Filed Pursuant to Rule 424(b)(3)

Registration No.: 333-264422

To the Shareholders of Agrico Acquisition Corp.:

You are cordially invited to attend the extraordinary general meeting of the shareholders (the “Agrico Special Meeting”) of Agrico Acquisition Corp. (“Agrico”), which will be held at 10:00 a.m., Eastern Time, on June 27, 2022, at the offices of Maples and Calder (Cayman) LLP at 121 South Church Street, Ugland House, Grand Cayman, Cayman Islands. Due to public health concerns relating to the coronavirus pandemic and our concerns about protecting the health and well-being of our shareholders and employees, we encourage shareholders to attend the Agrico Special Meeting virtually. You are cordially invited to attend and participate in the extraordinary general meeting online by visiting https://www.cstproxy.com/agricoacquisition/2022. This joint proxy statement/prospectus includes instruction on how to access the Agrico Special Meeting and how to listen and vote from home or any remote location with internet connectivity.

Agrico is a Cayman Islands blank check company established for the purpose of entering into a merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization or other similar business transaction with one or more businesses or entities, which we refer to as a “target business.” Holders of Agrico Class A ordinary shares, $0.0001 par value (“Agrico Shares”) and Class B ordinary shares, $0.0001 par value will be asked to approve, among other things, the First Merger, the Business Combination Agreement and the other related proposals.

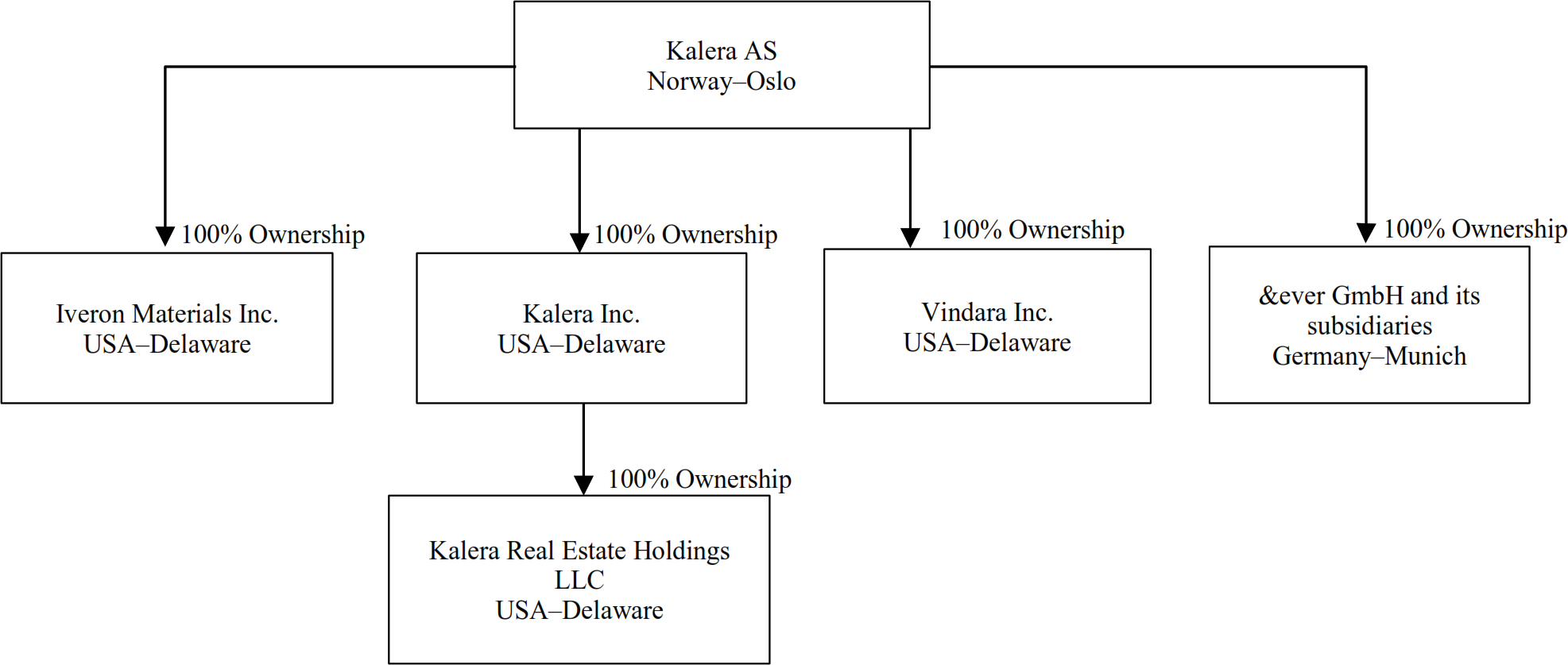

Agrico has entered into a Business Combination Agreement (as may be amended from time to time, the “Business Combination Agreement”, a copy of which is attached to the accompanying joint proxy statement/prospectus as Annex A) with (i) Figgreen Limited, a private limited company incorporated in Ireland with registered number 606356 (which subsequently was reregistered as an Irish public company and was renamed “Kalera Public Limited Company”) in connection with the Business Combination (“Pubco”), (ii) Kalera Cayman Merger Sub, a Cayman Islands exempted company (“Cayman Merger Sub”), (iii) Kalera Luxembourg Merger Sub SARL, a Luxembourg limited liability company (société à responsabilité limitée) (“Lux Merger Sub” and, together with Cayman Merger Sub, the “Merger Subs”) and (iv) Kalera AS, a Norwegian private limited liability company.

Pursuant to the Business Combination Agreement, (i) a merger will occur, pursuant to which Cayman Merger Sub will merge with and into Agrico, with Agrico continuing as the surviving entity and as a wholly owned subsidiary of Pubco (the “First Merger”) and Agrico will issue one Class A Agrico Ordinary Share to Pubco (the “Agrico Share Issuance”) and the holders of Agrico Ordinary Shares will receive shares in the capital of Pubco and holders of Agrico Warrants will have their Agrico Warrants assumed by Pubco and adjusted to become exercisable for shares in the capital of Pubco, in each case as consideration for the First Merger and the Agrico Share Issuance, (ii) at least one (1) business day following the First Merger and subject thereto, the second merger will occur, pursuant to which Lux Merger Sub will merge with and into Kalera (as defined in the accompanying joint proxy statement/prospectus) with Kalera as the surviving entity of the second merger (the “Second Merger”) and in this context Kalera will issue shares to Pubco (the “Kalera Share Issuance”), and (iii) immediately following the Second Merger and the Kalera Capital Reduction, the Kalera Shareholders (except Pubco) will receive shares in the capital of Pubco and the holders of the Kalera Options will receive options in the capital of Pubco, in each case as consideration for the Kalera Shares and the Kalera Options being cancelled and ceasing to exist or being assumed (as applicable) upon completion of the Second Merger by way of a capital reduction pursuant to the Luxembourg Companies Act (the “Kalera Capital Reduction”). As a result of the transactions contemplated by the Business Combination Agreement, Kalera will be a wholly owned subsidiary of Pubco.

Upon consummation of the First Merger, (i) each Agrico Class A ordinary share outstanding immediately prior to the First Merger Effective Time will be automatically cancelled in exchange for and converted into one Pubco Ordinary Share, (ii) each Agrico Class B ordinary share outstanding immediately prior to the First Merger Effective Time will be automatically cancelled in exchange for and converted into one Pubco Ordinary Share, and (iii) each outstanding Agrico Public Warrant and Private Placement Warrant will remain outstanding and will automatically be adjusted to become a Pubco Warrant. Upon closing of the Business Combination, Agrico will be a wholly owned

subsidiary of Pubco. If Agrico is solvent at such time, the voluntary winding-up of Agrico is expected to commence, and voluntary liquidators are expected to be appointed, by the passing of a special resolution by the shareholder. Upon the appointment of a voluntary liquidator, the powers of the directors are expected to cease and the business of Agrico is expected to be discontinued except to the extent necessary to facilitate the winding-up. During the winding up process, liabilities of Agrico are expected to be assumed by Pubco. The liquidator is expected to notify the Cayman Islands Registrar of Companies of the commencement of the winding-up and publish a notice in the Cayman Islands Government Gazette informing creditors of the same. Notice must be published in the Cayman Islands Government Gazette prior to the final general meeting of Agrico at which the accounts of the liquidation and the conduct of the liquidation will be presented for shareholder approval. This notice must be published at least 21 days in advance of the meeting. Notice of the final meeting must also be given to all shareholders. Following such notice, final general meeting of Agrico is expected to be held, following which, the liquidator is expected to make a final return to the Cayman Islands Registrar of Companies. Three months later, Agrico is expected to be deemed formally dissolved.

