UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under § 240.14a-12 |

ENDI CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

ENDI CORP.

2400 Old Brick Rd., Suite 115

Glen Allen, VA 23060

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 22, 2023

To the Stockholders of ENDI Corp.:

The 2023 Annual Meeting of Stockholders (the “2023 Annual Meeting”) of ENDI Corp., a Delaware corporation (the “Company,” “we,” “us,” or “our”), will be held on Monday, May 22, 2023, at 10:00 a.m. Eastern Time. The 2023 Annual Meeting will be a completely virtual meeting which will be conducted via live webcast. You will be able to attend the 2023 Annual Meeting by visiting www.colonialstock.com/ENDI2023.

In addition to voting by submitting your proxy prior to the 2023 Annual Meeting, you also will be able to vote your shares electronically during the 2023 Annual Meeting. Further details regarding the virtual meeting are included in the accompanying proxy statement. At the 2023 Annual Meeting, the holders of our outstanding Class A common stock and Class B common stock will act on the following matters:

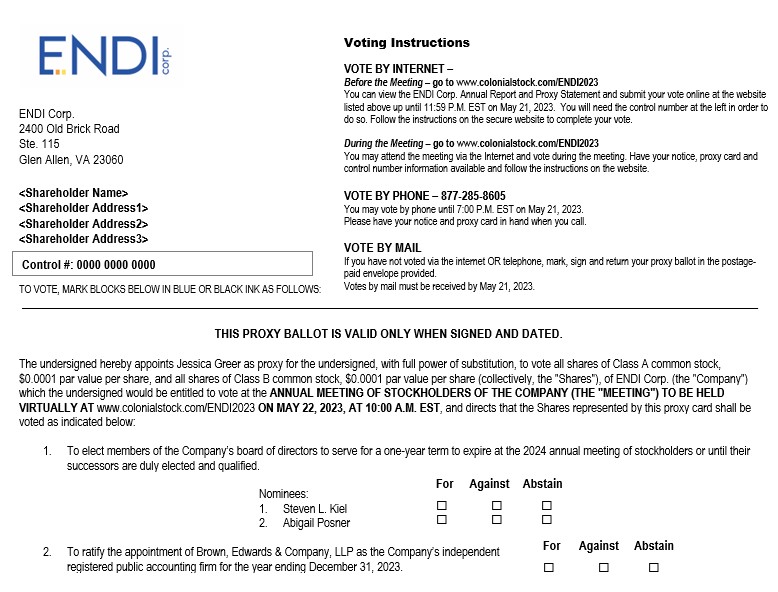

| | 1. | To elect members of the Company’s board of directors (the “Board”) to serve for a one-year term to expire at the 2024 annual meeting of stockholders or until their successors are duly elected and qualified. Holders of Class A common stock will elect two directors and the holder of Class B common stock will elect three directors as further described in the accompanying proxy statement; |

Holders of Class A common stock and holders of Class B common stock will vote together as one class on all other proposals.

| | 2. | To ratify the appointment of Brown, Edwards & Company, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023; |

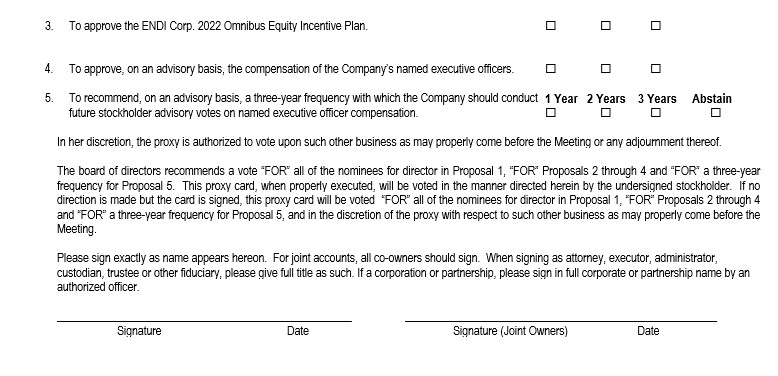

| | 3. | To approve the ENDI Corp. 2022 Omnibus Equity Incentive Plan (the “2022 Plan”); |

| | 4. | To approve, on an advisory basis, the compensation of the Company’s named executive officers; |

| | 5. | To recommend, on an advisory basis, a three-year frequency with which the Company should conduct future stockholder advisory votes on named executive officer compensation; and |

| | 6. | To transact such other business as may properly be brought before the 2023 Annual Meeting or any adjournment or postponement thereof. |

Our Board unanimously recommends that you vote “FOR” the election of our Board’s director nominees (Proposal 1), “FOR” the ratification of the appointment of Brown, Edwards & Company, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023 (Proposal 2), “FOR” the approval of the 2022 Plan (Proposal 3), “FOR” the approval of the compensation of the Company’s named executive officers (Proposal 4) and “FOR” the approval of a three-year frequency with which the Company should conduct future stockholder advisory votes on named executive officer compensation (Proposal 5).

Instead of mailing a printed copy of our proxy materials to all of our stockholders, we provide access to these materials via the Internet. This reduces the amount of paper necessary to produce these materials as well as the costs associated with mailing these materials to all stockholders. Accordingly, on or about April 11, 2023, we will begin mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders of record on our books at the close of business on March 24, 2023, the record date for the 2023 Annual Meeting, and we will post our proxy materials on the website referenced in the Notice. As more fully described in the Notice, stockholders may choose to access our proxy materials on the website referred to in the Notice or may request to receive a printed set of our proxy materials. The Notice provides information regarding how you may request to receive proxy materials in printed form.

If you are a stockholder of record, you may vote in one of the following ways:

| | ● | Vote over the Internet, by going to www.colonialstock.com/ENDI2023; |

| | ● | Vote by Mail, if you received (or requested and received) a printed copy of the proxy materials, by returning the enclosed proxy card (signed and dated) in the envelope provided; |

| | ● | Vote by phone by calling (877) 285-8605; or |

| | ● | Vote online at the 2023 Annual Meeting at www.colonialstock.com/ENDI2023. |

If your shares are held in “street name,” meaning that they are held for your account by a broker or other nominee, you will receive instructions from the holder of record that you must follow for your shares to be voted.

The 2023 Annual Meeting will be a virtual stockholders meeting, conducted via live audio webcast, through which you can submit questions and vote online. The 2023 Annual Meeting can be accessed by visiting www.colonialstock.com/ENDI2023.

Whether or not you plan to attend the 2023 Annual Meeting virtually, we urge you to take the time to vote your shares.

| | By Order of the Board of Directors, |

| | |

| | /s/ Thomas McDonnell |

| Glen Allen, Virginia | Thomas McDonnell |

| April 11, 2023 | Chairman of the Board of Directors |

| | |

ENDI CORP.

2400 Old Brick Rd., Suite 115

Glen Allen, VA 23060

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 22, 2023

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2023 ANNUAL MEETING TO BE HELD ON MONDAY, MAY 22, 2023

Copies of this proxy statement, the form of proxy card and the Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “2022 Annual Report”) are available without charge at www.colonialstock.com/ENDI2023, by notifying our Secretary, in writing, at ENDI Corp., 2400 Old Brick Rd., Suite 115, Glen Allen, VA 23060 or by following the instructions included in the Notice.

The board of directors (“Board” or “Board of Directors”) of ENDI Corp. (“Company,” “we,” “us,” or “our”) is soliciting the enclosed proxy for use at its 2023 annual meeting of stockholders (the “2023 Annual Meeting”). The 2023 Annual Meeting will be held on May 22, 2023 at 10:00 a.m. Eastern Time, and will be a completely virtual meeting which will be conducted via live webcast. You will be able to attend the 2023 Annual Meeting by visiting www.colonialstock.com/ENDI2023.

On or about April 11, 2023, we will begin mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders (other than those who previously requested electronic or paper delivery of proxy materials), directing stockholders to a website where they can access our proxy materials, including this proxy statement and the 2022 Annual Report, and view instructions on how to vote. If you would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the Notice. If you have previously elected to receive our proxy materials electronically, you will continue to receive access to those materials via e-mail unless you elect otherwise.

