THE INFORMATION IN THIS PRELIMINARY PROXY STATEMENT/PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. YOU SHOULD NOT RELY ON THIS PRELIMINARY PROXY STATEMENT/PROSPECTUS UNTIL IT IS DECLARED EFFECTIVE BY THE SECURITIES AND EXCHANGE COMMISSION AND THEN ONLY FOR ITS INTENDED PURPOSE. THE REGISTRANT MAY NOT OFFER THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PRELIMINARY PROXY STATEMENT/PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

PRELIMINARY – SUBJECT TO COMPLETION – DATED APRIL 7, 2022.

PROXY STATEMENT FOR ANNUAL MEETING OF R1 RCM INC.

PROSPECTUS FOR SHARES OF COMMON STOCK OF PROJECT ROADRUNNER PARENT INC.,

THE CONTINUING ENTITY FOLLOWING THE HOLDING COMPANY REORGANIZATION,

WHICH WILL BE RENAMED “R1 RCM INC.” IN CONNECTION WITH

THE TRANSACTIONS DESCRIBED HEREIN

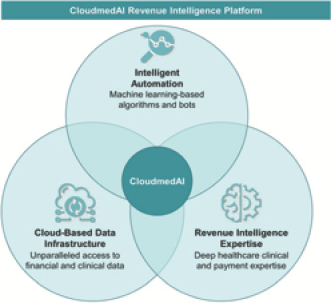

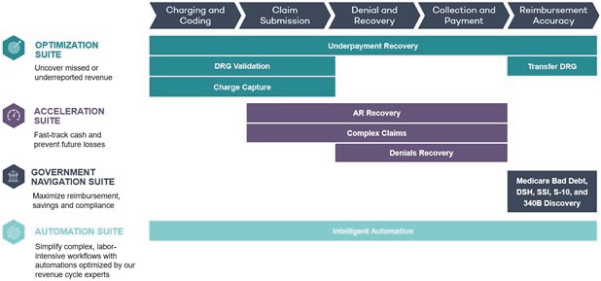

The board of directors (the “R1 Board”) of R1 RCM Inc., a Delaware corporation (“R1”), has unanimously approved the transactions contemplated by that certain Transaction Agreement and Plan of Merger, dated January 9, 2022 (as may be amended, supplemented or otherwise modified from time to time, the “Transaction Agreement”), by and among R1, Project Roadrunner Parent Inc., a Delaware corporation and a wholly owned subsidiary of R1 (“New R1”), Project Roadrunner Merger Sub Inc., a Delaware corporation and a wholly owned subsidiary of New R1 (“R1 Merger Sub”), Revint Holdings, LLC, a Delaware limited liability company (“Cloudmed”), CoyCo 1, L.P., a Delaware limited partnership (“CoyCo 1”), CoyCo 2., L.P., a Delaware limited partnership (“CoyCo 2”, and together with CoyCo 1, the “Sellers”), and, solely for certain purposes set forth therein, NMC Ranger Holdings, LLC, a Delaware limited liability company, a copy of which is attached to this proxy statement/prospectus as Annex A. As described in this proxy statement/prospectus, in addition to the election of directors and ratification of R1’s auditors, R1’s stockholders are being asked to consider a vote upon each of the Stock Issuance Proposal (as defined herein) and the Authorized Share Increase Proposal (as defined herein).

Pursuant to the Transaction Agreement, R1 has agreed to acquire Cloudmed and affiliated entities through (i) a merger of R1 Merger Sub with and into R1 with R1 as the surviving entity, which will result in R1 becoming a wholly owned subsidiary of New R1 (the “Holding Company Reorganization”) and (ii) the Sellers contributing 100% of the equity of Cloudmed Blocker Parent, L.L.C., which will be the parent company of Cloudmed as of the Closing Date (as defined herein), in exchange for 138,400,874 shares of common stock, par value $0.01 per share of New R1 (“New R1 Common Stock”), (subject to adjustment in accordance with the terms of the Transaction Agreement) or approximately 30% of the fully diluted shares of common stock, par value $0.01 per share, of R1 (“R1 Common Stock”) as of the date of the Transaction Agreement on a pro forma basis after giving effect to the Transactions (as defined below) (the “Contribution”, and together with the Holding Company Reorganization, the “Transactions”).

In connection with the Holding Company Reorganization, on the date the Transactions are consummated (the “Closing Date”), each issued and outstanding share of R1 Common Stock will, automatically and without any action on the part of the holder thereof, be converted into one share of New R1 Common Stock. Prior to this offering, there has been no public market for New R1 Common Stock. On April 6, 2022, 279,397,653 shares of R1 Common Stock were outstanding. Upon completion of the Transactions, all shares of R1 Common Stock will be cancelled. New R1 intends to apply to list the New R1 Common Stock, as successor to R1, on The Nasdaq Global Select Market and, upon the completion of the Transactions, the New R1 Common Stock will trade under the symbol under which R1 Common Stock currently trades, “RCM.” It is a condition to the consummation of the Transactions that the New R1 Common Stock shall have been approved for listing on Nasdaq, subject to official notice of issuance, but there can be no assurance such listing condition will be met. If such listing condition is not met, the Transactions will not be consummated unless the Nasdaq condition set forth in the Transaction Agreement is waived by the applicable parties. Any outstanding warrants to purchase shares of R1 Common Stock (the “R1 Warrants”) will, on the Closing Date, be automatically converted into warrants to purchase shares of New R1 Common Stock with substantially the same terms and conditions as applied to the R1 Warrants prior to the Closing Date in connection with the Holding Company Reorganization.

In addition, in accordance with the terms and subject to the conditions of the Transaction Agreement, on the Closing Date, each equity-based award of R1 outstanding as of immediately prior to the Closing Date will be exchanged for a comparable equity-based award that represents or relates to shares of New R1 Common Stock on substantially the same terms and conditions (including vesting schedule) as applied to such equity award prior to the Closing Date.

It is anticipated that, upon completion of the Transactions, (i) the former stockholders of R1, including TCP-ASC ACHI Series LLLP, a limited liability partnership jointly owned by Ascension Health Alliance and investment funds affiliated with TowerBrook Capital Partners L.P., will collectively own approximately 70% of the New R1 Common Stock on a fully diluted basis, and (ii) the Sellers, which are entities affiliated with New Mountain Capital, L.L.C., will collectively own approximately 30% of the New R1 Common Stock on a fully diluted basis.

This proxy statement/prospectus covers up to 332,877,963 shares of New R1 Common Stock (including shares issuable upon exercise of the R1 Warrants and equity-based awards described above) to be issued in connection with the Holding Company Reorganization. The number of shares of New R1 Common Stock that this proxy statement/prospectus covers represents the maximum number of shares that may be issued to holders of shares, R1 Warrants and equity-based awards of R1 in connection with the Holding Company Reorganization (as more fully described in this proxy statement/prospectus).

The accompanying proxy statement/prospectus provides stockholders of R1 with detailed information about the Transactions and other matters to be considered at the annual meeting of stockholders of R1. R1 encourages you to read the entire accompanying proxy statement/prospectus, including the Annexes and other documents referred to therein, carefully and in their entirety. You should also carefully consider the risk factors described in the section titled “Risk Factors” beginning on page 24 of the accompanying proxy statement/prospectus.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this proxy statement/prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The accompanying proxy statement/prospectus is dated , 2022

and is first being mailed to R1’s stockholders on or about , 2022.