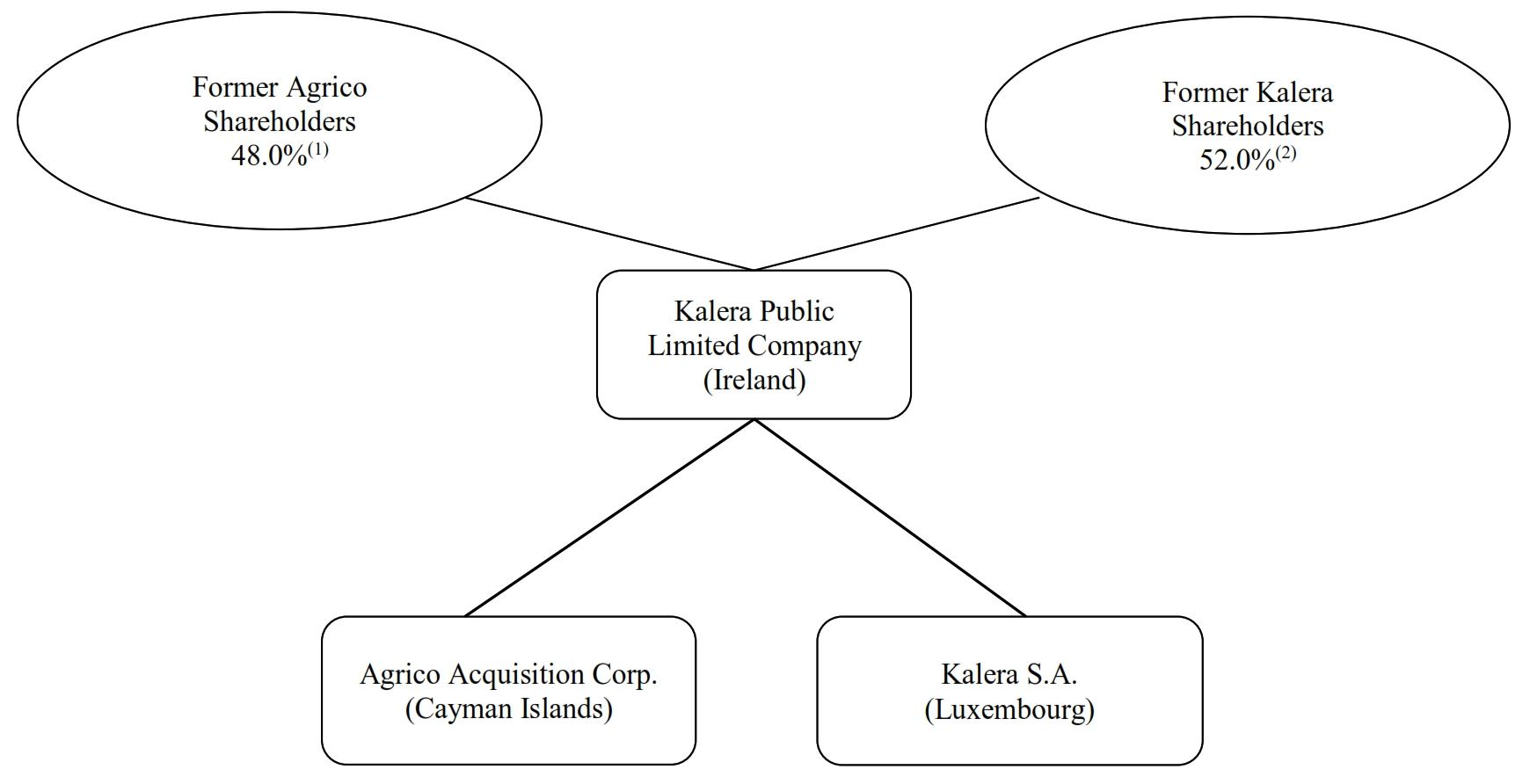

Upon consummation of the Second Merger, each Kalera Share outstanding immediately prior to the Second Merger Effective Time will be cancelled and cease to exist in the context of the Kalera Capital Reduction against the issuance of (i) the number of Pubco Ordinary Shares equal to the Exchange Ratio (the aggregate number of Pubco Ordinary Shares so issued, the “Exchange Shares”) and (ii) one CVR per Kalera Share. The completion of the Business Combination will cause, assuming no public shareholders of Agrico exercise their redemption rights, Kalera Shareholders to beneficially own approximately 52% and Agrico securityholders to beneficially own approximately 48% of the issued and outstanding Pubco Ordinary Shares (64.9% on a fully diluted basis giving effect to Pubco Ordinary Shares underlying the warrants that will be beneficially owned by Agrico warrantholders as of the Closing). Upon completion of the Business Combination, assuming no public shareholders of Agrico exercise their redemption rights, Agrico’s sponsor, DJCAAC, LLC, will beneficially own approximately 9.6% of the issued and outstanding Pubco Ordinary Shares (22.4% on a fully diluted basis giving effect to Pubco Ordinary Shares underlying the warrants that will be beneficially owned by Agrico’s sponsor as of the Closing). The foregoing statements assume exercisability of the Pubco Warrants on the date of Closing or within 60 days of the Closing.

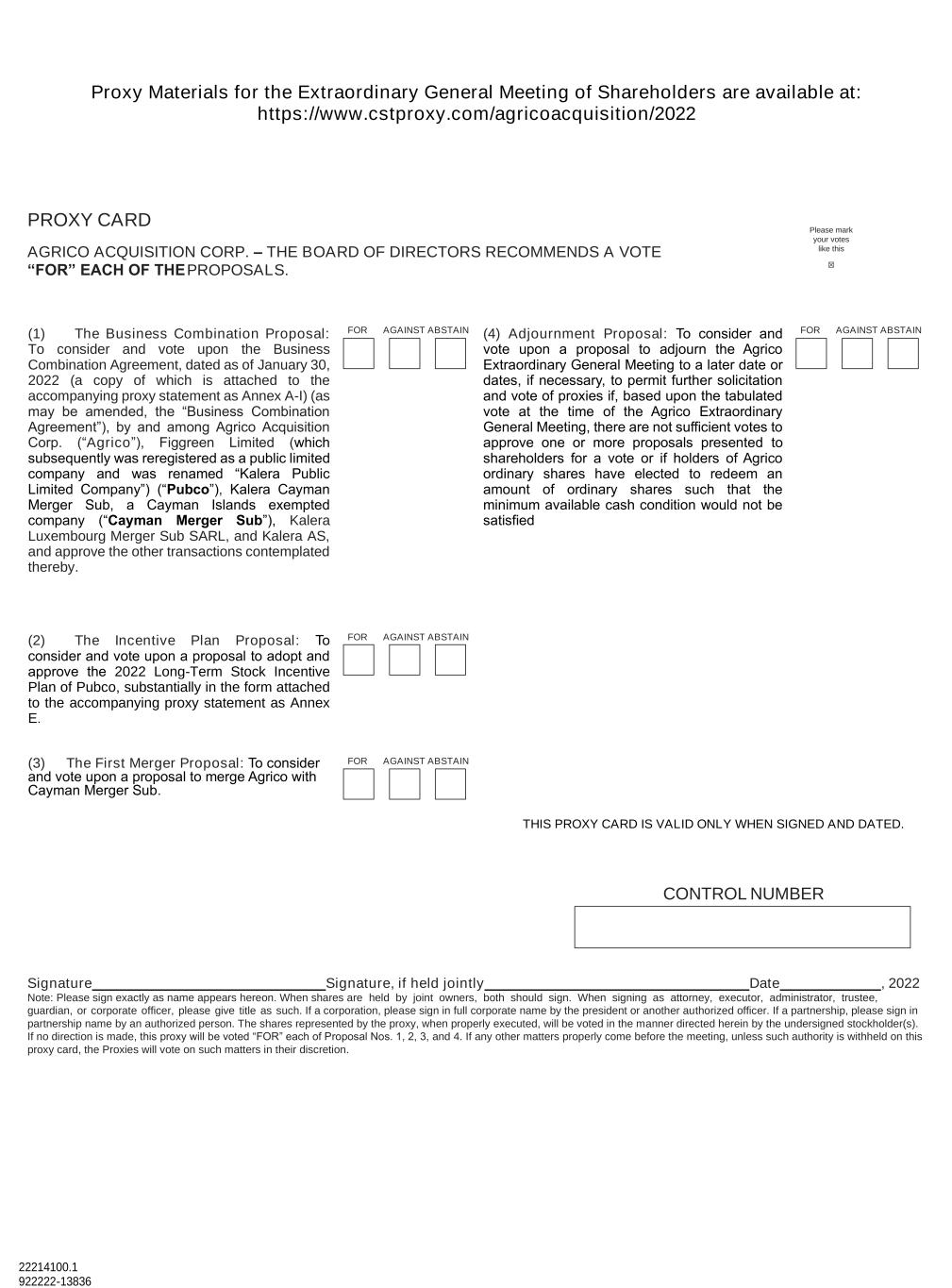

At the Agrico Special Meeting, Agrico Shareholders will be asked to consider and vote upon the following proposals:

1.The Business Combination Proposal — To consider and vote upon the consummation of the proposed business combination with Kalera S.A., as further described in the accompanying joint proxy statement/prospectus.

2.The Incentive Plan Proposal — To consider and vote upon a proposal to adopt and approve a long-term incentive plan for the combined company post-business combination;

3.The First Merger Proposal — To consider and vote upon a proposal to merge Agrico with Cayman Merger Sub;

4.Adjournment Proposal — to consider and vote upon a proposal to approve the adjournment of the Agrico Special Meeting by the chairman thereof to a later date, if necessary, under certain circumstances, including for the purpose of soliciting additional proxies in favor of the foregoing proposals, in the event Agrico does not receive the requisite shareholder vote to approve the proposals.

Each of these proposals is more fully described in the accompanying joint proxy statement/prospectus, which we encourage you to read carefully and in its entirety before voting. Only holders of record of Agrico Ordinary Shares at the close of business on May 12, 2022 are entitled to notice of the Agrico Special Meeting and to vote and have their votes counted at the special meeting and any adjournments or postponements thereof.

Each shareholder’s vote is very important. Whether or not you plan to participate in the Agrico Special Meeting, please submit your proxy card without delay. Shareholders may revoke proxies at any time before they are voted at the Agrico Special Meeting. Voting by proxy will not prevent a shareholder from voting at the Agrico Special Meeting if such shareholder subsequently chooses to participate in the Agrico Special Meeting.

NEITHER THE U.S. SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE BUSINESS COMBINATION OR THE OTHER TRANSACTIONS DESCRIBED IN THIS JOINT PROXY STATEMENT/PROSPECTUS OR ANY OF THE SECURITIES TO BE ISSUED IN THE BUSINESS COMBINATION, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS JOINT PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This joint proxy statement/prospectus is dated May 16, 2022, and is first being mailed to shareholders of Agrico on or about May 18, 2022.

| | |

| Very truly yours, |

|

| /s/ Brent de Jong |

| Brent de Jong, Chief Executive Officer of Agrico Acquisition |

| Corp. |

AGRICO ACQUISITION CORP.