TABLE OF CONTENTS

| | | Page |

FREQUENTLY ASKED QUESTIONS | | 1 |

PROPOSAL 1: ELECTION OF DIRECTORS | | 6 |

CORPORATE GOVERNANCE | | 8 |

AUDIT COMMITTEE REPORT | | 11 |

EXECUTIVE OFFICERS | | 12 |

EXECUTIVE COMPENSATION | | 13 |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | | 16 |

PROPOSAL 2: RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | 17 |

PROPOSAL 3: APPROVAL OF THE ENDI CORP. 2022 OMNIBUS EQUITY INCENTIVE PLAN | | 18 |

PROPOSAL 4: APPROVAL OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS | | 23 |

PROPOSAL 5: RECOMMENDATION OF A THREE-YEAR FREQUENCY WITH WHICH THE COMPANY SHOULD CONDUCT FUTURE STOCKHOLDER ADVISORY VOTES ON NAMED EXECUTIVE OFFICER COMPENSATION | | 24 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | 25 |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | | 27 |

STOCKHOLDER PROPOSALS AND DIRECTOR NOMINATIONS FOR 2024 ANNUAL MEETING OF STOCKHOLDERS | | 27 |

DELIVERY OF DOCUMENTS TO STOCKHOLDERS SHARING AN ADDRESS | | 27 |

ANNUAL REPORT | | 27 |

OTHER MATTERS | | 27 |

i

FREQUENTLY ASKED QUESTIONS

The following questions and answers present important information pertaining to the 2023 Annual Meeting:

Q: What is ENDI Corp.?

A: ENDI Corp. (“ENDI”) was incorporated in Delaware on December 23, 2021. On August 11, 2022 (the “Closing Date”), the Company (as defined herein) completed its mergers (the “Mergers”) pursuant to that certain Agreement and Plan of Merger dated December 29, 2021 (as amended, the “Merger Agreement”) by and among ENDI, Enterprise Diversified, Inc., Zelda Merger Sub 1, Inc., Zelda Merger Sub 2, LLC, CrossingBridge Advisors, LLC and Cohanzick Management, LLC. On the Closing Date, Enterprise Diversified, Inc. and CrossingBridge Advisors, LLC became wholly owned subsidiaries of ENDI as a result of the Mergers (collectively with the other transactions described in the Merger Agreement, the “Business Combination”). Unless the context otherwise requires, and when used in this proxy statement, the “Company,” “ENDI,” “ENDI Corp.,” “we,” “our,” or “us” refers to ENDI Corp. individually, or as the context requires, collectively with its subsidiaries as of and after the Closing Date.

Q: Why are we holding the 2023 Annual Meeting?

A: As a matter of good corporate practice, we will hold a meeting of stockholders annually. This year’s meeting will be held on May 22, 2023. There will be at least five items of business that must be voted on by our stockholders at the 2023 Annual Meeting, and our Board is seeking your proxy to vote on these items. This proxy statement contains important information about us and the matters that will be voted on at the 2023 Annual Meeting. Please read these materials carefully so that you have the information you need to make informed decisions.

Q: Why did I receive the Notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

A: In accordance with the rules adopted by the U.S. Securities and Exchange Commission (“SEC”), we may furnish proxy materials, including this proxy statement and our 2022 Annual Report, to our stockholders by providing access to such documents on the Internet instead of mailing printed copies. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice, which we will begin mailing to our stockholders on or about April 11, 2023, will instruct you as to how you may access and review all of the proxy materials over the Internet. The Notice also instructs you as to how you may submit your proxy on the Internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice.

Q: Who is entitled to vote?

A: Only stockholders of record as of the close of business on March 24, 2023 (the “Record Date”) will be entitled to notice of, and to vote at, the 2023 Annual Meeting. A list of stockholders eligible to vote at the 2023 Annual Meeting is available for inspection at any time up to the 2023 Annual Meeting. If you would like to inspect the list, please call our Secretary at (434) 336-7737.

Q: How many shares of Class A common stock and Class B common stock can vote?

A: There were 5,452,383 shares of Class A common stock and 1,800,000 shares of Class B common stock (collectively, the Class A common stock and the Class B common stock, the “common stock”) issued and outstanding as of the close of business on the Record Date. Each stockholder entitled to vote at the 2023 Annual Meeting may cast one vote for each share of Class A common stock and one vote for each share of Class B common stock owned by him, her or it which has voting power upon the matters to be considered at the 2023 Annual Meeting.

Q: What may I vote on if I own shares of the Company’s Class A common stock?

A: You may vote on the following matters:

1. the election of two members of the Board (Steven Kiel and Abigail Posner) to serve for a one-year term to expire at the 2024 annual meeting of stockholders or until their successors are duly elected and qualified;

2. the ratification of the appointment of Brown, Edwards & Company, LLP (“Brown Edwards”) as our independent registered public accounting firm for the year ending December 31, 2023;

3. the approval of the ENDI Corp. 2022 Omnibus Equity Incentive Plan (the “2022 Plan”);

4. the approval, on an advisory basis, of the compensation of the Company’s named executive officers;

5. the approval, on an advisory basis, of a three-year frequency with which the Company should conduct future stockholder advisory votes on named executive officer compensation; and

6. any other business that may properly come before the 2023 Annual Meeting and any adjournment or postponement thereof.

Q: What may I vote on if I own shares of the Company’s Class B common stock?

A: You may vote on the following matters:

1. the election of three members of the Board (David Sherman, Thomas McDonnell and Mahendra Gupta) to serve for a one-year term to expire at the 2024 annual meeting of stockholders or until their successors are duly elected and qualified;

2. the ratification of the appointment of Brown Edwards as our independent registered public accounting firm for the year ending December 31, 2023;

3. the approval of the 2022 Plan;

4. the approval, on an advisory basis, of the compensation of the Company’s named executive officers;

5. the approval, on an advisory basis, of a three-year frequency with which the Company should conduct future stockholder advisory votes on named executive officer compensation; and

6. any other business that may properly come before the 2023 Annual Meeting and any adjournment or postponement thereof.

Q: Will any other business be presented for action by stockholders at the 2023 Annual Meeting?

A: Management knows of no business that will be presented at the 2023 Annual Meeting other than Proposals 1, 2, 3, 4 and 5. If any other matter properly comes before the 2023 Annual Meeting, the person named as proxy in the proxy card intends to vote the proxies (which confer discretionary authority to vote on such matters) in accordance with her judgment on the matter.

Q: How does the Board recommend that I vote on each of the proposals?

A: Our Board recommends a vote “FOR” the director nominees (Proposal 1), “FOR” the ratification of the appointment of Brown Edwards as our independent registered public accounting firm for the fiscal year ending December 31, 2023 (Proposal 2), “FOR” the approval of the 2022 Plan (Proposal 3), “FOR” the approval, on an advisory basis, of the compensation of the Company’s named executive officers (Proposal 4) and “FOR” the approval, on an advisory basis, of a three-year frequency with which the Company should conduct future stockholder advisory votes on named executive officer compensation (Proposal 5).

Q: How do I vote my shares?

A: The answer depends on whether you own your shares of common stock directly (that is, you hold shares that show your name as the registered stockholder) or if your shares are held in a brokerage account or by another nominee holder.

If you own your shares directly (i.e., you are a “registered stockholder”): your proxy is being solicited directly by us, and you can vote by mail, over the Internet, or over the phone or you can vote at the 2023 Annual Meeting if you virtually attend the meeting.

If you wish to vote by mail, please do the following: (i) sign and date the proxy card, (ii) mark the boxes indicating how you wish to vote, and (iii) return the proxy card in the prepaid envelope provided. If you sign your proxy card but do not indicate how you wish to vote, the proxy will vote your shares “FOR” the director nominees (Proposal 1), “FOR” the ratification of the appointment of Brown Edwards as our independent registered public accounting firm for the fiscal year ending December 31, 2023 (Proposal 2), “FOR” the approval of the 2022 Plan (Proposal 3), “FOR” the approval, on an advisory basis, of the compensation of the Company’s named executive officers (Proposal 4) and “FOR the approval, on an advisory basis, of a three-year frequency with which the Company should conduct future stockholder advisory votes on named executive officer compensation (Proposal 5), and, in her discretion, on any other matter that properly comes before the 2023 Annual Meeting. Unsigned proxy cards will not be counted.

