, between annual meetings, the number of persons serving as directors and to fill the vacancies created as a result of the increase by a majority vote of the directors present at a meeting of directors. |

In addition, certain provisions of Wyoming law, including a provision which restricts certain business combinations between a Wyoming corporation and certain affiliated shareholders, may delay, discourage, or prevent an attempted acquisition or change in control.

We may change our operational policies and business and growth strategies without stockholder consent which may subject us to different and more significant risks in the future.

Our board of directors determines our operational policies and business and growth strategies. Our board of directors may make changes to, or approve transactions that deviate from, those policies, guidelines, and strategies without a vote of, or notice to, our shareholders. This could result in us conducting operational matters, making investments, or pursuing different business or growth strategies than those contemplated in this Offering Circular. Under any of these circumstances, we may expose ourselves to different and more significant risks in the future, which could have a material adverse effect on our business, prospects, liquidity, financial condition, and results of operations.

We are an “emerging growth company” and, as a result of the reduced disclosure and governance requirements applicable to emerging growth companies, our common stock may be less attractive to investors.