Boundary Hall, Cricket Square

Grand Cayman KY1-1102

Cayman Islands

NOTICE OF EXTRAORDINARY GENERAL MEETING

TO BE HELD ON JUNE 27, 2022

TO THE SHAREHOLDERS OF AGRICO ACQUISITION CORP.:

NOTICE IS HEREBY GIVEN that an Extraordinary General Meeting of Agrico Acquisition Corp., a Cayman Islands exempted company (“Agrico”), will be held at 10:00 a.m. Eastern Time, on June 27, 2022, at the offices of Maples and Calder (Cayman) LLP at 121 South Church Street, Ugland House, Grand Cayman, Cayman Islands. Due to public health concerns relating to the coronavirus pandemic and our concerns about protecting the health and well-being of our shareholders and employees, we encourage shareholders to attend the Agrico Special Meeting virtually. You are cordially invited to attend and participate in the extraordinary general meeting online by visiting https://www.cstproxy.com/agricoacquisition/2022. You can participate in the Agrico Special Meeting as described in “Questions and Answers About the Proposals—Questions and Answers About the Proposals for Agrico Shareholders”. The meeting will be held for the following purposes:

1.The Business Combination Proposal — To consider and vote upon the consummation of the proposed business combination with Kalera S.A., as further described in the accompanying joint proxy statement/prospectus;

2.The Incentive Plan Proposal — To consider and vote upon a proposal to adopt and approve a long-term incentive plan for the combined company post-business combination;

3.The First Merger Proposal — To consider and vote upon a proposal to merge Agrico with Cayman Merger Sub; and

4.The Adjournment Proposal — To consider and vote upon a proposal to adjourn the Agrico Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Agrico Special Meeting, there are not sufficient votes to approve one or more proposals presented to shareholders for a vote or if holders of the Agrico Shares have elected to redeem an amount of Agrico Shares such that the minimum available cash condition would not be satisfied.

In connection therewith, at the Agrico Special Meeting shareholders will be asked to consider and, if thought fit, approve the following resolutions 1 and 2 as ordinary resolutions (being where a quorum is present, the affirmative vote of the holders of at least a majority of the issued shares who are present in person or represented by proxy and entitled to vote thereon and who vote at the Agrico Special Meeting), and resolution 3 as a special resolution (being where a quorum is present, the affirmative vote of the holders of at least a two-thirds majority of the issued shares who are present in person or represented by proxy and entitled to vote thereon and who vote at the Agrico Special Meeting). Only if, based upon the tabulated vote at the time of the Agrico Special Meeting, there are not sufficient votes to approve one or more of resolutions 1 through 3, shareholders may be asked to consider and, if thought fit, approve resolution 4 as an ordinary resolution (together, the “Resolutions”):

The full text of the resolution to be passed is as follows:

RESOLUTION 1: THE BUSINESS COMBINATION RESOLUTION

RESOLVED THAT, as an ordinary resolution, that Agrico’s entry into the Business Combination Agreement (a copy of which is attached to the accompanying joint proxy statement/prospectus as Annex A) with (i) Figgreen Limited, a private limited company incorporated in Ireland with registered number 606356 (which subsequently was reregistered as a public limited company and was renamed “Kalera Public Limited Company”) (“Pubco”), (ii) Kalera Cayman Merger Sub, a Cayman Islands exempted company (“Cayman Merger Sub”), (iii) Kalera

Luxembourg Merger Sub SARL, a Luxembourg limited liability company (société à responsabilité limitée) (“Lux Merger Sub” and, together with Cayman Merger Sub, the “Merger Subs”) and (iv) Kalera AS, a Norwegian private limited liability company, pursuant to which (i) a merger will occur, pursuant to which Cayman Merger Sub will merge with and into Agrico, with Agrico continuing as the surviving entity and as a wholly owned subsidiary of Pubco (the “First Merger”) and Agrico will issue one Class A Agrico Ordinary Share to Pubco (the “Agrico Share Issuance”) and the holders of Agrico Ordinary Shares will receive shares in the capital of Pubco and holders of Agrico Warrants will have their Agrico Warrants assumed by Pubco and adjusted to become exercisable for shares in the capital of Pubco, in each case as consideration for the First Merger and the Agrico Share Issuance, (ii) at least one (1) business day following the First Merger and subject thereto, the second merger will occur, pursuant to which Lux Merger Sub will merge with and into Kalera (as defined in the accompanying joint proxy statement/prospectus) with Kalera as the surviving entity of the second merger (the “Second Merger”) and in this context Kalera will issue shares to Pubco (the “Kalera Share Issuance”), and (iii) immediately following the Second Merger and the Kalera Capital Reduction, the Kalera Shareholders (except Pubco) will receive shares in the capital of Pubco and the holders of the Kalera Options will receive options in the capital of Pubco, in each case as consideration for the Kalera Shares and the Kalera Options being cancelled and ceasing to exist or being assumed (as applicable) upon completion of the Second Merger by way of a capital reduction pursuant to the Luxembourg Companies Act (the “Kalera Capital Reduction”) and as a result of the transactions contemplated by the Business Combination Agreement, Kalera will be a wholly owned subsidiary of Pubco be approved, ratified and confirmed in all respects.

The full text of the resolution to be passed is as follows:

RESOLUTION 2: THE INCENTIVE PLAN RESOLUTION

RESOLVED THAT, as an ordinary resolution and conditioned upon the passing of the Business Combination Resolution that the adoption of the Incentive Plan (substantially in the form attached to the accompanying joint proxy statement/prospectus, as Annex E) be and is authorized, approved and adopted in all respects.

The full text of the resolution to be passed is as follows:

RESOLUTION 3: THE FIRST MERGER RESOLUTION

RESOLVED THAT, as a special resolution:

(a)Agrico be authorised to merge with Cayman Merger Sub so that Agrico be the surviving company and all the undertaking, property and liabilities of Cayman Merger Sub vest in Agrico by virtue of the merger pursuant to the Companies Act (As Revised) of the Cayman Islands;

(b)the First Merger Plan in the form annexed to the joint proxy statement/prospectus in respect of the general meeting as Annex C be authorised, approved and confirmed in all respects and Agrico be authorised to enter into the First Merger Plan;

(c)the First Merger Plan be executed by any director of Agrico for and on behalf of Agrico and any director of Agrico or Maples and Calder (Cayman) LLP, on behalf of Maples Corporate Services Limited, be authorised to submit the First Merger Plan, together with any supporting documentation, for registration to the Registrar of Companies of the Cayman Islands; and

(d)all actions taken and any documents or agreements executed, signed or delivered prior to or after the date hereof by any director of Agrico or officer of Agrico in connection with the transactions contemplated hereby be and are hereby approved, ratified and confirmed in all respects.

The full text of the resolution to be passed is as follows:

RESOLUTION 4: THE ADJOURNMENT RESOLUTION

RESOLVED THAT, as an ordinary resolution, the adjournment of the extraordinary general meeting to a later date or dates to be determined by the chairman of the extraordinary general meeting, if necessary, to permit further solicitation and vote of proxies be confirmed, ratified and approved in all respects.

NOTES TO THE NOTICE OF EXTRAORDINARY GENERAL MEETING

The items of business for the Agrico Special Meeting are described in the attached joint proxy statement/prospectus, which we encourage you to read in its entirety before voting.

Entitlement to attend and vote

Only holders of record of Agrico Class A ordinary shares and Agrico Class B ordinary shares at the close of business on May 12, 2022 (the “Agrico Record Date”) are entitled to notice of the Agrico Special Meeting and to vote and have their votes counted at the Agrico Special Meeting and any adjournments or postponements of the Agrico Special Meeting.

A complete list of Agrico Shareholders of record entitled to vote at the Agrico Special Meeting will be available for ten (10) days before the meeting at Transfer Agent’s offices for inspection by shareholders during ordinary business hours for any purpose germane to the meeting.

Board recommendation

After careful consideration, Agrico’s board of directors has determined that the Business Combination Proposal, the Incentive Plan Proposal, the First Merger Proposal and the Adjournment Proposal are fair to and in the best interests of Agrico and its shareholders and unanimously recommends that you vote or give instruction to vote “FOR” the Business Combination Proposal, “FOR” the Incentive Plan Proposal, “FOR” the First Merger Proposal and “FOR” the Adjournment Proposal, if presented.

Under the Business Combination Agreement, approval of the Business Combination Proposal and the First Merger Proposal by Agrico’s shareholders are conditions to the consummation of the Business Combination. The Business Combination Proposal, the Incentive Plan Proposal and the First Merger Proposal are conditioned on the approval of each other. As such, in the event that any of the Business Combination Proposal and the First Merger Proposal do not receive the requisite vote for approval, then Agrico will not consummate the Business Combination. Further, if the Business Combination Proposal does not receive the requisite vote for approval, Agrico will not implement the Incentive Plan. The Adjournment Proposal is not conditioned on the approval of any other proposal set forth in this joint proxy statement/prospectus.

Appointment of proxies

All Agrico Shareholders as at the Agrico Record Date are cordially invited to attend the Agrico Special Meeting. To ensure your representation at the Agrico Special Meeting, however, you are urged to complete, sign, date and return the enclosed proxy card as soon as possible in the envelope provided and, in any event so as to be received by Agrico at Continental Stock Transfer & Trust Company,1 State Street, 30th floor, New York, NY 10004, Attention: Mark Zimkind, no later than 10:00 a.m. Eastern Time, on June 25, 2022 being 48 hours before the time appointed for the holding of the Agrico Special Meeting (or, in the case of an adjournment, no later than 48 hours before the time appointed for the holding of the adjourned meeting). In the case of joint shareholders, where more than one of the joint shareholders purports to appoint a proxy, only the appointment submitted by the most senior holder (being the first named holder in respect of the shares in Agrico’s register of members) will be accepted. If you are a shareholder of record of Agrico Ordinary Shares as at the Agrico Record Date, you may also attend and cast your vote at the Agrico Special Meeting. Submitting a proxy now will NOT prevent you from being able to attend and vote during the meeting. If your shares are held in an account at a brokerage firm or bank, you must instruct your broker or bank on how to vote your shares or, if you wish to attend the Agrico Special Meeting and vote, obtain a proxy from your broker or bank.