If you wish to vote over the Internet, go to www.colonialstock.com/ENDI2023. Use the Internet to transmit your voting instructions until 11:59 p.m. Eastern Time on May 21, 2023. Have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form. There may be costs associated with electronic access, such as usage charges from Internet access providers that must be paid by the stockholder. The Internet voting procedures are designed to authenticate a stockholder’s identity to allow a stockholder to vote his, her or its shares and confirm that his, her or its instructions have been properly recorded. Voting over the Internet authorizes the named proxy to vote your shares in the same manner as if you had submitted a validly executed proxy card.

If you wish to vote by telephone, you may vote by calling (877) 285-8605 until 7:00 p.m. Eastern Time on May 21, 2023.

If you wish to vote during the meeting, go to www.colonialstock.com/ENDI2023. You will be able to attend the 2023 Annual Meeting online, vote your shares electronically until voting is closed and submit your questions during the 2023 Annual Meeting.

If you hold your shares through a broker, bank or other nominee: If you are the beneficial owner of shares held in street name through a bank, broker or other nominee, you may not vote your shares virtually at the 2023 Annual Meeting unless you obtain a “legal proxy” from the bank, broker or nominee that holds your shares, giving you the right to vote the shares virtually at the 2023 Annual Meeting. A voting instruction card has been provided to you by your broker, bank or other nominee describing how to vote your shares. If you receive a voting instruction card, you can vote by completing and returning the voting instruction card. Please be sure to mark your voting choices on your voting instruction card before you return it. See also “Will my shares be voted if I do not return my proxy?” below.

Q: What is a proxy?

A: A proxy is a person you appoint to vote on your behalf. By using any of the methods discussed above, you will be appointing as your proxy Jessica Greer, our Secretary. She may act on your behalf, and will have the authority to appoint a substitute to act as proxy. Whether or not you expect to virtually attend the 2023 Annual Meeting, we request that you please use the means available to you to vote by proxy so as to ensure that your shares of common stock may be voted.

Q: Will my shares be voted if I do not return my proxy?

A: If your shares are registered directly in your name, your shares will not be voted if you do not vote by returning your proxy by mail, over the phone or over the Internet before the 2023 Annual Meeting or virtually at the 2023 Annual Meeting.

If your shares are held in “street name,” your brokerage firm, bank or other nominee may, under certain circumstances, vote your shares if you do not timely return your voting instructions. Brokers, banks or other nominees can vote their customers’ unvoted shares on discretionary matters but cannot vote such shares on non-discretionary matters. If you do not timely return voting instructions to your brokerage firm, bank or other nominee to vote your shares, your brokerage firm, bank or other nominee may, on discretionary matters, either vote your shares or leave your shares unvoted. If you do not instruct your brokerage firm, bank or other nominee how to vote with respect to non-discretionary matters, your brokerage firm, bank or other nominee may not vote with respect to such non-discretionary matters and those shares that would have otherwise been entitled to be voted will be counted as “broker non-votes.” “Broker non-votes” are shares that are held in “street name” by a bank, brokerage firm or other nominee that indicates on its proxy that it does not have or did not exercise discretionary authority to vote on a particular matter.

Proposal 1, election of directors, is a non-discretionary matter. If you do not instruct your brokerage firm, bank or other nominee how to vote with respect to this proposal, your brokerage firm, bank or other nominee may not vote with respect to this proposal and those shares that would have otherwise been entitled to be voted will be counted as “broker non-votes.”

Proposal 2, ratification of the selection of Brown Edwards as our independent registered public accounting firm, is considered a discretionary matter, and your brokerage firm, bank or other nominee will be able to vote on this proposal even if it does not timely receive instructions from you, so long as it holds your shares in its name.

Proposal 3, approval of the 2022 Plan, is a non-discretionary matter. If you do not instruct your brokerage firm, bank or other nominee how to vote with respect to this proposal, your brokerage firm, bank or other nominee may not vote with respect to this proposal and those shares that would have otherwise been entitled to be voted will be counted as “broker non-votes.”

Proposal 4, approval, on an advisory basis, of the compensation of the Company’s named executive officers, is a non-discretionary matter. If you do not instruct your brokerage firm, bank or other nominee how to vote with respect to this proposal, your brokerage firm, bank or other nominee may not vote with respect to this proposal and those shares that would have otherwise been entitled to be voted will be counted as “broker non-votes.”

Proposal 5, approval, on an advisory basis, of a three-year frequency with which the Company should conduct future stockholder advisory votes on named executive officer compensation, is a non-discretionary matter. If you do not instruct your brokerage firm, bank or other nominee how to vote with respect to this proposal, your brokerage firm, bank or other nominee may not vote with respect to this proposal and those shares that would have otherwise been entitled to be voted will be counted as “broker non-votes.”

We encourage you to timely provide voting instructions to your brokerage firm, bank or other nominee. This ensures that your shares will be voted at the 2023 Annual Meeting according to your instructions. You should receive directions from your brokerage firm, bank or other nominee about how to submit your voting instructions to them.

Q: What if I want to change my vote or revoke my proxy?

A: If your shares are registered directly in your name, you may revoke your proxy and change your vote at any time before the 2023 Annual Meeting. To do so, you must do one of the following:

1. Vote over the Internet as instructed above. Only your latest Internet vote is counted. You may not revoke or change your vote over the Internet after 11:59 p.m. Eastern Time on May 21, 2023.

2. Sign a new proxy and submit it by mail to Colonial Stock Transfer, 7840 S. 700 E., Sandy, UT 84070 who must receive the proxy card no later than May 21, 2023. Only your latest dated proxy will be counted.

3. Vote by phone as instructed above. Only your latest vote is counted. You may not revoke or change your vote over the phone after 7:00p.m. Eastern Time on May 21, 2023.

4. Virtually attend the 2023 Annual Meeting and vote electronically at the meeting. Virtually attending the 2023 Annual Meeting alone will not revoke your Internet vote, telephone vote or proxy submitted by mail, as the case may be.

5. Give our Secretary written notice before or at the 2023 Annual Meeting that you want to revoke your proxy.

If your shares are held in “street name,” you may submit new voting instructions with a later date by contacting your bank, brokerage firm, or other nominee. You may also vote electronically at the 2023 Annual Meeting, which will have the effect of revoking any previously submitted voting instructions, if you obtain a broker’s legal proxy as described in the answer to the question “How do I vote my shares?” above.

Q: What is a quorum?

A: The holders of a majority of the 5,452,383 shares of Class A common stock and the holder of the majority of the 1,800,000 shares of Class B common stock outstanding, separately, as of the Record Date, either present or represented by proxy, constitute a quorum. A quorum is necessary in order to conduct the 2023 Annual Meeting. If you choose to have your shares represented by proxy at the 2023 Annual Meeting, you will be considered part of the quorum. Broker non-votes and abstentions will be counted as present for the purpose of establishing a quorum. If a quorum is not present by attendance at the 2023 Annual Meeting or represented by proxy, the chairperson of the meeting or the stockholders holding a majority in voting power of the shares of stock present by attendance at the meeting or by proxy that are entitled to vote at such meeting may adjourn the 2023 Annual Meeting until a quorum is present.

Q: What vote is required to approve each matter and how are votes counted?

A: The table below summarizes the proposals that will be voted on, the vote required to approve each item and how votes are counted:

Proposal | | Votes Required | | Voting

Options | | Impact of

“Abstain” Votes | | Broker Discretionary

Voting Allowed |

Proposal No. 1: Election of Directors | | The plurality of the votes cast. This means that the three nominees elected by the holder of Class B common stock receiving the highest number of affirmative “FOR” votes from the holder of shares of Class B common stock present virtually or represented by proxy and entitled to vote on the election of directors will be elected. The two other director nominees not elected by the holder of the Class B common stock that receive the highest number of affirmative “FOR” votes from the holders of shares of Class A common stock present virtually or represented by proxy and entitled to vote on the election of directors will be elected. | | “FOR” “AGAINST” “ABSTAIN” | | None (1) | | No (2) |

| | | | | | | | | |

Proposal No. 2: Ratification of the Appointment of Independent Registered Public Accounting Firm | | The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) at the 2023 Annual Meeting by the holders entitled to vote thereon. | | “FOR” “AGAINST” “ABSTAIN” | | None (3) | | Yes (4) |

| | | | | | | | | |

Proposal No. 3: Approval of the 2022 Plan | | The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) at the 2023 Annual Meeting by the holders entitled to vote thereon. | | “FOR” “AGAINST” “ABSTAIN” | | None (3) | | No (2) |

| | | | | | | | | |

Proposal No. 4: Approval, on an advisory basis, of the compensation to the Company’s named executive officers. | | The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) at the 2023 Annual Meeting by the holders entitled to vote thereon. | | “FOR” “AGAINST” “ABSTAIN” | | None (3) | | No (2) |

| | | | | | | | | |

Proposal No. 5: Approval, on an advisory basis, of a three-year frequency with which the Company should conduct future stockholder advisory votes on named executive officer compensation. | | The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) at the 2023 Annual Meeting by the holders entitled to vote thereon. | | “1 YEAR” “2 YEARS” “3 YEARS” “ABSTAIN” | | None (3) | | No (2) |

(1) A vote marked as “ABSTAIN” will not count as a vote “FOR” or “AGAINST” a director, because directors are elected by plurality voting.

(2) As this proposal is not considered a discretionary matter, brokers lack authority to exercise their discretion to vote uninstructed shares on this proposal.

(3) A vote marked as “ABSTAIN” is not considered a vote cast and will, therefore, not affect the outcome of this proposal.

(4) As this proposal is considered a discretionary matter, brokers are permitted to exercise their discretion to vote uninstructed shares on this proposal.

Q: What if additional proposals are presented at the 2023 Annual Meeting?

A: We do not intend to bring any other matter for a vote at the 2023 Annual Meeting, and we do not know of anyone else who intends to do so. However, with respect to any other business that properly comes before the 2023 Annual Meeting, your proxy is authorized to vote on your behalf using her judgment.

Q: Do the directors and officers of the Company have an interest in the outcome of the matters to be voted on?

A: Pursuant to our Amended and Restated Certificate of Incorporation, the holder of our Class B common stock, voting as a single class, has the right to designate such number of directors to our Board equal to the percentage of our common stock beneficially held by such holder of our Class B common stock and its affiliates, rounded up to the nearest whole number. Notwithstanding the foregoing, the holder of our Class B common stock shall not have the right to designate more than a majority of our director nominees. In addition, so long as the holder of our Class B common stock beneficially owns at least 5% of our outstanding common stock, such holder, voting as a single class, shall have the right to designate at least one director.

On August 11, 2022, we entered into a voting agreement (the “Voting Agreement”) with Cohanzick Management, LLC and Steven Kiel and Arquitos Capital Offshore Master, Ltd., in their capacity as the voting party (the “Voting Party”), pursuant to which the Voting Party shall vote all of its securities of our Company entitled to vote in the election of the Company’s directors that such Voting Party or its affiliates own (collectively, the “Voting Shares”) to elect or maintain in office the directors designated by Cohanzick Management, LLC (the “Cohanzick Member Designees”). The Voting Agreement will terminate automatically on the earlier of the date that (i) the holders of our Class B common stock or Cohanzick Management, LLC’s right to designate the Cohanzick Member Designees is terminated or expires for any reason, (ii) Steven Kiel is no longer a member of our Board and (iii) the Voting Party and its affiliates cease to hold any Voting Shares. The Voting Agreement will also terminate automatically with respect to any Voting Shares no longer held by the Voting Party or its affiliates.

In addition to the foregoing, members of the Board have an interest in Proposal 1, the election to the Board of the five director nominees set forth herein and Proposal 3, approval of the 2022 Plan. In addition, one officer, who is also a member of the Board, has an interest in Proposal 4, approval, on an advisory basis, of the compensation of the Company’s named executive officers and Proposal 5, approval on an advisory basis, of a three-year frequency with which the Company should conduct future stockholder advisory votes on named executive officer compensation. Members of the Board and officers of the Company do not have any interest in Proposal 2, the ratification of the appointment of the Company’s independent registered public accounting firm.

Q: How many shares do the affiliates, directors and officers of the Company beneficially own, and how do they plan to vote their shares?

A: Directors, executive officers and their affiliates, who, as of the Record Date, had beneficial ownership (or had the right to acquire beneficial ownership within sixty days following the Record Date) of approximately 65.94% of our outstanding Class A common stock and 100% of our Class B common stock and are expected to vote in favor of the election of the five director nominees set forth in this proxy statement, in favor of the ratification of the appointment of Brown Edwards as our independent registered public accounting firm for the fiscal year ending December 31, 2023, in favor of the adoption of the 2022 Plan, in favor of approving, on an advisory basis, the compensation of our named executive officers and in favor of approving, on an advisory basis, of a three-year frequency with which we should conduct future stockholder advisory votes on named executive officer compensation.

Q: Who will count the votes?

A: Jessica Greer, will serve as our inspector of elections and will count the votes cast by proxy and the votes cast in person at the 2023 Annual Meeting.

Q: Who can attend the 2023 Annual Meeting?

A: Only record holders and beneficial owners of our common stock, or their duly authorized proxies, may attend the Annual Meeting. If your shares of common stock are held in street name, you will need to bring a copy of a brokerage statement or other documentation reflecting your stock ownership as of the Record Date.

Q: How do I attend the 2023 Annual Meeting?

A: The 2023 Annual Meeting will be held on May 22, 2023 at 10:00 a.m. Eastern Time in a virtual format online at www.colonialstock.com/ENDI2023.

Q: Why a virtual meeting?

A: We are pleased to offer our stockholders a completely virtual 2023 Annual Meeting, which provides worldwide access, improved communication and cost savings for us and our stockholders.

Q: What if during the check-in time or during the meeting I have technical difficulties or trouble accessing the virtual meeting website?

A: We will have technicians ready to assist you with any technical difficulties you may have accessing the 2023 Annual Meeting. If you encounter any technical difficulties accessing the virtual meeting website during the check-in or meeting time, please call the technical support number that will be posted at www.colonialstock.com/ENDI2023.

Q: Are there any expenses associated with collecting the stockholder votes?

A: We will reimburse brokerage firms and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and other materials to our stockholders. We do not anticipate hiring an agency to solicit votes from stockholders at this time; however, if we determine that such action would be appropriate or necessary, we would pay the cost of such service. Our officers and other employees may solicit proxies in person or by telephone but will receive no special compensation for doing so.

Q: Do I have Dissenters’ Rights of Appraisal?

A: Our stockholders do not have appraisal rights under Delaware law or under our governing documents with respect to the matters to be voted upon at the 2023 Annual Meeting.

Q: Where can you find the voting results?

A: Voting results will be reported in a Current Report on Form 8-K, which we will file with the SEC within four business days following the 2023 Annual Meeting.

Q: Who is our Independent Registered Public Accounting Firm, and will they be represented at the 2023 Annual Meeting?

A: Brown Edwards served as our independent registered public accounting firm for the fiscal year ended December 31, 2022 and audited our financial statements for such fiscal year as of December 31, 2022. Brown Edwards has been selected by the audit committee to serve in the same role and to provide the same services for the fiscal year ending December 31, 2023. We do not expect representatives of Brown Edwards to be present at the 2023 Annual Meeting. As such, they will not have an opportunity to make a statement, if they desire, or be available to answer questions at the 2023 Annual Meeting.

Q: How do I obtain an Annual Report on Form 10-K?

A: If you would like a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 that we filed with the SEC, we will send you one without charge. Please write to:

ENDI Corp.

2400 Old Brick Rd., Suite 115

Glen Allen, VA 23060

Attn: Secretary

All of our SEC filings are also available free of charge under the heading “SEC Filings” of our website at www.endicorp.com.

PROPOSAL 1:

ELECTION OF DIRECTORS

Our Board currently consists of five directors, and their terms will expire at the 2023 Annual Meeting. Directors are elected at the annual meeting of stockholders each year and hold office until their resignation or removal or their successors are duly elected and qualified.