In the case of a shareholder that is a natural person, the proxy card must be executed under the hand of the shareholder or his or her attorney. In the case of a shareholder that is a corporation or other non-natural person, the proxy card must be executed on its behalf by a duly authorized representative or attorney for the corporation. Any power of attorney or any other authority under which the proxy card is signed (or a duly certified copy of such power of attorney or authority) must be included with the proxy card.

A vote withheld is not a vote in law, which means that the vote will not be counted in the calculation of votes for or against the Resolutions. If you return your proxy card without an indication of how you wish to vote, your shares will be voted in favor of each of the Resolutions presented at the Agrico Special Meeting.

Changing proxy instructions

To change your proxy instructions simply complete, sign, date and return a new proxy card following the procedure set out in the notes above. Note that the cut off time for receipt of proxy appointments specified in those notes also applies in relation to amended proxy instructions. Any amended proxy appointment received after the specified cut off time will be disregarded.

Termination of proxy appointment

In order to revoke a proxy instruction you will need to send a notice clearly stating your intention to revoke your proxy appointment to Agrico’s proxy solicitor at Morrow Sodali LLC, 333 Ludlow Street, 5th Floor, South Tower, Stamford, CT 06902, or via email at RICO.info@investor.morrowsodali.com. In the case of a shareholder that is a natural person, the revocation notice must be executed under the hand of the shareholder or his or her attorney. In the case of a shareholder that is a corporation or other non-natural person, the revocation notice must be executed on its behalf by a duly authorized representative or attorney for the corporation. Any power of attorney or any other authority under which the revocation notice is signed (or a duly certified copy of such power of attorney or authority) must be included with the revocation notice.

The revocation notice must be received by Agrico no later than 10:00 a.m. Eastern Time, on June 25, 2022 being 48 hours before the time appointed for the holding of the Agrico Special Meeting (or, in the case of an adjournment, no later than 48 hours before the time appointed for the holding of the adjourned meeting).

If you attempt to revoke your proxy instruction but the revocation notice is received after the time specified then your proxy will remain valid. Notwithstanding the foregoing, submitting a proxy will NOT prevent you from being able to attend and vote online during the meeting. If you have submitted a proxy and attend the Agrico Special Meeting, your proxy appointment will automatically be terminated.

Corporate representatives

A corporation or other non-natural person which is a shareholder can appoint one or more corporate representatives who may exercise, on its behalf, all its powers as a shareholder provided that no more than one corporate representative exercise powers over the same share.

Voting

Voting on all resolutions at the Agrico Special Meeting will be conducted by way of a poll rather than on a show of hands. On a poll votes are counted according to the number of shares registered in each shareholder’s name, with each share carrying one vote.

Results of the voting

As soon as practicable following the Agrico Special Meeting, the results of the voting will be announced via a regulatory information service and also placed on Agrico’s website.

YOUR VOTE IS IMPORTANT REGARDLESS OF THE NUMBER OF AGRICO ORDINARY SHARES YOU OWN. Whether you plan to attend the Agrico Special Meeting or not, please sign, date and return the enclosed proxy card as soon as possible in the envelope provided and, in any event so as to be received by Agrico no later than 48 hours prior to the time appointed for the holding of the Agrico Special Meeting (or, in the case of an adjournment, no later than 48 hours before the time appointed for the holding of the adjourned meeting). If your shares are held in “street name” or are in a margin or similar account, you should contact your broker to ensure that votes related to the shares you beneficially own are properly counted.

Thank you for your participation. We look forward to your continued support.

| | | | | |

| By Order of the Board of Directors | |

| |

| /s/ Brent de Jong | |

| |

| Brent de Jong, Chief Executive Officer of Agrico Acquisition Corp. |

IF YOU RETURN YOUR PROXY CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED IN FAVOR OF EACH OF THE PROPOSALS. TO EXERCISE YOUR REDEMPTION RIGHTS, YOU MUST DEMAND THAT AGRICO REDEEM YOUR SHARES FOR CASH NO LATER THAN 5:00 P.M. EASTERN TIME ON JUNE 23, 2022 (TWO (2) BUSINESS DAYS PRIOR TO THE MEETING) BY (A) DELIVERING A CONVERSION NOTICE TO AGRICO’S TRANSFER AGENT AND (B) TENDERING YOUR SHARES TO AGRICO’S TRANSFER AGENT. YOU MAY TENDER YOUR SHARES BY EITHER DELIVERING YOUR SHARE CERTIFICATES (IF ANY) AND OTHER REDEMPTION FORMS TO THE TRANSFER AGENT OR BY DELIVERING YOUR SHARES ELECTRONICALLY USING THE DEPOSITORY TRUST COMPANY’S DWAC (DEPOSIT/WITHDRAWAL AT CUSTODIAN) SYSTEM. IF YOU VOTE ON THE BUSINESS COMBINATION PROPOSAL, YOU MAY VOTE EITHER FOR OR AGAINST SUCH PROPOSAL WITHOUT AFFECTING YOUR ELIGIBILITY FOR EXERCISING REDEMPTION RIGHTS. IF THE BUSINESS COMBINATION IS NOT COMPLETED, THEN THESE SHARES WILL NOT BE REDEEMED FOR CASH. IF YOU HOLD THE SHARES IN STREET NAME, YOU WILL NEED TO INSTRUCT THE ACCOUNT EXECUTIVE AT YOUR BANK OR BROKER TO WITHDRAW THE SHARES FROM YOUR ACCOUNT IN ORDER TO EXERCISE YOUR REDEMPTION RIGHTS. SEE “EXTRAORDINARY GENERAL MEETING OF AGRICO SHAREHOLDERS—REDEMPTION RIGHTS” FOR MORE SPECIFIC INSTRUCTIONS.

This joint proxy statement/prospectus is dated May 16, 2022 and is first being mailed to Agrico Acquisition Corp. shareholders on or about May 18, 2022.

To the Shareholders of Kalera S.A.:

Agrico Acquisition Corp., a Cayman Islands exempted company (“Agrico”), has entered into a Business Combination Agreement (as may be amended from time to time, the “Business Combination Agreement”, a copy of which is attached to the accompanying joint proxy statement/prospectus as Annex A) with (i) Figgreen Limited, a private limited company incorporated in Ireland with registered number 606356 (which was reregistered as an Irish public limited company and was renamed “Kalera Public Limited Company”) in connection with the Business Combination (“Pubco”), (ii) Kalera Cayman Merger Sub, a Cayman Islands exempted company (“Cayman Merger Sub”), (iii) Kalera Luxembourg Merger Sub SARL, a Luxembourg limited liability company (société à responsabilité limitée) (“Lux Merger Sub” and, together with Cayman Merger Sub, the “Merger Subs”) and (iv) Kalera AS, a Norwegian private limited liability company.

Pursuant to the Business Combination Agreement, (i) a merger will occur, pursuant to which Cayman Merger Sub will merge with and into Agrico, with Agrico continuing as the surviving entity and as a wholly owned subsidiary of Pubco (the “First Merger”) and Agrico will issue one Class A Agrico Ordinary Share to Pubco (the “Agrico Share Issuance”) and the holders of Agrico Ordinary Shares will receive shares in the capital of Pubco and holders of Agrico Warrants will have their Agrico Warrants assumed by Pubco and adjusted to become exercisable for shares in the capital of Pubco, in each case as consideration for the First Merger and the Agrico Share Issuance, (ii) at least one (1) business day following the First Merger and subject thereto, the second merger will occur, pursuant to which Lux Merger Sub will merge with and into Kalera (as defined in the accompanying joint proxy statement/prospectus) with Kalera as the surviving entity of the second merger (the “Second Merger”) and in this context Kalera will issue shares to Pubco (the “Kalera Share Issuance”), and (iii) immediately following the Second Merger and the Kalera Capital Reduction, the Kalera Shareholders (except Pubco) will receive shares in the capital of Pubco and the holders of the Kalera Options will receive options in the capital of Pubco, in each case as consideration for the Kalera Shares and the Kalera Options being cancelled and ceasing to exist or being assumed (as applicable) upon completion of the Second Merger by way of a capital reduction pursuant to the Luxembourg Companies Act (the “Kalera Capital Reduction”). As a result of the transactions contemplated by the Business Combination Agreement, Kalera will be a wholly owned subsidiary of Pubco.

Upon consummation of the First Merger, (i) each Agrico Class A ordinary share outstanding immediately prior to the First Merger Effective Time will be automatically cancelled in exchange for and converted into one Pubco Ordinary Share, (ii) each Agrico Class B ordinary share outstanding immediately prior to the First Merger Effective Time will be automatically cancelled in exchange for and converted into one Pubco Ordinary Share, and (iii) each outstanding Agrico Public Warrant and Private Placement Warrant will remain outstanding and will automatically be adjusted to become a Pubco Warrant.

Upon closing of the Business Combination, Agrico will be a wholly owned subsidiary of Pubco. If Agrico is solvent at such time, the voluntary winding-up of Agrico is expected to commence, and voluntary liquidators are expected to be appointed, by the passing of a special shareholder resolution. Upon the appointment of a voluntary liquidator, the powers of the directors are expected to cease and the business of Agrico is expected to be discontinued except to the extent necessary to facilitate the winding-up. During the winding up process, liabilities of Agrico are expected to be assumed by Pubco. The liquidator is expected to notify the Cayman Islands Registrar of Companies of the commencement of the winding-up and publish a notice in the Cayman Islands Government Gazette informing creditors of the same. Notice must be published in the Cayman Islands Government Gazette prior to the final general meeting of Agrico at which the accounts of the liquidation and the conduct of the liquidation will be presented for shareholder approval. This notice must be published at least 21 days in advance of the meeting. Notice of the final meeting must also be given to all shareholders. Following such notice, final general meeting of Agrico is expected to be held, following which, the liquidator is expected to make a final return to the Cayman Islands Registrar of Companies. Three months later, Agrico is expected to be deemed formally dissolved.