At the 2023 Annual Meeting, five nominees (including three nominees to be elected solely by Cohanzick Management, LLC as the beneficial owner of 100% of our outstanding Class B common stock) to the Board of Directors will be elected to hold office for a one-year term ending at our 2024 annual meeting of stockholders or until their respective successors are duly elected and qualified or until their earlier death, resignation or removal.

Pursuant to our Amended and Restated Certificate of Incorporation, the holders of our Class B common stock, voting as a single class, have the right to designate such number of directors to our Board equal to the percentage of our common stock beneficially held by such holders of our Class B common stock and their affiliates, rounded up to the nearest whole number. Notwithstanding the foregoing, the holders of our Class B common stock shall not have the right to designate more than a majority of our director nominees. In addition, so long as the holders of our Class B common stock beneficially own at least 5% of our outstanding common stock, such holders, voting as a single class, shall have the right to designate at least one director.

With respect to Proposal 1, the holders of our Class A common stock may vote FOR, AGAINST or ABSTAIN with respect to the appointment of Steven Kiel and Abigail Posner as our directors. In addition, Cohanzick Management, LLC, as the owner of 100% of our outstanding Class B common stock may vote FOR, AGAINST or ABSTAIN with respect to the appointment of David Sherman, Thomas McDonnell and Mahendra Gupta as our directors.

Under our Amended and Restated Bylaws, a plurality of the votes cast at the 2023 Annual Meeting is required to elect a nominee as a director. As such, nominees receiving more votes FOR than AGAINST will be elected. If you ABSTAIN, your shares will be counted as present and entitled to vote for purposes of establishing a quorum but will not be counted for purposes of determining the number of votes cast. Proposal 1 is a non-discretionary matter. Therefore, if your shares are held by your brokerage firm, bank or other nominee in “street name” and you do not timely provide voting instructions with respect to your shares, your brokerage firm, bank or other nominee cannot vote your shares on Proposal 1. Shares held in “street name” by banks, brokerage firms, or nominees who indicate on their proxies that they do not have authority to vote the shares on Proposal 1 will not be counted as votes FOR or AGAINST any nominee. As a result, such “broker non-votes” or voting to ABSTAIN will have no effect on the voting on Proposal 1.

If no contrary indication is made, proxies will be voted “FOR” David Sherman, Steven Kiel, Thomas McDonnell, Abigail Posner and Mahendra Gupta. Our management has no reason to believe that any nominee will be unable to serve.

Recommendation of our Board

Our Board unanimously recommends that the Class A common stock holders vote “FOR” the election of Steven Kiel and Abigail Posner at the 2023 Annual Meeting. Our Board unanimously recommends that the Class B common stock holder vote “FOR” the election of David Sherman, Thomas McDonnell and Mahendra Gupta.

Nominees for Election to the Board for a Term Expiring at the 2024 Annual Meeting of Stockholders

Nominee | | Age | | Position(s) |

David Sherman | | 57 | | Chief Executive Officer and Director |

Steven Kiel | | 44 | | Director |

Thomas McDonnell | | 77 | | Chairman |

Abigail Posner | | 50 | | Director |

Mahendra Gupta | | 67 | | Director |

Nominee for Election by the Holders of our Class A Common Stock

Steven Kiel

Steven Kiel served as a director of Enterprise Diversified, Inc., the predecessor registrant to the Company and, effective as of the closing of the Business Combination, a wholly-owned subsidiary of the Company, from 2014 until the closing of the Business Combination. Since the closing of the Business Combination, he has served on the Board of the Company. Since 2009, Mr. Kiel has served as the President of Arquitos Capital Management, LLC, a private investment firm, and since April 2012 he has served as portfolio manager of Arquitos Capital Partners, LP, a U.S. onshore fund, and Arquitos Capital Offshore, Ltd, a British Virgin Islands offshore fund. Mr. Kiel is a judge advocate in the Army Reserves, a veteran of Operation Iraqi Freedom, and currently holds the rank of Major. Prior to launching Arquitos Capital Management, Mr. Kiel was an attorney in private practice. He is a graduate of Antonin Scalia Law School (formerly George Mason School of Law) and Illinois State University and is a member of the bar in Illinois (inactive) and Washington, DC. Mr. Kiel’s qualifications to serve on the Company’s Board include his prior experience as a long-time director and former Chief Executive Officer of Enterprise Diversified, Inc. and his relevant experience in the investment management industry.

Abigail Posner

Abigail Posner has served on the Board since the closing of the Business Combination. She has served as the Director of Google’s US Creative Works since May 2018, where she manages a set of cross-discipline teams who work closely with the advertising and marketing communities to help develop their strategic and creative efforts for the digital space. Before joining Google, Ms. Posner served as the Executive Vice President, Strategy Director at Publicis New York, an advertising agency, where she directed strategic brand planning efforts for major new business pitches and provided thought leadership to key global clients. She also previously served as Co-Strategy Director at DDB Worldwide, a worldwide marketing communications network. She graduated from Harvard University with a bachelor’s degree in social anthropology. Ms. Posner’s qualifications to serve on the Company’s Board include her years of brand development experience, management skills and experience advising a global client base.

Nominees for Election by the Holder of our Class B Common Stock

David Sherman

David Sherman has served as the Chief Executive Officer and a director of the Company since August 11, 2022, the closing date of the Business Combination. Since August 1996, Mr. Sherman has served as the Chief Executive Officer, Manager of and Chief Investment Officer of Cohanzick Management, LLC (“Cohanzick”), a registered investment adviser. Cohanzick specializes in corporate credit opportunities with a focus on high yield, stressed and distressed opportunities. Mr. Sherman has served as the President of CrossingBridge, the Company’s now wholly-owned subsidiary and registered investment adviser, since 2016. Prior to founding Cohanzick, Mr. Sherman worked at Leucadia National Corporation, a financial services company, for 10 years. In 1992, Mr. Sherman became a Vice President actively involved in corporate investments and acquisitions. In addition, Mr. Sherman was Treasurer of Leucadia’s insurance operations with $3 billion of assets. In 2021, Mr. Sherman was appointed as an adjunct professor within NYU Stern’s Finance Department focused on Global Value Investing. Mr. Sherman graduated from Washington University with a B.S. in business administration. Mr. Sherman’s qualifications to serve on the Company’s Board include the experience derived from the ownership and operation of his own investment management firm for almost 30 years, and his in depth knowledge of the investment management industry resulting from his years working in the industry.

Thomas McDonnell

Thomas McDonnell has served on the Board of the Company and as its Chairman since the closing of the Business Combination. Mr. McDonnell has served as a lead member of the board of directors of Euronet (Nasdaq: EEFT), an electronic payments processing provider, since its incorporation in December 1996, and since 2003, Mr. McDonnell has served as a member of the board of directors of Kansas City Southern, a holding company with domestic and international rail operations. In addition, since 2015, Mr. McDonnell has served as a director of Bank of Blue Valley. From 1969 to 2012, Mr. McDonnell served in various capacities at DST Systems, Inc., a company that provided advisory, technology and operations outsourcing services, including serving as its Chief Executive Officer from 1984 until 2012. He received his Bachelor of Science in Accounting from Rockhurst College and a Master of Business Administration from the Wharton School of Finance. Mr. McDonnell’s qualifications to serve on the Company’s Board include his more than 30 years of significant governance experience serving on boards of directors, his leadership experience as a Chief Executive Officer and his education in finance.

Mahendra Gupta

Dr. Mahendra Gupta has served on the Board since the closing of the Business Combination. Dr. Gupta has served on the Olin Business School at Washington University in St. Louis faculty since 1990 and in 2004 was named the Geraldine J. and Robert L. Virgil Professor of Accounting and Management. He was appointed dean of the Olin Business School in July 2005 and served in that role until June 2016. Dr. Gupta serves on the following board of directors and their audit committees: Credit Suisse Mutual Funds, USA (NYSE: CS); First Bank, a privately held bank in St. Louis, Missouri; and Caleres Inc. (NYSE: CAL), a footwear company. He is also on the boards of the Consortium for Graduate Study in Management, the Foundation for Barnes Jewish Hospital, and the Oasis Institute. Dr. Gupta has also served on the board of Dance St. Louis, Variety – Children’s Charity, Junior Achievement of Greater St. Louis, Guardian Angles Settlement Association and United Way of Greater St. Louis. Dr. Gupta’s research has been published in academic journals in the United States and abroad. Dr. Gupta received his PhD in accounting from Stanford University, his MSIA in business administration from Carnegie Mellon University and his bachelors of science in statistics/economics from Bombay University (currently known as the University of Mumbai). Dr. Gupta’s qualifications to serve on the Company’s Board include his governance experience serving on several board of directors and audit committees and his extensive academic experience and education in accounting, administration, statistics and economics.