Upon consummation of the Second Merger, each Kalera Share outstanding immediately prior to the Second Merger Effective Time will be cancelled and cease to exist in the context of the Kalera Capital Reduction against the issuance of the number of Pubco Ordinary Shares equal to the Exchange Ratio (the aggregate number of Pubco Ordinary Shares so issued, the “Exchange Shares”). The completion of the Business Combination will cause, assuming no public shareholders of Agrico exercise their redemption rights, Kalera Shareholders to beneficially own

approximately 52% and Agrico securityholders to beneficially own approximately 48% of the issued and outstanding Pubco Ordinary Shares (64.9% on a fully diluted basis giving effect to Pubco Ordinary Shares underlying the warrants that will be beneficially owned by Agrico warrantholders as of the Closing). Upon completion of the Business Combination, assuming no public shareholders of Agrico exercise their redemption rights, Agrico’s sponsor, DJCAAC, LLC, will beneficially own approximately 9.6% of the issued and outstanding Pubco Ordinary Shares (22.4% on a fully diluted basis giving effect to Pubco Ordinary Shares underlying the warrants that will be beneficially owned by Agrico’s sponsor as of the Closing). The foregoing statements assume exercisability of the Pubco Warrants on the date of Closing or within 60 days of the Closing.

NEITHER THE U.S. SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE BUSINESS COMBINATION OR THE OTHER TRANSACTIONS DESCRIBED IN THIS JOINT PROXY STATEMENT/PROSPECTUS OR ANY OF THE SECURITIES TO BE ISSUED IN THE BUSINESS COMBINATION, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS JOINT PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This joint proxy statement/prospectus is dated May 16, 2022.

| | |

| Very truly yours, |

|

| /s/ Curtis McWilliams |

| Curtis McWilliams, Interim Chief Executive Officer of Kalera S.A. |

KALERA S.A.

Société anonyme

(Public company limited by shares)

Registered office: 15, Boulevard Roosevelt, L - 2450 Luxembourg

Grand Duchy of Luxembourg

RCS Luxembourg: B 256.011

NOTICE OF SHAREHOLDER MEETING

TO BE HELD ON JUNE 27, 2022

TO THE SHAREHOLDERS OF KALERA S.A.:

NOTICE IS HEREBY GIVEN that a Shareholder Meeting (the “Shareholder Meeting”) of Kalera S.A., a Luxembourg public company limited by shares, will be held at 10:00 a.m. Eastern Time, on June 27, 2022. The meeting will be a completely virtual meeting of shareholders and attending is for information and Q&A purposes, which will be conducted via live webcast at the following link: https://arendt.webex.com/arendt/j.php?MTID=m6bd2433f97b2ee5d2e7055d6a4c88fff. In light of said meeting, you may however only validly cast your vote by appointing a proxy as per the below instructions (Appointment of proxies). You are cordially invited to attend the virtual meeting, which will be held for the following purposes:

1.The Business Combination Proposal — To consider and vote upon the consummation of the proposed business combination with Agrico Acquisition Corp., as further described in the accompanying joint proxy statement/prospectus;

2.The Incentive Plan Proposal — To consider and vote upon a proposal to adopt and approve a long-term incentive plan for the combined company post-business combination (the “Incentive Plan”);

3.The Second Merger Proposal — Subject to the approval of the Kalera Capital Reduction, to acknowledge that all the formalities of article 1021-7 of the Luxembourg Company Law, have been satisfied and to approve the common draft terms of merger between Kalera S.A. and Lux Merger Sub (the “Second Merger”), to approve the Second Merger and to subsequently approve the increase of the share capital of Kalera S.A. through the issue of shares and in relation therewith, to amend article 5.1 of the articles of association of Kalera S.A; and

4.The Kalera Capital Reduction Proposal — Subject to the approval and the effectiveness of the Second Merger, to waive any equal treatment rights of the shareholders of Kalera S.A. and to cancel all shares in issuance prior to the effectiveness of the Second Merger without distribution of any proceeds and subsequent amendment of article 5.1 of the articles of association of Kalera S.A.

In connection therewith, at the Shareholder Meeting shareholders will be asked to consider and, if thought fit, approve the following resolutions (together, the “Resolutions”):

RESOLUTION 1: THE BUSINESS COMBINATION RESOLUTION

RESOLVED THAT, the proposed business combination with Agrico Acquisition Corp., as further described in the accompanying joint proxy statement/prospectus, be and is authorized, approved and adopted in all respects.

RESOLUTION 2: THE INCENTIVE PLAN RESOLUTION

RESOLVED THAT, conditioned upon the passing of the Business Combination Resolution that the adoption of the Incentive Plan (substantially in the form attached to the accompanying joint proxy statement/prospectus, as Annex E) be and is authorized, approved and adopted in all respects.

RESOLUTION 3: THE SECOND MERGER RESOLUTION (to be taken before a notary in the Grand Duchy of Luxembourg)

RESOLVED TO, subject to the approval of the Kalera Capital Reduction under resolution 4, acknowledge that all the formalities of article 1021-7 of the Law of 10 August 1915 on commercial companies, as amended (the “Company Law”) have been satisfied and to approve the common draft terms of the Second Merger (between Kalera S.A. and Lux Merger Sub), to approve the Second Merger.

Subsequently, the Shareholder Meeting approved the increase of the share capital of Kalera S.A. by the amount of shares as determined by the board of directors of Kalera and the sole manager of Lux Merger Sub and validated by the Luxembourg auditors in the context of the Second Merger (the “New Shares”).

The Shareholder Meeting approved that the New Shares shall be issued to Pubco, in exchange for the shares owned by it in the share capital of the Lux Merger Sub in accordance with a share exchange ratio established in the common draft terms of merger.

The exchange ratio for the consideration shares to be issued in the context of the Second Merger has been established by the board of directors of Kalera and the sole manager of the Lux Merger Sub and has been submitted for evaluation purposes to, two independent experts, one for the benefit of each merging company, appointed in accordance with Article 1021-6 of the Company Law.

RESOLUTION 4: THE KALERA CAPITAL REDUCTION (to be taken before a notary in the Grand Duchy of Luxembourg)

RESOLVED TO, subject to the approval and effectiveness of the Second Merger, waive any equal treatment rights of the shareholders and to cancel all shares in issuance prior to the effectiveness of the Second Merger without distribution of any proceeds.

Subsequently the Shareholder Meeting approved the decrease of the share capital of Kalera S.A. by cancelling all the shares which have been issued in the context of the merger of Kalera AS and Kalera S.A. by absorption between Kalera AS and Kalera S.A., with Kalera S.A. as the surviving entity.

NOTES TO THE NOTICE OF SHAREHOLDER MEETING

The items of business for the Shareholder Meeting are described in the attached joint proxy statement/prospectus, which we encourage you to read in its entirety before voting.

Entitlement to attend and vote

Only holders of record of Kalera Shares at 11:59 p.m. CET on June 6, 2022 (the “Kalera Record Date”) are entitled to notice of the Shareholder Meeting and to vote and have their votes counted at the Shareholder Meeting in accordance with the present notice.

Board recommendation

After careful consideration, Kalera’s board of directors has determined that the transactions under the Resolutions are fair to and in the best interests of Kalera and its shareholders and unanimously recommends that you vote or give instruction to vote “FOR” the Resolutions.

Under the Business Combination Agreement, approval of each of the Business Combination Proposal and the Second Merger and the Kalera Capital Reduction by Kalera’s shareholders are conditions to the consummation of the Business Combination. The Second Merger and the Kalera Capital Reduction are conditioned on the approval of each other. As such, in the event that any of the Second Merger and the Kalera Capital Reduction do not receive the requisite vote for approval, then Kalera will not consummate the Business Combination.

Appointment of proxies

All Kalera shareholders as at the Kalera Record Date are cordially invited to attend the Shareholder Meeting virtually. To ensure your representation and/or vote at the Shareholder Meeting, however, you are urged to complete, sign, date and return the enclosed proxy and voting card as soon as possible in the envelope provided and, in any event so as to be received by Kalera no later than 10:00 a.m. Eastern Time, on June 22, 2022 being five (5) calendar days before the time appointed for the holding of the Shareholder Meeting. Kalera will recognise only one (1) holder per share. In case a share is owned by several persons, they shall appoint a single representative who shall represent them in respect of Kalera. Kalera has the right to suspend the exercise of all rights attached to that share, except for relevant information rights, until such representative has been appointed. Submitting a proxy and voting form will NOT prevent you from being able to attend the virtual meeting for information and Q&A purposes. If your shares are held in an account at a brokerage firm or bank, and unless otherwise specified in the relevant convening notice, you may either instruct your broker or bank on how to vote your shares or use the proxy and voting card as instructed by Kalera, together in the latter case with a share certificate certifying the number of shares recorded in the relevant account on the Kalera Record Date.

In the case of a shareholder that is a natural person, the proxy and voting card must be executed under the hand of the shareholder or his or her attorney. In the case of a shareholder that is a corporation or other non-natural person, the proxy and voting card must be executed on its behalf by a duly authorized representative or attorney for the corporation. Any power of attorney or any other authority under which the proxy and voting card is signed (or a duly certified copy of such power of attorney or authority) must be included with the proxy and voting card.

A vote withheld is not a vote in law, which means that the vote will not be counted in the calculation of votes for or against the Resolutions. If you return your proxy and voting card without an indication of how you wish to vote, this will be considered as an instruction to the proxyholder to vote in favor of each of the Resolutions presented at the Shareholder Meeting.

Changing proxy instructions

To change your proxy and voting instructions simply complete, sign, date and return a new proxy and voting card following the procedure set out in the notes above. Note that the cut off time for receipt of proxy appointments specified in those notes also applies in relation to amended proxy and voting instructions. Any amended proxy appointment or voting instruction received after the specified cut off time will be disregarded.