Family Relationships

There are no family relationships among any of our executive officers or directors.

Involvement in Certain Legal Proceedings

We are not aware of any of our directors or officers being involved in any legal proceedings in the past ten years relating to any matters in bankruptcy, insolvency, criminal proceedings (other than traffic and other minor offenses), or being subject to any of the items set forth under Item 401(f) of Regulation S-K.

CORPORATE GOVERNANCE

General

We believe that good corporate governance is important to ensure that our Company is managed for the long-term benefit of our stockholders. This section describes key corporate governance practices that we have adopted. We have adopted a Code of Business Conduct and Ethics which applies to all of our officers, directors and employees and charters for our audit committee, our compensation committee and our nominating and corporate governance committee. We have posted copies of our Code of Business Conduct and Ethics, as well as each of our committee charters, on our website, www.endicorp.com, which you can access free of charge. Information contained on the website is not incorporated by reference in, or considered part of, this proxy statement.

We will also provide copies of these documents as well as our other corporate governance documents, free of charge, to any stockholders upon written request to ENDI Corp., 2400 Old Brick Rd., Suite 115, Glen Allen, VA 23060, Attn: Secretary.

Director Independence

Our Board of Directors has determined that a majority of the Board consists of members who are currently “independent” as that term is defined under Nasdaq listing rules. Our Board of Directors considers Thomas McDonnell, Abigail Posner and Mahendra Gupta to be “independent.”

Board Leadership Structure and Role in Risk Oversight

The positions of Chief Executive Officer and Chair of our Board of Directors are held by two different individuals (David Sherman and Thomas McDonnell, respectively). This structure allows our Chief Executive Officer to focus on our day-to-day business while our Chair leads our Board of Directors in its fundamental role of providing advice to and independent oversight of management. Our Board of Directors believes such separation is appropriate, as it enhances the accountability of the Chief Executive Officer to the Board of Directors and strengthens the independence of the Board of Directors from management.

Board Meetings

During the fiscal year ended December 31, 2022, our Board held one meeting, which occurred following the closing of the Business Combination. In addition, during the fiscal year ended December 31, 2022, each of our audit committee, our compensation committee and our nominating and corporate governance committee held one meeting following the closing of the Business Combination. Each of our directors attended at least 75% of the aggregate of the total number of meetings of our Board of Directors and the total number of meetings held by all committees of the Board on which such member served.

Committees of Our Board of Directors

Our Board of Directors directs the management of our business and affairs, as provided by Delaware law, and conducts its business through meetings of the Board of Directors and its standing committees. Effective as of the Closing Date of the Business Combination, we have a standing audit committee, compensation committee and nominating and corporate governance committee. In addition, from time to time, special committees may be established under the direction of the Board of Directors when necessary to address specific issues.

Our Board of Directors has determined that all of the members of the audit committee, and a majority of the members of the nominating and corporate governance committee and the compensation committee are independent as defined under Nasdaq listing rules, including, in the case of all of the members of our audit committee, the independence requirements set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (“Exchange Act”). In making such determination, the Board of Directors considered the relationships that each director has with our Company and all other facts and circumstances that the Board of Directors deemed relevant in determining director independence, including the beneficial ownership of our capital stock by each director.

Audit Committee

Our audit committee is responsible for, among other things:

| | ● | providing oversight relating to the Company’s accounting and financial reporting processes and internal controls, including audits and the integrity of the Company’s consolidated financial statements; |

| | ● | reviewing and overseeing the qualifications, independence and performance of the Company’s independent auditors; |

| | ● | identifying and assessing certain risks and internal controls associated with audit matters; |

| | ● | overseeing compliance by the Company with legal and regulatory requirements; |

| | ● | reviewing and approving transactions between us and our directors, officers and affiliates; and |

| | ● | preparing the report, statements and/or disclosures of the audit committee that the rules of the SEC require to be included in our annual meeting proxy statement. |

Our audit committee consists of Thomas McDonnell, Mahendra Gupta, Steven Kiel. Our Board of Directors has determined that both Thomas McDonnell and Mahendra Gupta qualify as an “audit committee financial expert,” as such term is defined in Item 407(d)(5) of Regulation S-K.

Our Board of Directors adopted a written charter for the audit committee, which is available on our website at www.endicorp.com.

Compensation Committee

Our compensation committee is responsible for, among other things:

| | ● | assisting the Board with compensation and other related organizational matters; |

| | ● | reviewing the Company’s compensation strategy and evaluating the Company’s peer companies for compensation assessment purposes; |

| | ● | recommending and approving the standards and objectives to be considered in determining executive compensation in compliance with SEC rules and regulations; |

| | ● | reviewing and approving all forms of compensation, including executive compensation and service provider compensation as well as any cash-based and equity-based compensation; and |

| | ● | evaluating, confirming, amending or terminating any compensatory contracts or similar instrument with the executive officers of the Company. |

Our compensation committee consists of Mahendra Gupta, Abigail Posner and David Sherman.

Our Board of Directors adopted a written charter for the compensation committee, which is available on our website at www.endicorp.com.

Nominating and Governance Committee

Our nominating and governance committee is responsible for, among other things:

| | ● | Identifying, considering and recommending candidates for membership on the Board of Directors including providing assistance with recruiting candidates; |

| | ● | developing and recommending to the Board of Directors a set of corporate governance principles applicable to our Company; |

| | ● | overseeing the evaluation of our Board of Directors including director independence; and |

| | ● | advising on development of policies regarding the Board and recommending structure, size, qualifications, and member characteristics. |

Our nominating and corporate governance committee consists of Thomas McDonnell, Abigail Posner and David Sherman.

Our Board of Directors adopted a written charter for the nominating and corporate governance committee, which is available on our website at www.endicorp.com.

Director Nominations Process

With the exception of nominees of the holders of our Class B common stock pursuant to our Amended and Restated Certificate of Incorporation, our nominating and corporate governance committee is responsible for recommending candidates to serve on the Board. In addition, our nominating and corporate governance committee is responsible for recommending candidates to serve on our committees. In considering whether to recommend any particular candidate to serve on the Board or its committees or for inclusion in the Board’s slate of recommended director nominees for election at the annual meeting of stockholders, pursuant to the nominating and corporate governance committee charter, the nominating and corporate governance committee may develop and recommend to the Board the desired qualifications, expertise and characteristics of Board members.

We consider diversity a meaningful factor in identifying director nominees, but do not have a formal diversity policy. The Board evaluates each individual in the context of the Board as a whole, with the objective of assembling a group that has the necessary tools to perform its oversight function effectively in light of the Company’s business and structure. In determining whether to recommend a director for re-election, the nominating and corporate governance committee may also consider potential conflicts of interest with the candidates, other personal and professional pursuits, the director’s past attendance at meetings and participation in and contributions to the activities of the Board.

In identifying prospective director candidates, the nominating and corporate governance committee may seek referrals from other members of the Board or stockholders. The nominating and corporate governance committee also may, but need not, retain a third-party search firm in order to assist it in identifying candidates to serve as directors of the Company. The nominating and corporate governance committee uses the same criteria for evaluating candidates regardless of the source of the referral or recommendation. When considering director candidates, the nominating and corporate governance committee seeks individuals with backgrounds and qualities that, when combined with those of our incumbent directors, provide a blend of skills and experience to further enhance the Board’s effectiveness.

Our Board does not recall an instance in which a stockholder (other than Cohanzick pursuant to its rights) has recommended a director candidate; however, the nominating and corporate governance committee will consider potential nominees submitted by stockholders in accordance with the procedures set forth in our Amended and Restated Bylaws and other processes adopted from time to time for submission of director nominees by stockholders, and such candidates will be considered and evaluated under the same criteria described above. Stockholders wishing to propose a candidate for consideration may do so by submitting the above information to the attention of the Corporate Secretary, ENDI Corp., 2400 Old Brick Rd., Suite 115, Glen Allen, VA 23060.

Code of Ethics and Code of Conduct

We adopted a written code of business conduct and ethics that applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of the code is posted on our website at www.endicorp.com. Disclosure regarding any amendments to, or waivers from, provisions of the code of business conduct and ethics that apply to our directors, principal executive and financial officers will be posted on our website at www.endicorp.com or will be included in a Current Report on Form 8-K, which we will file within four business days following the date of the amendment or waiver.

Anti-hedging

As part of our Insider Trading Policy, all of our officers, directors, employees and consultants and family members or others sharing a household with any of the foregoing or that may have access to material non-public information regarding our Company are prohibited from engaging in or advising others to engage in any trades based on material non-public information, as well as any trades during certain prohibited times such as during the “blackout period” designated by our Chief Financial Officer in respect of our securities. Our Insider Trading Policy also prohibits short sales of our securities, any hedging or monetization transactions involving our securities and in transactions involving puts, calls or other derivative securities based on our securities by the relevant Company insiders. Our Insider Trading Policy further prohibits such persons from purchasing our securities on margin, borrowing against any account in which our securities are held or pledging our securities as collateral for a loan unless pre-cleared by our Chief Financial Officer. As of December 31, 2022, none of our directors or executive officers had pledged any shares of our common stock.

Director Attendance at Annual Meetings

Our policy is that directors should attend our annual meetings of stockholders.

Stockholder Communications with our Board

Stockholders and interested parties who wish to communicate with our Board of Directors or a specific member of our Board of Directors may do so by writing to ENDI Corp., 2400 Old Brick Rd., Suite 115, Glen Allen, VA 23060, Attention: Secretary.

All communications addressed to the attention of our Secretary will be reviewed by our Secretary and provided to the members of the Board of Directors unless such communications are unsolicited items, sales materials and other routine items and items unrelated to the duties and responsibilities of the Board of Directors.

Non-Employee Director Compensation

The following table presents the total compensation for each person who served as an independent, non-employee member of our Board of Directors and received compensation for such service during the fiscal year ended December 31, 2022. Other than as set forth in the table and described more fully below, we did not pay any compensation, make any equity awards or non-equity awards to, or pay any other compensation to any of the non-employee members of our Board of Directors in 2022. Directors are reimbursed for out-of-pocket expenses incurred for reasonable travel and other business expenses in connection with their service as directors.

Name | | Fees earned or paid in cash ($) | | | Total ($) | |

(a) | | (b) (1) (2) | | | (h) | |

Keith Smith | | $ | 22,500 | | | $ | 22,500 | |

Jeremy Deal | | $ | 22,500 | | | $ | 22,500 | |

Thomas Braziel | | $ | 22,500 | | | $ | 22,500 | |

Thomas McDonnell | | $ | 7,801 | | | $ | 7,801 | |

Abigail Posner | | $ | 7,801 | | | $ | 7,801 | |

Mahendra Gupta | | $ | 7,801 | | | $ | 7,801 | |

(1) We are considered a successor registrant to Enterprise Diversified, Inc. following the Business Combination, and as a result the amounts in this column for Keith Smith, Jeremy Deal, and Thomas Braziel reflect the annual cash retainer payments earned for service as a non-employee director of Enterprise Diversified Inc prior to the Business Combination.

(2) The amounts in this column for Thomas McDonnell, Abigail Posner and Mahendra Gupta reflect the annual cash retainer payments earned for services as non-employee directors during 2022 following the Business Combination, however, these payments were made in January 2023.

Non-Employee Director Compensation Policy

Prior the Business Combination, Enterprise Diversified, Inc., maintained a director compensation policy, pursuant to which directors were entitled to receive $30,000 cash or equity-based compensation per year for their service on the board of directors. The directors also receive reimbursement for expenses for reasonable travel expenses and other business expenses to attend board and committee meetings.

We adopted a director compensation policy on January 12, 2023 (the “Director Compensation Policy”). Beginning with calendar year 2023, independent directors are entitled to receive $20,000 cash compensation per year for their service on the Board of Directors and an equity award in the form of 5,250 restricted stock units pursuant to the Director Compensation Policy. All directors receive reimbursement for expenses for reasonable travel expenses and other business expenses to attend board and committee meetings.

AUDIT COMMITTEE REPORT

The primary purpose of the audit committee is to oversee our financial reporting processes on behalf of our Board. The audit committee’s functions are more fully described in its charter, which is available on our website at www.endicorp.com.

In the performance of its oversight function, the audit committee has reviewed and discussed our audited financial statements for the fiscal year ended December 31, 2022 with management and with our independent registered public accounting firm. In addition, the audit committee has discussed the matters required to be discussed by the statement on Auditing Standards No. 1301, as amended (AICPA, Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board (“PCAOB”) in Rule 3200T as well as applicable SEC rules, with Brown, Edwards & Company, LLP, our independent registered public accounting firm for the fiscal year ended December 31, 2022. The audit committee has also received and reviewed the written disclosures and the letter from Brown, Edwards & Company, LLP required by the applicable requirements of the PCAOB and has discussed with Brown, Edwards & Company, LLP their independence from us.

Based on the review and discussions referenced above, the audit committee recommended to our Board that our audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

Audit Committee:

Thomas McDonnell

Mahendra Gupta

Steven Kiel

The foregoing report of the audit committee does not constitute soliciting material and will not be deemed filed, incorporated by reference into or a part of any other filing by the Company (including any future filings) under the Exchange Act, except to the extent the Company specifically incorporates such report by reference therein.

EXECUTIVE OFFICERS

The following are biographical summaries of our executive officers and their ages, except for Mr. Sherman, whose biography is included under the heading “Proposal 1: Election of Directors” set forth above:

Name | | Age | | Position(s) |

David Sherman | | 57 | | Chief Executive Officer and Director |

Alea Kleinhammer | | 32 | | Chief Financial Officer |

Jessica Greer | | 44 | | Secretary |

Alea Kleinhammer

Alea Kleinhammer has served as the Chief Financial Officer of the Company since the closing of the Business Combination. She previously served as a director and Chief Financial Officer of Enterprise Diversified, Inc., the predecessor registrant to the Company and, effective as of the closing of the Business Combination, a wholly-owned subsidiary of the Company, from May 2019 until the closing of the Business Combination. Ms. Kleinhammer worked closely with all of Enterprise Diversified Inc.’s subsidiaries as part of the financial reporting process from 2016 until the closing of the Business Combination. Ms. Kleinhammer holds an active CPA license in the state of Virginia and has experience working in the public accounting sector. Ms. Kleinhammer received a Bachelor of Science in accounting from the University of Maryland at College Park.