Termination of proxy appointment

In order to revoke a proxy and voting instruction you will need to send a notice clearly stating your intention to revoke your proxy appointment and voting instruction to following the procedure set out in the notes above. In the case of a shareholder that is a natural person, the revocation notice must be executed under the hand of the shareholder or his or her attorney. In the case of a shareholder that is a corporation or other non-natural person, the revocation notice must be executed on its behalf by a duly authorized representative or attorney for the corporation. Any power of attorney or any other authority under which the revocation notice is signed (or a duly certified copy of such power of attorney or authority) must be included with the revocation notice.

The revocation notice must be received by Kalera no later than 10:00 a.m. Eastern Time, on June 22, 2022 being five (5) calendar days before the time appointed for the holding of the Shareholder Meeting.

If you attempt to revoke your proxy and voting instruction but the revocation notice is received after the time specified then your proxy and voting instruction will remain valid. Notwithstanding the foregoing, submitting a proxy and voting instruction will NOT prevent you from being able to attend and vote online during the virtual meeting for information and Q&A purposes.

Voting

Voting on all resolutions at the Shareholder Meeting will be conducted by way of a poll based on the proxy and voting cards received as per the above. Votes are counted according to the number of shares registered in each shareholder’s name, with each ordinary share carrying one vote.

Results of the voting

As soon as practicable following the Shareholder Meeting, the results of the voting will be announced via a regulatory information service and also placed on Kalera’s website.

YOUR VOTE IS IMPORTANT REGARDLESS OF THE NUMBER OF KALERA SHARES YOU OWN. Whether you plan to virtually attend the Shareholder Meeting for information and Q&A purposes or not, please instruct your broker or bank on how to vote your shares or sign, date and return the enclosed proxy and voting card as soon as possible following the procedure set out above.

Thank you for your participation. We look forward to your continued support.

| | | | | |

| By Order of the Board of Directors | |

| |

| /s/ Curtis McWilliams | |

| |

| Curtis McWilliams, Interim Chief Executive Officer of Kalera S.A. |

IF YOU RETURN YOUR PROXY AND VOTING CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, THIS WILL BE CONSIDERED AS AN INSTRUCTION TO THE PROXYHOLDER TO VOTE IN FAVOR OF EACH OF THE RESOLUTIONS.

This joint proxy statement/prospectus is dated May 16, 2022.

JOINT PROXY STATEMENT

FOR EXTRAORDINARY GENERAL MEETING OF AGRICO ACQUISITION CORP.

AND SHAREHOLDER MEETING OF KALERA S.A.

PROSPECTUS FOR UP TO 56,970,013 ORDINARY SHARES

14,347,500 WARRANTS

AND 112,184,453 CONTINGENT VALUE RIGHTS OF

KALERA PUBLIC LIMITED COMPANY

The board of directors of Agrico Acquisition Corp., a Cayman Islands exempted company (“Agrico”) and Kalera AS, a Norwegian private limited liability company, have unanimously approved the Business Combination Agreement, dated as of January 30, 2022, by and among Kalera AS, Pubco, Cayman Merger Sub and Lux Merger Sub.

Pursuant to the Business Combination Agreement, among other things, (i) a merger will occur, pursuant to which Cayman Merger Sub will merge with and into Agrico, with Agrico continuing as the surviving entity and as a wholly owned subsidiary of Pubco (the “First Merger”) and Agrico will issue one Class A Agrico Ordinary Share to Pubco (the “Agrico Share Issuance”) and the holders of Agrico Ordinary Shares will receive shares in the capital of Pubco and holders of Agrico Warrants will have their Agrico Warrants assumed by Pubco and adjusted to become exercisable for shares in the capital of Pubco, in each case as consideration for the First Merger and the Agrico Share Issuance, (ii) at least one (1) business day following the First Merger and subject thereto, the second merger will occur, pursuant to which Lux Merger Sub will merge with and into Kalera (as defined in the accompanying joint proxy statement/prospectus) with Kalera as the surviving entity of the second merger (the “Second Merger”) and in this context Kalera will issue shares to Pubco (the “Kalera Share Issuance”), and (iii) immediately following and in connection with the Second Merger and the Kalera Capital Reduction, the Kalera Shareholders (except Pubco) will receive shares in the capital of Pubco and the holders of the Kalera Options will receive options in the capital of Pubco, in each case as consideration for the Kalera Shares and the Kalera Options being cancelled and ceasing to exist or being assumed (as applicable) upon completion of the Second Merger by way of a capital reduction pursuant to the Luxembourg Companies Act (the “Kalera Capital Reduction”). The completion of the Business Combination will cause, assuming no public shareholders of Agrico exercise their redemption rights, Kalera Shareholders to beneficially own approximately 52% and Agrico securityholders to beneficially own approximately 48% of the issued and outstanding Pubco Ordinary Shares (64.9% on a fully diluted basis giving effect to Pubco Ordinary Shares underlying the warrants that will be beneficially owned by Agrico warrantholders as of the Closing). Upon completion of the Business Combination, assuming no public shareholders of Agrico exercise their redemption rights, Agrico’s sponsor, DJCAAC, LLC, will beneficially own approximately 9.6% of the issued and outstanding Pubco Ordinary Shares (22.4% on a fully diluted basis giving effect to Pubco Ordinary Shares underlying the warrants that will be beneficially owned by Agrico’s sponsor as of the Closing). The foregoing statements assume exercisability of the Pubco Warrants on the date of Closing or within 60 days of the Closing.

As a result of the transactions contemplated by the Business Combination Agreement, Kalera will be a wholly owned subsidiary of Pubco. Pubco will become a new public company and will be listed on Nasdaq. The former security holders of Agrico and Kalera will become security holders of Pubco.

Proposals to approve the Business Combination Agreement and the other matters discussed in this joint proxy statement/prospectus will be presented at each of the Agrico Special Meeting and Kalera Shareholder Meeting, as applicable.

The Agrico Special Meeting is scheduled to be held at 10:00 a.m., Eastern Time, on June 27, 2022, at the offices of Maples and Calder (Cayman) LLP at 121 South Church Street, Ugland House, Grand Cayman, Cayman Islands and virtually. The Kalera Shareholder Meeting is scheduled to be held at 10:00 a.m., Eastern Time, on June 27, 2022, virtually.

Pubco is an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 and has elected to comply with certain reduced public company reporting requirements.

This joint proxy statement/prospectus provides you with detailed information about the Business Combination and other matters to be considered at the shareholder meetings described herein. We encourage you to carefully read this entire document.

YOU SHOULD ALSO CAREFULLY CONSIDER THE RISK FACTORS DESCRIBED IN “RISK FACTORS” BEGINNING ON PAGE 85 OF THIS JOINT PROXY STATEMENT/PROSPECTUS FOR A DISCUSSION OF INFORMATION THAT SHOULD BE CONSIDERED BEFORE VOTING ON THE PROPOSED BUSINESS COMBINATION AND EACH OF THE OTHER MATTERS TO BE PRESENTED AT THE SHAREHOLDER MEETINGS. Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the Business Combination or the other transactions described in this joint proxy statement/prospectus or any of the securities to be issued in the Business Combination, passed upon the merits or fairness of the Business Combination or related

transactions or passed upon the adequacy or accuracy of the disclosure in this joint proxy statement/prospectus. Any representation to the contrary is a criminal offense.

This joint proxy statement/prospectus is dated May 16, 2022, and is first being mailed to security holders on or about May 18, 2022.

TABLE OF CONTENTS

ABOUT THIS JOINT PROXY STATEMENT/PROSPECTUS

This document, which forms part of a registration statement on Form S-4 filed with the U.S. Securities and Exchange Commission, or SEC, by Pubco (File No. 333-264422), constitutes a prospectus of Pubco under Section 5 of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the Pubco securities to be issued or assumed (as the case may be) if the Business Combination described herein is consummated. This document also constitutes: (i) a notice of meeting and a proxy statement under Section 14(a) of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), with respect to the Agrico Special Meeting at which Agrico Shareholders will be asked to consider and vote upon a proposal to approve the Business Combination by the approval and adoption of the Business Combination Agreement, among other matters; and (ii) a notice of meeting and a proxy statement with respect to the Kalera S.A. Shareholder Meeting at which its shareholders will be asked to consider and vote upon a proposal to approve the Business Combination by the approval and adoption of the Business Combination Agreement, among other matters. If you are an Agrico investor and would like additional copies of this joint proxy statement/prospectus or if you have questions about the Business Combination or the proposals to be presented at the Agrico Special Meeting, please contact Morrow Sodali LLC at RICO.info@investor.morrowsodali.com or (800) 662-5200 (banks and brokers can call: (203) 658-9400). If you are a shareholder of Agrico and would like to request documents, please do so by June 20, 2022 (the fifth business day before the meeting date) to receive them before the Agrico Special Meeting. If you request any documents from us, we will mail them to you by first class mail, or another equally prompt means.

If you are a Kalera investor and would like additional copies of this joint proxy statement/prospectus or if you have questions about the Business Combination or the proposals to be presented at the Kalera Shareholder Meeting, please contact Eric Birge at ir@kalera.com or (313) 309-9500. If you are a shareholder of Kalera and would like to request documents, please do so by June 20, 2022 (the fifth business day before the meeting date) to receive them before the Kalera Shareholder Meeting. If you request any documents from us, we will mail them to you by first class mail, or another equally prompt means.

You should rely only on the information contained in, or incorporated by reference into, this joint proxy statement/prospectus. No person is authorized to give any information or to make any representation with respect to the matters that this joint proxy statement/prospectus describes other than those contained in, or incorporated by reference into, this joint proxy statement/prospectus, and, if given or made, the information or representation must not be relied upon as having been authorized by Pubco, Agrico or Kalera. This joint proxy statement/prospectus does not constitute an offer to sell or a solicitation of an offer to buy securities or a solicitation of a proxy in any jurisdiction where, or to any person to whom, it is unlawful to make such an offer or a solicitation. This joint proxy statement/prospectus is dated as of the date set forth on the cover hereof. You should not assume that the information contained or incorporated in this joint proxy statement/prospectus is accurate as of any date other than the date(s) specified. Neither the delivery of this joint proxy statement/prospectus nor any distribution of securities made under this joint proxy statement/prospectus will, under any circumstances, create an implication to the contrary.