Jessica Greer

Jessica Greer has served as the Secretary of the Company since the closing of the Business Combination. From February 2018 until the closing of the Business Combination, Ms. Greer served as Vice President, Chief of Staff and Corporate Secretary of Enterprise Diversified, Inc., the predecessor registrant to the Company and, effective as of the closing of the Business Combination, a wholly-owned subsidiary of the Company. Since February 2018, Ms. Greer has served as the President of Willow Oak Asset Management, LLC, the Company’s wholly-owned asset management subsidiary, where she leads the fund management services division, offering operational and investor relations support to the funds on the Willow Oak platform. Previously, Ms. Greer served in various management, development, and fundraising roles for a public policy group in Washington, DC, as well as leadership roles on small non-profit boards. Ms. Greer is a graduate of Loyola University Maryland.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the compensation paid or accrued during the fiscal years ended December 31, 2022 and 2021 to our principal executive officer, our principal financial officer, and one additional officer (each, a “named executive officer”):

| | ● | David Sherman, Chief Executive Officer and Director; |

| | ● | Alea Kleinhammer, Chief Financial Officer; and |

| | ● | Jessica Greer, Secretary. |

Name and Principal Position (named executive officers) | | Year | | Salary ($) | | Bonus ($) | | Stock Awards ($) | | Option Awards ($) | | Non-Equity Incentive Plan Compensation | | All Other Compensation ($) | | Total ($) | |

(a) | | (b) (1) | | (c) (2) | | (d) (3) | | (e) (4) | | (f) (4) | | (g) (4) | | (h) (5) | | (i) | |

David Sherman, Chief Executive Officer and Director | | 2022 | | $ | 154,839 | | | - | | | - | | | - | | | - | | | - | | $ | 154,839 | |

| | | 2021 | | | - | | | - | | | - | | | - | | | - | | | - | | | - | |

Alea Kleinhammer, Chief Financial Officer | | 2022 | | $ | 169,812 | | $ | 111,500 | | | - | | | - | | | - | | | - | | $ | 281,312 | |

| | | 2021 | | $ | 126,000 | | $ | 55,000 | | $ | 30,000 | | | - | | | - | | | - | | $ | 211,000 | |

Jessica Greer, Secretary | | 2022 | | $ | 169,812 | | $ | 106,500 | | | - | | | - | | | - | | | - | | $ | 276,312 | |

| | | 2021 | | $ | 126,000 | | $ | 55,000 | | $ | 30,000 | | | - | | | - | | | - | | $ | 211,000 | |

Steven Kiel, Former Chief Executive Officer and Director of Enterprise Diversified Inc. | | 2022 | | $ | 22,500 | | | - | | | - | | | - | | | - | | $ | 51,000 | | $ | 73,500 | |

| | | 2021 | | | - | | $ | 100,000 | | $ | 90,000 | | | - | | | - | | $ | 51,000 | | $ | 241,000 | |

| | (1) | In respect to the fiscal year that ended on December 31, 2022, all compensation set forth above in the summary compensation table is the aggregate total compensation received by the named executive officers prior to and following the Business Combination. Notwithstanding the foregoing, David Sherman became the Company’s principal executive officer following the Business Combination, and as a result, all compensation received by Mr. Sherman was for services to the Company following the closing of the Business Combination. Mr. Sherman did not receive any compensation from the Company or Enterprise Diversified, Inc. prior to the Business Combination. Steven Kiel, although he held the title of Chief Executive Officer and principal executive officer, was not an employee of Enterprise Diversified Inc., and serviced Enterprise Diversified Inc. as Chairman and director of the board of directors. |

| | (2) | Alea Kleinhammer and Jessica Greer received compensation for the period in 2022 occurring prior to the closing of the Business Combination providing services to Enterprise Diversified Inc., and following the Business Combination as employees of the Company. Ms. Kleinhammer received $89,247 of salary compensation for services provided to Enterprise Diversified Inc. prior to the Business Combination. Following the closing of the Business Combination, Ms. Kleinhammer received $58,065 of salary compensation for services provided to the Company for the remainder 2022. Ms. Greer received $89,247 of salary compensation for services provided to Enterprise Diversified Inc. prior to the Business Combination. Following the closing of the Business Combination, Ms. Greer received $58,065 of salary compensation for services provided to the Company for the remainder 2022. |

| | (3) | The dollar amounts set forth in column (d) represent payments of discretionary bonuses for performance during the applicable years as determined by the Chief Executive Officer in consultation with the Company’s compensation committee, as further described below in the section titled “Bonus Arrangements”, and fees earned (which required employment for the duration of the entire fiscal year) related to director related services the named executive officers provided to the Company in respect of fiscal year 2021 (Mr. Kiel: $100,000; Ms. Kleinhammer and Ms. Greer: $30,000 each). In respect of the fiscal year ended December 31, 2022, bonuses paid to Ms. Kleinhammer and Ms. Greer represented the aggregate total of payments made by Enterprise Diversified, Inc. prior to the Business Combination and payments by the Company following the Business Combination. Prior to the closing of the Business Combination, Ms. Kleinhammer and Ms. Greer each received a bonus payment in the amount of $55,000. Following the Business Combination, Ms. Kleinhammer received a bonus payment of $56,500, and Ms. Greer received a bonus payment of $51,500 for their services to the Company. |

| | (4) | Represents the aggregate grant date fair value of Class A common stock granted for the fiscal year ended December 31, 2021 as determined in accordance with FASB ASC Topic 718. On February 3, 2021, each of Alea Kleinhammer, Jessica Greer, and Steven Kiel received fully vested shares of Class A common stock. In addition, the 2021 equity awards were granted on February 3, 2021 in consideration for services performed between January 1, 2020 and January 31, 2021. See Item 5, “Market for Company’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” included in the Annual Report on Form 10-K for the year ended December 31, 2021 filed with the SEC by Enterprise Diversified, Inc., the predecessor registrant to the Company, on March 28, 2022, and Item 5, “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” included in the Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC by the Company on March 30, 2023 for more information regarding the Company’s accounting for share-based compensation plans. |

| | (5) | Represents the value of services received pursuant to the service-based contract with Arquitos Investment Manager, LP, Arquitos Capital Management, LLC, Arquitos Epicus, LP, and Arquitos Capital Offshore Master, Ltd., which are managed by Steven Kiel, as further discussed in “Services Agreement with Arquitos” in the Section on “Certain Relationships and Related Party Transactions”. |

Employment Agreements

David Sherman Employment Agreement

On June 3, 2022, CrossingBridge, a subsidiary of our Company, entered into an amended and restated employment agreement (the “Sherman Employment Agreement”) with David Sherman, which became effective immediately prior to the closing of the Business Combination (the “Effective Date”), pursuant to which Mr. Sherman serves as Chief Executive Officer of the Company and President of CrossingBridge. The term of the Sherman Employment Agreement is five years from the Effective Date, unless terminated sooner pursuant to the terms thereof. Pursuant to the Sherman Employment Agreement, Mr. Sherman shall receive a base salary of $400,000 per year, is eligible to receive a discretionary bonus award each year, and eligible to receive certain other benefits. Pursuant to the Sherman Employment Agreement, CrossingBridge may terminate Mr. Sherman’s employment for Cause (as defined in the Sherman Employment Agreement), in which case Mr. Sherman shall be entitled to (i) the payment of any accrued but unpaid base salary through the date of termination, (ii) unreimbursed expenses through the date of termination and (iii) all vested and nonforfeitable compensation and benefits. CrossingBridge may also terminate Mr. Sherman’s employment for any reason other than for Cause, for Permanent Disability (as defined in the Sherman Employment Agreement) or upon his death, in which case Mr. Sherman shall receive (i) his base salary during the Payment Obligation Period (as defined herein), (ii) accrued but unpaid base salary through the date of termination, (iii) unreimbursed expenses through the date of termination, (iv) all vested and nonforfeitable compensation and benefits, and (v) during the COBRA Coverage Period (as defined in the Sherman Employment Agreement), reimbursement for premiums for COBRA coverage provided that Mr. Sherman elects and is eligible for such coverage and he timely executes the General Release (as defined Sherman Employment Agreement). Notwithstanding the foregoing, if CrossingBridge terminates Mr. Sherman’s employment without Cause and the decision to terminate Mr. Sherman’s employment was made by a decision of the Board without the approval of board members elected pursuant to the rights of the Principal Stockholder as set forth in the Stockholder Agreement entered into in connection with the closing of the Business Combination and/or the rights of the holders of the Company’s Class B Common Stock as set forth in the Company’s Amended and Restated Certificate of Incorporation, then in addition to other amounts due to Mr. Sherman, he shall be entitled to a lump sum payment equal to 2.5x his then annual base salary. In the event CrossingBridge terminates Mr. Sherman’s employment for Permanent Disability, Mr. Sherman shall receive (i) his base salary during the Payment Obligation Period, provided that Mr. Sherman timely executes the General Release, (ii) accrued but unpaid base salary through the date of termination, (iii) accrued but unreimbursed expenses and (iv) all other vested and nonforfeitable compensation and benefits. If Mr. Sherman’s employment is terminated for death, Mr. Sherman shall receive (i) any accrued but unpaid base salary through the date of his death, (ii) unreimbursed expenses incurred through the date of death and (iii) all vested and nonforfeitable compensation and benefits.