INDUSTRY AND MARKET DATA

In this joint proxy statement/prospectus, Kalera relies on and refers to industry data, information and statistics regarding the markets in which it competes from research as well as from publicly available information, industry and general publications and research and studies conducted by third parties. Kalera has supplemented this information where necessary with its own internal estimates, considering publicly available information about other industry participants and Kalera management’s best view as to information that is not publicly available. This information appears in “Industry Overview,” “Information about Kalera,”“Kalera’s Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and other sections of this joint proxy statement/prospectus. Kalera has taken such care as we consider reasonable in the extraction and reproduction of information from such data from third party sources.

Industry publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this joint proxy statement/prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in the forecasts or estimates from independent third parties and us.

FREQUENTLY USED TERMS

Unless otherwise stated or unless the context otherwise requires, the terms (i) “Agrico” refers to Agrico Acquisition Corp., a Cayman Islands exempted company, (ii) “Pubco” refers to Kalera Public Limited Company, a public limited company incorporated in Ireland with registered number 606356 and (iii) “Kalera” refers to (A) prior to the Norwegian Merger, Kalera AS, a Norwegian private limited liability company, and its consolidated subsidiaries, (B) following the Norwegian Merger, Kalera S.A., a public limited company incorporated in Luxembourg, and its consolidated subsidiaries, and (C) following the consummation of the Business Combination, Pubco.

In this document:

“$” means the currency in dollars of the United States of America.

“2022 Incentive Plan” means the 2022 Long-Term Incentive Plan of Pubco.

“Adjournment Proposal” means a proposal to adjourn the Agrico Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Agrico Special Meeting, there are not sufficient votes to authorize Agrico to consummate the Business Combination and each other matter to be considered at the Agrico Special Meeting, or if holders of the Agrico Shares have elected to redeem an amount of Agrico Shares such that the Minimum Cash Condition would not be satisfied.

“Agrico Articles” means the Amended and Restated Memorandum and Articles of Association of Agrico adopted on July 7, 2021.

“Agrico Class A ordinary shares” means the class A ordinary shares of Agrico, par value $0.0001 per share.

“Agrico Class B ordinary shares” means the class B ordinary shares of Agrico, par value $0.0001 per share.

“Agrico Initial Shareholders” means holders of Founder Shares prior to the Agrico IPO, including the Sponsor.

“Agrico IPO” means the initial public offering of Agrico Units consummated on July 12, 2021.

“Agrico Ordinary Shares” means Agrico’s Class A ordinary shares and Class B ordinary shares.

“Agrico Public Warrant” means each whole warrant (other than the Private Placement Warrants), entitling the holder thereof to purchase one Agrico ordinary share at a price of $11.50 per share.

“Agrico Record Date” refers to the record date for determining the holders of Agrico Ordinary Shares entitled to receive notice of and to attend and vote at the Agrico Special Meeting, which has been set as May 12, 2022.

“Agrico Share Issuance” means the issuance by Agrico of Agrico Ordinary Shares to Pubco.

“Agrico Shareholders” means the holders of Agrico Shares, including the Agrico Initial Shareholders and members of the Agrico management team, provided that each Agrico Initial Shareholder’s and member of Agrico’s management team’s status as an “Agrico Shareholder” shall only exist with respect to such Agrico Shares.

“Agrico Shares” means Class A ordinary shares of Agrico issued as part of the Agrico Units sold in the Agrico IPO.

“Agrico Special Meeting” means the Extraordinary General Meeting of Agrico, to be held at the offices of Maples and Calder (Cayman) LLP at 121 South Church Street, Ugland House, Grand Cayman, Cayman Islands and virtually by visiting https://www.cstproxy.com/agricoacquisition/2022 on June 27, 2022 at 10 a.m. Eastern Time.

“Agrico Units” means the Agrico units issued in the Agrico IPO, each consisting of one ordinary share and one-half of one Agrico Public Warrant.

“Agrico Warrants” means Private Placement Warrants and Agrico Public Warrants, collectively.

“Broker Non-Vote” means the failure of an Agrico Shareholder, who holds its shares in “street name” through a broker or other nominee, to give voting instructions to such broker or other nominee.

“Business Combination” means the transactions contemplated by the Business Combination Agreement.

“Business Combination Agreement” means the Business Combination Agreement, dated as of January 30, 2022, as it may be amended from time to time, by and among Agrico, Kalera, Pubco, Cayman Merger Sub and Lux Merger Sub.

“Business Combination Proposal” means a proposal to approve the Business Combination Agreement and the Business Combination.

“Cayman Companies Act” means the Companies Act (As Revised), as amended, of the Cayman Islands.

“Cayman Merger Sub” means Kalera Cayman Merger Sub, a Cayman Islands exempted company.

“Closing” means the consummation of the transactions contemplated under the Business Combination Agreement.

“Code” means the Internal Revenue Code of 1986, as amended.

“Company Material Contract” has the meaning assigned to it in the Business Combination Agreement.

“CVR” means one contractual contingent value right per Kalera Share which shall represent the right to receive up to two contingent payments of Pubco Ordinary Shares

“CVR Agreement” means the Contingent Value Rights Agreement to be entered into by Pubco and the Rights Agent party thereto.

“CVR Shares” means the Pubco Ordinary Shares issuable pursuant to the CVRs upon the satisfaction of certain conditions.

“Dissent Rights” means the right of each holder of Agrico Ordinary Shares to dissent in respect of the First Merger pursuant to Section 238 of the Cayman Companies Act.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Exchange Ratio” has the meaning assigned to it in the Business Combination Agreement.

“Exchange Shares” means the aggregate number of Pubco Ordinary Shares issued upon consummation of the Second Merger.

“Expenses” means all out-of-pocket expenses (including all fees and expenses of counsel, accountants, investment bankers, financial advisors, financing sources, experts and consultants to a party to the Business Combination Agreement or any of its Affiliates) incurred by a Party or on its behalf in connection with or related to the authorization, preparation, negotiation, execution or performance of the Business Combination Agreement or any Ancillary Documents (as defined in the Business Combination Agreement) and all other matters related to the consummation of the Business Combination Agreement. With respect to Agrico, Expenses shall include any and all deferred expenses (including fees or commissions payable to the underwriters and any legal fees) of the IPO upon consummation of a Business Combination.

“First Closing” means the consummation of the First Merger and the related transactions thereby.

“First Closing Date” means the date on which all conditions of the First Closing are satisfied.

“First Merger” means the first merger pursuant to which Cayman Merger Sub will merge with and into Agrico, with Agrico continuing as the surviving entity of the First Merger and as a wholly owned subsidiary of Pubco.

“First Merger Effective Time” has the meaning assigned to it in the Business Combination Agreement.

“First Merger Plan” means the plan of merger executed in connection with the First Merger.

“Founder Shares” means Class B ordinary shares of Agrico initially purchased by the Sponsor in a private placement prior to the Agrico IPO, of which 3,593,750 are currently outstanding.

“Incentive Plan Proposal” refers to the proposal for Agrico and Kalera Shareholders to approve the adoption of the 2022 Incentive Plan by Pubco.

“Interim Period” has the meaning assigned to it in the Business Combination Agreement.

“IRS” means the Internal Revenue Service of the United States.

“Kalera Articles” means the consolidated articles of association of Kalera, as amended from time to time.

“Kalera Capital Reduction” means certain of the Kalera Shares and all the Kalera Options being cancelled and ceasing to exist or being assumed (as applicable) upon completion of the Second Merger by way of a capital reduction pursuant to the Luxembourg Companies Act.

“Kalera Holders Support Agreement” means the agreement entered into by Agrico and Kalera with the Kalera Shareholders in connection with their entry into the Business Combination Agreement.

“Kalera Options” has the meaning assigned to it in the Business Combination Agreement.

“Kalera Record Date” refers to the record date for determining the holders of Kalera Shares entitled to receive notice of and to attend and vote at the Kalera Shareholder Meeting, which has been set as June 6, 2022.

“Kalera Share Issuance” means the issuance by Kalera of shares to Pubco pursuant to the Second Merger.

“Kalera Shareholder Meeting” means the general meeting of Kalera, to be held on June 27, 2022 at 10 a.m. Eastern Time.

“Kalera Shareholders” means the holders of Kalera Shares.

“Kalera Shares” the ordinary shares of Kalera.

“Lux Holdco” means Kalera S.A., a Luxembourg public limited company (société anonyme).

“Lux Merger Sub” means Kalera Luxembourg Merger Sub SARL, a Luxembourg limited liability company (société à responsabilité limitée).

“Luxembourg Company Law” means the Luxembourg law dated August 10, 1915 on commercial companies, as amended.

“Maxim” means Maxim Group, LLC, Agrico’s underwriters in the Agrico IPO.

“Merger Subs” means collectively, Cayman Merger Sub and the Lux Merger Sub.

“Minimum Cash Condition” means the minimum of $100,000,000 in the aggregate in (i) cash proceeds received or available at or prior to the applicable Closing in respect of debt or equity financing documents entered into by the Company during the Interim Period (excluding any funding relating to facilities that may be entered into with specified counterparties and provided that there shall not be double counting of cash proceeds that are received or available) and (ii) in the Trust Account that Kalera, its Subsidiaries and Agrico must have after giving effect to the Redemption and assuming that all expenses of Agrico, Pubco, Kalera and their respective Affiliates incurred prior to the applicable Closing have been paid (including, in each case, the Expenses), as Kalera’s condition to Closing.

“Nasdaq” means the Nasdaq Stock Market.

“Norwegian Merger” means the merger of Kalera AS and Kalera S.A. pursuant to a cross-border merger by absorption between Kalera AS and Kalera S.A., with Kalera S.A. as the surviving entity, and actions taken in connection therewith.

“Pre-Closing Shareholders” means the Company Shareholders as of immediately prior to the Second Merger Effective Time.

“Private Placement Warrants” means the Agrico Warrants purchased by the Sponsor and Maxim in a private placement at the time of the Agrico IPO for a purchase price of $1.00 per warrant, each of which is exercisable for one ordinary share.

“Pubco” means Kalera Public Limited Company, a public limited company incorporated in Ireland.

“Pubco Articles” means the articles of Pubco as of the date of the Closing unless otherwise provided herein.

“Pubco Options” has the meaning assigned to it in the Business Combination Agreement.

“Pubco Ordinary Shares” means the ordinary shares of Pubco.

“Pubco Warrant” means each one whole warrant entitling the holder thereof to subscribe for one Pubco Ordinary Share at a purchase price of $11.50 per share.

“Redemption” means the right of the holders of Agrico Shares to have their shares redeemed in accordance with the procedures set forth in this joint proxy statement/prospectus.

“Redemption Price” means an amount equal to a pro rata portion of the aggregate amount then on deposit in the Trust Account calculated in accordance with the Agrico Articles (as equitably adjusted for shares splits, shares dividends, combinations, recapitalizations and the like after the Closing). The redemption price will be calculated two (2) days prior to the completion of the Business Combination in accordance with the Agrico Articles.

“Registration Rights Agreement” means the registration rights agreement in the form agreed upon among the parties thereto.

“RESA” means Recueil Électronique des Sociétés et Associations of the Grand Duchy of Luxembourg.

“SEC” means the U.S. Securities and Exchange Commission.

“Second Closing” means the consummation of the Business Combination (other than those transactions which occur on the First Closing).

“Second Closing Date” means the date on which all conditions of the Second Closing are satisfied.

“Second Merger” means the second merger pursuant to which Lux Merger Sub will merge with and into Kalera with Kalera as the surviving entity of such merger.

“Second Merger Effective Time” has the meaning assigned to it in the Business Combination Agreement.

“Second Merger Plan” means the plan of merger executed in connection with the Second Merger.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Sponsor” means DJCAAC LLC, a Delaware limited liability company and each of the persons set forth on Schedule I to the Sponsor Support Agreement.

“Sponsor Support Agreement” means the agreement among the Sponsor, Agrico and Kalera.

“Target Companies” has the meaning assigned to it in the Business Combination Agreement.

“Transfer Agent” means, with respect to Agrico, the Continental Stock Transfer and Trust Company.

“Trust Account” means the trust account that holds a portion of the proceeds of the Agrico IPO and the concurrent sale of warrants to the Sponsor in a private placement.

“U.S. GAAP” means United States generally accepted accounting principles.

SUMMARY OF THE MATERIAL TERMS OF THE BUSINESS COMBINATION

•Agrico, Pubco, Cayman Merger Sub, Lux Merger Sub and Kalera are parties to the Business Combination Agreement.

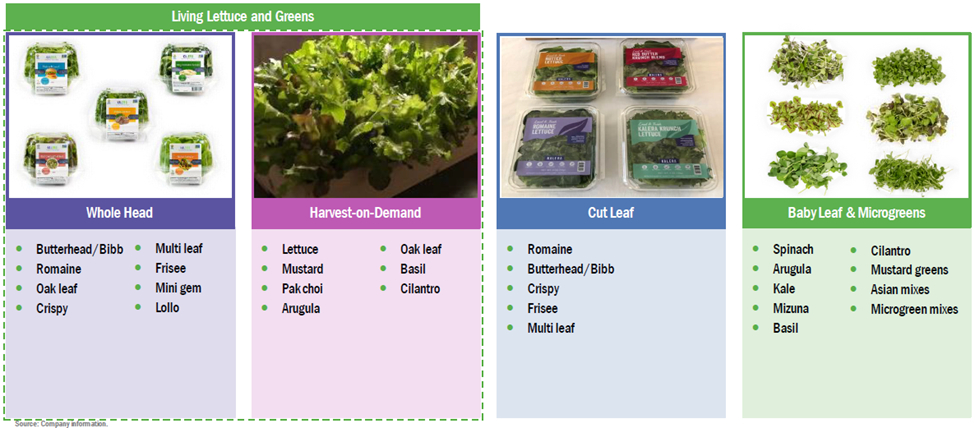

•Kalera engages in the business of controlled environment agriculture, seeds production and research and development of plant and seed science. See the section of this joint proxy statement/prospectus titled “Information About Kalera”.

•Following consummation of the Business Combination, Agrico and Merger Subs will have ceased to have a separate legal existence and Kalera will become a wholly owned subsidiary of Pubco. Merger Subs were formed solely as vehicles for consummating the Business Combination, and Merger Subs are currently direct wholly owned subsidiaries of Pubco. See the section of this joint proxy statement/prospectus titled “Summary of the Joint Proxy Statement/Prospectus—The Parties.”

•Pursuant to the Business Combination Agreement, (i) the First Merger will occur, and Agrico will issue one Class A Agrico Ordinary Share to Pubco (the “Agrico Share Issuance”), holders of Agrico Ordinary Shares will receive shares in the capital of Pubco, and holders of Agrico Warrants will have their Agrico Warrants assumed by Pubco and adjusted to become exercisable for shares in the capital of Pubco, in each case, as consideration for the First Merger and the Agrico Share Issuance, (ii) at least one business day following the First Merger and subject thereto, the Second Merger will occur, and in this context Kalera will issue shares to Pubco (the “Kalera Share Issuance”), and (iii) immediately following and in connection with the Second Merger, the Kalera Shareholders (except Pubco) will receive shares in the capital of Pubco and CVRs and the holders of the Kalera Options will receive options in the capital of Pubco and, in the case of holders of In-the-Money Options (as defined in the Business Combination Agreement), CVRs, in each case, as consideration for the Kalera Shares and the Kalera Options being cancelled and ceasing to exist or being assumed (as applicable) upon completion of the Second Merger by way of the Kalera Capital Reduction, and, as a result of the Second Merger and the Kalera Capital Reduction, Kalera will be a wholly owned subsidiary of Pubco. See the section of this joint proxy statement/prospectus titled “The Business Combination Proposal.”

•Upon consummation of the First Merger, (i) each Agrico Class A ordinary share outstanding immediately prior to the First Merger Effective Time will be automatically cancelled in exchange for and converted into one Pubco Ordinary Share, (ii) each Agrico Class B ordinary share outstanding immediately prior to the First Merger Effective Time will be automatically cancelled in exchange for and converted into one Pubco Ordinary Share, and (iii) each outstanding Agrico Public Warrant and Private Placement Warrant will remain outstanding and will automatically be adjusted to become a Pubco Warrant. See the section of this joint proxy statement/prospectus titled “The Business Combination Proposal—General—The First Merger: Consideration to Agrico Security holders.”

•Upon consummation of the Second Merger, each Kalera Share outstanding immediately prior to the Second Merger Effective Time will be cancelled and cease to exist in the context of the Kalera Capital Reduction against the issuance of the number of Pubco Ordinary Shares equal to the Exchange Ratio (the aggregate number of Pubco Ordinary Shares so issued, the “Exchange Shares”).

•In connection with their entry into the Business Combination Agreement, Agrico and Kalera entered into an agreement with DJCAAC LLC, a Delaware limited liability company (the “Sponsor”) (the “Sponsor Support Agreement”), pursuant to which the Sponsor agreed (i) to vote the Agrico Ordinary Shares (as defined in the Sponsor Support Agreement) held by the Sponsor in favor of the approval and adoption of the Business Combination Agreement and approval of the Business Combination Proposal and the transactions contemplated by the Business Combination Agreement, (ii) to not transfer, during the period commencing on the date of the Sponsor Support Agreement and ending on the earlier of (a) the First Closing and (b) the liquidation of Agrico, any Agrico Ordinary Shares (as defined in the Sponsor Support Agreement) owned by the Sponsor, (iii) to not transfer any Lock-up Shares (as defined in the Sponsor Support Agreement) until the end of the Lock-up Period (as defined in the Sponsor Support Agreement),

and (iv) to transfer to Agrico, surrender and forfeit a certain amount of Agrico Class B ordinary shares in the event that the amount of Agrico Ordinary Shares redeemed pursuant to the Redemption meets the threshold specified therein. See the section of this joint proxy statement/prospectus titled “The Business Combination Proposal—Related Agreements or Arrangements—Sponsor Support Agreement.” In connection with their entry into the Business Combination Agreement, Agrico and Kalera entered into an agreement with certain shareholders of Kalera, whose names appear on the signature pages thereto (such shareholders, the “Kalera Supporting Shareholders”, and such agreement, the “Kalera Holders Support Agreement”), pursuant to which each Kalera Supporting Shareholder agreed (i) to vote all of such Kalera Supporting Shareholder’s Covered Shares (as defined in the Kalera Holders Support Agreement) held by such shareholder in favor of the approval and adoption of the Business Combination Agreement and the transactions contemplated by the Business Combination Agreement, (ii) to not transfer, prior to the Second Closing Date, any of such Kalera Supporting Shareholder’s Covered Shares, and (iii) to not transfer any Lock-up Shares (as defined in the Kalera Holders Support Agreement) until the end of the Lock-up Period (as defined in the Kalera Holders Support Agreement). See the section of this joint proxy statement/prospectus titled “The Business Combination Proposal—Related Agreements or Arrangements—The Company Holders Support Agreements.”

•In addition to voting on a proposal to adopt the Business Combination Agreement and approve the Business Combination contemplated thereby as described in this joint proxy statement/prospectus, the shareholders of Agrico will also vote on proposals to approve the First Merger, the Incentive Plan and an adjournment of the extraordinary general meeting, if necessary or desirable in the reasonable determination of Agrico. See the sections of this joint proxy statement/prospectus titled “The First Merger Proposal,” “The Incentive Plan Proposal” and “The Adjournment Proposal.”

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS